UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

|

No fee required. | |

|

Fee paid previously with preliminary materials. | |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

How to vote

|

|

|

|

| Online | Phone | At the virtual meeting |

Shareholders as of the close of business on March 11, 2024, the record date, may vote at the meeting.

If you are a registered shareholder or Verizon savings plan participant, you may vote online at www.envisionreports.com/vz, by telephone or by mailing a proxy card. If you hold your shares through a bank, broker or other institution, you will receive a voting instruction form that explains the various ways you can vote. We encourage you to vote your shares as soon as possible.

March 25, 2024

By Order of the Board of Directors,

William L. Horton, Jr.

Senior Vice President, Deputy General Counsel and Corporate Secretary

Verizon Communications Inc.

1095 Avenue of the Americas

New York, New York 10036

Important Notice Regarding Availability of Proxy Materials for Verizon’s Shareholder Meeting to be Held on May 9, 2024

The 2024 Proxy Statement and 2023 Annual Report on Form 10-K are available at www.edocumentview.com/vz.

We are making the proxy materials first available on or about March 25, 2024.

Date and time

Thursday, May 9, 2024

10:00 AM, Eastern Daylight Time

Online virtual meeting site

meetnow.global/VZ2024

Information on how to access the meeting, vote and ask questions at the meeting, can be found beginning on page 79 of the proxy statement. You will not be able to attend the meeting at a physical location.

Items of business

| • | Elect the 10 Directors identified in the accompanying proxy statement |

| • | Approve, on an advisory basis, Verizon’s executive compensation |

| • | Ratify the appointment of the independent registered public accounting firm |

| • | Act on the shareholder proposals described in the proxy statement that are properly presented at the meeting |

| • | Consider any other business that is properly brought before the meeting |

The Verizon Board

| From left to right: | |||

| Clarence Otis, Jr. | Daniel Schulman | Hans Vestberg | Rodney Slater |

| Carol Tomé | Shellye Archambeau | Vittorio Colao | Melanie Healey |

| Gregory Weaver | Laxman Narasimhan | Mark Bertolini | Roxanne Austin |

A message from Hans Vestberg, our Chairman and CEO, and Clarence Otis, Jr., our Independent Lead Director

2023 was a critical year for Verizon, as we took several important steps to position ourselves for renewed growth and profitability, as well as continued leadership into the future.

Most significantly, at the beginning of 2023 we appointed the leadership team that will drive the next phase of Verizon’s growth. In the first quarter, we announced that four well-respected industry veterans would assume these new roles in the company:

| • | Tony Skiadas, Chief Financial Officer |

| • | Sowmyanarayan Sampath, CEO of Verizon Consumer |

| • | Kyle Malady, CEO of Verizon Business |

| • | Joe Russo, President of Global Networks and Technology |

That team hit the ground running, making significant changes to how we operate. Both the Consumer and Global Network organizations were restructured to enable a more regional, targeted market approach. The Consumer and Business teams also evolved their commercial models and employee incentives to increase their focus on providing the services and products that customers need and want while maintaining the profitability of the company.

The Finance team supported these efforts while simultaneously strengthening our balance sheet to allow us financial flexibility in the future. At the same time, the Global Network team continued to lay the foundation of our future mobility and broadband growth by expanding the coverage of our C-Band wireless spectrum throughout the country.

This leadership team’s work has already yielded strong results. In 2023:

| • | We increased our wireless subscriber base by appproximately 1.5 million connections, expanding our wireless business that was already the largest in the country |

| • | We grew our fixed wireless access subscriber base to more than 3 million – representing a significant business that did not exist a few years ago |

| • | We grew our wireless service revenue, which reflects the recurring revenue from our wireless operations, by a healthy 3.2% |

These results are indicative of the momentum we have in the business as we enter 2024. This year we expect to continue to see the benefits of our strategic decision to invest in C-Band spectrum. C-Band gives us a competitive advantage in the areas where it is deployed and will be the basis for our wireless mobility and fixed wireless access growth for years to come.

While our strong operational and financial results were important, equally important was that we achieved them in the right way. From logging over 530,000 volunteer hours, to recycling or reusing nearly 47 million pounds of e-waste, to enabling our customers to avoid over 20 million metric tons of CO₂e, our V Team employees supported our communities throughout the year at the same time they were providing excellent service to our customers.

We look forward to building on our success in 2024.

| Sincerely, | |

|

|

| Hans Vestberg Chairman and Chief Executive Officer |

Clarence Otis, Jr. Independent Lead Director |

Table of contents

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

This summary highlights information contained in the proxy statement and does not contain all of the information you should consider. We encourage you to read the entire proxy statement before voting. For information regarding Verizon’s 2023 performance, please read Verizon’s 2023 Annual Report on Form 10-K.

| 2023 highlights | ||

|

Wireless Service Revenue up 3.2% Raised dividend for 17th consecutive year | |

|

MyPlan Launch Netflix + MAX bundle Most awarded for Wireless Network Quality - JD Power | |

|

Consumer - Postpaid phone net adds improved compared to 2022 every quarter Business - 10 consecutive quarters with at least 125,000 postpaid phone net adds Broadband - >400,000 net adds per quarter | |

Meeting information

Date and time May 9, 2024 at 10:00 AM, Eastern Daylight Time

Online virtual meeting The meeting will be held virtually via the Internet at meetnow.global/VZ2024, where you will be able to vote electronically and submit questions during the meeting.

Record date March 11, 2024

Meeting access, submission of questions and voting information can be found beginning on page 79.

i

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

Agenda and voting recommendations

|

Item 1: Election of Directors | |

| The Board of Directors recommends that you vote FOR the election of the Board’s nominees. | ||

| The Director candidates nominated by our Board of Directors are all proven leaders with a strong sense of integrity and respect for differing viewpoints. As a group, they bring a mix of backgrounds, perspectives, skills, experiences and expertise that contributes to a well-rounded Board that is uniquely positioned to effectively oversee Verizon’s strategy and businesses. For additional information about the Director candidates and their respective qualifications, please see the “Governance” section beginning on page 1. |

| Our nominees’ skills and experience | ||

| 9 | Consumer/B2B/retail | |

| 3 | Cybersecurity | |

| 9 | Financial expertise | |

| 2 | Marketing and brand management | |

| 5 | Regulatory/public policy | |

| 10 | Risk management | |

| 10 | Strategic planning | |

| 5 | Technology | |

| 4 | Telecommunications | |

Board diversity*

40%

ethnic/racial diversity

30%

women

Board tenure and age*

7.3

years

average

tenure

64

years old

average

age

| * | Based on our 10 nominees as of March 25, 2024. See Appendix A for the Board diversity disclosure required by Rule 5606 of the Nasdaq Stock Market (Nasdaq), which reflects the diversity of all 12 Directors serving as of March 25, 2024. |

ii

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

Our nominees at a glance

|

|

|

|

|

| Shellye Archambeau | Roxanne Austin | Mark Bertolini | Vittorio Colao | Laxman Narasimhan |

|

|

|

|

|

| Clarence Otis, Jr. | Daniel Schulman | Rodney Slater | Carol Tomé | Hans Vestberg |

| Name | Committee membership* | Key skills and experience | ||||

| Audit | Corporate Governance and Policy |

Finance | Human Resources | |||

| Shellye Archambeau Former Chief Executive Officer, MetricStream, Inc. |

|

|

|

Marketing and brand

management Risk management Technology | ||

| Roxanne Austin President and CEO, Austin Investment Advisors |

|

|

|

Cybersecurity Financial expertise Strategic planning | ||

| Mark Bertolini Chief Executive Officer, Oscar Health, Inc. |

|

|

|

Financial expertise Regulatory/public policy Strategic planning | ||

| Vittorio Colao Former Chief Executive, Vodafone Group Plc |

|

|

|

Consumer/B2B/retail Technology Telecommunications | ||

| Laxman Narasimhan Chief Executive Officer, Starbucks Corporation |

|

|

|

Consumer/B2B/retail Risk management Strategic planning | ||

| Clarence Otis, Jr. Former Chairman and CEO, Darden Restaurants, Inc. Lead Director |

