(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

500 Virginia Street , East |

||

(Address of principal executive offices) |

(Zip Code) | |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

Accelerated filer ☐ | ||

Non-accelerated filer ☐ |

Smaller reporting company | |

Emerging growth company |

Page |

||||||

Part I |

||||||

Item 1. |

4 |

|||||

Item 1A. |

18 |

|||||

Item 1B. |

30 |

|||||

Item 2. |

30 |

|||||

Item 3. |

31 |

|||||

Item 4. |

31 |

|||||

Part II |

||||||

Item 5. |

32 |

|||||

Item 6. |

35 |

|||||

Item 7. |

36 |

|||||

Item 7A. |

64 |

|||||

Item 8. |

70 |

|||||

Item 9. |

145 |

|||||

Item 9A. |

145 |

|||||

Item 9B. |

145 |

|||||

Part III |

||||||

Item 10. |

146 |

|||||

Item 11. |

146 |

|||||

Item 12. |

146 |

|||||

Item 13. |

146 |

|||||

Item 14. |

147 |

|||||

Part VI |

||||||

Item 15. |

148 |

|||||

Item 1. |

BUSINESS |

• |

A minimum ratio of Common Equity Tier 1 (“CET1”) to risk-weighted assets of at least 4.5%, plus a 2.5% “capital conservation buffer” (resulting in a minimum ratio of CET1 to risk-weighted assets of 7.0%); |

• |

A minimum ratio of Tier 1 capital to risk-weighted assets of at least 6.0%, plus the capital conservation buffer (resulting in a minimum Tier 1 capital ratio of 8.5%); |

• |

A minimum ratio of total capital (Tier 1 capital plus Tier 2 capital) to risk-weighted assets of at least 8.0%, plus the capital conservation buffer (resulting in a minimum total capital ratio of 10.5%); and |

• |

A minimum leverage ratio of 4.0%, calculated as the ratio of Tier 1 capital to average consolidated assets as reported on consolidated financial statements (known as the “leverage ratio”). |

Item 1A. |

RISK FACTORS |

• |

Increased unemployment and decreased consumer confidence and business generally, leading to an increased risk of delinquencies, defaults and foreclosures. |

• |

Ratings downgrades, credit deterioration and defaults in many industries, including natural resources, hospitality, transportation and commercial real estate. |

• |

A sudden and significant reduction in the valuation of the equity, fixed-income and commodity markets and the significant increase in the volatility of those markets. |

• |

A decrease in the rates and yields on U.S. Treasury securities, which may lead to decreased net interest income. |

• |

Increased demands on capital and liquidity. |

• |

A reduction in the value of the assets that the Company manages or otherwise administers or services for others, affecting related fee income and demand for the Company’s services. |

• |

Heightened cybersecurity, information security and operational risks as a result of work-from-home arrangements. |

• |

If an existing agreement expires or a certain service is discontinued by a vendor, then United may not be able to continue to offer its customers the same breadth of products and its operating results would likely suffer unless it is able to find an alternate supply of a similar service. |

• |

Agreements United may negotiate in the future may commit it to certain minimum spending obligations. It is possible United will not be able to create the market demand to meet such obligations. |

• |

If market demand for United’s products increases suddenly, its current vendors might not be able to fulfill United’s commercial needs, which would require it to seek new arrangements or new sources of supply, and may result in substantial delays in meeting market demand. |

• |

United may not be able to control or adequately monitor the quality of services it receives from its vendors. Poor quality services could damage United’s reputation with its customers. |

• |

Actual or anticipated negative variations in quarterly results of operations; |

• |

Negative recommendations by securities analysts; |

• |

Poor operating and stock price performance of other companies that investors deem comparable to United; |

• |

News reports relating to negative trends, concerns and other issues in the financial services industry or the economy in general; |

• |

Negative perceptions in the marketplace regarding United and/or its competitors; |

• |

New technology used, or services offered, by competitors; |

• |

Adverse changes in interest rates or a lending environment with prolonged low interest rates; |

• |

Adverse changes in the real estate market; |

• |

Negative economic news; |

• |

Failure to integrate acquisitions or realize anticipated benefits from acquisitions; |

• |

Adverse changes in government regulations; and |

• |

Geopolitical conditions such as acts or threats of terrorism or military conflicts. |

Item 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

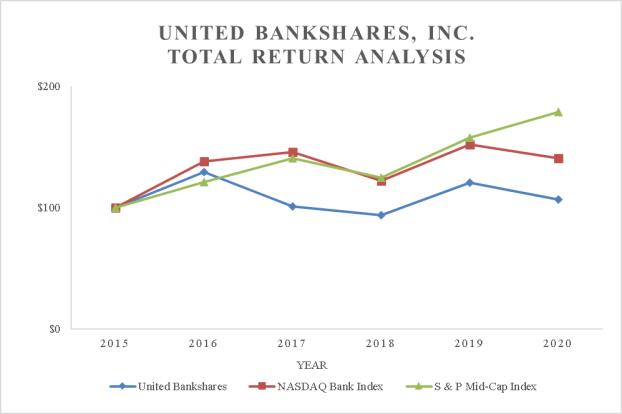

Period Ending |

||||||||||||||||||||||||

12/31/15 |

12/31/16 |

12/31/17 |

12/31/18 |

12/31/19 |

12/31/20 |

|||||||||||||||||||

| United Bankshares, Inc. |

100.00 |

129.21 |

100.62 |

93.53 |

120.49 |

106.68 |

||||||||||||||||||

| NASDAQ Bank Index |

100.00 |

137.97 |

145.50 |

121.96 |

151.69 |

140.31 |

||||||||||||||||||

| S&P Mid-Cap Index |

100.00 |

120.73 |

140.32 |

124.75 |

157.40 |

178.88 |

||||||||||||||||||

Period |

Total Number of Shares Purchased (1) (2) |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans (3) |

Maximum Number of Shares that May Yet be Purchased Under the Plans (3) |

||||||||||||

| 10/01 – 10/31/2020 |

0 |

$ |

00.00 |

0 |

4,000,000 |

|||||||||||

| 11/01 – 11/30/2020 |

5 |

$ |

24.85 |

0 |

4,000,000 |

|||||||||||

| 12/01 – 12/31/2020 |

660,000 |

$ |

31.38 |

0 |

3,340,000 |

|||||||||||

| |

|

|||||||||||||||

| Total |

660,005 |

$ |

31.38 |

|||||||||||||

| |

|

|||||||||||||||

(1) |

Includes shares exchanged in connection with the exercise of stock options under United’s stock option plans. Shares are purchased pursuant to the terms of the applicable stock option plan and not pursuant to a publicly announced stock repurchase plan. For the quarter ended December 31, 2020, no shares were exchanged by participants in United’s stock option plans. |

(2) |

Includes shares purchased in open market transactions by United for a rabbi trust to provide payment of benefits under a deferred compensation plan for certain key officers of United and its subsidiaries. For the quarter ended December 31, 2020, the following shares were purchased for the deferred compensation plan: November 2020 –5 shares at an average price of $24.85. |

(3) |

In October of 2019, United’s Board of Directors approved a repurchase plan to repurchase up to 4,000,000 shares of United’s common stock on the open market (the 2019 Plan). The timing, price and quantity of purchases under the plans are at the discretion of management and the plan may be discontinued, suspended or restarted at any time depending on the facts and circumstances. |

