Exhibit

EXHIBIT 99

|

|

Part I - Financial Information |

|

|

Item 1. Financial Statements (Unaudited) |

|

|

Condensed Consolidated Statements of Income Verizon Communications Inc. and Subsidiaries |

|

| | | | | | | |

| Three Months Ended | |

| March 31, | |

(dollars in millions, except per share amounts) (unaudited) | 2019 |

| | 2018 |

|

| | | |

Operating Revenues | | | |

Service revenues and other | $ | 27,197 |

| | $ | 26,732 |

|

Wireless equipment revenues | 4,931 |

| | 5,040 |

|

Total Operating Revenues | 32,128 |

| | 31,772 |

|

| | | |

Operating Expenses | | | |

Cost of services (exclusive of items shown below) | 7,792 |

| | 7,946 |

|

Cost of wireless equipment | 5,198 |

| | 5,309 |

|

Selling, general and administrative expense | 7,198 |

| | 6,844 |

|

Depreciation and amortization expense | 4,231 |

| | 4,324 |

|

Total Operating Expenses | 24,419 |

| | 24,423 |

|

| | | |

Operating Income | 7,709 |

| | 7,349 |

|

Equity in losses of unconsolidated businesses | (6 | ) | | (19 | ) |

Other income (expense), net | 295 |

| | (75 | ) |

Interest expense | (1,210 | ) | | (1,201 | ) |

Income Before Provision For Income Taxes | 6,788 |

| | 6,054 |

|

Provision for income taxes | (1,628 | ) | | (1,388 | ) |

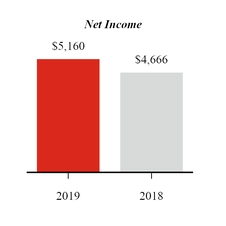

Net Income | $ | 5,160 |

| | $ | 4,666 |

|

| | | |

Net income attributable to noncontrolling interests | $ | 128 |

| | $ | 121 |

|

Net income attributable to Verizon | 5,032 |

| | 4,545 |

|

Net Income | $ | 5,160 |

| | $ | 4,666 |

|

| | | |

Basic Earnings Per Common Share | | | |

Net income attributable to Verizon | $ | 1.22 |

| | $ | 1.11 |

|

Weighted-average shares outstanding (in millions) | 4,138 |

| | 4,104 |

|

| | | |

Diluted Earnings Per Common Share | | | |

Net income attributable to Verizon | $ | 1.22 |

| | $ | 1.11 |

|

Weighted-average shares outstanding (in millions) | 4,140 |

| | 4,107 |

|

See Notes to Condensed Consolidated Financial Statements

|

|

Condensed Consolidated Statements of Comprehensive Income Verizon Communications Inc. and Subsidiaries |

|

| | | | | | | |

| Three Months Ended | |

| March 31, | |

(dollars in millions) (unaudited) | 2019 |

| | 2018 |

|

| | | |

Net Income | $ | 5,160 |

| | $ | 4,666 |

|

Other Comprehensive Income (Loss), Net of Tax (Expense) Benefit | | | |

Foreign currency translation adjustments, net of tax of $(5) and $(6) | 24 |

| | 93 |

|

Unrealized gain (loss) on cash flow hedges, net of tax of $5 and $(180) | (13 | ) | | 501 |

|

Unrealized gain (loss) on marketable securities, net of tax of $(2) and $1 | 4 |

| | (5 | ) |

Defined benefit pension and postretirement plans, net of tax of $56 and $60 | (169 | ) | | (173 | ) |

Other comprehensive income (loss) attributable to Verizon | (154 | ) | | 416 |

|

Total Comprehensive Income | $ | 5,006 |

| | $ | 5,082 |

|

| | | |

Comprehensive income attributable to noncontrolling interests | $ | 128 |

| | $ | 121 |

|

Comprehensive income attributable to Verizon | 4,878 |

| | 4,961 |

|

Total Comprehensive Income | $ | 5,006 |

| | $ | 5,082 |

|

See Notes to Condensed Consolidated Financial Statements

|

|

Condensed Consolidated Balance Sheets Verizon Communications Inc. and Subsidiaries |

|

| | | | | | | |

| At March 31, |

| | At December 31, |

|

(dollars in millions, except per share amounts) (unaudited) | 2019 |

| | 2018 |

|

| | | |

Assets | | | |

Current assets | | | |

Cash and cash equivalents | $ | 2,322 |

| | $ | 2,745 |

|

Accounts receivable, net of allowances of $744 and $765 | 24,469 |

| | 25,102 |

|

Inventories | 1,417 |

| | 1,336 |

|

Prepaid expenses and other | 5,189 |

| | 5,453 |

|

Total current assets | 33,397 |

| | 34,636 |

|

| | | |

Property, plant and equipment | 254,457 |

| | 252,835 |

|

Less accumulated depreciation | 166,608 |

| | 163,549 |

|

Property, plant and equipment, net | 87,849 |

| | 89,286 |

|

| | | |

Investments in unconsolidated businesses | 674 |

| | 671 |

|

Wireless licenses | 94,237 |

| | 94,130 |

|

Goodwill | 24,635 |

| | 24,614 |

|

Other intangible assets, net | 9,608 |

| | 9,775 |

|

Operating lease right-of-use assets | 23,105 |

| | — |

|

Other assets | 10,442 |

| | 11,717 |

|

Total assets | $ | 283,947 |

| | $ | 264,829 |

|

| | | |

Liabilities and Equity | | | |

Current liabilities | | | |

Debt maturing within one year | $ | 8,614 |

| | $ | 7,190 |

|

Accounts payable and accrued liabilities | 18,664 |

| | 22,501 |

|

Current operating lease liabilities | 2,997 |

| | — |

|

Other current liabilities | 8,332 |

| | 8,239 |

|

Total current liabilities | 38,607 |

| | 37,930 |

|

| | | |

Long-term debt | 105,045 |

| | 105,873 |

|

Employee benefit obligations | 17,888 |

| | 18,599 |

|

Deferred income taxes | 34,344 |

| | 33,795 |

|

Non-current operating lease liabilities | 18,971 |

| | — |

|

Other liabilities | 11,632 |

| | 13,922 |

|

Total long-term liabilities | 187,880 |

| | 172,189 |

|

| | | |

Commitments and Contingencies (Note 12) |

| |

|

| | | |

Equity | | | |

Series preferred stock ($0.10 par value; 250,000,000 shares authorized; none issued) | — |

| | — |

|

Common stock ($0.10 par value; 6,250,000,000 shares authorized in each period; 4,291,433,646 issued in each period) | 429 |

| | 429 |

|

Additional paid in capital | 13,418 |

| | 13,437 |

|

Retained earnings | 46,493 |

| | 43,542 |

|

Accumulated other comprehensive income | 2,216 |

| | 2,370 |

|

Common stock in treasury, at cost (155,727,000 and 159,400,267 shares outstanding) | (6,825 | ) | | (6,986 | ) |

Deferred compensation – employee stock ownership plans and other | 125 |

| | 353 |

|

Noncontrolling interests | 1,604 |

| | 1,565 |

|

Total equity | 57,460 |

| | 54,710 |

|

Total liabilities and equity | $ | 283,947 |

| | $ | 264,829 |

|

See Notes to Condensed Consolidated Financial Statements

|

|

Condensed Consolidated Statements of Cash Flows Verizon Communications Inc. and Subsidiaries |

|

| | | | | | | |

| Three Months Ended | |

| March 31, | |

(dollars in millions) (unaudited) | 2019 |

| | 2018 |

|

| | | |

Cash Flows from Operating Activities | | | |

Net Income | $ | 5,160 |

| | $ | 4,666 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization expense | 4,231 |

| | 4,324 |

|

Employee retirement benefits | (195 | ) | | (151 | ) |

Deferred income taxes | 459 |

| | 702 |

|

Provision for uncollectible accounts | 319 |

| | 239 |

|

Equity in losses of unconsolidated businesses, net of dividends received | 21 |

| | 30 |

|

Changes in current assets and liabilities, net of effects from acquisition/disposition of businesses | (2,702 | ) | | (2,033 | ) |

