Exhibit 99.2

FINANCIAL RESULTS FIRST QUARTER FISCAL 2025

2 FORWARD - LOOKING STATEMENTS This presentation includes certain statements that are “forward - looking” statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks . These forward - looking statements are not a guarantee of future performance . We cannot assure you that actual results will not differ materially from our expectations . Factors which could cause materially different results include, among others : the impact of inflation on the cost of our products as well as on general consumer demand ; the effect of raw material and commodity price fluctuations, including the impact of tariffs, and/or raw material, commodity or chassis supply constraints ; the impact of war, military conflict, terrorism and/or cyber - attacks, including state - sponsored or ransom attacks ; the impact of sudden or significant adverse changes in the cost and/or availability of energy or fuel, including those caused by geopolitical events, on our costs of operation, on raw material prices, on our suppliers, on our independent dealers or on retail customers ; the dependence on a small group of suppliers for certain components used in production, including chassis ; interest rates and interest rate fluctuations and their potential impact on the general economy and, specifically, on our independent dealers and consumers and our profitability ; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share ; the level and magnitude of warranty and recall claims incurred ; the ability of our suppliers to financially support any defects in their products ; the financial health of our independent dealers and their ability to successfully manage through various economic conditions ; legislative, regulatory and tax law and/or policy developments including their potential impact on our independent dealers, retail customers or on our suppliers ; the costs of compliance with governmental regulation ; the impact of an adverse outcome or conclusion related to current or future litigation or regulatory investigations ; public perception of and the costs related to environmental, social and governance matters ; legal and compliance issues including those that may arise in conjunction with recently completed transactions ; lower consumer confidence and the level of discretionary consumer spending ; the impact of exchange rate fluctuations ; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers ; management changes ; the success of new and existing products and services ; the ability to maintain strong brands and develop innovative products that meet consumer demands ; the ability to efficiently utilize existing production facilities ; changes in consumer preferences ; the risks associated with acquisitions, including : the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies ; a shortage of necessary personnel for production and increasing labor costs and related employee benefits to attract and retain production personnel in times of high demand ; the loss or reduction of sales to key independent dealers, and stocking level decisions of our independent dealers ; disruption of the delivery of units to independent dealers or the disruption of delivery of raw materials, including chassis, to our facilities ; increasing costs for freight and transportation ; the ability to protect our information technology systems from data breaches, cyber - attacks and/or network disruptions ; asset impairment charges ; competition ; the impact of losses under repurchase agreements ; the impact of the strength of the U . S . dollar on international demand for products priced in U . S . dollars ; general economic, market, public health and political conditions in the various countries in which our products are produced and/or sold ; the impact of changing emissions and other related climate change regulations in the various jurisdictions in which our products are produced, used and/or sold ; changes to our investment and capital allocation strategies or other facets of our strategic plan ; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt . These and other risks and uncertainties are discussed more fully in Item 1 A of our Annual Report on Form 10 - K for the year ended July 31 , 2024 . We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward - looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law .

3 Founded in 1980 and headquartered in Elkhart, Indiana, THOR is a global family of companies that makes it easier and more enjoyable to connect people with nature and each other to create lasting outdoor memories. Net Sales $2.14 B Gross Profit Margin 13.1% (1) (2) (3) Unit Shipments 42,394 For the fiscal quarter ended October 31, 2024 Attributable to THOR Industries, Inc. See Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures First Quarter Fiscal 2025 Results (1) EBITDA (3) $81.7 M Adjusted EBITDA (3) $107.8 M Net Income (Loss) (2) $(1.8) M Diluted EPS (2) $(0.03)

EUROPEAN SEGMENT NORTH AMERICAN MOTORIZED SEGMENT NORTH AMERICAN TOWABLE SEGMENT 4 We consist of a trusted family of brands that are loved by RV consumers