Item 6. |

SELECTED FINANCIAL DATA |

Five Year Summary |

||||||||||||||||||||

(Dollars in thousands, except per share data) |

2020 |

2019 |

2018 |

2017 |

2016 |

|||||||||||||||

| Summary of Operations: |

||||||||||||||||||||

| Total interest income |

$ |

798,382 |

$ |

762,562 |

$ |

717,715 |

$ |

623,806 |

$ |

470,341 |

||||||||||

| Total interest expense |

108,609 |

184,640 |

129,070 |

74,809 |

45,010 |

|||||||||||||||

| Net interest income |

689,773 |

577,922 |

588,645 |

548,997 |

425,331 |

|||||||||||||||

| Provision for loan losses |

106,562 |

21,313 |

22,013 |

28,406 |

24,509 |

|||||||||||||||

| Other income |

354,746 |

150,484 |

128,712 |

131,645 |

70,032 |

|||||||||||||||

| Other expense |

578,217 |

382,654 |

368,179 |

367,409 |

248,196 |

|||||||||||||||

| Income taxes |

70,717 |

64,340 |

70,823 |

134,246 |

75,575 |

|||||||||||||||

| Net income |

289,023 |

260,099 |

256,342 |

150,581 |

147,083 |

|||||||||||||||

| Cash dividends |

171,876 |

139,508 |

141,610 |

131,755 |

98,696 |

|||||||||||||||

| Per common share: |

||||||||||||||||||||

| Net income: |

||||||||||||||||||||

| Basic |

2.40 |

2.55 |

2.46 |

1.54 |

2.00 |

|||||||||||||||

| Diluted |

2.40 |

2.55 |

2.45 |

1.54 |

1.99 |

|||||||||||||||

| Cash dividends |

1.40 |

1.37 |

1.36 |

1.33 |

1.32 |

|||||||||||||||

| Book value per share |

33.37 |

33.12 |

31.78 |

30.85 |

27.59 |

|||||||||||||||

| Selected Ratios: |

||||||||||||||||||||

| Return on average shareholders’ equity |

7.30 |

% |

7.80 |

% |

7.84 |

% |

5.09 |

% |

7.67 |

% | ||||||||||

| Return on average assets |

1.20 |

% |

1.34 |

% |

1.36 |

% |

0.85 |

% |

1.10 |

% | ||||||||||

| Dividend payout ratio |

59.47 |

% |

53.64 |

% |

55.24 |

% |

87.50 |

% |

67.10 |

% | ||||||||||

| Selected Balance Sheet Data: |

||||||||||||||||||||

| Average assets |

$ |

24,137,070 |

$ |

19,475,468 |

$ |

18,848,027 |

$ |

17,617,429 |

$ |

13,376,803 |

||||||||||

| Investment securities |

3,186,184 |

2,669,797 |

2,543,727 |

2,071,645 |

1,403,638 |

|||||||||||||||

| Loans held for sale |

718,937 |

387,514 |

249,846 |

265,955 |

8,445 |

|||||||||||||||

| Total loans |

17,591,413 |

13,712,129 |

13,422,222 |

13,011,421 |

10,341,137 |

|||||||||||||||

| Total assets |

26,184,247 |

19,662,324 |

19,250,498 |

19,058,959 |

14,508,892 |

|||||||||||||||

| Total deposits |

20,585,160 |

13,852,421 |

13,994,749 |

13,830,591 |

10,796,867 |

|||||||||||||||

| Long-term borrowings |

864,369 |

1,838,029 |

1,499,103 |

1,363,977 |

1,172,026 |

|||||||||||||||

| Total liabilities |

21,886,627 |

16,298,491 |

15,998,874 |

15,818,429 |

12,273,145 |

|||||||||||||||

| Shareholders’ equity |

4,297,620 |

3,363,833 |

3,251,624 |

3,240,530 |

2,235,747 |

|||||||||||||||

Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

• |

The PPPFA amended the PPP to give borrowers more time to spend loan funds and still obtain forgiveness. |

• |

Borrowers now have 24 weeks to spend loan proceeds, up from 8 weeks. |

• |

The Act also reduces mandatory payroll spending from 75% to 60%. |

• |

Two new exceptions let borrowers obtain full forgiveness even without fully restoring their workforce. |

• |

Changes made by the PPPFA have been incorporated in new forgiveness applications released by the SBA. |

• |

Time to pay off the loan has been extended to five years from the original two. |

• |

The Act now allows businesses to delay paying payroll taxes even if they took a PPP loan. |

• |

Restricted all non-essential travel and large external gatherings and have instituted a mandatory quarantine period for anyone that has traveled to an impacted area. |

• |

Temporarily closed all of our financial center lobbies and other corporate facilities to non-employees, except for certain limited cases by appointment only. United continues to serve our consumer and business customers through our drive-through facilities, ATMs, internet banking, mobile app and telephone customer service capabilities. |

• |

Expanded remote-access availability so that our work-force has the capability to work from home or other remote locations. All activities are performed in accordance with our compliance and information security policies designed to ensure customer data and other information is properly safeguarded. |

• |

Instituted mandatory social distancing policies for those employees not working remotely. Members of certain operations teams have been split into separate buildings or locations to create redundancy for key functions across the organization. |

