UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended December 31, 2021

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ----- to -----

Commission file number 001-38669

| (Exact Name of Registrant as Specified in Its Charter) | ||||||||

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of Principal Executive Offices) | (Zip Code) | |||||||

( (Registrant's Telephone Number, Including Area Code) | ||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Securities registered pursuant to Section 12(g) of the Act: None | ||||||||

| Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | |||||||||||

| No [ ] | |||||||||||

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | |||||||||||

| No [ ] | |||||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | |||||

| Accelerated filer [ ] | |||||

| Non-accelerated filer [ ] | Smaller reporting company | ||||

Emerging growth company | |||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ] | |||||||||||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | |||||||||||

Yes | No [X] | ||||||||||

The number of shares of common stock, $ 0.10 par value per share, outstanding as of February 3, 2022 was 68,170,162 .

1

LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

REPORT ON FORM 10-Q

December 31, 2021

Page No. | ||||||||

Item 1. | Financial Statements | |||||||

2

Forward-looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are intended to enjoy the protection of the safe harbor for forward-looking statements provided by the Private Securities Litigation Report Act of 1933. These statements, which are not statements of historical fact, may contain estimates, assumptions, projections and/or expectations regarding the Company’s financial position, results of operations, market position, product development, growth opportunities, economic conditions, and other similar forecasts and statements of expectation. Forward-looking statements are often identified by words or phrases such as “anticipate,” “estimate,” “plan,” “expect,” “believe,” “intend,” “foresee,” or the negative of these terms or other similar variations thereof. These forward-looking statements are not guarantees of future performance and are subject to a number of factors and uncertainties that could cause the Company’s actual results and experiences to differ materially from the anticipated results and expectations expressed in the forward-looking statements.

Forward-looking statements may include but are not limited to the following:

•management’s expectations about the macro economy and trends within the consumer or business information industries, including the use of data and consumer expectations related thereto;

•statements regarding our competitive position within our industry and our differentiation strategies;

•our expectations regarding laws, regulations and industry practices governing the collection and use of

personal data;

•our expectations regarding the potential impact of the pandemic related to the current and continuing outbreak of a novel strain of coronavirus ("COVID-19") on our business, operations, and the markets in which we and our partners and customers operate;

•our expectations regarding the effect of the Coronavirus Aid, Relief and Economic Security Act (the "CARES Act") and other tax-related legislation on our tax position;

•statements regarding our liquidity needs or containing a projection of revenues, operating income (loss), income (loss), earnings (loss) per share, capital expenditures, dividends, capital structure, or other financial items;

•statements of the plans and objectives of management for future operations;

•statements of future performance, including, but not limited to, those statements contained in Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in this Quarterly Report on Form 10-Q;

•statements regarding future stock-based compensation expense;

•statements containing any assumptions underlying or relating to any of the above statements; and

•statements containing a projection or estimate.

Among the factors that may cause actual results and expectations to differ from anticipated results and expectations expressed in such forward-looking statements are the following:

•the risk factors described in Part I, “Item 1A. Risk Factors” included in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2021 filed with the Securities and Exchange Commission ("SEC") on May 27, 2021 and those described from time to time in our future reports filed with the SEC;

•the possibility that, in the event a change of control of the Company is sought, certain clients may attempt to invoke provisions in their contracts allowing for termination upon a change in control, which may result in a decline in revenue and profit;

•the possibility that the integration of acquired businesses may not be as successful as planned;

3

•the possibility that the fair value of certain of our assets may not be equal to the carrying value of those assets now or in future time periods;

•the possibility that sales cycles may lengthen;

•the possibility that we will not be able to properly motivate our sales force or other employees;

•the possibility that we may not be able to attract and retain qualified technical and leadership employees, or that we may lose key employees to other organizations;

•the possibility that competent, competitive products, technologies or services will be introduced into the marketplace by other companies;

•the possibility that there will be changes in consumer or business information industries and markets that negatively impact the Company;

•the possibility that we will not be able to protect proprietary information and technology or to obtain necessary licenses on commercially reasonable terms;

•the possibility that there will be changes in the judicial, legislative, regulatory, accounting, cultural and consumer environments affecting our business, including but not limited to litigation, investigations, legislation, regulations and customs impairing our ability to collect, process, manage, aggregate, store and/or use data;

•the possibility that data suppliers might withdraw data from us, leading to our inability to provide certain products and services;

•the possibility that data purchasers will reduce their reliance on us by developing and using their own, or alternative, sources of data generally or with respect to certain data elements or categories;

•the possibility that we may enter into short-term contracts that would affect the predictability of our revenues;

•the possibility that the amount of volume-based and other transactional based work will not be as expected;

•the possibility that we may experience a loss of data center capacity or capability or interruption of telecommunication links or power sources;

•the possibility that we may experience failures or breaches of our network and data security systems, leading to potential adverse publicity, negative customer reaction, or liability to third parties;

•the possibility that our clients may cancel or modify their agreements with us, or may not make timely or complete payments due to the COVID-19 pandemic or other factors;

•the possibility that we will not successfully meet customer contract requirements or the service levels specified in the contracts, which may result in contract penalties or lost revenue;

•the possibility that we experience processing errors that result in credits to customers, re-performance of services or payment of damages to customers;

•the possibility that our performance may decline and we lose advertisers and revenue if the use of "third-party cookies" or other tracking technology is rejected by Internet users, restricted or otherwise subject to unfavorable regulation, blocked or limited by technical changes on end users' devices, or our or our clients' ability to use data on our platform is otherwise restricted;

•general and global negative conditions, including the COVID-19 pandemic and related causes; and

•our tax rate and other effects of changes to U.S. federal tax law.

With respect to the provision of products or services outside our primary base of operations in the United States, all of the above factors apply, along with the difficulty of doing business in numerous sovereign jurisdictions due to differences in scale, competition, culture, laws and regulations.

4

Other factors are detailed from time to time in periodic reports and registration statements filed with the SEC. The Company believes that it has the product and technology offerings, facilities, employees and competitive and financial resources for continued business success, but future revenues, costs, margins and profits are all influenced by a number of factors, including those discussed above, all of which are inherently difficult to forecast.

In light of these risks, uncertainties and assumptions, the Company cautions readers not to place undue reliance on any forward-looking statements. Forward-looking statements and such risks, uncertainties and assumptions speak only as of the date of this Quarterly Report on Form 10-Q, and the Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statements contained herein, to reflect any change in our expectations with regard thereto, or any other change based on the occurrence of future events, the receipt of new information or otherwise, except to the extent otherwise required by law.

5

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

| December 31, | March 31, | |||||||||||||

| 2021 | 2021 | |||||||||||||

| ASSETS | (unaudited) | |||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Restricted cash | ||||||||||||||

| Trade accounts receivable, net | ||||||||||||||

| Refundable income taxes | ||||||||||||||

| Other current assets | ||||||||||||||

| Total current assets | ||||||||||||||

| Property and equipment, net of accumulated depreciation and amortization | ||||||||||||||

| Intangible assets, net | ||||||||||||||

| Goodwill | ||||||||||||||

| Deferred commissions, net | ||||||||||||||

| Other assets, net | ||||||||||||||

| $ | $ | |||||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Trade accounts payable | $ | $ | ||||||||||||

| Accrued payroll and related expenses | ||||||||||||||

| Other accrued expenses | ||||||||||||||

| Acquisition escrow payable | ||||||||||||||

| Deferred revenue | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Other liabilities | ||||||||||||||

| Commitments and contingencies (Note 15) | ||||||||||||||

| Stockholders' equity: | ||||||||||||||

| Preferred stock | ||||||||||||||

| Common stock | ||||||||||||||

| Additional paid-in capital | ||||||||||||||

| Retained earnings | ||||||||||||||

| Accumulated other comprehensive income | ||||||||||||||

| Treasury stock, at cost | ( | ( | ||||||||||||

| Total stockholders' equity | ||||||||||||||

| $ | $ | |||||||||||||

See accompanying notes to condensed consolidated financial statements.

