UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ________ to________ |

Commission File Number:

(Exact name of registrant as specified in its charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the registrant’s common stock held by non-affiliates was approximately $

The number of shares of the registrant’s common stock outstanding as of February 19, 2021 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission in connection with the registrant’s 2021 Annual Meeting of Stockholders are incorporated by reference in Part III of this report to the extent described herein.

Nucor Corporation

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2020

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

PART I |

|

|

|

|

|

|

||

|

|

|

|

|

|||||

|

|

|

Item 1. |

|

|

|

1 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 1A. |

|

|

|

14 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 1B. |

|

|

|

19 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 2. |

|

|

|

20 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 3. |

|

|

|

21 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 4. |

|

|

|

21 |

|

|

|

|

|

|

||||||

|

|

|

|

|

21 |

|

|||

|

|

|

|

||||||

|

PART II |

|

|

|

|

|

|

||

|

|

|

|

|

|||||

|

|

|

Item 5. |

|

|

|

24 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 6. |

|

|

|

25 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

26 |

|

|

|

|

|

|

|||||

|

|

|

Item 7A. |

|

|

|

44 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 8. |

|

|

|

45 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

|

83 |

|

|

|

|

|

|

|||||

|

|

|

Item 9A. |

|

|

|

83 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 9B. |

|

|

|

83 |

|

|

|

|

|

|

||||||

|

PART III |

|

|

|

` |

|

|

||

|

|

|

|

|

|||||

|

|

|

Item 10. |

|

|

|

84 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 11. |

|

|

|

84 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

|

84 |

|

|

|

|

|

|

|||||

|

|

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

|

84 |

|

|

|

|

|

|

|||||

|

|

|

Item 14. |

|

|

|

84 |

|

|

|

|

|

|

||||||

|

PART IV |

|

|

|

|

|

|

||

|

|

|

|

|

|||||

|

|

|

Item 15. |

|

|

|

85 |

|

|

|

|

|

|

|

|||||

|

|

|

Item 16. |

|

|

|

89 |

|

|

|

|

|

|

||||||

|

|

|

|

|

90 |

|

|||

i

PART I

|

Item 1. |

Business |

Overview

Nucor Corporation, a Delaware corporation incorporated in 1958, and its affiliates (“Nucor,” the “Company,” “we,” “us” or “our”) manufacture steel and steel products. The Company also produces direct reduced iron (“DRI”) for use in its steel mills. Through The David J. Joseph Company and its affiliates (“DJJ”), the Company also processes ferrous and nonferrous metals and brokers ferrous and nonferrous metals, pig iron, hot briquetted iron (“HBI”) and DRI. Most of the Company’s operating facilities and customers are located in North America. The Company’s operations include international trading and sales companies that buy and sell steel and steel products manufactured by the Company and others.

Nucor is North America’s largest recycler, using scrap steel as the primary raw material in producing steel and steel products. In 2020, we recycled approximately 17.8 million gross tons of scrap steel.

Segments, Principle Products Produced, and Markets and Marketing

Nucor reports its results in three segments: steel mills, steel products and raw materials. The steel mills segment is Nucor’s largest segment, representing 60% of the Company’s sales to external customers in the year ended December 31, 2020.

We market products from the steel mills and steel products segments mainly through in-house sales forces. We also utilize our internal distribution and trading companies to market our products abroad. The markets for these products are largely tied to capital and durable goods spending and are affected by changes in general economic conditions.

We are a leading domestic provider for most of the products we supply, and, in many cases (e.g., structural steel, merchant bar steel, steel joist and deck, pre-engineered metal buildings, steel piling and cold finish bar steel), we are the leading supplier.

Steel mills segment

In the steel mills segment, Nucor produces sheet steel (hot-rolled, cold-rolled and galvanized), plate steel, structural steel (wide-flange beams, beam blanks, H-piling and sheet piling) and bar steel (blooms, billets, concrete reinforcing bar, merchant bar and engineered special bar quality (“SBQ”)). Nucor manufactures steel principally from scrap steel and scrap steel substitutes using electric arc furnaces (“EAFs”), continuous casting and automated rolling mills. The steel mills segment also includes Nucor’s equity method investments in NuMit LLC (“NuMit”) and Nucor-JFE Steel Mexico, S. de R.L. de C.V. (“Nucor-JFE”), as well as international trading and distribution companies that buy and sell steel manufactured by the Company and other steel producers.

The steel mills segment sells its products primarily to steel service centers, fabricators and manufacturers located throughout the United States, Canada and Mexico. The steel mills segment sold approximately 18,049,000 tons to outside customers in 2020.

1

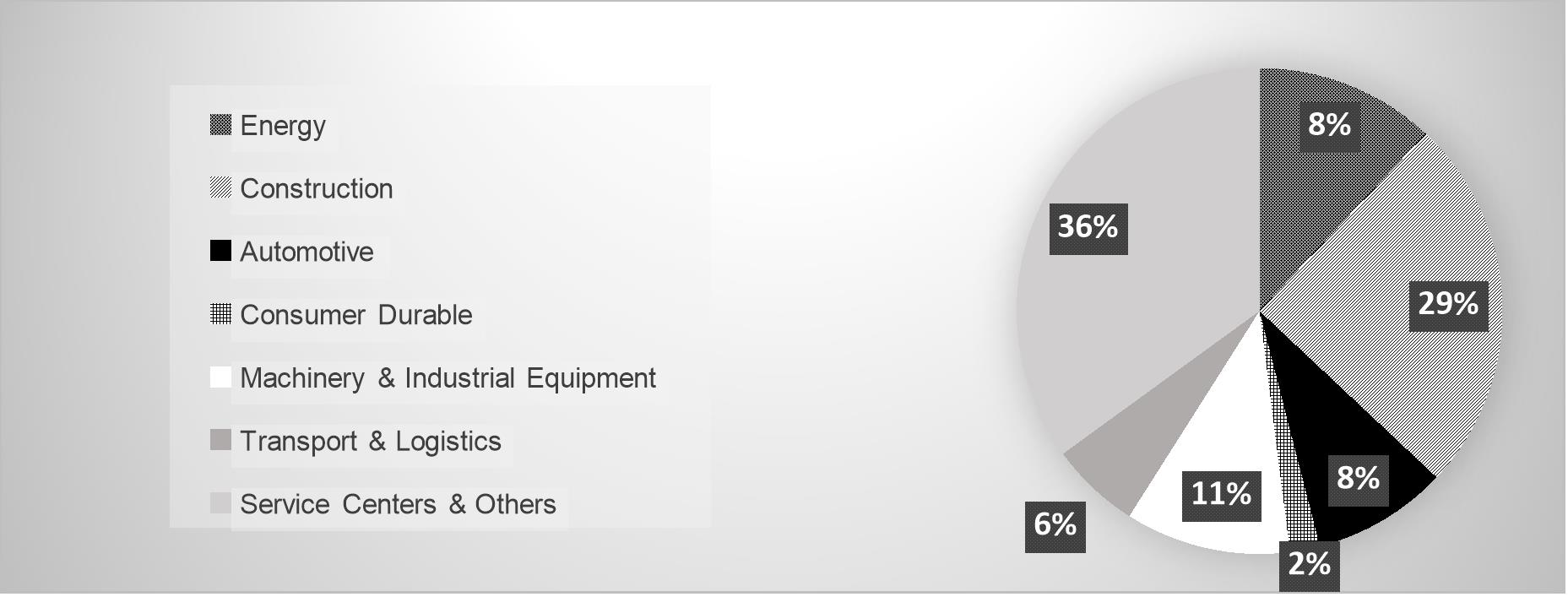

The following chart shows our outside steel shipments by end market:

In 2020, 80% of the shipments made by our steel mills segment were to external customers. The remaining 20% of the steel mills segment’s shipments went to our tubular products, piling distributor, joist, deck, rebar fabrication, fastener, metal buildings and cold finish operations.

|

|

• |

Bar mills - Nucor has 15 bar mills strategically located across the United States that manufacture a broad range of steel products, including concrete reinforcing bars, hot-rolled bars, rounds, light shapes, structural angles, channels, wire rod and highway products in carbon and alloy steels. Four of the bar mills have a significant focus on manufacturing SBQ and wire rod products. |

Steel produced by our bar mills has a wide usage serving end markets, including the agricultural, automotive, construction, energy, furniture, machinery, metal building, railroad, recreational equipment, shipbuilding, heavy truck and trailer market segments. Considering Nucor’s production capabilities and the mix of bar products generally produced and marketed, the capacity of the bar mills is estimated at approximately 9,560,000 tons per year.

Reinforcing and merchant bar steel are sold in standard sizes and grades, which allows us to maintain inventory levels of these products to meet our customers’ expected orders. Our SBQ products are hot-rolled to exacting specifications primarily servicing the automotive, energy, agricultural, heavy equipment and transportation sectors.

|

|

• |

Sheet mills - Nucor operates five strategically located sheet mills that utilize thin slab casters to produce flat-rolled steel for automotive, appliance, construction, pipe and tube and many other industrial and consumer applications. Considering Nucor’s production capabilities and the mix of flat-rolled products generally produced and marketed, the capacity of the sheet mills is estimated at approximately 11,300,000 tons per year. All of our sheet mills are equipped with galvanizing lines and four of them are equipped with cold rolling mills for the further processing of hot-rolled sheet steel. |

Nucor produces hot-rolled, cold-rolled and galvanized sheet steel to customers’ specifications. Contract sales within the steel mills segment are most notable in our sheet operations, as it is common for contract sales to account for the majority of sheet sales in a given year. We estimate that approximately 70% of our sheet steel sales in 2020 were to contract customers. The balance of our sheet steel sales were made in the spot market at prevailing prices at the time of sale. The amount of tons sold to contract customers at any given time depends on a variety of factors, including our consideration of current and future market conditions, our strategy to appropriately balance spot and contract tons in a manner to meet our customers’ requirements while considering the expected profitability, our desire to sustain a diversified customer base, and our end-use customers’ perceptions about future market conditions. These sheet sales contracts are noncancellable agreements that generally incorporate monthly or quarterly price adjustments reflecting changes in the current market-based indices and/or raw material cost, and typically have terms ranging from six to 12 months.

2

|

|

• |

Structural mills - Nucor operates two structural mills that produce wide-flange steel beams, pilings and heavy structural steel products for fabricators, construction companies, manufacturers and steel service centers. Nucor owns a 51% interest in Nucor-Yamato Steel Company (Limited Partnership) (“Nucor-Yamato”) located in Blytheville, Arkansas. Nucor-Yamato is the only North American producer of high-strength, low-alloy beams. Common applications for the high-strength, low-alloy beams include gravity columns for high-rise buildings, long-span trusses for stadiums and convention centers, and for all projects where seismic design is a critical factor. Nucor also owns a steel beam mill in Berkeley County, South Carolina. Considering Nucor’s production capabilities and the mix of structural products generally produced and marketed, the capacity of the two structural mills is estimated at approximately 3,250,000 tons per year. Both mills use a special continuous casting method that produces a beam blank closer in shape to that of the finished beam than traditional methods. |

Structural steel products come in standard sizes and grades, which allows us to maintain inventory levels of these products to meet our customers’ expected orders.

|

|

• |

Plate mills - Nucor operates three plate mills that produce plate for manufacturers of barges, bridges, heavy equipment, rail cars, refinery tanks, ships, wind towers and other items. Our products are further used in the pipe and tube, pressure vessel, transportation and construction industries. Considering Nucor’s production capabilities and the mix of plate products generally produced and marketed, the capacity of the plate mills is estimated at approximately 2,925,000 tons per year. Nucor is currently constructing a state-of-the-art plate mill in Brandenburg, Kentucky with an anticipated start-up date of late 2022. |

Plate steel products come in standard sizes and grades, which allows us to maintain inventory levels of these products to meet our customers’ expected orders.

|

|

• |

Steel joint ventures - Nucor owns 50% interests in a North American sheet steel processing joint venture and a galvanized sheet steel plant in Mexico. |

Nucor owns a 50% economic and voting interest in NuMit, a company that owns 100% of the equity interest in Steel Technologies LLC (“Steel Technologies”), an operator of 26 strategically located sheet processing facilities in the United States, Canada and Mexico. Steel Technologies transforms flat-rolled steel into products that meet the exact specifications for customers in a wide range of industries, including the automotive, agricultural and consumer goods markets.

Nucor owns a 50% economic and voting interest in Nucor-JFE, a joint venture with JFE Steel Corporation of Japan that operates a galvanized sheet steel plant in central Mexico that is expected to supply the country’s automotive market with an annual capacity of approximately 400,000 tons.

Steel products segment

In the steel products segment, Nucor produces hollow structural section (“HSS”) steel tubing, electrical conduit, steel joists and joist girders, steel deck, fabricated concrete reinforcing steel, cold finished steel, steel fasteners, metal building systems, steel grating and expanded metal, and wire and wire mesh. The steel products segment also includes our piling distributor. These products are sold primarily for use in nonresidential construction applications.

|

|

• |

Tubular Products – The Nucor Tubular Products (“NTP”) group has eight tubular facilities that are strategically located in close proximity to Nucor’s sheet mills as they are a consumer of hot-rolled coil. The NTP group produces HSS steel tubing, mechanical steel tubing, piling, sprinkler pipe, heat-treated tubing and electrical conduit. HSS steel tubing, mechanical steel tubing and sprinkler pipe are used in structural and mechanical applications, including nonresidential construction, infrastructure, agricultural, automotive and construction equipment end-use markets. Heat-treated tubing and electrical conduit are primarily used to protect and route electrical wiring in various nonresidential structures such as hospitals, schools, office buildings, hotels, stadiums and shopping malls. Total annual NTP capacity is approximately 1,365,000 tons. |

|

|

• |

Rebar fabrication - Harris Steel (“Harris”) fabricates, installs and distributes rebar for a wide variety of construction work classified as infrastructure (e.g., highways, bridges, reservoirs, |

3

|

|

utilities and airports) and various building projects, including hospitals, schools, stadiums, commercial office buildings and multi-tenant residential construction. We sell and install fabricated reinforcing products primarily on a construction contract bid basis. |

Reinforcing products are essential to concrete construction. They supply tensile strength, as well as additional compressive strength, and protect the concrete from cracking. In many markets, Harris sells reinforcing products on an installed basis (i.e., Harris fabricates the reinforcing products for a specific application and performs the installation). Harris operates nearly 70 fabrication facilities across the United States and Canada, with each facility serving a local market. Total annual rebar fabrication capacity is approximately 1,650,000 tons.

