UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-1A

File No. 002-87910

File No. 811-03910

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | /X/ | |||

|

|

| ||

| Pre-Effective Amendment No. |

|

| / / |

| Post-Effective Amendment No. | 70 |

| /X/ |

|

|

| ||

|

| and/or | ||

|

|

| ||

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | /X/ | |||

|

|

| ||

| Amendment No. | 71 |

| /X/ |

| ||||

(Check appropriate box or boxes) | ||||

|

|

| ||

VOYAGEUR TAX FREE FUNDS | ||||

(Exact Name of Registrant as Specified in Charter) | ||||

|

|

| ||

100 Independence, 610 Market Street, Philadelphia, PA 19106-2354 | ||||

(Address of Principal Executive Offices) | ||||

|

|

| ||

Registrant’s Telephone Number, including Area Code: | (800) 523-1918 | |||

|

|

| ||

David F. Connor, Esq., 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354 | ||||

(Name and Address of Agent for Service) | ||||

|

|

| ||

Please send copies of all communications to:

Mark R. Greer, Esq. Stradley, Ronon, Stevens & Young, LLP 191 North Wacker Drive, Suite 1601, Chicago, IL 60606 (312) 964-3505 | ||||

Approximate Date of Proposed Public Offering: | December 29, 2023 | |||

|

|

| ||

It is proposed that this filing will become effective (check appropriate box): | ||||

| ||||

/ / | immediately upon filing pursuant to paragraph (b) | |||

/X/ | on December 29, 2023 pursuant to paragraph (b) | |||

/ / | 60 days after filing pursuant to paragraph (a)(1) | |||

/ / | on (date) pursuant to paragraph (a)(1) | |||

/ / | 75 days after filing pursuant to paragraph (a)(2) | |||

/ / | on (date) pursuant to paragraph (a)(2) of Rule 485. | |||

|

|

| ||

If appropriate, check the following box: | ||||

| ||||

/ / | this post-effective amendment designates a new effective date for a previously filed post-effective amendment. | |||

--- C O N T E N T S ---

This Post-Effective Amendment No. 70 to Registration File No. 002-87910 includes the following:

| 1. | Facing Page |

| 2. | Contents Page |

| 3. | Part A – Prospectus (1) |

| 4. | Part B - Statement of Additional Information (1) |

| 5. | Part C - Other Information (1) |

| 6. | Signatures |

| 7. | Exhibits |

|

|

|

This Post-Effective Amendment relates only to the Class A, Class C and Institutional Class shares of the Registrant's one series, Delaware Tax-Free Minnesota Fund. | ||

|

|

|

| (1) | This Post-Effective Amendment contains a Prospectus and Statement of Additional Information for six registrants (each of which offers its shares in one or more series). A separate post-effective amendment, which includes the common Prospectus and Statement of Additional Information and its own Part C, is being filed for each of the other five registrants. |

|

| The Prospectus and Statement of Additional Information contained in this Post-Effective Amendment relate to the Class A, Class C and Institutional Class shares of the Registrant's one series, Delaware Tax-Free Minnesota Fund. The Prospectus and Statement of Additional Information also relate to the shares of Delaware Tax-Free Arizona Fund series of Voyageur Insured Funds; Delaware Tax-Free Minnesota Intermediate Fund series of Voyageur Intermediate Tax Free Funds; Delaware Minnesota High-Yield Municipal Bond Fund, Delaware Tax-Free California Fund, Delaware Tax-Free Idaho Fund and Delaware Tax-Free New York Fund series of Voyageur Mutual Funds; Delaware Tax-Free Colorado Fund series of Voyageur Mutual Funds II; and Delaware Tax-Free Pennsylvania Fund series of Delaware Group State Tax-Free Income Trust. The Part C contained in this Post-Effective Amendment relates only to the Registrant's one series. Separate post-effective amendments which include the Prospectus and Statement of Additional Information as they relate to the series of the other registrants as well as their own Part C are being filed for Voyageur Insured Funds, Voyageur Intermediate Funds, Voyageur Mutual Funds, Voyageur Mutual Funds II and Delaware Group State Tax-Free Income Trust. |

Fixed income mutual funds

Nasdaq ticker symbols | |||

| Class A | Class C | Institutional Class |

Delaware Tax-Free Arizona Fund | VAZIX | DVACX | DAZIX |

Delaware Tax-Free California Fund | DVTAX | DVFTX | DCTIX |

Delaware Tax-Free Colorado Fund | VCTFX | DVCTX | DCOIX |

Delaware Tax-Free Idaho Fund | VIDAX | DVICX | DTIDX |

Delaware Tax-Free New York Fund | FTNYX | DVFNX | DTNIX |

Delaware Tax-Free Pennsylvania Fund | DELIX | DPTCX | DTPIX |

Delaware Tax-Free Minnesota Fund | |||

Delaware Tax-Free Minnesota Intermediate Fund | DXCCX | DVSCX | DMIIX |

Delaware Minnesota High-Yield Municipal Bond Fund | DVMHX | DVMMX | DMHIX |

The US Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus.

Any representation to the contrary is a criminal offense.

Get shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Table of contents

Fund summaries | 1 |

Delaware Tax-Free Arizona Fund | 1 |

Delaware Tax-Free California Fund | 5 |

Delaware Tax-Free Colorado Fund | 9 |

Delaware Tax-Free Idaho Fund | 13 |

Delaware Tax-Free New York Fund | 17 |

Delaware Tax-Free Pennsylvania Fund | 21 |

Delaware Tax-Free Minnesota Fund | 25 |

Delaware Tax-Free Minnesota Intermediate Fund | 29 |

Delaware Minnesota High-Yield Municipal Bond Fund | 33 |

How we manage the Funds | 37 |

Our principal investment strategies | 37 |

The securities in which the Funds typically invest | 37 |

Other investment strategies | 41 |

The risks of investing in the Funds | 41 |

Disclosure of portfolio holdings information | 45 |

Who manages the Funds | 46 |

Investment manager | 46 |

Portfolio managers | 46 |

Manager of managers structure | 47 |

Who’s who | 47 |

About your account | 49 |

Investing in the Funds | 49 |

Choosing a share class | 49 |

Dealer compensation | 51 |

Payments to intermediaries | 52 |

How to reduce your sales charge | 53 |

Buying Class A shares at net asset value | 53 |

Waivers of contingent deferred sales charges | 54 |

How to buy shares | 54 |

Calculating share price | 55 |

Fair valuation | 56 |

Document delivery | 56 |

Inactive accounts | 56 |

How to redeem shares | 56 |

Low balance accounts | 58 |

Investor services | 58 |

Frequent trading of Fund shares (market timing and disruptive trading) | 59 |

Dividends, distributions, and taxes | 61 |

Financial highlights | 65 |

Additional information | 101 |

Fund summaries

Delaware Tax-Free Arizona Fund, a series of Voyageur Insured Funds

What is the Fund’s investment objective?

Delaware Tax-Free Arizona Fund seeks as high a level of current income exempt from federal income tax and from the Arizona state personal income tax as is consistent with preservation of capital.

