tho-ex992_98.htm

Exhibit 99.2

The following table provides a description by segment of the product types that we manufacture and sell.

|

|

|

|

|

|

|

|

Segment |

Product Type |

Description |

|

|

North American Towable Segment |

Travel Trailers |

Hitch to the bumper of the tow vehicle;

Retail Price: $15,000 - $280,000 |

|

|

Fifth Wheels |

Hitch to a specially mounted hitch in the bed of a pickup truck;

Retail Price: $24,000 - $150,000 |

|

|

North American Motorized Segment |

Class A |

Fully enclosed, bus-style motorhome;

Retail price: $115,000 - $750,000 |

|

|

Class C |

Living area built on van or pickup chassis;

Retail price: $110,000 - $280,000 |

|

|

Class B |

Van motorhomes;

Retail price: $90,000 - $270,000 |

|

|

European Segment |

Caravans |

Similar to Travel Trailers;

Retail price:

$15,000 - $80,000 |

|

|

Motorcaravans |

Similar to Class A & Class C;

Retail price:

$30,000 - $280,000 |

|

|

Campervans |

Similar to Class B;

Retail price:

$35,000 - $110,000 |

|

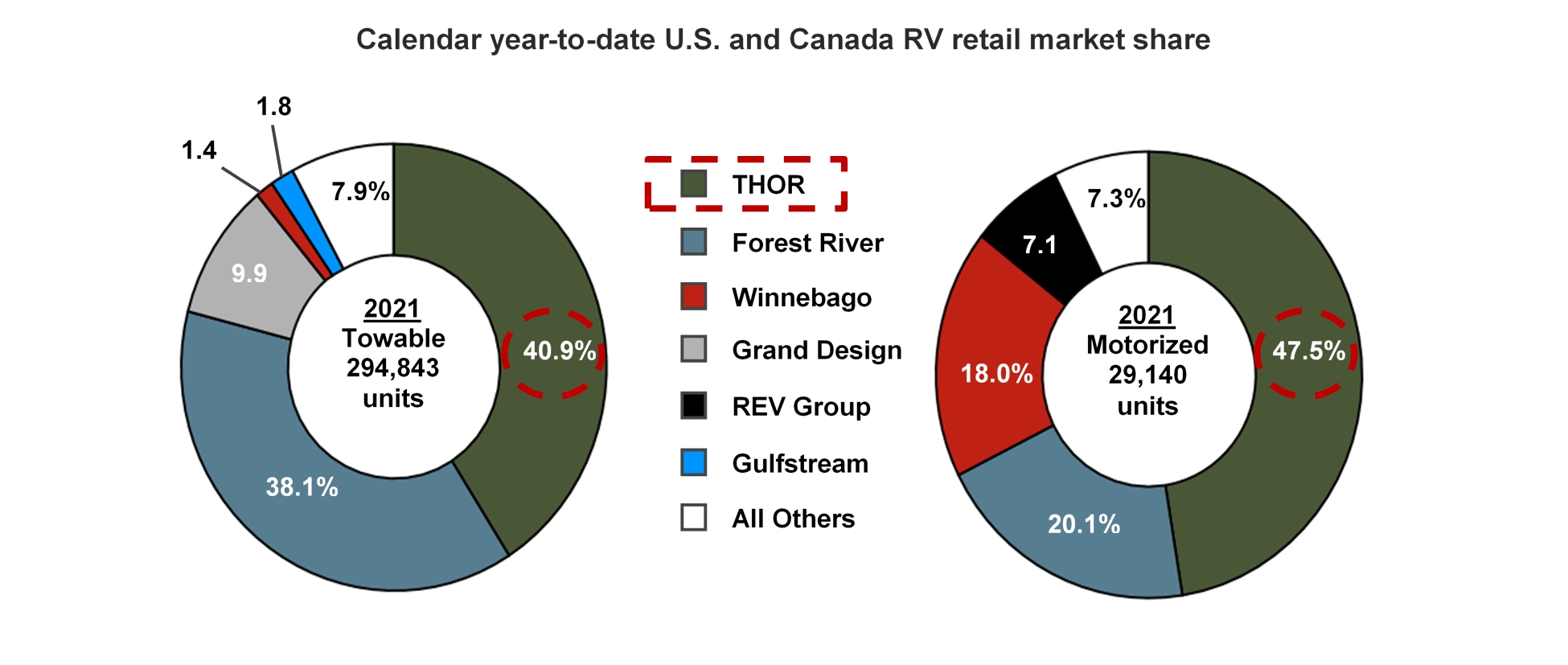

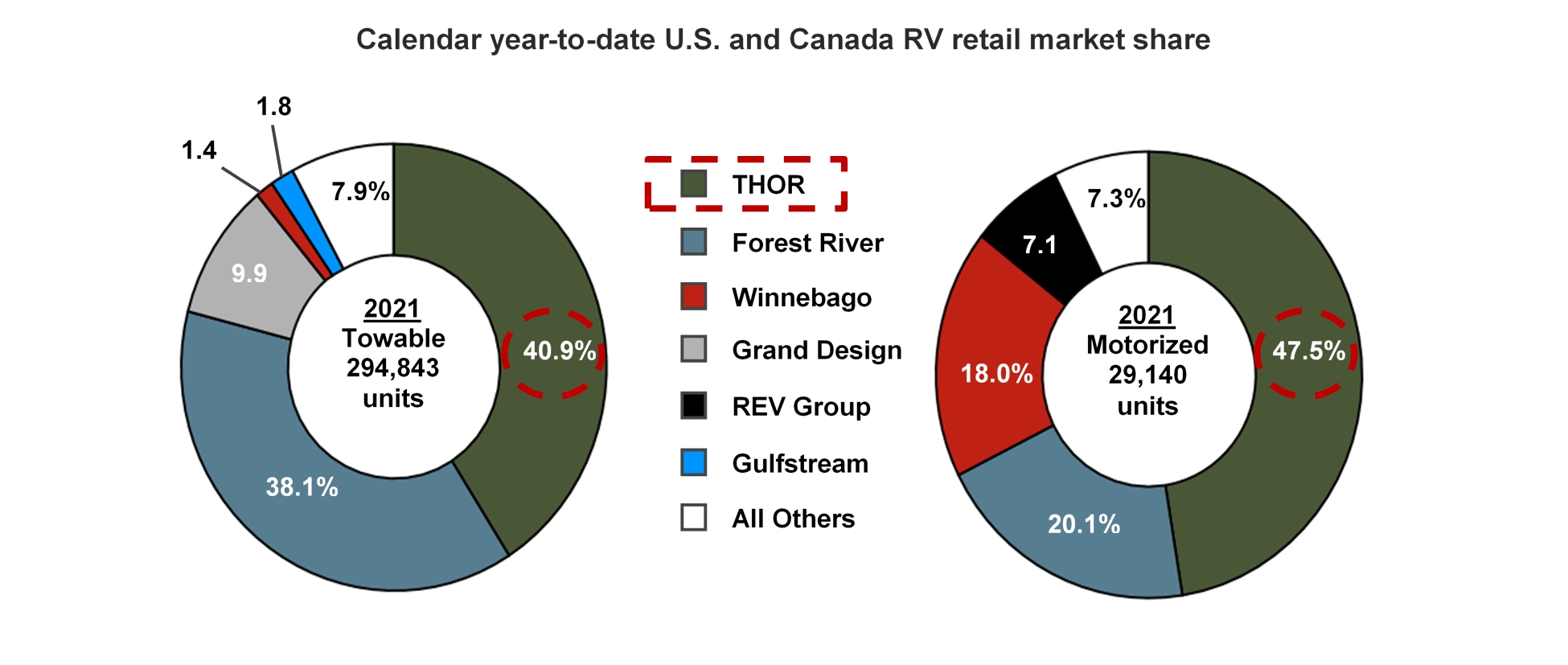

The below charts illustrate calendar year-to-date U.S. and Canada RV retail market share through June 30, 2021 for towable and motorized units.

Source: Statistical Surveys, Inc., U.S. and Canada; CYTD through June 30, 2021

Our acquisition of EHG on February 1, 2019, expanded our operations into the growing European market with a long-standing European industry leader. For the fiscal year ended July 31, 2021, our net sales by geographic region are presented below.

