x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

001-3034 | 41-0448030 | |

(Commission File Number) | (I.R.S. Employer Identification No.) | |

(Registrant, State of Incorporation or Organization, Address of Principal Executive Officers and Telephone Number) | ||

Xcel Energy Inc. | ||

(a Minnesota corporation) | ||

414 Nicollet Mall | ||

Minneapolis, MN 55401 | ||

612-330-5500 | ||

Title of each class | Name of each exchange on which registered | |

Common Stock, $2.50 par value per share | Nasdaq Stock Market LLC | |

Securities registered pursuant to section 12(g) of the Act: None | ||

PART I | ||

Item 1 — | ||

Item 1A — | ||

Item 1B — | ||

Item 2 — | ||

Item 3 — | ||

Item 4 — | ||

PART II | ||

Item 5 — | ||

Item 6 — | ||

Item 7 — | ||

Item 7A — | ||

Item 8 — | ||

Item 9 — | ||

Item 9A — | ||

Item 9B — | ||

PART III | ||

Item 10 — | ||

Item 11 — | ||

Item 12 — | ||

Item 13 — | ||

Item 14 — | ||

PART IV | ||

Item 15 — | ||

Item 16 — | ||

Xcel Energy Inc.’s Subsidiaries and Affiliates (current and former) | |

Capital Services | Capital Services, LLC |

Eloigne | Eloigne Company |

e prime | e prime inc. |

NCE | New Century Energies, Inc. |

NSP-Minnesota | Northern States Power Company, a Minnesota corporation |

NSP System | The electric production and transmission system of NSP-Minnesota and NSP-Wisconsin operated on an integrated basis and managed by NSP-Minnesota |

NSP-Wisconsin | Northern States Power Company, a Wisconsin corporation |

Operating companies | NSP-Minnesota, NSP-Wisconsin, PSCo and SPS |

PSCo | Public Service Company of Colorado |

SPS | Southwestern Public Service Co. |

Utility subsidiaries | NSP-Minnesota, NSP-Wisconsin, PSCo and SPS |

WGI | WestGas InterState, Inc. |

WYCO | WYCO Development, LLC |

Xcel Energy | Xcel Energy Inc. and its subsidiaries |

Federal and State Regulatory Agencies | |

CPUC | Colorado Public Utilities Commission |

D.C. Circuit | United States Court of Appeals for the District of Columbia Circuit |

DOC | Minnesota Department of Commerce |

DOE | United States Department of Energy |

DOJ | Department of Justice |

DOT | United States Department of Transportation |

EPA | United States Environmental Protection Agency |

FERC | Federal Energy Regulatory Commission |

Fifth Circuit | United States Court of Appeals for the Fifth Circuit |

IRS | Internal Revenue Service |

Minnesota District Court | U.S. District Court for the District of Minnesota |

MPSC | Michigan Public Service Commission |

MPUC | Minnesota Public Utilities Commission |

NDPSC | North Dakota Public Service Commission |

NERC | North American Electric Reliability Corporation |

Ninth Circuit | U.S. Court of Appeals for the Ninth Circuit |

NMPRC | New Mexico Public Regulation Commission |

NRC | Nuclear Regulatory Commission |

OAG | Minnesota Office of the Attorney General |

PHMSA | Pipeline and Hazardous Materials Safety Administration |

PSCW | Public Service Commission of Wisconsin |

PUCT | Public Utility Commission of Texas |

SDPUC | South Dakota Public Utilities Commission |

SEC | Securities and Exchange Commission |

TCEQ | Texas Commission on Environmental Quality |

Electric, Purchased Gas and Resource Adjustment Clauses | |

CIP | Conservation improvement program |

DCRF | Distribution cost recovery factor |

DSM | Demand side management |

DSMCA | Demand side management cost adjustment |

ECA | Retail electric commodity adjustment |

EE | Energy efficiency |

EECRF | Energy efficiency cost recovery factor |

EIR | Environmental improvement rider |

FCA | Fuel clause adjustment |

FPPCAC | Fuel and purchased power cost adjustment clause |

GCA | Gas cost adjustment |

GUIC | Gas utility infrastructure cost rider |

PCCA | Purchased capacity cost adjustment |

PCRF | Power cost recovery factor |

PGA | Purchased gas adjustment |

PSIA | Pipeline system integrity adjustment |

RDF | Renewable development fund |

RER | Renewable energy rider |

RES | Renewable energy standard |

RESA | Renewable energy standard adjustment |

SCA | Steam cost adjustment |

SEP | State energy policy rider |

TCA | Transmission cost adjustment |

TCR | Transmission cost recovery adjustment |

TCRF | Transmission cost recovery factor |

WCA | Windsource® cost adjustment |

Other | |

AFUDC | Allowance for funds used during construction |

ALJ | Administrative law judge |

APBO | Accumulated postretirement benefit obligation |

ARAM | Average rate assumption method |

ARO | Asset retirement obligation |

ASC | FASB Accounting Standards Codification |

ASU | FASB Accounting Standards Update |

ATM | At-the-market |

ATRR | Annual transmission revenue requirement |

BART | Best available retrofit technology |

Boulder | City of Boulder, CO |

C&I | Commercial and Industrial |

CAPM | Capital Asset Pricing Model |

CACJA | Clean Air Clean Jobs Act |

CAISO | California Independent System Operator |

CapX2020 | Alliance of electric cooperatives, municipals and investor-owned utilities in the upper Midwest involved in a joint transmission line planning and construction effort |

CBA | Collective-bargaining agreement |

CCR | Coal combustion residuals |

CCR Rule | Final rule (40 CFR 257.50 - 257.107) published by the EPA regulating the management, storage and disposal of CCRs as a nonhazardous waste |

CDD | Cooling degree-days |

CEP | Colorado Energy Plan |

CIG | Colorado Interstate Gas Company, LLC |

CO2 | Carbon dioxide |

Corps | U.S. Army Corps of Engineers |

CPCN | Certificate of public convenience and necessity |

CPP | Clean Power Plan |

CWA | Clean Water Act |

CWIP | Construction work in progress |

DCF | Discounted Cash Flows |

DECON | Decommissioning method where radioactive contamination is removed and safely disposed at a requisite facility, or decontaminated to a permitted level. |

