|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the Fiscal Year Ended December 31, 2015

|

|

|

or

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from ___________ to ____________

|

|

206 Van Vorst Street

Jersey City, NJ 07302

(201) 432-0463

|

NEW JERSEY

|

|

22-1463699

|

|

(State of incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

Title of Each Class |

|

Name of Each Exchange

on which Registered |

|

Class A Common Stock ($0.10 par value)

|

|

NASDAQ Global Select Market

|

|

Class B Common Stock ($0.10 par value)

|

NASDAQ Global Select Market

|

|

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes [ ] |

No [X] |

|

Indicate by checkmark if the registrant is not required to file reports to Section 13 or 15(d) of the Act.

|

Yes [ ]

|

No [X]

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes [X]

|

No [ ]

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes [X]

|

No [ ]

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

[X]

|

|

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

|

||

|

Large accelerated filer [ ]

|

Accelerated filer [X]

|

Non-accelerated filer [ ]

(Do not check if a smaller reporting company) |

Smaller reporting company [ ]

|

||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

Yes [ ]

|

No [X]

|

|||

|

Title of Each Class |

|

Number of Shares of Common Stock Outstanding as of March 1, 2016

|

|

Class A Common Stock

|

|

2,174,912

|

|

Class B Common Stock

|

9,701,977

|

|

BEL FUSE INC.

|

|||

|

Page

|

|||

|

Cautionary Notice Regarding Forward-Looking Information

|

1

|

||

|

Part I

|

|||

|

Item 1.

|

2

|

||

|

Item 1A.

|

7

|

||

|

Item 1B.

|

13

|

||

|

Item 2.

|

14

|

||

|

Item 3.

|

14

|

||

|

Item 4.

|

14

|

||

|

Part II

|

|||

|

Item 5.

|

|||

|

15

|

|||

|

Item 6.

|

17

|

||

|

Item 7.

|

|||

|

19

|

|||

|

Item 7A.

|

30

|

||

|

Item 8.

|

31

|

||

|

Item 9.

|

|||

|

71

|

|||

|

Item 9A.

|

71

|

||

|

Item 9B.

|

71

|

||

|

Part III

|

|||

|

Item 10.

|

72

|

||

|

Item 11.

|

72

|

||

|

Item 12.

|

|||

|

72

|

|||

|

Item 13.

|

72

|

||

|

Item 14.

|

72

|

||

|

Part IV

|

|||

|

Item 15.

|

73

|

||

|

75

|

|||

|

Product Line

|

Function

|

Applications

|

Brands Sold Under

|

|

|

Magnetic Solutions

|

Integrated Connector Modules (ICMs)

|

Condition, filter, and isolate the electronic signal to ensure accurate data/voice/video transmission and provide RJ45 and USB connectivity.

|

Network switches, routers, hubs, and PCs used in 10/100/1000 Gigabit Ethernet, Power over Ethernet (PoE), PoE Plus and home networking applications.

|

Bel, TRP, MagJack®

|

|

Power Transformers

|

Safety isolation and distribution.

|

Power supplies, alarm, fire detection, and security systems, HVAC, lighting and medical equipment. Class 2, three phase, chassis mount, and PC mount designs available.

|

Signal

|

|

|

SMD Power Inductors & SMPS Transformers

|

A passive component that stores energy in a magnetic field. Widely used in analog electronic circuitry.

|

Switchmode power supplies, DC-DC converters, LED lighting, automotive and consumer electronics.

|

Signal

|

|

|

Discrete Components-Telecom

|

Condition, filter, and isolate the electronic signal to ensure accurate data/voice/video transmission.

|

Network switches, routers, hubs, and PCs used in 10/100/1000 Gigabit Ethernet and Power over Ethernet (PoE).

|

Bel

|

|

Product Line

|

Function

|

Applications

|

Brands Sold Under

|

|

|

Power Solutions & Protection

|

Front-End Power Supplies

|

Provides the primary point of isolation between AC main line (input) and the low-voltage DC output that is used to power all electronics downstream

|

Servers, telecommunication, network and data storage equipment

|

Bel Power Solutions, Power-One

|

|

Board-Mount Power Products

|

These are designed to be mounted on a circuit board. These converters take input voltage and provide localized on-board power to low-voltage electronics.

|

Telecom (central office switches), networking and a broad range of industrial applications

|

Bel Power Solutions, Power-One, Melcher

|

|

|

Industrial Power Products

|

Converts between AC main line inputs and a wide variety of DC output voltages.

|

Rail, transportation, automation, test and measurement, medical, military and aerospace applications.

|

Bel Power Solutions, Power-One, Melcher

|

|

|

Module Products

|

Condition, filter, and isolate the electronic signal to ensure accurate data/voice/video transmission within a highly integrated, reduced footprint.

|

Broadband equipment, home networking, set top boxes, and telecom equipment supporting ISDN, T1/E1 and DSL technologies. Industrial applications include Smart Meters, Smart Grid communication platforms, vehicle communications and traffic management.

|

Bel

|

|

|

Circuit Protection

|

Protects devices by preventing current in an electrical circuit from exceeding acceptable levels.

|

Power supplies, cell phone chargers, consumer electronics, and battery protection.

|

Bel

|

|

Product Line

|

Function

|

Applications

|

Brands Sold Under

|

|

|

Connectivity Solutions

|

Expanded Beam Fiber Optic Connectors, Cable Assemblies and Active Optical Devices (transceivers and media converters)

|

Harsh-environment, high-reliability, flight-grade optical connectivity for high-speed communications.

|

Military/aerospace, oil and gas well monitoring and exploration, broadcast, communications, RADAR

|

Stratos, Fibreco

|

|

Copper-based Connectors / Cable Assemblies-FQIS

|

Harsh-environment, high-reliability connectivity and fuel quantity monitoring (FQIS).

|

Commercial aerospace, avionics, smart munitions, communications, navigations and various industrial equipment

|

Cinch

|

|

|

RF Connectors, Cable Assemblies, Microwave Devices and Low Loss Cable

|

Connectors and cable assemblies designed to provide connectivity within radio frequency (RF) applications.

|

Military/aerospace, test and measurement, high-frequency and wireless communications

|

Johnson, Trompeter, Midwest Microwave, Semflex

|

|

|

RJ Connectors and Cable Assemblies

|

RJ45 and RJ11 connectivity for data/voice/video transmission.

|

Largely Ethernet applications including network routers, hubs, switches, and patch panels.

|

Stewart Connector

|

In the PRC, the availability of labor is cyclical and is significantly affected by the migration of workers in relation to the annual Lunar New Year holiday as well as economic conditions in the PRC. In addition, we have little visibility into the ordering habits of our customers and can be subjected to large and unpredictable variations in demand for our products. Accordingly, we must continually recruit and train new workers to replace those lost to attrition each year and to address peaks in demand that may occur from time to time. These recruiting and training efforts and related inefficiences, as well as overtime required in order to meet demand, can add volatility to the costs incurred by the Company for labor in the PRC.

