☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☑ |

Definitive Proxy Statement |

|||||

☐ |

Definitive Additional Materials |

|||||

☐ |

Soliciting Material Pursuant to §240.14a-12 |

|||||

☑ No fee required. |

☐ Fee paid previously with preliminary materials. |

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i) (4) and 0-11. |

Notice of 2023 Annual Meeting of Shareholders and Proxy Statement

| ANNUAL MEETING | ITEMS OF BUSINESS | |||

|

|

DATE: |

1. To elect eight (8) directors, nominated by the Board of Directors, as more fully described in the Proxy Statement 2. To consider and ratify the selection of Ernst & Young LLP as independent registered public accountants for the fiscal year ending December 31, 2023 3. To consider and act upon a non-binding, advisory vote to approve the compensation of our named executive officers (“say-on-pay”) 4. To consider and act upon a non-binding, advisory vote on the frequency of future advisory votes on the compensation of our named executive officers (“say-on-frequency”) 5. To approve an amendment to our Certificate of Incorporation to permit the Board of Directors to adopt, amend or repeal our By-laws 6. To approve the ratification of the amendment and restatement of the By-laws adopted by the Board of Directors on January 27, 2021 to implement shareholder proxy access

NOTE: The Board of Directors will consider and act upon any other | ||

|

|

TIME: 8:00 a.m. ET

| |||

|

|

LOCATION: | |||

| www.virtualshareholdermeeting.com/RGEN2023

| ||||

WHO CAN VOTE

Shareholders of Repligen Corporation Common Stock at the close of business on March 20, 2023 (our “Record Date”). It is important that your shares be represented and voted at the 2023 Annual Meeting of Shareholders (the “Annual Meeting”). Whether or not you plan to attend the virtual Annual Meeting, please complete and return the enclosed proxy card in the envelope provided or vote by internet or telephone pursuant to instructions provided with the proxy card.

HOW TO VOTE

Our Annual Meeting will again be held in a virtual meeting format only, via the internet, with no physical in-person meeting. At our virtual Annual Meeting, shareholders will be able to attend, vote and submit questions as set forth in this section.

Voting instructions are the same for registered shareholders (shares are registered in your name with Repligen’s transfer agent, American Stock Transfer) and beneficial owners (shares are held in a stock brokerage account or by a bank or other holder of record). Here’s how to vote prior to the Annual Meeting:

|

|

|

||||||

| By internet at www.proxyvote.com |

By phone 1-800-690-6903 |

By mail, complete and return your proxy card or voting instruction form |

You may also vote at the Annual Meeting via www.virtualshareholdermeeting.com/RGEN2023. You will need the 16-digit control number included with these proxy materials to vote electronically, to vote by phone, and/or to attend the virtual Annual Meeting. A technical support telephone number will be posted on the Annual Meeting login page so that you can call if you encounter any difficulties accessing the Annual Meeting during the check-in or during the meeting.

Execution of a proxy card, or voting by telephone or via the internet prior to the Annual Meeting, will not in any way limit a shareholder’s right to attend the virtual Annual Meeting and vote during the meeting.

HOW TO SUBMIT QUESTIONS

During the Annual Meeting, if you have your 16-digit control number and wish to ask a question, you may do so by clicking the Q&A button on the virtual meeting platform and entering your question in the text box. If questions submitted are repetitive as to a particular topic, the Chairperson of the meeting may limit discussion on such topic. During the formal portion of the meeting, all questions presented should relate directly to the proposal under discussion. We will also hold a question and answer period at the end of the meeting, as time permits, during which time we welcome questions not relating to specific proposals.

DATE OF MAILING

Our Annual Report to Shareholders, containing a letter from our CEO and financial statements for the fiscal year ended December 31, 2022, is being provided together with this Proxy Statement to all stockholders entitled to vote at the Annual Meeting. It is anticipated that this Proxy Statement and the accompanying proxy will be first sent or given to shareholders on or about April 11, 2023.

By Order of the Board of Directors

Jon Snodgres

Chief Financial Officer

April 11, 2023

Table of Contents

| 38 | ||

| 38 | ||

| 38 | ||

| 38 | ||

| 38 | ||

| 40 | ||

| 42 | ||

| 46 | ||

| 47 | ||

| 47 | ||

| 48 | ||

| 48 | ||

| 48 | ||

| 62 | ||

| General Annual Meeting Information | 64 | |

| 64 | ||

| 64 | ||

| 64 | ||

| 64 | ||

| 64 | ||

| 65 | ||

| 65 | ||

| 66 | ||

| Additional Information | 67 | |

| 67 | ||

| 67 | ||

| 67 | ||

| 67 | ||

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in the Proxy Statement. As this summary does not contain all the information that you should consider in connection with the 2023 Annual Meeting of Shareholders (the “Annual Meeting”), we recommend reading the entire Proxy Statement carefully before voting.

References throughout the Proxy Statement to “Repligen Corporation”, “Repligen”, “we”, “us”, “our”, or the “Company” refer to Repligen Corporation and its subsidiaries, taken as a whole, unless the context otherwise indicates.

VOTING MATTERS

| Proposal |

Description | Board Recommendation | ||||||

|

|

Proposal 1: Election of directors (page 15) |

We are asking our shareholders to elect each of the eight (8) directors identified below to serve until the 2024 Annual Meeting of Shareholders. | FOR each nominee |

| ||||

|

|

Proposal 2: Ratification of the selection of the independent registered public accounting firm (page 30) |

We are asking our shareholders to ratify our Audit Committee’s selection of Ernst & Young LLP (“E&Y”) to act as the independent registered public accounting firm for Repligen in 2023. Although shareholder approval of the Audit Committee’s selection of E&Y is not required, our Board of Directors (“Board”) believes we should provide an opportunity for our shareholders to ratify this selection. | FOR |

| ||||

|

|

Proposal 3: Advisory vote on executive compensation (page 32) |

We are asking our shareholders to cast a non-binding, advisory vote to approve the compensation of our named executive officers (“NEOs”). In evaluating this year’s “say-on-pay” proposal, we recommend you review our Compensation Discussion and Analysis, describing how the Compensation Committee arrived at its executive compensation actions and decisions for 2022. | FOR |

| ||||

|

|

Proposal 4: Advisory vote on frequency of future advisory votes on the compensation of our NEOs (page 33) |

We are asking our shareholders to cast a non-binding, advisory vote on the frequency of future “say on pay” proposals. | 1 YEAR |

| ||||

|

|

Proposal 5: Approval of amendment to our Certificate of Incorporation (page 34) |

We are asking our shareholders to approve an amendment to our Certificate of Incorporation, as amended, to permit the Board to adopt, amend, or repeal the By-laws. | FOR |

| ||||

|

|

Proposal 6: Approve the ratification of amendment and restatement of our By-laws |

We are asking our shareholders to approve the ratification of the amendment and restatement of our By-laws adopted by the Board on January 27, 2021 to implement shareholder proxy access. | FOR |

| ||||

Please see the sections titled “General Annual Meeting Information” on page 64, and “Additional Information” on page 67 for important information about the proxy materials, including voting methods, vote requirements for adoption of each proposal, effect of abstentions and the deadlines to submit shareholder proposals and director nominations for next year’s annual meeting of shareholders.

| REPLIGEN CORPORATION | 1

|

2023 PROXY SUMMARY | |||||||||

OUR DIRECTOR NOMINEES

You are being asked to vote on the election of the following eight (8) nominees to our Board. All directors are elected annually by the affirmative vote of a majority of votes cast. The chart below summarizes our director nominees’ personal information and current committee memberships. You can find detailed information about each director nominee’s background, skill sets and areas of expertise later in this Proxy Statement.

|

Current Committee Memberships |

||||||||||||||||||

| Name and principal |

Age(1) | Director Since |

Independent | Other Public Boards |

Audit | Compensation |

Nominating & |

|||||||||||

| Tony J. Hunt President, Chief Executive |

59 | 2015 | 1 | |||||||||||||||

| Karen A. Dawes, Chairperson President, Knowledgeable |

71 | 2005 | ✓ | 2 | CHAIR | |||||||||||||

| Nicolas M. Barthelemy Former President and Chief Executive Officer, |

57 | 2014 | ✓ | - | CHAIR | • | ||||||||||||

| Carrie Eglinton Manner President and Chief Executive Officer, OraSure Technologies, Inc. |

49 | 2020 | ✓ | - | • | |||||||||||||

| Konstantin Konstantinov, Ph.D. Chief Technology Officer, Codiak BioSciences(2) |

65 | 2022 | ✓ | - | • | |||||||||||||

| Martin D. Madaus, D.V.M., Ph.D. Senior Operating Executive, |

63 | 2023 | ✓ | 2 | • | • | ||||||||||||

| Rohin Mhatre, Ph.D. Senior Vice President, |

58 | 2020 | ✓ | - | • | |||||||||||||

| Glenn P. Muir Retired Chief Financial Officer |

64 | 2015 | ✓ | 2 | CHAIR | • | ||||||||||||

| (1) | Age as of the date of the Annual Meeting. |

| (2) | Dr. Konstantinov joined the Board on May 26, 2022. |

| (3) | Dr. Madaus joined the Board on February 6, 2023. |

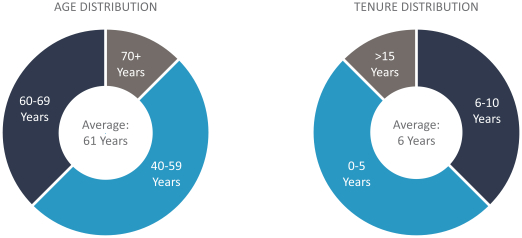

BOARD COMPOSITION

We continuously evaluate our director skill sets and expertise for alignment with Repligen’s strategic goals. Our independent directors bring extensive experience in areas that are critical to the Company’s strategy and long-term success, such as biopharmaceutical manufacturing, global and commercial operations, and finance. Below we highlight the key skills and experiences of our director nominees that are critical to Repligen’s success.

