Table of Contents

FORM 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2011

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 0-13322

United Bankshares, Inc.

(Exact name of registrant as specified in its charter)

| West Virginia | 55-0641179 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 300 United Center 500 Virginia Street, East Charleston, West Virginia |

25301 | |

| (Address of principal executive offices) |

(Zip Code) | |

Registrant’s telephone number, including area code: (304) 424-8704

Securities registered pursuant to section 12(b) of the Act:

| Common Stock, $2.50 Par Value | NASDAQ Global Select Market | |

| (Title of class) | (Name of exchange on which registered) |

Securities registered pursuant to 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ X ] No [ ]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or

Section 15(d) of the Act. Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Table of Contents

UNITED BANKSHARES, INC.

FORM 10-K

(Continued)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ X ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer [ X ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] |

Smaller reporting company [ ] | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [ X ]

The aggregate market value of United Bankshares, Inc. common stock, representing all of its voting stock that was held by non-affiliates on June 30, 2011, was approximately $960,832,558.

As of January 31, 2012, United Bankshares, Inc. had 50,212,948 shares of common stock outstanding with a par value of $2.50.

Documents Incorporated By Reference

Definitive Proxy Statement dated April 9, 2012 for the 2012 Annual Shareholders’ Meeting to be held on May 21, 2012, portions of which are incorporated by reference in Part III of this Form 10-K.

2

Table of Contents

UNITED BANKSHARES, INC.

FORM 10-K

(Continued)

As of the date of filing this Annual report, neither the annual shareholders’ report for the year ended December 31, 2011, nor the proxy statement for the annual United shareholders’ meeting has been mailed to shareholders.

| Page | ||||||

| Part I | ||||||

| Item 1. |

4 | |||||

| Item 1A. |

13 | |||||

| Item 1B. |

17 | |||||

| Item 2. |

17 | |||||

| Item 3. |

18 | |||||

| Item 4. |

18 | |||||

| Part II | ||||||

| Item 5. |

19 | |||||

| Item 6. |

23 | |||||

| Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

23 | ||||

| Item 7A. |

50 | |||||

| Item 8. |

55 | |||||

| Item 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES |

116 | ||||

| Item 9A. |

116 | |||||

| Item 9B. |

116 | |||||

| Part III | ||||||

| Item 10. |

117 | |||||

| Item 11. |

117 | |||||

| Item 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

117 | ||||

| Item 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

117 | ||||

| Item 14. |

118 | |||||

| Part VI | ||||||

| Item 15. |

119 | |||||

3

Table of Contents

UNITED BANKSHARES, INC.

| Item 1. | BUSINESS |

Organizational History and Subsidiaries

United Bankshares, Inc. (United) is a West Virginia corporation registered as a bank holding company pursuant to the Bank Holding Company Act of 1956, as amended. United was incorporated on March 26, 1982, organized on September 9, 1982, and began conducting business on May 1, 1984 with the acquisition of three wholly-owned subsidiaries. Since its formation in 1982, United has acquired twenty-eight banking institutions. As of December 31, 2011, United has three banking subsidiaries (the Banking Subsidiaries). Two are doing business under the name of United Bank, one operating under the laws of West Virginia referred to as United Bank (WV) and the other operating under the laws of Virginia referred to as United Bank (VA). United’s other banking subsidiary is Centra Bank, Inc. or Centra Bank which was acquired on July 8, 2011 and operates under the laws of West Virginia. United’s Banking Subsidiaries offer a full range of commercial and retail banking services and products. United also owns nonbank subsidiaries which engage in other community banking services such as asset management, real property title insurance, investment banking, financial planning, and brokerage services.

Employees

As of December 31, 2011, United and its subsidiaries had approximately 1,619 full-time equivalent employees and officers. None of these employees are represented by a collective bargaining unit and management considers employee relations to be excellent.

Web Site Address

United’s web site address is “www.ubsi-inc.com”. United makes available free of charge on its web site the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments thereto, as soon as reasonably practicable after United files such reports with the Securities and Exchange Commission (SEC). The reference to United’s web site does not constitute incorporation by reference of the information contained in the web site and should not be considered part of this document. These reports are also available at the SEC’s Public Reference Room at 450 Fifth Street, N.W., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Business of United

As a bank holding company registered under the Bank Holding Company Act of 1956, as amended, United’s present business is community banking. As of December 31, 2011, United’s consolidated assets approximated $8.5 billion and total shareholders’ equity approximated $969 million.

United is permitted to acquire other banks and bank holding companies, as well as thrift institutions. United is also permitted to engage in certain non-banking activities which are closely related to banking under the provisions of the Bank Holding Company Act and the Federal Reserve Board’s Regulation Y. Management continues to consider such opportunities as they arise, and in this regard, management from time to time makes inquiries, proposals, or expressions of interest as to potential opportunities, although no agreements or understandings to acquire other banks or bank holding companies or nonbanking subsidiaries or to engage in other nonbanking activities, other than those identified herein, presently exist. See Note B—Notes to Consolidated Financial Statements for a discussion of United’s most recent acquisition of Centra Financial Holdings, Inc. which occurred on July 8, 2011.

4

Table of Contents

Business of Banking Subsidiaries

United, through its subsidiaries, engages primarily in community banking and offers most banking products and services permitted by law and regulation. Included among the banking services offered are the acceptance of deposits in checking, savings, time and money market accounts; the making and servicing of personal, commercial, floor plan and student loans; and the making of construction and real estate loans. Also offered are individual retirement accounts, safe deposit boxes, wire transfers and other standard banking products and services. As part of their lending function, the Banking Subsidiaries offer credit card services.

United Bank (WV) and United Bank (VA) each maintain a trust department which acts as trustee under wills, trusts and pension and profit sharing plans, as executor and administrator of estates, and as guardian for estates of minors and incompetents, and in addition performs a variety of investment and security services. Trust services are available to customers of affiliate banks. United Bank (WV) provides services to its correspondent banks such as check clearing, safekeeping and the buying and selling of federal funds.

United Brokerage Services, Inc., a wholly-owned subsidiary of United Bank (WV), is a fully-disclosed broker/dealer and a registered Investment Advisor with the National Association of Securities Dealers, Inc., the Securities and Exchange Commission, and a member of the Securities Investor Protection Corporation. United Brokerage Services, Inc. offers a wide range of investment products as well as comprehensive financial planning and asset management services to the general public.

United Bank (WV) and Centra Bank are members of a network of automated teller machines known as the New York Currency Exchange (NYCE) ATM network. United Bank (VA) is currently a member of the STAR network but will be converting to the NYCE network in March of 2012. The NYCE is an interbank network connecting the ATMs of various financial institutions in the United States and Canada.

United through its Banking Subsidiaries offers an Internet banking service, Smart Touch Online Banking, which allows customers to perform various transactions using a computer from any location as long as they have access to the Internet and a secure browser. Specifically, customers can check personal account balances, receive information about transactions within their accounts, make transfers between accounts, stop payment on a check, and reorder checks. Customers may also pay bills online and can make payments to virtually any business or individual. Customers can set up recurring fixed payments, one-time future payments or a one-time immediate payment. Customers can also set up their own merchants, view and modify that merchant list, view pending transactions and view their bill payment history with approximately three (3) months of history.

United also offers an automated telephone banking system, Telebanc, which allows customers to access their personal account(s) or business account(s) information from a touch-tone telephone.

