OMB APPROVAL

OMB Number:

3235-0570

Expires: March 31, 2017

Estimated average burden hours per response...20.6

UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4815

Ultra Series Fund

(Exact

name of registrant as specified in charter)

550 Science Drive, Madison,

WI 53711

(Address of principal executive offices)(Zip code)

Lisa R. Lange

Madison

Funds Legal and Compliance Department

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant’s telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1. Certified Financial Statement

Annual Report

December 31, 2016

| ULTRA SERIES FUND |

| Conservative Allocation Fund |

| Moderate Allocation Fund |

| Aggressive Allocation Fund |

| Core Bond Fund |

| High Income Fund |

| Diversified Income Fund |

| Large Cap Value Fund |

| Large Cap Growth Fund |

| Mid Cap Fund |

| International Stock Fund |

| Ultra Series Fund | December 31, 2016 | |

| Table of Contents | |

| Page | |

| Management’s Discussion of Fund Performance | |

| Period in Review | 2 |

| Outlook. | 2 |

| Allocation Funds | 3 |

| Conservative Allocation Fund | 3 |

| Moderate Allocation Fund | 4 |

| Aggressive Allocation Fund | 5 |

| Core Bond Fund | 6 |

| High Income Fund | 7 |

| Diversified Income Fund | 8 |

| Large Cap Value Fund | 10 |

| Large Cap Growth Fund | 11 |

| Mid Cap Fund | 12 |

| International Stock Fund | 13 |

| Notes to Management’s Discussion of Fund Performance | 15 |

| Portfolios of Investments | |

| Conservative Allocation Fund | 17 |

| Moderate Allocation Fund | 18 |

| Aggressive Allocation Fund | 19 |

| Core Bond Fund | 20 |

| High Income Fund | 24 |

| Diversified Income Fund | 26 |

| Large Cap Value Fund | 31 |

| Large Cap Growth Fund | 32 |

| Mid Cap Fund | 33 |

| International Stock Fund | 34 |

| Financial Statements | |

| Statements of Assets and Liabilities | 36 |

| Statements of Operations | 38 |

| Statements of Changes in Net Assets | 40 |

| Financial Highlights for a Share of Beneficial Interest Outstanding | 44 |

| Notes to Financial Statements | 54 |

| Report of Independent Registered Public Accounting Firm | 70 |

| Other Information | 71 |

| Trustees and Officers | 77 |

Nondeposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of or guaranteed by any financial institution. For more complete information about Ultra Series Fund, including charges and expenses, request a prospectus from your financial advisor or from CMFG Life Insurance Company, 2000 Heritage Way, Waverly, IA 50677. Consider the investment objectives, risks, and charges and expenses of any fund carefully before investing. The prospectus contains this and other information about the investment company. For more current Ultra Series Fund performance information, please call 1-800-670-3600. Current performance may be lower or higher than the performance data quoted within. Past performance does not guarantee future results. Nothing in this report represents a recommendation of a security by the investment adviser. Portfolio holdings may have changed since the date of this report.

Ultra Series Fund | December 31, 2016

Management’s Discussion of Fund Performance (unaudited)

PERIOD IN REVIEW

Point-to-point, U.S. stocks posted solid gains for the fiscal year ended December 31, 2016. These gains, however, masked a year of volatility. By mid-February, the value of the S&P 500® Index had fallen 10.5% since December 31 of 2015 as markets focused on struggles in Europe, tepid economic growth in the U.S. and the ongoing need for central bank accommodation to prop up global economies and asset values. From their February low, however, domestic stocks staged an almost 20% rally by mid-August, interrupted only briefly by a sharp pullback after the UK’s decision to leave the European Union in June. Since the November election, stocks continued to move upward, adding 5.4% of total return to the S&P 500 thru the end of 2016. For the full fiscal year, the S&P 500 returned 11.96%. Mid cap stocks, as represented by the Russell Mid Cap® Index, returned 13.80%. Foreign equities were the underperformers for the year, as the MSCI EAFE® Index (net) returned 1.00% over the last twelve months. In general, value outpaced growth by a wide margin as value components in the Financial and Energy sectors posted strong returns for the year.

Fixed income markets were similarly volatile. Longer-term interest rates (10-year U.S. Treasury benchmark rate) ended fiscal 2015 at 2.27% but steadily fell in the first half of 2016, reaching a low of 1.36% in early July as it became evident that economic growth was stalling, inflation remained under control and the case for additional Fed tightening was weak. The resulting lack of confidence in the U.S. economy, declining oil prices and weak food prices allowed the Central Bank to ease off of the brake pedal, at least temporarily. The Fed, however, resumed its monetary sabre rattling late in the fiscal year as the economy improved, the Unemployment Rate fell and the inflation outlook firmed. From their July low, 10-year Treasury rates rose to a peak of 2.60% by mid-December as the Fed raised the Fed Funds Rate again by one quarter percentage point. Nonetheless, bonds posted positive total returns for the year. The Bloomberg Barclays Aggregate Index® totaled 2.65% for the fiscal year-to-date, and the Bloomberg Barclays Intermediate Government/ Credit Index® rose 2.08% for the period.

OUTLOOK

The U.S. economy has accelerated and inflation measures are firming. Real GDP growth, which began 2016 below a 1% annualized rate, is now advancing at a rate in excess of 3% and is expected to continue to move grudgingly higher. The Unemployment Rate is currently at 4.6% -down incrementally from the beginning of the fiscal year. This metric suggests modest improvement in the overall employment situation in the U.S. over the last year. In reality, over 2.5 million new jobs have been created in the last twelve months as previously discouraged job seekers have re-entered the labor force. Commensurate with more jobs, household incomes have rebounded as well, leading to forecasts of continued advance in consumption spending. The buoyancy of the labor markets, and an inflation rate near the Fed’s 2% target, have reignited the debate over the need for incremental monetary tightening. Recent comments by Fed officials suggest more interest rate increases lie ahead in 2017.

Fiscal policy in 2017 will likely prove stimulative to the economy. Initiatives offered so far by incoming President Trump and the Republican-controlled Congress suggest the potential for lower tax rates, higher infrastructure spending and a looser regulatory environment. As a result, we expect overall economic activity to continue to advance at a moderate pace and inflation to inch higher, sufficient for the Federal Reserve to continue raising short-term interest rates in the year ahead. Rising short-term interest rates will continue to have a negative effect on the U.S. bond market as yields across the term structure adjust to reflect the reality of tighter monetary policy. At some point, rising interest rates will catch the attention of the stock market too.

The blend of better economic growth here in the U.S., buoyant labor markets, advancing incomes and rising (although still relatively tame) inflation paint a challenging backdrop for U.S. financial markets. Combined with historically full equity valuations, rising interest rates both here and abroad and persistent fears over the soundness of Europe’s banking system, near-term caution is warranted. We believe that investors will be well-served going forward by focusing on lower-risk, higher-quality stocks along with

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

shorter duration, higher-quality bonds in their portfolios. This approach should provide a measure of safety amid more volatile markets.

The Ultra Series Conservative Allocation, Moderate Allocation and Aggressive Allocation Funds (the “Funds”) invest primarily in shares of registered investment companies (the “underlying funds”). The Funds will be diversified among a number of asset classes and their allocation among underlying funds will be based on an asset allocation model developed by Madison Asset Management, LLC (“Madison”), the Funds’ investment adviser.

The team may use multiple analytical approaches to determine the appropriate asset allocation, including:

• Asset allocation optimization analysis – considers the degree to which returns in different asset classes do or do not move together, and the Funds’ aim to achieve a favorable overall risk profile for any targeted portfolio return.

• Scenario analysis – historical and expected return data is analyzed to model how individual asset classes and combinations of asset classes would affect the Funds under different economic and market conditions.

• Fundamental analysis – draws upon Madison’s investment teams to judge each asset class against current and forecasted market conditions. Economic, industry and security analysis is used to develop return and risk expectations that may influence asset class selection.

In addition, Madison has a flexible mandate which permits the Funds, at the sole discretion of Madison, to materially reduce equity risk exposures when and if conditions are deemed to warrant such an action.

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Ultra Series Conservative Allocation Fund’s total net assets will be allocated among various asset classes and underlying funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 35% equity investments and 65% fixed income investments. Underlying funds in which the Fund invests may include funds advised by Madison and/or its affiliates, including the Madison Funds (the “affiliated underlying funds”). Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in affiliated underlying funds. Although actual allocations may vary, the Fund’s asset allocation among asset classes and underlying funds is expected to be approximately:

• 0-20% money market funds;

• 20-80% debt securities (e.g., bond funds and convertible bond funds);

• 0-20% below-investment grade (“junk”) debt securities (e.g., high income funds);

• 10-50% equity securities (e.g., U.S. stock funds);

• 0-40% foreign securities (e.g., international stock and bond funds, including emerging market securities); and

• 0-20% alternative asset classes (e.g., real estate investment trust funds, natural resources funds, precious metal funds and long/short funds).