2020 |

2019 |

2018 |

||||||||||

(In thousands) |

||||||||||||

| U.S. Treasury and obligations of U.S. Government corporations and agencies |

$ |

65,804 |

$ |

58,127 |

$ |

86,285 |

||||||

| States and political subdivisions |

538,082 |

272,014 |

212,670 |

|||||||||

| Mortgage-backed securities |

1,571,643 |

1,439,747 |

1,611,906 |

|||||||||

| Asset-backed securities |

297,834 |

284,390 |

272,459 |

|||||||||

| Trust preferred collateralized debt obligations |

0 |

6,045 |

6,176 |

|||||||||

| Single issue trust preferred securities |

18,230 |

18,196 |

8,754 |

|||||||||

| Corporate securities |

376,753 |

348,405 |

162,634 |

|||||||||

| |

|

|

|

|

|

|||||||

| TOTAL AVAILABLE FOR SALE SECURITIES, at amortized cost |

$ |

2,868,346 |

$ |

2,426,924 |

$ |

2,360,884 |

||||||

| |

|

|

|

|

|

|||||||

| TOTAL AVAILABLE FOR SALE SECURITIES, at fair value |

$ |

2,953,359 |

$ |

2,437,296 |

$ |

2,337,039 |

||||||

| |

|

|

|

|

|

|||||||

2020 |

2019 |

2018 |

||||||||||

(In thousands) |

||||||||||||

| U.S. Treasury and obligations of U.S. Government corporations and agencies |

$ |

0 |

$ |

0 |

$ |

5,074 |

||||||

| States and political subdivisions |

1,192 |

(1) |

1,426 |

5,473 |

||||||||

| Mortgage-backed securities |

0 |

0 |

20 |

|||||||||

| Single issue trust preferred securities |

0 |

0 |

9,412 |

|||||||||

| Other corporate securities |

20 |

20 |

20 |

|||||||||

| |

|

|

|

|

|

|||||||

| TOTAL HELD TO MATURITY SECURITIES, at amortized cost |

$ |

1,212 |

$ |

1,446 |

$ |

19,999 |

||||||

| |

|

|

|

|

|

|||||||

| TOTAL HELD TO MATURITY SECURITIES, at fair value |

$ |

1,212 |

(1) |

$ |

1,447 |

$ |

18,655 |

|||||

| |

|

|

|

|

|

|||||||

December 31 |

||||||||||||||||||||

(In thousands) |

2020 |

2019 |

2018 |

2017 |

2016 |

|||||||||||||||

| Commercial, financial & agricultural |

$ |

10,694,832 |

$ |

7,452,649 |

$ |

7,553,044 |

$ |

7,811,906 |

$ |

6,088,775 |

||||||||||

| Residential real estate |

3,899,885 |

3,686,401 |

3,501,393 |

2,996,171 |

2,403,437 |

|||||||||||||||

| Construction & land development |

1,826,349 |

1,408,205 |

1,410,468 |

1,504,907 |

1,255,738 |

|||||||||||||||

| Consumer |

1,201,517 |

1,166,293 |

964,627 |

714,353 |

608,769 |

|||||||||||||||

| Less: Unearned income |

(31,170 |

) |

(1,419 |

) |

(7,310 |

) |

(15,916 |

) |

(15,582 |

) | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

17,591,413 |

13,712,129 |

13,422,222 |

13,011,421 |

10,341,137 |

|||||||||||||||

| Allowance for loan losses |

(235,830 |

) |

(77,057 |

) |

(76,703 |

) |

(76,627 |

) |

(72,771 |

) | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL LOANS, NET |

$ |

17,355,583 |

$ |

13,635,072 |

$ |

13,345,519 |

$ |

12,934,794 |

$ |

10,268,366 |

||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans held for sale |

$ |

718,937 |

$ |

387,514 |

$ |

249,846 |

$ |

265,955 |

$ |

8,445 |

||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

(In thousands) |

Less Than One Year |

One To Five Years |

Over Five Years |

Total |

||||||||||||

| Commercial, financial & agricultural |

$ |

1,656,374 |

$ |

5,617,981 |

$ |

3,420,477 |

$ |

10,694,832 |

||||||||

| Construction & land development |

619,714 |

934,696 |

271,939 |

1,826,349 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

$ |

2,276,088 |

$ |

6,552,677 |

$ |

3,692,416 |

$ |

12,521,181 |

||||||||

| |

|

|

|

|

|

|

|

|||||||||

Less Than |

One to |

Over |

||||||||||||||

(In thousands) |

One Year |

Five Years |

Five Years |

Total |

||||||||||||

| Outstanding with fixed interest rates |

$ |

668,010 |

$ |

4,881,785 |

$ |

1,807,207 |

$ |

7,357,002 |

||||||||

| Outstanding with adjustable rates |

1,608,078 |

1,670,892 |

1,885,209 |

5,164,179 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

$ |

2,276,088 |

$ |

6,552,677 |

$ |

3,692,416 |

$ |

12,251,181 |

|||||||||

| |

|

|

|

|

|

|

|

|||||||||

December 31 |

December 31 |

$ |

% |

|||||||||||||

(Dollars in thousands) |

2020 |

2019 |

Change |

Change |

||||||||||||

| Demand deposits |

$ |

5,428,398 |

$ |

3,381,866 |

$ |

2,046,532 |

60.51 |

% | ||||||||

| Interest-bearing checking |

799,635 |

372,175 |

427,460 |

114.85 |

% | |||||||||||

| Regular savings |

1,283,823 |

882,889 |

400,934 |

45.41 |

% | |||||||||||

| Money market accounts |

10,165,334 |

6,891,696 |

3,273,638 |

47.50 |

% | |||||||||||

| Time deposits under $100,000 |

979,988 |

723,941 |

256,047 |

35.37 |

% | |||||||||||

| Time deposits over $100,000 (1) |

1,927,982 |

1,599,854 |

328,128 |

20.51 |

% | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total deposits |

$ |

20,585,160 |

$ |

13,852,421 |

$ |

6,732,739 |

48.60 |

% | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

(1) |

Includes time deposits of $250,000 or more of $889,334 and $803,414 at December 31, 2020 and December 31, 2019, respectively. |

| Year |

Amount |

|||

(In thousands) |

||||

| 2021 |

$ |

2,220,450 |

||

| 2022 |

441,567 |

|||

| 2023 |

139,716 |

|||

| 2024 |

73,368 |

|||

| 2025 and thereafter |

32,869 |

|||

| |

|

|||

| TOTAL |

$ |

2,907,970 |

||

| |

|

|||

Amount |

||||

(In thousands) |

||||

| 3 months or less |

$ |

629,224 |

||

| Over 3 through 6 months |

412,974 |

|||

| Over 6 through 12 months |

463,897 |

|||

| Over 12 months |

421,887 |

|||

| |

|

|||

| TOTAL |

$ |

1,927,982 |

||

| |

|

|||

2020 |

2019 |

2018 |

||||||||||||||||||||||||||||||||||

Interest |

Interest |

Interest |

||||||||||||||||||||||||||||||||||

Amount |

Expense |

Rate |

Amount |

Expense |

Rate |

Amount |

Expense |

Rate |

||||||||||||||||||||||||||||

(Dollars in thousands) |

||||||||||||||||||||||||||||||||||||

| Demand deposits |

$ |

6,433,349 |

$ |

0 |

0.00 |

% |

$ |

4,388,664 |

$ |

0 |

0.00 |

% |

$ |

4,297,474 |

$ |

0 |

0.00 |

% | ||||||||||||||||||

| NOW and money market deposits |

7,617,049 |

40,322 |

0.53 |

% |

6,297,715 |

88,591 |

1.41 |

% |

6,062,294 |

57,723 |

0.95 |

% | ||||||||||||||||||||||||

| Savings deposits |

1,149,201 |

2,087 |

0.18 |

% |

963,954 |

2,501 |

0.26 |

% |

1,043,348 |

2,161 |

0.21 |

% | ||||||||||||||||||||||||

| Time deposits |

2,952,944 |

36,170 |

1.22 |

% |

2,342,969 |

44,557 |

1.90 |

% |

2,337,368 |

31,623 |

1.35 |

% | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| TOTAL |

$ |

18,152,543 |

$ |

78,579 |

0.43 |

% |

$ |

13,993,302 |

$ |

135,649 |

0.97 |

% |

$ |

13,740,484 |

$ |

91,507 |

0.67 |

% | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

December 31 |

December 31 |

$ |

% |

|||||||||||||

(Dollars in thousands) |

2020 |

2019 |

Change |

Change |

||||||||||||

| Federal funds purchased |

$ |

0 |

$ |

0 |

$ |

0 |

0.00 |

% | ||||||||

| Short-term securities sold under agreements to repurchase |

142,300 |

124,654 |

17,646 |

14.16 |

% | |||||||||||

| Short-term FHLB advances |

0 |

250,000 |

(250,000 |

) |

(100.00 |

%) | ||||||||||

| Long-term FHLB advances |

584,532 |

1,601,865 |

(1,017,333 |

) |

(63.51 |

%) | ||||||||||

| Subordinated debt |

9,865 |

0 |

9,865 |

100.00 |

% | |||||||||||

| Issuances of trust preferred capital securities |

269,972 |

236,164 |

33,808 |

14.32 |

% | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total borrowings |

$ |

1,006,669 |

$ |

2,212,683 |

$ |

(1,206,014 |

) |

(54.50 |

%) | |||||||

| |

|

|

|

|

|

|

|

|||||||||

Year Ended |

||||||||

(Dollars in thousands) |

December 31, 2020 |

December 31, 2019 |

||||||

| Return on Average Tangible Equity: |

||||||||

| (a) Net Income (GAAP) |

$ |

289,023 |

$ |

260,099 |

||||

| Average Total Shareholders’ Equity (GAAP) |

3,956,969 |

3,336,075 |

||||||

| Less: Average Total Intangibles |

(1,716,738 |

) |

(1,511,501 |

) | ||||

| |

|

|

|

|||||

| (b) Average Tangible Equity (non-GAAP) |

$ |

2,240,231 |

$ |

1,824,574 |

||||

| Return on Tangible Equity (non-GAAP) [(a) / (b)] |

12.90 |

% |

14.26 |

% | ||||

Year Ended |

||||||||||||

(Dollars in thousands) |

December 31 2020 |

December 31 2019 |

December 31 2018 |

|||||||||

| Loan Accretion |

$ |

41,766 |

$ |

38,803 |

$ |

43,197 |

||||||

| Certificates of deposit |

7,925 |

791 |

1,258 |

|||||||||

| Long-term borrowings |

1,278 |

1,074 |

1,074 |

|||||||||

| |

|

|

|

|

|

|||||||

| Total |

$ |

50,969 |

$ |

40,668 |

$ |

45,529 |

||||||

| |

|

|

|

|

|

|||||||

Year Ended |

||||||||||||

(Dollars in thousands) |

December 31 2020 |

December 31 2019 |

December 31 2018 |

|||||||||

| Net interest income (GAAP) |

$ |

689,773 |

$ |

577,922 |

$ |

588,645 |

||||||

| Tax-equivalent adjustment (non-GAAP) (1) |

3,888 |

3,735 |

4,328 |

|||||||||

| |

|

|

|

|

|

|||||||

| Tax-equivalent net interest income (non-GAAP) |

$ |

693,661 |

$ |

581,657 |

$ |

592,973 |

||||||

| |

|

|

|

|

|

|||||||

(1) |

The tax-equivalent adjustment combines amounts of interest income on federally nontaxable loans and investment securities using the statutory federal income tax rate of 21% for 2020, 2019, and 2018. All interest income on loans and investment securities was subject to state income taxes. |