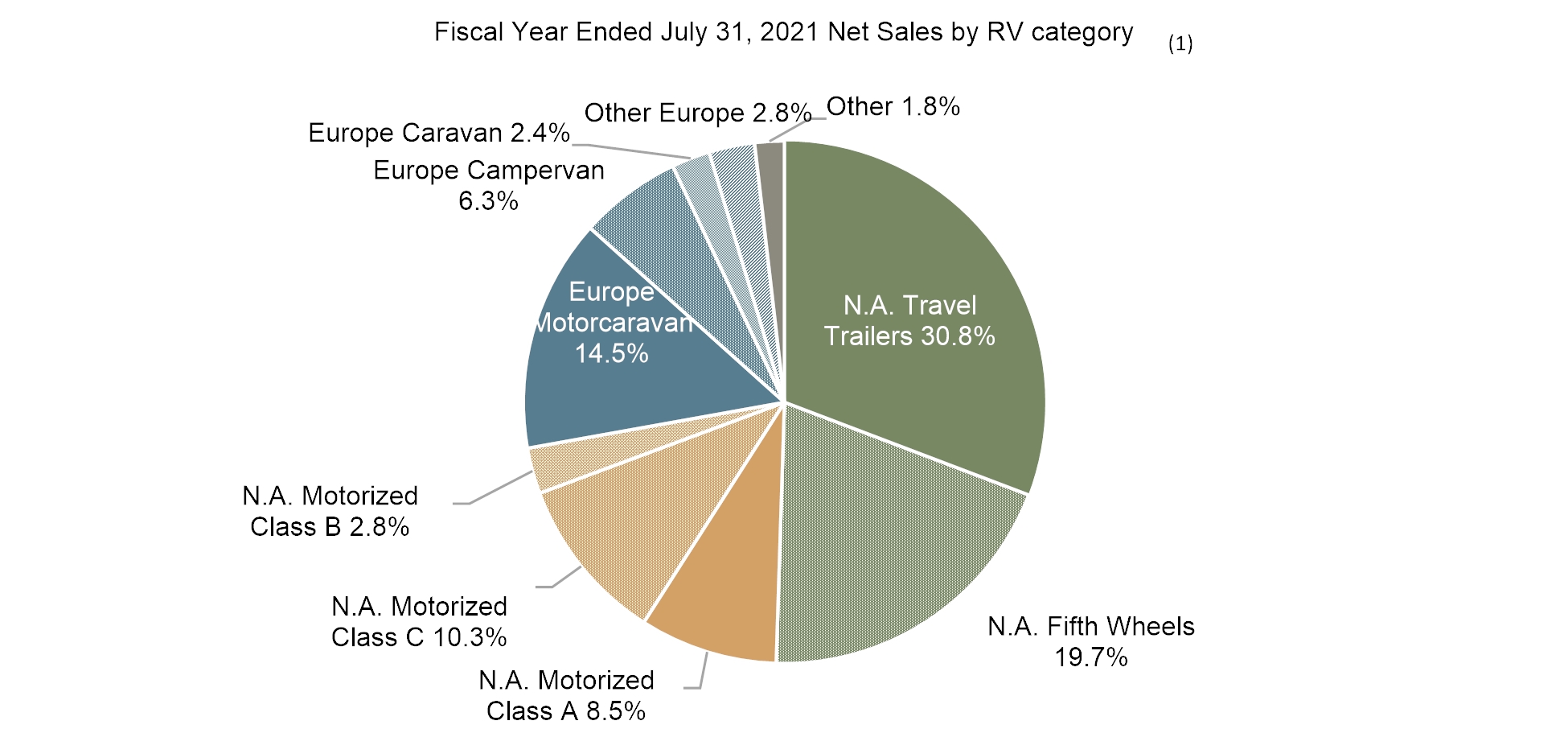

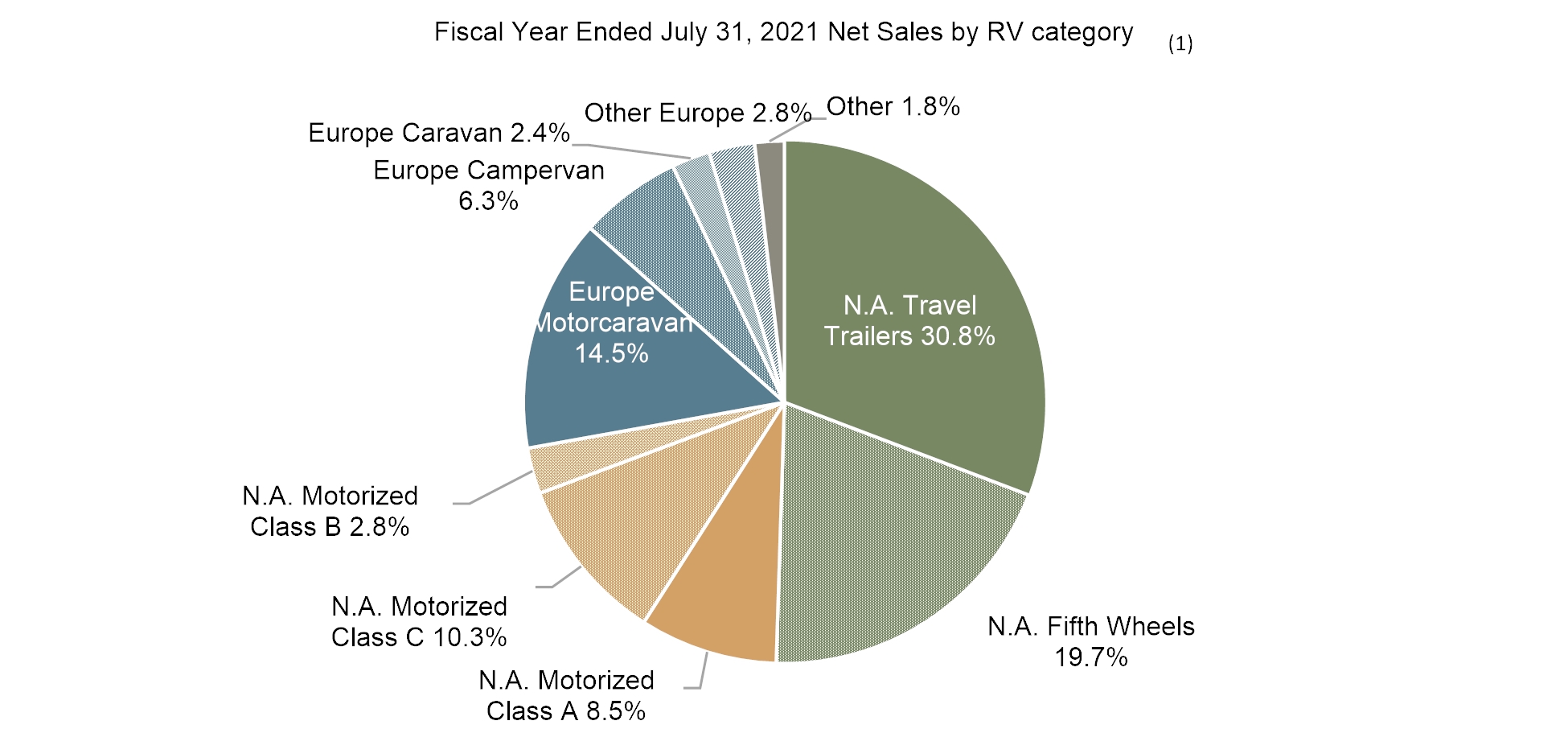

We offer a comprehensive portfolio of RV’s across our global footprint. The principal types of recreational vehicles that we produce in North America include conventional travel trailers and fifth wheels as well as Class A, Class C and Class B motorhomes. In Europe, we produce numerous types of motorized and towable recreational vehicles, including motorcaravans, campervans, urban vehicles, caravans and other RV-related products and services. For the fiscal year ended July 31, 2021, our net sales by RV category are demonstrated below.

(1) Numbers in pie charts above may not add to exactly 100.0% due to rounding.

Historically strong free cash flow generation and disciplined balance sheet management

We have historically generated significant free cash flow, and we believe our financial profile will allow us to continue to do so in the future. Over the last three years, we have generated $1.2 billion of free cash flow, generating approximately $398 million, $434 million and $378 million in fiscal years ended 2021, 2020 and 2019, respectively. For the definition of free cash flow and a reconciliation of this measure from operating cash flow, please see “—Summary historical financial data.”

