AT&T

2024

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS AND PROXY STATEMENT

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

AT&T

2024

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS AND PROXY STATEMENT

| To Our Stockholders

|

| |

IT’S A PLEASURE TO INVITE YOU TO OUR 2024 ANNUAL MEETING OF STOCKHOLDERS. I HOPE YOU CAN JOIN US VIRTUALLY ON THURSDAY, MAY 16, 2024, AT 3:30 P.M. CENTRAL TIME.

Dear Stockholders:

I am honored to serve as chairman of AT&T’s Board of Directors and further our Company’s tradition of strong, efficient governance.

The Board is dedicated to representing your interests and ensuring AT&T invests in long-term growth initiatives that deliver the returns you expect. The diversity of our experience and expertise bolsters our effectiveness in helping steer AT&T’s strategy and operations to create sustainable value for you.

We are committed to keeping you informed of our progress, and I hope you’ll join us for AT&T’s virtual Annual Meeting of Stockholders on Thursday, May 16. Thank you for continued confidence in AT&T.

Sincerely,

William E. Kennard

INDEPENDENT CHAIRMAN OF THE BOARD

|

|

| |

|

|

AT&T Inc. One AT&T Plaza Whitacre Tower 208 S. Akard Street Dallas, TX 75202 | |

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To the Holders of Common Stock of AT&T Inc.:

The 2024 Annual Meeting of Stockholders of AT&T Inc. will be conducted virtually on the Internet. There will be no in-person meeting.

| When: |

3:30 p.m. Central time | |

| Web Address: |

meetnow.global/ATT2024 | |

The purpose of the annual meeting is to consider and act on the following:

| 1. |

Election of Directors |

| 2. |

Ratification of Ernst & Young LLP as independent auditors |

| 3. |

Advisory approval of executive compensation |

| 4. |

Any other business that may properly come before the meeting, including stockholder proposals |

Holders of AT&T Inc. common stock of record at the close of business on March 18, 2024, are entitled to vote at the meeting and at any adjournment of the meeting.

By Order of the Board of Directors.

Stacey Maris

Senior Vice President, Secretary

and Chief Privacy Officer

April 4, 2024

| YOUR VOTE IS IMPORTANT

Please promptly sign, date and return your proxy card or voting instruction form, or submit your proxy and/or voting instructions by telephone or through the Internet so that a quorum may be represented at the meeting. Any person giving a proxy has the power to revoke it at any time, and stockholders who virtually attend the meeting may withdraw their proxies and vote electronically at the meeting.

|

| ATTENDING THE MEETING

A Stockholder of Record or a Beneficial Stockholder may access the meeting at meetnow.global/ATT2024 by following the prompts, which will ask for the Stockholder’s control number, which is shown in a box on the Proxy Card or Notice of Internet Availability of Proxy Materials.

More information about accessing the meeting is provided on the next page.

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 16, 2024:

The Proxy Statement and Annual Report to Stockholders are available at www.edocumentview.com/att

|

Attending the Meeting

The Record Date for AT&T’s 2024 Annual Meeting of Stockholders is March 18, 2024.

Stockholders of Record (shares are registered in your name)

If you were a Stockholder of Record of AT&T common stock at the close of business on the Record Date, you are eligible to attend the meeting, vote, change a prior vote, and submit questions. To access the meeting, visit meetnow.global/ATT2024 and follow the prompts, which will ask you to enter your control number. The control number is on your Proxy Card or, if applicable, shown in the Notice of Internet Availability of Proxy Materials.

Beneficial Stockholders (shares are held in the name of a bank, broker, or other institution)

If you were a beneficial stockholder of AT&T common stock as of the Record Date (i.e., you hold your shares through a broker or other intermediary), you may submit your voting instructions through your broker or other intermediary. To access the meeting, visit meetnow.global/ATT2024 and use your control number. You may vote your shares at the meeting or change a prior vote and submit questions. If you are a beneficial stockholder but do not have a control number, you may gain access to the meeting by contacting your broker or by following the instructions included with your proxy materials.

401(k) Plan Participants

If you are a participant in the AT&T Retirement Savings Plan, the AT&T Savings and Security Plan, the AT&T Puerto Rico Retirement Savings Plan, or the BellSouth Savings and Security Plan, and if you participated in the AT&T shares fund on the record date, you are eligible to listen to the meeting via the webcast and submit questions at the meeting. You may access the meeting and submit questions in the same manner as Stockholders of Record. Because plan participants may submit voting instructions only through the plan trustee or administrator, voting instructions must be submitted on or before May 13, 2024.

Guests

The meeting will also be available to the general public at the following link: meetnow.global/ATT2024. Please note that guests will not have the ability to ask questions or vote.

Asking Questions

If you are a Stockholder of Record, a Beneficial Stockholder, or 401(k) Plan Participant, you may submit questions in writing during the meeting through the meeting portal at meetnow.global/ATT2024 using your control number. In addition, you may submit questions beginning three days before the day of the meeting by going to meetnow.global/ATT2024. We will attempt to answer as many questions as we can during the meeting. Similar questions on the same topic will be answered as a group. Questions related to individual stockholders will be answered separately by our stockholder relations team. Our replies to questions of general interest, including those we are unable to address during the meeting, will be published on our Investor Relations website after the meeting.

Stockholder Proponents

Only stockholders who have submitted proposals pursuant to AT&T’s Bylaws may have a proposal submitted at the meeting. Unless otherwise determined by the Chairman of the meeting, each proponent will be permitted to pre-record the introduction of their proposal. The introduction must be relevant to the proposal and, of course, may not otherwise be inappropriate.

Control Number

Your control number appears on your Proxy Card, in our Notice of Internet Availability of Proxy Materials, or in the instructions that accompanied your proxy materials. If you do not have a control number, you may gain access to the meeting by contacting your broker or by following the instructions included with your proxy materials.

Technical Support

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the phone number displayed on the virtual meeting website on the meeting date.

Voting Results

The voting results of the Annual Meeting will be published no later than four business days after the Annual Meeting on a Form 8-K filed with the Securities and Exchange Commission, which will be available in the investor relations area of our website at investors.att.com.

| Table of Contents

|

| |

| SUM 1 | ||||

| 1 | ||||

| 3 | ||||

|

|

3 |

| ||

| Management Proposal – Item No. 2 - Ratification of the Appointment of |

|

10 |

| |

| Management Proposal – Item No. 3 - Advisory Approval of Executive Compensation |

|

11 |

| |

| Stockholder Proposal – Item No. 4 - Independent Board Chairman |

|

12 |

| |

| Stockholder Proposal – Item No. 5 - Improve Clawback Policy for Unearned Pay for Each NEO |

|

14 |

| |

| Stockholder Proposal – Item No. 6 - Report on Respecting Workforce Civil Liberties |

|

16 |

| |

| 20 | ||||

|

|

20 |

| ||

|

|

20 |

| ||

|

|

21 |

| ||

|

|

21 |

| ||

|

|

21 |

| ||

|

|

21 |

| ||

|

|

22 |

| ||

|

|

23 |

| ||

|

|

24 |

| ||

|

|

25 |

| ||

|

|

26 |

| ||

|

|

26 |

| ||

|

|

27 |

| ||

|

|

28 |

| ||

| 29 | ||||

| 31 | ||||

| 36 | ||||

| 39 | ||||

|

|

39 |

| ||

|

|

41 |

| ||

|

|

43 |

| ||

|

|

45 |

| ||

|

|

51 |

| ||

| 57 | ||||

| 58 | ||||

| 71 | ||||

|

|

71 |

| ||

|

|

71 |

| ||

|

|

71 |

| ||

|

|

72 |

| ||

|

|

72 |

| ||

|

|

72 |

| ||

|

|

74 |

| ||

|

|

A-1 |

| ||

| Proxy Statement Summary

This summary highlights information contained elsewhere in this Proxy Statement. Please read the entire Proxy Statement carefully before voting. |

|

2024 ANNUAL MEETING INFORMATION

|

Time 3:30 p.m. Central time |

Date Thursday May 16, 2024 |

Place meetnow.global/ATT2024 | ||

ATTENDING THE MEETING

You may access the meeting by going to meetnow.global/ATT2024 and following the prompts, which will ask you for your control number, on your Proxy Card or your Notice of

Internet Availability. If you do not have a control number, contact your broker for access or follow the instructions sent with your proxy materials.