|

|

• |

Vulcraft/Verco – The Vulcraft/Verco group is the nation’s largest producer and leading innovator of open-web steel joists, joist girders and steel deck, which are used primarily for nonresidential building construction. Steel joists and joist girders are produced and marketed throughout the United States by seven domestic Vulcraft facilities. The Vulcraft/Verco group’s steel decking is produced and marketed throughout the United States by nine domestic plants. Six of these plants are adjacent to Vulcraft joist facilities. The Vulcraft/Verco group also has two plants in Canada, one in Eastern Canada and one in Western Canada, that produce both joist and deck. The annual joist production capacity is approximately 745,000 tons and the annual deck production capacity is approximately 560,000 tons. |

Sales of steel joists, joist girders and steel decking are dependent on the nonresidential building construction market. The majority of steel joists, joist girders and steel decking are used extensively as part of the roof and floor structural support systems in warehouses, data centers, manufacturing buildings, retail stores, shopping centers, schools, hospitals, and, to a lesser extent, in multi-story buildings and apartments. We make these products to the customers’ specifications and do not sell these finished steel products out of inventory. The majority of these contracts are firm, fixed-price contracts that are, in most cases, competitively bid against other suppliers. Longer-term supply contracts may or may not permit us to adjust our prices to reflect changes in prevailing raw material costs.

|

|

• |

Piling products - Skyline Steel LLC and its subsidiaries (“Skyline”) are primarily a steel foundation distributor serving the North American market. Skyline distributes products to service marine construction, bridge and highway construction, heavy civil construction, storm protection, underground commercial parking and environmental containment projects in the infrastructure and construction industries. Skyline also manufactures a complete line of geostructural foundation solutions, including threaded bar, micropile, strand anchors and hollow bar. It also processes and fabricates spiral weld pipe piling, rolled and welded pipe piling, cold-formed sheet piling and threaded bar. |

|

|

• |

Cold finish - Nucor Cold Finish (“NCF”) is the largest and most diversified producer of cold finished bar products for a wide range of industrial markets in North America, with assets in Canada, Mexico and throughout the United States. The total capacity of the Nucor cold finished bar and wire facilities exceeds approximately 1,069,000 tons per year. |

Nucor’s cold finished facilities are among the most modern in the world, producing cold finished bars for the most demanding applications. NCF obtains most of its steel from the Nucor bar mills, ensuring consistent quality and supply through all market conditions. These facilities produce cold-drawn, turned, ground and polished steel bars that are used extensively for shafting and other precision machined applications. NCF produces rounds, hexagons, flats and squares in carbon, alloy and leaded steels. These bars are purchased by the appliance, automotive, construction equipment, electric motor, farm machinery and fluid power industries, as well as by service centers. NCF bars are used in tens of thousands of products. A few examples include anchor bolts, hydraulic cylinders and shafting for air conditioner compressors, ceiling fan motors, garage door openers, electric motors and lawn mowers.

4

Nucor owns a fully integrated precision castings company, Corporacion POK, S.A. de C.V. (“POK”), with a facility in Guadalajara, Mexico. POK produces complex castings and precision machined products used by the oil and gas, mining and sugar processing industries. POK produces a wide array of precision castings using steel, bronze, iron and specialty exotic alloys. POK complements NCF’s businesses and Nucor’s cold finish facility in Monterrey.

|

|

• |

Buildings group – Nucor produces metal buildings and components throughout the United States under the following brands: Nucor Building Systems, American Buildings Company, Kirby Building Systems and CBC Steel Buildings. In total, the Nucor Buildings group currently has nine metal buildings plants with an annual capacity of approximately 360,000 tons, as well as an insulated metal panels company in Laurens, South Carolina whose products are utilized in metal buildings made by the Nucor Buildings group as well as other applications. |

The sizes of the buildings that can be produced range from less than 1,000 square feet to more than 1,000,000 square feet. Complete metal building packages can be customized and combined with other materials such as glass, wood and masonry to produce cost-effective, energy efficient, aesthetically pleasing buildings designed to the customers’ special requirements. The buildings are sold primarily through independent builder distribution networks in order to provide fast-track, customized solutions for building owners. The primary markets served are commercial, industrial and institutional buildings, including distribution centers, data centers, automobile dealerships, retail centers, schools and manufacturing facilities.

|

|

• |

Steel mesh, grating and fasteners - Nucor manufactures wire products, grating and industrial fasteners. |

Nucor produces mesh at Nucor Steel Connecticut, Inc. and Nucor Wire Products Utah. Nucor also produces mesh in Canada at the Harris operations of Laurel Steel. The combined annual production capacity of the steel mesh facilities is approximately 128,000 tons.

Our grating business manufactures and fabricates steel and aluminum bar grating products at facilities located in North America and serves the new construction and maintenance-related markets. The annual production capacity for our grating business is approximately 80,000 tons.

Nucor Fastener’s bolt-making facility in Indiana produces carbon and alloy steel hex head cap screws, hex bolts, structural bolts, nuts and washers, finished hex nuts and custom-engineered fasteners. Nucor fasteners are used in a broad range of markets, including automotive, machine tool, farm implement, construction and military applications. The annual production capacity of this facility is approximately 75,000 tons.

Raw materials segment

In the raw materials segment, Nucor produces DRI; brokers ferrous and nonferrous metals, pig iron, HBI and DRI; supplies ferro-alloys; and processes ferrous and nonferrous scrap metal. The raw materials segment also includes our natural gas drilling operations. Nucor’s raw materials investments are focused on creating an advantage for its steelmaking operations, through a global information network and a multi-pronged and flexible approach to metallics supply.

|

|

• |

Scrap recycling and brokerage operations - DJJ operates six regional scrap recycling companies across the United States that together have shredders capable of processing approximately 5,000,000 tons of ferrous scrap annually. DJJ’s scrap recycling operations use industry-leading expertise and technology to maximize metal recovery and minimize waste. DJJ also operates 11 self-serve used auto parts stores called U Pull-&-Pay that complement its recycling operations. |

DJJ is the leading broker of ferrous scrap in North America and is a global trader of scrap metal, pig iron and other metallics. In addition to sourcing steel scrap for Nucor’s mills, DJJ is a global trader of ferro-alloys and nonferrous metals. DJJ’s logistics team owns and operates one of the largest independent fleets of railcars in the United States dedicated to the movement of scrap and steel and also offers railcar leasing and railcar fleet management services. These activities have strategic value to Nucor as the leading and most diversified North American steel producer.

