ramp-20220331FALSE2022FY0000733269http://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrent00007332692021-04-012022-03-3100007332692021-09-30iso4217:USD00007332692022-05-19xbrli:shares00007332692022-03-3100007332692021-03-31iso4217:USDxbrli:shares00007332692020-04-012021-03-3100007332692019-04-012020-03-310000733269us-gaap:CommonStockMember2019-03-310000733269us-gaap:AdditionalPaidInCapitalMember2019-03-310000733269us-gaap:RetainedEarningsMember2019-03-310000733269us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310000733269us-gaap:TreasuryStockCommonMember2019-03-3100007332692019-03-310000733269us-gaap:CommonStockMember2019-04-012020-03-310000733269us-gaap:AdditionalPaidInCapitalMember2019-04-012020-03-310000733269us-gaap:TreasuryStockCommonMember2019-04-012020-03-310000733269us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-012020-03-310000733269us-gaap:RetainedEarningsMember2019-04-012020-03-310000733269us-gaap:CommonStockMember2020-03-310000733269us-gaap:AdditionalPaidInCapitalMember2020-03-310000733269us-gaap:RetainedEarningsMember2020-03-310000733269us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310000733269us-gaap:TreasuryStockCommonMember2020-03-3100007332692020-03-310000733269us-gaap:CommonStockMember2020-04-012021-03-310000733269us-gaap:AdditionalPaidInCapitalMember2020-04-012021-03-310000733269us-gaap:TreasuryStockCommonMember2020-04-012021-03-310000733269us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012021-03-310000733269us-gaap:RetainedEarningsMember2020-04-012021-03-310000733269us-gaap:CommonStockMember2021-03-310000733269us-gaap:AdditionalPaidInCapitalMember2021-03-310000733269us-gaap:RetainedEarningsMember2021-03-310000733269us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310000733269us-gaap:TreasuryStockCommonMember2021-03-310000733269us-gaap:CommonStockMember2021-04-012022-03-310000733269us-gaap:AdditionalPaidInCapitalMember2021-04-012022-03-310000733269us-gaap:TreasuryStockCommonMember2021-04-012022-03-310000733269us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012022-03-310000733269us-gaap:RetainedEarningsMember2021-04-012022-03-310000733269us-gaap:CommonStockMember2022-03-310000733269us-gaap:AdditionalPaidInCapitalMember2022-03-310000733269us-gaap:RetainedEarningsMember2022-03-310000733269us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000733269us-gaap:TreasuryStockCommonMember2022-03-31ramp:segment0000733269us-gaap:SegmentContinuingOperationsMember2021-04-012022-03-310000733269us-gaap:SegmentContinuingOperationsMember2020-04-012021-03-310000733269us-gaap:SegmentContinuingOperationsMember2019-04-012020-03-310000733269us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2021-04-012022-03-310000733269us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2021-04-012022-03-310000733269us-gaap:ComputerEquipmentMembersrt:MinimumMember2021-04-012022-03-310000733269us-gaap:ComputerEquipmentMembersrt:MaximumMember2021-04-012022-03-310000733269us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2021-04-012022-03-310000733269us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2021-04-012022-03-31ramp:reporting_unit0000733269srt:MinimumMember2021-04-012022-03-310000733269srt:MaximumMember2021-04-012022-03-310000733269us-gaap:DevelopedTechnologyRightsMember2021-04-012022-03-310000733269us-gaap:CustomerRelationshipsMember2021-04-012022-03-310000733269ramp:PublisherRelationships1Member2021-04-012022-03-310000733269us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberramp:TenLargestCustomersMember2021-04-012022-03-31xbrli:pure0000733269us-gaap:SalesRevenueNetMemberramp:InterpublicGroupOfCompaniesMemberus-gaap:CustomerConcentrationRiskMember2021-04-012022-03-310000733269ramp:IncentiveStockOptionMembersrt:MinimumMember2021-04-012022-03-310000733269srt:MaximumMemberramp:IncentiveStockOptionMember2021-04-012022-03-310000733269srt:MaximumMemberramp:NonqualifiedOptionsMember2021-04-012022-03-310000733269country:US2021-04-012022-03-310000733269country:US2020-04-012021-03-310000733269country:US2019-04-012020-03-310000733269srt:EuropeMember2021-04-012022-03-310000733269srt:EuropeMember2020-04-012021-03-310000733269srt:EuropeMember2019-04-012020-03-310000733269srt:AsiaPacificMember2021-04-012022-03-310000733269srt:AsiaPacificMember2020-04-012021-03-310000733269srt:AsiaPacificMember2019-04-012020-03-310000733269ramp:SubscriptionMember2021-04-012022-03-310000733269ramp:SubscriptionMember2020-04-012021-03-310000733269ramp:SubscriptionMember2019-04-012020-03-310000733269ramp:MarketplaceAndOtherMember2021-04-012022-03-310000733269ramp:MarketplaceAndOtherMember2020-04-012021-03-310000733269ramp:MarketplaceAndOtherMember2019-04-012020-03-3100007332692022-04-012022-03-310000733269ramp:LeasedOfficeFacilitiesMember2022-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:EmployeeSeveranceMember2019-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:ContractTerminationMember2019-03-310000733269us-gaap:SegmentContinuingOperationsMember2019-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:EmployeeSeveranceMember2019-04-012020-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:ContractTerminationMember2019-04-012020-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:EmployeeSeveranceMember2020-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:ContractTerminationMember2020-03-310000733269us-gaap:SegmentContinuingOperationsMember2020-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:EmployeeSeveranceMember2020-04-012021-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:ContractTerminationMember2020-04-012021-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:EmployeeSeveranceMember2021-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:ContractTerminationMember2021-03-310000733269us-gaap:SegmentContinuingOperationsMember2021-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:EmployeeSeveranceMember2021-04-012022-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:ContractTerminationMember2021-04-012022-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:EmployeeSeveranceMember2022-03-310000733269us-gaap:SegmentContinuingOperationsMemberus-gaap:ContractTerminationMember2022-03-310000733269us-gaap:SegmentContinuingOperationsMember2022-03-310000733269ramp:UnitedStatesAndEuropeMemberus-gaap:EmployeeSeveranceMember2020-04-012021-03-310000733269us-gaap:EmployeeSeveranceMember2022-03-310000733269ramp:RestructuringActivity2020Memberus-gaap:EmployeeSeveranceMember2019-04-012020-03-310000733269srt:AsiaPacificMemberramp:RestructuringActivity2020Memberus-gaap:EmployeeSeveranceMember2019-04-012020-03-310000733269country:USramp:RestructuringActivity2020Memberus-gaap:EmployeeSeveranceMember2019-04-012020-03-310000733269ramp:RestructuringActivity2020Memberus-gaap:EmployeeSeveranceMember2020-03-310000733269us-gaap:FacilityClosingMemberramp:RestructuringActivity2017Member2021-04-012022-03-310000733269us-gaap:FacilityClosingMemberramp:RestructuringActivity2017Member2022-03-310000733269ramp:RestructuringActivity2021Memberus-gaap:FacilityClosingMember2020-04-012021-03-310000733269ramp:RakamTechnologyAssetAcquisitionMember2021-12-132021-12-130000733269us-gaap:RestrictedStockUnitsRSUMemberramp:RakamTechnologyAssetAcquisitionMember2021-12-132021-12-130000733269ramp:DiabloAIIncMember2021-04-212021-04-210000733269ramp:DiabloAIIncMember2021-04-210000733269ramp:DataFleetsLtdMember2021-02-172021-02-170000733269ramp:DataFleetsLtdMember2021-02-170000733269ramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMember2021-02-17ramp:annual_repayment_installments0000733269ramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMember2021-02-172021-02-170000733269us-gaap:DevelopedTechnologyRightsMemberramp:DataFleetsLtdMember2021-02-170000733269us-gaap:DevelopedTechnologyRightsMemberramp:DataFleetsLtdMember2021-02-172021-02-170000733269ramp:CustomerRelationshipsAndTradeNamesMemberramp:DataFleetsLtdMember2021-02-170000733269ramp:CustomerRelationshipsAndTradeNamesMemberramp:DataFleetsLtdMember2021-02-172021-02-170000733269ramp:AcuityDataMember2020-07-162020-07-160000733269ramp:AcuityDataMember2020-07-160000733269ramp:DataPlusMathCorporationMember2019-07-022019-07-020000733269ramp:DataPlusMathCorporationMember2019-07-020000733269ramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMember2019-07-020000733269ramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMember2019-07-022019-07-020000733269us-gaap:DevelopedTechnologyRightsMemberramp:DataPlusMathCorporationMember2019-07-020000733269us-gaap:DevelopedTechnologyRightsMemberramp:DataPlusMathCorporationMember2019-07-022019-07-020000733269ramp:DataSupplyRelationshipMemberramp:DataPlusMathCorporationMember2019-07-020000733269ramp:DataSupplyRelationshipMemberramp:DataPlusMathCorporationMember2019-07-022019-07-020000733269ramp:DataPlusMathCorporationMemberus-gaap:CustomerRelationshipsMember2019-07-020000733