AGENDA AND VOTING RECOMMENDATIONS

| Management Proposals: | Board Recommendation | Page | ||||

| 1 - Election of Directors |

FOR each nominee |

|

3 |

| ||

| 2 - Ratification of Ernst & Young LLP as auditors for 2024 |

FOR |

|

10 |

| ||

| 3 - Advisory Approval of Executive Compensation |

FOR |

|

11 |

| ||

| Stockholder Proposals: |

|

|

||||

| 4 - Independent Board Chairman |

AGAINST |

|

12 |

| ||

| 5 - Improve Clawback Policy for Unearned Pay for Each NEO |

AGAINST |

|

14 |

| ||

| 6 - Report on Respecting Workforce Civil Liberties |

AGAINST |

|

16 |

| ||

CORPORATE GOVERNANCE HIGHLIGHTS

We are committed to strong corporate governance policies that promote the long-term interests of stockholders, strengthen Board and management accountability, and build on our environmental, social and governance leadership. The Corporate Governance section beginning on page 20 describes our governance framework, which includes the following highlights:

|

Independent Chairman |

|

Ten Independent Director Nominees |

|

Demonstrated Board refreshment and diversity |

|

Independent Audit, Human Resources, and Governance and Policy Committees |

|

Regular sessions of non-management Directors |

|

Annual election of Directors by majority vote |

|

Long-standing commitment to sustainability |

|

Stockholder right to call special meetings |

|

Restitution and Clawback Policies |

|

Proxy Access |

| 2024 PROXY |

SUM1 |

AT&T INC. |

| 2024 Proxy Statement Summary

|

| |

DIRECTOR TENURE AND DIVERSITY

We are committed to strong corporate governance that directly aligns with our long-term strategy. We are focused on building a Board that reflects diverse perspectives, with directors who bring significant expertise in key areas supporting AT&T’s purpose and evolved strategy. The ongoing refreshment of the Board promotes the long-term interests of stockholders, strengthens Board and management accountability, and builds on our environmental, social and governance leadership.

| DIRECTORS AND NOMINEES*

|

||||

| TENURE

|

GENDER

|

RACE / ETHNICITY

|

| Name | Gender | Race/ Ethnicity |

Director Since | |||

| SCOTT T. FORD |

M |

W |

2012 | |||

| GLENN H. HUTCHINS |

M |

W |

2014 | |||

| WILLIAM E. KENNARD |

M |

B |

2014 | |||

| STEPHEN J. LUCZO |

M |

W |

2019 | |||

| MARISSA A. MAYER |

F |

W |

2024 | |||

| MICHAEL B. MCCALLISTER |

M |

W |

2013 | |||

| BETH E. MOONEY |

F |

W |

2013 | |||

| MATTHEW K. ROSE |

M |

W |

2010 | |||

| JOHN T. STANKEY |

M |

W |

2020 | |||

| CYNTHIA B. TAYLOR |

F |

W |

2013 | |||

| LUIS A. UBIÑAS |

M |

H |

2021 | |||

*All Directors are nominated for re-election. All Director nominees are independent, except for Mr. Stankey.

Key: F – Female; M – Male; B – Black or African American; H – Hispanic; W – White

| AT&T INC. |

SUM2 |

2024 PROXY |

| 2024 Proxy Statement Summary

|

| |

STOCKHOLDER ENGAGEMENT

AT&T has a long history of engaging with our stockholders, reaching out to our investors each spring and fall to discuss an array of topics. We believe it is important for our governance process to have meaningful engagement with our stockholders and understand their perspectives on corporate governance, executive compensation, and other issues that are important to them. These engagements help to inform our Board’s approach to governance, compensation, and oversight of sustainability initiatives. The Company also provides online reports designed to increase transparency on issues of importance to our investors, including sustainability, diversity, political contributions and privacy, as well as the Proxy Statement and Annual Report.

In the spring and fall of 2023, members of management and our Board Chairman, William Kennard, engaged with stockholders representing 29% of institutional shares outstanding on a variety of strategy, business performance and governance topics. Specifically, stockholders expressed interest in Board composition and how the collective skillset of our Board has evolved to support strategic priorities, and stockholders continued to express support for our approach to Board leadership and governance practices which promote independent Board oversight and management of risk. We also discussed our sustainability strategy’s alignment to business priorities and our executive compensation program and philosophy, which stockholders expressed continued support for. No further changes are anticipated for our 2024 compensation programs.

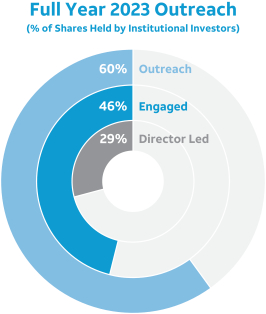

| • |

SCOPE OF OUTREACH IN 2023: We reached out to stockholders representing more than 34% of shares outstanding, or more than 60% of shares held by institutional investors. |

| • |

SCOPE OF ENGAGEMENT IN 2023: In the spring and fall of 2023 we engaged with stockholders representing approximately 20% of shares outstanding, or approximately 46% of shares held by institutional investors who accepted our request for a meeting. |

| 2024 PROXY |

SUM3 |

AT&T INC. |

| 2024 Proxy Statement Summary

|

| |

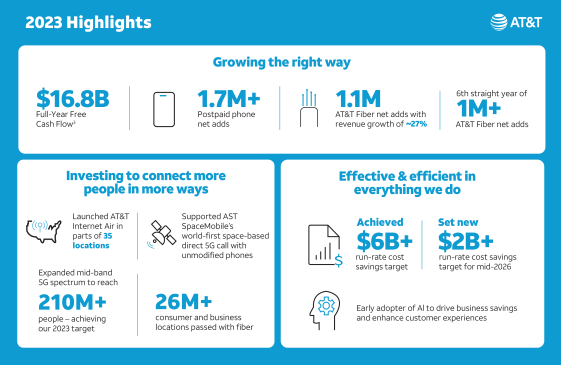

SUSTAINABILITY HIGHLIGHTS

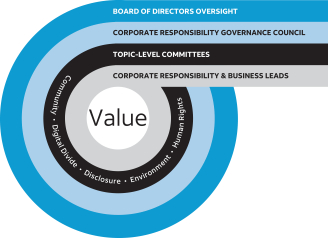

The issues we manage under our Corporate Responsibility umbrella represent risks, opportunities and important external impacts we consider in our strategy and operations. Our approach is integrated into our business through Board of Directors oversight, officer-level leadership across relevant departments, and collaboration among dedicated teams of corporate responsibility professionals and subject-matter experts throughout the Company. Pages 31-35 detail how our integrated approach delivers long-term value for AT&T and positive social and environmental impact for our stakeholders.

A sample of independent assessment organizations recognizing our approach and performance is provided on the inside back cover.

SELECT HIGHLIGHTS:

|

|

GOVERNANCE |

| Board oversight (page 31) |

• The Governance and Policy Committee (GPC) has direct oversight of environmental, social and governance (ESG) strategy, related policies, programs and ESG reporting. Two other Board committees supplement ESG oversight as needed, the Audit Committee and the Human Resources Committee. | |

| Political engagement transparency (page 32) |

• In 2023, our leadership in political engagement transparency was again recognized via independent third-party analysis. Additionally, we prepared and published our first Political Congruency Report, which provides insight into the congruency of votes made by recipients of political contributions from AT&T and from the AT&T Employee PACs with our Political and Corporate Sustainability Priorities. |

|

|

ENVIRONMENTAL |

| Net zero emissions (page 33) |

• Through 2023, we are on track toward our science-based target to reduce Scope 1 and 2 emissions 63% by the end of 2030, and our goal for net zero Scope 1 and 2 emissions by year-end 2035. | |

| Supplier and customer emissions reductions (page 34) |

• Through 2023, we continued toward our Gigaton Goal to equip business customers with connectivity solutions that cumulatively avoid a gigaton of GHG emissions by the end of 2035.