What are the Fund’s fees and expenses?

The table below describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales-charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Delaware Funds by Macquarie®. More information about these and other discounts is available from your financial intermediary, in the Fund’s Prospectus under the section entitled “About your account,” and in the Fund’s statement of additional information (SAI) under the section entitled “Purchasing Shares.”

Shareholder fees (fees paid directly from your investment)

Class | A | C | Inst. |

Maximum sales charge (load) imposed on purchases as a percentage of offering price | 4.50% | none | none |

Maximum contingent deferred sales charge (load) as a percentage of original purchase price or redemption price, whichever is lower | none (1) | 1.00% (1) | none |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

Class | A | C | Inst. | |

Management fees | 0.50% | 0.50% | 0.50% | |

Distribution and service (12b-1) fees | 0.25% | 1.00% | none | |

Other expenses | 0.35% | 0.35% | 0.35% | |

Total annual fund operating expenses | 1.10% | 1.85% | 0.85% | |

Fee waivers and expense reimbursements | (0.26%)(2) | (0.26%)(2) | (0.26%)(2) | |

Total annual fund operating expenses after fee waivers and expense reimbursements | 0.84% | 1.59% | 0.59% | |

1 | For Class A shares, a 1% contingent deferred sales charge (CDSC) is only imposed on certain Class A shares that are purchased at net asset value (NAV) for $250,000 or more that are subsequently redeemed within 18 months of purchase. For Class C shares, a 1% CDSC applies to redemptions within 12 months of purchase. | |||

2 | The Fund’s investment manager, Delaware Management Company (Manager), has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, inverse floater program expenses, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) in order to prevent total annual fund operating expenses from exceeding 0.59% of the Fund’s average daily net assets from December 29, 2023 through December 30, 2024. These waivers and reimbursements may only be terminated by agreement of the Manager and the Fund. | |||

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. In addition, the example shows expenses for Class C shares, assuming those shares were not redeemed at the end of those periods. The example also assumes that your investment has a 5% return each year and reflects the Manager’s expense waivers and reimbursements for the 1-year contractual period and the total operating expenses without waivers for years 2 through 10. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Class | A | (if not | C | Inst. |

1 year | $532 | $162 | $262 | $60 |

3 years | $759 | $556 | $556 | $245 |

5 years | $1,005 | $977 | $977 | $446 |

10 years | $1,708 | $2,148 | $2,148 | $1,025 |

1

Fund summaries

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 22% of the average value of its portfolio.

What are the Fund’s principal investment strategies?

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in municipal securities the income from which is exempt from federal income tax, including the federal alternative minimum tax, and from Arizona state personal income taxes. This is a fundamental investment policy that may not be changed without prior shareholder approval.

Municipal debt obligations are issued by state and local governments to raise funds for various public purposes such as hospitals, schools, and general capital expenses. Municipal debt obligations in which the Fund may invest may also include securities issued by US territories and possessions (such as the Commonwealth of Puerto Rico, Guam, and the US Virgin Islands) to the extent that these securities are also exempt from federal income tax and Arizona state personal income taxes. The Fund may invest up to 20% of its net assets in high yield (junk) bonds. The Fund will invest its assets in securities with maturities of various lengths, depending on market conditions. The Manager will adjust the average maturity of the bonds in the portfolio to attempt to provide a high level of tax-exempt income consistent with preservation of capital. The Fund’s income level will vary depending on current interest rates and the specific securities in the portfolio. The Fund may concentrate its investments in certain types of bonds or in a certain segment of the municipal bond market when the supply of bonds in other sectors does not suit its investment needs. The Fund may invest in insured municipal bonds. The Fund will generally have a dollar-weighted average effective maturity of between 5 and 30 years. The types of municipal debt obligations in which the Fund may invest include, but are not limited to, advance refunded bonds, revenue bonds, general obligation bonds, insured municipal bonds, private activity bonds, municipal leases, and certificates of participation.

What are the principal risks of investing in the Fund?

Investing in any mutual fund involves the risk that you may lose part or all of the money you invest. Over time, the value of your investment in the Fund will increase and decrease according to changes in the value of the securities in the Fund’s portfolio. An investment in the Fund may not be appropriate for all investors. The Fund’s principal risks include:

Market risk — The risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Interest rate risk — The risk that the prices of bonds and other fixed income securities will increase as interest rates fall and decrease as interest rates rise. Interest rate changes are influenced by a number of factors, such as government policy, monetary policy, inflation expectations, and the supply and demand of bonds. Bonds and other fixed income securities with longer maturities or duration generally are more sensitive to interest rate changes. A fund may be subject to a greater risk of rising interest rates when interest rates are low or inflation rates are high or rising.

Credit risk — The risk that an issuer of a debt security, including a governmental issuer or an entity that insures a bond, may be unable to make interest payments and/or repay principal in a timely manner.

High yield (junk bond) risk — The risk that high yield securities, commonly known as “junk bonds,” are subject to reduced creditworthiness of issuers, increased risk of default, and a more limited and less liquid secondary market. High yield securities may also be subject to greater price volatility and risk of loss of income and principal than are higher-rated securities. High yield bonds are sometimes issued by municipalities that have less financial strength and therefore have less ability to make projected debt payments on the bonds.

Call risk — The risk that a bond issuer will prepay the bond during periods of low interest rates, forcing a fund to reinvest that money at interest rates that might be lower than rates on the called bond.

Liquidity risk — The possibility that investments cannot be readily sold within seven calendar days at approximately the price at which a fund has valued them.

Geographic concentration risk — The risk that heightened sensitivity to regional, state, US territories or possessions (such as the Commonwealth of Puerto Rico, Guam, or the US Virgin Islands), and local political and economic conditions could adversely affect the holdings in and performance of a fund. There is also the risk that there could be an inadequate supply of municipal bonds in a particular state or US territory or possession.

2

Alternative minimum tax risk — If a fund invests in bonds whose income is subject to the alternative minimum tax, that portion of the fund’s distributions would be taxable for shareholders who are subject to this tax.

Government and regulatory risk — The risk that governments or regulatory authorities may take actions that could adversely affect various sectors of the securities markets and affect fund performance. For example, a tax-exempt security may be reclassified by the Internal Revenue Service or a state tax authority as taxable, and/or future legislative, administrative, or court actions could cause interest from a tax-exempt security to become taxable, possibly retroactively.

Industry and sector risk — The risk that the value of securities in a particular industry or sector (such as financial services or manufacturing) will decline because of changing expectations for the performance of that industry or sector.

IBOR risk — The risk that changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference LIBOR or a similar rate. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

Active management and selection risk — The risk that the securities selected by a fund’s management will underperform the markets, the relevant indices, or the securities selected by other funds with similar investment objectives and investment strategies. The securities and sectors selected may vary from the securities and sectors included in the relevant index.