269ramp:DataPlusMathCorporationMemberus-gaap:CustomerRelationshipsMember2019-07-022019-07-020000733269us-gaap:TrademarksMemberramp:DataPlusMathCorporationMember2019-07-020000733269us-gaap:TrademarksMemberramp:DataPlusMathCorporationMember2019-07-022019-07-020000733269ramp:FaktorBVMember2019-04-022019-04-020000733269ramp:FaktorBVMember2019-04-020000733269us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberramp:AcxiomMarketingSolutionsMember2019-03-310000733269us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberramp:AcxiomMarketingSolutionsMember2018-04-012019-03-310000733269ramp:AcxiomMarketingSolutionsMemberus-gaap:SegmentDiscontinuedOperationsMember2019-04-012020-03-310000733269ramp:ITInfrastructureManagementBusinessMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-03-310000733269ramp:ITInfrastructureManagementBusinessMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-04-012022-03-310000733269us-gaap:BuildingImprovementsMember2022-03-310000733269us-gaap:BuildingImprovementsMember2021-03-310000733269us-gaap:TechnologyEquipmentMember2022-03-310000733269us-gaap:TechnologyEquipmentMember2021-03-310000733269us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-03-310000733269us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2021-03-310000733269ramp:AcuityDataMember2020-04-012021-03-310000733269ramp:DataFleetsLtdMember2020-04-012021-03-310000733269ramp:DiabloAIIncMember2021-04-012022-03-310000733269country:US2022-03-310000733269srt:AsiaPacificMember2022-03-310000733269us-gaap:SoftwareDevelopmentMember2022-03-310000733269us-gaap:SoftwareDevelopmentMember2021-03-310000733269ramp:CustomerRelationshipsAndTradeNamesMember2022-03-310000733269ramp:CustomerRelationshipsAndTradeNamesMember2021-03-310000733269ramp:PublisherAndDataSupplyRelationshipsMember2022-03-310000733269ramp:PublisherAndDataSupplyRelationshipsMember2021-03-310000733269ramp:DataPlusMathCorporationMember2022-03-310000733269ramp:DataPlusMathCorporationMember2021-03-310000733269ramp:AcuityDataMember2022-03-310000733269ramp:AcuityDataMember2021-03-310000733269ramp:DataFleetsLtdMember2022-03-310000733269ramp:DataFleetsLtdMember2021-03-310000733269ramp:DiabloAIIncMember2022-03-310000733269ramp:DiabloAIIncMember2021-03-310000733269ramp:RakamTechnologyAssetAcquisitionMember2022-03-310000733269ramp:RakamTechnologyAssetAcquisitionMember2021-03-310000733269ramp:CommonStockRepurchaseProgramMember2022-03-310000733269ramp:CommonStockRepurchaseProgramMember2021-04-012022-03-310000733269ramp:CommonStockRepurchaseProgramMember2020-04-012021-03-310000733269ramp:CommonStockRepurchaseProgramMember2019-04-012020-03-310000733269ramp:StockOptionAndEquityCompensationPlansMember2022-03-310000733269us-gaap:EmployeeStockOptionMember2021-04-012022-03-310000733269us-gaap:EmployeeStockOptionMember2020-04-012021-03-310000733269us-gaap:EmployeeStockOptionMember2019-04-012020-03-310000733269us-gaap:RestrictedStockUnitsRSUMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310000733269us-gaap:RestrictedStockUnitsRSUMember2019-04-012020-03-310000733269ramp:DiabloAIIncMemberus-gaap:RestrictedStockUnitsRSUMember2021-04-012022-03-310000733269ramp:DiabloAIIncMemberus-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310000733269ramp:DiabloAIIncMemberus-gaap:RestrictedStockUnitsRSUMember2019-04-012020-03-310000733269ramp:ArborBusinessAcquisitionMemberramp:ArborHoldbackAgreementMember2021-04-012022-03-310000733269ramp:ArborBusinessAcquisitionMemberramp:ArborHoldbackAgreementMember2020-04-012021-03-310000733269ramp:ArborBusinessAcquisitionMemberramp:ArborHoldbackAgreementMember2019-04-012020-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMember2021-04-012022-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMember2020-04-012021-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMember2019-04-012020-03-310000733269ramp:PacificDataPartnersLLCMemberramp:PacificDataPartnersLLCAgreementPlanMember2021-04-012022-03-310000733269ramp:PacificDataPartnersLLCMemberramp:PacificDataPartnersLLCAgreementPlanMember2020-04-012021-03-310000733269ramp:PacificDataPartnersLLCMemberramp:PacificDataPartnersLLCAgreementPlanMember2019-04-012020-03-310000733269ramp:AcuityDataMemberramp:AcuityPerformanceEarnoutMember2021-04-012022-03-310000733269ramp:AcuityDataMemberramp:AcuityPerformanceEarnoutMember2020-04-012021-03-310000733269ramp:AcuityDataMemberramp:AcuityPerformanceEarnoutMember2019-04-012020-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMember2021-04-012022-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMember2020-04-012021-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMember2019-04-012020-03-310000733269ramp:OtherStockBasedCompensationMember2021-04-012022-03-310000733269ramp:OtherStockBasedCompensationMember2020-04-012021-03-310000733269ramp:OtherStockBasedCompensationMember2019-04-012020-03-310000733269ramp:LiabilityBasedAwardMember2021-04-012022-03-310000733269ramp:LiabilityBasedAwardMember2020-04-012021-03-310000733269ramp:LiabilityBasedAwardMember2019-04-012020-03-310000733269us-gaap:CostOfSalesMember2021-04-012022-03-310000733269us-gaap:CostOfSalesMember2020-04-012021-03-310000733269us-gaap:CostOfSalesMember2019-04-012020-03-310000733269us-gaap:ResearchAndDevelopmentExpenseMember2021-04-012022-03-310000733269us-gaap:ResearchAndDevelopmentExpenseMember2020-04-012021-03-310000733269us-gaap:ResearchAndDevelopmentExpenseMember2019-04-012020-03-310000733269ramp:SalesAndMarketingMember2021-04-012022-03-310000733269ramp:SalesAndMarketingMember2020-04-012021-03-310000733269ramp:SalesAndMarketingMember2019-04-012020-03-310000733269us-gaap:GeneralAndAdministrativeExpenseMember2021-04-012022-03-310000733269us-gaap:GeneralAndAdministrativeExpenseMember2020-04-012021-03-310000733269us-gaap:GeneralAndAdministrativeExpenseMember2019-04-012020-03-310000733269us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RestrictedStockUnitsRSUMember2021-03-012021-03-310000733269ramp:TimePeriodOneMemberus-gaap:EmployeeStockOptionMember2022-03-310000733269us-gaap:EmployeeStockOptionMemberramp:TimePeriodTwoMember2022-03-310000733269us-gaap:EmployeeStockOptionMemberramp:TimePeriodThreeMember2022-03-310000733269us-gaap:EmployeeStockOptionMemberramp:TimePeriodFourMember2022-03-310000733269us-gaap:EmployeeStockOptionMember2022-03-310000733269ramp:TimePeriodOneMemberus-gaap:RestrictedStockUnitsRSUMember2022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:TimePeriodTwoMember2022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:TimePeriodThreeMember2022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:TimePeriodFourMember2022-03-310000733269us-gaap:RestrictedStockUnitsRSUMember2022-03-310000733269ramp:TimePeriodOneMemberramp:DiabloAIIncMemberus-gaap:RestrictedStockUnitsRSUMember2022-03-310000733269ramp:DiabloAIIncMemberus-gaap:RestrictedStockUnitsRSUMemberramp:TimePeriodTwoMember2022-03-310000733269ramp:DiabloAIIncMemberus-gaap:RestrictedStockUnitsRSUMemberramp:TimePeriodThreeMember2022-03-310000733269ramp:DiabloAIIncMemberus-gaap:RestrictedStockUnitsRSUMemberramp:TimePeriodFourMember2022-03-310000733269ramp:DiabloAIIncMemberus-gaap:RestrictedStockUnitsRSUMember2022-03-310000733269ramp:TimePeriodOneMemberramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMember2022-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMemberramp:TimePeriodTwoMember2022-03-310000733269ramp:TimePeriodThreeMemberramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMember2022-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMemberramp:TimePeriodFourMember2022-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMember2022-03-310000733269ramp:TimePeriodOneMemberramp:AcuityDataMemberramp:AcuityPerformanceEarnoutMember2022-03-310000733269ramp:AcuityDataMemberramp:AcuityPerformanceEarnoutMemberramp:TimePeriodTwoMember2022-03-310000733269ramp:AcuityDataMemberramp:AcuityPerformanceEarnoutMemberramp:TimePeriodThreeMember2022-03-310000733269ramp:AcuityDataMemberramp:AcuityPerformanceEarnoutMemberramp:TimePeriodFourMember2022-03-310000733269ramp:AcuityDataMemberramp:AcuityPerformanceEarnoutMember2022-03-310000733269ramp:TimePeriodOneMemberramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMember2022-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMemberramp:TimePeriodTwoMember2022-03-310000733269ramp:TimePeriodThreeMemberramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMember2022-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMemberramp:TimePeriodFourMember2022-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMember2022-03-310000733269ramp:TimePeriodOneMemberramp:OtherStockBasedCompensationMember2022-03-310000733269ramp:OtherStockBasedCompensationMemberramp:TimePeriodTwoMember2022-03-310000733269ramp:OtherStockBasedCompensationMemberramp:TimePeriodThreeMember2022-03-310000733269ramp:OtherStockBasedCompensationMemberramp:TimePeriodFourMember2022-03-310000733