EX-13

Exhibit 13

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL HIGHLIGHTS |

|

|

(dollar and share amounts in thousands, except per share data)

|

| |

|

2013 |

|

|

2012 |

|

|

% CHANGE |

|

|

|

|

| FOR THE YEAR |

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

|

$19,052,046 |

|

|

|

$19,429,273 |

|

|

-2% |

| Earnings: |

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes

and noncontrolling interests |

|

|

791,123 |

|

|

|

852,940 |

|

|

-7% |

| Provision for income

taxes |

|

|

205,594 |

|

|

|

259,814 |

|

|

-21% |

| Net earnings |

|

|

585,529 |

|

|

|

593,126 |

|

|

-1% |

| Earnings attributable to

noncontrolling interests |

|

|

97,504 |

|

|

|

88,507 |

|

|

10% |

| Net earnings attributable to

Nucor stockholders |

|

|

488,025 |

|

|

|

504,619 |

|

|

-3% |

| Per share: |

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

1.52 |

|

|

|

1.58 |

|

|

-4% |

| Diluted |

|

|

1.52 |

|

|

|

1.58 |

|

|

-4% |

| Dividends declared per

share |

|

|

1.4725 |

|

|

|

1.4625 |

|

|

1% |

| Percentage of net earnings to

net sales |

|

|

2.6% |

|

|

|

2.6% |

|

|

|

| Return on average

stockholders’ equity |

|

|

6.4% |

|

|

|

6.7% |

|

|

|

| Capital expenditures |

|

|

1,230,418 |

|

|

|

1,019,334 |

|

|

21% |

| Depreciation |

|

|

535,852 |

|

|

|

534,010 |

|

|

— |

| Acquisitions (net of cash

acquired) |

|

|

— |

|

|

|

760,833 |

|

|

not meaningful |

|

Sales per employee |

|

|

859 |

|

|

|

906 |

|

|

-5%

|

| AT YEAR END |

|

|

|

|

|

|

|

|

|

|

| Working capital |

|

|

$ 4,449,830 |

|

|

|

$ 3,631,796 |

|

|

23% |

| Property, plant and equipment,

net |

|

|

4,917,024 |

|

|

|

4,283,056 |

|

|

15% |

| Long-term debt (including

current maturities) |

|

|

4,380,200 |

|

|

|

3,630,200 |

|

|

21% |

| Total Nucor stockholders’

equity |

|

|

7,645,769 |

|

|

|

7,641,571 |

|

|

— |

| Per share |

|

|

24.02 |

|

|

|

24.06 |

|

|

— |

| Shares outstanding |

|

|

318,328 |

|

|

|

317,663 |

|

|

— |

|

Employees |

|

|

22,300 |

|

|

|

22,200 |

|

|

—

|

FORWARD-LOOKING STATEMENTS Certain statements made in this annual report

are forward-looking statements that involve risks and uncertainties. The words “believe,” “expect,” “project,” “will,” “should,” “could” and similar expressions are intended to identify

those forward-looking statements. These forward-looking statements reflect the Company’s best judgment based on current information, and although we base these statements on circumstances that we believe to be reasonable when made, there can be

no assurance that future events will not affect the accuracy of such forward-looking information. As such, the forward-looking statements are not guarantees of future performance, and actual results may vary materially from the projected results and

expectations discussed in this report. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward-looking statements include, but are not limited to: (1) the sensitivity of the results of

our operations to prevailing steel prices and changes in the supply and cost of raw materials, including pig iron, iron ore and scrap steel; (2) availability and cost of electricity and natural gas which could negatively affect our cost of

steel production or could result in a delay or cancelation of existing or future drilling within our natural gas working interest drilling programs; (3) critical equipment failures and business interruptions; (4) market demand for steel

products, which, in the case of many of our products, is driven by the level of nonresidential construction activity in the U.S.; (5) competitive pressure on sales and pricing, including pressure from imports and substitute materials;

(6) impairment in the recorded value of inventory, equity investments, fixed assets, goodwill or other long-lived assets; (7) uncertainties surrounding the global economy, including the severe economic downturn in construction markets and

excess world capacity for steel production; (8) fluctuations in currency conversion rates; (9) U.S. and foreign trade policies affecting steel imports or exports; (10) significant changes in laws or government regulations affecting

environmental compliance, including legislation and regulations that result in greater regulation of greenhouse gas emissions that could increase our energy costs and our capital expenditures and operating costs or cause one or more of our permits

to be revoked or make it more difficult to obtain permit modifications; (11) the cyclical nature of the steel industry; (12) capital investments and their impact on our performance; and (13) our safety performance.

|

|

|

|

|

|

22

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

|

| |

|

|

| |

|

|

OVERVIEW

MACROECONOMIC CONDITIONS

After five years of

recession, the worst the United States has experienced in decades, we still do not see any real and sustained signs of a full recovery. Our nation’s unemployment rate remains high due to the loss of millions of jobs during the recession, the

slow pace of the recovery and the uncertainty surrounding domestic fiscal policies. In the face of these economic headwinds, the pace and degree of recovery has been weak and uneven at best, and it has been experienced in fits and starts. While

there has been some recent traction gained in single-family housing starts, nonresidential construction (the sector to which we are most closely tied) has continued to languish. Even though there has been some recent improvement in the U.S. Labor

Department’s U-6 unemployment figures, which include not only unemployed workers but also discouraged workers and those who are working part-time but would like to work full-time, those rates remain historically high and employment is not

expected to regain the peak reached during the most recent economic cycle for several more years. Until a stronger job recovery takes hold, consumer confidence and spending will be inconsistent, indirectly diminishing demand for our products.

Macro-level uncertainties in world markets will almost certainly continue to weigh on global and domestic growth in 2014. We believe our net sales and financial results will be stronger in 2014 than in 2013, but they will continue to be adversely

affected by these general economic factors as well as by the conditions specific to the steel industry that are described below.

CONDITIONS

IN THE STEEL INDUSTRY

The steel industry has always been cyclical in nature, but North American producers of steel and steel products have been facing and

are continuing to face some of the most challenging market conditions they have experienced in decades. The average capacity utilization rate of U.S. steel mills was at a historically unprecedented low of 52% in 2009. Since then, the average

capacity utilization rate increased to approximately 76% in 2013 and 75% in 2012. These rates, though improved, still compare unfavorably to capacity utilization rates of 81% and 87% in 2008 and 2007, respectively. As domestic demand for steel and

steel products is expected to improve only slightly in 2014, it is unlikely that average capacity utilization rates will increase significantly. The average utilization rates of all operating facilities in our steel mills, steel products and raw

materials segments were approximately 74%, 58% and 62%, respectively, in 2013, compared with 74%, 60% and 63% respectively, in 2012.

The steel industry has also

historically been characterized by global overcapacity and intense competition for sales among producers. This aspect of the industry remains true today despite the bankruptcies of numerous domestic steel companies and ongoing global steel industry

consolidation. The recent addition of new production capacity in the United States, as well as the very rapid and extraordinary increase in China’s total production of steel in the last decade, has exacerbated this overcapacity issue

domestically as well as globally.

Foreign imports of steel continued to significantly affect our domestic markets. Imported steel and steel products continue to

present unique challenges for us because foreign producers often benefit from government subsidies, either directly through government-owned enterprises or indirectly through government-owned or controlled financial institutions. Foreign imports of

finished and semi-finished steel accounted for approximately 30% of the U.S. steel market in 2013 despite significant unused domestic capacity. Rebar and hot-rolled bar were impacted especially hard by imports in 2013 as imports of these products

increased by 23% and 15%, respectively, over 2012 levels. Increased imports of bar have translated into even lower domestic utilization rates for that product – utilization in the mid-60% range – and significant decreases in domestic bar

pricing in 2013. Competition from China, the world’s largest producer and exporter of steel, which produces more than 45% of the steel produced globally, is a major challenge in particular. We believe that Chinese producers, many of which are

government-owned in whole or in part, benefit from their government’s manipulation of foreign currency exchange rates and from the receipt of government subsidies, which allow them to sell steel into our markets at artificially low prices.