Discretionary employee benefits contributions | (300 | ) | | (1,000 | ) |

Other, net | 88 |

| | (129 | ) |

Net cash provided by operating activities | 7,081 |

| | 6,648 |

|

| | | |

Cash Flows from Investing Activities | | | |

Capital expenditures (including capitalized software) | (4,268 | ) | | (4,552 | ) |

Acquisitions of businesses, net of cash acquired | (25 | ) | | (32 | ) |

Acquisitions of wireless licenses | (104 | ) | | (970 | ) |

Other, net | (406 | ) | | 269 |

|

Net cash used in investing activities | (4,803 | ) | | (5,285 | ) |

| | | |

Cash Flows from Financing Activities | | | |

Proceeds from long-term borrowings | 2,131 |

| | 1,956 |

|

Proceeds from asset-backed long-term borrowings | 1,117 |

| | 1,178 |

|

Repayments of long-term borrowings and finance lease obligations | (2,963 | ) | | (2,984 | ) |

Repayments of asset-backed long-term borrowings | (813 | ) | | — |

|

Dividends paid | (2,489 | ) | | (2,407 | ) |

Other, net | 360 |

| | 941 |

|

Net cash used in financing activities | (2,657 | ) | | (1,316 | ) |

| | | |

Increase (decrease) in cash, cash equivalents and restricted cash | (379 | ) | | 47 |

|

Cash, cash equivalents and restricted cash, beginning of period | 3,916 |

| | 2,888 |

|

Cash, cash equivalents and restricted cash, end of period (Note 1) | $ | 3,537 |

| | $ | 2,935 |

|

See Notes to Condensed Consolidated Financial Statements

|

|

Notes to Condensed Consolidated Financial Statements (Unaudited) Verizon Communications Inc. and Subsidiaries |

|

|

Note 1. Basis of Presentation |

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) in the United States (U.S.) and based upon Securities and Exchange Commission rules that permit reduced disclosure for interim periods. For a more complete discussion of significant accounting policies and certain other information, you should refer to the financial statements for the year ended December 31, 2018 of Verizon Communications Inc. (Verizon or the Company) included in its Current Report on Form 8-K dated August 8, 2019. These financial statements reflect all adjustments that are necessary for a fair presentation of results of operations and financial condition for the interim periods shown, including normal recurring accruals and other items. The results for the interim periods are not necessarily indicative of results for the full year.

In November 2018, we announced a strategic reorganization of our business. Under the new structure, effective April 1, 2019, there are two reportable segments that we operate and manage as strategic business units - Verizon Consumer Group (Consumer) and Verizon Business Group (Business). In conjunction with the new reporting structure, we recast our segment disclosures for all periods presented.

Our Consumer segment provides consumer-focused wireless and wireline communications services and products. Our wireless services are provided across one of the most extensive wireless networks in the U.S. under the Verizon Wireless brand and through wholesale and other arrangements. Our wireline services are provided in nine states in the Mid-Atlantic and Northeastern U.S., as well as Washington D.C., over our 100% fiber-optic network under the Fios brand and over a traditional copper-based network to customers who are not served by Fios. Our Consumer segment’s wireless and wireline products and services are available to our retail customers, as well as resellers that purchase wireless network access from us on a wholesale basis.

Our Business segment provides wireless and wireline communications services and products, video and data services, corporate networking solutions, security and managed network services, local and long distance voice services and network access to deliver various Internet of Things (IoT) services and products. We provide these products and services to businesses, government customers and wireless and wireline carriers across the U.S. and select products and services to customers around the world.

Basis of Presentation

We have reclassified certain prior year amounts to conform to the current year presentation, including impacts for changes in our reportable segments.

Earnings Per Common Share

There were a total of approximately 2 million outstanding dilutive securities, primarily consisting of restricted stock units, included in the computation of diluted earnings per common share for the three months ended March 31, 2019. There were a total of approximately 3 million outstanding dilutive securities, primarily consisting of restricted stock units, included in the computation of diluted earnings per common share for the three months ended March 31, 2018.

Cash, Cash Equivalents and Restricted Cash

We consider all highly liquid investments with an original maturity of 90 days or less when purchased to be cash equivalents. Cash equivalents are stated at cost, which approximates quoted market value and includes amounts held in money market funds.

Cash collections on the device payment plan agreement receivables collateralizing asset-backed debt securities are required at certain specified times to be placed into segregated accounts. Deposits to the segregated accounts are considered restricted cash and are included in Prepaid expenses and other and Other assets in our condensed consolidated balance sheets.

Cash, cash equivalents and restricted cash are included in the following line items on the condensed consolidated balance sheets:

|

| | | | | | | | | | | |

| At March 31, |

| | At December 31, |

| | Increase / (Decrease) |

|

(dollars in millions) | 2019 |

| | 2018 |

| |

Cash and cash equivalents | $ | 2,322 |

| | $ | 2,745 |

| | $ | (423 | ) |

Restricted cash: | | | | | |

Prepaid expenses and other | 1,091 |

| | 1,047 |

| | 44 |

|

Other assets | 124 |

| | 124 |

| | — |

|

Cash, cash equivalents and restricted cash | $ | 3,537 |

| | $ | 3,916 |

| | $ | (379 | ) |

Goodwill

Goodwill is the excess of the acquisition cost of businesses over the fair value of the identifiable net assets acquired. Impairment testing for goodwill is performed annually in the fourth quarter or more frequently if impairment indicators are present. In November 2018, we announced a strategic reorganization of our business which resulted in certain changes to our operating segments and reporting units. We transitioned to

the new segment reporting structure effective April 1, 2019, in connection with which we are reassigning goodwill to each of our new reporting units.

We performed an impairment assessment of the impacted reporting units, specifically our historical Wireless, historical Wireline and historical Connect reporting units on March 31, 2019, immediately before our strategic reorganization became effective. Our impairment assessments indicated that the fair value for each of our historical Wireless, historical Wireline and historical Connect reporting units exceeded their respective carrying value, and therefore did not result in a goodwill impairment. Our Media reporting unit was not impacted by the strategic reorganization and there were no indicators of impairment during the quarter ended March 31, 2019.

Recently Adopted Accounting Standard

The following Accounting Standard Updates (ASUs) were issued by Financial Accounting Standards Board (FASB), and have been recently adopted by Verizon.

|

| | | | | |

| | Description | Date of Adoption | Effect on Financial Statements |

| | ASU 2016-02, ASU 2018-01, ASU 2018-10, ASU 2018-11, ASU 2018-20 and ASU 2019-01, Leases (Topic 842) |

| | The FASB issued Topic 842 requiring entities to recognize assets and liabilities on the balance sheet for all leases, with certain exceptions. In addition, Topic 842 will enable users of financial statements to further understand the amount, timing and uncertainty of cash flows arising from leases. Topic 842 allows for a modified retrospective application and is effective as of the first quarter of 2019. Entities are allowed to apply the modified retrospective approach: (1) retrospectively to each prior reporting period presented in the financial statements with the cumulative-effect adjustment recognized at the beginning of the earliest comparative period presented; or (2) retrospectively at the beginning of the period of adoption (January 1, 2019) through a cumulative-effect adjustment. The modified retrospective approach includes a number of optional practical expedients that entities may elect to apply. | 1/1/2019 | We adopted Topic 842 beginning on January 1, 2019, using the modified retrospective approach with a cumulative-effect adjustment to opening retained earnings recorded at the beginning of the period of adoption. Therefore, upon adoption, we have recognized and measured leases without revising comparative period information or disclosure. We recorded an increase of $410 million (net of tax) to retained earnings on January 1, 2019 which related to deferred sale leaseback gains recognized from prior transactions. Additionally, the adoption of the standard had a significant impact in our condensed consolidated balance sheet due to the recognition of $22.1 billion of operating lease liabilities, along with $23.2 billion of operating lease right-of-use-assets. |

| |

The cumulative after-tax effect of the changes made to our condensed consolidated balance sheet for the adoption of Topic 842 were as follows:

|

| | | | | | | | | | | |

(dollars in millions) | At December 31, 2018 |

| | Adjustments due to Topic 842 |

| | At January 1, 2019 |

|

Prepaid expenses and other | $ | 5,453 |

| | $ | (329 | ) | | $ | 5,124 |

|

Operating lease right-of-use assets | — |

| | 23,241 |

| | 23,241 |

|

Other assets | 11,717 |

| | (2,048 | ) | | 9,669 |

|

Accounts payable and accrued liabilities | 22,501 |

| | (3 | ) | | 22,498 |

|

Other current liabilities | 8,239 |

| | (2 | ) | | 8,237 |

|

Current operating lease liabilities | — |

| | 2,931 |

| | 2,931 |

|

Deferred income taxes | 33,795 |

| | 139 |

| | 33,934 |

|

Non-current operating lease liabilities | — |

| | 19,203 |

| | 19,203 |

|

Other liabilities | 13,922 |

| | (1,815 | ) | | 12,107 |

|

Retained earnings | 43,542 |

| | 410 |

| | 43,952 |

|

Noncontrolling interests | 1,565 |

| | 1 |

| | 1,566 |

|

In addition to the increase to the operating lease liabilities and right-of-use assets and the derecognition of deferred sale leaseback gains through opening retained earnings, Topic 842 also resulted in reclassifying the presentation of prepaid and deferred rent to operating lease right-of-use assets. The operating lease right-of-use assets amount also includes the balance of any prepaid lease payments, unamortized initial direct costs, and lease incentives.

We elected the package of practical expedients permitted under the transition guidance within the new standard. Accordingly, we have adopted these practical expedients and did not reassess: (1) whether an expired or existing contract is a lease or contains an embedded lease; (2) lease classification of an expired or existing lease; (3) capitalization of initial direct costs for an expired or existing lease. In addition, we have elected the land easement transition practical expedient, and did not reassess whether an existing or expired land easement is a lease or contains a lease if it has not historically been accounted for as a lease.

We lease network equipment including towers, distributed antenna systems, small cells, real estate, connectivity mediums which include dark fiber, equipment leases, and other various types of assets for use in our operations under both operating and finance leases. We assess whether an arrangement is a lease or contains a lease at inception. For arrangements considered leases or that contain a lease that is accounted for

separately, we determine the classification and initial measurement of the right-of-use asset and lease liability at the lease commencement date, which is the date that the underlying asset becomes available for use.

For both operating and finance leases, we recognize a right-of-use asset, which represents our right to use the underlying asset for the lease term, and a lease liability, which represents the present value of our obligation to make payments arising over the lease term. The present value of the lease payments is calculated using the incremental borrowing rate for operating and finance leases. The incremental borrowing rate is determined using a portfolio approach based on the rate of interest that the Company would have to pay to borrow an amount equal to the lease payments on a collateralized basis over a similar term. Management uses the unsecured borrowing rate and risk-adjusts that rate to approximate a collateralized rate, which will be updated on a quarterly basis for measurement of new lease liabilities.

In those circumstances where the Company is the lessee, we have elected to account for non-lease components associated with our leases (e.g., common area maintenance costs) and lease components as a single lease component for substantially all of our asset classes. Additionally, in arrangements where we are the lessor, we have customer premise equipment for which we apply the lease and non-lease component practical expedient and account for non-lease components (e.g., service revenue) and lease components as combined components under the revenue recognition guidance in ASU 2014-09, "Revenue from Contracts with Customers" (Topic 606) as the service revenues are the predominant components in the arrangements.

Rent expense for operating leases is recognized on a straight-line basis over the term of the lease and is included in either Cost of services or Selling, general and administrative expense in our condensed consolidated statements of income, based on the use of the facility on which rent is being paid. Variable rent payments related to both operating and finance leases are expensed in the period incurred. Our variable lease payments consist of payments dependent on various external indicators, including real estate taxes, common area maintenance charges and utility usage.

Operating leases with a term of 12 months or less are not recorded on the balance sheet; we recognize a rent expense for these leases on a straight-line basis over the lease term.

We recognize the amortization of the right-of-use asset for our finance leases on a straight-line basis over the shorter of the term of the lease or the useful life of the right-of-use asset in Depreciation and amortization expense in our condensed consolidated statements of income. The interest expense related to finance leases is recognized using the effective interest method based on the discount rate determined at lease commencement and is included within Interest expense in our condensed consolidated statements of income.

See Note 5 for additional information related to leases, including disclosure required under Topic 842.

Recently Issued Accounting Standards

The following ASUs have been recently issued by the FASB.

|

| | | | | |

| | Description | Date of Adoption | Effect on Financial Statements |

| | ASU 2016-13, Financial Instruments - Credit Losses (Topic 326) |

| | In June 2016, the FASB issued this standard update which requires certain financial assets be measured at amortized cost net of an allowance for estimated credit losses such that the net receivable represents the present value of expected cash collection. In addition, this standard update requires that certain financial assets be measured at amortized cost reflecting an allowance for estimated credit losses expected to occur over the life of the assets. The estimate of credit losses must be based on all relevant information including historical information, current conditions and reasonable and supportable forecasts that affect the collectability of the amounts. An entity will apply the update through a cumulative effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is effective (January 1, 2020). A prospective transition approach is required for debt securities for which an other-than-temporary impairment has been recognized before the effective date. Early adoption of this standard is permitted. | 1/1/2020 | We are currently evaluating the impacts that this standard update will have on our various financial assets, which we expect to include, but is not limited to, our device payment plan agreement receivables, service receivables and contract assets. We have established a cross-functional coordinated team to address the potential impacts to our systems, processes and internal controls in order to meet the standard update's accounting and reporting requirements.

|

| |

| |

|

|

Note 2. Revenues and Contract Costs |

We earn revenue from contracts with customers, primarily through the provision of telecommunications and other services and through the sale of wireless equipment.

Revenue by Category

We have two reportable segments that we operate and manage as strategic business units - Consumer and Business. Revenue is disaggregated by products and services within Consumer, and customer groups (Global Enterprise, Small and Medium Business, Public Sector and Other, and Wholesale) within Business. See Note 11 for additional information on revenue by segment.

Corporate and other includes the results of our media business, Verizon Media Group (Verizon Media), which operated under the "Oath" brand until January 2019, and other businesses. Verizon Media generated revenues from contracts with customers under Topic 606 of approximately $1.8 billion and $1.9 billion during the three months ended March 31, 2019 and 2018, respectively.

We also earn revenues, that are not accounted for under Topic 606, from leasing arrangements (such as towers), captive reinsurance arrangements primarily related to wireless device insurance and the interest on equipment financed on a device payment plan agreement when sold to the customer by an authorized agent. As allowed by the practical expedient within Topic 842, we have elected to combine the lease and non-lease components for those arrangements of customer premise equipment where we are the lessor as components accounted for under Topic 606. During the three months ended March 31, 2019 and 2018, revenues from arrangements that were not accounted for under Topic 606 were approximately $787 million and $1.2 billion, respectively.

Remaining Performance Obligations

When allocating the total contract transaction price to identified performance obligations, a portion of the total transaction price may relate to service performance obligations which were not satisfied or are partially satisfied as of the end of the reporting period. Below we disclose information relating to these unsatisfied performance obligations. In the prior year, we have elected to apply the practical expedient available under Topic 606 that provides the option to exclude the expected revenues arising from unsatisfied performance obligations related to contracts that have an original expected duration of one year or less. This situation primarily arises with respect to certain month-to-month service contracts. At March 31, 2019, month-to-month service contracts represented approximately 86% of our wireless postpaid contracts and approximately 55% of our wireline Consumer and Small and Medium Business contracts, compared to March 31, 2018, for which month-to-month service contracts represented approximately 82% of our wireless postpaid contracts and 57% of our wireline Consumer and Small and Medium Business contracts.

Additionally, certain contracts provide customers the option to purchase additional services. The fees related to these additional services are recognized when the customer exercises the option (typically on a month-to-month basis).

Contracts for wireless services are generally either month-to-month and cancellable at any time (typically under a device payment plan) or contain terms ranging from greater than one month to up to two years (typically under a fixed-term plan). Additionally, customers may incur charges based on usage or additional optional services purchased in conjunction with entering into a contract that can be cancelled at any time and therefore are not included in the transaction price. The transaction price allocated to service performance obligations, which are not satisfied or are partially satisfied as of the end of the reporting period, are generally related to our fixed-term plans.

