Exhibit 99.1

ROGERS COMMUNICATIONS INC.

ANNUAL INFORMATION FORM

(for the fiscal year ended December 31, 2023)

March 5, 2024

| Rogers Communications Inc. | 1 | Fiscal 2023 | ||||||

Annual Information Form Index

The following is an index of the Annual Information Form (AIF) of Rogers Communications Inc. referencing the requirements of Form 51-102F2 and Form 52-110F1 of the Canadian Securities Administrators. Certain parts of this Annual Information Form are contained in Rogers Communications Inc.’s Management’s Discussion and Analysis (MD&A) for the fiscal year ended December 31, 2023 (2023 MD&A) and Rogers Communications Inc.’s 2023 Annual Audited Consolidated Financial Statements, each of which is filed on SEDAR+ at sedarplus.ca and incorporated herein by reference as noted below. All dollar amounts are in Canadian dollars unless otherwise stated.

| Page reference / incorporated by reference from | |||||||||||

| Annual Information Form (Page #) | 2023 MD&A (Page #) | ||||||||||

| Item 1 | Cover Page | 1 | |||||||||

| Item 2 | Index | 2 | |||||||||

| Item 3 | Corporate Structure | ||||||||||

| 3.1 | Name, Address and Incorporation | ||||||||||

| 3.2 | Intercorporate Relationships | ||||||||||

| Item 4 | General Development of the Business | ||||||||||

| 4.1 | Three-Year History | ||||||||||

| 4.2 | Significant Acquisitions | ||||||||||

| Item 5 | Narrative Description of the Business | ||||||||||

| 5.1 | About Rogers | 16 | |||||||||

| Understanding Our Business | 20 | ||||||||||

| Products and Services | 20 | ||||||||||

| Competition | 22 | ||||||||||

| Industry Trends | 23 | ||||||||||

| Our Strategy, Key Performance Drivers, and Strategic Highlights | 25 | ||||||||||

| Capability to Deliver Results | 29 | ||||||||||

| Employees | 41 | ||||||||||

| Commitments and Contractual Obligations | 59 | ||||||||||

| Properties, Trademarks, Environmental, and Other Matters | |||||||||||

| 5.2 | Risk Factors | 63 | |||||||||

| Item 6 | Dividends | ||||||||||

| 6.1 | Dividends | 58 | |||||||||

| Item 7 | Description of Capital Structure | ||||||||||

| 7.1 | General Description of Capital Structure | ||||||||||

| 7.2 | Constraints | ||||||||||

| 7.3 | Ratings | ||||||||||

| Item 8 | Market for Securities | ||||||||||

| 8.1 | Trading Price and Volume | ||||||||||

| 8.2 | Prior Sales | ||||||||||

| Item 9 | Escrowed Securities and Securities Subject to Contractual Restriction on Transfer | ||||||||||

| Item 10 | Directors and Officers | ||||||||||

| 10.1 | Name, Occupation and Security Holding | ||||||||||

| 10.2 | Cease Trade Orders, Bankruptcies, Penalties, or Sanctions | ||||||||||

| 10.3 | Conflicts of Interest | ||||||||||

| Item 11 | Promoters | ||||||||||

| Item 12 | Legal Proceedings and Regulatory Actions | ||||||||||

| 12.1 | Legal Proceedings | 69 | |||||||||

| 12.2 | Regulatory Actions | ||||||||||

| Item 13 | Interest of Management and Others in Material Transactions | ||||||||||

| Item 14 | Transfer Agents and Registrars | ||||||||||

| Item 15 | Material Contracts | ||||||||||

| Rogers Communications Inc. | 2 | Fiscal 2023 | ||||||

| Page reference / incorporated by reference from | |||||||||||

| Annual Information Form (Page #) | 2023 MD&A (Page #) | ||||||||||

| Item 16 | Interests of Experts | ||||||||||

| 16.1 | Name of Experts | ||||||||||

| 16.2 | Interests of Experts | ||||||||||

| Item 17 | Audit and Risk Committee | ||||||||||

| 17.1 | Audit and Risk Committee Mandate | ||||||||||

| 17.2 | Composition of the Audit and Risk Committee | ||||||||||

| 17.3 | Relevant Education and Experience | ||||||||||

| 17.4 | Reliance on Certain Exemptions | ||||||||||

| 17.5 | Reliance on the Exemption in Subsection 3.3(2) or Section 3.6 | ||||||||||

| 17.6 | Reliance on Section 3.8 | ||||||||||

| 17.7 | Audit and Risk Committee Oversight | ||||||||||

| 17.8 | Pre-Approval Policies and Procedures | ||||||||||

| 17.9 | External Auditors’ Fees and Services | ||||||||||

| Item 18 | Additional Information | ||||||||||

| 18.1 | Additional Information | ||||||||||

| Rogers Communications Inc. | 3 | Fiscal 2023 | ||||||

ITEM 3 – Corporate Structure

ITEM 3.1 – NAME, ADDRESS, AND INCORPORATION

Rogers Communications Inc. is a leading diversified Canadian technology and media company, and was amalgamated under the Business Corporations Act (British Columbia). The registered office is located at 2900-550 Burrard Street, Vancouver, British Columbia, V6C 0A3 and the head office is located at 333 Bloor Street East, 10th Floor, Toronto, Ontario, M4W 1G9.

We, us, our, Rogers, Rogers Communications, and the Company refer to Rogers Communications Inc. and its subsidiaries. RCI refers to the legal entity Rogers Communications Inc., not including its subsidiaries. Rogers also holds interests in various investments and ventures.

Trademarks in this AIF are owned or used under license by Rogers Communications Inc. or an affiliate. This AIF also includes trademarks of other parties. The trademarks referred to in this AIF may be listed without the ™ symbols. ©2024 Rogers Communications.

THREE REPORTABLE SEGMENTS

For the purposes of this AIF, we report our results of operations in three reportable segments:

| Segment | Principal activities | ||||

| Wireless | Wireless telecommunications operations for Canadian consumers and businesses. | ||||

| Cable | Cable telecommunications operations, including Internet, television and other video (Video), Satellite, telephony (Home Phone), and smart home monitoring services for Canadian consumers and businesses, and network connectivity through our fibre network and data centre assets to support a range of voice, data, networking, hosting, and cloud-based services for the business, public sector, and carrier wholesale markets. | ||||

| Media | A diversified portfolio of media properties, including sports media and entertainment, television and radio broadcasting, specialty channels, multi-platform shopping, and digital media. | ||||

ITEM 3.2 – INTERCORPORATE RELATIONSHIPS

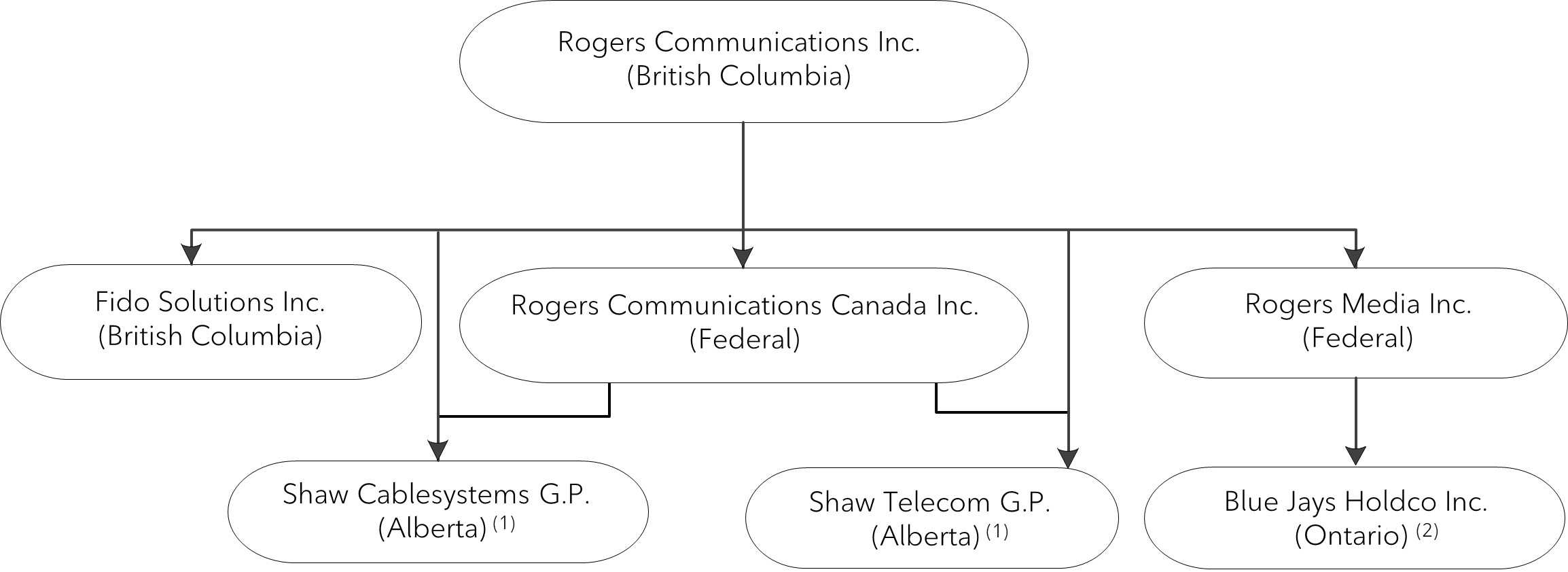

The summary organization chart illustrates the structure of the principal subsidiaries of RCI and indicates the jurisdiction of organization of each entity shown as at January 1, 2024. All subsidiaries are wholly owned, directly or indirectly, by RCI.