|

•

|

|

foreign currency exchange controls and tax rates;

|

|

•

|

|

foreign currency exchange rate fluctuations, including devaluations;

|

|

•

|

|

the potential for changes in regional and local economic conditions, including local inflationary pressures;

|

|

•

|

|

restrictive governmental actions such as those on transfer or repatriation of funds and trade protection matters, including antidumping duties, tariffs, embargoes and prohibitions or restrictions on acquisitions or joint ventures;

|

|

•

|

|

changes in laws and regulations, including the laws and policies of the United States affecting trade and foreign investment;

|

|

•

|

|

the difficulty of enforcing agreements and collecting receivables through certain foreign legal systems;

|

|

•

|

|

variations in protection of intellectual property and other legal rights;

|

|

•

|

|

more expansive legal rights of foreign unions or works councils;

|

|

•

|

|

changes in labor conditions and difficulties in staffing and managing international operations;

|

|

•

|

|

social plans that prohibit or increase the cost of certain restructuring actions;

|

|

•

|

|

the potential for nationalization of enterprises or facilities; and

|

|

•

|

|

unsettled political conditions and possible terrorist attacks against U.S. or other interests.

|

|

·

|

announcements of technological or competitive developments;

|

|

·

|

general market or economic conditions;

|

|

·

|

market or economic conditions specific to particular geographical areas in which we operate;

|

|

·

|

acquisitions or strategic alliances by us or our competitors;

|

|

·

|

the gain or loss of a significant customer or order; or

|

|

·

|

changes in estimates of our financial performance or changes in recommendations by securities analysts regarding us or our industry

|

To the extent that the voting rights of particular holders of Class A common stock are suspended as of times when the Company's shareholders vote due to the above-mentioned provisions, such suspension will have the effect of increasing the voting power of those holders of Class A common shares whose voting rights are not suspended. As of February 29, 2016, Daniel Bernstein, the Company's chief executive officer, beneficially owned 353,204 Class A common shares (or 21.1%) of the outstanding Class A common shares whose voting rights were not suspended, the Estate of Elliot Bernstein beneficially owned 82,357 Class A common shares (or 4.9%) of the outstanding Class A common shares whose voting rights were not suspended and all directors and executive officers as a group (which includes Daniel Bernstein, but does not include the Estate of Elliot Bernstein) beneficially owned 501,095 Class A common shares (or 29.9%) of the outstanding Class A common shares whose voting rights were not suspended.

|

Location

|

Approximate

Square Feet

|

Owned/

Leased

|

Percentage

Used for

Manufacturing

|

||||||

|

Dongguan, People's Republic of China

|

650,000

|

Leased

|

28

|

%

|

|||||

|

Pingguo, People's Republic of China

|

251,000

|

Leased

|

71

|

%

|

|||||

|

Shanghai, People's Republic of China

|

32,000

|

Leased

|

70

|

%

|

|||||

|

Shenzhen, People's Republic of China

|

227,000

|

Leased

|

100

|

%

|

|||||

|

Zhongshan, People's Republic of China

|

315,000

|

Leased

|

86

|

%

|

|||||

|

Zhongshan, People's Republic of China

|

118,000

|

Owned

|

100

|

%

|

|||||

|

Zhongshan, People's Republic of China

|

78,000

|

Owned

|

100

|

%

|

|||||

|

Louny, Czech Republic

|

11,000

|

Owned

|

75

|

%

|

|||||

|

Dubnica nad Vahom, Slovakia

|

35,000

|

Owned

|

100

|

%

|

|||||

|

Dubnica nad Vahom, Slovakia

|

70,000

|

Leased

|

100

|

%

|

|||||

|

Worksop, England (a)

|

52,000

|

Leased

|

28

|

%

|

|||||

|

Great Dunmow, England

|

9,000

|

Leased

|

52

|

%

|

|||||

|

Chelmsford, United Kingdom

|

21,000

|

Leased

|

60

|

%

|

|||||

|

Dominican Republic

|

41,000

|

Leased

|

85

|

%

|

|||||

|

Cananea, Mexico

|

42,000

|

Leased

|

60

|

%

|

|||||

|

Reynosa, Mexico

|

77,000

|

Leased

|

56

|

%

|

|||||

|

Inwood, New York

|

39,000

|

Owned

|

40

|

%

|

|||||

|

Glen Rock, Pennsylvania

|

74,000

|

Owned

|

60

|

%

|

|||||

|

Waseca, Minnesota

|

124,000

|

Leased

|

83

|

%

|

|||||

|

McAllen, Texas

|

40,000

|

Leased

|

56

|

%

|

|||||

|

Miami, Florida

|

29,000

|

Leased

|

85

|

%

|

|||||

|

Melbourne, Florida

|

18,000

|

Leased

|

64

|

%

|

|||||

|

Mesa, Arizona

|

7,000

|

Leased

|

100

|

%

|

|||||

|

2,360,000

|

|||||||||

|

(a)

|

Market Information

|

|

Class A

|

Class B

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

Year Ended December 31, 2015

|

||||||||||||||||

|

First Quarter

|

$

|

24.66

|

$

|

18.17

|

$

|

27.53

|

$

|

18.79

|

||||||||

|

Second Quarter

|

23.38

|

17.33

|

23.23

|

17.35

|

||||||||||||

|

Third Quarter

|

20.95

|

14.19

|

23.77

|

16.46

|

||||||||||||

|

Fourth Quarter

|

21.80

|

14.29

|

23.73

|

16.16

|

||||||||||||

|

Year Ended December 31, 2014

|

||||||||||||||||

|

First Quarter

|

$

|

20.04

|

$

|

17.80

|

$

|

22.10

|

$

|

17.80

|

||||||||

|

Second Quarter

|

27.23

|

19.00

|

27.50

|

19.57

|

||||||||||||

|

Third Quarter

|

25.73

|

21.17

|

26.67

|

22.16

|

||||||||||||

|

Fourth Quarter

|

26.70

|

20.33

|

29.26

|

22.18

|

||||||||||||

|

(d)