Year Ended December 31, 2020 |

Year Ended December 31, 2019 |

Year Ended December 31, 2018 |

||||||||||||||||||||||||||||||||||

(Dollars in thousands) |

Average Balance |

Interest (1) |

Avg. Rate (1) |

Average Balance |

Interest (1) |

Avg. Rate (1) |

Average Balance |

Interest (1) |

Avg. Rate (1) |

|||||||||||||||||||||||||||

| ASSETS |

||||||||||||||||||||||||||||||||||||

| Earning Assets: |

||||||||||||||||||||||||||||||||||||

| Federal funds sold, securities repurchased under agreements to resell & other short-term investments |

$ |

1,501,771 |

$ |

9,780 |

0.65 |

% |

$ |

733,865 |

$ |

21,338 |

2.91 |

% |

$ |

843,079 |

$ |

19,268 |

2.29 |

% | ||||||||||||||||||

| Investment Securities: |

||||||||||||||||||||||||||||||||||||

| Taxable |

2,700,416 |

61,808 |

2.29 |

% |

2,485,767 |

70,789 |

2.85 |

% |

2,080,145 |

56,273 |

2.71 |

% | ||||||||||||||||||||||||

| Tax-exempt |

217,836 |

6,285 |

2.89 |

% |

139,277 |

4,412 |

3.17 |

% |

231,009 |

6,904 |

2.99 |

% | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Securities |

2,918,252 |

68,093 |

2.33 |

% |

2,625,044 |

75,201 |

2.86 |

% |

2,311,154 |

63,177 |

2.73 |

% | ||||||||||||||||||||||||

| Loans and leases, net of unearned income (2) |

17,151,291 |

724,397 |

4.22 |

% |

13,879,662 |

669,758 |

4.83 |

% |

13,476,416 |

639,598 |

4.75 |

% | ||||||||||||||||||||||||

| Allowance for credit losses |

(186,640 |

) |

(76,731 |

) |

(76,848 |

) |

||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net loans and leases |

16,964,651 |

4.27 |

% |

13,802,931 |

4.85 |

% |

13,399,568 |

4.77 |

% | |||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total earning assets |

21,384,674 |

$ |

802,270 |

3.75 |

% |

17,161,840 |

$ |

766,297 |

4.47 |

% |

16,553,801 |

$ |

722,043 |

4.36 |

% | |||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Other assets |

2,752,396 |

2,313,628 |

2,294,226 |

|||||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| TOTAL ASSETS |

$ |

24,137,070 |

$ |

19,475,468 |

$ |

18,848,027 |

||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| LIABILITIES |

||||||||||||||||||||||||||||||||||||

| Interest-Bearing Funds: |

||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits |

$ |

11,719,194 |

$ |

78,579 |

0.67 |

% |

$ |

9,604,638 |

$ |

135,649 |

1.41 |

% |

$ |

9,443,010 |

$ |

91,507 |

0.97 |

% | ||||||||||||||||||

| Short-term borrowings |

145,768 |

1,027 |

0.70 |

% |

140,483 |

2,347 |

1.67 |

% |

224,948 |

2,245 |

1.00 |

% | ||||||||||||||||||||||||

| Long- term borrowings |

1,645,783 |

29,003 |

1.76 |

% |

1,821,504 |

46,644 |

2.56 |

% |

1,509,604 |

35,318 |

2.34 |

% | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Interest-Bearing Funds |

13,510,745 |

108,609 |

0.80 |

% |

11,566,625 |

184,640 |

1.60 |

% |

11,177,562 |

129,070 |

1.15 |

% | ||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Noninterest-bearing deposits |

6,433,349 |

4,388,664 |

4,297,474 |

|||||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities |

236,007 |

184,104 |

104,047 |

|||||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| TOTAL LIABILITIES |

20,180,101 |

16,139,393 |

15,579,083 |

|||||||||||||||||||||||||||||||||

| SHAREHOLDERS’ EQUITY |

3,956,969 |

3,336,075 |

3,268,944 |

|||||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

24,137,070 |

$ |

19,475,468 |

$ |

18,848,027 |

||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| NET INTEREST INCOME |

$ |

693,661 |

$ |

581,657 |

$ |

592,973 |

||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|||||||||||||||||||||||||||||||

| INTEREST SPREAD |

2.95 |

% |

2.87 |

% |

3.21 |

% | ||||||||||||||||||||||||||||||

| NET INTEREST MARGIN |

3.24 |

% |

3.39 |

% |

3.58 |

% | ||||||||||||||||||||||||||||||

(1) |

The interest income and the yields on federally nontaxable loans and investment securities are presented on a tax-equivalent basis using the statutory federal income tax rate of 21% for 2020, 2019 and 2018. |

(2) |

Nonaccruing loans are included in the daily average loan amounts outstanding. |

2020 Compared to 2019 |

2019 Compared to 2018 |

|||||||||||||||||||||||||||||||

Increase (Decrease) Due to |

Increase (Decrease) Due to |

|||||||||||||||||||||||||||||||

(In thousands) |

Volume |

Rate |

Rate/ Volume |

Total |

Volume |

Rate |

Rate/ Volume |

Total |

||||||||||||||||||||||||

| Interest income: |

||||||||||||||||||||||||||||||||

| Federal funds sold, securities purchased under agreements to resell and other short-term investments |

$ |

22,346 |

$ |

(16,585 |

) |

$ |

(17,319 |

) |

$ |

(11,558 |

) |

$ |

(2,501 |

) |

$ |

5,227 |

$ |

(656 |

) |

$ |

2,070 |

|||||||||||

| Investment securities: |

||||||||||||||||||||||||||||||||

| Taxable |

6,117 |

(13,920 |

) |

(1,178 |

) |

(8,981 |

) |

10,992 |

2,912 |

612 |

14,516 |

|||||||||||||||||||||

| Tax-exempt (1) |

2,490 |

(390 |

) |

(227 |

) |

1,873 |

(2,743 |

) |

416 |

(165 |

) |

(2,492 |

) | |||||||||||||||||||

| Loans (1),(2) |

153,343 |

(80,057 |

) |

(18,647 |

) |

54,639 |

19,240 |

10,720 |

200 |

30,160 |

||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL INTEREST INCOME |

184,296 |

(110,952 |

) |

(37,371 |

) |

35,973 |

24,988 |

19,275 |

(9 |

) |

44,254 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Interest expense: |

||||||||||||||||||||||||||||||||

| Interest-bearing deposits |

$ |

29,815 |

$ |

(71,074 |

) |

$ |

(15,811 |

) |

$ |

(57,070 |

) |

$ |

1,568 |

$ |

41,549 |

$ |

1,025 |

$ |

44,142 |

|||||||||||||

| Short-term borrowings |

88 |

(1,306 |

) |

(102 |

) |

(1,320 |

) |

(845 |

) |

1,507 |

(560 |

) |

102 |

|||||||||||||||||||

| Long-term borrowings |

(4,498 |

) |

(14,572 |

) |

1,429 |

(17,641 |

) |

7,298 |

3,321 |

707 |

11,326 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL INTEREST EXPENSE |

25,405 |

(86,952 |

) |

(14,484 |

) |

(76,031 |

) |

8,021 |

46,377 |

1,172 |

55,570 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| NET INTEREST INCOME |