269ramp:OtherStockBasedCompensationMember2022-03-310000733269ramp:TimePeriodOneMember2022-03-310000733269ramp:TimePeriodTwoMember2022-03-310000733269ramp:TimePeriodThreeMember2022-03-310000733269ramp:TimePeriodFourMember2022-03-310000733269us-gaap:EmployeeStockOptionMemberramp:DataFleetsLtdMember2021-02-012021-02-280000733269ramp:DataFleetsLtdMember2021-02-012021-02-280000733269us-gaap:EmployeeStockOptionMemberramp:DataPlusMathCorporationMember2019-04-012020-03-310000733269ramp:RangeOneOfExercisePricesMember2021-04-012022-03-310000733269ramp:RangeOneOfExercisePricesMember2022-03-310000733269ramp:RangeTwoOfExercisePricesMember2021-04-012022-03-310000733269ramp:RangeTwoOfExercisePricesMember2022-03-310000733269ramp:RangeThreeOfExercisePricesMember2021-04-012022-03-310000733269ramp:RangeThreeOfExercisePricesMember2022-03-310000733269us-gaap:RestrictedStockMemberramp:DiabloAIIncMember2021-04-012022-03-310000733269us-gaap:RestrictedStockMemberramp:DiabloAIIncMember2021-03-310000733269us-gaap:RestrictedStockMemberramp:DiabloAIIncMember2022-03-310000733269ramp:TimeBasedVestingOverFourYearsMemberus-gaap:RestrictedStockUnitsRSUMember2021-04-012022-03-310000733269ramp:DiabloAIIncMemberramp:TimeBasedVestingMemberus-gaap:RestrictedStockUnitsRSUMember2021-04-012022-03-310000733269ramp:TimeBasedVestingMemberus-gaap:RestrictedStockUnitsRSUMemberramp:RakamTechnologyAssetAcquisitionMember2021-04-012022-03-310000733269ramp:TimeBasedVestingMemberus-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310000733269ramp:TimeBasedVestingOverFourYearsMemberus-gaap:RestrictedStockUnitsRSUMember2020-04-012021-03-310000733269ramp:TimeBasedVestingMemberus-gaap:RestrictedStockUnitsRSUMemberramp:DataPlusMathCorporationMember2020-04-012021-03-310000733269ramp:TimeBasedVestingMemberus-gaap:RestrictedStockUnitsRSUMember2019-04-012020-03-310000733269ramp:TimeBasedVestingOverFourYearsMemberus-gaap:RestrictedStockUnitsRSUMember2019-04-012020-03-310000733269ramp:TimeBasedVestingMemberus-gaap:RestrictedStockUnitsRSUMemberramp:DataPlusMathCorporationMember2019-04-012020-03-310000733269ramp:TimeBasedVestingMemberus-gaap:RestrictedStockUnitsRSUMember2021-03-310000733269ramp:TimeBasedVestingMemberus-gaap:RestrictedStockUnitsRSUMember2021-04-012022-03-310000733269ramp:TimeBasedVestingMemberus-gaap:RestrictedStockUnitsRSUMember2022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceStockMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:AuthenticatedTrafficSolutionPerformancePlanVestingTotalShareholderReturnMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:AuthenticatedTrafficSolutionPerformancePlanVestingTotalShareholderReturnMembersrt:MinimumMember2021-04-012022-03-310000733269srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMemberramp:AuthenticatedTrafficSolutionPerformancePlanVestingTotalShareholderReturnMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMembersrt:MinimumMember2021-04-012022-03-310000733269srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceStockMemberramp:OperatingMetricsPerformancePlanMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMemberramp:PerformanceStockMemberramp:OperatingMetricsPerformancePlanMember2021-04-012022-03-310000733269srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceStockMemberramp:OperatingMetricsPerformancePlanMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:A2022PerformanceBasedStockUnitsThatWillVestImmediatelyMemberramp:OperatingMetricsPerformancePlanMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:A2022PerformanceBasedStockUnitsThatWillVestOnTheOneYearAnniversaryOfAttainmentMemberramp:OperatingMetricsPerformancePlanMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingOneYearAnniversaryOfAttainmentMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceStockMember2020-04-012021-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMember2020-04-012021-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMembersrt:MinimumMember2020-04-012021-03-310000733269srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMember2020-04-012021-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMember2022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingUnderTheSecondPlanMember2020-04-012021-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingUnderTheSecondPlanMembersrt:MinimumMember2020-04-012021-03-310000733269srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingUnderTheSecondPlanMember2020-04-012021-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:A2021PerformanceSharesThatWillVestImmediatelyMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:A2021PerformanceSharesThatWillVestImmediatelyMemberramp:OperatingMetricsPerformancePlanMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:A2021PerformanceSharesThatWillVestImmediatelyMember2022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceStockMember2019-04-012020-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMember2019-04-012020-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMembersrt:MinimumMember2019-04-012020-03-310000733269srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingTotalShareholderReturnMember2019-04-012020-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingInThreeEqualAnnualIncrementsMember2021-04-012022-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingUnderTheSecondPlanMember2019-04-012020-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingInThreeEqualAnnualIncrementsMember2020-04-012020-06-300000733269us-gaap:RestrictedStockUnitsRSUMemberramp:VestingBasedOnRelevantPerformancePeriodOverTwoPeriodsAtMarch312022Membersrt:MinimumMember2020-04-012020-06-300000733269srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMemberramp:VestingBasedOnRelevantPerformancePeriodOverTwoPeriodsAtMarch312022Member2020-04-012020-06-300000733269ramp:PerformanceSharesVestingBasedOnAttainmentOfTheYearOverYearRevenueGrowthTargetsMemberus-gaap:RestrictedStockUnitsRSUMember2019-04-012020-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:VestingBasedOnRelevantPerformancePeriodOverTwoPeriodsAtMarch312020Member2019-04-012020-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceSharesVestingInThreeEqualAnnualIncrementsMember2019-04-012020-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceStockMember2021-03-310000733269us-gaap:RestrictedStockUnitsRSUMemberramp:PerformanceStockMember2022-03-310000733269ramp:AcuityDataMember2021-04-012022-03-310000733269us-gaap:AccruedLiabilitiesMemberramp:AcuityDataMember2022-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataFleetsLtdMember2021-03-310000733269ramp:DataFleetsLtdMember2021-04-012022-03-310000733269us-gaap:AccruedLiabilitiesMemberramp:DataFleetsLtdMember2021-04-012022-03-310000733269ramp:DataPlusMathCorporationMember2019-04-012020-03-310000733269ramp:ConsiderationHoldbackMemberramp:DataPlusMathCorporationMember2020-03-310000733269ramp:DataPlusMathCorporationMember2021-04-012022-03-310000733269us-gaap:AccruedLiabilitiesMemberramp:DataPlusMathCorporationMember2021-04-012022-03-310000733269ramp:PacificDataPartnersLLCMember2021-04-012022-03-310000733269us-gaap:EmployeeStockMember2021-04-012022-03-310000733269us-gaap:EmployeeStockMember2022-03-310000733269us-gaap:TaxYear2021Member2020-03-310000733269us-gaap:TaxYear2020Member2021-03-310000733269us-gaap:InternalRevenueServiceIRSMember2022-03-310000733269us-gaap:StateAndLocalJurisdictionMember2022-03-310000733269us-gaap:DomesticCountryMember2022-03-310000733269us-gaap:ForeignCountryMember2022-03-310000733269ramp:IndefiniteTaxYearMember2022-03-310000733269ramp:IndefiniteTaxYearMemberus-gaap:StateAndLocalJurisdictionMember2022-03-3100007332692019-01-012019-01-010000733269ramp:SupplementalNonQualifiedDeferredCompensationPlanMember2022-03-310000733269ramp:SupplementalNonQualifiedDeferredCompensationPlanMember2021-03-310000733269ramp:GroupOfForeignCountriesMember2021-04-012022-03-310000733269ramp:GroupOfForeignCountriesMember2020-04-012021-03-310000733269ramp:GroupOfForeignCountriesMember2019-04-012020-03-310000733269country:US2021-03-310000733269srt:EuropeMember2022-03-310000733269srt:EuropeMember2021-03-310000733269srt:AsiaPacificMember2021-03-310000733269ramp:GroupOfForeignCountriesMember2022-03-310000733269ramp:GroupOfForeignCountriesMember2021-03-310000733269us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-03-310000733269us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-03-310000733269us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-03-310000733269us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-03-310000733269us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-03-310000733269us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-03-310000733269us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-03-310000733269us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2021-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2022