|

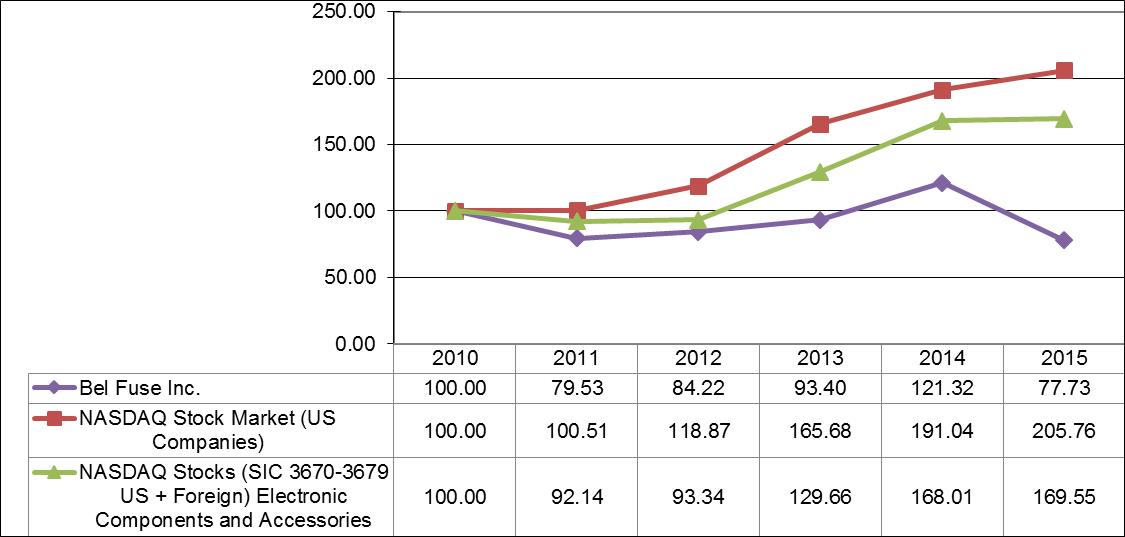

Common Stock Performance Comparisons

|

Assumes Initial Investment of $100

December 2015

|

Years Ended December 31,

|

||||||||||||||||||||

|

2015

|

2014

|

2013

|

2012

|

2011

|

||||||||||||||||

|

(In thousands of dollars, except per share data)

|

||||||||||||||||||||

|

Selected Consolidated Statements of Operations Data: (a)

|

||||||||||||||||||||

|

Net sales

|

$

|

567,080

|

$

|

487,076

|

$

|

349,189

|

$

|

286,594

|

$

|

295,121

|

||||||||||

|

Cost of sales

|

458,253

|

399,721

|

286,952

|

240,115

|

244,749

|

|||||||||||||||

|

Selling, general and administrative expenses

|

78,113

|

72,051

|

45,803

|

39,571

|

39,284

|

|||||||||||||||

|

Stock-based compensation

|

2,815

|

2,717

|

1,879

|

1,767

|

1,709

|

|||||||||||||||

|

Litigation charges (b)

|

-

|

-

|

41

|

26

|

3,471

|

|||||||||||||||

|

Restructuring charges (c)

|

2,114

|

1,832

|

1,387

|

5,245

|

314

|

|||||||||||||||

|

Earnings before income taxes

|

25,732

|

9,770

|

15,165

|

997

|

7,872

|

|||||||||||||||

|

Net earnings

|

$

|

19,197

|

$

|

8,603

|

$

|

15,908

|

$

|

2,373

|

$

|

3,764

|

||||||||||

|

Reconciliation of net earnings to EBITDA (d):

|

||||||||||||||||||||

|

Net earnings

|

$

|

19,197

|

$

|

8,603

|

$

|

15,908

|

$

|

2,373

|

$

|

3,764

|

||||||||||

|

Depreciation and amortization (e)

|

23,008

|

20,367

|

12,382

|

9,113

|

8,667

|

|||||||||||||||

|

Interest expense

|

7,588

|

3,978

|

156

|

16

|

-

|

|||||||||||||||

|

Income tax provision (benefit)

|

6,535

|

1,167

|

(743

|

)

|

(1,376

|

)

|

4,108

|

|||||||||||||

|

EBITDA (d)

|

$

|

56,328

|

$

|

34,115

|

$

|

27,703

|

$

|

10,126

|

$

|

16,539

|

||||||||||

|

Net earnings per share:

|

||||||||||||||||||||

|

Class A common share - basic and diluted

|

1.53

|

0.69

|

1.32

|

0.17

|

0.28

|

|||||||||||||||

|

Class B common share - basic and diluted

|

1.64

|

0.75

|

1.41

|

0.21

|

0.33

|

|||||||||||||||

|

Cash dividends declared per share:

|

||||||||||||||||||||

|

Class A common share

|

0.24

|

0.24

|

0.24

|

0.24

|

0.24

|

|||||||||||||||

|

Class B common share

|

0.28

|

0.28

|

0.28

|

0.28

|

0.28

|

|||||||||||||||

|

As of December 31,

|

||||||||||||||||||||

|

2015

|

2014

|

2013

|

2012

|

2011

|

||||||||||||||||

|

(In thousands of dollars, except percentages)

|

||||||||||||||||||||

|

Selected Consolidated Balance Sheet Data and Ratios:

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$

|

85,040

|

$

|

77,138

|

$

|

62,123

|

$

|

71,262

|

88,241

|

|||||||||||

|

Working capital

|

163,428

|

188,854

|

137,174

|

144,530

|

165,264

|

|||||||||||||||

|

Goodwill

|

121,634

|

118,369

|

18,490

|

13,559

|

4,163

|

|||||||||||||||

|

Total assets

|

587,011

|

635,421

|

308,141

|

275,189

|

276,911

|

|||||||||||||||

|

Total debt

|

187,188

|

232,625

|

-

|

-

|

-

|

|||||||||||||||

|

Stockholders' equity

|

233,122

|

224,273

|

228,702

|

215,362

|

221,080

|

|||||||||||||||

|

Return on average total assets (f)

|

3.0

|

%

|

1.8

|

%

|

5.4

|

%

|

0.9

|

%

|

1.4

|

%

|

||||||||||

|

Return on average stockholders' equity (f)

|

8.2

|

%

|

3.8

|

%

|

7.3

|

%

|

1.1

|

%

|

1.7

|

%

|

||||||||||

|

(a)

|

See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," for a discussion of the factors that contributed to our consolidated operating results and our consolidated cash flows for the three years ended December 31, 2015.

|

|

(b)

|

During 2011, the Company recorded litigation charges totaling $3.5 million related to the SynQor and Halo lawsuits. See Note 16, "Commitments and Contingencies," for further information on the SynQor lawsuit. The Halo lawsuit was resolved in 2011.

|

|

(c)

|

See Note 3, "Restructuring Activities," for further information on restructuring charges incurred during the three years ended December 31, 2015. During 2012, Bel initiated the closure of its Cinch North American manufacturing facility in Vinita, Oklahoma, and transition of the operations to Reynosa, Medico and a new facility in McAllen, Texas. The Company recorded $5.2 million related to this restructuring during 2012, comprised primarily of $3.2 million in severance costs, $1.4 million related to asset disposals and $0.6 million of other expenses. During 2011, the Company recorded restructuring costs associated with the realignment of its Cinch UK operations.

|

|

(d)

|

EBITDA is a non‑U.S. GAAP measure that is not a measure of performance under accounting principles generally accepted in the United States of America ("U.S. GAAP"). EBITDA has limitations as an analytical tool and should not be considered in isolation from or as a substitute for U.S. GAAP information. It does not purport to represent any similarly titled U.S. GAAP information and is not an indicator of our performance under U.S. GAAP. EBITDA may not be comparable with similarly titled measures used by others. Investors are cautioned against placing undue reliance on this non-GAAP measure. Our management may assess our financial results both on a U.S. GAAP basis and on a non-U.S. GAAP basis. Non-U.S. GAAP financial measures provide management with additional means to understand and evaluate the core operating results and trends in our ongoing business.

|

|

(e)

|

Depreciation and amortization is included in both cost of sales and selling, general and administrative expenses on the consolidated statements of operations.