$ |

158,891 |

$ |

(24,000 |

) |

$ |

(22,887 |

) |

$ |

112,004 |

$ |

16,967 |

$ |

(27,102 |

) |

$ |

(1,181 |

) |

$ |

(11,316 |

) | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

(1) |

Yields and interest income on federally tax-exempt loans and investment securities are computed on a fully tax-equivalent basis using the statutory federal income tax rate of 21% for 2020, 2019 and 2018. |

(2) |

Nonaccruing loans are included in the daily average loan amounts outstanding. |

2020 |

2019 |

2018 |

2017 |

2016 |

||||||||||||||||

(Dollars in thousands) |

||||||||||||||||||||

| Balance of allowance for loan losses at beginning of year |

$ |

77,057 |

$ |

76,703 |

$ |

76,627 |

$ |

72,771 |

$ |

75,726 |

||||||||||

| Impact of the adoption of ASU 2016-13 on January 1, 2020 |

52,321 |

0 |

0 |

0 |

0 |

|||||||||||||||

| Impact of the adoption of ASU 2016-13 for PCD loans on January 1, 2020 |

5,121 |

0 |

0 |

0 |

0 |

|||||||||||||||

| Loans charged off: |

||||||||||||||||||||

| Commercial, financial & agricultural |

25,679 |

21,973 |

19,963 |

23,731 |

26,130 |

|||||||||||||||

| Residential real estate |

1,760 |

2,967 |

3,162 |

2,973 |

4,597 |

|||||||||||||||

| Construction & land development |

2,027 |

1,303 |

2,731 |

3,337 |

2,659 |

|||||||||||||||

| Consumer |

3,517 |

2,867 |

2,750 |

2,822 |

2,794 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL CHARGE-OFFS |

32,983 |

29,110 |

28,606 |

32,863 |

36,180 |

|||||||||||||||

| Recoveries: |

||||||||||||||||||||

| Commercial, financial & agricultural |

6,279 |

6,412 |

4,696 |

6,238 |

7,198 |

|||||||||||||||

| Residential real estate |

1,063 |

858 |

1,114 |

601 |

639 |

|||||||||||||||

| Construction & land development |

1,513 |

175 |

197 |

726 |

433 |

|||||||||||||||

| Consumer |

531 |

706 |

662 |

748 |

446 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL RECOVERIES |

9,386 |

8,151 |

6,669 |

8,313 |

8,716 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| NET LOANS CHARGED OFF |

23,597 |

20,959 |

21,937 |

24,550 |

27,464 |

|||||||||||||||

| Provision for loan losses |

106,293 |

21,313 |

22,013 |

28,406 |

24,509 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| BALANCE OF ALLOWANCE FOR LOAN LOSSES AT END OF YEAR |

$ |

235,830 |

$ |

77,057 |

$ |

76,703 |

$ |

76,627 |

$ |

72,771 |

||||||||||

| Reserve for lending-related commitments |

19,250 |

1,733 |

1,389 |

679 |

1,044 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| BALANCE OF ALLOWANCE FOR CREDIT LOSSES AT END OF YEAR |

$ |

255,080 |

$ |

78,790 |

$ |

78,092 |

$ |

77,306 |

$ |

73,815 |

||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Loans outstanding at the end of period (gross) (1) |

$ |

17,591,413 |

$ |

13,713,548 |

$ |

13,429,532 |

$ |

13,027,337 |

$ |

10,356,719 |

||||||||||

| Average loans outstanding during period (net of unearned income) (1) |

$ |

16,584,938 |

$ |

13,570,789 |

$ |

13,258,619 |

$ |

12,399,901 |

$ |

9,983,828 |

||||||||||

| Net charge-offs as a percentage of average loans outstanding |

0.14 |

% |

0.15 |

% |

0.17 |

% |

0.20 |

% |

0.28 |

% | ||||||||||

| Allowance for loan losses, as a percentage of nonperforming loans |

178.38 |

% |

58.79 |

% |

53.71 |

% |

45.41 |

% |

64.25 |

% | ||||||||||

(1) |

Excludes loans held for sale. |

• |

Past events – This includes portfolio trends related to business conditions; past due, nonaccrual, and graded loans and leases; and concentrations. |

• |

Current conditions – United considered the impact of COVID-19 on the economy as well as loan deferrals and modifications made in light of the pandemic when making determinations related to factor adjustments, such as changes in economic and business conditions, collateral values, external factors and past due loans and leases, and the reasonable and supportable forecast. This is in contrast with the CECL adoption date (January 1, 2020) estimate as neither of these items were relevant for United’s footprint at the beginning of the year. Additional considerations were made for the Carolina Financial acquisition, such as the experience of lending management and staff and the nature and volume of the portfolio. |

• |

Reasonable and supportable forecasts – The forecast is determined on a portfolio-by-portfolio |

Ø |

The ranges for the economic variables of GDP and the unemployment rate have narrowed in the fourth quarter as compared to the third. |

Ø |

The forecast is less severe than third quarter while maintaining a gradual recovery pace extending beyond 2022. |

Ø |

Greater risk of loss is probable in the hotel and accommodations portfolio due to deteriorating economic conditions brought on by the pandemic which resulted in a more negative forecast relative to other portfolios. |

Ø |

Consideration was given to the $900 billion economic stimulus bill passed in December 2020 during the forecast selection process. |

Ø |

Reversion to historical loss data occurs via a straight-line method during the year following the one-year reasonable and supportable forecast period. |

2020 |

2019 |

2018 |

2017 |

2016 |

||||||||||||||||

(In thousands) |

||||||||||||||||||||

| Commercial, financial & agricultural |

$ |

150,642 |

$ |

61,403 |

$ |

53,323 |

$ |

56,959 |

$ |

45,243 |

||||||||||

| Residential real estate |

29,125 |

8,997 |

12,448 |

9,927 |

13,770 |

|||||||||||||||

| Construction & land development |

39,077 |

3,354 |

7,992 |

7,187 |

10,606 |

|||||||||||||||

| Consumer |

16,986 |

3,007 |

2,695 |

2,481 |

2,805 |

|||||||||||||||

| Allowance for estimated imprecision |

0 |

296 |

245 |

73 |

347 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Allowance for loan losses |

$ |

235,830 |

$ |

77,057 |

$ |

76,703 |

$ |

76,627 |

$ |

72,771 |

||||||||||

| Reserve for lending-related commitments |

19,250 |

1,733 |

1,389 |

679 |

1,044 |

|||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Allowance for credit losses |