OR | | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ----- to -----

Commission file number 001-38669 | | | | | | | | |

LiveRamp Holdings, Inc. |

| (Exact Name of Registrant as Specified in Its Charter) |

|

Delaware (State or Other Jurisdiction of Incorporation or Organization) | | 83-1269307 (I.R.S. Employer Identification No.) |

225 Bush Street, Seventeenth Floor San Francisco, CA (Address of Principal Executive Offices) | | 94104 (Zip Code) |

(866) 352-3267 (Registrant's Telephone Number, Including Area Code) |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, $.10 Par Value | RAMP | New York Stock Exchange |

| | |

| Securities registered pursuant to Section 12(g) of the Act: None |

| | | | | | | | | | | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

| Yes [X] | No [ ] | |

| | | |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. |

| Yes [ ] | No [X] | |

| | | |

| Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

| Yes [X] | No [ ] | |

| | | |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). |

| Yes [X] | No [ ] | |

| | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. |

Large accelerated filer [X] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company ☐ |

| Emerging growth company ☐ |

| | | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ] |

| | | |

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [☒] |

|

|

| | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

| Yes ☐ | No [X] | |

The aggregate market value of the voting stock held by non-affiliates of the registrant, based upon the closing sale price of the registrant’s Common Stock, $.10 par value per share, as of the last business day of the registrant’s most recently completed second fiscal quarter as reported on the New York Stock Exchange was approximately $2,795,923,382. (For purposes of determination of the above stated amount only, all directors, executive officers and 10% or more shareholders of the registrant are presumed to be affiliates.)

The number of shares of common stock, $0.10 par value per share, outstanding as of May 19, 2022 was 68,410,454.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2022 Annual Meeting of Stockholders (“2022 Proxy Statement”) of LiveRamp Holdings, Inc. (“LiveRamp,” the “Company,” “we”, “us”, or “our”) are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| Page No. |

| |

| |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

| | |

| | |

PART I

AVAILABILITY OF SEC FILINGS AND CORPORATE GOVERNANCE INFORMATION

Our website address is www.liveramp.com, where copies of documents that we have filed with the Securities and Exchange Commission (“SEC”) may be obtained free of charge as soon as reasonably practicable after being filed electronically. Included among those documents are our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Copies may also be obtained through the SEC’s EDGAR site at the website address http://www.sec.gov, or by sending a written request for copies to LiveRamp Investor Relations, 225 Bush Street, Seventeenth Floor, San Francisco, California 94104. Copies of all our SEC filings were available on our website during the past fiscal year covered by this Annual Report on Form 10-K. In addition, at the “Corporate Governance” section included in the investor relations section of our website, we have posted copies of our Corporate Governance Principles, the charters for the Audit/Finance, Compensation, Executive, and Governance/Nominating Committees of the Board of Directors, the codes of ethics applicable to directors, financial personnel and all employees, and other information relating to the governance of the Company. Although referenced herein, information contained on or connected to our corporate website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this report or any other filing we make with the SEC.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K, including, without limitation, the items set forth beginning on page F-2 in Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains and may incorporate by reference certain statements that may be deemed to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended (the “PSLRA”), and that are intended to enjoy the protection of the safe harbor for forward-looking statements provided by the PSLRA. These statements, which are not statements of historical fact, may contain estimates, assumptions, projections and/or expectations regarding the Company’s financial position, results of operations, market position, product development, growth opportunities, economic conditions, and other similar forecasts and statements of expectation. Forward-looking statements are often identified by words or phrases such as “anticipate,” “estimate,” “plan,” “expect,” “believe,” “intend,” “foresee,” or the negative of these terms or other similar variations thereof. These forward-looking statements are not guarantees of future performance and are subject to a number of factors and uncertainties that could cause the Company’s actual results and experiences to differ materially from the anticipated results and expectations expressed in the forward-looking statements.

Forward-looking statements may include but are not limited to the following:

•management’s expectations about the macro economy and trends within the consumer or business information industries, including the use of data and consumer expectations related thereto;

•statements regarding our competitive position within our industry and our differentiation strategies;

•our expectations regarding laws, regulations and industry practices governing the collection and use of personal data;

•our expectations regarding the potential impact of the pandemic related to the current and continuing outbreak of a novel strain of coronavirus ("COVID-19") on our business, operations, and the markets in which we and our partners and customers operate;

•our expectations regarding the effect of the Coronavirus Aid, Relief and Economic Security Act (the "CARES Act") and other tax-related legislation on our tax provision;

•statements regarding our liquidity needs or containing a projection of revenues, operating income (loss), income (loss), earnings (loss) per share, capital expenditures, dividends, capital structure, or other financial items;

•statements of the plans and objectives of management for future operations, including, but not limited to, those statements contained under the heading “Growth Strategy” in Part I, Item 1 of this Annual Report on Form 10-K;

•statements of future performance, including, but not limited to, those statements contained in Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in this Annual Report on Form 10-K;

•statements regarding future stock-based compensation expense;

•statements containing any assumptions underlying or relating to any of the above statements; and

•statements containing a projection or estimate.

Among the factors that may cause actual results and expectations to differ from anticipated results and expectations expressed in such forward-looking statements are the following:

•the risk factors described in Part I, “Item 1A. Risk Factors” and elsewhere in this report and those described from time to time in our future reports filed with the SEC;

•the possibility that, in the event a change of control of the Company is sought, certain clients may attempt to invoke provisions in their contracts allowing for termination upon a change in control, which may result in a decline in revenue and profit;

•the possibility that the integration of acquired businesses may not be as successful as planned;

•the possibility that the fair value of certain of our assets may not be equal to the carrying value of those assets now or in future time periods;

•the possibility that sales cycles may lengthen;

•the possibility that we will not be able to properly motivate our sales force or other employees;

•the possibility that we may not be able to attract and retain qualified technical and leadership employees, or that we may lose key employees to other organizations;

•the possibility that competent, competitive products, technologies or services will be introduced into the marketplace by other companies;

•the possibility that there will be changes in consumer or business information industries and markets that negatively impact the Company;

•the possibility that we will not be able to protect proprietary information and technology or to obtain necessary licenses on commercially reasonable terms;

•the possibility that there will be changes in the judicial, legislative, regulatory, accounting, cultural and consumer environments affecting our business, including but not limited to litigation, investigations, legislation, regulations and customs impairing our ability to collect, process, manage, aggregate store and/or use data;

•the possibility that data suppliers might withdraw data from us, leading to our inability to provide certain products and services;

•the possibility that data purchasers will reduce their reliance on us by developing and using their own, or alternative, sources of data generally or with respect to certain data elements or categories;

•the possibility that we may enter into short-term contracts that would affect the predictability of our revenues;

•the possibility that the amount of volume-based and other transactional-based work will not be as expected;

•the possibility that we may experience a loss of data center capacity or capability or interruption of telecommunication links or power sources;

•the possibility that we may experience failures or breaches of our network and data security systems, leading to potential adverse publicity, negative customer reaction, or liability to third parties;

•the possibility that our clients may cancel or modify their agreements with us, or may not make timely or complete payments due to the COVID-19 pandemic or other factors;

•the possibility that we will not successfully meet customer contract requirements or the service levels specified in the contracts, which may result in contract penalties or lost revenue;

•the possibility that we experience processing errors that result in credits to customers, re-performance of services or payment of damages to customers;

•the possibility that our performance may decline and we lose advertisers and revenue as the use of "third-party cookies" or other tracking technology continues to be pressured by Internet users, restricted or otherwise subject to unfavorable regulation, blocked or limited by technical changes on end users' devices, or our or our clients' ability to use data on our platform is otherwise restricted;

•general and global negative conditions, including the COVID-19 pandemic and related causes; and

•our tax rate and other effects of the changes to U.S. federal tax law.