|

|

(f)

|

Returns on average total assets and stockholders' equity are computed for each year by dividing net earnings for such year by the average balances of total assets or stockholders' equity, as applicable, on the last day of each quarter during such year and on the last day of the immediately preceding year.

|

|

·

|

Recent Acquisitions – The Company has completed four acquisitions since the first quarter of 2013. During the years ended December 31, 2015, 2014 and 2013, the acquired companies have contributed a combined $309.0 million, $209.8 million and $68.6 million of sales, respectively, and a combined $19.6 million, $10.2 million and $8.4 million in income from operations, respectively.

|

|

·

|

Net Sales – Excluding the net sales contributions from the 2013 and 2014 Acquisitions as described above, the Company's net sales for the years ended December 31, 2015, 2014 and 2013 were $258.1 million, $277.3 million and $280.6 million, respectively. By segment, excluding the net sales contributions from the 2013 and 2014 Acquisitions, net sales in Asia decreased by $18.4 million, European net sales were down by $2.7 million and sales in North America increased by $1.8 million in 2015 as compared to 2014. The decline in Bel's legacy business net sales resulted primarily from lower demand of its DC-DC converter, ICM and passive connector products as compared to 2014.

|

|

·

|

Product Mix – Material and labor costs vary by product line and any significant shift in product mix between higher- and lower-margin product lines will have a corresponding impact on the Company's gross margin percentage. As compared to the pre-2014 (legacy-Bel) business on average, the recently acquired Power Solutions business has lower margins and Connectivity Solutions has higher margins. Fluctuations in sales volume of Power Solutions or Connectivity Solutions products will have a corresponding impact on Bel's profit margins.

|

|

·

|

Pricing and Availability of Materials – Pricing and availability of components that constitute raw materials in our manufacturing processes have been stable for most of the Company's product lines, although lead times on certain electrical components continue to be extended. Pricing of electrical components during the year ended December 31, 2015 was flat compared to the same period of 2014. With regard to commodity pricing, the costs of certain commodities that are contained in components and other raw materials, such as gold and copper, were lower during 2015 as compared to 2014. Any fluctuations in component prices and other commodity prices associated with Bel's raw materials will have a corresponding impact on Bel's operating results.

|

|

·

|

Restructuring – The Company continued to implement restructuring programs throughout 2015 in connection with integrating the 2014 Acquisitions into the legacy-Bel structure and other cost savings and facility consolidation efforts. During the years ended December 31, 2015, 2014 and 2013, the Company incurred $2.1 million, $1.8 million and $1.4 million, respectively, in restructuring costs, primarily for severance and termination benefits. The measures implemented in 2015 are projected to result in incremental savings of $3 million to $4 million on an annualized basis, beginning in 2016. The Company will continue to review its operations for further cost containment opportunities and additional restructuring charges may be incurred in future quarters. The projected cost savings represent Forward-Looking Statements. See "Cautionary Notice Regarding Forward-Looking Information."

|

|

·

|

Labor Costs – Labor costs as a percentage of sales were 10.7% of sales in 2015 as compared to 12.1% of sales in 2014 and 14.5% of sales in 2013. The influx of the 2014 Acquisitions resulted in a lower consolidated labor cost as a percentage of sales as labor costs for the Power Solutions business in 2015 was 5.2% of their respective sales and Connectivity Solutions' labor costs were 7.0% of their respective sales.

|

|

·

|

Acquisition-Related Costs – The acquisitions of Power Solutions and Connectivity Solutions in 2014 gave rise to acquisition-related costs of $0.6 million in 2015 and $7.3 million in 2014, which includes professional fees for independent valuations and carve-out audits for each of the acquired companies. In addition to these costs, a combined $5.9 million of inventory step up costs were charged to cost of sales in 2014.

|

|

·

|

Impact of Foreign Currency – Since we are a U.S. domiciled company, we translate our foreign currency-denominated financial results into U.S. dollars. Due to the changes in the value of foreign currencies relative to the U.S. dollar, translating our financial results and the revaluation of certain intercompany transactions to and from foreign currencies to U.S. dollars may result in a favorable or unfavorable impact to our consolidated statements of operations and cash flows. The Company monitors changes in foreign currencies and implements pricing actions to help mitigate the impact that changes in foreign currencies may have on its operating results. See Selling, General and Administrative Expenses and Inflation and Foreign Currency Exchange below for further details.

|

|

·

|

Effective Tax Rate – The Company's effective tax rate will fluctuate based on the geographic segment in which our pretax profits are earned. Of the geographic segments in which we operate, the U.S. has the highest tax rates; Europe's tax rates are generally lower than U.S. tax rates; and Asia has the lowest tax rates of the Company's three geographical segments. See Note 9, "Income Taxes."

|

|

2015

|

2014

|

2013

|

||||||||||||||||||||||

|

North America

|

$

|

304,328

|

54

|

%

|

$

|

217,258

|

45

|

%

|

$

|

116,548

|

33

|

%

|

||||||||||||

|

Asia

|

188,146

|

33

|

%

|

201,338

|

41

|

%

|

193,647

|

56

|

%

|

|||||||||||||||

|

Europe

|

74,606

|

13

|

%

|

68,480

|

14

|

%

|

38,994

|

11

|

%

|

|||||||||||||||

|

$

|

567,080

|

100

|

%

|

$

|

487,076

|

100

|

%

|

$

|

349,189

|

100

|

%

|

|||||||||||||

|

2015

|

2014

|

2013

|

||||||||||

|

Total segment sales:

|

||||||||||||

|

North America

|

$

|

329,304

|

$

|

248,007

|

$

|

128,472

|

||||||

|

Asia

|

295,751

|

275,765

|

225,151

|

|||||||||

|

Europe

|

148,735

|

114,748

|

40,742

|

|||||||||

|

Total segment sales

|

773,790

|

638,520

|

394,365

|

|||||||||

|

Reconciling item:

|

||||||||||||

|

Intersegment sales

|

(206,710

|

)

|

(151,444

|

)

|

(45,176

|

)

|

||||||

|

Net sales

|

$

|

567,080

|

$

|

487,076

|

$

|

349,189

|

||||||

|

Income (loss) from operations:

|

||||||||||||

|

North America

|

$

|

11,012

|

$

|

(4,531

|

)

|

$

|

(1,560

|

)

