UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

FOR THE FISCAL YEAR ENDED

For the transition period from ____ to ____

COMMISSION FILE NUMBER:

CALAMP CORP.

(Exact name of Registrant as specified in its Charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

TITLE OF EACH CLASS |

|

TRADING SYMBOL(S) |

|

NAME OF EACH EXCHANGE |

|

|

|

|

|

The (The Nasdaq Global Select Market) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

|

Large accelerated filer |

☐ |

|

|

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ☐ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of August 31, 2021, the aggregate market value of shares held by non-affiliates of the registrant was approximately $

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the Annual Meeting of Stockholders to be held on July 26, 2022 are incorporated by reference into Part III, Items 10, 11, 12, 13 and 14 of this Form 10-K. This Proxy Statement will be filed within 120 days after the end of the fiscal year covered by this report.

Table of Contents

|

|

|

|

|

Page |

|

|

|

|

|

|

|

Item 1. |

|

|

2 |

|

|

Item 1A. |

|

|

10 |

|

|

Item 1B. |

|

|

27 |

|

|

Item 2. |

|

|

28 |

|

|

Item 3. |

|

|

28 |

|

|

Item 4. |

|

|

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

29 |

|

|

Item 6. |

|

|

30 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

30 |

|

Item 7A. |

|

|

46 |

|

|

Item 8. |

|

|

46 |

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

88 |

|

Item 9A. |

|

|

88 |

|

|

Item 9B. |

|

|

90 |

|

|

Item 9C. |

|

Disclosure Regarding Foreign Jurisdictions That Prevent Inspections |

|

90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

91 |

|

|

Item 11. |

|

|

91 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

91 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

91 |

|

Item 14. |

|

|

91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

92 |

|

|

|

|

|

|

|

PART I

|

ITEM 1. |

BUSINESS |

Company Overview

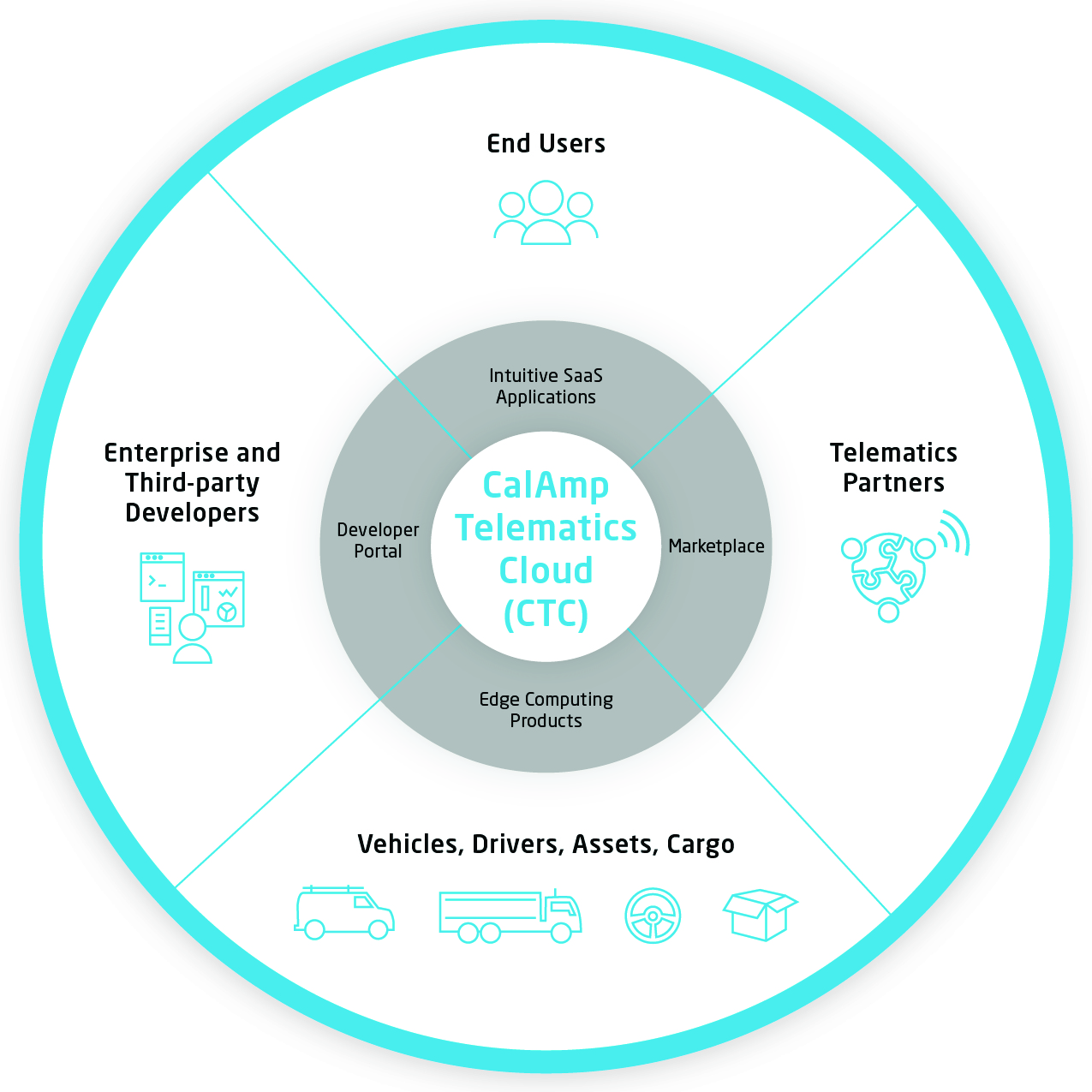

CalAmp Corp. (including its subsidiaries unless the context otherwise requires, “CalAmp”, “the Company”, “we”, “our”, or “us”) is a connected intelligence company that leverages a data-driven solutions ecosystem to help people and organizations improve operational performance. We solve complex problems for customers within the market verticals of transportation and logistics, commercial and government fleets, industrial equipment, and consumer vehicles by providing solutions that track, monitor, and recover their vital assets. The data and insights enabled by CalAmp solutions provide real-time visibility into a user’s vehicles, assets, drivers, and cargo, giving organizations greater understanding and control of their operations. Ultimately, these insights drive operational visibility, safety, efficiency, maintenance, and sustainability for organizations around the world.

Currently, CalAmp is generating data for a global customer portfolio across an installed base of approximately 10 million devices reporting to our cloud-based platform. The magnitude and diversity of this data generation has played an instrumental role in the development of our flexible and scalable cloud platform, the CalAmp Telematics Cloud™ (“CTC”). CTC’s ability to ingest vast amounts and types of data is critical to the company’s long-term strategy of providing differentiated insights to customers with a wide variety of needs and use cases. The platform also serves as the backbone for CalAmp’s software applications, which offer user-friendly interfaces to interact with the data and insights produced at the edge and in the cloud. Finally, to better address customer needs and enable a focused investment strategy, CalAmp is focused on enabling partnerships with third-party organizations, integrating devices, services, and application features into our consolidated solutions.