DRC | Development Recovery Company |

DRIP | Dividend Reinvestment Program |

EEI | Edison Electric Institute |

ELG | Effluent limitations guidelines |

EMANI | European Mutual Association for Nuclear Insurance |

EPS | Earnings per share |

EPU | Extended power uprate |

ERP | Electric resource plan |

ETR | Effective tax rate |

FASB | Financial Accounting Standards Board |

FTR | Financial transmission right |

GAAP | Generally accepted accounting principles |

GE | General Electric |

GHG | Greenhouse gas |

HDD | Heating degree-days |

HTY | Historic test year |

IM | Integrated market |

IPP | Independent power producing entity |

IRC | Internal Revenue Code |

IRP | Integrated Resource Plan |

ISFSI | Independent Spent Fuel Storage Installation |

ITC | Investment Tax Credit |

JOA | Joint operating agreement |

LCM | Life cycle management |

LLW | Low-level radioactive waste |

LSP Transmission | LSP Transmission Holdings, LLC |

Mankato 1 | Mankato Energy Center, LLC |

Mankato 2 | Mankato Energy Center II, LLC |

MDL | Multi-district litigation |

MGP | Manufactured gas plant |

MISO | Midcontinent Independent System Operator, Inc. |

Moody’s | Moody’s Investor Services |

NAAQS | National Ambient Air Quality Standard |

Native load | Demand of retail and wholesale customers that a utility has an obligation to serve under statute or contract |

NAV | Net asset value |

NEIL | Nuclear Electric Insurance Ltd. |

NETO | New England Transmission Owners |

NOL | Net operating loss |

NOX | Nitrogen oxide |

O&M | Operating and maintenance |

OATT | Open Access Transmission Tariff |

OCC | Office of Consumer Counsel |

Opinion 531 | Methodology for calculating base ROE adopted by the FERC in June 2014 |

Paris Agreement | Establishes a framework for GHG mitigation actions by all countries (“nationally determined contributions”) |

PI | Prairie Island nuclear generating plant |

PJM | PJM Interconnection, LLC |

PM | Particulate matter |

Post-65 | Post-Medicare |

PPA | Purchased power agreement |

Pre-65 | Pre-Medicare |

PRP | Potentially responsible party |

PTC | Production tax credit |

QF | Qualifying facilities |

R&E | Research and experimentation |

REC | Renewable energy credit |

RFP | Request for proposal |

ROE | Return on equity |

ROFR | Right-of-first-refusal |

RPS | Renewable portfolio standards |

RTO | Regional Transmission Organization |

Standard & Poor’s | Standard & Poor’s Ratings Services |

SAB | Staff Accounting Bulletin |

SAB 118 | Income Tax Accounting Implications of the Tax Cuts and Jobs Act |

SERP | Supplemental executive retirement plan |

SMMPA | Southern Minnesota Municipal Power Agency |

SO2 | Sulfur dioxide |

SPP | Southwest Power Pool, Inc. |

SSL | Statistically significant increase over established groundwater standards |

TCEH | Texas Competitive Energy Holdings |

TCJA | 2017 federal tax reform enacted as Public Law No: 115-97, commonly referred to as the Tax Cuts and Jobs Act |