|

||||

|

Asia

|

8,175

|

13,090

|

15,356

|

|||||||||

|

Europe

|

9,413

|

4,913

|

1,251

|

|||||||||

|

$

|

28,600

|

$

|

13,472

|

$

|

15,047

|

|||||||

|

Years Ended

|

||||||||||||||||||||||||

|

December 31,

|

||||||||||||||||||||||||

|

2015

|

2014

|

2013

|

||||||||||||||||||||||

|

Power solutions and protection

|

$

|

214,766

|

38

|

%

|

$

|

159,867

|

33

|

%

|

$

|

67,370

|

19

|

%

|

||||||||||||

|

Connectivity solutions

|

181,697

|

32

|

%

|

152,954

|

31

|

%

|

111,653

|

32

|

%

|

|||||||||||||||

|

Magnetic solutions

|

170,617

|

30

|

%

|

174,255

|

36

|

%

|

170,166

|

49

|

%

|

|||||||||||||||

|

$

|

567,080

|

100

|

%

|

$

|

487,076

|

100

|

%

|

$

|

349,189

|

100

|

%

|

|||||||||||||

|

Years Ended

|

||||||||||||

|

December 31,

|

||||||||||||

|

2015

|

2014

|

2013

|

||||||||||

|

Material costs

|

43.6

|

%

|

44.9

|

%

|

42.5

|

%

|

||||||

|

Labor costs

|

10.7

|

%

|

12.1

|

%

|

14.5

|

%

|

||||||

|

Research and development expenses

|

4.9

|

%

|

4.4

|

%

|

4.0

|

%

|

||||||

|

Other expenses

|

21.6

|

%

|

20.7

|

%

|

21.2

|

%

|

||||||

|

Total cost of sales

|

80.8

|

%

|

82.1

|

%

|

82.2

|

%

|

||||||

|

·

|

the incremental impact of SG&A expenses related to the 2013 and 2014 Acquisitions of $19.1 million;

|

|

·

|

higher acquisition-related costs of $6.5 million related to the 2014 Acquisitions; and

|

|

·

|

an increase in salaries of $1.5 million.

|

|

Payments due by period (dollars in thousands)

|

||||||||||||||||||||

|

Contractual Obligations

|

Total

|

Less than 1 year

|

1-3

years |

3-5

years |

More than

5 years |

|||||||||||||||

|

Long-term debt obligations(1)

|

$

|

187,188

|

$

|

24,772

|

$

|

43,001

|

$

|

119,415

|

$

|

-

|

||||||||||

|

Interest payments due on long-term debt(2)

|

15,312

|

5,208

|

8,522

|

1,582

|

-

|

|||||||||||||||

|

Capital expenditure obligations

|

1,541

|

1,541

|

-

|

-

|

-

|

|||||||||||||||

|

Operating leases

|

23,430

|

7,924

|

9,079

|

4,216

|

2,211

|

|||||||||||||||

|

Raw material purchase obligations

|

42,607

|

42,452

|

155

|

-

|

-

|

|||||||||||||||

|

First quarter 2016 quarterly cash dividend declared

|

810

|

810

|

||||||||||||||||||

|

Total

|

$

|

270,888

|

$

|

82,707

|

$

|

60,757

|

$

|

125,213

|

$

|

2,211

|

||||||||||

|

·

|

Applying a compounded annual growth rate for forecasted sales in our projected cash flows through 2020.

|

|

Reporting Unit

|

Compounded Annual Growth Rate

|

|||

|

North America

|

2.0

|

%

|

||

|

Asia

|

2.0

|

%

|

||

|

Europe

|

2.0

|

%

|

||

|

·

|

Applying a terminal value growth rate of 2% for our reporting units to reflect our estimate of stable and perpetual growth.

|

|

·

|

Determining an appropriate discount rate to apply to our projected cash flow results. This discount rate reflects, among other things, certain risks due to the uncertainties of achieving the cash flow results and the growth rates assigned. The discount rates applied were as follows:

|

|

Reporting Unit

|

Discount Rate

|

|||

|

North America

|

11.0

|

%

|

||

|

Asia

|

15.0

|

%

|

||

|

Europe

|

11.0

|

%

|

||

|

·

|

A weighting of the results of the income approach of 75% of our overall fair value calculation for each reporting unit.

|

The Company has not entered into, and does not expect to enter into, financial instruments for trading or hedging purposes. The Company does not currently anticipate entering into interest rate swaps and/or similar instruments.

|

BEL FUSE INC.

|

|||

|

INDEX

|

|||

|

Financial Statements

|

Page

|

||

|

33

|

|||

|

34

|

|||

|

35

|

|||

|

36

|

|||

|

37

|

|||

|

38

|

|||

|

40

|

|||

|

BEL FUSE INC. AND SUBSIDIARIES

|

||||||||

|

(dollars in thousands, except share and per share data)

|

||||||||

|

December 31,

|

December 31,

|

|||||||

|

2015

|

2014

|

|||||||

|

(Revised)

|

||||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

85,040

|

$

|

77,138

|

||||

|

Accounts receivable - less allowance for doubtful accounts

|

||||||||

|

of $1,747 and $1,989 at December 31, 2015 and 2014, respectively

|

86,268

|

99,605

|

||||||

|

Inventories

|

98,510

|

113,630

|

||||||

|

Other current assets

|

15,636

|

20,283

|

||||||

|

Total current assets

|

285,454

|

310,656

|

||||||

|

Property, plant and equipment, net

|

57,611

|

69,261

|

||||||

|

Intangible assets, net

|

87,827

|

95,502

|

||||||

|

Goodwill

|

121,634

|

118,369

|

||||||

|

Deferred income taxes

|

3,321

|

7,933

|

||||||

|

Other assets

|

31,164

|

33,700

|

||||||

|

Total assets

|

$

|

587,011

|

$

|

635,421

|

||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$

|

49,798

|

$

|

61,926

|

||||

|

Accrued expenses

|

38,323

|

42,588

|

||||||

|

Current maturities of long-term debt

|

24,772

|

13,438

|

||||||

|

Other current liabilities

|

9,133

|

3,850

|

||||||

|

Total current liabilities

|

122,026

|

121,802

|

||||||

|

Long-term liabilities:

|

||||||||

|

Long-term debt

|

162,416

|

219,187

|

||||||

|

Liability for uncertain tax positions

|

40,295

|

39,767

|

||||||

|

Minimum pension obligation and unfunded pension liability

|

15,576

|

14,205

|

||||||

|

Deferred income taxes

|

13,002

|

15,739

|

||||||

|

Other long-term liabilities

|

574

|

448

|

||||||

|

Total liabilities

|

353,889

|

411,148

|

||||||

|

Commitments and contingencies

|

||||||||

|

Stockholders' equity:

|

||||||||

|

Preferred stock, no par value, 1,000,000 shares authorized; none issued

|

-

|

-

|

||||||

|

Class A common stock, par value $.10 per share, 10,000,000 shares

|

||||||||

|

authorized; 2,174,912 shares outstanding at each date (net of

|

||||||||

|

1,072,769 treasury shares)

|

217

|

217

|

||||||

|

Class B common stock, par value $.10 per share, 30,000,000 shares

|

||||||||

|

authorized; 9,701,977 and 9,686,777 shares outstanding, respectively

|

||||||||

|

(net of 3,218,307 treasury shares)

|

970

|

969

|

||||||

|

Additional paid-in capital

|

24,440

|

21,626

|

||||||

|

Retained earnings

|

229,371

|

213,409

|

||||||

|

Accumulated other comprehensive (loss) income

|

(21,876

|

)

|

(11,948

|

)

|

||||

|

Total stockholders' equity

|

233,122

|

224,273

|

||||||

|

Total liabilities and stockholders' equity

|

$

|

587,011

|

$

|

635,421

|

||||

|

See accompanying notes to consolidated financial statements.