CalAmp’s ability to provide a full stack solution to end-users across the globe uniquely positions the company to capitalize on a $62 billion total addressable market (“TAM”) that is growing at a 5-year compounded annual growth rate of approximately 20%.1 The market in which we compete is highly fragmented, with the majority of competitors serving a range of subsets of CalAmp’s addressable market. We believe that this fragmentation will allow CalAmp to offer unparalleled value through a consolidated solution set. The company is focusing on transforming towards this vision by building out data-driven solutions, a robust portfolio of partners, and a world-class team of people.

The complexity that exists within CalAmp’s operating environment continues to be primarily driven by macro-economic conditions, competitive markets, global regulatory environments, technological evolution, the COVID-19 pandemic, and other macro-political and economic factors. We believe that the effect that these factors have on our customers further substantiates and augments the value of our solutions. As our customers’ operating complexity and costs continue to rise, the deployment of advanced telematics solutions becomes even more imperative. To maintain or enhance market share, revenue, profitability, and customer satisfaction, our customers require optimally efficient operating strategies, enabled by the visibility that CalAmp solutions provide.

|

|

1 |

Gartner, Market Guide for Transportation Mobility Technology (March 2021), Berg Insight, Trailer and Cargo Container Tracking (2021), Berg Insight, Global Automotive OEM Telematics Market (2021), and Berg Insight, Global Construction Equipment OEM Telematics Market (2021) |

2

Our Solutions

CalAmp Telematics Cloud (“CTC”). Since not all customers’ needs are the same, CalAmp offers flexible solutions to meet the requirements of varying organizations, business processes and operational strategies. At the core of the CalAmp approach is the CTC platform. This dependable and highly scalable platform seamlessly integrates with CalAmp’s edge computing products to provide customers detailed information and insights via Software-as-a-Service (“SaaS”). The information captured here helps companies more efficiently manage their vital assets including fleet video intelligence, remote asset tracking, real-time crash response and driver behavior scoring, among others. Customers can choose to access this information via intuitive purpose-built SaaS applications and/or they can programmatically integrate information from CTC with their own custom in-house applications and workflows using open Application Programming Interfaces (“APIs”) also offered by CalAmp. In this way, customers who want a complete turnkey solution can quickly leverage CalAmp’s information and insights while those customers wishing to integrate that information into their own applications and processes can easily do so, also.

Intuitive SaaS Applications. We provide our customers with intelligent analytics and reporting solutions that are accessible via a single view, user-friendly interface through a SaaS-based application designed to address market needs. This application, called CalAmp iOn™, is purpose-built for fleets, transportation and logistics needs, and industrial equipment, turning multiple data feeds from previously unconnected networks of vehicles, drivers and associated assets into clear and actionable insights that optimize operations, increase productivity and deliver compelling return on investment for virtually any business challenge. The applications also deliver real-time visibility about the location and environmental status of pharmaceuticals, electronics, food or other perishables from the manufacturing plant or point of origin to the point of delivery, helping to manage quality and compliance across land, air or sea shipments. Our K-through-12 solutions include Here Comes The Bus®, an award-winning mobile

3

application that provides real-time school bus location through push notifications and email alerts to help family members monitor bus arrival and keep students safe. Bus Guardian™ enables contact tracing and hygiene verification to keep students, drivers and other school staff safe amid the COVID-19 pandemic.

CalAmp Marketplace. The CalAmp Marketplace provides enhanced contextual information from third party systems or partners that augment the core telematics data being captured by CTC to provide customers with improved understanding of their business. Examples of these value-added insights include crash detection and notifications that speed life-saving assistance to drivers and fleet operators, and predictive remote diagnostics that enable preemptive alerts about vehicle issues before critical failures occur. This valued-added information provided by all the CalAmp Marketplace offerings bolsters the value we provide customers while also improving customer retention rates.

Developer Portal. The CalAmp Telematics Cloud is the core engine that enables seamless management of data through a diverse set of assets, from service vehicles to high-value equipment. CTC is an enablement platform that connects our customers to edge data and insights for a wide range of applications and software services. Through CTC CalAmp provides the Developer Portal to facilitate integration with third-party applications through open APIs. Our partners leverage the multiple APIs we’ve created to rapidly deliver full-featured telematics solutions to their customers and markets. Our proven CTC platform is architected to integrate with numerous global Mobile Network Operator account management systems and leverage these carrier backend systems to provide customers access to services that are essential for creating and managing flexible end-to-end solutions.

Flexible Edge Computing Products. We offer a series of telematics edge products that serve as the foundation of our mobile connected ecosystem by collecting data insights from vehicles, drivers, assets, and cargo. These wireless enabled devices--including asset tracking units, mobile telematics devices, fixed and mobile wireless gateways and routers--underpin our wide range of proprietary and third-party software applications and services for business-critical deployments demanding secure and reliable communications and controls anywhere in the world. Our customers select our products and solutions based on optimized feature sets, programmability, configurability, manageability, long-term support, reliability and, in particular, overall value.

Growth Strategy – Capitalize on $62B Total Addressable Market

Over the past several years, CalAmp has been focused on growing our subscription-based business through expanded data and application-driven solutions offerings. This transition has been driven by our desire to enhance the customer experience and maximize the value proposition that we provide our customers. By transforming our business model and solutions portfolio to focus on data-driven insights and the application experience, CalAmp offers customers the value and convenience of a consolidated full stack solution, while providing shareholders with the confidence that accompanies an increasingly recurring and predictable revenue model.

CalAmp operates at the nexus of several large market opportunities, including fleet, transportation and logistics, supply chain and connected-vehicle ecosystems, which includes tracking, monitoring, and recovering high-value vehicles, equipment, cargo and other vital assets in the markets around the world. We also operate at global scale, with a presence in the North American, EMEA, LATAM, and APAC regions, with plans to continue growing across the board. We believe these market opportunities constitute a TAM of approximately $62 billion. To capitalize on this TAM, our growth strategy includes the following key elements:

|

|

• |

Drive Ongoing Transformation to SaaS Business Model. We are relentlessly pursuing our goal to grow our software and subscription services business. To accomplish this goal, our team is focused on continual innovation across our proprietary full stack solution. We believe that by leveraging our existing brand presence and customer base, we can drive growth through the adoption of our software applications and open API solutions. As CalAmp continues to drive significant subscriber growth, the increased volumes of data will drive our innovation roadmaps towards increasingly unique and differentiated solutions. This strategy begins with converting the legacy installed base to SaaS arrangements, while simultaneously ramping up SaaS sales volumes to both new and existing customers. |

|

|

• |

Launch New Innovative Software Solutions in the Emerging Connected Asset Market Worldwide. Across the globe, CalAmp has established highly recognizable brands, as well as strong and unique relationships with the most reputable companies in each of our verticals. This is a direct result of the company’s ability to consistently push the frontiers of innovation and develop customer-focused solutions. With innovation as a central component of our culture, CalAmp continues to develop new telematics |