China is not only selling steel at artificially low prices into our domestic market but also across the globe. When they do so, steel products which would otherwise have

been consumed by the local steel customers in other countries are displaced into global markets, which compounds the issue. In a more indirect manner, but still significant, is the import of fabricated steel products, such as oil country tubular

goods, wind towers and other construction components that were produced in China.

OUR CHALLENGES AND RISKS

Sales of many of our products are dependent upon capital spending in the nonresidential construction markets in the United States, including in the industrial and

commercial sectors, as well as capital spending on infrastructure that is publicly funded such as bridges, schools, prisons and hospitals. Unlike recoveries from past recessions, the recovery from the recession of 2008-2009 has not included a strong

recovery in the severely depressed nonresidential construction market. In fact, while capital spending on nonresidential construction projects is slowly improving, it continues to lack sustained momentum, which is posing a significant challenge to

our business. We do not expect to see strong growth in our net sales until we see a sustained increase in capital spending on these types of construction projects.

Artificially cheap exports by

some of our major foreign competitors to the United States and elsewhere reduce our net sales and adversely impact our financial results. Aggressive enforcement of trade rules by the World Trade Organization to limit unfairly traded imports remains

uncertain, although it is critical to our ability to remain competitive. We have been encouraged by recent actions the United States International Trade Commission has taken on existing antidumping and countervailing duty orders on hot-rolled sheet

steel as well as on imports of rebar that threaten domestic rebar producers. We continue to believe that assertive enforcement of world trade rules must be one of the highest priorities of the United States government.

A major uncertainty we continue to face in our business is the price of our principal raw material, ferrous scrap, which is volatile and often increases rapidly in

response to changes in domestic demand, unanticipated events that decrease the flow of scrap into scrap yards and increased foreign demand for scrap. In periods of rapidly increasing raw material prices in the industry, which is often also

associated with periods of strong or rapidly improving steel market conditions, being able to increase our prices for the products we sell quickly enough to offset increases in the prices we pay for ferrous scrap is challenging but critical to

maintaining our profitability. We attempt to manage this risk via a raw material surcharge mechanism, which our customers understand is a necessary response by us to the market forces of supply and demand for our raw materials. The surcharge

mechanism functions to offset changes in prices of our raw materials and is based upon widely available market indices for prices of scrap and other raw materials. We monitor changes in those indices closely and make adjustments as needed, generally

on a monthly basis, to our surcharges and sometimes directly to the selling prices for our products. The surcharges are determined from a base scrap price and can differ by product. To further help mitigate the scrap price risk, we also aim to

manage scrap inventory levels at the steel mills to match the anticipated demand over a period of the next several weeks for various steel products. Certain scrap substitutes, including pig iron, have longer lead times for delivery than scrap.

During periods of stronger or improving steel market conditions, the surcharge is generally an effective mechanism that facilitates Nucor’s ability to pass through,

relatively quickly, the increased costs of ferrous scrap and scrap substitutes and to protect our gross margins from significant erosion. During weaker or rapidly deteriorating steel market conditions, including the steel market environment of the

past several years, weak steel demand, low industry utilization rates and the impact of imports create an even more intensified competitive environment. All of those factors, to some degree, impact base pricing, which increases the likelihood that

Nucor will experience lower gross margins. During these periods, the surcharge mechanism is less effective at protecting our gross margins; however, there are typically less frequent and smaller raw material cost increases.

Although the majority of our steel sales are to spot market customers who place their orders each month based on their business needs and our pricing competitiveness

compared to both domestic and global producers and trading companies, we also sell contract tons, primarily in our sheet operations. Approximately 65% of our sheet sales was to contract customers in 2013 (65% in 2012), with the balance in the spot

market at the prevailing prices at the time of sale. Steel contract sales outside of our sheet operations are not significant. The amount of tons sold to contract customers depends on the overall market conditions at the time, how the end-use

customers see the market moving forward and the strategy that Nucor management believes is appropriate to the upcoming period. Nucor management considerations include maintaining an appropriate balance of spot and contract tons based on market

projections and appropriately supporting our diversified customer base. The percentage of tons that is placed under contract also depends on the overall market dynamics and customer negotiations. In years of strengthening demand, we typically see an

increase in the percentage of sheet sales sold under contract as our customers have an expectation that transaction prices will rapidly rise and available capacity will quickly be sold out. To mitigate this risk, customers prefer to enter into

contracts in order to obtain committed volumes of supply from the mills. Our contracts include a method of adjusting prices on a periodic basis to reflect changes in the market pricing for steel and/ or scrap. Market indices for steel generally

trend with scrap pricing changes but during periods of steel market weakness, including the market conditions of the past several years, the more intensified competitive steel market environment can cause the sales price indices to result in reduced

gross margins and profitability. Furthermore, since the selling price adjustments are not immediate, there will always be a timing difference between changes in the prices we pay for raw materials and the adjustments we make to our contract selling

prices. Generally, in periods of increasing scrap prices, we experience a short-term margin contraction on contract tons. Conversely, in periods of decreasing scrap prices, we typically experience a short-term margin expansion. Contract sales

typically have terms ranging from six to twelve months.

Another significant uncertainty we face is the cost of energy. The availability and prices of electricity and

natural gas are influenced today by many factors including changes in supply and demand, advances in drilling technology and, increasingly, by changes in public policy relating to energy production and use. Proposed regulation of greenhouse gas

emissions from new and refurbished power plants could increase our cost of electricity in future years, particularly if they are adopted in a form that requires deep reductions in greenhouse gas emissions. Adopting these regulations in an onerous

form could lead to foreign producers that are not affected by them gaining a competitive advantage over us. We are monitoring these regulatory developments closely and will seek to educate public policy makers during the adoption process about their

potential impact on our business.

Finally, due to our natural gas working

interest drilling programs with Encana, a substantial or extended decline in natural gas prices could have a material adverse effect on these programs and, by extension, us. In order to mitigate this risk, we announced a joint decision with Encana

in the fourth quarter of 2013 to temporarily suspend drilling new wells until there is a sustained improvement in natural gas pricing. A substantial or extended decline in the price of natural gas could result in further delays or cancellation of

existing or future drilling programs or curtailment in production at some properties, all of which could have an adverse effect on our revenues, profitability and cash flows. In addition, natural gas drilling and production are subject to intense

federal and state regulation as well as to public interest in environmental protection. Such regulation and interest, when coupled, could result in these drilling programs being forced to comply with certain future regulations, resulting in unknown

impacts on the programs’ ability to achieve the cost and hedge benefits we expect from the programs.

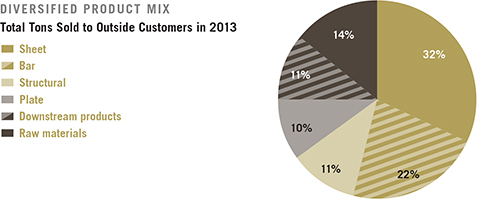

OUR STRENGTHS AND OPPORTUNITIES

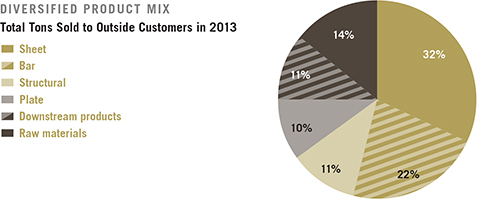

We are North America’s most diversified steel producer. As a result, our short-term performance is not tied to any one market. The pie chart below

shows the diversity of our product mix by total tons sold to outside customers in 2013.