We maintain a highly variable cost structure and working capital and capital expenditure profile which allows us to preserve cash in weaker economic environments. Our working capital dynamics are such that in periods of economic weakness, net working capital is a source of cash as inventory is released. For example, in 2009, the trough of the recession, we generated $47.3 million from inventory turnover. Our focus on assembly, not manufacturing, allows us to adjust capacity quickly. Capital expenditures are typically made (i) to purchase land, (ii) to expand production facilities and (iii) to replace machinery and equipment used in the ordinary course of business. We have proven our ability to quickly decrease these expenditures as shown in 2009 when we spent $5.6 million (0.4% of revenues) on cash capital expenditures, approximately 61% less than in the prior year. During 2009, we maintained positive free cash flow and positive net income despite a challenging operating environment.

We strive to maintain adequate cash balances to ensure we have sufficient resources to respond to opportunities and changing business conditions. Our priorities for the use of current and future available cash generated from operations remain consistent with our history, and include reducing our indebtedness, maintaining and, over time, growing our dividend payments and funding our growth both organically and opportunistically through acquisitions.

On an as adjusted basis, after giving effect to this offering and the use of proceeds therefrom, we expect to have approximately $1.0 billion of available liquidity and total net leverage of 1.5x. For a reconciliation of Adjusted EBITDA to net income, please see “—Summary historical financial data.” In addition, we have historically demonstrated a priority, willingness and ability to pay down debt consistent with our capital allocation objectives. Since the closing of the EHG acquisition on February 1, 2019, we have repaid approximately $580 million under our Term Loan Facility.

Recent developments

Acquisition of Airxcel

On September 1, 2021, we and AirX MidCo, LLC entered into a Stock Purchase Agreement (the “Purchase Agreement”) pursuant to which we acquired all of the issued and outstanding shares of capital stock of AirX Intermediate, Inc. (“Airxcel”). Airxcel manufactures and sells a comprehensive line of functionally critical, branded products to original equipment manufacturers (OEMs) as well as consumers via aftermarket sales through dealers and retailers. The purchase price was $750 million, subject to standard post-closing adjustments. We funded the acquisition of Airxcel from a combination of cash on-hand and from our Asset-Based Credit Facility entered into on February 1, 2019, as amended on September 1, 2021 (the “ABL Credit Facility”). In conjunction with the Airxcel acquisition, we expanded our ABL Credit Facility from $750 million to $1.0 billion.

This acquisition is consistent with our long-term strategic growth plan to grow sales and enhance consolidated gross margins. The acquisition of Airxcel provides us with significant long-term, strategic benefits, including strengthening our RV supply chain and expanding our offering of functionally critical components. The acquisition also is expected to diversity and grow our revenue streams with enhanced gross margin, particularly in the aftermarket business. With the acquisition of Airxcel, our North American footprint includes manufacturing facilities in five states and a distribution center in Indiana.

Approximately 80% of Airxcel’s revenues are from OEM sales with the remaining 20% from aftermarket sales. Approximately 30% of Airxcel’s OEM revenues were generated from sales to subsidiaries of ours.

For the last twelve months ended July 31, 2021, Airxcel generated net sales of $659 million, which excludes net sales from Airxcel’s Cleer Vision subsidiary which was acquired on April 1, 2021.

________________________________________________________________________________________

Summary historical financial data

The following tables set forth our summary historical consolidated financial information as of and for the years ended July 31, 2021, 2020 and 2019. The summary historical consolidated financial information as of July 31, 2021 and 2020 and for fiscal years 2021, 2020 and 2019 is derived from our audited consolidated financial statements incorporated by reference in this offering memorandum. Our historical results are not necessarily indicative of the results that may be expected in any future period.

The summary historical consolidated financial information should be read together with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report and our audited consolidated financial statements and related notes, which are incorporated by reference in this offering memorandum.