None of the entities noted in this document is an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia) and the obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (Macquarie Bank). Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these entities. In addition, if this document relates to an investment (a) each investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group company guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

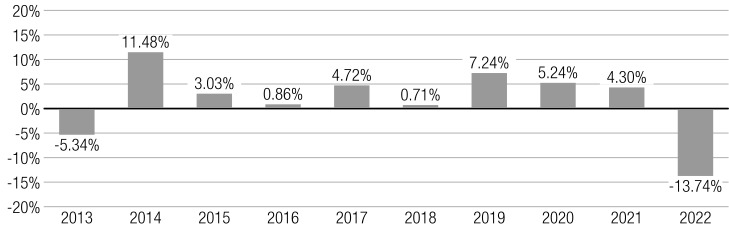

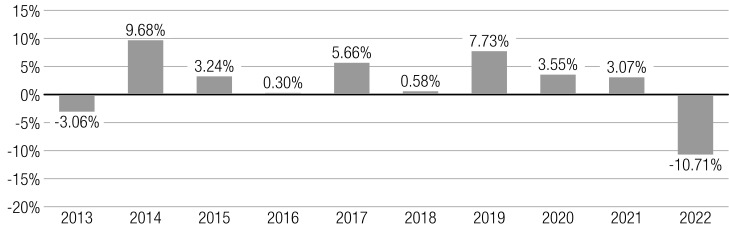

How has Delaware Tax-Free Arizona Fund performed?

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for the 1-, 5-, and 10-year or lifetime periods compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how it will perform in the future. The returns reflect any expense caps in effect during these periods. The returns would be lower without the expense caps. You may obtain the Fund’s most recently available month-end performance by calling 800 523-1918 or by visiting our website at delawarefunds.com/performance.

Calendar year-by-year total return (Class A)

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Year Total Return | -5.34% | 11.48% | 3.03% | 0.86% | 4.72% | 0.71% | 7.24% | 5.24% | 4.30% | -13.74% |

As of September 30, 2023, the Fund’s Class A shares had a calendar year-to-date return of -4.58%. During the periods illustrated in this bar chart, Class A’s highest quarterly return was 3.96% for the quarter ended March 31, 2014, and its lowest quarterly return was -6.13% for the quarter ended March 31, 2022. The maximum Class A sales charge of 4.50%, which is normally deducted when you purchase shares, is not reflected in the highest/lowest quarterly returns or in the bar chart. If this fee were included, the returns would be less than those shown. The average annual total returns in the table below do include the sales charge.

3

Fund summaries

Average annual total returns for periods ended December 31, 2022

| 1 year | 5 years | 10 years |

Class A return before taxes | -17.59% | -0.48% | 1.15% |

Class A return after taxes on distributions | -17.60% | -0.51% | 1.13% |

Class A return after taxes on distributions and sale of Fund shares | -9.37% | 0.36% | 1.62% |

Class C return before taxes | -15.18% | -0.30% | 0.86% |

Institutional Class return before taxes (lifetime: 12/31/13–12/31/22) | -13.52% | 0.70% | 2.70% |

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes) | -8.53% | 1.25% | 2.13% |

After-tax performance is presented only for Class A shares of the Fund. The after-tax returns for other Fund classes may vary. Actual after-tax returns depend on the investor’s individual tax situation and may differ from the returns shown. After-tax returns are not relevant for shares held in tax-advantaged investment vehicles such as employer-sponsored 401(k) plans and individual retirement accounts (IRAs). The after-tax returns shown are calculated using the highest individual federal marginal income tax rates in effect during the periods presented and do not reflect the impact of state and local taxes.

Who manages the Fund?

Investment manager

Delaware Management Company, a series of Macquarie Investment Management Business Trust (a Delaware statutory trust)

Portfolio managers | Title with Delaware Management Company | Start date on the Fund |

Gregory A. Gizzi | Managing Director, Head of US Fixed Income and Head of Municipal Bonds | December 2012 |

Stephen J. Czepiel | Managing Director, Senior Portfolio Manager | July 2007 |

William Roach | Vice President, Portfolio Manager | May 2023 |

Purchase and redemption of Fund shares

You may purchase or redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (Business Day). Shares may be purchased or redeemed: through your financial intermediary; through the Fund’s website at delawarefunds.com/account-access; by calling 800 523-1918; by regular mail (c/o Delaware Funds by Macquarie®, P.O. Box 534437, Pittsburgh, PA 15253-4437); by overnight courier service (c/o Delaware Funds by Macquarie Service Center, Attention: 534437, 500 Ross Street, 154-0520, Pittsburgh, PA 15262); or by wire.

For Class A and Class C shares, the minimum initial investment is generally $1,000 and subsequent investments can be made for as little as $100. For Institutional Class shares (except those shares purchased through an automatic investment plan), there is no minimum initial purchase requirement, but certain eligibility requirements must be met. The eligibility requirements are described in this Prospectus under “Choosing a share class” and on the Fund’s website. We may reduce or waive the minimums or eligibility requirements in certain cases.

Tax information

The Fund’s distributions primarily are exempt from regular federal income taxes and state personal income taxes for residents of Arizona. A portion of these distributions, however, may be subject to the federal alternative minimum tax for noncorporate shareholders and state and local taxes. The Fund may also make distributions that are taxable to you as ordinary income or capital gains.

Payments to broker/dealers and other financial intermediaries

If you purchase shares of the Fund through a broker/dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

4

Delaware Tax-Free California Fund, a series of Voyageur Mutual Funds

What is the Fund’s investment objective?

Delaware Tax-Free California Fund seeks as high a level of current income exempt from federal income tax and from the California state personal income tax as is consistent with preservation of capital.

What are the Fund’s fees and expenses?

The table below describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales-charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Delaware Funds by Macquarie®. More information about these and other discounts is available from your financial intermediary, in the Fund’s Prospectus under the section entitled “About your account,” and in the Fund’s statement of additional information (SAI) under the section entitled “Purchasing Shares.”

Shareholder fees (fees paid directly from your investment)

Class | A | C | Inst. |

Maximum sales charge (load) imposed on purchases as a percentage of offering price | 4.50% | none | none |

Maximum contingent deferred sales charge (load) as a percentage of original purchase price or redemption price, whichever is lower | none (1) | 1.00% (1) | none |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

Class | A | C | Inst. | |

Management fees | 0.55% | 0.55% | 0.55% | |

Distribution and service (12b-1) fees | 0.25% | 1.00% | none | |

Other expenses | 0.20% | 0.20% | 0.20% | |

Total annual fund operating expenses | 1.00% | 1.75% | 0.75% | |

Fee waivers and expense reimbursements | (0.20%)(2) | (0.20%)(2) | (0.20%)(2) | |

Total annual fund operating expenses after fee waivers and expense reimbursements | 0.80% | 1.55% | 0.55% | |

1 | For Class A shares, a 1% contingent deferred sales charge (CDSC) is only imposed on certain Class A shares that are purchased at net asset value (NAV) for $250,000 or more that are subsequently redeemed within 18 months of purchase. For Class C shares, a 1% CDSC applies to redemptions within 12 months of purchase. | |||

2 | The Fund’s investment manager, Delaware Management Company (Manager), has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, inverse floater program expenses, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) in order to prevent total annual fund operating expenses from exceeding 0.55% of the Fund’s average daily net assets from December 29, 2023 through December 30, 2024. These waivers and reimbursements may only be terminated by agreement of the Manager and the Fund. | |||

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. In addition, the example shows expenses for Class C shares, assuming those shares were not redeemed at the end of those periods. The example also assumes that your investment has a 5% return each year and reflects the Manager’s expense waivers and reimbursements for the 1-year contractual period and the total operating expenses without waivers for years 2 through 10. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Class | A | (if not | C | Inst. |

1 year | $528 | $158 | $258 | $56 |

3 years | $735 | $532 | $532 | $220 |

5 years | $959 | $930 | $930 | $397 |

10 years | $1,602 | $2,046 | $2,046 | $912 |

5

Fund summaries

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 22% of the average value of its portfolio.