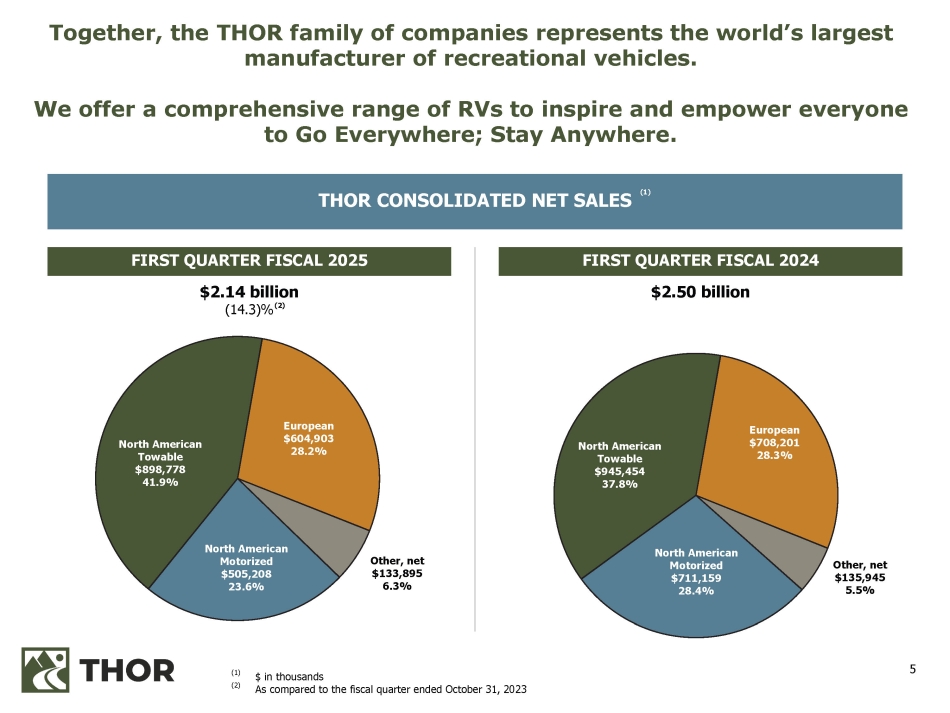

5 Together, the THOR family of companies represents the world’s largest manufacturer of recreational vehicles. We offer a comprehensive range of RVs to inspire and empower everyone to Go Everywhere; Stay Anywhere. Other, net $133,895 6.3% North American Motorized $505,208 23.6% (1) (2) $ in thousands As compared to the fiscal quarter ended October 31, 2023 THOR CONSOLIDATED NET SALES (1) North American Towable $898,778 41.9% European $604,903 28.2% Other, net $135,945 5.5% North American Motorized $711,159 28.4% North American Towable $945,454 37.8% European $708,201 28.3% FIRST QUARTER FISCAL 2025 FIRST QUARTER FISCAL 2024 $2.50 billion $2.14 billion (14.3)% (2)

6 ($ in thousands) Q1 2025 Q1 2024 Change Net Sales – Segments (4.9)% $ 945,454 $ 898,778 North American Towable (29.0)% 711,159 505,208 North American Motorized (14.6)% 708,201 604,903 European (1.5)% 135,945 133,895 Other, net (14.3)% $ 2,500,759 $ 2,142,784 Total (120) bps 14.3% 13.1% Gross Profit Margin % (103.4)% $ 53,565 $ (1,832) Net Income (Loss) (1) (103.0)% $ 0.99 $ (0.03) Diluted Earnings (Loss) per Share (1) (48.9)% $ 160,057 $ 81,733 EBITDA (2) (35.4)% $ 166,918 $ 107,782 Adjusted EBITDA (2) THOR remains committed to our strategic approach resulting in strong performance relative to current market conditions (1) (2) Attributable to THOR Industries, Inc. See the Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures First Quarter Fiscal 2025 Summary First Quarter Fiscal 2025 Highlights • Maintained strong margin performance relative to the challenging market • Remained focused on our strategic commitment to long - term investments to create competitive advantage and enhanced margin profile a sustainable • Restructured leadership team to allow for greater focus in North America from our CEO, Bob Martin • Strategic, nonrecurring costs incurred during the quarter unfavorably impacted first quarter results, but actions are expected to result in future annual savings of over $10 million • Announced an increase in our dividend for the 15th consecutive year • Received incredibly strong reception of our new product lineup at both our Open House in Elkhart, IN and the Caravan Salon trade fair in Düsseldorf, Germany