(1) Shaw Cablesystems G.P. and Shaw Telecom G.P. were dissolved into Rogers Communications Canada Inc. on January 31, 2024.

(2) Blue Jays Holdco Inc., together with its subsidiaries, holds a 100% interest in the Toronto Blue Jays Baseball Club (Toronto Blue Jays) and in the Rogers Centre.

| Rogers Communications Inc. | 4 | Fiscal 2023 | ||||||

OVERVIEW

Rogers is Canada’s Largest Provider of Wireless Communications Services

As at December 31, 2023, we had:

•approximately 11.6 million wireless mobile phone subscribers; and

•approximately one-third subscriber and revenue share of the Canadian wireless market.

One of Canada’s Leading Providers of High-Speed Internet, Cable Television, and Phone Services

As at December 31, 2023, we had:

•approximately 4.2 million retail Internet subscribers;

•approximately 2.8 million Video subscribers; and

•a network passing approximately 9.9 million homes across Canada.

Diversified Canadian Media Company

We have a broad portfolio of media properties, which most significantly includes:

•sports media and entertainment, such as Sportsnet (Canada's number-one sports media brand) and the Toronto Blue Jays;

•our exclusive national 12-year National Hockey League (NHL) Agreement, which runs through the 2025-2026 season;

•category-leading television and radio broadcasting properties;

•multi-platform televised and online shopping; and

•digital media.

PRODUCTS AND SERVICES

Wireless

We are the largest provider of wireless communication services in Canada as at December 31, 2023. We are a Canadian leader in delivering a range of innovative wireless network technologies and services. We were the first Canadian carrier to launch a 5G network and we have the largest 5G network in Canada, serving over 2,200 communities as at December 31, 2023. Our postpaid and prepaid wireless services are offered under the Rogers, Fido, and chatr brands, and provide consumers and businesses with the latest wireless devices, services, and applications including:

•mobile high-speed Internet access, including our Rogers Infinite unlimited data plans;

•wireless voice and enhanced voice features;

•Express Pickup, a convenient service for purchasing devices online or through a customer care agent, with the ability to pick up in-store as soon as the same day;

•direct device shipping to the customer's location of choice;

•device financing;

•device protection;

•global voice and data roaming, including Roam Like Home and Fido Roam;

•wireless home phone;

•advanced wireless solutions for businesses, including wireless private network services;

•bridging landline phones with wireless phones; and

•machine-to-machine solutions and Internet of Things (IoT) solutions.

Cable

We are one of the largest cable services providers in Canada. Our cable network provides an innovative and leading selection of high-speed broadband Internet access, Internet protocol-based (IP) television, applications, online viewing, phone, smart home monitoring, and advanced home WiFi services to consumers across Canada. We also provide services to businesses across Canada that aim to meet the increasing needs of today's critical business applications.

Our newest WiFi modem with WiFi 6E, a technology that eases network congestion by simplifying network design and delivering increased performance with higher throughput and wider spectrum channels, allows us to offer new fibre-powered Ignite Internet packages and bundles with up to 8 gigabit per second (Gbps) symmetrical speeds in select areas.

Internet services include:

•Internet access through broadband and fixed wireless access (including basic and unlimited usage packages), security solutions, and e-mail;

•access speeds of up to:

•1 Gbps, covering our entire Cable footprint; and

•1.5 Gbps, covering the vast majority of our Cable footprint, with some areas able to receive access speeds of up to 8 Gbps symmetrical speeds;

•Rogers Ignite unlimited packages, combining fast and reliable speeds with the freedom of unlimited usage and options for self-installation;

•Rogers Ignite WiFi Hub, offering a personalized WiFi experience with a simple digital dashboard for customers to manage their home WiFi network, providing visibility and control over family usage, and Ignite WiFi Pods, an advanced WiFi system you can plug into different electrical outlets in your home to extend your WiFi coverage;

| Rogers Communications Inc. | 5 | Fiscal 2023 | ||||||

•Rogers Smart Home Monitoring, offering services such as monitoring, security, automation, energy efficiency, and smart control through a smartphone app; and

•Rogers WiFi Hotspots, an extension of our customer experience with over 100,000 public access points used by our customers in coffee shops, restaurants, gyms, malls, public transit, and other public spaces covering locations from British Columbia to Ontario. In addition to these public access points, Wireless customers can access more than 950,000 Home Hotspots across Western Canada.

Television services include:

•local and network TV, made available through traditional digital or IP-based Ignite TV, including starter and premium channel packages along with à la carte channels;

•on-demand television with Ignite TV services;

•cloud-based digital video recorders (DVRs) available with Ignite TV services;

•voice-activated remote controls, restart features, and integrated apps such as YouTube, Netflix, Sportsnet NOW, Amazon Prime Video, Disney+, and Apple TV+ on Ignite TV and Ignite Streaming;

•personal video recorders (PVRs), including Whole Home PVR and 4K PVR capabilities;

•an Ignite TV app, giving customers the ability to experience Ignite TV (including setting recordings) on their smartphone, tablet, laptop, or computer;

•Ignite Streaming, an entertainment add-on for Ignite Internet customers, giving them access to their favourite streaming services in one place;

•Download and Go, the ability to download recorded programs onto your smartphone or tablet to watch at a later time using the Ignite TV app;

•linear and time-shifted programming;

•digital specialty channels; and

•4K television programming, including regular season Toronto Blue Jays home games and select marquee National Hockey League (NHL) and National Basketball Association (NBA) games.

Phone services include:

•residential and small business local telephony service; and

•calling features such as voicemail, call waiting, and long distance.

Satellite services include:

•video and audio programming by satellite; our customers have access to over 370 digital video channels and thousands of on-demand, pay-per-view (PPV), and subscription movie and television titles; and

•flexibility with each of our current primary TV packages, which includes a base set of channels and tiered customization options depending on the size of the TV package.

Enterprise services include:

•voice, data networking, IP, and Ethernet services over multi-service customer access devices that allow customers to scale and add services, such as private networking, Internet, IP voice, and cloud solutions, which blend seamlessly to grow with their business requirements;

•optical wave, Internet, Ethernet, and multi-protocol label switching services, providing scalable and secure metro and wide area private networking that enables and interconnects critical business applications for businesses that have one or many offices, data centres, or points of presence (as well as cloud applications) across Canada;

•simplified information technology (IT) and network technology offerings with security-embedded, cloud-based, professionally managed solutions;

•extensive cable access network services for primary, bridging, and back-up (including through our wireless network, if applicable) connectivity; and

•specialized telecommunications technical consulting for Internet service providers (ISPs).

Media

Our portfolio of Media assets, with a focus on sports and regional TV and radio programming, reaches Canadians from coast to coast.

In Sports Media and Entertainment, we own the Toronto Blue Jays, Canada's only Major League Baseball (MLB) team, and the Rogers Centre event venue, which hosts the Toronto Blue Jays' home games, concerts, trade shows, and special events.

Our agreement with the NHL (NHL Agreement), which runs through the 2025-2026 NHL season, allows us to deliver more than 1,300 regular season games during a typical season across television, smartphones, tablets, personal computers, and other streaming devices. It also grants Rogers national rights on those platforms to the Stanley Cup Playoffs and Stanley Cup Final, all NHL-related special events and non-game events (such as the NHL All-Star Game and the NHL Draft), and rights to sublicense broadcasting rights.

| Rogers Communications Inc. | 6 | Fiscal 2023 | ||||||

In Television, we operate several conventional and specialty television networks, including:

•Sportsnet's four regional stations along with Sportsnet ONE, Sportsnet 360, and Sportsnet World;

•Citytv network, which, together with affiliated stations, has broadcast distribution to approximately 72% of Canadian individuals;

•OMNI multicultural broadcast television stations, including OMNI Regional, which provide multilingual newscasts nationally to all digital basic television subscribers;

•specialty channels that include FX (Canada), FXX (Canada), and OLN (formerly Outdoor Life Network); and

•Today's Shopping Choice, Canada's only nationally televised shopping channel, which generates a significant and growing portion of its revenue from online sales.

In Radio, we operate 52 AM and FM radio stations in markets across Canada, including popular radio brands such as 98.1 CHFI, CityNews 680, Sportsnet 590 The FAN, KiSS, JACK, and SONiC.

We also offer a range of digital services and products, including:

•our digital sports-related assets, including sportsnet.ca and Sportsnet+;

•other digital assets, including Citytv+;

•a range of other websites, apps, podcasts, and digital products associated with our various brands and businesses; and

•out-of-home advertising assets and partnerships allowing us to reach school campuses, bars and restaurants, elevators, salons, and spas, among others.

Other

We offer both the Rogers Mastercard and the Rogers World Elite Mastercard, which allow customers to earn cash back rewards points on credit card spending.

Other Investments

We hold interests in a number of associates and joint arrangements, some of which include:

•our 37.5% ownership interest in Maple Leaf Sports & Entertainment Ltd. (MLSE), which owns the Toronto Maple Leafs, the Toronto Raptors, Toronto FC, the Toronto Argonauts, and the Toronto Marlies, as well as various associated real estate holdings; and

•our 50% ownership interest in Glentel Inc. (Glentel), a large provider of multicarrier wireless and wireline products and services with several hundred Canadian retail distribution outlets.