• More than 50% of suppliers (by spend) have set their own science-based targets – achieving our supplier climate engagement target for the second consecutive year. | |

| Community resilience (page 33) |

• In collaboration with the Federal Emergency Management Agency and Argonne National Laboratory, we enhanced and grew awareness of the Climate Risk and Resilience Portal, which provides emergency managers and community leaders with critical climate data so they can better understand and address the future impacts of climate change. |

|

|

COMMUNITY IMPACT |

| $2B commitment to address the digital divide (page 34) |

• In 2023, we completed our $2B commitment to help close the digital divide. We also are on-track toward our 2025 goal to reach 1 million people through AT&T Connected Learning®. Through the end of 2023 we launched 34 AT&T Connected Learning Centers® in neighborhoods facing barriers to connectivity. We anticipate launching more than 50 total AT&T Connected Learning Centers by the end of 2024.

• We enabled more low-income households to access low-cost broadband service offerings with our Access from AT&T service and through participation in the Federal Communications Commission’s (FCC’s) Affordable Connectivity Program (ACP). | |

| A welcoming and inclusive workforce (page 35) |

• AT&T focuses efforts in three primary areas: 1) Diversifying our talent pipeline, 2) Enabling all talent to thrive, and 3) Strengthening our inclusive culture. To accomplish these goals, we regularly explore ways to tailor talent searches to attract a broader array of qualified applicants, provide key talent with opportunities and exposure to senior leaders, and develop our people leaders with inclusive leadership skills that help them build an ecosystem where all employees can feel a sense of belonging. |

| AT&T INC. |

SUM4 |

2024 PROXY |

| Proxy Statement

|

| |

GENERAL

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of AT&T Inc. (AT&T, the Company, or we) for use at the 2024 Annual Meeting of Stockholders of AT&T. The meeting will be conducted virtually over the Internet at 3:30 p.m. Central time on Thursday, May 16, 2024.

The purpose of the meeting is set forth in the Notice of Annual Meeting of Stockholders. This Proxy Statement and form of proxy are being sent or made available beginning April 4, 2024, to stockholders who were record holders of AT&T’s common stock, $1.00 par value per share, at the close of business on March 18, 2024. These materials are also available at www.envisionreports.com/att. Each share entitles the registered holder to one vote. As of March 18, 2024, there were 7,173,434,903 shares of AT&T common stock entitled to vote at the meeting.

To constitute a quorum to conduct business at the meeting, stockholders representing at least 40% of the shares of common stock entitled to vote at the meeting must be present or represented by proxy.

Each share of AT&T common stock represented at the Annual Meeting is entitled to one vote on each matter properly brought before the meeting. All matters, except as provided below, are determined by a majority of the votes cast, unless a greater number is required by law or our Certificate of Incorporation for the action proposed. A majority of votes cast means the number of votes cast “for” a matter exceeds the number of votes cast “against” such matter.

If the proxy is submitted and no voting instructions are provided, the person or persons designated on the card will vote the shares for the election of the Board of Directors’ nominees and in accordance with the recommendations of the Board of Directors on the other subjects listed on the proxy card and at their discretion on any other matter that may properly come before the meeting.

The Board of Directors is not aware of any matters that will be presented at the meeting for action on the part of stockholders other than those described in this Proxy Statement.

Election of Directors

In the election of Directors, each Director is elected by the vote of the majority of the votes cast with respect to that Director’s election. Under our Bylaws, if a

nominee for Director is not elected and the nominee is an existing Director standing for re-election (or incumbent Director), the Director must promptly tender his or her resignation to the Board, subject to the Board’s acceptance. The Governance and Policy Committee will make a recommendation to the Board as to whether to accept or reject the tendered resignation or whether other action should be taken. The Board will act on the tendered resignation, taking into account the Governance and Policy Committee’s recommendation, and publicly disclose (by a press release, a filing with the SEC, or other broadly disseminated means of communication) its decision regarding the tendered resignation and the rationale behind the decision within 90 days from the date of the certification of the election results. The Governance and Policy Committee in making its recommendation and the Board of Directors in making its decision may each consider any factors or other information that they consider appropriate and relevant. Any Director who tenders his or her resignation as described above will not participate in the recommendation of the Governance and Policy Committee or the decision of the Board of Directors with respect to his or her resignation.

If the number of persons nominated for election as Directors as of ten days before the record date for determining stockholders entitled to notice of or to vote at such meeting shall exceed the number of Directors to be elected, then the Directors shall be elected by a plurality of the votes cast. Because no persons other than the incumbent Directors have been nominated for election at the 2024 Annual Meeting, the majority vote provisions will apply.

Advisory Vote on Executive Compensation

The advisory vote on executive compensation is non-binding, and the preference of the stockholders will be determined by the choice receiving the greatest number of votes.

All Other Matters to be Voted Upon

All other matters at the 2024 Annual Meeting will be determined by a majority of the votes cast.

Abstentions

Except as noted above, shares represented by proxies marked “abstain” with respect to the proposals described on the proxy card and by proxies marked to deny discretionary authority on other matters will not be counted in determining the vote obtained on such matters.

| 2024 PROXY |

1 |

AT&T INC. |

GENERAL

Broker Non-Votes

Under the rules of the New York Stock Exchange (“NYSE”), on certain routine matters, brokers may, at their discretion, vote shares they hold in “street name” on behalf of beneficial owners who have not returned voting instructions to the brokers. On all other matters, brokers are prohibited from voting uninstructed shares. In instances where brokers are prohibited from exercising discretionary authority (so-called broker non-votes), the shares they hold are not included in the vote totals.

At the 2024 Annual Meeting, brokers will be prohibited from exercising discretionary authority with respect to each of the matters submitted other than the ratification of the auditors. As a result, for each of the matters upon which the brokers are prohibited from voting, the broker non-votes will have no effect on the results.

VOTING

Stockholders of Record

Stockholders whose shares are registered in their name on the Company records (also known as “stockholders of record”) will receive either a proxy card by which they may indicate their voting instructions or a notice on how they may obtain a proxy. Instead of submitting a signed proxy card, stockholders may submit their proxies by telephone or through the Internet. Telephone and Internet proxies must be used in conjunction with, and will be subject to, the information and terms contained on the form of proxy. Similar procedures may also be available to stockholders who hold their shares through a broker, nominee, fiduciary or other custodian.

All shares represented by proxies will be voted by one or more of the persons designated on the form of proxy in accordance with the stockholders’ directions. If the proxy card is signed and returned or the proxy is submitted by telephone or through the Internet without specific directions with respect to the matters to be acted upon, it will be treated as an instruction to vote such shares in accordance with the recommendations of the Board of Directors. Any stockholder giving a proxy may revoke it at any time before the proxy is voted at the meeting by giving written notice of revocation to the Secretary of AT&T, by submitting a later-dated proxy, or by virtually

attending the meeting and voting electronically. The Chairman of the Board will announce the closing of the polls during the Annual Meeting. Proxies must be received before the closing of the polls in order to be counted.

Shares Held Through a Broker, Nominee, Fiduciary, or Other Custodian

Where the stockholder is not the record holder (“Beneficial Stockholder”), such as where the shares are held through a broker, nominee, fiduciary or other custodian, the stockholder must provide voting instructions to the record holder of the shares in accordance with the record holder’s requirements in order to ensure the shares are properly voted. Beneficial Stockholders that attend the virtual meeting will be able to vote, change a prior vote, or ask questions.

Shares Held on Your Behalf under Company Benefit Plans or under The DirectSERVICE Investment Program

The proxy card, or a proxy submitted by telephone or through the Internet, will also serve as voting instructions to the plan administrator or trustee for any shares held on behalf of a participant under any of the following employee benefit plans: the AT&T Retirement Savings Plan; the AT&T Savings and Security Plan; the AT&T Puerto Rico Retirement Savings Plan; and the BellSouth Savings and Security Plan. Subject to the trustee’s fiduciary obligations, shares in each of the above employee benefit plans for which instructions are not received will not be voted. To allow sufficient time for voting by the trustees and/or administrators of the plans, your voting instructions must be received by May 13, 2024.

In addition, the proxy card or a proxy submitted by telephone or through the Internet will constitute voting instructions to the plan administrator under The DirectSERVICE Investment Program sponsored and administered by Computershare Trust Company, N.A. (AT&T’s transfer agent) for shares held on behalf of plan participants.

