Exhibit

Exhibit 99.3

Management’s Responsibility for Financial Reporting

December 31, 2017

The accompanying consolidated financial statements of Rogers Communications Inc. and its subsidiaries and all the information in Management's Discussion and Analysis (MD&A) are the responsibility of management and have been approved by the Board of Directors.

Management has prepared the consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. The consolidated financial statements include certain amounts that are based on management's best estimates and judgments and, in their opinion, present fairly, in all material respects, Rogers Communications Inc.'s financial position, results of operations, and cash flows. Management has prepared the financial information presented elsewhere in MD&A and has ensured that it is consistent with the consolidated financial statements.

Management has developed and maintains a system of internal controls that further enhances the integrity of the consolidated financial statements. The system of internal controls is supported by the internal audit function and includes management communication to employees about its policies on ethical business conduct.

Management believes these internal controls provide reasonable assurance that:

| |

• | transactions are properly authorized and recorded; |

| |

• | financial records are reliable and form a proper basis for the preparation of consolidated financial statements; and |

| |

• | the assets of Rogers Communications Inc. and its subsidiaries are properly accounted for and safeguarded. |

The Board of Directors is responsible for overseeing management's responsibility for financial reporting and is ultimately responsible for reviewing and approving the consolidated financial statements. The Board of Directors carries out this responsibility through its Audit and Risk Committee.

The Audit and Risk Committee meets regularly with management, as well as the internal and external auditors, to discuss internal controls over the financial reporting process, auditing matters, and financial reporting issues; to satisfy itself that each party is properly discharging its responsibilities; and to review MD&A, the consolidated financial statements, and the external auditors' report. The Audit and Risk Committee reports its findings to the Board of Directors for its consideration when approving the consolidated financial statements for issuance to the shareholders. The Audit and Risk Committee also considers the engagement or re-appointment of the external auditors before submitting its recommendation to the Board of Directors for review and for shareholder approval.

The consolidated financial statements have been audited by KPMG LLP, the external auditors, in accordance with Canadian generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States) on behalf of the shareholders. Our internal control over financial reporting as at December 31, 2017 has been audited by KPMG LLP, in accordance with the standards of the Public Company Accountability Oversight Board (United States). KPMG LLP has full and free access to the Audit and Risk Committee.

March 8, 2018

|

| | | |

"Joe Natale" | | "Anthony Staffieri" | |

Joe Natale | | Anthony Staffieri, FCPA, FCA | |

President and Chief Executive Officer | | Chief Financial Officer | |

|

| | |

Rogers Communications Inc. | 1 | 2017 Annual Financial Statements |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Rogers Communications Inc.

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated financial statements of Rogers Communications Inc., which comprise the consolidated statements of financial position as at December 31, 2017 and December 31, 2016, the consolidated statements of income, comprehensive income, changes in shareholders' equity and cash flows for the years then ended, and the related notes, comprising a summary of significant accounting policies and other explanatory information (collectively referred to as the "consolidated financial statements").

In our opinion, the consolidated financial statements present fairly, in all material respects, the consolidated financial position of Rogers Communication Inc. as at December 31, 2017 and December 31, 2016, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Report on Internal Control Over Financial Reporting

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Rogers Communications Inc.'s internal control over financial reporting as of December 31, 2017, based on the criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated March 8, 2018 expressed an unqualified (unmodified) opinion on the effectiveness of Rogers Communications Inc.'s internal control over financial reporting.

Basis for Opinion

A - Management's Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

B - Auditors' Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with Canadian generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States) ("PCAOB"). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement, whether due to error or fraud. Those standards also require that we comply with ethical requirements, including independence. We are required to be independent with respect to Rogers Communications Inc. in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in Canada, the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We are a public accounting firm registered with the PCAOB.

An audit includes performing procedures to assess the risks of material misstatements of the consolidated financial statements, whether due to error or fraud, and performing procedures to respond to those risks. Such procedures included obtaining and examining, on a test basis, audit evidence regarding the amounts and disclosures in the consolidated financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to Rogers Communications Inc.’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances.

An audit also includes evaluating the appropriateness of accounting policies and principles used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a reasonable basis for our audit opinion.

"KPMG LLP"

Chartered Professional Accountants, Licensed Public Accountants

We have served as Rogers Communications Inc.'s auditor since 1969.

Toronto, Canada

March 8, 2018

|

| | |

Rogers Communications Inc. | 2 | 2017 Annual Financial Statements |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Rogers Communications Inc.

Opinion on Internal Control over Financial Reporting

We have audited Rogers Communications Inc.’s internal control over financial reporting as of December 31, 2017, based on the criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

In our opinion, Rogers Communications Inc. maintained, in all material respects, effective internal control over financial reporting as of December 31, 2017, based on the criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

Report on the Consolidated Financial Statements

We also have audited, in accordance with Canadian generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States) ("PCAOB"), the consolidated financial statements of Rogers Communications Inc., which comprise the consolidated statements of financial position as at December 31, 2017 and December 31, 2016, the consolidated statements of income, comprehensive income, changes in shareholders’ equity and cash flows for the years then ended, and the related notes, comprising a summary of significant accounting policies and other explanatory information (collectively referred to as the "consolidated financial statements") and our report dated March 8, 2018 expressed an unmodified (unqualified) opinion on those consolidated financial statements.

Basis for Opinion

Rogers Communications Inc.’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included under the heading Management’s Report on Internal Control over Financial Reporting contained within Management’s Discussion and Analysis for the year ended December 31, 2017. Our responsibility is to express an opinion on Rogers Communications Inc.’s internal control over financial reporting based on our audit.

We are a public accounting firm registered with the PCAOB and are required to be independent with respect to Rogers Communications Inc. in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB and in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Definition and Limitations of Internal Control over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

"KPMG LLP"

Chartered Professional Accountants, Licensed Public Accountants

Toronto, Canada

March 8, 2018

|

| | |

Rogers Communications Inc. | 3 | 2017 Annual Financial Statements |

Consolidated Statements of Income

(In millions of Canadian dollars, except per share amounts)

|

| | | | | | |

Years ended December 31 | Note |

| 2017 |

| 2016 |

|

| | | |

Revenue | 5 |

| 14,143 |

| 13,702 |

|

| |

| |

Operating expenses: | |

| |

Operating costs | 6 |

| 8,825 |

| 8,671 |

|

Depreciation and amortization | 7, 8 |

| 2,142 |

| 2,276 |

|

Gain on disposition of property, plant and equipment | 7 |

| (49 | ) | — |

|

Restructuring, acquisition and other | 7, 9 |

| 152 |

| 644 |

|

Finance costs | 10 |

| 746 |

| 761 |

|

Other (income) expense | 11 |

| (19 | ) | 191 |

|

| |

|

| |

Income before income tax expense | | 2,346 |

| 1,159 |

|

Income tax expense | 12 |

| 635 |

| 324 |

|

| |

|

| |

Net income for the year | | 1,711 |

| 835 |

|

| |

| |

Earnings per share: | |

| |

Basic | 13 |

| $3.32 | $1.62 |

Diluted | 13 |

| $3.31 | $1.62 |

The accompanying notes are an integral part of the consolidated financial statements.

|

| | |

Rogers Communications Inc. | 4 | 2017 Annual Financial Statements |

Consolidated Statements of Comprehensive Income

(In millions of Canadian dollars)

|

| | | | | | |

Years ended December 31 | Note |

| 2017 |

| 2016 |

|

| | | |

Net income for the year | | 1,711 |

| 835 |

|

| | | |

Other comprehensive income (loss): | | | |

| | | |

Items that will not be reclassified to income: | | | |

Defined benefit pension plans: | | | |

Remeasurements | 22 |

| (62 | ) | (101 | ) |

Related income tax recovery | | 17 |

| 27 |

|

| | | |

Items that will not be reclassified to net income | | (45 | ) | (74 | ) |

| | | |

Items that may subsequently be reclassified to income: | | | |

Available-for-sale investments: | | | |

Increase in fair value | | 433 |

| 90 |

|

Reclassification to net income for gain on sale of investment | | — |

| (39 | ) |

Related income tax expense | | (62 | ) | (7 | ) |

| | | |

Available-for-sale investments | | 371 |

| 44 |

|

| | | |

Cash flow hedging derivative instruments: | | | |

Unrealized loss in fair value of derivative instruments | | (566 | ) | (336 | ) |