4

|

|

solutions for the connected asset market such as our award-winning iOn™ application, Here Comes the Bus application and Bus Guardian solution. |

|

|

• |

Expand in Key Verticals and Target Geographies. CalAmp continues to leverage our existing customer relationships, international subscribers, and recent acquisitions to further expand into global markets including Latin America, Europe, Middle East & Africa, and Asia Pacific. Our global expansion strategy is focused on countries with anticipated demand for our full stack of SaaS applications and data services. The launch of iOn in EMEA demonstrates our commitment to execute on this strategy and extend the value of our CTC platform and applications into global markets. We expect this strategy to generate significant growth over time as our international solutions continue to mature and adjust to unique regional market needs. |

|

|

• |

Continue to Help Customers Realize the Value of Fully Connected Ecosystems. Because CalAmp solutions are capable of connecting diverse asset portfolios and offering consolidated insights, the value of our solution grows as we become more embedded across customers’ operational ecosystems. This value is not only attractive to new customers looking for a consolidated solution, but it is also the basis for our ability to upsell existing customers. As our teams continue to build out innovative data services and edge capabilities, we expect to see significant average revenue per unit (“ARPU”) expansion and new customer growth. |

Customer Benefits

Our software and subscription services solutions and edge-computing products are deployed in a wide variety of applications across key market verticals ranging from small to large enterprises. Companies using CalAmp’s solutions require constant communication with remote and/or mobile assets as they perform business-critical tasks and services that are otherwise difficult to manage in real time. Our solutions provide a clear and demonstrable return on investment for these customers by:

|

|

• |

Improving efficiency, cost savings and sustainability. CalAmp’s solutions enable customers to gain better control and visibility of how their drivers, cargo, assets and vehicles are operating. With this information they are better able to streamline and optimize their operations which reduces fuel usage, decreases labor costs and improves overall efficiency. Additionally, using less fuel reduces the carbon footprint of an organization and helps them in reaching their sustainability goals. |

|

|

• |

Improving tracking and transparency. One of the most important benefits our customers receive by using CalAmp’s solutions is gaining greater understanding of where and how their assets, vehicles, and cargo are being used. The insights we provide help organizations operate more effectively, provide better support to both their internal and external customers, and ensure that their resources are being properly deployed, used and delivered. |

|

|

• |

Increasing safety and compliance. Because our solutions enable fleet operators to track, monitor and gain greater transparency of how their vehicles and assets are being used, they also allow customers to improve the behavior of employees which bolsters safety while also ensuring personnel are complying with governance policies. Additionally, for K-through-12 students all over the U.S. and Canada, our proprietary school bus tracking and mobile app provide pick-up and drop-off information to give parents and students peace of mind as they travel to and from school. |

|

|

• |

Better maintenance and increased uptime. CalAmp’s solutions provide visibility into maintenance, usage, and tracking of on- and off-road high-value assets including assets like vehicles, “yellow-iron” and attachments, forklifts and loaders to generators, compressors and other mission-critical equipment. The detailed insights into information like engine hours, impact and other diagnostics help our customers head off issues before they occur in order to improve overall equipment/fleet uptime. |

Manufacturing and Operations

While our products are largely designed in the U.S., we currently outsource our manufacturing to certain contract manufacturers in Taiwan, Malaysia and Mexico as well as some limited production in China and Hong Kong. The devices, components and assemblies used in our solutions and products can be obtained from these manufacturers, although a few components are obtained from sole source suppliers. Although we do not have any long-term purchase contracts, we have executed product supply agreements with these manufacturers, which provide for certain product quality requirements. We are not vertically integrated, which provides us with flexibility and an ability to adapt to changes in the market, product supply and pricing while keeping our fixed costs low. Our relationships with our

5

manufacturers are critical to the success of our business. We have strong relationships with our manufacturers, helping us to meet supply and support requirements stipulated by our customers.

We focus on driving alignment of our solutions and product roadmaps with all our manufacturers and determining what we can do collectively to reduce costs across the supply chain. Our operations team based in the U.S. coordinates with our manufacturers’ engineers and quality control personnel to develop the requisite manufacturing processes, quality checks and testing as well as a general oversight of ongoing manufacturing activities. We believe this model has allowed us to deliver high quality and innovative products in a timely manner while enabling us to minimize costs, manage inventory risk and maintain flexibility.

We and our contract manufacturers are certified to the ISO (International Organization for Standardization) 9001 quality management systems standard.

Research and Development

We compete in markets characterized by industry disruption, rapid technological change, evolving industry standards and new product features. We believe that our future success depends upon our ability to develop innovative new products and solutions as well as enhancements to our existing products and solutions with advanced functionality and ease of use to drive customer demand and to further enhance our global brand and drive recurring revenue. We will continue to focus our research and development resources primarily on developing telematics products, services and software solutions for fleet management, heavy equipment monitoring and optimization, stolen vehicle recovery, consumer aftermarket telematics, trailer and asset tracking, transportation and logistics, and industrial monitoring. We have developed a technology platform that can be leveraged across many of our vertical markets, applications and geographic regions. This includes a cloud-based telematics application enablement platform and end-user software applications, a comprehensive purpose-built telematics edge platform, cellular and satellite communications network-based asset tracking units as well as 4G and 5G LTE broadband router products primarily for mobile applications. In addition, our development resources have been allocated to rationalizing existing product lines, reducing product costs, and improving performance through product redesign efforts. Our research and development efforts have resulted in generating significant intellectual property in the telematics vertical as is evident in our broad patent portfolio. We continue to actively pursue developing innovative solutions that add to our intellectual property portfolio.

Our research and development expenses from continuing operations in fiscal years ended February 28/29, 2022, 2021 and 2020, were $28.4 million, $25.8 million and $27.0 million, respectively. During this three-year period, our research and development expenses have ranged between 8% and 10% of annual consolidated revenues.

Sales and Marketing

We market and sell our solutions and services through our global direct sales organization, channel partner program and Original Equipment Manufacturers (“OEM”) sales organizations while driving awareness through our websites and digital presence. Our global direct sales organization consists of teams of field salespeople, key account managers and business development managers, who work closely with solutions and applications specialists and other internal sales support personnel. We have organized our field sales personnel, together with internal sales and field support personnel, into teams within each business group based on their specialized knowledge and expertise relating to specific solutions and service areas, geographies and customer groups. These sales teams are closely aligned with their respective solutions management, engineering and operations organizations.

We sell our solutions and services to large global enterprises, small- to mid-sized companies, channel accounts and distributors as well as industrial OEM customers. These categories of customers require very different selling approaches and support requirements, and we have organized our sales teams to address these distinct requirements. Additionally, certain customers often have unique technical requirements and manufacturing processes, and may request specific system configurations, feature sets and designs. Sales to large enterprise customers often involve complex program management and long sales cycles, and require close cooperation between sales, operations and engineering personnel. As such, we have developed teams of key account managers and business development managers to serve the unique requirements of these customers.

We also actively sell our products in certain markets through independent sales representatives and distributors. In some cases, we have granted representatives and distributors exclusive authorization to sell certain products in

6

specific geographic areas. These agreements generally have a term of one year, which automatically renews on an annual basis, and are generally terminable by either party following a specified notice period.

