Exhibit 4.1

[Face of Note]

Unless this certificate is presented by an authorized representative of The Depository Trust Company, a New York corporation (“DTC”), to the Company or its agent for registration of transfer, exchange or payment, and any certificate issued is registered in the name of Cede & Co. or in such other name as requested by an authorized representative of DTC (and any payment is made to Cede & Co. or such other entity as is requested by an authorized representative of DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL inasmuch as the registered owner hereof, Cede & Co., has an interest herein.

|

CUSIP NO. 95001HJ36 |

FACE AMOUNT: $_________ |

|

REGISTERED NO. ___ |

|

WELLS FARGO FINANCE LLC

MEDIUM-TERM NOTE, SERIES A

Fully and Unconditionally Guaranteed by Wells Fargo & Company

Principal at Risk Securities Linked to

the Lowest Performing of the

S&P 500® Index and the Dow Jones Industrial

Average® due April 14, 2025

WELLS FARGO FINANCE LLC, a limited liability company duly organized and existing under the laws of the State of Delaware (hereinafter called the “Company,” which term includes any successor corporation under and as defined in the Indenture hereinafter referred to), for value received, hereby promises to pay to CEDE & Co., or registered assigns, an amount equal to the Maturity Payment Amount (as defined below), in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts, on the Stated Maturity Date. The “Initial Stated Maturity Date” shall be April 14, 2025. If the Calculation Day (as defined below) is not postponed, the Initial Stated Maturity Date will be the “Stated Maturity Date.” If the Calculation Day is postponed, the “Stated Maturity Date” shall be the later of (i) the Initial Stated Maturity Date and (ii) three Business Days (as defined below) after the last Calculation Day as postponed. This Security shall not bear any interest.

Any payments on this Security at Maturity will be made against presentation of this Security at the office or agency of the Company maintained for that purpose in the City of Minneapolis, Minnesota and at any other office or agency maintained by the Company for such purpose.

“Face Amount” shall mean, when used with respect to this Security, the amount set forth on the face of this Security as its “Face Amount.”

Determination of Maturity Payment Amount

The “Maturity Payment Amount” of this Security will equal:

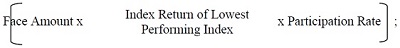

| ● | if the Ending Level of the Lowest Performing Index is greater than its Starting Level: the Face Amount plus: |

| ● | if the Ending Level of the Lowest Performing Index is less than or equal to its Starting Level, but greater than or equal to its Threshold Level: the Face Amount; or |

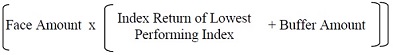

| ● | if the Ending Level of the Lowest Performing Index is less than its Threshold Level: the Face Amount plus: |

All calculations with respect to the Maturity Payment Amount will be rounded to the nearest one hundred-thousandth, with five one-millionths rounded upward (e.g., 0.000005 would be rounded to 0.00001); and the Maturity Payment Amount will be rounded to the nearest cent, with one-half cent rounded upward.

“Index” shall mean each of the S&P 500 Index and the Dow Jones Industrial Average.

The “Pricing Date” shall mean April 6, 2020.

The “Lowest Performing Index” will be the Index with the lowest Index Return as measured from its Starting Level to its Ending Level.

The “Index Return” with respect to an Index is the percentage change from its Starting Level to its Ending Level, measured as follows:

Ending Level – Starting Level

Starting Level

The “Buffer Amount” is 10%.

The “Starting Level” with respect to the S&P 500 Index is 2663.68, its Closing Level on the Pricing Date, and with respect to the Dow Jones Industrial Average is 22679.99, its Closing level on the Pricing Date.

The “Ending Level” of an Index will be its Closing Level on the Calculation Day.

2

The “Threshold Level” with respect to the S&P 500 Index is 2397.312, which is equal to 90% of its Starting Level, and with respect to the Dow Jones Industrial Average is 20411.991, which is equal to 90% of its Starting Level.

The “Participation Rate” is 170%.

The “Closing Level” with respect to each Index on any Trading Day means the official closing level of that Index reported by the relevant Index Sponsor on such Trading Day, as obtained by the Calculation Agent on such Trading Day from the licensed third-party market data vendor contracted by the Calculation Agent at such time; in particular, taking into account the decimal precision and/or rounding convention employed by such licensed third-party market data vendor on such date, subject to the provisions set forth below under “—Market Disruption Events,” “—Adjustments to an Index” and “—Discontinuance of an Index.”