Statements of Income and Comprehensive Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended July 31 |

|

|

|

2021 |

|

2020 |

|

2019 |

|

(amounts in thousands) |

|

|

Net sales |

|

$ |

12,317,380 |

|

|

$ |

8,167,933 |

|

|

$ |

7,864,758 |

|

|

Cost of products sold |

|

10,422,407 |

|

|

7,049,726 |

|

|

6,891,664 |

|

|

Gross profit |

|

1,894,973 |

|

|

1,118,207 |

|

|

973,094 |

|

|

Selling, general and administrative expenses |

|

869,916 |

|

|

634,119 |

|

|

536,044 |

|

|

Amortization of intangible assets |

|

117,183 |

|

|

97,234 |

|

|

75,638 |

|

|

Impairment charges |

|

— |

|

|

10,057 |

|

|

— |

|

|

Acquisition-related costs |

|

— |

|

|

— |

|

|

114,866 |

|

|

Interest income |

|

797 |

|

|

3,116 |

|

|

8,080 |

|

|

Interest expense |

|

94,342 |

|

|

107,322 |

|

|

68,112 |

|

|

Other income (expense), net |

|

30,252 |

|

|

305 |

|

|

(1,848) |

|

|

Income before income taxes |

|

844,581 |

|

|

272,896 |

|

|

184,666 |

|

|

Income taxes |

|

183,711 |

|

|

51,512 |

|

|

52,201 |

|

|

Net income |

|

660,870 |

|

|

221,384 |

|

|

132,465 |

|

|

Less: net income (loss) attributable to non-controlling interests |

|

998 |

|

|

(1,590) |

|

|

(810) |

|

|

Net income attributable to THOR Industries, Inc. |

|

$ |

659,872 |

|

|

$ |

222,974 |

|

|

$ |

133,275 |

|

|

Comprehensive income: |

|

|

|

|

|

|

|

Net income |

|

$ |

660,870 |

|

|

$ |

221,384 |

|

|

$ |

132,465 |

|

|

Other comprehensive income (loss), net of tax |

|

|

|

|

|

|

|

Foreign currency translation gain (loss), net of tax |

|

7,723 |

|

|

92,735 |

|

|

(47,078) |

|

|

Unrealized gain (loss) on derivatives, net of tax |

|

10,168 |

|

|

(9,351) |

|

|

(9,472) |

|

|

Other (loss) income, net of tax |

|

(180) |

|

|

352 |

|

|

(1,048) |

|

|

Total other comprehensive income (loss), net of tax |

|

17,711 |

|

|

83,736 |

|

|

(57,598) |

|

|

Total comprehensive income |

|

678,581 |

|

|

305,120 |

|

|

74,867 |

|

|

Comprehensive income (loss) attributable to non-controlling interest |

|

1,081 |

|

|

(1,851) |

|

|

(1,404) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income attributable to THOR Industries, Inc. |

|

$ |

677,500 |

|

|

$ |

306,971 |

|

|

$ |

76,271 |

|

|

|

|

|

|

|

|

|

|

As of July 31 |

|

|

|

2021 |

|

2020 |

|

Consolidated Balance Sheet Data: |

|

(amounts in thousands) |

|

Cash and cash equivalents |

$ |

445,852 |

|

$ |

538,519 |

|

Total assets |

|

6,654,088 |

|

|

5,771,460 |

|

Total debt(1) |

|

1,607,232 |

|

|

1,666,648 |

|

Total liabilities |

|

3,705,982 |

|

|

3,425,891 |

|

Stockholders’ equity attributable to THOR Industries, Inc. |

|

2,921,843 |

|

|

2,319,782 |

|

Non-controlling interests |

|

26,263 |

|

|

25,787 |

|

Total stockholders’ equity |

|

2,948,106 |

|

|

2,345,569 |

Cash Flow Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended July 31 |

|

|

|

2021 |

|

2020 |

|

2019 |

|

(amounts in thousands) |

|

|

Net cash provided by (used in): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Activities |

|

$ |

526,482 |

|

|

$ |

540,941 |

|

|

$ |

508,019 |

|

|

Investing Activities………………………………………….………… |

|

(428,493) |

|

|

(84,249) |

|

|

(1,865,503) |

|

|

Financing Activities…………………………………………………… |

|

(188,438) |

|

|

(392,916) |

|

|

1,539,073 |

|

Other Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended July 31 |

|

|

|

2021 |

|

2020 |

|

2019 |

|

(amounts in thousands) |

|

|

(Unaudited) |

|

|

EBITDA(2) |

|

$ |

1,168,506 |

|

|

$ |

577,975 |

|

|

$ |

402,365 |

|

|

Adjusted EBITDA(2) |

|

|

1,235,095 |

|

|

|

643,979 |

|

|

|

675,918 |

|

|

Pro Forma Adjusted EBITDA(2) |

|

1,330,195 |

|

|

643,979 |

|

|

675,918 |

|

|

Free Cash Flow(2) |

|

397,647 |

|

|

434,244 |

|

|

377,795 |

|

|

Pro forma net debt(3) |

|

1,949,841 |

|

|

|

|

|

|

|

|

Ratio of pro forma net debt to Adjusted EBITDA(2)(4) |

|

1.6x |

|

|

|

|

|

|

|

|

Ratio of pro forma net debt to Pro Forma Adjusted EBITDA(2)(5) |

|

1.5x |

|

|

|

|

|

|

|

(1)Net of debt issuance costs.