In addition to diversity of skills and experience, we believe that establishing and maintaining a Board that includes diverse demographics, such as gender, race, ethnicity, culture, nationality and sexual orientation, is important because having varying perspectives and a breadth of experience improves the quality of dialogue, contributes to more effective decision-making on behalf of the Company and its shareholders and enhances the overall chemistry and collaborative culture in the boardroom. Our Board includes directors who represent ethnic and gender diversity, and two (2) of our eight (8) director nominees are women, one of whom serves as the Chairperson of our Board.

| REPLIGEN CORPORATION | 2

|

2023 PROXY SUMMARY | |||||||||

| Key Skills & Experience | ||||||||||||||||||||

| Director Nominee | Public Company Board/CEO |

Risk Oversight |

Finance & Capital Markets |

Manufacturing & Global |

Strategic Planning and M&A |

Life Sciences Technology & Innovation |

Commercial Sales & Marketing |

|||||||||||||

|

|

Tony J. Hunt |

|

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

| ||||||||||

|

|

Karen A. Dawes |

|

✓ |

✓ |

✓ |

|

✓ |

|

✓ |

| ||||||||||

|

|

Nicolas M. Barthelemy |

|

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

| ||||||||||

|

|

Carrie Eglinton Manner |

|

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

| ||||||||||

|

|

Konstantin Konstantinov, Ph.D. |

|

|

✓ |

|

✓ |

|

✓ |

|

| ||||||||||

|

|

Martin Madaus, D.V.M., Ph.D. |

|

✓ |

✓ |

|

✓ |

✓ |

✓ |

✓ |

| ||||||||||

|

|

Rohin Mhatre, Ph.D. |

|

|

✓ |

|

✓ |

|

✓ |

|

| ||||||||||

|

|

Glenn P. Muir |

|

✓ |

✓ |

✓ |

|

✓ |

|

|

| ||||||||||

| Board Diversity Matrix | ||||||||

| Total Number of Directors |

8 | |||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||

| Directors |

2 |

6 |

— |

— | ||||

| Number of Directors who self-identify in any of the categories below: | ||||||||

| African American or Black |

— |

— |

— |

— | ||||

| Alaskan Native or Native American |

— |

— |

— |

— | ||||

| Asian |

— |

1 |

— |

— | ||||

| Hispanic or Latinx |

— |

— |

— |

— | ||||

| Native Hawaiian or Pacific Islander |

— |

— |

— |

— | ||||

| White |

2 |

5 |

— |

— | ||||

| Two or More Races or Ethnicities |

— |

— |

— |

— | ||||

| LGBTQ+ |

— |

|||||||

| Did not Disclose Demographic Background |

— |

|||||||

| Supplemental self-identification: | ||||||||

| Persons with Disabilities |

— |

|||||||

| Military Veteran |

— |

|||||||

| REPLIGEN CORPORATION | 3

|

2023 PROXY SUMMARY | |||||||||

CORPORATE GOVERNANCE HIGHLIGHTS

Repligen is committed to implementing and maintaining effective corporate governance practices that further long-term shareholder value, promote the Board’s accountability, and align the interests of our executive team with those of our shareholders. The following represent the key elements of our corporate governance programs:

| Director Independence |

• All of our director nominees, other than our President and Chief Executive Officer (“CEO”), are independent • 37.5% of our director nominees represent gender and ethnic diversity • All Committee members are independent • Executive sessions of independent directors are held at each Board meeting

| |

| Board Refreshment |

• Board refreshment is a key area of focus as shown by the 2022 addition of Dr. Konstantinov, a bioprocessing technical expert, and the 2023 addition of Dr. Madaus, a former CEO of a major bioprocessing tools company

| |

| Board Governance Practices |

• We conduct annual Board and committee evaluations and self-assessments • All directors and officers are subject to our Code of Business Conduct & Ethics • All directors serving on the Board attended 100% of Board and committee meetings held during the period for which they have been directors and/or on the committees of the Board • Our Chairperson and CEO positions are separate and our current Chairperson is female

| |

| Shareholder Rights |

• All of our directors are elected annually • In uncontested elections, our directors must be elected by a majority of votes cast • Our By-laws include shareholder rights to amend our By-laws • We have no super-majority voting requirements in our Charter or By-laws • Robust investor communication program including Environmental, Social, and Governance (“ESG”)-focused outreach

| |

| Compensation Practices/Policies |

• We have stock ownership guidelines for all directors and NEOs • Our executive compensation program links pay with corporate and individual performance • A significant percentage of target compensation is “at-risk” through short-term and long-term incentive awards • We have anti-hedging, anti-pledging and anti-short sale policies • We have a compensation clawback policy |

SHAREHOLDER ENGAGEMENT

We actively seek and highly value the views and insights of our shareholders. We meet regularly with our shareholders through a robust schedule of investor meetings, conferences, roadshows and other events. In addition to our traditional investor relations outreach efforts over the last several years, we have also expanded our shareholder engagement program to include meetings with shareholder stewardship and proxy governance teams specifically, to discuss proxy proposals, overall governance and executive compensation programs, and ESG reporting and initiatives. These discussions often involve our Board Chairperson and/or Board committee members, our CEO, members of our executive management team as appropriate, and our Global Head of Investor Relations.

Our shareholder engagement program in 2022, and into 2023, was directed by our Global Head of Investor Relations, with oversight by our CEO, Tony J. Hunt, and our Board Chairperson, Karen A. Dawes, who also serves as Chair of our Nominating and Corporate Governance (“N&CG”) Committee. Participants included Nicolas M. Barthelemy, who serves as Chair of our Compensation Committee and is a member of our N&CG Committee, and Glenn Muir, who serves as Chair of our Audit Committee and is a member of our Compensation Committee. Several of those meetings included Mr. Hunt, as appropriate to the topics of discussion, or by request.

Our shareholder engagement activities have guided our Board meeting agendas and have led to governance enhancements that help us address the issues that matter most to our shareholders. We consider this ongoing engagement process important in creating long-term value, and maintaining a culture of integrity, compliance and sustainability.

Conversations with institutional investors in 2022 and into 2023 covered a wide range of topics, primarily focused on the following: our near-term financial performance and long-term financial goals; our business strategies and execution; our investments in capacity to meet customer demand; our plans for managing declines in revenue related to COVID-19; our competitive and market positioning; the durability of headwinds such as industry stocking and supply challenges and currency fluctuations; and growth drivers for the Company including new applications of our technologies. Our ESG-specific

| REPLIGEN CORPORATION | 4

|

2023 PROXY SUMMARY | |||||||||

discussions were primarily focused on the environmental and social categories, having previously focused more on governance items and responded, for example, with updates to our executive compensation performance metrics and structure (see our 2022 Proxy Statement – “What We Heard, How We Responded” tables). More specific to our ESG discussions in 2022 and into 2023, the primary topics were: where and how the Company is positively impacting energy consumption; the status of single-use recycling programs; actions being taken to support and advance our human capital; and steps taken to advance Diversity, Equity, and Inclusion (“DE&I”) initiatives and tracking.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE MATTERS

We believe our commitment to ESG matters at all of our global facilities is an important part of creating long-term business value for all stakeholders. We are strongly committed to corporate responsibility and transparency, and we continue to factor sustainability into our business decisions and operations.