7 Fiscal 2025 First Quarter Key Drivers • Net sales decreased year - over - year on 6 . 8 % higher shipment volume due to a shift in product mix toward our lower - cost travel trailers • Gross profit margin percentage remained constant despite the 4 . 9 % decrease in net sales through the combined impact of lower sales discounting, cost - saving initiatives and the change in product mix in the current - year quarter • Maintained disciplined approach to the alignment of production to match the current retail environment and independent dealer demand North American Towable Segment Q1 2025 Q1 2024 Change (4.9)% $ 945,454 $ 898,778 Net Sales (1) 0 bps 12.5% 12.5% Gross Profit Margin % 6.8 % 28,107 30,018 Wholesale Unit Shipments (11.0)% $ 33,638 $ 29,941 Average Sales Price October 31, 2024 October 31, 2023 Change 17.2 % $ 795,798 $ 933,051 Backlog (1) (9.1)% 71,624 65,109 Dealer Inventory (2) (1) (2) $ in thousands Independent Dealer Inventory of THOR products, in units

8 North American Motorized Segment Fiscal 2025 First Quarter Key Drivers • Net sales decreased 29 . 0 % compared to the first quarter of fiscal 2024 due to a softening of current independent dealer and consumer demand for motorized products • Gross profit margin percentage decreased 270 bps from the prior - year period primarily driven by the combined impact of the decrease in sales volume along with increased sales discounting and chassis costs • Independent dealer inventory of THOR Motorized products at October 31 , 2024 decreased 18 . 3 % from the prior year as independent dealers have adjusted their ordering patterns and optimal unit stocking levels in response to elevated carrying costs and current retail activity Q1 2025 Q1 2024 Change (29.0)% $ 711,159 $ 505,208 Net Sales (1) (270) bps 11.2% 8.5% Gross Profit Margin % (33.0)% 5,582 3,741 Wholesale Unit Shipments 6.0 % $ 127,402 $ 135,046 Average Sales Price October 31, 2024 October 31, 2023 Change (22.2)% $ 1,237,547 $ 963,141 Backlog (1) (18.3)% 12,127 9,909 Dealer Inventory (2) (1) (2) $ in thousands Independent Dealer Inventory of THOR products, in units