|

||||||||

|

BEL FUSE INC. AND SUBSIDIARIES

|

||||||||||||

|

(dollars in thousands, except per share data)

|

||||||||||||

|

Year Ended December 31,

|

||||||||||||

|

2015

|

2014

|

2013

|

||||||||||

|

(Revised)

|

||||||||||||

|

Net sales

|

$

|

567,080

|

$

|

487,076

|

$

|

349,189

|

||||||

|

Cost of sales

|

458,253

|

399,721

|

286,952

|

|||||||||

|

Selling, general and administrative expenses

|

78,113

|

72,051

|

45,803

|

|||||||||

|

Restructuring charges

|

2,114

|

1,832

|

1,387

|

|||||||||

|

Income from operations

|

28,600

|

13,472

|

15,047

|

|||||||||

|

Interest expense

|

(7,588

|

)

|

(3,978

|

)

|

(156

|

)

|

||||||

|

Interest income and other, net

|

4,720

|

276

|

274

|

|||||||||

|

Earnings before provision (benefit) for income taxes

|

25,732

|

9,770

|

15,165

|

|||||||||

|

Provision (benefit) for income taxes

|

6,535

|

1,167

|

(743

|

)

|

||||||||

|

Net earnings available to common shareholders

|

$

|

19,197

|

$

|

8,603

|

$

|

15,908

|

||||||

|

Net earnings per common share:

|

||||||||||||

|

Class A common shares - basic and diluted

|

$

|

1.53

|

$

|

0.69

|

$

|

1.32

|

||||||

|

Class B common shares - basic and diluted

|

$

|

1.64

|

$

|

0.75

|

$

|

1.41

|

||||||

|

Weighted-average shares outstanding:

|

||||||||||||

|

Class A common shares - basic and diluted

|

2,175

|

2,175

|

2,175

|

|||||||||

|

Class B common shares - basic and diluted

|

9,698

|

9,491

|

9,240

|

|||||||||

|

Dividends paid per common share:

|

||||||||||||

|

Class A common shares

|

$

|

0.24

|

$

|

0.24

|

$

|

0.24

|

||||||

|

Class B common shares

|

$

|

0.28

|

$

|

0.28

|

$

|

0.28

|

||||||

|

See accompanying notes to consolidated financial statements.

|

||||||||||||

|

BEL FUSE INC. AND SUBSIDIARIES

|

||||||||||||

|

(dollars in thousands)

|

||||||||||||

|

|

||||||||||||

|

|

||||||||||||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2015

|

2014

|

2013

|

|||||||||

|

|

(Revised)

|

|||||||||||

|

|

||||||||||||

|

Net earnings

|

$

|

19,197

|

$

|

8,603

|

$

|

15,908

|

||||||

|

|

||||||||||||

|

Other comprehensive (loss) income:

|

||||||||||||

|

Currency translation adjustment, net of taxes of ($194), ($219) and $77

|

(9,954

|

)

|

(11,255

|

)

|

977

|

|||||||

|

Reclassification adjustment for gain (loss) on sale of marketable

|

||||||||||||

|

securities included in net earnings, net of tax of $-, $- and ($37)

|

-

|

-

|

(61

|

)

|

||||||||

|

Unrealized holding (losses) gains on marketable securities arising during

|

||||||||||||

|

the period, net of taxes of $5, $90 and $45

|

5

|

147

|

87

|

|||||||||

|

Change in unfunded SERP liability, net of taxes of $2, ($631) and

|

||||||||||||

|

$457, respectively

|

21

|

(1,485

|

)

|

1,069

|

||||||||

|

Other comprehensive (loss) income

|

(9,928

|

)

|

(12,593

|

)

|

2,072

|

|||||||

|

|

||||||||||||

|

Comprehensive income (loss)

|

$

|

9,269

|

$

|

(3,990

|

)

|

$

|

17,980

|

|||||

|

|

||||||||||||

|

|

||||||||||||

|

See accompanying notes to consolidated financial statements.

|

||||||||||||

|

BEL FUSE INC. AND SUBSIDIARIES

|

||||||||||||||||||||||||

|

(dollars in thousands)

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

|

Accumulated

|

|||||||||||||||||||||||

|

|

Other

|

Class A

|

Class B

|

Additional

|

||||||||||||||||||||

|

|

Retained

|

Comprehensive

|

Common

|

Common

|

Paid-In

|

|||||||||||||||||||

|

|

Total

|

Earnings

|

(Loss) Income

|

Stock

|

Stock

|

Capital

|

||||||||||||||||||

|

Balance at December 31, 2012

|

$

|

215,362

|

$

|

195,183

|

$

|

(1,427

|

)

|

$

|

217

|

$

|

937

|

$

|

20,452

|

|||||||||||

|

|

||||||||||||||||||||||||

|

Cash dividends declared on Class A common stock

|

(522

|

)

|

(522

|

)

|

||||||||||||||||||||

|

Cash dividends declared on Class B common stock

|

(2,576

|

)

|

(2,576

|

)

|

||||||||||||||||||||

|

Issuance of restricted common stock

|

-

|

16

|

(16

|

)

|

||||||||||||||||||||

|

Forfeiture of restricted common stock

|

-

|

(2

|

)

|

2

|

||||||||||||||||||||

|

Repurchase/retirement of Class B common stock

|

(3,356

|

)

|

(18

|

)

|

(3,338

|

)

|

||||||||||||||||||

|

Foreign currency translation adjustment, net of taxes of $77

|

977

|

977

|

||||||||||||||||||||||

|

Unrealized holding gains on marketable securities

|

||||||||||||||||||||||||

|

arising during the year, net of taxes of $45

|

87

|

87

|

||||||||||||||||||||||

|

Reclassification adjustment for unrealized holding

|

||||||||||||||||||||||||

|

gains included in net earnings, net of taxes of ($37)

|

(61

|

)

|

(61

|

)

|

||||||||||||||||||||

|

Reduction in APIC pool associated with tax

|

||||||||||||||||||||||||

|

deficiencies related to restricted stock awards

|

(65

|

)

|

(65

|

)

|

||||||||||||||||||||

|

Stock-based compensation expense

|

1,879

|

1,879

|

||||||||||||||||||||||

|

Change in unfunded SERP liability, net of taxes of $457

|

1,069

|

1,069

|

||||||||||||||||||||||

|

Net earnings

|

15,908

|

15,908

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Balance at December 31, 2013

|

$

|

228,702

|

$

|

207,993

|

$

|

645

|

$

|

217

|

$

|

933

|

$

|

18,914

|

||||||||||||

|

|

||||||||||||||||||||||||

|

Cash dividends declared on Class A common stock

|

(522

|

)

|

(522

|

)

|

||||||||||||||||||||

|

Cash dividends declared on Class B common stock

|

(2,665

|

)

|

(2,665

|

)

|

||||||||||||||||||||

|

Issuance of restricted common stock

|

-

|

38

|

(38

|

)

|

||||||||||||||||||||

|

Forfeiture of restricted common stock

|

-

|

(2

|

)