ESG Oversight

The Chair of our N&CG Committee oversees ESG matters and practices, as set forth in the N&CG Committee charter. The N&CG Committee reports to the full Board on ESG matters and the Company’s progress on sustainability initiatives. In preparation of our initial sustainability report, published in November 2021, we established an internal Corporate Responsibility Team (“CRT”), comprised of senior leaders across multiple disciplines including sustainability, business operations, human resources, investor relations, legal affairs and corporate compliance, supply chain management and engineering. In addition, we have identified an ESG ambassador at each of our sites around the globe, who takes responsibility for site-level input and data. At least on a quarterly basis, a CRT representative and the N&CG Committee Chair meet to review progress against the Company’s ESG objectives and, on an annual basis, an ESG status update is presented to the full Board. Our commitment to ESG oversight at both the Board and management levels reflects the importance of ESG-driven policies and programs to our long-term strategic plan.

Compensation-Related ESG Measures

In light of input from our stakeholders, the N&CG Committee has discussed the inclusion of an ESG metric as part of short-term and/or long-term incentive awards made to our NEOs. Beginning in 2022, the N&CG Committee determined that NEOs will annually be assigned certain ESG responsibilities, as appropriate to their roles, to support and advance defined corporate ESG goals. Their level of effectiveness in helping to achieve the corporate ESG goals is considered when determining individual achievement.

| For the year 2022, the corporate ESG goals, all of which were achieved, are listed below:

• Increase the number of key sites that have transitioned to 100% renewable electricity

• Advance additional right-sized packaging programs that reduce the number, size and weight of shipments

• Pilot/explore a single-use product recycling/repurpose program

• Advance a comprehensive DE&I program

For the year 2023, the corporate ESG goals include the following:

• Reduce carbon emissions by 10%

• Implement in-process manufacturing waste recycling and landfill mitigation programs across our sites

• Create pathways for post-consumer use product recycling

• Drive employee engagement; act upon employee survey results and further expand professional development programs

• Expand employee resource group support and community outreach programs |

United Nations Global Compact Communications on Progress

In establishing a formal approach to ESG in 2020, we completed a materiality assessment to glean insights from internal and external stakeholders, and joined the United Nations Global Compact (“UNGC”) in support of its Ten Principles related to human rights, labor, the environment, and anti-corruption. We committed to providing the UNGC with a periodic communication on progress. We believe our ESG reporting and alliances demonstrate our high ambition, and the actions we have taken to advance our ESG strategy demonstrate our longer-term commitment to being a responsible global corporate citizen.

| REPLIGEN CORPORATION | 5

|

2023 PROXY SUMMARY | |||||||||

Our initial sustainability report, “Committed to Making a Difference” is built on four pillars: Principles, People, Product and Planet (“4Ps”). Our “4Ps” embody the belief shared by our Board and the executive leadership team that corporate responsibility is essential to sustaining business and economic growth in a manner that can also deliver positive environmental and social impact. At Repligen, we are embracing sustainability as a mindset that encompasses and enhances our ESG profile.

ESG Progress in 2022

In 2022, our ESG initiatives took on fresh energy and momentum, as we hired three full-time employees focused on sustainability, and established an employee resource group (“ERG”) to support employee-driven activities. Our ESG ambassadors at each site continue to populate our financial grade ESG reporting software, enabling more robust analyses across critical ESG metrics.

During 2022, we were pleased to be upgraded to “AA” by MSCI ESG Ratings, from our previous rating of “BBB”. We also received honors from Corporate Register for our 2020 sustainability report, and importantly, we completed a second communication on progress to the UNGC. We were recognized by the UNGC with the prestigious “2022 SDG Pioneer Award, USA Network” for exceptional work toward advancing global goals, through implementation of UNGC’s Ten Principles and integration of Sustainable Development Goals (“SDGs”) into our strategy and daily business activities. We are now preparing our next report, for publication during the second half of 2023. We plan to again report disclosures in accordance with the Sustainability Accounting Standards Board (“SASB”) standards and Global Reporting Initiative (“GRI”) standards, and we also plan to include Task Force on Climate-Related Disclosures (“TCFD”) and Carbon Disclosure Project (“CDP”) disclosures.

In our next report, we expect to disclose more about our ESG targets and where we have made meaningful progress, for example: our transition to 100% renewable electricity at additional key sites; the diversion of waste streams from landfills to recyclers; steps forward on a single-use recycling pilot program; outcomes from our most recent employee engagement survey; advances in our DE&I initiatives; and more.

EXECUTIVE COMPENSATION HIGHLIGHTS

Repligen’s compensation philosophy is to provide compensation that will attract and retain high-performing talent in our industry, motivate the Company’s executive officers to create long-term, enhanced shareholder value, provide a fair reward for robust effort and stimulate our executive officers’ professional and personal growth. The Company believes that the compensation of its executive officers should align the executive officers’ interests with those of the shareholders and focus executive officer behavior not only on the achievement of near-term corporate goals, but also on the achievement of long-term business objectives and strategies. For more on compensation philosophy see the section titled “Executive Compensation” on page 42.

| REPLIGEN CORPORATION | 6

|

2023 PROXY SUMMARY | |||||||||

Compensation Practices

The following features of our compensation program are designed to align the interests of our executive team with those of our shareholders and with market best practices:

| We Do | We Don’t | |||||||||||

|

|

✓ | Pay for Performance: We emphasize performance-based compensation that aligns the interests of our executives with those of our shareholders through the use of both near-term cash incentive compensation and longer-term equity awards subject to both time- and performance-based vesting. |

X | Hedge or Pledge: We do not allow executive officers to engage in hedging or pledging of our securities. |

|

|

| |||||

|

|

✓ | Benchmark: We maintain an industry-specific peer group for annual benchmarking of executive compensation. This benchmarking is a key factor among those used to determine appropriate compensation for our NEOs. |

X | Re-Pricing: We do not allow for re-pricing of underwater stock options without shareholder approval. |

|

|

| |||||

|

|

✓ | Benefits: We offer market-competitive benefits for executives that are consistent with the benefits we offer to all employees. |

X | Gross Up Payments: We do not provide tax gross-up payments for our executive officers. |

|

|

| |||||

|

|

✓ | Consult: We consistently engage an independent compensation consultant to advise on compensation levels and practices. |

X | Excess Perquisites: We do not provide excessive perquisites to our employees. |

|

|

| |||||

|

|

✓ | Risk Assessment: We perform an annual compensation risk assessment. |

X | Executive Retirement Benefits: We do not provide supplemental executive retirement plans, nonqualified defined contribution or deferred compensation plans to our executive officers. |

|

|

| |||||

|

|

✓ | Stock Ownership Requirements: We maintain stock ownership guidelines that require our directors, our CEO and our other NEOs to maintain a specified level of ownership in the Company. | X | Guaranteed Bonuses: We do not provide guaranteed bonuses to our executive officers. |

|

|

| |||||

|

|

✓ | Clawback: We have a clawback policy and may claw back all or a portion of cash and equity incentive compensation paid to NEOs in the event of a financial accounting restatement. In light of the SEC’s adoption of final clawback rules in October 2022, we intend to update our clawback policy to comply with applicable Nasdaq listing rules when effective. |

|

|

|

|

| |||||

|

|

✓ | Double Trigger: We provide each NEO severance benefits that are triggered only upon a qualifying termination of employment following a change in control (i.e., double trigger), except for a one-time special long-term equity award to the CEO(1). |

|

|

|

|

| |||||

| (1) | The one-time special award was granted to Mr. Hunt in 2018 in recognition of past performance and to provide additional long-term retention incentive in light of high demand for executive talent within our industry, and was overall designed to protect shareholder interests. |

| REPLIGEN CORPORATION | 7

|

2023 PROXY SUMMARY | |||||||||

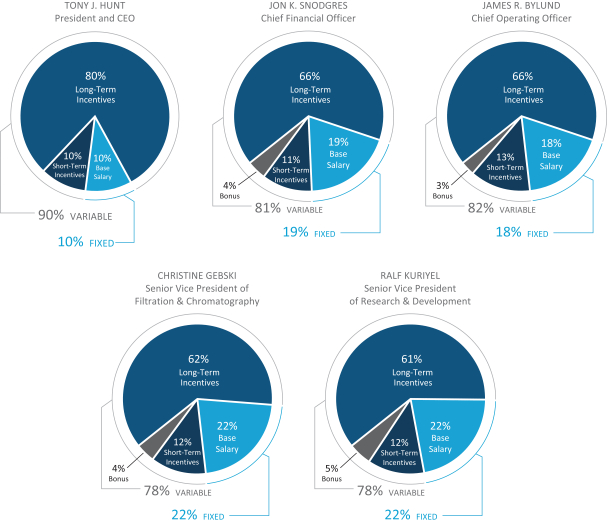

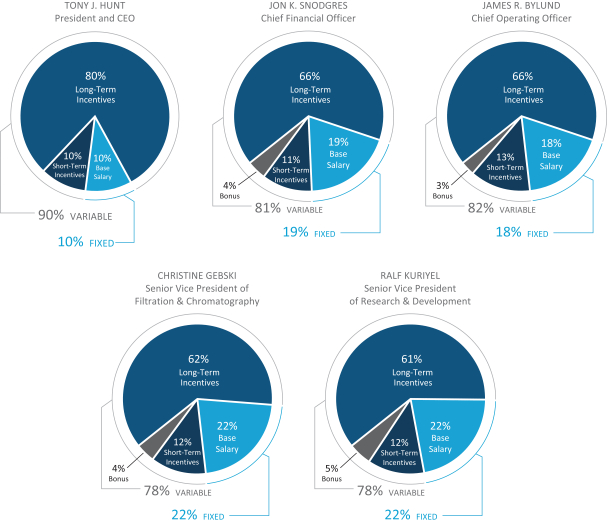

Compensation Earned

The graphs below reflect the allocation of salary, cash incentive compensation and equity incentive compensation earned by the Company’s Chief Executive Officer (“CEO”), Chief Financial Officer, Chief Operating Officer, Senior Vice President of Filtration & Chromatography, and Senior Vice President of Research & Development in 2022, all five of whom were serving as the Company’s NEOs as of December 31, 2022. Additional NEO compensation detail and notes can be found in the “Executive Compensation Tables - 2022 Summary Compensation Table” on page 48.