|

|

|

|

Consumer/B2B/retail Financial expertise Risk management | |

| Daniel Schulman Former President and CEO, PayPal Holdings, Inc. |

|

|

Cybersecurity Strategic planning Technology | |||

| Rodney Slater Senior Partner, Squire Patton Boggs LLP |

|

|

|

Regulatory/public policy Risk management Strategic planning | ||

| Carol Tomé Chief Executive Officer, United Parcel Service, Inc. |

|

|

Consumer/B2B/retail Financial expertise Strategic planning | |||

| Hans Vestberg Chairman and CEO, Verizon Communications Inc. |

Strategic planning Technology Telecommunications | |||||

| * | Committee memberships are as of March 25, 2024. |

|

Independent |  |

Committee Chair |  |

Audit Committee Financial Expert |

iii

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

Governance highlights

Our Board has adopted robust governance structures and practices to enhance our independent oversight, effectiveness and accountability to shareholders.

Independent |

• 11 of our 12 current Directors are independent • Strong independent Lead Director with clearly delineated duties • Regular executive sessions of independent Directors | |

| Board effectiveness |

• Active Board refreshment plan with a focus on diversity, with six new Directors added since 2017, half of whom are women or diverse with respect to race or ethnicity • Orientation program for new Directors and continuing education for all Directors • Limits on other public board service • Annual Board and committee assessments • Average tenure goal for independent Directors | |

| Accountability to shareholders |

• Annual election of all Directors by majority voting • Shareholder right to call special meetings • Proxy access right with market terms • No poison pill, and shareholder ratification required for any future poison pill • No dual-class shares or voting right restrictions • Robust stock ownership requirements for executive officers and Directors • Proactive year-round shareholder engagement program | |

| 2023

Environmental, Social and Governance (ESG) highlights |

• Issued fifth US$1 billion green bond, with final allocation completed and a sixth US$1 billion green bond issued in February 2024 • Set a new interim target to source renewable energy equivalent to 100% of our total annual electricity consumption by 2030 • Top 10 ranking and Telecom Industry Leader in Just Capital’s 2023 America’s Most JUST companies • Published third TCFD-aligned report |

|

Item 2: Advisory vote to approve executive compensation | |

| The Board of Directors recommends that you vote FOR this proposal. | ||

| We are asking shareholders to approve, on an advisory basis, the compensation of our named executive officers, as described in the Compensation Discussion and Analysis and Compensation Tables beginning on pages 23 and 40, respectively. |

iv

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

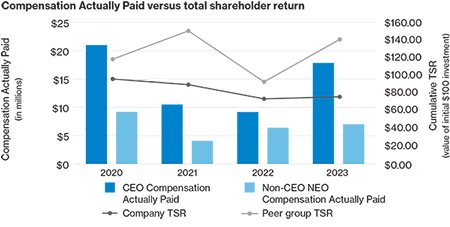

Executive compensation program highlights

Our executive compensation program reflects Verizon’s commitment to industry-leading compensation and governance practices. For a detailed discussion of the executive compensation program, please see the Compensation Discussion and Analysis beginning on page 23.

| Compensation strategy | • Align executives’ and shareholders’ interests • Attract, retain and motivate high-performing executives | |

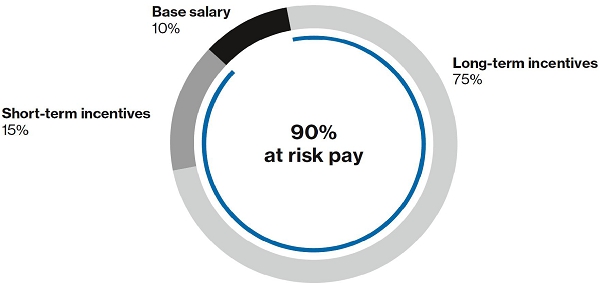

| Pay-for- performance essentials |

• Approximately 90% of named executive officers’ total compensation opportunity is variable, incentive-based pay • Defined benefit pension and supplemental executive retirement benefits frozen over 15 years ago • Quantitative ESG metric in Short-Term Incentive Plan (Short-Term Plan) | |

| Best practice highlights | • Shareholder approval policy for severance benefits • No cash severance benefits for the Chief Executive Officer (CEO) • Significant executive share ownership requirements • Clawback policies • Anti-hedging policy • No tax gross-ups • No executive employment agreements |

The summary below shows the 2023 compensation for each of our named executive officers, as required to be reported in the Summary Compensation table pursuant to U.S. Securities and Exchange Commission (SEC) rules. For more information, please see the notes accompanying the Summary Compensation table beginning on page 40.

| Name and principal position | Salary ($) | Bonus ($) | Stock awards ($) | Option awards ($) | Non-equity incentive plan compensation ($) | Change in pension value and nonqualified deferred compensation earnings ($) | All other compensation ($) | Total ($) | ||||||||

| Hans Vestberg Chairman and Chief Executive Officer | 1,500,000 | 0 | 18,000,042 | 0 | 4,087,500 | 0 | 541,775 | 24,129,317 | ||||||||

| Anthony Skiadas* Executive Vice President and Chief Financial Officer | 741,667 | 0 | 7,000,069 | 0 | 1,076,375 | 0 | 113,202 | 8,931,313 | ||||||||

| Sowmyanarayan Sampath** Executive Vice President and Group CEO – Verizon Consumer | 1,016,667 | 0 | 8,500,049 | 0 | 1,716,750 | 0 | 146,496 | 11,379,962 | ||||||||

| Kyle Malady** Executive Vice President and Group CEO – Verizon Business | 983,333 | 0 | 8,000,027 | 0 | 1,635,000 | 2,959 | 188,884 | 10,810,203 | ||||||||

| Craig Silliman Executive Vice President and President – Verizon Global Services | 900,000 | 0 | 7,500,021 | 0 | 1,471,500 | 633 | 172,028 | 10,044,182 | ||||||||

| Matthew Ellis* Former Executive Vice President and Chief Financial Officer | 444,551 | 0 | 7,000,052 | 0 | 517,750 | 0 | 4,990,096 | 12,952,449 |

| * | Mr. Skiadas succeeded Mr. Ellis as Executive Vice President and Chief Financial Officer effective April 29, 2023. Prior to that appointment, Mr. Skiadas served as Verizon’s Senior Vice President and Controller. Mr. Ellis separated from Verizon on April 29, 2023. |

| ** | Mr. Sampath served as Executive Vice President and Group CEO – Verizon Business until March 2, 2023, and Mr. Malady succeeded Mr. Sampath in that role on that date. Prior to that appointment, Mr. Malady served as Executive Vice President and President – Global Networks and Technology. |

v

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

|

Item 3: Ratification of auditors | |

| The Board of Directors recommends that you vote FOR ratification. | ||

| We are asking shareholders to ratify the Audit Committee’s appointment of Ernst & Young LLP (Ernst & Young) as Verizon’s independent registered public accounting firm for 2024. For information on fees paid to Ernst & Young in 2023 and 2022, please see page 59. |

|

Item 4-10: Shareholder proposals | |

| The Board of Directors recommends that you vote AGAINST each of the shareholder proposals. | ||

| In accordance with SEC rules, we have included in this proxy statement proposals submitted by shareholders for consideration, if presented at the meeting. The proposals can be found beginning on page 64. |

vi

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

We believe that good governance starts with an independent, effective and diverse Board. Our Board is one of Verizon’s most critical strategic assets. As such, the composition of the Board evolves along with our strategic needs for the future. We believe we are more likely to achieve sustainable growth in shareholder value when our Board has the right mix of skills, expertise and tenure, and can devote sufficient time to their duties as active and engaged members of our Board.