If a stockholder participates in the plans listed above and/or maintains stockholder accounts under more than one name (including minor differences in registration, such as with or without a middle initial), the stockholder may receive more than one set of proxy materials. To ensure that all shares are voted, please submit proxies for all of the shares you own.

| AT&T INC. |

2 |

2024 PROXY |

| VOTING ITEMS - MANAGEMENT PROPOSALS |

|

ITEM NO. 1 - ELECTION OF DIRECTORS

Under our Bylaws, the Board of Directors has the authority to determine the size of the Board and to fill vacancies. Currently, the Board is comprised of eleven Directors, one of whom is an Executive Officer of AT&T. There are no vacancies on the Board. Under AT&T’s Corporate Governance Guidelines, a Director will not be nominated by the Board for re-election if the Director would be 75 or older at the time of the election.

The Board of Directors has nominated the eleven persons listed below for election as Directors to one-year terms of office that would expire at the 2025 Annual Meeting. Each of the nominees is an incumbent Director of AT&T recommended for re-election by the Governance and Policy Committee. In making these nominations, the Board reviewed the background of the nominees (each nominee’s biography can be found beginning on the next page) and determined to nominate each of the current Directors for re-election.

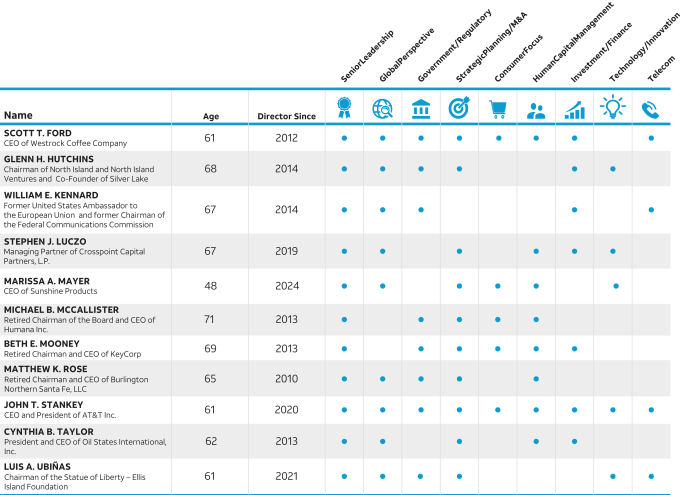

The Board believes that each nominee has valuable individual skills, attributes, and experiences that, taken together, provide us with the variety and depth of knowledge, judgment and vision necessary to provide effective oversight of a large and varied enterprise like AT&T. As indicated in the table below and in the following biographies, the nominees have exhibited significant leadership skills and extensive experience in a variety of fields, each of which the Board believes provides valuable knowledge about important elements of AT&T’s business.

If one or more of the nominees should at the time of the meeting be unavailable or unable to serve as a Director, the shares represented by the proxies will be voted to elect the remaining nominees and any substitute nominee or nominees designated by the Board. The Board knows of no reason why any of the nominees would be unavailable or unable to serve.

| The Board recommends you vote FOR each of the following candidates |

All Director nominees are independent, except for Mr. Stankey.

| 2024 PROXY |

3 |

AT&T INC. |

VOTING ITEMS - MANAGEMENT PROPOSALS

|

|

—

Age: 67 Director since 2014 Independent Chairman of the Board Former United States Ambassador to the European Union and former Chairman of the Federal Communications Commission

|

|

| Mr. Kennard is Chairman of the Board of Directors of AT&T Inc. and has served in this capacity since January 2021. Mr. Kennard served as the United States Ambassador to the European Union from 2009 to 2013. From 2001 to 2009, Mr. Kennard was Managing Director of The Carlyle Group (a global asset management firm) where he led investments in the telecommunications and media sectors. Mr. Kennard served as Chairman of the U.S. Federal Communications Commission from 1997 to 2001. Before his appointment as FCC Chairman, he served as the FCC’s General Counsel from 1993 until 1997. Mr. Kennard joined the FCC from the law firm of Verner, Liipfert, Bernhard, McPherson and Hand (now DLA Piper) where he was a partner and member of the firm’s board of directors. Mr. Kennard is a co-founder of Astra Capital Management (a private equity firm) and has served on the board of trustees of Yale University since 2014. Mr. Kennard received his B.A. in communications from Stanford University and earned his law degree from Yale Law School.

Skills and Qualifications Mr. Kennard brings expertise in the global telecommunications industry including knowledge of the complex regulatory and policy landscape for communications and an understanding of the technological and strategic shifts in the industry. He also has experience in international trade and global investment.

|

||||

|

|

Senior

|

|

Investment/

|

|

Global

|

|||||||||

|

|

Government/

|

|

Telecom

|

|||||||||||

| Other Public Company Directorships • Ford Motor Company • MetLife, Inc.

Past Public Company Directorships • Duke Energy Corporation (2014-2021)

Committees • Executive (Chair) • Governance and Policy

|

|

—

Age: 61 Director since 2012 Chief Executive Officer of Westrock Coffee Company

|

|

| Mr. Ford currently serves as a director and Chief Executive Officer of Westrock Coffee Company (a fully integrated manufacturer of coffee, tea and coffee-related products), which he co-founded in 2009 and where he has served as Chief Executive Officer since 2009. Mr. Ford also founded Westrock Group, LLC (a private investment firm in Little Rock, Arkansas) in 2013, where he has served as Member and Chief Executive Officer since its inception. Mr. Ford previously served as President and Chief Executive Officer of Alltel Corporation (a provider of wireless voice and data communications services) from 2002 to 2009 and served as an executive member of Alltel Corporation’s board of directors from 1996 to 2009. He also served as Alltel Corporation’s President and Chief Operating Officer from 1998 to 2002. Mr. Ford led Alltel through several major business transformations, culminating with the sale of the company to Verizon Wireless in 2009. Mr. Ford received his B.S. in finance from the University of Arkansas, Fayetteville.

Skills and Qualifications Mr. Ford brings extensive experience in the telecommunications industry through his leadership of a large, publicly traded wireless and wireline communications company. He has experience managing complex business operations in various regulatory environments internationally and has led several major business transformations, including the spin-off of Windstream and Alltel.

|

||||

|

|

Senior

|

|

Investment/

|

|

Global

|

|||||||||

|

|

Government/Regulatory

|

|

Strategic Planning/M&A

|

|

Human Capital Management

|

|||||||||

|

|

Consumer

|

|

Telecom

|

|||||||||||

| Other Public Company Directorships • Westrock Coffee Company

Committees • Corporate Development and Finance (Chair) • Executive • Human Resources

|

| AT&T INC. |

4 |

2024 PROXY |

| VOTING ITEMS - MANAGEMENT PROPOSALS |

|

|

|

—

Age: 68 Director since 2014 Chairman of North Island and North Island Ventures and Co-Founder of Silver Lake

|

|

| Mr. Hutchins is Chairman of North Island Management, LLC (a family investment office, aka Tide Mill, LLC, based in New York, New York) and has served in this capacity since 2013. Since 2020, Mr. Hutchins has also been Chairman of North Island Ventures (an investment firm in New York, New York). Mr. Hutchins is Vice Chairman and Lead Independent Director of Santander starting in 2023; on the Investment Board and the International Advisory Board of GIC Private Limited, the sovereign wealth fund of Singapore, which he joined in 2020. He is a co-founder of Silver Lake (a technology investment firm based in New York, New York and Menlo Park, California), which was founded in 1999 and where Mr. Hutchins served as co-CEO until 2011 and as Managing Director from 1999 until 2011. Prior to that, Mr. Hutchins was Senior Managing Director at The Blackstone Group (a global investment firm) from 1994 to 1999. Mr. Hutchins served as Chairman of the Board of SunGard Data Systems Inc. (a software and technology services company) from 2005 until 2015, and a director of Nasdaq, Inc. and Virtu Financial (2017-2021). Previously, Mr. Hutchins served as a Special Advisor in the White House on economic and health-care policy from 1993 to 1994 and as Senior Advisor on the transition of the Administration from 1992 to 1993. He is co-Chairman of the Brookings Institution. Mr. Hutchins served as a director of the Federal Reserve Bank of New York from 2011 until 2020. He holds an A.B. from Harvard College, an M.B.A. from Harvard Business School, and a J.D. from Harvard Law School.