5

Our primary external customers for ferrous scrap are EAF steel mills and foundries that use ferrous scrap as a raw material in their manufacturing process. External customers purchasing nonferrous scrap metal include aluminum can producers, secondary aluminum smelters, steel mills, and other processors and consumers of various nonferrous metals. We market scrap metal products and related services to our external customers through in-house sales forces. In 2020, approximately 9% of the ferrous and nonferrous metals and scrap substitute tons we brokered and processed were sold to external customers. We consumed the balance in our steel mills.

|

|

• |

Direct reduced iron operations - DRI is a substitute material for high-quality grades of scrap and pig iron. Nucor operates two DRI plants with a combined annual capacity of approximately 4,500,000 metric tons of material with world-class metallization rates and carbon content. Nucor’s wholly owned subsidiary, Nu-Iron Unlimited, is in Trinidad and benefits from a low-cost supply of natural gas and favorable logistics for inbound iron ore and shipment of DRI to the United States. Nucor’s second DRI plant in Louisiana (“Nucor Steel Louisiana”) also benefits from favorable logistics and proximity to its steel mill customers. |

Nucor’s DRI production capabilities provide our steel mills flexibility to quickly adjust the metallic mix to changing market conditions and to maintain competitiveness in the sometimes-volatile scrap market. With the potential for high-quality scrap becoming scarcer, coupled with the risk of third-party supplier disruptions, Nucor’s DRI facilities provide a greater degree of certainty over its metallics supply.

|

|

• |

Natural gas drilling programs - Nucor owns leasehold interests in natural gas properties in the Piceance Basin in the Western Slope of Colorado. |

Nucor’s access to a long-term, low-cost supply of natural gas is a component in the execution of Nucor’s raw material strategy. Natural gas produced by Nucor’s drilling operations is being sold to third parties to offset our exposure to changes in the price of natural gas consumed by our DRI plant in Louisiana and our steel mills in the United States.

Customers

A significant portion of our steel mills and steel products segments’ sales are into the commercial, industrial and municipal construction markets. We have a diverse customer base and are not dependent on any single customer. Our largest single customer in 2020 represented less than 5% of sales and consistently pays within terms. Our steel mills use a significant portion of the products of the raw materials segment.

General Development of Our Business in Recent Years

Nucor has invested significant capital in recent years to expand our product portfolio to include more value-added steel mill products and capabilities, improve our cost structure, enhance our operational flexibility and provide additional channels to market for our products. These investments totaled approximately $4.24 billion over the last three years, with approximately 95% going to capital expenditures and the remainder going to acquisitions. We believe that our focus on lowering costs and diversifying our operations will enable us to deliver profitable long-term growth. Further, we believe shifting our product mix to a greater proportion of value-added products and increasing end-use market diversity will make us less susceptible to being negatively impacted by imports.

Several new capital projects that support our expansion of value-added product offerings and cost-reduction strategies were completed in 2020. Nucor’s $245 million rebar micro mill near Kansas City in Sedalia, Missouri finished commissioning in the second quarter of 2020 and is capable of producing approximately 380,000 tons annually. We believe that positioning the micro mill near the Kansas City market will provide us with a freight cost advantage relative to more distant suppliers, and we will also benefit from the scrap supply in the immediate area provided by our existing DJJ operations. In December 2020, Nucor’s $249 million investment in a new rebar micro mill in Frostproof, Florida began production and commissioning. This mill is capable of producing approximately 350,000 tons annually. We believe this new micro mill will also benefit from the scrap supply in the immediate area provided by

6

our existing DJJ operations as well as strong regional demand for its products. Also in December 2020, Nucor Steel Kankakee, Inc. finished commissioning its full-range merchant bar quality mill with approximately 500,000 tons of annual capacity at its existing mill in Bourbonnais, Illinois at a cost of $187 million. Like the new micro mills, we believe that the Kankakee mill will also benefit from logistical advantages serving its customers and low-cost scrap supply.

Nucor is constructing a new $325 million 3rd generation flexible galvanizing line with an annual capacity of approximately 500,000 tons at our Nucor Steel Arkansas facility. This project complements the new $245 million specialty cold mill at Nucor Steel Arkansas that completed its first full year of production in 2020. We believe these investments will accelerate our goal of increasing our automotive market share. The new galvanizing line is expected to be operational in the second half of 2021. In September 2018, Nucor announced an approximately $650 million investment to modernize and expand the production capability at its Gallatin flat-rolled sheet mill located in Ghent, Kentucky. This investment will increase the production capability from approximately 1,400,000 tons to approximately 3,000,000 tons annually and will increase the maximum coil width to approximately 73 inches. This expansion is expected to be completed in the second half of 2021 and complements the mill’s new $200 million hot band galvanizing and pickling line that completed its first full year of production in 2020. In January 2019, Nucor announced plans to build a state-of-the-art plate mill, which will be based in Brandenburg, Kentucky on the Ohio river. With an expected investment of $1.70 billion, we anticipate the mill will be completed in late 2022 and will be capable of producing approximately 1,200,000 tons per year of steel plate products.

In addition to growing through capital expansions at our existing operations and acquisitions, Nucor also uses joint ventures as a platform for growth. Nucor-JFE, our joint venture with JFE Steel Corporation of Japan, in which Nucor has 50% ownership, resumed production in late 2020 after lengthy government-mandated shutdowns related to the COVID-19 pandemic. Located in central Mexico, Nucor-JFE will supply galvanized sheet steel to the growing Mexican automotive market. The investment totaled $360 million, with Nucor's share of these amounts being 50%. Nucor’s sheet mills are expected to provide a significant portion of the hot-rolled steel substrate that will be consumed by Nucor-JFE.

Capital Allocation Strategy

The significant developments in Nucor’s business in recent years have been driven by our capital allocation strategy. Our highest capital allocation priority is to invest in our business for profitable long-term growth through our multi-pronged strategy of optimizing existing operations, greenfield expansions and acquisitions.

Our second priority is to return capital to our stockholders through cash dividends and share repurchases. Nucor has paid $1.47 billion in dividends to its stockholders during the past three years. That dividend payout represents 19% of cash flows from operations during that three-year period. The Company repurchased $39.5 million of its common stock in 2020 ($298.5 million in 2019 and $854.0 million in 2018).

We intend to return at least 40% of our net income to stockholders over time via a combination of both cash dividends and share repurchases. Over the past three years, we have returned approximately 61% of our net income in this manner. At December 31, 2020, the Company had approximately $1.16 billion available for share repurchases under the current share repurchase program.

We intend to execute on this strategy while maintaining a strong balance sheet, with relatively low financial leverage, as measured in terms of net debt to total capital, as well as ample liquidity. At year-end 2020, our net debt to total capital was approximately 13% and we had cash and cash equivalents, short-term investments and restricted cash and cash equivalents on hand of $3.16 billion. At the end of 2020, Nucor had the strongest credit ratings in the North American steel sector (Baa1/A-) with stable outlooks at both Moody’s and Standard & Poor’s.

7

Competition

We compete in a variety of steel and metal markets, including markets for finished steel products, unfinished steel products and raw materials. These markets are highly competitive with many domestic and foreign firms participating, and, as a result of this highly competitive environment, we find that we primarily compete on price and service.

In our steel mills segment, our EAF steel mills face many different forms of competition, including domestic integrated steel producers (who use iron ore converted into liquid form in a blast furnace as their basic raw material instead of scrap steel), other domestic EAF steel mills, steel imports and alternative materials. Large domestic integrated steel producers have the ability to manufacture a variety of products but face significantly higher energy costs and are often burdened with higher capital and fixed operating costs. EAF-based steel producers, such as Nucor, are sensitive to increases in scrap prices but tend to have lower capital and fixed operating costs compared with large integrated steel producers. EAF-based steel producers also typically emit less carbon dioxide per ton of steel produced than integrated steel producers.