2022 Summary Compensation Allocations

The following table sets forth the total compensation earned by the NEOs during 2022. For more information on the total compensation see “Executive Compensation Tables - 2022 Summary Compensation Table” on page 48.

| Tony J. Hunt | Jon K. Snodgres | James R. Bylund | Christine Gebski | Ralf Kuriyel | ||||||||||

|

|

Title | President & CEO |

Chief Financial Officer |

Chief Operating Officer |

Senior Vice President of Filtration & Chromatography |

Senior Vice President of Research & Development |

| |||||||

| Total 2022 Compensation | $7,713,930 | $2,426,541 | $2,378,323 | $1,639,616 | $1,676,334 | |||||||||

| REPLIGEN CORPORATION | 8

|

2023 PROXY SUMMARY | |||||||||

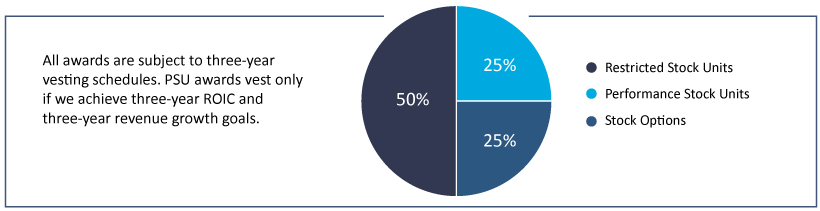

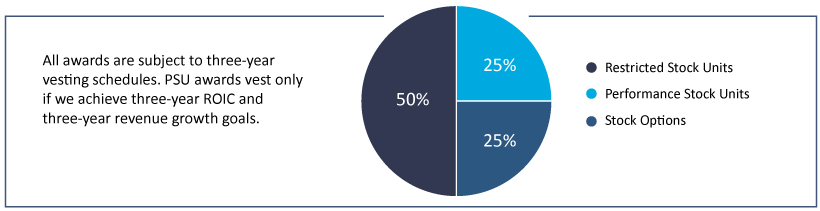

Long-term Equity Incentive Breakout for NEOs

We believe that the mix of time-based and performance-based equity awards under our long-term incentive compensation program provides balance to the program, motivates our executives to drive organizational achievement of our near- and long-term corporate goals and aligns the interests of our executive officers with those of our shareholders.

As shown in the graph below, the target split of the long-term equity incentive compensation awards made to our NEOs based upon dollar value is 25% PSUs, 25% stock options subject to time-based vesting and 50% restricted stock units (“RSUs”) subject to time-based vesting. Our Compensation Committee annually reviews our long-term equity incentive program and has determined that the current composition and weightings remain appropriate in furthering our objective of recruiting and retaining top talent in our industry at this time.

PSU awards are earned only if we achieve three-year Adjusted Return on Invested Capital (“Adjusted ROIC”) and specific three-year revenue growth goals, which are set at challenging levels. The revenue growth goals are either based on compound annual growth rate (“CAGR”) or average annual growth rate. The Compensation Committee set sequentially more aggressive three-year Adjusted ROIC and revenue growth goals for the 2020, 2021 and 2022 PSU awards. The revenue goals for the 2020 program reflect overall revenue growth, with the exception of revenues from acquisitions after May 31, 2019. The revenue goals for the 2021 program reflect three-year average organic revenue growth for the total business. For the 2022 and 2023 programs the Compensation Committee set the revenue targets for these programs based on organic growth in base business (“Base Organic Growth”), excluding revenue related to COVID-19 from the programs due to the volatility in demand related to COVID-19 and associated revenues. Base Organic Growth excludes the impact of revenue related to COVID-19, inorganic acquisition-related revenue, and the impact of changes in foreign exchange rates.

In 2020, we granted PSU awards subject to a three-year performance period ending December 31, 2022. The following table presents the performance goals and actual achievement for the 2020 program:

| Goals and Achievement for the Three-Year Performance Period Ending December 31, 2022

|

||||||||

| High End of Target Range

|

Achievement

|

|||||||

|

|

Revenue CAGR 2020-2022 | 25.0% | 39.2% |

| ||||

|

|

Adjusted ROIC(1) |

8.0% | 12.9% |

| ||||

| (1) | Adjusted ROIC means the Company’s Adjusted NOPAT (as defined below), divided by Adjusted Invested Capital. |

| Adjusted NOPAT means the Company’s Adjusted Income from Operations multiplied by the Adjusted Tax Rate. |

| Adjusted Income from Operations means the Company’s income from operations under U.S. generally accepted accounting principles (“GAAP”), adjusted for inventory step-up charges, acquisition and integration costs, contingent consideration expense and intangible asset amortization. |

| Adjusted Tax Rate means the Company’s tax rate under GAAP, adjusted for the tax effect of non-GAAP charges. |

| Adjusted Invested Capital means the average of the year-end balances for the final two years of the ROIC performance period of (a) the sum of (i) the Company’s total stockholders’ equity under GAAP and (ii) the Company’s total short-term and long-term debt recorded under GAAP, less (b) the Company’s cash and cash equivalents under GAAP, but excluding in all cases the impact of any business acquisition after the first two acquisitions completed during the plan period. |

We have granted our NEOs performance-based equity awards, including PSUs, each year since 2019 and we anticipate that we will continue to include such equity awards as part of our long-term incentive compensation program going forward for the reasons noted above.

| REPLIGEN CORPORATION | 9

|

2023 PROXY SUMMARY | |||||||||

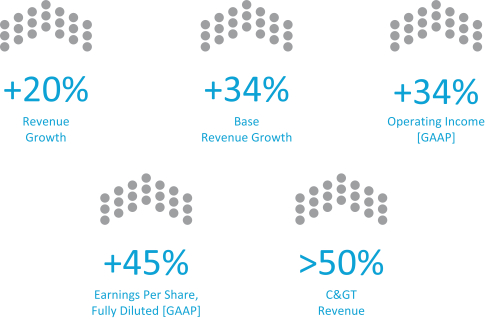

BUSINESS & FINANCIAL HIGHLIGHTS 2022

We achieved our business and financial goals for 2022, remaining focused on base business growth and new product launches into the bioprocessing market, where we serve the needs of biopharmaceutical developers, contract development and manufacturing organizations and other life sciences tools companies. We are proud to offer our customers highly differentiated technologies and systems that are suited to the complexities and pressure of modern biopharmaceutical manufacturing, enabling efficiencies in the production of biologics such as monoclonal antibodies (“mAbs”), recombinant proteins, mRNA vaccines and therapeutics, and cell and gene therapies (“C>”). We operate true to our vision of “inspiring advances in bioprocessing.”