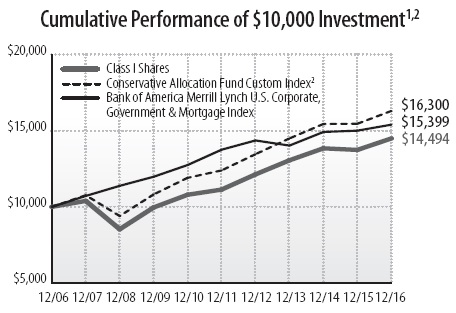

PERFORMANCE

The Ultra Series Conservative Allocation Fund (Class I) returned 5.48% over the 12-month period, slightly outperforming the Conservative Allocation Fund Custom Index return of 5.43%. The Fund modestly lagged the

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

Morningstar Conservative Allocation Category peer group, which returned 5.57%.

Factors contributing positively to performance within the Fund’s fixed income allocation included overweight allocations to TIPS and corporate bonds, specifically below investment grade bonds and bank loans, as well as an underweight duration stance as interest rates rose over the back half of the year. After contributing positively for the first half of 2016, the Fund’s dedicated U.S. Treasury holdings provided a net drag on performance. Within the equity allocation, our preference for U.S. over foreign stocks was the largest positive contributor to performance, followed by an overweight to U.S. mid cap and technology stocks. Timely additions to energy equities in February and financial stocks in the fall provided a boost to performance. On the negative side, the Fund was held back by its elevated cash position and more defensive posturing (equity underweight) during the strong market advance from the February market low. Also detracting from performance was our preference for developed markets over emerging markets within the international equity allocation.

We continue to maintain a rather cautious stance. The divergence between generally elevated equity valuations and the preponderance of fragile, highly indebted global economies is both concerning and confounding. We believe investor expectations are quite extended. We’d prefer to make fuller commitments to higher risk asset classes when valuations are more closely aligned with the overall risk/ reward profile of global economies. In short, we believe investors are generally not receiving adequate compensation for investing in higher risk asset classes.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series Conservative Allocation, Class I | 5.48 | 3.54 | 5.41 | 3.78 | – | ||

| Ultra Series Conservative Allocation, Class II | 5.21 | 3.28 | 5.15 | – | 6.69 | ||

| Conservative Allocation Fund Custom Index | 5.43 | 3.99 | 5.63 | 5.01 | 7.36 | ||

| Bank of America Merrill Lynch US Corp, Govt & Mortgage Index | 2.61 | 3.16 | 2.28 | 4.41 | 3.99 |

See accompanying Notes to Management’s Discussion of Fund Performance.

|

PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

|||||

| Alternative Funds | 2.0 | % | Money Market Funds | 1.9 | % |

| Bond Funds | 61.3 | % | Stock Funds | 26.4 | % |

| Foreign Stock Funds | 9.1 | % | Other Net Assets and Liabilities | (0.7 | )% |

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Ultra Series Moderate Allocation Fund’s total net assets will be allocated among various asset classes and underlying funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 60% equity investments and 40% fixed income investments. Underlying funds in which the Fund invests may include funds advised by Madison and/or its affiliates, including the Madison Funds (the “affiliated underlying funds”). Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in affiliated underlying funds. Although actual allocations may vary, the Fund’s asset allocation among asset classes and underlying funds is expected to be approximately:

• 0-15% money market funds;

• 10-60% debt securities (e.g., bond funds and convertible bond funds);

• 0-20% below-investment grade (“junk”) debt securities (e.g., high income funds);

• 20-80% equity securities (e.g., U.S. stock funds);

• 0-50% foreign securities (e.g., international stock and bond funds, including emerging market securities); and

• 0-20% alternative asset classes (e.g., real estate investment trust funds, natural resources funds, precious metal funds and long/short funds).

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

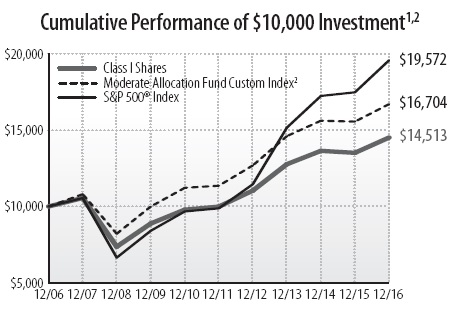

The Ultra Series Moderate Allocation Fund (Class I) returned 7.39% over the 12-month period, modestly outperforming the Moderate Allocation Fund Custom Index return of 7.35%. The Fund also outperformed the Morningstar Moderate Allocation Category peer group, which returned 6.86%.

Factors contributing positively to performance within the Fund’s fixed income allocation included overweight allocations to TIPS and corporate bonds, specifically below investment grade bonds and bank loans, as well as an underweight duration stance as interest rates rose over the back half of the year. After contributing positively for the first half of 2016, the Fund’s dedicated U.S. Treasury holdings provided a net drag on performance. Within the equity allocation, our preference for U.S. over foreign stocks was the largest positive contributor to performance, followed by an overweight to U.S. mid cap and technology stocks. Timely additions to energy equities in February and financial stocks in the fall provided a boost to performance. On the negative side, the Fund was held back by its elevated cash position and more defensive posturing (equity underweight) during the strong market advance from the February market low. Also detracting from performance was our preference for developed markets over emerging markets within the international equity allocation.

We continue to maintain a rather cautious stance. The divergence between generally elevated equity valuations and the preponderance of fragile, highly indebted global economies is both concerning and confounding. We believe investor expectations are quite extended. We’d prefer to make fuller commitments to higher risk asset classes when valuations are more closely aligned with the overall risk/reward profile of global economies. In short, we believe investors are generally not receiving adequate compensation for investing in higher risk asset classes.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series Moderate Allocation, Class I | 7.39 | 4.36 | 7.76 | 3.79 | – | ||

| Ultra Series Moderate Allocation, Class II | 7.12 | 4.10 | 7.49 | – | 8.79 | ||

| Moderate Allocation Fund Custom Index | 7.35 | 4.57 | 8.02 | 5.26 | 9.64 | ||

| S&P 500® Index | 11.96 | 8.87 | 14.66 | 6.95 | 15.42 |

See accompanying Notes to Management’s Discussion of Fund Performance.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

|||||

| Alternative Funds | 2.0 | % | Money Market Funds | 2.8 | % |

| Bond Funds | 35.0 | % | Stock Funds | 45.0 | % |

| Foreign Stock Funds | 16.1 | % | Other Net Assets and Liabilities | (0.9) | % |

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Ultra Series Aggressive Allocation Fund’s total net assets will be allocated among various asset classes and underlying funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 80% equity investments and 20% fixed income investments. Underlying funds in which the Fund invests may include funds advised by Madison and/or its affiliates, including the Madison Funds (the “affiliated underlying funds”). Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in affiliated underlying funds. Although actual allocations may vary, the Fund’s asset allocation among asset classes and underlying funds is expected to be approximately:

• 0-10% money market funds;

• 0-40% debt securities, all of which could be in below investment grade (“junk”) debt securities (e.g., bond funds, convertible bond funds and high income funds);

• 30-90% equity securities (e.g., U.S. stock funds);

• 0-60% foreign securities (e.g., international stock and bond funds, including emerging market securities); and

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

• 0-20% alternative asset classes (e.g., real estate investment trust funds, natural resources funds, precious metal funds and long/short funds).

PERFORMANCE

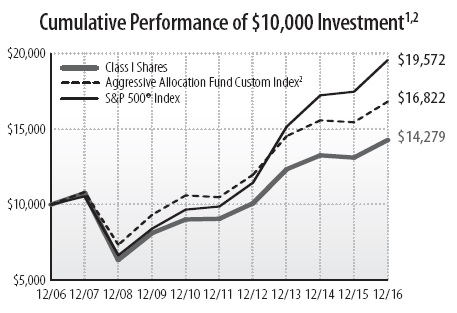

The Ultra Series Aggressive Allocation Fund (Class I) returned 8.87% over the 12-month period, modestly outperforming the Aggressive Allocation Fund Custom Index return of 8.83%. The Fund also outperformed the Morningstar Aggressive Allocation Category peer group, which returned 7.57%.

Within the Fund’s equity allocation, our preference for U.S. over foreign stocks was the largest positive contributor to performance, followed by an overweight to U.S. mid cap and technology stocks. Timely additions to Energy equities in February and Financial stocks in the fall provided a boost to performance. On the negative side, the Fund was held back by its elevated cash position and more defensive posturing (equity underweight) during the strong market advance from the February market low. Also detracting from performance was our preference for developed markets over emerging markets within the international equity allocation. Contributing positively to performance within the Fund’s fixed income allocation was an overweight allocation to corporate bonds, as well as an underweight duration stance as interest rates rose over the back half of the year. After contributing positively for the first half of 2016, the Fund’s dedicated U.S. Treasury holdings provided a net drag on performance.