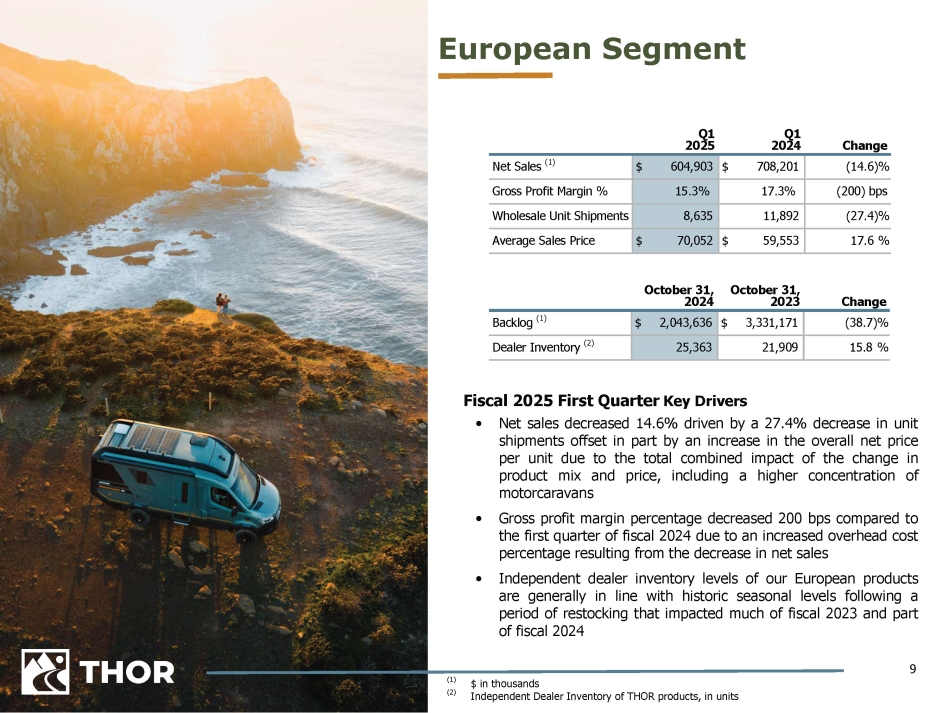

9 European Segment Fiscal 2025 First Quarter Key Drivers • Net sales decreased 14 . 6 % driven by a 27 . 4 % decrease in unit shipments offset in part by an increase in the overall net price per unit due to the total combined impact of the change in product mix and price, including a higher concentration of motorcaravans • Gross profit margin percentage decreased 200 bps compared to the first quarter of fiscal 2024 due to an increased overhead cost percentage resulting from the decrease in net sales • Independent dealer inventory levels of our European products are generally in line with historic seasonal levels following a period of restocking that impacted much of fiscal 2023 and part of fiscal 2024 Q1 2025 Q1 2024 Change (14.6)% $ 708,201 $ 604,903 Net Sales (1) (200) bps 17.3% 15.3% Gross Profit Margin % (27.4)% 11,892 8,635 Wholesale Unit Shipments 17.6 % $ 59,553 $ 70,052 Average Sales Price October 31, 2024 October 31, 2023 Change (38.7)% $ 3,331,171 $ 2,043,636 Backlog (1) 15.8 % 21,909 25,363 Dealer Inventory (2) (1) (2) $ in thousands Independent Dealer Inventory of THOR products, in units

10 $ 1,305,297 $ 1,091,397 Outstanding Debt (1) ($ in thousands) As of October 31, 2024 As of October 31, 2023 $ 425,828 $ 445,222 Cash and Cash Equivalents 998,000 865,000 Availability under Revolving Credit Facility $ 1,423,828 $ 1,310,222 Total Liquidity Leverage Ratios (2) Q1 FY 2025 Q1 FY 2024 1.2 x 1.0 x Net Debt / TTM EBITDA 1.1 x 1.0 x Net Debt / TTM Adjusted EBITDA Cash Flow Generation Q1 FY 2025 Q1 FY 2024 $ 59,668 $ 30,740 Cash from Operating Activities (1) (2) Total gross debt obligations inclusive of the current portion of long - term debt See the Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures Liquidity, low leverage ratio and strong cash flow generation are unrivaled strengths of THOR’s within the RV industry

11 Capital Management PRIORITIES AND FISCAL 2025 ACTIONS Invest in THOR’s business ▪ Capex investment of $ 25 . 3 million for Q 1 FY 25 , while we continue to manage non - critical spend in response to current market conditions Pay THOR's dividend ▪ Increased regular quarterly dividend to $0.50 in October 2024 ▪ Represents 15 th consecutive year of dividend increases Reduce the Company's debt obligations ▪ Payments on total debt of $61.8 million during Q1 FY25 ▪ Committed to long - term net debt leverage ratio target of approximately 1.0x; currently at 1.0x Repurchase shares on a strategic and opportunistic basis ▪ $422.8 million available to be repurchased under current authorizations as of October 31, 2024 Support opportunistic strategic investments