The COVID-19 pandemic has exacerbated the ongoing risks Nucor and the entire steel industry face from excess global steelmaking capacity, particularly in non-market economies. China set a record for steel production in 2020, despite the pandemic. Steel production in China rose from approximately 1.10 billion tons in 2019 to approximately 1.16 billion tons in 2020. As a result, China’s share of global crude steel production rose from 53.3% in 2019 to 56.6% in 2020. The Organisation for Economic Co-operation and Development (the “OECD”) estimates that excess global steel production capacity will be approximately 776 million tons in 2020, up from 624 million tons in 2019, which was itself up significantly from the prior year. China’s largest steel companies are state-owned and receive significant financial support from the Chinese government.

The Section 232 steel tariffs implemented in 2018 continue to be effective in preventing the dumping of steel products in the U.S. market. Successful industry trade cases over the past several years have had an impact on import levels as well. For the full year 2020, imports of finished steel were down approximately 23% from the previous year and accounted for approximately 18% of U.S. market share. In 2020, finished steel import market share was at its lowest level since 2003.

The new United States-Mexico-Canada (USMCA) trade agreement went into effect in July 2020. The agreement has several provisions that we believe will benefit the steel industry, including requiring that higher levels of a vehicle’s content, including steel, be produced in North America for a vehicle to qualify for zero tariffs, and that 70% of the steel used in vehicles be melted and poured in North America. There are also provisions addressing currency manipulation and state-owned enterprises.

We also experience competition from other materials. Depending on our customers’ end use of our products, there are often other materials, such as concrete, aluminum, plastics, composites and wood that compete with our steel products. When the price of steel relative to other raw materials rises, these alternatives can become more attractive to our customers.

Competition in our scrap and raw materials business is also vigorous. The scrap metals market consists of many firms and is highly fragmented. Firms typically compete on price and geographic proximity to the sources of scrap metal.

Backlog

In the steel mills segment, Nucor’s backlog of orders was approximately $2.58 billion and $1.68 billion at December 31, 2020 and 2019, respectively. Order backlog for the steel mills segment includes only orders from external customers and excludes orders from other Nucor businesses. Nucor’s backlog of orders in the steel products segment was approximately $2.66 billion and $2.24 billion at December 31, 2020 and 2019, respectively. The majority of these orders are expected to be filled within one year. Order backlog within our raw materials segment is not meaningful because the vast majority of the raw materials that segment produces are used internally.

8

Sources and Availability of Raw Materials

An ample supply of high-quality scrap and scrap substitutes is critical to support Nucor’s ability to produce high-quality steel. Nucor’s raw materials segment safely produces, sources, trades and transports steelmaking raw materials. Nucor’s raw materials investments are focused on creating an advantage for its steelmaking operations, through a global information network and a multi-pronged and flexible approach to metallics supply.

Scrap and scrap substitutes are the most significant element in the total cost of steel production. The average cost of scrap and scrap substitutes used in our steel mills segment decreased 8% from $314 per gross ton used in 2019 to $290 per gross ton used in 2020. On average, it takes approximately 1.1 tons of scrap and scrap substitutes to produce one ton of steel. Depending on the market conditions at the time, a raw material surcharge or variable steel pricing mechanism may be implemented to assist Nucor in maintaining operating margins and in meeting our customer commitments during periods of rapidly changing scrap and scrap substitute costs.

For the past decade, Nucor has focused on securing access to low-cost raw material inputs as they are the Company’s largest expense. We believe Nucor’s broad, balanced supply chain is an important strength which allows us to reduce the cost of our steelmaking operations, create a shorter supply chain and have greater optionality over our metallic inputs. Our investment in DRI production facilities and scrap yards, as well as our access to international raw materials markets, provides Nucor with significant flexibility in optimizing our raw material costs. Additionally, having a significant portion of our raw materials supply under our control minimizes risk associated with the global sourcing of raw materials, particularly since a good deal of scrap substitutes comes from regions of the world that have historically experienced greater political turmoil. We believe the continued successful implementation of our raw material strategy, including key investments in DRI production, as well as in the scrap brokerage and processing services performed by our team at DJJ, gives us greater control over our metallic inputs and thus helps us mitigate the risk of significant fluctuations in the availability and costs of critical inputs.

DJJ acquires ferrous scrap from numerous sources, including manufacturers of products made from steel, industrial plants, scrap dealers, peddlers, auto wreckers and demolition firms. We purchase pig iron as needed from a variety of sources and operate DRI plants in Trinidad and Louisiana with respective annual production capacities of approximately 2,000,000 and 2,500,000 metric tons. The primary raw material for our DRI facilities is pelletized iron ore, which we purchase from various international suppliers. Another major source of raw materials used in the production of steel is pig iron. We received over 2.6 million gross tons of pig iron in 2020. As with scrap and iron ore, we source pig iron from a number of international suppliers.

The primary raw material for our steel products segment is steel produced by Nucor’s steel mills.

Energy Consumption and Costs

Most of our operations are energy intensive. As a result, we continuously strive to make our operations in all three of our business segments more energy efficient. In addition, we proactively engage with suppliers, regulators and other energy industry participants to ensure the continued availability of reliable, low cost sources of energy in various forms.

Our steel mills utilize EAFs for 100% of their steel production, with approximately 50% of their total energy consumed as electricity. The total energy consumed by Nucor also includes natural gas, oxygen, and carbon raw material inputs. For the scrap melting process, electricity is the primary energy source, with natural gas combustion serving as the fuel for reheat furnaces and other pre-heating operations. Our DRI facilities in Trinidad and Louisiana are also large consumers of natural gas.

The availability and prices of electricity and natural gas are influenced today by many factors, including changes in supply and demand, the regulatory environment and pipeline/transmission infrastructure.

We closely monitor developments in public policy relating to energy production and consumption. We work with policymakers to provide technical information that can inform policy making and avoid

9

unintended adverse consequences of legislative and regulatory actions. We believe that a thoughtful approach to domestic energy policy can help ensure that steel and steel products manufactured in the United States remain competitive in an increasingly global marketplace.

Greenhouse gas (“GHG”) emissions by the energy sector have received an increasing amount of attention in recent years, as more people become concerned that these emissions are a significant contributor to climate change. This has led to increasing support for, and investment in, low or zero carbon energy generation technologies such as solar, wind and nuclear. As a result, the development of these technologies has accelerated, and in many cases they are now more cost competitive with traditional, fossil fuel-based power generation. We believe that this ongoing diversification of power generation technologies is fundamentally positive, but without careful planning and investment there is some risk to the reliability of the domestic power grid as this transition continues. In particular, legacy fossil fuel-based assets will remain essential for some time to come and the U.S. transmission grid is broadly in need of substantial upgrades to take full advantage of these newer, more intermittent power sources. We are also optimistic about the related demand for our products as transmission grid upgrades are executed and newer power generation assets are developed using steel.

In November of 2020, we executed a 15-year, 250-megawatt Virtual Power Purchase Agreement (“VPPA”) with a major North American renewable energy company. Under the VPPA, we have agreed to purchase for a fixed price a portion of the output of a solar array being developed in northwestern Texas. The VPPA will be settled financially on a monthly basis. We have undertaken this initiative to support the ongoing transition of the U.S. power grid to a greater reliance on renewable power. As part of this arrangement we will also receive Renewable Energy Credits (“RECs”) commensurate with the power we purchase. These RECs can be applied against a portion of our GHG emissions, enabling us to receive credit for reducing them. The pay fixed, received floating nature of this arrangement also offsets a portion of our exposure to higher prices for electricity over the life of the contract. We are evaluating and considering more transactions like this one.