THI | Temperature-humidity index |

TOs | Transmission owners |

TransCo | Transmission-only subsidiary |

TSR | Total shareholder return |

VaR | Value at Risk |

VIE | Variable interest entity |

WOTUS | Waters of the U.S. |

Measurements | |

Bcf | Billion cubic feet |

KV | Kilovolts |

KWh | Kilowatt hours |

MMBtu | Million British thermal units |

MW | Megawatts |

MWh | Megawatt hours |

• | Lead the clean energy transition; |

• | Enhance the customer experience; and, |

• | Keep the bills low. |

| |||

NSP-Minnesota | |||

Electric customers | 1.5 million | ||

Natural gas customers | 0.5 million | ||

Consolidated earnings contribution | 35% to 45% | ||

Total assets | $18.5 billion | ||

Electric generating capacity | 7,530 MW | ||

Gas storage capacity | 14.7 Bcf | ||

| |||

NSP-Wisconsin | |||

Electric customers | 0.3 million | ||

Natural gas customers | 0.1 million | ||

Consolidated earnings contribution | 5% to 10% | ||

Total assets | $2.7 billion | ||

Electric generating capacity | 563 MW | ||

Gas storage capacity | 3.6 Bcf | ||

| |||

PSCo | |||

Electric customers | 1.5 million | ||

Natural gas customers | 1.4 million | ||

Consolidated earnings contribution | 35% to 45% | ||

Total assets | $17.3 billion | ||

Electric generating capacity | 5,685 MW | ||

Gas storage capacity | 27.1 Bcf | ||

| |||

SPS | |||

Electric customers | 0.4 million | ||

Consolidated earnings contribution | 15% to 20% | ||

Total assets | $6.7 billion | ||

Electric generating capacity | 4,406 MW | ||

Year Ended Dec. 31 | |||||||||||

2018 | 2017 | 2016 | |||||||||

Electric sales (Millions of KWh) | |||||||||||

Residential | 25,518 | 24,216 | 24,726 | ||||||||

Large C&I | 28,686 | 27,951 | 27,664 | ||||||||

Small C&I | 36,308 | 35,493 | 35,830 | ||||||||

Public authorities and other | 1,071 | 1,055 | 1,103 | ||||||||

Total retail | 91,583 | 88,715 | 89,323 | ||||||||

Sales for resale | 24,199 | 18,349 | 18,694 | ||||||||

Total energy sold | 115,782 | 107,064 | 108,017 | ||||||||

Number of customers at end of period | |||||||||||

Residential | 3,117,262 | 3,082,974 | 3,053,732 | ||||||||

Large C&I | 1,253 | 1,241 | 1,228 | ||||||||

Small C&I | 436,836 | 433,883 | 432,012 | ||||||||

Public authorities and other | 69,794 | 69,376 | 68,935 | ||||||||

Total retail | 3,625,145 | 3,587,474 | 3,555,907 | ||||||||

Wholesale | 70 | 58 | 52 | ||||||||

Total customers | 3,625,215 | 3,587,532 | 3,555,959 | ||||||||

Electric revenues (Millions of Dollars) | |||||||||||

Residential | $ | 3,006 | $ | 2,975 | $ | 2,966 | |||||

Large C&I | 1,696 | 1,779 | 1,707 | ||||||||

Small C&I | 3,343 | 3,463 | 3,328 | ||||||||

Public authorities and other | 136 | 143 | 140 | ||||||||

Total retail | 8,181 | 8,360 | 8,141 | ||||||||

Wholesale | 801 | 719 | 693 | ||||||||

Other electric revenues | 737 | 597 | 666 | ||||||||

Total electric revenues | $ | 9,719 | $ | 9,676 | $ | 9,500 | |||||

KWh sales per retail customer | 25,263 | 24,729 | 25,120 | ||||||||

Revenue per retail customer | $ | 2,257 | $ | 2,330 | $ | 2,289 | |||||

Residential revenue per KWh | 11.78 | ¢ | 12.29 | ¢ | 11.99 | ¢ | |||||

Large C&I revenue per KWh | 5.91 | 6.36 | 6.17 | ||||||||

Small C&I revenue per KWh | 9.21 | 9.76 | 9.29 | ||||||||

Total retail revenue per KWh | 8.93 | 9.42 | 9.11 | ||||||||

Wholesale revenue per KWh | 3.31 | 3.92 | 3.71 | ||||||||

Xcel Energy | NSP System | PSCo | SPS | ||||||||

2018 | |||||||||||

Owned Generation | 67 | % | 77 | % | 70 | % | 49 | % | |||

Purchased Generation | 33 | 23 | 30 | 51 | |||||||

100 | % | 100 | % | 100 | % | 100 | % | ||||

2017 | |||||||||||

Owned Generation | 66 | % | 75 | % | 70 | % | 47 | % | |||

Purchased Generation | 34 | 25 | 30 | 53 | |||||||

100 | % | 100 | % | 100 | % | 100 | % | ||||

2018 | 2017 | |||||

Wind | 16.4 | % | 18.3 | % | ||

Hydroelectric | 5.8 | 6.3 | ||||

Biomass and solar | 4.8 | 4.2 | ||||

Renewable | 27.0 | % | 28.8 | % | ||

• | The NSP System had approximately 2,550 MW and 2,600 MW of wind energy on its system at the end of 2018 and 2017, respectively. |

• | Average cost per MWh of wind energy under existing PPAs was approximately $44 for 2018 and 2017. |

• | Average cost per MWh of wind energy from owned generation was approximately $37 and $42 for 2018 and 2017, respectively. |

2018 | 2017 | |||||

Wind | 23.8 | % | 23.7 | % | ||

Hydroelectric and solar | 3.6 | 3.9 | ||||

Renewable | 27.4 | % | 27.6 | % | ||

• | PSCo had approximately 3,160 MW and 2,560 MW of wind energy on its system at the end of 2018 and 2017, respectively. |

• | Average cost per MWh of wind energy under these contracts was approximately $43 and $42 for 2018 and 2017, respectively. |

• | Rush Creek became operational in December 2018. The 2019 average cost per MWh is expected to be $29. |

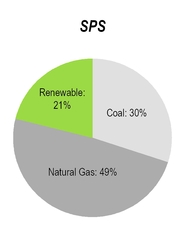

2018 | 2017 | |||||

Wind | 19.1 | % | 21.2 | % | ||

Solar | 2.0 | 2.8 | ||||

Renewable | 21.1 | % | 24.0 | % | ||

• | SPS had approximately 1,565 MW and 1,500 MW of wind energy on its system at the end of 2018 and 2017, respectively. |

• | Average cost per MWh of wind energy under the IPP contracts and QF tariffs was approximately $26 and $27 for 2018 and 2017, respectively. |

• | In 2018, SPS began construction on the Sagamore and Hale County wind farms. Refer to the SPS Wind Development section for further information. |

Coal (a) | Nuclear | Natural Gas | |||||||||||||||||||

Cost | Percent | Cost | Percent | Cost | Percent | ||||||||||||||||

NSP System | |||||||||||||||||||||

2018 | $ | 2.13 | 42 | % | $ | 0.80 | 45 | % | $ | 3.87 | 13 | % | |||||||||

2017 | 2.08 | 45 | 0.78 | 45 | 4.10 | 10 | |||||||||||||||

PSCo | |||||||||||||||||||||

2018 | 1.45 | 62 | — | — | 3.74 | 38 | |||||||||||||||

2017 | 1.56 | 70 | — | — | 3.82 | 30 | |||||||||||||||

SPS | |||||||||||||||||||||

2018 | 2.04 | 56 | — | — | 2.24 | 44 | |||||||||||||||

2017 | 2.18 | 74 | — | — | 3.39 | 26 | |||||||||||||||

(a) | Includes refuse-derived fuel and wood for the NSP System. |

NSP System | PSCo | SPS | ||||||||||

2018 | $ | 1.78 | $ | 2.33 | $ | 2.13 | ||||||

2017 | 1.72 | 2.25 | 2.50 | |||||||||

Normal | Dec. 31, 2018 Actual | Dec. 31, 2017 Actual (a) | |||

NSP System | 35 - 50 | 47 | 53 | ||

PSCo | 35 - 50 | 48 | 48 | ||

SPS | 35 - 50 | 44 | 52 | ||

(a) | Milder weather, purchase commitments and low power and natural gas prices impacted coal inventory levels. |

2018 | 2017 | |||

NSP System | 7.8 | 8.0 | ||

PSCo | 9.4 | 10.0 | ||

SPS | 5.1 | 5.5 | ||

Contracted Coal Supply | 2019 Estimated Requirements | ||

NSP System (a) | 76% | (b) | 8.4 |

PSCo (a) | 83 | 8.4 | |

SPS (a) | 64 | 4.1 | |

(a) | The general coal purchasing objective is to contract for approximately 75% of first year requirements, 40% of year two requirements and 20% of year three requirements. |

(b) | Increase in estimated million tons was due to lower delivered coal prices at Sherco in January 2019, combined with higher future forecasted gas prices for 2019 (higher burn forecast). |

2019 | 2020 | ||

NSP System | 100% | 100% | |

PSCo | 100 | 100 | |

SPS | 100 | 100 | |

NSP System | PSCo | SPS | ||||||||||||||||||||||

(Millions of Dollars) | Gas Supply | Gas Transportation and Storage (a) | Gas Supply (b) | Gas Transportation and Storage (a) | Gas Supply | Gas Transportation and Storage (a) | ||||||||||||||||||

2018 | $ | — | $ | 406 | $ | 412 | $ | 589 | $ | 20 | $ | 152 | ||||||||||||

2017 | — | 398 | 545 | 620 | 11 | 191 | ||||||||||||||||||

Year of Expiration | N/A | 2020 - 2037 | 2021 - 2023 | 2019 - 2040 | One year or less | 2019 - 2033 | ||||||||||||||||||

(a) | For incremental supplies, there are limited on-site fuel storage facilities, with a primary reliance on the spot market. |

(b) | Majority of natural gas supply under contract is covered by a long-term agreement with Anadarko Energy Services Company and the balance of natural gas supply contracts have variable pricing features tied to changes in various natural gas indices. PSCo hedges a portion of that risk through financial instruments. See Note 10 to the consolidated financial statements for further information. |

• | Current nuclear fuel supply contracts cover 100% of uranium concentrates requirements through 2021 and approximately 51% of the requirements for 2022 - 2033. |

• | Current contracts for conversion services cover 100% of the requirements through 2021 and approximately 43% of the requirements for 2022 - 2033. |

• | Current enrichment service contracts cover 100% of the requirements through 2025 and approximately 19% of the requirements for 2026 - 2033. |