With respect to the provision of products or services outside our primary base of operations in the United States, all of the above factors apply, along with the difficulty of doing business in numerous sovereign jurisdictions due to differences in scale, competition, culture, laws and regulations.

Other factors are detailed from time to time in periodic reports and registration statements filed with the SEC. The Company believes that it has the product and technology offerings, facilities, employees and competitive and financial resources for continued business success, but future revenues, costs, margins and profits are all influenced by a number of factors, including those discussed above, all of which are inherently difficult to forecast.

In light of these risks, uncertainties and assumptions, the Company cautions readers not to place undue reliance on any forward-looking statements. Forward-looking statements and such risks, uncertainties and assumptions speak only as of the date of this Annual Report on Form 10-K, and the Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statements contained herein, to reflect any change in our expectations with regard thereto, or any other change based on the occurrence of future events, the receipt of new information or otherwise, except to the extent otherwise required by law.

Item 1. Business

LiveRamp Holdings, Inc. ("LiveRamp", "we", "us", or the "Company") is a global technology company with a vision of making it safe and easy for companies to use data. We provide a best-in-class enterprise data enablement platform that helps organizations better leverage customer data within and outside their four walls. Powered by core identity capabilities and an extensive network, LiveRamp enables companies and their partners to better connect, control, and activate data to transform customer experiences and generate more valuable business outcomes.

LiveRamp is a Delaware corporation headquartered in San Francisco, California. Our common stock is listed on the New York Stock Exchange under the symbol “RAMP.” We serve a global client base from locations in the United States, Europe, and the Asia-Pacific (“APAC”) region. Our direct client list includes many of the world’s largest and best-known brands across most major industry verticals, including but not limited to financial, insurance and investment services, retail, automotive, telecommunications, high tech, consumer packaged goods, healthcare, travel, entertainment, non-profit, and government. Through our extensive reseller and partnership network, we serve thousands of additional companies, establishing LiveRamp as a foundational and neutral enabler of the customer experience economy.

Industry

We are experiencing a convergence of several key industry trends that are shaping the future of how data is used to power the customer experience economy. Some of these key industry trends include:

Growing Data Usage

Advances in software and hardware and the growing use of the Internet have made it possible to collect and rapidly process massive amounts of personal data. Data vendors are able to collect user information across a wide range of offline and online properties and connected devices, and to aggregate and combine it with other data sources. With proper permissions, this data can be integrated with a company's own proprietary data and can be made non-identifiable if the use case requires it. Through the use of data, marketers and publishers can more effectively acquire customers, elevate their lifetime value, and serve their needs.

Growing Complexity

The customer experience economy has evolved significantly in recent years, driven by rapid innovation and an explosion of data, channels, devices, and applications. Historically, brands interacted with consumers through a limited number of channels, with limited visibility into the activities taking place. Today, companies interact with consumers across a growing number of touchpoints, including online, social, mobile and point-of-sale. The billions of interactions that take place each day between brands and consumers create a trove of valuable data that can be harnessed to power better interactions and experiences. However, most enterprise marketers remain unable to navigate through the complexity to effectively leverage this data.

Additionally, innovation has fueled the growth of a highly-fragmented technology landscape, forcing companies to contend with thousands of marketing technologies and data silos. To make every customer experience relevant across channels and devices, organizations need a trusted platform that can break down those silos, make data portable, and accurately recognize individuals throughout the customer journey. Marketing is becoming more audience-centric, automated, and optimized. However, several important factors still prevent data from being used effectively to optimize the customer experience:

•Identity. For organizations to target audiences at the individual level, they must be able to recognize consumers across all channels and devices, and link multiple identifiers and data elements back to a persistent identifier to create a single view of the customer. The evolving digital identity landscape further highlights the importance of authenticated, first-party identity.

•Scaled Data Assets. Quality, depth, and recency of data matter when deriving linkages between identifiers. Organizations must have access to an extensive set of data and be able to match that data with a high degree of accuracy to perform true cross-device audience targeting and measurement.

•Connectivity. The fragmented marketing landscape creates a need for a common network of integrations that make it easy and safe to connect and activate data anywhere in the ecosystem.

•Data Control. Organizations are increasingly looking to collaborate with their most important partners but do not want to give up control of their data or, in certain cases, do not want their data to leave their environment.

•Walled Gardens. Walled gardens, or marketing platforms that restrict the use of data outside of their walls, are becoming more pervasive and can result in loss of control, lack of transparency, and fragmented brand experiences. Organizations need a solution that enables an open ecosystem and ensures complete control over customer data, along with the flexibility to choose a diversified approach to meeting marketing goals.

•Data Governance. Preserving brand integrity while delivering positive customer experiences is a top priority for every company. Organizations must be able to manage large sets of complex data ethically, securely, within legal boundaries, and in a way that protects consumers from harm. Importantly, they must also honor consumer preferences and put procedures in place that enable individuals to control how, when and for what reasons companies collect and use information about them.

Increasing Fragmentation

Today, customer journeys span multiple channels and devices over time, resulting in data silos and fragmented identities. As consumers engage with brands across various touchpoints – over the web, mobile devices and applications, by email and television, and in physical stores – they may not be represented as single unique individuals with complex behaviors, appearing instead as disparate data points with dozens of different identifiers. Becky Smith who lives at 123 Main Street may appear as beckys@acme.com when she uses Facebook, becky@yahoo.com when she signs into Yahoo Finance, cookie 123 when she browses msn.com, cookie ABC when she browses aol.com, device ID 234 on Hulu and so on. As a result, enterprise marketers struggle to understand the cross-channel, cross-device habits of consumers and the different steps they take on their path to conversion. More specifically, data silos and fragmented identities prevent companies from being able to resolve all relevant data to a specific individual; this poses a challenge to the formation of accurate, actionable insights about a brand’s consumers or campaigns.

Marketing Waste

Every day, brands spend billions of dollars on advertising and marketing, yet many of the messages they deliver are irrelevant, repetitive, mistimed, or simply reach the wrong audience. In addition, as the marketing landscape continues to grow and splinter across a growing array of online and offline channels, it is increasingly difficult to attribute marketing spend to a measurable outcome, such as an in-store visit or sale. Wasted marketing spend is largely driven by the fragmented ecosystem of brands, data providers, marketing applications, media providers, and agencies that are involved in the marketing process, but operate without cohesion. Without a common understanding of consumer identity to unify otherwise siloed data, brands are unable to define accurate audience segments and derive insights that would enable better decision making.

Heightened Privacy and Security Concerns

In the era of regulation such as the European General Data Protection Regulation ("GDPR") and the California Consumer Privacy Act ("CCPA"), diligence in the areas of consumer privacy and security is and will continue to be paramount. Consumer understanding of the benefits of marketing technology often lags the pace of innovation, giving rise to new demands from government agencies and consumer advocacy groups across the world. These factors challenge the liability every company faces when managing and activating consumer data.

Marketing and Customer Experience in the Data-Driven Era

As the world becomes more multichannel, consumer behavior is rapidly shifting, and organizations are increasingly realizing that true competitive advantage lies in providing meaningful customer experiences – experiences that are personalized, relevant and cohesive across all channels and interactions. Experience is the key to brand differentiation and retention. Companies that fail to prioritize customer experience as a strategic growth initiative will simply get left behind.

In concert, consumer expectations are also at an all-time high. Consumers are demanding personalization – and, in this new area, every consumer interaction has the potential to be individually relevant, addressable, and measurable.

Data is at the center of exceptional customer experiences but is still vastly underutilized. Organizations must capture, analyze, understand – and, most importantly use – customer data to power the customer experience. By understanding which devices, email addresses, and postal addresses relate to the same individual, enterprise marketers can leverage that insight to deliver seamless experiences as consumers engage with a company across all touchpoints. At the same time, by reaching consumers at the individual level, organizations can reduce marketing waste and more easily attribute their marketing spend to actual results. Enterprise marketers recognize the huge opportunity big data brings, yet many admit they are not using their data effectively to drive their customer experience.