6

LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(Dollars in thousands, except per share amounts)

| For the three months ended | For the nine months ended | |||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||||||||||||||

| Cost of revenue | ||||||||||||||||||||||||||

| Gross profit | ||||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||

| Research and development | ||||||||||||||||||||||||||

| Sales and marketing | ||||||||||||||||||||||||||

| General and administrative | ||||||||||||||||||||||||||

| Gains, losses and other items, net | ( | |||||||||||||||||||||||||

| Total operating expenses | ||||||||||||||||||||||||||

| Loss from operations | ( | ( | ( | ( | ||||||||||||||||||||||

| Total other income (expense), net | ( | ( | ||||||||||||||||||||||||

| Loss before income taxes | ( | ( | ( | ( | ||||||||||||||||||||||

| Income tax expense (benefit) | ( | ( | ( | |||||||||||||||||||||||

| Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Basic loss per share | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Diluted loss per share | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

7

LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

(Dollars in thousands)

| For the three months ended | For the nine months ended | ||||||||||||||||||||||||||||

| December 31, | December 31, | ||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||

| Net loss | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||

| Other comprehensive income (loss): | |||||||||||||||||||||||||||||

| Change in foreign currency translation adjustment | ( | ( | |||||||||||||||||||||||||||

| Comprehensive loss | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

8

LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

THREE AND NINE MONTHS ENDED DECEMBER 31, 2021

(Unaudited)

(Dollars in thousands)

| Accumulated | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional | other | Treasury Stock | |||||||||||||||||||||||||||||||||||||||||||||||

| Number | paid-in | Retained | comprehensive | Number | Total | |||||||||||||||||||||||||||||||||||||||||||||

| For the three months ended December 31, 2021 | of shares | Amount | Capital | earnings | income (loss) | of shares | Amount | Equity | ||||||||||||||||||||||||||||||||||||||||||

| Balances at September 30, 2021 | $ | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||

| Employee stock awards, benefit plans and other issuances | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||

| Non-cash stock-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Restricted stock units vested | ( | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Acquisition of treasury stock | — | — | — | — | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

| Comprehensive loss: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Balances at December 31, 2021 | $ | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||

| For the nine months ended December 31, 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Balances at March 31, 2021 | $ | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||

| Employee stock awards, benefit plans and other issuances | — | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||

| Non-cash stock-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Restricted stock units vested | ( | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Acquisition-related restricted stock award | ( | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Liability-classified restricted stock units vested | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Acquisition of treasury stock | — | — | — | — | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Balances at December 31, 2021 | $ | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

9

LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

THREE AND NINE MONTHS ENDED DECEMBER 31, 2020

(Unaudited)

(Dollars in thousands)

| Accumulated | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional | other | Treasury Stock | |||||||||||||||||||||||||||||||||||||||||||||||

| Number | paid-in | Retained | comprehensive | Number | Total | |||||||||||||||||||||||||||||||||||||||||||||

| For the three months ended December 31, 2020 | of shares | Amount | Capital | earnings | income | of shares | Amount | Equity | ||||||||||||||||||||||||||||||||||||||||||

| Balances at September 30, 2020 | $ | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||

| Employee stock awards, benefit plans and other issuances | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||

| Non-cash stock-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Restricted stock units vested | ( | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Balances at December 31, 2020 | $ | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||

| For the nine months ended December 31, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Balances at March 31, 2020 | $ | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||

| Employee stock awards, benefit plans and other issuances | — | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||

| Non-cash stock-based compensation | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Restricted stock units vested | ( | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Liability-classified restricted stock units vested | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Acquisition of treasury stock | — | — | — | — | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Balances at December 31, 2020 | $ | $ | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

10

| LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES | ||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||||||||

| (Unaudited) | ||||||||||||||

| (Dollars in thousands) | ||||||||||||||

| For the nine months ended | ||||||||||||||

| December 31, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Cash flows from operating activities: | ||||||||||||||

| Net loss | $ | ( | $ | ( | ||||||||||

| Non-cash operating activities: | ||||||||||||||

| Depreciation and amortization | ||||||||||||||

| Loss on disposal or impairment of assets | ||||||||||||||

| Gain on distribution from retained profits interest | ( | |||||||||||||

| Provision for doubtful accounts | ||||||||||||||

| Deferred income taxes | ( | |||||||||||||

| Non-cash stock compensation expense | ||||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||

| Accounts receivable, net | ( | ( | ||||||||||||

| Deferred commissions | ( | ( | ||||||||||||

| Other assets | ||||||||||||||

| Accounts payable and other liabilities | ( | ( | ||||||||||||

| Income taxes, net | ( | |||||||||||||

| Deferred revenue | ||||||||||||||

| Net cash provided by (used in) operating activities | ( | |||||||||||||

| Cash flows from investing activities: | ||||||||||||||

| Capital expenditures | ( | ( | ||||||||||||

| Cash paid in acquisitions, net of cash received | ( | ( | ||||||||||||

| Distribution from retained profits interest | ||||||||||||||

| Purchases of investments | ( | |||||||||||||

| Purchases of strategic investments | ( | |||||||||||||

| Net cash provided by (used in) investing activities | ( | |||||||||||||

| Cash flows from financing activities: | ||||||||||||||

| Proceeds related to the issuance of common stock under stock and employee benefit plans | ||||||||||||||

| Shares repurchased for tax withholdings upon vesting of stock-based awards | ( | ( | ||||||||||||

| Acquisition of treasury stock | ( | ( | ||||||||||||

| Net cash used in financing activities | ( | ( | ||||||||||||

| Effect of exchange rate changes on cash | ( | |||||||||||||

11

| LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES | ||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||||||||

| (Unaudited) | ||||||||||||||

| (Dollars in thousands) | ||||||||||||||

| For the nine months ended | ||||||||||||||

| December 31, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Net change in cash and cash equivalents | ( | ( | ||||||||||||

| Cash and cash equivalents at beginning of period | ||||||||||||||

| Cash and cash equivalents at end of period | $ | $ | ||||||||||||

| Supplemental cash flow information: | ||||||||||||||

| Cash (received) for income taxes, net | $ | ( | $ | ( | ||||||||||

| Operating lease assets obtained in exchange for operating lease liabilities | ||||||||||||||

See accompanying notes to condensed consolidated financial statements.

12

LIVERAMP HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

These condensed consolidated financial statements have been prepared by LiveRamp Holdings, Inc. ("LiveRamp", "we", "us" or the "Company"), without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). In the opinion of the Company's management, all adjustments necessary for a fair presentation of the results for the periods included have been made, and the disclosures are adequate to make the information presented not misleading. All such adjustments are of a normal recurring nature. Certain note information has been omitted because it has not changed significantly from that reflected in Notes 1 through 19 of the Notes to Consolidated Financial Statements filed as part of Item 8 of the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2021 (“2021 Annual Report”), as filed with the SEC on May 27, 2021. This quarterly report and the accompanying condensed consolidated financial statements should be read in connection with the 2021 Annual Report. The financial information contained in this quarterly report is not necessarily indicative of the results to be expected for any other period or for the full fiscal year ending March 31, 2022.