System Peak Demand (in MW) | |||||||||

2018 | 2017 | ||||||||

NSP System (a) | 8,927 | June 29 | 8,546 | July 17 | |||||

PSCo (a) | 6,718 | July 10 | 6,671 | July 19 | |||||

SPS (a) | 4,648 | July 19 | 4,374 | July 26 | |||||

(a) | Peak demand typically occurs in the summer. The increase in peak load from 2017 to 2018 is partly due to warmer weather in 2018. |

• | CIP rider — Recovers the costs of conservation and demand-side management programs. |

• | EIR — Recovers the costs of environmental improvement projects. |

• | RDF — Allocates money collected from retail customers to support the research and development of emerging renewable energy projects and technologies. |

• | RES — Recovers the cost of renewable generation in Minnesota. |

• | RER — Recovers the cost of renewable generation located in North Dakota. |

• | SEP — Recovers costs related to various energy policies approved by the Minnesota legislature. |

• | TCR — Recovers costs associated with investments in electric transmission and distribution grid modernization costs. |

• | Infrastructure rider — Recovers costs for investments in generation and incremental property taxes in South Dakota. |

• | ECA — Recovers fuel and purchased energy costs. Short-term sales margins are shared with retail customers through the ECA. The ECA is revised quarterly. |

• | PCCA — Recovers purchased capacity payments. |

• | SCA — Recovers the difference between PSCo’s actual cost of fuel and costs recovered under its steam service rates. The SCA rate is revised quarterly. |

• | DSMCA — Recovers DSM, interruptible service costs and performance initiatives for achieving energy savings goals. |

• | RESA — Recovers the incremental costs of compliance with the RES with a maximum of 2% of the customer’s bill. |

• | WCA — Recovers costs for customers who choose renewable resources. |

• | TCA — Recovers costs for transmission investment outside of rate cases. |

• | CACJA — Recovers costs associated with the CACJA. |

Total Capacity | PSCo's Ownership | |||

Wind generation | 1,100 MW | 500 MW | ||

Solar generation | 700 MW | — | ||

Battery storage | 275 MW | — | ||

Natural gas generation | 380 MW | 380 MW | ||

• | DCRF — Recovers distribution costs not included in rates in Texas. |

• | EECRF — Recovers costs for energy efficiency programs in Texas. |

• | EE rider — Recovers costs for energy efficiency programs in New Mexico. |

• | FPPCAC — Adjusts monthly to recover the actual fuel and purchased power costs in New Mexico. |

• | PCRF — Allows recovery of purchased power costs not included in rates in Texas. |

• | RPS — Recovers deferred costs for renewable energy programs in New Mexico. |

• | TCRF — Recovers certain transmission infrastructure improvement costs and changes in wholesale transmission charges not included in base rates in Texas. |

Year Ended Dec. 31 | |||||||||||

2018 | 2017 | 2016 | |||||||||

Natural gas deliveries (Thousands of MMBtu) | |||||||||||

Residential | 149,036 | 134,189 | 132,853 | ||||||||

C&I | 96,447 | 87,271 | 84,082 | ||||||||

Total retail | 245,483 | 221,460 | 216,935 | ||||||||

Transportation and other | 173,092 | 142,497 | 133,498 | ||||||||

Total deliveries | 418,575 | 363,957 | 350,433 | ||||||||

Number of customers at end of period | |||||||||||

Residential | 1,878,576 | 1,856,221 | 1,835,507 | ||||||||

C&I | 158,424 | 157,798 | 157,286 | ||||||||

Total retail | 2,037,000 | 2,014,019 | 1,992,793 | ||||||||

Transportation and other | 7,951 | 7,705 | 7,316 | ||||||||

Total customers | 2,044,951 | 2,021,724 | 2,000,109 | ||||||||

Natural gas revenues (Millions of Dollars) | |||||||||||

Residential | $ | 1,045 | $ | 1,006 | $ | 930 | |||||

C&I | 556 | 524 | 469 | ||||||||

Total retail | 1,601 | 1,530 | 1,399 | ||||||||

Transportation and other | 138 | 120 | 132 | ||||||||

Total natural gas revenues | $ | 1,739 | $ | 1,650 | $ | 1,531 | |||||

MMBtu sales per retail customer | 120.51 | 109.96 | 108.86 | ||||||||

Revenue per retail customer | $ | 786 | $ | 760 | $ | 702 | |||||

Residential revenue per MMBtu | 7.01 | 7.50 | 7.00 | ||||||||

C&I revenue per MMBtu | 5.76 | 6.00 | 5.58 | ||||||||

Transportation and other revenue per MMBtu | 0.80 | 0.84 | 0.99 | ||||||||

2018 | 2017 | |||||||||

Utility Subsidiary | MMBtu | Date | MMBtu | Date | ||||||

NSP-Minnesota | 786,751 | (a) | Jan. 12 | 893,062 | Dec. 26 | |||||

NSP-Wisconsin | 159,700 | Jan. 5 | 160,170 | Dec. 26 | ||||||

PSCo | 1,903,878 | (a) | Feb. 20 | 1,948,167 | Jan. 5 | |||||

(a) | Decrease in MMBtu output due to milder winter temperatures in 2018. |

Utility Subsidiary | MMBtu Per Day | |||

NSP-Minnesota | 645,171 | |||

NSP-Wisconsin | 140,195 | |||

PSCo | 1,834,843 | (a) | ||

(a) | Includes 871,418 MMBtu of natural gas under third-party underground storage agreements. |

Utility Subsidiary | Percent of Winter Requirements | Peak Day Firm Requirements | ||

NSP-Minnesota | 24% | 29% | ||

NSP-Wisconsin | 30 | 33 | ||

NSP-Minnesota | NSP-Wisconsin | PSCo | |||||||||

2018 | $ | 4.03 | $ | 3.84 | $ | 3.20 | |||||

2017 | 3.89 | 3.88 | 3.45 | ||||||||

• | NSP-Minnesota — $437 million (expire 2019 - 2033); |

• | NSP-Wisconsin — $89 million (expire 2019 - 2029); and, |

• | PSCo — $1.1 billion (expire 2019 - 2029). |

• | GCA — Recovers the costs of purchased natural gas and transportation to meet customer requirements and is revised quarterly to allow for changes in natural gas rates. |

• | DSMCA — Recovers costs of DSM and performance initiatives to achieve various energy savings goals. |

• | PSIA — Recovers costs for transmission and distribution pipeline integrity management programs. |

• | Development of renewable energy facilities; |

• | Retirement and replacement of existing generating plants; and, |

• | Customer energy efficiency programs. |

Employees Covered by CBAs | Total Employees | |||||

NSP-Minnesota | 2,064 | 3,278 | ||||

NSP-Wisconsin | 386 | 540 | ||||

PSCo | 1,904 | 2,426 | ||||

SPS | 775 | 1,151 | ||||

XES | — | 3,697 | ||||

Total | 5,129 | 11,092 | ||||

EXECUTIVE OFFICERS (a) | ||||||

Name | Age (b) | Current and Recent Positions Held | Time in Position | |||

Ben Fowke | 60 | Chairman of the Board, President and Chief Executive Officer and Director, Xcel Energy Inc. | August 2011 - Present | |||