In December 2023, we sold our investment interests in Cogeco Inc. and Cogeco Communications Inc. for $829 million to Caisse de dépôt et placement du Québec in a private transaction.

WIDESPREAD PRODUCT DISTRIBUTION

Wireless

We have an extensive national distribution network and offer our wireless products nationally through multiple channels, including:

•company-owned Rogers, Fido, and chatr retail stores;

•customer self-serve using rogers.com, fido.ca, chatrwireless.com, and e-commerce sites;

•an extensive independent dealer network;

•major retail chains and convenience stores;

•other distribution channels, such as WOW! mobile boutique, as well as Wireless Wave and TBooth Wireless through our ownership interest in Glentel;

•our contact centres; and

•outbound telemarketing.

Cable

We distribute our residential cable products using various channels, including:

•company-owned Rogers retail stores;

•customer self-serve using rogers.com;

•our Canada-based contact centres, outbound telemarketing, and door-to-door agents; and

•major retail chains.

Our sales team and third-party retailers sell services to the business, public sector, and carrier wholesale markets. An extensive network of third-party channel distributors deals with IT integrators, consultants, local service providers, and other indirect sales relationships. This diverse approach gives greater breadth of coverage and allows for strong sales growth for next-generation services.

| Rogers Communications Inc. | 7 | Fiscal 2023 | ||||||

ITEM 4 – General Development of the Business

ITEM 4.1 – THREE-YEAR HISTORY

RECENT DEVELOPMENTS

2024 Highlights to Date

•Declared a quarterly dividend of $0.50 per each outstanding Class A Voting Share and Class B Non-Voting Share in January 2024.

•Issued US$2.5 billion of senior notes in February. We received net proceeds of US$2.46 billion ($3.3 billion) from the issuance.

2023 Highlights

For revenue and other financial information on the two most recently completed financial years, see the section entitled "2023 Financial Results" in our 2023 MD&A.

Build the biggest and best networks in the country

•Invested a record $3.9 billion in capital expenditures, primarily in our wireless and wireline network infrastructure.

•Recognized as the best and most reliable wireless network in Canada for the fifth straight year by umlaut in July 2023.

•Expanded Canada's largest and most reliable 5G network to 267 new communities.

•Launched 5G service for all transit riders in the busiest sections of the Toronto Transit Commission (TTC) subway system.

•Signed agreements with SpaceX and Lynk Global to bring satellite-to-mobile phone coverage and completed Canada's first test call.

•Secured 3800 MHz spectrum licences, making Rogers the largest 5G spectrum investor.

•Invested in wildfire detection and prevention technology to help combat climate change events.

•Delivered an additional 50 kilometres of 5G cellular connectivity on Highway 16 in British Columbia to improve public safety.

Deliver easy to use, reliable products and services

•Introduced Rogers Internet and TV services to customers in Western Canada.

•Upgraded all migrated legacy Shaw Mobile customers to Rogers 5G service.

•Introduced the red Rogers Mastercard with 48-month device equal payment plan with 0% interest and up to 3% cash back value for customers.

•Introduced Ignite Self Protect for customers to self-monitor their homes with connected devices.

Be the first choice for Canadians

•Led the industry in wireless subscriber additions with 674,000 postpaid mobile phone net additions.

•Launched our "We Speak Your Language" program across all retail stores, with the goal of serving customers in their preferred language.

•Secured number-one spots for flagship radio brands 98.1 CHFI, CityNews 680, and KiSS 92.5 for the Summer 2023 ratings period.

•Helped bring Taylor Swift to Canada in 2024 for six shows in Toronto and three in Vancouver.

•Signed a long-term broadcast agreement with UFC that will bring live UFC events to Sportsnet.

| Rogers Communications Inc. | 8 | Fiscal 2023 | ||||||

Be a strong national company investing in Canada

•Successfully completed the historic Shaw Transaction (as defined below) in April 2023.

•Repatriated the Shaw customer service teams as part of our commitment to 100% Canada-based teams.

•Expanded Connected for Success, our high-speed, low-cost Internet program to Western Canada.

•Announced a new five-year deal as title sponsor of the Shaw Charity Classic.

•Drove benefits to community organizations across Canada of over $100 million.

Be a growth leader in our industry

•Total service revenue up 27%; adjusted EBITDA up 34%.

•Generated free cash flow1 of $2,414 million and cash provided by operating activities of $5,221 million.

•Achieved strong Cable adjusted EBITDA margin expansion of 330 basis points; Shaw integration tracking ahead of plan.

•Delivered on industry-leading 2023 financial guidance.

Other highlights

•Declared a quarterly dividend of $0.50 per each outstanding Class A Voting Share and Class B Non-Voting Share during 2023.

•Issued senior notes with an aggregate principal amount of $3 billion. We received net proceeds of $2.98 billion from the issuance.

•Ended the year with approximately $5.9 billion of available liquidity1, including $5.1 billion available under our bank and letter of credit facilities and $0.8 billion in cash and cash equivalents.

2022 Highlights

Successfully complete the Shaw acquisition

•Received approval from the Canadian Radio-television and Telecommunications Commission (CRTC) for the transfer of Shaw's broadcasting services.

•Entered into a definitive agreement with Shaw and Quebecor Inc. (Quebecor) for the sale of Freedom Mobile Inc. (Freedom) to Quebecor (Freedom Transaction).

•Successfully obtained financing of $13 billion to fund the Shaw Transaction, including the largest cross-border financing in Canadian history.

•Successfully argued for the dismissal by the Competition Tribunal (Tribunal) of the Competition Bureau's (Bureau) application to block the Shaw Transaction, with the panel concluding unanimously that the transactions are pro-competitive; the decision of the Tribunal was upheld by the Federal Court of Appeal on January 24, 2023.

Invest in our networks to deliver world-class connectivity to Canadian consumers and businesses

•Invested a then-record $3.1 billion in capital investments in Canada, the majority of which was invested in our networks.

•Continued to expand Canada’s largest 5G network as at December 31, 2022, reaching over 1,900 communities across the country.

•Became the first service provider in Canada to deploy 3500 MHz spectrum to increase 5G network capacity, boost speeds, and deliver ultra-low latency services, starting in Nanaimo, British Columbia and continuing its deployment across Canada, including in Calgary, Edmonton, Montreal, Ottawa, Toronto, Vancouver, and multiple rural areas.

•Committed to investing $20 billion in network reliability over the next five years and announced plans to separate our wireless and wireline IP core networks.

1 Free cash flow and available liquidity are capital management measures. These are not standardized financial measures under IFRS and might not be comparable to similar financial measures disclosed by other companies. See "Non-GAAP and Other Financial Measures" for more information about these measures, and "Financial Condition" for a reconciliation of available liquidity, in our 2023 MD&A, available at www.sedarplus.ca.

| Rogers Communications Inc. | 9 | Fiscal 2023 | ||||||

•Signed a memorandum of understanding with Canada's other major telecommunications carriers regarding reciprocal support for emergency roaming, mutual assistance, and communications protocols in the event of a future major network outage.

Invest in our customer experience to deliver timely, high-quality customer service consistently to our customers

•Introduced new fibre-powered Ignite Internet packages and bundles, with symmetrical download and upload speeds of up to 2.5 Gbps, with existing Ignite Internet Gigabit 1.5 customers upgraded at no extra cost.

•First major provider in Canada to launch a new Wi-Fi modem with Wi-Fi 6E, currently the world's most powerful Wi-Fi technology, and introduced premium Ignite Internet with 8 Gbps symmetrical speeds in certain areas.

•Continued to accelerate our digital-first plan to make it easier for customers, with digital adoption at 88% of eligible transactions; includes 24/7 virtual assistant support tools and the ability for Fido and Rogers customers to complete price plan changes, hardware upgrades, and other account updates online.

•Donated $1 million to Jays Care Foundation in support of their ambitious goal to bring programming to 45,000 kids across Canada through Indigenous Rookie League, Challenger Baseball, and Girls at Bat.

Improve execution and deliver strong financial performance across all lines of business

•Attracted 545,000 net postpaid mobile phone subscribers to lead the Canadian industry, up 35% and our strongest results since 2007.

•Delivered on robust 2022 full-year guidance after increasing guidance ranges in April for total service revenue, adjusted EBITDA, and free cash flow excluding Shaw financing guidance.

•Generated total service revenue of $13,305 million, up 6%; adjusted EBITDA2 of $6,393 million, up 9%; and net income of $1,680 million, up 8%.

•Generated free cash flow of $1,773 million and cash provided by operating activities of $4,493 million.

•Paid dividends of $1,010 million to our shareholders.

Other highlights

•Declared a quarterly dividend of $0.50 per each outstanding Class A Voting Share and Class B Non-Voting Share during 2022.

•Issued US$750 million subordinated notes due 2082 with an initial coupon of 5.25% for the first five years in February. We received net proceeds of US$740 million ($938 million) from the issuance.

•Issued $13.3 billion of senior notes, consisting of US$7.05 billion ($9.05 billion) and $4.25 billion, in order to partially finance the cash consideration for the Shaw Transaction.

•Ended the year with approximately $4.9 billion of available liquidity, including $4.4 billion available under our bank and letter of credit facilities and $0.5 billion in cash and cash equivalents.