Skills and Qualifications Mr. Hutchins brings extensive experience in areas that intersect technology, innovation and investment, along with financial, public policy and strategic planning experience. As the co-founder and former co-CEO of a global investment firm, he brings significant leadership, business planning and human capital management expertise.

|

||||

|

|

Senior

|

|

Investment/

|

|

Government/

|

|||||||||

|

|

Strategic

|

|

Global

|

|

Technology/ Innovation

|

|||||||||

| Other Public Company Directorships • Banco Santander

Past Public Company Directorships • Virtu Financial, Inc. (2017-2021)

Committees • Corporate Development and Finance • Executive • Governance and Policy (Chair) |

||||

|

|

—

Age: 67 Director since 2019 Managing Partner of Crosspoint Capital Partners, L.P.

|

|

| Mr. Luczo is a Managing Partner of Crosspoint Capital Partners, L.P. (a private equity investment firm focused on the cybersecurity and privacy sectors located in Menlo Park, California) and has served in this capacity since February 2020. Mr. Luczo served as Chairman of the Board of Seagate Technology plc (a global provider of data storage technology and solutions in Fremont, California) from 2002 until July 2020 and as a member of Seagate’s board of directors until October 2021. Mr. Luczo joined Seagate’s predecessor company in 1993 as Senior Vice President of Corporate Development, joined its board of directors in 1998, and served as its Chief Executive Officer from 1998 to 2004 and from 2009 to 2017. Prior to joining Seagate, Mr. Luczo held various roles in investment banking. He holds an A.B. in economics from Stanford University and earned an M.B.A. from Stanford Graduate School of Business.

Skills and Qualifications Mr. Luczo brings deep experience in technology, business development, strategic planning, and operations through his leadership at Seagate. He has significant experience in financial matters and executing strategic cost initiatives and transactions.

|

||||

|

|

Senior

|

|

Investment/

|

|

Global

|

|||||||||

|

|

Strategic

|

|

Human Capital

|

|

Technology/

|

|||||||||

| Other Public Company Directorships • Morgan Stanley

Past Public Company Directorships • Seagate Technology plc (2002-2021)

Committees • Audit • Corporate Development and Finance

|

||||

| 2024 PROXY |

5 |

AT&T INC. |

VOTING ITEMS - MANAGEMENT PROPOSALS

|

|

—

MARISSA A.

Age: 48 Director since March 2024 Chief Executive Officer of Sunshine Products

|

|

| Ms. Mayer has served as Chief Executive Officer of Sunshine Products (a technology startup company based in Palo Alto, California that uses artificial intelligence to develop consumer-facing applications for automating everyday tasks) since she co-founded the company in 2018. She previously served as Chief Executive Officer, President and a member of the Board of Directors of Yahoo!, Inc. from 2012 to 2017. Before joining Yahoo!, Ms. Mayer spent 13 years at Google, Inc., from 1999 to 2012, where she held various roles of increasing responsibility including Vice President, Local, Maps and Locations Services, and Vice President, Search Products and User Experience. She has served on the board of Walmart Inc. since 2012. In addition, she serves on the board of the San Francisco Ballet and previously served on the foundation board for the Forum of Young Global Leaders at the World Economic Forum. Ms. Mayer holds a bachelor’s degree in symbolic systems and a master’s degree in computer science with a specialization in artificial intelligence from Stanford University.

Skills and Qualifications Ms. Mayer brings extensive expertise in technology and a deep understanding of the consumer Internet experience. She has senior leadership and human capital management experience through her CEO role at Yahoo!. As a long tenured director of Walmart Inc., she brings valuable experience in the oversight of a large publicly traded retail and ecommerce business.

|

||||

|

|

Senior

|

|

Consumer

|

|

Global

|

|||||||||

|

|

Strategic

|

|

Human Capital

|

|

Technology/

|

|||||||||

| Other Public Company Directorships • Walmart Inc.

Committees • Audit • Corporate Development and Finance

|

||||

|

—

Age: 71 Director since 2013 Retired Chairman of the Board and Chief Executive Officer of Humana Inc.

|

|

| Mr. McCallister served as Chairman of Humana Inc. (a health care company in Louisville, Kentucky) from 2010 to 2013 and as a member of Humana’s board of directors beginning in 2000. He also served as Humana’s Chief Executive Officer from 2000 until his retirement in 2012. During Mr. McCallister’s tenure, he led Humana through significant expansion and growth, nearly quadrupling its annual revenues between 2000 and 2012, and led the company to become a FORTUNE 100 company. Mr. McCallister received his B.S. in accounting from Louisiana Tech University and earned his M.B.A. from Pepperdine University.

Skills and Qualifications Mr. McCallister has extensive leadership experience in the oversight of a large, publicly traded company with a focus on strategic planning and organic growth in the evolving health care sector. He also has deep experience in the development of customer-focused solutions.

|

||||

|

|

Senior

|

|

Government/

|

|

Strategic

|

|||||||||

|

|

Human Capital

|

|

Consumer

|

|||||||||||

| Other Public Company Directorships • Fifth Third Bancorp • Zoetis Inc.

Committees • Audit • Human Resources

|

||||

| AT&T INC. |

6 |

2024 PROXY |

| VOTING ITEMS - MANAGEMENT PROPOSALS |

|

|

—

Age: 69 Director since 2013 Retired Chairman and Chief Executive Officer of KeyCorp

|

|

| Ms. Mooney served as Chairman and Chief Executive Officer of KeyCorp (a bank holding company in Cleveland, Ohio) from 2011 until her retirement in May 2020. She previously served as KeyCorp’s President and Chief Operating Officer from 2010 to 2011. Ms. Mooney joined KeyCorp in 2006 as a Vice Chair and head of Key Community Bank. Prior to joining KeyCorp, beginning in 2000 she served as Senior Executive Vice President at AmSouth Bancorporation (now Regions Financial Corporation), where she also became Chief Financial Officer in 2004. Ms. Mooney served as a director of the Federal Reserve Bank of Cleveland in 2016 and served three one-year terms representing the Fourth Federal Reserve District on the Federal Advisory Council from 2017 to 2019. She received her B.A. in history from the University of Texas at Austin and earned her M.B.A. from Southern Methodist University.

Skills and Qualifications Ms. Mooney brings executive leadership skills through the management of a large, publicly traded and highly-regulated company, knowledge of business strategy, and more than 30 years of experience in the customer-focused financial services industry.

|

||||

|

|

Senior

|

|

Investment/

|

|

Government/

|

|||||||||

|

|

Strategic

|

|

Human Capital

|

|

Consumer

|

|||||||||

| Other Public Company Directorships • Accenture plc • Ford Motor Company

Past Public Company Directorships • KeyCorp (2011-2020)

Committees • Executive • Governance and Policy • Human Resources (Chair)

|

||||

|

|

—

Age: 65 Director since 2010 Retired Chairman and Chief Executive Officer of Burlington Northern Santa Fe, LLC

|

|

| Mr. Rose served as Chairman of the Board and Chief Executive Officer of Burlington Northern Santa Fe, LLC (a freight rail system based in Fort Worth, Texas and a subsidiary of Berkshire Hathaway Inc., formerly known as Burlington Northern Santa Fe Corporation) from 2002 until his retirement in April 2019, having also served as BNSF’s President until 2010. Mr. Rose began his 26-year career with BNSF (then Burlington Northern Railroad Company) in 1993. During his tenure as CEO, Mr. Rose helped guide the acquisition of BNSF by Berkshire Hathaway in 2009. Before serving as Chairman, Mr. Rose held several leadership positions there and at its predecessors, including President and Chief Executive Officer from 2000 to 2002, President and Chief Operating Officer from 1999 to 2000, and Senior Vice President and Chief Operations Officer from 1997 to 1999. Mr. Rose also served as Executive Chairman of BNSF Railway Company (a subsidiary of Burlington Northern Santa Fe, LLC) until his retirement in 2019, having served as Chairman and Chief Executive Officer from 2002 to 2013. He earned his B.S. in marketing from the University of Missouri.