Reclassification to net income of loss on debt derivatives | | 591 |

| 255 |

|

Reclassification to net income or property, plant and equipment of loss (gain) on expenditure derivatives | | 39 |

| (80 | ) |

Reclassification to net income for accrued interest | | (60 | ) | (69 | ) |

Related income tax recovery | | 40 |

| 66 |

|

| | | |

Cash flow hedging derivative instruments | | 44 |

| (164 | ) |

| | | |

Equity-accounted investments: | | | |

Share of other comprehensive loss of equity-accounted investments, net of tax | | (15 | ) | (8 | ) |

Reclassification to net income of realized other comprehensive income for equity-accounted investments | | — |

| (15 | ) |

| |

|

|

|

|

Equity-accounted investments | | (15 | ) | (23 | ) |

| | | |

Items that may subsequently be reclassified to net income | | 400 |

| (143 | ) |

| | | |

Other comprehensive income (loss) for the year | | 355 |

| (217 | ) |

| | | |

Comprehensive income for the year | | 2,066 |

| 618 |

|

The accompanying notes are an integral part of the consolidated financial statements.

|

| | |

Rogers Communications Inc. | 5 | 2017 Annual Financial Statements |

Consolidated Statements of Financial Position

(In millions of Canadian dollars)

|

| | | | | | |

As at December 31 | Note |

| 2017 |

| 2016 |

|

| | | |

Assets | | | |

Current assets: | | | |

Accounts receivable | 14 |

| 2,041 |

| 1,949 |

|

Inventories | 15 |

| 313 |

| 315 |

|

Other current assets | | 197 |

| 215 |

|

Current portion of derivative instruments | 16 |

| 421 |

| 91 |

|

Total current assets | | 2,972 |

| 2,570 |

|

| | | |

Property, plant and equipment | 7 |

| 11,143 |

| 10,749 |

|

Intangible assets | 8 |

| 7,244 |

| 7,130 |

|

Investments | 17 |

| 2,561 |

| 2,174 |

|

Derivative instruments | 16 |

| 953 |

| 1,708 |

|

Other long-term assets | | 82 |

| 98 |

|

Deferred tax assets | 12 |

| 3 |

| 8 |

|

Goodwill | 8 |

| 3,905 |

| 3,905 |

|

| | | |

Total assets | | 28,863 |

| 28,342 |

|

| | | |

Liabilities and shareholders’ equity | |

|

|

Current liabilities: | | | |

Bank advances | | 6 |

| 71 |

|

Short-term borrowings | 18 |

| 1,585 |

| 800 |

|

Accounts payable and accrued liabilities | | 2,931 |

| 2,783 |

|

Income tax payable | | 62 |

| 186 |

|

Current portion of provisions | 19 |

| 4 |

| 134 |

|

Unearned revenue | | 346 |

| 367 |

|

Current portion of long-term debt | 20 |

| 1,756 |

| 750 |

|

Current portion of derivative instruments | 16 |

| 133 |

| 22 |

|

Total current liabilities | | 6,823 |

| 5,113 |

|

| | | |

Provisions | 19 |

| 35 |

| 33 |

|

Long-term debt | 20 |

| 12,692 |

| 15,330 |

|

Derivative instruments | 16 |

| 147 |

| 118 |

|

Other long-term liabilities | 21 |

| 613 |

| 562 |

|

Deferred tax liabilities | 12 |

| 2,206 |

| 1,917 |

|

Total liabilities | | 22,516 |

| 23,073 |

|

| | | |

Shareholders’ equity | 23 |

| 6,347 |

| 5,269 |

|

| | | |

Total liabilities and shareholders’ equity | | 28,863 |

| 28,342 |

|

| | | |

Guarantees | 26 |

| | |

Commitments and contingent liabilities | 27 |

| | |

Subsequent events | 20, 23 |

| | |

The accompanying notes are an integral part of the consolidated financial statements.

On behalf of the Board of Directors:

|

| | | |

"Edward S. Rogers" | | "John H. Clappison" | |

Edward S. Rogers Director | | John H. Clappison, FCPA, FCA Director | |

|

| | |

Rogers Communications Inc. | 6 | 2017 Annual Financial Statements |

Consolidated Statements of Changes in Shareholders' Equity

(In millions of Canadian dollars, except number of shares)

|

| | | | | | | | | | | | | | | | | | |

| Class A Voting Shares | Class B Non-Voting Shares | | | | | |

Year ended December 31, 2017 | Amount |

| Number of shares (000s) |

| Amount |

| Number of shares (000s) |

| Retained earnings |

| Available- for-sale financial assets reserve |

| Hedging reserve |

| Equity investment hedging reserve |

| Total shareholders’ equity |

|

Balances, January 1, 2017 | 72 |

| 112,412 |

| 405 |

| 402,396 |

| 4,247 |

| 642 |

| (107 | ) | 10 |

| 5,269 |

|

Net income for the year | — |

| — |

| — |

| — |

| 1,711 |

| — |

| — |

| — |

| 1,711 |

|

| | | | | | | | | |

Other comprehensive income (loss): | | | | | | | | | |

Defined benefit pension plans, net of tax | — |

| — |

| — |

| — |

| (45 | ) | — |

| — |

| — |

| (45 | ) |

Available-for-sale investments, net of tax | — |

| — |

| — |

| — |

| — |

| 371 |

| — |

| — |

| 371 |

|

Derivative instruments accounted for as hedges, net of tax | — |

| — |

| — |

| — |

| — |

| — |

| 44 |

| — |

| 44 |

|

Share of equity-accounted investments, net of tax | — |

| — |

| — |

| — |

| — |

| — |

| — |

| (15 | ) | (15 | ) |

Total other comprehensive income (loss) | — |

| — |

| — |

| — |

| (45 | ) | 371 |

| 44 |

| (15 | ) | 355 |

|

Comprehensive income (loss) for the year | — |

| — |

| — |

| — |

| 1,666 |

| 371 |

| 44 |

| (15 | ) | 2,066 |

|

| | | | | | | | | |

Transactions with shareholders recorded directly in equity: | | | | | | | | | |

Dividends declared | — |

| — |

| — |

| — |

| (988 | ) | — |

| — |

| — |

| (988 | ) |

Shares issued on exercise of stock options | — |

| — |

| — |

| 2 |

| — |

| — |

| — |

| — |

| — |

|

Share class exchange | — |

| (5 | ) | — |

| 5 |

| — |

| — |

| — |

| — |

| — |

|

Total transactions with shareholders | — |

| (5 | ) | — |

| 7 |

| (988 | ) | — |

| — |

| — |

| (988 | ) |

| | | | | | | | | |

Balances, December 31, 2017 | 72 |

| 112,407 |

| 405 |

| 402,403 |

| 4,925 |

| 1,013 |

| (63 | ) | (5 | ) | 6,347 |

|

|

| | | | | | | | | | | | | | | | | | |

| Class A Voting Shares | Class B Non-Voting Shares | | | | | |

Year ended December 31, 2016 | Amount |

| Number of shares (000s) |

| Amount |

| Number of shares (000s) |

| Retained earnings |

| Available- for-sale financial assets reserve |

| Hedging reserve |

| Equity investment hedging reserve |

| Total shareholders’ equity |

|

Balances, January 1, 2016 | 72 |

| 112,439 |

| 402 |

| 402,308 |

| 4,474 |

| 598 |

| 57 |

| 33 |

| 5,636 |

|

Net income for the year | — |

| — |

| — |

| — |

| 835 |

| — |

| — |

| — |

| 835 |

|

| | | | | | | | | |

Other comprehensive income (loss): | | | | | | | | | |

Defined benefit pension plans, net of tax | — |

| — |

| — |

| — |

| (74 | ) | — |

| — |

| — |

| (74 | ) |

Available-for-sale investments, net of tax | — |

| — |

| — |

| — |

| — |

| 44 |

| — |

| — |

| 44 |

|

Derivative instruments accounted for as hedges, net of tax | — |

| — |

| — |

| — |

| — |

| — |

| (164 | ) | — |

| (164 | ) |

Share of equity-accounted investments, net of tax | — |

| — |

| — |

| — |

| — |

| — |

| — |

| (23 | ) | (23 | ) |

Total other comprehensive income (loss)