$ |

255,080 |

$ |

78,790 |

$ |

78,092 |

$ |

77,306 |

$ |

73,815 |

||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

2020 |

2019 |

2018 |

2017 |

2016 |

||||||||||||||||

| Commercial, financial & agricultural |

60.80 |

% |

54.35 |

% |

56.27 |

% |

60.04 |

% |

58.88 |

% | ||||||||||

| Residential real estate |

22.17 |

% |

26.88 |

% |

26.09 |

% |

23.03 |

% |

23.24 |

% | ||||||||||

| Construction & land development |

10.38 |

% |

10.27 |

% |

10.51 |

% |

11.56 |

% |

12.14 |

% | ||||||||||

| Consumer |

6.65 |

% |

8.50 |

% |

7.13 |

% |

5.37 |

% |

5.74 |

% | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

100.00 |

% |

100.00 |

% |

100.00 |

% |

100.00 |

% |

100.00 |

% | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

(In thousands) |

Amount |

|||

| Commitments to extend credit: |

||||

| Revolving open-end secured by 1-4 residential |

$ |

688,670 |

||

| Credit card and personal revolving lines |

130,804 |

|||

| Commercial |

4,911,402 |

|||

| |

|

|||

| Total unused commitments |

$ |

5,730,876 |

||

| |

|

|||

| Financial standby letters of credit |

$ |

58,108 |

||

| Performance standby letters of credit |

76,807 |

|||

| Commercial letters of credit |

5,092 |

|||

| |

|

|||

| Total letters of credit |

$ |

140,007 |

||

| |

|

|||

2020 |

2019 |

2018 |

||||||||||

| Return on average assets |

1.20 |

% |

1.34 |

% |

1.36 |

% | ||||||

| Return on average equity |

7.30 |

% |

7.80 |

% |

7.84 |

% | ||||||

| Dividend payout ratio |

59.47 |

% |

53.64 |

% |

55.24 |

% | ||||||

| Average equity to average assets ratio |

16.39 |

% |

17.13 |

% |

17.34 |

% | ||||||

Item 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

| Change in Interest Rates |

Percentage Change in Net Interest Income | |||

| (basis points) |

December 31, 2020 |

December 31, 2019 | ||

| +200 |

(4.32%) |

(2.37%) | ||

| +100 |

(2.61%) |

(1.09%) | ||

| -100 |

0.03% |

0.86% | ||

| -200 |

(0.05%) |

(1.34%) | ||

| /s/ Richard M. Adams |

/s/ W. Mark Tatterson | |||

| Richard M. Adams, Chairman of the Board and Chief Executive Officer |

W. Mark Tatterson, Executive Vice President and Chief Financial Officer |

| /s/ Ernst & Young LLP |

| Charleston, West Virginia |

| March 1, 2021 |

Item 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

| Description of the Matter |

On January 1, 2020, the Company adopted ASU 2016-13, Financial Instruments – Credit Losses (ASC 326): Measurement of Credit Losses on Financial Instruments and recorded an increase in the allowance for loan losses (ALL) of $57.4 million. The Company’s loan portfolio totaled $17.6 billion as of December 31, 2020, and the associated ALL for the loan portfolio was $235.8 million. As discussed in Notes A, E and F to the consolidated financial statements, the ALL is an estimate of the expected credit losses on loans at amortized cost to present the net amount expected to be collected as of the balance sheet date. The ALL is based on the credit losses expected to arise over the life of the asset. Management pools its loans based on similar risk characteristics and assigns an appropriate calculation method to estimate the expected credit losses. For loans that do not share risk characteristics, management evaluates the ALL on an individual basis based on the present value of expected future cash flows using the loan’s effective interest rate, or as a practical expedient, the loan’s observable market price or the fair value of the collateral if the loan is collateral-dependent. For loans not specifically reviewed on an individual basis, management measures the ALL using a probability of default/loss given default method or cohort method based on portfolio segment. Management also records qualitative adjustments to the allowance for past events, current conditions and reasonable and supportable forecasts that have not been fully captured in the allowance calculation. | |

How We Addressed the Matter in Our Audit |

Auditing management’s estimate used in determining the ALL for the loan portfolio involved a high degree of subjectivity in evaluating management’s determination of the forecast selection used to derive the reasonable and supportable forecast qualitative adjustment. | |

| We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over the Company’s ALL process for the loan portfolio. Controls tested included, among others, those over the risk rating process, the identification of indicators of impairment, management’s review and approval of the calculations used to determine the ALL, including the underlying data and data inputs and outputs of those calculations, and management’s evaluation and review of the qualitative adjustments, including the reasonable and supportable forecast qualitative adjustment. | ||

| To test the Company’s reasonable and supportable qualitative adjustment for the loan portfolio, we tested the underlying data used in the estimate calculation to determine it was accurate, complete and relevant. Further, we evaluated management’s basis for the adjustment in relation to changes in economic conditions and forecasts. Our procedures included evaluating management’s inputs and assumptions used in determining the qualitative adjustment by comparing the information to internal and external source data including, among others, the economic forecasts utilized by the Company and third-party economic outlook reports. We involved our internal modeling specialists in evaluating the model methodology, performance and governance. In addition, we evaluated the overall ALL amount, inclusive of the qualitative adjustments, and whether the amount appropriately reflects losses expected in the loan portfolios as of the consolidated balance sheet date. For example, we evaluated the Company’s analysis of their historical loss experience and peer losses to the Company’s recorded ALL to test the ALL in totality. We also reviewed subsequent events and transactions and considered whether they corroborate or contradict the Company’s conclusion. | ||

Accounting for Acquisitions | ||

Description of the Matter |

During 2020, the Company completed the acquisition of Carolina Financial Corporation (CARO) for consideration of $817.9 million, as disclosed in Note B to the consolidated financial statements. The transaction was accounted for by applying the acquisition method. | |

| Auditing the Company’s accounting for the acquisition of CARO was complex due to the significant estimation required by management to determine the fair value of the net loans and leases acquired of $3.2 billion. The Company determined the fair value of the acquired loans and leases by estimating the principal and interest cash flows expected to be collected on the loans and | ||

| leases and discounting those cash flows at a market rate of interest. Management considered a number of factors in evaluating the acquisition-date fair value including expected credit losses, the prevailing market interest rates for comparable assets and liquidity from the perspective of a market participant. The significant estimation was primarily due to the judgement applied by the Company in determining the discount and loss rates used to calculate the expected cash flows for acquired loans and leases to establish the acquisition date fair value. These factors are forward looking and could be affected by future economic and market conditions. | ||

How We Addressed the Matter in Our Audit |

We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over the Company’s accounting for the acquisition. Our tests included testing controls over the completeness and accuracy of the data and the estimation process supporting the fair value of loans acquired. We also tested management’s review of significant assumptions used in the valuation models. | |

| To test the estimated fair value of the loans and leases acquired, we performed audit procedures that included, among others, evaluating the Company’s valuation methodology, evaluating the factors used by the Company’s valuation specialist, and evaluating the completeness and accuracy of the underlying data supporting the factors and estimates. For example, when evaluating the discount and loss rates noted above, we compared the factors to current industry, market and economic information in addition to factors used in historical acquisitions. We involved our valuation specialists to assist with the evaluation of the methodology used by the Company and factors included in the fair value estimates. | ||