Our Consumer group customers also include other telecommunications companies who utilize Verizon's networks to resell wireless service to their respective end customers. Reseller arrangements generally include a stated contract term, which typically extends longer than two years. These arrangements generally include an annual minimum revenue commitment over the term of the contract for which revenues will be recognized in future periods.

Consumer customer contracts for wireline services generally have a service term of two years; however, this term may be shorter at twelve months or month-to-month. Certain contracts with Business customers for wireline services extend into future periods, contain fixed monthly fees and usage-based fees, and can include annual commitments in each year of the contract or commitments over the entire specified contract term; however, a significant number of contracts for wireline services with our Business customers have a contract term that is twelve months or less.

Additionally, there are certain contracts with Business customers for wireline services that have a contractual minimum fee over the total contract term. We cannot predict the time period when revenue will be recognized related to those contracts; thus, they are excluded from the time bands below. These contracts have varying terms spanning over four years ending in January 2024 and have aggregate contract minimum payments totaling $3.8 billion.

At March 31, 2019, the transaction price related to unsatisfied performance obligations for total wireless and wireline revenue contracts expected to be recognized for 2019, 2020 and thereafter was $14.2 billion, $10.7 billion and $3.4 billion, respectively.

Accounts Receivable and Contract Balances

The timing of revenue recognition may differ from the time of billing to our customers. Receivables presented in our consolidated balance sheet represent an unconditional right to consideration. Contract balances represent amounts from an arrangement when either Verizon has performed, by transferring goods or services to the customer in advance of receiving all or partial consideration for such goods and services from the customer, or the customer has made payment to Verizon in advance of obtaining control of the goods and/or services promised to the customer in the contract.

Contract assets primarily relate to our rights to consideration for goods or services provided to customers but for which we do not have an unconditional right at the reporting date. Under a fixed-term plan, total contract revenue is allocated between wireless service and equipment

revenues. In conjunction with these arrangements, a contract asset is created, which represents the difference between the amount of equipment revenue recognized upon sale and the amount of consideration received from the customer when the performance obligation related to the transfer of control of the equipment is satisfied. The contract asset is reclassified to accounts receivable as wireless services are provided and billed. We have the right to bill the customer as service is provided over time, which results in our right to the payment being unconditional. The contract asset balances are presented in our consolidated balance sheet as Prepaid expenses and other and Other assets. We assess our contract assets for impairment on a quarterly basis and will recognize an impairment charge to the extent their carrying amount is not recoverable.

Contract liabilities arise when we bill our customers and receive consideration in advance of providing the goods or services promised in the contract. We typically bill service one month in advance, which is the primary component of the contract liability balance. Contract liabilities are recognized as revenue when services are provided to the customer. The contract liability balances are presented in our condensed consolidated balance sheet as Other current liabilities and Other liabilities.

The following table presents information about receivables from contracts with customers:

|

| | | | | | | | | | | | | | | |

| At January 1, |

| | At March 31, |

| | At January 1, |

| | At March 31, |

|

(dollars in millions) | 2019 |

| | 2019 |

| | 2018 |

| | 2018 |

|

Receivables(1) | $ | 12,104 |

| | $ | 11,601 |

| | $ | 12,073 |

| | $ | 11,028 |

|

Device payment plan agreement receivables(2) | 8,940 |

| | 9,687 |

| | 1,461 |

| | 3,630 |

|

| |

(1) | Balances do not include receivables related to the following contracts: leasing arrangements (such as towers), captive reinsurance arrangements primarily related to wireless device insurance and the interest on equipment financed on a device payment plan agreement when sold to the customer by an authorized agent. |

| |

(2) | Included in device payment plan agreement receivables presented in Note 7. Balances do not include receivables related to contracts completed prior to January 1, 2018 and receivables derived from the sale of equipment on a device payment plan through an authorized agent. |

The following table presents information about contract balances:

|

| | | | | | | | | | | | | | | |

| At January 1, |

| | At March 31, |

| | At January 1, |

| | At March 31, |

|

(dollars in millions) | 2019 |

| | 2019 |

| | 2018 |

| | 2018 |

|

Contract asset | $ | 1,003 |

| | $ | 1,021 |

| | $ | 1,170 |

| | $ | 1,106 |

|

Contract liability (1) | 4,943 |

| | 4,973 |

| | 4,452 |

| | 4,571 |

|

(1) Revenue recognized related to contract liabilities existing at January 1, 2019 and January 1, 2018 were $3.7 billion and $3.5 billion for the three months ended March 31, 2019 and March 31, 2018, respectively.

The balance of contract assets and contract liabilities recorded in our condensed consolidated balance sheet were as follows:

|

| | | | | | | |

| At March 31, |

| | At December 31, |

|

(dollars in millions) | 2019 |

| | 2018 |

|

Assets | | | |

Prepaid expenses and other | $ | 770 |

| | $ | 757 |

|

Other assets | 251 |

| | 246 |

|

Total | $ | 1,021 |

| | $ | 1,003 |

|

| | | |

Liabilities | | | |

Other current liabilities | $ | 4,255 |

| | $ | 4,207 |

|

Other liabilities | 718 |

| | 736 |

|

Total | $ | 4,973 |

| | $ | 4,943 |

|

Contract Costs

Topic 606 requires the recognition of an asset for incremental costs to obtain a customer contract, which are then amortized to expense, over the respective periods of expected benefit. We recognize an asset for incremental commission expenses paid to internal sales personnel and agents in conjunction with obtaining customer contracts. We only defer these costs when we have determined the commissions are, in fact, incremental and would not have been incurred absent the customer contract. Costs to obtain a contract are amortized and recorded ratably as commission expense over the period representing the transfer of goods or services to which the assets relate. Costs to obtain wireless contracts are amortized over both of our Consumer and Business customers' estimated device upgrade cycles, as such costs are typically incurred each time a customer upgrades. Costs to obtain wireline contracts are amortized as expense over the estimated customer relationship period for our Consumer customers. Incremental costs to obtain wireline contracts for our Business customers are insignificant. Costs to obtain contracts are recorded in Selling, general and administrative expense.

We also defer costs incurred to fulfill contracts that: (1) relate directly to the contract; (2) are expected to generate resources that will be used to satisfy our performance obligation under the contract; and (3) are expected to be recovered through revenue generated under the contract. Contract fulfillment costs are expensed as we satisfy our performance obligations and recorded in Cost of services. These costs principally relate to direct costs that enhance our wireline business resources, such as costs incurred to install circuits.

We determine the amortization periods for our costs incurred to obtain or fulfill a customer contract at a portfolio level due to the similarities within these customer contract portfolios.

Other costs, such as general costs or costs related to past performance obligations, are expensed as incurred.

Collectively, costs to obtain a contract and costs to fulfill a contract are referred to as Deferred contract costs, and amortized over a two- to five-year period. Deferred contract costs are classified as current or non-current within Prepaid expenses and other and Other assets, respectively. The balances of Deferred contract costs included in our condensed consolidated balance sheet were as follows:

|

| | | | | | | |

| At March 31, |

| | At December 31, |

|

(dollars in millions) | 2019 |

| | 2018 |

|

Assets | | | |

Prepaid expenses and other | $ | 2,230 |

| | $ | 2,083 |

|

Other assets | 1,791 |

| | 1,812 |

|

Total | $ | 4,021 |

| | $ | 3,895 |

|

For the three months ended March 31, 2019 and 2018, we recognized expense of $615 million and $405 million, respectively, associated with the amortization of Deferred contract costs, primarily within Selling, general and administrative expense in our condensed consolidated statements of income.

We assess our Deferred contract costs for impairment on a quarterly basis. We recognize an impairment charge to the extent the carrying amount of a deferred cost exceeds the remaining amount of consideration we expect to receive in exchange for the goods and services related to the cost, less the expected costs related directly to providing those goods and services that have not yet been recognized as expenses. There have been no impairment charges recognized for the three months ended March 31, 2019 or March 31, 2018.

|

|

Note 3. Acquisitions and Divestitures |

Spectrum License Transactions

During the three months ended March 31, 2019, we entered into and completed various wireless license transactions for an insignificant amount of cash consideration.