We use a variety of strategies to manage our exposure to price risk of natural gas, including cash flow hedges, as well as our owned natural gas drilling operations. In addition to the currently producing wells in the Piceance Basin, Nucor owns leasehold interests in natural gas properties in the South Piceance Basin, in the Western Slope of Colorado. To support Nucor’s operating wells and potential future well developments on these properties, Nucor has entered into long-term agreements directly with third-party gathering and processing service providers. Natural gas produced by Nucor’s drilling operations is being sold to offset our exposure to changes in the price of natural gas consumed by our DRI plant in Louisiana, and by our steel mills in the United States. Nucor has full discretion on its participation in all future drilling capital investments.

Government and Environmental Regulations

Our business operations are subject to numerous federal, state and local laws and regulations, the most significant of which are intended to protect our teammates and the environment. Due to the nature of the steel industry, we are subject to substantial regulations related to safety in the workplace. In addition to the requirements of the state and local governments of the communities in which we operate, we must comply with federal health and safety regulations, the most significant of which are enforced by the Occupational Safety and Health Administration (“OSHA”). Because safety and safety compliance is one of our primary values, its effect on our capital expenditures, earnings and competitive position is not estimable.

Nucor operates a robust and sustainable environmental program that incorporates the concept of each individual teammate, as well as management, being responsible for environmental performance. All of Nucor’s steelmaking operations are ISO 14001 certified. Achieving ISO 14001 certification requires Nucor’s steel mills to implement an environmental management system with measurable targets and objectives, such as reducing the use of oil and grease and minimizing electricity use.

The principal federal environmental laws that regulate our business include the Clean Air Act (the “CAA”) that regulates air emissions; the Clean Water Act (the “CWA”) that regulates water withdrawals and discharges; the Resource Conservation and Recovery Act (the “RCRA”) that addresses solid and hazardous waste treatment, storage and disposal; and the Comprehensive Environmental Response,

10

Compensation and Liability Act (the “CERCLA”) that governs releases of hazardous substances, and remediation of contaminated sites. Our operations are also subject to state and local environmental laws and regulations.

As it relates to air emission rates, EAFs are the most efficient and cleanest steel making process commercially available today. In comparison to blast furnaces, emissions of sulfur oxides from EAFs are approximately 14% of the amount emitted from blast furnaces. EAFs emit less than 1% of the particulate emissions compared to blast furnace operations. Importantly, EAF emissions of greenhouse gases per ton of steel average less than half of the rates typically generated by blast furnaces. Operating EAFs instead of blast furnaces is a proven air quality improvement strategy. In addition, each of our steel mills operate air pollution control devices (baghouses) to collect and capture particulate emissions (“EAF dust”) from the steel making process. We strive to maintain compliance with all applicable CAA requirements.

The primary raw material of Nucor’s steelmaking operations is scrap metal. As mentioned previously, the process of recycling scrap metal generates particulate matter emissions that includes contaminants such as paint, zinc, chrome and other metals. Initially, the particulate matter captured and collected is classified as a listed hazardous waste under the RCRA. Because these contaminants contain valuable metals, the EAF dust is recycled to recover these metals. Nucor sends all but a small fraction of the EAF dust it collects to recycling facilities that recover the zinc, lead, chrome and other valuable metals from this dust. By recycling this material, Nucor believes it is not only acting in a sustainable, responsible manner but it is also substantially limiting its potential for future liability under both the CERCLA and the RCRA.

In addition to recycling EAF dust, Nucor mills beneficially reuse steel slag in road materials as a granular base, embankments, engineered fill, highway shoulders, and hot mix asphalt pavement. The physical, chemical, mechanical and thermal properties of steel slag provide a vital resource for construction companies and activities. We take considerable pride in our recycling efforts.

Notably in both 2019 and 2018, the U.S. Environmental Protection Agency (the “EPA”) identified Nucor as a Top 10 Parent Company in terms of pollution source reduction activities in its assessment publication, National Analysis of Toxics Release Inventory. To illustrate potential reduction strategies, the EPA used a Nucor facility as an example of pollution prevention. Nucor focuses on pollution prevention at all of our facilities.

Not only does the RCRA establish standards for the management of solid and hazardous wastes, the RCRA also addresses the environmental impact of contamination from waste disposal activities and from recycling and storage of most wastes. Periodically, past waste disposal activities that were legal when conducted but now may pose a contamination threat are discovered. When the EPA determines these off-site properties are contaminated, Nucor quickly evaluates such claims and, if Nucor is determined to be responsible, we do our part to remediate our share of such issues. Nucor believes all identified liabilities under the RCRA are either currently being resolved or have been fully resolved.

Because Nucor has historically implemented environmental practices that have resulted in the responsible disposal of waste materials, Nucor is also not presently considered a major contributor to any major cleanups under the CERCLA for which Nucor has been named a potentially responsible party. Nucor regularly evaluates these types of potential liabilities and, if appropriate, maintains reserves sufficient to remediate the identified liabilities. Under the RCRA, private citizens may also bring an action against the operator of a regulated facility for potential damages and payment of cleanup costs. Nucor believes that its system of internal evaluation and due diligence has sufficiently identified these types of potential liabilities so that compliance with these regulations will not have a material adverse effect on our results of operations, cash flows or financial condition beyond that already reflected in the reserves established for them.

To protect water resources, the CWA regulates water discharges and withdrawals. When applicable, Nucor maintains discharge and water withdrawal permits at its facilities under the national pollutant discharge elimination system program of the CWA and conducts its operations in compliance with those

11

permits. Nucor also maintains permits from local governments if the facility discharges into publicly owned treatment works.

Capital expenditures at our facilities that are associated with environmental regulation compliance for 2021 and 2022 are estimated to be less than $100 million per year.

Human Capital Resources

Culture, Organization and Compensation

We consider our teammates the most important part of Nucor and believe that our culture – and the encouragement that we provide to our teammates to “grow the core; expand beyond; and live our culture” – provides us with a competitive advantage. Our culture’s key principles are: Safety First, Trust, Open Communications, Teamwork, Community Stewardship and Results.

Nucor has a simple, streamlined organizational structure that allows our teammates to make quick decisions and innovate. Our organization is also highly decentralized, with most day-to-day operating decisions made by our division general managers and their teams. With more than 26,000 teammates, only 150 work in our principal executive offices in Charlotte, North Carolina. By empowering our teammates, our goal is to foster an entrepreneurial mindset, along with a strong sense of personal responsibility and a culture of accountability. This empowerment is reinforced by our compensation policies, so as to drive results and contribute to our success.

Teammate input is essential for us to maintain our culture of empowering teammates to make operational decisions. Aside from our practice of everyday open communication, we periodically ask our teammates to formally provide feedback. Beginning in 1986, we have asked our teammates to complete a comprehensive survey in order to gather feedback on a range of topics, including matters relating to the effectiveness of our culture. We view the survey as an important tool we use to continually improve our company and ensure our teammates remain engaged and satisfied. This survey is conducted every three years, the last of which was conducted in 2019. In the most recent survey, 90% of the responses were favorable in the category of “Satisfaction & Commitment.” The overall percentage of negative responses in the most recent survey has dropped by 25 percentage points since the survey began in 1986. Teammates of certain previously acquired businesses – most notably DJJ and Harris, which together accounted for approximately 27% of our workforce as of December 31, 2020 – complete comparable surveys that have also shown an improving trend over time.