The Corporate Governance and Policy Committee is strategic and purposeful in its approach to refreshment and succession planning. The Committee considers the following key factors when nominating Directors:

| • | Skills and experience. Verizon’s strategy is to extend our network leadership through continued innovation, grow our core business and provide our customers with best-in-class experiences, while maintaining the balanced capital allocation approach and financial discipline that our investors expect of us. In light of the Company’s strategy and expected future business needs, the Committee has identified the skills and experience listed below as important to be represented on the Board as a whole. |

| • | Consumer/B2B/retail |

| • | Cybersecurity |

| • | Financial expertise |

| • | Marketing and brand management |

| • | Regulatory/public policy |

| • | Risk management |

| • | Strategic planning |

| • | Technology |

| • | Telecommunications |

| • | Diversity. The Committee recognizes that a diverse set of viewpoints and practical experiences enhances the effectiveness of our Board in assessing the challenges and opportunities impacting our business and helping management achieve better outcomes. In evaluating Director candidates, the Committee considers how a candidate’s particular background, experience, qualifications, attributes and skills may complement, supplement or duplicate those of other prospective candidates. The Committee seeks a diverse group of candidates who possess the requisite judgment, background, skill, expertise and time, as well as diversity with respect to race, ethnicity and gender, to strengthen and increase the diversity, breadth of skills and qualifications of the Board. See Appendix A for the Board diversity disclosure required by Nasdaq Rule 5606. |

| • | Age and tenure. The Committee believes it is important to bring new perspectives and talents to the Board on a regular basis. Verizon does not have term limits for Directors because the Board recognizes that Directors who have served on the Board for an extended period can provide valuable insight into Verizon’s operations and future based on their experience with, and understanding of, Verizon’s history, policies and objectives. As an alternative to term limits, the Board seeks to maintain an average tenure of nine years or less for its independent Directors. In addition, to encourage new viewpoints on the Board, the Board seeks to add at least one new Director every two years on average. We have exceeded this goal by adding six new Directors since 2017, half of whom are women or diverse with respect to race or ethnicity. Under Verizon’s Corporate Governance Guidelines, a Director must retire from the Board the day before the annual meeting of shareholders that follows his or her 72nd birthday. |

| • | Board size. The Committee periodically evaluates whether to change the size of the Board based on the Board’s needs and the availability of qualified candidates. |

| • | Board dynamics. The Committee considers each Director candidate’s individual contribution or potential contribution to the Board as a whole and strives to maintain one hundred percent active and collaborative participation. |

1

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

Our Board’s independence

Verizon’s Corporate Governance Guidelines establish standards for evaluating Director independence and require that a substantial majority of the Directors be independent. The Board determines the independence of each Director under New York Stock Exchange (NYSE) and Nasdaq governance standards, as well as the more stringent standards included in the Corporate Governance Guidelines. These standards identify the types of relationships that, if material, could impair independence, and fix monetary thresholds at which the relationships are considered to be material. The Corporate Governance Guidelines are available on the Corporate Governance section of our website at www.verizon.com/about/investors/corporate-governance. The Corporate Governance and Policy Committee conducts an annual review of any relevant business relationships that each Director may have with Verizon and reports its findings to the full Board.

Based on the Committee’s recommendation, the Board has determined that all of the non-employee Director candidates meet the independence requirements of applicable law, the NYSE, Nasdaq and Verizon’s Corporate Governance Guidelines: Ms. Archambeau, Ms. Austin, Mr. Bertolini, Mr. Colao, Mr. Narasimhan, Mr. Otis, Mr. Schulman, Mr. Slater and Ms. Tomé. The Board also determined that Ms. Healey, who is not standing for re-election, and Mr. Weaver, who is not standing for re-election as a result of the retirement standard in our Guidelines, were independent.

Additionally, the Board has determined that each member of the Audit Committee and the Human Resources Committee meets the additional, heightened independence criteria applicable to such committee members under the applicable NYSE and Nasdaq rules.

The employers or former employers of Mr. Bertolini, Mr. Narasimhan, Mr. Schulman, and Ms. Tomé each made payments to Verizon for telecommunications services during 2023. In addition, during 2023 Verizon made payments to Mr. Bertolini’s former employer for fees relating to investment of pension plan assets, to Mr. Narasimhan’s employer for Starbucks gift cards purchased by Verizon customers, to Mr. Schulman’s former employer for processing fees relating to payments to and from our customers in connection with Verizon services and wireless devices, and to Ms. Tomé’s employer for shipping services. Applying the independence standards above, the Board considered the foregoing payments and determined that these general business transactions and relationships are not material and did not impair the ability of the Director to act independently. |

What ESG skills and experience do our Directors bring to the boardroom?

ESG is incorporated into strategic and operational decision-making at Verizon. Each of our Directors has skills and experience in one or more aspects of ESG, including:

• business ethics and compliance • cybersecurity and data privacy • diversity, equity and inclusion • environmental sustainability, including renewable energy • governance • network reliability and resilience • regulatory and public policy trends • responsible business and corporate social responsibility • risk management • talent attraction, retention and development |

Director nominations

The Corporate Governance and Policy Committee considers and recommends candidates for our Board. The Committee reviews all nominations submitted to Verizon, including individuals recommended by shareholders, Directors or members of management. The Committee also retains executive search firms from time to time to help identify and evaluate potential candidates.

Any shareholder who wishes to recommend a Director candidate to the Committee for its consideration should write to the Assistant Corporate Secretary at the address provided under “Contacting us.” A recommendation for a Director candidate should include the candidate’s name, biographical data and a description of the candidate’s qualifications in light of the requirements described below. If we make any material changes to the Committee’s procedure for considering and nominating candidates, we will file a report with the SEC and post the information on the Corporate Governance section of our website at www.verizon.com/about/investors/corporate-governance.

2

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

The Committee reviews the qualifications of each candidate for election or re-election to the Board. For incumbent Directors, this review includes the Director’s participation in and contributions to the activities of the Board, the Director’s independence and past meeting attendance, and whether the Director’s skills and expertise continue to align with Verizon’s long-term business strategy. After the Committee evaluates all candidates for Director, it presents its recommendation to the Board. The Committee also discusses with the Board any candidates who the Committee considered but did not recommend for election or re-election.

Before being nominated, each candidate for election and each incumbent Director standing for re-election must consent to stand for election or re-election and provide certain representations required under Verizon’s bylaws. Each candidate who is standing for election must also submit an irrevocable resignation, which will only become effective if (i) our Board or any Committee determines that any of the required representations were untrue in any material respect, or that the candidate breached any obligation under Verizon’s bylaws, or (ii) the candidate does not receive a majority of the votes cast at the annual meeting of shareholders, and the independent members of our Board decide to accept the resignation. Any decision about a resignation following an incumbent Director’s failure to obtain a majority of the votes cast will be disclosed within 90 days after the election results are certified.

Director criteria, qualifications and experience

To be eligible for consideration, any proposed Director candidate must:

| • | Possess exemplary ethics and integrity |

| • | Have proven judgment and competence |

| • | Have professional skills and experience that align with the needs of Verizon’s long-term business strategy and complement the experience represented on the Board |

| • | Have demonstrated the ability to act independently and be willing to represent the long-term interests of all shareholders and not just those of a particular constituency or perspective |

| • | Be willing and able to devote sufficient time to fulfill responsibilities to Verizon and our shareholders |

Election process

Verizon’s Directors are elected annually for a term of one year. We believe annual elections are consistent with good corporate governance because they foster Director accountability and increase shareholder confidence. Verizon’s bylaws require Directors to be elected by a majority of the votes cast in an uncontested election.