| — |

| — |

| — |

| — |

| (74 | ) | 44 |

| (164 | ) | (23 | ) | (217 | ) |

Comprehensive income (loss) for the year | — |

| — |

| — |

| — |

| 761 |

| 44 |

| (164 | ) | (23 | ) | 618 |

|

| | | | | | | | | |

Transactions with shareholders recorded directly in equity: | | | | | | | | | |

Dividends declared | — |

| — |

| — |

| — |

| (988 | ) | — |

| — |

| — |

| (988 | ) |

Shares issued on exercise of stock options

| — |

| — |

| 3 |

| 61 |

| — |

| — |

| — |

| — |

| 3 |

|

Share class exchange | — |

| (27 | ) | — |

| 27 |

| — |

| — |

| — |

| — |

| — |

|

Total transactions with shareholders | — |

| (27 | ) | 3 |

| 88 |

| (988 | ) | — |

| — |

| — |

| (985 | ) |

| | | | | | | | | |

Balances, December 31, 2016 | 72 |

| 112,412 |

| 405 |

| 402,396 |

| 4,247 |

| 642 |

| (107 | ) | 10 |

| 5,269 |

|

The accompanying notes are an integral part of the consolidated financial statements.

|

| | |

Rogers Communications Inc. | 7 | 2017 Annual Financial Statements |

Consolidated Statements of Cash Flows

(In millions of Canadian dollars)

|

| | | | | | |

Years ended December 31 | Note |

| 2017 |

| 2016 |

|

Operating activities: | | | |

Net income for the year | | 1,711 |

| 835 |

|

Adjustments to reconcile net income to cash provided by operating activities: | | | |

Depreciation and amortization | 7, 8 |

| 2,142 |

| 2,276 |

|

Program rights amortization | 8 |

| 64 |

| 71 |

|

Finance costs | 10 |

| 746 |

| 761 |

|

Income tax expense | 12 |

| 635 |

| 324 |

|

Stock-based compensation | 24 |

| 61 |

| 61 |

|

Post-employment benefits contributions, net of expense | 22 |

| 4 |

| (3 | ) |

Net loss on divestitures pertaining to investments | | — |

| 11 |

|

(Recovery) loss on wind-down of shomi | 11 |

| (20 | ) | 140 |

|

Gain on disposition of property, plant and equipment | 7 |

| (49 | ) | — |

|

Impairment of assets and related onerous contract charges | 7 |

| — |

| 484 |

|

Other | |

| 8 |

| 34 |

|

Cash provided by operating activities before changes in non-cash working capital items, income taxes paid, and interest paid | | 5,302 |

| 4,994 |

|

Change in non-cash operating working capital items | 28 |

| (154 | ) | 14 |

|

Cash provided by operating activities before income taxes paid and interest paid | | 5,148 |

| 5,008 |

|

Income taxes paid | | (475 | ) | (295 | ) |

Interest paid | |

| (735 | ) | (756 | ) |

| | | |

Cash provided by operating activities | |

| 3,938 |

| 3,957 |

|

| | | |

Investing activities: | | | |

Capital expenditures | 7, 28 |

| (2,436 | ) | (2,352 | ) |

Additions to program rights | 8 |

| (59 | ) | (46 | ) |

Changes in non-cash working capital related to capital expenditures and intangible assets | | 109 |

| (103 | ) |

Acquisitions and other strategic transactions, net of cash acquired | 8 |

| (184 | ) | — |

|

Other | | (60 | ) | 45 |

|

| | | |

Cash used in investing activities | |

| (2,630 | ) | (2,456 | ) |

| | | |

Financing activities: | | | |

Net proceeds received on short-term borrowings | 18 |

| 858 |

| — |

|

Net repayment of long-term debt | 20 |

| (1,034 | ) | (538 | ) |

Net payments on settlement of debt derivatives and forward contracts | 16 |

| (79 | ) | (45 | ) |

Transaction costs incurred | | — |

| (17 | ) |

Dividends paid | 23 |

| (988 | ) | (988 | ) |

Other | | — |

| 5 |

|

| | | |

Cash used in financing activities | |

| (1,243 | ) | (1,583 | ) |

| | | |

Change in cash and cash equivalents | | 65 |

| (82 | ) |

(Bank advances) cash and cash equivalents, beginning of year | |

| (71 | ) | 11 |

|

| | | |

Bank advances, end of year | |

| (6 | ) | (71 | ) |

Cash and cash equivalents are defined as cash and short-term deposits that have an original maturity of less than 90 days, less bank advances.

The accompanying notes are an integral part of the consolidated financial statements.

|

| | |

Rogers Communications Inc. | 8 | 2017 Annual Financial Statements |

Notes to Consolidated Financial Statements

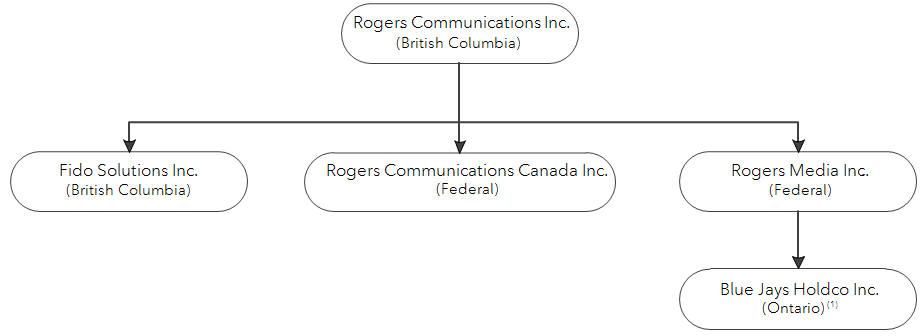

We, us, our, Rogers, Rogers Communications, and the Company refer to Rogers Communications Inc. and its subsidiaries. RCI refers to the legal entity Rogers Communications Inc., not including its subsidiaries. RCI also holds interests in various investments and ventures.

|

| | | | | | |

Page | | Note | | Page | | Note |

| Note 1 | Nature of the Business | | | Note 16 | Financial Risk Management and Financial Instruments |

| Note 2 | Significant Accounting Policies | | | |

| Note 3 | Capital Risk Management | | | Note 17 | Investments |

| Note 4 | Segmented Information | | | Note 18 | Short-Term Borrowings |

| Note 5 | Revenue | | | Note 19 | Provisions |

| Note 6 | Operating Costs | | | Note 20 | Long-Term Debt |

| Note 7 | Property, Plant and Equipment | | | Note 21 | Other Long-Term Liabilities |

| Note 8 | Intangible Assets and Goodwill | | | Note 22 | Post-Employment Benefits |

| Note 9 | Restructuring, Acquisition and Other | | | Note 23 | Shareholders' Equity |

| Note 10 | Finance Costs | | | Note 24 | Stock-Based Compensation |

| Note 11 | Other (Income) Expense | | | Note 25 | Related Party Transactions |

| Note 12 | Income Taxes | | | Note 26 | Guarantees |

| Note 13 | Earnings Per Share | | | Note 27 | Commitments and Contingent Liabilities |

| Note 14 | Accounts Receivable | | | Note 28 | Supplemental Cash Flow Information |

| Note 15 | Inventories | | | | |

|

| | |

Rogers Communications Inc. | 9 | 2017 Annual Financial Statements |

NOTE 1: NATURE OF THE BUSINESS

Rogers Communications Inc. is a diversified Canadian communications and media company. Substantially all of our operations and sales are in Canada. RCI is incorporated in Canada and its registered office is located at 333 Bloor Street East, Toronto, Ontario, M4W 1G9. RCI's shares are publicly traded on the Toronto Stock Exchange (TSX: RCI.A and RCI.B) and on the New York Stock Exchange (NYSE: RCI).