2022 Business Highlights

| • | We continued our track record of innovation, launching 10 new products through our research and development (“R&D”) programs. |

| • | We grew C> revenue by over 50%, expanding our presence in this important and growing market. |

| • | We signed strategic partnerships with DRS Daylight Solutions, Inc. (“Daylight”) and Purolite (an Ecolab company), respectively expanding and strengthening our advanced analytics platform and our Proteins franchise. |

| • | We integrated our fluid management acquisitions, and completed the build-out of our first fluid management assembly center in Hopkinton, Massachusetts. |

| • | We completed capacity expansion projects at three sites, strengthening our overall business continuity capabilities for our expanding customer base. |

| • | We advanced our ESG initiatives, particularly in the areas of renewable electricity implementation, wastewater and recycling, and DE&I programs. |

2022 Financial Highlights

Overall Revenue Growth and Key Drivers of Revenue Growth

| • | Revenue increased to $801.5 million, representing reported revenue growth of 20%, which includes five percentage points of foreign exchange headwind. |

| • | Base business performance was exceptionally strong, contributing approximately $642 million to full year revenue, and representing 34% year-over-year growth, which includes five percentage points of foreign exchange headwind. |

| • | Inorganic M&A contributed approximately $18 million to 2022 revenues. |

| • | Revenue from programs related to COVID-19 contributed approximately $141 million, a decrease of approximately $49 million from 2021, and representing 18% of overall revenue in 2022. |

| • | We continued to build business with C> customers, finishing the year with over 350 active accounts, including over 20 accounts that each generated more than $1 million in revenues. Overall sales to C> accounts increased by over 50% to approximately $115 million, or 14% of overall revenue. |

| • | We also made inroads in mRNA markets, building off the success we had in mRNA-based COVID-19 vaccine manufacturing. |

| • | We generated free cash flow of $83.7 million and reported cash, cash equivalents and short-term investments of $623.8 million as of December 31, 2022. |

Revenue Growth by Franchise

| • | In 2022, the majority of our franchises delivered strong revenue growth year-over-year: |

| ○ | Filtration revenue increased 23% as reported, to approximately $496 million. This includes six percentage points of foreign exchange headwind. While overall Filtration sales decreased toward year end, as revenue related to COVID-19 tapered off, the base Filtration business remained robust. Our XCell® ATF systems had a strong year, driven by success in commercial processes and we saw traction with new ARTeSYN® systems that were launched during the year. A highlight of the year was our launch in the fourth quarter of the KrosFlo® RS 20 system for gene therapy and mRNA applications. |

| REPLIGEN CORPORATION | 10

|

2023 PROXY SUMMARY | |||||||||

| ○ | Chromatography revenue increased by 45% as reported, to approximately $132 million. This includes six percentage points of foreign exchange headwind. Growth was driven by increased demand for OPUS® pre-packed columns as resin availability improved in the second half of 2022, and as orders picked up significantly at C> accounts. |

| ○ | Proteins revenue decreased by 8% as reported to approximately $114 million. This includes six percentage points of foreign exchange headwind. The decrease in Proteins revenue reflects the anticipated ramp down of Protein A ligand demand from Cytiva. Over half of the decrease in revenue from sales to Cytiva was offset by increased demand for our next generation (“NGL”) ligands, which we supply to Purolite, and from Avitide, Inc. (“Avitide”) revenue, as we continue to strengthen our proteins portfolio. |

| ○ | Process Analytics revenue increased by 11% as reported, to approximately $54 million. This includes less than one percentage point of foreign exchange headwind. The pipeline of opportunities for this franchise expanded toward year end, as we launched our new KrosFlo® KR2i RPMTM system. |

Capital Investments

| • | Capital expenditures increased to approximately $88 million in 2022, the great majority of which was invested in manufacturing capacity expansion projects to provide business continuity and address our expectations for increased demand as we continue to grow. The focus in 2022 was on building out our hollow fiber filtration, flat sheet filtration and filtration systems manufacturing sites in Rancho Dominguez, California and Marlborough, Massachusetts. We also completed the build out and validation of our fluid management assemblies facility in Hopkinton, Massachusetts. Other smaller but important capital investments were related to our proteins and fluid management components business, and the next phase of our global SAP implementation programs. |

R&D and New Product Launches

| • | We continued to invest in R&D, with approximately 5% of revenue reinvested into new product development. |

| • | In 2022, we launched several innovative new products across all of our franchises, including: |

| ○ | Filtration: We launched our KrosFlo RS 20 series of systems, focusing their use in mRNA and C> applications, where they are used primarily in downstream applications. We also launched three ARTeSYN standardized, configurable tangential flow filtration systems. |

| ○ | Chromatography: We optimized ARTeSYN custom systems to deliver on a portfolio of standardized, configurable ARTeSYN chromatography systems. |

| ○ | Proteins: We launched three advanced affinity chromatography resins for use in gene therapy manufacturing workflows. The AVIPure® resins were developed by Avitide, which we acquired in 2021, and are specific to the major adeno-associated virus vectors used today. We also developed and launched AVIPure CH1, a cross-linked agarose-based resin specifically engineered for mAb fragment purification. |

| ○ | Process Analytics: We completed development of the KrosFlo KR2i RPM, a hollow fiber system with integrated FlowVPX® process monitoring and measurement technology. This exciting platform, where RPM stands for Real Time Process Management, gives customers the ability to measure, monitor and control drug concentration, not only in real time, but also in a fully automated way. |

Strategic Partnerships

| • | We entered into a 15-year license agreement with Daylight in September 2022. Pursuant to this agreement we obtained the exclusive right to use Daylight’s Quantum Cascade Laser (“QCL”) technology, including its Culpeo®QCL-IR Liquid Analyzer (“Culpeo”) specifically in the field of bioprocessing. Our in-licensing of these rights to Culpeo complements our existing Process Analytics franchise. We believe this partnership will serve to accelerate and expand adoption of off-line and in-line process monitoring in the bioprocessing industry. |

| • | We extended our existing supply agreement with Purolite through 2032, and expanded our partnership to include new ligands developed by Avitide for the mAb and mAb fragment market. The Purolite resin products that combine our NGL-Impact® ligands with Purolite’s Jetted bead technology continue to do well in the marketplace. |

| • | We successfully completed the integrations of Polymem S.A. (“Polymem”), Avitide, and both Bioflex Solutions LLC and Newton T&M Corp. (collectively, “BioFlex”) into the Company in 2022, strengthening our Filtration and Proteins franchises as well as further integrating fluid management components and assemblies. |

| REPLIGEN CORPORATION | 11

|

2023 PROXY SUMMARY | |||||||||

We grew our business on a year-over-year basis across many metrics, including those exhibited below:

| REPLIGEN CORPORATION | 12

|

2023 PROXY SUMMARY | |||||||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of shares of Repligen’s common stock with a par value of $0.01 (“Common Stock”) as of March 20, 2023 by: (i) each person who is known by the Company to beneficially own more than 5% of the outstanding shares of Common Stock; (ii) each director or nominee of the Company; (iii) each named executive officer (“NEO”) of the Company; and (iv) all directors, nominees and executive officers of Repligen as a group. The business address of each director and executive officer is Repligen Corporation, 41 Seyon Street, Building #1, Suite 100, Waltham, Massachusetts 02453.

| Beneficial Owner | Amount and Nature of Beneficial Ownerships (1) |

Percent of Class (2) | ||||

|

|

BlackRock, Inc(3) |

6,123,594 |

11.0% | |||

|

|

The Vanguard Group(4) |

5,205,155 |

9.4% | |||

|

|

T. Rowe Price Associates, Inc(5) |

5,070,657 |

9.1% | |||

|

|

Entities Associated with the Estate of Roy T. Eddleman(6) |

3,500,000 |

6.3% | |||

|

|

Tony J. Hunt(7) |

344,200 |

* | |||

|

|

Jon K. Snodgres(8) |

48,322 |

* | |||

|

|

James Bylund(9) |

11,540 |

* | |||

|

|

Christine Gebski(10) |

27,321 |

* | |||

|

|

Ralf Kuriyel(11) |

20,927 |

* | |||

|

|

Karen A. Dawes(12) |

96,220 |

* | |||

|

|

Nicolas M. Barthelemy(13) |

4,530 |

* | |||

|

|

Carrie Eglinton Manner(14) |

7,607 |

* | |||

|

|

Konstantin Konstantinov, Ph.D.(15) |

1,832 |

* | |||

|

|

Martin Madaus, D.V.M., Ph.D.(16) |

350 |

* | |||

|

|

Rohin Mhatre, Ph.D.(17) |

9,182 |

* | |||

|

|

Glenn P. Muir(18) |

45,843 |

* | |||

|

|

All directors, nominees and executive officers as a group (12 Persons)(19) |

617,874 |

1.1% | |||

| * | Less than one percent |

| (1) | Beneficial ownership, as such term is used herein, is determined in accordance with Rule 13d-3 promulgated under the Securities Exchange Act of 1934 as amended (the “Exchange Act”), and includes voting and/or investment power with respect to shares of Common Stock of Repligen. Unless otherwise indicated, the named person possesses sole voting and investment power with respect to the shares. The shares shown include shares that such person has the right to acquire within 60 days of March 20, 2023. |

| (2) | Percentages of ownership are based upon 55,644,246 shares of Common Stock issued and outstanding as of March 20, 2023. Shares of Common Stock that may be acquired pursuant to options that are exercisable or RSUs that will vest within 60 days of March 20, 2023 are deemed outstanding for computing the percentage ownership of the person holding such options or RSUs but are not deemed outstanding for the percentage ownership of any other person. |

| (3) | Based solely on a Schedule 13G/A filed on January 23, 2023 for the December 31, 2022 filing event. BlackRock, Inc.’s business address is 55 East 52nd Street, New York, NY 10055. BlackRock, Inc. has sole voting power with respect to 5,859,890 shares and sole dispositive power with respect to 6,123,594 shares. |