“Index Sponsor” shall mean the sponsor or publisher of an Index.

“Business Day” shall mean a day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close in New York, New York.

The “Calculation Day” shall be April 7, 2025. If such day is not a Trading Day with respect to either Index, the Calculation Day for each Index will be postponed to the next succeeding day that is a Trading Day with respect to each Index. The Calculation Day for an Index is also subject to postponement due to the occurrence of a Market Disruption Event (as defined below) with respect to such Index. If a Market Disruption Event occurs or is continuing with respect to an Index on the Calculation Day, then the Calculation Day for such Index will be postponed to the first succeeding Trading Day for such Index on which a Market Disruption Event for such Index has not occurred and is not continuing; however, if such first succeeding Trading Day has not occurred as of the eighth Trading Day for such Index after the originally scheduled Calculation Day, that eighth Trading Day shall be deemed to be the Calculation Day for such Index. If the Calculation Day has been postponed eight Trading Days for an Index after the originally scheduled Calculation Day and a Market Disruption Event occurs or is continuing with respect to such Index on such eighth Trading Day, the Calculation Agent will determine the Closing Level of such Index on such eighth Trading Day in accordance with the formula for and method of calculating the Closing Level of such Index last in effect prior to commencement of the Market Disruption Event, using the closing price (or, with respect to any relevant security, if a Market Disruption Event has occurred with respect to such security, its good faith estimate of the value of such security at the Scheduled Closing Time of the Relevant Stock Exchange for such security or, if earlier, the actual closing time of the regular trading session of such Relevant Stock Exchange) on such date of each security included in such Index. As used herein, “closing price” means, with respect to any security on any date, the Relevant Stock Exchange traded or quoted price of such security as of the Scheduled Closing Time of the Relevant Stock Exchange for such security or, if earlier, the actual closing time of the regular trading session of such Relevant Stock Exchange. Notwithstanding the postponement of the Calculation Day for one Index due to a Market Disruption Event with respect to such Index on the Calculation Day, the originally scheduled Calculation Day will remain the Calculation Day for the other Index if such other Index is not affected by a Market Disruption Event on such day.

3

“Calculation Agent Agreement” shall mean the Calculation Agent Agreement dated as of May 18, 2018 between the Company and the Calculation Agent, as amended from time to time.

“Calculation Agent” shall mean the Person that has entered into the Calculation Agent Agreement with the Company providing for, among other things, the determination of the Maturity Payment Amount, which term shall, unless the context otherwise requires, include its successors under such Calculation Agent Agreement. The initial Calculation Agent shall be Wells Fargo Securities, LLC. Pursuant to the Calculation Agent Agreement, the Company may appoint a different Calculation Agent from time to time after the initial issuance of this Security without the consent of the Holder of this Security and without notifying the Holder of this Security.

Certain Definitions

A “Trading Day” with respect to an Index means a day, as determined by the Calculation Agent, on which (i) the Relevant Stock Exchanges with respect to each security underlying such Index are scheduled to be open for trading for their respective regular trading sessions and (ii) each Related Futures or Options Exchange with respect to such Index is scheduled to be open for trading for its regular trading session.

The “Relevant Stock Exchange” for any security underlying an Index means the primary exchange or quotation system on which such security is traded, as determined by the Calculation Agent.

The “Related Futures or Options Exchange” for an Index means an exchange or quotation system where trading has a material effect (as determined by the Calculation Agent) on the overall market for futures or options contracts relating to such Index.

Adjustments to an Index

If at any time the method of calculating an Index or a Successor Equity Index, or the closing level thereof, is changed in a material respect, or if an Index or a Successor Equity Index is in any other way modified so that such index does not, in the opinion of the Calculation Agent, fairly represent the level of such index had those changes or modifications not been made, then the Calculation Agent will, at the close of business in New York, New York, on each date that the closing level of such index is to be calculated, make such calculations and adjustments as, in the good faith judgment of the Calculation Agent, may be necessary in order to arrive at a level of an index comparable to such Index or Successor Equity Index as if those changes or modifications had not been made, and the Calculation Agent will calculate the closing level of such Index or Successor Equity Index with reference to such index, as so adjusted. Accordingly, if the method of calculating an Index or Successor Equity Index is modified so that the level of such index is a fraction or a multiple of what it would have been if it had not been modified (e.g., due to a split or reverse split in such equity index), then the Calculation Agent will adjust such Index or Successor Equity Index in order to arrive at a level of such index as if it had not been modified (e.g., as if the split or reverse split had not occurred).