We report our results of operations in four reportable segments. Each segment and the nature of its business is as follows:

|

| |

Segment | Principal activities |

Wireless | Wireless telecommunications operations for Canadian consumers and businesses. |

Cable | Cable telecommunications operations, including Internet, television, and telephony (phone) services for Canadian consumers and businesses. |

Business Solutions | Network connectivity through our fibre network and data centre assets to support a range of voice, data, networking, hosting, and cloud-based services for the enterprise, public sector, and carrier wholesale markets. |

Media | A diversified portfolio of media properties, including sports media and entertainment, television and radio broadcasting, specialty channels, multi-platform shopping, digital media, and publishing.

|

During the year ended December 31, 2017, Wireless, Cable, and Business Solutions were operated by our wholly-owned subsidiary, Rogers Communications Canada Inc. (RCCI), and certain other wholly-owned subsidiaries. Media was operated by our wholly-owned subsidiary, Rogers Media Inc., and its subsidiaries.

See note 4 for more information about our reportable operating segments.

STATEMENT OF COMPLIANCE

We prepared our consolidated financial statements in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB). The Board of Directors (the Board) authorized these consolidated financial statements for issue on March 8, 2018.

NOTE 2: SIGNIFICANT ACCOUNTING POLICIES

All amounts are in Canadian dollars unless otherwise noted. Our functional currency is the Canadian dollar. We prepare the consolidated financial statements on a historical cost basis, except for:

| |

• | certain financial instruments as disclosed in note 16, which are measured at fair value; |

| |

• | the net deferred pension liability, which is measured as described in note 22; and |

| |

• | liabilities for stock-based compensation, which are measured at fair value as disclosed in note 24. |

| |

(b) | BASIS OF CONSOLIDATION |

Subsidiaries are entities we control. We include the financial statements of our subsidiaries in our consolidated financial statements from the date we gain control of them until our control ceases. We eliminate all intercompany transactions and balances between our subsidiaries on consolidation.

| |

(c) | FOREIGN CURRENCY TRANSLATION |

We translate amounts denominated in foreign currencies into Canadian dollars as follows:

| |

• | monetary assets and monetary liabilities - at the exchange rate in effect as at the date of the Consolidated Statements of Financial Position; |

| |

• | non-monetary assets, non-monetary liabilities, and related depreciation and amortization expenses - at the historical exchange rates; and |

| |

• | revenue and expenses other than depreciation and amortization - at the average rate for the month in which the transaction was recognized. |

We account for business combinations using the acquisition method of accounting. Only acquisitions that result in our gaining control over the acquired businesses are accounted for as business combinations. We possess control over an entity when we conclude we are exposed to variable returns from our involvement with the acquired entity and we have the ability to affect those returns through our power over the acquired entity.

|

| | |

Rogers Communications Inc. | 10 | 2017 Annual Financial Statements |

We calculate the fair value of the consideration paid as the sum of the fair value at the date of acquisition of the assets we transferred and the equity interests we issued, less the liabilities we assumed to acquire the subsidiary.

We measure goodwill as the fair value of the consideration transferred less the net recognized amount of the identifiable assets acquired and liabilities assumed, which are generally measured at fair value as of the acquisition date. When the excess is negative, a gain on acquisition is recognized immediately in net income.

We expense the transaction costs associated with acquisitions as we incur them.

| |

(e) | NEW ACCOUNTING PRONOUNCEMENTS ADOPTED IN 2017 |

We adopted the following IFRS amendments prospectively beginning on January 1, 2017.

| |

• | Amendments to IAS 7, Statement of Cash Flows, requiring entities to provide additional disclosures that enable financial statement users to evaluate cash flow and non-cash changes in liabilities arising from financing activities. |

| |

• | Amendments to IAS 12, Income Taxes, clarifying the requirements for deferred tax assets for unrealized losses on debt instruments. |

| |

• | Amendments to IFRS 12, Disclosure of Interests in Other Entities, clarifying the required disclosures regarding an entity's interest in subsidiaries, joint arrangements, and associates that are held for sale, held for distribution, or classified as discontinued operations. |

The adoption of these amendments did not have a material effect on our consolidated financial statements.

| |

(f) | ADDITIONAL SIGNIFICANT ACCOUNTING POLICIES, ESTIMATES, AND JUDGMENTS |

When preparing our consolidated financial statements, management makes judgments, estimates, and assumptions that affect how accounting policies are applied and the amounts we report as assets, liabilities, revenue, and expenses. Our significant accounting policies, estimates, and judgments are identified in this note. Furthermore, the following information is disclosed throughout the notes as identified in the table below:

| |

• | information about assumptions and estimation uncertainties that have a significant risk of resulting in a material adjustment to the amounts recognized in the consolidated financial statements; |

| |

• | information about judgments made in applying accounting policies that have the most significant effect on the amounts recognized in the consolidated financial statements; and |

| |

• | information on our significant accounting policies. |

|

| | | | | |

Note | Topic | Page | Accounting Policy | Use of Estimates | Use of Judgments |

4 | Reportable Segments | | X | | X |

5 | Revenue Recognition | | X | | |

7 | Property, Plant and Equipment | | X | X | X |

8 | Intangible Assets and Goodwill | | X | X | X |

12 | Income Taxes | | X | | X |

13 | Earnings Per Share | | X | | |

14 | Accounts Receivable | | X | | |

15 | Inventories | | X | | |

16 | Financial Instruments | | X | X | X |

17 | Investments | | X | | |

19 | Provisions | | X | X | X |

22 | Post-Employment Benefits | | X | X | |

24 | Stock-Based Compensation | | X | X | |

27 | Commitments and Contingent Liabilities | | X | | X |

|

| | |

Rogers Communications Inc. | 11 | 2017 Annual Financial Statements |

| |

(g) | RECENT ACCOUNTING PRONOUNCEMENTS NOT YET ADOPTED |

The IASB has issued the following new standards that will become effective in a future year and will have an impact on our consolidated financial statements in future periods.

IFRS 15, REVENUE FROM CONTRACTS WITH CUSTOMERS (IFRS 15)

Effective January 1, 2018, we will adopt IFRS 15. Our first quarter 2018 interim financial statements will be our first financial statements issued in accordance with IFRS 15. IFRS 15 supersedes current accounting standards for revenue, including IAS 18, Revenue and IFRIC 13, Customer Loyalty Programmes.

IFRS 15 introduces a single model for recognizing revenue from contracts with customers. This standard applies to all contracts with customers, with only some exceptions, including certain contracts accounted for under other IFRSs. The standard requires revenue to be recognized in a manner that depicts the transfer of promised goods or services to a customer and at an amount that reflects the consideration expected to be received in exchange for transferring those goods or services. This is achieved by applying the following five steps:

1. identify the contract with a customer;

2. identify the performance obligations in the contract;

3. determine the transaction price;

4. allocate the transaction price to the performance obligations in the contract; and

5. recognize revenue when (or as) the entity satisfies a performance obligation.

IFRS 15 also provides guidance relating to the treatment of contract acquisition and contract fulfillment costs.