What are the Fund’s principal investment strategies?

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in municipal securities the income from which is exempt from federal income tax, including the federal alternative minimum tax, and from California state personal income taxes. This is a fundamental investment policy that may not be changed without prior shareholder approval.

Municipal debt obligations are issued by state and local governments to raise funds for various public purposes such as hospitals, schools, and general capital expenses. Municipal debt obligations in which the Fund may invest may also include securities issued by US territories and possessions (such as the Commonwealth of Puerto Rico, Guam, and the US Virgin Islands) to the extent that these securities are also exempt from federal income tax and California state personal income taxes. The types of municipal debt obligations in which the Fund may invest include, but are not limited to, advance refunded bonds, revenue bonds, general obligation bonds, insured municipal bonds, private activity bonds, municipal leases, and certificates of participation. The Fund may invest up to 20% of its net assets in high yield (junk) bonds. The Fund will invest its assets in securities with maturities of various lengths, depending on market conditions. The Manager will adjust the average maturity of the bonds in the portfolio to attempt to provide a high level of tax-exempt income consistent with preservation of capital. The Fund’s income level will vary depending on current interest rates and the specific securities in the portfolio. The Fund may concentrate its investments in certain types of bonds or in a certain segment of the municipal bond market when the supply of bonds in other sectors does not suit its investment needs. The Fund may invest in insured municipal bonds. The Fund will generally have a dollar-weighted average effective maturity of between 5 and 30 years.

What are the principal risks of investing in the Fund?

Investing in any mutual fund involves the risk that you may lose part or all of the money you invest. Over time, the value of your investment in the Fund will increase and decrease according to changes in the value of the securities in the Fund’s portfolio. An investment in the Fund may not be appropriate for all investors. The Fund’s principal risks include:

Market risk — The risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Interest rate risk — The risk that the prices of bonds and other fixed income securities will increase as interest rates fall and decrease as interest rates rise. Interest rate changes are influenced by a number of factors, such as government policy, monetary policy, inflation expectations, and the supply and demand of bonds. Bonds and other fixed income securities with longer maturities or duration generally are more sensitive to interest rate changes. A fund may be subject to a greater risk of rising interest rates when interest rates are low or inflation rates are high or rising.

Credit risk — The risk that an issuer of a debt security, including a governmental issuer or an entity that insures a bond, may be unable to make interest payments and/or repay principal in a timely manner.

High yield (junk bond) risk — The risk that high yield securities, commonly known as “junk bonds,” are subject to reduced creditworthiness of issuers, increased risk of default, and a more limited and less liquid secondary market. High yield securities may also be subject to greater price volatility and risk of loss of income and principal than are higher-rated securities. High yield bonds are sometimes issued by municipalities that have less financial strength and therefore have less ability to make projected debt payments on the bonds.

Call risk — The risk that a bond issuer will prepay the bond during periods of low interest rates, forcing a fund to reinvest that money at interest rates that might be lower than rates on the called bond.

Liquidity risk — The possibility that investments cannot be readily sold within seven calendar days at approximately the price at which a fund has valued them.

Geographic concentration risk — The risk that heightened sensitivity to regional, state, US territories or possessions (such as the Commonwealth of Puerto Rico, Guam, or the US Virgin Islands), and local political and economic conditions could adversely affect the holdings in and performance of a fund. There is also the risk that there could be an inadequate supply of municipal bonds in a particular state or US territory or possession.

6

Alternative minimum tax risk — If a fund invests in bonds whose income is subject to the alternative minimum tax, that portion of the fund’s distributions would be taxable for shareholders who are subject to this tax.

Government and regulatory risk — The risk that governments or regulatory authorities may take actions that could adversely affect various sectors of the securities markets and affect fund performance. For example, a tax-exempt security may be reclassified by the Internal Revenue Service or a state tax authority as taxable, and/or future legislative, administrative, or court actions could cause interest from a tax-exempt security to become taxable, possibly retroactively.

Industry and sector risk — The risk that the value of securities in a particular industry or sector (such as financial services or manufacturing) will decline because of changing expectations for the performance of that industry or sector.

IBOR risk — The risk that changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference LIBOR or a similar rate. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

Active management and selection risk — The risk that the securities selected by a fund’s management will underperform the markets, the relevant indices, or the securities selected by other funds with similar investment objectives and investment strategies. The securities and sectors selected may vary from the securities and sectors included in the relevant index.

None of the entities noted in this document is an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia) and the obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (Macquarie Bank). Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these entities. In addition, if this document relates to an investment (a) each investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group company guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

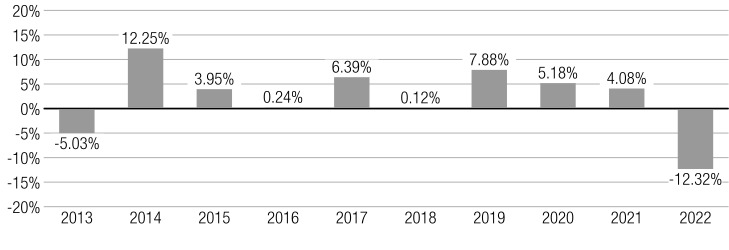

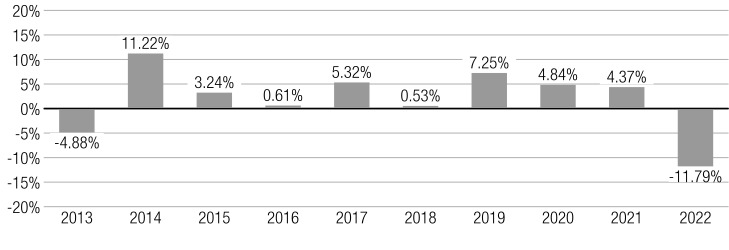

How has Delaware Tax-Free California Fund performed?

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for the 1-, 5-, and 10-year or lifetime periods compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how it will perform in the future. The returns reflect any expense caps in effect during these periods. The returns would be lower without the expense caps. You may obtain the Fund’s most recently available month-end performance by calling 800 523-1918 or by visiting our website at delawarefunds.com/performance.