Management of the Company has made a number of estimates and assumptions relating to the reporting of assets and liabilities and the disclosure of contingent assets and liabilities to prepare these condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States (“U.S. GAAP”). Actual results could differ from those estimates. Certain of the accounting policies used in the preparation of these condensed consolidated financial statements are complex and require management to make judgments and/or significant estimates regarding amounts reported or disclosed in these financial statements. Additionally, the application of certain of these accounting policies is governed by complex accounting principles and their interpretation. A discussion of the Company’s significant accounting principles and their application is included in Note 1 of the Notes to Consolidated Financial Statements and in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, of the Company’s 2021 Annual Report.

Due to the COVID-19 Coronavirus pandemic ("COVID-19" or "COVID-19 pandemic"), there has been uncertainty and disruption in the global economy and financial markets. We are not aware of any specific event or circumstance that would require an update to our estimates or judgments or a revision of the carrying value of our assets or liabilities as of December 31, 2021. While there was not a material impact to our condensed consolidated financial statements as of and for the nine months ended December 31, 2021, these estimates may change, as new events occur and additional information is obtained, as well as other factors related to the COVID-19 pandemic that could result in material impacts to our condensed consolidated financial statements in future reporting periods.

| Accounting pronouncements adopted during the current year | |||||||||||

| Standard | Description | Date of Adoption | Effect on Financial Statements or Other Significant Matters | ||||||||

Accounting Standards Update ("ASU") ASU 2019-12 Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes ("ASU 2019-12") | ASU 2019-12 simplifies the accounting for income taxes, eliminates certain exceptions to the general principles in Topic 740 and clarifies and amends existing guidance to improve consistent application. | April 1, 2021 | The effect of prospectively adopting ASU 2019-12 on our condensed consolidated financial statements and related disclosures was not material. | ||||||||

13

| Recent accounting pronouncements not yet adopted | |||||||||||

| Standard | Description | Date of Adoption | Effect on Financial Statements or Other Significant Matters | ||||||||

| There are no material accounting pronouncements applicable to the Company not yet adopted | |||||||||||

2. LOSS PER SHARE AND STOCKHOLDERS’ EQUITY:

Loss Per Share

A reconciliation of the numerator and denominator of basic and diluted loss per share is shown below (in thousands, except per share amounts):

| For the three months ended | For the nine months ended | |||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Basic loss per share: | ||||||||||||||||||||||||||

| Net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Basic weighted-average shares outstanding | ||||||||||||||||||||||||||

| Basic loss per share | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

| Diluted loss per share: | ||||||||||||||||||||||||||

| Basic weighted-average shares outstanding | ||||||||||||||||||||||||||

| Dilutive effect of common stock options and restricted stock as computed under the treasury stock method (1) | ||||||||||||||||||||||||||

| Diluted weighted-average shares outstanding | ||||||||||||||||||||||||||

| Diluted loss per share | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||

(1) The number of common stock options and restricted stock units as computed under the treasury stock method that would have otherwise been dilutive but are excluded from the table above because their effect would have been anti-dilutive due to the net loss position of the Company was (i) 1.7 million and 1.4 million in the three and nine months ended December 31, 2021, respectively and (ii) 3.3 million and 2.6 million in the three and nine months ended December 31, 2020, respectively.

14

Restricted stock units that were outstanding during the periods presented but were not included in the computation of diluted loss per share because their effect would have been anti-dilutive (other than due to the net loss position of the Company) are shown below (shares in thousands):

| For the three months ended | For the nine months ended | |||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Number of shares underlying restricted stock units | ||||||||||||||||||||||||||

Stockholders’ Equity

Under the modified common stock repurchase program, the Company may purchase up to $1.0 billion of its common stock through the period ending December 31, 2022. During the nine months ended December 31, 2021, the Company repurchased 1.1 million shares of its common stock for $49.2 million under the stock repurchase program. Through December 31, 2021, the Company had repurchased a total of 29.4 million shares of its stock for $722.8 million under the stock repurchase program, leaving remaining capacity of $277.2 million.

Accumulated other comprehensive income balances of $5.9 million and $7.5 million at December 31, 2021 and March 31, 2021, respectively, reflect accumulated foreign currency translation adjustments.

3. REVENUE FROM CONTRACTS WITH CUSTOMERS:

Disaggregation of Revenue

In the following table, revenue is disaggregated by primary geographical market and major service offerings (dollars in thousands):

| For the nine months ended December 31, | ||||||||||||||

| Primary Geographical Markets | 2021 | 2020 | ||||||||||||

| United States | $ | $ | ||||||||||||

| Europe | ||||||||||||||

| Asia-Pacific ("APAC") | ||||||||||||||

| $ | $ | |||||||||||||

| Major Offerings/Services | ||||||||||||||

| Subscription | $ | $ | ||||||||||||

| Marketplace and Other | ||||||||||||||

| $ | $ | |||||||||||||

Transaction Price Allocated to the Remaining Performance Obligations

We have performance obligations associated with fixed commitments in customer contracts for future services that have not yet been recognized in our condensed consolidated financial statements. The amount of fixed revenue not yet recognized was $380.0 million as of December 31, 2021, of which $289.3 million will be recognized over the next twelve months . The Company expects to recognize revenue on substantially all of these remaining performance obligations by March 31, 2026.

15

4. LEASES:

| December 31, 2021 | March 31, 2021 | |||||||||||||

| $ | $ | |||||||||||||

| $ | $ | |||||||||||||

| $ | $ | |||||||||||||

| Supplemental balance sheet information: | ||||||||||||||

| Weighted average remaining lease term | ||||||||||||||

| Weighted average discount rate | % | % | ||||||||||||

The Company leases its office facilities under non-cancellable operating leases that expire at various dates through fiscal 2030. Certain leases contain provisions for property-related costs that are variable in nature for which the Company is responsible, including common area maintenance and other property operating services. These costs are calculated based on a variety of factors including property values, tax and utility rates, property service fees, and other factors. Operating lease costs were $8.1 million and $8.7 million for the nine months ended December 31, 2021 and 2020, respectively.

In the quarter ended September 30, 2021, the Company negotiated lease extensions at three of its leased office space locations. The lease period extensions ranged from 2 to 7 years and included the lease extension of the Company's primary corporate headquarters in San Francisco, California by 7 years. As a result, approximately $35.7 million of right-of-use assets and lease liabilities were recognized in the condensed consolidated balance sheets and as supplemental information to the condensed consolidated statements of cash flows.

In the quarter ended December 31, 2021, the Company negotiated lease extensions at one other leased office space location and new leases for two other office locations. The lease periods ranged from 7 to 8 years. As a result, approximately $17.2 million of right-of-use assets and lease liabilities were recognized in the condensed consolidated balance sheets and as supplemental information to the condensed consolidated statements of cash flows.

Future minimum payments under all operating leases (including operating leases with a duration of one year or less) as of December 31, 2021 are as follows (dollars in thousands):

| Amount | ||||||||

| Fiscal 2022 | $ | |||||||

| Fiscal 2023 | ||||||||

| Fiscal 2024 | ||||||||

| Fiscal 2025 | ||||||||

| Fiscal 2026 | ||||||||

| Thereafter | ||||||||

| Total undiscounted lease commitments | ||||||||

| Less: Interest and short-term leases | ||||||||

| Total discounted operating lease liabilities | $ | |||||||

Future minimum payments as of December 31, 2021 related to restructuring plans as a result of the Company's exit from certain leased office facilities (see Note 14) are as follows (dollars in thousands): Fiscal 2022: $661 ; Fiscal 2023: $2,663 ; Fiscal 2024: $2,698 ; Fiscal 2025: $2,698 ; and Fiscal 2026: $1,799 .