Nominees for election

Our Board has nominated the 10 candidates below, all of whom currently serve as Directors of Verizon, for election as Directors.

Each candidate has consented to stand for election, and we do not anticipate that any candidate will be unavailable to serve. If any candidate were to become unavailable before the election, the proxy committee could vote the shares it represents for a substitute named by the Board. Each candidate has submitted an irrevocable, conditional letter of resignation that our Board will consider if that candidate fails to receive a majority of the votes cast.

Biographical information for each Director nominee follows, including career highlights, the key skills and experience that we believe each Director nominee brings to our Board, and other public board directorships. All of our nominees bring more qualifications to the Board than those highlighted in their biographies, and these are reflected in the aggregate Board composition statistics provided in the Proxy Summary.

When deciding to re-nominate these Directors, the Corporate Governance and Policy Committee and the Board considered each Director’s individual qualifications, as well as the aggregate of skills and experience represented on the Board, in light of the Company’s strategy and expected future business needs.

|

The Board of Directors recommends that you vote FOR the election of the following Director candidates. |

3

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

| Shellye Archambeau | ||

|

Independent Director since: 2013 Age: 61 Committees: Audit | |

Key skills and experience:

| • | Leadership: Highly regarded and accomplished executive with over 30 years of experience building and scaling consumer and B2B businesses in the technology industry. As CEO of MetricStream, led the company’s transformation into a leader in Governance, Risk and Compliance solutions. |

| • | Marketing and brand management: Served as Chief Marketing Officer at two public companies (Loudcloud and NorthPoint Communications), leading the design and implementation of all sales and marketing strategies and driving revenue growth. As President of Blockbuster.com, launched the entertainment retailer’s first online presence. |

| • | Risk management: Acquired significant expertise with integrated enterprise risk management, regulatory compliance functions and quality, vendor and audit management software solutions across a wide array of industries during her tenure at MetricStream, as well as through service on the audit committees of Verizon, Okta and Arbitron. |

| • | Technology: Gained valuable experience developing and marketing emerging technology applications and solutions, including internet infrastructure, cloud-based and identity security services, business software platforms, e-commerce and digital media. |

Career highlights:

| • | MetricStream, Inc., a leading provider of governance, risk, compliance and quality management |

| ° | Chief Executive Officer (2002-2018) |

| • | Executive positions at Loudcloud, Inc., NorthPoint Communications, Blockbuster Inc. and IBM (domestic and international) (1984-2002) |

Other public company boards:

Okta, Inc. (since 2018)

Roper Technologies, Inc. (since 2018)

Nordstrom, Inc. (2015-2022)

| Roxanne Austin | ||

|

Independent Director since: 2020 Age: 63 Committees: Audit (Chair)

| |

Key skills and experience:

| • | Leadership: Seasoned leader who served as CEO of Move Networks, President and COO of DIRECTV, and CFO of Hughes Electronics. Named 2018 Director of the Year – Corporate Leadership and Service by the Forum for Corporate Directors and one of the most influential directors in the board room by the National Association of Corporate Directors in 2022 and 2013. Serves as co-chair of the annual Corporate Governance Conference at Northwestern’s Kellogg School of Management. |

| • | Cybersecurity: Acquired significant cybersecurity experience through her extensive management and operating roles in a range of technology industries, including service as a director of CrowdStrike, a leader in cloud-delivered endpoint protection. |

| • | Financial expertise: Developed a comprehensive background in finance and accounting as a public company audit committee member, CFO of Hughes Electronics and a partner at Deloitte & Touche LLP. Chaired the Mid Market Investment Advisory Committee of EQT Partners from 2017 to 2023. |

| • | Strategic planning: Oversaw a dramatic turnaround of the business within one year of her arrival at DIRECTV, with cash flow increasing from negative $400 million annually to cash flow positive by $400 million, and revenue increasing by 40%. Overhauled customer service at DIRECTV, resulting in the company winning J.D. Power’s award ranking #1 in customer satisfaction. |

Career highlights:

| • | President and Chief Executive Officer of Austin Investment Advisors, a private investment and consulting firm (2003-present) |

| • | President and Chief Executive Officer of Move Networks, Inc., an IP-based television delivery service (2009-2010) |

| • | President and Chief Operating Officer of DIRECTV, Inc., a digital television entertainment service (2001-2003) |

| • | Chief Financial Officer and various executive positions at Hughes Electronics Corporation (1993-2001) |

| • | Audit Partner and various audit positions at Deloitte & Touche LLP (1983-1993) |

Other public company boards:

AbbVie, Inc. (since 2013)

CrowdStrike Holdings, Inc. (since 2018)

Freshworks Inc. (since 2021)

Abbott Laboratories Inc. (2000-2022)

Teledyne Technologies Incorporated (2006-2021)

Target Corporation (2002-2020)

Ericsson (2008-2016)

4

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

| Mark Bertolini | ||

|

Independent Director since: 2015 Age: 67 Committees: Finance (Chair) | |

Key skills and experience:

| • | Leadership: Recognized as an accessible, forward-thinking and solutions-oriented leader. Transformed Aetna from a traditional health insurance company to a consumer-oriented health care company focused on delivering holistic integrated care to local communities and serving over 46 million people. |

| • | Financial expertise: Developed deep financial and risk management expertise in his executive roles at Aetna and as a board member of MassMutual Life Insurance Company, a leading life insurance mutual company. Served as Co-Chief Executive Officer of Bridgewater Associates, the world’s largest hedge fund, from 2022 to 2023, and continues to serve on the board of Bridgewater. |

| • | Regulatory/public policy: A national health care thought leader with extensive regulatory and public policy experience. Successfully navigated changes in the health insurance marketplace resulting from the Affordable Care Act and led Aetna through antitrust reviews of various acquisitions and proposed acquisitions. |

| • | Strategic planning: Led Aetna through a period of strategic and regulatory transformation and domestic and international growth through strategic acquisitions and dispositions, culminating in the $78 billion acquisition of Aetna by CVS completed in 2018. |

Career highlights:

| • | Chief Executive Officer of Oscar Health, Inc., a health insurance company built around a full stack technology platform (April 2023-present) |

| • | Co-Chief Executive Officer of Bridgewater Associates, LP, a global investment management firm (2022-March 2023) |

| • | Aetna Inc., a multi-national, Fortune 100 diversified healthcare benefits company |

| ° | Chairman (2011-2018) | ||

| ° | Chief Executive Officer (2010-2018) | ||

| ° | President (2007-2010) | ||

| ° | Other executive positions (2003-2007) |

| • | Executive positions at Cigna, NYLCare Health Plans and SelectCare, Inc. (1985-2003) |

Other public company boards:

Oscar Health, Inc. (since April 2023)

CVS Health Corporation (2018-2020)

| Vittorio Colao | ||

|

Independent Director since: 2022 Age: 62 Committees: Corporate Governance and Policy | |