Skills and Qualifications Mr. Rose has extensive experience in the executive oversight of a large, complex and highly-regulated organization with considerable knowledge of operations management and logistics. He brings experience overseeing long-term strategic planning and a unionized workforce. |

||||

|

|

Senior

|

|

Government/

|

|

Global

|

|||||||||

|

|

Strategic

|

|

Human Capital

|

|||||||||||

| Other Public Company Directorships • Fluor Corporation

Past Public Company Directorships • BNSF Railway Company (2002-2019) • Burlington Northern Santa Fe, LLC (2000-2019)

Committees • Corporate Development and Finance • Human Resources

|

||||

| 2024 PROXY |

7 |

AT&T INC. |

VOTING ITEMS - MANAGEMENT PROPOSALS

|

|

—

Age: 61 Director since 2020 Chief Executive Officer and President of

|

|

| Mr. Stankey is Chief Executive Officer and President of AT&T Inc. and has served in this capacity since July 2020. Prior to that, he served as President and Chief Operating Officer from October 2019 through June 2020. From June 2018 through April 2020, Mr. Stankey also served as CEO of Warner Media, LLC. During his tenure with the Company, Mr. Stankey has held a variety of other leadership positions, including serving as CEO-AT&T Entertainment Group (2015-2017); Chief Strategy Officer (2012-2015); President and CEO of AT&T Business Solutions (2010-2011); President and CEO of AT&T Operations, Inc. (2008-2010); Group President-Telecom Operations (2007-2008); Chief Technology Officer (2004-2006); and Chief Information Officer (2003-2004). Mr. Stankey began his career with the Company in 1985. He holds a bachelor’s degree in finance from Loyola Marymount University and an M.B.A. from the University of California, Los Angeles.

Skills and Qualifications Mr. Stankey has more than 38 years of experience spanning nearly every area of AT&T’s business, which has provided him with intimate knowledge of our Company, values and culture. He has served in a variety of roles including CEO of WarnerMedia; CEO of AT&T Entertainment Group; Chief Strategy Officer; Chief Technology Officer; CEO of AT&T Operations; and CEO of AT&T Business Solutions. |

||||

|

|

Senior

|

|

Investment/

|

|

Global

|

|||||||||

|

|

Government/ Regulatory

|

|

Technology/ Innovation

|

|

Strategic Planning/M&A |

|||||||||

|

|

Human Capital

|

|

Consumer

|

|

Telecom |

|||||||||

| Past Public Company Directorships • United Parcel Service, Inc. (2014-2020)

|

||||

|

|

—

Age: 62 Director since 2013 President and Chief Executive Officer of Oil States International, Inc.

|

|

| Ms. Taylor is President, Chief Executive Officer and a director of Oil States International, Inc. (a globally diversified manufacturing and energy services provider based in Houston, Texas) and has served in this capacity since 2007. She previously served as Oil States International, Inc.’s President and Chief Operating Officer from 2006 to 2007 and as its Senior Vice President-Chief Financial Officer from 2000 to 2006. Ms. Taylor was Chief Financial Officer of L.E. Simmons & Associates, Inc. from 1999 to 2000 and Vice President-Controller of Cliffs Drilling Company from 1992 to 1999, and prior to that, held various management positions with Ernst & Young LLP, a public accounting firm. She has been a director of the Federal Reserve Bank of Dallas since January 2020 and previously served as a director of the Federal Reserve Bank’s Houston Branch from 2018 to 2019. She received her B.B.A. in accounting from Texas A&M University and is a Certified Public Accountant.

Skills and Qualifications Ms. Taylor brings executive leadership skills in the oversight of a large, publicly traded company, vast experience in finance and public accounting, and her experience in international business and affairs.

|

||||

|

|

Senior

|

|

Investment/

|

|

Global

|

|||||||||

|

|

Strategic

|

|

Human Capital

|

|||||||||||

| Other Public Company Directorships • Oil States International, Inc.

Committees • Audit (Chair) • Executive

|

||||

| AT&T INC. |

8 |

2024 PROXY |

| VOTING ITEMS - MANAGEMENT PROPOSALS |

|

|

|

—

Age: 61 Director since 2021 Chairman of the Statue of Liberty - Ellis Island Foundation

|

|

| Mr. Ubiñas is Chairman of the Statue of Liberty - Ellis Island Foundation (a nonprofit organization that works to preserve the Statue of Liberty and Ellis Island) and has served in this capacity since January 2021; he previously served as Vice Chair from 2018 until 2021 and has served as a member of its board of directors since 2014. Mr. Ubiñas served as President of the Ford Foundation (an independent, global nonprofit grant-making organization based in New York, New York) from 2008 to 2013. From 2000 to 2007, he was Senior Partner with McKinsey & Company (a global management consulting firm based in New York, New York), where he led the firm’s west coast media practice working with companies in the technology, telecommunications, and media sectors. Mr. Ubiñas joined McKinsey & Company in 1989, holding various leadership positions prior to being named Senior Partner. From 2013 to 2017, he served on the Advisory Committee on U.S. Competitiveness of the Export-Import Bank, and from 2010 to 2014, he served on the Advisory Committee for Trade Policy and Negotiations. He holds an A.B. in government from Harvard College and an M.B.A. from Harvard Business School.

Skills and Qualifications Mr. Ubiñas has extensive leadership experience and expertise across the broadband and wireless industries, government, and the nonprofit sector, all of which align with AT&T’s priorities to serve customers, investors, and our communities.

|

||||

|

|

Senior

|

|

Government/ Regulatory

|

|

Global

|

|||||||||

|

|

Strategic

|

|

Technology/ Innovation

|

|

Telecom

|

|||||||||

| Other Public Company Directorships/Trusteeships • Electronic Arts Inc. • Mercer Funds • Tanger Factory Outlet Centers, Inc.

Past Public Company Directorships • Boston Private Financial Holdings, Inc. (2017-2021) • FirstMark Horizon Acquisition Corp. (2020-2022)

Committees • Audit • Governance and Policy

|

||||

| 2024 PROXY |

9 |

AT&T INC. |

VOTING ITEMS - MANAGEMENT PROPOSALS

ITEM NO. 2 - RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS

This proposal would ratify the Audit Committee’s appointment of Ernst & Young LLP (EY) to serve as independent auditors of AT&T for the fiscal year ending December 31, 2024. The Audit Committee’s decision to re-appoint our independent auditor was based on the following considerations:

| • |

quality and performance of the lead audit partner and the overall engagement team, |

| • |

knowledge of the telecommunications industry and company operations, |

| • |

global capabilities and technical expertise, |

| • |

auditor independence and objectivity, and |

| • |

the potential impact of rotating to another independent audit firm. |

The Audit Committee’s oversight of EY includes regular private sessions with EY, discussions about audit scope and business imperatives, and - as described above - a comprehensive annual evaluation to determine whether to re-engage EY. Considerations concerning auditor independence include:

| • |

Limits on non-audit services: The Audit Committee preapproves audit and permissible non-audit services provided by EY in accordance with AT&T’s pre-approval policy. |

| • |

Audit partner rotation: EY rotates the lead audit partner and other partners on the engagement consistent with independence requirements. The Audit Committee oversees the selection of each new lead audit partner. |

| • |

EY’s internal independence process: EY conducts periodic internal reviews of its audit and other work and assesses the adequacy of partners and other personnel working on the Company’s account. |

| • |

Strong regulatory framework: EY, as an independent registered public accounting firm, is subject to PCAOB inspections, “Big 4” peer reviews and PCAOB and SEC oversight. |

Based on these considerations, the Audit Committee believes that the selection of Ernst & Young LLP is in the best interest of the Company and its stockholders. Therefore, the Audit Committee recommends that stockholders ratify the appointment of Ernst & Young LLP. If stockholders do not ratify the appointment, the Committee will reconsider its decision. One or more members of Ernst & Young LLP are expected to be present at the Annual Meeting, will be able to make a statement if they so desire, and will be available to respond to appropriate questions.

| The Board recommends you vote FOR this proposal |

| AT&T INC. |

10 |

2024 PROXY |

| VOTING ITEMS - MANAGEMENT PROPOSALS |

|

ITEM NO. 3 - ADVISORY APPROVAL OF EXECUTIVE COMPENSATION

This proposal would approve the compensation of Executive Officers as disclosed in the Compensation Discussion and Analysis, the compensation tables, and the accompanying narrative disclosures (see pages 39 through 70). These sections describe our executive compensation program.

The Human Resources Committee is responsible for executive compensation and works to structure a balanced program that addresses the dynamic, global marketplace in which AT&T competes for talent. The compensation structure includes pay-for-performance and equity-based incentive programs and seeks to reward executives for attaining performance goals.

AT&T submits this proposal to stockholders on an annual basis. While this is a non-binding, advisory vote, the Committee intends to take into account the outcome of the vote when considering future executive compensation arrangements. AT&T is providing this vote as required pursuant to Section 14A of the Securities Exchange Act.