4

Discontinuance of an Index

If an Index Sponsor discontinues publication of an Index, and such Index Sponsor or another entity publishes a successor or substitute equity index that the Calculation Agent determines, in its sole discretion, to be comparable to such Index (a “Successor Equity Index”), then, upon the Calculation Agent’s notification of that determination to the Trustee and the Company, the Calculation Agent will substitute the Successor Equity Index as calculated by the relevant Index Sponsor or any other entity and calculate the Ending Level of such Index as described above. Upon any selection by the Calculation Agent of a Successor Equity Index, the Company will cause notice to be given to the Holder of this Security.

In the event that an Index Sponsor discontinues publication of an Index prior to, and the discontinuance is continuing on, the Calculation Day and the Calculation Agent determines that no Successor Equity Index is available at such time, the Calculation Agent will calculate a substitute Closing Level for such Index in accordance with the formula for and method of calculating such Index last in effect prior to the discontinuance, but using only those securities that comprised such Index immediately prior to that discontinuance. If a Successor Equity Index is selected or the Calculation Agent calculates a level as a substitute for such Index, the Successor Equity Index or level will be used as a substitute for such Index for all purposes, including the purpose of determining whether a Market Disruption Event exists.

If on the Calculation Day an Index Sponsor fails to calculate and announce the level of an Index, the Calculation Agent will calculate a substitute Closing Level of such Index in accordance with the formula for and method of calculating such Index last in effect prior to the failure, but using only those securities that comprised such Index immediately prior to that failure; provided that, if a Market Disruption Event occurs or is continuing on such day with respect to such Index, then the provisions set forth above under the definition of “Calculation Day” shall apply in lieu of the foregoing.

Market Disruption Events

A “Market Disruption Event” with respect to an Index means any of the following events as determined by the Calculation Agent in its sole discretion:

| (A) | The occurrence or existence of a material suspension of or limitation imposed on trading by the Relevant Stock Exchanges or otherwise relating to securities which then comprise 20% or more of the level of such Index or any Successor Equity Index at any time during the one-hour period that ends at the Close of Trading on that day, whether by reason of movements in price exceeding limits permitted by those Relevant Stock Exchanges or otherwise. |

| (B) | The occurrence or existence of a material suspension of or limitation imposed on trading by any Related Futures or Options Exchange or otherwise in futures or options contracts relating to such Index or any Successor Equity Index on any Related Futures or Options Exchange at any time during the one-hour period that ends at the Close of Trading on that day, whether by reason of movements in |

5

price exceeding limits permitted by the Related Futures or Options Exchange or otherwise.

| (C) | The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, securities that then comprise 20% or more of the level of such Index or any Successor Equity Index on their Relevant Stock Exchanges at any time during the one-hour period that ends at the Close of Trading on that day. |

| (D) | The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, futures or options contracts relating to such Index or any Successor Equity Index on any Related Futures or Options Exchange at any time during the one-hour period that ends at the Close of Trading on that day. |

| (E) | The closure on any Exchange Business Day of the Relevant Stock Exchanges on which securities that then comprise 20% or more of the level of such Index or any Successor Equity Index are traded or any Related Futures or Options Exchange with respect to such Index or any Successor Equity Index prior to its Scheduled Closing Time unless the earlier closing time is announced by the Relevant Stock Exchange or Related Futures or Options Exchange, as applicable, at least one hour prior to the earlier of (1) the actual closing time for the regular trading session on such Relevant Stock Exchange or Related Futures or Options Exchange, as applicable, and (2) the submission deadline for orders to be entered into the Relevant Stock Exchange or Related Futures or Options Exchange, as applicable, system for execution at such actual closing time on that day. |

| (F) | The Relevant Stock Exchange for any security underlying such Index or Successor Equity Index or any Related Futures or Options Exchange with respect to such Index or Successor Equity Index fails to open for trading during its regular trading session. |