Lending Activities

United’s loan portfolio, net of unearned income, increased $976.4 million to $6.2 billion in 2011 mainly as a result of the acquisition of Centra Financial Holdings, Inc. (Centra) which added approximately $1.0 billion, including purchase accounting amounts, in portfolio loans. The loan portfolio is comprised of commercial, real estate and consumer loans including credit card and home equity loans. Virtually all classifications of loans increased for 2011 due to the Centra acquisition. Commercial real estate loans and commercial loans (not secured by real estate) increased $497.4 million or 27.6% and $173.9 million or 16.8%, respectively. Residential real estate loans increased $197.3 million or 11.6% and construction loans increased $78.9 million or 16.8%. Consumer loans increased $29.4 million or 11.5%.

Commercial Loans

The commercial loan portfolio consists of loans to corporate borrowers primarily in small to mid-size industrial and commercial companies, as well as automobile dealers, service, retail and wholesale merchants. Collateral securing these loans includes equipment, machinery, inventory, receivables, vehicles and commercial real estate. Commercial loans are considered to contain a higher level of risk than other loan types although care is

5

Table of Contents

taken to minimize these risks. Numerous risk factors impact this portfolio including industry specific risks such as economy, new technology, labor rates and cyclicality, as well as customer specific factors, such as cash flow, financial structure, operating controls and asset quality. United diversifies risk within this portfolio by closely monitoring industry concentrations and portfolios to ensure that it does not exceed established lending guidelines. Diversification is intended to limit the risk of loss from any single unexpected economic event or trend. Underwriting standards require a comprehensive credit analysis and independent evaluation of virtually all larger balance commercial loans by the loan committee prior to approval.

Real Estate Loans

Commercial real estate loans consist of commercial mortgages, which generally are secured by nonresidential and multi-family residential properties. Also included in this portfolio are loans that are secured by owner-occupied real estate, but made for purposes other than the construction or purchase of real estate. Commercial real estate loans are to many of the same customers and carry similar industry risks as the commercial loan portfolio. Real estate mortgage loans to consumers are secured primarily by a first lien deed of trust. These loans are traditional one-to-four family residential mortgages. The loans generally do not exceed an 80% loan to value ratio at the loan origination date and most are at a variable rate of interest. These loans are considered to be of normal risk. Also included in the category of real estate mortgage loans are home equity loans.

As of December 31, 2011, approximately $394.2 million or 6.3% of United’s loan portfolio were real estate loans that met the regulatory definition of a high loan-to-value loan. A high loan-to-value real estate loan is defined as any loan, line of credit, or combination of credits secured by liens on or interests in real estate that equals or exceeds a certain percentage established by United’s primary regulator of the real estate’s appraised value, unless the loan has other appropriate credit support. The certain percentage varies depending on the loan type and collateral. Appropriate credit support may include mortgage insurance, readily marketable collateral, or other acceptable collateral that reduces the loan-to-value ratio below the certain percentage. Of the $394.2 million, $138.8 million is secured by first deeds of trust on residential real estate with $124.4 million of that total falling in a loan-to-value (LTV) range of 90% to 100% and $14.4 million above a LTV of 100%; $15.5 million is secured by subordinate deeds of trust on residential real estate with $10.9 million between a LTV of 90% to 100% and $4.6 million above a LTV of 100%; and $174.9 million is secured by commercial real estate generally ranging from the regulatory limit for the type of commercial real estate up to a LTV of 100%. Of the $174.9 million high loan to value commercial loans, $63.7 million are classified as Other Construction Loans and Land Loans, $60.7 million are Non-residential Secured, $11.4 million are Commercial Owner occupied properties, $28.3 million are 1-4 family Residential Secured properties, $5.4 million are Multi-family Residential Secured properties, $4.6 million are Residential Construction Loans and the remaining $864 thousand are secured by farmland.

Consumer Loans

Consumer loans are secured by automobiles, boats, recreational vehicles, and other personal property. Personal loans, student loans and unsecured credit card receivables are also included as consumer loans. United monitors the risk associated with these types of loans by monitoring such factors as portfolio growth, lending policies and economic conditions. Underwriting standards are continually evaluated and modified based upon these factors.

Underwriting Standards

United’s loan underwriting guidelines and standards are updated periodically and are presented for approval by the respective Boards of Directors of each of its subsidiary banks. The purpose of the standards and guidelines is to grant loans on a sound and collectible basis; to invest available funds in a safe, profitable manner; to serve the legitimate credit needs of the communities of United’s primary market area; and to ensure that all loan applicants receive fair and equal treatment in the lending process. It is the intent of the underwriting guidelines and standards to: minimize loan losses by carefully investigating the credit history of each applicant, verify the source of repayment and the ability of the applicant to repay, collateralize those loans in which collateral is deemed to be required, exercise care in the documentation of the application, review, approval, and origination process, and administer a comprehensive loan collection program.

6

Table of Contents

United’s underwriting standards and practices are designed to originate both fixed and variable rate loan products in a manner which is consistent with the prudent banking practices applicable to these exposures. Typically, both fixed and variable rate loan underwriting practices incorporate conservative methodology, including the use of stress testing for commercial loans, and other product appropriate measures designed to provide an adequate margin of safety for the full collection of both principal and interest within contractual terms. Consumer real estate secured loans are underwritten to the initial rate, and to a higher assumed rate commensurate with normal market conditions. Therefore, it is the intent of United’s underwriting standards to insure that adequate primary repayment capacity exists to address both future increases in interest rates, and fluctuations in the underlying cash flows available for repayment. Historically, and at December 31, 2011, United has not offered “teaser rate” loans, and had no loan portfolio products which were specifically designed for “sub-prime” borrowers. Management defines “sub-prime” borrowers as consumer borrowers with a credit score of less than 660.

The above guidelines are adhered to and subject to the experience, background and personal judgment of the loan officer assigned to the loan application. A loan officer may grant, with justification, a loan with variances from the underwriting guidelines and standards. However, the loan officer may not exceed his or her respective lending authority without obtaining the prior, proper approval as outlined in United’s loan policy from a superior, a regional supervisor or market president (dual approval per policy) or the Loan Committee, whichever is deemed appropriate for the nature of the variance.

Loan Concentrations

United has commercial loans, including real estate and owner-occupied, income-producing real estate and land development loans, of approximately $4.0 billion as of December 31, 2011. These loans are primarily secured by real estate located in West Virginia, southeastern Ohio, southwestern Pennsylvania, Virginia, Maryland and the District of Columbia. United categorizes these commercial loans by industry according to the North American Industry Classification System (NAICS) to monitor the portfolio for possible concentrations in one or more industries. As of the most recent fiscal year-end, United has two such industry classifications that exceeded 10% of total loans. As of December 31, 2011, approximately $1.7 billion or 26.5% and $639.5 million or 10.3% of United’s total loan portfolio were for the purpose of renting or leasing real estate and construction, respectively. The loans were originated by United’s subsidiary banks using underwriting standards as set forth by management. United’s loan administration policies are focused on the risk characteristics of the loan portfolio, including commercial real estate loans, in terms of loan approval and credit quality. It is the opinion of management that these loans do not pose any unusual risks and that adequate consideration has been given to the above loans in establishing the allowance for loan losses.

