UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

☒ Filed by the Registrant

☐ Filed by a Party other than the Registrant

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Rule 240.14a-12

TRIO-TECH INTERNATIONAL

(Name of Registrant as Specified In Its Charter)

_____________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On December 7, 2022

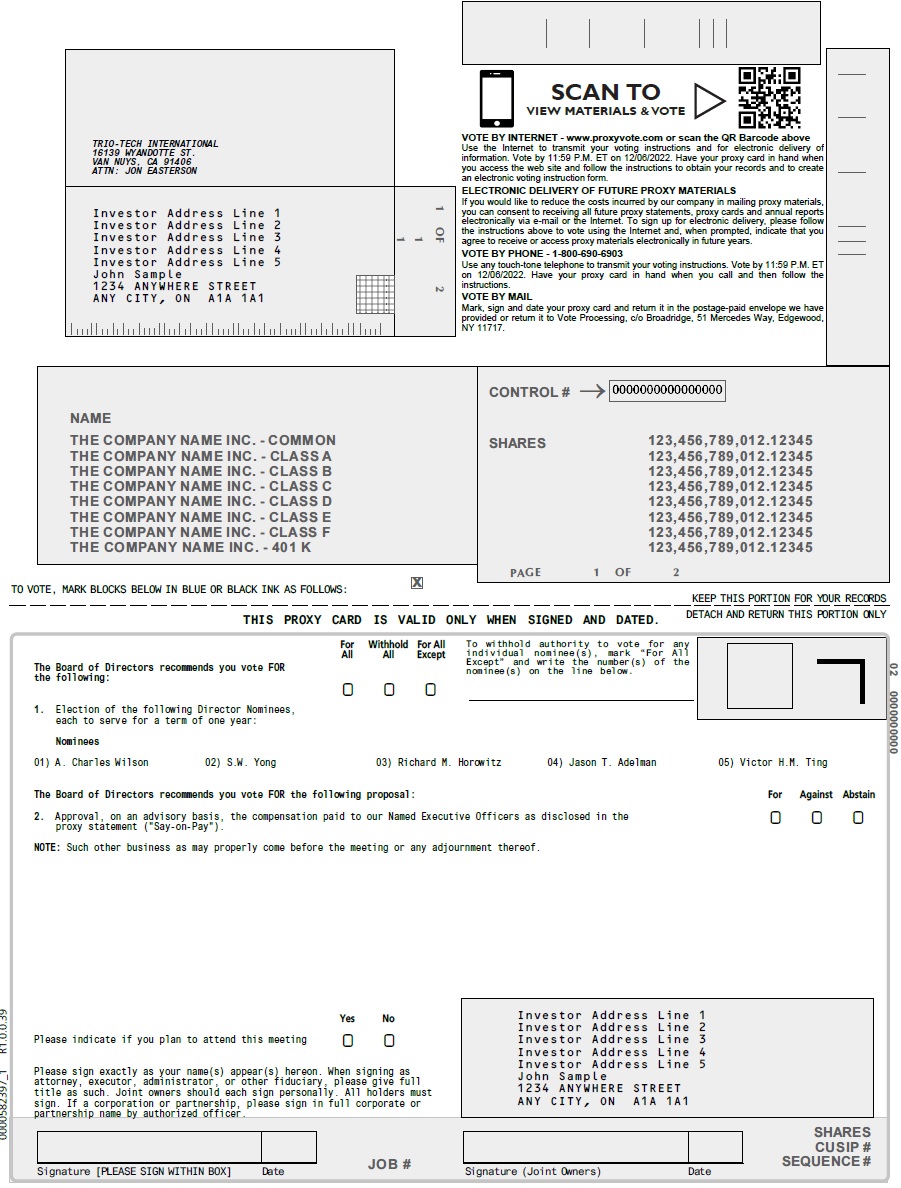

NOTICE IS HEREBY GIVEN that the 2022 Annual Meeting of Shareholders (the “Annual Meeting”) of Trio‑Tech International, a California corporation (the “Company”), will be held at our U.S. corporate office, located at 16139 Wyandotte Street, Van Nuys, California 91406, on, December 7, 2022 at 10:00 A.M. Pacific Standard Time, for the following purposes, as set forth in the attached proxy statement (the “Proxy Statement”):

|

1. |

to elect five directors to our Board of Directors, each to serve until our next annual meeting of shareholders, or until their respective successor is duly elected and qualified; |

|

2. |

to hold a non-binding, advisory vote on the compensation of our Named Executive Officers (as defined in the Proxy Statement); and |

|

3. |

transaction of such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors of the Company (the “Board of Directors” or the “Board”) has fixed the close of business on October 12, 2022 (the “Record Date”) as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment and postponements thereof.

The Securities and Exchange Commission permits proxy materials to be furnished over the Internet rather than in paper form. Accordingly, most shareholders will receive a notice in the mail regarding the availability of the Proxy Statement, Annual Report on Form 10-K for the fiscal year ended June 30, 2022 (the “Annual Report”), and other proxy materials (the "Notice") via Internet. This electronic process provides fast, convenient access to the materials, reduces the impact on the environment and reduces our printing and mailing costs. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. The Notice instructs you on how to access and review all of the important information contained in the Proxy Statement and Annual Report. The Notice also instructs you on how you may submit your vote over the Internet. If you would like to receive a printed copy of the proxy materials, please follow the instructions for requesting such materials included in the Notice.

Whether you plan to attend the Annual Meeting or not, please vote by telephone or electronically via the Internet. Alternatively, if you received a paper copy, you may sign, and date the enclosed proxy card and return it without delay in the enclosed postage-prepaid envelope. If you do attend the Annual Meeting, you may withdraw your proxy and vote personally on each matter brought before the Annual Meeting.

|

October 20, 2022 |

By Order of the Board of Directors

A. CHARLES WILSON |

IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO VOTE PROMPTLY OVER THE INTERNET, BY TELEPHONE, OR IF YOU REQUESTED TO RECEIVE PRINTED PROXY MATERIALS, BY MAILING A PROXY OR VOTING INSTRUCTION CARD IN THE ENCLOSED POSTAGE-PREPAID RETURN ENVELOPE TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING.

THANK YOU FOR ACTING PROMPTLY

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on December 7, 2022: The Proxy Statement and our 2022 Annual Report to Shareholders are available at http://www.triotech.com/investors/, which does not have “cookies” that identify visitors to the site.

| 1 | |

| 2 | |

|

PROPOSAL 2: APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

4 |

| 5 | |

| 6 | |

| 7 | |

| 7 | |

| 8 | |

| 9 | |

| 9 | |

| 12 | |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND MANAGEMENT |

17 |

| 18 | |

| 19 | |

| 19 |

FOR THE ANNUAL MEETING OF SHAREHOLDERS

OF

TRIO-TECH INTERNATIONAL

To Be Held on December 7, 2022

This proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of the enclosed proxy (the “Proxy”) on behalf of the Board of Directors (the “Board”) of Trio‑Tech International, a California corporation (“Trio‑Tech”, or, the “Company”), for use at the 2022 Annual meeting of shareholders of the Company (the “Annual Meeting”) to be held at our U.S. Corporate office, located at 16139 Wyandotte Street, Van Nuys, California 91406, on December 7, 2022 at 10:00 A.M. Pacific Standard Time.

For directions to our U.S. Corporate office, please email us at CRT.Reports@triotech.com.sg. This Proxy Statement and the enclosed proxy card (the “Proxy Card”) are intended to be electronically available to shareholders on or about October 24, 2022.

Voting

The Board fixed the close of business on October 12, 2022 as the record date (“Record Date”) for shareholders entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 4,076,680 shares of the Company’s common stock, no par value (the “Common Stock”), outstanding and entitled to vote, the holders of which are entitled to one vote per share.

The presence in person or by proxy of holders of a majority of the shares entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining the presence of a quorum. Broker non-votes occur when a shareholder who beneficially owns shares that are held in street name, that is through a broker, does not provide the broker with instructions on how to vote those shares on matters that are considered non-routine. Brokers can vote without instruction from the beneficial owners only on routine matters, such as the ratification of the appointment of our independent auditors. The election of directors and the Say-on-Pay proposal (as defined in Proposal No. 2, below) are non-routine matters and brokers are not authorized to vote on these matters without instruction.