| /s/ Ernst & Young LLP |

| We have served as the Company’s auditor since 1986. |

| Charleston, West Virginia |

| March 1, 2021 |

December 31 |

December | |||||||

2020 |

2019 | |||||||

| Assets |

||||||||

| Cash and due from banks |

$ |

$ |

||||||

| Interest-bearing deposits with other bank s |

||||||||

| Federal funds sold |

||||||||

| |

|

|

|

|||||

| Total cash and cash equivalents |

||||||||

| Securities available for sale at estimated fair value (amortized cost-$ 31, |

||||||||

| Securities held to maturity, net of allowance for credit losses of $ |

||||||||

| Equity securities at estimated fair value |

||||||||

| Other investment securities |

||||||||

| Loans held for sale (at fair value-$ 31, 2019) |

||||||||

| Loans and leases |

||||||||

| Less: Unearned income |

( |

( |

||||||

| |

|

|

|

|||||

| Loans and leases, net of unearned income |

||||||||

| Less: Allowance for loan and lease losses |

( |

( |

||||||

| |

|

|

|

|||||

| Net loans and leases |

||||||||

| Bank premises and equipment |

||||||||

| Operating lease right-of-use |

||||||||

| Goodwill |

||||||||

| Mortgage servicing rights, net of valuation allowance of $ |

||||||||

| Accrued interest receivable, net of allowance for credit losses of $ |

||||||||

| Other assets |

||||||||

| |

|

|

|

|||||

| TOTAL ASSETS |

$ |

$ |

||||||

| |

|

|

|

|||||

| Liabilities |

||||||||

| Deposits: |

||||||||

| Noninterest-bearing |

$ |

$ |

||||||

| Interest-bearing |

||||||||

| |

|

|

|

|||||

| Total deposits |

||||||||

| Borrowings: |

||||||||

| Securities sold under agreements to repurchase |

||||||||

| Federal Home Loan Bank (“FHLB”) borrowings |

||||||||

| Other long-term borrowings |

||||||||

| Reserve for lending-related commitments |

||||||||

| Operating lease liabilities |

||||||||

| Accrued expenses and other liabilities |

||||||||

| |

|

|

|

|||||

| TOTAL LIABILITIES |

||||||||

| Shareholders’ Equity |

||||||||

| Preferred stock, $ Authorized- shares, |

||||||||

| Common stock, $ Authorized- shares; issued- and respectively |

||||||||

| Surplus |

||||||||

| Retained earnings |

||||||||

| Accumulated other comprehensive gain (loss) |

( |

|||||||

| Treasury stock, at cost |

( |

( |

||||||

| |

|

|

|

|||||

| TOTAL SHAREHOLDERS’ EQUITY |

||||||||

| |

|

|

|

|||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

$ |

||||||

| |

|

|

|

|||||

Year Ended December 31 | ||||||||||||

2020 |

2019 |

2018 | ||||||||||

Interest income |

||||||||||||

Interest and fees on loans and leases |

$ |

$ |

$ |

|||||||||

Interest on federal funds sold and other short-term investments |

||||||||||||

Interest and dividends on securities: |

||||||||||||

Taxable |

||||||||||||

Tax-exempt |

||||||||||||

Total interest income |

||||||||||||

Interest expense |

||||||||||||

Interest on deposits |

||||||||||||

Interest on short-term borrowings |

||||||||||||

Interest on long-term borrowings |

||||||||||||

Total interest expense |

||||||||||||

Net interest income |

||||||||||||

Provision for credit losses |

||||||||||||

Net interest income after provision for credit losses |

||||||||||||

Other income |

||||||||||||

Fees from trust services |

||||||||||||

Fees from brokerage services |

||||||||||||

Fees from deposit services |

||||||||||||

Bankcard fees and merchant discounts |

||||||||||||

Other service charges, commissions, and fees |

||||||||||||

Income from bank-owned life insurance |

||||||||||||

Income from mortgage banking activities |

||||||||||||

Mortgage loan servicing income |

||||||||||||

Net gain on the sale of bank premises |

||||||||||||

Net investment securities gains (losses) |

( |

) | ||||||||||

Other income |

||||||||||||

Total other income |

||||||||||||

Other expense |

||||||||||||

Employee compensation |

||||||||||||

Employee benefits |

||||||||||||

Net occupancy expense |

||||||||||||

Other real estate owned (OREO) expense |

||||||||||||

Equipment expense |

||||||||||||

Data processing expense |

||||||||||||

Mortgage loan servicing expense and impairment |

||||||||||||

Bankcard processing expense |

||||||||||||

FDIC insurance expense |

||||||||||||

FHLB prepayment penalties |

||||||||||||

Other expense |

||||||||||||

Total other expense |

||||||||||||

Income before income taxes |

||||||||||||

Income taxes |

||||||||||||

Net income |

$ |

$ |

$ |

|||||||||

| |

Year Ended December 31 | |||||||||||

2020 |

2019 |

2018 | ||||||||||

| Earnings per common share: |

||||||||||||

| Basic |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|

|

| ||||

| Diluted |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|

|

| ||||

| Dividends per common share |

$ |

$ |

$ |

|||||||||

| |

|

|

|

|

|

|

|

| ||||

| Average outstanding shares: |

||||||||||||

| Basic |

||||||||||||

| Diluted |

||||||||||||

Year Ended December 31 |

||||||||||||

2020 |

2019 |

2018 |

||||||||||

| Net income |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Change in net unrealized gain (loss) on available-for-sale |

( |

|||||||||||

| Accretion of the net unrealized loss on the transfer of AFS securities to held-to-maturity |