Secondary Markets

United generally originates loans within the primary market area of its banking subsidiaries. United may from time to time make loans to borrowers and/or on properties outside of its primary market area as an accommodation to its customers. Processing of all loans is centralized in the Charleston, West Virginia office. As of December 31, 2011, the balance of mortgage loans being serviced by United for others was insignificant.

United Bank (WV) and Centra Bank engage in the origination and acquisition of residential real estate loans for resale. These loans are for single-family, owner-occupied residences with either adjustable or fixed rate terms, with a variety of maturities tailored to effectively serve its markets. United Bank (WV)’s originations are predominately in its West Virginia markets while Centra Bank’s originations are mainly in West Virginia, Maryland and Pennsylvania. Mortgage loan originations are generally intended to be sold in the secondary market on a best efforts basis.

During 2011, United originated $67.0 million of real estate loans for sale in the secondary market and sold $72.0 million of loans designated as held for sale in the secondary market. Net gains on the sales of these loans during 2011 were $952 thousand.

7

Table of Contents

The principal sources of revenue from United’s mortgage banking business are: (i) loan origination fees; (ii) gains or losses from the sale of loans; and (iii) interest earned on mortgage loans during the period that they are held by United pending sale, if any.

Investment Activities

United’s investment policy stresses the management of the investment securities portfolio, which includes both securities held to maturity and securities available for sale, to maximize return over the long-term in a manner that is consistent with good banking practices and relative safety of principal. United currently does not engage in trading account activity. The Asset/Liability Management Committee of United is responsible for the coordination and evaluation of the investment portfolio.

Sources of funds for investment activities include “core deposits”. Core deposits include certain demand deposits, statement and special savings and NOW accounts. These deposits are relatively stable and they are the lowest cost source of funds available to United. Short-term borrowings have also been a significant source of funds. These include federal funds purchased, securities sold under agreements to repurchase and FHLB borrowings. Repurchase agreements represent funds that are generally obtained as the result of a competitive bidding process.

United’s investment portfolio is comprised of a significant amount of U.S. Treasury securities and obligations of U.S. Agencies and Corporations as well as mortgage-backed securities. Obligations of States and Political Subdivisions are comprised of primarily “AAA” rated municipal securities. Interest and dividends on securities for the years of 2011, 2010, and 2009 were $27.1 million, $39.3 million, and $55.5 million, respectively. For the years of 2011, 2010 and 2009, United recognized net losses on security transactions of $18.8 million, $7.8 million and $14.7 million, respectively. In the year 2011, United recognized other-than-temporary impairment (OTTI) charges of $20.4 million consisting primarily of $17.3 million on pooled trust preferred collateralized debt obligations (TRUP CDOs) and $3.2 million on collateralized mortgage obligations (CMOs), which are not expected to be sold. In the year 2010, United recognized other-than-temporary impairment charges of $9.8 million on certain investment securities consisting primarily of $7.3 million on pooled trust preferred collateralized debt obligations (TRUP CDOs), $1.2 million on collateralized mortgage obligations (CMOs) and $1.3 million on a certain investment security carried at cost.

Competition

United faces a high degree of competition in all of the markets it serves. United considers all of West Virginia to be included in its market area. This area includes the five largest West Virginia Metropolitan Statistical Areas (MSA): the Parkersburg MSA, the Charleston MSA, the Huntington MSA, the Wheeling MSA and the Weirton MSA. United serves the Ohio counties of Lawrence, Belmont, Jefferson and Washington and Fayette county in Pennsylvania primarily because of their close proximity to the Ohio and Pennsylvania borders and United banking offices located in those counties or in nearby West Virginia. United’s Virginia markets include the Maryland, northern Virginia and Washington, D.C. MSA, the Winchester MSA, the Harrisonburg MSA, and the Charlottesville MSA. United considers all of the above locations to be the primary market area for the business of its banking subsidiaries.

With prior regulatory approval, West Virginia and Virginia banks are permitted unlimited branch banking throughout each state. In addition, interstate acquisitions of and by West Virginia and Virginia banks and bank holding companies are permissible on a reciprocal basis, as well as reciprocal interstate acquisitions by thrift institutions. These conditions serve to intensify competition within United’s market.

As of December 31, 2011, there were 68 bank holding companies operating in the State of West Virginia registered with the Federal Reserve System and the West Virginia Board of Banking and Financial Institutions and 101 bank holding companies operating in the Commonwealth of Virginia registered with the Federal Reserve System and the Virginia Corporation Commission. These holding companies are headquartered in various states and control banks throughout West Virginia and Virginia, which compete for business as well as for the acquisition

8

Table of Contents

of additional banks.

Economic Characteristics of Primary Market Area

As of December 2011, West Virginia’s unemployment rate was 7.7% according to information from West Virginia’s Bureau of Employment Programs. The number of unemployed state residents rose 4,800 to 59,600 for the month of December as compared to the month of November. Total unemployment was down 13,400 over the year of 2011. The state unemployment rate of 7.7% for December 2011 was an increase from a rate of 7.1% for the month of November 2011 but a decline from 9.5% for December 2010. West Virginia’s seasonally adjusted unemployment rate remained at 7.9% in December, while the national rate declined two-tenths of a percentage point to 8.5%. West Virginia is expected to post modest job growth in 2012 according to the latest forecast from the West Virginia University College of Business and Economics. Overall, the state is likely to continue to expand during the next five years, assuming the national economy avoids recession. The forecast calls for West Virginia’s job growth to average 1.0% per year during the 2011-2016 period. Job growth in natural resources and mining is expected to slow significantly during the next five years. This reflects contrasting trends in coal mining and oil and gas extraction. The forecast calls for coal production to decline significantly during the next five years. Declining coal production in the future reflects the increasingly challenging geologic conditions in the southern part of the state, as well as the cumulative effect of a number of regulatory policies related to concerns about air and water quality. In addition, natural gas is expected to be a more potent competitor in the future. While construction and manufacturing employment are expected to expand modestly during the forecast, most job growth is expected in the service-providing industries, particularly health care; professional and business services; and trade, transportation, and utilities. Job gains in health care are related to the aging of the state’s residents and to the continued funding growth in Medicare and Medicaid. Jobs in professional and business services are expected to expand as state and national growth raises demand for business services like accounting, legal, management, computing and call center services. The trade, transportation and utilities sector should add jobs during the next five years, with growth expected to be strongest in the near term.

United’s Virginia subsidiary banking offices are located in markets that historically have reflected low unemployment rate levels. According to information available from the Virginia Employment Commission, Virginia’s seasonally adjusted unemployment rate as of December 2011 remained the same from November at 6.2% and was four-tenths of a percent below the year-ago December rate of 6.6%. The number of unemployed decreased by 1,726 while the labor force increased by 8,555, as an additional 10,281 people reported they were working. Virginia’s seasonally adjusted unemployment rate of 6.2% continues to be below the national rate of 8.5%. In Northern Virginia, which represents 36% of all jobs in the state, total employment rose by 28,800 jobs. The professional and business services sector added 10,900 new jobs in 2011. The government sector added 3,000 jobs. The housing market improved, with the construction and financial activities sectors adding a combined 200 jobs for the year. Employment in Virginia is expected to modestly increase by 1.2% and 1.0 % in 2012 and 2013, respectively. Much of the growth will be in the services sector. Growth in employment sectors related to the housing industry is anticipated to be sluggish. The government employment sector is expected to continue to shed jobs. Construction employment is expected to grow slightly in 2012 which would mark the first year of growth in this sector since 2006. Employment in trade, transportation and utilities is expected to increase as well in 2012.