Because a shareholder’s broker may not vote on behalf of the shareholder on the election of directors or the Say on Pay proposal unless the shareholder provides specific instructions by completing and returning the voting instruction form, for a shareholder’s vote to be counted, we ask that our shareholders communicate their voting decisions to the broker or other nominee before the date of the Annual Meeting or give a proxy to vote their shares at the Annual Meeting.

Required Vote for Approval

Proposal No. 1: Election of Directors. Directors are elected by a plurality vote. This means that the five director nominees who receive the greatest number of affirmative votes cast at the Annual Meeting by the shares present, either in attendance or represented by proxy, and entitled to vote will be elected. Abstentions and broker non-votes will have no effect on the outcome of the election of the directors. Pursuant to California law, cumulative voting is available for the election of directors. Under cumulative voting, you would have five votes for each share of Common Stock you own. You may cast all of your votes for one candidate, or you may distribute your votes among different candidates as you choose. However, you may cumulate votes (cast more than one vote per share) for a candidate only if the candidate is nominated before the voting and at least one shareholder gives notice at the Annual Meeting, before the voting, that he or she intends to cumulate votes. If you do not specify how to distribute your votes, by giving your Proxy you are authorizing the proxyholders (the individuals named on your Proxy Card) to cumulate votes in their discretion. The five persons properly placed in nomination at the Annual Meeting and receiving the most affirmative votes will be elected as directors.

Proposal No. 2: Approval of the Compensation of our Named Executive Officers. The approval, on an advisory, non-binding basis, of the compensation of our Named Executive Officers (as defined under the heading “EXECUTIVE COMPENSATION” below) (“Say on Pay”) as described under Proposal No. 2 of this Proxy Statement requires the affirmative vote of a majority of the shares present, either in attendance or represented by proxy, at the Annual Meeting and entitled to vote on the matter. A properly executed Proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of the Say on Pay proposal. Accordingly, an abstention will have the effect of a vote against Proposal No. 2. Broker non-votes are not considered present and entitled to vote on the Say on Pay proposal and thus will have the effect of reducing the number of affirmative votes required to achieve a majority for such matter by reducing the total number of shares from which the majority is calculated.

Deadline for Voting by Proxy

In order to be counted, votes cast by proxy must be received prior to the Annual Meeting.

Revocation of Proxies

Any Proxy given may be revoked by the shareholder at any time before it is voted by delivering written notice of revocation to the Secretary of the Company, by filing with the Secretary of the Company a Proxy bearing a later date, or by attending the Annual Meeting and voting in person. All Proxies properly executed and returned will be voted in accordance with the instructions specified thereon. If no instructions are specified, Proxies will be voted FOR the election of the five nominees for directors named under “Election of Directors” (Proposal No. 1), and FOR the approval, on a non-binding, advisory basis, of the compensation of our Named Executive Officers (Proposal No. 2) and (iii) at the discretion of the proxy holders on any other matter that may properly come before the Annual Meeting or any adjournment or postponement thereof.

ELECTION OF DIRECTORS

A majority of the independent directors of our Board have nominated the persons listed below for election to the Board at the Annual Meeting, to hold office until the next annual meeting of shareholders, or until their respective successors are elected and qualified. There is one vacancy on the Board. The Board does not intend to fill the vacancy at this time due to the costs associated therewith. It is intended that the Proxies received, unless otherwise specified, will be voted “FOR” the five nominees named below, all of whom are incumbent directors of the Company and, with the exception of Messrs. Yong and Ting, are “independent” as specified in Section 803 of the NYSE American (formerly The NYSE MKT) rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). It is not contemplated that any of the nominees will be unable or unwilling to serve as a director but, should that occur, the persons designated as proxies will vote in accordance with their best judgment. In no event will Proxies be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

The following section sets forth certain information regarding the nominees for election as directors of the Company.

|

NAME |

AGE |

POSITIONS |

||

|

A. Charles Wilson |

98 |

Chairman of the Board |

||

|

S. W. Yong |

69 |

Chief Executive Officer, President and Director |

||

|

Richard M. Horowitz |

81 |

Director |

||

|

Jason T. Adelman |

53 |

Director |

||

|

Victor H. M. Ting |

68 |

Director |

A. Charles Wilson

Mr. Wilson has served as a director of the Company since 1966, and was President and Chief Executive Officer of the Company from 1981 to 1989. In 1989, he was elected to serve as Chairman of the Board. Mr. Wilson is also Chairman of the Board of Ernest Packaging Solutions and is Chairman of the Board of Daico Industries, as well as an attorney admitted to practice law in California and a business consultant until December 2021.

In determining that Mr. Wilson should serve on the Company’s Board, the Board has considered, among other qualifications, his professional background and experience, his leadership skills as a result of his nine years serving as President and Chief Executive Officer of the Company, his service as a chairman on other corporate boards and his broad range of knowledge of the Company’s history and business through his 56 years of service as a director of the Company.

S. W. Yong

Mr. Yong has served as a director, Chief Executive Officer and President of the Company since 1990. He joined Trio‑Tech International Pte. Ltd. in Singapore in 1976 and was appointed as its Managing Director in August 1980. Mr. Yong holds a Master’s Degree in Business Administration, a Graduate Diploma in Marketing Management and a Diploma in Industrial Management.

In determining that Mr. Yong should serve on the Company’s Board, the Board has considered, among other qualifications, his 46 years of history with the Company, his intimate knowledge of the Company’s business and operations and the markets in which the Company operates, as well as the Company’s customers and suppliers, and his detailed in-depth knowledge of the issues, opportunities, and challenges facing the Company and its principal industries.

Richard M. Horowitz

Mr. Horowitz has served as a director of the Company since 1990. He has been the President of Management Brokers Insurance, Inc. since 1974. Mr. Horowitz holds a Master’s Degree in Business Administration from Pepperdine University. Mr. Horowitz was the subject of a Securities and Exchange Commission (“SEC”) administrative proceeding arising out of the sale of certain annuity products in 2007 by Management Brokers Insurance, Inc. The proceeding was wholly unrelated to the Company’s business and was settled in March 2014 without requiring Mr. Horowitz to admit to any of the allegations. The Board believes that the proceeding and the actions alleged thereunder do not impinge upon Mr. Horowitz’s ability or integrity as a director of the Company.

In determining that Mr. Horowitz should serve on the Company’s Board, the Board has considered, among other qualifications, his extensive experience and expertise in administration and management based on his position as President of Management Brokers, Inc. for more than 48 years and his broad range of knowledge of the Company’s history and business through his 32 years of service as a director of the Company.

Jason T. Adelman

Mr. Adelman was elected to the Board of the Company in April 1997. Mr. Adelman is the Founder and Chief Executive Officer of Burnham Hill Capital Group, LLC, a privately held financial services holding company headquartered in New York. Mr. Adelman also serves as the Managing Member of Cipher Capital Partners LLC, a private investment fund. Prior to founding Burnham Hill Capital Group, LLC in 2003, Mr. Adelman served as the Managing Director of Investment Banking at H.C. Wainwright and Co., Inc. Mr. Adelman currently serves on the Board of Oblong, Inc. Mr. Adelman graduated Cum Laude with a B.A. in Economics from the University of Pennsylvania and earned a JD from Cornell Law School where he served as Editor of the Cornell International Law Journal.

In determining that Mr. Adelman should serve on the Company’s Board, the Board has considered, among other qualifications, his experience and expertise in finance, accounting, banking and management based on his positions as Chief Executive Officer of Burnham Hill Capital Group LLC for 19 years, as the Managing Member of Cipher Capital Partners LLC as well as his position as Managing Director of Investment Banking in the New York offices of H. C. Wainwright & Co.

Victor H. M. Ting

Mr. Ting was appointed as a director of the Company on September 16, 2010, and served as Corporate Vice‑President and Chief Financial Officer of the Company from November 1992 until his retirement in June 2022. Mr. Ting joined the Company as the Financial Controller for the Company’s Singapore subsidiary in 1980. He was promoted to the level of Business Manager in 1985, in December 1989 he was promoted to the level of Director of Finance and Sales & Marketing, and later he was promoted to the level of General Manager of the Singapore subsidiary. Mr. Ting holds a Bachelor of Accountancy Degree and Master’s Degree in Business Administration.