Other

During the three months ended March 31, 2019, we completed various other acquisitions for an insignificant amount of cash consideration.

|

|

Note 4. Wireless Licenses, Goodwill, and Other Intangible Assets |

Wireless Licenses

The carrying amounts of Wireless licenses are as follows:

|

| | | | | | |

| At March 31, |

| At December 31, |

|

(dollars in millions) | 2019 |

| 2018 |

|

Wireless licenses | $ | 94,237 |

| $ | 94,130 |

|

At March 31, 2019 and 2018, approximately $7.2 billion and $13.6 billion, respectively, of wireless licenses were under development for commercial service for which we were capitalizing interest costs. We recorded approximately $88 million and $124 million of capitalized interest on wireless licenses for the three months ended March 31, 2019 and 2018, respectively.

The average remaining renewal period of our wireless licenses portfolio was 4.4 years as of March 31, 2019.

Goodwill

In November 2018, we announced a strategic reorganization of our business. As discussed in Note 1, the Company began reporting externally under the new structure as of April 1, 2019. The below table relates to the previous reporting structure in effect as of March 31, 2019.

Changes in the carrying amount of Goodwill are as follows:

|

| | | | | | | | | | | | | | | |

(dollars in millions) | Historical Wireless |

| | Historical Wireline |

| | Historical Other |

| | Total |

|

Balance at January 1, 2019 (1) | $ | 18,397 |

| | $ | 3,871 |

| | $ | 2,346 |

| | $ | 24,614 |

|

Acquisitions (Note 3) | — |

| | 20 |

| | — |

| | 20 |

|

Reclassifications, adjustments and other | — |

| | 1 |

| | — |

| | 1 |

|

Balance at March 31, 2019 (1) | $ | 18,397 |

| | $ | 3,892 |

| | $ | 2,346 |

| | $ | 24,635 |

|

(1) Goodwill is net of accumulated impairment charge of $4.6 billion, related to our Media reporting unit (included within Historical Other in the table above), which was recorded in the fourth quarter of 2018.

Other Intangible Assets

The following table displays the composition of Other intangible assets, net:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| At March 31, 2019 | | | At December 31, 2018 | |

(dollars in millions) | Gross Amount |

| | Accumulated Amortization |

| | Net Amount |

| | Gross Amount |

| | Accumulated Amortization |

| | Net Amount |

|

Customer lists (8 to 13 years) | $ | 3,953 |

| | $ | (1,213 | ) | | $ | 2,740 |

| | $ | 3,951 |

| | $ | (1,121 | ) | | $ | 2,830 |

|

Non-network internal-use software (3 to 7 years) | 18,958 |

| | (13,192 | ) | | 5,766 |

| | 18,603 |

| | (12,785 | ) | | 5,818 |

|

Other (2 to 25 years) | 1,999 |

| | (897 | ) | | 1,102 |

| | 1,988 |

| | (861 | ) | | 1,127 |

|

Total | $ | 24,910 |

| | $ | (15,302 | ) | | $ | 9,608 |

| | $ | 24,542 |

| | $ | (14,767 | ) | | $ | 9,775 |

|

The amortization expense for Other intangible assets was as follows:

|

| | | |

| Three Months Ended |

|

(dollars in millions) | March 31, |

|

2019 | $ | 555 |

|

2018 | 534 |

|

The estimated future amortization expense for Other intangible assets for the remainder of the current year and next 5 years is as follows:

|

| | | |

Years | (dollars in millions) |

|

Remainder of 2019 | $ | 1,603 |

|

2020 | 1,837 |

|

2021 | 1,544 |

|

2022 | 1,276 |

|

2023 | 1,004 |

|

2024 | 749 |

|

|

|

Note 5. Leasing Arrangements |

We enter into various lease arrangements for network equipment including towers, distributed antenna systems, small cells, real estate and connectivity mediums including dark fiber, equipment leases, and other various types of assets for use in our operations. Our leases have remaining lease terms ranging from 1 year to 24 years, some of which include options to extend the leases term for up to 25 years, and some of which include options to terminate the leases. For the majority of leases entered into during the current period, we have concluded it is not reasonably certain that we would exercise the options to extend the lease or terminate the lease. Therefore, as of the lease commencement date, our lease terms generally do not include these options. We include options to extend the lease when it is reasonably certain that we will exercise that option.

During March 2015, we completed a transaction with American Tower Corporation (American Tower) pursuant to which American Tower acquired the exclusive rights to lease and operate approximately 11,300 of our wireless towers for an upfront payment of $5.0 billion. We have subleased capacity on the towers from American Tower for a minimum of 10 years at current market rates in 2015, with options to renew. We continue to include the towers in Property, plant and equipment, net in our condensed consolidated balance sheets and depreciate them accordingly. In addition to the rights to lease and operate the towers, American Tower assumed the interest in the underlying ground leases related to these towers. While American Tower can renegotiate the terms of and is responsible for paying the ground leases, we are still the primary obligor for these leases and accordingly, the present value of these ground leases are included in our operating lease right-of-use assets and operating lease liabilities. We do not expect to be required to make ground lease payments unless American Tower defaults, which we determined to be remote.

The components of net lease cost were as follows:

|

| | | | |

| | Three Months Ended |

|

| | March 31, |

|

(dollars in millions) | Classification | 2019 |

|

Operating lease cost (1) | Cost of services Selling, general and administrative expense | $ | 1,170 |

|

Finance lease cost: | | |

Amortization of right-of-use assets | Depreciation and amortization expense | 86 |

|

Interest on lease liabilities | Interest expense | 9 |

|

Short-term lease cost (1) | Cost of services Selling, general and administrative expense | 16 |

|

Variable lease cost (1) | Cost of services

Selling, general and administrative expense | 57 |

|

Sublease income | Service revenues and other | (67 | ) |

Total net lease cost | | $ | 1,271 |

|

(1) All operating lease costs, including short-term and variable lease costs, are split between Cost of services and Selling, general and administrative expense in the condensed consolidated statements of income based on the use of the facility that the rent is being paid on. See Note 1 for additional information. Variable lease costs represent payments that are dependent on a rate or index, or on usage of the asset.

Supplemental disclosure for the statement of cash flows related to operating and finance leases were as follows:

|

| | | |

| Three Months Ended |

|

| March 31, |

|

(dollars in millions) | 2019 |

|

Cash Flows from Operating Activities | |

Cash paid for amounts included in the measurement of lease liabilities | |

Operating cash flows for operating leases | $ | (1,058 | ) |

Operating cash flows for finance leases | (9 | ) |

Cash Flows from Financing Activities | |

Financing cash flows for finance leases | (86 | ) |

Supplemental lease cash flow disclosures | |

Operating lease right-of-use assets obtained in exchange for new operating lease liabilities | 668 |

|

Right-of-use assets obtained in exchange for new finance lease liabilities | 115 |

|

Supplemental disclosure for the balance sheet related to finance leases were as follows:

|

| | | |

| At March 31, |

|

(dollars in millions) | 2019 |

|

Assets | |

Property, plant and equipment, net | $ | 742 |

|

| |

Liabilities | |

Debt maturing within one year | $ | 323 |

|

Long-term debt | 611 |

|

Total Finance lease liabilities | $ | 934 |

|

The weighted-average remaining lease term and the weighted-average discount rate of our leases were as follows:

|

| | |

| At March 31, |

|

| 2019 |

|

Weighted-average remaining lease term (years) | |

Operating Leases | 9 |

|

Finance Leases | 4 |

|

Weighted-average discount rate | |

Operating Leases | 4.2 | % |

Finance Leases | 3.6 | % |

The Company's maturity analysis of operating and finance lease liabilities as of March 31, 2019 were as follows:

|

| | | | | | | |

(dollars in millions) | Operating Leases |

| | Finance Leases |

|

Remainder of 2019 | $ | 3,051 |

| | $ | 279 |

|

2020 | 3,805 |

| | 270 |

|

2021 | 3,462 |

| | 173 |

|

2022 | 3,045 |

| | 122 |

|

2023 | 2,689 |

| | 75 |

|

Thereafter | 10,792 |

| | 105 |

|

Total lease payments | 26,844 |

| | 1,024 |

|

Less interest | (4,876 | ) | | (90 | ) |

Present value of lease liabilities | 21,968 |

| | 934 |

|

Less current obligation | (2,997 | ) | | (323 | ) |

Long-term obligation at March 31, 2019 | $ | 18,971 |

| | $ | 611 |

|

As of March 31, 2019, we have contractually obligated lease payments amounting to $477 million for an office facility operating lease that has not yet commenced. We have legally obligated lease payments for various other operating leases that have not yet commenced for which the total obligation was not significant. We have certain rights and obligations for these leases, but have not recognized an operating lease right-of-use asset or an operating lease liability since they have not yet commenced.