Regulation and Supervision

United, as a bank holding company, is subject to the restrictions of the Bank Holding Company Act of 1956, as amended, and is registered pursuant to its provisions. As such, United is subject to the reporting requirements of and examination by the Board of Governors of the Federal Reserve System (Board of Governors).

The Bank Holding Company Act prohibits the acquisition by a bank holding company of direct or indirect ownership of more than five percent of the voting shares of any bank within the United States without prior approval of the Board of Governors. With certain exceptions, a bank holding company also is prohibited from acquiring direct or indirect ownership or control of more than five percent of the voting shares of any company which is not a bank, and from engaging directly or indirectly in business unrelated to the business of banking, or managing or controlling banks.

9

Table of Contents

The Board of Governors, in its Regulation Y, permits bank holding companies to engage in preapproved non-banking activities closely related to banking or managing or controlling banks. Approval of the Board of Governors is necessary to engage in certain other non-banking activities which are not preapproved or to make acquisitions of corporations engaging in these activities. In addition, on a case-by-case basis, the Board of Governors may approve other non-banking activities.

On July 30, 2002, the President of the United States signed into law the Sarbanes-Oxley Act of 2002, a broad accounting, auditing, disclosure and corporate governance reform law. The legislation was passed in an effort to increase corporate responsibility by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws and to allow stockholders to more easily and efficiently monitor the performance of companies and directors.

On October 3, 2008, the Emergency Economic Stabilization Act of 2008 (the EESA) was signed into law. EESA temporarily raised the limit on federal deposit insurance coverage from $100,000 to $250,000 per depositor. Separate from EESA, in October 2008, the Federal Deposit Insurance Corporation (FDIC) also announced the Temporary Liquidity Guarantee Program (TLGP) to guarantee eligible newly issued senior unsecured debt by FDIC-insured institutions through October 31, 2009. Under one component of this program, the Transaction Account Guaranty Program (TAGP), the FDIC temporarily provided a full guarantee on all noninterest-bearing transaction accounts held by any depositor, regardless of dollar amount, through December 31, 2009. The $250,000 deposit insurance coverage limit was scheduled to return to $100,000 on January 1, 2010, but was extended by congressional action until December 31, 2013. The TLGP expired on December 31, 2010 while the TAGP expired on June 30, 2010. As discussed on the following page, separate temporary unlimited coverage for noninterest-bearing transaction accounts became effective on December 31, 2010 and will last until December 31, 2012.

On July 21, 2010, President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act), into law. The Dodd-Frank Act significantly changes regulation of financial institutions and the financial services industry. The Dodd-Frank Act includes, among other things, provisions creating a Financial Services Oversight Council to identify emerging systemic risks and improve interagency cooperation; centralizing the responsibility for consumer financial protection by creating a new agency, the Consumer Financial Protection Bureau, which will be responsible for implementing, examining and enforcing compliance with federal consumer financial laws; permanently raising the current standard maximum deposit insurance amount to $250,000; establishing strengthened capital standards for banks, and disallowing trust preferred securities as qualifying for Tier 1 capital (subject to certain grandfather provisions for existing trust preferred securities); establishing new minimum mortgage underwriting standards; granting the Federal Reserve Board the power to regulate debit card interchange fees; and implementing corporate governance changes. Many aspects of the Dodd-Frank Act are subject to rulemaking that will take effect over several years, thus making it difficult to assess all the effects the Dodd-Frank Act will have on the financial industry, including United, at this time.

As a bank holding company doing business in West Virginia, United is also subject to regulation and examination by the West Virginia Board of Banking and Financial Institutions (the West Virginia Banking Board) and must submit annual reports to the West Virginia Banking Board. Further, any acquisition application that United must submit to the Board of Governors must also be submitted to the West Virginia Banking Board for approval.

United is also under the jurisdiction of the SEC and certain state securities commissions in regard to the offering and sale of its securities. Generally, United must file under the Securities Exchange Act of 1933, as amended, to issue additional shares of its common stock. United is also registered under and is subject to the regulatory and disclosure requirements of the Securities Exchange Act of 1934, as amended, as administered by the SEC. United is listed on the NASDAQ Global Select Market under the quotation symbol “UBSI,” and is subject to the rules of the NASDAQ for listed companies.

United Bank (WV) and United Bank (VA), as state member banks, are subject to supervision, examination

10

Table of Contents

and regulation by the Federal Reserve System, and as such, are subject to applicable provisions of the Federal Reserve Act and regulations issued thereunder. Centra Bank is subject to supervision, examination and regulation by the FDIC. Each Banking Subsidiary is subject to regulation by its state banking authority.

Deposit Insurance

The deposits of United’s Banking Subsidiaries are insured by the FDIC to the extent provided by law. Accordingly, these Banking Subsidiaries are also subject to regulation by the FDIC. The Banking Subsidiaries are subject to deposit insurance assessments to maintain the Deposit Insurance Fund (DIF) of the FDIC. The FDIC utilizes a risk-based assessment system that imposes insurance premiums based upon a risk matrix that takes into account a bank’s capital level and supervisory rating (CAMELS rating). The risk matrix utilizes four risk categories which are distinguished by capital levels and supervisory ratings.

In December 2008, the FDIC issued a final rule that raised assessment rates for the first quarter of 2009 by a uniform 7 basis points, resulting in a range between 12 and 50 basis points, depending upon the risk category. In March 2009, the FDIC issued final rules to further change the assessment system beginning in the second quarter of 2009. The changes commenced April 1, 2009 to ensure that riskier institutions bear a greater share of the increase in assessments, and are subsidized to a lesser degree by less risky institutions.

In May 2009, the FDIC issued a final rule which levied a special assessment applicable to all insured depository institutions totaling 5 basis points of each institution’s total assets less Tier 1 capital as of June 30, 2009, not to exceed 10 basis points of domestic deposits. The special assessment was part of the FDIC’s efforts to rebuild the DIF. United’s deposit insurance expense during 2009 included $3.6 million recognized in the second quarter related to the special assessment.

In November 2009, the FDIC issued a rule that required all insured depository institutions, with limited exceptions, to prepay their estimated quarterly risk-based assessments for the fourth quarter of 2009 and for all of 2010, 2011 and 2012. The FDIC also adopted a uniform three-basis point increase in assessment rates effective on January 1, 2011; however, as further discussed below, the FDIC has elected to forego this increase under a new DIF restoration plan adopted in October 2010.

In December 2009, United paid $36.4 million in prepaid risk-based assessments, of which $20.7 million is remaining and included in other assets in the accompanying Consolidated Balance Sheet as of December 31, 2011.

In October 2010, the FDIC adopted a new DIF restoration plan to ensure that the fund reserve ratio reaches 1.35% by September 30, 2020, as required by the Dodd-Frank Act. Under the new restoration plan, the FDIC will update its loss and income projections at least semi-annually for the fund and, if needed, will increase or decrease assessment rates, following notice-and-comment rulemaking if required.

In November 2010, the FDIC issued a final rule to implement provisions of the Dodd-Frank Act that provide for temporary unlimited coverage for non-interest-bearing transaction accounts. The separate coverage for non-interest-bearing transaction accounts became effective on December 31, 2010 and terminates on December 31, 2012.