We continue to maintain a rather cautious stance. The divergence between generally elevated equity valuations and the preponderance of fragile, highly indebted global economies is both concerning and confounding. We believe investor expectations are quite extended. We’d prefer to make fuller commitments to higher risk asset classes when valuations are more closely aligned with the overall risk/ reward profile of global economies. In short, we believe investors are generally not receiving adequate compensation for investing in higher risk asset classes.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series Aggressive Allocation, Class I | 8.87 | 4.97 | 9.52 | 3.63 | – | ||

| Ultra Series Aggressive Allocation, Class II | 8.60 | 4.71 | 9.25 | – | 10.58 | ||

| Aggressive Allocation Fund Custom Index | 8.83 | 4.98 | 9.90 | 5.34 | 11.39 | ||

| S&P 500® Index | 11.96 | 8.87 | 14.66 | 6.95 | 15.42 |

See accompanying Notes to Management’s Discussion of Fund Performance.

|

PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

|||||

| Alternative Funds | 2.0 | % | Money Market Funds | 2.9 | % |

| Bond Funds | 14.5 | % | Stock Funds | 58.9 | % |

| Foreign Stock Funds | 21.6 | % | Other Net Assets and Liabilities | 0.1 | % |

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Ultra Series Core Bond Fund invests at least 80% of its net assets in bonds. To keep current income relatively stable and to limit share price volatility, the Fund emphasizes investment grade securities and maintains an intermediate (typically 3-7 year) average portfolio duration, with the goal of being between 85-115% of the market benchmark duration. The Fund also strives to add incremental return in the portfolio by making strategic decisions relating to credit risk, sector exposure and yield curve positioning. The Fund may invest in corporate debt securities, U.S. Government debt securities, foreign government debt securities, non-rated debt securities, and asset-backed, mortgage-backed and commercial mortgage-backed securities.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

PERFORMANCE

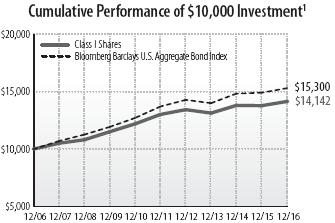

The Ultra Series Core Bond Fund (Class I) returned 2.67% over the 12-month period, slightly outperforming the Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, which returned 2.65%. The Fund underperformed the Morningstar Intermediate-Term Bond peer group, which returned 3.07% for the period.

The Fund’s slight outperformance versus its benchmark was mainly due to an overweight in corporate bonds and a lower duration versus the index. Credit spreads tightened significantly over the last twelve months as investors reached for yield in a low rate environment. The Fund was overweight BBB rated corporate bonds which was the best performing category within investment grade credit. The Fund also owned high yield bonds which outperformed investment grade credit given lower interest rate sensitivity. Finally, the Fund benefited by having a lower duration versus the index. The portfolio duration entering the fourth quarter was roughly 87% of the index. During the quarter, interest rates rose between 70-80 basis points.

The largest detractor from performance was a slight overweight to mortgage backed securities (MBS). Mortgages underperformed due to the large increase in rates and duration extension. The Fund is currently yielding 2.73% (before expenses) with an effective duration of 5.20 years as of December 31, 2016.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series Core Bond, Class I | 2.67 | 2.51 | 1.68 | 3.53 | – | ||

| Ultra Series Core Bond, Class II | 2.41 | 2.26 | 1.43 | – | 3.21 | ||

| Bloomberg Barclays U.S. Aggregate Bond Index | 2.65 | 3.03 | 2.23 | 4.34 | 4.02 |

See accompanying Notes to Management’s Discussion of Fund Performance.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

||

| Asset Backed Securities | 2.7 | % |

| Collateralized Mortgage Obligations | 2.3 | % |

| Commercial Mortgage-Backed Securities | 2.7 | % |

| Corporate Notes and Bonds | 28.8 | % |

| Long Term Municipal Bonds | 7.3 | % |

| Mortgage Backed Securities | 27.4 | % |

| U.S. Government and Agency Obligations | 24.7 | % |

| Short-Term Investments | 2.9 | % |

| Other Net Assets and Liabilities | 1.2 | % |

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series High Income Fund invests primarily in lower-rated, higher-yielding income bearing securities, such as “junk” bonds. Because the performance of these securities has historically been strongly influenced by economic conditions, the Fund may rotate securities selection by business sector according to the economic outlook. Under normal market conditions, the Fund invests at least 80% of its net assets in bonds rated lower than investment grade (BBB/Baa) and their unrated equivalents or other high-yielding securities.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

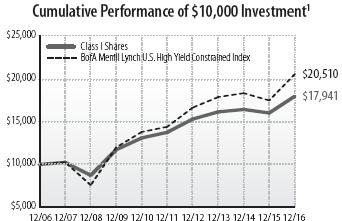

PERFORMANCE

The Ultra Series High Income Fund (Class I) returned 12.15% during the period, lagging the BofA Merrill Lynch U.S. High Yield Constrained Index’s 17.49% return. The Fund also trailed its Morningstar High Yield Bond Category peer group, which returned 16.57%.

The vast majority of the Fund’s underperformance can be attributed to an underweight of triple-C rated bonds. The triple-C ratings category reported a substantial total return of +36.46% during the trailing twelve months, more than twice the returns of less-risky B and BB rated bonds. On a sector level, the Fund had underexposure to Steel (+48.31%) and Metals & Mining (+43.83%), both of which significantly outpaced the overall market return. The Fund also had an overweight to Containers (+10.01%) and Healthcare (+4.08%), both of which lagged the overall market return. Positive contributors to performance included exposure to Technology (+16.85%), Chemicals (+23.19%) and outperformance within Leisure (+10.21%). As of December 31, 2016, the yield-to-worst of the Fund was 5.12% and the average rating within the Fund was Ba3.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series High Income, Class I | 12.15 | 3.63 | 5.48 | 6.02 | – | ||

| Ultra Series High Income, Class II | 11.87 | 3.37 | 5.22 | – | 7.72 | ||

| BofAmerica Merrill Lynch US High Yield Constrained Index | 17.49 | 4.73 | 7.35 | 7.45 | 11.45 |

See accompanying Notes to Management’s Discussion of Fund Performance.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

||

| Consumer Discretionary | 22.9 | % |

| Consumer Staples | 4.4 | % |

| Energy | 6.5 | % |

| Financials | 6.1 | % |

| Health Care | 8.7 | % |

| Industrials | 15.5 | % |

| Information Technology | 6.4 | % |

| Materials | 5.7 | % |

| Telecommunication Services | 6.1 | % |

| Utilities | 4.4 | % |

| Bond Funds | 1.4 | % |

| Short-Term Investments | 10.6 | % |

| Other Net Assets and Liabilities | 1.3 | % |

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Diversified Income Fund seeks income by investing in a broadly diversified array of securities including bonds, common stocks, real estate securities, foreign market bonds and stocks and money market instruments. Bonds, stock and cash components will vary, reflecting the portfolio managers’ judgments of the relative availability of attractively yielding and priced stocks and bonds. Generally, however, bonds will constitute up to 70% of the Fund’s assets, stocks will constitute up to 60% of the Fund’s assets, real estate securities will constitute up to 25% of the Fund’s assets, foreign stocks and bonds will constitute up to 25% of the Fund’s assets and money market instruments will constitute up to 25% of the Fund’s assets. Under normal market conditions, the Fund intends to limit the investment in lower credit quality bonds (rated BB+ or lower by Standard & Poor’s or Ba1 or lower by Moody’s) to less than 50% of the Fund’s assets. The balance between the two strategies of the Fund (fixed income and equity investing) is determined after reviewing the risks associated with each type of investment, with the goal of meaningful risk reduction as market conditions demand.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

PERFORMANCE

For the twelve month period, the Ultra Series Diversified Income Fund (Class I) returned 8.99% compared to its custom blended benchmark (50% S&P 500® Index and 50% Bank of America Merrill Lynch U.S. Corporate Government and Mortgage Index) return of 7.36%. The Fund’s Morningstar peer group, the Moderate Allocation Category, returned 6.86% over the same period.

The equity portion of the Fund gained + 15.3% during 2016, outperforming the S&P 500® Index return of + 11.9%. Sector allocation was neutral and strong stock selection accounted for all of the outperformance. There was positive stock picking in Technology, Health Care, and Consumer Discretionary partially offset by weaker results in Financials and Energy. Within Technology, analog semiconductor firm Linear Technology (LLTC) was the most additive stock in the portfolio as it reached a deal to be acquired by rival Analog Devices (ADI), while semiconductor peer Texas Instruments (TXN) also favorably impacted performance. Within Health Care, diversified medical products firm Johnson & Johnson (JNJ) and pharmaceutical company Merck (MRK) contributed nicely to results. We believe both companies have promising drug pipelines and strong balance sheets that are helping to drive earnings growth. Another notable outperforming stock was garbage disposal firm Waste Management (WM). It is benefitting from strong pricing and growing volumes as the U.S. economy continues to grow. On the negative side, within Financials, Travelers Companies (TRV) was the most detractive stock in the portfolio. Regional bank Wells Fargo (WFC) was another underperforming Financials stock. While its reputation was damaged by a cross-selling scandal where the firm opened accounts without notifying its clients, we believe in the long-term franchise and expect the stock and the company’s reputation to recover over time. Another notable underperforming stock was General Electric (GE) in Industrials. The Fund continues to hold all stocks mentioned except for WM and LLTC, which was sold after its acquisition deal was announced.