16

5. ACQUISITIONS:

Rakam

On December 13, 2021, the Company completed the acquisition of certain technology assets owned by Rakam, Inc. ("Rakam") for approximately $2.2 million in cash (including a holdback amount of $0.2 million included in other accrued expenses in the condensed consolidated balance sheet - see Note 8). The technology asset is a cloud-agnostic customer data analytics platform that is deployed direct in the client's data warehouse. The purchased technology will be embedded into the Company's platform, enabling us to provide a single, unified segmentation solution and enable our clients to generate real-time insights and create custom audiences wherever their data resides.

The Company concluded the acquired assets did not meet the definition of a business under ASU 2017-01, "Clarifying the Definition of a Business", and therefore has accounted for the acquisition as an asset acquisition. The purchased asset was recorded as a $2.2 million developed technology intangible asset included in other assets, net in the condensed consolidated balance sheet and will be amortized over a period of three years based on its estimated useful life.

In connection with acquisition, the Company extended employment agreements and granted $2.6 million of restricted stock units to two key Rakam employees (see Note 6). The restricted stock units will vest over four years and are not considered part of the asset purchase price as they require future service and continued employment by those individuals to vest.

Diablo

On April 21, 2021, the Company completed the acquisition of Diablo.ai, Inc. ("Diablo"), a first-party data resolution platform and graph builder, for approximately $9.7 million in cash (including a holdback amount of $1.2 million included in other accrued expenses in the condensed consolidated balance sheet - see Note 8). The acquisition also included $1.9 million of assumed restricted stock awards that will be recorded as non-cash stock compensation over a period of three years (see Note 6). Diablo's technology will be embedded into our unified platform and will play an integral role in our global identity capability. The Company has omitted pro forma disclosures related to this acquisition as the pro forma effect of this acquisition is not material. The results of operations for this acquisition are included in the Company's condensed consolidated results beginning April 21, 2021.

| April 21, 2021 | ||||||||

| Assets acquired: | ||||||||

| Cash | $ | |||||||

| Goodwill | ||||||||

| Intangible assets | ||||||||

| Total assets acquired | ||||||||

| Deferred income taxes | ( | |||||||

| Accounts payable and accrued expenses | ( | |||||||

| Net assets acquired | ||||||||

| Less: | ||||||||

| Cash acquired | ( | |||||||

| Net purchase price allocated | ||||||||

| Less: | ||||||||

| Cash held back | ( | |||||||

| Net cash paid in acquisition | ||||||||

17

6. STOCK-BASED COMPENSATION:

Stock-based Compensation Plans

The Company has stock option and equity compensation plans for which a total of 39.1 million shares of the Company’s common stock have been reserved for issuance since the inception of the plans. At December 31, 2021, there were a total of 3.0 million shares available for future grants under the plans.

Stock-based Compensation Expense

| For the nine months ended | ||||||||||||||

| December 31, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Stock options | $ | $ | ||||||||||||

| Restricted stock units | ||||||||||||||

| Diablo restricted stock awards | ||||||||||||||

| Data Plus Math ("DPM") acquisition consideration holdback | ||||||||||||||

| Pacific Data Partners ("PDP") assumed performance plan | ||||||||||||||

| Acuity performance plan | ||||||||||||||

| DataFleets acquisition consideration holdback | ||||||||||||||

| Other stock-based compensation | ||||||||||||||

| Total non-cash stock-based compensation included in the condensed consolidated statements of operations | ||||||||||||||

| Less expense related to liability-based equity awards | ( | ( | ||||||||||||

| Total non-cash stock-based compensation included in the condensed consolidated statements of equity | $ | $ | ||||||||||||

The effect of stock-based compensation expense on income, by financial statement line item, was (dollars in thousands):

| For the nine months ended | ||||||||||||||

| December 31, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Cost of revenue | $ | $ | ||||||||||||

| Research and development | ||||||||||||||

| Sales and marketing | ||||||||||||||

| General and administrative | ||||||||||||||

| Total non-cash stock-based compensation included in the condensed consolidated statements of operations | $ | $ | ||||||||||||

18

| For the years ending March 31, | ||||||||||||||||||||||||||||||||||||||

| 2022 | 2023 | 2024 | 2025 | 2026 | Total | |||||||||||||||||||||||||||||||||

| Stock options | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Restricted stock units | ||||||||||||||||||||||||||||||||||||||

| Diablo restricted stock awards | ||||||||||||||||||||||||||||||||||||||

| DPM acquisition consideration holdback | ||||||||||||||||||||||||||||||||||||||

| PDP assumed performance plan | ||||||||||||||||||||||||||||||||||||||

| Acuity performance plan | ||||||||||||||||||||||||||||||||||||||

| DataFleets acquisition consideration holdback | ||||||||||||||||||||||||||||||||||||||

| Other stock-based compensation | ||||||||||||||||||||||||||||||||||||||

| Expected future expense | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

Stock Options Activity

| Weighted-average | ||||||||||||||||||||||||||

| Weighted-average | remaining | Aggregate | ||||||||||||||||||||||||

| Number of | exercise price | contractual term | Intrinsic value | |||||||||||||||||||||||

| shares | per share | (in years) | (in thousands) | |||||||||||||||||||||||

| Outstanding at March 31, 2021 | $ | |||||||||||||||||||||||||

| Exercised | ( | $ | $ | |||||||||||||||||||||||

| Forfeited or canceled | ( | $ | ||||||||||||||||||||||||

| Outstanding at December 31, 2021 | $ | $ | ||||||||||||||||||||||||

| Exercisable at December 31, 2021 | $ | $ | ||||||||||||||||||||||||

The aggregate intrinsic value at period end represents the total pre-tax intrinsic value (the difference between LiveRamp’s closing stock price on the last trading day of the period and the exercise price for each in-the-money option) that would have been received by the option holders had they exercised their options on December 31, 2021. This amount changes based upon changes in the fair market value of LiveRamp’s common stock.

A summary of stock options outstanding and exercisable as of December 31, 2021 was:

| Options outstanding | Options exercisable | |||||||||||||||||||||||||||||||||||||||||||

| Range of | Weighted-average | Weighted-average | Weighted-average | |||||||||||||||||||||||||||||||||||||||||

| exercise price | Options | remaining | exercise price | Options | exercise price | |||||||||||||||||||||||||||||||||||||||

| per share | outstanding | contractual life | per share | exercisable | per share | |||||||||||||||||||||||||||||||||||||||

| $ | — | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||

| $ | — | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||

| $ | — | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||||||||||||||||||||||

19

Diablo Restricted Stock Awards

During the nine months ended December 31, 2021, in connection with the acquisition of Diablo, the Company replaced the unvested outstanding restricted stock shares held by a Diablo employee immediately prior to the acquisition with restricted shares of LiveRamp common stock having substantially the same terms and conditions as were applicable under the original restricted stock agreement. The conversion calculation resulted in issuance of 40,600 replacement restricted stock shares having an acquisition-date fair value of $1.9 million. The restricted shares vest subject to post-combination service requirements. As a result, the acquisition-date fair value is considered future compensation cost and will be recognized as stock-based compensation cost over the approximate three-year vesting period of the awards.