Our highly variable cost structure, combined with our financial strength and liquidity, has allowed us to succeed during cyclical

severely depressed steel industry market conditions in the past. In such times, our incentive-based pay system reduces our payroll costs, both hourly and salary, which helps to offset lower selling prices. Our pay-for-performance system, which is

closely tied to our levels of production, also allows us to keep our work force intact and to continue operating our facilities when some of our competitors with greater fixed costs are forced to shut down some of their facilities. Because we use

electric arc furnaces to produce our steel, we can easily vary our production levels to match short-term changes in demand, unlike our integrated competitors. We believe these strengths also give us opportunities to gain market share during such

times.

EVALUATING OUR OPERATING PERFORMANCE

We report our results of operations in three segments: steel mills, steel products and raw materials. Most of the steel we produce in our mills is sold to outside

customers, but a significant percentage is used internally by many of the facilities in our steel products segment.

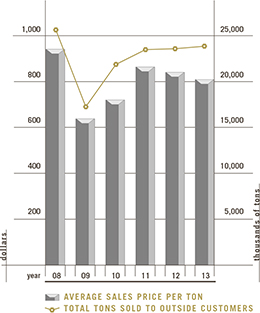

We begin measuring our performance by comparing

our net sales, both in total and by individual segment, during a reporting period with our net sales in the corresponding period in the prior year. In doing so, we focus on changes in and the reasons for such changes in the two key variables that

have the greatest influence on our net sales: average sales price per ton during the period and total tons shipped to outside customers.

We also focus on both dollar

and percentage changes in gross margins, which are key drivers of our profitability, and the reasons for such changes. There are many factors from period to period that can affect our gross margins. One consistent area of focus for us is changes in

“metal margins,” which is the difference between the selling price of steel and the cost of scrap and scrap substitutes. Increases in the cost of scrap and scrap substitutes that are not offset by increases in the selling price of steel

can quickly compress our margins and reduce our profitability.

Another factor affecting our gross margins in any given period is the application of the last-in,

first-out (LIFO) method of accounting to a substantial portion of our inventory (45% of total inventories as of December 31, 2013). LIFO charges or credits for interim periods are based on management’s interim period-end estimates, after

considering current and anticipated market conditions, of both inventory costs and quantities at fiscal year end. The actual year end amounts may differ significantly from these estimated interim amounts. Annual LIFO charges or credits are largely

based on the relative changes in cost and quantities year over year, primarily with raw material inventory in the steel mills segment.

Because we are such a large user

of energy, material changes in energy costs per ton can significantly affect our gross margins as well. Lower energy costs per ton increase our gross margins. Generally, our energy costs per ton are lower when the average utilization rates of all

operating facilities in our steel mills segment are higher.

Changes in marketing, administrative and other expenses, particularly profit sharing costs, can have a

material effect on our results of operations for a reporting period as well. Profit sharing costs vary significantly from period to period as they are based upon changes in our pre-tax earnings and are a reflection of our pay-for-performance system

that is closely tied to our levels of production.

EVALUATING OUR FINANCIAL CONDITION

We evaluate our financial condition each reporting period by focusing primarily on the amounts of and reasons for changes in cash provided by operating activities, our

current ratio, the turnover rate of our accounts receivable and inventories, the amount and reasons for changes in cash used in investing activities, the amounts and reasons for changes in cash provided by or used in financing activities and our

cash and cash equivalents and short-term investments position at period end. Our conservative financial practices have served us well in the past and are serving us well today. As a result, our financial position remains strong despite the negative

effects on our business of the continued weakness in the domestic and global economies.

COMPARISON OF 2013 TO 2012

RESULTS OF OPERATIONS

NET SALES

Net sales to external customers by segment for 2013 and 2012 were as follows:

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(in thousands) |

| Year Ended December 31, |

|

2013 |

|

|

2012 |

|

|

% Change |

|

|

|

|

| Steel mills |

|

$ |

13,311,948 |

|

|

$ |

13,781,797 |

|

|

-3% |

| Steel products |

|

|

3,607,333 |

|

|

|

3,738,381 |

|

|

-4% |

| Raw materials |

|

|

2,132,765 |

|

|

|

1,909,095 |

|

|

12% |

|

|

|

|

|

|

|

|

|

|

|

| Total net sales to external customers |

|

$ |

19,052,046 |

|

|

$ |

19,429,273 |

|

|

-2% |

| |

|

|

|

|

|

|

|

|

|

|

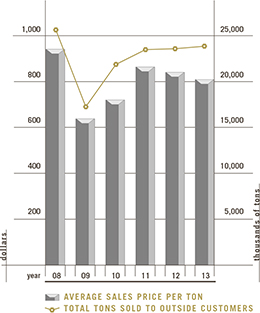

Net sales for 2013 decreased 2% from the prior year. The average sales price per ton decreased 5% from $841 in 2012 to $803 in 2013,

while total tons shipped to outside customers increased 3% in 2013 as compared to 2012.

Net sales in the fourth quarter of 2013 increased 10% compared with the

fourth quarter of 2012 due to a 10% increase in tons shipped to outside customers. The average sales price per ton was $813 in the fourth quarters of 2013 and 2012.

In the steel mills segment, production

and sales tons were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

| Year Ended December 31, |

|

2013 |

|

|

2012 |

|

|

% Change |

| Steel production |

|

|

|

|

19,900 |

|

|

|

|

|

19,865 |

|

|

— |

| Outside steel

shipments |

|

|

|

|

17,733 |

|

|

|

|

|

17,473 |

|

|

1% |

| Inside steel shipments |

|

|

|

|

2,917 |

|

|

|

|

|

2,769 |

|

|

5% |

| Total steel shipments |

|

|

|

|

20,650 |

|

|

|

|

|

20,242 |

|

|

2% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales to external customers in the steel mills segment decreased 3% due to a 5% decrease in the average sales price per ton from $792

in 2012 to $751 in 2013, partially offset by a 1% increase in tons sold to outside customers.

The average selling prices for our sheet, bar and plate products

decreased in 2013 as compared to 2012 due to pressure from imports and excess domestic capacity. Though average selling prices for our sheet products were lower in 2013 than 2012, average selling prices for sheet products increased during the last

half of 2013 due to pricing increases that began late in the second quarter that were supported by competitor supply disruptions and slightly improved demand. Average selling prices for our structural products group increased in 2013 as compared to

2012 because Skyline’s distribution business is included for the entire year in 2013. Skyline was only included in 2012 after its June 20, 2012 acquisition date. Skyline has higher average sales prices for its products because of the

value-added functions it provides to its customers. Demand in nonresidential construction markets is slowly improving but continues to lack sustained momentum. The strongest end markets in 2013 continue to be in manufactured goods, including energy

and automotive, much like they were in 2012.

Tonnage data for the steel products segment is as follows:

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(in thousands) |

| Year Ended December 31, |

|

2013 |

|

|

2012 |

|

|

% Change |

| Joist production |

|

|

342 |

|

|

|

291 |

|

|

18% |

| Deck sales |

|

|

334 |

|

|

|

308 |

|

|

8% |

| Cold finished sales |

|

|

474 |

|

|

|

492 |

|

|

-4% |

| Fabricated concrete reinforcing steel sales

|

|

|

1,065 |

|

|

|

1,180 |

|

|

-10%

|

Net sales to external customers in the steel products segment decreased 4% from 2012 due to a 3% decrease in tons sold to outside

customers and a 1% decrease in the average sales price per ton from $1,393 to $1,375. The 10% decrease in volume of our rebar fabricated products in 2013 as compared to 2012 was partially offset by a 3% increase in the average sales price per ton.