12 As forecasted, overall performance continued to be impacted by a soft retail and wholesale environment Held relatively strong margins despite a challenging market Remained focused on our strategic commitment to long - term investments to create a sustainable competitive advantage and enhanced margin profile Restructured leadership team to allow for greater focus on North America from our CEO, Bob Martin Incurred strategic, nonrecurring costs during the quarter unfavorably impacting current results, but actions are expected to result in future annual savings of over $ 10 million Paid down approximately $ 61 . 8 million of our total debt during the first quarter of FY 2025 Key takeaways from Q1 FY 2025

13 Full - Year Fiscal 2025 Guidance ▪ We reconfirm our initial financial forecast and guidance for fiscal 2025 , which ends July 31 , 2025 , following the results of our first quarter ▪ We expect to have a challenging second quarter ahead, followed by stronger third and fourth quarters ▪ We will continue to control what we can control, maximize our performance in the current environment and position THOR to outperform upon the market’s return Fiscal Year 2025 Guidance (1) $9.0B – $9.8B Consolidated Net Sales 325,000 – 340,000 North American RV Industry Wholesale Unit Shipments 14.7% – 15.2% Consolidated Gross Profit Margin $4.00 – $5.00 Diluted Earnings per Share Outlook ▪ We hold steadfast to our strategy of prudence in the face of a difficult market ▪ We continue to be very optimistic about global consumer interest in the RV lifestyle and long - term demand for our products ▪ We anticipate that the retail market will begin to trend positively by the end of our fiscal 2025 , setting up our fiscal 2026 to be a stronger year (1) Our Fiscal Year 2025 runs from August 1, 2024 through July 31, 2025

14 Appendix

15 (1) All retail information presented is for the CYTD period through September 30 , 2024 . North American retail data is reported by Statistical Surveys, Inc . and is based on official state and provincial records . This information is subject to adjustment, is continuously updated and is often impacted by delays in reporting by various states or provinces . European retail data is reported by the Caravaning Industry Association e . V . (“CIVD”) and the European Caravan Federation (“ECF ” ) . This information is subject to adjustment, continuously updated and is often impacted by delays in reporting by various countries (some countries, including the United Kingdom, do not report OEM - specific data and are thus excluded from the market share calculation) . (2) (3) EUROPEAN (3) All RV Segments NORTH AMERICAN (2) CATEGORY Class B Class C Class A Fifth Wheels Travel Trailers 23.4% 40.2% 50.7% 48.5% 40.7% 39.3% MARKET SHARE (1) #1 #1 #1 #1 #1 #2 MARKET POSITION (1) THOR – The Global RV Industry Leader

16 298.3 323.0 334.5 298.1 208.6 152.4 217.1 227.6 257.6 282.8 312.8 326.9 376.0 442.0 426.1 359.4 389.6 544.0 434.9 267.3 289.8 309.3 370.0 384.5 390.4 353.5 237.0 165.6 242.3 252.4 285.7 321.1 356.7 374.2 430.7 504.6 483.7 406.1 430.4 600.2 493.3 313.2 324.1 346.1 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) (e) TOWABLE RV WHOLESALE MARKET TRENDS (UNITS 000's) YTD Shipments (Units) % Change Unit Change Sept. 2023 Sept. 2024 +7.7% 18,291 238,121 256,412 YTD Shipments (Units) % Change Unit Change Sept. 2023 Sept. 2024 +13.4% 27,130 202,361 229,491 71.7 61.4 55.8 55.4 28.4 13.2 25.2 24.8 28.2 38.3 44.0 47.3 54.7 62.6 57.6 46.6 40.8 56.2 58.4 45.9 34.3 36.8 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) (e) YTD Shipments (Units) % Change Unit Change Sept. 2023 Sept. 2024 (24.7)% (8,839) 35,760 26,921 Historical Data: Recreation Vehicle Industry Association (RVIA) (e) Calendar years 2024 and 2025 represent the most recent RVIA "most likely" estimates from their September 2024 issue of Roadsigns RV Industry Overview North America RV WHOLESALE MARKET TRENDS (UNITS 000's) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) (e) MOTORIZED RV WHOLESALE MARKET TRENDS (UNITS 000's)