2021 Highlights

On March 15, 2021, we announced an agreement with Shaw to acquire all of Shaw's issued and outstanding Class A Participating Shares and Class B Non-Voting Participating Shares for a price of $40.50 per share. See Item 4.2 for more information on the Shaw Transaction.

Create best-in-class customer experiences by putting our customers first in everything we do

•Improved Wireless postpaid churn by 5 basis points to 0.95%.

•Continued to accelerate our digital-first plan to make it easier for customers, with digital adoption at 86%, up from 84% in 2020.

•Transformed 130 retail stores into dual-door locations that offer both Rogers and Fido brands, growing our distribution footprint nationally to a total of 140 dual-door locations, including our flagship store at Yonge and Dundas in Toronto.

2 Adjusted EBITDA is a total of segments measure. See "Non-GAAP and Other Financial Measures" for more information about this measure in our 2023 MD&A, available at www.sedarplus.ca.

| Rogers Communications Inc. | 10 | Fiscal 2023 | ||||||

•Launched Express Pickup through our customer care channels, a free service that allows customers to purchase a new device through a customer care agent and pick it up the same day in-store.

•Launched certified walk-in repairs in select Rogers and Fido locations, offering our customers fast and reliable service to fix batteries, screens, cameras, audio, software, and more.

Invest in our networks and technology to deliver leading performance, reliability and coverage

•Expanded Canada's largest and most reliable 5G network which reached more than 1,500 communities and 70% of the Canadian population as at December 31, 2021.

•Invested $3.3 billion in 3500 MHz spectrum licences, covering 99.4% of the Canadian population, to enhance and accelerate the expansion of Canada's first, largest, and most reliable 5G network. This investment positions Rogers as the largest single investor in 5G spectrum in the country across rural, suburban, and urban markets.

•Awarded Best In Test and recognized as Canada's most reliable 4G and 5G network by umlaut, the global leader in mobile network benchmarking, for the third year in a row in July, and ranked number one in 5G Reach, 5G Availability, 5G Voice App Experience, 5G Games Experience, and tied first for 5G Upload Speed in Canada by OpenSignal in August.

•Recognized as Canada's most consistent national wireless and broadband provider by Ookla for Q4 2021, with the fastest fixed broadband Internet in Ontario, New Brunswick, and Newfoundland and Labrador.

•Completed the rollout of Canada's first national standalone 5G core to help bring the best of 5G to our customers and achieved the first 5G standalone device certification in Canada.

•Announced a multi-year partnership with Coastal First Nations in British Columbia, which includes a commitment to build five new cell towers, provide more than 100 kilometres of new service coverage along Highway 16 on Graham Island, and improve wireless connectivity throughout Haida Gwaii. We broke ground on the first tower in December 2021.

•Announced a $300 million agreement, alongside the Government of Canada, the Province of Ontario, and the Eastern Ontario Regional Network, to expand wireless connectivity in rural and remote communities throughout eastern Ontario, the largest wireless private-public partnership in Canadian history.

•Announced investments of over $350 million to connect almost 50,000 homes and businesses in Ontario, New Brunswick, and Newfoundland and Labrador, fully funded by Rogers.

•In partnership with the Governments of Canada and British Columbia, we announced 12 new cell tower sites to enhance wireless coverage along Highway 16 between Prince George and Prince Rupert; we broke ground on the first tower in December 2021.

•Announced the construction of seven new towers along Highway 14 from Sooke to Port Renfrew in partnership with Governments of Canada and British Columbia, and more than 90 kilometres of new coverage along Highways 95 and 97 in partnership with the government of British Columbia.

Drive market-leading growth in each of our lines of business

•Launched Ignite Internet Gigabit 1.5 to eligible customers, giving customers access to even faster Internet service.

•Launched the first "Wireless Private Network" managed solution nationally in Canada, through Rogers for Business, enabling large enterprises to transform their digital capabilities and drive innovation in their business.

•Unveiled Sportsnet's new state-of-the-art NHL Studio, one of the first entirely IP-based sports studios in North America, capable of delivering interactive and immersive content through augmented and virtual reality, real-time data and statistics, and in-broadcast versatility.

•Launched eight streaming services on our Ignite TV and Ignite Streaming platforms, including Disney+ and Spotify, enhancing Rogers industry-leading selection of streaming services.

•Relaunched Sportsnet NOW, delivering world-class stream quality and reliability combined with new pricing and packaging that gives customers more flexibility and choice; paid subscriber growth is up over 175% year-on-year.

•Launched a Cloud Unified Communications product in Rogers Business, a feature-rich, cloud-based phone system for enterprise business customers with complex needs.

| Rogers Communications Inc. | 11 | Fiscal 2023 | ||||||

Drive best-in-class financial outcomes for our shareholders

•Earned total service revenue of $12,533 million, up 5%.

•Attracted 448,000 net Wireless postpaid subscribers, 49,000 net Internet subscribers, and 244,000 net Ignite TV subscribers.

•Generated free cash flow of $1,671 million and cash provided by operating activities of $4,161 million.

•Paid dividends of $1,010 million to our shareholders.

Develop our people, drive engagement, and build a high-performing and inclusive culture

•Awarded Canada's Top 100 Employers, including in the Greater Toronto Area, for Young People, Best Diversity Employer, and Greenest Employers by MediaCorp Canada Inc. in November 2021; LinkedIn Canada's Top 25 Companies in April 2021; and Canada's Most Admired Corporate Cultures by Waterstone Human Capital in October 2021.

•Achieved a score of 89% for employee pride in our employee pulse survey in June 2021.

Be a strong, socially and environmentally responsible leader in our communities

•Awarded 90 Ted Rogers Community Grants across Canada in 2021, to organizations supporting Canadian youth. Nearly 400 Ted Rogers Community Grants have been awarded since 2017.

•Awarded Ted Rogers Scholarships to 375 young Canadians for post-secondary studies. Nearly three quarters of all scholarships in the Class of 2021 were awarded to youth from equity-deserving communities.

•Expanded our ESG Report and introduced an interactive multimedia Social Impact Report, celebrating and tracking our impact on the environment and our communities. We now disclose information in accordance with the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-Related Financial Disclosures (TCFD) standards, and we committed to supporting the United Nations Sustainable Development Goals.

•Launched a 2021 Orange Shirt Day campaign in support of Indigenous communities across the country. Over the past two years, the Orange Shirt Day campaign has raised $250,000 for the Orange Shirt Society and the Indian Residential School Survivors Society (IRSSS).

•Launched our new corporate responsibility brand, Generation Possible, the youth and education pillar focused on giving the next generation the chance they need to succeed through Ted Rogers Scholarships, Community Grants, and Jays Care Foundation. Team Possible is about our team and partners' commitment to making a meaningful impact in communities through volunteering, bridging the digital divide, and partnering with organizations like Women's Shelters Canada.

•Expanded eligibility for Connected for Success, so even more Canadians can connect to social services, learning, employment, and loved ones. Now available to upwards of 750,000 Canadian households, the expanded low-cost high-speed Internet program is available across our Internet footprint in Ontario, New Brunswick, and Newfoundland to eligible customers receiving disability, seniors' or income support, and through rent-geared-to-income community housing partners.

Other highlights

•Declared a quarterly dividend of $0.50 per each outstanding Class A Voting Share and Class B Non-Voting Share during 2021.

•Issued $2 billion subordinated notes due 2081 with an initial coupon of 5% for the first five years in December 2021. We received net proceeds of $1,980 million from the issuance.

•Ended the year with approximately $4.2 billion of available liquidity, including $3.1 billion available under our bank and letter of credit facilities, $0.4 billion available under our $1.2 billion receivables securitization program, and $0.7 billion in cash and cash equivalents.

ITEM 4.2 – SIGNIFICANT ACQUISITIONS

On April 3, 2023, RCI acquired all of Shaw Communications Inc.'s (Shaw) issued and outstanding Class A Participating Shares and Class B Non-Voting Participating Shares (Shaw Transaction). For further information on the Shaw Transaction, see the section entitled "Shaw Transaction" in our 2023 MD&A, which section is incorporated by reference herein. A Form 51-102F4 Business Acquisition Report was filed with the securities regulatory authorities via SEDAR+ on June 7, 2023.

| Rogers Communications Inc. | 12 | Fiscal 2023 | ||||||

ITEM 5 – Narrative Description of the Business

ITEM 5.1 – GENERAL – BUSINESS OVERVIEW

This section incorporates by reference the following sections contained in our 2023 MD&A:

| About Rogers | 16 | |||||||

| Understanding Our Business | 20 | |||||||

| Wireless | 20 | |||||||

| Cable | 20 | |||||||

| Media | 20 | |||||||

| Products and Services | 20 | |||||||

| Wireless | 20 | |||||||

| Cable | 20 | |||||||

| Media | 21 | |||||||

| Other | 21 | |||||||

| Other Investments | 22 | |||||||

| Competition | 22 | |||||||

| Wireless | 22 | |||||||

| Cable | 22 | |||||||

| Media | 23 | |||||||

| Industry Trends | 23 | |||||||

| Our Strategy, Key Performance Drivers, and Strategic Highlights | 25 | |||||||

| Capability to Deliver Results | 29 | |||||||

| Employees | 41 | |||||||

| Commitments and Contractual Obligations | 59 | |||||||

PROPERTIES, TRADEMARKS, ENVIRONMENTAL, AND OTHER MATTERS

In most instances, the Company, through its subsidiaries, owns the assets essential to its operations. Our major fixed assets are:

•transmitters; microwave systems; antennae; buildings; electronic transmission, receiving, and processing accessories; and other wireless network equipment (including switches, radio channels, base station equipment, microwave facilities, and cell equipment);

•coaxial and fibre optic cables; set-top terminals, cable modems, and home monitoring equipment; electronic transmission, receiving, processing, digitizing, and distributing equipment; IP routers; data storage servers and network management equipment; and microwave equipment and antennae; and

•radio and television broadcasting equipment (including television cameras and television and radio production facilities and studios).