We will continue our investment in sales and marketing programs that further build brand awareness, improve revenue generation and foster long-term relationships with our customers. Our marketing programs are focused on supporting multi-channel product launches in new geographic markets.

Additionally, we are focused on maximizing our efficiency and the reach of our marketing spend by investing in product marketing, content development, public relations, social media and digital marketing programs. These programs are developed to educate our potential customers and other industry influencers to drive sales engagement around our products and services. Our activities around product marketing, content development, public relations, thought leadership, social media and digital marketing are aligned with our customary product launches, media campaigns and presence at tradeshows and high exposure venues focused in the transportation and logistics sector such as Technology and Maintenance Council (TMC), Management Conference & Exhibition (MCE) and other high-profile industry events, as such in-person events recommence amid easing of COVID-19 restrictions.

Competition

Our markets are highly competitive. We face competition from small to large public and private competitors some of which have greater financial, distribution, marketing and other resources as well as greater economies of scale than we do. We believe the principal competitive factors impacting the market for our products and services are global scale, innovation, reputation, customer service, product quality, functionality and reliability, time-to-market, responsiveness and price. We believe that we compete favorably in all of these areas. Our continued success in our vertical markets will depend in part upon our ability to continue to innovate, design quality products and deploy solutions at competitive prices and with superior support services to our customers.

The competitive landscape is incredibly fragmented, and most companies offer solutions to solve the needs of specific verticals, sub verticals, or asset classes. For instance, many companies specialize in cab and fleet visibility, such as Geotab and Verizon Connect, while others specialize in trailer visibility, like Phillips Connect, Sky Bitz, and Xirgo. However, we also encounter competitors like Keep Truckin’ and Samsara, who specialize in multiple verticals.

Backlog

Total consolidated backlog, comprised of our remaining performance obligations for software & subscription services and telematics devices backlog aggregated $285 million at February 28, 2022, compared to $211 million at February 28, 2021.

As of February 28, 2022, our remaining contractual performance obligations for software & subscription services were $202 million as compared to $145 million as of February 28, 2021. The majority of our growth in contractual performance obligations was driven by new customer acquisitions within the government and municipalities and connected car markets as well as the conversion of several significant telematics products customers to multi-year subscription contracts in the fleet market. We expect to recognize approximately 47% of our remaining contractual performance obligations in fiscal 2023.

Total backlog for our telematics devices as of February 28, 2022 and February 28, 2021 was $83 million and $66 million, respectively. Substantially all of the backlog at February 28, 2022 is expected to be shipped in fiscal 2023. Our backlog for telematics devices increased year-over-year as we experienced significant supply shortages which were primarily attributable to global supply imbalances caused by the lingering impact of the COVID-19 pandemic. As we drive toward a SaaS business model, we expect that a significant portion of the February 28, 2022 telematics devices backlog will ultimately be bundled and fulfilled in connection with multi-year subscription contracts.

Intellectual Property

Intellectual property is an important aspect of our business, and we seek protection for our intellectual property as appropriate. We rely upon a combination of patent, trade secret, and trademark laws and contractual restrictions,

7

such as confidentiality agreements and licenses, to establish and protect our proprietary rights. In addition, we often rely on inbound licenses of intellectual property for use in our business.

We own and utilize the tradename “CalAmp” as well as the related logos and trademarks on many of our products and solutions. We believe that having distinctive marks that are registered and readily identifiable is an important factor in identifying our brand. We own over 200 active trademark applications and registrations throughout the world, with approximately 30 pending and registered trademarks in the U.S.

In addition to the foregoing protections, we generally control access to and the use of our proprietary and other confidential information through the use of internal and external controls, including contractual protections with employees, manufacturers, and others. We will continue to file and prosecute patent applications when appropriate to protect our rights in our proprietary technologies.

As of February 28, 2022, we had nearly 300 patents worldwide. In addition to our awarded patents, we have approximately 70 patent applications in process. Although a number of these trademarks, and patents relate to software and products that are significant to our business and operations, we do not believe we are dependent on a single trademark, copyright or patent.

Governmental Regulation

We are subject to a variety of U.S. and foreign laws and regulations in connection with our operations, including those governing discharges of pollutants into the air and water, the management and disposal of hazardous substances and the clean-up of contaminated sites, and close oversight of our products’ material compliance including adherence to relevant EPA regulations under the Toxic Substances Control Act. While we believe that we are currently in material compliance with these regulatory requirements, the requirements may change or new requirements may be imposed that could require significant unanticipated expenditures by us.

We have established environmental management systems and continually update our environmental policies and standard operating procedures for our operations worldwide. We believe that our operations are in material compliance with applicable environmental laws, regulations and permits. We budget for operating and capital costs on an ongoing basis to comply with environmental laws.

Corporate Responsibility and Sustainability

We believe responsible and sustainable business practices support our long-term success. As a company, we are deeply committed to protecting and supporting our people, our environment, and our communities. That commitment is reflected through various corporate initiatives as well as day-to-day activities, including our adoption of sustainability-focused policies and procedures, our publicly recognized focus on fostering an inclusive workplace, our constant drive toward more efficient use of materials and energy, our careful and active management of our supply chain, our services and products which help reduce carbon footprints and enhance road safety, and our impactful, globally integrated ethics and compliance program.

|

|

• |

We seek to protect the human rights and civil liberties of our employees and the employees of our contract manufacturers through policies, procedures, and programs aimed at avoiding risks of compulsory and child labor, both within our company and throughout our supply chain. |

|

|

• |

We foster a workplace of dignity, respect, diversity, and inclusion through our recruiting and advancement practices, internal communications, and employee resource groups. |

|

|

• |

We educate our employees annually on relevant ethics and compliance topics, publish accessible guidance on ethical issues and related company resources in our global Code of Business Conduct and Ethics, and encourage reporting of ethical concerns through any one of several global and local reporting channels. |

|

|

• |

We innovate to reduce the energy used by our products, the energy used to manufacture them, and the amount of new materials required to manufacture them. |

8

Human Capital

People are our greatest asset and we are committed to being an employer of choice in our industry. We proudly offer the security of a large publicly traded tech company without the rigidity and red tape.

CalAmp offers an engaging and diverse work environment where people take pride in their contributions and share in the company’s success. We empower our employees to showcase their talent, sharpen their skills, develop new professional and leadership capabilities while being part of a global team that develops revolutionary technologies.

CalAmp continually strives to be a deeply inclusive employer with diversity reflected in our teams. We encourage employees to be truly themselves and thrive in an environment where their voices matter, differences are understood and valued, and where they are supported to express their unique ideas openly. We aim to foster a highly engaged and energized workplace, where everyone is treated with dignity and respect and is excited to achieve more.

Our employees engage in meaningful work with access to cutting-edge tools and technologies to develop solutions that disrupt entire industries.