Chief Executive Officer, NSP-Minnesota, NSP-Wisconsin, PSCo, and SPS | January 2015 - Present | |||||

Brett C. Carter | 52 | Executive Vice President and Chief Customer and Innovation Officer, Xcel Energy Inc. | May 2018 - Present | |||

Senior Vice President and Shared Services Executive, Bank of America | October 2015 - May 2018 | |||||

Senior Vice President and Chief Operating Officer, Bank of America | March 2015 - October 2015 | |||||

Senior Vice President and Chief Distribution Officer, Duke Energy Co. | February 2013 - March 2015 | |||||

Christopher B. Clark | 52 | President and Director, NSP-Minnesota | January 2015 - Present | |||

Regional Vice President, Rates and Regulatory Affairs, NSP-Minnesota | October 2012 - December 2014 | |||||

David L. Eves | 60 | Executive Vice President and Group President, Utilities, Xcel Energy Inc. | March 2018 - Present | |||

President and Director, PSCo | January 2015 - February 2018 | |||||

President, Director and Chief Executive Officer, PSCo | December 2009 - December 2014 | |||||

Darla Figoli | 56 | Senior Vice President, Human Resources & Employee Services, Chief Human Resources Officer, Xcel Energy Inc. | May 2018 - Present | |||

Senior Vice President, Human Resources and Employee Services, Xcel Energy Inc. | May 2015 - May 2018 | |||||

Vice President, Human Resources, Xcel Energy Inc. | February 2010 - May 2015 | |||||

Robert C. Frenzel | 48 | Executive Vice President, Chief Financial Officer, Xcel Energy Inc. | May 2016 - Present | |||

Senior Vice President and Chief Financial Officer, Luminant, a subsidiary of Energy Future Holdings Corp. (c) | February 2012 - April 2016 | |||||

David T. Hudson | 58 | President and Director, SPS | January 2015 - Present | |||

President, Director and Chief Executive Officer, SPS | January 2014 - December 2014 | |||||

Alice Jackson | 40 | President and Director, PSCo | May 2018 - Present | |||

Area Vice President, Strategic Revenue Initiatives, Xcel Energy Services Inc. | November 2016 - May 2018 | |||||

Regional Vice President, Rates and Regulatory Affairs, PSCo | October 2011 - November 2016 | |||||

Kent T. Larson | 59 | Executive Vice President and Group President Operations, Xcel Energy Inc. | January 2015 - Present | |||

Senior Vice President, Group President Operations, Xcel Energy Services Inc. | August 2014 - December 2014 | |||||

Senior Vice President Operations, Xcel Energy Services Inc. | September 2011 - August 2014 | |||||

Timothy O’Connor | 59 | Senior Vice President, Chief Nuclear Officer, Xcel Energy Services Inc. | February 2013 - Present | |||

Judy M. Poferl | 59 | Senior Vice President, Corporate Secretary and Executive Services, Xcel Energy Inc. | January 2015 - Present | |||

Vice President, Corporate Secretary, Xcel Energy Inc. | May 2013 - December 2014 | |||||

Jeffrey S. Savage | 47 | Senior Vice President, Controller, Xcel Energy Inc. | January 2015 - Present | |||

Vice President, Controller, Xcel Energy Inc. | September 2011 - December 2014 | |||||

Mark E. Stoering | 58 | President and Director, NSP-Wisconsin | January 2015 - Present | |||

President, Director and Chief Executive Officer, NSP-Wisconsin | January 2012 - December 2014 | |||||

Scott M. Wilensky | 62 | Executive Vice President, General Counsel, Xcel Energy Inc. | January 2015 - Present | |||

Senior Vice President, General Counsel, Xcel Energy Inc. | September 2011 - December 2014 | |||||

(c) | In April 2014, Energy Future Holdings Corp., the majority of its subsidiaries, including TCEH the parent company of Luminant, filed a voluntary bankruptcy petition. TCEH emerged from Chapter 11 in October 2016. |

• | Risks associated with use of radioactive material in the production of energy, the management, handling, storage and disposal of radioactive materials; |

• | Limitations on insurance available to cover losses that might arise in connection with nuclear operations, as well as obligations to contribute to an insurance pool in the event of damages at a covered U.S. reactor; and, |

• | Uncertainties with the technological and financial aspects of decommissioning nuclear plants. For example, assumptions regarding decommissioning costs may change based on economic conditions and changes in the expected life of the asset may cause our funding obligations to change. |

NSP-Minnesota Station, Location and Unit | Fuel | Installed | MW (a) | |||||

Steam: | ||||||||

A.S. King-Bayport, MN, 1 Unit | Coal | 1968 | 511 | |||||

Sherco-Becker, MN | ||||||||

Unit 1 | Coal | 1976 | 680 | |||||

Unit 2 | Coal | 1977 | 682 | |||||

Unit 3 | Coal | 1987 | 517 | (b) | ||||

Monticello, MN, 1 Unit | Nuclear | 1971 | 617 | |||||

PI-Welch, MN | ||||||||

Unit 1 | Nuclear | 1973 | 521 | |||||

Unit 2 | Nuclear | 1974 | 519 | |||||

Various locations, 4 Units | Wood/Refuse | Various | 36 | (c) | ||||

Combustion Turbine: | ||||||||

Angus Anson-Sioux Falls, SD, 3 Units | Natural Gas | 1994 - 2005 | 327 | |||||

Black Dog-Burnsville, MN, 3 Units | Natural Gas | 1987 - 2002 | 494 | (d) | ||||

Blue Lake-Shakopee, MN, 6 Units | Natural Gas | 1974 - 2005 | 453 | |||||

High Bridge-St. Paul, MN, 3 Units | Natural Gas | 2008 | 530 | |||||

Inver Hills-Inver Grove Heights, MN, 6 Units | Natural Gas | 1972 | 282 | |||||

Riverside-Minneapolis, MN, 3 Units | Natural Gas | 2009 | 454 | |||||

Various locations, 14 Units | Natural Gas | Various | 67 | |||||

Wind: | ||||||||

Border-Rolette County, ND, 75 Units | Wind | 2015 | 148 | (e) | ||||

Courtenay Wind, ND, 100 Units | Wind | 2016 | 195 | (e) | ||||

Grand Meadow-Mower County, MN, 67 Units | Wind | 2008 | 101 | (e) | ||||

Nobles-Nobles County, MN., 134 Units | Wind | 2010 | 200 | (e) | ||||

Pleasant Valley-Mower County, MN, 100 Units | Wind | 2015 | 196 | (e) | ||||

Total | 7,530 | |||||||

(a) | Summer 2018 net dependable capacity. |

(b) | Based on NSP-Minnesota’s ownership of 59%. |

(c) | Refuse-derived fuel is made from municipal solid waste. |

(d) | Black Dog Unit 6 was commissioned and placed into operation in the third quarter of 2018. |