In determining that Mr. Ting should serve on the Company’s Board, the Board has considered, among other qualifications, his expertise in finance, accounting and management based on his 30 years of history as Vice‑President and Chief Financial Officer of the Company and his intimate knowledge of the Company’s operations.

Required Vote and Recommendation

The five persons receiving the highest number of affirmative votes will be elected as directors of the Company. Votes withheld (whether by broker non-votes or otherwise) will have no legal effect on the vote.

The Board recommends that shareholders vote “FOR” the election of Messrs. A. Charles Wilson, S. W. Yong, Richard M. Horowitz, Jason T. Adelman and Victor H. M. Ting

ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION

Pursuant to Section 14A of the Exchange Act, we are required to provide shareholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our Chief Executive Officer and our two most highly compensated executive officers (other than our Chief Executive Officer) who were serving as executive officers at the end of the fiscal year ended June 30, 2022 (“Fiscal 2022”) (the “Named Executive Officers”), as disclosed in this Proxy Statement. This advisory vote, commonly known as a “Say-on-Pay” vote, gives our shareholders the opportunity to express their views on the Company’s executive compensation policies and programs and the compensation paid to our Named Executive Officers for Fiscal 2022.

We are asking our shareholders to indicate their support for the compensation of our Named Executive Officers as described in this Proxy Statement by approving the following resolution at the Annual Meeting:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in the Company’s Proxy Statement for the 2022 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and accompanying narrative disclosure, is hereby APPROVED.”

The Board believes that the Company’s executive compensation program effectively reflects the goals and objectives described in the Compensation Discussion and Analysis and the Executive Compensation sections of this Proxy Statement and the overall compensation philosophy of the Company.

Required Vote and Recommendation

The approval, on an advisory, non-binding basis, of the compensation of our Named Executive Officers requires the affirmative vote of a majority of the shares present, either in attendance or represented by proxy, at the Annual Meeting and entitled to vote on the matter. The vote on this Proposal 2 is advisory only and therefore is not binding on the Company, the Board or the Compensation Committee. However, the Board and the Compensation Committee will review and consider the voting results in crafting their approach to future executive compensation matters. Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the advisory resolution above, approving of the compensation paid to the Company’s Named Executive Officers.

The Board recommends that shareholders vote “FOR” the advisory resolution above, approving of the compensation paid to the Company’s Named Executive Officers.

Corporate Governance Program

Our Board has established a written Corporate Governance Program to address significant corporate governance issues that may arise. It sets forth the responsibilities and qualification standards of the members of the Board and is intended as a governance framework within which the Board, assisted by its committees, directs our affairs.

Policy Against Hedging Stock

Our policy prohibits our directors, officers, and other employees, and their designees, from engaging in short sales or from hedging transactions of any nature that are designed to hedge or offset a decrease in market value of such person’s ownership of the Company’s equity securities.

Code of Ethics

The Company has adopted a written code of business conduct and ethics applicable to all directors, officers, management and employees and a separate code of ethics applicable to its principal executive officer, principal financial officer and principal accounting officer or controller or persons performing similar functions. A copy of the Company's code of business conduct and ethics may be obtained, without charge, upon written request to the Secretary of the Company at Block 1008 Toa Payoh North #03-09 Singapore 318996.

Board Leadership Structure

The Board believes it is important to select its Chairman and the Company’s Chief Executive Officer in the manner it considers in the best interests of the Company at any given point in time. The Chairman of the Board and Chief Executive Officer of the Company are held by separate persons as an aid in the Board's oversight of management. The duties of the non-executive Chairman of the Board include:

|

● |

presiding over all meetings of the Board; |

|

● |

preparing the agenda for Board meetings in consultation with the Chief Executive Officer and other members of the Board; |

|

● |

calling and presiding over meetings of the independent directors; |

|

● |

managing the Board's process for annual director self-assessment and evaluation of the Board and of the Chief Executive Officer; and |

|

● |

presiding over all meetings of shareholders. |

The Board believes that there may be advantages to having an independent chairman for matters such as communications and relations between the Board, the Chief Executive Officer, and other senior management; assisting the Board in reaching consensus on particular strategies and policies; and facilitating robust director, Board, and Chief Executive Officer evaluation processes.

Risk Management

The Chief Executive Officer, Chief Financial Officer, and senior management are primarily responsible for identifying and managing the risks facing the Company, and the Board oversees these efforts. The Chief Executive Officer and Chief Financial Officer report to the Board regarding any risks identified and steps the Company is taking to manage those risks. In addition, the Audit Committee identifies, monitors and analyzes the priority of financial risks, and reports to the Board regarding its financial risk assessments.

Certain Relationships and Related Transactions

The Board’s Audit Committee is responsible for review, approval, or ratification of “related-person transactions” between the Company or its subsidiaries and related persons. Under SEC rules, a related person is a director, officer, nominee for director, or 5% shareholder of the Company and their immediate family members. The Company's code of business conduct and ethics provides guidance to the Audit Committee for addressing actual or potential conflicts of interests that may arise from transactions and relationships between the Company and its executive officers or directors. Potential conflicts relating to other personnel must be addressed by the Chief Executive Officer or the Chief Financial Officer. There were no related party transactions during Fiscal 2022 for which disclosure would be required under SEC rules.

The Board held seven regularly scheduled and special meetings during Fiscal 2022. All of the directors attended (in person or by telephone) at least 75% of the meetings of the Board and any committees of the Board on which they served during the last full fiscal year. Directors are expected to use their best efforts to be present at the Annual Meeting of Shareholders. All of our directors attended the Annual Meeting of Shareholders held on December 8, 2021.

The Company does not have a standing nominating committee. The Board consists of five directors, three of whom are “independent” (as defined under the rules of the NYSE American upon which the Company’s securities are listed), including Jason T. Adelman, Richard M. Horowitz and A. Charles Wilson. Pursuant to a resolution adopted by the Board, a majority of the independent directors, following a discussion with the entire Board, has the sole and ultimate responsibility to determine and nominate Board candidates for election at the Annual Meeting. Although nominations are made by a majority of the independent directors, the three current independent directors value the input of the entire Board and thus discuss proposed nominees at the Board level before the ultimate nomination determinations are made by the independent directors. The Board does not believe that it is necessary, at this time, given the Board composition and such Board resolution, to have a separately constituted nominating committee. At such time as the Board composition changes, the Board may elect to establish a separate nominating committee.

The Board has also adopted a resolution addressing the nomination process and related matters and it states, among other things, that the Board believes that the continuing service of qualified incumbents promotes stability and continuity in the boardroom, contributing to the Board's ability to work as a collective body, while giving the Company the benefit of the familiarity and insight into the Company's affairs that its directors have accumulated during their tenure. The resolution further states that the Board will evaluate the performance of its Board members on an annual basis in connection with the nomination process. The Board may solicit recommendations for nominees from persons that the Board believes are likely to be familiar with qualified candidates, including without limitation members of the Board and management of the Company. The Board may also determine to engage a professional search firm to assist in identifying qualified candidates if the need arises. In addition, the Board has the authority to retain third-party consultants to provide advice regarding compensation issues. The Board has not adopted specific minimum qualifications for a position on the Company’s Board or any specific skills or qualities that the Board believes are necessary for one or more of its members to possess. However, the Board will consider various factors including without limitation the candidate’s qualifications, the extent to which the membership of the candidate on the Board will promote diversity among the directors, and such other factors as the Board may deem to be relevant at the time and under the then existing facts and circumstances. The Company does not have a formal policy with regard to the consideration of diversity in identifying nominees for director. The Board seeks to nominate directors with a variety of skills and experience so that the Board will have the necessary expertise to oversee the Company’s business. The Company did not receive any recommendations as to nominees for election of directors for the Annual Meeting of Shareholders to be held on December 7, 2022.

The Board will consider candidates proposed by shareholders of the Company and will evaluate all such candidates upon criteria similar to the criteria used by the Board to evaluate other candidates. Shareholders desiring to propose a nominee for election to the Board must do so in writing sufficiently in advance of an annual meeting so that the Board has the opportunity to make an appropriate evaluation of such candidate and his or her qualifications and skills and to obtain information necessary for preparing all of the disclosures required to be included in the Company’s proxy statement for the related meeting should such proposed candidate be nominated for election by shareholders. Shareholder candidate proposals should be sent to the attention of the Secretary of the Company at Block 1008 Toa Payoh North #03-09 Singapore 318996.