Changes in the Company's restricted stock for the nine months ended December 31, 2021 was:

| Weighted-average | ||||||||||||||||||||

| fair value per | Weighted-average | |||||||||||||||||||

| Number | share at grant | remaining contractual | ||||||||||||||||||

| of shares | date | term (in years) | ||||||||||||||||||

| Unvested restricted stock awards at March 31, 2021 | $ | |||||||||||||||||||

| Diablo replacement restricted stock award | $ | |||||||||||||||||||

| Vested | ( | $ | ||||||||||||||||||

| Unvested restricted stock awards at December 31, 2021 | $ | |||||||||||||||||||

Restricted Stock Unit Activity

Time-vesting restricted stock units ("RSUs") -

During the nine months ended December 31, 2021, the Company granted time-vesting RSUs covering 2,753,140 shares of common stock and having a fair value at the date of grant of $132.7 million. The RSUs granted in the current year primarily vest over four years . Grant date fair value of these units is equal to the quoted market price for the shares on the date of grant. Included in the RSUs granted in the current fiscal year were units related to the Diablo acquisition and the Rakam acquisition (see Note 5). Following the closing of the Diablo acquisition, the Company granted new awards of RSUs, covering 98,442 shares of common stock having a grant date fair value of $4.7 million, to select employees to induce them to accept employment with the Company. In connection with the Rakam acquisition, the Company extended employment agreements and granted new awards of RSUs, covering 55,927 shares of common stock having a grant date fair value of $2.6 million, to two key Rakam employees.

| Weighted-average | ||||||||||||||||||||

| fair value per | Weighted-average | |||||||||||||||||||

| Number | share at grant | remaining contractual | ||||||||||||||||||

| of shares | date | term (in years) | ||||||||||||||||||

| Outstanding at March 31, 2021 | $ | |||||||||||||||||||

| Granted | $ | |||||||||||||||||||

| Vested | ( | $ | ||||||||||||||||||

| Forfeited or canceled | ( | $ | ||||||||||||||||||

| Outstanding at December 31, 2021 | $ | |||||||||||||||||||

The total fair value of RSUs vested during the nine months ended December 31, 2021 was $20.7 million and is measured as the quoted market price of the Company's common stock on the vesting date for the number of shares vested.

20

Performance-based restricted stock units ("PSUs") -

Fiscal 2022 plans:

During the nine months ended December 31, 2021, the Company granted PSUs covering 249,152 shares of common stock having a fair value at the date of grant of $12.6 million. The grants were made under three separate performance plans.

Under a special incentive performance plan, units covering 36,425 shares of common stock were granted having a fair value at the date of grant of $1.7 million, which was equal to the quoted market price for the shares on the date of grant. The units vest subject to attainment of performance criteria established by the compensation committee and continuous employment through the vesting date. The units may vest in a number of shares from 0 % to 100 % of the award, based on the attainment of key productivity metrics for the period from January 1, 2023 to December 31, 2023. Performance will be measured and vesting evaluated on a quarterly basis beginning with the period ending March 31, 2023 and continuing through the end of the performance period.

Under the total shareholder return ("TSR") performance plan, units covering 63,815 shares of common stock were granted having a fair value at the date of grant of $3.8 million, determined using a Monte Carlo simulation model. The units vest subject to attainment of market conditions established by the compensation committee of the board of directors (“compensation committee”) and continuous employment through the vesting date. The units may vest in a number of shares from 0 % to 200 % of the award, based on the TSR of LiveRamp common stock compared to the TSR of the Russell 2000 market index for the period from April 1, 2021 to March 31, 2024.

Under the operating metrics performance plan, units covering 148,912 shares of common stock were granted having a fair value at the date of grant of $7.1 million, which was equal to the quoted market price for the shares on the date of grant. The units vest subject to attainment of performance criteria established by the compensation committee and continuous employment through the vesting date. The units may vest in a number of shares from 0 % to 200 % of the award, based on the attainment of trailing twelve-month revenue growth and EBITDA margin targets for the period from April 1, 2021 to March 31, 2024. Performance will be measured and vesting evaluated on a quarterly basis beginning with the period ending June 30, 2022 and continuing through the end of the performance period. To the extent that shares are earned in a given quarter, 50 % vest immediately and 50 % vest on the one-year anniversary of attainment approval, except that all earned but unvested shares will vest fully at the end of the measurement period.

Fiscal 2021 plans:

Units under the Company's fiscal 2021 TSR PSU plan covering 59,634 shares of common stock will reach maturity of their relevant performance period at March 31, 2023. The units may vest in a number of shares from 0 % to 200 % of the award, based on the total shareholder return of LiveRamp common stock compared to total shareholder return of the Russell 2000 market index for the period from April 1, 2020 to March 31, 2023.

The initial measurement date for the fiscal 2021 operating metrics performance plan was June 30, 2021. Through December 31, 2021 performance measurements have resulted in an accumulated 50 % achievement, or 71,668 total earned units under this plan. Of the earned amount, one-half will vest immediately, while the remaining one-half will vest one year later. As of December 31, 2021, there remains a maximum potential of 208,748 additional units eligible for attainment under the plan. Quarterly measurements of attainment will continue through March 31, 2023.

Fiscal 2020 plans:

Units under the Company's fiscal 2020 TSR PSU plan covering 54,012 shares of common stock will reach maturity of their relevant performance period at March 31, 2022. The units may vest in a number of shares from 0 % to 200 % of the award, based on the total shareholder return of LiveRamp common stock compared to total shareholder return of the Russell 2000 market index for the period from April 1, 2019 to March 31, 2022.

21

Units under the Company's fiscal 2020 compound revenue growth PSU plan will reach maturity of their relevant performance period at March 31, 2022. 82,494 units may vest in a number of shares from 0 % to 200 % of the award, based on attainment of the Company's three-year revenue compound annual growth rate target for the period from April 1, 2019 to March 31, 2022. Performance measurement through December 31, 2021 indicates no attainment at the end of the performance period.

Fiscal 2019 plans:

Through December 31, 2021, the compensation committee has previously approved quarterly performance measurements totaling 90 % attainment under this plan. Net of forfeitures, this resulted in a total of 232,063 units earned. Performance measurement through December 31, 2021 indicates cumulative performance attainment of 91 % which, if approved by the compensation committee, will bring the total units earned under the plan, net of forfeitures, to 233,153 units. As of December 31, 2021, there remains a maximum potential of 240,292 additional units eligible for attainment under the plan. Quarterly measurements of attainment will continue through September 30, 2022.

| Weighted-average | ||||||||||||||||||||

| fair value per | Weighted-average | |||||||||||||||||||

| Number | share at grant | remaining contractual | ||||||||||||||||||

| of shares | date | term (in years) | ||||||||||||||||||

| Outstanding at March 31, 2021 | $ | |||||||||||||||||||

| Granted | $ | |||||||||||||||||||

| Vested | ( | $ | ||||||||||||||||||

| Forfeited or canceled | ( | $ | ||||||||||||||||||

| Outstanding at December 31, 2021 | $ | |||||||||||||||||||

The total fair value of PSUs vested in the nine months ended December 31, 2021 was $6.6 million and is measured as the quoted market price of the Company’s common stock on the vesting date for the number of shares vested.

Acquisition-related Performance Plan

Through December 31, 2021, the Company has recognized a total of $3.8 million as stock-based compensation expense related to the Acuity performance earnout plan. At December 31, 2021, the recognized, but unpaid, balance in other accrued expense in the condensed consolidated balance sheet was $2.1 million. The next annual settlement of $1.7 million is expected to occur in the second quarter of fiscal 2023.

Acquisition-related Consideration Holdback

Through December 31, 2021, the Company has recognized a total of $5.3 million as stock-based compensation expense related to the DataFleets consideration holdback. At December 31, 2021, the recognized, but unpaid, balance related to the DataFleets consideration holdback in other accrued expenses in the condensed consolidated balance sheet was $5.3 million. The first annual settlement of $6.0 million is expected to occur in the fourth quarter of fiscal 2022.