|

2

|

||||||||||||||||||||

|

Foreign currency translation adjustment, net of taxes of ($219)

|

(11,255

|

)

|

(11,255

|

)

|

||||||||||||||||||||

|

Unrealized holding gains on marketable securities

|

||||||||||||||||||||||||

|

arising during the year, net of taxes of $90

|

147

|

147

|

||||||||||||||||||||||

|

Increase in APIC pool associated with tax

|

||||||||||||||||||||||||

|

benefits related to restricted stock awards

|

31

|

31

|

||||||||||||||||||||||

|

Stock-based compensation expense

|

2,717

|

2,717

|

||||||||||||||||||||||

|

Change in unfunded SERP liability, net of taxes of ($631)

|

(1,485

|

)

|

(1,485

|

)

|

||||||||||||||||||||

|

Net earnings

|

8,603

|

8,603

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Balance at December 31, 2014 (Revised)

|

$

|

224,273

|

$

|

213,409

|

$

|

(11,948

|

)

|

$

|

217

|

$

|

969

|

$

|

21,626

|

|||||||||||

|

|

||||||||||||||||||||||||

|

Cash dividends declared on Class A common stock

|

(522

|

)

|

(522

|

)

|

||||||||||||||||||||

|

Cash dividends declared on Class B common stock

|

(2,713

|

)

|

(2,713

|

)

|

||||||||||||||||||||

|

Issuance of restricted common stock

|

-

|

8

|

(8

|

)

|

||||||||||||||||||||

|

Forfeiture of restricted common stock

|

-

|

(7

|

)

|

7

|

||||||||||||||||||||

|

Foreign currency translation adjustment, net of taxes of ($194)

|

(9,954

|

)

|

(9,954

|

)

|

||||||||||||||||||||

|

Unrealized holding gains on marketable securities

|

||||||||||||||||||||||||

|

arising during the year, net of taxes of $5

|

5

|

5

|

||||||||||||||||||||||

|

Increase in APIC pool associated with tax

|

||||||||||||||||||||||||

|

benefits related to restricted stock awards

|

0

|

|||||||||||||||||||||||

|

Stock-based compensation expense

|

2,815

|

2,815

|

||||||||||||||||||||||

|

Change in unfunded SERP liability, net of taxes of $2

|

21

|

21

|

||||||||||||||||||||||

|

Net earnings

|

19,197

|

19,197

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Balance at December 31, 2015

|

$

|

233,122

|

$

|

229,371

|

$

|

(21,876

|

)

|

$

|

217

|

$

|

970

|

$

|

24,440

|

|||||||||||

|

|

||||||||||||||||||||||||

|

See accompanying notes to consolidated financial statements.

|

||||||||||||||||||||||||

|

BEL FUSE INC. AND SUBSIDIARIES

|

||||||||||||

|

(dollars in thousands)

|

||||||||||||

|

|

||||||||||||

|

|

Years Ended December 31,

|

|||||||||||

|

|

2015

|

2014

|

2013

|

|||||||||

|

|

(Revised)

|

|||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net earnings

|

$

|

19,197

|

$

|

8,603

|

$

|

15,908

|

||||||

|

Adjustments to reconcile net earnings to net cash

|

||||||||||||

|

provided by operating activities:

|

||||||||||||

|

Depreciation and amortization

|

23,009

|

20,367

|

12,382

|

|||||||||

|

Stock-based compensation

|

2,815

|

2,717

|

1,879

|

|||||||||

|

Amortization of deferred financing costs

|

1,432

|

699

|

-

|

|||||||||

|

Deferred income taxes

|

(356

|

)

|

(2,691

|

)

|

(877

|

)

|

||||||

|

Other, net

|

(1,419

|

)

|

(3,651

|

)

|

407

|

|||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Accounts receivable

|

12,187

|

1,382

|

(8,025

|

)

|

||||||||

|

Inventories

|

12,951

|

9,121

|

(6,538

|

)

|

||||||||

|

Other current assets

|

846

|

693

|

1,702

|

|||||||||

|

Other assets

|

2,161

|

(450

|

)

|

(62

|

)

|

|||||||

|

Accounts payable

|

(10,022

|

)

|

(3,890

|

)

|

1,485

|

|||||||

|

Accrued expenses

|

(3,154

|

)

|

(10,170

|

)

|

(7,670

|

)

|

||||||

|

Other liabilities

|

(295

|

)

|

423

|

165

|

||||||||

|

Income taxes payable

|

6,437

|

(696

|

)

|

(175

|

)

|

|||||||

|

Net cash provided by operating activities

|

65,789

|

22,457

|

10,581

|

|||||||||

|

|

||||||||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Purchase of property, plant and equipment

|

(9,891

|

)

|

(9,042

|

)

|

(6,940

|

)

|

||||||

|

Purchase of intangible asset

|

-

|

(1,336

|

)

|

|||||||||

|

Purchase of marketable securities

|

-

|

(2,936

|

)

|

-

|

||||||||

|

Purchase of company-owned life insurance

|

(2,820

|

)

|

(2,820

|

)

|

(2,820

|

)

|

||||||

|

Cash transferred from (to) restricted cash

|

-

|

-

|

12,993

|

|||||||||

|

Payments for acquisitions, net of cash acquired

|

-

|

(208,693

|

)

|

(30,994

|

)

|

|||||||

|

Proceeds from cash surrender of COLI policies

|

-

|

5,756

|

-

|

|||||||||

|

Proceeds from sale of marketable securities

|

2,820

|

-

|

2,820

|

|||||||||

|

Proceeds from disposal/sale of property, plant and equipment

|

77

|

65

|

96

|

|||||||||

|

Net cash used in investing activities

|

(9,814

|

)

|

(217,670

|

)

|

(26,181

|

)

|

||||||

|

|

||||||||||||

|

(continued)

|

||||||||||||

|

|

||||||||||||

|

See notes to consolidated financial statements.

|

||||||||||||

|

BEL FUSE INC. AND SUBSIDIARIES

|

||||||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

|

||||||||||||

|

(dollars in thousands)

|

||||||||||||

|

|

||||||||||||

|

|

Year Ended December 31,

|

|||||||||||

|

|

2015

|

2014

|

2013

|

|||||||||

|

|

(Revised)

|

|||||||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Dividends paid to common shareholders

|

(3,238

|

)

|

(3,160

|

)

|

(3,111

|

)

|

||||||

|

Deferred financing costs

|

(15

|

)

|

(5,756

|

)

|

-

|

|||||||

|

Borrowings under revolving credit line

|

12,500

|

23,000

|

12,000

|

|||||||||

|

Repayments under revolving credit line

|

(35,500

|

)

|

(12,000

|

)

|

-

|

|||||||

|

(Reduction) increase in notes payable

|

(123

|

)

|

(161

|

)

|

506

|

|||||||

|

Proceeds from long-term debt

|

-

|

215,000

|

-

|

|||||||||

|

Repayments of long-term debt

|

(22,438

|

)

|

(5,375

|

)

|

-

|

|||||||

|

Purchase and retirement of Class B common stock

|

-

|

-

|

(3,356

|

)

