Exhibit 2.1 Agreement

EXECUTION VERSION

|

|

|

PURCHASE AND SALE AGREEMENT |

by and between |

PPL Montana, LLC |

and |

NorthWestern Corporation |

Dated as of September 26, 2013 |

|

|

TABLE OF CONTENTS

Page

|

| | | |

| ARTICLE I | |

| DEFINITIONS | |

|

| |

SECTION 1.1. | Definitions | 1 |

|

| | |

| ARTICLE II | |

| PURCHASE AND SALE | |

|

| |

SECTION 2.1. | Purchase and Sale of the Acquired Assets and Purchase Price | 2 |

|

SECTION 2.2. | Capital Expenditures Adjustment; PPA Termination Adjustment | 6 |

|

SECTION 2.3. | Allocation of Purchase Price | 8 |

|

SECTION 2.4. | Acquired Assets Proration | 8 |

|

SECTION 2.5. | Closing | 10 |

|

SECTION 2.6. | Seller's Deliverables | 10 |

|

SECTION 2.7. | Buyer Deliverables | 11 |

|

SECTION 2.8. | Withholding | 12 |

|

| | |

| ARTICLE III | |

| REPRESENTATIONS AND WARRANTIES RELATING TO SELLER | |

| | |

SECTION 3.1. | Organization and Existence | 12 |

|

SECTION 3.2. | Authorization | 12 |

|

SECTION 3.3. | Noncontravention | 13 |

|

SECTION 3.4. | Governmental Consents | 13 |

|

SECTION 3.5. | Absence of Certain Changes or Events | 13 |

|

SECTION 3.6. | Legal Proceedings | 13 |

|

SECTION 3.7. | Compliance with Laws; Permits | 14 |

|

SECTION 3.8. | Title to Acquired Assets; Sufficiency of Acquired Assets; Condition of Acquired Assets | 14 |