(e) | Values disclosed are the maximum generation levels for these wind units. Capacity is attainable only when wind conditions are sufficiently available (on-demand net dependable capacity is zero). |

NSP-Wisconsin Station, Location and Unit | Fuel | Installed | MW (a) | |||||

Steam: | ||||||||

Bay Front-Ashland, WI, 3 Units | Coal/Wood/Natural Gas | 1948 - 1956 | 56 | |||||

French Island-La Crosse, WI, 2 Units | Wood/Refuse | 1940 - 1948 | 16 | (b) | ||||

Combustion Turbine: | ||||||||

French Island-La Crosse, WI, 2 Units | Oil | 1974 | 122 | |||||

Wheaton-Eau Claire, WI, 5 Units | Natural Gas/Oil | 1973 | 234 | |||||

Hydro: | ||||||||

Various locations, 63 Units | Hydro | Various | 135 | |||||

Total | 563 | |||||||

(a) | Summer 2018 net dependable capacity. |

(b) | Refuse-derived fuel is made from municipal solid waste. |

PSCo Station, Location and Unit | Fuel | Installed | MW (a) | |||||

Steam: | ||||||||

Comanche-Pueblo, CO (b) | ||||||||

Unit 1 | Coal | 1973 | 325 | |||||

Unit 2 | Coal | 1975 | 335 | |||||

Unit 3 | Coal | 2010 | 500 | (c) | ||||

Craig-Craig, CO, 2 Units (d) | Coal | 1979 - 1980 | 82 | (e) | ||||

Hayden-Hayden, CO, 2 Units | Coal | 1965 - 1976 | 233 | (f) | ||||

Pawnee-Brush, CO, 1 Unit | Coal | 1981 | 505 | |||||

Cherokee-Denver, CO, 1 Unit | Natural Gas | 1968 | 310 | |||||

Combustion Turbine: | ||||||||

Blue Spruce-Aurora, CO, 2 Units | Natural Gas | 2003 | 264 | |||||

Cherokee-Denver, CO, 3 Units | Natural Gas | 2015 | 576 | |||||

Fort St. Vrain-Platteville, CO, 6 Units | Natural Gas | 1972 - 2009 | 968 | |||||

Rocky Mountain-Keenesburg, CO, 3 Units | Natural Gas | 2004 | 580 | |||||

Various locations, 6 Units | Natural Gas | Various | 171 | |||||

Hydro: | ||||||||

Cabin Creek-Georgetown, CO | ||||||||

Pumped Storage, 2 Units | Hydro | 1967 | 210 | |||||

Various locations, 9 Units | Hydro | Various | 26 | |||||

Wind: | ||||||||

Rush Creek, CO, 300 units | Wind | 2018 | 600 | (g) | ||||

Total | 5,685 | |||||||

(a) | Summer 2018 net dependable capacity. |

(b) | In 2018, the CPUC approved early retirement of PSCo’s Comanche Units 1 and 2 in 2022 and 2025, respectively. |

(c) | Based on PSCo’s ownership of 67%. |

(d) | Craig Unit 1 is expected to be retired early in 2025. |

(e) | Based on PSCo’s ownership of 10%. |

(f) | Based on PSCo’s ownership of 75% of Unit 1 and 37% of Unit 2. |

(g) | Generation capability is based on the maximum output level of wind units, including the Rush Creek Wind Project. Capacity is attainable only when wind conditions are sufficiently available (on-demand net dependable capacity is zero). |

SPS Station, Location and Unit | Fuel | Installed | MW (a) | |||||

Steam: | ||||||||

Cunningham-Hobbs, NM, 2 Units | Natural Gas | 1957 - 1965 | 251 | |||||

Harrington-Amarillo, TX, 3 Units | Coal | 1976 - 1980 | 1,018 | |||||

Jones-Lubbock, TX, 2 Units | Natural Gas | 1971 - 1974 | 486 | |||||

Maddox-Hobbs, NM, 1 Unit | Natural Gas | 1967 | 112 | |||||

Nichols-Amarillo, TX, 3 Units | Natural Gas | 1960 - 1968 | 457 | |||||

Plant X-Earth, TX, 4 Units | Natural Gas | 1952 - 1964 | 411 | |||||

Tolk-Muleshoe, TX, 2 Units | Coal | 1982 - 1985 | 1,067 | |||||

Combustion Turbine: | ||||||||

Cunningham-Hobbs, NM, 2 Units | Natural Gas | 1998 | 209 | |||||

Jones-Lubbock, TX, 2 Units | Natural Gas | 2011 - 2013 | 334 | |||||

Maddox-Hobbs, TX, 1 Unit | Natural Gas | 1963 - 1976 | 61 | |||||

Total | 4,406 | |||||||

(a) | Summer 2018 net dependable capacity. |

Conductor Miles | NSP-Minnesota | NSP-Wisconsin | PSCo | SPS | ||||||||

500 KV | 2,917 | — | — | — | ||||||||

345 KV | 13,560 | 3,415 | 4,062 | 9,028 | ||||||||

230 KV | 2,202 | — | 12,053 | 9,675 | ||||||||

161 KV | 615 | 1,823 | — | — | ||||||||

138 KV | — | — | 91 | — | ||||||||

115 KV | 7,372 | 1,817 | 5,051 | 14,493 | ||||||||

Less than 115 KV | 86,185 | 32,831 | 78,446 | 25,820 | ||||||||

NSP-Minnesota | NSP-Wisconsin | PSCo | SPS | |||||||||

Quantity | 348 | 203 | 232 | 459 | ||||||||

Miles | NSP-Minnesota | NSP-Wisconsin | PSCo | SPS | WGI | ||||||||||

Transmission | 90 | 3 | 2,080 | 20 | 11 | ||||||||||

Distribution | 10,437 | 2,466 | 22,518 | — | — | ||||||||||

* | $100 invested on Dec. 31, 2013 in stock or index — including reinvestment of dividends. Fiscal years ended Dec. 31. |

(Millions of Dollars, Millions of Shares, Except Per Share Data) | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

Operating revenues | $ | 11,537 | $ | 11,404 | $ | 11,107 | $ | 11,024 | $ | 11,686 | ||||||||||

Operating expenses (a) | 9,572 | 9,181 | 8,867 | 9,024 | 9,738 | |||||||||||||||

Net income | 1,261 | 1,148 | 1,123 | 984 | 1,021 | |||||||||||||||

Earnings available to common shareholders | 1,261 | 1,148 | 1,123 | 984 | 1,021 | |||||||||||||||