Calendar year-by-year total return (Class A)

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Year Total Return | -5.03% | 12.25% | 3.95% | 0.24% | 6.39% | 0.12% | 7.88% | 5.18% | 4.08% | -12.32% |

As of September 30, 2023, the Fund’s Class A shares had a calendar year-to-date return of -1.59%. During the periods illustrated in this bar chart, Class A’s highest quarterly return was 4.92% for the quarter ended December 31, 2022, and its lowest quarterly return was -6.36% for the quarter ended March 31, 2022. The maximum Class A sales charge of 4.50%, which is normally deducted when you purchase shares, is not reflected in the highest/lowest quarterly returns or in the bar chart. If this fee were included, the returns would be less than those shown. The average annual total returns in the table below do include the sales charge.

7

Fund summaries

Average annual total returns for periods ended December 31, 2022

| 1 year | 5 years | 10 years |

Class A return before taxes | -16.25% | -0.21% | 1.58% |

Class A return after taxes on distributions | -16.25% | -0.28% | 1.55% |

Class A return after taxes on distributions and sale of Fund shares | -8.50% | 0.59% | 1.98% |

Class C return before taxes | -13.88% | -0.03% | 1.29% |

Institutional Class return before taxes (lifetime: 12/31/13–12/31/22) | -12.17% | 0.97% | 3.14% |

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes) | -8.53% | 1.25% | 2.13% |

After-tax performance is presented only for Class A shares of the Fund. The after-tax returns for other Fund classes may vary. Actual after-tax returns depend on the investor’s individual tax situation and may differ from the returns shown. After-tax returns are not relevant for shares held in tax-advantaged investment vehicles such as employer-sponsored 401(k) plans and individual retirement accounts (IRAs). The after-tax returns shown are calculated using the highest individual federal marginal income tax rates in effect during the periods presented and do not reflect the impact of state and local taxes.

Who manages the Fund?

Investment manager

Delaware Management Company, a series of Macquarie Investment Management Business Trust (a Delaware statutory trust)

Portfolio managers | Title with Delaware Management Company | Start date on the Fund |

Gregory A. Gizzi | Managing Director, Head of US Fixed Income and Head of Municipal Bonds | December 2012 |

Stephen J. Czepiel | Managing Director, Senior Portfolio Manager | July 2007 |

William Roach | Vice President, Portfolio Manager | May 2023 |

Purchase and redemption of Fund shares

You may purchase or redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (Business Day). Shares may be purchased or redeemed: through your financial intermediary; through the Fund’s website at delawarefunds.com/account-access; by calling 800 523-1918; by regular mail (c/o Delaware Funds by Macquarie®, P.O. Box 534437, Pittsburgh, PA 15253-4437); by overnight courier service (c/o Delaware Funds by Macquarie Service Center, Attention: 534437, 500 Ross Street, 154-0520, Pittsburgh, PA 15262); or by wire.

For Class A and Class C shares, the minimum initial investment is generally $1,000 and subsequent investments can be made for as little as $100. For Institutional Class shares (except those shares purchased through an automatic investment plan), there is no minimum initial purchase requirement, but certain eligibility requirements must be met. The eligibility requirements are described in this Prospectus under “Choosing a share class” and on the Fund’s website. We may reduce or waive the minimums or eligibility requirements in certain cases.

Tax information

The Fund’s distributions primarily are exempt from regular federal income taxes and state personal income taxes for residents of California. A portion of these distributions, however, may be subject to the federal alternative minimum tax for noncorporate shareholders and state and local taxes. The Fund may also make distributions that are taxable to you as ordinary income or capital gains.

Payments to broker/dealers and other financial intermediaries

If you purchase shares of the Fund through a broker/dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

8

Delaware Tax-Free Colorado Fund, a series of Voyageur Mutual Funds II

What is the Fund’s investment objective?

Delaware Tax-Free Colorado Fund seeks as high a level of current income exempt from federal income tax and from the personal income tax in Colorado as is consistent with preservation of capital.

What are the Fund’s fees and expenses?

The table below describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales-charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Delaware Funds by Macquarie®. More information about these and other discounts is available from your financial intermediary, in the Fund’s Prospectus under the section entitled “About your account,” and in the Fund’s statement of additional information (SAI) under the section entitled “Purchasing Shares.”

Shareholder fees (fees paid directly from your investment)

Class | A | C | Inst. |

Maximum sales charge (load) imposed on purchases as a percentage of offering price | 4.50% | none | none |

Maximum contingent deferred sales charge (load) as a percentage of original purchase price or redemption price, whichever is lower | none (1) | 1.00% (1) | none |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

Class | A | C | Inst. | |

Management fees | 0.55% | 0.55% | 0.55% | |

Distribution and service (12b-1) fees | 0.25% | 1.00% | none | |

Other expenses | 0.18% | 0.18% | 0.18% | |

Total annual fund operating expenses | 0.98% | 1.73% | 0.73% | |

Fee waivers and expense reimbursements | (0.16%)(2) | (0.16%)(2) | (0.16%)(2) | |

Total annual fund operating expenses after fee waivers and expense reimbursements | 0.82% | 1.57% | 0.57% | |

1 | For Class A shares, a 1% contingent deferred sales charge (CDSC) is only imposed on certain Class A shares that are purchased at net asset value (NAV) for $250,000 or more that are subsequently redeemed within 18 months of purchase. For Class C shares, a 1% CDSC applies to redemptions within 12 months of purchase. | |||

2 | The Fund’s investment manager, Delaware Management Company (Manager), has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, inverse floater program expenses, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) in order to prevent total annual fund operating expenses from exceeding 0.57% of the Fund’s average daily net assets from December 29, 2023 through December 30, 2024. These waivers and reimbursements may only be terminated by agreement of the Manager and the Fund. | |||

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. In addition, the example shows expenses for Class C shares, assuming those shares were not redeemed at the end of those periods. The example also assumes that your investment has a 5% return each year and reflects the Manager’s expense waivers and reimbursements for the 1-year contractual period and the total operating expenses without waivers for years 2 through 10. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Class | A | (if not | C | Inst. |

1 year | $530 | $160 | $260 | $58 |

3 years | $733 | $529 | $529 | $217 |

5 years | $952 | $924 | $924 | $390 |

10 years | $1,583 | $2,028 | $2,028 | $891 |

9

Fund summaries

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 34% of the average value of its portfolio.

What are the Fund’s principal investment strategies?

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in municipal securities the income from which is exempt from federal income tax, including the federal alternative minimum tax, and from Colorado state personal income taxes. This is a fundamental investment policy that may not be changed without prior shareholder approval.