|

(2) |

We define EBITDA as net income or loss before interest expense, income taxes and depreciation and amortization. We define Adjusted EBITDA as EBITDA, as further adjusted to eliminate the impact of certain items that we do not consider in the evaluation of our ongoing operating performance from period to period. We define Pro Forma Adjusted EBITDA as Adjusted EBITDA, as further adjusted for our acquisition of Airxcel. We define Free Cash Flow as net cash provided by operating activities less capital expenditures. EBITDA, Adjusted EBITDA, Pro Forma Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. We believe such non-GAAP financial measures are useful measures to investors because they may help investors to compare our results to previous periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. While we believe that the presentation of these non-GAAP measures will enhance an investor’s understanding of our operating performance, the use of these non-GAAP measures as analytical tools has limitations and should not be considered in isolation, or as substitutes for an analysis of our results of operations as reported in accordance with GAAP. |

|

|

We present these non-GAAP financial measures because we believe they assist investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that management and the board of directors do not believe are indicative of our core operating results when assessing our performance. In addition, we use Adjusted EBITDA because the Senior Secured Credit Facilities use measures, and the indenture governing the notes will use measures, similar to Adjusted EBITDA to measure compliance with certain covenants. |

|

|

While we believe that these non-GAAP financial measures provide useful supplemental information, there are limitations associated with the use of these non-GAAP financial measures. These non-GAAP financial measures are not prepared in accordance with GAAP, do not reflect a comprehensive system of accounting and may not be comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation between companies. Items that are excluded from our non-GAAP financial measures can have a material impact on net income. Because of these limitations, these non-GAAP financial measures should not be considered in isolation from, or as a substitute for, net income, cash flow from operations or other measures of performance prepared in accordance with GAAP. For further detail, see “Non-GAAP financial measures.” |

Reconciliation of Net Income to Adjusted EBITDA and Pro Forma Adjusted EBITDA

The table below reconciles Adjusted EBITDA to net income for the periods shown.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended July 31 |

|

|

|

2021 |

|

2020 |

|

2019 |

|

(amounts in thousands) |

|

|

Net income |

|

$ |

659,872 |

|

|

$ |

222,974 |

|

|

$ |

133,275 |

|

|

Depreciation and amortization |

|

230,581 |

|

|

196,167 |

|

|

148,777 |

|

|

Interest expense |

|

94,342 |

|

|

107,322 |

|

|

68,112 |

|

|

Income taxes |

|

183,711 |

|

|

51,512 |

|

|

52,201 |

|

|

EBITDA |

|

1,168,506 |

|

|

577,975 |

|

|

402,365 |

|

|

EHG pre-acquisition EBITDA(a) |

|

— |

|

|

— |

|

|

66,236 |

|

|

Non-cash charges(b) |

|

58,445 |

|

|

31,361 |

|

|

22,645 |

|

|

COVID-19 expenses(c) |

|

— |

|

|

22,272 |

|

|

— |

|

|

JV losses(d) |

|

15,751 |

|

|

6,884 |

|

|

8,798 |

|

|

Transaction fees(e) |

|

2,394 |

|

|

5,711 |

|

|

114,866 |

|

|

EHG inventory step-up costs(f) |

|

— |

|

|

— |

|

|

61,418 |

|

|

Other(g) |

|

(10,001) |

|

|

(224) |

|

|

(410) |

|

|

Adjusted EBITDA |

|

$ |

1,235,095 |

|

|

$ |

643,979 |

|

|

$ |

675,918 |

|

|

Airxcel pre-acquisition adjusted EBITDA(h) |

|

|

95,100 |

|

|

|

— |

|

|

|

— |

|

|

Pro Forma Adjusted EBITDA |

|

$ |

1,330,195 |

|

|

$ |

643,979 |

|

|

$ |

675,918 |

|

|

|

|

|

|

|

|

|

|

(a) |

Reflects EHG’s EBITDA for August 1, 2018 through January 1, 2019 prior to the consummation of the EHG acquisition, excluding the EHG North American operations. |