Significant Debt Transactions

Exchange Offers

The following table shows the transactions that occurred in the first quarter of 2019.

|

| | | | | | |

(dollars in millions) | Principal Amount Exchanged |

| Principal Amount Issued |

|

Verizon 1.750% - 5.150% notes and floating rate notes, due 2021 - 2025 | $ | 3,892 |

| $ | — |

|

GTE LLC 8.750% debentures, due 2021 | 21 |

| — |

|

Verizon 4.016% notes due 2029 (1) | — |

| 4,000 |

|

Total | $ | 3,913 |

| $ | 4,000 |

|

(1) Total exchange amount issued in consideration does not include an insignificant amount of cash used to settle.

Debt Redemptions, Repurchases and Repayments

The following table shows the transactions that occurred in the first quarter of 2019.

|

| | | | | |

(dollars in millions) | Principal Redeemed / Repaid |

| Amount Paid as % of Principal (1) |

|

Verizon 5.900% notes due 2054 | $ | 500 |

| 100.000 | % |

Verizon 1.375% notes due 2019 | 206 |

| 100.000 | % |

Verizon 1.750% notes due 2021 | 621 |

| 100.000 | % |

Verizon 3.000% notes due 2021 | 930 |

| 101.061 | % |

Verizon 3.500% notes due 2021 | 315 |

| 102.180 | % |

Open market repurchases of various Verizon notes | 163 |

| Various |

|

Total | $ | 2,735 |

| |

(1) Percentages represent price paid to redeem, repurchase and repay.

In April 2019, we notified investors of our intention to redeem in May 2019 in whole $831 million aggregate principal amount of 2.625% Notes due 2020 and $736 million aggregate principal amount of 3.500% Notes due 2021.

Debt Issuances

The following table shows the transactions that occurred in the first quarter of 2019.

|

| | | | | | |

(dollars in millions) | Principal Amount Issued |

| Net Proceeds (1) |

|

Verizon 3.875% notes due 2029 (2) | $ | 1,000 |

| $ | 994 |

|

Verizon 5.000% notes due 2051 | 510 |

| 506 |

|

Total | $ | 1,510 |

| $ | 1,500 |

|

(1) Net proceeds were net of discount and issuance costs.

(2) An amount equal to the net proceeds from this green bond will be used to fund, in whole or in part, "Eligible Green Investments." "Eligible Green Investments" include new and existing investments made by us during the period from two years prior to the issuance of the green bond through the maturity date of the green bond, in the following categories: (1) renewable energy; (2) energy efficiency; (3) green buildings; (4) sustainable water management; and (5) biodiversity and conservation. "Eligible Green Investments" include operating expenditures as well as capital investments.

In April 2019, we issued €2.5 billion of notes with interest rates of 0.875% and 1.250% per year due on 2027 and 2030 respectively, and £500 million of notes with an interest rate of 2.500% per year due on 2031.

Short-Term Borrowing and Commercial Paper Program

In July 2018, we entered into a short-term uncommitted credit facility with the ability to borrow up to $700 million. During the three months ended March 31, 2019, we drew $600 million from the facility.

As of March 31, 2019, we had no commercial paper outstanding.

Asset-Backed Debt

As of March 31, 2019, the carrying value of our asset-backed debt was $10.4 billion. Our asset-backed debt includes Asset-Backed Notes (ABS Notes) issued to third-party investors (Investors) and loans (ABS Financing Facilities) received from banks and their conduit facilities (collectively, the Banks). Our consolidated asset-backed debt bankruptcy remote legal entities (each, an ABS Entity or collectively, the ABS Entities) issue the debt or are otherwise party to the transaction documentation in connection with our asset-backed debt transactions. Under the terms of our asset-backed debt, Cellco Partnership (Cellco) and certain other affiliates of Verizon (collectively, the Originators) transfer device payment plan agreement receivables to one of the ABS Entities, which in turn transfers such receivables to another ABS Entity that issues the debt. Verizon entities retain the equity interests in the ABS Entities, which represent the rights to all funds not needed to make required payments on the asset-backed debt and other related payments and expenses.

Our asset-backed debt is secured by the transferred device payment plan agreement receivables and future collections on such receivables. The device payment plan agreement receivables transferred to the ABS Entities and related assets, consisting primarily of restricted cash, will only be available for payment of asset-backed debt and expenses related thereto, payments to the Originators in respect of additional transfers of device payment plan agreement receivables, and other obligations arising from our asset-backed debt transactions, and will not be available to pay other obligations or claims of Verizon’s creditors until the associated asset-backed debt and other obligations are satisfied. The Investors or Banks, as applicable, which hold our asset-backed debt have legal recourse to the assets securing the debt, but do not have any recourse to Verizon with respect to the payment of principal and interest on the debt. Under a parent support agreement, Verizon has agreed to guarantee certain of the payment obligations of Cellco and the Originators to the ABS Entities.

Cash collections on the device payment plan agreement receivables collateralizing asset-backed debt securities are required at certain specified times to be placed into segregated accounts. Deposits to the segregated accounts are considered restricted cash and are included in Prepaid expenses and other and Other assets in our condensed consolidated balance sheets.

Proceeds from our asset-backed debt transactions are reflected in Cash flows from financing activities in our condensed consolidated statements of cash flows. The asset-backed debt issued and the assets securing this debt are included in our condensed consolidated balance sheets.

ABS Notes

During the three months ended March 31, 2019, we completed the following ABS Notes transactions:

|

| | | | | | | |

(dollars in millions) | Interest Rates % |

| | Expected Weighted-average Life to Maturity | Principal Amount Issued |

|

A-1a Senior class notes | 2.930 |

| | 2.50 | $ | 900 |

|

A-1b Senior floating rate class notes | LIBOR + 0.330 |

| (1) | 2.50 | 100 |

|

B Junior class notes | 3.020 |

| | 3.22 | 69 |

|

C Junior class notes | 3.220 |

| | 3.40 | 53 |

|

Total ABS notes | | | | $ | 1,122 |

|

(1) The one-month London Interbank Offered Rate (LIBOR) rate at March 31, 2019 was 2.495%.

Under the terms of each series of ABS Notes, there is a two year revolving period during which we may transfer additional receivables to the ABS Entity. The two year revolving period of the ABS Notes we issued in July 2016 and November 2016 ended in July 2018 and November 2018 respectively, and we began to repay principal on the 2016-1 Class A senior ABS Notes and the 2016-2 Class A senior ABS Notes in August 2018 and December 2018, respectively. During the three months ended March 31, 2019, we made aggregate repayments of $559 million.

ABS Financing Facilities

In May 2018, we entered into a device payment plan agreement financing facility with a number of financial institutions (2018 ABS Financing Facility). Under the terms of the 2018 ABS Financing Facility, the financial institutions made advances under asset-backed loans backed by device payment plan agreement receivables of business customers for proceeds of $540 million. The loan agreement entered into in connection with the 2018 ABS Financing Facility has a final maturity date in December 2021 and bears interest at a floating rate. There is a one year revolving period beginning from May 2018 during which we may transfer additional receivables to the ABS Entity. Subject to certain conditions, we may also remove receivables from the ABS Entity. Under the loan agreement, we have the right to prepay all or a portion of the advances at any time without penalty, but in certain cases, with breakage costs. If we choose to prepay, the amount prepaid shall be available for further drawdowns until May 2019, except in certain circumstances. As of March 31, 2019, the 2018 ABS Financing Facility is fully drawn and the outstanding borrowing under the 2018 ABS Financing Facility was $540 million.