GUIDING PAY PRINCIPLES

Alignment with Stockholders

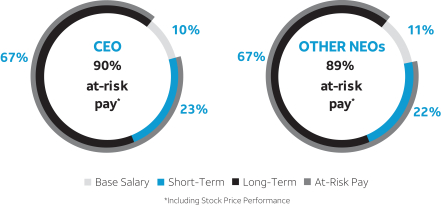

Incorporate stockholder perspectives and feedback into any compensation program enhancements. Engage with stockholders as a key part of the Committee’s decision-making process and utilize compensation elements and set performance targets that closely align executives’ interests with those of stockholders. For example, approximately 67% of annual target pay for active NEOs is tied to stock price performance. In addition, we have executive stock ownership guidelines and stock holding requirements, as described on page 56. Each NEO is in compliance with AT&T’s common stock ownership guidelines.

Competitive and Market Based

Evaluate all components of our compensation and benefits program compared to appropriate peer company practices to ensure we are able to attract and retain world-class talent with the leadership abilities and experience necessary to develop and execute business strategies, obtain superior results, and build long-term stockholder value in an organization as large and complex as AT&T.

Pay for Performance

Tie a significant portion of compensation to stock price and/or the achievement of predetermined goals and recognize individual accomplishments that contribute to our success. For example, in 2023, 90% of the CEO’s target compensation (and an average, 89% for other active NEOs) was at risk and tied to short- and long-term performance incentives, including stock price performance.

Balanced Short- and Long-Term Focus

Ensure that the compensation program provides an appropriate balance between the achievement of short- and long-term performance objectives, with a clear emphasis on managing the sustainability of the business and mitigating risk.

Principled Program

Structure our program so that it aligns with both corporate governance best practices and our strategic objectives, while remaining easy to explain and communicate.

| The Board recommends you vote FOR this proposal |

| 2024 PROXY |

11 |

AT&T INC. |

VOTING ITEMS - STOCKHOLDER PROPOSALS

STOCKHOLDER PROPOSALS

Certain stockholders, as noted below, have advised the Company that they intend to introduce at the 2024 Annual Meeting the proposals set forth below. The addresses of, and the number of shares owned by, each such stockholder will be provided upon request to the Office of the Corporate Secretary of AT&T at 208 S. Akard Street, Suite 2951, Dallas, Texas 75202.

| ITEM NO. 4 - | Stockholder Proposal - Independent Board Chairman |

Kenneth Steiner proposes the following:

Proposal 4 – Independent Board Chairman

Shareholders request that the Board of Directors adopt an enduring policy, and amend the governing documents as necessary in order that 2 separate people hold the office of the Chairman and the office of the CEO.

Whenever possible, the Chairman of the Board shall be an Independent Director.

The Board has the discretion to select a Temporary Chairman of the Board who is not an Independent Director to serve while the Board is seeking an Independent Chairman of the Board on an accelerated basis.

Although it is a best practice to adopt this policy soon this policy could be phased in when there is a contract renewal for our current CEO or for the next CEO transition.

The roles of Chairman and CEO are fundamentally different and should be held by 2 directors, a CEO and a Chairman who is completely independent of the CEO and our company.

This proposal is important to AT&T because the Board of Directors can repeatedly appoint one person to do the 2 most important jobs at AT&T, Chairman and CEO, for decades into the future.

This proposal topic won 40% support at the 2020 AT&T annual meeting. It took much more AT&T shareholder conviction of the merits of this proposal topic to vote for the 2020 shareholder proposal, and thereby override the recommendation of the Board of Directors, than to simply go along with the AT&T Board of Directors recommendation.

This 40%-support likely represented close to or more than 50%-support from professional investors who have access to independent proxy voting advice

A Lead Director is no substitute for an independent Board Chairman. According to the 2022 AT&T annual meeting proxy the AT&T Lead Director has 4 primary duties some of which are shared with others. When the Lead Director shares roles with others it means that the Lead Director may need to do little or nothing in those roles in a given year.

A new independent Board Chairman can focus more on developing the performance of the directors. For instance Glenn Hutchins, governance committee chair, was rejected by 17% of shares in 2023. Mr. Luis Ubiñas was rejected by 11% of shares in 2023. This compares to a 5% rejection often being the norm for well-performing directors.

The ascending complexities of a company with $100 Billion in market capitalization, like AT&T, increasingly demand that 2 persons fill the 2 most important jobs at AT&T on an enduring basis – Chairman and CEO. It is time for a change since AT&T stock is down significantly from its $43 price in 1999.

Please vote yes:

Independent Board Chairman—Proposal 4

| AT&T INC. |

12 |

2024 PROXY |

| VOTING ITEMS - STOCKHOLDER PROPOSALS |

|

BOARD RESPONSE:

The Board is committed to independent Board leadership and has had an Independent Chair in place since 2021. The Board does not anticipate any changes to its current leadership structure, which it believes is consistent with other S&P 500 companies and supported by AT&T’s stockholders, and recommends that stockholders vote AGAINST this inflexible, one-size fits all, proposal that seeks to influence the decisions of future Boards regardless of the circumstances relevant to the Company at that time.

Our Board currently has an Independent Chair, and our governance structure promotes strong independent Board leadership.

The AT&T Board currently has an Independent Chair and has since 2021 when Bill Kennard began serving in that role. The Board has determined that such a leadership structure is the most appropriate for our Company at this time and believes that Mr. Kennard’s expertise in the global communications industry and knowledge of our complex regulatory landscape enable him to effectively serve in this role. While the Board’s current practice is to elect an Independent Chair, its Directors have a fiduciary duty to regularly evaluate and determine the most appropriate Board leadership structure for AT&T and our stockholders, considering the Company’s needs, circumstances, and opportunities. Moreover, the Board is firmly committed to independent Board leadership, and in situations where the Chair of the Board is not independent, our Company policies require the appointment of an independent Lead Director, to be elected by the independent Directors at the time, with robust and clearly defined responsibilities as detailed further below.

The Board believes that its current structure with an Independent Chair, and its system of appointing an independent Lead Director in the event the Chair is not independent, provides effective oversight of management. The Board maintains strong, independent oversight on behalf of stockholders by consistently ensuring that each Board committee is led by and composed entirely of independent Directors, and we maintain strong corporate governance practices, as described in more detail beginning on page 20 of this proxy. Additionally, according to the 2023 Spencer Stuart Board Index, less than 40% of S&P 500 companies have an independent chair in place and, based on information collected by an independent, third-party advisor, only 3% of S&P 500 companies have a codified policy in their corporate governance guidelines requiring that the chair of the board be independent.

Maintaining flexibility in approach is in the best interest of AT&T and its stockholders.

The Board believes continued flexibility to appoint the appropriate Board leadership is in the best interests of the Company and its stockholders. Given the large and complex nature of our business and the challenges of operating in a highly regulated industry, a policy requiring an independent chair would unnecessarily restrict the ability of Directors in structuring AT&T’s Board leadership when faced with new or different circumstances. The rigid standard imposed by this proposal does not allow the Board flexibility to select the leadership structure best suited to meet the needs of the Company and prioritize the interests of its stockholders based on the particular environment, circumstances, and challenges confronting the Board and the Company at any given time.

Our Corporate Governance Guidelines provide for the appointment of an independent Lead Director with robust and clearly defined responsibilities in the event that the Chair is not independent.

Should the best interests of the Company and its stockholders warrant the appointment of a Chair who is not independent, in compliance with existing policies, the independent Directors of the Board would simultaneously appoint an independent Lead Director with clearly delineated and comprehensive responsibilities including – among others – presiding at Board meetings at which the Chair is not present, acting as the principal liaison between management and non-management Directors, and acting as a contact for major stockholders and other interested persons. The Board believes that in the event the Chair is not independent this structure would serve as an appropriate counterbalance, promoting consistent independent Board oversight, and providing for clearly established leadership roles on the Board. The full list of Lead Director responsibilities is detailed on page 4 of the AT&T Corporate Governance Guidelines at investors.att.com.

| 2024 PROXY |

13 |

AT&T INC. |

VOTING ITEMS - STOCKHOLDER PROPOSALS

Through our long-standing stockholder engagement program, we have received consistent support for the Board’s flexible approach, including during our most recent leadership transition.