The Board has a standing Compensation Committee, which currently consists of the three independent directors; Jason T. Adelman, Richard M. Horowitz and A. Charles Wilson, Chairman of the Compensation Committee. The Compensation Committee determines salary and bonus arrangements. The Compensation Committee met four times during Fiscal 2022. The Compensation Committee has a written charter. For Fiscal 2022, the Compensation Committee did not retain a third-party consultant to review the Company’s current policies and procedures with respect to executive compensation.

The Board has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members thereof consist of Jason T. Adelman, Richard M. Horowitz and A. Charles Wilson, Chairman of the Audit. Committee. The Board has determined that the Audit Committee has at least one financial expert, A. Charles Wilson. The Board has affirmatively determined that Mr. Wilson does not have a material relationship with the Company that would interfere with the exercise of independent judgment and is “independent” as independence is defined in Section 803 of the rules of the NYSE American. Pursuant to its written charter, which charter was adopted by the Board, the Audit Committee is charged with, among other responsibilities, selecting our independent public accountants, reviewing our annual audit and meeting with our independent public accountants to review planned audit procedures. The Audit Committee also reviews with the independent public accountants and management the results of the audit, including any recommendations of the independent public accountants for improvements in accounting procedures and internal controls. The Audit Committee held seven meetings during Fiscal 2022. Each of the members of the Audit Committee satisfies the independence standards specified in Section 803 of the rules of the NYSE American and Rule 10A-3 under the Exchange Act.

During the fiscal year ended June 30, 2022, the Audit Committee fulfilled its duties and responsibilities as outlined in its charter. The Audit Committee reviewed and discussed the Company’s audited consolidated financial statements and related footnotes for the fiscal year ended June 30, 2022, and the independent auditor’s report on those financial statements, with the Company’s management and Mazars LLP, the Company’s independent auditor. Management presented to the Audit Committee that the Company’s financial statements were prepared in accordance with accounting principles generally accepted in the United States of America. The Audit Committee has discussed with Mazars LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission. The Audit Committee’s review included a discussion with management and the independent auditor of the quality (not merely the acceptability) of the Company’s accounting principles, the reasonableness of significant estimates and judgments, and the disclosures in the Company’s financial statements, including the disclosures relating to critical accounting policies.

The Audit Committee recognizes the importance of maintaining the independence of the Company’s independent auditor, both in fact and appearance. The Audit Committee has evaluated Mazars LLP’s qualifications, performance, and independence, including that of the lead audit partner. As part of its auditor engagement process, the Audit Committee considers whether to rotate the independent audit firm. The Audit Committee has established a policy pursuant to which all services, audit and non-audit, provided by the independent auditor must be pre-approved by the Audit Committee or its delegate. The Company’s pre-approval policy is more fully described in this Proxy Statement under the heading “Independent Registered Public Accounting Firm.” The Audit Committee has concluded that provision of the non-audit services described in that section is compatible with maintaining the independence of Mazars LLP. In addition, the Audit Committee has received the written disclosure and the letter from Mazars LLP required by the applicable requirements of the Public Company Accounting Oversight Board regarding Mazars LLP’s communications with the Audit Committee concerning independence and has discussed with Mazars LLP its independence.

Based on the above-described review, written disclosures, letter and discussions, the Audit Committee recommended to the Board of the Company that the audited financial statements for the fiscal year ended June 30, 2022 be included in the Company’s Annual Report on Form 10-K.

Dated October 20, 2022

THE AUDIT COMMITTEE

A. Charles Wilson, Chairman

Jason T. Adelman

Richard M. Horowitz

Our directors play a critical role in guiding our strategic direction and overseeing our management. In order to compensate them for their substantial time commitment, we provide a mix of cash and equity-based compensation. We do not provide pension or retirement plans for non-employee directors. S.W. Yong does not receive separate cash compensation for Board service as he is an employee director.

During Fiscal 2022, Richard M. Horowitz and Jason T. Adelman, as non‑employee directors, received quarterly fees in an amount equal to $9,000 for each quarter and for service on the various committees of which they are a member. A. Charles Wilson, as a non-employee director, Chairman of the Board, Chairman of the Audit Committee and Chairman of the Compensation Committee, received $18,000 in quarterly fees for each quarter and for service on the various committees of which he is a member. The directors were also reimbursed for out-of-pocket expenses incurred in attending meetings.

Each of our directors is entitled to participate in our 2017 Directors Equity Incentive Plan (the “2017 Directors Plan”). Mr. Yong, as an employee of the Company, is also entitled to participate in our 2017 Employee Stock Option Plan (the “2017 Employee Plan”). On March 24, 2022, pursuant to the 2017 Directors Plan, Mr. Wilson was granted an option to purchase 40,000 shares, and Messrs. Horowitz and Adelman each were granted an option to purchase 20,000 shares of Common Stock at an exercise price of $7.76 per share. Each such option vested immediately upon grant and will terminate five years from the date of grant unless terminated sooner upon termination of the optionee’s status as a director or otherwise pursuant to the 2017 Directors Plan. The exercise price under the options was set at 100% of fair market value (as defined in the 2017 Directors Plan) of the Company’s Common Stock on the date of grant of each such option. Information regarding option grants to Messrs. Yong and Ting are described under EXECUTIVE COMPENSATION below.

As of June 30, 2022, there were 180,000 shares available for grant under the 2017 Directors Plan and 292,500 shares under the 2017 Employee Plan.

The Compensation Committee reviewed the average directors’ fees for comparable public companies. The Compensation Committee believes that the director fees paid to its directors were and are substantially less than the fees paid to directors of comparable public companies. Directors’ compensation may be increased based on the profitability of the Company.

The following table contains information on compensation for our non-employee members of our Board for Fiscal 2022.

DIRECTOR COMPENSATION

|

Name |

Fees Earned or Paid in Cash ($) |

Option Awards ($)(1) |

Total ($) |

|||||||||

|

A. Charles Wilson (2) |

72,000 | 141,200 | 213,200 | |||||||||

|

Richard M. Horowitz (3) |

36,000 | 70,600 | 106,600 | |||||||||

|

Jason T. Adelman (4) |

36,000 | 70,600 | 106,600 | |||||||||

|

Victor H.M. Ting (5) |

- | - | - | |||||||||

|

(1) |

The option awards are based on the fair value of stock options on the grant date computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation – Stock Compensation (“ASC Topic 718”). |

|

(2) |

The total number of shares underlying option awards held by Mr. Wilson outstanding as of June 30, 2022 were 200,000. |

|

(3) |

The total number of shares underlying option awards outstanding held by Mr. Horowitz as of June 30, 2022 were 100,000. |

|

(4) |

The total number of shares underlying option awards outstanding held by Mr. Adelman as of June 30, 2022 were 100,000. |

|

|

(5) |

Mr. Ting served as the Company's Chief Financial Officer and Corporate Vice President until his retirement in June 2022. See the "Summary Compensation Table" on page 13 of this proxy statement for Mr. Ting's compensation. |

The following persons were our only executive officers as of October 12, 2022:

S. W. Yong - Mr. Yong, age 69, is the Company’s President and Chief Executive Officer and a member of the Company’s Board. Biographical information regarding Mr. Yong is set forth under the section entitled “Election of Directors.”

Srinivasan Anitha - Ms. Srinivasan, age 43, was appointed as the Company’s Chief Financial Officer effective July 1, 2022. Ms. Srinivasan, a Chartered Accountant and a Certified Internal Auditor, has over twenty years of diversified experience in areas of audit, finance and corporate consulting. Ms. Srinivasan has been a consultant to the Company for more than the past 5 years and served as the Internal Audit Team Leader of the Company. She had been employed by the Company from 2006 to 2012. She holds a Bachelor’s Degree in Commerce from the University of Madras, India. She is a member of The Institute of Singapore Chartered Accountants, The Institute of Chartered Accountants of India and The Institute of Internal Auditors.