We entered into an ABS Financing Facility in September 2016 with a number of financing institutions (2016 ABS Financing Facility). Under the terms of the 2016 ABS Financing Facility, the financial institutions made advances under asset-backed loans backed by device payment plan agreement receivables of consumer customers. Two loan agreements were entered into in connection with the 2016 ABS Financing Facility in September 2016 and May 2017. The loan agreements have a final maturity date in March 2021 and bear interest at floating rates. The two year revolving period of the two loan agreements ended in September 2018. Under the loan agreements, we have the right to prepay all or a portion of the advances at any time without penalty, but in certain cases, with breakage costs. Subject to certain conditions, we may also remove receivables from the ABS Entity. During the three months ended March 31, 2019, we made an aggregate of $253 million in repayments. The aggregate outstanding borrowings under the two loans were $671 million as of March 31, 2019.

Variable Interest Entities (VIEs)

The ABS Entities meet the definition of a VIE for which we have determined that we are the primary beneficiary as we have both the power to direct the activities of the entity that most significantly impact the entity’s performance and the obligation to absorb losses or the right to receive benefits of the entity. Therefore, the assets, liabilities and activities of the ABS Entities are consolidated in our financial results and are included in amounts presented on the face of our condensed consolidated balance sheets.

The assets and liabilities related to our asset-backed debt arrangements included in our condensed consolidated balance sheets were as follows:

|

| | | | | | | |

| At March 31, |

| | At December 31, |

|

(dollars in millions) | 2019 |

| | 2018 |

|

Assets | | | |

Account receivable, net | $ | 9,535 |

| | $ | 8,861 |

|

Prepaid expenses and other | 1,045 |

| | 989 |

|

Other assets | 3,263 |

| | 2,725 |

|

| | | |

Liabilities | | | |

Accounts payable and accrued liabilities | 10 |

| | 7 |

|

Short-term portion of long-term debt | 5,494 |

| | 5,352 |

|

Long-term debt | 4,892 |

| | 4,724 |

|

See Note 7 for additional information on device payment plan agreement receivables used to secure asset-backed debt.

Credit Facilities

As of March 31, 2019, the unused borrowing capacity under our $9.5 billion credit facility was approximately $9.4 billion. The credit facility does not require us to comply with financial covenants or maintain specified credit ratings, and it permits us to borrow even if our business has incurred a material adverse change. We use the credit facility for the issuance of letters of credit and for general corporate purposes.

In March 2016, we entered into a $1.0 billion credit facility insured by Eksportkreditnamnden Stockholm, Sweden, the Swedish export credit agency. As of March 31, 2019, the outstanding balance was $706 million. We used this credit facility to finance network equipment-related purchases.

In July 2017, we entered into credit facilities insured by various export credit agencies providing us with the ability to borrow up to $4.0 billion to finance equipment-related purchases. The facilities have borrowings available, portions of which extend through October 2019, contingent upon the amount of eligible equipment-related purchases that we make. During the three months ended March 31, 2019, we drew $424 million from these facilities. As of March 31, 2019, we had an outstanding balance of $3.1 billion.

Non-Cash Transaction

During the three months ended March 31, 2019 and 2018, we financed, primarily through vendor financing arrangements, the purchase of approximately $115 million and $345 million respectively, of long-lived assets consisting primarily of network equipment. At both March 31, 2019 and 2018, $1.0 billion and $1.3 billion, respectively, relating to these financing arrangements, including those entered into in prior years and liabilities assumed through acquisitions, remained outstanding. These purchases are non-cash financing activities and therefore are not reflected within Capital expenditures in our condensed consolidated statements of cash flows.

Early Debt Redemptions

During the three months ended March 31, 2019 and 2018, we recorded losses on early debt redemptions of an insignificant amount and $249 million, respectively, which were recorded in Other income (expense), net in our condensed consolidated statements of income.

Guarantees

We guarantee the debentures of our operating telephone company subsidiaries. As of March 31, 2019, $796 million aggregate principal amount of these obligations remained outstanding. Each guarantee will remain in place for the life of the obligation unless terminated pursuant to its terms, including the operating telephone company no longer being a wholly-owned subsidiary of Verizon.

We also guarantee the debt obligations of GTE LLC as successor in interest to GTE Corporation that were issued and outstanding prior to July 1, 2003. As of March 31, 2019, $423 million aggregate principal amount of these obligations remained outstanding.

|

|

Note 7. Wireless Device Payment Plans |

Under the Verizon device payment program, our eligible wireless customers purchase wireless devices under a device payment plan agreement. Customers that activate service on devices purchased under the device payment program pay lower service fees as compared to those under our fixed-term service plans, and their device payment plan charge is included on their wireless monthly bill. As of January 2017, we no longer offer Consumer customers new fixed-term, subsidized service plans for phones; however, we continue to offer subsidized plans to our Business customers. We also continue to service existing fixed-term subsidized plans for Consumer customers who have not yet purchased and activated devices under the Verizon device payment program.

Wireless Device Payment Plan Agreement Receivables

The following table displays device payment plan agreement receivables, net, recognized in our condensed consolidated balance sheets:

|

| | | | | | | |

| At March 31, |

| | At December 31, |

|

(dollars in millions) | 2019 |

| | 2018 |

|

Device payment plan agreement receivables, gross | $ | 18,865 |

| | $ | 19,313 |

|

Unamortized imputed interest | (493 | ) | | (546 | ) |

Device payment plan agreement receivables, net of unamortized imputed interest | 18,372 |

| | 18,767 |

|

Allowance for credit losses | (526 | ) | | (597 | ) |

Device payment plan agreement receivables, net | $ | 17,846 |

| | $ | 18,170 |

|

| | | |

Classified in our condensed consolidated balance sheets: | | | |

Accounts receivable, net | $ | 12,607 |

| | $ | 12,624 |

|

Other assets | 5,239 |

| | 5,546 |

|

Device payment plan agreement receivables, net | $ | 17,846 |

| | $ | 18,170 |

|

Included in our device payment plan agreement receivables, net at March 31, 2019 and December 31, 2018, are net device payment plan agreement receivables of $12.7 billion and $11.5 billion, respectively, that have been transferred to ABS Entities and continue to be reported in our condensed

consolidated balance sheets. See Note 6 for additional information. We believe the carrying value of our installment loans receivables approximate their fair value using a Level 3 expected cash flow model.

We may offer certain promotions that allow a customer to trade in their owned device in connection with the purchase of a new device. Under these types of promotions, the customer receives a credit for the value of the trade-in device. In addition, we may provide the customer with additional future credits that will be applied against the customer’s monthly bill as long as service is maintained. We recognize a liability for the trade-in device measured at fair value, which is determined by considering several factors, including the weighted-average selling prices obtained in recent resales of similar devices eligible for trade-in. Future credits are recognized when earned by the customer. Device payment plan agreement receivables, net does not reflect the trade-in device liability. At March 31, 2019 and December 31, 2018 the amount of trade-in liability was insignificant and $64 million, respectively.

From time to time, we offer certain marketing promotions that allow our customers to upgrade to a new device after paying down a certain specified portion of the required device payment plan agreement amount as well as trading in their device in good working order. When a customer enters into a device payment plan agreement with the right to upgrade to a new device, we account for this trade-in right as a guarantee obligation.

For indirect channel wireless contracts with customers, we impute risk adjusted interest on the device payment plan agreement receivables. We record the imputed interest as a reduction to the related accounts receivable. Interest income, which is included within Service revenues and other in our condensed consolidated statements of income, is recognized over the financed device payment term. See Note 2 for additional information on financing considerations with respect to direct channel wireless contracts with customers.