The application of this new standard will have significant impacts on our reported Wireless results, specifically with regards to the timing of recognition and classification of revenue, and the treatment of costs incurred in acquiring customer contracts. The timing of recognition and classification of revenue is affected because, at contract inception, IFRS 15 requires the estimation of total consideration over the contract term and the allocation of that consideration to all performance obligations in the contract based on their relative stand-alone selling prices. This will most significantly affect our Wireless arrangements that bundle equipment and service together into monthly service fees, which will result in an increase to equipment revenue recognized at contract inception and a decrease to service revenue recognized over the course of the contracts. We do not expect the application of IFRS 15 to affect our cash flows from operations or the methods and underlying economics through which we transact with our customers.

The treatment of costs incurred in acquiring customer contracts is affected as IFRS 15 requires certain contract acquisition costs (such as sales commissions) to be recognized as an asset and amortized into operating expenses over time. Currently, such costs are expensed as incurred.

In addition, new assets and liabilities will be recognized on our Consolidated Statements of Financial Position. Specifically, a contract asset and contract liability will be recognized to account for any timing differences between the revenue recognized and the amounts billed to the customer.

Significant judgment is needed to define the enforceable rights and obligations of a contract and to determine when the customer obtains control of the distinct good or service.

We plan to retrospectively apply IFRS 15 to all contracts that are not complete on the date of initial application. We have made a policy choice to restate each prior period presented and will recognize the cumulative effect of initially applying IFRS 15 as an adjustment to the opening balance of equity as at January 1, 2017, subject to certain practical expedients we adopted.

We have implemented a new revenue recognition system to enable us to comply with the requirements of IFRS 15, including appropriately allocating revenue between different performance obligations within individual contracts for certain revenue streams. We have had detailed data validation processes in place throughout the transition work period to implement IFRS 15.

We have a team dedicated to ensuring our compliance with IFRS 15. This team was responsible for determining system requirements, ensuring our data collection was appropriate, and communicating the upcoming changes with various stakeholders. In addition, this team assisted in the development of new internal controls that will help ensure our new revenue recognition system operates as intended and the related results are complete and accurate.

|

| | |

Rogers Communications Inc. | 12 | 2017 Annual Financial Statements |

EFFECT OF TRANSITION TO IFRS 15

Consolidated Statements of Income

Below is the estimated effect of transition to IFRS 15 on our Consolidated Statements of Income for the year ended December 31, 2017, all of which pertain to our Wireless segment. Only metrics that are impacted by the IFRS 15 conversion are presented.

|

| | | | | | | |

| | Year ended December 31, 2017 | |

(In billions of dollars) | Note 2(g) | As reported |

| Estimated effect of transition |

| Subsequent to transition 1 |

|

| | | | |

Revenue | i | 14.1 |

| 0.2 |

| 14.3 |

|

| | | | |

Operating expenses: | | | | |

Operating costs | ii, iii | 8.8 |

| *** |

| 8.8 |

|

Other non-operating costs | | 3.0 |

| — |

| 3.0 |

|

| | | | |

Income before income tax expense | | 2.3 |

| 0.2 |

| 2.5 |

|

Income tax expense | | 0.6 |

| *** |

| 0.6 |

|

| | | | |

Net income for the year | | 1.7 |

| 0.2 |

| 1.9 |

|

*** Amounts less than $0.1 billion; these amounts have been excluded from subtotals.

| |

1 | As a result of IFRS 15 being adopted effective January 1, 2018, we will retrospectively amend our 2017 results in our fiscal 2018 financial filings. |

Consolidated Statements of Financial Position

Below is the estimated effect of transition to IFRS 15 on our Consolidated Statements of Financial Position as at January 1, 2017 and as at December 31, 2017.

|

| | | | | | | | | | | | | | |

| | As at January 1, 2017 | | | As at December 31, 2017 | |

(in billions of dollars) | Note 2(g) | As reported |

| Estimated effect of transition |

| Subsequent to transition 1 |

| | As reported |

| Estimated effect of transition |

| Subsequent to transition 1 |

|

| | | | | | | | |

Assets | | | | | | | | |

Current assets: | | | | | | | | |

Accounts receivable | | 1.9 |

| *** |

| 1.9 |

| | 2.0 |

| *** |

| 2.0 |

|

Inventories | iii | 0.3 |

| 0.1 |

| 0.4 |

| | 0.3 |

| 0.1 |

| 0.4 |

|

Current portion of contract assets | i | — |

| 0.7 |

| 0.7 |

| | — |

| 0.8 |

| 0.8 |

|

Other current assets | ii | 0.2 |

| 0.2 |

| 0.4 |

| | 0.2 |

| 0.2 |

| 0.4 |

|

Remainder of current assets | | 0.2 |

| — |

| 0.2 |

| | 0.5 |

| — |

| 0.5 |

|

Total current assets | | 2.6 |

| 1.0 |

| 3.6 |

| | 3.0 |

| 1.1 |

| 4.1 |

|

| | | | | | | | |

Contract assets | i | — |

| 0.4 |

| 0.4 |

| | — |

| 0.4 |

| 0.4 |

|

Other long-term assets | ii | 0.1 |

| *** |

| 0.1 |

| | 0.1 |

| *** |

| 0.1 |

|

Remainder of long-term assets | | 25.6 |

| — |

| 25.6 |

| | 25.8 |

| — |

| 25.8 |

|

Total assets | | 28.3 |

| 1.4 |

| 29.7 |

| | 28.9 |

| 1.5 |

| 30.4 |

|

| | | | | | | | |

Liabilities and shareholders’ equity | | | | | | | | |

Current liabilities: | | | | | | | | |

Other current liabilities 2 | iii | 0.1 |

| 0.1 |

| 0.2 |

| | — |

| 0.1 |

| 0.1 |

|

Current portion of contract liabilities 3 | i | 0.4 |

| *** |

| 0.4 |

| | 0.3 |

| *** |

| 0.3 |

|

Remainder of current liabilities | | 4.6 |

| — |

| 4.6 |

| | 6.5 |

| — |

| 6.5 |

|

Total current liabilities | | 5.1 |

| 0.1 |

| 5.2 |

| | 6.8 |

| 0.1 |

| 6.9 |

|

| | | | | | | | |

Deferred tax liabilities | | 1.9 |

| 0.4 |

| 2.3 |

| | 2.2 |

| 0.4 |

| 2.6 |

|

Remainder of long-term liabilities | | 16.0 |

| — |

| 16.0 |

| | 13.5 |

| — |

| 13.5 |

|

Total liabilities | | 23.0 |

| 0.5 |

| 23.5 |

| | 22.5 |

| 0.5 |

| 23.0 |

|

Shareholders’ equity | | 5.3 |

| 0.9 |

| 6.2 |

| | 6.4 |

| 1.0 |

| 7.4 |

|

Total liabilities and shareholders’ equity | | 28.3 |

| 1.4 |

| 29.7 |

| | 28.9 |

| 1.5 |

| 30.4 |

|

*** Amounts less than $0.1 billion; these amounts have been excluded from subtotals.

1 As a result of IFRS 15 being adopted effective January 1, 2018, we will retrospectively amend our 2017 results in our fiscal 2018 financial filings.

| |

2 | Previously reported as "current portion of provisions". |

| |

3 | Previously reported as "unearned revenue". |

The application of IFRS 15 will not affect our cash flows from operating, investing, or financing activities.

|

| | |

Rogers Communications Inc. | 13 | 2017 Annual Financial Statements |

i) Contract assets and liabilities

Contract assets arise primarily as a result of the difference between revenue recognized on the sale of a wireless device at the onset of a term contract and the cash collected at the point of sale. Revenue recognized at point of sale requires the estimation of total consideration over the contract term and the allocation of that consideration to all performance obligations in the contract based on their relative stand-alone selling prices. For Wireless term contracts, revenue will be recognized earlier than previously reported, with a larger allocation to equipment revenue. Prior to the adoption of IFRS 15, the amount allocated to equipment revenue was limited to the non-contingent consideration received at the point of sale when recovery of the remaining consideration in the contract was contingent upon the delivery of future services.