We either own or license the operating systems and software related to these assets. We also lease various distribution facilities from third parties, including space on utility poles and underground ducts for the placement of some of the cable distribution system. We either own or lease land or premises for the placement of hub sites, head-ends, switches, and space for other portions of the cable distribution system. We also lease premises and space on buildings for the placement of antenna towers. We also lease space in buildings for some of our office, media, and warehousing needs and in malls and stores for our retail operations. We have highly clustered and technologically advanced broadband cable networks across Canada.

We operate a North American transcontinental fibre-optic network extending 114,000 kilometres, providing a significant North American geographic footprint connecting Canada’s largest markets while also reaching key US markets for the exchange of data and voice traffic, also known as peering.

We own or have licensed various brands and trademarks used in our businesses. Certain of our trade names and properties are protected by trademark and/or copyright. We maintain customer lists for our businesses. Our intellectual property, including our trade names, brands, properties, and customer lists, is important to our operations.

In 2023, we spent approximately $0.2 million relating to environmental protection and management requirements. Environmental protection and management requirements applicable to our operations are not expected to have a significant effect on our capital expenditures, earnings, or competitive position in the current or future fiscal years.

| Rogers Communications Inc. | 13 | Fiscal 2023 | ||||||

ITEM 5.2 – RISK FACTORS

The following section is incorporated by reference herein: “Risks and Uncertainties Affecting Our Business” contained on pages 63 to 70 of our 2023 MD&A.

ITEM 6 – Dividends

ITEM 6.1 – DIVIDENDS

On January 31, 2024, the RCI Board of Directors (the Board) declared a quarterly dividend of $0.50 per Class A Voting Share and Class B Non-Voting Share, to be paid on April 3, 2024, to shareholders of record on March 11, 2024.

The table below shows when dividends have been declared and paid on the Class A Voting Shares and Class B Non-Voting Shares for the three most recently completed financial years.

| Dividends paid (in millions of dollars) | ||||||||||||||||||||

| Declaration date | Record date | Payment date | Dividend per share (dollars) | In cash | In Class B Non-Voting Shares | Total | ||||||||||||||

| February 1, 2023 | March 10, 2023 | April 3, 2023 | 0.50 | 252 | — | 252 | ||||||||||||||

| April 25, 2023 | June 9, 2023 | July 5, 2023 | 0.50 | 264 | — | 264 | ||||||||||||||

| July 25, 2023 | September 8, 2023 | October 3, 2023 | 0.50 | 191 | 74 | 265 | ||||||||||||||

| November 8, 2023 | December 8, 2023 | January 2, 2024 | 0.50 | 190 | 75 | 265 | ||||||||||||||

| January 26, 2022 | March 10, 2022 | April 1, 2022 | 0.50 | 252 | — | 252 | ||||||||||||||

| April 19, 2022 | June 10, 2022 | July 4, 2022 | 0.50 | 253 | — | 253 | ||||||||||||||

| July 26, 2022 | September 9, 2022 | October 3, 2022 | 0.50 | 253 | — | 253 | ||||||||||||||

| November 8, 2022 | December 9, 2022 | January 3, 2023 | 0.50 | 253 | — | 253 | ||||||||||||||

| January 27, 2021 | March 10, 2021 | April 1, 2021 | 0.50 | 252 | — | 252 | ||||||||||||||

| April 20, 2021 | June 10, 2021 | July 2, 2021 | 0.50 | 253 | — | 253 | ||||||||||||||

| July 20, 2021 | September 9, 2021 | October 1, 2021 | 0.50 | 253 | — | 253 | ||||||||||||||

| October 20, 2021 | December 10, 2021 | January 4, 2022 | 0.50 | 252 | — | 252 | ||||||||||||||

Rogers amended its Dividend Reinvestment Plan (DRIP) effective August 11, 2023. The DRIP enables eligible holders of Class A Voting Shares and Class B Non-Voting Shares to have all or a portion of their regular quarterly cash dividends automatically reinvested in additional Class B Non-Voting Shares. The amendment permits, at the Board's discretion, a small discount when shares are issued from treasury under the plan. Class B Non-Voting Shares will be issued by Rogers under the plan from treasury at a 2% discount from the Average Market Price (as defined in the plan). Previously, Class B Non-Voting Shares received by participants under the plan were purchased in the Canadian open market with no discount from the Average Market Price.

ITEM 7 – Description of Capital Structure

ITEM 7.1 – GENERAL DESCRIPTION OF CAPITAL STRUCTURE

The information required under the heading General Description of Capital Structure is contained in the 2023 Audited Consolidated Financial Statements, Note 26, and is incorporated herein by reference.

Each Class A Voting Share of RCI carries the right to fifty votes on a poll and may be voted at the meetings of shareholders of RCI. Holders of Class B Non-Voting Shares of RCI and any series of preferred shares of RCI are entitled to receive notice of and to attend meetings of shareholders of RCI, but except as required by law or stipulated by stock exchanges, are not entitled to vote at such meetings. If an offer is made to purchase outstanding Class A Voting Shares, there is no requirement under applicable law or RCI’s constating documents that an offer be made for the outstanding Class B Non-Voting Shares and there is no other protection available to holders of Class B Non-Voting Shares under RCI’s constating documents. If an offer is made to purchase both Class A Voting Shares and Class B Non-Voting Shares, the offer for the Class A Voting Shares may be made on different terms than the offer made to the holders of Class B Non-Voting Shares.

| Rogers Communications Inc. | 14 | Fiscal 2023 | ||||||

ITEM 7.2 – CONSTRAINTS

RESTRICTIONS ON THE TRANSFER, VOTING, AND ISSUE OF SHARES

We have ownership interests in several Canadian entities licensed or authorized to operate under applicable communications laws (the Laws), including the:

•Broadcasting Act (Canada);

•Telecommunications Act (Canada); and

•Radiocommunication Act (Canada).

The Laws have foreign ownership limits (the Limits) for various classes of licensed or authorized entities. A copy of the Limits can be obtained from our Corporate Secretary. The Laws also impose a number of restrictions on changes in effective control of licensees or authorized entities, and the transfer of licences held by them. RCI’s Articles of Amalgamation therefore impose restrictions on the issue and transfer of its shares and the exercise of voting rights to ensure that we, and any corporation existing in a Canadian jurisdiction in which we have an interest, are:

•qualified to hold or obtain any cable television, broadcasting, or telecommunications licence or authorized to operate a similar entity under the Laws; and

•not in breach of the Laws or any licences issued to us or to any of our Canadian subsidiaries, associates, or affiliates under the Laws.

If the Board considers that RCI's, or its subsidiaries', ability to hold and obtain licences, or to remain in compliance with the Laws, may be in jeopardy, the Board may invoke the restrictions in our Articles of Amalgamation on transfer, voting, and issue of our shares.

ITEM 7.3 – RATINGS

Credit ratings provide an independent measure of credit quality of an issue of securities and can affect our ability to obtain short-term and long-term financing and the terms of the financing. If rating agencies lower the credit ratings on our debt, particularly a downgrade below investment-grade, it could adversely affect our cost of financing and access to liquidity and capital.

We have engaged, and compensated, each of S&P Global Ratings Services (S&P), Moody's Investors Service (Moody's), Fitch Ratings (Fitch), and DBRS Morningstar to rate certain of our public debt issues. During the last two years, we have made an annual payment of less than $100,000 to a credit rating organization for an information service other than a credit rating service. Below is a summary of the credit ratings on RCI's outstanding senior and subordinated notes and debentures (long-term) and US CP (short-term) as at December 31, 2023.

| Issuance | S&P Global Ratings Services | Moody's | Fitch | DBRS Morningstar | ||||||||||

| Corporate credit issuer default rating | BBB- (outlook negative) | Baa3 (stable) | BBB- (stable) | BBB (low) (stable) | ||||||||||

| Senior unsecured debt | BBB- (outlook negative) | Baa3 (stable) | BBB- (stable) | BBB (low) (stable) | ||||||||||

| Subordinated debt | BBB- (outlook negative) | Ba2 (stable) | BB- (stable) | N/A 1 | ||||||||||

| US commercial paper | A-3 | P-3 | N/A 1 | N/A 1 | ||||||||||

1We have not sought a rating from Fitch or DBRS Morningstar for our short-term obligations or from DBRS Morningstar for our subordinated debt

Ratings for long-term debt instruments across the universe of composite rates range from AAA (S&P, Fitch, and DBRS Morningstar) or Aaa (Moody's), representing the highest quality of securities rated, to D (S&P and DBRS Morningstar), Substantial Risk (Fitch), and C (Moody's) for the lowest quality of securities rated. Investment-grade credit ratings are generally considered to range from BBB- (S&P and Fitch), BBB (DBRS Morningstar), or Baa3 (Moody's) to AAA (S&P, Fitch, and DBRS Morningstar) or Aaa (Moody's).