|

||||||||

|

Net cash (used in) provided by financing activities

|

(48,814

|

)

|

211,548

|

6,039

|

||||||||

|

Effect of exchange rate changes on cash

|

741

|

(1,320

|

)

|

422

|

||||||||

|

|

||||||||||||

|

Net increase (decrease) in cash and cash equivalents

|

7,902

|

15,015

|

(9,139

|

)

|

||||||||

|

|

||||||||||||

|

Cash and cash equivalents - beginning of year

|

77,138

|

62,123

|

71,262

|

|||||||||

|

|

||||||||||||

|

Cash and cash equivalents - end of year

|

$

|

85,040

|

$

|

77,138

|

$

|

62,123

|

||||||

|

|

||||||||||||

|

|

||||||||||||

|

Supplemental cash flow information:

|

||||||||||||

|

|

||||||||||||

|

Cash paid (received) during the year for:

|

||||||||||||

|

Income taxes, net of refunds received

|

$

|

580

|

$

|

4,686

|

$

|

(474

|

)

|

|||||

|

Interest payments

|

$

|

6,153

|

$

|

3,210

|

$

|

156

|

||||||

|

|

||||||||||||

|

Details of acquisition (see Note 2):

|

||||||||||||

|

Fair value of identifiable net assets acquired

|

$

|

-

|

$

|

130,747

|

$

|

34,541

|

||||||

|

Goodwill

|

-

|

105,402

|

4,812

|

|||||||||

|

Fair value of net assets acquired

|

$

|

-

|

$

|

236,149

|

$

|

39,353

|

||||||

|

|

||||||||||||

|

Fair value of consideration transferred

|

$

|

-

|

$

|

236,149

|

$

|

39,353

|

||||||

|

Less: Cash acquired in acquisition

|

-

|

(27,456

|

)

|

(8,359

|

)

|

|||||||

|

Cash paid for acquisition, net of cash acquired

|

$

|

-

|

$

|

208,693

|

$

|

30,994

|

||||||

|

See notes to consolidated financial statements.

|

||||||||||||

|

2015

|

2014

|

2013

|

||||||||||

|

Numerator:

|

||||||||||||

|

Net earnings

|

$

|

19,197

|

$

|

8,603

|

$

|

15,908

|

||||||

|

Less dividends declared:

|

||||||||||||

|

Class A

|

522

|

522

|

522

|

|||||||||

|

Class B

|

2,713

|

2,665

|

2,576

|

|||||||||

|

Undistributed earnings

|

$

|

15,962

|

$

|

5,416

|

$

|

12,810

|

||||||

|

Undistributed earnings allocation - basic and diluted:

|

||||||||||||

|

Class A undistributed earnings

|

$

|

2,809

|

$

|

970

|

$

|

2,346

|

||||||

|

Class B undistributed earnings

|

13,153

|

4,446

|

10,464

|

|||||||||

|

Total undistributed earnings

|

$

|

15,962

|

$

|

5,416

|

$

|

12,810

|

||||||

|

Net earnings allocation - basic and diluted:

|

||||||||||||

|

Class A net earnings

|

$

|

3,331

|

$

|

1,492

|

$

|

2,868

|

||||||

|

Class B net earnings

|

15,866

|

7,111

|

13,040

|

|||||||||

|

Net earnings

|

$

|

19,197

|

$

|

8,603

|

$

|

15,908

|

||||||

|

Denominator:

|

||||||||||||

|

Weighted average shares outstanding:

|

||||||||||||

|

Class A - basic and diluted

|

2,175

|

2,175

|

2,175

|

|||||||||

|

Class B - basic and diluted

|

9,698

|

9,491

|

9,240

|

|||||||||

|

Net earnings per share:

|

||||||||||||

|

Class A - basic and diluted

|

$

|

1.53

|

$

|

0.69

|

$

|

1.32

|

||||||

|

Class B - basic and diluted

|

$

|

1.64

|

$

|

0.75

|

$

|

1.41

|

||||||

|

2.

|

ACQUISITIONS AND DISPOSITION

|

|

Power Solutions

|

Connectivity Solutions

|

2014 Acquisitions

|

||||||||||||||||||||||||||||

|

June 19, 2014

|

July 25, 2014/

|

|||||||||||||||||||||||||||||

|

(As Reported at

|

Measurement

|

June 19,

|

August 29, 2014(a)

|

Measurement

|

July 25, 2014/

|

Acquisition-Date

|

||||||||||||||||||||||||

|

December 31,

|

Period

|

2014

|

(As Reported at

|

Period

|

August 29, 2014

|

Fair Values

|

||||||||||||||||||||||||

|

2014)

|

|

Adjustments

|

(Revised)

|

December 31, 2014)

|

Adjustments

|

(Revised)

|

(Revised)

|

|||||||||||||||||||||||

|

Cash

|

$

|

20,912

|

$

|

-

|

$

|

20,912

|

$

|

6,544

|

$

|

-

|

$

|

6,544

|

$

|

27,456

|

||||||||||||||||

|

Accounts receivable

|

29,389

|

-

|

29,389

|

9,375

|

-

|

9,375

|

38,764

|

|||||||||||||||||||||||

|

Inventories

|

36,429

|

-

|

36,429

|

17,632

|

-

|

17,632

|

54,061

|

|||||||||||||||||||||||

|

Other current assets

|

7,350

|

-

|

7,350

|

2,615

|

(1,761

|

)

|

(c)

|

854

|

8,204

|

|||||||||||||||||||||

|

Property, plant and equipment

|

28,175

|

(1,060

|

)

|

(b)

|

27,115

|

9,900

|

-

|

9,900

|

37,015

|

|||||||||||||||||||||

|

Intangible assets

|

33,220

|

-

|

33,220

|

40,000

|

-

|

40,000

|

73,220

|

|||||||||||||||||||||||

|

Other assets

|

19,171

|

-

|

19,171

|

2,345

|

2,388

|

(c)

|

4,733

|

23,904

|

||||||||||||||||||||||

|

Total identifiable assets

|

174,646

|

(1,060

|

)

|

173,586

|

88,411

|

627

|

89,038

|

262,624

|

||||||||||||||||||||||

|

Accounts payable

|

(26,180

|

)

|

-

|

(26,180

|

)

|

(10,682

|

)

|

-

|

(10,682

|

)

|

(36,862

|

)

|

||||||||||||||||||

|

Accrued expenses

|

(25,545

|

)

|

-

|

(25,545

|

)

|

(5,307

|

)

|

76

|

(5,231

|

)

|

(30,776

|

)

|

||||||||||||||||||

|

Other current liabilities

|

223

|

-

|

223

|

(57

|

)

|

946

|

(c)

|

889

|

1,112

|

|||||||||||||||||||||

|

Noncurrent liabilities

|

(42,062

|

)

|

(4,623

|

)

|

(c)

|

(46,685

|

)

|

(17,314

|

)

|

(1,352

|

)

|

(c)

|

(18,666

|

)

|

(65,351

|

)

|

||||||||||||||

|

Total liabilities assumed

|

(93,564

|

)

|