Selling prices of our joist and deck products decreased in 2013 as compared to 2012, but these decreases were more than offset by increased sales volumes due to moderately improved demand in nonresidential construction. Pricing and volumes of cold

finished bar products decreased from the prior year. Steel products segment shipments to external customers decreased 6% in the fourth quarter of 2013 from the third quarter of 2013 because of typical seasonality in the nonresidential construction

market. Tons shipped to external customers in the fourth quarter of 2013 increased 3% over the fourth quarter of 2012. Though we have seen slow improvement in demand related to nonresidential construction, that improvement has lacked sustained

momentum, causing net sales in the steel products segment to remain depressed.

Sales for the raw materials segment increased 12% from 2012 primarily due to

increased volumes in DJJ’s brokerage and processing operations and increased volumes at our natural gas drilling working interests, partially offset by decreased pricing experienced by DJJ. Raw materials segment sales increased 25% in the

fourth quarter of 2013 as compared to the fourth quarter of 2012, due mainly to increases in volumes at DJJ’s brokerage operations and at our natural gas drilling working interests. Approximately 83% of outside sales in the raw materials

segment in 2013 were from brokerage operations of DJJ and approximately 12% of the outside sales were from the scrap processing facilities (85% and 13%, respectively, in 2012).

GROSS

MARGIN

In 2013, Nucor recorded gross margins of $1.41 billion (7%) compared to $1.51 billion (8%) in 2012. The year-over-year dollar and gross

margin percentage decreases were primarily the result of the 5% decrease in the average sales price per ton, partially offset by the 3% increase in tons shipped to outside customers. Additionally, gross margins were impacted by the following

factors:

|

|

|

|

|

|

|

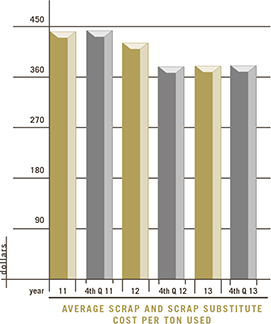

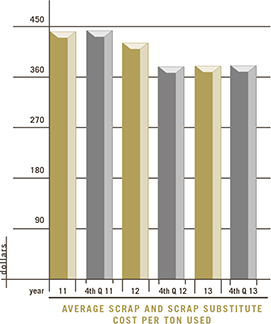

| • |

|

In the steel mills segment, the average scrap and scrap substitute cost per ton used decreased 8% from $407 in 2012 to $376 in 2013; however, metal margins also decreased for our sheet, bar and plate products from

2012 due to the previously mentioned decreases in selling prices in those categories. Metal margin dollars for all of our steel mill products increased in the fourth quarter of 2013 as compared to the fourth quarter of 2012. Metal margins increased

in the fourth quarter of 2013 as compared to the third quarter of 2013 due to increased metal margins from our sheet, structural and plate products. |

|

|

|

|

|

|

|

|

|

|

Scrap prices are driven by global supply and demand for scrap and other iron-based raw materials used to make steel. We experienced less quarterly volatility in scrap costs during 2013 than in 2012. We expect that early 2014

conditions in the domestic scrap market will be very dependent on the region of the country where they are located. Some regions are experiencing less export demand while weather conditions in other regions are negatively impacting the flow of scrap

into scrap yards. We anticipate low volatility in scrap costs going forward until we see stronger market demand either domestically or globally. |

|

|

|

|

|

• |

|

Nucor’s gross margins are significantly impacted by the application of the

LIFO method of accounting. LIFO charges or credits are largely based on the relative changes in cost and quantities year over year, primarily within raw material inventory in the steel mills segment. The average scrap and scrap substitute cost per

ton in ending inventory within our steel mills segment at December 31, 2013 increased 3% as compared to December 31, 2012. Ending inventory quantities also increased as compared to December 31, 2012. As a result of these factors,

Nucor recorded a LIFO charge of $17.4 million in 2013 (a LIFO credit of $155.9 million in 2012). The increases in cost per ton were driven by market conditions at the end of 2013, which experienced stronger demand for steel and raw materials than

market conditions at the end of 2012. |

|

| |

In the fourth quarter of 2013, Nucor recorded a LIFO charge of $17.4

million compared with a LIFO credit of $71.9 million in the fourth quarter of 2012. |

|

|

|

| • |

|

Nucor’s 2012 gross margins were negatively impacted by $48.8 million in inventory-related purchase accounting adjustments associated with our acquisition of Skyline (none in 2013). Purchase accounting adjustments

related to Skyline were $12.0 million in the fourth quarter of 2012 with none being recorded in the fourth quarter of 2013. |

|

|

|

| • |

|

Gross margins at our rebar fabrication businesses increased significantly in 2013 as compared to 2012 due to higher average sales prices and the effects of management initiatives that have resulted in lower costs, better

selling strategies and improved supplier relationships. With the exception of the fourth quarter, in which margins were down slightly from the prior year fourth quarter, the rebar fabrication businesses had higher gross margins in each quarter of

2013 than in the comparable quarter of 2012. |

|

|

|

| • |

|

Total energy costs decreased approximately $1 per ton from 2012 to 2013, primarily due to the negative impact of natural gas hedge

settlements on our overall natural gas costs in 2012. Due to the efficiency of Nucor’s steel mills, energy costs remained less than 6% of the sales dollar in 2013 and 2012.

|

|

| |

In the fourth quarter of 2013, total energy costs decreased approximately $2 per ton from the third quarter of 2013 due primarily to lower electricity unit costs, and decreased approximately $3 per ton from the fourth

quarter of 2012 primarily due to natural gas hedge settlement costs in the fourth quarter of last year. |

|

|

|

| • |

|

Gross margins related to DJJ’s scrap processing operations decreased significantly during 2013 compared to 2012 due to excess shredding capacity increasing DJJ’s cost of scrap purchases and weather-related

effects in the first quarter of 2013 that reduced the flow of scrap into our scrap processing operations. |

|

MARKETING,

ADMINISTRATIVE AND OTHER EXPENSES

A major component of marketing, administrative and other expenses is profit sharing and other incentive compensation

costs. These costs, which are based upon and fluctuate with Nucor’s financial performance, decreased from 2012 to 2013. In 2013, profit sharing costs consisted of $71.7 million of contributions, including the Company’s matching

contribution, made to the Company’s Profit Sharing and Retirement Savings Plan for qualified employees ($77.7 million in 2012). Other bonus costs also fluctuate based on Nucor’s achievement of certain financial performance goals, including

comparisons of Nucor’s financial performance to peers in the steel industry and other companies. Stock-based compensation included in marketing, administrative and other expenses decreased by 8% to $22.9 million in 2013 compared with $25.0

million in 2012 and includes costs associated with vesting of stock awards granted in prior years.

Of the $27.0 million increase in marketing, administrative and

other expenses in 2013 as compared to 2012, $15.3 million was due to the inclusion of Skyline’s results for the entire 2013 year as compared to only being included after its June 2012 acquisition date during 2012. Additionally, in the third

quarter of 2013, a storage dome collapsed at Nucor Steel Louisiana in St. James Parish. As a result, Nucor recorded a partial write-down of assets at the facility, including $7.0 million of inventory and $21.0 million of property, plant and

equipment, offset by a $14.0 million insurance receivable that was based on management’s estimate of probable insurance recoveries. Included in marketing, administrative and other expenses in 2012 was a $17.6 million loss on the sale of the

assets of Nucor Wire Products Pennsylvania, Inc.