Ratings for short-term debt instruments across the universe of composite rates ranges from A-1+ (S&P) or P-1 (Moody's), representing the highest quality of securities rated, to C (S&P), and not prime (Moody's) for the lowest quality of securities rated. Investment-grade credit ratings are generally considered to be ratings of at least A-3 (S&P), or P-3 (Moody's) quality or higher.

Credit ratings are not recommendations to purchase, hold, or sell securities, nor are they a comment on market price or investor suitability. There is no assurance that a rating will remain in effect for a given period, or that a rating will not be revised or withdrawn entirely by a rating agency if it believes circumstances warrant it. The ratings on our senior debt provided by S&P, Fitch, Moody's, and DBRS Morningstar are investment-grade ratings.

| Rogers Communications Inc. | 15 | Fiscal 2023 | ||||||

ITEM 8 – Market for Securities

Class B Non-Voting Shares (CUSIP # 775109200) are listed in Canada on the Toronto Stock Exchange under the symbol RCI.B and in the United States on the New York Stock Exchange under the symbol RCI. Class A Voting Shares (CUSIP # 775109101) are listed on the Toronto Stock Exchange under the symbol RCI.A.

ITEM 8.1 – TRADING PRICE AND VOLUME

The following table sets forth, for the periods indicated, the reported high, low, and close prices and volume traded on the Toronto Stock Exchange for Class B Non-Voting Shares and Class A Voting Shares.

| RCI.B | ||||||||||||||

| Month | High ($) | Low ($) | Close ($) | Volume | ||||||||||

| 2023/01 | 67.07 | 63.05 | 64.69 | 22,710,007 | ||||||||||

| 2023/02 | 66.35 | 64.12 | 65.18 | 18,317,132 | ||||||||||

| 2023/03 | 65.97 | 60.00 | 62.64 | 32,168,139 | ||||||||||

| 2023/04 | 67.25 | 59.92 | 66.94 | 23,952,360 | ||||||||||

| 2023/05 | 67.67 | 59.29 | 59.85 | 23,853,747 | ||||||||||

| 2023/06 | 61.00 | 56.90 | 60.44 | 41,743,201 | ||||||||||

| 2023/07 | 61.97 | 57.24 | 57.74 | 22,694,812 | ||||||||||

| 2023/08 | 58.33 | 53.02 | 54.97 | 27,930,141 | ||||||||||

| 2023/09 | 57.26 | 51.38 | 52.15 | 39,249,434 | ||||||||||

| 2023/10 | 54.26 | 50.15 | 51.38 | 18,567,811 | ||||||||||

| 2023/11 | 59.13 | 51.34 | 58.43 | 28,583,105 | ||||||||||

| 2023/12 | 62.84 | 58.53 | 62.03 | 34,296,951 | ||||||||||

| RCI.A | ||||||||||||||

| Month | High ($) | Low ($) | Close ($) | Volume | ||||||||||

| 2023/01 | 67.85 | 61.05 | 66.00 | 68,036 | ||||||||||

| 2023/02 | 67.49 | 65.05 | 66.74 | 18,039 | ||||||||||

| 2023/03 | 67.00 | 61.00 | 64.00 | 17,533 | ||||||||||

| 2023/04 | 67.75 | 62.00 | 67.75 | 33,498 | ||||||||||

| 2023/05 | 68.25 | 61.25 | 62.00 | 23,513 | ||||||||||

| 2023/06 | 62.97 | 58.45 | 62.46 | 15,959 | ||||||||||

| 2023/07 | 63.20 | 58.48 | 60.04 | 16,733 | ||||||||||

| 2023/08 | 60.50 | 53.75 | 56.30 | 20,362 | ||||||||||

| 2023/09 | 57.50 | 52.00 | 52.35 | 32,268 | ||||||||||

| 2023/10 | 54.00 | 50.50 | 51.65 | 28,594 | ||||||||||

| 2023/11 | 60.00 | 52.00 | 58.65 | 27,502 | ||||||||||

| 2023/12 | 63.00 | 59.22 | 62.19 | 37,608 | ||||||||||

ITEM 8.2 – PRIOR SALES

In September 2023, we issued $3.0 billion of senior notes, including:

•$500 million of 5.65% senior notes due 2026;

•$1 billion of 5.70% senior notes due 2028;

•$500 million of 5.80% senior notes due 2030; and

•$1 billion of 5.90% senior notes due 2033.

In February 2024, we issued US$2.5 billion of senior notes, including:

•$1.25 billion of 5.00% senior notes due 2029; and

•$1.25 billion of 5.30% senior notes due 2034.

| Rogers Communications Inc. | 16 | Fiscal 2023 | ||||||

ITEM 9 – Escrowed Securities and Securities Subject to Contractual Restriction on Transfer

N/A

ITEM 10 – Directors and Officers

ITEM 10.1 - Name, Occupations and Security Holding

Set forth below is information regarding the directors and senior executive officers of RCI as at March 5, 2024, including their city, province or state, and country of residence, and their principal occupation(s) within the five preceding years. Each director is elected at the annual meeting of shareholders to serve until the next annual meeting or until a successor is duly elected unless, prior thereto, he or she resigns or his or her office becomes vacant by death or other cause under applicable law. Officers are appointed by, and serve at the discretion of, the Board.

| Name | Position | ||||

| Directors | |||||

Edward S. Rogers (1)(2)(3)(9)(10) | Director, Chair of RCI, and Chair of the Rogers Control Trust | ||||

| Tony Staffieri | Director, President and Chief Executive Officer | ||||

Michael J. Cooper (5) | Director | ||||

Trevor English (4)(5)(8) | Director | ||||

Ivan Fecan (6)(7)(8) | Director | ||||

Robert J. Gemmell (1)(2)(3)(6)(8) | Lead Director | ||||

Jan L. Innes (2)(4)(5)(7)(10) | Director and member of the Advisory Committee of the Rogers Control Trust | ||||

Dr. Mohamed Lachemi (5)(6) | Director | ||||

David A. Robinson (1)(2)(7)(8)(10) | Director and member of the Advisory Committee of the Rogers Control Trust | ||||

Lisa A. Rogers (4)(9)(10) | Director and member of the Advisory Committee of the Rogers Control Trust | ||||

Bradley S. Shaw (3) | Director | ||||

| Senior Executive Officers | |||||

| Tony Staffieri | Director, President and Chief Executive Officer | ||||

| Glenn A. Brandt | Chief Financial Officer | ||||

The Honourable Navdeep Bains | Chief Corporate Affairs Officer | ||||

Marisa Fabiano | Chief Human Resources Officer | ||||

| Philip J. Hartling | President, Wireless | ||||

| Bret D. Leech | President, Residential | ||||

| Ron McKenzie | Chief Technology and Information Officer | ||||

Thomas (Tom) A. Turner(10) | President, Business and member of the Advisory Committee of the Rogers Control Trust | ||||

| Terrie Tweddle | Chief Brand and Communications Officer | ||||

| Colette S. Watson | President, Rogers Sports & Media | ||||

| Mahes S. Wickramasinghe | President, Group Operations | ||||

| Marisa L. Wyse | Chief Legal Officer and Corporate Secretary | ||||

(1)Denotes member of Executive Committee

(2)Denotes member of Nominating Committee

(3)Denotes member of Finance Committee

(4)Denotes member of ESG Committee

(5)Denotes member of Pension Committee

(6)Denotes member of Corporate Governance Committee

(7)Denotes member of Human Resources Committee

(8)Denotes member of Audit and Risk Committee

(9)Edward S. Rogers and Lisa A. Rogers are immediate family members of each other and members of the family of the late Ted Rogers. For additional information, please see “Outstanding Shares and Main Shareholders” in RCI’s 2023 Information Circular available on SEDAR+ at sedarplus.ca.

(10)Voting control of RCI is held by the Rogers Control Trust. See “Outstanding Shares and Main Shareholders” in RCI’s 2023 Information Circular available on SEDAR+ at sedarplus.ca. Each of the individuals that are noted above as holding positions with the Rogers Control Trust have held such positions since December 2008, with the exception of Jan L. Innes who has held such position since December 2023, and Thomas (Tom) A. Turner who has held such position since March 2023.

Edward S. Rogers resides in Toronto, Ontario, Canada and has been a director of RCI since May 1997. Mr. Rogers currently serves as Chair of the Board of RCI. He was first appointed Chair in January 2018. Prior to that, he served as Deputy Chair of RCI from September 2009. Mr. Rogers is also Chair of Rogers Bank, Chair of the Toronto Blue Jays, Chair of Cablelabs, and is on the Board of Directors of Maple Leaf Sports & Entertainment. He is the Rogers Control Trust Chair. Mr. Rogers served in various management positions at Rogers Communications for over 20 years, including as President and

| Rogers Communications Inc. | 17 | Fiscal 2023 | ||||||

CEO of Rogers Cable Inc. After graduating from the University of Western Ontario, Mr. Rogers spent three years with Comcast Corporation. Mr. Rogers was a member of the Economic Council of Canada from 2010 to 2013.