Diluted earnings per common share | 2.47 | 2.25 | 2.21 | 1.94 | 2.03 | |||||||||||||||

Financial information | ||||||||||||||||||||

Dividends declared per common share | 1.52 | 1.44 | 1.36 | 1.28 | 1.20 | |||||||||||||||

Total assets (b) (c) | 45,987 | 43,030 | 41,155 | 38,821 | 36,958 | |||||||||||||||

Long-term debt (c) (d) | 15,803 | 14,520 | 14,195 | 12,399 | 11,500 | |||||||||||||||

(a) | As a result of adopting ASU No. 2017-07 (Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, Topic 715), $33 million and $26 million of pension costs were retrospectively reclassified from operating and maintenance expenses to other income, net on the consolidated statements of income for the years ended Dec. 31, 2017 and Dec. 31, 2016, respectively. |

(b) | As a result of adopting ASU No. 2015-17 (Balance Sheet Classification of Deferred Taxes, Topic 740), $140 million of current deferred income taxes was retrospectively reclassified to long-term deferred income tax liabilities on the consolidated balance sheet as of Dec. 31, 2015. |

(c) | As a result of adopting ASU No. 2015-03 (Simplifying the Presentation of Debt Issuance Costs, Subtopic 835-30), $92 million of deferred debt issuance costs was retrospectively reclassified from other non-current assets to long-term debt on the consolidated balance sheet as of Dec. 31, 2015. |

(d) | Includes capital lease obligations. |

• | Lead the clean energy transition; |

• | Enhance the customer experience; and, |

• | Keep bills low. |

• | Increasing the use of affordable renewable energy; |

• | Offering energy efficiency programs for customers; |

• | Retiring or repowering coals units and modernizing our generating plants; and, |

• | Advancing power grid capabilities. |

• | Deliver long-term annual EPS growth of 5% to 7%; |

• | Deliver annual dividend increases of 5% to 7%; |

• | Target a dividend payout ratio of 60% to 70% of annual ongoing EPS; and, |

• | Maintain senior secured debt credit ratings in the A range and senior unsecured debt credit ratings in the BBB+ to A range. |

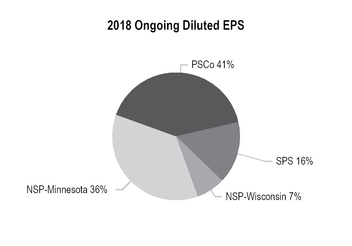

2018 | 2017 | 2016 | ||||||||||||||||||

Diluted Earnings (Loss) Per Share | GAAP and Ongoing Diluted EPS | GAAP Diluted EPS | Impact of TCJA (a) | Ongoing Diluted EPS | GAAP and Ongoing Diluted EPS | |||||||||||||||

PSCo | $ | 1.08 | $ | 0.97 | $ | (0.03 | ) | $ | 0.94 | $ | 0.91 | |||||||||

NSP-Minnesota | 0.96 | 0.96 | 0.05 | 1.01 | 0.96 | |||||||||||||||

SPS | 0.42 | 0.31 | (0.01 | ) | 0.30 | 0.30 | ||||||||||||||

NSP-Wisconsin | 0.19 | 0.16 | — | 0.16 | 0.14 | |||||||||||||||

Equity earnings of unconsolidated subsidiaries (a) | 0.04 | 0.07 | (0.04 | ) | 0.03 | 0.05 | ||||||||||||||

Regulated utility (b) | 2.69 | 2.47 | (0.03 | ) | 2.45 | 2.35 | ||||||||||||||

Xcel Energy Inc. and other | (0.22 | ) | (0.22 | ) | 0.07 | (0.15 | ) | (0.15 | ) | |||||||||||

Total (b) | $ | 2.47 | $ | 2.25 | $ | 0.05 | $ | 2.30 | $ | 2.21 | ||||||||||

(a) | Includes income taxes. |

(b) | Amounts may not add due to rounding. |

2018 vs. 2017 | ||||

Diluted Earnings (Loss) Per Share | Dec. 31 | |||

GAAP diluted EPS — 2017 | $ | 2.25 | ||

Impact of the TCJA (a) | 0.05 | |||

Ongoing diluted EPS — 2017 | $ | 2.30 | ||

Components of change — 2018 vs. 2017 | ||||

Higher electric margins (excluding TCJA impacts) (a) | 0.31 | |||

Higher natural gas margins (excluding TCJA impacts) (a) | 0.13 | |||

Higher AFUDC — equity | 0.07 | |||

Higher O&M expenses | (0.10 | ) | ||

Higher depreciation and amortization (excluding TCJA impacts) (a) | (0.10 | ) | ||

Higher ETR (excluding TCJA impacts) (a) | (0.07 | ) | ||

Higher interest charges | (0.04 | ) | ||

Higher conservation and demand side management (DSM) program expenses (offset by higher revenues) | (0.02 | ) | ||

Higher taxes (other than income taxes) | (0.01 | ) | ||

GAAP and ongoing diluted EPS — 2018 | $ | 2.47 | ||

Estimated net impact of the TCJA, including assumptions regarding future regulatory proceedings: (a) | ||||

Income tax — rate change and ARAM (net of deferral) | 0.68 | |||

Electric margin reductions (net) | (0.46 | ) | ||

Natural gas margin reductions (net) | (0.06 | ) | ||

Depreciation and amortization reductions (Colorado prepaid pension) | (0.11 | ) | ||

Holding company — interest expense | (0.04 | ) | ||

Total | $ | 0.01 | ||

2017 vs. 2016 | ||||

Diluted Earnings (Loss) Per Share | Dec. 31 | |||

GAAP and ongoing diluted EPS — 2016 | $ | 2.21 | ||

Components of change — 2017 vs. 2016 | ||||

Higher electric margins (a) | 0.16 | |||

Lower ETR (b) | 0.07 | |||

Higher natural gas margins | 0.03 | |||

Higher AFUDC — equity | 0.03 | |||

Lower O&M expenses | 0.03 | |||

Higher depreciation and amortization | (0.21 | ) | ||

Higher conservation and DSM program expenses (c) | (0.03 | ) | ||

Higher interest charges | (0.02 | ) | ||

Higher taxes (other than income taxes) | (0.02 | ) | ||

Equity earnings of unconsolidated subsidiaries | (0.02 | ) | ||

Other, net | 0.02 | |||

GAAP diluted EPS — 2017 | $ | 2.25 | ||

Impact of the TCJA | 0.05 | |||

Ongoing diluted EPS — 2017 | $ | 2.30 | ||

(a) | Includes an increase of $23 million in revenues from conservation and DSM programs, offset by related expenses, for the twelve months ended Dec. 31, 2017. |