In April 2011, the FDIC implemented rulemaking under the Dodd-Frank Act to reform the deposit insurance assessment system. The final rule redefined the assessment base used for calculating deposit insurance assessments. Specifically, the rule bases assessments on an institution’s total assets less tangible capital, as opposed to total deposits. Since the new base is larger than the prior base, the FDIC also proposed lowering assessment rates so that the rules would not significantly alter the total amount of revenue collected from the industry. The new assessment scale ranges from 2.5 basis points for the least risky institutions to 45 basis points for the riskiest.

United’s FDIC insurance expense totaled $8.5 million, $9.7 million and $9.2 million in 2011, 2010 and 2009, respectively.

11

Table of Contents

Capital Requirements

As a bank holding company, United is subject to consolidated regulatory capital requirements administered by the Federal Reserve Board. United’s Banking Subsidiaries are also subject to the capital requirements administered by the Federal Reserve Board. The Federal Reserve Board’s risk-based capital guidelines are based upon the 1988 capital accord (Basel I) of the Basel Committee on Banking Supervision (the Basel Committee). The requirements are intended to ensure that banking organizations have adequate capital given the risk levels of assets and off-balance sheet financial instruments. Under the requirements, banking organizations are required to maintain minimum ratios for Tier 1 capital and total capital to risk-weighted assets (including certain off-balance sheet items, such as letters of credit). For purposes of calculating the ratios, a banking organization’s assets and some of its specified off-balance sheet commitments and obligations are assigned to various risk categories.

United and its Banking Subsidiaries are currently required to maintain Tier 1 capital and “total capital” (the sum of Tier 1 and Tier 2 capital) equal to at least 4.0% and 8.0%, respectively, of its total risk-weighted assets (including various off-balance-sheet items, such as letters of credit). In addition, for a depository institution to be considered “well capitalized” under the regulatory framework for prompt corrective action, its Tier 1 and total capital ratios must be at least 6.0% and 10.0% on a risk-adjusted basis, respectively. Bank holding companies and banks are also required to comply with minimum leverage ratio requirements. The leverage ratio is the ratio of a banking organization’s Tier 1 capital to its total adjusted quarterly average assets (as defined for regulatory purposes). The requirements necessitate a minimum leverage ratio of 4.0% for United and its banking subsidiaries. In addition, for a depository institution to be considered “well capitalized” under the regulatory framework for prompt corrective action, its leverage ratio must be at least 5.0%.

In 2004, the Basel Committee published a new capital accord (Basel II) to replace Basel I. A definitive final rule for implementing the advanced approaches of Basel II in the United States, which applies only to certain large or internationally active banking organizations, or “core banks” – defined as those with consolidated total assets of $250 billion or more or consolidated on-balance sheet foreign exposures of $10 billion or more, became effective as of April 1, 2008. United and its banking subsidiaries were not required to comply with the advanced approaches of Basel II.

In December 2010, the Basel Committee released its final framework for strengthening international capital and liquidity regulation, now officially identified by the Basel Committee as “Basel III”. Basel III, when implemented by the U.S. banking agencies and fully phased-in, will require bank holding companies and their bank subsidiaries to maintain substantially more capital, with a greater emphasis on common equity.

The Basel Committee continued to refine Basel III during 2011 and plans to make further technical adjustments, especially relating to the new liquidity requirements. Capital and liquidity standards consistent with Basel III will be formally implemented in the United States through a series of rulemakings. The U.S. banking agencies intend to issue a notice of proposed rulemaking during the first quarter of 2012 and a final rule later in the year that would implement the Basel III capital reforms. The capital surcharge for the largest banks and liquidity standards are expected to be implemented through subsequent rulemakings. On November 22, 2011, the Federal Reserve Board issued a final rule requiring top-tier U.S. bank holding companies with total consolidated assets of $50 billion or more to submit annual capital plans for review. In addition, the Federal Reserve also expects these banks to demonstrate that they can achieve the capital ratios required by the Basel III framework as applied to the U.S. In the coming months, we should see the issuance of new rules and additional guidance on Basel III implementation clarifying regulatory expectations for U.S. banking institutions, including smaller, less complex U.S. banks.

In addition to Basel III, the Dodd-Frank Act requires or permits the Federal banking agencies to adopt regulations affecting banking institutions’ capital requirements in a number of respects, including potentially more stringent capital requirements for systemically important financial institutions. Accordingly, the regulations ultimately applicable to United and its banking subsidiaries may be substantially different from the Basel III

12

Table of Contents

final framework as published in December 2010 and refined in 2011. Requirements to maintain higher levels of capital or to maintain higher levels of liquid assets could adversely impact United’s net income and return on equity.

| Item 1A. | RISK FACTORS |

United is subject to risks inherent to the Company’s business. The material risks and uncertainties that management believes affect the Company are described below. Before making an investment decision, you should carefully consider the risks and uncertainties described below together with all of the other information included or incorporated by reference in this report. The risks and uncertainties described below are not the only ones facing the Company. Additional risks and uncertainties that management is not aware of or focused on or that management currently deems immaterial may also impair United’s business operations. This report is qualified in its entirety by these risk factors.

United’s business may be adversely affected by conditions in financial markets and economic conditions generally

United’s business is concentrated in the West Virginia, Northern Virginia and Shenandoah Valley Virginia market areas. As a result, its financial condition, results of operations and cash flows are subject to changes if there are changes in the economic conditions in these areas. A prolonged period of economic recession or other adverse economic conditions in these areas could have a negative impact on United. A significant decline in general economic conditions nationally, caused by inflation, recession, acts of terrorism, outbreak of hostilities or other international or domestic occurrences, unemployment, changes in securities markets, declines in the housing market, a tightening credit environment or other factors could impact these local economic conditions and, in turn, have a material adverse effect on United’s financial condition and results of operations which occurred during this past year.

Economic conditions began deteriorating during the latter half of 2007 and continued throughout 2011. Business activity across a wide range of industries and regions has been greatly reduced and many businesses are experiencing serious difficulties due to a lack of consumer spending and the lack of liquidity in credit markets. Unemployment has also increased significantly. As a result of this economic crisis, many lending institutions, including United, have experienced declines in the performance of their loans, including construction, land development and land loans, commercial loans and consumer loans. Moreover, competition among depository institutions for deposits and quality loans has increased significantly. In addition, the values of real estate collateral supporting many commercial loans and home mortgages have declined and may continue to decline. Overall, the general business environment has had an adverse effect on United’s business, and there can be no assurance that the environment will improve in the near term. Accordingly, until conditions improve, United’s business, financial condition and results of operations could continue to be adversely affected.

The value of certain investment securities is volatile and future declines or other-than-temporary impairments could have a materially adverse affect on future earnings and regulatory capital

Continued volatility in the fair value for certain investment securities, whether caused by changes in market conditions, interest rates, credit risk of the issuer, the expected yield of the security, or actual defaults in the portfolio could result in significant fluctuations in the value of the securities. This could have a material adverse impact on United’s accumulated other comprehensive income and shareholders’ equity depending on the direction of the fluctuations. Furthermore, future downgrades or defaults in these securities could result in future classifications as other-than-temporarily impaired. This could have a material impact on United’s future earnings, although the impact on shareholders’ equity will be offset by any amount already included in other comprehensive income for securities that were temporarily impairment.