Michael J. Cooper resides in Toronto, Ontario, Canada and has been a director of RCI since October 2021. Mr. Cooper is the President and Chief Responsible Officer of Dream Unlimited Corp. and founder of Dream Asset Management Corporation (DAM). He is also the Chair and Chief Executive Officer of Dream Office Real Estate Investment Trust. Mr. Cooper helped found DAM in 1996 and continues to lead the business as President and Chief Responsible Officer. Mr. Cooper was also involved in the formation of Dream Global Real Estate Investment Trust, previously a TSX-listed real estate investment trust, the assets and subsidiaries of which were sold in 2019. Mr. Cooper holds a LL.B from the University of Western Ontario and a M.B.A. from York University.

Trevor English resides in Calgary, Alberta, Canada and has been a director of RCI since April 2023. Mr. English has over 25 years of experience in corporate finance, mergers & acquisitions, investor relations, business development, and financial analysis. Mr. English joined the Shaw Family Group in April 2023, and currently holds the position of Chief Investment Officer. Mr. English served as Executive Vice President, Chief Financial & Corporate Development Officer of Shaw from May 2018 until prior to Shaw's acquisition by Rogers in April 2023. Previously, Mr. English served as Shaw's Executive Vice President, Chief Strategy and Business Development Officer from March 2016 to May 2018. Prior to joining Shaw in 2004, Mr. English worked for CIBC World Markets Inc. in Canada and the United Kingdom, commencing in 1997. Mr. English holds a B.Comm from the University of Calgary and a Chartered Financial Analyst designation.

Ivan Fecan resides in Vancouver, British Columbia, Canada and has been a director of RCI since October 2021. Mr. Fecan is a Canadian media executive and producer. Mr. Fecan was President and CEO of Baton Broadcasting and its successors, CTV Inc. and CTVglobemedia, from 1996 to 2011. Previously, he was VP of English TV at the CBC, VP of Creative Affairs at NBC, News Director at Citytv, and a CBC Radio Producer. Most recently, he was the Executive Chair of Thunderbird Entertainment Group Inc. Mr. Fecan serves on the boards of the University Health Network Foundation, the Council for Canadian American Relations, and is a Trustee Emeritus at the Art Gallery of Ontario. Mr. Fecan was the producer and executive producer of the hit Canadian sitcom Kim's Convenience. Mr. Fecan holds a B.A. from York University, and has two honorary doctorates.

Robert J. Gemmell resides in Oakville, Ontario, Canada, has been a director of RCI since April 2017, and has served as Lead Director since November 2021. Mr. Gemmell spent 25 years as an investment banker in the United States and in Canada. Mr. Gemmell was President and Chief Executive Officer of Citigroup Global Markets Canada and its predecessor companies (Salomon Brothers Canada and Salomon Smith Barney Canada) from 1996 to 2008. In addition, he was a member of the Global Operating Committee of Citigroup Global Markets from 2006 to 2008. Mr. Gemmell holds a B.A. from Cornell University, a LL.B from Osgoode Hall Law School, and a M.B.A. from the Schulich School of Business.

Jan L. Innes resides in Toronto, Ontario, Canada and has been a director of RCI since October 2021. Ms. Innes is a board director and public affairs specialist. Ms. Innes spent most of her career at Rogers Communications. She joined Rogers in 1995 as Vice President, Communications, and in 2011, became Vice President, Government Relations. Ms. Innes retired from Rogers in 2015. Prior to joining Rogers, Ms. Innes was Vice President of Public Affairs at Unitel Communications Inc. Previously, Ms. Innes held senior political staff positions at both Queen's Park in Toronto and Parliament Hill in Ottawa. Ms. Innes is the Chair of the Board of Directors of the Rogers Group of Funds and a member of the Advisory Committee of the Rogers Control Trust. Ms. Innes holds a B.A. (Honours) from the University of Toronto and in 2014, completed the Directors Education Program at the Rotman School of Management, receiving the ICD.D designation.

Dr. Mohamed Lachemi resides in Mississauga, Ontario, Canada and has been a director of RCI since April 2022. Dr. Lachemi has been President and Vice-Chancellor of Toronto Metropolitan University since April 2016. Since joining Toronto Metropolitan University in 1998 as professor of civil engineering, Dr. Lachemi has served in progressively senior roles, including Dean of the Faculty of Engineering and Architecture Science, and Provost (COO) and Vice President Academic. Dr. Lachemi is a recipient of the Order of Ontario, a Fellow of the Canadian Society for Civil Engineering, a Fellow of the Canadian Academy of Engineering, and a board member of Trillium Health Partners. Dr. Lachemi also serves as a board member of DMZ Ventures. He is past Chair of the Council of Ontario Universities and COU Holding Association Inc. and was a member of the NRC Council from 2018 to 2021. Dr. Lachemi holds a M.A.Sc. and Ph.D. from the University of Sherbrooke and a B.Sc. in Civil Engineering from the University of Science and Technology of Oran, Algeria.

David A. Robinson resides in Toronto, Ontario, Canada and has been a director of RCI since April 2022. Until its recent acquisition by Paramount Commerce Inc., Mr. Robinson was the Chief Commercial Officer of Foghorn Payments Inc., a Canadian payment processing service provider for businesses. Mr. Robinson joined Rogers in 1990 and served in progressively more senior roles over his 30-year career at the Company. From August 2015 to June 2019, Mr. Robinson served as President and Chief Executive Officer of Rogers Bank. As SVP, Financial Services, Rogers Communications from 2014 to 2015, Mr. Robinson provided executive sponsorship of financial services efforts at Rogers, including Rogers Bank, the Today's Shopping Choice private label credit card program, as well as the Company’s investments in its mobile-payment joint ventures, Enstream and Suretap. Mr. Robinson is a member of the Advisory Committee of the Rogers Control Trust. He also serves as a director of Mobi724 Global Solutions Inc. Mr. Robinson holds a B.A. (Honours) from Queen’s University, a M.B.A. from the University of Western Ontario, and in 2021, completed the Directors Education Program at the Rotman School of Management, receiving the ICD.D designation.

| Rogers Communications Inc. | 18 | Fiscal 2023 | ||||||

Lisa A. Rogers resides in Victoria, British Columbia, Canada and has been a director of RCI since April 2023. Ms. Rogers is the founder and President and CEO of The Annual Foundation, a private foundation focused predominantly on supporting smaller Canadian charitable organizations and those located outside of the major Canadian centres. Ms. Rogers is a member of the Advisory Committee of the Rogers Control Trust and a director of The Rogers Foundation. Ms. Rogers has previously served on the Board of Directors for Rogers Broadcasting (now Rogers Media) and worked as a Business Development Analyst for Rogers Cablesystems Limited. Ms. Rogers has a B.A. from the University of Western Ontario, a graduate diploma from The London School of Economics and Political Science, and a M.B.A. from Bayes Business School (City, University of London).

Bradley S. Shaw resides in Calgary, Alberta, Canada and has been a director of RCI since April 2023. Mr. Shaw served as Chief Executive Officer of Shaw from November 2010 to April 3, 2023. He was also the Executive Chair of the Board of Shaw and Chair of the Executive Committee from March 2020 to April 3, 2023. Mr. Shaw led the transformation of Shaw from a Western-based cable company to a leading Canadian connectivity company. He was instrumental in building Shaw Direct into one of North America's leading direct-to-home satellite television providers and he played a key role in the launch of Shaw's digital home phone service in 2005. Mr. Shaw is Chair of the Shaw Family Living Trust and a director of several private companies. Mr. Shaw is a director of Shaw Family Foundation and managing director of The HOP Foundation, both non-profit organizations. Mr. Shaw sits on the Patrons' Council of the Alberta Children's Hospital Foundation.

Tony Staffieri resides in Toronto, Ontario, Canada and has served as President and Chief Executive Officer and a director of RCI since January 2022. He first joined the Company as Chief Financial Officer in April 2012. Since becoming Chief Executive Officer, he has closed the transformative merger with Shaw, turned around the Company's performance, and led the industry with innovative firsts. Prior to joining Rogers, he held senior executive positions with Bell Canada and Celestica, and was a Partner at PwC. He serves as Chair of the Board of Governors for Toronto Metropolitan University and is a Board Director at Maple Leaf Sports & Entertainment. He is a Fellow Chartered Professional Accountant and Fellow Chartered Accountant. He holds a B.B.A. from the Schulich School of Business.

Glenn A. Brandt resides in Millgrove, Ontario, Canada and has served as Chief Financial Officer since January 2022. Since joining Rogers 32 years ago, Mr. Brandt has held several senior roles in the company, most recently as Senior Vice President, Corporate Finance from September 2016 to January 2022, overseeing various portfolios including Treasury, Tax, Corporate Development, Investor Relations, and Procurement and Supply Chain. Mr. Brandt is a trusted advisor with over 35 years in financial management, including extensive experience across corporate finance, raising capital, and working with credit rating agencies. Prior to joining Rogers, Mr. Brandt was with the Toronto Dominion Bank in Corporate & Investment and Commercial Banking. Mr. Brandt holds a B.Comm from the University of Toronto and a M.B.A. from the Schulich School of Business.