| (4) | Based solely on a Schedule 13G/A filed on February 9, 2023 for the December 31, 2022 filing event. The Vanguard Group’s business address is 100 Vanguard Blvd., Malvern, PA 19355. The Vanguard Group has sole voting power with respect to 33,847 shares, shared dispositive power with respect to 73,909 shares and sole dispositive power with respect to 5,131,246 shares. |

| (5) | Based solely on a Schedule 13G/A filed on February 14, 2023 for the December 31, 2022, filing event. T. Rowe Price Associates, Inc. business address is 100 E. Pratt Street, Baltimore, MD 21202. T. Rowe Price Associates, Inc. has sole voting power with respect to 881,136 shares and sole dispositive power with respect to 5,070,657 shares. |

| REPLIGEN CORPORATION | 13

|

2023 PROXY STATEMENT | |||||||||

| (6) | Based solely on a Schedule 13G/A filed on February 15, 2023 for the December 31, 2022 filing event. Consists of (i) 2,705,689 shares held by Roy T. Eddleman Living Trust, (ii) 509,318 shares held by Roy T. Eddleman Charitable Remainder Trust #1, and (iii) 284,993 shares held by Roy T. Eddleman Charitable Remainder Trust #2 (collectively, the “Eddleman Trusts”). Nereyda Rubio and Anis Garci serve as co-trustees of the Eddleman Trusts, and each has investment and voting control over the shares held by the Eddleman Trusts (the “Shares”) and may be deemed to have shared voting power and shared investment power with respect to all such Shares. The business address of each of the Eddleman Trusts is c/o TroyGould PC, 1801 Century Park East, 16th Floor, Los Angeles, CA 90067. |

| (7) | Includes 247,946 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023. |

| (8) | Includes 19,779 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 1,600 RSUs which will vest within 60 days of March 20, 2023. |

| (9) | Includes 6,792 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 1,000 RSUs which will vest within 60 days of March 20, 2023. |

| (10) | Includes 2,219 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 1,000 RSUs which will vest within 60 days of March 20, 2023. |

| (11) | Includes 3,709 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 1,600 RSUs which will vest within 60 days of March 20, 2023. |

| (12) | Includes 19,819 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 644 RSUs which will vest within 60 days of March 20, 2023. |

| (13) | Includes 2,449 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 534 RSUs which will vest within 60 days of March 20, 2023. |

| (14) | Includes 5,501 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 1,024 RSUs which will vest within 60 days of March 20, 2023. |

| (15) | Includes 1,298 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 534 RSUs which will vest within 60 days of March 20, 2023. |

| (16) | Includes 239 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 111 RSUs which will vest within 60 days of March 20, 2023. |

| (17) | Includes 7,523 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 1,202 RSUs which will vest within 60 days of March 20, 2023. |

| (18) | Includes 38,947 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 534 RSUs which will vest within 60 days of March 20, 2023. |

| (19) | See footnotes 7 through 18 above. Includes 356,221 shares issuable pursuant to stock options which are exercisable within 60 days of March 20, 2023 and 9,783 RSUs which will vest within 60 days of March 20, 2023. |

| REPLIGEN CORPORATION | 14

|

2023 PROXY STATEMENT | |||||||||

PROPOSAL 1

ELECTION OF DIRECTORS

DIRECTOR NOMINEES

There are eight (8) nominees for director, all of whom are current directors of Repligen that have been nominated by the Nominating and Corporate Governance (“N&CG”) Committee and the Board of Directors (“Board”) for re-election.

If elected, each of the director nominees will hold office until the 2024 Annual Meeting of Shareholders and until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation or removal.

| Nominee’s Name | Year First Elected Director |

Position(s) with the Company | ||

| Tony J. Hunt |

2015 |

President, Chief Executive Officer and Director | ||

| Karen A. Dawes |

2005 |

Director, Chairperson of the Board | ||

| Nicolas M. Barthelemy |

2014 |

Director | ||

| Carrie Eglinton Manner |

2020 |

Director | ||

| Konstantin Konstantinov, Ph.D. |

2022 |

Director | ||

| Martin D. Madaus, D.V.M., Ph.D. |

2023 |

Director | ||

| Rohin Mhatre, Ph.D. |

2020 |

Director | ||

| Glenn P. Muir |

2015 |

Director | ||

Shares represented by all proxies received by the Board and not marked or voted to abstain from voting for any individual director or for any group of directors will be voted, unless otherwise indicated, FOR the election of the nominees named above. Proxies may not be voted for a greater number of persons than the number of nominees named. The Board knows of no reason why any nominee should be unable or unwilling to serve, but if any nominee should be unable or unwilling to serve, proxies will be voted in accordance with the judgment of the persons named as attorneys-in-fact on the proxy cards with respect to the directorship for which that nominee was unable or unwilling to serve.

Proposal 1 relates solely to the election of the eight (8) above-named directors nominated by the Company and does not include any other matters relating to the election of directors, including without limitation, the election of directors nominated by any shareholders of the Company.

The Board unanimously recommends a vote FOR each of the nominees for election as directors of the Company. If authorized proxies are submitted without specifying an affirmative or negative vote on any proposal, the shares represented by such proxies will be voted in favor of the Board’s recommendations.

| REPLIGEN CORPORATION | 15

|

2023 PROXY STATEMENT | |||||||||

OCCUPATIONS OF DIRECTORS AND EXECUTIVE OFFICERS

Repligen’s executive officers are appointed by, and serve at the discretion of, the Board. Each executive officer is a full-time employee of Repligen. The current directors, including director nominees, and executive officers of Repligen as of March 20, 2023 are as follows:

|

|

Name |

Age(1) | Position(s) with the Company |

| ||||

|

|

Tony J. Hunt |

59 |

President, Chief Executive Officer and Director |

| ||||

|

|

Jon K. Snodgres |

57 |

Chief Financial Officer |

| ||||

|

|

James R. Bylund |

60 |

Chief Operating Officer |

| ||||

|

|

Christine Gebski |

55 |

Senior Vice President, Filtration and Chromatography |

| ||||

|

|

Ralf Kuriyel |

65 |

Senior Vice President, Research and Development |

| ||||

|

|

Nicolas M. Barthelemy(2)(3) |

57 |

Director |

| ||||

|

|

Karen A. Dawes(3) |

71 |

Director, Chairperson of the Board |

| ||||

|

|

Carrie Eglinton Manner(4) |

49 |

Director |

| ||||

|

|

Konstantin Konstantinov, Ph.D.(3)(5) |

65 |

Director |

| ||||

|

|

Martin D. Madaus, D.V.M., Ph.D.(3)(4)(6) |

63 |

Director |

| ||||

|

|

Rohin Mhatre, Ph.D.(2) |

58 |

Director |

| ||||

|

|

Glenn P. Muir (2)(4) |

64 |

Director |

| ||||

| (1) | Age as of the date of the 2023 Annual Meeting of Shareholders (“Annual Meeting”). |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the N&CG Committee. |

| (4) | Member of the Audit Committee. |

| (5) | Dr. Konstantinov was elected to the Board on May 26, 2022. |

| (6) | Dr. Madaus was elected to the Board on February 6, 2023. |

| REPLIGEN CORPORATION | 16

|

2023 PROXY STATEMENT | |||||||||

BIOGRAPHICAL INFORMATION

The following paragraphs provide information about the Company’s continuing directors and executive officers. The information presented includes information about each director’s specific experience, qualifications, attributes and skills that led the Board to the conclusion that he or she should serve as a director.