There are no assurances as to adequacy of the allowance for credit losses

United believes that its allowance for credit losses is maintained at a level appropriate to absorb any

13

Table of Contents

probable losses in its loan portfolio given the current information known to management.

Management establishes the allowance based upon many factors, including, but not limited to:

| • | historical loan loss experience; |

| • | industry diversification of the commercial loan portfolio; |

| • | the effect of changes in the local real estate market on collateral values; |

| • | the amount of nonperforming loans and related collateral security; |

| • | current economic conditions that may affect the borrower’s ability to pay and value of collateral; |

| • | volume, growth and composition of the loan portfolio; and |

| • | other factors management believes are relevant. |

These determinations are based upon estimates that are inherently subjective, and their accuracy depends on the outcome of future events, so ultimate losses may differ from current estimates. Changes in economic, operating and other conditions, including changes in interest rates, that are generally beyond United’s control, can affect the Company’s credit losses. With unfavorable economic conditions since the end of 2007, United’s credit losses have been on the rise. If the economic conditions do not improve or continue to decline, United’s credit losses could continue to increase, perhaps significantly. As a result, such losses could exceed United’s current allowance estimates. United can provide no assurance that its allowance is sufficient to cover actual credit losses should such losses differ substantially from our current estimates.

In addition, federal and state regulators, as an integral part of their respective supervisory functions, periodically review United’s allowance for credit losses.

Changes in interest rates may adversely affect United’s business

United’s earnings, like most financial institutions, are significantly dependent on its net interest income. Net interest income is the difference between the interest income United earns on loans and other assets which earn interest and the interest expense incurred to fund those assets, such as on savings deposits and borrowed money. Therefore, changes in general market interest rates, such as a change in the monetary policy of the Board of Governors of the Federal Reserve System or otherwise beyond those which are contemplated by United’s interest rate risk model and policy, could have an effect on net interest income. For more information concerning United’s interest rate risk model and policy, see the discussion under the caption “Quantitative and Qualitative Disclosures About Market Risk” under Item 7A.

United is subject to credit risk

There are risks inherent in making any loan, including risks with respect to the period of time over which the loan may be repaid, risks resulting from changes in economic and industry conditions, risks inherent in dealing with individual borrowers and risks resulting from uncertainties as to the future value of collateral. United seeks to mitigate the risk inherent in its loan portfolio by adhering to prudent loan approval practices. Although United believes that its loan approval criteria are appropriate for the various kinds of loans the Company makes, United may incur losses on loans that meet our loan approval criteria. Due to recent economic conditions affecting the real estate market, many lending institutions, including United, have experienced substantial declines in the performance of their loans, including construction, land development and land loans. The value of real estate collateral supporting many construction and land development loans, land loans, commercial and multi-family loans have declined and may continue to decline. United cannot assure that the economic conditions affecting customers and the quality of the loan portfolio will improve and thus, United’s financial condition and results of operations could continue to be adversely affected.

14

Table of Contents

Loss of United’s Chief Executive Officer or other executive officers could adversely affect its business

United’s success is dependent upon the continued service and skills of its executive officers and senior management. If United loses the services of these key personnel, it could have a negative impact on United’s business because of their skills, years of industry experience and the difficulty of promptly finding qualified replacement personnel. The services of Richard M. Adams, United’s Chief Executive Officer, would be particularly difficult to replace. United and Mr. Adams are parties to an Employment Agreement providing for his continued employment by United through March 31, 2014.

United operates in a highly competitive market

United faces a high degree of competition in all of the markets it serves. United considers all of West Virginia to be included in its market area. This area includes the five largest West Virginia Metropolitan Statistical Areas (MSA): the Parkersburg MSA, the Charleston MSA, the Huntington MSA, the Wheeling MSA and the Weirton MSA. United serves the Ohio counties of Lawrence, Belmont, Jefferson and Washington and Fayette county in Pennsylvania primarily because of their close proximity to the Ohio and Pennsylvania borders and United banking offices located in those counties or in nearby West Virginia. United’s Virginia markets include the Maryland, northern Virginia and Washington, D.C. MSA, the Winchester MSA, the Harrisonburg MSA, and the Charlottesville MSA. United considers all of the above locations to be the primary market area for the business of its banking subsidiaries.

There is a risk that aggressive competition could result in United controlling a smaller share of these markets. A decline in market share could lead to a decline in net income which would have a negative impact on stockholder value.

Dividend payments by United’s subsidiaries to United and by United to its shareholders can be restricted

The declaration and payment of future cash dividends will depend on, among other things, United’s earnings, the general economic and regulatory climate, United’s liquidity and capital requirements, and other factors deemed relevant by United’s board of directors. Federal Reserve Board policy limits the payment of cash dividends by bank holding companies, without regulatory approval, and requires that a holding company serve as a source of strength to its banking subsidiaries.

United’s principal source of funds to pay dividends on its common stock is cash dividends from its subsidiaries. The payment of these dividends by its subsidiaries is also restricted by federal and state banking laws and regulations. As of December 31, 2011, an aggregate of approximately $24.0 million, $19.2 million and $1.8 million was available for dividend payments from United Bank (WV), United Bank (VA) and Centra Bank, respectively, to United without regulatory approval.

United may be adversely affected by the soundness of other financial institutions

Financial services institutions are interrelated as a result of trading, clearing, counterparty, or other relationships. United has exposure to many different industries and counterparties, and routinely executes transactions with counterparties in the financial services industry, including brokers and dealers, commercial banks, investment banks, mutual and hedge funds, or other institutional clients. Recent defaults by financial services institutions, and even rumors or questions about a financial institution or the financial services industry in general, have led to marketwide liquidity problems and could lead to losses or defaults by United or other institutions. Any such losses could adversely affect United’s financial condition or results of operations.

United is subject to extensive government regulation and supervision

United is subject to extensive federal and state regulation, supervision and examination. Banking regulations are primarily intended to protect depositors’ funds, federal deposit insurance funds and the banking system as a whole, not shareholders. These regulations affect United’s lending practices, capital structure, investment practices, dividend policy, operations and growth, among other things. These regulations also impose

15

Table of Contents

obligations to maintain appropriate policies, procedures and controls, among other things, to detect, prevent and report money laundering and terrorist financing and to verify the identities of United’s customers. Congress and federal regulatory agencies continually review banking laws, regulations and policies for possible changes. Changes to statutes, regulations or regulatory policies, including changes in interpretation or implementation of statutes, regulations or policies, could affect United in substantial and unpredictable ways. Such changes could subject the Company to additional costs, limit the types of financial services and products United may offer and/or increase the ability of nonbanks to offer competing financial services and products, among other things. United expends substantial effort and incurs costs to improve its systems, audit capabilities, staffing and training in order to satisfy regulatory requirements, but the regulatory authorities may determine that such efforts are insufficient. Failure to comply with relevant laws, regulations or policies could result in sanctions by regulatory agencies, civil money penalties and/or reputation damage, which could have a material adverse effect on United’s business, financial condition and results of operations. While the Company has policies and procedures designed to prevent any such violations, there can be no assurance that such violations will not occur. As an example, the FDIC imposed higher assessments on deposits in 2009 based on the adequacy of the deposit insurance fund, conditions of the banking industry and as a result of changes in specific programs. Recently, the Dodd-Frank Act changed the FDIC’s assessment base for federal deposit insurance from the amount of insured deposits to consolidated average assets less tangible capital. It is possible that United’s deposit insurance premiums could increase even more in the future under this new requirement.