Hwee Poh Lim - Mr. Lim, age 63, is the Company’s Corporate Vice‑President -Testing. Mr. Lim joined the Company in 1982 and became the Quality Assurance Manager in 1985. He was promoted to the position of Operations Manager in 1988. In 1990 he was promoted to Business Manager and was responsible for the Malaysian operations in Penang and Kuala Lumpur. Mr. Lim became the General Manager of the Company’s Malaysia subsidiary in 1991. In February 1993, all test facilities in Southeast Asia came under Mr. Lim’s responsibility. He holds diplomas in Electronics & Communications and Industrial Management and a Master’s Degree in Business Administration. He was elected Corporate Vice‑President‑Testing in July 1998.

S. K. Soon – Ms. Soon, age 64, joined Trio-Tech Singapore in 1981 and became the Personnel and Administration Manager in 1985. In 1991, she was promoted to Group Logistics Manager and was responsible for the overall logistics and human resources functions for our operations in Asia. Effective July 1, 2015, she was appointed as Corporate Vice-President and currently oversees the Company's Logistics and Human Resources functions in Asia.

EQUITY COMPENSATION PLAN INFORMATION

The Company previously had two equity plans, the 2007 Employee Stock Option Plan (the “2007 Employee Plan”) the 2007 Directors Equity Incentive Plan (the “2007 Directors Plan”), each of which were previously approved by shareholders. The purpose of these two plans was to enable the Company to attract and retain top-quality employees, officers, directors and consultants and to provide them with an incentive to enhance shareholder return. On September 24, 2017, each of the 2007 Employee Plan and 2007 Director Plan terminated in accordance with its terms. No further options may be granted pursuant to the 2007 Employee Plan or the 2007 Directors Plan. However, outstanding options to purchase shares remain that were granted pursuant to those plans.

The Company’s 2017 Employee Plan and 2017 Directors Plan were approved by the Board on September 14, 2017, and approved by shareholders on December 4, 2017. An amendment to the 2017 Employee Plan was approved by the Board on October 20, 2021 and by shareholders on December 8, 2021. An amendment to the 2017 Directors Plan was approved by the Board on October 27, 2020 and by shareholders on December 8, 2020. The purpose of these two plans is also to enable the Company to attract and retain top-quality employees, officers, directors and consultants and to provide them with an incentive to enhance shareholder return as well as contributing to the Company’s long-term growth and profitability objectives.

The following table provides information as of June 30, 2022 with respect to the following compensation plans of the Company under which equity securities of the Company are authorized for issuance:

EQUITY COMPENSATION PLAN INFORMATION

|

Plan Category |

Number of securities to be issued upon exercise of outstanding options |

Weighted average exercise price of outstanding options |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in |

|||||||||

|

(a) |

(b) |

column (a)) |

||||||||||

|

Equity compensation plans approved by shareholders: |

||||||||||||

|

2007 Employee Plan |

- | $ | - | - | ||||||||

|

2017 Employee Plan |

307,500 | $ | 5.21 | 292,500 | ||||||||

|

2007 Directors Plan |

- | $ | - | - | ||||||||

|

2017 Directors Plan |

420,000 | $ | 5.10 | 180,000 | ||||||||

|

Total |

656,375 | $ | 5.14 | |||||||||

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Committee

The Compensation Committee reviews and approves corporate goals and objectives relating to the compensation of the Chief Executive Officer; reviews goals and objectives of other executive officers; establishes the performance criteria (including both long-term and short-term goals) to be considered in light of those goals and objectives; evaluates the performance of the executives; determines and approves the compensation level for the Chief Executive Officer; and reviews and approves compensation levels of other key executive officers.

Compensation Objectives

The Company operates in a highly competitive and rapidly changing industry. The key objectives of the Company’s executive compensation programs are to:

|

● |

attract, motivate and retain executives who drive the Company’s success and industry leadership; |

|

● |

provide each executive, from Vice-President to Chief Executive Officer, with a base salary based on the market value of that role, and the individual’s demonstrated ability to perform that role; |

|

● |

motivate executives to create sustained shareholder value by ensuring all executives have an “at risk” component of total compensation that reflects their ability to influence business outcomes and financial performance. |

What Our Compensation Program is Designed to Reward

Our compensation program is designed to reward each individual executive officer’s contribution to the advancement of the Company’s overall performance and execution of our goals, ideas and objectives. It is designed to reward and encourage exceptional performance at the individual level in the areas of organization, creativity and responsibility while supporting the Company’s core values and ambitions. This in turn aligns the interest of our executive officers with the interests of our shareholders, and thus with the interests of the Company.

Determining Executive Compensation

The Compensation Committee reviews and approves the compensation program for executive officers annually after the closing of each fiscal year. Reviewing the compensation program at such time allows the Compensation Committee to consider the overall performance of the past fiscal year and the financial and operating plans for the upcoming fiscal year in determining the compensation program for the upcoming fiscal year.

The Compensation Committee also annually reviews market compensation levels with comparable jobs in the industry to determine whether the total compensation for our officers remains in the targeted median pay range. This assessment includes evaluation of base salary, annual incentive opportunities, and long-term incentives for the key executive officers of the Company. The Company did not hire any compensation consultants in connection with setting executive compensation for Fiscal 2022.

The Compensation Committee’s compensation decisions are based on the Company’s operation performance, the performance and contribution of each individual officer, and the compensation budget and objectives of the Company. The Compensation Committee also considers other factors, such as the experience and potential of the officer and the market compensation level for a similar position.

Role of Executive Officers in Determining Executive Compensation

The Compensation Committee determines compensation for the Chief Executive Officer, which is based on different factors, such as level of responsibility and contributions to the performance of the Company. The Chief Executive Officer recommends the compensation for the Company's executive officers (other than the compensation of the Chief Executive Officer) to the Compensation Committee. The Compensation Committee reviews the recommendations made by the Chief Executive Officer and determines the compensation of the Chief Executive Officer and the other executive officers. The Chief Executive Officer is not present during voting on, or deliberations concerning, his compensation.

Components of Executive Compensation

The Company’s compensation program has three major components: (1) base annual salary; (2) potential annual cash incentive awards that are based primarily on financial performance of the Company or its relevant business operating units; and (3) long-term incentive compensation in the form of stock options.

Base Salary

Base salaries are provided as compensation for day-to-day responsibilities and services to the Company and to meet the objective of attracting and retaining the talent needed to run the business.

Base salary for our executive officers was determined utilizing various factors.

One factor that was taken into account in determining base salary for our executive officers was the compensation policies of other companies comparable in size to and within substantially the same industry as the Company. Keeping our executive officers’ salaries in line with the market ensures the Company’s competitiveness in the marketplace in which the Company competes for talent.

Another factor taken into account in determining base salary for our executive officers was salaries paid by us to our executive officers during the immediately preceding year and increases in the cost of living.

The salary for each of our Named Executive Officers for the year ended June 30, 2022 and the percentage increase in their salary from the prior fiscal year’s salary were as follows:

|

Executives(1) |

Base Salary |

Percent Increased (2) |

||||||

|

S. W. Yong, President and Chief Executive Officer |

$ | 271,863 | 0.89 |

% |

||||

|

Victor H. M. Ting, Former Chief Financial Officer and Corporate Vice President (3) |

$ | 158,848 | 1.01 |

% |

||||

|

Hwee Poh Lim, Corporate Vice President-Testing |

$ | 106,093 | 1.38 |

% |

||||

|

Siew Kuan Soon, Corporate Vice President |

$ | 99,166 | 1.12 |

% |

||||

|

(1) |

Ms. Srinivasan joined the Company as Chief Financial Officer effective July 1, 2022, subsequent to the year ended June 30, 2022, and therefore is excluded from the table above. |

|

|

(2) |

Percent increase is based on the increase in base salary in the currency of Singapore. The appreciation of Singapore dollars against U.S. dollars is excluded in the calculation. The base cash compensation for the above named officers of the Company, each of whom resides in Singapore, in Fiscal 2022, was denominated in the currency of Singapore. The exchange rate therefore was established as of June 30, 2022 and was computed to be 1.3573 Singapore dollars to each U.S. dollar. |

|

|

(3) |

Mr. Ting resigned as the Company’s Chief Financial Officer and Corporate Vice President in June 2022. |

Singapore executive officers’ base salaries are credited with a compulsory contribution ranging from 1.5% to 6.7% of base salary as required under Singapore’s provident pension fund.

Bonuses

In November 2016, the Compensation Committee approved the bonus formula for Company's executive officers, as intended to satisfy the requirements of Section 162(m) of the Code.