Municipal debt obligations are issued by state and local governments to raise funds for various public purposes such as hospitals, schools, and general capital expenses. Municipal debt obligations in which the Fund may invest may also include securities issued by US territories and possessions (such as the Commonwealth of Puerto Rico, Guam, and the US Virgin Islands) to the extent that these securities are also exempt from federal income tax and Colorado state personal income taxes. The types of municipal debt obligations in which the Fund may invest include, but are not limited to, advance refunded bonds, revenue bonds, general obligation bonds, insured municipal bonds, private activity bonds, municipal leases, and certificates of participation. The Fund may invest up to 20% of its net assets in high yield (junk) bonds. The Fund will invest its assets in securities with maturities of various lengths, depending on market conditions. The Manager will adjust the average maturity of the bonds in the portfolio to attempt to provide a high level of tax-exempt income consistent with preservation of capital. The Fund’s income level will vary depending on current interest rates and the specific securities in the portfolio. The Fund may concentrate its investments in certain types of bonds or in a certain segment of the municipal bond market when the supply of bonds in other sectors does not suit its investment needs. The Fund may invest in insured municipal bonds. The Fund will generally have a dollar-weighted average effective maturity of between 5 and 30 years.

What are the principal risks of investing in the Fund?

Investing in any mutual fund involves the risk that you may lose part or all of the money you invest. Over time, the value of your investment in the Fund will increase and decrease according to changes in the value of the securities in the Fund’s portfolio. An investment in the Fund may not be appropriate for all investors. The Fund’s principal risks include:

Market risk — The risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Interest rate risk — The risk that the prices of bonds and other fixed income securities will increase as interest rates fall and decrease as interest rates rise. Interest rate changes are influenced by a number of factors, such as government policy, monetary policy, inflation expectations, and the supply and demand of bonds. Bonds and other fixed income securities with longer maturities or duration generally are more sensitive to interest rate changes. A fund may be subject to a greater risk of rising interest rates when interest rates are low or inflation rates are high or rising.

Credit risk — The risk that an issuer of a debt security, including a governmental issuer or an entity that insures a bond, may be unable to make interest payments and/or repay principal in a timely manner.

High yield (junk bond) risk — The risk that high yield securities, commonly known as “junk bonds,” are subject to reduced creditworthiness of issuers, increased risk of default, and a more limited and less liquid secondary market. High yield securities may also be subject to greater price volatility and risk of loss of income and principal than are higher-rated securities. High yield bonds are sometimes issued by municipalities that have less financial strength and therefore have less ability to make projected debt payments on the bonds.

Call risk — The risk that a bond issuer will prepay the bond during periods of low interest rates, forcing a fund to reinvest that money at interest rates that might be lower than rates on the called bond.

Liquidity risk — The possibility that investments cannot be readily sold within seven calendar days at approximately the price at which a fund has valued them.

Geographic concentration risk — The risk that heightened sensitivity to regional, state, US territories or possessions (such as the Commonwealth of Puerto Rico, Guam, or the US Virgin Islands), and local political and economic conditions could adversely affect the holdings in and performance of a fund. There is also the risk that there could be an inadequate supply of municipal bonds in a particular state or US territory or possession.

10

Alternative minimum tax risk — If a fund invests in bonds whose income is subject to the alternative minimum tax, that portion of the fund’s distributions would be taxable for shareholders who are subject to this tax.

Government and regulatory risk — The risk that governments or regulatory authorities may take actions that could adversely affect various sectors of the securities markets and affect fund performance. For example, a tax-exempt security may be reclassified by the Internal Revenue Service or a state tax authority as taxable, and/or future legislative, administrative, or court actions could cause interest from a tax-exempt security to become taxable, possibly retroactively.

Industry and sector risk — The risk that the value of securities in a particular industry or sector (such as financial services or manufacturing) will decline because of changing expectations for the performance of that industry or sector.

IBOR risk — The risk that changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference LIBOR or a similar rate. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

Active management and selection risk — The risk that the securities selected by a fund’s management will underperform the markets, the relevant indices, or the securities selected by other funds with similar investment objectives and investment strategies. The securities and sectors selected may vary from the securities and sectors included in the relevant index.

None of the entities noted in this document is an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia) and the obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (Macquarie Bank). Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these entities. In addition, if this document relates to an investment (a) each investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group company guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

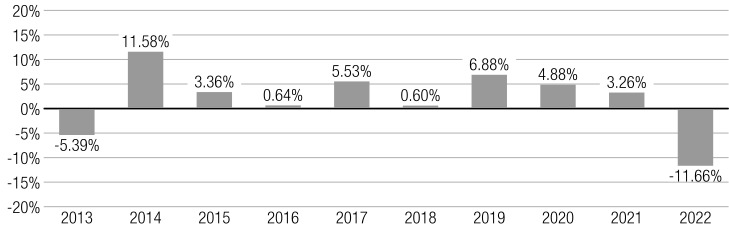

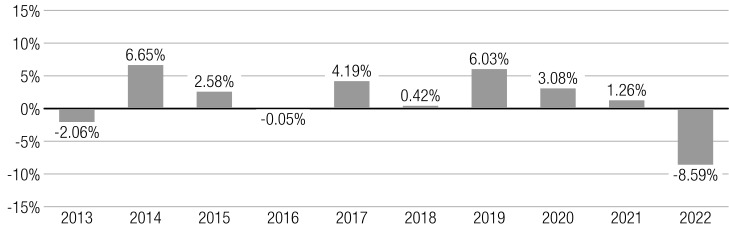

How has Delaware Tax-Free Colorado Fund performed?

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for the 1-, 5-, and 10-year or lifetime periods compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how it will perform in the future. The returns reflect any expense caps in effect during these periods. The returns would be lower without the expense caps. You may obtain the Fund’s most recently available month-end performance by calling 800 523-1918 or by visiting our website at delawarefunds.com/performance.

Calendar year-by-year total return (Class A)

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Year Total Return | -5.39% | 11.58% | 3.36% | 0.64% | 5.53% | 0.60% | 6.88% | 4.88% | 3.26% | -11.66% |

As of September 30, 2023, the Fund’s Class A shares had a calendar year-to-date return of -2.32%. During the periods illustrated in this bar chart, Class A’s highest quarterly return was 4.26% for the quarter ended March 31, 2014, and its lowest quarterly return was -5.49% for the quarter ended March 31, 2022. The maximum Class A sales charge of 4.50%, which is normally deducted when you purchase shares, is not reflected in the highest/lowest quarterly returns or in the bar chart. If this fee were included, the returns would be less than those shown. The average annual total returns in the table below do include the sales charge.

11

Fund summaries

Average annual total returns for periods ended December 31, 2022

| 1 year | 5 years | 10 years |

Class A return before taxes | -15.64% | -0.35% | 1.30% |

Class A return after taxes on distributions | -15.64% | -0.35% | 1.30% |

Class A return after taxes on distributions and sale of Fund shares | -8.18% | 0.45% | 1.75% |

Class C return before taxes | -13.23% | -0.20% | 1.01% |

Institutional Class return before taxes (lifetime: 12/31/13–12/31/22) | -11.44% | 0.82% | 2.88% |

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes) | -8.53% | 1.25% | 2.13% |

After-tax performance is presented only for Class A shares of the Fund. The after-tax returns for other Fund classes may vary. Actual after-tax returns depend on the investor’s individual tax situation and may differ from the returns shown. After-tax returns are not relevant for shares held in tax-advantaged investment vehicles such as employer-sponsored 401(k) plans and individual retirement accounts (IRAs). The after-tax returns shown are calculated using the highest individual federal marginal income tax rates in effect during the periods presented and do not reflect the impact of state and local taxes.