Key skills and experience:

| • | Leadership: Built and transformed Vodafone Group Plc through organic growth, acquisitions and sales into one of the world’s largest communications companies with mobile operations in 24 countries and partnerships in over 40 more countries. |

| • | Consumer/B2B/retail: Grew Vodafone to serve, directly and through joint ventures, approximately 640 million mobile customers, 21 million broadband customers and 14 million TV customers. Additional consumer experience with RCS MediaGroup, a leading Italian publishing company. |

| • | Technology: Led Vodafone in the rapid and continuous development of mobile and other communications technology, with intensive capital spending to enhance high speed mobile networks, provide broadband and enterprise services, enhance the secure exchange of data, and develop 5G and the internet of things. |

| • | Telecommunications: Brings a valuable global perspective on, and extensive operational experience with, the rapidly changing telecommunications industry. Led Italy’s efforts to roll out broadband and 5G connectivity across the country as Italian Minister for Innovation, Digital Transition and Space. Provides unique insight into Verizon Wireless’ business as a result of his five-year tenure on the Board of Representatives when Verizon Wireless was still a joint venture between Vodafone and Verizon. |

Career highlights:

| • | Italian Minister for Innovation, Digital Transition and Space (2021-2022) |

| • | Vodafone Group Plc, a global mobile communications company |

| ° | Chief Executive (2008-2018) | ||

| ° | Director (2006-2018) | ||

| ° | Other executive positions, including Regional Chief Executive Officer for Southern Europe, Middle East and Africa (1999-2004) |

| • | Member, Verizon Wireless Board of Representatives (2008-2013) |

| • | Senior Advisor, Vice Chairman EMEA, General Atlantic (2019-2021; 2023-present) |

Other public company boards:

Unilever PLC and Unilever N.V. (2015-2021)

Mr. Colao previously served on our Board from 2019 to 2021.

5

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

| Laxman Narasimhan | ||

|

Independent Director since: 2021 Age: 56 Committees: Audit | |

Key skills and experience:

| • | Leadership: Insightful and strategic leader with wide experience across the consumer goods sector and a proven track record in developing purpose-led brands, including as CEO of Starbucks and Reckitt Benckiser Group Plc, a global consumer health, hygiene and nutrition company. Credited with improving sales and profit while managing approximately $18 billion in revenue at businesses across 100 countries and 125,000 employees as CEO of PepsiCo’s Latin America, Europe and Sub-Saharan Africa operations. |

| • | Consumer/B2B/retail: Provides valuable expertise and thought leadership in helping complex, global consumer-facing businesses improve demand and widespread appeal for core brand name labels. Prior to joining Starbucks, Reckitt Benckiser and PepsiCo, spent 19 years at McKinsey & Company, focusing on its consumer, retail and technology practices in the United States, Asia and India. |

| • | Risk management: Developed significant risk management experience, including supply chain risk management experience, while piloting Reckitt Benckiser through the supply chain disruptions of the COVID-19 pandemic. |

| • | Strategic planning: Articulated corporate purpose at Reckitt Benckiser and led the company through a major strategic transformation and a return to sustainable growth. Eliminated complexity and simplified operations in order to remain agile and manage surging demand for certain consumer products during the COVID-19 pandemic. |

Career highlights:

| • | Starbucks Corporation, the premier roaster, marketer and retailer of specialty coffee in the world |

| ° | Chief Executive Officer (2023-present) | ||

| ° | Chief Executive Officer-elect (2022-2023) |

| • | Chief Executive Officer of Reckitt Benckiser Group Plc, a global consumer-goods company (2019-2022) |

| • | PepsiCo, Inc., a leading global food and beverage company |

| ° | Global Chief Commercial Officer (2019) | ||

| ° | Chief Executive Officer, Latin America, Europe and Sub-Saharan Africa (2017-2019) | ||

| ° | Other executive positions (2012-2017) |

| • | McKinsey & Company (1993-2012) |

Other public company boards:

Starbucks Corporation (since 2023)

Reckitt Benckiser Group Plc (2019-2022)

| Clarence Otis, Jr. (Lead Director) | ||

|

Independent Director since: 2006 Age: 67 Committees: Audit | |

Key skills and experience:

| • | Leadership: Led Darden Restaurants, Inc., the largest company-owned and operated full-service restaurant company in the world, as CEO for 10 years, achieving sales growth of over 75% during the period. Known as a purpose-driven and values-based leader, with Darden being recognized by Fortune magazine for four consecutive years during his tenure as one of its 100 Best Companies to Work For. Named one of the most influential directors in the board room by the National Association of Corporate Directors in 2019. |

| • | Consumer/B2B/retail: Brings deep and valuable insights into consumer services and retail operations gleaned from his experience leading a Fortune 500 company that owned well-known national consumer brands including Olive Garden, LongHorn Steakhouse, Red Lobster and Capital Grille. Further consumer and retail expertise through board position at VF Corporation, which owns well-known national brands including Timberland and North Face. |

| • | Financial expertise: Gained substantial financial expertise through, among other roles, investment banking positions of increasing seniority over 12 years, the CFO role at Darden, serving as a director of the Federal Reserve Bank of Atlanta and as trustee or director of mutual funds pursuing a wide array of investment strategies. |

| • | Risk management: Acquired significant expertise with financial risk assessment and enterprise risk management during his career in investment banking and at Darden, as well as through his many years of service on the Federal Reserve Bank of Atlanta Board, the audit committees of VF Corporation and Verizon, the Investment & Capital Markets Committee of Travelers and as a trustee of 138 funds within the MFS Mutual Funds complex. |

Career highlights:

| • | Darden Restaurants, Inc. |

| ° | Chairman (2005-2014) | ||

| ° | Chief Executive Officer (2004-2014) | ||

| ° | Other executive positions (1995-2014) |

| • | Director of the Federal Reserve Bank of Atlanta (2010-2015) |

| • | Investment banker and lawyer specializing in securities and finance |

Other public company boards:

The Travelers Companies, Inc. (since 2017)

VF Corporation (since 2004)

MFS Mutual Funds complex (since 2017)

6

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

| Daniel Schulman | ||

|

Independent Director since: 2018 Age: 66 Committees: Human Resources (Chair) | |

Key skills and experience:

| • | Leadership: Built a career as a successful and dynamic leader in the fiercely competitive technology and e-commerce space, with a proven track record of creating shareholder value through innovation and a focus on values at numerous companies, including PayPal, which reached approximately 430 million active accounts across more than 200 markets, Priceline, and Virgin Mobile USA. |

| • | Cybersecurity: Gained extensive cybersecurity and risk management experience as a director of Symantec Corporation, a global leader in cybersecurity, for nearly 20 years, including serving as the independent chairman for 6 years. |

| • | Strategic planning: Spearheaded innovation and growth at start-ups and established companies, including Priceline, where he grew annual revenues from $20 million to nearly $1 billion over two years, Virgin Mobile USA, where he successfully built a pre-paid cellphone business, American Express, where he expanded global mobile and online payment services, and PayPal, where he achieved significant revenue growth. |

| • | Technology: Acquired significant expertise in mobile technology and digital innovation over a long career spanning the telecommunications, financial technology and e-commerce industries. |

Career highlights:

| • | PayPal Holdings, Inc., a leading online payments company |

| ° | President and Chief Executive Officer (2015-September 2023) | ||

| ° | President and CEO-Designee (2014-2015) |

| • | Group President of the Enterprise Group at American Express Company (2010-2014) |

| • | President of the Prepaid Group at Sprint Nextel Corporation (2009-2010) |

| • | Founding CEO of Virgin Mobile USA, Inc. (2001-2009) |

| • | President and CEO of Priceline Group, Inc. |

| • | Various executive positions, including President of the Consumer Markets Division, at AT&T, Inc. |

Other public company boards:

Lazard, Inc. (since February 2024)

Cisco Systems, Inc. (since October 2023)

PayPal Holdings, Inc. (2015-December 2023)

NortonLifeLock Inc. (formerly Symantec Corporation) (2000-2019)

| Rodney Slater | ||

|

Independent Director since: 2010 Age: 69 Committees: Corporate Governance and Policy | |