EQUITY IN (EARNINGS) LOSSES OF UNCONSOLIDATED AFFILIATES

Nucor recorded equity method investment earnings of $9.3 million in 2013 compared with losses of $13.3 million in 2012. The equity method investment results included

amortization expense and other purchase accounting adjustments. The improvement in the equity method investment results in 2013 from 2012 is primarily due to greater equity method earnings at NuMit, a decrease in losses at Duferdofin Nucor and

earnings at Hunter Ridge (acquired in November 2012). Equity in earnings of unconsolidated affiliates was $6.6 million in the fourth quarter of 2013 compared to losses of $4.2 million in the fourth quarter of 2012 and earnings of $2.3 million in the

third quarter of 2013. The improvement in equity method earnings in the fourth quarter of 2013 from the fourth quarter of last year is mainly due to an increase in equity method earnings at NuMit as well as a decrease in losses at Duferdofin Nucor.

The improvement in equity method earnings in the fourth quarter of 2013 from the previous quarter is primarily due to a decrease in losses at Duferdofin Nucor.

IMPAIRMENT OF NON-CURRENT ASSETS

In 2013, Nucor incurred no charges for impairment of non-current assets compared to $30.0 million in

2012. In the second quarter of 2012, Nucor recorded a $30.0 million impairment charge related to its equity method investment in Duferdofin Nucor (see Note 10 to the Consolidated Financial Statements).

INTEREST EXPENSE (INCOME)

Net interest expense is

detailed below:

|

|

|

|

|

|

|

|

|

| Year Ended December 31, |

|

2013 |

|

|

2012 |

|

| Interest expense |

|

$ |

151,986 |

|

|

$ |

173,503 |

|

| Interest income |

|

|

(5,091 |

) |

|

|

(11,128 |

) |

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

$ |

146,895 |

|

|

$ |

162,375 |

|

| |

|

|

|

|

|

|

|

|

The 12% decrease in gross interest expense from 2012 is primarily attributable to a 6% decrease in average debt outstanding and a 2%

decrease in the average interest rate. In 2013, Nucor issued $1.0 billion of new notes at a lower weighted average interest rate than the $900.0 million of debt that matured between the fourth quarter of 2012 and the second quarter of 2013. Gross

interest income decreased 54% due to a 50% decrease in average investments and a 45% decrease in the average interest rate on investments.

EARNINGS

BEFORE INCOME TAXES AND NONCONTROLLING INTERESTS

Earnings before income taxes and noncontrolling interests by segment for 2013 and 2012 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year Ended December 31, |

|

|

|

2013 |

|

|

|

|

2012 |

|

| Steel mills |

|

|

|

$ |

1,156,715 |

|

|

|

|

$ |

1,162,270 |

|

| Steel products |

|

|

|

|

82,129 |

|

|

|

|

|

(17,140 |

) |

| Raw materials |

|

|

|

|

13,686 |

|

|

|

|

|

55,264 |

|

| Corporate/eliminations |

|

|

|

|

(461,407 |

) |

|

|

|

|

(347,454 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes and noncontrolling interests |

|

|

|

$ |

791,123 |

|

|

|

|

$ |

852,940 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before income taxes and noncontrolling interests in the steel mills segment in 2013 decreased slightly from 2012. Gross margin

was negatively affected in 2013 by lower metal margin dollars resulting from factors discussed above. The profitability of the steel mills segment in 2013 benefited from improved results from the NuMit and Duferdofin Nucor equity method investments

as compared to 2012. Other factors impacting the profitability of the steel mills segment in 2012 that did not occur in 2013 were the $30.0 million impairment charge related to Duferdofin Nucor and the $48.8 million of inventory-related purchase

accounting adjustments related to Skyline. Earnings before income taxes and noncontrolling interests in the steel mills segment increased significantly in the fourth quarter of 2013 as compared to the fourth quarter of 2012 due to more favorable

market conditions in our sheet mills resulting from competitor supply disruptions that began late in the second quarter and slightly improved demand. Although conditions are slowly improving from historically low levels, the nonresidential

construction market continues to lack sustained momentum. The strongest end markets continue to be in manufactured goods, including energy and automotive.

The steel

products segment had earnings before income taxes and noncontrolling interests in 2013 as compared to a loss in 2012. Although the average sales price and volume for the segment were lower in 2013 than 2012, profitability in our joist, cold finish

and rebar fabrication businesses improved from 2012. The largest increase in profitability was in our rebar fabrication businesses, which experienced higher average sales prices and the effects of management initiatives that have resulted in lower

costs, better selling strategies and improved supplier relationships. The steel products segment’s 2012 results were impacted by the $17.6 million loss on the sale of assets of Nucor Wire Products Pennsylvania, Inc. in the third quarter of

2012. In 2013, the steel products segment experienced its first profitable year since 2008. Though the profitability of the steel products segment has improved, conditions in the nonresidential construction markets continue to negatively impact the

results of the segment.

The profitability of our raw materials segment decreased from 2012. Difficult conditions in the scrap processing industry have had a

negative impact on the profitability of the scrap processing operations of DJJ since the first quarter of 2012. During this time, excess shredding capacity has increased competition and therefore the cost of raw materials while the selling price of

scrap has decreased in 2013 as compared to 2012. Also negatively affecting profitability in the raw materials segment were the third quarter 2013 charges related to the net $14.0 million write-down of inventory and property, plant and equipment as a

result of the dome collapse at Nucor Steel Louisiana. Nucor Steel Louisiana also had increased startup costs in 2013 as it began production in late December. An unplanned 18-day outage at our Trinidad DRI facility in early 2013 also contributed to

lower profitability for the raw materials segment in 2013 as compared to 2012.

The decrease in results in Corporate/eliminations in 2013 was primarily due to a LIFO

charge of $17.4 million in 2013 as compared to a $155.9 million LIFO credit in 2012.

NONCONTROLLING INTERESTS

Noncontrolling interests represent the income attributable to the minority interest partners of Nucor’s joint ventures, primarily Nucor-Yamato Steel Company (NYS) of

which Nucor owns 51%. The 10% increase in earnings attributable to noncontrolling interests in 2013 over the previous year was primarily due to increased margins as a result of a shift in product mix at NYS. Under the NYS limited partnership

agreement, the minimum amount of cash to be distributed each year to the partners is the amount needed by each partner to pay applicable U.S. federal and state income taxes.

PROVISION FOR INCOME TAXES

The effective tax rate

in 2013 was 26.0% compared with 30.5% in 2012. The change in the rate between 2012 and 2013 was primarily due to a $21.3 million out-of-period adjustment to the deferred tax balances recorded in 2013. The out-of-period item did not have a material

impact in the current or any previously reported period. Nucor has concluded U.S. federal income tax matters for years through 2009. The 2010 through 2013 tax years are open to examination by the Internal Revenue Service. The Canada Revenue Agency

has completed an audit examination for the periods 2006 to 2008 for Harris Steel Group Inc. and subsidiaries with immaterial adjustments to the income tax returns. The tax years 2009 through 2013 remain open to examination by other major taxing

jurisdictions to which Nucor is subject (primarily Canada and other state and local jurisdictions).

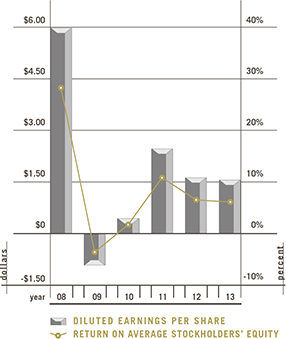

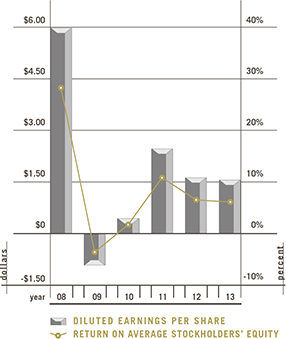

NET EARNINGS

AND RETURN ON EQUITY

Nucor reported net earnings of $488.0 million, or $1.52 per diluted share, in 2013 compared to net earnings of $504.6 million, or

$1.58 per diluted share, in 2012. Net earnings attributable to Nucor stockholders as a percentage of net sales were 3% in both 2013 and 2012. Return on average stockholders’ equity was 6% and 7% in 2013 and 2012, respectively.