For purposes of determining whether a Market Disruption Event has occurred with respect to an Index:

| (1) | the relevant percentage contribution of a security to the level of such Index or any Successor Equity Index will be based on a comparison of (x) the portion of the level of such Index attributable to that security and (y) the overall level of such Index or Successor Equity Index, in each case immediately before the occurrence of the Market Disruption Event; |

| (2) | the “Close of Trading” on any Trading Day for such Index or any Successor Equity Index means the Scheduled Closing Time of the Relevant Stock Exchanges with respect to the securities underlying such Index or Successor Equity Index on such Trading Day; provided that, if the actual closing time of the regular trading session of |

6

any such Relevant Stock Exchange is earlier than its Scheduled Closing Time on such Trading Day, then (x) for purposes of clauses (A) and (C) of the definition of “Market Disruption Event” above, with respect to any security underlying such Index or Successor Equity Index for which such Relevant Stock Exchange is its Relevant Stock Exchange, the “Close of Trading” means such actual closing time and (y) for purposes of clauses (B) and (D) of the definition of “Market Disruption Event” above, with respect to any futures or options contract relating to such Index or Successor Equity Index, the “Close of Trading” means the latest actual closing time of the regular trading session of any of the Relevant Stock Exchanges, but in no event later than the Scheduled Closing Time of the Relevant Stock Exchanges;

| (3) | the “Scheduled Closing Time” of any Relevant Stock Exchange or Related Futures or Options Exchange on any Trading Day for such Index or any Successor Equity Index means the scheduled weekday closing time of such Relevant Stock Exchange or Related Futures or Options Exchange on such Trading Day, without regard to after hours or any other trading outside the regular trading session hours; and |

| (4) | an “Exchange Business Day” means any Trading Day for such Index or any Successor Equity Index on which each Relevant Stock Exchange for the securities underlying such Index or any Successor Equity Index and each Related Futures or Options Exchange with respect to such Index or any Successor Equity Index are open for trading during their respective regular trading sessions, notwithstanding any such Relevant Stock Exchange or Related Futures or Options Exchange closing prior to its Scheduled Closing Time. |

Calculation Agent

The Calculation Agent will determine the Maturity Payment Amount. In addition, the Calculation Agent will (i) determine if adjustments are required to the Closing Level of an Index under the circumstances described in this Security, (ii) if publication of an Index is discontinued, select a Successor Equity Index or, if no Successor Equity Index is available, determine the Closing Level of such Index under the circumstances described in this Security, and (iii) determine whether a Market Disruption Event or non-Trading Day has occurred.

The Company covenants that, so long as this Security is Outstanding, there shall at all times be a Calculation Agent (which shall be a broker-dealer, bank or other financial institution) with respect to this Security.

All determinations made by the Calculation Agent with respect to this Security will be at the sole discretion of the Calculation Agent and, in the absence of manifest error, will be conclusive for all purposes and binding on the Company and the Holder of this Security.

Tax Considerations

The Company agrees, and by acceptance of a beneficial ownership interest in this Security each Holder of this Security will be deemed to have agreed (in the absence of a statutory, regulatory, administrative or judicial ruling to the contrary), for United States federal income tax

7

purposes to characterize and treat this Security as a prepaid derivative contract that is an “open transaction.”

Redemption and Repayment

This Security is not subject to redemption at the option of the Company or repayment at the option of the Holder hereof prior to April 14, 2025. This Security is not entitled to any sinking fund.

Acceleration

If an Event of Default, as defined in the Indenture, with respect to this Security shall occur and be continuing, the Maturity Payment Amount (calculated as set forth in the next sentence) of this Security may be declared due and payable in the manner and with the effect provided in the Indenture. The amount payable to the Holder hereof upon any acceleration permitted under the Indenture will be equal to the Maturity Payment Amount hereof calculated as provided herein as though the date of acceleration was the Calculation Day.

__________________

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been executed by the Trustee referred to on the reverse hereof by manual signature or its duly authorized agent under the Indenture referred to on the reverse hereof by manual signature, this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

[The remainder of this page has been left intentionally blank]

8

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed.