We will record a contract liability when we receive payment from a customer in advance of providing goods and services. We will account for contract assets and liabilities on a contract-by-contract basis, with each contract being presented as a single net contract asset or net contract liability accordingly.

All contract assets will be recorded net of an allowance for expected credit losses, measured in accordance with IFRS 9.

ii) Deferred commission cost asset

Under IFRS 15, we will defer commission costs paid to internal and external representatives as a result of obtaining contracts with customers as deferred commission cost assets and amortize them over the pattern of the transfer of goods and services to the customer, which is typically evenly over either 12 or 24 consecutive months.

iii) Inventories and other current liabilities

Under IFRS 15, significant judgment is required to determine when the customer obtains control of the distinct good or service. For affected transactions, we have defined our customer as the end subscriber and determined that they obtain control when they receive possession of a wireless device, which typically occurs upon activation. For certain transactions through third-party franchise operators and other retailers, the timing of when the customer obtains control of a wireless device will be deferred in comparison to our current policy where revenue is recognized when the wireless device is delivered and accepted by the independent dealer. This will result in a greater inventory balance and a corresponding increase in other current liabilities.

IFRS 9, FINANCIAL INSTRUMENTS (IFRS 9)

Effective January 1, 2018, we will adopt IFRS 9. Our first quarter 2018 interim financial statements will be our first financial statements issued in accordance with IFRS 9. In July 2014, the IASB issued the final publication of the IFRS 9 standard, which supersedes IAS 39, Financial Instruments: recognition and measurement (IAS 39). IFRS 9 includes revised guidance on the classification and measurement of financial instruments, new guidance for measuring impairment on financial assets, and new hedge accounting guidance. We have made a policy choice to adopt IFRS 9 on a retrospective basis; however, our 2017 comparatives will not be restated because it is not possible to do so without the use of hindsight.

Under IFRS 9, financial assets are classified and measured based on the business model in which they are held and the characteristics of their contractual cash flows. IFRS 9 contains three primary measurement categories for financial assets: measured at amortized cost, fair value through other comprehensive income (FVTOCI), and fair value through profit and loss (FVTPL). Under IFRS 9, we will irrevocably elect to present subsequent changes in the fair value of our equity investments that are neither held-for-trading nor contingent consideration arising from a business combination in other comprehensive income (FVTOCI with no reclassification to net income). For these equity investments, any impairment on the instrument will be recorded in other comprehensive income, and cumulative gains or losses in other comprehensive income will not be reclassified into net income on disposal.

Under IFRS 9, the loss allowance for trade receivables must be calculated using the expected lifetime credit loss and recorded at the time of initial recognition. A portion of our trade receivables require an incremental loss allowance in order to comply with the requirements of IFRS 9; as a result, we will recognize a $4 million decrease to accounts receivable and a corresponding decrease to retained earnings within shareholders’ equity, effective January 1, 2018. In addition, the expected loss allowance using the lifetime credit loss approach will be applied to contract assets under IFRS 15. There is no significant effect on the carrying value of our other financial instruments under IFRS 9 related to this new requirement.

The new hedge accounting guidance aligns hedge accounting more closely with an entity’s risk management strategies. IFRS 9 does not fundamentally change the types of hedging relationships or the requirement to measure and recognize ineffectiveness; however, it allows more hedging strategies used for risk management to qualify for hedge accounting and introduces more judgment to assess the effectiveness of a hedging relationship, primarily from a qualitative standpoint. This is not expected to have an effect on our reported results and will simplify our application of effectiveness tests going forward.

|

| | |

Rogers Communications Inc. | 14 | 2017 Annual Financial Statements |

Below is a summary showing the classification and measurement bases of our financial instruments as at January 1, 2018 as a result of adopting IFRS 9 (along with a comparison to IAS 39).

|

| | |

Financial instrument | IAS 39 | IFRS 9 |

| | |

Financial assets | | |

Cash and cash equivalents | Loans and receivables | Amortized cost |

Accounts receivable | Loans and receivables | Amortized cost |

Investments | Available-for-sale 1 | FVTOCI with no reclassification to net income |

| | |

Financial liabilities | | |

Bank advances | Other financial liabilities | Amortized cost |

Short-term borrowings | Other financial liabilities 2 | Amortized cost |

Accounts payable | Other financial liabilities | Amortized cost |

Accrued liabilities | Other financial liabilities | Amortized cost |

Long-term debt | Other financial liabilities 2 | Amortized cost |

| | |

Derivatives 3 | | |

Debt derivatives 4 | Held-for-trading | FVTOCI and FVTPL |

Bond forwards | Held-for-trading | FVTOCI |

Expenditure derivatives | Held-for-trading | FVTOCI |

Equity derivatives | Held-for-trading 5 | FVTPL |

| |

1 | Subsequently measured at fair value with changes recognized in other comprehensive income. The net change subsequent to initial recognition, in the case of investments, is reclassified into net income upon disposal of the investment or when the investment becomes impaired. |

| |

2 | Subsequently measured at amortized cost using the effective interest method. |

| |

3 | The derivatives can be in an asset or liability position at a point in time historically or in the future. For derivatives designated as cash flow hedges for accounting purposes, the effective portion of the hedge is recognized in accumulated other comprehensive income and the ineffective portion of the hedge is recognized immediately into net income. |

| |

4 | Debt derivatives related to our senior notes and debentures have been designated as hedges for accounting purposes and will be classified as fair value through other comprehensive income (FVTOCI). Debt derivatives related to our credit facility and commercial paper borrowings have not been designated as hedges for accounting purposes and will be classified as fair value through profit and loss (FVTPL). |

| |

5 | Subsequent changes are offset against stock-based compensation expense or recovery in operating costs. |

IFRS 16, LEASES (IFRS 16)

In January 2016, the IASB issued the final publication of the IFRS 16 standard, which will supersede the current IAS 17, Leases (IAS 17) standard. IFRS 16 introduces a single accounting model for lessees and for all leases with a term of more than 12 months, unless the underlying asset is of low value. A lessee will be required to recognize a right-of-use asset, representing its right to use the underlying asset, and a lease liability, representing its obligation to make lease payments. The accounting treatment for lessors will remain largely the same as under IAS 17.

The standard is effective for annual periods beginning on or after January 1, 2019. We have the option to either:

| |

• | apply IFRS 16 with full retrospective effect; or |

| |

• | recognize the cumulative effect of initially applying IFRS 16 as an adjustment to opening equity at the date of initial application. |

We believe that, as a result of adopting IFRS 16, we will recognize a significant increase to both assets and liabilities, as we will be required to record a right-of-use asset and a corresponding lease liability on our Consolidated Statements of Financial Position, as well as a decrease to operating costs, an increase to finance costs (due to accretion of the lease liability), and an increase to depreciation and amortization (due to depreciation of the right-of-use asset).

We have a team engaged to ensuring our compliance with IFRS 16. This team has been responsible for determining process requirements, ensuring our data collection is appropriate, and communicating the upcoming changes with various stakeholders. In addition, this team is assisting in the development of new internal controls that will help ensure the system runs as intended and the related results are accurate.

We are implementing a process that will enable us to comply with the requirements of IFRS 16 on a lease-by-lease basis. We expect to begin a parallel run under both IAS 17 and IFRS 16 using this system in 2018. We will have detailed data validation processes that will continue throughout the course of 2018. As a result, we are continuing to assess the effect of this standard on our consolidated financial statements and it is not yet possible to make a reliable estimate of its effect. We expect to disclose the estimated financial effects of the adoption of IFRS 16 in our 2018 consolidated financial statements.

|

| | |

Rogers Communications Inc. | 15 | 2017 Annual Financial Statements |

NOTE 3: CAPITAL RISK MANAGEMENT

Our objectives in managing capital are to ensure we have sufficient liquidity to meet all of our commitments and to execute our business plan. We define capital that we manage as shareholders' equity and indebtedness (including current portion of our long-term debt, long-term debt, and short-term borrowings).