|

(b) |

Represents losses, expenses or impairments, including stock-based compensation and last in, first out expense (but excluding any non-cash charge to the extent that it represents an accrual or reserve for cash expenses in any future period). |

|

(c) |

Includes any extraordinary, unusual or non-recurring expenses or losses (including losses on sale of equipment or businesses outside of the ordinary course of business). |

|

(d) |

Represents losses on joint venture investments. |

|

(e) |

Any fees and expenses incurred in connection with certain financing and strategic transactions, including (i) any financial advisory fees, accounting fees, legal fees and other similar advisory and consulting fees, and (ii) cash charges in respect of strategic market reviews, stay or sign-on bonuses, integration-related bonuses, restructuring, consolidation, severance or discontinuance of any portion of operations, employees and / or management. |

|

(f) |

Represents one-time, non-cash expense related to the fair value step-up in purchase accounting of acquired inventory for EHG, which was acquired in February 2019. |

|

(g) |

Other includes net unrealized losses on swap agreements, any other non-cash income (including gains on the sale of equipment or businesses), other than normal accruals in the ordinary course of business for non-cash income that represents an accrual for cash income in a future period, and other income / (expense) not otherwise captured. |

|

(h) |

Reflects Airxcel’s adjusted EBITDA for August 1, 2020 through July 31, 2021 prior to the consummation of the Airxcel acquisition. |

Reconciliation of Free Cash Flow to net cash provided by operating activities

The table below reconciles Free Cash Flow to net cash provided by operating activities for the periods shown.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended July 31 |

|

|

|

2021 |

|

2020 |

|

2019 |

|

(amounts in thousands) |

|

|

Net cash provided by operating activities |

|

$ |

526,482 |

|

|

$ |

540,941 |

|

|

$ |

508,019 |

|

|

Capital expenditures |

|

(128,835) |

|

|

(106,697) |

|

|

(130,224) |

|

|

Free Cash Flow |

|

$ |

397,647 |

|

|

$ |

434,244 |

|

|

$ |

377,795 |

|

|

(3) |

Pro forma net debt equals total debt, before fees and net of cash and cash equivalents, pro forma for the acquisition of Airxcel and the notes offered hereby and the use of proceeds therefrom. |

|

(4) |

The ratio of pro forma net debt to Adjusted EBITDA is determined by dividing pro forma net debt, as of July 31, 2021, by Adjusted EBITDA for the year ended July 31, 2021. |

|

(5) |

The ratio of pro forma net debt to pro forma Adjusted EBITDA is determined by dividing pro forma net debt, as of July 31, 2021, by pro forma Adjusted EBITDA for the year ended July 31, 2021. |

Guarantees

The obligations of the Company under the Notes and the Indenture will be, jointly and severally, unconditionally guaranteed on a senior unsecured basis (the “Note Guarantees”) by each Domestic Restricted Subsidiary that Guarantees the Company’s obligations under the Term Loan Credit Agreement. Following the Issue Date, Subsidiaries will be required to Guarantee the Notes to the extent described in “—Certain covenants—Limitation on guarantees.”

For the year ended July 31, 2021, the Non-Guarantor Subsidiaries that are Foreign Subsidiaries represented 26% of our net sales and 19% of our Adjusted EBITDA, respectively. As of July 31, 2021, the Non-Guarantor Subsidiaries that are Foreign Subsidiaries represented 45% of our consolidated total assets and had $963 million of total liabilities, including trade payables, accrued expenses and lease liabilities, but excluding intercompany liabilities. For the year ended July 31, 2021, the Non-Guarantor Subsidiaries that are domestic Unrestricted Subsidiaries represented less than 1% of our net sales and less than 1% of our Adjusted EBITDA, respectively. As of July 31, 2021, the Non-Guarantor Subsidiaries that are domestic Unrestricted Subsidiaries represented less than 2% of our consolidated total assets and had approximately $8 million of total liabilities, including trade payables, accrued expenses and lease liabilities, but excluding intercompany liabilities.