Key skills and experience:

| • | Leadership: Visionary and thoughtful leader in the transportation and infrastructure space, with extensive experience gained through service as U.S. Secretary of Transportation and previous board positions at Kansas City Southern, Transurban Group and Delta Air Lines. Nationally recognized for innovative infrastructure development and forging strategic public and private partnerships. As U.S. Secretary of Transportation, oversaw national transportation policy, spearheaded several historic legislative measures, including record funding for surface transportation investment and aviation safety and security, promoted intermodal transportation systems and led effort to significantly expand high speed rail network. |

| • | Regulatory/public policy: Brings a strategic, collaborative and result-oriented approach to oversight of regulatory and public policy issues developed over his long and accomplished career in both the public and private sectors. |

| • | Risk management: Globally recognized advisor for reputational risk management, corporate compliance and emergency preparedness, having served as an independent monitor/advisor for Toyota, Takata and Fiat Chrysler as these companies worked through safety issues, and coordinated the Federal Highway Administration’s response to several major natural disasters. |

| • | Strategic planning: Implemented a groundbreaking strategic plan for the U.S. Department of Transportation to expand its focus on safety, mobility and access, economic development and trade, the environment and national security. Developed an innovative financing and contracting program at the Federal Highway Administration that produced significant operational and cost efficiencies. |

Career highlights:

| • | Squire Patton Boggs LLP, a law firm |

| ° | Senior Partner (2023-present) | ||

| ° | Partner (2001-2023) |

| • | U.S. Secretary of Transportation (1997-2001) |

| • | Administrator, Federal Highway Administration (1993-1997) |

| • | Various policy positions with the State of Arkansas |

Other public company boards:

Stagwell Inc. (since 2021)

EVgo Inc. (2021-May 2023)

Kansas City Southern (2001-2019)

Transurban Group (2009-2018)

7

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

| Carol Tomé | ||

|

Independent Director since: 2021 Age: 67 Committees: Finance | |

Key skills and experience:

| • | Leadership: Accomplished and skillful leader with a proven track record in growing and innovating at both consumer and B2B businesses with large geographic footprints and employee bases. Guided UPS through an unprecedented surge in demand while improving competitiveness and reducing bureaucracy during the COVID-19 pandemic. Spearheaded initiatives to improve the employee experience and maintain a strong talent pipeline. Demonstrated strong financial leadership as CFO for over 18 years at Home Depot, with responsibility for all corporate finance matters including financial reporting, financial planning and analysis, financial operations, internal audit, investor relations and tax. Led strategic business development during a critical time for Home Depot, as well as the IT and cybersecurity function. |

| • | Consumer/B2B/retail: Leading efforts at UPS to optimize B2B profits through the use of automated technologies and enhanced distribution networks to improve delivery volumes. Reinvigorated Home Depot’s consumer business while navigating the Great Recession and housing crisis. |

| • | Financial expertise: Gained extensive and deep corporate finance expertise during her tenure at Home Depot, during her service on the Board of the Federal Reserve Bank of Atlanta, where she served as both Vice-Chair and Chair of the Board, and during her tenure as chair of the audit committee of UPS from 2018 to 2020. |

| • | Strategic planning: Driving efforts to strengthen network capabilities and supply chain infrastructure at UPS through investments in digital technologies. Played a pivotal role in strategic business development at Home Depot as it transformed into one of the world’s largest retailers – during her tenure as CFO, Home Depot doubled sales to over $108 billion and generated a 450% increase in shareholder value. |

Career highlights:

| • | Chief Executive Officer of United Parcel Service, Inc., the world’s largest package delivery company and a premier provider of global supply chain management solutions (2020-present) |

| • | The Home Depot, Inc., one of the world’s largest home improvement retailers |

| ° | Executive Vice President – Corporate Services and Chief Financial Officer (2007-2019) | |

| ° | Chief Financial Officer (2001-2007) | |

| ° | Other executive positions (1995-2001) |

| • | Director of the Federal Reserve Bank of Atlanta (2008-2013) |

Other public company boards:

United Parcel Service, Inc. (since 2003)

Cisco Systems, Inc. (2019-2020)

Certain Fidelity Mutual Funds (2017)

Ms. Tomé previously served on our Board in 2020.

| Hans Vestberg (Chairman) | ||

|

Director since: 2018 Age: 58 | |

Key skills and experience:

| • | Leadership: Driving Verizon’s leadership position in the deployment of 5G technology and multi-access edge computing in the U.S. Built an industry-leading telecommunications software and services organization at Ericsson, one of the world’s largest telecommunications companies. Member of the board of directors of the United Nations Foundation that actively works with the U.N.’s Sustainable Development Goals. Effectively navigated the challenges of the COVID-19 pandemic, creating a cohesive workplace culture with a focus on diversity, equity and inclusion. |

| • | Strategic planning: Architect of Verizon’s “one network for all” 5G strategy. Implemented bold and innovative strategic changes, including Verizon 2.0, the transformation of Verizon’s operating model to a customer-focused business served by industry-leading networks, as well as Ericsson’s successful diversification into the software and services business from its traditional hardware-centric business. |

| • | Technology: Gained significant expertise in mobile technology and telecommunications network architecture as Verizon’s Chief Technology Officer and over his 25-year career at Ericsson. |

| • | Telecommunications: Brings to the Board extensive operational and strategic experience and a deep understanding of the challenges and opportunities presented in the evolving global telecommunications landscape, as well as in-depth knowledge of Verizon’s businesses. |

Career highlights:

| • | Verizon Communications Inc. |

| ° | Chairman (2019-present) and Chief Executive Officer (2018-present) | ||

| ° | Executive Vice President, President – Global Networks and Chief Technology Officer (2017-2018) |

| • | Ericsson |

| ° | President and Chief Executive Officer (2010-2016) | ||

| ° | Chief Financial Officer (2007-2009) | ||

| ° | Other executive positions throughout the global operations |

Other public company boards:

BlackRock, Inc. (since 2021)

8

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

The membership, structure, policies and practices of our Board and its committees promote the effective exercise of the Board’s role in the governance of Verizon. In addition, our Corporate Governance Guidelines provide a framework for the Board’s operations and address key governance practices. The Corporate Governance and Policy Committee monitors best practices and developments in corporate governance, considers the views of Verizon’s shareholders, and periodically recommends changes to the Board’s policies and practices, including the Corporate Governance Guidelines. Our Directors provide input on the operation of the Board annually, as part of the Board assessment process, and as warranted throughout the year.

Board leadership structure

Verizon’s governance framework provides the Board with the flexibility to select the appropriate Board leadership structure for the Company. In making this leadership structure determination, the Board considers many factors, including the specific needs of the business and the long-term interests of our shareholders.

Given the dynamic and highly competitive environment in which Verizon operates, the Board believes that Verizon and our shareholders are best served by a Chairman who has broad and deep knowledge of our industry, providing valuable knowledge to the Board and increasing the information available to the Board, and who has the vision, energy and experience to position Verizon as the leader of transformational change in the communications ecosystem. Based on these considerations, the Board has determined that, at this time, our CEO, Hans Vestberg, is the Director best qualified to serve in the role of Chairman. As CEO, Mr. Vestberg also has a greater understanding of the strategies and tactics of the Company and can most readily identify potential opportunities and challenges.

To maintain an appropriate level of independent oversight, checks and balances in its governance, and consistent with the Corporate Governance Guidelines, the independent members of the Board have elected an independent Lead Director who has the responsibilities described under “Role of the Lead Director.” Clarence Otis, Jr. currently serves as Lead Director. Mr. Otis acquired significant expertise in financial risk assessment and enterprise risk management as a member of the Federal Reserve Bank of Atlanta Board, multiple public company boards and audit committees, and as CEO of Darden Restaurants, and is well qualified to lead the Board in fulfilling its oversight role.