The bonus for each of our Named Executive Officers paid in the year ended June 30, 2022 for prior year efforts was as follows:

|

Executives(1) |

Bonus |

|||

|

S. W. Yong, President and Chief Executive Officer |

$ | - | ||

|

Victor H. M. Ting, Former Chief Financial Officer and Corporate Vice President (2) |

$ | 26,475 | ||

|

Hwee Poh Lim, Corporate Vice President-Testing |

$ | 8,731 | ||

|

Siew Kuan Soon, Corporate Vice President |

$ | 17,774 | ||

|

(1) |

Ms. Srinivasan joined the Company as Chief Financial Officer effective July 1, 2022, subsequent to the year ended June 30, 2022, and therefore is excluded from the table above. |

|

|

(2) |

Mr. Ting resigned as the Company’s Chief Financial Officer and Corporate Vice President in June 2022. |

Option Grants

Stock options are intended to align the interests of key executives and shareholders by placing a portion of the key executives’ compensation at risk, tied to long-term shareholder value creation. Stock options are granted at 100% of the “fair market value” (as defined under the applicable plan) of the Company’s Common Stock on the date of grant. The Compensation Committee believes that stock options are flexible and relatively inexpensive to implement when compared with cash bonuses. It also has no negative impact on the Company’s cash flow. The Compensation Committee believes that long-term incentives in the form of stock options can better encourage the executive officers to improve operations and increase profits for the Company through participation in the growth in value of the Company’s Common Stock.

The Compensation Committee views any option grant portion of our executive officer compensation packages as a special form of long-term incentive compensation to be awarded on a limited and non-regular basis, with the exception of the Chief Executive Officer and Chief Financial Officer. The objective of these awards is to ensure that the interests of our executives are closely aligned with those of our shareholders. These awards provide rewards to our executive officers based upon the creation of incremental shareholder value and the attainment of long-term financial goals. Stock options produce value to our executive officers only if the price of our stock appreciates, thereby directly linking the interests of our executive officers with those of our shareholders.

Awards of stock options are determined based on the Compensation Committee’s subjective determination of the amount of awards necessary, as a supplement to an executive officer’s base salary, to retain and motivate the executive officer.

In Fiscal 2022, we granted the following stock options to the following Named Executive Officers pursuant to the 2017 Directors Plan, Amendment to 2017 Directors Plan and 2017 Employee Plan as indicated below.

|

Executives(1) |

2017 Directors Plan |

2017 Employee Plan |

Total |

|||||||||

|

S. W. Yong, President and Chief Executive Officer |

- | 25,000 | 25,000 | |||||||||

|

Victor H. M. Ting, Former Chief Financial Officer and Corporate Vice President(2) |

20,000 | - | 20,000 | |||||||||

|

Hwee Poh Lim, Corporate Vice President |

- | 1,500 | 1,500 | |||||||||

|

Siew Kuan Soon, Corporate Vice President |

- | 1,500 | 1,500 | |||||||||

|

(1) |

Ms. Srinivasan joined the Company as Chief Financial Officer effective July 1, 2022, subsequent to the year ended June 30, 2022, and therefore is excluded from the table above. |

|

|

(2) |

Mr. Ting resigned as the Company’s Chief Financial Officer and Corporate Vice President in June 2022. |

At the annual meeting of shareholders held in December 2019 (“2019 Annual Meeting”), the Company’s shareholders voted to conduct future non-binding, advisory votes on executive compensation on an “every one year” basis. The Board had recommended in the proxy statement for the 2019 Annual Meeting a vote for the “every three years” option. The Board had made such recommendation based on its conclusion that an advisory vote at such frequency would provide the Company’s shareholders with sufficient time to evaluate the effectiveness of its overall compensation philosophy, policies and practices in the context of the Company’s long-term business results, while avoiding more emphasis on short term variations in compensation and business results. Thus, the Board decided to conduct future advisory votes on executive compensation on an “every three years” basis until at least the next vote by the Company’s shareholders on the frequency of such votes, which will be no later than the Annual Meeting to be held in 2025.

Delinquent Section 16(A) Reports

Pursuant to Rule 16a-2 of the Exchange Act, our directors, executive officers and beneficial owners of 10% or more of our common stock are currently required to file statements of beneficial ownership with respect to their ownership of our equity securities under Sections 13 or 16 of the Exchange Act. Based on a review of written representations from our executive officers and directors and a review of Forms 4 and 5 furnished to us, we believe that during Fiscal 2022 the directors, executive officers and owners of more than 10% of our common stock filed, on a timely basis, all reports required by Section 16(a) of the Exchange Act, with the exception of one late Form 3 and one late Form 4 filed by Anitha Srinivasan, and one late Form 4 filed by Richard M. Horowitz.

The following table sets forth information regarding the compensation awarded to or earned by our Named Executive Officers during the years ended June 30, 2022 and 2021, consisting of our principal executive officer, and the two most highly compensated executive officers other than our principal executive officer. In addition, we have elected to provide disclosure for up to two additional executive officers during the year.

SUMMARY COMPENSATION TABLE

|

Name and Principal Position (1) |

Fiscal Year |

Salary ($) |

Bonus(15) |

Option Awards ($) (2) |

All Other Compensation ($) |

Total ($) |

|||||||||||||||

|

S. W. Yong (3) |

2022 |

271,863 | - | 92,250 | (4) | 20,636 | (6) | 384,749 | |||||||||||||

|

President and Chief Executive Officer |

2021 |

271,433 | 61,208 | 78,800 | (5) | 23,378 | (6) | 434,819 | |||||||||||||

|

Victor H. M. Ting (3)(14) |

2022 |

158,848 | 26,475 | 70,600 | (7) | 118,027 | (9) | 373,950 | |||||||||||||

|

Former Chief Financial Officer and Corporate Vice President |

2021 |

158,410 | 37,684 | 39,400 | (8) | 20,024 | (9) | 255,518 | |||||||||||||

|

Hwee Poh Lim |

2022 |

106,093 | 8,731 | 5,535 | (10) | 19,039 | (11) | 139,398 | |||||||||||||

|

Corporate Vice President |

2021 |

105,458 | 8,788 | -- | 18,137 | (11) | 132,383 | ||||||||||||||

|

Siew Kuan Soon |

2022 |

99,166 | 17,774 | 5,535 | (12) | 16,933 | (13) | 139,408 | |||||||||||||

|

Corporate Vice President |

2021 |

98,784 | 8,232 | 2,720 | 17,241 | (13) | 126,977 | ||||||||||||||

|

(1) |

Ms. Srinivasan was appointed as Chief Financial Officer of the Company effective July 1, 2022, subsequent to the fiscal year ended June 30, 2022, and therefore is excluded from the able above. |

|

|

(2) |

The option awards are based on the fair value of stock options on the grant date computed in accordance with ASC Topic 718. |

|

|

(3) |

Neither Mr. Yong nor Mr. Ting received any fees for services rendered as a director of the Company. |

|

|

(4) |

A stock option covering 25,000 shares of Common Stock was granted to Mr. Yong pursuant to the 2017 Employee Plan on March 24, 2022. The option has a five-year term and vests over the period as follows: 25% vesting on the grant date and the remaining balance vesting in equal installments on the next three succeeding anniversaries of the grant date. |

|

|

(5) |

A stock option covering 40,000 shares of Common Stock was granted to Mr. Yong pursuant to the 2017 Employee Plan on February 19, 2021. The option has a five-year term and vests over the period as follows: 25% vesting on the grant date and the remaining balance vesting in equal installments on the next three succeeding anniversaries of the grant date. |

|

|

(6) |

The amount shown in the other compensation column for Mr. Yong for Fiscal 2022 includes central provident fund contributions of $4,111, car benefits of $11,071 and director fees of $5,454 for service as a director for Trio-Tech Malaysia and Trio-Tech Kuala Lumpur, which are 55% owned by the Company.

The amount shown in the other compensation column for Mr. Yong for the fiscal year ended June 30, 2021 (“Fiscal 2021”) includes central provident fund contributions of $5,673, car benefits of $12,137 and director fees of $5,568 for service as a director for Trio-Tech Malaysia and Trio-Tech Kuala Lumpur.