In the normal course of business, United and its subsidiaries are routinely subject to examinations and challenges from federal and state tax authorities regarding the amount of taxes due in connection with investments that the Company has made and the businesses in which United has engaged. Recently, federal and state taxing authorities have become increasingly aggressive in challenging tax positions taken by financial institutions. These tax positions may relate to tax compliance, sales and use, franchise, gross receipts, payroll, property and income tax issues, including tax base, apportionment and tax credit planning. The challenges made by tax authorities may result in adjustments to the timing or amount of taxable income or deductions or the allocation of income among tax jurisdictions. If any such challenges are made and are not resolved in the Company’s favor, they could have a material adverse effect on United’s financial condition and results of operations.

United may elect or be compelled to seek additional capital in the future, but capital may not be available when it is needed

United is required by federal and state regulatory authorities to maintain adequate levels of capital to support the Company’s operations. In addition, United may elect to raise additional capital to support the Company’s business or to finance acquisitions, if any, or United may otherwise elect to raise additional capital. In that regard, a number of financial institutions have recently raised considerable amounts of capital as a result of deterioration in their results of operations and financial condition arising from the turmoil in the mortgage loan market, deteriorating economic conditions, declines in real estate values and other factors, which may diminish United’s ability to raise additional capital.

United’s ability to raise additional capital, if needed, will depend on conditions in the capital markets, economic conditions and a number of other factors, many of which are outside the Company’s control, and on United’s financial performance. Accordingly, United cannot be assured of its ability to raise additional capital if needed or on terms acceptable to the Company. If United cannot raise additional capital when needed, it may have a material adverse effect on the Company’s financial condition, results of operations and prospects.

United’s information systems may experience an interruption or breach in security

United relies heavily on communications and information systems to conduct its business. In addition, as part of its business, United collects, processes and retains sensitive and confidential client and customer information. United’s facilities and systems, and those of our third party service providers, may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human errors, or other similar events. Any failure, interruption or breach in security of these systems could result in failures or

16

Table of Contents

disruptions in the Company’s customer relationship management, general ledger, deposit, loan and other systems. While United has policies and procedures designed to prevent or limit the effect of the failure, interruption or security breach of its information systems, there can be no assurance that any such failures, interruptions or security breaches will not occur or, if they do occur, that they will be adequately addressed. The occurrence of any failures, interruptions or security breaches of the Company’s information systems could damage United’s reputation, result in a loss of customer business, subject United to additional regulatory scrutiny, or expose the Company to civil litigation and possible financial liability, any of which could have a material adverse effect on United’s financial condition and results of operations.

The Dodd-Frank Act may adversely affect United’s business, financial condition and results of operations.

The Dodd-Frank Act significantly changes regulation of financial institutions and the financial services industry. The Dodd-Frank Act includes, among other things, provisions creating a Financial Services Oversight Council to identify emerging systemic risks and improve interagency cooperation; centralizing the responsibility for consumer financial protection by creating a new agency, the Consumer Financial Protection Bureau, which will be responsible for implementing, examining and enforcing compliance with federal consumer financial laws; permanently raising the current standard maximum deposit insurance amount to $250,000; establishing strengthened capital standards for banks, and disallowing trust preferred securities as qualifying for Tier 1 capital (subject to certain grandfather provisions for existing trust preferred securities); establishing new minimum mortgage underwriting standards; granting the Federal Reserve Board the power to regulate debit card interchange fees; and implementing corporate governance changes. Many aspects of the Dodd-Frank Act are subject to rulemaking that will take effect over several years, thus making it difficult to assess all the effects the Dodd-Frank Act will have on the financial industry, including United, at this time. However, it is possible that United’s interest expense could increase and deposit insurance premiums could change, and steps may need to be taken to increase qualifying capital. United expects that operating and compliance costs will increase and could adversely affect its financial condition and results of operations.

In addition, these changes may also require United to invest significant management attention and resources to evaluate and make any changes necessary to comply with new statutory and regulatory requirements which may negatively impact United’s financial condition and results of operation. United is currently reviewing the provisions of the Dodd-Frank Act and assessing their probable impact on United and its operations.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None

| Item 2. | PROPERTIES |

Offices

United is headquartered in the United Center at 500 Virginia Street, East, Charleston, West Virginia. United’s executive offices are located in Parkersburg, West Virginia at Fifth and Avery Streets. United operates one hundred and twenty-six (126) full service offices—sixty-one (61) offices located throughout West Virginia, fifty-eight (58) offices in the Shenandoah Valley region of Virginia and the Northern Virginia, Maryland and Washington, D.C. metropolitan area, four (4) in southwestern Pennsylvania and three (3) in southeastern Ohio. United owns all of its West Virginia facilities except for two in the Wheeling area, two in the Charleston area, two in the Beckley area, two in the Charles Town area, two in the Morgantown area and one each in Parkersburg and Clarksburg, all of which are leased under operating leases. United owns most of its facilities in the Shenandoah Valley region of Virginia except for ten offices, three in Winchester, one each in Charlottesville, Front Royal, Harrisonburg, Staunton, Waynesboro, Weyers Cave and Woodstock, all of which are leased under operating leases. United leases all of its facilities under operating lease agreements in the Northern Virginia, Maryland and Washington, D.C. areas except for four offices, one each in Fairfax, Alexandria, and Vienna, Virginia and one in

17

Table of Contents

Bethesda, Maryland, which are owned facilities. United owns all of its Pennsylvania facilities. In Ohio, United leases two of its three facilities, one each in Bellaire and St. Clairsville. United leases operations centers in the Charleston, West Virginia and Chantilly, Virginia areas.

| Item 3. | LEGAL PROCEEDINGS |

In April of 2011, United Bankshares, Inc. and United Bank, Inc. of West Virginia were named as defendants in two putative class actions. In the first putative class action, the plaintiffs seek to represent a national class of United Bank, Inc. of West Virginia customers allegedly harmed by United Bank’s overdraft practices relating to debit card transactions. In the second putative class action, the plaintiff seeks to represent a class of West Virginia residents allegedly harmed by United Bank’s overdraft practices relating to debit card transactions.

These lawsuits are substantially similar to class action lawsuits being filed against financial institutions nationwide. With respect to the second putative class action, in September of 2011, the West Virginia state court ruled on a motion to dismiss filed by United Bankshares, Inc. and United Bank, Inc. of West Virginia. Although the West Virginia state court denied the motion as to United Bank, Inc. of West Virginia, the motion was granted, without prejudice, as to United Bankshares, Inc. Otherwise, at this stage of the proceedings, it is too early to determine if these matters would be reasonably expected to have a material adverse effect on United’s financial condition. An estimate as to possible loss cannot be provided at this time because such estimate cannot be made with certainty. United believes there are meritorious defenses to the claims asserted in both proceedings.

In the normal course of business, United and its subsidiaries are currently involved in various legal proceedings. Management is vigorously pursuing all its legal and factual defenses and, after consultation with legal counsel, believes that all such litigation will be resolved with no material effect on United’s financial position.

| Item 4. | MINE SAFETY DISCLOSURES |

Not applicable.

18

Table of Contents

UNITED BANKSHARES, INC.