The Lead Director and our Chairman and CEO meet and speak with each other regularly about the Company’s strategy and operations and the functioning of the Board. The Lead Director provides a tangible independent source of authority and serves as an impartial resource for the Board to express its views regarding management. In addition, the Lead Director represents the Board in communications with shareholders and other stakeholders regularly, and any shareholder or interested party may communicate directly with the Lead Director.

All Directors play an active role in overseeing Verizon’s business at both the Board and committee level. Every Director receives the agenda for each Board meeting in advance and can request changes. In addition, all Directors have unrestricted access to the Chairman and the senior leadership team at all times.

The Board believes that shareholders are best served by this current leadership structure because it features an independent Lead Director who provides independent and objective oversight, and who can express the Board’s positions in a forthright manner. |

Clarence Otis, Jr. Lead Director

Role of the Lead Director

• Promotes a strong Board culture, including encouraging and facilitating active participation of all Directors • Approves the agenda, schedule and materials for all Board meetings, in consultation with the Chairman • Is available to advise the committee chairs in fulfilling their designated responsibilities • Acts as principal liaison with the Chairman • Chairs executive sessions, including those held to evaluate the CEO’s performance and compensation • Chairs any meeting of the Board if the Chairman is not present • Calls Board meetings and executive sessions as needed • Leads the Board’s annual self-evaluation • Oversees the process for CEO succession planning along with the Human Resources Committee • Acts as a primary point of contact for Board communication with major shareholders and other key stakeholders, as appropriate |

9

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

This structure also strengthens our independent Directors’ ability to be fully involved in the Board’s operations and decision-making, and to fulfill their risk management and oversight responsibilities.

Board meetings and executive sessions

In 2023, our Board of Directors held 11 meetings, including six regularly scheduled meetings and five special meetings.

No incumbent Director attended fewer than 75% of the total number of meetings of our Board and the committees to which the Director was assigned in 2023. Directors standing for re-election are expected to attend the annual meeting of shareholders. In 2023, all but one Director attended the annual meeting.

The Corporate Governance Guidelines require the independent Directors to meet in executive session without any members of management present at least twice a year to review and evaluate the performance of the Board and to evaluate the performance and approve the compensation of the CEO. In practice, the independent members of our Board typically meet in executive session during each regularly scheduled Board meeting.

Service on other boards and time commitments

Based on the increasing demands placed upon directors of public companies and the need to devote sufficient time to fulfill their responsibilities effectively, the Board has a policy that a Director who is an executive officer of a public company should serve on no more than two public company boards, and other Directors should serve on no more than four public company boards. In addition, members of the Audit Committee should serve on no more than two other public company audit committees. All of our Directors are in compliance with these policies, which can be found in the Corporate Governance Guidelines.

When the Corporate Governance and Policy Committee identifies and evaluates Director candidates, it considers their qualifications along with their other time commitments to determine whether the candidate can devote the necessary time for effective service on the Board. Each year when considering incumbent Directors for re-nomination, the Committee considers the extent to which each incumbent Director is prepared for and actively participates in Board and Committee meetings, to ensure that each incumbent Director who is re-nominated is devoting sufficient time to fulfill his or her responsibilities to the Company and its shareholders.

Board committees

Our Board of Directors has established four standing committees: the Audit Committee, the Corporate Governance and Policy Committee, the Finance Committee and the Human Resources Committee. Each committee has a written charter that defines its specific responsibilities. The chair of each committee approves the agenda and materials for each meeting. Each committee has the authority to retain independent advisors to assist it in carrying out its responsibilities.

Our committee meetings are not held concurrently, which enables our Directors to sit on multiple committees. Our newly appointed Directors also attend all committee meetings for a period prior to being appointed to any particular committee, which gives them a broad-based introduction to the Company and allows them to understand the inner workings of all committees. |

Beyond the boardroom

Engagement outside of Board meetings provides our Directors with additional insight into our business and our industry. It also gives them valuable perspectives on the performance of our Company, the Board, our CEO and other members of senior management, as well as on the Company’s strategic direction.

• Our independent Directors have discussions with each other and with our CEO, and have informal individual and small group meetings with high potential members of our senior management team in order to gain insight into the Company’s management development program and succession pipeline. • Our committee chairs and Lead Director meet and speak regularly with each other and with members of our management in connection with planning for meetings. All Directors are encouraged to provide suggestions for meeting agendas and materials. • Our Directors periodically attend “deep dives” on current topics of interest and technology training as part of their ongoing Director education program. • Our Directors receive weekly updates on recent developments, press coverage and current events that relate to our business, as well as monthly business operation reviews and analyst reports. |

10

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

Key responsibilities and activities

• Assess and discuss with management Verizon’s significant business risk exposures (including those related to cybersecurity, data privacy, data security, bribery and corruption, and certain environmental and climate-related risks), and oversee management’s programs and policies to monitor, assess and manage such exposures • Assess Verizon’s overall control environment, including controls related to financial reporting, disclosure, compliance and significant financial and business risks • Appoint, approve fees for, assess the independence and oversee the work of the independent registered public accounting firm • Oversee financial reporting and disclosure matters, including review of the annual and quarterly reports on Forms 10-K and 10-Q, earnings releases and guidance, and the process for the CEO and Chief Financial Officer (CFO) certifications • Oversee Verizon’s internal audit function and review significant internal audit findings and recommendations • Assess Verizon’s compliance processes and programs, including the Code of Conduct • Review the Chief Compliance Officer’s annual report regarding anti-corruption compliance, compliance with significant regulatory obligations, export controls and data protection • Assess policies and procedures for executive officer expense accounts and perquisites, including the use of corporate assets • Assess procedures for handling complaints and confidential, anonymous employee submissions relating to accounting, internal accounting controls or auditing matters • Review reports and disclosures of significant conflicts of interest and related person transactions The Board has determined that each of Ms. Austin, Ms. Archambeau, Mr. Narasimhan, Mr. Otis and Mr. Weaver is an audit committee financial expert. |

Members Roxanne Austin (Chair) Shellye Archambeau Laxman Narasimhan Clarence Otis, Jr. Gregory Weaver 2023 meetings 11 |

Key responsibilities and activities

• Evaluate the structure and practices of our Board and its committees, including size, composition, independence and operations • Recommend changes to our Board’s policies or practices or the Corporate Governance Guidelines • Identify and evaluate the qualifications of Director candidates and recommend to the Board candidates for election as Directors • Recommend Directors to serve as members of each Board committee and as committee chairs • Review potential related person transactions • Facilitate the annual assessment of the performance of the Board and its committees • Serve as hub for oversight of ESG, including ESG commitments, reporting and engagement, corporate responsibility and sustainability • Oversee Verizon’s position and engagement on important public policy and technology issues, including those relating to political contributions, lobbying activities and human rights, that may affect our business and reputation • Review the activities of Verizon’s community and social impact initiatives, including philanthropic activities |

Members Shellye Archambeau (Chair) Vittorio Colao Melanie Healey Laxman Narasimhan Rodney Slater 2023 meetings 5 |

11

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

Key responsibilities and activities

• Monitor Verizon’s capital needs, financing arrangements and ability to access the capital markets • Monitor expenditures under the annual capital plan approved by our Board • Review Verizon’s policies and strategies for managing currency, interest rate, renewable energy and counterparty exposures • Review and approve Verizon’s derivatives policy, and monitor the use of derivatives, including our renewable power purchase agreement strategy • Review Verizon’s insurance and self-insurance programs • Oversee the investment of pension assets and the funding of pension and other postretirement benefit obligations |