Singapore officers are credited with a compulsory contribution to their central provident fund at a certain percentage of their base salaries and bonuses in accordance with Singapore law. The compulsory contribution with respect to Mr. Yong was 1.5% and 2.1% for Fiscal 2022 and 2021, respectively. |

|

|

(7) |

A stock option covering 20,000 shares of Common Stock was granted to Mr. Ting pursuant to the 2017 Director Plan on March 24, 2022. The option vested immediately upon grant and will terminate five years from the date of grant unless terminated sooner upon termination of the optionee’s status as a director or otherwise pursuant to the 2017 Directors Plan. |

|

|

(8) |

A stock option covering 20,000 shares of Common Stock was granted to Mr. Ting pursuant to the 2017 Employee Plan on February 19, 2021. The option has a five-year term and vests over the period as follows: 25% vesting on the grant date and the remaining balance vesting in equal installments on the next three succeeding anniversaries of the grant date. |

|

|

(9) |

The amount shown in the other compensation column for Mr. Ting for Fiscal 2022 includes central provident fund contributions of $6,534, car benefits $11,201, retirement benefits $62,546, ex-gratia and unutilized leave payment $33,478 and director fees of $4,268 for the service as a director for Trio-Tech Malaysia and Trio-Tech Kuala Lumpur, which are 55% owned by the Company.

The amount shown in the other compensation column for Mr. Ting for Fiscal 2021 includes central provident fund contributions of $5,673, car benefits of $9,994 and director fees of $4,357 for service as a director for Trio-Tech Malaysia and Trio-Tech Kuala Lumpur.

Singapore officers are credited with a compulsory contribution to their central provident fund at a certain percentage of their base salaries and bonuses in accordance with Singapore law. The compulsory contribution with respect to Mr. Ting was 4.1% and 3.6% for Fiscal 2022 and 2021, respectively. |

|

|

(10) |

A stock option covering 1,500 shares of Common Stock was granted to Mr. Lim pursuant to the 2017 Employee Plan on March 24, 2022. The option has a five-year term and vests over the period as follows: 25% vesting on the grant date and the remaining balance vesting in equal installments on the next three succeeding anniversaries of the grant date. |

|

|

(11) |

The amount shown in the other compensation column for Mr. Lim for Fiscal 2022 includes central provident fund contributions of $5,826, car benefits $11,079 and director fees of $2,134 for the service as a director for Trio-Tech Malaysia and Trio-Tech Kuala Lumpur.

The amount shown in the other compensation column for Mr. Lim for Fiscal 2021 includes central provident fund contributions of $5,597, car benefits of $10,361 and director fees of $2,179 for service as a director for Trio-Tech Malaysia and Trio-Tech Kuala Lumpur.

Singapore officers are credited with a compulsory contribution to their central provident fund at a certain percentage of their base salaries and bonuses in accordance with Singapore law. The compulsory contribution with respect to Mr. Lim was 5.5% and 5.3% for Fiscal 2022 and 2021, respectively. |

|

|

(12) |

A stock option covering 1,500 shares of Common Stock was granted to Ms. Soon pursuant to the 2017 Employee Plan on March 24, 2022. The option has a five-year term and vests over the period as follows: 25% vesting on the grant date and the remaining balance vesting in equal installments on the next three succeeding anniversaries of the grant date. |

|

|

(13) |

The amount shown in the other compensation column for Ms. Soon for Fiscal 2022 includes central provident fund contributions and insurance premium amounting to $8,124, car benefits $6,675 and director fees of $2,134 for the service as a director for Trio-Tech Malaysia and Trio-Tech Kuala Lumpur.

The amount shown in the other compensation column for Ms. Soon for Fiscal 2021 includes central provident fund contributions and insurance premium amounting to $7,042, car benefits of $8,020 and director fees of $2,179 for service as a director for Trio-Tech Malaysia and Trio-Tech Kuala Lumpur.

Singapore officers are credited with a compulsory contribution to their central provident fund at a certain percentage of their base salaries and bonuses in accordance with Singapore law. The compulsory contribution with respect to Ms. Soon was 6.7% and 5.6% for Fiscal 2022 and 2021, respectively. |

|

|

(14) |

Mr. Ting resigned as the Company’s Chief Financial Officer and Corporate Vice President in June 2022. |

|

|

(15) |

The amounts reported in this column represent annual cash bonus awards paid in each year under our annual cash incentive program for the financial performance of the Company in prior fiscal year |

Narrative Disclosure to Summary Compensation Table

Base Salary. Base salaries for Fiscal 2022 for Messrs. Yong, Ting, Lim and Ms. Soon were $271,863, $158,848, $106,093 and $99,166 respectively.

Bonuses. Bonuses paid in Fiscal 2022 for prior year efforts for Messrs. Ting, Lim and Ms. Soon were $26,475, $8,731, and $17,774 respectively.

Option Awards. Stock options are granted at 100% of the fair market value of the Company’s Common Stock on the date of grant. Awards of stock options are determined based on the Compensation Committee’s subjective determination of amount of awards necessary, as a supplement to an executive officer’s base salary, to retain and motivate the executive officer. In Fiscal 2022, options covering 28,000 shares were granted on March 24, 2022 pursuant to the 2017 Employee Plan, which options vest over the period as followings: 25% vesting on the grant date and the remaining balance vesting in equal installments on the next three succeeding anniversaries of the grant date. 20,000 shares were granted on March 24, 2022 pursuant to the 2017 Director Plan which option vested immediately upon grant and will terminate five years from the date of grant unless terminated sooner upon termination of the optionee’s status as a director or otherwise pursuant to the 2017 Directors Plan. In Fiscal 2021, options covering 2,000 and 60,000 shares were granted on December 8, 2020 and February 19, 2021 respectively pursuant to the 2017 Employee Plan, which options vest over the period as followings: 25% vesting on the grant date and the remaining balance vesting in equal installments on the next three succeeding anniversaries of the grant date.

All Other Compensation. All other compensation includes central provident fund contributions at a certain percentage of the base salaries in accordance with Singapore law, car benefits and director fees for service as a director for certain subsidiaries of the Company.

The Company does not generally provide its executive officers with payments or other benefits at, following, or in connection with retirement. The Company does not have a nonqualified deferred compensation plan that provides for deferral of compensation on a basis that is not tax-qualified for its executive officers.

Outstanding Equity Awards at Fiscal Year-End

The following table provides information concerning shares of our Common Stock covered by exercisable and unexercisable options held by the Named Executive Officers as of June 30, 2022, our last completed fiscal year end.

|

OUTSTANDING EQUITY AWARDS AT JUNE 30, 2022

|

||||||||||||||

|

Option Awards |

||||||||||||||

|

Number of Securities Underlying Unexercised Options |

Number of Securities Underlying Unexercised Options |

Option Exercise Price |

Option Expiration |

|||||||||||

|

(#) Exercisable |

(#) Unexercisable |

($) |

Date |

|||||||||||

|

S. W. Yong |

6,250 | (1) | 18,750 | $ | 7.76 |

3/23/2027 |

||||||||

| 20,000 | (2) | 20,000 | $ | 5.27 |

02/18/2026 |

|||||||||

| 10,000 | (3) | 10,000 | $ | 2.53 |

03/24/2025 |

|||||||||

| 40,000 | (4) | - | $ | 3.28 |

04/10/2024 |

|||||||||

| 40,000 | (5) | - | $ | 5.98 |

03/22/2023 |

|||||||||

|

Victor H.M. Ting (9) |

20,000 | (8) | - | $ | 7.76 |

3/23/2027 |

||||||||

| 20,000 | (5) | - | $ | 5.98 |

09/30/2022(10) |

|||||||||

| 20,000 | (2) | 10,000 | $ | 5.27 |

09/30/2022(10) |

|||||||||

|

Hwee Poh Lim |

375 | (1) | 1,125 | $ | 7.76 |

3/23/2027 |

||||||||

| 5,000 | (6) | - | $ | 3.75 |

12/03/2023 |

|||||||||

|

Siew Kuan Soon |

375 | (1) | 1,125 | $ | 7.76 |

3/23/2027 |

||||||||

| - | (7) | 1,000 | $ | 3.73 |

12/07/2025 |

|||||||||

|

(1) |

Stock option granted on March 24, 2022 pursuant to the 2017 Employee Plan, that will fully vest on March 23, 2025 (one-fourth of the grant vested or will vest every year beginning on February 19, 2021). |