The fixed income portion of the Madison Diversified Income Fund continued to perform well during the fourth quarter of 2016. For the quarter, the fixed income allocation outperformed the Bank of America Merrill Lynch U.S. Corporate, Government, and Mortgage Index by 90 basis points (bps), adding to the 149 bps of outperformance year-to-date. The Fund’s conservative duration posture, relative credit overweight, and mortgage underweight all impacted performance positively. The Fund’s credit positioning was aided by an overweight to BBB rated credits, and further aided by a small exposure to BB issuers. Furthermore, the Fund’s relative underweight to financial issues was additive as financials underperformed late in the quarter as several European banks caused renewed sector concerns. The portfolio’s conservative duration positioning, mostly through underweighting Treasury issues, contributed to performance as rates across the curve moved significantly higher during the quarter.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series Diversified Income, Class I | 8.99 | 5.34 | 7.97 | 5.73 | – | ||

| Ultra Series Diversified Income, Class II | 8.72 | 5.07 | 7.70 | – | 9.41 | ||

| Custom Blended Index (50% Fixed, 50% Equity) | 7.36 | 6.15 | 8.47 | 6.01 | 9.82 | ||

| Bank of America Merrill Lynch US Corp, Govt & Mortgage Index | 2.61 | 3.16 | 2.28 | 4.41 | 3.99 | ||

| S&P 500® Index | 11.96 | 8.87 | 14.66 | 6.95 | 15.42 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

||

| Asset Backed Securities | 1.5 | % |

| Collateralized Mortgage Obligations | 1.4 | % |

| Commercial Mortgage-Backed Securities | 1.1 | % |

| Common Stocks | 55.8 | % |

| Corporate Notes and Bonds | 12.8 | % |

| Long Term Municipal Bonds | 3.4 | % |

| Mortgage Backed Securities | 10.3 | % |

| U.S. Government and Agency Obligations | 10.8 | % |

| Short-Term Investments | 2.6 | % |

| Other Net Assets and Liabilities | 0.3 | % |

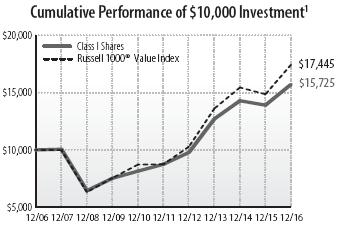

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Large Cap Value Fund will, under normal market conditions, maintain at least 80% of its net assets in large cap stocks. The Fund follows a “value” approach, meaning the portfolio managers seek to invest in stocks at prices below their perceived intrinsic value as estimated based on fundamental analysis of the issuing company and its prospects. By investing in value stocks, the Fund attempts to limit the downside risk over time but may also produce smaller gains than other stock funds if their intrinsic values are not realized by the market or if growth-oriented investments are favored by investors. The Fund will diversify its holdings among various industries and among companies within those industries.

PERFORMANCE

For the full year, the Ultra Series Large Cap Value Fund (Class I) returned 13.01%, which lagged the Russell 1000® Value Index return of 17.34%. The Fund underperformed its Morningstar peer group, the Morningstar Large Value Category, which returned 15.20% for the period.

Both sector allocation and stock selection detracted from performance. For sector allocation, underweight positions in the Energy, Utilities and Materials negatively impacted results. In terms of stock selection, there were positive results in Telecom, Consumer Staples, Energy and Real Estate, while there were negative results in Financials, Technology and Industrials. Within Telecom, mobile phone carrier T-Mobile US (TMUS) positively impacted results. It continues to take subscriber market share with innovative marketing programs and an improved cellular network. In Consumer Staples, global meat processor Tyson Foods (TSN) and cereal maker General Mills (GIS) performed well. Both TSN and GIS were sold after reaching what we believe were full valuations. Within Energy, oilfield service company Baker Hughes (BHI) was the most additive stock in the portfolio. It formed a joint venture with the oilfield services businesses of General Electric (GE), a deal we expect will create significant value for shareholders over time. Within the newly formed Real Estate sector (these stocks used to be classified within Financials) Digital Realty Trust (DLR) benefited from strong demand for its data centers. On the negative side, in Financials, stock and derivatives exchange operator Nasdaq (NDAQ) was the most detractive stock in the portfolio, while specialty insurer Markel (MKL), life insurance firm Aflac (AFL) and insurance conglomerate American International Group (AIG) were all notably weak. Within Technology, three names detracted from results including software firm Oracle (ORCL), switching and router manufacturer Cisco Systems (CSCO) and defense technology firm FLIR Systems (FLIR). ORCL and FLIR reported disappointing earnings reports that showed lack of margin expansion. In Industrials, engineering and construction firm Fluor (FLR) and conglomerate General Electric (GE) lagged the index. Over the course of the year, the Fund sold GIS, FLR, FLIR, ORCL and TSN and continues to hold the other stocks mentioned.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series Large Cap | |||||||

| Value, Class I | 13.01 | 7.33 | 12.45 | 4.63 | – | ||

| Ultra Series Large Cap | |||||||

| Value, Class II | 12.73 | 7.06 | 12.17 | – | 13.22 | ||

| Russell 1000® Value Index | 17.34 | 8.59 | 14.80 | 5.72 | 15.34 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

||

| Consumer Discretionary | 5.0 | % |

| Energy | 18.4 | % |

| Financials† | 27.7 | % |

| Health Care | 4.2 | % |

| Industrials | 15.6 | % |

| Information Technology | 7.6 | % |

| Materials | 8.0 | % |

| Real Estate | 4.4 | % |

| Telecommunication Services | 4.2 | % |

| Utilities | 2.5 | % |

| Short-Term Investments | 2.3 | % |

| Other Net Assets and Liabilities | 0.1 | % |

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Large Cap Growth Fund invests primarily in common stocks of larger companies and will, under normal market conditions, maintain at least 80% of its net assets in large cap stocks. Stocks selected for the Fund will represent primarily well-established companies that have a demonstrated pattern of consistent growth. To a lesser extent, the Fund may invest in less established companies that may offer more rapid growth potential. The Fund has an active trading strategy which will lead to more portfolio turnover than a more passively-managed fund.

PERFORMANCE

The Ultra Series Large Cap Growth Fund (Class I) returned 5.74% for the year ending 12/31/2016, lagging the Russell 1000® Growth Category return of 7.08%. The Fund outperformed its peer group, the Morningstar Large Growth Category, which returned 3.17% for the same period.

Stock selection attribution was positive for the year. In fact, every sector in which we invested resulted in better than market results except for the Consumer Staples and Energy sectors. Almost the entire shortfall in the Consumer Staples sector can be attributed to CVS Health Corporation, which was negatively impacted by weak results in the Health Care sector. The most additive sectors for the year were Technology, Industrials and Consumer Discretionary.

Despite strong stock picking overall, our exposure to certain Health Care industries was a drag on results. In particular, the debate surrounding prescription drug pricing negatively impacted our pharmaceutical, biotechnology, pharmacy-benefit management and drug wholesaling companies. We did cut back on our holdings in these areas in the second half of the year. However, given that many of these companies appear to be very inexpensive, we have maintained ample exposure to these industries. In addition, we did benefit from our significant Technology holdings, including Linear Technology, a semiconductor company that received a takeover offer mid-year.

During the year, sector allocation results were slightly negative primarily due to our overweighting of the poorly performing Health Care sector as well as holding a marginal amount of cash (approximately 3%) during a rising market. In addition, our underweighting of the strongly performing Industrial, Technology and Telecommunications sectors also hampered relative results. On the other hand, we benefited from our overweighting in the Financial and Energy sectors which produced better than benchmark results for the period.

Despite a less than desirable backdrop, the stock market posted a very strong year and reached record highs near year-end. To many, it came as a bit of a surprise that the market continued to advance despite the fact that earnings remain under pressure, valuations are above average and the economy is growing at a moderate rate. The vast majority of the market’s price appreciation over the past several quarters has come from valuation expansion rather than improving fundamentals. This is not a recipe for long-term success. In our opinion, the accommodative stance of global central banks has contributed significantly to supporting the stock market.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

Our view on the market remains optimistic but cautious. We believe that stocks will continue to be characterized by elevated volatility and more moderate returns. We think investors will be well served by focusing on lower-risk, higher quality companies for the foreseeable future. As such, we remain diligent and committed to investing in high quality growth companies that can deliver consistent results in a variety of economic environments and also offer a margin of safety from a valuation perspective.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series Large Cap | |||||||

| Growth, Class I | 5.74 | 6.98 | 12.18 | 6.72 | – | ||

| Ultra Series Large Cap | |||||||

| Growth, Class II | 5.47 | 6.71 | 11.90 | – | 12.35 | ||

| Russell 1000® Growth | |||||||

| Index | 7.08 | 8.55 | 14.50 | 8.33 | 15.71 |

See accompanying Notes to Management’s Discussion of Fund Performance.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

||

| Consumer Discretionary | 18.2 | % |

| Consumer Staples | 9.5 | % |

| Energy | 1.7 | % |

| Financials | 5.7 | % |

| Health Care | 21.6 | % |

| Industrials | 7.0 | % |

| Information Technology† | 30.2 | % |

| Real Estate | 1.9 | % |

| Short-Term Investments | 4.2 | % |

| Other Net Assets and Liabilities | – | |

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Mid Cap Fund generally invests in common stocks of midsize companies and will, under normal market conditions, maintain at least 80% of its net assets in mid cap securities. The Fund seeks attractive long-term returns through bottom-up security selection based on fundamental analysis in a diversified portfolio of high-quality growth companies with attractive valuations. These will typically be industry leading companies in niches with strong growth prospects. The Fund’s portfolio managers believe in selecting stocks for the Fund that show steady, sustainable growth and reasonable valuations. As a result, stocks of issuers that are believed to have a blend of both value and growth potential will be selected for investment.