COMPARISON OF 2012 TO 2011

RESULTS OF OPERATIONS

NET SALES

Net sales to external customers by

segment for 2012 and 2011 were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year Ended December 31, |

|

2012 |

|

|

2011 |

|

|

% Change |

|

| Steel mills |

|

$ |

13,781,797 |

|

|

$ |

14,463,683 |

|

|

|

-5% |

|

| Steel products |

|

|

3,738,381 |

|

|

|

3,431,490 |

|

|

|

9% |

|

| Raw materials |

|

|

1,909,095 |

|

|

|

2,128,391 |

|

|

|

-10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net sales to external customers |

|

$ |

19,429,273 |

|

|

$ |

20,023,564 |

|

|

|

-3% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales for 2012 decreased 3% from the prior year. The average sales price per ton decreased 3% from $869 in 2011 to $841 in 2012,

while total tons shipped to outside customers only slightly increased.

In the steel mills segment, production and sales tons were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year Ended December 31, |

|

2012 |

|

|

2011 |

|

|

% Change |

|

| Steel production |

|

|

19,865 |

|

|

|

19,561 |

|

|

|

2% |

|

| Outside steel

shipments |

|

|

17,473 |

|

|

|

16,796 |

|

|

|

4% |

|

| Inside steel shipments |

|

|

2,769 |

|

|

|

3,329 |

|

|

|

-17% |

|

| Total steel shipments |

|

|

20,242 |

|

|

|

20,125 |

|

|

|

1% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales to external customers

in the steel mills segment decreased 5% in 2012 from 2011 due to a decrease in the average sales price per ton, partially offset by an increase in tons sold to outside customers.

Tonnage data for the steel products segment is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year Ended December 31, |

|

2012 |

|

|

2011 |

|

|

% Change |

|

| Joist production |

|

|

291 |

|

|

|

288 |

|

|

|

1% |

|

| Deck sales |

|

|

308 |

|

|

|

312 |

|

|

|

-1% |

|

| Cold finished sales |

|

|

492 |

|

|

|

494 |

|

|

|

— |

|

| Fabricated concrete reinforcing steel sales

|

|

|

1,180 |

|

|

|

1,074 |

|

|

|

10% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales to external customers in the steel products segment increased 9% over 2011 due to a 4% increase in tons sold to outside

customers and a 4% increase in the average sales price per ton from $1,335 to $1,393. Pricing of joists, deck, metal buildings and components and rebar fabricated products improved over the prior year as nonresidential construction activity showed

modest improvement; however, sales in the steel products segment were depressed as demand in the nonresidential construction market remained well below historical averages. Pricing and volumes of cold finished bar products decreased slightly from

2011. Sales of rebar fabricated products contributed most significantly to the year-over-year increases in volumes and prices in the steel products segment due to the modest improvement in nonresidential construction activity.

Sales for the raw materials segment decreased 10% from 2011 primarily due to decreased pricing and decreased volumes in DJJ’s brokerage operations. Approximately 85%

of outside sales in the raw materials segment in 2012 were from brokerage operations of DJJ and approximately 13% of the outside sales were from the scrap processing facilities (86% and 13%, respectively, in 2011).

GROSS MARGIN

In 2012, Nucor recorded gross

margins of $1.51 billion (8%) compared to $1.88 billion (9%) in 2011. The year-over-year dollar and gross margin percentage decreases were primarily the result of the 3% decrease in the average sales price per ton. Additionally, gross

margins were impacted by the following factors:

| • |

|

In the steel mills segment, the average scrap and scrap substitute cost per ton used decreased 7% from $439 in 2011 to $407 in 2012; however, metal margins also decreased from 2011.

|

The average scrap and scrap substitute cost per ton used decreased each quarter during 2012. However, the average sales price

per ton also decreased each quarter of 2012 for all of the products within our steel mills segment except for structural. The decrease in sales prices and the resulting decrease in metal margins is primarily the result of new domestic suppliers and

very high import levels in 2012 that increased from 2011 levels.

| • |

|

The average scrap and scrap substitute cost per ton in ending inventory within our steel mills segment at December 31, 2012 decreased 13% as compared to December 31, 2011, which was partially offset by

increased quantities included in ending inventory. As a result of these factors, Nucor recorded a LIFO credit of $155.9 million (a LIFO charge of $142.8 million in 2011). |

| • |

|

Nucor’s 2012 gross margins were negatively impacted by $48.8 million in inventory-related purchase accounting adjustments associated with our acquisition of Skyline. |

| • |

|

Total energy costs decreased $2 per ton from 2011 to 2012 due primarily to lower natural gas unit costs. Due to the efficiency of Nucor’s steel mills, energy costs remained less than 6% of the sales dollar in 2012

and 2011. |

| • |

|

Gross margins related to DJJ’s scrap processing operations were significantly lower in 2012 compared to 2011. The decrease was due to conditions in the scrap processing industry, in which excess shredding capacity

increased competition for raw materials. As scrap selling prices decreased throughout 2012, DJJ experienced severe downward pressure on margins. |

| • |

|

Gross margins were impacted in the fourth quarter of 2011 by a non-cash gain of $29.0 million as a result of the correction of an actuarial calculation related to the medical plan covering certain eligible early

retirees. |

| • |

|

Gross margins in 2012 were positively affected by the improved performance of our steel products segment, which experienced gross margin improvement between the third and fourth quarters of 2012.

|

MARKETING,

ADMINISTRATIVE AND OTHER EXPENSES

Profit sharing costs decreased from 2011 to 2012. In 2012, profit sharing costs consisted of $77.7 million of

contributions, including the Company’s matching contribution, made to the Company’s Profit Sharing and Retirement Savings Plan for qualified employees ($117.7 million in 2011). Stock-based compensation included in marketing, administrative

and other expenses increased 1% to $25.0 million in 2012 compared with $24.7 million in 2011 and includes costs associated with vesting of stock awards granted in prior years.

In 2012, marketing, administrative and other expenses included a charge of $17.6 million for the loss on the sale of the assets of Nucor Wire Products Pennsylvania, Inc.

Also contributing to the increase in marketing, administrative and other expenses in 2012 was the inclusion of Skyline’s results since the acquisition date and a general increase in the steel products segment related to increased shipments to

outside customers.

EQUITY IN LOSSES OF UNCONSOLIDATED AFFILIATES

Nucor incurred equity method investment losses of $13.3 million and $10.0 million in 2012 and 2011, respectively. The increase in the equity method investment losses is

primarily attributable to an increase in losses generated by Duferdofin Nucor S.r.l.

IMPAIRMENT OF NON-CURRENT ASSETS

In 2012, Nucor recorded $30.0 million in charges for impairment of non-current assets compared with $13.9 million in 2011. In the second quarter of 2012, Nucor incurred a

$30.0 million charge related to its equity method investment in Duferdofin Nucor. The entire impairment charge recorded in 2011 relates to the impairment of Nucor’s investment in a dust recycling joint venture that has since been terminated

(see Note 10 to the Consolidated Financial Statements).

INTEREST EXPENSE (INCOME)

Net interest expense is detailed below:

|

|

|

|

|

|

|

|

|

| Year Ended December 31, |

|

2012 |

|

|

2011 |

|

| Interest expense |

|

|

$173,503 |

|

|

|

$178,812 |

|

| Interest income |

|

|

(11,128 |

) |

|

|

(12,718 |

) |

| Interest expense, net |

|

|

$162,375 |

|

|

|

$166,094 |

|

| |

|

|

|

|

|

|

|

|

The 3% decrease in gross interest expense from 2011 is primarily attributable to a 3% decrease in average debt outstanding and a slight

decrease in the average interest rate. Gross interest income decreased 13% due primarily to a decrease in average investments.