Safety

One of Nucor’s core values is our teammates’ well-being and safety, and it is our goal to become the safest steel company in the world. Our foremost responsibility is to work safely, which requires our teammates to identify unsafe conditions and activities and mitigate these hazards. We will continue working to eliminate exposures that can lead to injury and encourage our teammates to share their ideas for safety improvement. Two key metrics Nucor uses to measure safety are: the Injury/Illness Rate and Days Away, Restricted and Transfer (“DART”) Case Rate.

Nucor calculates the annual Injury/Illness Rate by dividing the number of work-related injuries and illnesses by the total number of hours worked by all Nucor teammates in a given year, and then multiplying the resulting percentage by 200,000, the equivalent of 100 full-time employees working 40 hours per week, 50 weeks per year. In 2020, we achieved an annual Injury/Illness Rate of 1.10.

Nucor uses the DART Case Rate to assess and manage the risk of serious injury in the workplace. Nucor calculates the annual DART Case Rate by dividing the number of cases resulting in days away from work, restricted work activity and/or job transfers by the total number of hours worked by all Nucor teammates in a given year, and then multiplying the resulting percentage by 200,000, the equivalent of

12

100 full-time employees working 40 hours per week, 50 weeks per year. In 2020, we achieved an annual DART Case Rate of 0.59.

Beginning in 1998, Nucor has used the President’s Safety Award to recognize divisions that achieve strong records of safety performance based on objective metrics. Since 2004, the President’s Safety Award has gone to divisions and mills where the Injury/Illness Rate and DART Case Rate are less than one-third the national average for comparable facilities. In 2020, 40 of Nucor’s mills and divisions achieved the President’s Safety Award. Nucor also has 25 OSHA Voluntary Protection Program Sites, OSHA’s highest level of recognition.

Our Teammates

Nucor had approximately 26,400 teammates as of December 31, 2020. The vast majority of our teammates are located in the United States, with only a small number of teammates located outside of North America. Our operations are highly automated, allowing us to take advantage of lower employment costs while still providing our teammates with compensation that we believe is highly competitive as compared to comparable businesses in our industry. At Nucor, we believe in “Pay-for-Performance.” Nucor teammates typically earn a significant part of their compensation based on their productivity. Production teammates work under group incentives that provide increased earnings for increased production. This additional incentive compensation is paid weekly in most cases. Nucor has also historically contributed 10% of earnings before federal taxes to a profit sharing plan for the majority of teammates below the officer level. We believe such compensation practices incentivize our workforce and reinforce our culture.

While Nucor seeks to hire qualified and talented individuals as teammates, we also believe in developing the skills of our workforce by providing educational and on-the-job training, in addition to safety training. Further, Nucor believes it is important for senior management to also be familiar with, and have had direct experience running, Nucor’s mills and other operational divisions. The vast majority of our teammates are not represented by labor unions and we believe our teammate turnover is low.

At Nucor, we believe that a diversity of perspectives and background helps to facilitate the “Nucor Way” as we work to “grow the core; expand beyond; and live our culture.” We also believe that recruiting and hiring the best talent available will continue to provide us with a more diverse and capable workforce. In addition, Nucor has a long history of conducting our businesses in a manner consistent with high standards of social responsibility. We have adopted a comprehensive Human Rights Policy, which operates in conjunction with many other Nucor policies related to ethical conduct and human rights, including our Standards of Business Conduct and Ethics, Code of Ethics for Senior Financial Professionals, Supplier Code of Conduct and Policy on Eliminating Forced Labor from our Supply Chain. We will continue to evaluate our approach and look for opportunities to improve, so that Nucor and its stockholders benefit to the greatest extent possible from our teammates.

Available Information

Nucor’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to these reports, as well as proxy statements and other information, are available on our website at www.nucor.com, as soon as reasonably practicable after Nucor files these documents electronically with, or furnishes them to, the U.S. Securities and Exchange Commission (the “SEC”).

We use the investor relations portion of our website, www.nucor.com/investors, to distribute information, including as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. We routinely post and make accessible financial and other information regarding the Company on our website. Accordingly, investors should monitor the investor relations portion of our website, in addition to our press releases, SEC filings and other public communications. Except as otherwise expressly stated in these documents, the information contained on

13

our website or available by hyperlink from our website is not a part of this report and is not incorporated into this report or any other documents we file with, or furnish to, the SEC.

|

Item 1A. |

Risk Factors |

Many of the factors that affect our business and operations involve risk and uncertainty. The factors described below are some of the risks that could materially negatively affect our business, financial condition, results of operations and cash flows.

Industry Specific Risk Factors

Overcapacity in the global steel industry could increase the level of steel imports, which may negatively affect our business, results of operations, financial condition and cash flows.

Recent additions of new steelmaking capacity and the decrease in steel production due to the economic impact of the COVID-19 pandemic has caused excess steelmaking capacity to grow during the last two years after several years of decline. According to the OECD, global steel production overcapacity is projected to be approximately 776 million tons in 2020. China continues to be a significant contributor to excess steelmaking capacity.

During periods of global economic weakness, this overcapacity is amplified because of weaker global demand for steel and steel products. This excess capacity often results in manufacturers in certain countries exporting significant amounts of steel and steel products at prices that are at or below their costs of production. In some countries the steel industry is subsidized or owned in whole or in part by the government, giving imported steel from those countries certain cost advantages. These imports, which are also affected by demand in the domestic market, international currency conversion rates, and domestic and international government actions, can result in downward pressure on steel prices, which could materially adversely affect our business, results of operations, financial condition and cash flows.

Section 232 steel tariffs are currently keeping some dumped steel products out of the U.S. market. The U.S. government has also been negotiating new trade agreements with many countries, including China, which may provide another opportunity to address excess steelmaking capacity. Should these efforts be abandoned or fail to reduce the impact of global excess capacity and the Section 232 tariffs be lifted, U.S. steelmakers would be at greater risk of having to compete against steel products dumped in the U.S. market.

Our business requires substantial capital investment and maintenance expenditures, and our capital resources may not be adequate to provide for all of our cash requirements.

Our operations are capital intensive. For the three-year period ended December 31, 2020, our total capital expenditures were approximately $4.04 billion. Our business also requires substantial expenditures for routine maintenance. Although we expect requirements for our business needs, including the funding of capital expenditures, debt service for financings and any contingencies, will be financed by internally generated funds, short-term commercial paper issuance, offerings of our debt and equity securities or from borrowings under our $1.50 billion unsecured revolving credit facility, we cannot guarantee that this will be the case. Additional acquisitions or unforeseen events could require financing from additional sources.

Changes in the availability and cost of electricity and natural gas are subject to volatile market conditions that could adversely affect our business.

Our steel mills are large consumers of electricity and natural gas. In addition, our DRI facilities are also large consumers of natural gas. We rely upon third parties for our supply of energy resources consumed in the manufacture of our products. The prices for and availability of electricity and natural gas are subject to volatile market conditions. These market conditions often are affected by weather, political, regulatory and economic factors beyond our control, and we may be unable to raise the price of our products to cover increased energy costs. Disruptions, including physical or information systems related

14

issues, that impact the supply of our energy resources could temporarily impair our ability to manufacture our products for our customers. Increases in our energy costs resulting from regulations that are not equally applicable across the entire global steel market could materially adversely affect our business, results of operations, financial condition and cash flows.