DATED:

|

|

WELLS FARGO FINANCE LLC |

||

|

|

|

|

|

|

|

By: |

|

|

|

|

|

Its: |

|

|

|

|

|

|

|

|

Attest: |

|

|

|

|

|

|

|

|

|

|

|

Its: |

TRUSTEE’S CERTIFICATE OF AUTHENTICATION This is one of the Securities of the series designated therein described in the within-mentioned Indenture. |

||

|

CITIBANK, N.A., |

|

|

|

|

as Trustee |

|

|

By: |

|

|

|

|

Authorized Signature |

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

WELLS FARGO BANK, N.A., |

|

|

|

|

|

|

|

By: |

|

|

|

|

Authorized Signature |

|

9

[Reverse of Note]

WELLS FARGO FINANCE LLC

MEDIUM-TERM NOTE, SERIES A

Fully and Unconditionally Guaranteed by Wells Fargo & Company

Principal at Risk Securities Linked to

the Lowest Performing of the

S&P 500® Index and the Dow Jones Industrial

Average® due April 14, 2025

This Security is one of a duly authorized issue of securities of the Company (herein called the “Securities”), issued and to be issued in one or more series under an indenture dated as of April 25, 2018, as amended or supplemented from time to time (herein called the “Indenture”), among the Company, as issuer, Wells Fargo & Company, as guarantor (the “Guarantor”) and Citibank, N.A., as trustee (herein called the “Trustee,” which term includes any successor trustee under the Indenture), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Guarantor, the Trustee and the Holders of the Securities, and of the terms upon which the Securities are, and are to be, authenticated and delivered. This Security is one of the series of the Securities designated as Medium-Term Notes, Series A, of the Company. The amount payable on the Securities of this series may be determined by reference to the performance of one or more equity-, commodity- or currency-based indices, exchange traded funds, securities, commodities, currencies, statistical measures of economic or financial performance, or a basket comprised of two or more of the foregoing, or any other market measure or may bear interest at a fixed rate or a floating rate. The Securities of this series may mature at different times, be redeemable at different times or not at all, be repayable at the option of the Holder at different times or not at all and be denominated in different currencies.

The Securities are issuable only in registered form without coupons and will be either (a) book-entry securities represented by one or more Global Securities recorded in the book-entry system maintained by the Depositary or (b) certificated securities issued to and registered in the names of, the beneficial owners or their nominees.

The Company agrees, to the extent permitted by law, not to voluntarily claim the benefits of any laws concerning usurious rates of interest against a Holder of this Security.

Guarantee

The Securities of this series are fully and unconditionally guaranteed by the Guarantor as and to the extent set forth in the Indenture.

Modification and Waivers

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Company and the Guarantor and the rights of the Holders of the Securities of each series to be affected under the Indenture at any time by the

10

Company, the Guarantor and the Trustee with the consent of the Holders of a majority in principal amount of the Securities at the time Outstanding of all series to be affected, acting together as a class. The Indenture also contains provisions permitting the Holders of a majority in principal amount of the Securities of all series at the time Outstanding affected by certain provisions of the Indenture, acting together as a class, on behalf of the Holders of all Securities of such series, to waive compliance by the Company or the Guarantor with those provisions of the Indenture. Certain past defaults under the Indenture and their consequences may be waived under the Indenture by the Holders of a majority in principal amount of the Securities of each series at the time Outstanding, on behalf of the Holders of all Securities of such series. Solely for the purpose of determining whether any consent, waiver, notice or other action or Act to be taken or given by the Holders of Securities pursuant to the Indenture has been given or taken by the Holders of Outstanding Securities in the requisite aggregate principal amount, the principal amount of this Security will be deemed to be equal to the amount set forth on the face hereof as the “Face Amount” hereof. Any such consent or waiver by the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this Security and of any Security issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Security.

Defeasance

Section 403 and Article Fifteen of the Indenture and the provisions of clause (ii) of Section 401(1)(B) of the Indenture, relating to defeasance at any time of (a) the entire indebtedness on this Security and (b) certain restrictive covenants, upon compliance by the Company or the Guarantor with certain conditions set forth therein, shall not apply to this Security. The remaining provisions of Section 401 of the Indenture shall apply to this Security.