PERFORMANCE

The Ultra Series Mid Cap Fund (Class I) returned 12.84% for the annual period, slightly trailing its benchmark Russell Midcap® Index’s 13.80% return. The Fund outperformed its peer group, the Morningstar Mid-Cap Growth category, which returned 5.72%.

Our sector allocation was unfavorable, offsetting strong individual stock-picking. The Fund was underweighted in the top performing sectors of the Index, Energy and Materials. These sectors generally offer fewer businesses with sustainable competitive advantages and solid long-term value compounding characteristics that we ideally look for in our investments, and, thus, we were underweight in these areas. Additionally, we were overweighted in one of the weakest performing sectors, Consumer Discretionary.

Strong stock-picking was driven by our holdings in Liberty Broadband, Copart and Brown & Brown. Liberty Broadband’s value is nearly entirely comprised of its 17% ownership stake in cable provider Charter Communications. We initiated a position in Liberty Broadband near the beginning of the year following an abrupt sell-off in the shares of Charter and a corresponding drop in Liberty Broadband shares. Since then the results at Charter have beaten expectations, and the opportunities foreseen from their acquisition of Time Warner Cable are now greater than anticipated which has resulted in nice gains in both the stocks of Charter and Liberty Broadband. Long-time holding Copart was also nicely additive to performance. Business performance this year has

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2016

been exceptionally strong given a robust salvage car market as well as recent market share wins by Copart. Profitability has also meaningfully expanded given tighter cost controls and increased pricing. Finally, our holding in Brown & Brown benefited the portfolio due to improving organic revenue growth, a metric that had proven disappointing to investors for some time. Additionally, as a purely domestic company, Brown & Brown’s shares have benefited from the prospects for lower corporate tax rates and an improving economy.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series Mid Cap, | |||||||

| Class I | 12.84 | 7.78 | 13.48 | 7.19 | – | ||

| Ultra Series Mid Cap, | |||||||

| Class II | 12.55 | 7.51 | 13.19 | – | 15.03 | ||

| Russell Midcap® Index | 13.80 | 7.92 | 14.72 | 7.86 | 16.74 |

See accompanying Notes to Management’s Discussion of Fund Performance.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

||

| Consumer Discretionary† | 28.7 | % |

| Consumer Staples | 0.8 | % |

| Energy | 3.8 | % |

| Financials | 19.4 | % |

| Health Care | 6.9 | % |

| Industrials | 12.7 | % |

| Information Technology | 6.1 | % |

| Materials | 6.3 | % |

| Real Estate | 7.8 | % |

| Short-Term Investments | 7.5 | % |

| Other Net Assets and Liabilities | – | |

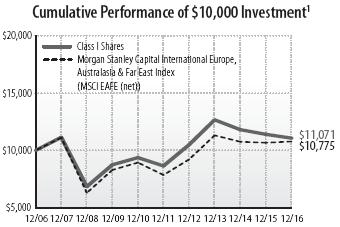

INTERNATIONAL STOCK FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series International Stock Fund will invest, under normal market conditions, at least 80% of its net assets in the stock of foreign companies. Typically, a majority of the Fund’s assets are invested in relatively large cap stocks of companies located or operating in developed countries. The Fund may also invest up to 30% of its assets in securities of companies whose principal business activities are located in emerging market countries. The portfolio managers typically maintain this segment of the Fund’s portfolio in such stocks which it believes have a low market price relative to their perceived value based on fundamental analysis of the issuing company and its prospects. The Fund may also invest in foreign debt and other income bearing securities at times when it believes that income bearing securities have greater capital appreciation potential than equity securities.

PERFORMANCE

The Ultra Series International Stock Fund (Class I) returned -2.91% for the year compared to the MSCI EAFE (net) Index return of 1.00%. The Fund underperformed its peer group, the Morningstar Foreign Large Blend Category, which returned 0.58%.

During the quarter, in an environment that extended the strong rotation into cyclicals and the low-quality rally that began in the third quarter, the Ultra Series International Equity portfolio lagged the MSCI EAFE benchmark. Much of the underperformance was due to the rally in stocks with negative to low financial productivity that occurred while stocks with higher financial productivity lagged. As we focus on companies with sustainably high, or improving, financial productivity, we were not exposed to some of the best performing stocks. Furthermore, some of our holdings, despite consistent fundamentals, were negatively impacted by the strong sector rotation.

The most significant source of underperformance was our positioning in the Financials sector. The portfolio was negatively impacted by the opportunity cost of not owning less financially productive financials, such as Société Générale. These stocks rallied on the anticipation of earnings improvement, the probability of which is less likely in Europe given the challenging regulatory, tax, and interest rate environment. We remain underweight given the numerous risks still pervasive in the market.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - concluded | December 31, 2016

Additionally, the portfolio was negatively impacted by its positioning in the Industrials sector, where we remain overweight. The sector was generally led higher by stocks with lower financial productivity, and additionally, some of our holdings in this sector underperformed due to the aforementioned rotation into less financially productive stocks, despite consistent fundamentals. One notable example is our holding in Dutch commercial and professional services provider Wolters Kluwer, whose consistent fundamentals and high financial productivity were not rewarded and the stock declined during the quarter. During the period, the company not only reported strong earnings but also reaffirmed their outlook. As such, we continue to maintain a position.

The portfolio was also negatively impacted by its holdings in Emerging Markets. This was partly due to the negative impact stemming from U.S. dollar strength following the results of the U.S. election.

In contrast, the portfolio benefitted from stock selection in the real estate sector, where our holding of Japanese real estate developer Daiwa House performed well following good results.

Tightening labor markets in the U.S., and commodity price increases, spurred in large part by China’s return to debt-fueled investment growth, has driven rising inflation. This pressures profit margins and interest rates, both negative for profits and valuations. However, the market is now assuming that inflation and fiscal loosening will lead to a generalized pick-up in growth – ‘good’ inflation – hence the rise in cyclical stocks. The major short-term risk to this scenario is that rising rates could quickly drag down economic activity, and the ability of governments to loosen fiscally, given the very high and still rising levels of debt around the world. In emerging markets, much of the debt is in U.S. dollars, exacerbating the risk. Over a longer period, rising inflation and rates tend to derate equities, while fiscal expansion may give only a temporary boost to activity, and China will have to rein back its debt growth again at some stage.

The response of the portfolio team to a period of weaker relative performance is always to focus on the key source of alpha over time, namely fundamental stock analysis. While risk control is important, rotations of the type just witnessed tend to wash out over time leaving stock selection as the key driver of returns. With the level of macroeconomic and political uncertainty very high, the team is working especially hard to identify investment ideas, which have a strong internal or structural dynamic not correlated to, or dependent upon, a certain external environment. At the same time, some of the higher-return companies the portfolio tends to favor have fallen sharply through the rotation period and are starting to offer interesting relative value again.

Overall, the portfolio team remains confident that, by continuing to focus on stock selection, and seeking to find stocks with sustainably high or improving returns trading at attractive valuations, the strong long-term track record of the portfolio will continue.

| 1 Year | 3 Years | 5 Years | 10 Years |

Since 5/1/09 Inception |

|||

| Ultra Series International | |||||||

| Stock, Class I | -2.91 | -4.39 | 5.07 | 1.02 | – | ||

| Ultra Series International | |||||||

| Stock, Class II | -3.16 | -4.63 | 4.80 | – | 6.71 | ||

| MSCI EAFE Index (net) | 1.00 | -1.60 | 6.53 | 0.75 | 7.67 |

See accompanying Notes to Management’s Discussion of Fund Performance.

|

GEOGRAPHICAL ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/16 |

||

| United Kingdom | 25.6 | % |

| Japan | 18.0 | % |

| France | 9.6 | % |

| Canada | 5.8 | % |

| United States | 4.3 | % |

| Switzerland | 3.8 | % |

| Sweden | 3.6 | % |

| Belgium | 3.4 | % |

| Netherlands | 3.3 | % |

| Norway | 2.6 | % |

| Germany | 2.4 | % |

| Finland | 2.4 | % |

| Taiwan | 2.3 | % |

| Ireland | 2.2 | % |

| Israel | 1.8 | % |

| Australia | 1.5 | % |

| Bermuda | 1.4 | % |

| Brazil | 1.1 | % |

| Denmark | 1.1 | % |

| Spain | 0.9 | % |

| Italy | 0.8 | % |

| Luxembourg | 0.7 | % |

| Turkey | 0.6 | % |

| Philippines | 0.3 | % |

| Other Net Assets and Liabilities | 0.5 | % |

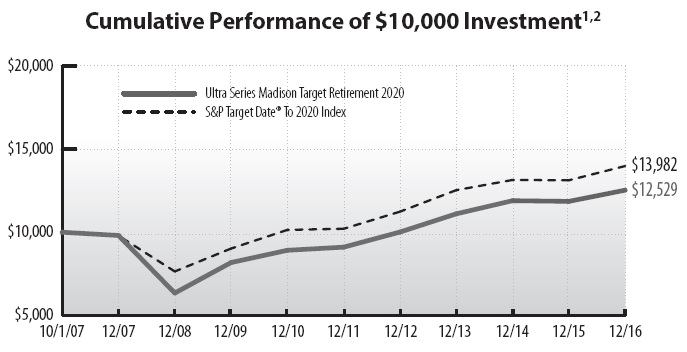

| Ultra Series Fund | December 31, 2016 | |

| Notes to Management’s Discussion of Fund Performance (unaudited) | |

| 1 | Fund returns are calculated after fund level expenses have been subtracted, but do not include any separate account fees, charges or expenses imposed by the variable annuity and variable life insurance contracts that invest in the fund, as described in the Prospectus. If these fees, charges, or expenses were included, fund returns would have been lower. Fund returns also assume that dividends and capital gains are reinvested in additional shares of the fund. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than when purchased. Further information relating to the fund’s performance is contained in the Prospectus and elsewhere in this report. The fund’s past performance is not indicative of future performance. Current performance may be lower or higher than the performance data cited. For Ultra Series Fund performance data current to the most recent month-end, please call 1-800-670-3600 or visit www.ultraseriesfund.com. Indices are unmanaged and investors cannot invest in them directly. Index returns do not reflect fees or expenses. |

| 2 | Effective July 1, 2014 the Investment Adviser contractually agreed to waive a portion of the management fee for the Conservative, Moderate and Aggressive Allocation Funds until at least June 30, 2015. This waiver was renewed through April 30, 2018. If these waivers were not in place, returns would have been lower. |