CalAmp’s strategic leadership comes from a solid base of worldwide experience in technology, from connected vehicles to networking to public safety to energy and beyond. The executive team has years of expertise in both start-up and enterprise environments designing software and hardware for a wide variety of applications.

Our company culture is driven by four core values:

|

|

• |

Customer Success – we seek to achieve total customer satisfaction by understanding what the customer wants and delivering it flawlessly. We communicate and collaborate effectively with others for the benefit of the customer. Satisfied customers are essential to our success. |

|

|

• |

Innovation – we do not accept the status quo. We are committed to transforming ideas into new and improved solutions and processes. We respond resourcefully to demands and challenges in order to advance, compete and differentiate ourselves successfully in the marketplace and bring value to our customers. |

|

|

• |

Execution – we make and meet our commitments. We deliver results in tight timeframes. Our can-do attitude supports us in overcoming obstacles with solutions, and we are accountable when errors are made. We learn from mistakes and move forward. |

|

|

• |

Inclusion – we believe in the integrity, honesty and trust of our employees, and we value their diversity of thought and opinion. We embrace collaboration by listening to the opinions of others, valuing their differences and speaking in a positive, respectful manner. We take personal responsibility for our actions and are committed to building diverse teams with fairness and respect for all. |

As of February 28, 2022, we had 887 employees. From time to time we also hire contracted workers that are generally engaged through independent temporary labor agencies. None of our employees or contract workers are represented by a labor union.

Recent Developments

COVID-19 and Global Supply Imbalances

In March 2020, the World Health Organization declared COVID-19 (“COVID-19” or the “pandemic”) to be a public health pandemic of international concern, which has resulted in travel restrictions and in some cases, prohibitions of non-essential activities, disruption and shutdown of businesses and greater uncertainty in global financial markets. The pandemic continues to have widespread and unpredictable impact on global economies, financial markets, and business practices, and continues to impact our business operations, including our employees, customers and suppliers. During fiscal 2021, our revenues were negatively impacted by COVID-19 as various small-to-medium sized customers postponed expenditures due to the pandemic and related macro-economic uncertainties. During fiscal 2022, we experienced supply shortages as a result of global supply imbalances initially driven by the global pandemic. These global supply imbalances have negatively impacted all parts of our business and operations during fiscal 2022, both in the form of reduced availability of devices as well as increased costs to procure available devices. It is difficult to predict the extent to which the pandemic will continue to impact our future business or

9

operating results, which are highly dependent on uncertain future developments, including actions taken or to be taken by governments and private businesses in relation to its containment and the resolution of supply chain issues and supply shortages. Because our business is dependent on telematics product fulfillment, device installations and related subscription-based services, the ultimate effect of COVID-19 and the current supply shortages may not be fully reflected in our operating results until future periods.

AVAILABLE INFORMATION

Our primary Internet address is www.calamp.com. We make our U.S. Securities and Exchange Commission (“SEC”) periodic reports (Forms 10-Q and Forms 10-K) and current reports (Forms 8-K) available free of charge through our website as soon as reasonably practicable after they are filed electronically with the SEC. Within the Investor Relations section of our website, we provide information concerning corporate governance, including our Corporate Governance Guidelines, Board committee charters and composition, Code of Business Conduct and Ethics, and other information. The content of our website is not incorporated by reference into this Annual Report on Form 10-K or into any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

Materials that we file with the SEC may be read and copied at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet website at http://www.sec.gov that contains reports, proxy and information statements, and other information that we file electronically with the SEC.

|

ITEM 1A. |

RISK FACTORS |

We operate in a rapidly changing environment that involves a number of risks and uncertainties, some of which are beyond our control. The following list describes several risk factors that are applicable to our business and speaks as of the date of this document. These and other risks could have a material adverse effect on our business, results of operations, financial condition, and cash flows and the trading price of our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us.

Summary of Risk Factors

Our business is subject to a number of risks of which you should be aware before making a decision to invest in our common stock. Among others, and including those described in this section “Item 1A. Risk Factors”, these risks include:

|

|

• |

Our contract manufacturers and diversified supply chain, component shortages and uncertainty in international trade relations with China may adversely impact us and have a material adverse effect on our business, results of operations and financial condition. |

|

|

• |

The COVID-19 pandemic could have a material adverse impact on our business, results of operations and financial condition. |

|

|

• |

Because some of our components, assemblies and electronics manufacturing services are purchased from sole source suppliers or require long lead times, our business is subject to unexpected interruptions, which may adversely affect our ability to bring products to market, damage our reputation and adversely affect our results of operations. |

|

|

• |

Because we depend on a few significant customers for a substantial portion of our revenues and we generally do not have long-term contracts with customers, the loss or significant decline or slowdown of sales to these customers could have an adverse effect on our business, financial condition or results of operations. |

|

|

• |

Our operations are subject to the effects of a rising rate of inflation. |

|

|

• |

Because the markets in which we compete are highly competitive and some of our competitors have greater resources than us, we cannot be certain that our products and services will continue to be accepted in the marketplace or will maintain or capture increased market share. |

10

|

|

• |

We have been subject to breaches of our information technology systems, and are at risk of future attacks, which could damage our reputation, vendor and customer relationships, and our customers’ access to our services. |

|

|

• |

The ongoing military action between Russia and Ukraine could adversely affect our business, financial condition and results of operations. |

|

|

• |

If demand for our products and services fluctuates rapidly and unpredictably, it may be difficult to manage our business efficiently, which may result in reduced gross margins and profitability. |

|

|

• |

If we do not meet product and services introduction deadlines or if we fail to predict carrier and end user customer preferences among the many evolving wireless industry standards, our business could be adversely affected. |

|

|

• |

Any acquisitions we pursue could disrupt our business and harm our financial condition and results of operations. |

|

|

• |

Our global operations and continued international expansion expose us to risks and challenges associated with conducting business internationally. |

|

|

• |

Some of our products are subject to mandatory regulatory approvals in the U.S. and other countries that are subject to change, which could make compliance costly and unpredictable. |

|

|

• |

Ongoing changes to U.S. tax, tariff and import/export regulations may have a negative effect on global economic conditions, financial markets and our business. |

|

|

• |

We may not be able to adequately protect our intellectual property, and our competitors may be able to offer similar products and services that would harm our competitive position. |

|

|

• |

We rely on access to third-party patents and intellectual property, and our future results could be materially and adversely affected if we are unable to secure such access in the future. |

|

|

• |

We depend to some extent upon wireless networks owned and controlled by others, unproven business models, and emerging wireless carrier models to deliver existing services and to grow. |

|

|

• |

We may not have the ability to raise the funds necessary to settle conversions of the convertible notes in cash, repay the convertible notes at maturity or repurchase the convertible notes upon a fundamental change, and our future debt may contain limitations on our ability to pay cash upon conversion or repurchase of the convertible notes. |

|

|

• |

The trading price of shares of our common stock may be affected by many factors and the price of shares of our common stock could decline. |

Risks Related to Our Business Operations and Financial Condition

Our contract manufacturers and diversified supply chain, component shortages and uncertainty in international trade relations with China may adversely impact us and have a material adverse effect on our business, results of operations and financial condition.