Members Mark Bertolini (Chair) Roxanne Austin Vittorio Colao Clarence Otis, Jr. Carol Tomé Gregory Weaver 2023 meetings 5 |

Key responsibilities and activities

• Oversee the development of Verizon’s executive compensation program and policies • Approve corporate goals relevant to the CEO’s compensation • Evaluate the CEO’s performance and recommend his compensation to the Board • Review and approve compensation and benefits for selected senior managers • Consult with the CEO on talent development • Oversee succession planning and assignments to key leadership positions • Oversee human capital management, including with respect to employee diversity, equity and inclusion; talent acquisition, retention and development; employee engagement; pay equity; and corporate culture • Review and make determinations under Verizon’s clawback policies • Review the impact of Verizon’s executive compensation policies and practices, and the performance metrics underlying the compensation program, on Verizon’s risk profile • Review and recommend non-employee Director compensation |

Members Daniel Schulman (Chair) Mark Bertolini Melanie Healey Clarence Otis, Jr. Rodney Slater 2023 meetings 5 |

12

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

Our Board conducts a comprehensive annual assessment to enhance the effectiveness of the Board and its committees and to continue to reflect evolving best practices in their processes. The Lead Director generally leads the assessment process, but the Board periodically engages a third-party consulting firm to bring an outside perspective to the process. As part of the annual assessment, each Director completes a detailed written questionnaire designed to elicit suggestions for improving the effectiveness of the Board and its committees, and to obtain feedback on a range of issues, including Board leadership, culture, corporate purpose and strategy, composition and structure, and risk management. Following the Directors’ submissions of their completed questionnaires, the Lead Director or the third-party consulting firm conducts individual interviews with each of the independent Directors to discuss these topics, among others. The Lead Director then facilitates an evaluation session with the full Board to discuss the feedback received from the questionnaires and from the Director interviews. The evaluation for 2023 was conducted by a third-party consulting firm and concluded that the Board and its committees are operating effectively. Recommendations in recent years to further enhance Board effectiveness, which we addressed, have included continued focus on Board refreshment, strategic and operational oversight, and the development of Verizon’s next generation of leaders.

In addition to annual assessments, the Board evaluates and modifies its oversight of Verizon’s operations on an ongoing basis. During their executive sessions, the independent Directors consider agenda topics that they believe deserve additional focus and raise new topics to be addressed in future meetings.

The Corporate Governance and Policy Committee annually appraises the framework for our Board and committee assessment processes.

| Board and committee assessment process | ||||||||||

| Feedback solicited | One-on-one discussions | Reporting back | Closed session discussion | Feedback incorporated | ||||||

|

Questionnaire on a range of topics relating to enhancing Board effectiveness |

Candid, one-on-one discussions between the Lead Director or third-party consulting firm and Directors to elicit additional feedback |

A summary of the assessment results provided to the Board |

Closed session discussion of the assessment results facilitated by the Lead Director |

Policies and practices updated as appropriate to address any suggestions or enhancements per the assessment |

||||||

|

|

|

|

|

||||||

We provide our Directors with comprehensive orientation and education programs to promote a deep understanding of issues affecting our business and industry, help Directors stay current and knowledgeable about the Company’s business and its competitive and technology landscape, and support Directors in performing their oversight duties.

New Director orientation. When a new Director joins the Board, we conduct an orientation program that includes, among other things, a review of the Company’s purpose, business strategy and operations, technology, financial condition, legal and regulatory framework, and other relevant topics.

Director continuing education. We support current Directors in their ongoing learning by providing continuing education opportunities and programs. These programs may include presentations by thought leaders and industry experts, formal education sessions, meetings with management subject matter experts, participation in industry forums and site visits.

All of our Directors have deep experience and expertise in strategic planning and execution. The Board engages Verizon’s senior leaders in robust discussions about strategic goals and challenges them to execute on the strategic plan, address emerging challenges and disruptions, and promote innovation. In addition to an annual strategy retreat, the agenda for each regularly scheduled Board meeting allocates substantial time for a strategy review. During these reviews, the Board engages with senior management regarding the competitive landscape, operational objectives and challenges and regulatory developments.

13

| Proxy summary | Governance | Executive compensation | Audit matters | Stock ownership | Shareholder proposals | Additional information |

While senior management has primary responsibility for managing business risks, our Board of Directors is responsible for risk oversight. The Board works closely with senior management to develop a comprehensive view of Verizon’s key short- and long-term business risks. Verizon has a formalized business risk management reporting process that is designed to provide visibility to the Board about critical risks and risk mitigation strategies.

The Board of Directors uses several different levels of review in overseeing the management of risks inherent in the operation of Verizon’s businesses and the implementation of our strategic plan. The Board addresses the primary risks associated with Verizon’s business units and corporate functions in its operations reviews of those units and functions. Further, the Board reviews the risks associated with Verizon’s strategic plan throughout the year.

In addition, each of our Board committees oversees the management of risks that fall within that committee’s areas of responsibility. In performing this function, each Board committee has full access to management and may engage independent advisors. As part of the Board’s risk oversight function, the Board regularly brings in outside advisors and experts to speak to the Board on topics including emerging business risks. In 2023, these topics included geopolitical, technological and economic risks, opportunities and trends.

Enterprise risk management. The Audit Committee oversees the operations of Verizon’s Enterprise Risk Management program, which identifies the primary risks to Verizon’s business and also assesses Verizon’s overall control environment, including controls related to financial reporting, disclosure, compliance and significant financial and business risks. These risks inform Board and Audit Committee discussion topics throughout the year.

Senior management teams from across the business meet with the Audit Committee, on at least a semi-annual basis, to discuss the primary risks associated with their respective business units and functions, and related risk mitigation initiatives. As part of Verizon’s annual enterprise risk assessment process, the Audit Committee also reviews key business risks with the CFO, the Senior Vice President of Internal Audit and the Chief Compliance Officer.

| • | The CFO updates the Audit Committee on a quarterly basis on the activities of the Verizon Management Audit Committee, which has management oversight responsibility for the implementation of the Enterprise Risk Management program. |

| • | Verizon’s Senior Vice President of Internal Audit, who functionally reports directly to the Audit Committee, facilitates the Committee’s oversight of the Company’s implementation of risk management controls and methodologies to address identified risks, including financial, operational, regulatory and compliance risks. |

| • | Verizon’s Chief Compliance Officer, who also functionally reports directly to the Audit Committee, oversees periodic risk assessments of specific compliance risk areas, such as anti-corruption, and reports the findings to the Committee. |

The Audit Committee routinely meets privately with representatives from the independent registered public accounting firm, the Senior Vice President of Internal Audit, and the Chief Legal Officer.

Strategic crisis management. The Company maintains a Strategic Crisis Management Program in order to position our leadership team and the Board to respond to strategic risks and protect Verizon’s core assets in a potential crisis. The Program defines clear roles and responsibilities in dealing with various potential crises and outlines a process to make decisions and implement appropriate actions on a timely basis. Through the Program, the Verizon Strategic Crisis Leadership Team is positioned to assume executive ownership of strategic crisis events through drills and scenario-based training. The Program also includes employee crisis awareness training, which encourages employees across the Company to quickly identify and report circumstances or events that could develop into a strategic crisis, so that our leadership team can take appropriate steps in response. In addition, our Board of Directors maintains a Board Crisis Response Plan, which is structured to be used in connection with any crisis that could have a significant strategic impact on the Company’s brand, reputation, or finances, or legal, political or regulatory position. The Plan provides a framework for appropriate Board oversight and assessment of the response to a crisis that allows the necessary flexibility to address the different types of crises that might arise.