We manage our capital structure, commitments, and maturities and make adjustments based on general economic conditions, financial markets, operating risks, our investment priorities, and working capital requirements. To maintain or adjust our capital structure, we may, with approval from the Board, issue or repay debt and/or short-term borrowings, issue or repurchase shares, pay dividends, or undertake other activities as deemed appropriate under the circumstances. The Board reviews and approves the annual capital and operating budgets, as well as any material transactions that are not part of the ordinary course of business, including proposals for acquisitions or other major financing transactions, investments, or divestitures.

We monitor debt leverage ratios as part of the management of liquidity and shareholders' return to sustain future development of the business, conduct valuation-related analyses, and make decisions about capital.

The wholly-owned subsidiary through which our Rogers Platinum MasterCard and Fido MasterCard programs are operated is regulated by the Office of the Superintendent of Financial Institutions, which requires that a minimum level of regulatory capital be maintained. Rogers' subsidiary was in compliance with that requirement as at December 31, 2017 and 2016. The capital requirements are not material to the Company as at December 31, 2017 or December 31, 2016.

With the exception of the Rogers Platinum MasterCard and the Fido MasterCard programs and the subsidiary through which they are operated, we are not subject to externally-imposed capital requirements. Our overall strategy for capital risk management has not changed since December 31, 2016.

NOTE 4: SEGMENTED INFORMATION

ACCOUNTING POLICY

Reportable segments

We determine our reportable segments based on, among other things, how our chief operating decision maker, the Chief Executive Officer and Chief Financial Officer of RCI, regularly review our operations and performance. They review adjusted operating profit as the key measure of profit for the purpose of assessing performance for each segment and to make decisions about the allocation of resources. Adjusted operating profit is defined as income before stock-based compensation, depreciation and amortization, restructuring, acquisition and other, finance costs, other expense (income), and income tax expense.

We will redefine our reportable segments effective January 1, 2018 as a result of technological evolution and the increased overlap between the various product offerings within our Cable and Business Solutions reportable segments, as well as how we allocate resources amongst, and the general management of, our reportable segments. Effective January 1, 2018, the results of our existing Cable segment, Business Solutions segment, and our Smart Home Monitoring products will be presented within a redefined Cable segment. Financial results related to our Smart Home Monitoring product are currently reported within Corporate items and intercompany eliminations. We will retrospectively amend our 2017 comparative segment results in 2018 to account for this redefinition.

Effective January 1, 2018, our chief operating decision maker will commence using adjusted EBITDA as the key measure of profit for the purpose of assessing performance for each segment and to make decisions about the allocation of resources. Adjusted EBITDA will be defined as income before depreciation and amortization, restructuring, acquisition and other, finance costs, other expense (income), and income tax expense.

We follow the same accounting policies for our segments as those described in the notes to our consolidated financial statements. We account for transactions between reportable segments in the same way we account for transactions with external parties, but eliminate them on consolidation.

USE OF ESTIMATES AND JUDGMENT

JUDGMENTS

We make significant judgments in determining our operating segments. These are components that engage in business activities from which they may earn revenue and incur expenses, for which operating results are regularly reviewed by our chief operating decision makers to make decisions about resources to be allocated and assess component performance, and for which discrete financial information is available.

|

| | |

Rogers Communications Inc. | 16 | 2017 Annual Financial Statements |

EXPLANATORY INFORMATION

Our reportable segments are Wireless, Cable, Business Solutions, and Media (see note 1). All four segments operate substantially in Canada. Corporate items and eliminations include our interests in businesses that are not reportable operating segments, corporate administrative functions, and eliminations of inter-segment revenue and costs. Segment results include items directly attributable to a segment as well as those that can be allocated on a reasonable basis.

INFORMATION BY SEGMENT

|

| | | | | | | | | | | | | | | |

| | Year ended December 31, 2017 | Note |

| Wireless |

| Cable |

| Business Solutions |

| Media |

| Corporate items and eliminations |

| Consolidated totals |

|

| |

| | (In millions of dollars) |

| | | | | | | | | |

| | Revenue | 5 |

| 8,343 |

| 3,466 |

| 387 |

| 2,153 |

| (206 | ) | 14,143 |

|

| | | | | | | | | |

| | Operating costs 1 | |

| 4,782 |

| 1,757 |

| 259 |

| 2,014 |

| (48 | ) | 8,764 |

|

| | | | | | | | | |

| | Adjusted operating profit | | 3,561 |

| 1,709 |

| 128 |

| 139 |

| (158 | ) | 5,379 |

|

| | | | | | | | | |

| | Stock-based compensation 1 | 24 |

| | | | | | 61 |

|

| | Depreciation and amortization | 7, 8 |

| | | | | | 2,142 |

|

| | Gain on disposition of property, plant and equipment | 7 |

| | | | | | (49 | ) |

| | Restructuring, acquisition and other | 9 |

| | | | | | 152 |

|

| | Finance costs | 10 |

| | | | | | 746 |

|

| | Other income | 11 |

| |

| |

| |

| |

| |

| (19 | ) |

| | | | | | | | | |

| | Income before income tax expense | |

| |

| |

| |

| |

| |

| 2,346 |

|

| | | | | | | | | |

| | Capital expenditures before proceeds on disposition 2 | |

| 806 |

| 1,172 |

| 131 |

| 83 |

| 318 |

| 2,510 |

|

| | Goodwill | |

| 1,160 |

| 1,379 |

| 429 |

| 937 |

| — |

| 3,905 |

|

| | Total assets | |

| 14,261 |

| 6,033 |

| 1,196 |

| 2,405 |

| 4,968 |

| 28,863 |

|

| |

1 | Included in operating costs on the Consolidated Statements of Income. |

| |

2 | Excludes proceeds on disposition of $74 million (see note 28). |

|

| | | | | | | | | | | | | | | |

| | Year ended December 31, 2016 | Note |

| Wireless |

| Cable |

| Business Solutions |

| Media |

| Corporate items and eliminations |

| Consolidated totals |

|

| |

| | (In millions of dollars) |

| | | | | | | | | |

| | Revenue | 5 |

| 7,916 |

| 3,449 |

| 384 |

| 2,146 |

| (193 | ) | 13,702 |

|

| | | | | | | | | |

| | Operating costs 1 | |

| 4,631 |

| 1,775 |

| 261 |

| 1,977 |

| (34 | ) | 8,610 |

|

| | | | | | | | | |

| | Adjusted operating profit | | 3,285 |

| 1,674 |

| 123 |

| 169 |

| (159 | ) | 5,092 |

|

| | | | | | | | | |

| | Stock-based compensation 1 | 24 |

| | | | | | 61 |

|

| | Depreciation and amortization | 7, 8 |

| | | | | | 2,276 |

|

| | Restructuring, acquisition and other | 7, 9 |

| | | | | | 644 |

|

| | Finance costs | 10 |

| | | | | | 761 |

|

| | Other expense | 11 |

| |

| |

| |

| |

| |

| 191 |

|

| | | | | | | | | |

| | Income before income tax expense | |

| |

| |

| |

| |

| |

| 1,159 |

|

| | | | | | | | | |

| | Capital expenditures before proceeds on disposition | |

| 702 |

| 1,085 |

| 146 |

| 62 |

| 357 |

| 2,352 |

|

| | Goodwill | |

| 1,160 |

| 1,379 |

| 429 |

| 937 |

| — |

| 3,905 |

|

| | Total assets | |

| 14,074 |

| 5,288 |

| 1,219 |

| 2,474 |

| 5,287 |

| 28,342 |

|

| |

1 | Included in operating costs on the Consolidated Statements of Income. |

|

| | |

Rogers Communications Inc. | 17 | 2017 Annual Financial Statements |

NOTE 5: REVENUE

ACCOUNTING POLICY

Revenue recognition

We recognize revenue when we can estimate its amount, have delivered on our obligations within the revenue-generating arrangements, and are reasonably assured that we can collect it. Revenue is recognized net of discounts.