We regularly discuss our leadership structure with stockholders as part of our annual engagement program; stockholders continue to express support for our flexible approach to Board leadership and our governance practices which promote independent Board oversight of management, including throughout leadership transitions. In our most recent stockholder outreach in the fall of 2023, we prioritized this topic in our discussions with stockholders. We continued to hear strong support for our current Board leadership structure, flexibility for the Board to evolve the leadership structure if it determines it is necessary, and appreciation for a robust and clearly defined independent Lead Director role in the event of a non-independent Chair.

Additionally, similar stockholder proposals have been presented at six of the last eight annual meetings, and our stockholders have voted against the proposal each time.

For these reasons, the Board believes that the rigid approach to the Company’s leadership structure requested by the proposal is not necessary and not in the best interest of our stockholders. The Board has a demonstrated commitment to independent Board leadership and believes it is best positioned to determine the most effective leadership structure for the Company in consideration of the relevant circumstances facing the Company at any given time.

| The Board recommends you vote AGAINST this proposal. |

| ITEM NO. 5 - | Stockholder Proposal - Improve Clawback Policy for Unearned Pay for Each NEO |

John Chevedden proposes the following:

Proposal 5 – Improve Clawback Policy for Unearned Pay for Each NEO

Shareholders ask the Board of Directors to amend the Company Policy on recoupment of incentive pay to apply to the each Named Executive Officer and to state that conduct or negligence – not merely serious misconduct – may trigger application of that policy. Also the Board is to report to shareholders in an EDGAR filing the results of any deliberations about whether or not to cancel or seek recoupment of compensation paid, granted or awarded to NEOs.

These amendments should operate prospectively and be implemented so as not to violate any contract, compensation plan, law or regulation. This includes that at the time of the amendment that no section of such revised policy be adopted that would act against this proposal and make it more difficult to clawback unearned NEO pay and that no section of such revised policy shall further restrict the current policy.

The current AT&T policy applies only to knowing fraudulent or illegal conduct.

The current AT&T policy requires no report to shareholders.

Because the AT&T clawback policy is limited to knowing fraudulent or illegal conduct and does not require disclosure to shareholders, that policy is too narrow, too vague, and does not address situations where an executive fails to exercise oversight responsibilities that result in significant financial or reputational damage to AT&T. It should.

A clawback policy based on conduct – not serious misconduct is consistent with a 2022 rule from the Securities and Exchange Commission that requires a clawback of erroneously awarded incentive pay – even with no misconduct – if a company restates its financial statements owing to material errors.

There are only 50-words in the 2023 AT&T annual meeting proxy under the heading of Clawback Policy and there is no listing of the web address for the complete AT&T Clawback Policy.

Wells Fargo offers a prime example of why AT&T needs a stronger policy. After 2016 Congressional hearings, Wells Fargo agreed to pay $185 million to resolve claims of fraudulent sales practices. Wells Fargo’s board then moved to claw back $136 million from 2 top executives. Wells Fargo unfortunately concluded that the CEO had only turned a blind eye to the practice of opening fraudulent accounts.

Please vote yes:

Improve Clawback Policy for Unearned Pay for Each NEO—Proposal 5

| AT&T INC. |

14 |

2024 PROXY |

| VOTING ITEMS - STOCKHOLDER PROPOSALS |

|

BOARD RESPONSE:

The proposal ignores AT&T’s existing policies regarding the recovery of employee compensation which, in certain respects, are even more comprehensive than what the proposal requests. The Board recommends that stockholders vote AGAINST this proposal for the following reasons:

| • |

AT&T recently adopted a Clawback Policy1 in compliance with SEC rules and NYSE standards, and conducted a thorough review to ensure the policy best protects stockholder interests and adequately discourages excessive risk-taking by executives. |

| • |

Additionally, AT&T has long had protections on employee compensation that extend beyond the terms of the Clawback Policy. Specifically, since 2009, AT&T’s Policy on Restitution2 has permitted the Company to seek restitution of any bonus, commission, or other compensation received by any employee as a result of fraudulent or illegal conduct, regardless of whether a restatement of the Company’s financial statements is required. |

| • |

AT&T’s policies and SEC rules already require disclosure of information about the application of these policies. |

| • |

AT&T’s policies provide the Board with appropriate guidance, authority, and discretion to seek recoupment of incentive-based compensation when such action is warranted and to act in the best interest of the Company and its stockholders. Furthermore, the Company’s policies protect the interests of its stockholders and promote transparency and management accountability. |

We crafted our Clawback Policy to be comprehensive in nature and in compliance with relevant laws and regulations.

Effective October 2, 2023, we adopted our new Clawback Policy, which addresses SEC rules and NYSE listing standards requiring companies to adopt, disclose and enforce a clawback policy providing for the recovery of erroneously awarded incentive-based compensation received by current and former executive officers in connection with a financial restatement, regardless of fault or misconduct. Our Clawback Policy applies to all incentive-based compensation received by covered executives of the Company regardless of fault or misconduct “in the event that the Company is required to prepare an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws.” In this respect, the Clawback Policy has a no-fault standard, which is an even lower standard than the proposal’s requested standard of “conduct or negligence.” Under the Clawback Policy, the Board does not need to determine that a covered executive of the Company was negligent or acted (or omitted to act) in any way at all for the policy to apply. If the Company is required to prepare an accounting restatement, the Clawback Policy is automatically triggered, and the Company must “recover reasonably promptly the amount of erroneously awarded” incentive-based compensation from any covered executives of the Company who received such compensation during the covered period. By adopting the Clawback Policy, we specifically intended to comply with the new NYSE listing requirement. Notably, the proposal acknowledges that the policy it requests is consistent with that clawback policy listing requirement. The proposal thus would not provide stockholders with any meaningful protection or benefit beyond what our Clawback Policy already provides.

We maintain a Policy on Restitution, which includes additional parameters that extend beyond the proposal’s ask.

Our Policy on Restitution allows the Board to “seek restitution of any bonus, commission, or other compensation received by any employee as a result of the employee’s intentional or knowing fraudulent or illegal conduct, including the making of a material misrepresentation contained in the Company’s financial statements.” Unlike the policy requested by the proposal, the Policy on Restitution is not limited to incentive-based compensation received by Named Executive Officers of the Company but applies to all employees and to other forms of compensation, as well. Because the scope of the Policy on Restitution is broad, the Board believes it is appropriate to limit its application to circumstances involving misconduct. The proposal does not discuss specific circumstances, events, actions, or outcomes that trigger the application of the requested policy. As a result, the Board believes that the proposal lacks the appropriate guidelines to direct its application.

| 1 |

Available at https://investors.att.com/~/media/Files/A/ATT-IR-V2/governance-documents/att-clawback-policy. pdf. |

| 2 |

Available at https://investors.att.com/~/media/Files/A/ATT-IR-V2/governance-documents/policy-on-restitution. pdf. |

| 2024 PROXY |

15 |

AT&T INC. |

VOTING ITEMS - STOCKHOLDER PROPOSALS

We disclose our full Clawback Policy and Policy on Restitution on our company website, and details surrounding their application are disclosed in a Form 8-K, as required, which is accessible to all stakeholders.

The proposal claims that the “AT&T clawback policy does not require disclosure for shareholders”; however, the Company is required to disclose information about the application of these policies in its SEC filings and complies with these requirements. The Clawback Policy requires the Company to disclose not only the Board’s determination that the policy applies, as in the proposal’s request, but also the basis for any conclusion by the Board that an exception under the policy is warranted and detailed information about the amounts subject to recoupment. To the extent the Company were to recoup material compensation paid to a Named Executive Officer pursuant to the Policy on Restitution, disclosure would be required in a Form 8-K filed with the SEC.

The Board believes that the Company’s Clawback Policy and Policy on Restitution provide the Board with appropriate guidance, authority, and discretion to seek recoupment of incentive-based compensation in circumstances when such action is warranted and to act in the best interest of the Company and its stockholders. Furthermore, the Company’s policies protect stockholders’ interests, and promote transparency and management accountability.

| The Board recommends you vote AGAINST this proposal. |

| ITEM NO. 6 - | Stockholder Proposal - Report on Respecting Workforce Civil Liberties |

The National Center for Public Policy Research proposes the following:

Report on Respecting Workforce Civil Liberties

Supporting Statement:

AT&T (Company) employs more than 160,000 people.1 It should respect its employees’ speech rights and religious freedom. Company legally must comply with many laws prohibiting discrimination against employees on many grounds, including religion and sometimes political affiliation.