Through December 31, 2021, the Company has recognized a total of $20.3 million as stock-based compensation expense related to the DPM consideration holdback. At December 31, 2021, the recognized, but unpaid, balance related to the DPM consideration holdback in the condensed consolidated balance sheet was $4.1 million. The next and final annual settlement of $8.1 million is expected to occur at the end of the first quarter of fiscal 2023.

PDP Assumed Performance Plan

In connection with the fiscal 2018 acquisition of PDP, the Company assumed the outstanding performance compensation plan under the PDP 2018 Equity Compensation Plan ("PDP PSU plan"). During fiscal 2020, the Company converted the outstanding PDP PSU plan to a time-vesting restricted stock plan ("PDP RSU plan").

22

Through December 31, 2021, the Company has recognized a total of $63.3 million as stock-based compensation expense related to the PDP RSU plan. At December 31, 2021, the recognized, but unpaid, balance related to the liability-classified PDP RSU plan in other accrued expenses in the condensed consolidated balance sheet was $6.1 million. The final annual settlement is expected to occur in the fourth quarter of fiscal 2022.

Qualified Employee Stock Purchase Plan ("ESPP")

During the nine months ended December 31, 2021, 103,447 shares of common stock were purchased under the ESPP at a weighted-average price of $41.44 per share, resulting in cash proceeds of $4.3 million over the relevant offering periods.

Stock-based compensation expense associated with the ESPP was $1.3 million for the nine months ended December 31, 2021. At December 31, 2021, there was approximately $0.9 million of total unrecognized stock-based compensation expense related to the ESPP, which is expected to be recognized on a straight-line basis over the remaining term of the current offering period.

7. OTHER CURRENT AND NONCURRENT ASSETS:

| December 31, 2021 | March 31, 2021 | |||||||||||||

| Prepaid expenses and other | $ | $ | ||||||||||||

| Share receivable for cash settlement of withheld income tax withholdings on equity award | ||||||||||||||

| Certificates of deposit | ||||||||||||||

| Assets of non-qualified retirement plan | ||||||||||||||

| Other current assets | $ | $ | ||||||||||||

| December 31, 2021 | March 31, 2021 | |||||||||||||

| Long-term prepaid revenue share | $ | $ | ||||||||||||

| Right-of-use assets (see Note 4) | ||||||||||||||

| Deferred tax asset | ||||||||||||||

| Deposits | ||||||||||||||

| Strategic investments | ||||||||||||||

| Other miscellaneous noncurrent assets | ||||||||||||||

| Other assets, net | $ | $ | ||||||||||||

23

8. OTHER ACCRUED EXPENSES:

| December 31, 2021 | March 31, 2021 | |||||||||||||

| Liabilities of non-qualified retirement plan | $ | $ | ||||||||||||

| Short-term lease liabilities (see Note 4) | ||||||||||||||

| PDP performance plan liability (see Note 6) | ||||||||||||||

| DPM consideration holdback (see Note 6) | ||||||||||||||

| Acuity performance earnout liability (see Note 6) | ||||||||||||||

| DataFleets consideration holdback (see Note 6) | ||||||||||||||

| Diablo consideration holdback (see Note 5) | ||||||||||||||

| Rakam consideration holdback (see Note 5) | ||||||||||||||

| Other miscellaneous accrued expenses | ||||||||||||||

| Other accrued expenses | $ | $ | ||||||||||||

9. PROPERTY AND EQUIPMENT:

| December 31, 2021 | March 31, 2021 | |||||||||||||

| Leasehold improvements | $ | $ | ||||||||||||

| Data processing equipment | ||||||||||||||

| Office furniture and other equipment | ||||||||||||||

| Less accumulated depreciation and amortization | ||||||||||||||

| Property and equipment, net of accumulated depreciation and amortization | $ | $ | ||||||||||||

Depreciation expense on property and equipment was $4.2 million and $7.0 million for the nine months ended December 31, 2021 and 2020, respectively.

10. GOODWILL:

Changes in goodwill for the nine months ended December 31, 2021 were as follows (dollars in thousands):

| Total | ||||||||

| Balance at March 31, 2021 | $ | |||||||

| Acquisition of Diablo | ||||||||

| Change in foreign currency translation adjustment | ( | |||||||

| Balance at December 31, 2021 | $ | |||||||

Goodwill by geography as of December 31, 2021 was:

| Total | ||||||||

| U.S. | $ | |||||||

| APAC | ||||||||

| Balance at December 31, 2021 | $ | |||||||

24

11. INTANGIBLE ASSETS:

The amounts allocated to intangible assets from acquisitions include developed technology, customer relationships, trade names, and publisher and data supply relationships. The following table shows the amortization activity of intangible assets (dollars in thousands):

| December 31, 2021 | March 31, 2021 | |||||||||||||

| Developed technology, gross | $ | $ | ||||||||||||

| Accumulated amortization | ( | ( | ||||||||||||

| Net developed technology | $ | $ | ||||||||||||

| Customer relationship/Trade name, gross | $ | $ | ||||||||||||

| Accumulated amortization | ( | ( | ||||||||||||

| Net customer/trade name | $ | $ | ||||||||||||

| Publisher/Data supply relationships, gross | $ | $ | ||||||||||||

| Accumulated amortization | ( | ( | ||||||||||||

| Net publisher relationship | $ | $ | ||||||||||||

| Total intangible assets, gross | $ | $ | ||||||||||||

| Total accumulated amortization | ( | ( | ||||||||||||

| Total intangible assets, net | $ | $ | ||||||||||||

Total amortization expense related to intangible assets was $13.9 million for the nine months ended December 31, 2021 and 2020, respectively.

The following table presents the estimated future amortization expenses related to intangible assets. The amount for 2022 represents the remaining three months ending March 31, 2022 (dollars in thousands):

| Fiscal Year: | ||||||||

| 2022 | $ | |||||||

| 2023 | ||||||||

| 2024 | ||||||||

| 2025 | ||||||||

| $ | ||||||||

12. OTHER LIABILITIES:

Other liabilities consist of the following (dollars in thousands):

| December 31, 2021 | March 31, 2021 | |||||||||||||

| Uncertain tax positions | $ | $ | ||||||||||||

| Long-term lease liabilities (see Note 4) | ||||||||||||||

| Restructuring accruals | ||||||||||||||

| Other | ||||||||||||||

| Other liabilities | $ | $ | ||||||||||||

25

13. ALLOWANCE FOR CREDIT LOSSES:

Trade accounts receivable are presented net of allowances for credit losses, returns and credits based on the probability of future collections. The probability of future collections is based on specific considerations of historical loss patterns and an assessment of the continuation of such patterns based on past collection trends and known or anticipated future economic events that may impair collectability. Accounts receivable that are determined to be

uncollectible are charged against the allowance for doubtful accounts. Indicators that there is no reasonable

expectation of recovery include past due status greater than 360 days or bankruptcy of the debtor.

We are monitoring the continuing impacts from the COVID-19 pandemic on our customers and various counterparties and have considered these risks in establishing our reserve balance as of December 31, 2021.