EXECUTIVE OFFICERS

|

Tony J. Hunt was named President and CEO and has served on the Board since May 2015. He joined Repligen in May 2014 as Chief Operating Officer, overseeing commercial and manufacturing operations. Before coming to Repligen, Mr. Hunt was President of Bioproduction at Life Technologies, a global life sciences company which was acquired by Thermo Fisher Scientific in 2014. He joined Life Technologies in 2008, serving as General Manager of Bioproduction Chromatography and Pharma Analytics before being named President of Bioproduction in 2011. From 2000 to 2008, Mr. Hunt was with Applied Biosystems as Senior Director of Pharma Programs where he launched the Pharma Analytics business that in 2008 became a part of the Bioproduction platform at Life Technologies. Mr. Hunt also serves on the board of directors of one publicly traded company, 908 Devices Inc. |

Mr. Hunt received a B.S. in Microbiology and an M.S. in Biotechnology from University College in Galway, Ireland, and an M.B.A. from Boston University School of Management. Mr. Hunt brings to the Board his deep understanding of the bioprocessing market.

|

Jon K. Snodgres joined Repligen in July 2014 as the Chief Financial Officer, where he oversees financial operations for the Company. Mr. Snodgres was previously with Maquet Cardiovascular (“Maquet”), a medical device company, where he served as Chief Financial Officer for five years. At Maquet, in addition to being responsible for the preparation and oversight of the company’s financial statements, he was a key participant in growth planning and profit improvement strategies. Mr. Snodgres previously spent eight years with life sciences company Thermo Fisher Scientific in various roles, most recently as Vice President of Finance for the Laboratory Products Group. He began his career in finance at AlliedSignal/Honeywell International. Mr. Snodgres received a B.S. in Business Administration, Finance from Northern Arizona University. |

|

James R. Bylund was named Chief Operating Officer of the Company in January 2022 and serves as the Company’s principal operating officer. He joined Repligen in March of 2020 as Senior Vice President, Global Operations and IT, overseeing all operations and IT functions on a global basis. Between March 2019 and March 2020, Mr. Bylund also worked in real estate at Inspire Development in Austin, Texas. Prior to joining Repligen, Mr. Bylund spent ten years at Thermo Fisher Scientific in a number of roles including Vice President and General Manager of the Single Use Technologies Business Unit and Vice President of Global Operations for the Bioproduction Division. Prior to joining Thermo Fisher, Mr. Bylund also worked for Fiserv (9 years) and Eli Lilly and Company (7 years) in a variety of leadership roles. He has significant experience in managing multiple operating |

sites across the globe and scaling operations to meet rapidly growing demand. Mr. Bylund is a passionate proponent of continuous improvement and has consistently demonstrated the ability to assemble and grow highly effective teams. He holds a B.S. in Accounting from Utah State University and an M.B.A. from Indiana University.

|

Christine Gebski joined Repligen in May 2015 and currently serves as the Senior Vice President, Filtration and Chromatography where she oversees the general management and strategy of the Company’s upstream and downstream filtration and chromatography portfolio. Ms. Gebski also manages the Field Applications function within the Company, ensuring strong customer experience. Prior to joining Repligen, Ms. Gebski was head of the Chromatography Business Unit within the Bioproduction Division of Thermo Fisher Scientific. At Thermo Fisher she managed the Global Process Chromatography Applications and R&D functions for ten years. Before joining Thermo Fisher Scientific, Ms. Gebski was a Process Development Scientist for 15 years in the biotechnology industry, having held positions of increasing responsibility at Genzyme, TKT/Shire and |

EMD Pharmaceuticals. She has significant experience in downstream process development and engineering, technology transfer and validation across a variety of biological molecule classes and diagnostic reagents. She holds a B.S. in Biology from the University of Vermont and a M.S. in Biotechnology from the University of Massachusetts at Lowell.

| REPLIGEN CORPORATION | 17

|

2023 PROXY STATEMENT | |||||||||

|

Ralf Kuriyel joined Repligen in October 2016 as the Senior Vice President, Research and Development where he oversees the Company’s R&D efforts. Mr. Kuriyel was previously Vice President of Applications for the single-use business unit within the Life Sciences division of Pall Corporation (“Pall”), whose acquisition by Danaher Corporation was completed in August 2015. At Pall, Mr. Kuriyel served as Vice President of R&D, Field Applications and Process Development Services from November 2014 to October 2016. In addition, Mr. Kuriyel served as Vice President, Applications R&D at Pall from November 2011 to November 2014. Mr. Kuriyel received a B.S. and an M.S. in Chemical Engineering from Rensselaer Polytechnic Institute and has completed his coursework for the Tufts University Ph.D. program in Chemical Engineering. He is an inventor of multiple patents and has |

co-authored over 30 scientific publications on bioprocessing, including separations technologies, membrane separations methods, protein processing and enhanced microfiltration techniques.

DIRECTORS

|

Nicolas M. Barthelemy has served as a director of Repligen since June 2014. Mr. Barthelemy brings over 30 years of industry experience to the director role. Mr. Barthelemy served as President and CEO of bioTheranostics, a molecular diagnostics company, from September 2014 until February 2017. Prior to bioTheranostics, he served as President, Global Commercial Operations at Life Technologies, which was acquired by Thermo Fisher Scientific in February 2014. Prior to Life Technologies, Mr. Barthelemy was with Biogen Inc. (“Biogen”) for eight years, most recently as Vice President, Manufacturing and General Manager for the company’s manufacturing organization at Research Triangle Park. He began his career with Merck & Co., Inc. as a Senior Project Engineer, Vaccine Technology. Mr. Barthelemy also serves on the board of directors of three privately held companies: |

Biocare Medical LLC, NanoCellect Biomedical, and Slingshot Biosciences. He also serves as an advisor to Warburg Pincus, a private equity firm. Mr. Barthelemy previously served as a board member of Twist Bioscience, 908 Devices Inc. and Standard BioTools, Inc. (previously Fluidigm Corporation). Mr. Barthelemy received a M.S. in Chemical Engineering from the University of California, Berkeley, and an engineering degree from Ecole Supérieure de Physique et Chimie Industrielles, Paris. Mr. Barthelemy’s qualifications to sit on the Company’s Board include his extensive experience in the bioprocessing field, including large scale biologics manufacturing and commercialization of consumables used in bioprocessing.

|

Karen A. Dawes, Chairperson of the Board, has served as a director of Repligen since September 2005. She is currently President of Knowledgeable Decisions, LLC, a management consulting firm. Ms. Dawes served from 1999 to 2003 as Senior Vice President and U.S. Business Group Head for Bayer Corporation’s U.S. Pharmaceuticals Group. Prior to joining Bayer, she was Senior Vice President, Global Strategic Marketing, at Wyeth LLC (“Wyeth”), a pharmaceutical company (formerly known as American Home Products), where she held responsibility for worldwide strategic marketing. Ms. Dawes also served as Vice President, Commercial Operations for Genetics Institute, Inc., which was acquired by Wyeth in January 1997, designing and implementing that company's initial commercialization strategy to launch BeneFIX(R) and Neumega(R). Ms. Dawes began her |

pharmaceuticals industry career at Pfizer, Inc. where, from 1984 to 1994, she held a number of marketing positions, serving most recently as Vice President, Marketing of the Pratt Division. At Pfizer, she directed launches of Glucotrol®/Glucotrol XL®, Zoloft®, and Cardura®. Ms. Dawes also serves on the board of directors of two publicly traded companies: Vaccitech Limited and Medicenna Therapeutics Corp, one private company, JPA Health, and one not-for-profit company, Medicines 360. Ms. Dawes received a B.A. and M.A. in English from Simmons College and an M.B.A. from Harvard University Graduate School of Business. Ms. Dawes’ qualifications to sit on the Company’s Board include her extensive strategic experience in both a managerial and consulting capacity with pharmaceutical companies as well as her considerable commercial background.

| REPLIGEN CORPORATION | 18

|

2023 PROXY STATEMENT | |||||||||

|

Carrie Eglinton Manner has served as a director of Repligen since June 2020. She brings to the director role over 25 years of leadership experience across multiple disciplines. Ms. Eglinton Manner currently serves as President and CEO of OraSure Technologies, Inc. (“OraSure”), which she joined in June 2022. OraSure is a leader in the development, manufacture and distribution of rapid diagnostic tests, sample collection and stabilization devices, and molecular service solutions designed to discover and detect critical medical conditions. Prior to OraSure, Ms. Eglinton Manner served as Senior Vice President, Advanced & General Diagnostics and Clinical Solutions at Quest Diagnostics (“Quest”), which she joined in 2017. In her role at Quest, Ms. Eglinton Manner was responsible for value creation across the company's $10 billion clinical portfolio, driving innovation in R&D, |

along with partnerships and acquisitions. She helped accelerate growth in Quest’s $2 billion Advanced Diagnostics portfolio, which included its specialty molecular and genetic offerings, along with Quest’s global and pharmaceutical services businesses. Prior to Quest, Ms. Eglinton Manner held various roles of increasing scope and responsibility over a period of 20 years at GE Healthcare. From 2009 through 2016, she served as President & CEO of four distinct GE Healthcare global businesses in the areas of diagnostic imaging, lab services and medical devices, ranging in size from approximately $150 million to $3 billion in revenue. In addition to the Repligen Board, Ms. Eglinton Manner serves as board director for the not-for-profit Thrive Networks, focused on advancing women and building healthy, resilient communities. Ms. Eglinton Manner holds a B.S. in Mechanical Engineering from the University of Notre Dame. Ms. Eglinton Manner’s qualifications to sit on the Company’s Board include her track record of delivering business expansion and profitability for rapidly growing global businesses, including her experience with integrating acquisitions and building operations excellence, with a commitment to quality and process improvements.