Competition from other steel producers, imports or alternative materials may adversely affect our business.

We face strong competition from other steel producers and imports that compete with our products on price, quality and service. The steel markets are highly competitive and a number of firms, domestic and foreign, participate in the steel, steel products and raw materials markets. Depending on a variety of factors, including the cost and availability of raw materials, energy, technology, labor and capital costs, currency exchange rates and government subsidies of foreign steel producers, our business may be materially adversely affected by competitive forces.

In many applications, steel competes with other materials, such as concrete, aluminum, plastics, composites and wood. Increased use of these materials in substitution for steel products could have a material adverse effect on prices and demand for our steel products.

Since 2011, automobile producers have begun taking steps towards complying with new Corporate Average Fuel Economy mileage requirements for new cars and light trucks that they produce. As automobile producers work to produce vehicles in compliance with these new standards, they may seek to reduce the amount of steel they incorporate in their vehicles or begin utilizing alternative materials in cars and light trucks to improve fuel economy, thereby reducing their demand for steel. Certain automakers have begun to use greater amounts of aluminum and smaller proportions of steel in some models since 2015.

Our industry is cyclical and both recessions and prolonged periods of slow economic growth could have an adverse effect on our business.

Demand for most of our products is cyclical in nature and sensitive to general economic conditions. Our business supports cyclical industries such as the commercial construction, energy, metals service centers, appliance and automotive industries. As a result, downturns in the U.S. economy or any of these industries could materially adversely affect our results of operations, financial condition and cash flows. The U.S. economy is recovering from its lows during the second quarter of 2020, but the pace of the recovery in 2021 will likely depend on how quickly the U.S. population is vaccinated and normal activities can resume as well as government stimulus programs or infrastructure spending. Even with this economic recovery, challenges from global production overcapacity in the steel industry and ongoing uncertainties, both in the United States and in other regions of the world, remain.

We are unable to predict the duration of current economic conditions. Future economic downturns, prolonged slow growth or stagnation in the economy, or a sector-specific slowdown in one of our key end-use markets, such as nonresidential construction, could materially adversely affect our business, results of operations, financial condition and cash flows, especially in light of the capital-intensive nature of our business.

The results of our operations are sensitive to volatility in steel prices and the cost of raw materials, particularly scrap steel.

We rely to an extent on outside vendors to supply us with key consumables such as graphite electrodes and raw materials, including both scrap and scrap substitutes that are critical to the manufacture of our steel products. The raw material required to produce DRI is pelletized iron ore. Although we have vertically integrated our business by constructing our DRI facilities in Trinidad and Louisiana and also by acquiring DJJ in 2008, we still must purchase most of our primary raw material, steel scrap, from numerous other sources located throughout the United States and internationally.

15

Although we believe that the supply of scrap and scrap substitutes is adequate to operate our facilities, prices of these critical raw materials are volatile and are influenced by changes in scrap exports in response to changes in the scrap, scrap substitutes and iron ore demands of our global competitors, as well as currency fluctuations. At any given time, we may be unable to obtain an adequate supply of these critical raw materials with price and other terms acceptable to us. The availability and prices of raw materials may also be negatively affected by new laws and regulations, allocation by suppliers, interruptions in production, accidents or natural disasters, changes in exchange rates, worldwide price fluctuations, and the availability and cost of transportation. Many countries that export steel into our markets restrict the export of scrap, protecting the supply chain of some foreign competitors. This trade practice creates an artificial competitive advantage for foreign producers that could limit our ability to compete in the U.S. market.

If our suppliers increase the prices of our critical raw materials, we may not have alternative sources of supply. In addition, to the extent that we have quoted prices to our customers and accepted customer orders for our products prior to purchasing necessary raw materials, we may be unable to raise the price of our products to cover all or part of the increased cost of the raw materials. Also, if we are unable to obtain adequate and timely deliveries of our required raw materials, we may be unable to timely manufacture sufficient quantities of our products. This could cause us to lose sales, incur additional costs, experience margin compressions or suffer harm to our reputation.

Our steelmaking processes, our DRI processes, and the manufacturing processes of many of our suppliers, customers and competitors are energy intensive and generate carbon dioxide and other GHGs. The regulation of these GHGs could have a material adverse impact on our results of operations, financial condition and cash flows.

Our operations are subject to numerous federal, state and local laws and regulations relating to protection of the environment, and, accordingly, we make provision in our financial statements for the estimated costs of compliance. There are inherent uncertainties in these estimates. Most notably, the uncertainty of policies, enforcement priorities, legislation and regulations related to climate change mitigation strategies pose the greatest risk.

As a carbon steel producer, Nucor could be increasingly affected both directly and indirectly if carbon policy decisions and mandates are not properly implemented. Carbon is an essential raw material in Nucor’s steel production processes. Furthermore, Nucor steel mills utilize EAFs for 100% of their steel melting operations and the costs associated with the decarbonization of electricity generation is a significant concern. Significant new rulemaking or legislation could have a material adverse impact on our results of operations, financial condition and cash flows.

Environmental regulation compliance and remediation could result in substantially increased costs and materially adversely impact our competitive position.

We incur significant costs in meeting our environmental regulation compliance and remediation obligations. The principal federal environmental laws include the CAA, that regulates air emissions; the CWA that regulates water withdrawals and discharges; RCRA, that addresses solid and hazardous waste treatment, storage and disposal; and CERCLA, that governs releases of hazardous substances, and remediation of contaminated sites. Our operations are also subject to state and local environmental laws and regulations. Capital expenditures at our facilities that are associated with environmental regulation compliance for 2021 and 2022 are estimated to be less than $100 million per year.

In addition to the above mentioned statutes, certain revisions to National Air Ambient Quality Standards could make it significantly more difficult for us to obtain construction permits and permits to expand existing operations. Resulting cancellations, delays or unanticipated costs to these projects could negatively impact our ability to generate expected returns on our investments. These regulations can also increase our cost of energy, primarily electricity, which we use extensively in the steelmaking process. We may in the future incur substantially increased costs complying with such regulations, particularly if federal regulatory agencies were to change their enforcement posture with respect to such regulations.

16

Emerging customer preferences for greater product transparency and less GHG intensive materials may put us at a competitive disadvantage or reduce demand for our products.

Numerous states, including Washington, Oregon and New York, are considering establishing requirements for Environmental Product Declarations (“EPDs”) to evaluate environmental impacts of products. California has enacted the “Buy Clean California Act” and California has established Global Warming Potential (GWP) benchmarks through EPDs for certain materials, including certain steel products. Currently, the federal government is considering similar legislation. EPD legislation has the potential to put domestic steel manufacturers at a disadvantage to foreign competitors unless standardized mechanisms are used to fully evaluate products produced by foreign steel producers.

General Risk Factors

The COVID-19 pandemic, as well as similar epidemics and public health emergencies in the future, could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our operations expose us to risks associated with pandemics, epidemics and other public health emergencies, such as the ongoing COVID-19 pandemic which spread from China to many other countries including the United States. In March 2020, the World Health Organization characterized the outbreak of COVID-19 as a pandemic, and the United States declared the COVID-19 pandemic a national emergency.