©Morningstar, Inc. All Rights Reserved. The Morningstar related information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Morningstar Percentile rankings note: 1st percentile is top, 99th percentile is bottom.

BENCHMARK DESCRIPTIONS

Allocation Fund Indexes*

The Conservative Allocation Fund Custom Index consists of 65% Bloomberg Barclays US Aggregate Bond Index, 24.5% Russell 3000® Index and 10.5% MSCI ACWI ex-USA Index (net). See market index descriptions below.

The Moderate Allocation Fund Custom Index consists of 40% Bloomberg Barclays US Aggregate Bond Index, 42% Russell 3000® Index and 18% MSCI ACWI ex-USA Index (net). See market index descriptions below.

The Aggressive Allocation Fund Custom Index consists of 20% Bloomberg Barclays US Aggregate Bond Index, 56% Russell 3000® Index and 24% MSCI ACWI ex-USA Index (net). See market index descriptions below.

Hybrid Fund Custom Indexes*

The Custom Blended Index consists of 50% S&P 500 Index and 50% Bank of America Merrill Lynch U.S. Corporate, Government & Mortgage Index. See market indexes descriptions below.

*The Custom Indexes are calculated using a monthly re-balancing frequency (i.e., rebalanced back to original constituent weight every calendar month-end).

Market Indexes

The Bank of America Merrill Lynch U.S. Corporate, Government & Mortgage Index is a broad-based measure of the total rate of return performance of the U.S. investment-grade bond markets. The index is a capitalization-weighted aggregation of outstanding U.S. treasury, agency and supranational mortgage pass-through, and investment-grade corporate bonds meeting specified selection criteria.

Ultra Series Fund | Notes to Management’s Discussion of Fund Performance (unaudited) - concluded | December 31, 2016

The Bank of America Merrill Lynch U.S. High Yield Constrained Index tracks the performance of below investment grade U.S. dollar denominated corporate bonds publicly issued in the U.S. domestic market, but limits any individual issuer to a maximum weighting of 2%.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage backed securities, asset backed securities and commercial mortgage-backed securities.

The MSCI EAFE (Europe, Australasia & Far East) Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI EAFE Index (net) is calculated on a total return basis with dividends reinvested after the deduction of withholding taxes.

The MSCI ACWI ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI ex USA (net) is calculated on a total return basis with dividends reinvested after the deduction of withholding taxes.

The Russell 1000® Index is a large-cap market index which measures the performance of the 1,000 largest companies in the Russell 3000® Index (see definition below).

The Russell 1000® Growth Index is a large-cap market index which measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000® Value Index is a large-cap market index which measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000® Index is a small-cap market index which measures the performance of the smallest 2,000 companies in the Russell 3000® Index (see definition below).

The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents 98% of the investable U.S. equity market.

The Russell Midcap® Index is a mid-cap market index which measures the performance of the mid-cap segment of the U.S. equity universe.

The S&P 500® Index is a large-cap market index which measures the performance of a representative sample of 500 leading companies in leading industries in the U.S.