We accelerated our supply chain diversification program to transition our manufacturing to tier one global contract manufacturers with facilities outside of China. This program was initiated against the backdrop of the escalation of trade tensions between the U.S. and China. This transition contributed to various supply disruptions, including component shortages, beginning in the third and fourth quarter of fiscal 2020. Additionally, during fiscal 2022, we experienced supply shortages as a result of global supply imbalances initially driven by the global pandemic, which have negatively impacted all parts of our business. Although we are taking steps to address these matters, the related operational challenges and supply chain disruptions may persist for some time.

The COVID-19 pandemic could have a material adverse impact on our business, results of operations and financial condition.

In March 2020, the World Health Organization declared COVID-19 a pandemic. The outbreak has spread globally, resulting in the implementation of significant governmental measures, including lockdowns, closures,

11

quarantines and travel bans, each intended to control the spread of the virus. The COVID-19 pandemic has caused severe global disruptions which have created significant volatility, uncertainty and economic disruption.

Uncertainties regarding the economic impact of COVID-19 are likely to result in sustained market turmoil, which could also negatively impact our business, financial condition and cash flows. This pandemic could negatively affect our ability to sell-through our backlog. Our ability to manage normal commercial relationships with our suppliers, contract manufacturers, and customers may suffer. Our customers could shift purchases to lower-priced or other perceived value offerings during the pandemic-caused economic downturn as a result of various factors, including workforce reductions, reduced access to credit, and changes in federal economic policy. In particular, customers may become more conservative in response to these conditions and seek to reduce their purchases and inventories. Our results of operations depend upon, among other things, our ability to maintain and increase sales volume with our existing customers, our ability to attract new customers, and the financial condition of our customers. Decreases in demand for our products and solutions without a corresponding decrease in costs would put downward pressure on our margins and would negatively impact our financial results.

Governmental organizations, such as the U.S. Centers for Disease Control and Prevention and state and local governments, have recommended and/or imposed increased community-based interventions, including event cancellations, social distancing measures, and restrictions on gatherings.

Through fiscal 2021, our revenues were negatively impacted by COVID-19 as various small-to-medium customers postponed their capital expenditure due to the pandemic and related macro-economic uncertainties. Although our business was initially negatively impacted by the COVID-19 pandemic in the first half of fiscal 2021, we resumed device installation and activation services soon thereafter. We have experienced supply shortages as a result of global supply imbalances driven by the global pandemic. These global supply imbalances have negatively impacted all parts of our business during fiscal 2022. It is difficult to predict the extent to which the pandemic will continue to impact our future business or operating results, which are highly dependent on uncertain future developments, including the severity of the continuing pandemic, the actions taken or to be taken by governments and private businesses in relation to its containment and the resolution of supply chain issues and supply shortages. Because our business is dependent on telematics product sales, device installations and related subscription-based services, the ultimate effect of COVID-19 and the current supply shortages may not be fully reflected in our operating results until future periods.

To the extent that COVID-19 adversely affects our business, results of operations, financial condition and cash flows, it may also heighten many of the risk factors described in this “Risk Factors” section.

Because some of our components, assemblies and electronics manufacturing services are purchased from sole source suppliers or require long lead times, our business is subject to unexpected interruptions, which may adversely affect our ability to bring products to market, damage our reputation and adversely affect our results of operations.

We operate an outsourced manufacturing business model that utilizes contract manufacturers. We depend on a limited number of contract manufacturers to allocate sufficient manufacturing capacity to meet our needs, to produce products of acceptable quality at acceptable yields, and to deliver those products to us on a timely basis. Some of our key components are complex to manufacture and have long lead times. In the event of a reduction or interruption of supply, or degradation in quality, it could take up to six months to begin receiving adequate supplies from alternative suppliers, if any. As a result, product shipments could be delayed and revenues and profitability could suffer. Instances of continued supply chain disruptions and delays, as well as continued heightened inflation, could lead to inefficiencies and increased costs that could negatively impact our performance and our results of operations. In such circumstances, we may be unable to meet our customer demand and may fail to meet our contractual obligations. This could result in the payment of significant damages by us to our customers, a decline in net revenue and a loss of market share as our customers could choose to purchase competing products and services, all of which could adversely affect our business, financial condition and results of operations. Any substantial disruption in our contract manufacturers’ supply as a result of a pandemic, natural disaster, trade wars, political unrest, economic instability, equipment failure, component shortage or other cause, could materially harm our business, customer relationships and results of operations.

12

Because we depend on a few significant customers for a substantial portion of our revenues and we generally do not have long-term contracts with customers, the loss of or significant decline or slowdown of sales to these customers could have an adverse effect on our business, financial condition or results of operations.

Our revenues depend on a small number of significant customers and some of them represented more than 10% of our total revenues in fiscal year 2022, 2021 and 2020 (see Note 4 to our consolidated financial statements). They are also expected to represent a substantial portion of our revenues in the near future. As a result, the loss of any one of these customers, or a decline or slowdown in purchases from any of these customers, could have a material adverse effect on our business, financial condition and results of operations. In addition, because service revenue depends either partially or entirely on the usage levels of data transmission by our customers and end users, the decline or slowdown in the growth of usage patterns of these customers, which has and could continue to occur at any time and with or without a reduction in the number of our subscriber base could have a material adverse effect on our business, financial condition and results of operations. We generally do not have long-term contracts with our customers. As a result, our agreements with our customers generally do not provide us with any assurance of future sales. These customers can cease purchasing products and services from us at any time without penalty, are free to purchase products and services from our competitors, may expose us to competitive price pressure on each order and are not required to make minimum purchases. Any of these actions taken by our customers could have a material adverse effect on our business, financial condition or results of operations.

Our operations are subject to the effects of a rising rate of inflation.

The United States has recently experienced historically high levels of inflation. According to the U.S. Department of Labor, the annual inflation rate for the United States was approximately 7.0% for the 12 months ended December 31, 2021. If the inflation rate continues to increase, such as increases in the costs of labor and supplies, it will affect our expenses. Additionally, the United States is experiencing an acute workforce shortage, which in turn, has created a hyper-competitive wage environment that may increase our operating costs. To the extent inflation results in rising interest rates and has other adverse effects on the market, it may adversely affect our consolidated financial condition and results of operations.

Because the markets in which we compete are highly competitive and some of our competitors have greater resources than us, we cannot be certain that our products and services will continue to be accepted in the marketplace or will maintain or capture increased market share.

The markets for our products and services are intensely competitive and characterized by rapid technological change, evolving standards, short product life cycles, and price erosion. Given the highly competitive environment in which we operate, we cannot be sure that any competitive advantages currently enjoyed by our products and services will be sufficient to establish and sustain our products and services in the markets we serve. Any increase in price or other competition could result in erosion of our market share, to the extent we have obtained market share, and could have a negative impact on our financial condition and results of operations. We cannot provide assurance that we will have the financial resources, technical expertise or marketing and support capabilities to compete successfully. We expect competition to intensify in the future with the introduction of new technologies and market entrants and with the possible consolidation of competitors.