The Honourable Navdeep Bains resides in Mississauga, Ontario, Canada and has served as Chief Corporate Affairs Officer since May 2023. Mr. Bains leads the Public Policy and Environmental, Social and Governance (ESG) efforts for the Company, drawing on his deep expertise in policy matters to advance critical issues, including the digital divide and Canada's digital economy. Prior to joining Rogers, Mr. Bains served as Vice-Chair in Global Investment Banking for CIBC from October 2021 to May 2023. From November 2015 to January 2021, Mr. Bains served as one of the longest serving federal Ministers of Innovation, Science and Industry, where he introduced the most comprehensive innovation and skills plan for Canada in over three decades. Mr. Bains was a distinguished visiting professor at Toronto Metropolitan University's Ted Rogers School of Management, an adjunct lecturer at the Master of Public Service program at the University of Waterloo, and worked for several years in accounting and finance for the Ford Motor Company of Canada. Mr. Bains holds a Fellow Chartered Professional Accountant designation and has a M.B.A. from the University of Windsor and a B.Com from York University.

Marisa Fabiano resides in North York, Ontario, Canada and has served as Chief Human Resources Officer since February 2024. Ms. Fabiano is responsible for leading the company’s HR portfolio, including creating an engaging and inclusive employee experience. She has spent over a decade at Rogers in financial leadership roles, including Head of Business Finance & Shaw Integration from April 2022 to December 2022, and most recently as Senior Vice President of Corporate Finance & Controller from December 2022 to February 2024. Prior to that, she served as Senior Vice President and Head of Financial Operations from July 2017 to April 2022. Ms. Fabiano has more than 25 years of experience in leadership positions within the telecommunication, industrial, and consumer goods industries, including at Bell Canada, Husky Injection Molding, and Coca Cola Beverages. Ms. Fabiano holds a B.B.A. from Schulich School of Business, ICD.D designation from the Canadian Institute of Corporate Directors, and is a Certified Professional Accountant.

Philip J. Hartling resides in Toronto, Ontario, Canada and has served as President, Wireless since January 2022. Since joining Rogers in 2005 when it acquired Sprint Canada, Mr. Hartling has held various senior leadership positions within Rogers, in marketing, sales, customer service, and operations. Mr. Hartling's most recent position was Executive Vice President, Service Expansion from January 2021 to January 2022. Prior to that, he served as President, Connected Home from June 2018 to January 2021, and as Interim President, Consumer from December 2017 to June 2018. Mr. Hartling is responsible for the Company's Wireless business, including the Rogers, Fido, and chatr brands. Mr. Hartling holds a M.P.A. and a B.Comm from Dalhousie University.

| Rogers Communications Inc. | 19 | Fiscal 2023 | ||||||

Bret D. Leech resides in Toronto, Ontario, Canada and has served as President, Residential since February 2024. Mr. Leech is responsible for the strategy and execution of Residential Product, Content, Marketing, and Sales. Mr. Leech was previously Chief Human Resources Officer from February 2022 to February 2024, where he played an integral role in the Company’s integration with Shaw. Prior to joining Rogers, Mr. Leech held a series of senior executive leadership positions with telecommunication, financial, and technology organizations in Canada, China, Japan, and the United States. Most recently, Mr. Leech was Group Vice President at Southeast Toyota Finance from January 2021 to December 2021. Before returning to Rogers, Mr. Leech was Division President Lending Solutions at Fiserv, Inc. from March 2016 to February 2018. In April 2018, Mr. Leech led the sale of Fiserv, Inc.'s Lending Solutions business to an independent joint venture, Sagent Lending Technologies (Sagent), becoming its President and CEO and member of the board. Following a series of acquisitions, Mr. Leech separated Sagent's two primary lines of business, taking a board and Executive Chairman position with Sagent in March 2021 and continuing as President and CEO of the second entity, defi SOLUTIONS, until October 2020. Mr. Leech holds a B.A. from Dalhousie University, a M.B.A. from the University of Toronto, a MSc from the University of Reading Henley’s School of Business, and is a graduate of Harvard's Advanced Management Program.

Ron McKenzie resides in Calgary, Alberta, Canada and has served as Chief Technology and Information Officer since July 2022. Mr. McKenzie is responsible for leading an expert team of engineers, developers, and technology professionals responsible for designing, building, and operating the Company's wireline, wireless, and media networks, as well as IT and digital strategy and systems. Mr. McKenzie was formerly President, Business from June 2021 to July 2022, where he was responsible for delivering Wireless, Wireline, IoT, Advanced Services, and Data Centre products and solutions to small, medium, large, and public sector businesses across Canada. Mr. McKenzie was previously Senior Vice President, Technical Operations of Rogers from November 2019 to June 2021. Mr. McKenzie has more than 30 years' experience in the telecom industry across Canada and the United States. Prior to joining Rogers, Mr. McKenzie spent more than 10 years in senior leadership positions at Shaw in Calgary, including SVP and Chief Operating Officer and SVP Business. He is currently Secretary of the Board of Directors of the Society of Cable Telecommunications Engineers (SCTE). Mr. McKenzie graduated with a B.A.Sc. in Electrical Engineering from the University of Toronto and has attended the CTAM Executive Management programs at Harvard.

Thomas (Tom) A. Turner resides in Toronto, Ontario, Canada and has served as President, Business since July 2022. Mr. Turner is responsible for delivering Wireless, Wireline, IoT, Wholesale, and Data Centre/Cloud products and solutions to small, medium, large, and public sector businesses across Canada. Prior to taking on the President, Business role, Mr. Turner held several executive leadership positions within Rogers, most recently as the Senior Vice President of Sales for Business, from July 2011 to July 2022. Mr. Turner built his career at Rogers Communications since 1992, holding key leadership roles across Rogers Cable, Wireless, and Media business units. Mr. Turner is a member of the Advisory Committee of the Rogers Control Trust. Mr. Turner has previously served as a Board Member for the Toronto Board of Trade, the largest policy and advocacy group for the city’s business community. Mr. Turner holds a B.A. from Michigan State University and a J.D. from the Ph.D. program at Michigan State University College of Law.

Terrie Tweddle resides in Oakville, Ontario, Canada and has served as Chief Brand and Communications Officer since April 2023. She is responsible for leading the Company's Branding, Communications, and Sponsorship portfolios. She previously worked at Rogers from August 2008 to February 2020 leading Communications and Corporate Social Responsibility. She brings 25 years' experience leading Communications, Branding, and Social Responsibility for top-tier brands including Molson-Coors, Visa International, and Sun Life Financial. Prior to rejoining Rogers, she served as Global Head of Marketing and Communications at a global pension plan with $250 billion in net assets. She holds a B.A. from the University of Ottawa and is a graduate of Harvard's Leadership Development program.

Colette S. Watson resides in Ottawa, Ontario, Canada and has served as President, Rogers Sports & Media since January 2022. Ms. Watson was previously Senior Vice President, TV & Broadcast Operations from November 2016 to June 2020. Ms. Watson is responsible for driving strategy and overseeing operations for the Company’s robust portfolio of media assets. Prior to rejoining Rogers, Ms. Watson was the President of CPAC, a not-for-profit, commercial-free specialty television channel from April 2019 to January 2022. Fluently bilingual, Ms. Watson has 33 years of experience across programming, regulatory, and communications, including a variety of senior roles across Rogers' Media, Regulatory, and Cable divisions. Ms. Watson joined Rogers in 1990 as Bureau Chief of the Rogers Ottawa Bureau. She became Vice President of Community Programming in 1995 and performed the dual role of President of CPAC and Vice President of Community Programming until her appointment to Rogers Media in 2016. Ms. Watson is also a past recipient of the esteemed Trailblazer of the Year award by Canadian Women in Communications. Ms. Watson holds a diploma in Communications from St. Lawrence College.

Mahes S. Wickramasinghe resides in Toronto, Ontario, Canada and has served as President, Group Operations since February 2024. Mr. Wickramasinghe was previously Chief Commercial Officer from April 2023 to February 2024, and prior to that, Chief Administrative Officer from January 2022. Mr. Wickramasinghe is responsible for Customer Experience, including Digital, Capital Management, Financial Services (including Rogers Bank), Information Security, Procurement, and Corporate Security. Procurement and Supply Chain, Corporate Development and Corporate Security. Mr. Wickramasinghe has spent over two decades in senior executive roles across large Canadian and global organizations, most recently as Executive Vice-President, Canadian Tire Corporation from September 2016 to October 2021, including as Chief Corporate Officer from September 2016 to March 2020, as President, Canadian Tire Financial Services and President & CEO,

| Rogers Communications Inc. | 20 | Fiscal 2023 | ||||||

Canadian Tire Bank from March 2020 to July 2021, and as Chairman of Helly Hansen until October 2021. Prior to that, Mr. Wickramasinghe was Chief Strategy Officer at Canadian Tire from February 2014 to September 2016. Mr. Wickramasinghe also held executive leadership positions at BCE Inc. and Bell Aliant from 2003 to 2008. From 2008 to 2012, Mr. Wickramasinghe was Chief Administrative Officer of CIBC FirstCaribbean, based in Barbados, and from July 2012 to September 2013, he was Senior Vice President, Corporate Finance at Rogers. He started his career in public accounting and was a partner with Arthur Andersen and joined CIBC in 1995 and held a number of senior positions and was appointed Senior Vice President in 2001. Mr. Wickramasinghe is a member of the Institute of Chartered Accountants (Sri Lanka) and the American Institute of Certified Public Accountants and a Fellow of the Chartered Institute of Management (UK). He is on the Board of Directors for SunOpta Inc. and Helly Hansen China.