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Stock

As of January 31, 2012, 100,000,000 shares of common stock, par value $2.50 per share, were authorized for United, of which 50,867,630 were issued, including 654,682 shares held as treasury shares. The outstanding shares are held by approximately 7,382 shareholders of record, as well as 14,583 shareholders in street name as of January 31, 2012. The unissued portion of United’ s authorized common stock (subject to registration approval by the SEC) and the treasury shares are available for issuance as the Board of Directors determines advisable. United offers its shareholders the opportunity to invest dividends in shares of United stock through its dividend reinvestment plan. United has also established stock option plans and a stock bonus plan as incentive for certain eligible officers. In addition to the above incentive plans, United is occasionally involved in certain mergers in which additional shares could be issued and recognizes that additional shares could be issued for other appropriate purposes.

In May of 2006, United’s Board of Directors approved a new stock repurchase plan, whereby United could buy up to 1,700,000 shares of its common stock in the open market. During 2011 and 2010, no shares were repurchased under the plan.

The Board of Directors believes that the availability of authorized but unissued common stock of United is of considerable value if opportunities should arise for the acquisition of other businesses through the issuance of United’s stock. Shareholders do not have preemptive rights, which allows United to issue additional authorized shares without first offering them to current shareholders.

Currently, United has only one voting class of stock issued and outstanding and all voting rights are vested in the holders of United’s common stock. On all matters subject to a vote of shareholders, the shareholders of United will be entitled to one vote for each share of common stock owned. Shareholders of United have cumulative voting rights with regard to election of directors.

On December 23, 2008, the shareholders of United authorized the issuance of preferred stock up to 50,000,000 shares with a par value of $1.00 per share. The authorized preferred stock may be issued by the Company’s Board of Directors in one or more series, from time to time, with each such series to consist of such number of shares and to have such voting powers, full or limited, or no voting powers, and such designations, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, as shall be stated in the resolution or resolutions providing for the issuance of such series adopted by the Board of Directors. Currently, no shares of preferred stock have been issued.

The authorization of preferred stock will not have an immediate effect on the holders of the Company’s common stock. The actual effect of the issuance of any shares of preferred stock upon the rights of the holders of common stock cannot be stated until the Board of Directors determines the specific rights of any shares of preferred stock. However, the effects might include, among other things, restricting dividends on common stock, diluting the voting power of common stock, reducing the market price of common stock or impairing the liquidation rights of the common stock without further action by the shareholders. Holders of the common stock will not have preemptive rights with respect to the preferred stock.

There are no preemptive or conversion rights or, redemption or sinking fund provisions with respect to United’s stock. All of the issued and outstanding shares of United’s stock are fully paid and non-assessable.

19

Table of Contents

Dividends

The shareholders of United are entitled to receive dividends when and as declared by its Board of Directors. Dividends have been paid quarterly. Dividends were $1.21 per share in 2011, $1.20 per share in 2010 and $1.17 per share in 2009. See “Market and Stock Prices of United” for quarterly dividend information.

The payment of dividends is subject to the restrictions set forth in the West Virginia Corporation Act and the limitations imposed by the Federal Reserve Board. Payment of dividends by United is dependent upon receipt of dividends from its Banking Subsidiaries. Payment of dividends by United’s state member Banking Subsidiaries is regulated by the Federal Reserve System and generally, the prior approval of the Federal Reserve Board (FRB) is required if the total dividends declared by a state member bank in any calendar year exceeds its net profits, as defined, for that year combined with its retained net profits for the preceding two years. Additionally, prior approval of the FRB is required when a state member bank has deficit retained earnings but has sufficient current year’s net income, as defined, plus the retained net profits of the two preceding years. The FRB may prohibit dividends if it deems the payment to be an unsafe or unsound banking practice. The FRB has issued guidelines for dividend payments by state member banks emphasizing that proper dividend size depends on the bank’s earnings and capital. See Note S, Notes to Consolidated Financial Statements.

Market and Stock Prices of United

United Bankshares, Inc. stock is traded over the counter on the National Association of Securities Dealers Automated Quotations System, Global Select Market (NASDAQ) under the trading symbol UBSI. The closing sale price reported for United’s common stock on February 24, 2012, the last practicable date, was $29.06.

The high and low prices listed below are based upon information available to United’s management from NASDAQ listings. No attempt has been made by United’s management to ascertain the prices for every sale of its stock during the periods indicated. However, based on the information available, United’s management believes that the prices fairly represent the amounts at which United’s stock was traded during the periods reflected.

The following table presents the dividends and high and low prices of United’s common stock during the periods set forth below:

| 2012 |

Dividends | High | Low | |||||||||

| First Quarter through February 24, 2012 |

--- | $ | 29.68 | $ | 27.36 | |||||||

| 2011 |

||||||||||||

| Fourth Quarter |

$ | 0.31 | $ | 29.29 | $ | 19.06 | ||||||

| Third Quarter |

$ | 0.30 | $ | 25.21 | $ | 18.78 | ||||||

| Second Quarter |

$ | 0.30 | $ | 27.46 | $ | 22.36 | ||||||

| First Quarter |

$ | 0.30 | $ | 30.84 | $ | 25.66 | ||||||

| 2010 |

||||||||||||

| Fourth Quarter |

$ | 0.30 | $ | 30.25 | $ | 24.15 | ||||||

| Third Quarter |

$ | 0.30 | $ | 27.25 | $ | 22.09 | ||||||

| Second Quarter |

$ | 0.30 | $ | 31.99 | $ | 23.82 | ||||||

| First Quarter |

$ | 0.30 | $ | 28.00 | $ | 20.15 | ||||||

20

Table of Contents

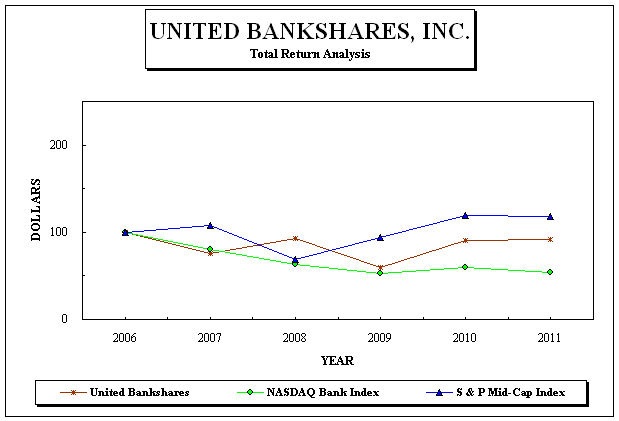

Stock Performance Graph

The following Stock Performance Graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that United specifically incorporates it by reference into such filing.

The following graph compares United’s cumulative total shareholder return (assuming reinvestment of dividends) on its common stock for the five-year period ending December 31, 2011, with the cumulative total return (assuming reinvestment of dividends) of the Standard and Poor’s Midcap 400 Index and with the NASDAQ Bank Index. The cumulative total shareholder return assumes a $100 investment on December 31, 2006 in the common stock of United and each index and the cumulative return is measured as of each subsequent fiscal year-end. There is no assurance that United’s common stock performance will continue in the future with the same or similar trends as depicted in the graph.

| Period Ending | ||||||||||||||||||||||||

| 12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | 12/31/11 | |||||||||||||||||||

| United Bankshares, Inc. |