Our Approach

Companies want to enable better decisions, improve return on investment and deliver better experiences to their customers – and it all begins with data. However, given the rapid adoption of new platforms and channels, enterprise marketers remain plagued by fragmented data – resulting in a shallow, incomplete or incorrect understanding of the people with whom they do business. Data today is still too hard to access, too hard to make sense of and too hard to activate across all the touchpoints where it could power better decision-making and better experiences. Data fragmentation is one of the key reasons companies struggle to deliver relevant, consistent and meaningful experiences to their customers. Our mission is to break down silos and make data safe and easy to use. Leveraging our core capabilities in data access, identity resolution, connectivity and data stewardship, we create the foundation from which the ecosystem can deliver innovative products and services.

We are middleware for the customer experience economy. LiveRamp provides the trusted platform that sits in between customer data and the thousands of applications that data could power. We make data consistent, consumable and portable. We ensure the seamless connection of data to and from the customer experience applications our customers use and the partners with which they collaborate. We empower businesses to make data more accessible and create richer, more meaningful experiences for their customers.

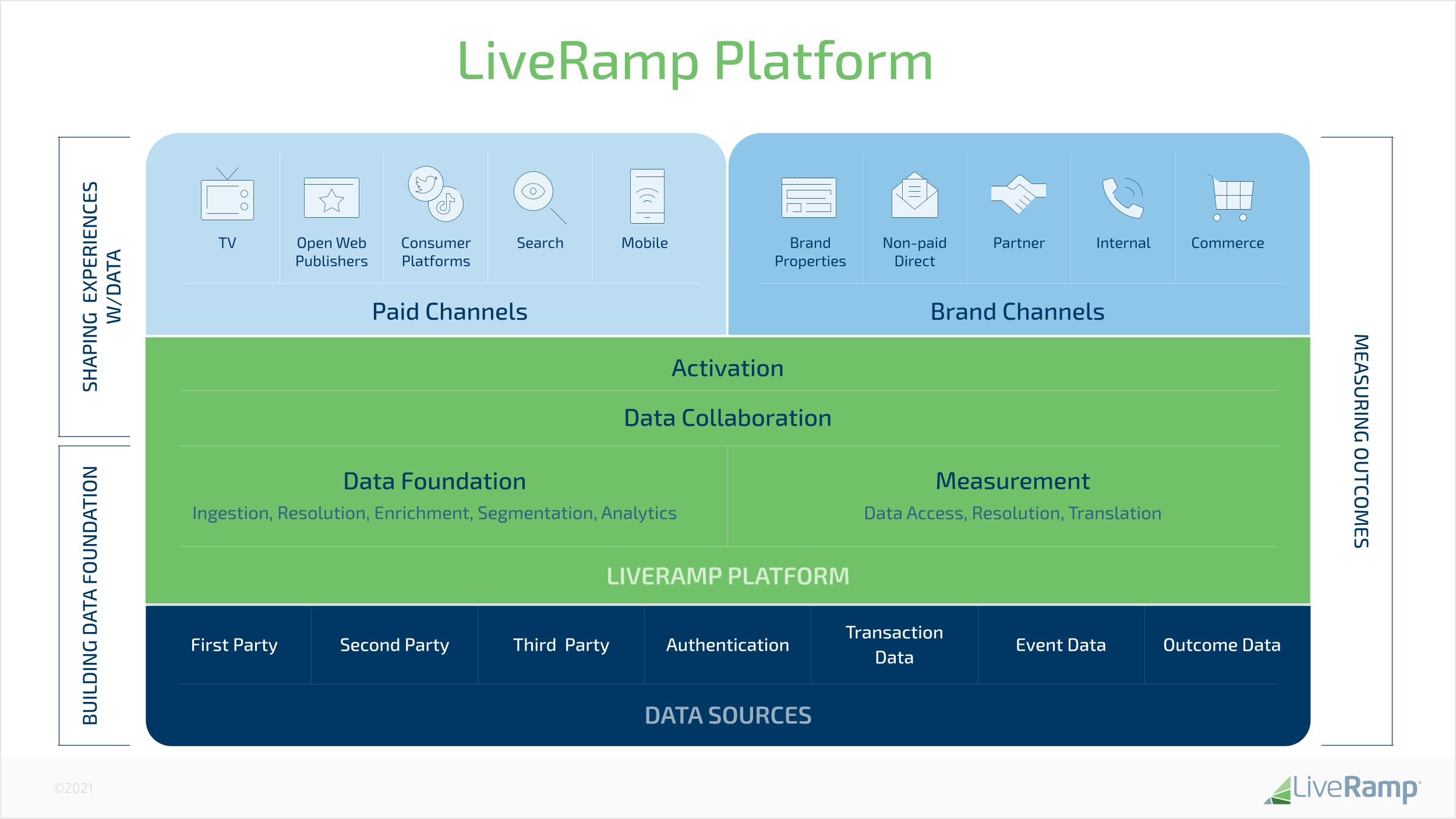

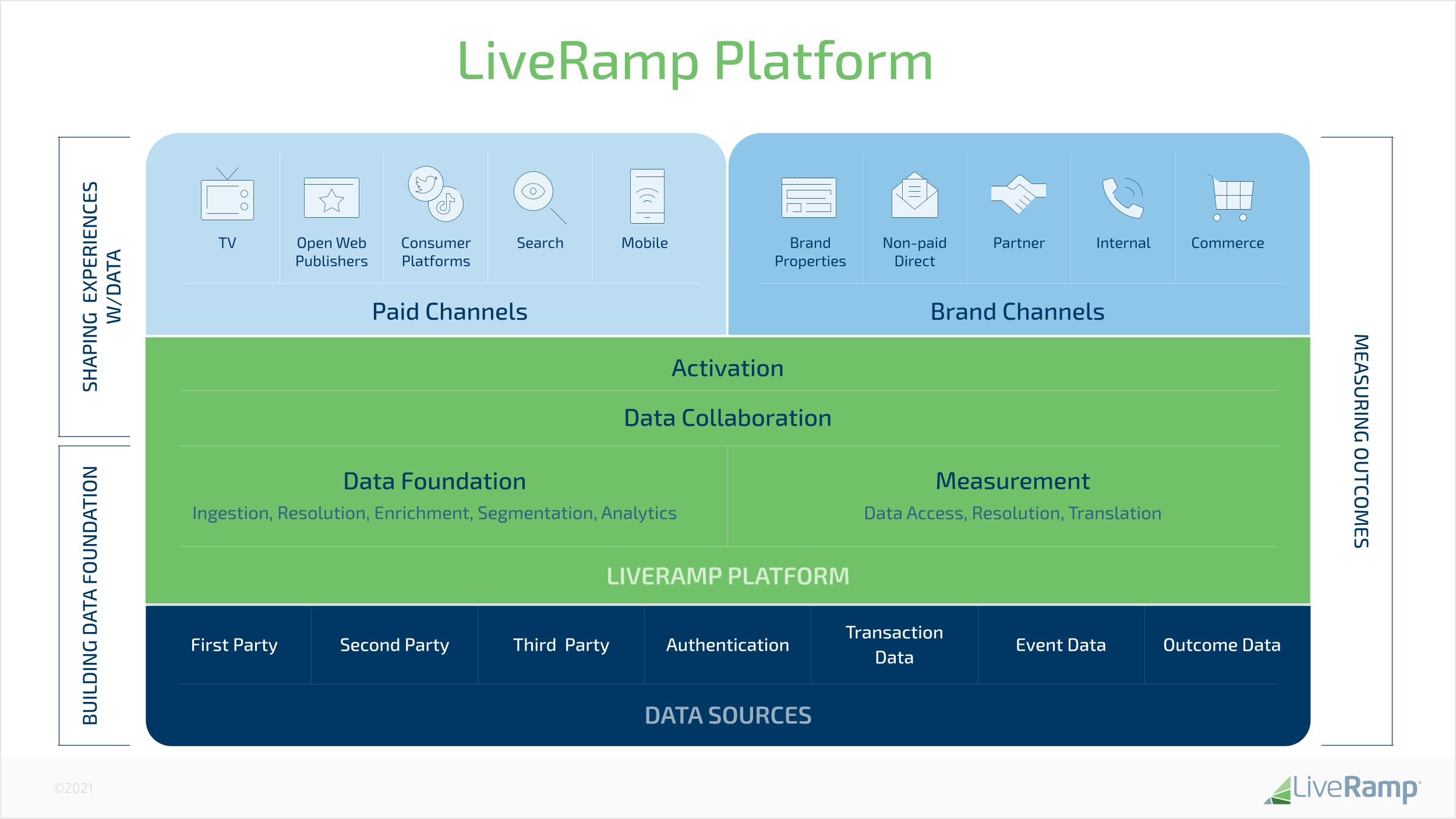

The LiveRamp Enterprise Platform

As depicted in the graphic below, we power the industry’s leading enterprise data enablement platform, Safe Haven. We enable organizations to access and leverage data more effectively across the applications they use to interact with their customers. A core component of our platform is the omnichannel, deterministic identity asset that sits at its center. Leveraging deep expertise in identity and data collaboration, the Safe Haven platform enables an organization to unify customer and prospect data (first-, second-, or third-party) to build a single view of the customer in a way that protects consumer privacy. This single customer view can then be enhanced and activated across any of the 550 partners in our ecosystem in order to support a variety of people-based marketing solutions, including:

•Activation. We enable organizations to leverage their customer and prospect data in the digital and TV ecosystems and across the customer experience applications they use through a safe and secure data matching process called data onboarding. Our technology ingests a customer’s first-party data, removes all offline data (personally identifiable information or "PII"), and replaces them with anonymized IDs called RampID™, a true people-based identifier. RampID can then be distributed through direct integrations to the top platforms our customers work with, including leading marketing cloud providers, publishers and social networks, personalization tools, and connected TV services.

•Measurement & Analytics. We power more accurate, more complete measurement with the measurement vendors and partners our customers use. Our platform allows customers to combine disparate data files (typically ad exposure and customer events, like transactions), replacing customer identifiers with RampID. Customers then can use that aggregated view of each customer for measurement of reach and frequency, sales lift, closed loop offline to online conversion and cross-channel attribution.

•Identity. We provide enterprise-level identity solutions that enable organizations to: 1) resolve and connect disparate identities, 2) enrich data sets with hygiene capabilities and additional audience data from Data Marketplace providers, and 3) translate data between different systems. Our approach to identity is built from two complementary graphs, combining offline data and online data and providing the highest level of accuracy with a focus on privacy. LiveRamp technology for PII gives brands and platforms the ability to connect and update what they know about consumers, resolving PII across enterprise databases and systems to deliver better customer experiences in a privacy-conscious manner. Our digital identity graph powered by our Authenticated Traffic Solution (or "ATS") associates pseudonymous device IDs, TV IDs and other online customer IDs from premium publishers, platforms or data providers, around a RampID. This allows marketers to perform the personalized segmentation, targeting, and measurement use cases that require a consistent view of the user. There are currently more than 125 supply-side platforms live or committed to bid on RampID or ATS. In addition, to date more than 1,500 publishers, representing more than 11,000 publisher domains, have integrated ATS worldwide.

•Data Collaboration. We enable trusted second-party data collaboration between organizations and their partners in a neutral, permissioned environment. Our platform provides customers with collaborative opportunities to safely and securely build a more accurate, dynamic view of their customers leveraging partner data. Advanced measurement and analytics use cases can be performed on this shared data without either party giving up control or compromising privacy.

•Data Marketplace. Our Data Marketplace provides customers with simplified access to trusted, industry- leading third-party data globally. The Safe Haven platform allows for the search, discovery and distribution of data to improve targeting, measurement, and customer intelligence. Data accessed through our Data Marketplace is connected via RampID and is utilized to enrich our customers’ first-party data and can be leveraged across technology and media platforms, agencies, analytics environments, and TV partners. Our platform also provides tools for data providers to manage the organization, distribution, and operation of their data and services across our network of customers and partners. Today we work with more than 200 data providers across all verticals and data types (see below for discussion on Marketplace and Other).

Consumer privacy and data protection, what we call Data Ethics, are at the center of how we design our products and services. Accordingly, the Safe Haven platform operates with technical, operational, and personnel controls designed to keep our customers’ data private and secure.

Our solutions are sold to enterprise marketers and the companies they partner with to execute their marketing, including agencies, marketing technology providers, publishers and data providers. Today, we work with 905 direct customers world-wide, including approximately 25% of the Fortune 500, and serve thousands of additional customers indirectly through our reseller partnership arrangements.

•Brands and Agencies. We work with over 450 of the largest brands and agencies in the world, helping them execute people-based marketing by creating an omni-channel understanding of the consumer and activating that understanding across their choice of best-of-breed digital marketing platforms.

•Marketing Technology Providers. We provide marketing technology providers with the identity foundation required to offer people-based targeting, measurement and personalization within their platforms. This adds value for brands by increasing reach, as well as the speed at which they can activate their marketing data.

•Publishers. We enable publishers of any size to offer people-based marketing on their properties. This adds value for brands by providing direct access to their customers and prospects in the publisher's premium inventory.

•Data Owners. Leveraging our vast network of integrations, we allow data owners to easily connect to the digital ecosystem and monetize their own data. Data can be distributed to clients or made available through the LiveRamp Data Marketplace feature. This adds value for brands as it allows them to augment their understanding of consumers and increase both their reach against and understanding of customers and prospects.

We primarily charge for our platform on an annual subscription basis. Our subscription pricing is based primarily on data volume, which is a function of data input records and connection points.

Marketplace and Other

As we have scaled the LiveRamp network and technology, we have found additional ways to leverage our platform, deliver more value to clients and create incremental revenue streams. Leveraging our common identity system and broad integration network, the LiveRamp Data Marketplace is a solution that seamlessly connects data owners’ audience data across the marketing ecosystem. The Data Marketplace allows data owners to easily monetize their data across hundreds of marketing platforms and publishers with a single contract. At the same time, it provides a single gateway where data buyers, including platforms and publishers, in addition to brands and their agencies, can access third-party data from more than 200 data providers, supporting all industries and encompassing all types of data. Data providers include sources and brands exclusive to LiveRamp, emerging platforms with access to previously unavailable deterministic data, and data partnerships enabled by our platform.

We generate revenue from the Data Marketplace primarily through revenue-sharing arrangements with data owners that are monetizing their data assets on our marketplace. We also generate Marketplace and Other revenue through transactional usage-based arrangements with certain publishers and addressable TV providers.

Competitive Strengths

Our competitive strengths can be mapped back to our core capabilities around data access, identity, connectivity and data stewardship – which together create strong network effects that form a larger strategic moat around the entire business.

•Extensive Coverage. We activate data across an ecosystem of more than 550 partners, representing one of the largest networks of connections in the digital marketing space. We use 100% deterministic matching, resulting in the strongest combination of reach and accuracy. Through our Data Marketplace, we offer multi-sourced insight into approximately 700 million consumers worldwide, and over 5,000 data elements from hundreds of sources with permission rights.

•Most Advanced Consumer-Level Recognition. Our proprietary, patented recognition technology draws upon an extensive historical reference base to identify and link together multiple consumer records and identifiers. We use the pioneering algorithms of AbiliTec® and deterministic digital matching to link individuals and households to the right digital identifiers including cookies, mobile device IDs, Advanced TV IDs, and user accounts at social networks. As a result, we are able to match online and offline data with a high degree of speed and accuracy.

•Scale Leader in Data Connectivity. We are a category creator and one of the largest providers of identity and data connectivity at scale. We match records with the highest level of accuracy and offer the most flexibility for activating data through our extensive set of integrations. Our platform processes more than 4 trillion data records daily.

•Unique Position in Marketing Ecosystem. We are one of the only open and neutral data connectivity platforms operating at large scale. We provide the data connectivity required to build best-of-breed integrated marketing stacks, allowing our customers to innovate through their preferred choice of data, technology, and services providers. We strive to make every customer experience application more valuable by providing access to more customer data. We enable the open marketing stack and power the open ecosystem.

•Standard Bearer for Privacy and Security. LiveRamp has been a leader in data stewardship and a strong and vocal proponent of providing consumers with more visibility and control over their data. A few examples of our commitment in this area:

◦In all of our major geographies we have Privacy teams focused on the protection and responsible use of consumer data

◦The use of our privacy-enabled environment that allows marketers and partners to connect different types of data while protecting and governing its use

◦Industry-leading expertise in safely connecting data across the online and offline worlds

◦In fiscal 2020, the acquisition and integration of Faktor to streamline consent management across the open ecosystem. Faktor is a global consent management platform that allows consumers to better manage how and where their data is used.