Who manages the Fund?

Investment manager

Delaware Management Company, a series of Macquarie Investment Management Business Trust (a Delaware statutory trust)

Portfolio managers | Title with Delaware Management Company | Start date on the Fund |

Gregory A. Gizzi | Managing Director, Head of US Fixed Income and Head of Municipal Bonds | December 2012 |

Stephen J. Czepiel | Managing Director, Senior Portfolio Manager | July 2007 |

William Roach | Vice President, Portfolio Manager | May 2023 |

Purchase and redemption of Fund shares

You may purchase or redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (Business Day). Shares may be purchased or redeemed: through your financial intermediary; through the Fund’s website at delawarefunds.com/account-access; by calling 800 523-1918; by regular mail (c/o Delaware Funds by Macquarie®, P.O. Box 534437, Pittsburgh, PA 15253-4437); by overnight courier service (c/o Delaware Funds by Macquarie Service Center, Attention: 534437, 500 Ross Street, 154-0520, Pittsburgh, PA 15262); or by wire.

For Class A and Class C shares, the minimum initial investment is generally $1,000 and subsequent investments can be made for as little as $100. For Institutional Class shares (except those shares purchased through an automatic investment plan), there is no minimum initial purchase requirement, but certain eligibility requirements must be met. The eligibility requirements are described in this Prospectus under “Choosing a share class” and on the Fund’s website. We may reduce or waive the minimums or eligibility requirements in certain cases.

Tax information

The Fund’s distributions primarily are exempt from regular federal income taxes and state personal income taxes for residents of Colorado. A portion of these distributions, however, may be subject to the federal alternative minimum tax for noncorporate shareholders and state and local taxes. The Fund may also make distributions that are taxable to you as ordinary income or capital gains.

Payments to broker/dealers and other financial intermediaries

If you purchase shares of the Fund through a broker/dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker/dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

12

Delaware Tax-Free Idaho Fund, a series of Voyageur Mutual Funds

What is the Fund’s investment objective?

Delaware Tax-Free Idaho Fund seeks as high a level of current income exempt from federal income tax and from Idaho personal income taxes as is consistent with preservation of capital.

What are the Fund’s fees and expenses?

The table below describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales-charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Delaware Funds by Macquarie®. More information about these and other discounts is available from your financial intermediary, in the Fund’s Prospectus under the section entitled “About your account,” and in the Fund’s statement of additional information (SAI) under the section entitled “Purchasing Shares.”

Shareholder fees (fees paid directly from your investment)

Class | A | C | Inst. |

Maximum sales charge (load) imposed on purchases as a percentage of offering price | 4.50% | none | none |

Maximum contingent deferred sales charge (load) as a percentage of original purchase price or redemption price, whichever is lower | none (1) | 1.00% (1) | none |

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment)

Class | A | C | Inst. | |

Management fees | 0.55% | 0.55% | 0.55% | |

Distribution and service (12b-1) fees | 0.25% | 1.00% | none | |

Other expenses | 0.23% | 0.23% | 0.23% | |

Total annual fund operating expenses | 1.03% | 1.78% | 0.78% | |

Fee waivers and expense reimbursements | (0.17%)(2) | (0.17%)(2) | (0.17%)(2) | |

Total annual fund operating expenses after fee waivers and expense reimbursements | 0.86% | 1.61% | 0.61% | |

1 | For Class A shares, a 1% contingent deferred sales charge (CDSC) is only imposed on certain Class A shares that are purchased at net asset value (NAV) for $250,000 or more that are subsequently redeemed within 18 months of purchase. For Class C shares, a 1% CDSC applies to redemptions within 12 months of purchase | |||

2 | The Fund’s investment manager, Delaware Management Company (Manager), has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, inverse floater program expenses, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) in order to prevent total annual fund operating expenses from exceeding 0.61% of the Fund’s average daily net assets from December 29, 2023 through December 30, 2024. These waivers and reimbursements may only be terminated by agreement of the Manager and the Fund. | |||

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. In addition, the example shows expenses for Class C shares, assuming those shares were not redeemed at the end of those periods. The example also assumes that your investment has a 5% return each year and reflects the Manager’s expense waivers and reimbursements for the 1-year contractual period and the total operating expenses without waivers for years 2 through 10. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Class | A | (if not | C | Inst. |

1 year | $534 | $164 | $264 | $62 |

3 years | $747 | $544 | $544 | $232 |

5 years | $977 | $949 | $949 | $417 |

10 years | $1,638 | $2,081 | $2,081 | $950 |

13

Fund summaries

Portfolio turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 25% of the average value of its portfolio.

What are the Fund’s principal investment strategies?

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in municipal securities the income from which is exempt from federal income tax, including the federal alternative minimum tax, and from Idaho state personal income taxes. This is a fundamental investment policy that may not be changed without prior shareholder approval.

Municipal debt obligations are issued by state and local governments to raise funds for various public purposes such as hospitals, schools, and general capital expenses. Municipal debt obligations in which the Fund may invest may also include securities issued by US territories and possessions (such as the Commonwealth of Puerto Rico, Guam, and the US Virgin Islands) to the extent that these securities are also exempt from federal income tax and Idaho state personal income taxes. The types of municipal debt obligations in which the Fund may invest include, but are not limited to, advance refunded bonds, revenue bonds, general obligation bonds, insured municipal bonds, private activity bonds, municipal leases, and certificates of participation. The Fund may invest up to 20% of its net assets in high yield (junk) bonds. The Fund will invest its assets in securities with maturities of various lengths, depending on market conditions. The Manager will adjust the average maturity of the bonds in the portfolio to attempt to provide a high level of tax-exempt income consistent with preservation of capital. The Fund’s income level will vary depending on current interest rates and the specific securities in the portfolio. The Fund may concentrate its investments in certain types of bonds or in a certain segment of the municipal bond market when the supply of bonds in other sectors does not suit its investment needs. The Fund may invest in insured municipal bonds. The Fund will generally have a dollar-weighted average effective maturity of between 5 and 30 years.

What are the principal risks of investing in the Fund?

Investing in any mutual fund involves the risk that you may lose part or all of the money you invest. Over time, the value of your investment in the Fund will increase and decrease according to changes in the value of the securities in the Fund’s portfolio. An investment in the Fund may not be appropriate for all investors. The Fund’s principal risks include:

Market risk — The risk that all or a majority of the securities in a certain market — such as the stock or bond market — will decline in value because of factors such as adverse political or economic conditions, future expectations, investor confidence, or heavy institutional selling.