||||||||||||

| Change in net unrealized gain on cash flow hedge, net of tax |

||||||||||||

| Change in defined benefit pension plan, net of tax |

( |

( |

||||||||||

| |

|

|

|

|

|

|

|

| ||||

| Comprehensive income, net of tax |

$ |

$ |

|

$ |

||||||||

| |

|

|

|

|

|

|

|

| ||||

Accumulated |

||||||||||||||||||||||||||||

Common Stock |

Other |

Total |

||||||||||||||||||||||||||

Par |

Retained |

Comprehensive |

Treasury |

Shareholders’ |

||||||||||||||||||||||||

Shares |

Value |

Surplus |

Earnings |

Income (Loss) |

Stock |

Equity |

||||||||||||||||||||||

| Balance at January 1, 2018 |

$ |

$ |

$ |

$ |

( |

) |

$ |

( |

) |

$ |

||||||||||||||||||

| Cumulative effect of adopting Accounting Standard Update 2016-01 |

0 |

( |

) |

|||||||||||||||||||||||||

| Reclass due to adopting Ac c ounting Standard Update 2018-02 |

0 |

( |

) |

|||||||||||||||||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||||

| Net income |

0 |

|||||||||||||||||||||||||||

| Other comprehensive income, net of tax |

0 |

( |

) |

( |

) | |||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||

| Total comprehensive income, net of tax |

||||||||||||||||||||||||||||

| Stock based compensation expense |

0 |

|||||||||||||||||||||||||||

| Purchase of treasury stock ( |

0 |

( |

) |

( |

) | |||||||||||||||||||||||

| Distribution of treasury stock for deferred compensation plan ( |

0 |

|||||||||||||||||||||||||||

| Cash dividends ($ |

0 |

( |

) |

( |

) | |||||||||||||||||||||||

| Grant of restricted stock ( |

( |

) |

||||||||||||||||||||||||||

| Forfeiture of restricted stock ( |

0 |

( |

) |

|||||||||||||||||||||||||

| Common stock options exercised ( |

||||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||

| Balance at December 31, 2018 |

( |

) |

( |

) |

||||||||||||||||||||||||

| Cumulative effect of adopting Accounting Standard Update 2016-02 |

0 |

( |

) |

( |

) | |||||||||||||||||||||||

| Reclass due to adopting Accounting Standard Update 2017-12 |

0 |

|||||||||||||||||||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||||

| Net income |

0 |

|||||||||||||||||||||||||||

| Other comprehensive income, net of tax |

0 |

|||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||

| Total comprehensive income, net of tax |

||||||||||||||||||||||||||||

| Stock based compensation expense |

0 |

|||||||||||||||||||||||||||

| Purchase of treasury stock ( |

0 |

( |

) |

( |

) | |||||||||||||||||||||||

| Distribution of treasury stock for deferred compensation plan ( |

0 |

|||||||||||||||||||||||||||

| Cash dividends ($ |

0 |

( |

) |

( |

) | |||||||||||||||||||||||

| Grant of restricted stock ( |

( |

) |

||||||||||||||||||||||||||

| Forfeiture of restricted stock ( |

0 |

( |

) |

|||||||||||||||||||||||||

| Common stock options exercised ( |

||||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||

| Balance at December 31, 2019 |

( |

) |

( |

) |

||||||||||||||||||||||||

| Update 2016-13 |

0 |

( |

) |

( |

) | |||||||||||||||||||||||

| Comprehensive income: |

||||||||||||||||||||||||||||

| Net income |

0 |

|||||||||||||||||||||||||||

| Other comprehensive income, net of tax |

0 |

|||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||

| Total comprehensive income, net of tax |

||||||||||||||||||||||||||||

| Stock based compensation expense |

0 |

|||||||||||||||||||||||||||

| Acquisition of Carolina Financial Corporation ( |

||||||||||||||||||||||||||||

| Purchase of treasury stock ( |

0 |

( |

) |

( |

) | |||||||||||||||||||||||

| Distribution of treasury stock for deferred compensation plan ( |

0 |

|||||||||||||||||||||||||||

| Cash dividends ($ |

0 |

( |

) |

( |

) | |||||||||||||||||||||||

| Grant of restricted stock ( |

( |

) |

||||||||||||||||||||||||||

| Forfeiture of restricted stock ( |

0 |

( |

) |

|||||||||||||||||||||||||

| Common stock options exercised ( |

||||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||

| Balance at December 31, 2020 |

$ |

$ |

$ |

$ |

$ |

$ |

( |

) |

$ |

|||||||||||||||||||

| |

|

|||||||||||||||||||||||||||

(Dollars in thousands) |

Year Ended December 31 |

|||||||||||

2020 |

2019 |

2018 |

||||||||||

OPERATING ACTIVITIES |

||||||||||||

Net income |

$ |

$ |

$ |

|||||||||

Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||

Provision for credit losses |

||||||||||||

Amortization and accretion |

( |

) |

( |

) |

( |

) | ||||||

Loss (Gain) on sales of bank premises, OREO, leases and equipment |

( |

) | ||||||||||

Write-downs on bank premises, OREO, leases and equipment |

||||||||||||

Depreciation |

9 |

|||||||||||

(Gain) loss on securities |

( |

) |

( |

) |

||||||||

Loans originated for sale |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from sales of loans |

||||||||||||

Gain on sales of loans |

( |

) |

( |

) |

( |

) | ||||||

Mortgage repurchase loan losses paid, net of recoveries |

( |

) |

( |

) | ||||||||

Stock-based compensation |

||||||||||||

Excess tax benefits from stock-based compensation arrangements |

||||||||||||

Deferred income tax (benefit) expense |

( |

) |

||||||||||

Amortization of tax credit investments |

||||||||||||

Originations of mortgage servicing rights |

( |

) |

||||||||||

Impairment of mortgage servicing rights |

||||||||||||

Increase in cash surrender value of bank-owned life insurance policies |

( |

) |

( |

) |

( |

) | ||||||

Contribution to pension plan |

( |

) |

( |

) | ||||||||

Amortization of net periodic pension costs |

||||||||||||

Changes in: |

||||||||||||

Loans held for sale |

||||||||||||

Interest receivable |

( |

) | ||||||||||

Other assets |

( |

) |

||||||||||

Accrued expenses and other liabilities |

( |

) |

||||||||||

NET CASH PROVIDED BY OPERATING ACTIVITIES |

||||||||||||

INVESTING ACTIVITIES |

||||||||||||

Proceeds from maturities and calls of held to maturity securities |

||||||||||||

Proceeds from sales of securities available for sale |

||||||||||||

Proceeds from maturities and calls of securities available for sale |

||||||||||||

Purchases of securities available for sale |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from sales of equity securities |

||||||||||||

Purchases of equity securities |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from sales and redemptions of other investment securities |

||||||||||||

Purchases of other investment securities |

( |

) |

( |

) |

( |

) | ||||||

Redemption of bank-owned life insurance policies |

||||||||||||

Purchases of bank premises and equipment |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from sales of bank premises and equipment |

||||||||||||

Acquisition of Carolina Financial Corporation, net of cash paid |

||||||||||||

Proceeds from sales of OREO properties |

||||||||||||

Net change in loans and leases |

( |

) |

( |

) |

( |

) | ||||||

NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES |

( |

) |

( |

) | ||||||||

FINANCING ACTIVITIES |

||||||||||||

Cash dividends paid |

( |

) |

( |

) |

( |

) | ||||||

Acquisition of treasury stock |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from exercise of stock options |

||||||||||||

Distribution of treasury stock for deferred compensation plan |

||||||||||||

Repayment of long-term Federal Home Loan Bank borrowings |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from issuance of long-term Federal Home Loan Bank borrowings |

||||||||||||

Repayment of trust preferred issuance |

( |

) | ||||||||||

Changes in: |

||||||||||||

Time deposits |

( |

) | ||||||||||

Other deposits |

( |

) |

||||||||||

Federal funds purchased, securities sold under agreements to repurchase and other short-term borrowings |

( |

) |

( |

) | ||||||||

NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES |

( |

) | ||||||||||

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS |

( |

) |

( |

) | ||||||||

CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR |

||||||||||||

CASH AND CASH EQUIVALENTS AT END OF YEAR |

$ |

$ |

$ |

|||||||||

(Dollars in thousands) |

Year Ended December 31 |

|||||||||||

2020 |

2019 |

2018 |

||||||||||

| Supplemental information |

||||||||||||

| Cash paid for: |

||||||||||||

| Interest on deposits and borrowed funds |

$ |

$ |

$ |

|||||||||

| Income taxes |

||||||||||||

| Noncash investing activities: |

||||||||||||

| Transfers of loans to OREO |

||||||||||||

| Transfers of held to maturity debt securities to available for sale debt securities |

||||||||||||

| Acquisition of Carolina Financial: |

||||||||||||

| Assets acquired, net of cash |

||||||||||||

| Liabilities assumed |

||||||||||||

| Goodwill |

||||||||||||

· |

Financial assets that are delinquent as of the acquisition date |

· |

Financial assets that have been downgraded since origination |

· |

Financial assets that have been placed on nonaccrual status |

· |

Method: Probability of Default/Loss Given Default (PD/LGD) |

Ø |

Commercial Real Estate Owner-Occupied |

Ø |

Commercial Real Estate Nonowner-Occupied |

Ø |

Commercial Other |

· |

Method: Cohort |

Ø |

Residential Real Estate |

Ø |

Construction & Land Development |

Ø |

Consumer |

Ø |

Bankcard |

• |

Presenting accrued interest receivable balances separately from their underlying instruments within the consolidated statements of financial condition. |

• |

Excluding accrued interest receivable that is included in the amortized cost of financing receivables from related disclosure requirements. |

• |

Continuing our policy to write off accrued interest receivable by reversing interest income in cases where the Company does not reasonably expect to receive payment. |

• |

Generally, not measuring an allowance for credit losses for accrued interest receivable due to the Company’s policy of writing off uncollectible accrued interest receivable balances in a timely manner. However, due to loan interest payment deferrals on certain loans and leases granted by United under the CARES Act, United assessed the collectability of the accrued interest receivables on these deferring loans and leases. As a result of this assessment, United recorded an allowance for credit losses of $ |

Year Ended December 31 |

||||||||||||

(Dollars in thousands, except per share) |

2020 |

2019 |

2018 |

|||||||||

Distributed earnings allocated to common stock |

$ |

$ |

$ |

|||||||||

Undistributed earnings allocated to common stock |

||||||||||||

Net earnings allocated to common shareholders |

$ |

$ |

$ |

|||||||||

Average common shares outstanding |

||||||||||||

Dilutive effect of stock compensation |

||||||||||||

Average diluted shares outstanding |

||||||||||||

Earnings per basic common share |

$ |

$ |

$ |

|||||||||

Earnings per diluted common share |

$ |

$ |

$ |

|||||||||

Level 1 |

- |

Valuation is based on quoted prices in active markets for identical assets and liabilities. | ||

Level 2 |

- |