UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended December 31, 2015

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from to

Commission file number: 0-12015

HEALTHCARE SERVICES GROUP, INC.

(Exact name of registrant as specified in its charter)

Pennsylvania | 23-2018365 | |

(State or other jurisdiction of incorporated or organization) | (IRS Employer Identification No.) | |

3220 Tillman Drive, Suite 300, Bensalem, PA | 19020 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(215) 639-4274

Securities registered pursuant to Section 12(b) of the 1934 Act:

Common Stock ($.01 par value) | The NASDAQ Global Select Market | |

Title of Class | Name of each exchange on which securities registered | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES þ NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | þ | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

(Do not check if a smaller reporting company) | ||||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO þ

The aggregate market value of the voting stock (Common Stock, $.01 par value) held by non-affiliates of the Registrant as of the close of business on June 30, 2015 was approximately $1,665,396,000 based on closing sale price of the Common Stock on the NASDAQ Global Select Market on that date. The determination of affiliate status is not a determination for any other purpose. The Registrant does not have any non-voting common equity authorized or outstanding.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock (Common Stock, $.01 par value) as of the latest practicable date (February 16, 2016). 72,177,000

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the Registrant’s Annual Meeting of Shareholders to be held on May 31, 2016 have been incorporated by reference into Parts II and III of this Annual Report on Form 10-K.

1

Healthcare Services Group, Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2015

TABLE OF CONTENTS

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-K may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, which are not historical facts but rather are based on current expectations, estimates and projections about our business and industry, our beliefs and assumptions. Words such as “believes,” “anticipates,” “plans,” “expects,” “will,” “goal,” and similar expressions are intended to identify forward-looking statements. The inclusion of forward-looking statements should not be regarded as a representation by us that any of our plans will be achieved. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Such forward-looking information is also subject to various risks and uncertainties. Such risks and uncertainties include, but are not limited to, risks arising from our providing services exclusively to the health care industry, primarily providers of long-term care; credit and collection risks associated with this industry; having several significant clients who each individually contributed at least 3% with one as high as 9% to our total consolidated revenues for the year ended December 31, 2015; our claims experience related to workers’ compensation and general liability insurance; the effects of changes in, or interpretations of laws and regulations governing the industry, our workforce and services provided, including state and local regulations pertaining to the taxability of our services and other labor related matters such as minimum wage increases; tax benefits arising from our corporate reorganization and self-funded health insurance program transition; risks associated with the reorganization of our corporate structure; and the risk factors described in Part I in this report under “Government Regulation of Clients,” “Competition” and “Service Agreements/Collections,” and under Item IA “Risk Factors.”

These factors, in addition to delays in payments from clients and/or clients in bankruptcy or clients for which we are in litigation to collect payment, have resulted in, and could continue to result in, significant additional bad debts in the near future. Additionally, our operating results would be adversely affected if unexpected increases in the costs of labor and labor-related costs, materials, supplies and equipment used in performing services could not be passed on to our clients.

In addition, we believe that to improve our financial performance we must continue to obtain service agreements with new clients, provide new services to existing clients, achieve modest price increases on current service agreements with existing clients and maintain internal cost reduction strategies at our various operational levels. Furthermore, we believe that our ability to sustain the internal development of managerial personnel is an important factor impacting future operating results and successfully executing projected growth strategies.

3

PART I

In this Annual Report on Form 10-K for the year ended December 31, 2015, Healthcare Services Group, Inc. (together with its wholly-owned subsidiaries, included in Exhibit 21 which has been filed as part of this Report) is referred to as the "Company," "we," "us" or "our."

Item I. Business.

General

The Company is a Pennsylvania corporation, incorporated on November 22, 1976. We provide management, administrative and operating expertise and services to the housekeeping, laundry, linen, facility maintenance and dietary service departments of the health care industry, including nursing homes, retirement complexes, rehabilitation centers and hospitals located throughout the United States. Based on the nature and similarities of the services provided, our business operations consist of two business segments (Housekeeping and Dietary). We believe that we are the largest provider of our services to the long-term care industry in the United States, rendering such services to approximately 3,500 facilities in 48 states as of December 31, 2015. We provide our Housekeeping services to essentially all client facilities and provide Dietary services to over 1,000 of such facilities. Although we do not directly participate in any government reimbursement programs, our clients’ reimbursements are subject to government regulation. Therefore, they are directly affected by any legislation and regulations relating to Medicare and Medicaid reimbursement programs.

Segment Information

The information called for herein is discussed below in Description of Services, and within Item 8 of this Annual Report on Form 10-K under Note 15 of Notes to Consolidated Financial Statements for the years ended December 31, 2015, 2014 and 2013.

Description of Services

We provide management, administrative and operating expertise and services to the housekeeping, laundry, linen, facility maintenance and dietary service departments of the health care industry.

We are organized into, and provide our services through two reportable segments: housekeeping, laundry, linen and other services (“Housekeeping”), and dietary department services (“Dietary”). The operating results from our professional employer organization ("PEO") service contracts are included primarily in our Housekeeping segment as these services include the provision of housekeeping and laundry personnel. The Company’s corporate headquarters provides centralized financial management and administrative services to the Housekeeping and Dietary business segments.

Housekeeping consists of managing the client’s housekeeping department which is principally responsible for the cleaning, disinfecting and sanitizing of patient rooms and common areas of a client’s facility, as well as the laundering and processing of the personal clothing belonging to the facility’s patients. Also within the scope of this segment’s service is the responsibility for laundering and processing the bed linens, uniforms and other assorted linen items utilized by a client facility.

Dietary consists of managing the client’s dietary department which is principally responsible for food purchasing, meal preparation and providing professional dietitian consulting services, which includes the development of a menu that meets the patient’s dietary needs.

Both segments provide our services primarily pursuant to full service agreements with our clients. In such agreements, we are responsible for the management of the department serviced, the employees located at our clients’ facilities and the provision of certain supplies. We also provide services on the basis of a management-only agreement for a limited number of clients. Our agreements with clients typically provide for renewable one year service terms, cancelable by either party upon 30 to 90 days’ notice after an initial period of 60 to 120 days.

Our labor force is interchangeable with respect to each of the services within Housekeeping. Our labor force with respect to Dietary is specific to it. There are many similarities in the nature of the services performed by each segment. However, there are some differences in the specialized expertise required of the professional management personnel responsible for delivering the services of the respective segments. We believe the services of each segment provide opportunity for growth.

4

An overview of each of our segments follows:

Housekeeping

Housekeeping services. Housekeeping services is our largest service sector, representing approximately 44%, or $631,875,000, of consolidated revenues in 2015. This service involves the management of the client’s housekeeping department which is principally responsible for cleaning, disinfecting and sanitizing resident areas in our clients’ facilities. In providing services to any given client facility, we typically hire and train the employees that were previously employed by such facility. We normally assign an on-site manager to each facility to supervise and train the front line personnel and coordinate housekeeping services with other facility support functions in accordance with the direction provided by the client. Such management personnel also oversee the execution of a variety of quality and cost-control procedures including continuous training and employee evaluation and on-site testing for infection control. The on-site management team also assists the facility in complying with federal, state and local regulations.

Laundry and linen services. Laundry and linen services represented approximately 19%, or $275,477,000, of consolidated revenues in 2015. Laundry services are under the responsibility of the housekeeping department and involve the laundering and processing of the residents’ personal clothing. We provide laundry services to mostly all of our housekeeping clients. Linen services involve providing, laundering and processing of the sheets, pillow cases, blankets, towels, uniforms and assorted linen items used by our clients’ facilities. At some facilities that utilize our laundry and linen services, we install our own equipment. Such installation generally requires an initial capital outlay by us ranging from $5,000 to $100,000 depending on the size of the facility, installation and construction costs, and the cost of equipment required. We could incur relocation or other costs in the event of the cancellation of a linen service agreement where there was an investment by us in a corresponding laundry installation. The hiring, training and supervision of the employees who perform laundry and linen services are similar to, and performed by the same management personnel who oversee the housekeeping employees located at the respective client facility. In some instances we own the linen supplies utilized at our clients’ facilities and therefore, maintain a sufficient inventory of linen supplies to ensure their availability.

Maintenance and other services. Maintenance services consist of repair and maintenance of laundry equipment, plumbing and electrical systems, as well as carpentry and painting. This service sector’s total revenues of $2,357,000 represented less than 1% of consolidated revenues in 2015.

Laundry installation sales. We (as a distributor of laundry equipment) sell laundry installations to our clients, which typically represents the construction and installation of a turn-key operation. We generally offer payment terms, ranging from 36 to 60 months. During the years 2013 through 2015, laundry installation sales were not material to our operating results as we prefer to own such laundry installations in connection with performance of our service agreements during the term of such agreements.

Housekeeping operating performance is significantly impacted by our management of labor costs. Labor accounted for approximately 80% of operating costs incurred at a facility service location, as a percentage of Housekeeping revenues. Changes in employee compensation resulting from legislative or other actions, anticipated staffing levels, and other unforeseen variations in our use of labor at a client service location will result in volatility of these costs. Additionally, the costs of supplies consumed in performing Housekeeping services, including linen costs, are affected by product specific market conditions and therefore are subject to price volatility. Generally, this volatility is influenced by factors outside our control and is unpredictable. Where possible, we try to obtain fixed pricing from vendors for an extended period of time on certain supplies to mitigate such price volatility. Although we endeavor to pass on increases in our labor and supply costs to our clients, the inability to attain such increases may negatively impact Housekeeping’s profit margins.

PEO services. Through the Company's wholly-owned subsidiary, HCSG Staff Leasing Solutions, LLC ("Staff Leasing"), we enter into a client services agreement to become a co-employer of the client's existing workforce, assuming responsibility for payroll, payroll taxes, insurance coverage and certain other administrative functions, while the client maintains physical care, custody and control of their workforce, including the authority to hire and terminate employees. Our services include housekeeping and laundry personnel and are provided to clients in the health care industry. As of December 31, 2015, we have PEO service contracts in several states. During the years 2013 through 2015, operating results from our PEO service contracts were not material to our operating results.

Dietary

Dietary services. Dietary services represented approximately 37%, or $527,140,000, of consolidated revenues in 2015. Dietary consists of managing the client’s dietary department which is principally responsible for food purchasing, meal preparation and providing professional dietitian consulting services, which includes the development of a menu that meets the dietary needs of the residents. On-site management is responsible for all daily dietary department activities, with regular support being provided

5

by a district manager specializing in dietary services, as well as a registered dietitian. We also offer consulting services to facilities to assist them in cost containment and to promote improvement in their dietary department service operations.

Dietary operating performance is also impacted by price volatility in labor and supply costs resulting from similar factors discussed above in Housekeeping. The primary difference in impact on Dietary operations from price volatility in costs of labor and food-related supplies is that such costs represent approximately 53% and 39% of Dietary revenues, respectively. In contrast, labor is approximately 80% of operating costs as a percentage of Housekeeping revenues.

Operational Management Structure

By applying our professional management techniques, we generally contain or control certain housekeeping, laundry, linen, facility maintenance and dietary service costs on a continuing basis. We manage and provide our services through a network of management personnel, as illustrated below.

President and CEO | ||||||||||||

↓ | ||||||||||||

Executive Vice President & Senior Vice President | ||||||||||||

↓ | ||||||||||||

Divisional Vice President | ||||||||||||

(10 Divisions) | ||||||||||||

↓ | ||||||||||||

Regional Vice President/Manager and Director | ||||||||||||

(80 Regions) | ||||||||||||

↓ | ||||||||||||

District Manager | ||||||||||||

(443 Districts) | ||||||||||||

↓ | ||||||||||||

Training Manager/Facility Manager and | ||||||||||||

Assistant Facility Manager | ||||||||||||

Each facility is generally managed by an on-site Facility Manager, an Assistant Facility Manager, and if necessary, additional supervisory personnel. Districts, typically consisting of eight to twelve facilities, are supported by a District Manager and a Training Manager. District Managers bear overall responsibility for the facilities within their districts. They are generally based in close proximity to each facility. These managers provide active support to clients in addition to the support provided by our on-site management team. Training Managers are responsible for the recruitment, training and development of Facility Managers. A division consists of a number of regions within a specific geographical area. Divisional Vice Presidents manage each division. At December 31, 2015 we had 80 regions within 10 divisions. Each region is headed by a Regional Vice President/Manager. Most regions also have a Regional Director who assumes primary responsibility for marketing our services within the respective region. Regional Vice Presidents/Managers and Directors provide management support to a number of districts within a specific geographical area. Regional Vice Presidents/Managers and Directors report to Divisional Vice Presidents who in turn report to Senior Vice Presidents and/or Executive Vice Presidents. We believe that our divisional, regional and district organizational structure facilitates our ability to best serve, and/or sell additional services to, our existing clients, as well as obtain new clients.

Market

The market for our services consists of a large number of facilities involved in various aspects of the health care industry, including long-term and post-acute care facilities (skilled nursing facilities, residential care and assisted living facilities, etc.) and hospitals (acute care, critical access, psychiatric, etc.).

These facilities primarily range in size from small private facilities to facilities with over 500 beds. Such facilities may be specialized or general, privately owned or public, profit or not-for-profit, and may serve patients on a long-term or short-term basis. We market our services to such facilities after consideration of a variety of factors including facility type, size, location, and service (Housekeeping or Dietary). The market for our services, particularly in long-term and post-acute care, is expected to continue to

6

grow as the elderly population increases as a percentage of the United States population and as government reimbursement policies require increased cost control or containment by the constituents that comprise our target market.

Marketing and Sales

Our services are marketed at four levels of our organization: at the corporate level by the President & Chief Executive Officer, Executive Vice Presidents and Senior Vice Presidents; at the divisional level by Divisional Vice Presidents; at the regional level by the Regional Vice Presidents/Divisional Managers and Directors; and at the district level by District Managers. We provide incentive compensation to our operational personnel based on achieving financial and non-financial goals and objectives which are aligned with the key elements the Company believes are necessary for it to achieve overall improvement in its financial results, along with continued business development.

Our services are marketed primarily through referrals and in-person solicitation of target facilities. We also participate in industry trade shows, health care trade associations and healthcare support service seminars that are offered in conjunction with state or local health authorities in many of the states in which we conduct our business. Our programs have been approved for continuing education credits by state nursing home licensing boards in certain states, and are typically attended by facility owners, administrators and supervisory personnel, thus presenting marketing opportunities for us. Indications of interest in our services arising from initial marketing efforts are followed up with a presentation regarding our services and an assessment of the service requirements of the facility. Thereafter, a formal proposal, including operational recommendations and recommendations for proposed savings, is submitted to the prospective client. Once the prospective client accepts the proposal and signs the service agreement, we can set up our operations on-site within days.

Government Regulation of Clients

Our clients are subject to government regulation. Congress has enacted a number of major laws during the past several years that have significantly altered or will alter government reimbursement for nursing home services, including the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010. In July 2011, Centers for Medicare and Medicaid Services (“CMS”) issued a final rule that reduced Medicare payments to nursing centers by 11.1% and changed the reimbursement for the provision of group rehabilitation therapy services to Medicare beneficiaries. This new rule was effective as of October 1, 2011. Furthermore, in the coming year and beyond, new proposals or additional changes in existing regulations could be made which could directly impact the governmental reimbursement programs in which our clients participate. As a result, some state Medicaid programs are reconsidering previously approved increases in nursing home reimbursement or are considering delaying or foregoing those increases. A few states have indicated it is possible they will run out of cash to pay Medicaid providers, including nursing homes.

In January 2013, the U.S. Congress enacted the American Taxpayer Relief Act of 2012, which delayed automatic spending cuts of $1.2 trillion, including reduced Medicare payments to plans and providers up to 2%. These discretionary spending caps were originally enacted under provisions in the Budget Control Act of 2011, an initiative to reduce the federal deficit through the year 2021, also known as “sequestration.” The sequestration went into effect starting March 2013. In December 2013, the U.S. Congress enacted the Bipartisan Budget Act of 2013, which reduces the impact of sequestration over the next two years. This began in fiscal year 2014 and extended the reduction in Medicare payments to plans and providers for two years from 2021 through 2023.

Although laws and rulings directly affect how clients are paid for certain services, we do not directly participate in any government reimbursement programs. Accordingly, all of our contractual relationships with our clients continue to determine the clients’ payment obligations to us. However, because clients’ revenues are generally highly reliant on Medicare and Medicaid reimbursement funding rates, the overall effect of these laws and trends in the long term care industry have affected and could adversely affect the liquidity of our clients, resulting in their inability to make payments to us on agreed upon payment terms (See “Liquidity and Capital Resources" included in our "Management's Discussion and Analysis of Financial Condition and Results of Operations").

The prospects for legislative action, both on the federal and state level (particularly in light of current economic environment affecting government budgets), regarding funding for nursing homes are uncertain. We are unable to predict or to estimate the ultimate impact of any further changes in reimbursement programs affecting our clients’ future results of operations and/or their impact on our cash flows and operations.

Environmental Regulation

The Company’s operations are subject to various federal, state and/or local laws concerning emissions into the air, discharges into the waterways and the generation, handling and disposal of waste and hazardous substances. The Company’s past expenditures

7

relating to environmental compliance have not had a material effect on the Company and are included in normal operating expenses. These laws and regulations are constantly evolving, and it is impossible to predict accurately the effect they may have upon the capital expenditures, earnings and competitive position of the Company in the future. Based upon information currently available, management believes that expenditures relating to environmental compliance will not have a material impact on the financial position of the Company for the foreseeable future.

Service Agreements and Collections

We provide our services primarily pursuant to full service agreements with our clients. In such agreements, we are responsible for the management of the department serviced, the employees located at our clients’ facilities and the provision of certain supplies. We also provide services on the basis of a management-only agreement for a limited number of clients. In such agreements, our services are comprised of providing on-site management personnel, while the non-supervisory staff remain employees of the respective client.

We typically adopt and follow the client’s employee wage structure, including its policy of wage rate increases, and pass through to the client any labor cost increases associated with wage rate adjustments. Under a management agreement, we provide management and supervisory services while the client facility retains payroll responsibility for the non-supervisory staff. Substantially all of our agreements are full service agreements. These agreements typically provide for renewable one year terms, cancelable by either party upon 30 to 90 days’ notice after the initial 60 to 120 day period. As of December 31, 2015, we provided services to approximately 3,500 client facilities.

Although many of our service agreements are cancelable on short notice, we have historically had a favorable client retention rate and expect to continue to maintain satisfactory relationships with our clients. The risks associated with short-term service agreements have not materially affected either our linen and laundry services, which may from time-to-time require capital investment, or our laundry installation sales, which may require us to finance the sales price. Such risks are often mitigated by certain provisions set forth in the agreements entered into with our clients.

State Medicaid programs are experiencing increased demand, and with lower revenues than projected, they have fewer resources to support their Medicaid programs. In addition, Federal health reform legislation has been enacted that would significantly expand state Medicaid programs. As a result, some state Medicaid programs are reconsidering previously approved increases in nursing home reimbursement or are considering delaying those increases. A few states have indicated it is possible they will run out of cash to pay Medicaid providers, including nursing homes. Any of these changes would adversely affect the liquidity of our clients, resulting in their inability to make payments to us as agreed upon.

We have had varying collection experience with respect to our accounts and notes receivable. When contractual terms are not met, we generally encounter difficulty in collecting amounts due from certain of our clients. Therefore, we have sometimes been required to extend the period of payment for certain clients beyond contractual terms. These clients include those who have terminated service agreements and slow payers experiencing financial difficulties. In order to provide for these collection problems and the general risk associated with the granting of credit terms, we have recorded bad debt provisions (in an Allowance for Doubtful Accounts) of $4,335,000, $4,470,000 and $1,990,000 in the years ended December 31, 2015, 2014 and 2013, respectively (See Schedule II - Valuation and Qualifying Accounts and Reserves, for year-end balances). As a percentage of total revenues, these provisions represented approximately 0.3% for each of the years ended December 31, 2015 and 2014 and 0.2% for the year ended December 31, 2013. In making our credit evaluations, in addition to analyzing and anticipating, where possible, the specific cases described above, we consider the general collection risk associated with trends in the long-term care industry. We also establish credit limits, perform ongoing credit evaluation and monitor accounts to minimize the risk of loss. Notwithstanding our efforts to minimize credit risk exposure, our clients could be adversely affected if future industry trends change in such a manner as to negatively impact their cash flows, as discussed in “Government Regulation of Clients” and “Risk Factors” in this report. If our clients experience a negative impact in their cash flows, it would have a material adverse effect on our consolidated results of operations and financial condition.

Competition

We compete primarily with the in-house support service departments of our potential clients. Most healthcare facilities perform their own support service functions without relying upon outside management firms. In addition, a number of local firms compete with us in the regional markets in which we conduct business. Several national service firms are larger and have greater financial and marketing resources than us, although historically, such firms have concentrated their marketing efforts primarily on hospitals, rather than the long-term care facilities typically serviced by us. Although the competition to provide service to health care facilities is strong, we believe that we compete effectively for new agreements, as well as renewals of existing agreements, based upon the quality and dependability of our services and the cost savings we believe we can usually implement for clients.

8

Employees

At December 31, 2015, we employed approximately 8,600 management, office support and supervisory personnel. Of these employees, approximately 650 held executive, regional/district management and office support positions, and approximately 7,900 of these employees were on-site management personnel. On such date, we employed approximately 37,300 hourly employees. Many of our hourly employees were previously support employees of our clients. We manage, for a limited number of our client facilities, the hourly employees who remain employed by those clients.

Approximately 23% of our hourly employees are unionized. The majority of these employees are subject to collective bargaining agreements that are negotiated by individual client facilities and are assented by us, so as to bind us as an “employer” under the agreements. We may be adversely affected by relations between our client facilities and the employee unions or between us and such unions. We consider our relationship with our employees to be good.

Financial Information about Geographic Areas

Our Housekeeping segment provided services in Canada during 2015 and 2014, although essentially all of its revenues and net income, 99% in each category, were earned in one geographic area, the United States. The Housekeeping segment no longer provides services to Canada as of December 31, 2015. The Dietary segment provides services only in the United States.

Available Information

Healthcare Services Group, Inc. is a reporting company under the Securities Exchange Act of 1934, as amended, and files reports, proxy statements and other information with the Securities and Exchange Commission (the “Commission” or “SEC”). The public may read and copy any of our filings at the Commissioner’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. Additionally, because we make filings to the Commission electronically, you may access this information at the Commission’s internet site: www.sec.gov. This site contains reports, proxies and information statements and other information regarding issuers that file electronically with the Commission.

Website Access

Our website address is www.hcsg.com. Our filings with the Commission, as well as other pertinent financial and Company information are available at no cost on our website as soon as reasonably practicable after the filing of such reports with the Commission.

9

Item 1A. Risk Factors.

You should carefully consider the risk factors we have described below, as well as other related information contained within this annual report on Form 10-K because these factors could cause the actual results and our financial condition to differ materially from those projected in forward-looking statements. We believe that the risks described below are our most significant risk factors but there may be risks and uncertainties that are not currently known to us or that we currently deemed to be immaterial. Therefore, any such unknown or deemed immaterial risks and uncertainties, as well as those noted below could materially adversely affect our business, financial condition or results of operations and cash flows.

We provide services to several clients which contribute significantly, on an individual, as well as aggregate basis, to our total revenues.

We have several clients who each have made a contribution to our total consolidated revenues ranging from 3% to 9% for the year ended December 31, 2015. Although we expect to continue the relationship with these clients, there can be no assurance thereof. The loss, individually or in combination, of such clients, or a significant reduction in the revenues we receive from such clients, could have a material adverse effect on the results of operations of our two operating segments. In addition, if any of these clients change or alter current payment terms it could increase our accounts receivable balance and have a material adverse effect on our cash flows and cash and cash equivalents.

Our clients are concentrated in the health care industry which is currently facing considerable legislative proposals to reform it. Many of our clients rely on reimbursement from Medicare, Medicaid and other third-party payors. Rates from such payors may be altered or reduced, thus affecting our Clients’ results of operations and cash flows.

We provide our services primarily to providers of long-term and post-acute care. In March 2010, the U.S. Congress enacted the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (together, the "Act"), and is considering further legislation to reform healthcare in the United States which could significantly impact our clients. In July 2011, CMS issued final rulings which, among other things, reduced, effective October 1, 2011, Medicare payments to nursing centers by 11.1% and changed the reimbursement for the provision of group rehabilitation therapy services to Medicare beneficiaries. In January 2013, the U.S. Congress enacted the American Taxpayer Relief Act of 2012, which delayed automatic spending cuts of $1.2 trillion, including reduced Medicare payments to plans and providers up to 2%. These discretionary spending caps were originally enacted under provisions in the Budget Control Act of 2011, an initiative to reduce the federal deficit through the year 2021, also known as “sequestration.” The sequestration went into effect starting March 2013. In December 2013, the U.S. Congress enacted the Bipartisan Budget Act of 2013, which reduces the impact of sequestration over the next two years. This began in fiscal year 2014 and extended the reduction in Medicare payments to plans and providers for two years from 2021 through 2023. Some states have enacted or are considering enacting measures designed to reduce their Medicaid expenditures. We cannot predict what efforts, and to what extent, such legislation and proposals to contain healthcare costs will ultimately impact our clients’ revenues through reimbursement rate modifications. Congress has enacted a number of major laws during the past decade that have significantly altered, or may alter, overall government reimbursement for nursing home services. Because our clients’ revenues are generally highly reliant on Medicare, Medicaid and other third-party payors’ reimbursement funding rates and mechanisms, the overall effect of these laws and trends in the long term care industry have affected and could adversely affect the liquidity of our clients, resulting in their inability to make payments to us on agreed upon payment terms. These factors, in addition to delays in payments from clients have resulted in, and could continue to result in, significant additional bad debts in the future.

Federal health care reform legislation’s eventual impact, including requiring most individuals to have health insurance and establish new regulation on health plans, may adversely affect our operating costs and results of operations.

The Act includes a large number of health-related provisions that become effective over the next several years, including requiring most individuals to have health insurance and establishing new regulations on health plans. While much of the cost of the recent healthcare legislation enacted began in 2015 due to provisions of the legislation being phased in over time, changes to our healthcare cost structure could have a continuing impact on our operating costs. Providing such additional health insurance benefits to our employees or the payment of penalties if such coverage is not provided, would increase our expense. If we are unable to pass-through these charges to our clients to cover this expense, such increases in expense could adversely impact our operating costs and results of operations.

In addition, under the Act, employers will have to file a significant amount of additional information with the Internal Revenue Service. These and other requirements related to compliance under the Act could result in increased costs, expanded liability exposure, and other changes in the way we provide healthcare and other benefits to our employees.

10

We have clients located in many states which have had and may continue to experience significant budget deficits and such deficits may result in reduction of reimbursements to nursing homes.

Many states in which our clients are located have significant budget deficits as a result of lower than projected revenue collections and increased demand for the funding of entitlements. As a result of these and other adverse economic factors, state Medicaid programs are reconsidering previously approved increases in nursing home reimbursement or are considering delaying those increases. Some states have over the past year indicated they may be unable to make entitlement payments, including Medicaid payments to nursing homes. Any disruption or delay in the distribution of Medicaid and related payments to our clients will adversely affect their liquidity and impact their ability to pay us as agreed upon for the services provided.

The Company has substantial investment in the creditworthiness and financial condition of our customers.

The largest current asset on our balance sheet is our accounts and notes receivable balances from our customers. We grant credit to substantially all of our customers. Deterioration in financial condition across a significant component of our customer base could hinder our ability to collect amounts from our customers. The potential causes of such decline include national or local economic downturns, customers’ dependence on continued Medicare and Medicaid funding and the impact of additional regulatory actions. When contractual terms are not met, we generally encounter difficulty in collecting amounts due from certain of our clients. Therefore, we have sometimes been required to extend the period of payment for certain clients beyond contractual terms. These clients include those who have terminated service agreements and slow payers experiencing financial difficulties. In making our credit evaluations, in addition to analyzing and anticipating, where possible, the specific cases described above, we consider the general collection risk associated with trends in the long-term care industry. We also establish credit limits, perform ongoing credit evaluation and monitor accounts to minimize the risk of loss. Notwithstanding our efforts to minimize credit risk exposure, our clients could be adversely affected if future industry trends change in such a manner as to negatively impact their cash flows. If our clients experience a negative impact in their cash flows, it would have a material adverse effect on our consolidated results of operations, financial condition and cash flows.

We have a Paid Loss Retrospective Insurance Plan for general liability and workers’ compensation insurance.

We self-insure or carry a high deductible, and therefore retain a substantial portion of the risk associated with the expected losses under our general liability and workers' compensation programs. Under our insurance plans for general liability and workers’ compensation, predetermined loss limits are arranged with our insurance company to limit both our per occurrence cash outlay and annual insurance plan cost. We regularly evaluate our claims pay-out experience and other factors related to the nature of specific claims in arriving at the basis for our accrued insurance claims estimate. Our evaluation is based primarily on current information derived from reviewing our claims experience and industry trends. In the event that our known claims experience and/or industry trends result in an unfavorable change in initial estimates of costs to settle such claims resulting from, among other factors, the severity levels of reported claims and medical cost inflation, it would have an adverse effect on our consolidated results of operations, financial condition and cash flows. During 2014, the Company recorded a one-time, non-cash adjustment of $37,416,000 related to a change in estimate and reserve methodology through the utilization of a third party actuary. Although we engage third-party experts to assist us in estimating appropriate insurance accounting reserves, the determination of the required reserves is dependent upon significant actuarial judgments that have a material impact on our reserves. Changes in our insurance reserves as a result of our periodic evaluation of the related liabilities may cause significant volatility in our operating results.

Federal, State and Local tax rules can adversely impact our results of operations and financial position.

We are subject to Federal, State and Local taxes in the United States. Significant judgment is required in determining the provision of income taxes. We believe our income tax estimates are reasonable. Although, if the Internal Revenue Service or other taxing authority disagrees with a taken tax position and upon final adjudication we are unsuccessful, we could incur additional tax liability, including interest and penalty. Such costs and expenses could have a material adverse impact on our results of operations and financial position. Additionally, the taxability of our services is subject to various interpretations within the taxing jurisdictions of our markets. Consequently, in the ordinary course of business, a jurisdiction may contest our reporting positions with respect to the application of its tax code to our services. A conflicting position taken by a state or local taxation authority on the taxability of our services could result in additional tax liabilities which we may not be able to pass on to our clients or could negatively impact our competitive position in that jurisdiction. Additionally, if we fail to comply with applicable tax laws and regulations we could suffer civil or criminal penalties in addition to the delinquent tax assessment. In the taxing jurisdictions where our services have been determined to be subject to tax, the jurisdiction may increase the tax rate assessed on such services. We endeavor to pass-through to our clients such tax increases. In the event we are not able to pass-through any portion of the tax increase, our gross margin could be adversely impacted.

11

Our business and financial results could be adversely affected by unfavorable results of material litigation or governmental inquiries.

We are currently involved in civil litigations and government inquiries which arise in the ordinary course of business. These matters relate to, among other things, general liability, payroll or employee-related matters, as well as inquiries from governmental agencies. Legal actions could result in substantial monetary damages and expenses and may adversely affect our reputation and business status with our clients whether we are ultimately determined to be liable or not. The outcome of litigation, particularly class action and collective action lawsuits and regulatory actions, is difficult to assess or quantify. The plaintiffs in these types of actions may seek recovery of very large or indeterminate amounts, and estimates may remain unknown for substantial periods of time.

We assess contingencies to determine the degree of probability and range of possible loss of potential accrual in our financial statements. We would accrue an estimated loss contingency in our financial statements if it were probable that a liability had been incurred and the amount of the loss could be reasonably estimated. Due to the unpredictable and unfavorable nature of litigation, assessing contingencies is highly subjective and requires judgments about future events. The amount of actual losses may differ from our current assessment. As a result of the costs and expenses of defending ourselves against lawsuits or claims, and risks and consequences of legal actions, regardless of merit, our results of operations and financial position could be adversely affected or cause variability in our results compared to expectations.

We primarily provide our services pursuant to agreements which have a one year term, cancelable by either party upon 30 to 90 days’ notice after the initial 60 to 120 day service agreement period.

We do not enter into long-term contractual agreements with our clients for the rendering of our services. Consequently, our clients can unilaterally decrease the amount of services we provide or terminate all services pursuant to the terms of our service agreements. Any loss of a significant number of clients during the first year of providing services, for which we have incurred significant start-up costs or invested in an equipment installation, could in the aggregate materially adversely affect our consolidated results of operations and financial position.

The Company's business success depends on the management experience of our key personnel.

We manage and provide our services through a network of management personnel, from the on-site facility manager up to our executive officers. Therefore, we believe that our ability to recruit and sustain the internal development of managerial personnel is an important factor impacting future operating results and our ability to successfully execute projected growth strategies. Our professional management personnel are the key personnel in maintaining and selling additional services to current clients and obtaining new clients.

Governmental regulations related to labor, employment, immigration and health and safety could adversely impact our results of operations and financial condition.

Our business is subject to various federal, state, and local laws and regulations, in areas such as labor, employment, immigration, and health and safety. These laws frequently evolve through case law, legislative changes and changes in regulatory interpretation, implementation and enforcement. Our policies and procedures and compliance programs are subject to adjustments in response to these changing regulatory and enforcement environments. For example, the Department of Labor (“DOL”) recently issued proposed rule changes to the Fair Labor Standards Act (“FLSA”) that would increase the minimum salary threshold for employees exempt from overtime along with an automatic annual increase to this salary threshold. This proposed change, as well as other potential changes, could increase our cost of services provided. Although we have contractual rights to pass cost increases we incur to our clients due to regulatory changes, our delay in, or inability to pass such costs of our compliance with legislative changes and changes in regulatory interpretation or enforcement in general, through to our clients could have a material adverse effect on our financial condition, results of operations and cash flows

In addition, if we fail to comply with applicable laws, we may be subject to lawsuits, investigations, criminal sanctions or civil remedies, including fines, penalties, damages, reimbursement, or injunctions. Also, our clients’ facilities are subject to periodic inspection by federal, state, and local authorities for compliance with state and local departments of health requirements. Expenses resulting from failed inspections of the departments that we service could result in our clients’ being fined and seeking recovery from us, which could also adversely impact our financial condition, results of operations and cash flows.

12

We may be adversely affected by inflationary or market fluctuations in the cost of products consumed in providing our services or our cost of labor. Additionally, we rely on certain vendors for housekeeping, laundry and dietary supplies.

The prices we pay for the principal items we consume in performing our services are dependent primarily on current market prices. We have consolidated certain supply purchases with national vendors through agreements containing negotiated prospective pricing. In the event such vendors are not able to comply with their obligations under the agreements and we are required to seek alternative suppliers, we may incur increased costs of supplies.

Dietary supplies, to a much greater extent than Housekeeping supplies, are impacted by commodity pricing factors, which in many cases are unpredictable and outside of our control. We endeavor to pass on to clients such increased costs but sometimes we are unable to do so. Even when we are able to pass on te incremental costs to our clients, from time to time, sporadic unanticipated increases in the costs of certain supply items due to market economic conditions may result in a timing delay in passing on such increases to our clients. It is this type of spike in Dietary supplies’ costs that could most adversely affect Dietary’s operating performance. The adverse effect would be realized if we delay in passing on such costs to our clients or in instances where we may not be able to pass such increase on to our clients until the time of our next scheduled service billing review. We endeavor to mitigate the impact of an unanticipated increase in such supplies’ costs through consolidation of vendors, which increases our ability to obtain reduced pricing.

Our cost of labor may be influenced by unanticipated factors in certain market areas or increases in the respective collective bargaining agreements that we are a party to. A substantial number of our employees are hourly employees whose wage rates are affected by increases in the federal or state minimum wage rate. As collective bargaining agreements are renegotiated or minimum wage rates increase, which currently will occur in about eighteen states in 2016, we may need to increase the wages paid to employees. This may be applicable to not only minimum wage employees but also to employees at wage rates which are currently above the minimum wage. Although we have contractual rights to pass such wage increases through to our clients, our delay in, or inability to pass such wage increases through to our clients could have a material adverse effect on our financial condition, results of operations and cash flows.

Any perceived or real health risks related to the food industry could adversely affect our Dietary segment.

We are subject to risks affecting the food industry generally, including food spoilage and food contamination. Our products are susceptible to contamination by disease-producing organisms, or pathogens, such as listeria monocytogenes, salmonella, campylobacter, hepatitis A, trichinosis and generic E. coli. Because these pathogens are generally found in the environment, there is a risk that these pathogens could be introduced to our products as a result of improper handling at the manufacturing, processing or food service level. Our suppliers' manufacturing facilities and products are subject to extensive laws and regulations relating to health, food preparation, sanitation and safety standards. Difficulties or failures by these companies in obtaining any required licenses or approvals or otherwise complying with such laws and regulations could adversely affect our revenue that is generated from these companies. Furthermore, there can be no assurance that compliance with governmental regulations by our suppliers will eliminate the risks related to food safety.

Additionally, the Company may be subject to liability if the consumption of our food products causes injury, illness or death. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertion that the Company's products caused injury or illness could adversely affect the Company's reputation.

Events reported in the media, such as incidents involving food-borne illnesses or food tampering, whether or not accurate, can cause damage to the reputation of our dietary segment. In addition, to the extent there is an outbreak of food related illness in any of our client facilities, it could materially harm our business, results of operations and financial condition.

Changes in interest rates and changes in financial market conditions may result in fluctuating and even negative returns in our investments, and could increase the cost of the borrowings under our borrowing agreements.

Although management believes we have a prudent investment policy, we are exposed to fluctuations in interest rates and in the market values of our investment portfolio which could adversely impact our financial condition and results of operations. Our marketable securities are primarily invested in municipal bonds. We believe that our investment criteria which includes reducing our exposure to individual states, requiring certain credit ratings and monitoring our investments’ duration period, reduces our exposure related to the financial duress and budget shortfalls that many state and local governments currently face. Increases in market interest rates in our borrowing agreements that have variable interest rates could adversely affect our payment obligations and adversely affect our liquidity and earnings.

13

Market expectations are high and rely greatly on execution of our growth strategy and related increases in financial performance.

Management believes the historical price increases of our Common Stock reflect high market expectations for our future operating results. In particular, our ability to attract new clients, through organic growth or acquisitions, has enabled us to execute our growth strategy and increase market share. Our business strategy focuses on growth and improving profitability through obtaining service agreements with new clients, providing new services to existing clients, obtaining modest price increases on service agreements with clients and maintaining internal cost reduction strategies at our various operational levels. In respect to providing new services to new or existing clients, our strategy is to achieve corresponding profit margins in each of our segments. If, in the event we are not able to continue either historical client revenue and profitability growth rates or projected improvement, our operating performance may be adversely affected and the high expectations for our market performance may not be met. Any failure to meet the market’s high expectations for our revenue and operating results may have an adverse effect on the market price of our Common Stock.

Failure to maintain effective internal control over financial reporting could have a material adverse effect on our ability to report our financial results on a timely and accurate basis.

We are required to maintain internal control over financial reporting pursuant to Rule 13a-15 under the Exchange Act. Failure to maintain such controls could result in misstatements in our financial statements and potentially subject us to sanctions or investigations by the SEC or other regulatory authorities or could cause us to delay the filing of required reports with the SEC and our reporting of financial results. Any of these events could result in a decline in the market price of our Common Stock. Although we have taken steps to maintain our internal control structure as required, we cannot assure you that control deficiencies will not result in a misstatement in the future.

Recent government regulations may impact our ability to distribute dividends or the amount of such dividends to shareholders. Any decrease in or suspension of our dividend could cause our stock price to decline.

We expect to continue to pay a regular quarterly cash dividend. However, our dividend policy and the payment of future cash dividends under the policy are subject to the final determination each quarter by our Board of Directors that (i) the dividend will be made in compliance with laws applicable to the declaration and payment of cash dividends, including Section 1551(b) of the Pennsylvania Business Corporation Law, and (ii) the policy remains in our best interests, which determination will be based on a number of factors, including the impact of changing laws and regulations, economic conditions, our results of operations and/or financial condition, capital resources, the ability to satisfy financial covenants and other factors considered relevant by the Board of Directors. While we have continually increased the amount of our dividends, given these considerations, there can be no assurance these increases will continue and our Board of Directors may increase or decrease the amount of the dividend at any time and may also decide to suspend or discontinue the payment of cash dividends in the future. Any decrease in the amount of the dividend, or suspension or discontinuance of payment of a dividend, could cause our stock price to decline.

14

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We lease our corporate offices, located at 3220 Tillman Drive, Suite 300, Bensalem, Pennsylvania 19020. We also lease office space at other locations in Pennsylvania, Colorado, South Carolina, Connecticut, Georgia, Illinois, California and New Jersey. The New Jersey office is the headquarters of our subsidiaries and HCSG Insurance Corp. The other locations serve as divisional or regional offices providing management and administrative services to both of our operating segments in their respective geographical areas.

We are also provided with office and storage space at each of our client facilities.

Management does not foresee any difficulties with regard to the continued utilization of all of the aforementioned premises. We also believe that such properties are sufficient for our current operations.

We presently own laundry equipment, office furniture and equipment, housekeeping equipment and vehicles. Such office furniture and equipment, and vehicles are primarily located at our corporate office, warehouse, and divisional and regional offices. We have housekeeping equipment at all client facilities where we provide services under a full service housekeeping agreement. Generally, the aggregate cost of housekeeping equipment located at each client facility is less than $2,500. Additionally, we have laundry installations at certain client facilities. Our cost of such laundry installations ranges between $5,000 and $100,000. We believe that such laundry equipment, office furniture and equipment, housekeeping equipment and vehicles are sufficient for our current operations.

Item 3. Legal Proceedings.

In the normal course of business, the Company is involved in various administrative and legal proceedings, including labor and employment, contracts, personal injury, and insurance matters. The Company believes it is not a party to, nor are any of its properties the subject of, any pending legal proceeding or governmental examination that would have a material adverse effect on the Company's consolidated financial condition or liquidity. However, in light of the uncertainties involved in such proceedings, the ultimate outcome of a particular matter could become material to the Company’s results of operations for a particular period depending on, among other factors, the size of the loss or liability imposed and the level of the Company’s operating income for that period.

Item 4. Mine Safety Disclosures.

Not applicable.

15

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock, $.01 par value (the “Common Stock”), is traded under the symbol “HCSG” on the NASDAQ Global Select Market. As of February 16, 2016, there were approximately 72,177,000 shares of our Common Stock outstanding.

The high and low sales price quotations for our Common Stock during the years ended December 31, 2015 and 2014 ranged as follows:

2015 | |||||||

Quarter Ended | High | Low | |||||

March 31, 2015 | $ | 34.75 | $ | 29.93 | |||

June 30, 2015 | $ | 33.90 | $ | 29.42 | |||

September 30, 2015 | $ | 35.49 | $ | 31.57 | |||

December 31, 2015 | $ | 38.49 | $ | 33.10 | |||

2014 | |||||||

Quarter Ended | High | Low | |||||

March 31, 2014 | $ | 29.14 | $ | 24.40 | |||

June 30, 2014 | $ | 30.58 | $ | 28.12 | |||

September 30, 2014 | $ | 30.69 | $ | 25.51 | |||

December 31, 2014 | $ | 31.96 | $ | 26.54 | |||

Holders

We have been advised by our transfer agent, American Stock Transfer and Trust Company, that we had approximately 550 holders of record of our Common Stock as of February 16, 2016. Based on reports of security position listings compiled for the 2015 annual meeting of shareholders, we believe we may have approximately 7,000 beneficial owners of our Common Stock.

Dividends

We have paid regular quarterly cash dividends since the second quarter of 2003. During 2015, we paid regular quarterly cash dividends totaling $51,375,000 as detailed below:

Quarter Ended | |||||||||||||||

March 31, 2015 | June 30, 2015 | September 30, 2015 | December 31, 2015 | ||||||||||||

Cash dividend per common share | $ | 0.17625 | $ | 0.17750 | $ | 0.17875 | $ | 0.18000 | |||||||

Total cash dividends paid | $ | 12,655,000 | $ | 12,760,000 | $ | 12,923,000 | $ | 13,037,000 | |||||||

Record date | February 20, 2015 | May 22, 2015 | August 21, 2015 | November 20, 2015 | |||||||||||

Payment date | March 27, 2015 | June 26, 2015 | September 25, 2015 | December 18, 2015 | |||||||||||

Additionally, on January 26, 2016, our Board of Directors declared a regular quarterly cash dividend of $0.18125 per common share, which will be paid on March 25, 2016 to shareholders of record as of the close of business on February 19, 2016.

Our Board of Directors reviews our dividend policy on a quarterly basis. Although there can be no assurance that we will continue to pay dividends or the amount of the dividend, we expect to continue to pay a regular quarterly cash dividend. In connection with the establishment of our dividend policy, we adopted a Dividend Reinvestment Plan in 2003.

16

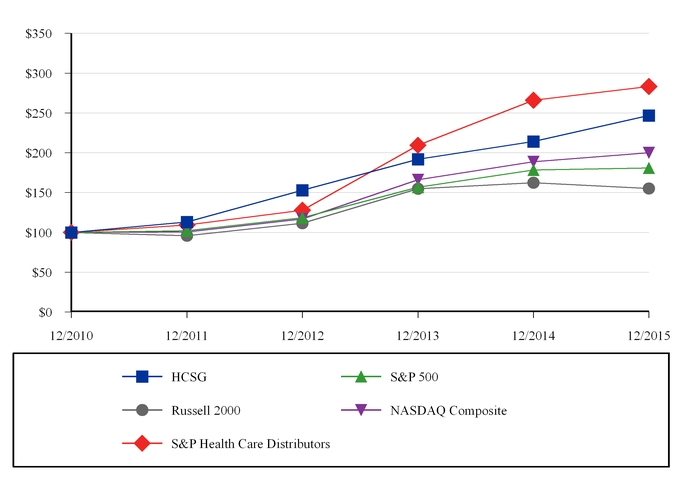

Performance Graph

The graph below matches Healthcare Services Group, Inc.'s cumulative 5-Year total shareholder return on common stock with the cumulative total returns of the S&P 500 index, the Russell 2000 index, the NASDAQ Composite index, and the S&P Health Care Distributors index. The graph tracks the performance of a $100 investment in our common stock and in each index (with the reinvestment of all dividends) from 12/31/2010 to 12/31/2015.

The Company has changed its indexes for fiscal 2015, removing S&P Health Care Distributers index and replacing it with the Russell 2000 and NASDAQ Composite indexes. The company believes these two indexes more appropriately reflect our performance relative to our peers. As required by Item 201 (e) (4) of Regulation S-K, we are also including the S&P Health Care Distributors index.

Comparison of 5 Year Cumulative Total Return*

Among Healthcare Services Group, Inc., the S&P 500 Index,

the Russell 2000 Index, the NASDAQ Composite Index and the S&P Health Care Distributors Index

the Russell 2000 Index, the NASDAQ Composite Index and the S&P Health Care Distributors Index

*$100 invested on 12/31/10 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

Copyright© 2016 S&P, a division of McGraw Hill Financial. All rights reserved.

Copyright© 2016 Russell Investment Group. All rights reserved.

Fiscal year ending December 31.

Copyright© 2016 S&P, a division of McGraw Hill Financial. All rights reserved.

Copyright© 2016 Russell Investment Group. All rights reserved.

17

December 31, | |||||||||||||||||||||||||

Company/Index | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||||||

Healthcare Services Group, Inc. | $ | 100.00 | $ | 112.90 | $ | 152.79 | $ | 191.78 | $ | 214.25 | $ | 246.72 | |||||||||||||

S&P 500 | $ | 100.00 | $ | 102.11 | $ | 118.45 | $ | 156.82 | $ | 178.29 | $ | 180.75 | |||||||||||||

Russell 2000 | $ | 100.00 | $ | 95.82 | $ | 111.49 | $ | 154.78 | $ | 162.35 | $ | 155.18 | |||||||||||||

NASDAQ Composite | $ | 100.00 | $ | 100.53 | $ | 116.92 | $ | 166.19 | $ | 188.78 | $ | 199.95 | |||||||||||||

S&P Health Care Distributors | $ | 100.00 | $ | 109.38 | $ | 127.71 | $ | 209.42 | $ | 266.00 | $ | 283.24 | |||||||||||||

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

18

Item 6. Selected Financial Data.

The following selected condensed consolidated financial data has been derived from, and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and Notes thereto, included elsewhere in this report on Form 10-K and incorporated herein by reference.

Years Ended December 31, | |||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

(in thousands, except per share amounts) | |||||||||||||||||||

Selected Operating Results | |||||||||||||||||||

Revenues | $ | 1,436,849 | $ | 1,293,183 | $ | 1,149,890 | $ | 1,077,435 | $ | 889,065 | |||||||||

Net income | $ | 58,024 | $ | 21,850 | $ | 47,129 | $ | 44,214 | $ | 38,156 | |||||||||

Basic earnings per common share | $ | 0.81 | $ | 0.31 | $ | 0.68 | $ | 0.65 | $ | 0.57 | |||||||||

Diluted earnings per common share | $ | 0.80 | $ | 0.31 | $ | 0.67 | $ | 0.65 | $ | 0.56 | |||||||||

Selected Balance Sheet Date | |||||||||||||||||||

Total assets | $ | 480,949 | $ | 469,579 | $ | 425,342 | $ | 331,183 | $ | 289,695 | |||||||||

Stockholders’ equity | $ | 296,456 | $ | 275,830 | $ | 285,143 | $ | 229,570 | $ | 217,726 | |||||||||

Selected Other Financial Data | |||||||||||||||||||

Working capital | $ | 269,881 | $ | 216,869 | $ | 210,089 | $ | 200,182 | $ | 186,734 | |||||||||

Cash dividends per common share | $ | 0.72 | $ | 0.69 | $ | 0.67 | $ | 0.65 | $ | 0.63 | |||||||||

Weighted average number of common shares outstanding - basic EPS | 71,826 | 70,616 | 69,206 | 67,511 | 66,637 | ||||||||||||||

Weighted average number of common shares outstanding - diluted EPS | 72,512 | 71,341 | 70,045 | 68,485 | 67,585 | ||||||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

You should read the following discussion and analysis of our financial condition and results of our operations in conjunction with our consolidated financial statements and the related notes to those statements included elsewhere in this report. This discussion contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. Our actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed in the section entitled "Risk Factors," and elsewhere in this report on Form 10-K. We are on a calendar year end, and except where otherwise indicated below, "2015" refers to the year ended December 31, 2015, "2014" refers to the year ended December 31, 2014 and "2013" refers to the year ended December 31, 2013.

Results of Operations

The following discussion is intended to provide the reader with information that will be helpful in understanding our financial statements including the changes in certain key items in comparing financial statements period to period. We also intend to provide the primary factors that accounted for those changes, as well as a summary of how certain accounting principles affect our financial statements. In addition, we are providing information about the financial results of our two operating segments to further assist in understanding how these segments and their results affect our consolidated results of operations. This discussion should be read in conjunction with our financial statements as of December 31, 2015 and the year then ended and the notes accompanying those financial statements contained herein under Item 8.

Overview

We provide management, administrative and operating expertise and services to the housekeeping, laundry, linen, facility maintenance and dietary service departments of the health care industry, including nursing homes, retirement complexes, rehabilitation centers and hospitals located throughout the United States. We believe that we are the largest provider of housekeeping and laundry management services to the long-term care industry in the United States, rendering such services to approximately 3,500 facilities in 48 states as of December 31, 2015. Although we do not directly participate in any government reimbursement programs, our clients’ reimbursements are subject to government regulation. Therefore, our clients are directly affected by any legislation relating to Medicare and Medicaid reimbursement programs.

19

We provide our services primarily pursuant to full service agreements with our clients. In such agreements, we are responsible for the day to day management of employees located at our clients’ facilities. We also provide services on the basis of a management-only agreement for a limited number of clients. Our agreements with clients typically provide for renewable one year service terms, cancelable by either party upon 30 to 90 days’ notice after the initial 60 to 120 day period.

We are organized into two reportable segments; housekeeping, laundry, linen and other services (“Housekeeping”) and dietary department services (“Dietary”). At December 31, 2015, we provided Housekeeping at essentially all of our 3,500 client facilities, generating approximately 63% or $909,709,000 of 2015 total revenues. Dietary is provided to over 1,000 client facilities at December 31, 2015 and contributed approximately 37% or $527,140,000 of 2015 total revenues.

Housekeeping consists of managing the client’s housekeeping department which is principally responsible for the cleaning, disinfecting and sanitizing of patient rooms and common areas of a client’s facility, as well as laundering and processing of the personal clothing belonging to the facility’s patients. Also within the scope of this segment’s service is the responsibility for laundering and processing the bed linens, uniforms and other assorted linen items utilized by a client facility.

Dietary consists of managing the client’s dietary department which is principally responsible for food purchasing, meal preparation and providing dietitian consulting professional services, which includes the development of a menu that meets the patient’s dietary needs.

Our ability to acquire new clients and increase revenues is affected by many factors. Competitive factors consist primarily of competing with the potential client utilizing an in-house support staff, as well as local companies which provide services similar to ours. We are unaware of any other companies, on a national or local level, which have a significant presence or impact on our procurement of new clients in our market. We believe the primary revenue drivers of our business are our ability to obtain new clients and to pass through, by means of service billing increases, increases in our cost of providing the services. In addition to the recoupment of costs increases, we endeavor to obtain modest annual revenue increases from our existing clients to preserve current profit margins at the facility level. The primary economic factor in acquiring new clients is our ability to demonstrate the cost-effectiveness of our services, because many of our clients’ revenues are generally highly reliant on Medicare and Medicaid reimbursement funding rates and mechanisms. Therefore, their economic decision-making process in engaging us is driven significantly by their reimbursement funding rate structure in relation to how their costs are currently being reimbursed and the financial impact on their reimbursement as a result of engaging us for the respective services. Another factor is our ability to demonstrate to potential clients the benefit of being relieved of the administrative and operational challenges related to the day-to-day management of their respective department services for which they contract with us. In addition, we must be able to assure new clients that we can to improve the quality of service that they are providing to their patients and residents. We believe the factors discussed above are equally applicable to each of our segments with respect to acquiring new clients and increasing revenues.