EARNINGS

BEFORE INCOME TAXES AND NONCONTROLLING INTERESTS

Earnings before income taxes and noncontrolling interests by segment for 2012 and 2011 are as follows:

|

|

|

|

|

|

|

|

|

| Year Ended December 31, |

|

2012 |

|

|

2011 |

|

| Steel mills |

|

|

$1,162,270 |

|

|

|

$1,813,155 |

|

| Steel products |

|

|

(17,140 |

) |

|

|

(60,282 |

) |

| Raw materials |

|

|

55,264 |

|

|

|

156,180 |

|

| Corporate/eliminations |

|

|

(347,454 |

) |

|

|

(657,241 |

) |

| Earnings before income taxes and noncontrolling interests |

|

|

$ 852,940 |

|

|

|

$1,251,812 |

|

| |

|

|

|

|

|

|

|

|

Earnings before income taxes and noncontrolling interests in the steel mills segment for 2012 decreased 36% from 2011. A major factor

behind the decrease is that metal margin dollars decreased from 2011 resulting from the factors described above. Other factors impacting the profitability of the steel mills segment in 2012 were the $30.0 million impairment charge related to

Duferdofin Nucor and the $48.8 million of inventory-related purchase accounting adjustments related to Skyline. The market conditions that impacted the steel mills segment include an import surge across most products that began late in 2011 and

continued through 2012. In addition, U.S. sheet steel markets were negatively impacted by new domestic supply that began ramping up production in 2011. The strongest end markets were manufactured goods, including automotive, energy and heavy

equipment.

Losses before income taxes and

noncontrolling interests in the steel products segment in 2012 decreased from 2011. The 2012 loss was impacted by the $17.6 million loss on the sale of assets of Nucor Wire Products Pennsylvania, Inc. At our rebar fabrication businesses, 2012

shipments to outside customers increased 10% over 2011, which led to improved profitability within the segment. Although the segment experienced market share gains, improved pricing and effective management of costs, the profitability of this

segment was weak due to the continued challenging conditions in the nonresidential construction market.

The profitability of our raw materials segment, particularly

DJJ, decreased significantly from 2011 primarily due to margin compression at the scrap processing operations resulting from falling scrap selling prices and excess shredding capacity.

The improvements in results in Corporate/eliminations in 2012 were primarily due to the change in LIFO from a charge to a credit and lower profit sharing and incentive

compensation costs.

NONCONTROLLING INTERESTS

The 7% increase in noncontrolling interests from 2011 to 2012 was primarily attributable to the increased earnings of NYS, which were primarily due to increases in

volumes and changes in product mix.

PROVISION FOR INCOME TAXES

The effective tax rate in 2012 was 30.5% compared with 31.2% in 2011. The change in the rate between 2011 and 2012 was primarily due to the change in relative proportions

of net earnings attributable to noncontrolling interests to total pre-tax earnings, a greater benefit in 2012 from the domestic manufacturing deduction and the recognition of a deferred tax asset related to state tax credit carryforwards and the

adjustment of tax expense to previously filed returns.

NET EARNINGS AND RETURN ON EQUITY

Nucor reported net earnings of $504.6 million, or $1.58 per diluted share, in 2012 compared to net earnings of $778.2 million, or $2.45 per diluted share, in 2011. Net

earnings attributable to Nucor stockholders as a percentage of net sales were 3% in 2012 and 4% in 2011. Return on average stockholders’ equity was 7% and 11% in 2012 and 2011, respectively.

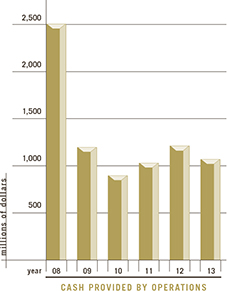

LIQUIDITY AND CAPITAL RESOURCES

Cash flows

provided by operating activities provide us with a significant source of liquidity. When needed, we also have external short-term financing sources available, including the issuance of commercial paper and borrowings under our bank credit

facilities. We also issue long-term debt from time to time.

In 2013, Nucor’s $1.5 billion revolving credit facility was amended and restated to extend the

maturity date to August 2018. The revolving credit facility was undrawn and Nucor had no commercial paper outstanding at December 31, 2013. We believe our financial strength is a key strategic advantage among domestic steel producers,

particularly during recessionary business cycles. We currently carry the highest credit ratings of any metals and mining company in North America with an A rating from Standard & Poor’s and a Baa1 rating from Moody’s. Based upon

these factors, we expect to continue to have adequate access to the capital markets at a reasonable cost of funds for liquidity purposes when needed. Our credit ratings are dependent, however, upon a number of factors, both qualitative and

quantitative, and are subject to change at any time. The disclosure of our credit ratings is made in order to enhance investors’ understanding of our sources of liquidity and the impact of our credit ratings on our cost of funds.

Nucor’s cash and cash equivalents and short-term investments position remains robust at $1.51 billion as of December 31, 2013. Approximately $173.2 million and

$186.2 million of the cash and cash equivalents position at December 31, 2013 and December 31, 2012, respectively, was held by our majority-owned joint ventures.

|

|

|

|

|

| Selected Measures of Liquidity |

|

|

|

|

|

|

|

|

|

|

|

| December 31, |

|

2013 |

|

|

2012 |

|

| Cash and cash

equivalents |

|

$ |

1,483,252 |

|

|

$ |

1,052,862 |

|

| Short-term investments |

|

|

28,191 |

|

|

|

104,167 |

|

| Restricted cash and investments |

|

|

— |

|

|

|

275,163 |

|

| Working capital |

|

|

4,449,830 |

|

|

|

3,631,796 |

|

| Current ratio

|

|

|

3.3 |

|

|

|

2.8 |

|

The current ratio was 3.3 at year end

2013 compared with 2.8 at year end 2012. The current ratio was positively impacted by a 31% increase from 2012 in cash and cash equivalents and short-term investments. The increase in cash and cash equivalents and short-term investments was

primarily due to proceeds from the issuance of debt and cash generated by operations, partially offset by cash paid for capital expenditures and dividend payments. In addition, inventories increased by 12% due primarily to increases at the new DRI

plant in Louisiana, as well as an 8% increase in inventory tons on hand and a 3% increase in scrap costs in inventory over the prior year. The current ratio was also positively impacted by an 88% decrease from 2012 in long-term debt due within one

year and short-term debt, due primarily to the repayment of $250 million of debt in the second quarter of 2013. The next significant debt maturity is not until 2017.

Accounts receivable increased by 6% over 2012 due primarily to the 10% increase in net sales in the fourth quarter of 2013 compared with the prior year fourth quarter.

This increase is the result of a 10% increase in outside shipments in the fourth quarter of 2013 as compared with the fourth quarter of 2012. In 2013, total accounts receivable turned approximately every five weeks and inventories turned

approximately every seven weeks. This compares to turns of every five weeks for accounts receivable and every six weeks for inventory in 2012. Inventory turnover has slowed slightly from historical rates due mainly to the acquisition of Skyline

which, as a distributor, must keep a larger supply of inventory on hand.