When originating device payment plan agreements, we use internal and external data sources to create a credit risk score to measure the credit quality of a customer and to determine eligibility for the device payment program. If a customer is either new to Verizon Wireless or has less than 210 days of customer tenure with Verizon Wireless (a new customer), the credit decision process relies more heavily on external data sources. If the customer has 210 days or more of customer tenure with Verizon Wireless (an existing customer), the credit decision process relies on internal data sources. Verizon Wireless’ experience has been that the payment attributes of longer tenured customers are highly predictive for estimating their reliability to make future payments. External data sources include obtaining a credit report from a national consumer credit reporting agency, if available. Verizon Wireless uses its internal data and/or credit data obtained from the credit reporting agencies to create a custom credit risk score. The custom credit risk score is generated automatically (except with respect to a small number of applications where the information needs manual intervention) from the applicant’s credit data using Verizon Wireless’ proprietary custom credit models, which are empirically derived, demonstrably and statistically sound. The credit risk score measures the likelihood that the potential customer will become severely delinquent and be disconnected for non-payment. For a small portion of new customer applications, a traditional credit report is not available from one of the national credit reporting agencies because the potential customer does not have sufficient credit history. In those instances, alternate credit data is used for the risk assessment.

Based on the custom credit risk score, we assign each customer to a credit class, each of which has specified offers of credit including an account level spending limit and either a maximum amount of credit allowed per device or a required down payment percentage. During the fourth quarter of 2018 Verizon Wireless moved all customers, new and existing, from a required down payment percentage, between zero and 100%, to a maximum amount of credit per device.

Subsequent to origination, Verizon Wireless monitors delinquency and write-off experience as key credit quality indicators for its portfolio of device payment plan agreements and fixed-term service plans. The extent of our collection efforts with respect to a particular customer are based on the results of proprietary custom empirically derived internal behavioral scoring models that analyze the customer’s past performance to predict the likelihood of the customer falling further delinquent. These customer scoring models assess a number of variables, including origination characteristics, customer account history and payment patterns. Based on the score derived from these models, accounts are grouped by risk category to determine the collection strategy to be applied to such accounts. We continuously monitor collection performance results and the credit quality of our device payment plan agreement receivables based on a variety of metrics, including aging. Verizon Wireless considers an account to be delinquent and in default status if there are unpaid charges remaining on the account on the day after the bill’s due date.

The balance and aging of the device payment plan agreement receivables on a gross basis were as follows:

|

| | | | | | | |

| At March 31, |

| | At December 31, |

|

(dollars in millions) | 2019 |

| | 2018 |

|

Unbilled | $ | 17,586 |

| | $ | 18,043 |

|

Billed: | | | |

Current | 990 |

| | 986 |

|

Past due | 289 |

| | 284 |

|

Device payment plan agreement receivables, gross | $ | 18,865 |

| | $ | 19,313 |

|

Activity in the allowance for credit losses for the device payment plan agreement receivables was as follows:

|

| | | | | | | |

(dollars in millions) | 2019 |

| | 2018 |

|

Balance at January 1, | $ | 597 |

| | $ | 848 |

|

Bad debt expense | 155 |

| | 104 |

|

Write-offs | (226 | ) | | (149 | ) |

Balance at March 31, | $ | 526 |

| | $ | 803 |

|

|

|

Note 8. Fair Value Measurements |

Recurring Fair Value Measurements

The following table presents the balances of assets and liabilities measured at fair value on a recurring basis as of March 31, 2019:

|

| | | | | | | | | | | | | | | |

(dollars in millions) | Level 1(1) |

| | Level 2(2) |

| | Level 3(3) |

| | Total |

|

Assets: | | | | | | | |

Other assets: | | | | | | | |

Fixed income securities | $ | — |

| | $ | 430 |

| | $ | — |

| | $ | 430 |

|

Interest rate swaps | — |

| | 100 |

| | — |

| | 100 |

|

Cross currency swaps | — |

| | 215 |

| | — |

| | 215 |

|

Interest rate caps | — |

| | 6 |

| | — |

| | 6 |

|

Total | $ | — |

| | $ | 751 |

| | $ | — |

| | $ | 751 |

|

| | | | | | | |

Liabilities: | | | | | | | |

Other liabilities: | | | | | | | |

Interest rate swaps | $ | — |

| | $ | 361 |

| | $ | — |

| | $ | 361 |

|

Cross currency swaps | — |

| | 519 |

| | — |

| | 519 |

|

Forward starting interest rate swaps | — |

| | 242 |

| | — |

| | 242 |

|

Interest rate caps | — |

| | 2 |

| | — |

| | 2 |

|

Foreign exchange forwards | — |

| | 10 |

| | — |

| | 10 |

|

Total | $ | — |

| | $ | 1,134 |

| | $ | — |

| | $ | 1,134 |

|

The following table presents the balances of assets and liabilities measured at fair value on a recurring basis as of December 31, 2018:

|

| | | | | | | | | | | | | | | |

(dollars in millions) | Level 1(1) |

| | Level 2(2) |

| | Level 3(3) |

| | Total |

|

Assets: | | | | | | | |

Other assets: | | | | | | | |

Fixed income securities | $ | — |

| | $ | 405 |

| | $ | — |

| | $ | 405 |

|

Interest rate swaps | — |

| | 3 |

| | — |

| | 3 |

|

Cross currency swaps | — |

| | 220 |

| | — |

| | 220 |

|

Interest rate caps | — |

| | 14 |

| | — |

| | 14 |

|

Total | $ | — |

| | $ | 642 |

| | $ | — |

| | $ | 642 |

|

| | | | | | | |

Liabilities: | | | | | | | |

Other liabilities: | | | | | | | |

Interest rate swaps | $ | — |

| | $ | 813 |

| | $ | — |

| | $ | 813 |

|

Cross currency swaps | — |

| | 536 |

| | — |

| | 536 |

|

Forward starting interest rate swaps | — |

| | 60 |

| | — |

| | 60 |

|

Interest rate caps | — |

| | 4 |

| | — |

| | 4 |

|

Total | $ | — |

| | $ | 1,413 |

| | $ | — |

| | $ | 1,413 |

|

| |

(1) | Quoted prices in active markets for identical assets or liabilities |

| |

(2) | Observable inputs other than quoted prices in active markets for identical assets and liabilities |

| |

(3) | Unobservable pricing inputs in the market |

Certain of our equity investments do not have readily determinable fair values and are excluded from the tables above. Such investments are measured at cost, less any impairment, plus or minus changes resulting from observable price changes in orderly transactions for an identical or similar investment of the same issuer and are included in Investments in unconsolidated businesses in our condensed consolidated balance sheets. As of March 31, 2019 and December 31, 2018, the carrying amount of our investments without readily determinable fair values were $278 million and $248 million, respectively. During the three months ended March 31, 2019, there was an insignificant adjustment due to

observable price changes and we did not recognize an impairment charge. Cumulative adjustments due to observable price changes and impairment charges were $57 million and insignificant, respectively.

Fixed income securities consist primarily of investments in municipal bonds. For fixed income securities that do not have quoted prices in active markets, we use alternative matrix pricing resulting in these debt securities being classified as Level 2.

Derivative contracts are valued using models based on readily observable market parameters for all substantial terms of our derivative contracts and thus are classified within Level 2. We use mid-market pricing for fair value measurements of our derivative instruments. Our derivative instruments are recorded on a gross basis.

We recognize transfers between levels of the fair value hierarchy as of the end of the reporting period. There were no transfers between Level 1 and Level 2 during the three months ended March 31, 2019 and 2018.

Fair Value of Short-term and Long-term Debt

The fair value of our debt is determined using various methods, including quoted prices for identical terms and maturities, which is a Level 1 measurement, as well as quoted prices for similar terms and maturities in inactive markets and future cash flows discounted at current rates, which are Level 2 measurements. The fair value of our short-term and long-term debt, excluding finance leases, was as follows:

|

| | | | | | | | | | | | | | | |

| At March 31, | | | At December 31, | |

| 2019 | | | 2018 | |

(dollars in millions) | Carrying Amount |

| | Fair Value |

| | Carrying Amount |

| | Fair Value |

|

Short- and long-term debt, excluding finance leases | $ | 112,725 |

| | $ | 125,307 |

| | $ | 112,159 |

| | $ | 118,535 |

|

Derivative Instruments

The following table sets forth the notional amounts of our outstanding derivative instruments:

|

| | | | | | | |

| At March 31, |

| | At December 31, |