•Strong Customer Relationships. We work with 905 direct customers world-wide and serve thousands of additional customers indirectly through our partner and reseller network. We have deep relationships with companies and marketing leaders in key industries, including financial services, retail, telecommunications, media, insurance, health care, automotive, technology, and travel and entertainment. Our customers are loyal and typically grow their use of the platform over time, as evidenced by our growth in the number of customers whose subscription contracts exceed $1 million in annual revenue.

Growth Strategy

LiveRamp is a category creator, thought leader and innovator in how data is used to power the customer experience. Key elements of our growth strategy include:

•Grow our Customer Base. We have strong relationships with many of the world’s largest brands, agencies, marketing technology providers, publishers and data providers. Today, we work with 905 direct customers globally; however, we believe our target market includes the world’s top 2,000 marketers, signaling there is still significant opportunity to add new customers to our roster. We expect to continue making investments in growing our sales and customer success team to support this strategy.

•Expand Existing Customer Relationships. A key growth lever for our business is the ability to land and expand – or grow existing customer relationships. Our subscription pricing is based on data volume, so over time, as customers expand their usage and leverage their data across more use cases, we are able to grow our relationships. As of March 31, 2022, we worked with 87 clients whose subscription contracts exceed $1 million in annual revenue, and as we continue to expand our coverage beyond programmatic, we expect to see this number grow.

•Continue to Innovate and Extend Leadership Position in Identity. We intend to establish LiveRamp as the standard for consumer-level recognition across the marketing ecosystem, providing a single source of user identity for audience targeting, measurement and personalization.

•Establish LiveRamp as the Trusted, Best and Essential Industry Standard for Connected Data and Collaboration. We intend to continue to make substantial investments in our platform and solutions and extend our market leadership through innovation. Our investments will focus on automation, speed, higher match rates, expanded partner integrations and use cases, and new product development.

•Expand Global Footprint. Many of our customers and partners serve their customers on a global basis, and we intend to expand our presence outside of the United States to serve the needs of our customers in additional geographies. As we expand relationships with our existing customers, we are investing in select regions in Europe and APAC.

•Expand Addressable Market. Historically, our focus has been to enable data-driven advertising for paid media. As customers look to deploy data across additional use cases, we intend to power all customer experience use cases and expand our role inside the enterprise. Advanced TV, B2B and data collaboration are great examples of this strategy. In addition, over time, we intend to pursue adjacent markets beyond marketing, like risk and fraud, healthcare and government, where similar identity and data connectivity challenges exist.

•Build an Exceptional Business. We do not aspire to be mediocre, good, or even great – we intend to be the absolute best in everything we do. We attract and employ exceptional people, challenge them to accomplish exceptional things, and achieve exceptional results for our clients and shareholders. We will do this through six guiding principles: 1) Above all, we do what is right; 2) We love our customers; 3) We say what we mean and do what we say; 4) We empower people; 5) We respect people and time; and 6) We get stuff done.

Privacy Considerations

The growing online advertising and e-commerce industries are converging, with consumers expecting a seamless experience across all channels, in real time. This challenges marketing organizations to balance the deluge of data and demands of the consumer with responsible, privacy-compliant methods of managing data internally and with advertising technology intermediaries.

We have policies and operational practices governing our use of data that are designed to actively promote a set of meaningful privacy guidelines for digital advertising and direct marketing via all channels of addressable media, e-commerce, risk management and information industries as a whole. Since the judgment of the Court of Justice of the European Union ("EU") in July 2020, as part of our effort to ensure our continued ability to process information across borders we continue to adhere to the principles of the EU-U.S. and Swiss-U.S. Privacy Shield networks, although we do not rely on those frameworks as a legal basis for transfers of personal data. We have dedicated teams in place to oversee our compliance with the data protection regulations that govern our business activities in the various countries in which we operate.

The U.S. Congress and state legislatures, along with federal regulatory authorities, have recently increased their attention on matters concerning the collection and use of consumer data. Data privacy legislation has been introduced in the U.S. Congress, and California and Virginia have enacted broad-based privacy legislation: the California Consumer Privacy Act, the California Privacy Rights Act, and the Virginia Consumer Data Protection Act. State legislatures outside of California and Virginia have proposed, and in certain cases enacted, a variety of types of data privacy legislation. In all of the non-U.S. locations in which we do business, laws and regulations governing the collection and use of personal data either exist or are being developed.

We expect the trend of enacting and revising data protection laws to continue and that new and expanded data privacy legislation in various forms will be implemented in the U.S. and in other countries around the globe. We are supportive of legislation that codifies current industry guidelines of accountability-based data governance that includes meaningful transparency for the individual, and appropriate controls over personal information and choice whether that information is shared with independent third parties for marketing purposes. We also support legislation requiring all custodians of sensitive information to deploy reasonable information security safeguards to protect that information.

Changes in laws and regulations and violations of laws or regulations by us could have a significant direct or indirect effect on our operations and financial condition, as detailed below and set forth under "Risk Factors-Risks Related to Government Regulation and Taxation."

Customers

Our customer base consists primarily of Fortune 1000 companies and organizations in the financial services, insurance, information services, direct marketing, retail, consumer packaged goods, technology, automotive, healthcare, travel and communications industries as well as in non-profit and government sectors. Given the strong network effects associated with our platform, we work with both enterprise marketers and the companies they partner with to execute their marketing, including agencies, marketing technology providers, publishers and data providers.

We seek to maintain long-term relationships with our clients. Our customers are loyal and typically grow their use of the platform over time, as evidenced by our growing number of customers whose subscription contracts exceed $1 million in annual revenue, which totaled 87 at the end of fiscal year 2022, up from 70 the year prior.

Our ten largest clients represented approximately 28% of our revenues in fiscal year 2022. If all of our individual client contractual relationships were aggregated at the holding company level, one client, The Interpublic Group of Companies, accounted for 11% of our revenues in fiscal year 2022.

Sales and Marketing

Our sales teams focus on new business development across all markets – sales to new clients and sales of new lines of business to existing clients, as well as revenue growth within existing accounts. We organize our customer relationships around customer type and industry vertical, as we believe that understanding and speaking to the nuances of each industry is the most effective way to positively impact our customers’ businesses.

Our partner organization focuses on enabling key media partners, agencies and software providers who can help drive value for our customers.

Our marketing efforts are focused on increasing awareness for our brand, executing thought leadership initiatives, supporting our sales team and generating new leads. We seek to accomplish these objectives by hosting and presenting at industry conferences, hosting client advisory boards, publishing white papers and research, public relations activities, social media presence and advertising campaigns.

Research and Development

We continue to invest in our global data connectivity platform to enable effective use of data. Our research and development teams are focused on the full cycle of product development from customer discovery through development, testing and release. Research and development expense was $157.9 million in fiscal 2022, compared to $135.1 million in fiscal 2021, and $106.0 million in fiscal 2020. Management expects to maintain research and development spending, as a percentage of revenue, at similar levels in fiscal 2023.

Seasonality

While the majority of our business is not subject to seasonal fluctuations, our Marketplace and other business experiences modest seasonality, as the revenue generated from this area of the business is more transactional in nature and tied to advertising spend. For example, many advertisers allocate the largest portion of their budgets to the fourth quarter of the calendar year in order to coincide with increased holiday purchasing. We expect our Marketplace and other revenue to continue to fluctuate based on seasonal factors that affect the advertising industry as a whole.

Competition

Competitors of LiveRamp are typically also members of our partner and reseller ecosystem, creating a paradigm where competition is the norm. Our primary competitors are companies that sell data onboarding as part of a suite of marketing applications or services. Walled gardens that offer a direct interface for matching CRM data compete for a portion of our services, particularly amongst marketers that have not yet adopted in-house platforms for programmatic marketing or attribution. Some providers of tag management, data management, and cross-device marketing solutions have adopted positioning similar to our business and compete for mindshare. In markets outside the United States, we primarily face small, local market players.

We continue to focus on levers to increase our competitiveness and believe that investing in the product and technology platform of our business is a key to our continued success. Further, we believe that enabling a broad partner ecosystem will help us to continue to provide competitive differentiation.

Pricing

Approximately 80% of our revenue is derived from subscription-based arrangements sold on an annual or multi-year basis. Our subscription pricing is based on data volume supported by our platform. We also generate revenue from data providers, digital publishers and advanced TV platforms in the form of revenue-sharing agreements.

Our Human Capital

LiveRamp's most valuable resource is our people. Our Board considers LiveRamp's Talent strategy and Diversity, Belonging and Inclusion commitment and programs to be a critical component of our Company strategy and a competitive advantage. We believe each hire is an opportunity to diversify our workforce and add new skills and capabilities that will foster greater innovation.