|

Konstantin Konstantinov, Ph.D., has served as a director of Repligen since May 2022. He has also been a member of our Scientific Advisory Board since March 2016. Dr. Konstantinov is currently Chief Technology Officer at Codiak BioSciences (“Codiak”), where he previously served for six years as Executive Vice President, Manufacturing & Process Sciences. Before joining Codiak, Dr. Konstantinov was responsible for the late-stage bioprocess and technology development at Sanofi’s Boston Hub, including all functions, from cell banking to fill/finish/lyophilization. Prior to Sanofi, Dr. Konstantinov worked for Bayer in Berkeley, California for 14 years, advancing to the position of Head of Process Sciences. He has published 60 peer reviewed papers and has more than 15 patents and patent applications. During the last 23 years, Dr. Konstantinov has worked on the |

development and commercialization of various products, including monoclonal antibodies, blood factors and enzymes expressed in mammalian cells. Most recently, he has pioneered the development of an end-to-end integrated continuous biomanufacturing platform, which is becoming a strategic technological trend for the biomanufacturing industry worldwide. Dr. Konstantinov received his Ph.D. in Biochemical Engineering from Osaka University, Japan, which was followed by a post-doctoral assignment at DuPont and the University of Delaware.

|

Martin D. Madaus, D.V.M., Ph.D., has served as a director of Repligen since February 2023. Dr. Madaus joins the Board with over 25 years of industry experience, including five years as Chairman, President and CEO of Millipore Corporation (“Millipore”), where he was integral to the company’s transformation into a life science leader, and its acquisition by Merck KGaA (“Merck”) in 2010. He is an active board leader, currently serving two other public companies: as Lead Director for precision health technology company Quanterix Corporation and as a board member for mass cytometry player Standard BioTools, Inc. (previously Fluidigm Corporation). He also serves on the boards of three private companies: Unchained Labs, Emulate Inc. and Ultivue Inc. Dr. Madaus is currently a senior operating executive at The Carlyle Group (since 2019), a multinational private equity and asset |

management services company. He previously served as Chairman and CEO at Ortho-Clinical Diagnostics from 2014 to 2019. His tenure with biopharmaceutical and diagnostic industry leader Roche Holding AG (“Roche”) from 1996 to 2004 included his position from 2000 to 2004 as President and CEO, N.A. of Roche Diagnostics Corp. Dr. Madaus began his career as a veterinarian, before joining global pharmaceutical and diagnostic company Boehringer Mannheim Corporation (“Boehringer”). While at Boehringer, he held sales, marketing and product management roles from 1989 to 1996, until his move into general management coincided with the company’s acquisition by Roche in 1996. He holds a D.V.M. from the University of Munich in Germany and a Ph.D. from the University of Veterinary Medicine of Hanover in Germany. Dr. Madaus’ qualifications to sit on the Company’s Board include his extensive bioprocessing and biopharmaceutical industry experience, especially in the areas of strategy, mergers and acquisitions, and commercial operations.

| REPLIGEN CORPORATION | 19

|

2023 PROXY STATEMENT | |||||||||

|

Rohin Mhatre, Ph.D., was appointed to the Board in March 2020. Dr. Mhatre brings over 25 years of relevant experience to the director role, including his current position since January 2017, as Senior Vice President, Product and Technology Development at Biogen. He has held numerous other roles of increasing responsibility within Biogen, which he joined in 1996, including six years as Vice President of Biopharmaceutical Development, where he led a 300-member team responsible for cell line, cell culture, purification and device development. Earlier in Dr. Mhatre’s career at Biogen, he focused on building out analytical development and technical services. Prior to Biogen, Dr. Mhatre led the purification and applications group at Applied BioSystems (formerly Perspective Biosystems). Dr. Mhatre holds a Ph.D. in Chemistry from Northeastern University. Dr. Mhatre's qualifications |

to sit on the Company’s Board include his extensive technical expertise, his leadership abilities and his deep understanding of the dependencies between biological drug development and efficient manufacturing workflows.

|

Glenn P. Muir has served as a director of Repligen since October 2015. Mr. Muir brings over 30 years of experience to the director role, including 26 years with Hologic, Inc. (“Hologic”), a large multi-national medical device and diagnostics company where he most recently served as Chief Financial Officer and Executive Vice President. Mr. Muir retired in May 2014 from Hologic, where he helped steer the company’s evolution from a venture-backed single product company to a publicly traded diversified organization with over 5,000 employees and $2.5 billion in revenue. He joined Hologic in 1988 and served as Chief Financial Officer since 1992 and Executive Vice President since 2000. Prior to Hologic, Mr. Muir was with Metallon Engineered Materials Co., a private company where from 1986-1988 he held the role of Vice President, Finance. Previously, from 1981-1984, he was a |

Senior Auditor with Arthur Andersen & Co. Mr. Muir also serves on the board of directors of two publicly traded companies: medical technology company, Neuronetics, Inc., and life science company G1 Therapeutics, Inc., and one privately held company: medical device company Impulse Dynamics Limited. Previously, Mr. Muir served on the board of directors of ReWalk Robotics Ltd. from July 2014 to December 2017. Mr. Muir is a Certified Public Accountant (inactive since 2022) with a Bachelors of Business Administration from the University of Massachusetts, Amherst. He also earned an M.S. from Bentley University and an M.B.A. from Harvard University. Mr. Muir’s qualifications to sit on Repligen’s Board include his extensive experience with integrating strategic acquisitions and leading the financial operations for a global manufacturing and commercial organization.

CERTAIN RELATIONSHIPS AND RELATED PERSONS TRANSACTIONS

No family relationship exists among the officers and directors of Repligen. The Audit Committee conducts an appropriate review of all related party transactions for potential conflict of interest situations on an ongoing basis, and the approval of the Audit Committee is required for all such transactions. The term “related party transactions” shall refer to transactions required to be disclosed by the Company pursuant to Item 404 of Regulation S-K promulgated by the Securities and Exchange Commission (“SEC”).

DELINQUENT SECTION 16(a) REPORTS

Under U.S. securities laws, directors, certain officers and persons holding more than 10% of our Common Stock must report their initial ownership of our Common Stock and any changes in their ownership to the SEC. The SEC has designated specific due dates for these reports and we must identify in this Proxy Statement those persons who did not file these reports when due. Based solely on our review of copies of the reports filed with the SEC and the written representations of our directors and executive officers, we believe that all reporting requirements for fiscal year 2022 were complied with by each person who at any time during the 2022 fiscal year was a director or an executive officer or held more than 10% of our Common Stock, except for the following: Due to an administrative error, a transaction for the purchase on March 16, 2022 of 625 shares on the open market by Carrie Eglinton Manner, a current member of the Board of Directors, was not initially reported. The required Form 4 for this transaction was filed on December 14, 2022.

| REPLIGEN CORPORATION | 20

|

2023 PROXY STATEMENT | |||||||||

CORPORATE GOVERNANCE AND BOARD MATTERS

BOARD INFORMATION

Director Independence

The Board of Directors (“Board”) has determined that each of the directors who has served during the fiscal year ended December 31, 2022 and each of the nominees for director at the 2023 Annual Meeting of Shareholders (“Annual Meeting”), with the exception of Mr. Hunt, has no material relationship with the Company and is independent within the meaning of the director independence standards of The Nasdaq Stock Market LLC (“Nasdaq”). Furthermore, the Board has determined that each member of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance (“N&CG”) Committee of the Board is independent within the meaning of Nasdaq’s director independence standards and that each member of the Audit Committee meets the heightened director independence standards of the Securities and Exchange Commission (“SEC”) for audit committee members.

Board Leadership Structure

The Board is led by its Chairperson, Karen Dawes, who is an independent director. The Board believes that separating the roles of CEO and Chairperson of the Board is the most appropriate structure for the Company at this time. Having an independent Chairperson ensures that the CEO is accountable for managing the Company in the best interests of the shareholders while, at the same time, acknowledging that managing the Board is a separate and time intensive responsibility. Additionally, this structure ensures a greater role for the non-management directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board. The Board also believes that having an independent Chairperson can serve to curb conflicts of interests, promote oversight of risk and manage the relationship between the Board and the CEO.

Executive Sessions

The Board holds executive sessions of the independent directors at each regularly scheduled Board meeting and/or as deemed necessary by the Chairperson. Executive sessions do not include any employee directors of the Company, and the Chairperson of the Board is responsible for chairing the executive sessions.

Director Nomination Policies

Director Qualifications

The N&CG Committee is responsible for selecting and recommending nominees for election as directors to the Board. The full Board participates in an annual Board effectiveness assessment, which includes evaluating the appropriate qualities, skills and characteristics of current Board members and identifying skills and qualifications desired for director nominees. These assessments include consideration of the following minimum qualifications that the N&CG Committee believes must be met by all directors:

| • | Directors must be of high ethical character, have no conflict of interest and share the values of the Company as reflected in the Company’s Second Amended and Restated Code of Business Conduct & Ethics; |

| • | Directors must have reputations, both personal and professional, consistent with the image and reputation of the Company; |