Interest rate risk — The risk that the prices of bonds and other fixed income securities will increase as interest rates fall and decrease as interest rates rise. Interest rate changes are influenced by a number of factors, such as government policy, monetary policy, inflation expectations, and the supply and demand of bonds. Bonds and other fixed income securities with longer maturities or duration generally are more sensitive to interest rate changes. A fund may be subject to a greater risk of rising interest rates when interest rates are low or inflation rates are high or rising.

Credit risk — The risk that an issuer of a debt security, including a governmental issuer or an entity that insures a bond, may be unable to make interest payments and/or repay principal in a timely manner.

High yield (junk bond) risk — The risk that high yield securities, commonly known as “junk bonds,” are subject to reduced creditworthiness of issuers, increased risk of default, and a more limited and less liquid secondary market. High yield securities may also be subject to greater price volatility and risk of loss of income and principal than are higher-rated securities. High yield bonds are sometimes issued by municipalities that have less financial strength and therefore have less ability to make projected debt payments on the bonds.

Call risk — The risk that a bond issuer will prepay the bond during periods of low interest rates, forcing a fund to reinvest that money at interest rates that might be lower than rates on the called bond.

Liquidity risk — The possibility that investments cannot be readily sold within seven calendar days at approximately the price at which a fund has valued them.

Geographic concentration risk — The risk that heightened sensitivity to regional, state, US territories or possessions (such as the Commonwealth of Puerto Rico, Guam, or the US Virgin Islands), and local political and economic conditions could adversely affect the holdings in and performance of a fund. There is also the risk that there could be an inadequate supply of municipal bonds in a particular state or US territory or possession.

14

Alternative minimum tax risk — If a fund invests in bonds whose income is subject to the alternative minimum tax, that portion of the fund’s distributions would be taxable for shareholders who are subject to this tax.

Government and regulatory risk — The risk that governments or regulatory authorities may take actions that could adversely affect various sectors of the securities markets and affect fund performance. For example, a tax-exempt security may be reclassified by the Internal Revenue Service or a state tax authority as taxable, and/or future legislative, administrative, or court actions could cause interest from a tax-exempt security to become taxable, possibly retroactively.

Industry and sector risk — The risk that the value of securities in a particular industry or sector (such as financial services or manufacturing) will decline because of changing expectations for the performance of that industry or sector.

IBOR risk — The risk that changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference LIBOR or a similar rate. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

Active management and selection risk — The risk that the securities selected by a fund’s management will underperform the markets, the relevant indices, or the securities selected by other funds with similar investment objectives and investment strategies. The securities and sectors selected may vary from the securities and sectors included in the relevant index.

None of the entities noted in this document is an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia) and the obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (Macquarie Bank). Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these entities. In addition, if this document relates to an investment (a) each investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group company guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

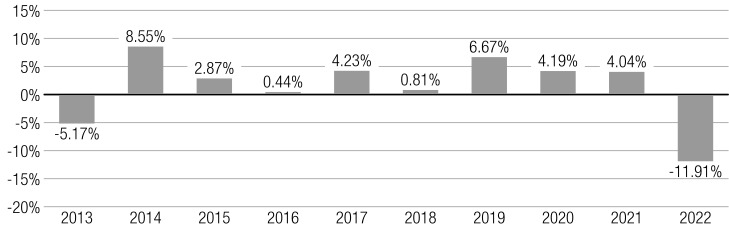

How has Delaware Tax-Free Idaho Fund performed?

The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual total returns for the 1-, 5-, and 10-year or lifetime periods compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how it will perform in the future. The returns reflect any expense caps in effect during these periods. The returns would be lower without the expense caps. You may obtain the Fund’s most recently available month-end performance by calling 800 523-1918 or by visiting our website at delawarefunds.com/performance.

Calendar year-by-year total return (Class A)

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Year Total Return | -5.17% | 8.55% | 2.87% | 0.44% | 4.23% | 0.81% | 6.67% | 4.19% | 4.04% | -11.91% |

As of September 30, 2023, the Fund’s Class A shares had a calendar year-to-date return of -2.98%. During the periods illustrated in this bar chart, Class A’s highest quarterly return was 3.88% for the quarter ended December 31, 2022, and its lowest quarterly return was -5.72% for the quarter ended June 30, 2022. The maximum Class A sales charge of 4.50%, which is normally deducted when you purchase shares, is not reflected in the highest/lowest quarterly returns or in the bar chart. If this fee were included, the returns would be less than those shown. The average annual total returns in the table below do include the sales charge.

15

Fund summaries

Average annual total returns for periods ended December 31, 2022

| 1 year | 5 years | 10 years |

Class A return before taxes | -15.87% | -0.40% | 0.84% |

Class A return after taxes on distributions | -15.87% | -0.40% | 0.84% |

Class A return after taxes on distributions and sale of Fund shares | -8.36% | 0.39% | 1.33% |

Class C return before taxes | -13.36% | -0.21% | 0.55% |

Institutional Class return before taxes (lifetime: 12/31/13–12/31/22) | -11.77% | 0.78% | 2.33% |

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes) | -8.53% | 1.25% | 2.13% |

After-tax performance is presented only for Class A shares of the Fund. The after-tax returns for other Fund classes may vary. Actual after-tax returns depend on the investor’s individual tax situation and may differ from the returns shown. After-tax returns are not relevant for shares held in tax-advantaged investment vehicles such as employer-sponsored 401(k) plans and individual retirement accounts (IRAs). The after-tax returns shown are calculated using the highest individual federal marginal income tax rates in effect during the periods presented and do not reflect the impact of state and local taxes.

Who manages the Fund?

Investment manager

Delaware Management Company, a series of Macquarie Investment Management Business Trust (a Delaware statutory trust)

Portfolio managers | Title with Delaware Management Company | Start date on the Fund |

Gregory A. Gizzi | Managing Director, Head of US Fixed Income and Head of Municipal Bonds | December 2012 |

Stephen J. Czepiel | Managing Director, Senior Portfolio Manager | July 2007 |

William Roach | Vice President, Portfolio Manager | May 2023 |

Purchase and redemption of Fund shares

You may purchase or redeem shares of the Fund on any day that the New York Stock Exchange (NYSE) is open for business (Business Day). Shares may be purchased or redeemed: through your financial intermediary; through the Fund’s website at delawarefunds.com/account-access; by calling 800 523-1918; by regular mail (c/o Delaware Funds by Macquarie®, P.O. Box 534437, Pittsburgh, PA 15253-4437); by overnight courier service (c/o Delaware Funds by Macquarie Service Center, Attention: 534437, 500 Ross Street, 154-0520, Pittsburgh, PA 15262); or by wire.

For Class A and Class C shares, the minimum initial investment is generally $1,000 and subsequent investments can be made for as little as $100. For Institutional Class shares (except those shares purchased through an automatic investment plan), there is no minimum initial purchase requirement, but certain eligibility requirements must be met. The eligibility requirements are described in this Prospectus under “Choosing a share class” and on the Fund’s website. We may reduce or waive the minimums or eligibility requirements in certain cases.

Tax information