|

|

(2) |

Stock option granted on February 19, 2021 pursuant to the 2017 Employee Plan, that will fully vest on February 18, 2024 (one-fourth of the grant vested or will vest every year beginning on February 19, 2021). |

|

|

(3) |

Stock option granted on March 25, 2020 pursuant to the 2017 Employee Plan, that will fully vest on March 24, 2023 (one-fourth of the grant vested or will vest every year beginning on March 25, 2020). |

|

|

(4) |

Stock option granted on April 11, 2019 pursuant to the 2017 Employee Plan, that fully vested on April 10, 2022. |

|

|

(5) |

Stock option granted on March 23, 2018 pursuant to the 2017 Employee Plan, that fully vested on March 22, 2021. |

|

|

(6) |

Stock option granted on December 4, 2018 pursuant to the 2017 Employee Plan, that will fully vest on December 3, 2021 (one-fourth of the grant vested or will vest every year beginning on December 4, 2018). |

|

|

(7) |

Stock option granted on December 8, 2020 pursuant to the 2017 Employee Plan, that will fully vest on December 7, 2023 (one-fourth of the grant vested or will vest every year beginning on December 8, 2020). |

|

(8) |

Stock option granted on March 24, 2022 pursuant to the 2017 Director Plan, that vested immediately upon grant and will terminate five years from the date of grant unless terminated sooner upon termination of the optionee’s status as a director or otherwise pursuant to the 2017 Directors Plan. |

|

|

(9) |

Mr. Ting resigned as the Company’s Chief Financial Officer and Corporate Vice President in June 2022. |

|

|

(10) |

Stock option granted to Mr. Ting under 2017 Employee Plan expired on September 30, 2022, 3 months after his resignation as Company’s Chief Financial Officer. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND MANAGEMENT

The following table sets forth, as of September 30, 2022, certain information regarding the beneficial ownership of the Common Stock by (i) all persons known by the Company to be the beneficial owners of more than 5% of its Common Stock, (ii) each of the directors of the Company, (iii) each of the Named Executive Officers, and (iv) all executive officers and directors of the Company as a group. To the knowledge of the Company, unless otherwise indicated, each of the shareholders has sole voting and investment power with respect to shares beneficially owned, subject to applicable community property and similar statutes.

|

Name |

Amount of Shares Owned Beneficially (1) |

Percent of Class (1) |

||||||

|

S. W. Yong (2) |

646,318 | 15.4 |

% |

|||||

|

A. Charles Wilson (3) |

595,500 | (4) | 13.9 |

% |

||||

|

Richard M. Horowitz (5) |

455,364 | 10.9 |

% |

|||||

|

Jason T. Adelman (6) |

122,188 | 2.9 |

% |

|||||

|

Victor H. M. Ting (7) |

111,657 | 2.7 |

% |

|||||

|

Hwee Poh Lim (8) |

82,108 | 2.0 |

% |

|||||

|

Siew Kuan Soon (9) |

23,225 | 0.6 |

% |

|||||

|

Anitha Srinivasan (10) |

1,875 | 0.0 |

% |

|||||

|

All Directors and Executive Officers as a group (8 persons) |

2,038,235 | (11) | 48.4 |

% |

||||

|

Renaissance Technologies LLC |

247,569 | (12) | 6.1 |

% |

||||

|

(1) |

The percent of class is based upon 4,076,680 shares outstanding. The number of shares indicated and the percentage shown for each individual assumes the exercise of options that are presently exercisable or may become exercisable within 60 days from September 30, 2022 which are held by that individual or by all executive officers and directors as a group, as the case may be. The address for each of the directors and executive officers above is in care of the Company at Block 1008 Toa Payoh North Unit 03-09 Singapore. |

|

(2) |

Includes an aggregate of 116,250 shares of the Common Stock that may be acquired upon the exercise of options which are presently exercisable or which may become exercisable within 60 days from September 30, 2022 at exercise prices from $2.53 to $7.76 per share. |

|

(3) |

Includes an aggregate of 200,000 shares of the Common Stock that may be acquired upon the exercise of options which are presently exercisable at exercise prices from $2.53 to $7.76 per share. |

|

(4) |

The shares are held in a revocable family trust. |

|

(5) |

Includes an aggregate of 100,000 shares of the Common Stock that may be acquired upon the exercise of options which are presently exercisable at exercise prices from $2.53 to $7.76 per share. |

|

(6) |

Includes an aggregate of 100,000 shares of the Common Stock that may be acquired upon the exercise of options that are presently exercisable at exercise prices from $2.53 to $7.76 per share. |

|

(7) |

Includes an aggregate of 20,000 shares of the Common Stock that may be acquired upon the exercise of options which are presently exercisable or which may become exercisable within 60 days from September 30, 2022 at exercise prices of $7.76 per share. |

|

(8) |

Includes an aggregate of 1,375 shares of the Common Stock that may be acquired upon the exercise of options which are presently exercisable or which may become exercisable within 60 days from September 30, 2022 at an exercise price of $5.18 to $7.76 per share. |

|

(9) |

Includes an aggregate of 875 shares of the Common Stock that may be acquired upon the exercise of options which are presently exercisable or which may become exercisable within 60 days from September 30, 2022 at an exercise price of $5.18 to $7.76 per share. |

|

(10) |

Includes an aggregate of 375 shares of the Common Stock that may be acquired upon the exercise of options which are presently exercisable or which may become exercisable within 60 days from September 30, 2022 at an exercise price of $5.18 per share. |

|

|

(11) |

Includes an aggregate of 538,875 shares of the Common Stock that may be acquired upon the exercise of options which are presently exercisable or which may become exercisable within 60 days from September 30, 2022 at exercise prices from $2.53 to $7.76 per share. |

|

(12) |

Based on Form 13G filed by Renaissance Technologies LLC and Renaissance Technologies Holdings Corporation on February 11, 2022. The address of Renaissance Technologies is 800 Third Ave, New York, NY 10022. |

The Company does not know of any arrangements that may at a subsequent date result in a change of control of the Company.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee selected Mazars LLP (“Mazars”) as the independent registered public accounting firm for the fiscal year ended June 30, 2022.

The following table shows the fees that we paid or accrued for audit and other services provided by Mazars for Fiscal 2022 and 2021. All of the services described in the following fee table were approved in conformity with the Audit Committee’s pre-approval process.

|

2022 |

2021 |

|||||||

|

Audit Fees |

$ | 201,577 | $ | 202,900 | ||||

|

Tax Fees |

11,051 | 10,720 | ||||||

|

All Other Fees |

5,950 | 5,990 | ||||||

|

Total: |

$ | 218,578 | $ | 219,610 | ||||

Audit Fees

The amounts set forth opposite “Audit Fees” above reflect the aggregate fees billed by Mazars or to be billed for professional services rendered for the audit of the Company’s Fiscal 2022 and 2021 annual financial statements and for the review of the financial statements included in the Company’s quarterly reports during such periods.

Tax Fees

The amounts set forth opposite “Tax Fees” above reflect the aggregate fees billed for Fiscal 2022 and 2021 for professional services rendered for tax compliance and return preparation. The compliance and return preparation services consisted of the preparation of original and amended tax returns and support during the income tax audit or inquiries.

The Audit Committee’s policy is to pre-approve all audit services and all non-audit services that our independent accountants are permitted to perform for us under applicable federal securities regulations. The Audit Committee’s policy utilizes an annual review and general pre-approval of certain categories of specified services that may be provided by the independent accountant, up to pre-determined fee levels. Any proposed services not qualifying as a pre-approved specified service, and pre-approved services exceeding the pre-determined fee levels, require further specific pre-approval by the Audit Committee. The Audit Committee has delegated to the Chairman of the Audit Committee the authority to pre-approve audit and non-audit services proposed to be performed by the independent accountants. Since June 30, 2004, all services provided by our auditors require pre-approval by the Audit Committee. The policy has not been waived in any instance.

All Other Fees

The amounts set forth opposite “All Other Fees” above reflect the aggregate fees billed for Fiscal 2022 and 2021 for professional services rendered for the Information Technology (IT) audit. This is to ensure rigorous IT controls in place for maintaining an appropriate internal controls over financial reporting.

ADDITIONAL MEETING INFORMATION

Shareholder Proposals