Ultra Series Fund | December 31, 2016

| Conservative Allocation Fund Portfolio of Investments |

| Shares | Value (Note 2) | |||||

| INVESTMENT COMPANIES - 100.7% | ||||||

| Alternative Funds - 2.0% | ||||||

| SPDR Gold Shares * | 27,975 | $ | 3,066,339 | |||

| Bond Funds - 61.3% | ||||||

| Baird Aggregate Bond Fund Institutional Shares | 577,270 | 6,176,792 | ||||

| iShares 7-10 Year Treasury Bond ETF | 148,743 | 15,591,241 | ||||

| iShares TIPS Bond Fund ETF | 68,404 | 7,741,281 | ||||

| Madison Core Bond Fund Class Y (A) | 3,716,264 | 36,828,176 | ||||

| Madison Corporate Bond Fund Class Y (A) | 1,017,856 | 11,583,199 | ||||

| PowerShares Senior Loan Portfolio | 461,909 | 10,790,194 | ||||

| Vanguard Long-Term Corporate Bond ETF | 8,565 | 765,283 | ||||

| Vanguard Short-Term Corporate Bond ETF | 50,916 | 4,041,203 | ||||

| 93,517,369 | ||||||

| Foreign Stock Funds - 9.1% | ||||||

| iShares Core MSCI EAFE ETF | 64,572 | 3,462,996 | ||||

| iShares MSCI United Kingdom ETF | 30,202 | 926,900 | ||||

| Vanguard FTSE All-World ex-U.S. ETF | 129,646 | 5,727,760 | ||||

| WisdomTree Europe Hedged Equity Fund | 35,912 | 2,061,349 | ||||

| WisdomTree Japan Hedged Equity Fund | 33,835 | 1,676,186 | ||||

| 13,855,191 | ||||||

| Money Market Funds - 1.9% | ||||||

| State Street Institutional U.S. Government | ||||||

| Money Market Fund, 0.42%, Premier Class | 2,917,358 | 2,917,358 | ||||

| Stock Funds - 26.4% | |||||||

| Energy Select Sector SPDR Fund | 14,792 | 1,114,133 | |||||

| Industrial Select Sector SPDR Fund | 6,223 | 387,195 | |||||

| iShares Core S&P Mid-Cap ETF | 23,125 | 3,823,488 | |||||

| Madison Dividend Income Fund Class Y (A) | 532,539 | 12,333,613 | |||||

| Madison Investors Fund Class Y (A) | 512,889 | 10,129,559 | |||||

| Madison Large Cap Value Fund Class Y (A) | 47,728 | 671,060 | |||||

| Madison Mid Cap Fund Class Y (A) | 468,217 | 4,139,040 | |||||

| SPDR S&P Regional Banking ETF | 23,630 | 1,313,119 | |||||

| Vanguard Growth ETF | 12,020 | 1,339,990 | |||||

| Vanguard Health Care ETF | 9,056 | 1,148,029 | |||||

| Vanguard Information Technology ETF | 20,134 | 2,446,281 | |||||

| Vanguard Value ETF | 14,674 | 1,364,829 | |||||

| 40,210,336 | |||||||

| TOTAL INVESTMENTS - 100.7% (Cost $149,693,332**) | 153,566,593 | ||||||

| NET OTHER ASSETS AND LIABILITIES - (0.7%) | (1,100,140 | ) | |||||

| TOTAL NET ASSETS - 100.0% | $ | 152,466,453 | |||||

| * Non-income producing. | |||||||

| ** Aggregate cost for Federal tax purposes was $150,293,759. | |||||||

| (A) Affiliated Company (see Note 11). | |||||||

| ETF Exchange Traded Fund. | |||||||

| See accompanying Notes to Financial Statements. |

| 17 |

Ultra Series Fund | December 31, 2016

| Moderate Allocation Fund Portfolio of Investments |

| Shares | Value (Note 2) | |||||

| INVESTMENT COMPANIES - 100.9% | ||||||

| Alternative Funds - 2.0% | ||||||

| SPDR Gold Shares * | 48,869 | $ | 5,356,531 | |||

| Bond Funds - 35.0% | ||||||

| Baird Aggregate Bond Fund Institutional Shares | 252,273 | 2,699,321 | ||||

| iShares 7-10 Year Treasury Bond ETF | 170,318 | 17,852,733 | ||||

| iShares Intermediate Credit Bond ETF | 26,917 | 2,912,150 | ||||

| iSharesTIPS Bond Fund ETF | 59,014 | 6,678,614 | ||||

| Madison Core Bond Fund Class Y (A) | 4,549,746 | 45,087,981 | ||||

| Madison Corporate Bond Fund Class Y (A) | 481,207 | 5,476,135 | ||||

| PowerShares Senior Loan Portfolio | 425,062 | 9,929,448 | ||||

| Vanguard Long-Term Corporate Bond ETF | 14,810 | 1,323,274 | ||||

| 91,959,656 | ||||||

| Foreign Stock Funds - 16.1% | ||||||

| iShares Core MSCI EAFE ETF | 112,653 | 6,041,580 | ||||

| iShares MSCI United Kingdom ETF | 85,876 | 2,635,535 | ||||

| Vanguard FTSE All-World ex-U.S. ETF | 463,244 | 20,466,120 | ||||

| Vanguard FTSE Emerging Markets ETF | 18,454 | 660,284 | ||||

| Vanguard FTSE Europe ETF | 41,411 | 1,985,243 | ||||

| WisdomTree Europe Hedged Equity Fund | 94,619 | 5,431,131 | ||||

| WisdomTree Japan Hedged Equity Fund | 101,017 | 5,004,382 | ||||

| 42,224,275 | ||||||

| Money Market Funds - 2.8% | ||||||

| State Street Institutional U.S. Government | ||||||

| Money Market Fund, 0.42%, Premier Class | 7,494,423 | 7,494,423 | ||||

| Stock Funds - 45.0% | |||||||

| Energy Select Sector SPDR Fund | 34,609 | 2,606,750 | |||||

| Industrial Select Sector SPDR Fund | 16,023 | 996,951 | |||||

| iShares Core S&P Mid-Cap ETF | 76,533 | 12,653,966 | |||||

| Madison Dividend Income Fund Class Y (A) | 1,221,753 | 28,295,800 | |||||

| Madison Investors Fund Class Y (A) | 1,458,799 | 28,811,272 | |||||

| Madison Large Cap Value Fund Class Y (A) | 766,876 | 10,782,276 | |||||

| Madison Mid Cap Fund Class Y (A) | 1,206,267 | 10,663,405 | |||||

| SPDR S&P Regional Banking ETF | 47,976 | 2,666,026 | |||||

| Vanguard Growth ETF | 70,296 | 7,836,598 | |||||

| Vanguard Health Care ETF | 25,948 | 3,289,428 | |||||

| Vanguard Information Technology ETF | 53,778 | 6,534,027 | |||||

| Vanguard Value ETF | 35,180 | 3,272,092 | |||||

| 118,408,591 | |||||||

| TOTAL INVESTMENTS - 100.9% (Cost $249,663,039**) | 265,443,476 | ||||||

| NET OTHER ASSETS AND LIABILITIES - (0.9%) | (2,391,749 | ) | |||||

| TOTAL NET ASSETS - 100.0% | $ | 263,051,727 | |||||

| * Non-income producing. | |||||||

| ** Aggregate cost for Federal tax purposes was $251,152,012. | |||||||

| (A) Affiliated Company (see Note 11). | |||||||

| ETF Exchange Traded Fund. | |||||||

| See accompanying Notes to Financial Statements. |

| 18 |

Ultra Series Fund | December 31, 2016

| Aggressive Allocation Fund Portfolio of Investments |

| Shares | Value (Note 2) | ||||

| INVESTMENT COMPANIES - 99.9% | |||||

| Alternative Funds - 2.0% | |||||

| SPDR Gold Shares * | 16,883 | $ | 1,850,546 | ||

| Bond Funds - 14.5% | |||||

| iShares 7-10 Year Treasury Bond ETF | 32,179 | 3,373,003 | |||

| iShares Intermediate Credit Bond ETF | 9,904 | 1,071,514 | |||

| Madison Core Bond Fund Class Y (A) | 881,077 | 8,731,473 | |||

| 13,175,990 | |||||

| Foreign Stock Funds - 21.6% | |||||

| iShares Core MSCI EAFE ETF | 41,966 | 2,250,636 | |||

| iShares MSCI United Kingdom ETF | 44,169 | 1,355,547 | |||

| Vanguard FTSE All-World ex-U.S. ETF | 211,679 | 9,351,978 | |||

| Vanguard FTSE Emerging Markets ETF | 12,829 | 459,021 | |||

| Vanguard FTSE Europe ETF | 23,845 | 1,143,129 | |||

| WisdomTree Europe Hedged Equity Fund | 44,855 | 2,574,677 | |||

| WisdomTree Japan Hedged Equity Fund | 49,483 | 2,451,388 | |||

| 19,586,376 | |||||

| Money Market Funds - 2.9% | |||||

| State Street Institutional U.S. Government | |||||

| Money Market Fund, 0.42%, Premier Class | 2,674,682 | 2,674,682 | |||

| Stock Funds - 58.9% | ||||||

| Energy Select Sector SPDR Fund | 14,960 | 1,126,787 | ||||

| Industrial Select Sector SPDR Fund | 9,750 | 606,645 | ||||

| iShares Core S&P Mid-Cap ETF | 41,524 | 6,865,578 | ||||

| Madison Dividend Income Fund Class Y (A) | 503,222 | 11,654,618 | ||||

| Madison Investors Fund Class Y (A) | 583,972 | 11,533,445 | ||||

| Madison Large Cap Value Fund Class Y (A) | 332,277 | 4,671,810 | ||||

| Madison Mid Cap Fund Class Y (A) | 591,687 | 5,230,517 | ||||

| SPDR S&P Regional Banking ETF | 24,896 | 1,383,471 | ||||

| Vanguard Growth ETF | 34,333 | 3,827,443 | ||||

| Vanguard Health Care ETF | 12,567 | 1,593,118 | ||||

| Vanguard Information Technology ETF | 25,708 | 3,123,522 | ||||

| Vanguard Value ETF | 20,683 | 1,923,726 | ||||

| 53,540,680 | ||||||

| TOTAL INVESTMENTS - 99.9% (Cost $83,360,045**) | 90,828,274 | |||||

| NET OTHER ASSETS AND LIABILITIES - 0.1% | 121,554 | |||||

| TOTAL NET ASSETS - 100.0% | $ | 90,949,828 | ||||

| * Non-income producing. | ||||||

| ** Aggregate cost for Federal tax purposes was $83,932,448. | ||||||

| (A) Affiliated Company (see Note 11). | ||||||

| ETF Exchange Traded Fund. | ||||||

| See accompanying Notes to Financial Statements. |

| 19 |

Ultra Series Fund | December 31, 2016

| Core Bond Fund Portfolio of Investments |

| Par Value | Value (Note 2) | |||||

| ASSET BACKED SECURITIES - 2.7% | ||||||

| ABSC Long Beach Home Equity Loan Trust, | ||||||

| Series 2000-LB1, Class AF5 (A), 8.185%, | ||||||

| 9/21/30 | $ | 652,045 | $ | 662,315 | ||

| Chase Issuance Trust, Series 2007-A2, Class A2 | ||||||

| (A), 0.754%, 4/15/19 | 1,000,000 | 1,000,000 | ||||

| Chase Issuance Trust, Series 2007-C1, Class C1 | ||||||

| (A), 1.164%, 4/15/19 | 750,000 | 749,938 | ||||

| Ford Credit Auto Owner Trust, Series 2014-A, | ||||||

| Class A3, 0.79%, 5/15/18 | 59,600 | 59,586 | ||||

| Hyundai Auto Receivables Trust, Series 2014-A, | ||||||

| Class A3, 0.79%, 7/16/18 | 28,074 | 28,063 | ||||

| Santander Drive Auto Receivables Trust, Series | ||||||

| 2012-5, Class D, 3.3%, 9/17/18 | 749,560 | 753,194 | ||||

| Santander Drive Auto Receivables Trust, Series | ||||||

| 2013-5, Class D, 2.73%, 10/15/19 | 525,000 | 531,014 | ||||

| Santander Drive Auto Receivables Trust, Series | ||||||

| 2013-A, Class C (B), 3.12%, 10/15/19 | 480,836 | 483,993 | ||||

| Santander Drive Auto Receivables Trust, Series | ||||||

| 2013-4, Class C, 3.25%, 1/15/20 | 638,896 | 643,052 | ||||

| Total Asset Backed Securities | ||||||

| (Cost $4,926,093) | 4,911,155 | |||||

| COLLATERALIZED MORTGAGE | ||||||

| OBLIGATIONS - 2.3% | ||||||

| Fannie Mae REMICS, Series 2015-12, Class NI, | ||||||

| IO, 3.5%, 3/25/30 | 2,991,577 | 364,024 | ||||

| Fannie Mae REMICS, Series 2011-31, Class DB, | ||||||

| 3.5%, 4/25/31 | 375,000 | 393,961 | ||||

| Fannie Mae REMICS, Series 2011-36, Class QB, | ||||||

| 4%, 5/25/31 | 500,000 | 537,394 | ||||

| Fannie Mae REMICS, Series 2005-79, Class LT, | ||||||

| 5.5%, 9/25/35 | 646,706 | 721,271 | ||||

| Fannie Mae REMICS, Series 2011-101, Class | ||||||

| NC, 2.5%, 4/25/40 | 559,717 | 562,399 | ||||

| Fannie Mae REMICS, Series 2016-21, Class BA, | ||||||

| 3%, 3/25/42 | 882,649 | 897,529 | ||||

| Freddie Mac REMICS, Series 4066, Class DI, IO, | ||||||

| 3%, 6/15/27 | 3,783,080 | 351,036 | ||||

| Government National Mortgage Association, | ||||||

| Series 2015-53, Class IL, IO, 3%, 9/20/44 | 2,706,460 | 475,761 | ||||

| Total Collateralized Mortgage Obligations (Cost $4,296,803) | 4,303,375 | |||||