Authorized Denominations

This Security is issuable only in registered form without coupons in denominations of $1,000 or any amount in excess thereof which is an integral multiple of $1,000.

Registration of Transfer

Upon due presentment for registration of transfer of this Security at the office or agency of the Company in the City of Minneapolis, Minnesota, a new Security or Securities of this series, with the same terms as this Security, in authorized denominations for an equal aggregate Face Amount will be issued to the transferee in exchange herefor, as provided in the Indenture and subject to the limitations provided therein and to the limitations described below, without charge except for any tax or other governmental charge imposed in connection therewith.

This Security is exchangeable for definitive Securities in registered form only if (x) the Depositary notifies the Company that it is unwilling or unable to continue as Depositary for this Security or if at any time the Depositary ceases to be a clearing agency registered under the Securities Exchange Act of 1934, as amended, and a successor depositary is not appointed within 90 days after the Company receives such notice or becomes aware of such ineligibility, (y) the Company in its sole discretion determines that this Security shall be exchangeable for definitive Securities in registered form and notifies the Trustee thereof or (z) an Event of Default with respect

11

to the Securities represented hereby has occurred and is continuing. If this Security is exchangeable pursuant to the preceding sentence, it shall be exchangeable for definitive Securities in registered form, having the same date of issuance, Stated Maturity Date and other terms and of authorized denominations aggregating a like amount.

This Security may not be transferred except as a whole by the Depositary to a nominee of the Depositary or by a nominee of the Depositary to the Depositary or another nominee of the Depositary or by the Depositary or any such nominee to a successor of the Depositary or a nominee of such successor. Except as provided above, owners of beneficial interests in this Global Security will not be entitled to receive physical delivery of Securities in definitive form and will not be considered the Holders hereof for any purpose under the Indenture.

Prior to due presentment of this Security for registration of transfer, the Company, the Guarantor, the Trustee and any agent of the Company, the Guarantor or the Trustee may treat the Person in whose name this Security is registered as the owner hereof for all purposes, whether or not this Security be overdue, and neither the Company, the Guarantor, the Trustee nor any such agent shall be affected by notice to the contrary.

Obligation of the Company Absolute

No reference herein to the Indenture and no provision of this Security or the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the Maturity Payment Amount at the times, place and rate, and in the coin or currency, herein prescribed, except as otherwise provided in this Security.

No Personal Recourse

No recourse shall be had for the payment of the Maturity Payment Amount, or for any claim based hereon, or otherwise in respect hereof, or based on or in respect of the Indenture or any indenture supplemental thereto, against any incorporator, stockholder, officer or director, as such, past, present or future, of the Company or any successor corporation or of the Guarantor or any successor corporation, whether by virtue of any constitution, statute or rule of law, or by the enforcement of any assessment or penalty or otherwise, all such liability being, by the acceptance hereof and as part of the consideration for the issuance hereof, expressly waived and released.

Defined Terms

All terms used in this Security which are defined in the Indenture shall have the meanings assigned to them in the Indenture unless otherwise defined in this Security.

Governing Law

This Security shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts of laws.

12

ABBREVIATIONS

The following abbreviations, when used in the inscription on the face of this instrument, shall be construed as though they were written out in full according to applicable laws or regulations:

| TEN COM | -- | as tenants in common |

| TEN ENT | -- | as tenants by the entireties |

| JT TEN | -- | as joint tenants with right |

| of survivorship and not | ||

| as tenants in common |

|

UNIF GIFT MIN ACT |

-- |

|

|

Custodian |

|

|

|

|

(Cust) |

|

|

(Minor) |

Under Uniform Gifts to Minors Act

| (State) |

Additional abbreviations may also be used though not in the above list.

FOR VALUE RECEIVED, the undersigned hereby sell(s) and transfer(s) unto

Please Insert Social Security or

Other Identifying Number of Assignee

| (Please print or type name and address including postal zip code of Assignee) |

13

the within Security of WELLS FARGO FINANCE LLC and does hereby irrevocably constitute and appoint __________________ attorney to transfer the said Security on the books of the Company, with full power of substitution in the premises.

| Dated: _________________________ | |

NOTICE: The signature to this assignment must correspond with the name as written upon the face of the within instrument in every particular, without alteration or enlargement or any change whatever.

14