17 RV Industry Overview THOR Forest River Winnebago Grand Design Gulfstream REV Group All Others 2024 Motorized 31,771 units 2023 Motorized 37,318 units 2023 Towable 281,045 units 47.5% 49.0% 40.9% 2015 2016 2017 RV Retail Registrations (1) 2018 2019 CCS Index (2) 2010 2011 2012 2013 2014 2020 2021 2022 2023 0 100,000 200,000 300,000 400,000 500,000 600,000 North America CONSUMER CONFIDENCE VS. RV RETAIL REGISTRATIONS (1)(2) 0 25 50 75 100 125 150 16.7% 6.9% 10.0% 10.1% 16.7% 6.4% (1) (2) Source: Statistical Surveys, Inc., U.S. and Canada; CYTD through September 30, 2024 and 2023 Source: The Conference Board, Consumer Confidence Survey ® , through September 2024 2024 Towable 256,906 units 37.5% 8.6% 12.5% 38.5% 9.0% 1.5% Note: 2024 represented above includes the trailing twelve months of registrations through September 30, 2024 CALENDAR YEAR - TO - DATE RV RETAIL MARKET SHARE (1) 1.6% 1.7% 1.3% 35.3% 11.6% 18.9% 17.8%

18 Change Total Nine Months Ended September 30, 2024 2023 Motorcaravans & Campervans Nine Months Ended September 30, 2024 2023 Change Change Caravans Nine Months Ended September 30, 2024 2023 Country 6.9 % 76,128 81,385 9.9 % 57,376 63,046 (2.2)% 18,752 18,339 Germany 6.3 % 24,758 26,329 8.6 % 19,102 20,753 (1.4)% 5,656 5,576 France 11.7 % 20,148 22,512 35.5 % 9,990 13,534 (11.6)% 10,158 8,978 U.K. 0.9 % 52,550 53,034 4.1 % 34,391 35,788 (5.0)% 18,159 17,246 All Others 5.6 % 173,584 183,260 10.1 % 120,859 133,121 (4.9)% 52,725 50,139 Total EUROPEAN INDUSTRY UNIT REGISTRATIONS BY COUNTRY (1) 198 203 210 208 189 154 150 156 147 137 140 152 168 190 202 211 236 261 219 210 324 320 310 366 289 206 228 247 264 304 333 376 416 471 493 465 449 379 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Europe North America The Company monitors retail trends in the European RV market as reported by the European Caravan Federation, whose industry data is reported to the public quarterly. Industry wholesale shipment data for the European RV market is not available. FULL - YEAR COMPARISON OF NEW VEHICLE REGISTRATIONS BY CONTINENT (UNITS 000's) (1) (2) 570 522 RV Industry Overview: Europe (1) (2) Source: European Caravan Federation; CYTD September 30, 2024 and 2023; European retail registration data available at www.CIVD.de Source: Statistical Surveys; North American retail registration data available at www.statisticalsurveys.com

19 Opportunities for New RVers entering the market Significant growth in RV ownership RV Owner future purchase intent is high RVing included in 2024 holiday travel plans 95 % of new RV owners plan to purchase another RV in the future (3) 21 million Americans plan to go RVing between Thanksgiving and New Year’s (2) 97 % increase in RV ownership for leisure travelers since 2014 (1) 26 % of those interested in buying an RV are motivated by a new hobby (4) Real data from RVers underpins long - term RV industry growth (1) (2) (3) (4) KOA 2024 Camping & Outdoor Hospitality Report RVIA 2024 Winter Travel Intention Survey THOR 2024 North American New RV Path to Purchase Study RV Trader 2024 Report