Information about our competitors is included in Part I, Item 1 of this Annual Report on Form 10-K under the heading “COMPETITION”.

13

If demand for our products and services fluctuates rapidly and unpredictably, it may be difficult to manage our business efficiently, which may result in reduced gross margins and profitability.

Our cost structure is based in part on our expectations for future demand. Many costs, particularly those relating to capital equipment and manufacturing overhead, are largely fixed. Rapid and unpredictable shifts in demand for our products and services may make it difficult to plan production capacity and business operations efficiently. If demand is significantly below expectations, we may be unable to rapidly reduce these fixed costs, which can diminish gross margins and cause losses. A sudden downturn may also leave us with excess inventory, which may be rendered obsolete if products and services evolve during the downturn and demand shifts to newer products and services. Our ability to reduce costs and expenses may be further constrained because we must continue to invest in research and development to maintain our competitive position and to maintain service and support for our existing customer base. Conversely, in the event of a sudden upturn, we may incur significant costs to rapidly expedite delivery of components, procure scarce components and outsource additional manufacturing processes. These costs could reduce our gross margins and overall profitability. Any of these results could adversely affect our business, financial condition or results of operations.

We may be unable to successfully implement a disposition or wind-down of certain business activities that no longer fit our strategic plan.

Effective March 15, 2021, we sold certain assets and transferred certain liabilities related to our LoJack North America business. We may engage in future dispositions or wind-downs of certain businesses. Key risks associated with exiting a business include:

|

|

• |

our ability to price a sale transaction appropriately and otherwise negotiate acceptable terms; |

|

|

• |

our ability to identify and implement key customer, technology systems, and other transition actions to avoid or minimize negative effects on retained business activities; |

|

|

• |

our ability to assess and manage any loss of synergies that the exited business activity had with our retained business activities; |

|

|

• |

our ability to replace legacy earnings from the exited business or activity with new revenues; and |

|

|

• |

our ability to manage capital, liquidity, and other challenges that may arise if an exit results in significant legacy cash expenditures or financial loss. |

Any acquisitions we pursue could disrupt our business and harm our financial condition and results of operations.

As part of our business strategy, we continually review acquisition opportunities that we believe would be advantageous or complementary to the development of our business. In the first quarter of fiscal year 2020, we acquired LoJack Mexico and Synovia, and we may acquire additional businesses, assets, or technologies in the future. If we make any acquisitions, we could take any or all of the following actions, any one of which could adversely affect our business, financial condition, results of operations or share price:

|

|

• |

use a substantial portion of our available cash; |

|

|

• |

require a significant devotion of management’s time and resources in the pursuit or consummation of any acquisition; |

|

|

• |

incur substantial debt, which may not be available to us on favorable terms and may adversely affect our liquidity; |

|

|

• |

issue equity or equity-based securities that would dilute existing stockholders’ ownership percentage; |

|

|

• |

assume contingent liabilities; and |

|

|

• |

take substantial charges in connection with acquired assets. |

14

Acquisitions also entail numerous other risks, including, without limitation: difficulties in assimilating acquired operations, products, technologies and personnel; unanticipated costs; diversion of management’s attention from existing operations; risks of entering markets in which we have limited or no prior experience; potential loss of key employees from either our existing business or the acquired organization; and a negative effect on our existing relationships with suppliers and customers. Acquisitions may result in substantial accounting charges for restructuring and other expenses, amortization of purchased technology and intangible assets and stock-based compensation expense, any of which could materially and adversely affect our operating results. We may not be able to realize the anticipated benefits of or successfully integrate with our existing business the businesses, products, technologies or personnel that we acquire, and our failure to do so could harm our business and operating results. Our industry is being affected by the trend toward consolidation and the creation of strategic relationships. If we are unable to successfully adapt to this rapidly changing environment, we could suffer a reduction in the volume of business with our customers and suppliers, or we could lose customers or suppliers entirely, which could materially and adversely affect our financial condition and operating results.

We have been subject to breaches of our information technology systems, which could damage our reputation, vendor, and customer relationships, and our customers’ access to our services.

Our presence in the Internet of Things (“IoT”) industry with offerings of telematics products and services, including vehicle telematics, could also increase our exposure to potential costs and expenses and reputational harm in the event of cyber-attacks impacting these products or services. Our business operations require that we use and store sensitive data, including intellectual property, proprietary business information and personally identifiable information, in our secure data centers and on our networks. We face a number of threats to our data centers and networks in the form of unauthorized access, security breaches and other system disruptions. It is critical to our business strategy that our infrastructure remains secure and is perceived by customers and partners to be secure. Despite our security measures, our information technology systems have been and will continue to be vulnerable to attacks by hackers or other disruptive problems.

We experience cyber-attacks and other security incidents of varying degrees from time to time, and we incur significant costs in protecting against or remediating such incidents. For example, we detected and interrupted a ransomware attack on a portion of our network in February 2021, which led to the theft of company data and notifications to affected third parties, and we experienced a second attempt to hack our network in March 2021. In response, we retained outside experts to advise on the incidents and to make recommendations for security improvements. While we have not experienced any material loss or expense relating to these cyber-attacks or other information security breaches, there can be no assurance that we will not suffer additional attacks or incur more serious financial consequences or expense in the future.

In addition, we are subject to a variety of laws and regulations in the United States and abroad relating to cybersecurity and data protection. As a result, affected users or government authorities could initiate legal or regulatory actions against us in connection with any actual or perceived security breaches or improper access to or disclosure of data, which has occurred in the past and which could cause us to incur significant expense and liability or result in orders or consent decrees forcing us to modify our business practices.

Any security breach may compromise information used or stored on our networks and may result in significant data losses or theft of our customers’ or our business partners’ intellectual property, proprietary business information or personally identifiable information. A cybersecurity breach could negatively affect our reputation by adversely affecting the market’s perception of the security or reliability of our products or services. In addition, a cyber-attack could result in other negative consequences, including remediation costs, disruption of internal operations, increased cybersecurity protection costs, lost revenues or litigation, which could have a material adverse effect on our business, results of operations and financial condition.

Repurposing of satellite spectrum by adjacent operators of L-band spectrum for terrestrial services could interfere with our GPS IoT products and services.

In 2011, the U.S. Federal Communications Commission (“FCC”) granted Ligado Networks (then known as Lightsquared) (“Ligado”) a waiver to convert its L-band satellite spectrum to terrestrial use, including a 10 MHz band close to the spectrum that we use for all of our Global Positioning System (“GPS”) products and services. That waiver was subsequently suspended in 2012 due to concerns about potential interference to GPS operations. Ligado sought another waiver in 2015, that it then amended in 2018, to modify its L-band mobile satellite service network with a

15

terrestrial-only proposal designed to address GPS industry-wide concerns. In April 2020, the FCC granted Ligado’s waiver request. We oppose this waiver grant out of concern for the interference that we believe Ligado’s proposed operations would cause to our IoT GPS devices. Ligado’s operations pursuant to the waiver would result in terrestrial use of L-band spectrum, and such operations may interfere with, and harmfully affect, the performance of the Global Navigation Satellite System (“GNSS”) receivers in our IoT GPS devices that operate in the 1559-1610MHz band, which is adjacent to, and within range of, the L-band downlink allocation for GPS operations. Ligado’s L-band terrestrial operations could impact our operations and impose costs on us to retrofit or replace affected GNSS receivers, which could have a material adverse effect on our business, results of operations, and financial condition.