|

SECTION 3.9. | Material Contracts; Assigned Contracts | 15 |

|

SECTION 3.10. | Real Property | 17 |

|

SECTION 3.11. | Employee Benefits Matters | 18 |

|

SECTION 3.12. | Labor Matters | 19 |

|

SECTION 3.13. | Environmental Matters | 20 |

|

SECTION 3.14. | Insurance | 21 |

|

SECTION 3.15. | Taxes | 22 |

|

SECTION 3.16. | Intellectual Property | 22 |

|

SECTION 3.17. | Credit Support | 23 |

|

SECTION 3.18. | Brokers | 23 |

|

SECTION 3.19. | Exclusive Representations and Warranties | 23 |

|

| | |

| ARTICLE IV | |

| REPRESENTATIONS AND WARRANTIES OF BUYER | |

| | |

SECTION 4.1. | Organization and Existence | 23 |

|

SECTION 4.2. | Authorization | 23 |

|

|

| | | |

SECTION 4.3. | Consents | 24 |

|

SECTION 4.4. | Noncontravention | 24 |

|

SECTION 4.5. | Legal Proceedings | 24 |

|

SECTION 4.6. | Compliance with Laws | 24 |

|

SECTION 4.7. | Brokers | 24 |

|

SECTION 4.8. | Financing; Available Funds | 24 |

|

SECTION 4.9. | Investigation | 25 |

|

SECTION 4.10. | Disclaimer Regarding Projections | 25 |

|

SECTION 4.11. | Regulatory Status | 25 |

|

SECTION 4.12. | Tax Matters | 25 |

|

SECTION 4.13. | No Other Representations or Warranties | 26 |

|

| | |

| ARTICLE V | |

| COVENANTS | |

| | |

SECTION 5.1. | Access to Information | 26 |

|

SECTION 5.2. | Conduct of Business Pending the Closing | 28 |

|

SECTION 5.3. | Support Obligations | 31 |

|

SECTION 5.4. | Assigned Contracts | 32 |

|

SECTION 5.5. | Confidentiality; Publicity | 33 |

|

SECTION 5.6. | Expenses | 33 |

|

SECTION 5.7. | Regulatory and Other Approvals | 33 |

|

SECTION 5.8. | Seller Marks | 35 |

|

SECTION 5.9. | Casualty Losses | 36 |

|

SECTION 5.10. | Condemnation | 37 |

|

SECTION 5.11. | Insurance | 38 |

|

SECTION 5.12. | Terminated Contracts and Transition Services | 38 |

|

SECTION 5.13. | Transfer Taxes | 39 |

|

SECTION 5.14. | Employee, Labor and Benefits Matters | 39 |

|

SECTION 5.15. | Cash Grant Matters | 43 |

|

SECTION 5.16. | Real Property | 44 |

|

SECTION 5.17. | Monthly Operating Report | 45 |

|

SECTION 5.18. | Kerr Conveyance Price | 45 |

|

SECTION 5.19. | Seller Financing Cooperation | 47 |

|

SECTION 5.20. | Further Actions | 48 |

|

SECTION 5.21 | Assigned Transmission Contract | 48 |

|

SECTION 5.22. | Resolution of Certain Claims | 48 |

|

SECTION 5.23. | Buyer Financing Efforts | 49 |

|

SECTION 5.24. | Sale-Leaseback | 50 |

|

SECTION 5.25. | Rainbow Demolition Plan | 51 |

|

| | |

| ARTICLE VI | |

| SPECIFIED CONDITIONS | |

| | |

SECTION 6.1. | Buyer's Conditions Precedent | 51 |

|

SECTION 6.2. | Seller's Conditions Precedent | 53 |

|

|

| | | |

| ARTICLE VII | |

| SURVIVAL; INDEMNIFICATION AND RELEASE | |

| | |

SECTION 7.1. | Survival | 54 |

|

SECTION 7.2. | Indemnification by Seller | 55 |

|

SECTION 7.3. | Indemnification by Buyer | 56 |

|

SECTION 7.4. | Indemnification Procedures | 56 |

|

SECTION 7.5. | General | 58 |

|

SECTION 7.6. | “As Is” Sale; Release | 59 |

|

SECTION 7.7. | Right to Specific Performance; Certain Limitations | 60 |

|

| | |

| ARTICLE VIII | |

| TERMINATION, AMENDMENT AND WAIVER | |

| | |

SECTION 8.1. | Grounds for Termination | 61 |

|

SECTION 8.2. | Effect of Termination | 62 |

|

| | |

| ARTICLE IX | |

| MISCELLANEOUS | |

| | |

SECTION 9.1. | Notices | 62 |

|

SECTION 9.2. | Severability | 63 |

|

SECTION 9.3. | Counterparts | 63 |

|

SECTION 9.4. | Entire Agreement; No Third-Party Beneficiaries | 63 |

|

SECTION 9.5. | Governing Law | 64 |

|

SECTION 9.6. | Consent to Jurisdiction; Waiver of Jury Trial | 64 |

|

SECTION 9.7. | Assignment | 64 |

|

SECTION 9.8. | Headings | 65 |

|

SECTION 9.9. | Construction | 65 |

|

SECTION 9.10. | Amendments and Waivers | 66 |

|

SECTION 9.11. | Schedules and Exhibits | 66 |

|

SECTION 9.12. | Waiver of Claims Against Financing Sources | 66 |

|

|

| |

Appendices | |

| |

Appendix A | Defined Terms |

| |

Exhibits | |

| |

Exhibit A | Seller Guaranty |

Exhibit B | Deeds |

Exhibit C | Bill of Sale and Assignment Agreement |

Exhibit D | FIRPTA Certificate |

Exhibit E | [Reserved] |

Exhibit F-1 | Seller Officer's Certificate |

Exhibit F-2 | Seller Secretary's Certificate |

Exhibit G-1 | Buyer Officer's Certificate |

Exhibit G-2 | Buyer Secretary's Certificate |

Exhibit H | Post-Closing Confidentiality Agreement |

Exhibit I | Termination and Release Agreement |

Exhibit J | WECC Registration Letter |

Exhibit K | Sale-Leaseback Termination Letter Agreements |

| |

Schedules | |

| |

Schedule 1.1(a) | Budgeted Capital Expenditures |

Schedule 1.1(b) | FERC Approvals |

Schedule 1.1(c) | Kerr Conveyance |

Schedule 1.1(d) | MPSC Approvals |

Schedule 1.1(e) | Permitted Liens |

Schedule 1.1(f) | PPA Termination Adjustment |

Schedule 1.1(g) | Retained Environmental Liabilities |

Schedule 2(a) | Seller's Knowledge |

Schedule 2(b) | Buyer's Knowledge |

Schedule 2.1(a)(ii) | Equipment and Materials |

Schedule 2.1(a)(iv) | Permit Applications |

Schedule 2.1(a)(v) | Assigned Contracts |

Schedule 2.1(a)(vii) | Assigned Intellectual Property |

Schedule 2.1(a)(viii) | Vehicles and Rolling Stock |

Schedule 2.4 | Acquired Assets Proration |

Schedule 3.3 | Seller's Third Party Consents |

Schedule 3.4 | Seller's Governmental Consents |

Schedule 3.5 | Seller's Absence of Certain Changes or Events |

Schedule 3.6(a) | Seller's Legal Proceedings - Claims |

Schedule 3.6(b) | Seller's Legal Proceedings - Orders |

Schedule 3.7(b) | Seller's Compliance with Laws |

Schedule 3.7(c)(i) | Seller's Material Permits |

Schedule 3.7(c)(ii) | Seller's Permit Matters |

Schedule 3.8(b) | Seller's Sufficiency of Acquired Assets |

Schedule 3.8(d) | Seller's Warranty Matters |

|

| |

Schedule 3.9(a) | Seller's Material Contracts |

Schedule 3.9(d) | Seller's Material Contract Defaults |

Schedule 3.9(e) | Seller's Affiliate Services |

Schedule 3.9(f) | Seller's Exceptions to Lease Participation Agreements |

Schedule 3.10(a)(i) | Seller's Owned Real Property |

Schedule 3.10(a)(ii) | Seller's Owned Real Property Exceptions |

Schedule 3.10(b)(i) | Seller's Leased Real Property |

Schedule 3.10(b)(ii) | Seller's Leased Real Property Exceptions |

Schedule 3.10(d) | Seller's Sufficiency of Real Estate |

Schedule 3.10(e) | Seller's Absence of Condemnation Proceedings |

Schedule 3.11(a) | Seller's Employee Benefit Plans |

Schedule 3.11(g) | Severance and Acceleration of Benefit Plans |

Schedule 3.11(i) | Death or Medical Benefits |

Schedule 3.12(a) | Scheduled Employees |

Schedule 3.12(b) | Seller's Collective Bargaining Agreements, Strikes, Lockouts and Employment Investigations |

Schedule 3.13(a)(i) | Seller's Compliance with Environmental Law and Permits |

Schedule 3.13(a)(ii) | Seller's Environmental Permits |

Schedule 3.13(b) | Seller's Other Environmental Matters |

Schedule 3.14(a) | Seller's Insurance Policies |

Schedule 3.14(b) | Seller's Insurance Claims |

Schedule 3.14(c) | Seller's Insurance Matters |

Schedule 3.16 | Seller's Intellectual Property |

Schedule 3.17 | Seller's Support Obligations |

Schedule 4.3 | Buyer's Consents |

Schedule 4.5 | Buyer's Legal Proceedings |

Schedule 5.2(a) | Conduct of Business Pending the Closing (Acquired Assets) |

Schedule 5.2(b) | Conduct of Business Pending the Closing (Assigned Contracts and Support Obligations) |

Schedule 5.4 | Assigned Contracts Consents |

Schedule 5.12(a) | Terminated Contracts |

Schedule 5.12(b) | Transition Services |

Schedule 5.14(e) | Severance Programs |

Schedule 5.15(d) | Section 1603 Grant |

Schedule 5.17 | Monthly Operating Reports |

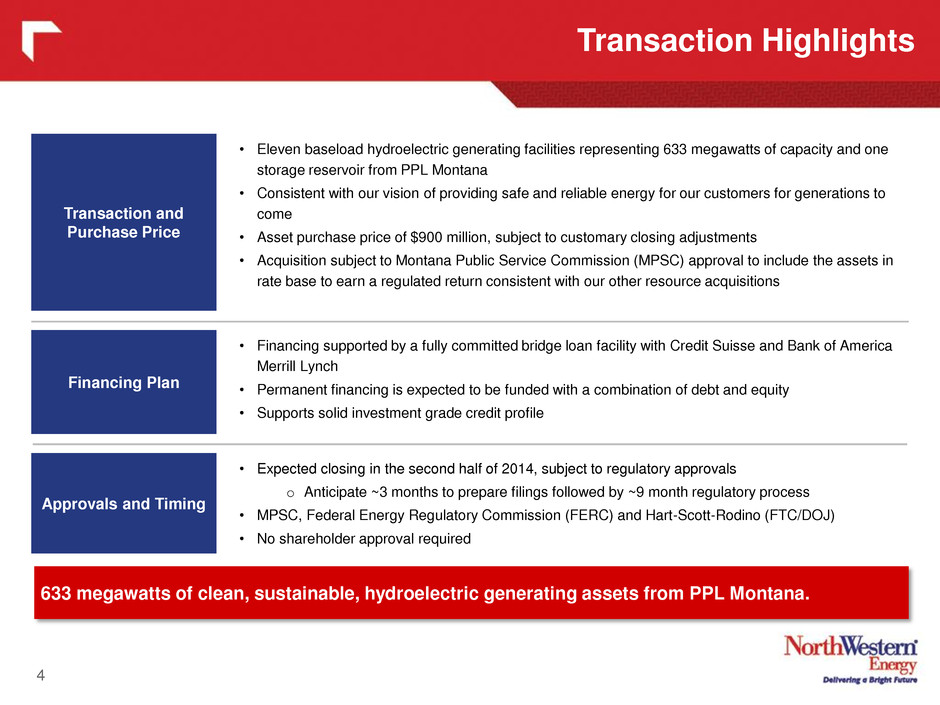

This PURCHASE AND SALE AGREEMENT (this “Agreement”) is dated as of September 26, 2013 and is by and between PPL Montana, LLC, a Delaware limited liability company (“Seller”) and NorthWestern Corporation, a corporation organized under the Laws of the state of Delaware (“Buyer”).

RECITALS

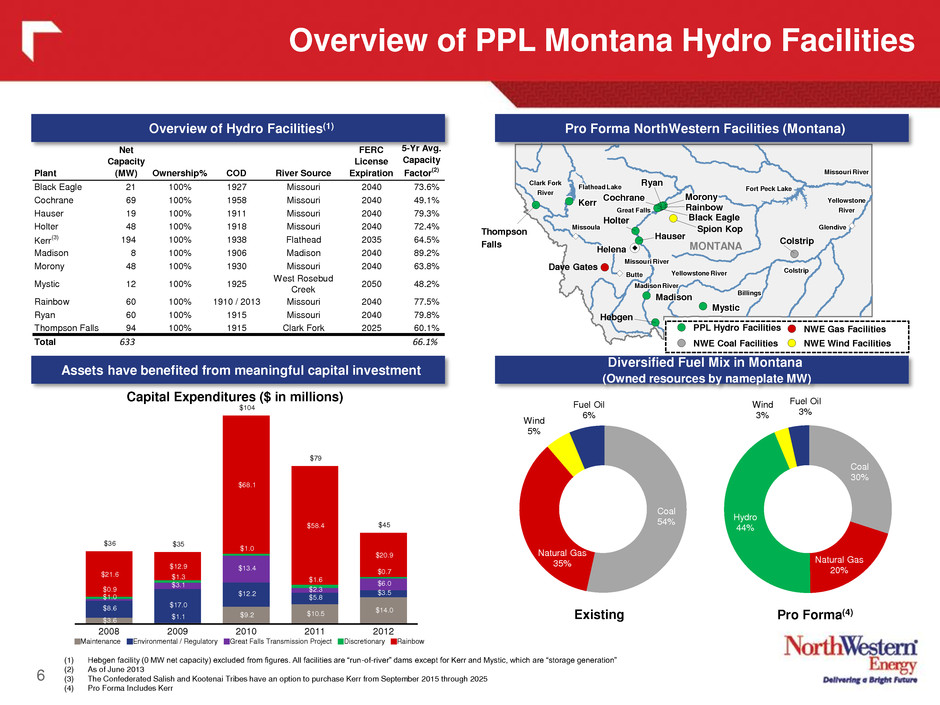

WHEREAS, Seller owns each of the following hydroelectric generating facilities, and certain facilities and other assets associated therewith and ancillary thereto: (i) Hebgen Lake storage reservoir (the “Hebgen Reservoir”); (ii) Madison Dam hydroelectric generating facility (“Madison Plant”); (iii) Hauser Dam hydroelectric generating facility (“Hauser Plant”); (iv) Holter Dam hydroelectric generating facility (“Holter Plant”); (v) Black Eagle Dam hydroelectric generating facility (“Black Eagle Plant”); (vi) Rainbow Dam hydroelectric generating facility (“Rainbow Plant”); (vii) Cochrane Dam hydroelectric generating facility (“Cochrane Plant”); (viii) Ryan Dam hydroelectric generating facility (“Ryan Plant”); (ix) Morony Dam hydroelectric generating facility (“Morony Plant” and together with the Hebgen Reservoir, the Madison Plant, the Hauser Plant, the Holter Plant, the Black Eagle Plant, the Rainbow Plant, the Cochrane Plant and the Ryan Plant, collectively the, “Missouri-Madison Project” ); (x) Kerr Dam hydroelectric generating facility (the “Kerr Plant”); (xi) Thompson Falls Dam hydroelectric generating facility (the “Thompson Falls Plant”); and (xii) Mystic Dam hydroelectric generating facility (the “Mystic Plant” and together with the Missouri-Madison Project, the Kerr Plant and the Thompson Falls Plant, collectively, the “Facilities”);

WHEREAS, in accordance with this Agreement, Buyer desires to purchase and assume, and Seller desires to sell and assign (or cause to be assigned) to Buyer the Facilities and the other Acquired Assets (along with the Assumed Liabilities) upon the Closing; and

WHEREAS, contemporaneously with the execution and delivery of this Agreement, the Guarantor, which indirectly owns 100% of the equity interests of Seller, has entered into the Guaranty, a copy of which is attached hereto as Exhibit A, pursuant to which the Guarantor guarantees all obligations of Seller under this Agreement.

NOW THEREFORE, in consideration of the premises and agreements in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby agree as follows:

ARTICLE I

DEFINITIONS

SECTION 1.1. Definitions. Capitalized terms used in this Agreement have the meanings ascribed to them by definition in this Agreement or in Appendix A hereto.

ARTICLE II

PURCHASE AND SALE

SECTION 2.1. Purchase and Sale of the Acquired Assets and Purchase Price.

(a) Seller agrees to (or, in the case of the Assigned Transmission Contract, to cause PPL EnergyPlus, LLC (“PPL EPlus”) to) sell, assign and transfer to Buyer and Buyer agrees to purchase from Seller (or, in the case of the Assigned Transmission Contract, from PPL EPlus) at Closing, subject to and upon the terms and conditions contained herein, each Facility and all of the following properties and assets used, or held for use, in the operation or maintenance of any of the Facilities (together with the Facilities, collectively, the “Acquired Assets”) free and clear of any Liens other than Permitted Liens:

(i) all parcels of real property, including any easements, license and all other real estate rights comprising or otherwise used for, the Facilities or other Acquired Assets which are described on Schedule 3.10(a)(i), and all appurtenances thereto, together with all buildings, fixtures, component parts, other constructions and other improvements thereon and thereto, including all construction work in progress (collectively, the “Owned Real Property”);

(ii) the machinery, equipment, materials, supplies, spare parts, fixed assets, furniture, inventory, vehicles and other tangible and intangible personal property (A) owned or held by Seller which are located at the Facilities (including the personal property listed on Part A of Schedule 2.1(a)(ii)) and, in the case of intangible personal property (other than Intellectual Property), otherwise used for the Facilities or the other Acquired Assets, including any Prepayments, all Material Warranties and, to the extent assignable, all other applicable warranties against manufacturers or vendors and (B) the tangible personal property in transit to the Facilities or otherwise not located at the Facilities, which is listed on Part B of Schedule 2.1(a)(ii);

(iii) all Permits owned or held by Seller related to any Facility or the Acquired Assets or otherwise owned or held by Seller for use in connection with the operation of any Facility or the Acquired Assets, including (A) the Permits listed on Schedule 3.7(c)(i) and Schedule 3.13(a)(ii), and (B) all water rights owned or held by Seller related to any Facility or the Acquired Assets or otherwise used or held for use in connection with the operation of any Facility or the Acquired Assets (the “Water Rights”), however evidenced, including those listed in Schedule 3.7(c)(i) (collectively, such Permits and Water Rights, the “Transferred Permits”); provided, that Seller shall, during the Interim Period, amend such Schedules to account for applicable changes regarding Permits, to the extent such changes are not in violation of any applicable covenants in Section 5.2;

(iv) all applications for Permits listed on Schedule 2.1(a)(iv) existing or, to the extent permitted by this Agreement, filed on or before the Closing Date related to any of the Facilities or the Acquired Assets, including any acknowledgment of Buyer as successor to Seller thereunder (“Permit Applications”); provided, that Seller shall, during the Interim Period, amend such Schedule to account for applicable changes regarding Permit

Applications, to the extent such changes are not in violation of any applicable covenants in Section 5.2;

(v) all of the right, title and interest of Seller (or, in the case of the Assigned Transmission Contract, PPL EPlus) in and to Contracts relating to the ownership, operation, maintenance or use of any of the Facilities or the Acquired Assets, including any Material Contracts, in each case listed on Schedule 2.1(a)(v) (the “Assigned Contracts”); provided, that Seller shall, during the Interim Period, amend such Schedule to account for additional Contracts entered into during the Interim Period that relate to the ownership, operation, maintenance or use of any of the Facilities or the Acquired Assets and are not in violation of any applicable covenants in Section 5.2;

(vi) subject to the right of Seller to the extent set forth herein to retain copies for its use, all Books and Records; provided that any Books and Records (or copies thereof) retained by Seller pursuant to this Agreement shall be subject to the confidentiality provisions at Section 5.5;

(vii) all of the right, title and interest of Seller in and to the Intellectual Property that is part of, or used for, the Facilities or the Acquired Assets listed on Schedule 2.1(a)(vii), and any replacement thereof (the “Assigned Intellectual Property”); provided, that the Seller may, during the Interim Period, amend such Schedule to account for applicable changes arising during the Interim Period, to the extent such changes are not in violation of any applicable covenants in Section 5.2; and

(viii) all vehicles and other rolling stock listed on Schedule 2.1(a)(viii), and any vehicles or other rolling stock in replacement thereof.

Notwithstanding the foregoing, the Acquired Assets shall in no event include any of the Excluded Assets specified in Section 2.1(b)(i)-(xiii) below.

(b) The “Excluded Assets” shall include all assets of Seller, other than the Acquired Assets, including the following:

(i) except for Prepayments, any cash, cash equivalents, certificates of deposit, bank deposits, commercial paper, securities, rights to payment, accounts receivable, credits, offsets, in-kind or exchange arrangements, and any similar rights arising from or relating to the ownership or operation of the Acquired Assets with respect to any period of time prior to the Closing (excluding any rights relating to breach of Assigned Contracts or the assertion of any warranty claims under Assigned Contracts, which rights are addressed in clause (iv) below);

(ii) all claims, causes of action, rights of recovery, rights of set-off, rights to refunds and similar rights of any kind in favor of Seller arising from or relating to the ownership or operation of the Acquired Assets that (A) pertain to an Excluded Liability or (B) are related to “Excluded Assets” of the type described in clause (iv) below;

(iii) any rights of Seller or any of its Affiliates in the name “PPL”, any other trade names, trademarks, service marks, corporate symbols or logos or any other Intellectual Property other than Assigned Intellectual Property;

(iv) any refund, credit, payment, adjustment or reconciliation (A) related to real property Taxes, personal property Taxes or other Taxes paid prior to the Closing in respect of the Acquired Assets (including any refund, credit, payment, adjustment or reconciliation relating to such Taxes attributable to any period of time prior to the Closing that are received after the Closing), except to the extent the amount of any such Taxes gave rise to an increase in the Purchase Price pursuant to Section 2.4, whether such refund, adjustment or reconciliation is received as a payment or as a credit against future Taxes payable or (B) arising under the Assigned Contracts (including payments in respect of warranty claims and claims for breach thereunder), the Permit Applications or Transferred Permits and relating to any period or portion thereof before the Closing Date; provided that payments in respect of warranty claims and claims for breach under Assigned Contracts shall only constitute “Excluded Assets” to the extent asserted by Seller or its Affiliates prior to the Closing Date and, if payments in respect of such claims are on account of damage or defects to the Acquired Assets, only to the extent such damage or defects have been repaired by or on behalf of Seller and its Affiliates prior to the Closing Date;

(v) the rights under any Contracts of Seller or its Affiliates other than the Assigned Contracts;

(vi) the rights under any Permits of Seller or its Affiliates other than the Transferred Permits or the Permit Applications;

(vii) (A) duplicate copies of all Books and Records transferred to Buyer pursuant to this Agreement or (B) any other records of Seller or its Affiliates other than the Books and Records; provided that any Books and Records (or copies thereof) retained by Seller pursuant to this Agreement shall be subject to the confidentiality provisions at Section 5.5;

(viii) any assets disposed of by Seller after the date of this Agreement to the extent such dispositions are not in violation of any applicable covenants in Section 5.2;

(ix) all of the issued and outstanding membership interests of PPL Colstrip I, LLC and PPL Colstrip II, LLC;

(x) any right or interest of Seller or its Affiliates to, or under, and any funds and property held in trust or any other funding vehicle pursuant to, any Benefit Plan;

(xi) any rights and assets to the extent associated with the ownership, operation and maintenance of the electric generation facilities of Seller other than the Facilities (the “Thermal Assets”);

(xii) all right, title and interest of Seller in owned or leased real property at Seller's offices in Billings, Butte and Helena, Montana; and

(xiii) the rights of Seller under this Agreement.

(c) On the terms and subject to the conditions set forth herein, from and after the Closing, Buyer will assume and satisfy or perform all of the following Liabilities, excluding, in all cases, the Excluded Liabilities (the “Assumed Liabilities”):

(i) all Liabilities of Seller or its Affiliates under the Assigned Contracts and Assigned Intellectual Property arising after the Closing Date;

(ii) all Liabilities associated with the Transferred Permits arising after the Closing Date;

(iii) all Liabilities associated with the Transferred Employees arising after the Closing Date;

(iv) any Liability for real property taxes and other Taxes attributable to the Acquired Assets to the extent allocated to taxable periods or portions thereof beginning after the Closing Date pursuant to the proration provided for in Section 2.4;

(v) all Environmental Liabilities of or relating to the ownership, operation or maintenance of the Acquired Assets, whether arising before, on or after the Closing Date; provided, that any Liability arising out of or relating to the matters described at items 2 or 3 on Schedule 3.13(b) shall not constitute Assumed Liabilities under this Agreement; and

(vi) the Assumed Claims Liabilities.

Subject to the other terms and conditions of this Agreement, Buyer, for itself and each of its Affiliates, hereby irrevocably and unconditionally waives and releases Seller and each of its Affiliates from all Assumed Liabilities. Notwithstanding anything to the contrary herein, nothing in this Section 2.1(c) shall limit or reduce any Indemnified Buyer Entity's rights to indemnification from Seller, or Seller's obligations to indemnify the Indemnified Buyer Entities, pursuant to Sections 5.16(b), 5.18(a) and 7.2(a).

(d) Neither Buyer nor its designees shall assume, satisfy or be responsible for the performance of any of the following Liabilities (the “Excluded Liabilities”), all of which shall remain the sole responsibility of Seller and/or its Affiliates and Seller shall satisfy or perform, or caused to be satisfied or performed, all such Liabilities:

(i) any obligations to make payments, accounts payable, Liabilities of Seller or its Affiliates in respect of refunds, credits, offsets, in-kind or exchange arrangements, income, sales, payroll or other tax Liabilities, and any similar Liability of Seller or its Affiliates arising from or relating to the ownership or operation of the Acquired Assets with respect to any period of time prior to the Closing;

(ii) any Liabilities of Seller in respect of any Excluded Assets, including in respect of the Thermal Assets or any Contract other than Assigned Contracts;

(iii) any Liabilities for real property and other Taxes attributable to the Acquired Assets to the extent allocated to taxable periods or portions thereof ending on or before the Closing Date pursuant to the proration provided for in Section 2.4;

(iv) any Liabilities arising out of or related to a breach or default by Seller or its Affiliates under an Assigned Contract, prior to the Closing;

(v) except as expressly provided under Section 5.14, any liability or obligation of Seller or any of its Affiliates: (A) under applicable Laws relating to (I) any employee, agent, contractor (including any subcontractor of any tier), or other representative of Seller or such Affiliate (or any former employee, agent, contractor (including any subcontractor of any tier), or other representative of Seller or such Affiliate), including wages, salary or other compensation and withholding and payment of any Taxes, or (II) any spouse, children or other dependents or beneficiaries of any such Person or successor in interest to such Person, each of clause (I) and (II), to the extent allocable to incidents, events, actions, omissions, exposures or circumstances existing or occurring on or at any time prior to the Closing, or (B) pursuant to any Benefit Plan or any other employee benefit plan, program, agreement or arrangement established or maintained by Seller or any ERISA Affiliate;

(vi) the Retained Environmental Liabilities;

(vii) the Excluded Claims Liabilities; and

(viii) any Objectionable Title and Survey Matter, to the extent (A) Seller makes an election with respect thereto in accordance with clause (ii) of Section 5.16(b) or (B) Seller is obligated to remove or rectify such matter pursuant to clause (B) of Section 5.16(b).

Subject to the other terms and conditions of this Agreement, Seller, for itself and each of its Affiliates, hereby irrevocably and unconditionally waives and releases Buyer and each of its Affiliates from all Excluded Liabilities.

(e) The aggregate purchase price (the “Purchase Price”) for the Acquired Assets and other rights under this Agreement shall be an amount equal to Nine Hundred Million Dollars ($900,000,000) (the “Base Purchase Price”), which shall be increased or decreased (in accordance with Section 2.2(a)) by (i) the Capital Expenditures Adjustment and (ii) the PPA Termination Adjustment, and shall be further subject to any adjustments for prorations pursuant to Section 2.4. At the Closing, Buyer shall pay to (A) Seller the Base Purchase Price, which shall be increased or decreased (in accordance with Section 2.2(a) or Section 2.4(b), as applicable) by (I) the Estimated Capital Expenditures Adjustment as determined pursuant to Section 2.2, and (II) the Estimated Proration Adjustment Amount, as determined pursuant to Section 2.4, and (B) PPL EPlus the Estimated PPA Termination Adjustment, as determined pursuant to Section 2.2, in each case by wire transfer of immediately available funds in U.S. Dollars to such account or accounts as specified by Seller or PPL EPlus, as applicable, to Buyer in writing at least two (2) Business Days prior to the Closing.

SECTION 2.2. Capital Expenditures Adjustment; PPA Termination Adjustment.

(a) At least five (5) Business Days prior to the Closing Date, Seller will deliver to Buyer a worksheet setting forth Seller's good faith reasonable estimate of (A) the Capital

Expenditures Adjustment as of the Closing Date (the “Estimated Capital Expenditures Adjustment”) and (B) the PPA Termination Adjustment as of the Closing Date (the “Estimated PPA Termination Adjustment” and, together with the Estimated Capital Expenditures Adjustment, each an “Estimated Adjustment Amount”), together with reasonable detail and supporting material regarding the computations thereof. If any Estimated Adjustment Amount is a positive number, the Base Purchase Price payable at Closing will be increased by an amount equal to such Estimated Adjustment Amount. If any Estimated Adjustment Amount is a negative number, the Base Purchase Price payable at the Closing will be decreased by an amount equal to the absolute value of such Estimated Adjustment Amount.

(b) Within sixty (60) days after the Closing, Seller will prepare and deliver to Buyer a computation (the “Adjustment Statement”) of the actual PPA Termination Adjustment as of the Closing Date (the “Actual PPA Termination Adjustment”) and the actual Capital Expenditures Adjustment as of the Closing Date (the “Actual Capital Expenditures Adjustment” and, together with the Actual PPA Termination Adjustment, the “Actual Adjustment Amount”), together with reasonable detail and supporting material regarding the computations thereof. If within thirty (30) days following delivery of such Adjustment Statement, Buyer does not object in writing thereto to Seller, then the Actual Capital Expenditures Adjustment and the Actual PPA Termination Adjustment shall be as reflected on the Adjustment Statement.

(c) If within thirty (30) days following delivery of the Adjustment Statement Buyer objects to the Adjustment Statement to Seller in writing, then Buyer and Seller shall negotiate in good faith and attempt to resolve their disagreement. Should such negotiations not result in an agreement within twenty (20) days after receipt by Seller of such written objection from Buyer, then the matter shall be submitted for resolution and determination to the Independent Accounting Firm. The Independent Accounting Firm will deliver to Buyer and Seller a written determination of such disputed Actual Adjustment Amount (such determination to include a worksheet setting forth all material calculations used in arriving at such determination and to be based solely on information provided to the Independent Accounting Firm by Buyer and Seller) within thirty (30) days of the submission of the dispute to the Independent Accounting Firm, which determination will be final, binding and conclusive on the Parties. In resolving any disagreement, the Independent Accounting Firm may not assign any value to a disputed item greater than the greatest value claimed for such disputed item by any Party or lesser than the lowest value claimed for such disputed item by any Party. All fees and expenses relating to the work, if any, to be performed by the Independent Accounting Firm pursuant to this Section 2.2 will be allocated between Seller and Buyer in inverse proportion as each shall prevail in respect of the dollar amount of disputed items so submitted (as finally determined by the Independent Accounting Firm).

(d) If, following the determination of any Actual Adjustment Amount (as agreed between the Parties or as determined by the Independent Accounting Firm), the related Estimated Adjustment Amount less such Actual Adjustment Amount is a positive number, then Seller, or PPL EPlus, as applicable, shall be obligated to pay Buyer a cash payment equal to such positive number. If the related Estimated Adjustment Amount less such Actual Adjustment Amount is a negative number, then Buyer shall be obligated to pay Seller or PPL EPlus, as applicable, a cash payment equal to the absolute value of such negative number. Any such payment, together with interest thereon at the rate of five percent (5%) per annum from the Closing Date through the date of payment, will be due and payable within ten (10) Business Days after such Actual Adjustment

Amount is finally determined as provided in this Section 2.2 and will be payable by wire transfer of immediately available funds to such account or accounts as shall be specified by Buyer, Seller or PPL EPlus, as applicable, to the other Party in writing. The payments to be made pursuant to this Section 2.2(d), if due and payable within the same ten (10)-Business Day period, may be netted against each other. Any such payment will be treated as an adjustment to the Purchase Price for all Tax purposes, to the maximum extent permitted by applicable Law.

(e) Following the Closing, Seller and Buyer shall cooperate and provide each other and, if applicable, the Independent Accounting Firm, with reasonable access to such books, records and employees as are reasonably requested in connection with the preparation of the Adjustment Statement and the other matters addressed in this Section 2.2.

SECTION 2.3. Allocation of Purchase Price.

(a) Not later than 120 days after the Closing, Buyer shall provide Seller with an allocation of the Purchase Price, plus any liabilities deemed assumed for U.S. federal income Tax purposes, among the Acquired Assets as of the Closing Date using the allocation method provided by Section 1060 of the Code and the Treasury regulations thereunder (the “Purchase Price Allocation”); provided, however, that the Parties agree that the amount to be allocated to the Kerr Plant shall be equal to the fixed amount set forth in Schedule 1.1(c), subject to adjustment for any Kerr True-Up Amount actually paid pursuant to Section 5.18. The Purchase Price Allocation shall be subject to the consent of Seller, which shall not be unreasonably withheld, conditioned or delayed. The Parties shall cooperate to comply with all substantive and procedural requirements of Section 1060 of the Code and the regulations thereunder, and except for any adjustment to the Purchase Price, the Purchase Price Allocation shall be adjusted only if and to the extent necessary to comply with such requirements. Buyer and Seller agree that they will not take nor will they permit any Affiliate to take, for Tax purposes, any position inconsistent with such Purchase Price Allocation; provided, however, that (a) Buyer's cost may differ from the total amount allocated hereunder to reflect, for example, the inclusion in the total cost of items (such as capitalized acquisition costs) not included in the total amount so allocated and (b) the amount realized by Seller may differ from the amount allocated to reflect, for example, transaction costs that reduce the amount realized for federal income Tax purposes. Seller, on the one hand, or Buyer, on the other hand, shall notify Buyer or Seller, respectively, within twenty (20) days after notice or commencement of an examination, audit or other proceeding regarding the allocation determined under this Section 2.3.

(b) Buyer and Seller shall negotiate in good faith and attempt to resolve any disagreement with respect to the Purchase Price Allocation, provided that if such negotiations do not result in an agreement within twenty (20) days after Seller's receipt of the Purchase Price Allocation from Buyer, then the matter shall be submitted for resolution and determination to the Independent Accounting Firm. The Independent Accounting Firm will deliver to Buyer and Seller a written determination of the disputed Purchase Price Allocation within thirty (30) days of the submission of the dispute to the Independent Accounting Firm, which determination will be final, binding and conclusive on the Parties.

SECTION 2.4. Acquired Assets Proration.

(a) Buyer and Seller agree that, except as otherwise set forth in this Agreement, with respect to the sale of the Acquired Assets, all of the items listed in Schedule 2.4 (including any Prepayments with respect to such items) (collectively, the “Prorated Items”) relating to the Acquired Assets shall be prorated as of the Closing in accordance with this Section 2.4. Schedule 2.4 also contains an example of the calculation of the proration of the real property taxes and other Taxes attributable to the Acquired Assets.

(b) As of the date at least five (5) Business Days prior to the Closing Date, Seller will deliver to Buyer a worksheet setting forth (i) Seller's good faith reasonable estimate of the Prorated Amount for each Prorated Item (with respect to each Prorated Item, the “Estimated Prorated Amount”), as well as, in each case, reasonable detail and supporting material regarding the computation thereof, and (ii) an amount equal to the sum of the Estimated Prorated Amounts (the “Estimated Proration Adjustment Amount”). In the event that, with respect to any Prorated Item, actual figures are not available as of the time of the calculation of the Estimated Prorated Amount, the Estimated Prorated Amount for such Prorated Item shall be a good faith reasonable estimate, including (as applicable) based upon the actual fee, cost or amount of the Prorated Item for the most recent preceding year (or appropriate period) for which an actual fee, cost or amount paid is available. If the Estimated Proration Adjustment Amount is a positive number, the Base Purchase Price payable at Closing will be increased by an amount equal to such Estimated Proration Adjustment Amount. If the Estimated Proration Adjustment Amount is a negative number, the Base Purchase Price payable at Closing will be decreased by an amount equal to the absolute value of such Estimated Proration Adjustment Amount.

(c) As soon as either Party obtains Knowledge of the actual Prorated Amount with respect to any Prorated Item, it shall promptly notify the other Party of such Prorated Item and actual Prorated Amount, together with reasonable detail and supporting material regarding the computation thereof. For any Prorated Item with respect to which the Estimated Prorated Amount is not equal to the actual Prorated Amount, upon the request of either Seller or Buyer, made within thirty (30) days of the date when such Party first obtained Knowledge of the actual Prorated Amount with respect to such Prorated Item (the “Request Date”), the Parties shall calculate (A) the Prorated Amount for such Prorated Item using the actual available amounts (the “Actual Prorated Amount”), and (B) the absolute value of the difference between the Estimated Prorated Amount and the Actual Prorated Amount for such Prorated Item (the “Prorated Difference”). If the Actual Prorated Amount (whether a positive or a negative number) is greater than the Estimated Prorated Amount (whether a positive or a negative number) for such Prorated Item, Buyer shall pay an amount equal to the Prorated Difference to Seller within ten (10) days of the Request Date. If the Estimated Prorated Amount (whether a positive or a negative number) is greater than the Actual Prorated Amount (whether a positive or a negative number) for such Prorated Item, Seller shall pay an amount equal to the Prorated Difference to Buyer within ten (10) days of the Request Date. The Parties shall furnish each other with such documents and other records as may be reasonably requested in order to confirm all proration calculations made pursuant to this Section 2.4.

(d) In the event any Party disagrees with the other Party on the computation of the Actual Prorated Amount for any Prorated Item to be determined under this Section 2.4, such Party may provide a written notice of the disagreement to the other Party, and Buyer and Seller shall

negotiate in good faith and attempt to resolve their disagreement. Should such negotiations not result in an agreement within twenty (20) days after delivery of such notice of disagreement, then the matter shall be submitted to the Independent Accounting Firm. The Independent Accounting Firm will deliver to Buyer and Seller a written determination of the Actual Prorated Amount and the Prorated Difference with respect to the disputed item (such determination to include a worksheet setting forth all material calculations used in arriving at such determination and to be based solely on information provided to the Independent Accounting Firm by Buyer and Seller) within thirty (30) days of the submission of the dispute to the Independent Accounting Firm, which determination will be final, binding and conclusive on the Parties. In resolving any disagreement, the Independent Accounting Firm may not assign any value to a disputed item greater than the greatest value claimed for such disputed item by any Party or lesser than the lowest value claimed for such disputed item by any Party. All fees and expenses relating to the work, if any, to be performed by the Independent Accounting Firm pursuant to this Section 2.4(d) will be allocated between Seller and Buyer in inverse proportion as each shall prevail in respect of the dollar amount of disputed items so submitted (as finally determined by the Independent Accounting Firm).

(e) If, after the Closing, Seller or any of its Affiliates receives any payment with respect to the Acquired Assets relating to periods on or after the Closing Date, Seller shall pay to Buyer within three (3) Business Days after such receipt an amount equal to the amount received with respect to periods on or after the Closing Date.

SECTION 2.5. Closing

. The closing of the purchase and sale of the Acquired Assets and the assignment of the Assigned Contracts (the “Closing”) shall take place at 10:00 a.m., local time, at the offices of Simpson Thacher & Bartlett LLP, 425 Lexington Avenue, New York, New York three (3) Business Days following the satisfaction or waiver of the conditions set forth in Article VI (other than those conditions that by their nature are to be satisfied at the Closing), and subject to the expiration of the Financing Marketing Period (if any); or at such other time, date and place as may be mutually agreed upon in writing by the Parties (the date on which the Closing actually occurs being referred to as the “Closing Date”). The Closing shall be deemed effective as of 11:59:59 p.m. (Mountain Time) on the Closing Date.

SECTION 2.6. Seller's Deliverables. At the Closing, Seller shall have delivered, or cause to have been delivered, to Buyer each of the following, with each delivery being deemed to have occurred simultaneously with the other events:

(a) the Deeds, duly executed and properly acknowledged by Seller;

(b) a counterpart of the Bill of Sale, duly executed by Seller, which shall effect the assignment by Seller to Buyer of each Assigned Contract (subject to Section 5.4 hereof), Transferred Permit or Permit Application, subject to the assumption by Buyer of the Assumed Liabilities;

(c) a counterpart of a service agreement, in the form of Attachment A-1 to Buyer's Montana Transmission Tariff, in respect of the Assigned Transmission Contract, duly executed by PPL EPlus;

(d) a certification of PPL Montana Holdings, LLC, substantially in the form attached

as Exhibit D, as to its non-foreign status as set forth in Section 1445 of the Code;

(e) a counterpart of the Transition Services Agreement, duly executed by each of Seller and the Services Provider;

(f) evidence, in form and substance reasonably satisfactory to Buyer, demonstrating that Seller has obtained all of the Seller Required Consents, together with copies thereof;

(g) certificates, dated the Closing Date and duly executed in the name and on behalf of Seller, substantially in the form attached as Exhibit F-1;

(h) certificates, dated the Closing Date and duly executed by the Secretary or Assistant Secretary of each of Seller and the Guarantor, substantially in the form attached as Exhibit F-2;

(i) a certificate of good standing with respect to Seller, dated no more than five (5) Business Days before the Closing Date, issued by the Secretary of State of the State of Delaware;

(j) all necessary documentation to transfer and convey to Buyer the Water Rights (including Fee Log Sheets in the form promulgated by the Montana Department of Natural Resources and Conservation) in proper form to be filed with the appropriate Governmental Entities; and

(k) any other documents required for such Closing under applicable Law or reasonably requested by Buyer to facilitate the transactions contemplated by this Agreement or any Ancillary Agreement.

SECTION 2.7. Buyer Deliverables. At the Closing, Buyer shall have delivered, or cause to have been delivered, to Seller, or PPL EPlus as applicable, each of the following, with each delivery being deemed to have occurred simultaneously with the other events:

(a) a counterpart of the Bill of Sale, duly executed by Buyer;

(b) a counterpart of the Transition Services Agreement, duly executed by Buyer;

(c) a counterpart of a service agreement, in the form of Attachment A-1 to Buyer's Montana Transmission Tariff, in respect of the Assigned Transmission Contract, duly executed by Buyer;

(d) a certificate, dated the Closing Date and duly executed in the name and on behalf of Buyer, substantially in the form attached as Exhibit G-1;

(e) a certificate, dated the Closing Date and duly executed by the Secretary or Assistant Secretary of Buyer, substantially in the form attached as Exhibit G-2;

(f) a certificate of good standing with respect to Buyer, dated no more than five (5) Business Days before the Closing Date, issued by the Secretary of State of the State of Delaware;

(g) evidence, in form and substance reasonably satisfactory to Seller, demonstrating that Buyer has obtained all of the Buyer Required Consents, together with copies thereof;

(h) any other documents required for such Closing under applicable Law or reasonably requested by Seller to facilitate the transactions contemplated by this Agreement or any Ancillary Agreement; and

(i) the Base Purchase Price, which shall be increased or decreased in accordance with Section 2.2(a) and Section 2.4(b) (as applicable) by (i) the Estimated Capital Expenditures Adjustment, as determined pursuant to Section 2.2(a), (ii) the Estimated PPA Termination Adjustment, as determined pursuant to Section 2.2(a) and (iii) the Estimated Proration Adjustment Amount, as determined pursuant to Section 2.4(b).

SECTION 2.8. Withholding. Buyer or any Affiliate or agent of Buyer shall be entitled to deduct and withhold from payment of the Purchase Price, or any other amounts (or any portion thereof) payable pursuant to this Agreement, such amounts as it may reasonably believe are required to be deducted and withheld with respect to the making of such payment under the Code or any other Tax Law. To the extent that amounts are so withheld, such withheld amounts shall be paid by such withholding party to the relevant Taxing Authority and shall be treated for all purposes of this Agreement as having been paid to the Party to whom such amounts would otherwise have been paid.

ARTICLE III

REPRESENTATIONS AND WARRANTIES RELATING TO SELLER

Seller hereby represents and warrants to Buyer as of the date hereof and (if the Closing occurs) as of the Closing, except for those representations and warranties that are made as of a specific date, as follows:

SECTION 3.1. Organization and Existence. Each Seller Party is a limited liability company or corporation, duly formed or incorporated (as applicable), validly existing and in good standing under the Laws of the State of Delaware or, in the case of the Guarantor, the Commonwealth of Pennsylvania, with all requisite power and authority required to (a) own, lease and operate its material assets and properties (including, in the case of Seller, the Acquired Assets); (b) carry on its business as it is now being conducted; and (c) enter into this Agreement and the Ancillary Agreements to which it is a party and consummate the transactions contemplated hereby and thereby. Each such Seller Party is duly qualified or licensed to do business in each jurisdiction where the actions required to be performed by it hereunder or under any Ancillary Agreement make such qualification or licensing necessary, except in those jurisdictions where the failure to be so qualified or licensed would not, individually or in the aggregate, reasonably be expected to result in a material adverse effect on (i) the assets, liabilities, operations or financial condition of the Acquired Assets, taken as a whole or (ii) such Seller Party's ability to perform its obligations under this Agreement and the Ancillary Agreements to which it is a party.

SECTION 3.2. Authorization. The execution, delivery and performance by each Seller Party of this Agreement and the Ancillary Agreements to which it is or will be a party

and the consummation by each Seller Party of the transactions contemplated hereby and thereby are within such Seller Party's powers and have been duly authorized by all necessary action on the part of such Seller Party. This Agreement has been and each Ancillary Agreement to which it is or will be a party has been or will (as of the Closing) be duly and validly executed and delivered by such Seller Party and this Agreement constitutes and each Ancillary Agreement to which it is or will be a party does or will constitute (assuming the due execution and delivery by Buyer) a valid and legally binding obligation of such Seller Party, enforceable against such Seller Party in accordance with its terms, subject to the effects of bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium and other Laws relating to or affecting creditors' rights generally and general equitable principles (whether considered in a proceeding in equity or at Law).

SECTION 3.3. Noncontravention. The execution, delivery and performance of this Agreement and the Ancillary Agreements by the Seller Parties does not, and the consummation by the Seller Parties of the transactions contemplated hereby and thereby will not (i) contravene or violate any provision of the Organizational Documents of any such Seller Party; (ii) subject to obtaining or making the Permits and Consents listed in Schedule 3.3, contravene or violate, in any material respect, any provision of, or result in the termination or acceleration of, or entitle any party to accelerate any material obligation or indebtedness under, any mortgage, lease, Contract (including any Material Contract or Assigned Contract), Permit which is specified on Schedule 3.7(c)(i) or Schedule 3.13(a)(ii) or Law to which any Seller Party is a party or by which any such Seller Party is bound; or (iii) result in the imposition or creation of any Lien on the Acquired Assets (other than Permitted Liens and Liens created by Buyer at or following the Closing).

SECTION 3.4. Governmental Consents. Except as set forth on Schedule 3.4, no material Permit or Consent of any Governmental Entity is required for or in connection with the execution, delivery and performance of this Agreement and the Ancillary Agreements by each Seller Party or the consummation by the Seller Parties of the transactions contemplated hereby.

SECTION 3.5. Absence of Certain Changes or Events. Except (a) as set forth on Schedule 3.5, and (b) for any action taken by Seller with respect to the Acquired Assets that would be permitted without Buyer's consent under Section 5.2, since December 31, 2012, Seller's ownership, operation and maintenance of the Acquired Assets has been conducted in accordance with the ordinary course of business consistent with past practices, except in connection with any process relating to the sale of the Acquired Assets, including entering into this Agreement. Since December 31, 2012, there has not been any change, event or effect (i) that, individually or in the aggregate with other changes, events or effects, has resulted in, or would reasonably be expected to result in, a Material Adverse Effect or (ii) except as set forth on Schedule 3.5, that would have been prohibited (absent Buyer's prior approval) pursuant to clauses (i), (ii), (xi), (xii) or (xiii) of Section 5.2(a) had this Agreement been in full force and effect as of the date thereof.

SECTION 3.6. Legal Proceedings.

(a) Except as disclosed on Schedule 3.6(a), there are no Claims pending or, to Seller's Knowledge, threatened, against or otherwise relating to Seller or the Acquired Assets before any Governmental Entity or any arbitrator that (i) would, individually or in the aggregate, reasonably be expected to have a material adverse effect on Seller's ability to perform its obligations

hereunder or under any Ancillary Agreement, (ii) adversely effect, in any material respect, any of the Acquired Assets or (iii) as of the date of this Agreement, seek a writ, judgment, order, injunction or decree restraining, enjoining or otherwise prohibiting or making illegal any of the transactions contemplated by this Agreement.

(b) Except as disclosed on Schedule 3.6(b), Seller is not subject to, nor are any of the Acquired Assets bound by, any Order (other than any Order of general applicability) that would, individually or in the aggregate, (i) reasonably be expected to have a material adverse effect on Seller's ability to perform its obligations hereunder or under any Ancillary Agreement, (ii) impose any material liability with respect to the Acquired Assets or (iii) materially impair the operation of any Facility as currently operated. As of the date of this Agreement, Seller is not subject to any Order that prohibits the consummation of the transactions contemplated by this Agreement.

SECTION 3.7. Compliance with Laws; Permits.

(a) Seller is not in violation of any Law, except for violations that would not, individually or in the aggregate, reasonably be expected to result in a material adverse effect on Seller's ability to perform its obligations under this Agreement and the Ancillary Agreements.

(b) Except as disclosed on Schedule 3.7(b), (i) Seller is in compliance, in all material respects, with all Laws applicable to the Acquired Assets or Seller's ownership, operation or maintenance thereof, and (ii) Seller and its Affiliates have not received written notice of any material violation of Law with respect to the Acquired Assets or Seller's ownership, operation or maintenance thereof during the last three (3) years through the date of this Agreement.

(c) Schedule 3.7(c)(i) sets forth all material Permits with Governmental Entities necessary and sufficient for the ownership, operation or maintenance of the Acquired Assets by Seller as currently conducted. Seller has Made Available to Buyer a true and correct copy of each such Permit. Except as set forth on Schedule 3.7(c)(ii), (i) all Permits set forth on Schedule 3.7(c)(i) are properly in the name of Seller; (ii) Seller is in compliance, in all material respects, with the terms of all such Permits; (iii) each such Permit is in full force and effect; and (iv) Seller and its Affiliates have not received written notice of any material violation of any such Permit during the last three (3) years through the date of this Agreement.

(d) This Section 3.7 does not relate to (i) matters related to employee benefits plans, which are addressed in Section 3.11, (ii) matters related to labor and employment practices, which are addressed in Section 3.12, (iii) compliance with Environmental Permits or Environmental Laws, which is addressed in Section 3.13 or (iv) matters related to Taxes, which are addressed in Section 3.15.

SECTION 3.8. Title to Acquired Assets; Sufficiency of Acquired Assets; Condition of Acquired Assets.

(a) Seller has valid title to, or valid leasehold interests in the Acquired Assets (other than any Intellectual Property, which is addressed in Section 3.16 and other than real estate interests, which are addressed in Section 3.10), free and clear of all Liens, other than Permitted Liens.

(b) Except for such exceptions as are not, individually or in the aggregate, reasonably likely to have a material adverse effect on the Acquired Assets, or as provided on Schedule 3.8(b), (i) the machinery and equipment included among the Acquired Assets are in normal operating condition for similar facilities of a similar age and in a state of reasonable maintenance and repair and are suitable for the purposes for which they are now being used in the conduct of the business of Seller, (ii) there are no pending claims for defective work, equipment or materials relating to the Facilities made by Seller against any Person, and (iii) neither Seller nor its Affiliates has deferred maintenance of any Acquired Assets in contemplation of the purchase and sale of the Acquired Assets hereunder.

(c) Except as set forth on Part B of Schedule 2.1(a)(ii), all Acquired Assets that constitute physical personal property are currently located at the Facilities and no such Acquired Assets intended for the Facilities are being held by third parties.

(d) Schedule 3.8(d) identifies all currently effective warranties by any vendor, materialman, supplier, contractor or subcontractor to Seller covering the Acquired Assets or any component thereof with a value of $250,000 or more (the “Material Warranties”). Except as set forth on Schedule 3.8(d), to Seller's Knowledge, there are no events that have occurred or conditions applicable that constitute or may constitute a valid defense to the continuing effectiveness of each such warranty.

SECTION 3.9. Material Contracts; Assigned Contracts.

(a) Schedule 3.9(a) sets forth a list of the following Contracts to which Seller (or, in the case of the Assigned Transmission Contract, PPL EPlus) is a party, or to which Seller (or, in the case of the Assigned Transmission Contract, PPL EPlus) is subject or otherwise bound, which relate to the Acquired Assets and are intended to be Assigned Contracts (the “Material Contracts”); provided, that Seller shall, during the Interim Period, amend Schedule 3.9(a) to account for additional Contracts entered into during the Interim Period, to the extent such additional Contracts are entered into during the Interim Period in compliance with Section 5.2 (or that would be permitted without Buyer's consent thereunder and would otherwise constitute Material Contracts):

(i) Contracts for the purchase, exchange coordination or sale of electric energy, capacity or ancillary services (other than any Terminated Contract);

(ii) Contracts for the purchase, exchange, sale or transportation of water;

(iii) Contracts for the transmission of electric power (other than any Terminated Contract), but in any event, including the Assigned Transmission Contract;

(iv) Contracts for the interconnection of electric generation facilities to third-party transmission facilities;

(v) other than Contracts of the nature addressed by Section 3.9(a)(i)-(iv), Contracts (A) for the exchange or sale of any asset that otherwise would constitute an Acquired Asset or (B) that grant a right or option to purchase or exchange any asset that

otherwise would constitute an Acquired Asset, other than in each case Contracts entered into in the ordinary course of business relating to the operation or maintenance of the Acquired Assets with a value of less than $250,000 individually or $1,000,000 in the aggregate (in each case, including any potential payment to exercise any right or option related to the Acquired Assets);

(vi) Contracts (A) which contain any covenant restricting the ability of Seller (with respect to the operation of the Facilities or the Acquired Assets) to compete or to engage in any activity or business (including in respect of any geographic area) or (B) under which a Lien has been granted on any of the Acquired Assets (other than Permitted Liens);

(vii) outstanding futures, swap, collar, put, call, floor, cap, option or other Contracts that have underlying value and payment liability driven by or tied to fluctuations in interest rates, the price of commodities (including electric power, coal, natural gas, fuel oil or other fuel) or securities;

(viii) any Lease of any Acquired Assets;

(ix) partnership, joint venture or limited liability company agreements and any other similar Contracts to which Seller is a party involving a sharing of profits with or the investment or loan of capital to, a third party;

(x) Contracts involving resolution or settlement of any actual or threatened Claim in an amount greater than $250,000 individually or $1,000,000 in the aggregate relating to the Acquired Assets that have not been fully performed by Seller or otherwise impose continuing Liabilities on Seller;

(xi) any guaranty, surety or indemnification Contracts, direct or indirect;

(xii) Contracts which contain outstanding manufacturer's, vendor's or other warranties listed on Schedule 3.8(d); or

(xiii) any other Contract that (A) requires (x) payments to or from Seller of more than $250,000 in any one-year period with respect to the Acquired Assets or (y) aggregate payments to or from Seller of more than $1,000,000 with respect to the Acquired Assets or (B) exposes Seller to guaranty, surety or indemnification obligations with respect to the Acquired Assets reasonably likely to exceed $250,000 for each individual Contract or $1,000,000 in the aggregate for all such Contracts with respect to the Acquired Assets.

(b) Seller has Made Available to Buyer true and complete copies of all Material Contracts and all Assigned Contracts (other than, as of the date of this Agreement, certain Assigned Contracts that (a) each require aggregate payments to or from Seller of less than $100,000 and (b) are not otherwise material to the ownership, operation or maintenance of the Acquired Assets as currently conducted), including all amendments, supplements, schedules and exhibits thereto.

(c) Each Material Contract and Assigned Contract is in full force and effect and constitutes the legal, valid and binding obligation of Seller (or, in the case of the Assigned Transmission Contract, PPL EPlus) and, to Seller's Knowledge, the other parties thereto, enforceable against Seller and, to Seller's Knowledge, each other party thereto, as applicable, in accordance with its terms, subject to the effects of bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium and other Laws relating to or affecting creditors' rights generally and general equitable principles (whether considered in a proceeding in equity or at Law).

(d) Except as set forth on Schedule 3.9(d), (i) Seller (or, in the case of the Assigned Transmission Contract, PPL EPlus) is not in material default under any Material Contract; (ii) Seller (or, in the case of the Assigned Transmission Contract, PPL EPlus) is not in material default under any Assigned Contract; (iii) to Seller's Knowledge, no other party is in material default in the performance or observance of any material term or provision of any Material Contract or Assigned Contract; and (iv) no event has occurred which, with lapse of time or action by a third party, would result in a material default under any Material Contract or Assigned Contract.

(e) The Acquired Assets include all materials, equipment, material Contracts or other assets or rights that are necessary for Seller to operate and maintain the Facilities in all material respects as currently operated and maintained, except for (i) Terminated Contracts and (ii) the goods and services provided to Seller by Affiliates of Seller in connection with its ownership, operation or maintenance of the Acquired Assets as currently conducted (the “Affiliate Services”), which are set forth on Schedule 3.9(e) and each of which will be terminated as of the Closing in accordance with Section 5.12(a).

(f) Except as set forth on Schedule 3.9(f), Seller has Made Available to Buyer true and complete copies of the Lease Participation Agreements, including all amendments, supplements, schedules and exhibits thereto, and there are no Contracts to which Seller is a party, or to which Seller or the Acquired Assets are subject or otherwise bound (other than the Lease Participation Agreements, the “Operative Documents” referenced in the Lease Participant Agreements and the Material Contracts) under which a Lien has been granted on any of the Acquired Assets (other than Permitted Liens).

SECTION 3.10. Real Property.

(a) Schedule 3.10(a)(i) sets forth the legal description of each parcel of Owned Real Property. Except as set forth on Schedule 3.10(a)(ii), Seller has valid title to the Owned Real Property together with valid title to all rights, privileges, interests, easements and appurtenances now or hereafter belonging or in any way pertaining to such real property, and to all of the buildings structures and other improvements thereon, free and clear of all Liens except Permitted Liens.

(b) Schedule 3.10(b)(i) sets forth, for each Facility, the leases, licenses and occupancy agreements regarding real property (other than any real property which constitutes an Excluded Asset), and sets forth the address or legal description of each such parcel thereof, pursuant to which Seller uses real property in respect of such Facility (each, a “Lease”; such real property being referred to as the “Leased Real Property”). Except as set forth in Schedule 3.10(b)(ii), Seller

has a valid leasehold interest or license in the Leased Real Property, as applicable, subject to no Liens other than Permitted Liens.

(c) Seller has not subleased or otherwise granted any Person the right to use or occupy any Owned Real Property or Leased Real Property or any material portion thereof, and Seller has not granted any outstanding options, rights of first refusals, rights of first offer or other third-party rights to sell, assign or dispose any interest in such Owned Real Property or Leased Real Property, other than the granting of Permitted Liens.

(d) Except as set forth on Schedule 3.10(d) and any real property which constitutes an Excluded Asset, the Owned Real Property and the Leased Real Property constitute all of the real property necessary and sufficient for Seller to operate and maintain the Facilities in all material respects, and otherwise conduct its business, as currently operated, maintained and conducted in all material respects. Seller has Made Available to Buyer true and complete copies of all mortgages, deeds of trust, title insurance policies, title reports and surveys and all amendments thereto with respect to the Owned Real Property and the Leased Real Property that are in possession of Seller and its Affiliates and that were created after the MPC Closing Date.

(e) As of the date of this Agreement, except as set forth on Schedule 3.10(e), neither the Owned Real Property nor the Leased Real Property is subject to any written notice of any pending or, to the Knowledge of Seller, threatened proceeding to condemn or take by power of eminent domain all or any part of the Owned Real Property or the Leased Real Property.

SECTION 3.11. Employee Benefits Matters.

(a) Schedule 3.11(a) contains a true and complete list of each material employment, bonus, deferred compensation, incentive compensation, stock purchase, stock option, severance or termination pay, employee relocation, hospitalization or other medical, life or other insurance, supplemental unemployment benefits, profit-sharing, pension, or retirement plan, program, agreement or arrangement, and each other employee benefit plan, program, agreement or arrangement (collectively, the “Benefit Plans”) currently maintained or contributed to or required to be contributed to by Seller or any trade or business, whether or not incorporated (an “ERISA Affiliate”), that together with Seller would be deemed a “single employer” within the meaning of Section 4001(b) of ERISA, for the benefit of any Scheduled Employee.

(b) With respect to each of the Benefit Plans as applicable, Seller has Made Available to Buyer complete copies of each of the following documents: (i) the Benefit Plan (including all amendments thereto); (ii) the most recent “Summary Plan Description,” together with each “Summary of Material Modifications,” if required (and as defined) under ERISA; and (iii) the most recent determination letter received from the Internal Revenue Service with respect to each Benefit Plan that is intended to be qualified under Section 401(a) of the Code.

(c) Neither Seller nor any ERISA Affiliate maintains or contributes to a multiemployer plan within the meaning of Section 3(37) of ERISA.

(d) No liability under Title IV of ERISA has been incurred by Seller or any ERISA Affiliate that has not been satisfied in full when due, and no condition exists that could reasonably

be expected to cause Buyer or any of its Affiliates to incur a liability under Title IV of ERISA. Each Benefit Plan subject to the minimum funding requirements of Section 412 of the Code or Section 302 of ERISA has satisfied such requirements at all times, and no such Benefit Plan has been the subject of any funding waiver under Section 412 of the Code or Section 302 of ERISA.

(e) Each Benefit Plan intended to be “qualified” within the meaning of Section 401(a) of the Code has received a favorable determination letter from the Internal Revenue Service as to its qualification and, to Seller's Knowledge, no event has occurred that could reasonably be expected to result in disqualification of such Benefit Plan.

(f) Each Benefit Plan has been operated and administered in all material respects in accordance with its terms and all applicable Laws, including ERISA and the Code.

(g) Except as set forth on Schedule 3.11(g), the consummation of the transactions contemplated by this Agreement (whether alone or together with any other event) will not (i) entitle any Scheduled Employee to severance pay or any other payment or (ii) accelerate the time of payment or vesting, or increase the amount, of compensation due any Scheduled Employee. No Scheduled Employee is a party to any agreement, contract or arrangement with Seller or any of its Affiliates that could result, separately or in the aggregate, in the payment of any “excess parachute payments” within the meaning of Section 280G of the Code by reason of the transactions contemplated by this Agreement.

(h) There are no pending or, to Seller's Knowledge, threatened material claims in respect of any of the Benefit Plans, by any Scheduled Employee or beneficiary thereof covered under any Benefit Plan as such or otherwise involving any Scheduled Employee's rights under any Benefit Plan (other than routine claims for benefits).

(i) Except as set forth on Schedule 3.11(i), no Benefit Plan provides death or medical benefits (whether or not insured), with respect to Scheduled Employees beyond their retirement or other termination of service, other than (i) coverage mandated solely by applicable Law; (ii) death benefits under any employee pension benefit plan within the meaning of Section 3(2) of ERISA; or (iii) benefits the full costs of which are borne by any Scheduled Employee or other current or former employee or director or his or her beneficiary.

SECTION 3.12. Labor Matters.

(a) Schedule 3.12(a) sets forth (i) a list of (A) all employees of Seller or its Affiliates employed at the Facilities, other than any such employee on long-term disability or non-protected leave, as of the date hereof (“Facilities Employees”) and (B) those employees of Seller or its Affiliates whose job responsibilities are primarily related to the Facilities but are not employed at the Facilities as of the date hereof (“Off-Site Facilities Employees” and, together with the Facilities Employees, the “Scheduled Employees”), which list shall be amended during the Interim Period to reflect (I) any changes thereto, to the extent such changes are not in violation of any applicable covenants in Section 5.2 and (II) additional employees of Seller or its Affiliates who, upon the reasonable request of Buyer and subject to Seller's consent, shall become Scheduled Employees, and (ii) in each case, Seller shall provide to Representatives of Buyer the following information on a confidential basis: each Scheduled Employee's current base salary or wage rate

and target bonus for the 2013 fiscal year (if any), position, date of hire (and, if different, years of recognized service), status as exempt or non-exempt under the Fair Labor Standards Act, and details of any applicable visa and leave status (including nature and duration of any leave and benefits available to such individual).

(b) Except as set forth on Schedule 3.12(b):

(i) No Scheduled Employees are represented by a union or other collective bargaining representative;

(ii) From and after January 1, 2011, there have been no actual nor, to Seller's Knowledge, threatened, labor strikes, slowdowns, work stoppages, lockouts or similar material labor disputes involving employees of Seller or any Scheduled Employee, and there are no material grievances by any Scheduled Employee currently pending;

(iii) To Seller's Knowledge, no labor union, labor organization or group of Scheduled Employees has made a pending demand for recognition or certification, and there are no representation or certification proceedings or petitions seeking a representation proceeding presently pending or threatened in writing to be brought or filed with the National Labor Relations Board or any other labor relations tribunal or authority with respect to the Scheduled Employees, and Seller has no Knowledge of any labor union organizing activities with respect to any Scheduled Employees;

(iv) Seller and its Affiliates are, with respect to Scheduled Employees, in compliance in all material respects with all applicable Laws respecting employment practices, including all Laws respecting terms and conditions of employment, health and safety, wage and hours, child labor, immigration, employment discrimination, disability rights or benefits, equal opportunity, plant closures and layoffs, affirmative action, workers' compensation, labor relations, employee leave issues and unemployment insurance;

(v) Neither Seller nor any of its Affiliates has received written notice of any complaint, lawsuit or other proceeding pending or threatened in any forum before any Governmental Entity by or on behalf of (i) any present or former employee of Seller; (ii) any Scheduled Employee; (iii) any applicant for employment; or (iv) any class of the foregoing, in each case, alleging breach of any express or implied contract of employment, any applicable Law governing employment or the termination thereof or other discriminatory, wrongful or tortious conduct in connection with an employment relationship;

(vi) Neither Seller nor any of its Affiliates has received written notice of any pending charges before any Governmental Entity responsible for the prevention of unlawful employment practices; and

(vii) Neither Seller nor any of its Affiliates has received written notice of any pending investigation by a Governmental Entity relating to employees or employment practices.

SECTION 3.13. Environmental Matters.

(a) Except as disclosed on Schedule 3.13(a)(i), with respect to the ownership, operation and maintenance of Acquired Assets, (i) Seller is in compliance, in all material respects, with all applicable Environmental Laws; (ii) Seller is in possession of, and in compliance with the terms of, all Permits required under Environmental Law in order to own, operate or maintain the Facilities in all material respects (the “Environmental Permits”), which are set forth on Schedule 3.13(a)(ii); (iii) Seller has not received written notice of any material violation of Environmental Law or Environmental Permit during the last three (3) years through the date of this Agreement; and (iv) all Environmental Permits are properly in the name of Seller and in full force and effect. Seller has Made Available to Buyer a true and correct copy of each Environmental Permit.

(b) Except as set forth on Schedule 3.13(b):

(i) There are no Claims pending or, to Seller's Knowledge, threatened against Seller with respect to the Acquired Assets asserting any material violation of, or material liability under, any Environmental Law, including any such Claims challenging Seller's compliance with, in any material respect, or the validity of, any Environmental Permit or seeking the termination or adverse modification of any Environmental Permit;

(ii) No Hazardous Substance has been Released by Seller or, to Seller's Knowledge, by any other Person at any Owned Real Property or, to Seller's Knowledge, at any other location in an amount or condition that would reasonably be expected to result in a material liability to Seller with respect to the Acquired Assets under any Environmental Law;

(iii) Seller is not subject to any Order (excluding Orders of general applicability) with respect to the Acquired Assets that would reasonably be expected to result in material liability under Environmental Law; and

(iv) Seller has Made Available to Buyer true, complete and correct copies of any material written reports, audits, assessments (including Phase I environmental site assessments and Phase II environmental site assessments) studies, analyses, tests or environmental sampling or monitoring data in the possession of Seller or its Affiliates and created on or after the MPC Closing Date (other than materials, if any, subject to attorney-client or attorney-work product privilege) pertaining to (A) any Claims pending or threatened against Seller related to Environmental Laws with respect to the Acquired Assets; (B) any Release of any Hazardous Substance in, on or beneath the Acquired Assets; or (C) Seller's compliance with applicable Environmental Laws with respect to the Acquired Assets.

(c) This Section 3.13 and Sections 3.4, 3.5 and 3.6 contain the sole and exclusive representations and warranties of Seller relating to Environmental Laws, Hazardous Substances or other environmental matters.

SECTION 3.14. Insurance.

(a) Schedule 3.14(a) sets forth the insurance policies under which the Acquired Assets are covered (the “Insurance Policies”). Each Insurance Policy is in full force and effect and all premiums with respect thereto have been paid to the extent due and payable. No written notice of cancellation or termination has been received by Seller with respect to any such material Insurance Policy that has not been replaced on substantially similar terms prior to the date of such cancellation or termination.

(b) Schedule 3.14(b) sets forth a list of all pending claims that have been made under any Insurance Policy with respect to the Acquired Assets.