| COMMERCIAL MORTGAGE-BACKED | ||||||

| SECURITIES - 2.7% | ||||||

| Bear Stearns Commercial Mortgage Securities | ||||||

| Trust, Series 2007-PW17, Class A1A (A), | ||||||

| 5.65%, 6/11/50 | 790,448 | 804,967 | ||||

| Fannie Mae-Aces, Series 2016-M2, Class X2, IO | ||||||

| (A), 1.113%, 1/25/23 | 10,837,561 | 567,080 | ||||

| FHLMC Multifamily Structured Pass Through | ||||||

| Certificates, Series K718, Class X1, IO (A), | ||||||

| 0.647%, 1/25/22 | 24,235,083 | 662,454 | ||||

| FREMF Mortgage Trust, Series 2011-K702, | ||||||

| Class B (A) (B), 4.765%, 4/25/44 | 500,000 | 514,767 | ||||

| FREMF Mortgage Trust, Series 2012-K708, | ||||||

| Class B (A) (B), 3.751%, 2/25/45 | 1,000,000 | 1,025,644 | ||||

| FREMF Mortgage Trust, Series 2013-K502, | ||||||

| Class B (A) (B), 2.609%, 3/25/45 | 400,000 | 400,720 | ||||

| FREMF Mortgage Trust, Series 2011-K701, | ||||||

| Class C (A) (B), 4.286%, 7/25/48 | 1,000,000 | 1,004,367 | ||||

| Total Commercial Mortgage-Backed | ||||||

| Securities (Cost $5,117,486) | 4,979,999 | |||||

| CORPORATE NOTES AND BONDS - 28.8% | ||||||

| Consumer Discretionary - 6.1% | ||||||

| Advance Auto Parts Inc., 4.5%, 12/1/23 | 1,000,000 | 1,034,044 | ||||

| Charter Communications Operating LLC / | ||||||

| Charter Communications Operating Capital | ||||||

| Corp., 4.464%, 7/23/22 | 800,000 | 836,025 | ||||

| ERAC USA Finance LLC (B), 6.7%, 6/1/34 | 500,000 | 606,383 | ||||

| Expedia Inc., 5%, 2/15/26 | 300,000 | 309,272 | ||||

| Ford Motor Credit Co. LLC, MTN, 2.943%, | ||||||

| 1/8/19 | 1,000,000 | 1,011,412 | ||||

| GameStop Corp. (B), 6.75%, 3/15/21 | 200,000 | 201,500 | ||||

| General Motors Financial Co. Inc., 3.2%, 7/6/21 | 750,000 | 743,743 | ||||

| GLP Capital L.P. / GLP Financing II Inc., 4.875%, | ||||||

| 11/1/20 | 253,000 | 265,650 | ||||

| Harman International Industries Inc., 4.15%, | ||||||

| 5/15/25 | 400,000 | 412,972 | ||||

| Lennar Corp., 4.75%, 4/1/21 | 500,000 | 516,250 | ||||

| Lowe’s Cos. Inc., 2.5%, 4/15/26 | 500,000 | 474,832 | ||||

| Marriott International Inc., 3.125%, 6/15/26 | 400,000 | 378,613 | ||||

| McDonald’s Corp., MTN, 4.875%, 12/9/45 | 400,000 | 428,430 | ||||

| Newell Brands Inc., 4.2%, 4/1/26 | 800,000 | 835,024 | ||||

| Omnicom Group Inc., 3.6%, 4/15/26 | 750,000 | 742,253 | ||||

| Priceline Group Inc./The, 3.65%, 3/15/25 | 300,000 | 299,166 | ||||

| Priceline Group Inc./The, 3.6%, 6/1/26 | 500,000 | 494,502 | ||||

| Sirius XM Radio Inc. (B), 6%, 7/15/24 | 350,000 | 365,750 | ||||

| Toll Brothers Finance Corp., 4%, 12/31/18 | 500,000 | 513,125 | ||||

| Under Armour Inc., 3.25%, 6/15/26 | 225,000 | 212,496 | ||||

| Walgreens Boots Alliance Inc., 3.45%, 6/1/26 | 600,000 | 588,960 | ||||

| 11,270,402 |

| See accompanying Notes to Financial Statements. |

| 20 |

Ultra Series Fund | December 31, 2016

| Core Bond Fund Portfolio of Investments - continued |

| Par Value | Value (Note 2) | |||||

| CORPORATE NOTES AND BONDS - continued | ||||||

| Consumer Staples - 3.0% | ||||||

| Anheuser-Busch InBev Finance Inc., 4.9%, 2/1/46 | $ | 1,000,000 | $ | 1,080,870 | ||

| Bunge Ltd. Finance Corp., 3.25%, 8/15/26 | 850,000 | 816,234 | ||||

| CVS Health Corp., 4.75%, 12/1/22 | 1,060,000 | 1,151,084 | ||||

| CVS Health Corp., 5.125%, 7/20/45 | 1,000,000 | 1,114,447 | ||||

| Kraft Heinz Foods Co., 4.375%, 6/1/46 | 1,000,000 | 940,979 | ||||

| Molson Coors Brewing Co., 2.1%, 7/15/21 | 400,000 | 389,565 | ||||

| 5,493,179 | ||||||

| Energy - 2.3% | ||||||

| Antero Resources Corp., 5.625%, 6/1/23 | 300,000 | 307,125 | ||||

| Energy Transfer Partners L.P., 5.2%, 2/1/22 | 1,000,000 | 1,070,735 | ||||

| Enterprise Products Operating LLC, 3.75%, | ||||||

| 2/15/25 | 750,000 | 762,046 | ||||

| Helmerich & Payne International Drilling Co., | ||||||

| 4.65%, 3/15/25 | 400,000 | 413,309 | ||||

| Marathon Oil Corp., 2.7%, 6/1/20 | 750,000 | 750,998 | ||||

| Marathon Petroleum Corp., 2.7%, 12/14/18 | 400,000 | 405,325 | ||||

| Williams Partners L.P. / ACMP Finance Corp., | ||||||

| 4.875%, 5/15/23 | 450,000 | 458,401 | ||||

| 4,167,939 | ||||||

| Financials - 8.2% | ||||||

| AerCap Ireland Capital Ltd. / AerCap Global | ||||||

| AviationTrust (C), 3.75%, 5/15/19 | 400,000 | 407,500 | ||||

| Affiliated Managers Group Inc., 4.25%, | ||||||

| 2/15/24 | 1,500,000 | 1,507,831 | ||||

| Air Lease Corp., 3.875%, 4/1/21 | 500,000 | 513,705 | ||||

| Air Lease Corp., 3.75%, 2/1/22 | 700,000 | 721,033 | ||||

| Bank of America Corp., MTN, 2.503%, | ||||||

| 10/21/22 | 400,000 | 386,851 | ||||

| Bank of Montreal, MTN (C), 1.9%, 8/27/21 | 1,000,000 | 969,024 | ||||

| Berkshire Hathaway Inc., 3.125%, 3/15/26 | 250,000 | 248,376 | ||||

| Boston Properties L.P., 2.75%, 10/1/26 | 1,000,000 | 914,327 | ||||

| Brookfield Finance Inc. (C), 4.25%, 6/2/26 | 500,000 | 495,251 | ||||

| Discover Bank, 3.45%, 7/27/26 | 400,000 | 386,244 | ||||

| Goldman Sachs Group Inc./The, 5.75%, | ||||||

| 1/24/22 | 750,000 | 843,161 | ||||

| Goldman Sachs Group Inc./The, 3.5%, | ||||||

| 11/16/26 | 500,000 | 488,493 | ||||

| Huntington National Bank/The, 2.4%, 4/1/20 | 1,000,000 | 995,042 | ||||

| JPMorgan Chase & Co., 3.125%, 1/23/25 | 900,000 | 879,799 | ||||

| Liberty Mutual Group Inc. (B), 4.25%, 6/15/23 | 1,000,000 | 1,046,975 | ||||

| Morgan Stanley, 4.3%, 1/27/45 | 1,000,000 | 996,569 | ||||

| Nasdaq Inc., 3.85%, 6/30/26 | 100,000 | 99,340 | ||||

| Old Republic International Corp., 3.875%, | ||||||

| 8/26/26 | 500,000 | 475,608 |

| Raymond James Financial Inc., 3.625%, | ||||||

| 9/15/26 | 300,000 | 292,567 | ||||

| Regions Bank, 2.25%, 9/14/18 | 250,000 | 250,821 | ||||

| Regions Financial Corp., 3.2%, 2/8/21 | 750,000 | 760,613 | ||||

| Synchrony Financial, 3.75%, 8/15/21 | 1,100,000 | 1,130,599 | ||||

| Synchrony Financial, 3.7%, 8/4/26 | 400,000 | 384,508 | ||||

| 15,194,237 | ||||||

| Health Care - 1.2% | ||||||

| AbbVie Inc., 4.45%, 5/14/46 | 300,000 | 287,258 | ||||

| Actavis Funding SCS (C), 4.55%, 3/15/35 | 435,000 | 430,560 | ||||

| Forest Laboratories LLC (B), 5%, 12/15/21 | 250,000 | 270,296 | ||||

| HCA Inc., 3.75%, 3/15/19 | 500,000 | 513,750 | ||||

| Shire Acquisitions Investments Ireland DAC (C), | ||||||