The following table summarizes the Company's activity of allowance for credit losses, returns and credits (dollars in thousands):

| Balance at beginning of period | Additions charged to costs and expenses | Other changes | Bad debts written off, net of amounts recovered | Balance at end of period | ||||||||||||||||||||||||||||

For the nine months ended December 31, 2021 | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||

14. RESTRUCTURING, IMPAIRMENT AND OTHER CHARGES:

The following table summarizes the Company's restructuring activity for the nine months ended December 31, 2021 (dollars in thousands).

| Employee-related reserves | Lease accruals | Total | ||||||||||||||||||

| Balances at March 31, 2021 | $ | $ | $ | |||||||||||||||||

| Restructuring charges and adjustments | ||||||||||||||||||||

| Payments | ( | ( | ( | |||||||||||||||||

| Balances at December 31, 2021 | $ | $ | $ | |||||||||||||||||

Employee-related Restructuring Plans

In fiscal 2021, the Company recorded a total of $1.7 million in employee-related restructuring charges and adjustments. The expense included severance and other employee-related charges in the United States and Europe. The remaining employee-related charges are expected to be paid out during fiscal 2022.

Lease-related Restructuring Plans

In fiscal 2017, the Company made the strategic decision to exit and sub-lease a certain leased office facility under a staggered-exit plan. The full exit was completed in fiscal 2019. We intend to continue subleasing the facility to the extent possible. The liability will be satisfied over the remainder of the leased property's term, which continues through November 2025. Any future changes in the estimates or in the actual sublease income may require future adjustments to the liabilities, which would impact net earnings (loss) in the period the adjustment is recorded. Through December 31, 2021, the Company has recorded a total of $7.3 million of restructuring charges and adjustments related to this lease. Of the amount accrued for this facility lease, $3.3 million remained accrued at December 31, 2021.

26

Gains, Losses and Other Items, net

The following table summarizes the activity included in gains, losses and other items, net in the condensed consolidated statements of operations for each of the periods presented (dollars in thousands):

| Three Months Ended December 31, | Nine Months Ended December 31, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Restructuring plan charges and adjustments | $ | $ | ( | $ | $ | |||||||||||||||||||||

| Early contract terminations | ||||||||||||||||||||||||||

| Other | ( | |||||||||||||||||||||||||

| $ | $ | ( | $ | $ | ||||||||||||||||||||||

15. COMMITMENTS AND CONTINGENCIES:

Legal Matters

The Company is involved in various claims and legal proceedings that arise in the ordinary course of business. Management routinely assesses the likelihood of adverse judgments or outcomes to these matters, as well as ranges of probable losses, to the extent losses are reasonably estimable. The Company records accruals for these matters to the extent that management concludes a loss is probable and the financial impact, should an adverse outcome occur, is reasonably estimable. These accruals are adjusted to reflect the impacts of negotiations, settlements, rulings, advice of legal counsel, and other information and events pertinent to a particular matter. These accruals are reflected in the Company’s condensed consolidated financial statements. In management’s opinion, the Company has made appropriate and adequate accruals for these matters, and management believes the probability of a material loss beyond the amounts accrued to be remote. However, the ultimate liability for these matters is uncertain, and if accruals are not adequate, an adverse outcome could have a material effect on the Company’s consolidated financial condition or results of operations. The Company maintains insurance coverage above certain limits.

Commitments

The following table presents the Company’s purchase commitments at December 31, 2021. Purchase commitments primarily include contractual commitments for the purchase of data, hosting services and software-as-a-service arrangements. The table does not include the future payment of liabilities related to uncertain tax positions of $24.1 million as the Company is not able to predict the periods in which the payments will be made (dollars in thousands):

| For the years ending March 31, | ||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2023 | 2024 | 2025 | 2026 | Thereafter | Total | ||||||||||||||||||||||||||||||||||||||

| Purchase commitments | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||

27

16. INCOME TAX:

17. FAIR VALUE OF FINANCIAL INSTRUMENTS:

The Company measures certain financial assets at fair value. Fair value is determined based upon the exit price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants, as determined by either the principal market or the most advantageous market. Inputs used in the valuation techniques to derive fair values are classified based on a three-level hierarchy, as follows:

•Level 1 - Quoted prices in active markets for identical assets or liabilities.

•Level 2 - Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities.

•Level 3 - Unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities.

For certain financial instruments, including accounts receivable, certificates of deposit, and accounts payable, the carrying amounts approximate their fair value due to the relatively short maturity of these balances.

The following table details the fair value measurements within the fair value hierarchy of the Company's financial assets and liabilities at December 31, 2021 and March 31, 2021 (dollars in thousands):

| December 31, 2021 | ||||||||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||||||

| Other current assets: | ||||||||||||||||||||||||||

| Assets of non-qualified retirement plan | $ | $ | $ | $ | ||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

| March 31, 2021 | ||||||||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||||||

| Other current assets: | ||||||||||||||||||||||||||

| Assets of non-qualified retirement plan | $ | $ | $ | $ | ||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

28

29

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Introduction and Overview

LiveRamp is a global technology company with a vision of making it safe and easy for companies to use data effectively. We provide a best-in-class enterprise data connectivity platform that helps organizations better leverage customer data within and outside their four walls. Powered by core identity capabilities and an extensive network, LiveRamp enables companies and their partners to better connect, control, and activate data to transform customer experiences and generate more valuable business outcomes.

LiveRamp is a Delaware corporation headquartered in San Francisco, California. Our common stock is listed on the New York Stock Exchange under the symbol “RAMP.” We serve a global client base from locations in the United States, Europe, and the Asia-Pacific (“APAC”) region. Our direct client list includes many of the world’s largest and best-known brands across most major industry verticals, including but not limited to financial, insurance and investment services, retail, automotive, telecommunications, high tech, consumer packaged goods, healthcare, travel, entertainment, non-profit, and government. Through our extensive reseller and partnership network, we serve thousands of additional companies, establishing LiveRamp as a foundational and neutral enabler of the customer experience economy.

Operating Segment

The Company operates as one operating segment. An operating segment is defined as a component of an enterprise for which separate financial information is evaluated regularly by the chief operating decision maker. Our chief operating decision maker evaluates our financial information and resources and assesses the performance of these resources on a consolidated basis. Since we operate as one operating segment, all required financial segment information can be found in the condensed consolidated financial statements.

Sources of Revenues

LiveRamp recognizes revenue from the following sources: (i) Subscription revenue, which consists primarily of subscription fees from clients accessing our platform; and (ii) Marketplace and Other revenue, which primarily consists of revenue-sharing fees generated from data transactions through our LiveRamp Data Marketplace, and transactional usage-based revenue from arrangements with certain publishers and addressable TV providers.