Funds provided by operations, cash and cash equivalents, short-term investments and new

borrowings under existing credit facilities are expected to be adequate to meet future capital expenditure and working capital requirements for existing operations for at least the next 24 months.

|

|

|

|

|

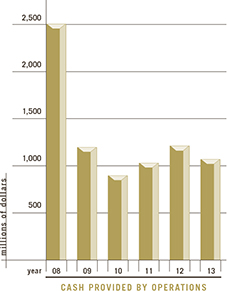

| We have a simple capital structure with no off-balance sheet arrangements or relationships with unconsolidated special purpose entities that we

believe could have a material impact on our financial condition or liquidity. OPERATING ACTIVITIES Cash provided by operating activities was $1.08 billion in 2013 compared with $1.20 billion in 2012, a decrease of

10%. The change in operating assets and liabilities of ($235.2) million in 2013 compared with ($86.1) million in 2012 was partially offset by the increase in deferred income taxes over the prior year. The funding of working capital increased over

the prior year due mainly to increases in accounts receivable and inventory, somewhat offset by a decrease in cash provided by the change in accounts payable. Accounts receivable increased due to increased outside shipments in the fourth quarter

over the prior year fourth quarter. Inventory increased due to an increase in inventory on hand and an increase in scrap prices in inventory from year end 2012. The increase in scrap prices also drove the increase in the accounts payable

balance. INVESTING ACTIVITIES

Our business is capital intensive; therefore, cash used in investing activities primarily represents capital expenditures for new facilities, the expansion and upgrading

of existing facilities and the acquisition of other companies. Nucor invested $1.20 billion in new facilities |

|

|

|

|

or upgrading of existing facilities in 2013 compared with $947.6 million in 2012, an increase of 26%. This increase in capital

expenditures was in large part due to the construction of our DRI facility in Louisiana and the funding of our natural gas working interest drilling program. Offsetting the increase in capital expenditures was the decrease in acquisitions. In 2012,

Nucor invested $760.8 million in the acquisition of other companies (primarily Skyline); however, there were no acquisitions in 2013. Another factor contributing to the increase in cash used in investing activities was the net decrease of $1.22

billion in proceeds from the sale of investments and restricted investments (net of purchases) and changes in restricted cash from 2012.

FINANCING ACTIVITIES

Cash provided by financing

activities was $196.0 million in 2013 compared with cash used in financing activities of $1.15 billion in 2012. The increase in cash provided by financing activities is primarily attributable to the issuance of debt in 2013 and a decrease in

required debt repayments in 2013 than 2012. In the third quarter of 2013, Nucor issued $500.0 million of 4.0% notes due in 2023 and $500.0 million of 5.2% notes due in 2043. The bond offering effectively refinanced $900.0 million of debt that

matured between the fourth quarter of 2012 ($650.0 million) and the second quarter of 2013 ($250.0 million). The weighted average interest rate of the new debt is 35 basis points lower than the retired debt, and the new debt also lengthens our debt

maturity profile with its weighted average term to maturity of 20 years. Additionally, over 99% of our long-term debt matures in 2017 and beyond.

In 2013, Nucor

increased its quarterly base dividend resulting in dividends paid of $471.0 million ($466.4 million in 2012).

Although there were no repurchases in 2013 or 2012,

approximately 27.2 million shares remain authorized for repurchase under the Company’s stock repurchase program.

Our credit facility includes only

one financial covenant, which is a limit of 60% on the ratio of funded debt to total capitalization. In addition, the credit facility contains customary non-financial covenants, including a limit on Nucor’s ability to pledge the Company’s

assets and a limit on consolidations, mergers and sales of assets. Our funded debt to total capital ratio was 36% and 32% at year-end 2013 and 2012, respectively, and we were in compliance with all other covenants under our credit facility.

MARKET RISK

Nucor’s largest exposure to

market risk is in our steel mills and steel products segments. Our utilization rates for the steel mills and steel products facilities for the fourth quarter of 2013 were 75% and 58%, respectively. A significant portion of our steel and steel

products segments sales are into the commercial, industrial and municipal construction markets, which continue to be depressed. Our largest single customer in 2013 represented approximately 5% of sales and consistently pays within terms. In the raw

materials segment, we are exposed to price fluctuations related to the purchase of scrap steel and iron ore. Our exposure to market risk is mitigated by the fact that our steel mills use a significant portion of the products of this segment.

The majority of Nucor’s tax-exempt industrial revenue bonds (IDRBs), including the Gulf Opportunity Zone bonds, have variable interest rates that are adjusted

weekly, with the rate of one IDRB adjusted annually. These IDRBs represent 24% of Nucor’s long-term debt outstanding at December 31, 2013. The remaining 76% of Nucor’s long-term debt is at fixed rates. Future changes in interest rates

are not expected to significantly impact earnings. From time to time, Nucor makes use of interest rate swaps to manage interest rate risk. As of December 31, 2013, there were no such interest rate swap contracts outstanding. Nucor’s

investment practice is to invest in securities that are highly liquid with short maturities. As a result, we do not expect changes in interest rates to have a significant impact on the value of our investment securities recorded as short-term

investments.

Nucor also uses derivative financial instruments from time to time to partially manage its exposure to price risk related to natural gas purchases used

in the production process as well as scrap, copper and aluminum purchased for resale to its customers. In addition, Nucor uses forward foreign exchange contracts from time to time to hedge cash flows associated with certain assets and liabilities,

firm commitments and anticipated transactions. Nucor generally does not enter into derivative instruments for any purpose other than hedging the cash flows associated with specific volumes of commodities that will be purchased and processed or sold

in future periods and hedging the exposures related to changes in the fair value of outstanding fixed rate debt instruments and foreign currency transactions. Nucor recognizes all material derivative instruments in the consolidated balance sheets at

fair value.

The Company is exposed to foreign currency risk through its operations in Canada, Europe, Trinidad and Colombia. We periodically use derivative

contracts to mitigate the risk of currency fluctuations.

CONTRACTUAL OBLIGATIONS AND OTHER COMMERCIAL COMMITMENTS

The following table sets forth our contractual obligations and other commercial commitments as of December 31, 2013 for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Payments Due By Period |

|

| Contractual Obligations |

|

Total |

|

|

2014 |

|

|

2015 - 2016 |

|

|

2017 - 2018 |

|

|

2019 and thereafter |

|

| Long-term debt |

|

|

$ 4,380,200 |

|

|

|

$ 3,300 |

|

|

|

$ 16,300 |

|

|

|

$1,100,000 |

|

|

|

$3,260,600 |

|

| Estimated interest on long-term debt(1) |

|

|

2,519,614 |

|

|

|

179,775 |

|

|

|

359,436 |

|

|

|

304,911 |

|

|

|

1,675,492 |

|

| Capital leases |

|

|

34,200 |

|

|

|

3,420 |

|

|

|

6,840 |

|

|

|

6,840 |

|

|

|

17,100 |

|

| Operating leases |

|

|

92,171 |

|

|

|

26,781 |

|

|

|

32,955 |

|

|

|

17,984 |

|

|

|

14,451 |

|

| Raw material purchase commitments(2) |

|

|

4,595,800 |

|

|

|

1,246,713 |

|

|

|

2,021,166 |

|

|

|

1,072,757 |

|

|

|

255,164 |

|

| Utility purchase commitments(2) |

|

|

1,093,797 |

|

|

|

325,193 |

|

|

|

235,216 |

|

|

|

113,923 |

|

|

|

419,465 |

|

| Natural gas drilling commitments |

|

|

4,709,322 |

|

|

|

42,920 |

|

|

|

584,916 |

|

|

|

927,168 |

|

|

|

3,154,318 |

|

| Other unconditional purchase obligations(3) |

|

|

166,106 |

|

|

|

147,563 |

|

|

|

3,441 |

|

|

|

3,356 |

|

|

|

11,746 |

|

| Other long-term obligations(4) |

|

|

355,173 |

|

|

|

188,333 |

|

|

|

60,690 |

|

|

|

26,757 |

|

|

|

79,393 |

|

| Total contractual obligations |

|

|

$17,946,383 |

|

|

|

$2,163,998 |

|

|

|

$3,320,960 |

|

|

|

$3,573,696 |

|

|

|

$8,887,729 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |