EXHIBIT 99.2

To Form 8-K dated July 26, 2012

Seacoast Banking Corporation of Florida

Second Quarter 2012 Earnings Conference

Call

July 27, 2012

9:00 AM Eastern Time

Operator: Welcome to the

Seacoast Second Quarter 2012 Earnings Conference Call. My name is Dawn, and I will be your operator for today's call. At this time,

all participants are in a listen-only mode. Later, we will conduct a question-and-answer session. Please note that this conference

is being recorded.

I will now turn the call over to Dennis

S. Hudson. Mr. Hudson, you may begin.

Dennis S. Hudson III: Thank you

very much, and welcome to Seacoast's Second Quarter Conference Call. Before I begin, as always, we direct your attention to the

statement contained at the end of our press release regarding forward statements. During the call, we may be discussing issues

that constitute forward-looking statements within the meaning of the Securities and Exchange Act and, accordingly, our comments

are intended to be covered within the meaning of 27A of that Act.

With me today is Bill Hahl, our CFO; Russ

Holland, our Chief Lending Officer; and David Houdeshell, our Chief Credit Officer.

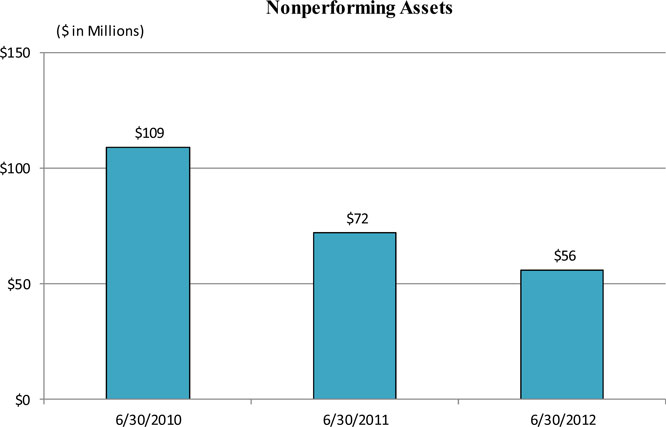

Our progress this quarter continued on

the problem asset front, which I want to talk about in a minute. But first, I want to talk about our decision to wind down the

remaining problem assets at a faster pace, and our decision to more aggressively execute cost reductions and accelerate growth

initiatives designed to build revenue. I have in many ways been pleased with our progress. We have been bringing down the level

of problem assets consistently over the past couple of years while maintaining high levels of capital. We have in the past year

significantly ramped up our performance in terms of our new household growth at a time when most banks, particularly large banks,

are losing households. We know they are losing them because they are showing up in our offices. Over the past year, we ramped up

our lending production capacity and have produced now several consecutive quarters of net loan growth. Our residential mortgage

production this past quarter was record-breaking and contributed to some of the best growth in total noninterest income we have

seen in many years. We expanded our household growth initiatives to include small business and have had great success over this

past year, particularly in this quarter. And finally, we emerged with positive profitability throughout 2011 and into the first

quarter of this year.

As proud as I am of the work by our associates

to accomplish these tremendous improvements, we need to move faster to strengthen our results in the coming year. As a result,

we launched an internal project a couple of months ago with an objective to achieve faster improvement in our earnings in the coming

year. The project has identified a number of actions we intend to take over the coming months. Some of these actions impacted the

current quarter. To be clear, our focus going forward will be on three main themes. First, we are going to pick-up the pace in

liquidating our remaining problem assets. Second, we are going to accelerate the execution of our very successful initiatives to

grow personal and business relationships and the revenue that comes with that. And third, we are going to be taking a number of

actions to reduce our overall cost structure. We intend to execute these actions quickly, and we have established goals and checkpoints

to keep us on track. In the coming quarters, we are going to be reporting our progress.

The results of this quarter were impacted

by substantial write-downs and specific reserves taken on certain loan assets that we determined could potentially be resolved

more quickly over the balance of this year. This decision was made late in the quarter and it resulted from our project to accelerate

performance. As a result, our provision for the quarter totaled $6.5 million, which contributed to our loss for the quarter, which

was $2.3 million. After preferred stock dividends and accretion, the loss to common shareholders was $0.03 per share.

During the quarter, we were pleased to

complete all of the sales of foreclosed properties, OREO, which we projected last quarter during this call, and we picked up a

few new sales, which were also completed. As a result, our other real estate-owned balances fell to just over $7 million. This

represents the lowest level we’ve seen since 2008, and it represented a 54% decline for the quarter and 72% decline for the

year.

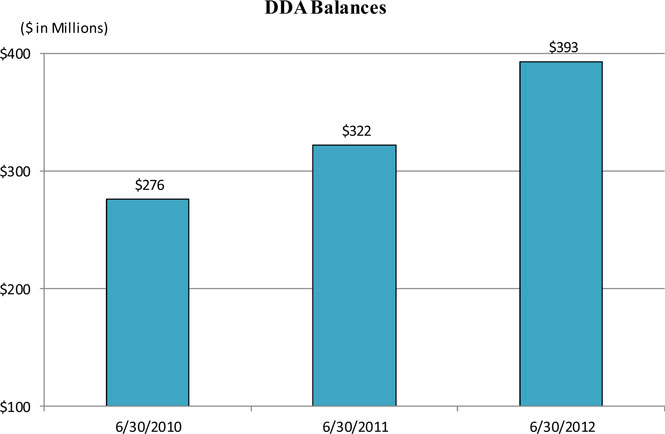

Our growth initiatives continue to perform

well in the quarter. Customer funding was up $200 million, or 16% for the year. Deposit mix continued to improve with noninterest-bearing

deposits growing 22.3% for the year, and they now total 23% of total deposits. This compares with a mix of 19% one year ago. Interest-bearing

checking deposits were also up 9% for the year. Our growth in households is now improving our growth in fees as well. Debit card

fees grew 16% year-over-year, which of course is directly related to our successful household growth. Total fees, excluding security

gains, grew by 15% in the quarter compared with the same quarter last year. This improvement came across a broad range of categories,

including trust, mortgage, and marine fees, as well as service charges and other deposit fees that are associated with our household

growth.

Loan production and loan pipelines continued

to grow for the quarter as they have every quarter over the past year. Total production over the past 12 months has exceeded $240

million, and our pipelines continue to be strong as we look forward. Much of our production has been focused on the home purchase

market, which has continued to show signs of strengthening here in our markets and across Florida. In fact, inventory levels for

existing homes in many of our markets is now at a three- or four-month supply, some of the lowest levels we’ve seen since

the bubble period, and they are being priced at price points that predate that bubble period.

I’m going to turn the call over to

Bill now for a few more comments on the quarter, and then we’d be pleased to open the line for a few questions. Bill.

William R. Hahl: Thanks, Denny.

Good morning. Thank you for joining us today. We posted some slides on our website for this morning’s call that I will be

referring to during my comments; however, I’ll begin with a high level review of the income statement.

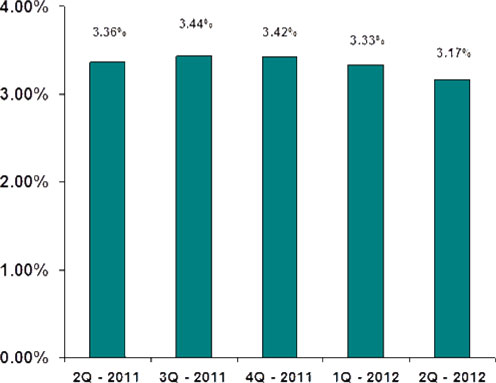

The low rate environment continues to be

very challenging. While low rates are positive for cost of funds, principal payments will likely remain higher, creating tougher

reinvestment decisions. In addition, like last quarter, we sold some investments to reduce our price risk as a result of those

accelerating prepayments of principal. So interest income from securities this quarter was lower, partially offset by lower funding

costs, while interest from loans was stable compared to the prior quarter. However, higher revenue from noninterest income areas,

excluding security gains, during the quarter allowed total revenue to remain flat at around $21 million for the second quarter,

comparable to the first quarter this year and last year’s second quarter. Core operating expenses were nearly unchanged for

the quarter compared to the first quarter, as reduction in expenses has been reinvested to increase future earnings growth at an

accelerating pace. More on this in a minute. So as Denny mentioned, the accelerating resolution of nonperforming assets this quarter

increased the provisioning for loan losses and other credit costs and resulted in a bottom line loss for the quarter and the six

months.

Now let’s take a look at some of

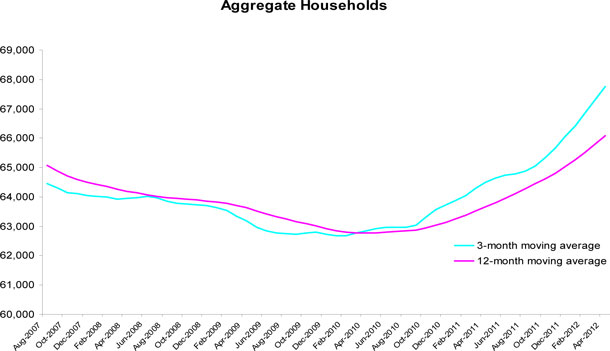

our successful household growth over the last several quarters and how that’s driving fee income improvement and loan growth.

Looking at slide five, you can see the increasing growth in households since 2009. We began a focus with retail households in 2008

and added businesses beginning late in 2010. In 2011, we added new commercial relationship managers, and this resulted in even

better business household growth and both increased new loan balances and core deposit relationships. On a sequential basis, household

growth is up 19.2% over the last 12 months compared to the same period for 2011. Over the first six months this year, new checking

household growth has doubled compared to 2011.

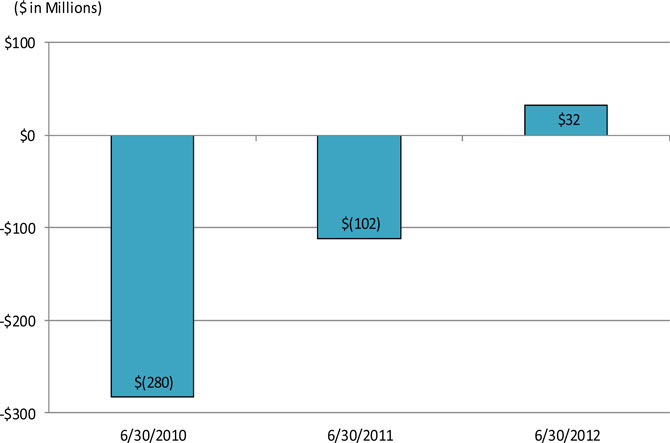

Loan growth over the past 12 months is

up $32 million, but, as Denny mentioned, new loan production was even much better. A total of $244 million of new loans was produced

and added to the portfolio during the last 12 months ended June 30, with $196 million of consumer loans and $68 million of

commercial loans. On a sequential quarterly basis, loan production totaled $91.9 million and was up 25.2% in the second quarter.

We expect to see increased loan growth, which will be additive to net interest income going forward. Although, as you are aware,

most of the add-on rates are lower than the portfolio’s current yield, they are still better than cash and securities.

Our security balances declined somewhat

this quarter as a result of the sales I discussed earlier as we didn’t see many attractive alternatives in light of the continued

low yields. We continue to look for opportunities to invest our excess liquidity, but believe the best current use is to fund loan

growth. The key to improving net interest income and the margin will be to increase the loan portfolio while continuing to improve

the deposit mix at an accelerated pace. Without the decline in interest income from investment sales, net interest income would

have increased this quarter. Our expectation for total revenues is that the run rate will resume its growth in the third quarter

2012 and that total revenues will exceed the $21 million we earned this quarter.

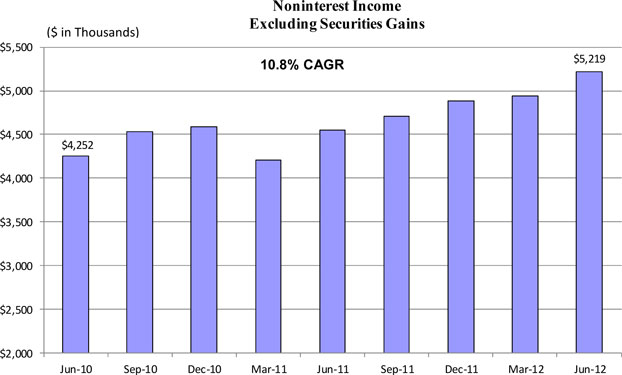

Moving to slide six, we show the impact

that increases in households have had on revenues and fees. The onboarding of new revenue from our well-executed process to cross-sell

additional products during and after the initial account opening has resulted in nearly an 11% compounded annual growth rate for

noninterest income since the second quarter of 2010. Despite lower overdraft income, primarily the result of the implementation

of Reg E, total interest income increased 5.7% linked-quarter or 22.8% annualized compared to the first quarter of 2012 and is

up 15% compared to last year’s second quarter. What these results show is that continued increases in households are restoring

a major element of normalized earnings and that our goal to complete the process in 2013 is achievable.

I’ll now turn to the liability side

and our deposit cost, mix and growth results. As Denny mentioned, the real story for deposits is the favorable shift in mix towards

lower cost accounts, most notably the DDA growth he mentioned of 22% year-over-year, and lower deposit costs including NOW and

regular savings have also increased by $35 million and $30 million, respectively, over the last 12 months. The growth in lower

cost and no cost accounts throughout the last 12 months has enabled us to manage down the higher cost time deposits and helped

with the net interest margin. Deposit costs have also benefited from the higher cost CDs maturing and rolling into lower rate products.

As a result, it has reduced time certificates to 22% of total deposits compared to 31% last year.

Turning to slide 10 and a review of expenses,

total noninterest expenses were lower linked-quarter as a result of lower net losses on OREO and repossessed assets. Salaries and

wages were up in the quarter compared to the second quarter of 2011, as the result of additional relationship managers who, as

I mentioned, have assisted us in building momentum leading to the increases in net new loan volumes. In addition, commissions and

incentives related to our revenue growth in various fee-based businesses have also been higher. Core operating expenses we believe

are being well managed, but we have areas that we are looking at, as Denny mentioned. In addition, credit-related expenses remain

high, but we continue to expect those to trend lower, as they have, as we resolve our nonperforming assets. In addition, we expect

to add some additional commercial relationship managers over the balance of 2012 which will further help in increasing loan growth

in 2013.

I’ll continue my comments by turning

to slide 12 on capital. Capital ratios remain well above regulatory minimums. Our Tier 1 and risk-based capital ratios remain very

strong and at levels higher than before the bubble at 17.2% and 18.4%, respectively. These ratios indicate that we have capacity

to grow the balance sheet. In that respect, we will continue to take advantage, we think, of the great opportunity to take market

share from the mega banks. Our most immediate capital deployment opportunity is to grow our loan portfolio, which we have done

over the last three quarters, as Denny has mentioned.

That concludes my remarks. I’ll turn

the call back to Denny.

Dennis S. Hudson III: Thanks, Bill.

I guess to sum things up, we are seeing good results with our growth initiatives, but we are in a tough environment. As I see and

look out over the next several quarters, I think we are going to remain in a tough environment, and the industry will face that

environment and will likely make it difficult for us to achieve spreads we would like to see. As a result, we are adjusting our

plan to meet this reality and to achieve the earnings power this franchise is capable of producing.

I’d be happy now to open the call for a few questions.

Operator: Thank you. We

will now begin the question-and-answer session. If you do have a question, please press star then one on your touchtone phone.

If you wish to be removed from the queue, please press the pound sign or hash key. If you are using a speakerphone, you may need

to pick up the handset first before pressing the numbers. Once again, if you have a question, please press star then one on your

touchtone phone.

Our first question comes from Jefferson

Harralson from KBW. Please go ahead.

Jefferson Harralson: Hi. Thanks,

guys. Can I ask you a question on capital and how you think about it with the changes in the rules that are going on, with your

TARP auction and trust preferreds possibly not being Tier 1, and OCI being most likely in the regulatory ratios; has all that changed

how you think about your capital structure?

William R. Hahl: Hi, Jefferson.

It’s Bill. I just had a little coughing jag here, but I’ll tell you what we’ve learned over the last couple of

weeks as we’ve looked at the proposed regulations on capital. We’ve taken a look at our ratios post—and, as you

know, the key is the risk-weighted asset ratios—and we find that our ratios remain quite strong in spite of the fact that,

as you pointed out, there are some adjustments that they are proposing. We’ll wait and see whether or not from the comments

that all of those proposals go through in terms of how OCI is going to be impacted by the unrealized gains and losses in the securities

book, et cetera. Long and short of it, we think we have plenty of capacity to grow the balance sheet under the new regulations

as well.

Jefferson Harralson: Okay. Thanks,

guys.

Dennis S. Hudson III: Thanks, Jefferson.

Operator: Thank you. Our

next question comes from Michael Rose with Raymond James. Please go ahead.

Michael Rose: Hey, good morning,

everyone. How are you?

Dennis S. Hudson III: Good morning,

Mike.

Michael Rose: Just a question on your

comments, Denny, on your more cautious outlook over the next couple quarters. Some of your competitors or other Florida-based banks

have actually expressed that banks are starting to turn up here and pipelines are growing, particularly on the commercial and commercial

real estate side. How do you couch that?

Dennis S. Hudson III: Well, my caution

was more related to the rather unusual interest rate environment we find ourselves in. I think we made pretty clear in our comments

that we are seeing, just as you are hearing, very healthy pipelines and we are anticipating loan growth. We are having to work

for it. We are having to go out and find those opportunities, but we are getting some good growth there. Again, the caution that

I talked about was more that I’m afraid the spreads that we are going to book on that new volume may be less attractive than

we would have thought they would have been even six or eight months ago. As a result, I think it’s imperative that we adjust

our plan to face that reality, and that leads us to some of the acceleration activities that I’ve mentioned and also some

of the looks at various things, including office consolidations and other ways to adjust our cost structure. So we are in the middle

of that review. We’re about half way through it, and we are looking to make some pretty meaningful progress as we go forward.

Again, as I said at the end of the call, this franchise has an earnings power that it is capable of producing, and we are committed

to working faster to help the franchise achieve that result. So my caution is not so much related to the business environment as

much as it is the interest rate environment. I will tell you, the business environment has certainly stabilized, although it is

still tough out there. We have focused our lending activities in areas where we think we are seeing some growth, probably the most

obvious of that is the good results we are getting with home purchase mortgages. We’ve had some great results there, and

that market is frankly quite hot throughout the state, we think.

Michael Rose: Okay, that’s

helpful. Then as a follow-up, now with other real estate balances at very low levels, how should we think about provisioning

on a go-forward basis now that most of the heavy lifting has been done. Your loan loss reserve ratio is about 2%. Where do you

think that normalizes, and what should we expect in terms of inflows into nonperformers in future quarters? Thanks.

Dennis S. Hudson III: Right. Well

you know we had some inflows this quarter. They were around $6 million in inflows that we produced. Those inflows were primarily

local, and half of them were related to retail and the other half office. When I look at that, the issue is how fast we wind down

the classifieds. We came to the conclusion this quarter, in fact as we tackled our project, that there are a number of our classified

credits, frankly, that have not progressed forward. These are performing classified credits that have not progressed forward with

improvements that we would have expected to see by now. So our judgment is that they will likely remain classified for a longer

period of time than we maybe would have thought a year ago, and so we are adjusting our plan to seek resolution strategies for

those assets to achieve more rapid improvement of our classified exposure. We think that’s important because it continues

to cost us overhead and money to monitor and resolve those assets. We just think we are at a point where things have stabilized

generally in the market, not getting worse, and we are now taking another look at the remaining problem assets that we are dealing

with and seeking ways to achieve resolution more quickly perhaps than we would have planned six months ago with some of those assets.

These are generally things that have some cash flow associated with them, but the cash flow hasn't improved enough to get it repaired

to a better quality.

Michael Rose: So would that include

additional bulk sales?

Dennis S. Hudson III: We don't know.

We think there is some of that, but I also think it’s just adjusting our resolution strategies in a more aggressive fashion.

Looking at several assets this quarter, we increased write downs and reserves on specific assets that we have adjusted our outlook

on in terms of creating a faster wind down. So to your question “What does the provisioning look like going forward?”,

we haven’t completed our work, but we’ve done a lot of it. We think we got a lot of it behind us this quarter. We’ll

have some provisioning next quarter. We don’t think it’s going to be nearly what it was this quarter, obviously. Our

objective is to get all of this completed to position us in a much stronger fashion as we enter 2013.

Michael Rose: Okay. Thanks for taking

my questions.

Dennis S. Hudson III: Yep.

Operator: Thank you. Our

next question comes from David Bishop from Stifel Nicolaus. Please go ahead.

David Bishop: Yeah. Hey, good morning,

Denny.

Dennis S. Hudson III: Hi, David.

David Bishop: Hey, a follow-up

on Mike’s question, in terms of the inflows of the nonperforming loans this quarter, when we think about loss content relative

to what we saw a couple years ago or so, how should we think about it on a go-forward basis in terms of net charge offs as well?

Dennis S. Hudson III: Well the loss

content isn’t anywhere near what it was several years ago because we blew through a lot of land and extreme high loss content

assets. I think what we are dealing with now is the more traditional commercial real estate asset that is performing, perhaps,

but not where we would like to see it, or it is partially performing.

David, any general thoughts or comments there?

David D. Houdeshell: I think you’re

right on point. Good morning, David. This is David Houdeshell. Most of our emerging problems have been in our commercial real estate

income portfolio where we have seen continued economic conditions strain rental factors, and as they are adjusted and netted down,

we are having to reevaluate the cash flow and the workout strategies for these assets. There is some good cash flow coming off

these assets that we can work with to resolve these more quickly than we would a land loan or things we have struggled with in

the past years.

Dennis S. Hudson III: Does that

answer your question, David?

David Bishop: Yeah. Thank you. And,

Denny, maybe just commentary in terms of the overall commercial pipeline, what you are seeing?

Dennis S. Hudson III: Yeah.

H. Russell Holland III: Good morning.

This is Russ Holland. Our pipeline is pretty broad. We have teams covering Orlando down through the Treasure Coast into Palm Beach,

and generally our focus is on the small business segment. Owner-occupied real estate is our primary pipeline right now, but we

also have some small balance investor real estate opportunities and lines of credit, equipment loans. It’s a pretty general

community bank type commercial pipeline.

Dennis S. Hudson III: And Russ…

H. Russell Holland III: The average

loan we have originated this year is $500,000. That’s the loan size.

Dennis S. Hudson III: …On

the commercial side.

H. Russell Holland III: Yes, on

the commercial side. On the residential side, as Denny described, it’s purchase money financing.

Dennis S. Hudson III: And, Russ,

any comments on where that production is coming from? I mean it’s not…

H. Russell Holland III: It’s

very balanced throughout our footprint. Orlando is about a third of it. A third to half is coming out of the Treasure Coast and

the balance is Palm Beach County.

Dennis S. Hudson III: Yeah, and

a lot of this production is a result of our growth in commercial households. We are focusing on acquiring those deposit relationships

and, in so doing, moving credit relationships over. We’ve hired a number of lenders, as you well know, over the last year.

We are continuing to recruit in that area, which is adding to our cost, but we think it’s important as we ramp up our production

capacity, particularly in the small business area. We are having some great success with it, so we’re very pleased. And again,

whether it be on the consumer side of the bank or the small business side of the bank, there is just really a lot of interest I

think out there on the part of individuals and businesses in getting away from some of the mega banks that have really struggled

from a service standpoint over the last year.

David Bishop: Thanks for the color.

Operator: Thank you. Our

next question comes from Mac Hodgson from SunTrust Robinson Humphrey. Please go ahead.

Michael Young: Hi, this is Michael

Young in for Mac. Just wanted to ask a question regarding DTA recapture timing. We have seen some other banks take about five

quarters of profitability. Do you feel that this quarter acts as a reset to that timeline?

Dennis S. Hudson III: I don’t

think it resets it. I don’t think the fundamentals have changed. I think the challenge we’ve had is, as you probably

are aware, there is no rule that follows recapture after five consecutive quarters or anything like that. It’s really more

of a focus on what the forward earnings, near-term earnings, look like. I think that we are still looking at probably the earliest

would be late this year and more likely sometime in 2013.

Bill, any other comments? We have commented

on that before. It’s a very complex discussion and we are confident it will happen. I’ll state that again. It absolutely

happens. I think it is just a question of timing.

William R. Hahl: Right, and I think

that the whole thought process of acceleration of our earnings back to more normalized earnings is the key, and that’s why

we are focused on '13. As soon as that can be revealed in a way that can be objectively looked at by the external auditors, we’ll

be there.

Michael Young: Okay. And I was

just going to also see if you could provide some color on some of the cost cutting initiatives. You mentioned potentially considering

office consolidations and things of that nature.

Dennis S. Hudson III: We are not

prepared to talk about that today, but we will be in the next call. We are focused on a whole host of issues, and it covers the

gamut across the organization. I think we’ll just push that off until next quarter. It does include the possibility of office

combinations. I don’t know that we are looking at a significant number there, but we have been doing some modeling over the

past two months on that score. We consolidated one office this quarter with a nearby office. It happened late this quarter. We

will just have to see. We are looking at a couple more probably in the next quarter or two. We would like to get all of this completed

by year-end.

Michael Young: Thanks.

Operator: Thank you. Our

next question comes from Timothy Orkins from FIG Partners. Please go ahead.

Timothy Orkins: Good morning, everybody.

Dennis S. Hudson III: Good morning.

William R. Hahl: Good morning.

Timothy Orkins: My first question

is: Could you all tell me what percentage of the charge-offs this quarter has specific reserves against them?

Dennis S. Hudson III: Say that again,

what percentage… Say that again.

Timothy Orkins: Of the charge-offs

had specific reserves against them?

William R. Hahl: I’m not sure

that there… I think most of the charge-offs… for the most part, we were adding specific reserves to certain credits…

Dennis S. Hudson III: Yeah, our

charge-off…

William R. Hahl: …rather

to our provisioning, and we charged down loans, I think.

Dennis S. Hudson III: I would say

generally speaking, most of the charge downs tended to have additional reserves associated with those assets, generally speaking.

William R. Hahl: Right.

Dennis S. Hudson III: Right?

William R. Hahl: Yes.

Dennis S. Hudson III: Yeah. Hope

that answers your question.

Operator: At this time,

I’m showing no further questions.

Dennis S. Hudson III: Well, thank

you very much for attending today, and we look forward to reporting further progress when we next speak together in the coming

quarter. Thank you.

Operator: Thank you, ladies

and gentlemen. This concludes today’s conference. Thank you for participating. You may now disconnect.

Please Note: *

Proper names/organizations spelling not verified.