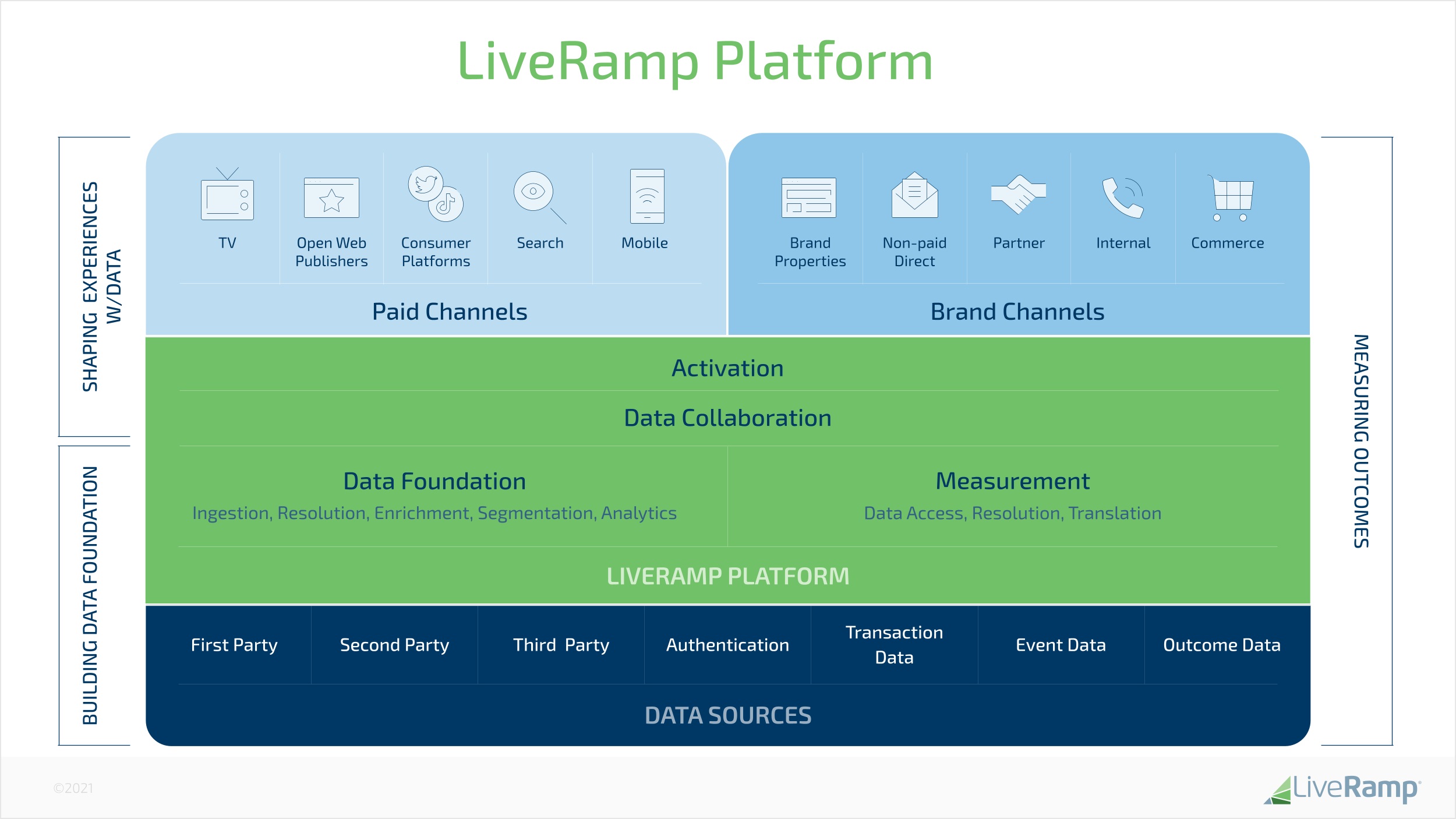

The LiveRamp Platform

As depicted in the graphic below, we power the industry’s leading enterprise data connectivity platform. We enable organizations to access and leverage data more effectively across the applications they use to interact with their customers. A core component of our platform is the omnichannel, deterministic identity asset that sits at its center. Leveraging deep expertise in identity and data collaboration, the LiveRamp platform enables an organization to unify customer and prospect data (first-, second-, or third-party) to build a single view of the customer in a way that protects consumer privacy. This single customer view can then be enhanced and activated across any of the 550 partners in our ecosystem in order to support a variety of people-based marketing solutions, including:

•Activation. We enable organizations to leverage their customer and prospect data in the digital and TV ecosystems and across the customer experience applications they use through a safe and secure data matching process called data onboarding. Our technology ingests a customer’s first-party data, removes all offline data (personally identifiable information or "PII"), and replaces them with anonymized IDs called RampID™, a true people-based identifier. RampID can then be distributed through direct integrations to the top platforms our customers work with, including leading marketing cloud providers, publishers and social networks, personalization tools, and connected TV services.

30

•Measurement & Analytics. We power accurate and complete measurement with the measurement vendors and partners our customers use. Our platform allows customers to combine disparate data files (typically ad exposure and customer events, like transactions), replacing customer identifiers with RampID. Customers then can use that aggregated view of each customer for measurement of reach and frequency, sales lift, closed loop offline-to-online conversion and cross-channel attribution.

•Identity. We provide enterprise-level identity solutions that enable organizations to: 1) resolve and connect disparate identities, 2) enrich data sets with hygiene capabilities and additional audience data from Data Marketplace providers, and 3) translate data between different systems. Our approach to identity is built from two complementary graphs, combining offline data and online data and providing the highest level of accuracy with a focus on privacy. LiveRamp technology for PII gives brands and platforms the ability to connect and update what they know about consumers, resolving PII across enterprise databases and systems to deliver better customer experiences in a privacy-conscious manner. Our digital identity graph powered by our Authenticated Traffic Solution (or ATS) associates pseudonymous device IDs, TV IDs and other online customer IDs from premium publishers, platforms or data providers, around a RampID. This allows marketers to perform the personalized segmentation, targeting, and measurement use cases that require a consistent view of the user. There are currently more than 125 supply-side platforms live or committed to bid on RampID and ATS. In addition, to date more than 500 publishers, representing more than 8,000 publisher domains, have integrated ATS worldwide.

•Data Collaboration with Safe Haven. We enable trusted second-party data collaboration between organizations and their partners in a neutral, permissioned environment. Safe Haven provides customers with collaborative opportunities to safely and securely build a more accurate, dynamic view of their customers leveraging partner data. Advanced measurement and analytics use cases can be performed on this shared data without either party giving up control or compromising privacy.

•Data Marketplace. Our Data Marketplace provides customers with simplified access to trusted, industry-leading third-party data globally. The LiveRamp platform allows for the search, discovery and distribution of data to improve targeting, measurement, and customer intelligence. Data accessed through our Data Marketplace is connected via RampID and is utilized to enrich our customers’ first-party data and can be leveraged across technology and media platforms, agencies, analytics environments, and TV partners. Our platform also provides tools for data providers to manage the organization, distribution, and operation of their data and services across our network of customers and partners. Today we work with more than 150 data providers across all verticals and data types (see below for discussion on Marketplace and Other).

31

Consumer privacy and data protection, what we call Data Ethics, are at the center of how we design our products and services. Accordingly, the LiveRamp platform operates with technical, operational, and personnel controls designed to keep our customers’ data private and secure.

Our solutions are sold to enterprise marketers and the companies they partner with to execute their marketing, including agencies, marketing technology providers, publishers and data providers. Today, we work with 890 direct subscription customers world-wide, including approximately 22% of the Fortune 500, and serve thousands of additional customers indirectly through our reseller partnership arrangements.

•Brands and Agencies. We work with over 450 of the largest brands and agencies in the world, helping them execute people-based marketing by creating an omni-channel understanding of the consumer and activating that understanding across their choice of best-of-breed digital marketing platforms.

•Marketing Technology Providers. We provide marketing technology providers with the identity foundation required to offer people-based targeting, measurement and personalization within their platforms. This adds value for brands by increasing reach, as well as the speed at which they can activate their marketing data.

•Publishers. We enable publishers of any size to offer people-based marketing on their properties. This adds value for brands by providing direct access to their customers and prospects in the publisher's premium inventory.

•Data Owners. Leveraging our vast network of integrations, we allow data owners to easily connect to the digital ecosystem and monetize their own data. Data can be distributed to clients or made available through the LiveRamp Data Marketplace feature. This adds value for brands as it allows them to augment their understanding of consumers and increase both their reach against and understanding of customers and prospects.

We primarily charge for our platform on an annual subscription basis. Our subscription pricing is based primarily on data volume, which is a function of data input records and connection points.

32

Marketplace and Other