20 Additional Historical Metrics $5,364,516 $3,939,828 $795,798 $933,051 $1,237,547 $963,141 $3,331,171 $2,043,636 NA Towables NA Motorized European 10/31/23 10/31/24 82,400 122,300 83,800 75,000 Inventory Units 10/31/21 10/31/22 10/31/23 10/31/24 NORTH AMERICAN INDEPENDENT DEALER INVENTORY OF THOR PRODUCTS RV BACKLOG OF $3.94 billion (26.6)% (1) (1) (2) As compared to October 31, 2023 Comparable independent dealer inventory unit information was not available prior to July 31, 2023 21,900 25,400 Inventory Units 10/31/23 10/31/24 EUROPEAN INDEPENDENT DEALER INVENTORY OF THOR PRODUCTS (2)

Adjusted EBITDA is a non - GAAP performance measure included to illustrate and improve comparability of the Company's results from period to period, particularly in periods with unusual or one - time items . Adjusted EBITDA is defined as net income (loss) before net interest expense, income tax expense (benefit) and depreciation and amortization adjusted for certain unusual items and other one - time items . The Company considers this non - GAAP measure in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends . The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies . 21 Quarterly EBITDA Reconciliation TTM 1QFY25 4QFY24 3QFY24 2QFY24 1QFY24 $ 209,494 $ (873) $ 91,464 $ 113,577 $ 5,326 $ 55,033 Net Income (Loss) 83,697 15,228 18,410 21,830 28,229 20,197 Add Back: Interest Expense, Net (1) 65,612 (283) 35,554 28,773 1,568 17,549 Income Tax Provision (Benefit) 277,528 67,661 73,597 68,151 68,119 67,278 Depreciation and Amortization of Intangible Assets $ 636,331 $ 81,733 $ 219,025 $ 232,331 $ 103,242 $ 160,057 EBITDA Add Back: 37,986 10,537 8,852 9,351 9,246 10,452 Stock - Based Compensation Expense (14,494) — (6,494) (5,000) (3,000) — Change in LIFO Reserve, net (7,979) — (1,079) (2,700) (4,200) (10,000) Net Expense (Income) Related to Certain Contingent Liabilities 5,311 3,392 (1,380) 1,575 1,724 (979) Non - Cash Foreign Currency Loss (Gain) 454 388 117 (581) 530 2,871 Market Value Loss (Gain) on Equity Investments 9,425 2,254 779 2,890 3,502 5,935 Equity Method Investment Loss (Gain) 2,500 — — 2,500 — — Weather - Related Losses 7,175 — — — 7,175 — Debt Amendment Expenses 15,459 15,459 — — — — Employee & Facility Strategic Initiatives (21,209) (5,981) (1,428) (4,267) (9,533) (1,418) Other Loss (Gain), Including Sales of PP&E $ 670,959 $ 107,782 $ 218,392 $ 236,099 $ 108,686 $ 166,918 Adjusted EBITDA $ 9,685,433 $ 2,142,784 $ 2,534,167 $ 2,801,113 $ 2,207,369 $ 2,500,759 Net Sales 6.9 % 5.0 % 8.6 % 8.4 % 4.9 % 6.7 % Adjusted EBITDA Margin (%) $ 1,091,397 Total Long - Term Debt as of October 31, 2024 (2) 445,222 Less: Cash and Cash Equivalents $ 646,175 Net Debt 1.0 x Net Debt / TTM EBITDA 1.0 x Net Debt / TTM Adjusted EBITDA ($ in thousands) TTM Fiscal Quarters (1) Includes $7,566 of costs associated with the debt amendment for 2QFY24 as discussed in Note 13 to the Consolidated Financial Statements of the Company’s Annual Report on Form 10 - K for the period ended July 31, 2024. Total debt obligations as of October 31, 2024 inclusive of the current portion of long - term debt. (2)

www.thorindustries.com INVESTOR RELATIONS CONTACT Jeff Tryka, CFA Lambert Global jtryka@lambert.com (616) 295 - 2509