|

| | |

Source of revenue | How we recognize revenue |

Monthly subscriber fees for: ● wireless airtime and data services; ● cable, telephony, and Internet services; ● network services; ● media subscriptions; and ● rental of equipment | ● | As the service is provided |

Revenue from roaming, long distance, pay per use, and other optional or non-subscription services and other sales of products | ● | As the service is provided or product is delivered |

Revenue from the sale of wireless and cable equipment | ● | When the equipment is delivered and accepted by the independent dealer or subscriber in a direct sales channel |

Equipment subsidies related to providing equipment to new and existing subscribers | ● | Equipment subsidies are recognized as a reduction of equipment revenue when the equipment is activated |

Activation fees charged to subscribers in Wireless | ●

| As part of service revenue upon activation

|

● | These fees do not meet the criteria as a separate unit of accounting |

Advertising revenue | ● | When the advertising airs on our radio or television stations, is featured in our publications, or displayed on our digital properties |

Monthly subscription revenue received by television stations for subscriptions from cable and satellite providers | ● | When the services are delivered to cable and satellite providers' subscribers |

Toronto Blue Jays revenue from home game admission and concessions | ● | When the related games are played during the baseball season and when goods are sold |

Toronto Blue Jays revenue from Major League Baseball, including fund redistribution and other distributions | ● | When the amount can be determined |

Revenue from Toronto Blue Jays, radio, and television broadcast agreements | ● | At the time the related games are aired |

Revenue from sublicensing of program rights | ● | Over the course of the applicable season |

Rewards granted to customers through customer loyalty programs, which are considered a separately identifiable component of the sales transactions | ●

| Estimate the portion of the original sales transaction to allocate to the reward credit based on the fair value of the reward credit that can be obtained when the credit is redeemed |

● | Defer the allocated amount as a liability until the rewards are redeemed by the customer and we provide the goods or services |

Interest income on credit card receivables | ● | As it is earned (i.e. upon the passage of time) using the effective interest method |

Multiple deliverable arrangements

We offer some products and services as part of multiple deliverable arrangements. We recognize these as follows:

| |

• | divide the products and services into separate units of accounting, as long as the delivered elements have stand-alone value to customers and we can determine the fair value of any undelivered elements objectively and reliably; then |

| |

• | measure and allocate the arrangement consideration among the accounting units based on their relative fair values and recognize revenue related to each unit when the relevant criteria are met for each unit individually; however |

| |

• | when an amount allocated to a delivered item is contingent upon the delivery of additional items or meeting specified performance conditions, the amount allocated to the delivered item is limited to the non-contingent amount, as applicable. |

Unearned revenue

We recognize payments we receive in advance of providing goods and services as unearned revenue. Advance payments include subscriber deposits, cable installation fees, ticket deposits related to Toronto Blue Jays ticket sales, and amounts subscribers pay for services and subscriptions that will be provided in future periods.

|

| | |

Rogers Communications Inc. | 18 | 2017 Annual Financial Statements |

EXPLANATORY INFORMATION

|

| | | | |

| Years ended December 31 | |

(In millions of dollars) | 2017 |

| 2016 |

|

| | |

Wireless: | | |

Service revenue | 7,775 |

| 7,258 |

|

Equipment revenue | 568 |

| 658 |

|

| | |

Total Wireless | 8,343 |

| 7,916 |

|

| | |

Cable: | | |

Internet | 1,606 |

| 1,495 |

|

Television | 1,501 |

| 1,562 |

|

Phone | 353 |

| 386 |

|

Service revenue | 3,460 |

| 3,443 |

|

Equipment revenue | 6 |

| 6 |

|

| | |

Total Cable | 3,466 |

| 3,449 |

|

| | |

Business Solutions: | | |

Next generation | 322 |

| 307 |

|

Legacy | 58 |

| 71 |

|

Service revenue | 380 |

| 378 |

|

Equipment revenue | 7 |

| 6 |

|

| | |

Total Business Solutions | 387 |

| 384 |

|

| | |

Media: | | |

Advertising | 838 |

| 870 |

|

Subscription | 511 |

| 474 |

|

Retail | 352 |

| 325 |

|

Other | 452 |

| 477 |

|

| | |

Total Media | 2,153 |

| 2,146 |

|

| | |

Corporate items and intercompany eliminations | (206 | ) | (193 | ) |

| | |

Total revenue | 14,143 |

| 13,702 |

|

NOTE 6: OPERATING COSTS

|

| | | | |

| Years ended December 31 | |

(In millions of dollars) | 2017 |

| 2016 |

|

| | |

Cost of equipment sales and direct sales channel subsidies | 2,039 |

| 1,954 |

|

Merchandise for resale | 237 |

| 209 |

|

Other external purchases | 4,429 |

| 4,435 |

|

Employee salaries and benefits and stock-based compensation | 2,120 |

| 2,073 |

|

| | |

Total operating costs | 8,825 |

| 8,671 |

|

|

| | |

Rogers Communications Inc. | 19 | 2017 Annual Financial Statements |

NOTE 7: PROPERTY, PLANT AND EQUIPMENT

ACCOUNTING POLICY

Recognition and measurement, including depreciation

We measure property, plant and equipment upon initial recognition at cost and begin recognizing depreciation when the asset is ready for its intended use. Subsequently, property, plant and equipment is carried at cost less accumulated depreciation and accumulated impairment losses.

Cost includes expenditures (capital expenditures) that are directly attributable to the acquisition of the asset. The cost of self-constructed assets includes:

| |

• | the cost of materials and direct labour; |

| |

• | costs directly associated with bringing the assets to a working condition for their intended use; |

| |

• | expected costs of decommissioning the items and restoring the sites on which they are located (see note 19); and |

| |

• | borrowing costs on qualifying assets. |

We depreciate property, plant and equipment over its estimated useful life by charging depreciation expense to net income as follows:

|

| | |

Asset | Basis | Estimated useful life |

Buildings | Diminishing balance | 5 to 40 years |

Cable and wireless network | Straight-line | 3 to 40 years |

Computer equipment and software | Straight-line | 4 to 10 years |

Customer premise equipment | Straight-line | 3 to 5 years |

Leasehold improvements | Straight-line | Over shorter of estimated useful life or lease term |

Equipment and vehicles | Diminishing balance | 3 to 20 years |

We recognize all costs related to subscriber acquisition and retention in net income as incurred, except connection and installation costs that relate to the cable network, which are capitalized and depreciated over the expected life of the Cable customer.

We calculate gains and losses on the disposal of property, plant and equipment by comparing the proceeds from the disposal with the item's carrying amount and recognize the gain or loss in net income.

We capitalize development expenditures if they meet the criteria for recognition as an asset and amortize them over their expected useful lives once the assets to which they relate are available for use. We expense research expenditures, maintenance costs, and training costs as incurred.

Impairment testing

We test non-financial assets with finite useful lives for impairment whenever an event or change in circumstances indicates that their carrying amounts may not be recoverable. The asset is impaired if the recoverable amount is less than the carrying amount. If we cannot estimate the recoverable amount of an individual asset because it does not generate independent cash inflows, we test the entire cash generating unit (CGU) for impairment.

A CGU is the smallest identifiable group of assets that generates cash inflows largely independent of the cash inflows from other assets or groups of assets.

Recognition and measurement of an impairment charge

An item of property, plant and equipment, an intangible asset, or goodwill is impaired if the recoverable amount is less than the carrying amount. The recoverable amount of a CGU or asset is the higher of its:

| |

• | fair value less costs to sell; and |

If our estimate of the asset's or CGU’s recoverable amount is less than its carrying amount, we reduce its carrying amount to the recoverable amount and recognize the loss in net income immediately.