Our business is subject to many factors that could cause our quarterly or annual operating results to fluctuate and our stock price to be volatile.

Our quarterly and annual operating results have fluctuated in the past and may fluctuate significantly in the future due to a variety of factors, many of which are outside of our control. A majority of our product orders are shipped in the final month of the quarter and a significant amount in the last two weeks of the quarter. Some of the other factors that could affect our quarterly or annual operating results include:

|

|

• |

the timing and amount, or cancellation or rescheduling, of orders for our products or services; |

|

|

• |

our ability to develop, introduce, ship and support new products, services and enhancements, and manage product and services transitions; |

|

|

• |

announcements of new product and service introductions and reductions in the price of products and services offered by our competitors; |

|

|

• |

fluctuations in the cost of telematics devices due to supply shortages or other market factors; |

|

|

• |

our ability to achieve cost reductions; |

|

|

• |

our ability to obtain sufficient supplies of sole or limited source components for our products; |

|

|

• |

our ability to achieve and maintain production volumes and quality levels for our products; |

|

|

• |

our ability to maintain the volume of products and services sold and the mix of distribution channels through which they are sold; |

|

|

• |

the loss of any one of our major customers or a significant reduction in orders from those customers; |

|

|

• |

increased competition, particularly from larger, better capitalized competitors; |

|

|

• |

fluctuations in demand for our products and services; and |

|

|

• |

changes in telecommunications and wireless market conditions specifically and economic conditions generally, including as a result of a pandemic or other catastrophic event. |

Due in part to factors such as the timing of product release dates, purchase orders and product availability, significant volume shipments of products could occur close to the end of a fiscal quarter. Failure to ship products by the end of a quarter may adversely affect operating results in such quarter. In the future, our customers may delay delivery schedules or cancel their orders without notice. Due to these and other factors, our quarterly revenue, expenses and results of operations could vary significantly in the future, and period-to-period comparisons should not be relied upon as indications of future performance.

If we do not meet product and services introduction deadlines or if we fail to predict carrier and end user customer preferences among the many evolving wireless industry standards, our business could be adversely affected.

In the past, we have experienced design and manufacturing difficulties that have delayed the development, introduction or marketing of new products, services and enhancements and which caused us to incur unexpected expenses and lost revenue. In addition, some of our existing customers have conditioned their future purchases of our products and services on the addition of new features. In the past, we have experienced delays in introducing some new product features. Furthermore, in order to compete in some markets, we will have to develop different versions of existing products and services that comply with diverse, new or varying governmental regulations and evolving wireless industry standards in each market. In our industry, it is critical to our success that we accurately anticipate evolving wireless technology standards and that our products and services comply with these standards in relevant respects. We are currently focused on engineering and manufacturing products and services that comply with several different wireless standards. Any failure of our products and services to comply with any one of these or future

16

applicable standards could prevent or delay their introduction and require costly and time-consuming engineering changes. Additionally, if an insufficient number of wireless operators or subscribers adopt the standards to which we engineer our products and services, then sales of our new products and services designed to those standards could be materially harmed. Our inability to develop new products, services, product features on a timely basis, or the failure of new products, services or features to align with evolving wireless standards and achieve market acceptance, could adversely affect our business.

Disruptions in global credit and financial markets could materially and adversely affect our business and results of operations.

There is significant uncertainty about the stability of global credit and financial markets. Credit market dislocations could cause interest rates and the cost of borrowing to rise or reduce the availability of credit, which could negatively affect customer demand for our products and services if they responded to such credit market dislocations by suspending, delaying or reducing their capital expenditures. Moreover, since we currently generate more than 25% of our revenues outside the U.S., fluctuations in foreign currency exchange rates can have an impact on demand for our products and services for which the sales are generally denominated in U.S. dollars.

We may be subject to product liability, warranty and recall claims that may increase the costs of doing business and adversely affect our business, financial condition and results of operations.

We are subject to a risk of product liability or warranty claims if our products or services actually or allegedly fail to perform as expected or the use of our products or services results, or is alleged to result, in bodily injury and/or property damage. While we maintain what we believe to be reasonable limits of insurance coverage to appropriately respond to such liability exposures, large product liability claims, if made, could exceed our insurance coverage limits and insurance may not continue to be available on commercially acceptable terms, if at all. There can be no assurance that we will not incur significant costs to defend these claims or that we will not experience any product liability losses in the future. In addition, if any of our designed products are, or are alleged to be, defective, we may be required to participate in recalls and exchanges of such products. The future cost associated with providing product and service warranties and/or bearing the cost of repair or replacement of our products, including those that enable our service offerings, could exceed our historical experience and have a material adverse effect on our business, financial condition and results of operations.

Our inability to identify the origin of conflict minerals in our products could have a material adverse effect on our business.

Many of our product lines include tantalum, tungsten, tin, gold and other materials that are considered to be “conflict minerals” under the SEC’s rules. Those rules require public reporting companies to provide disclosure regarding the use of conflict minerals sourced from the Democratic Republic of the Congo and adjoining countries in the manufacture of products. Those rules, or similar rules that may be adopted in other jurisdictions, could adversely affect our costs, the availability of minerals used in our products and our relationships with customers and suppliers.

We may experience significant disruptions in our operations resulting from our enterprise resource planning system initiatives.

We depend on our information technology systems for the efficient functioning of our global business, including accounting, billing, data storage, purchasing and inventory management. In order to integrate and enhance our global operations, we initiated the phased implementation of an enterprise resource planning (“ERP”) system across our global operating locations to support our operations. The implementation of this ERP system required, and will continue to require, the investment of human and financial resources. We have incurred, and expect to incur, additional expenses as we continue to implement, enhance and develop our ERP system. As a result of our ERP initiatives, we may encounter difficulties in operating our business, which could disrupt our operations, including our ability to timely ship and track customer orders, determine inventory requirements, manage our supply chain, manage customer billing and adequately service our customers. If we experience significant disruptions resulting from our ERP initiatives, our business and operations could be disrupted, including our ability to report accurate and timely financial results. Accordingly, such events may disrupt or reduce the efficiency of our global operations and have a material adverse effect on our operating results and cash flows.

17

Because we currently sell, and we intend to grow the sales of, certain of our products and services in countries other than the U.S., we are subject to different regulatory regimes. We may not be able to develop products and services that comply with the standards of different countries, which could result in our inability to sell our products and services and further, we may be subject to political, economic, and other conditions affecting such countries, which could result in reduced sales of our products and services and which could adversely affect our business.