(b) | ETR includes the impact of an additional $20 million of wind PTCs for the twelve months ended Dec. 31, 2017, which are largely flowed back to customers through electric margin, as well as the impact of the TCJA recorded in the fourth quarter of 2017. |

(c) | Offset by higher revenues. |

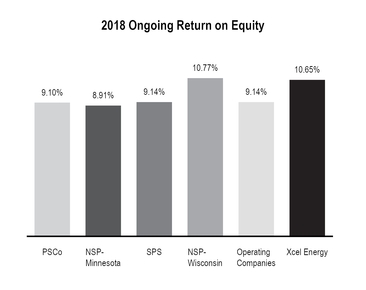

2018 | 2017 | |||||||||||

ROE | GAAP and Ongoing ROE | GAAP ROE | Impact of the TCJA | Ongoing ROE | ||||||||

PSCo | 9.10 | % | 8.90 | % | (0.24 | )% | 8.66 | % | ||||

NSP-Minnesota | 8.91 | 9.05 | 0.45 | 9.50 | ||||||||

SPS | 9.14 | 7.84 | (0.30 | ) | 7.54 | |||||||

NSP-Wisconsin | 10.77 | 9.41 | 0.09 | 9.50 | ||||||||

Operating Companies | 9.14 | 8.84 | 0.03 | 8.87 | ||||||||

Xcel Energy | 10.65 | 10.21 | 0.21 | 10.42 | ||||||||

(Millions of Dollars) | 2018 | 2017 | 2016 | |||||||||

GAAP earnings | $ | 1,261 | $ | 1,148 | $ | 1,123 | ||||||

Estimated impact of TCJA | — | 23 | — | |||||||||

Ongoing earnings | $ | 1,261 | $ | 1,171 | $ | 1,123 | ||||||

Diluted EPS | 2018 | 2017 | 2016 | |||||||||

GAAP diluted EPS | $ | 2.47 | $ | 2.25 | $ | 2.21 | ||||||

Estimated impact of TCJA | — | 0.05 | — | |||||||||

Ongoing diluted EPS | $ | 2.47 | $ | 2.30 | $ | 2.21 | ||||||

2018 vs. Normal | 2017 vs. Normal | 2018 vs. 2017 | 2016 vs. Normal | 2017 vs. 2016 | ||||||||||

HDD | 2.2 | % | (10.0 | )% | 12.2 | % | (13.4 | )% | 2.6 | % | ||||

CDD | 26.7 | 6.5 | 20.5 | 11.1 | (3.5 | ) | ||||||||

THI | 37.3 | (11.3 | ) | 56.9 | 7.7 | (18.5 | ) | |||||||

2018 vs. Normal | 2017 vs. Normal | 2018 vs. 2017 | 2016 vs. Normal | 2017 vs. 2016 | |||||||||||||||

Retail electric | $ | 0.114 | $ | (0.036 | ) | $ | 0.150 | $ | 0.004 | $ | (0.040 | ) | |||||||

Firm natural gas | 0.007 | (0.023 | ) | 0.030 | (0.025 | ) | 0.002 | ||||||||||||

Total (excluding decoupling) | $ | 0.121 | $ | (0.059 | ) | $ | 0.180 | $ | (0.021 | ) | $ | (0.038 | ) | ||||||

Decoupling — Minnesota electric | (0.051 | ) | 0.022 | (0.073 | ) | (0.002 | ) | 0.024 | |||||||||||

Total (adjusted for recovery from decoupling) | $ | 0.070 | $ | (0.037 | ) | $ | 0.107 | $ | (0.023 | ) | $ | (0.014 | ) | ||||||

2018 vs. 2017 | |||||||||||||||

PSCo | NSP-Minnesota | SPS | NSP-Wisconsin | Xcel Energy | |||||||||||

Actual | |||||||||||||||

Electric residential | 3.6 | % | 5.8 | % | 8.6 | % | 5.7 | % | 5.4 | % | |||||

Electric C&I | 1.5 | 1.1 | 5.4 | 3.2 | 2.4 | ||||||||||

Total retail electric sales | 2.2 | 2.5 | 5.9 | 3.9 | 3.2 | ||||||||||

Firm natural gas sales | 9.3 | 14.6 | N/A | 13.1 | 11.3 | ||||||||||

2018 vs. 2017 | |||||||||||||||

PSCo | NSP-Minnesota | SPS | NSP-Wisconsin | Xcel Energy | |||||||||||

Weather-normalized | |||||||||||||||

Electric residential | 1.8 | % | (0.5 | )% | 2.0 | % | 0.2 | % | 0.8 | % | |||||

Electric C&I | 1.2 | (0.4 | ) | 4.6 | 2.3 | 1.5 | |||||||||

Total retail electric sales | 1.3 | (0.4 | ) | 4.1 | 1.7 | 1.3 | |||||||||

Firm natural gas sales | 2.2 | 2.7 | N/A | 3.1 | 2.4 | ||||||||||

• | PSCo — Higher residential sales growth reflects customer additions and slightly higher use per customer. C&I growth was due to an increase in customers and higher use per customer, predominately from the fabricated metal, food products, metal mining and oil and gas extraction industries. |

• | NSP-Minnesota — Residential sales decrease was a result of lower use per customer, partially offset by customer growth. The decline in C&I sales was due to an increase in customers offset by lower use per customer. Increased sales to large customers in manufacturing and energy were offset by declines in services. |

• | SPS — Residential sales grew largely due to higher use per customer and customer additions. The increase in C&I sales was driven by the oil and natural gas industry in the Permian Basin. |

• | NSP-Wisconsin — Sales growth was primarily attributable to customer additions, partially offset by lower use per customer. C&I growth was largely due to higher use per large customer, customer additions and increased sales to sand mining and energy industries. |

• | Higher natural gas sales reflect an increase in the number of customers combined with increasing customer use. |

2017 vs. 2016 | |||||||||||||||

PSCo | NSP-Minnesota | SPS | NSP-Wisconsin | Xcel Energy | |||||||||||

Actual | |||||||||||||||

Electric residential | (1.8 | )% | (2.1 | )% | (3.5 | )% | (0.8 | )% | (2.1 | )% | |||||

Electric C&I | (0.1 | ) | (1.4 | ) | 1.3 | 2.2 | (0.1 | ) | |||||||

Total retail electric sales | (0.6 | ) | (1.6 | ) | 0.2 | 1.3 | (0.7 | ) | |||||||

Firm natural gas sales | (2.2 | ) | 9.3 | N/A | 11.3 | 2.1 | |||||||||

2017 vs. 2016 | |||||||||||||||

PSCo | NSP-Minnesota | SPS | NSP-Wisconsin | Xcel Energy | |||||||||||

Weather-normalized | |||||||||||||||

Electric residential | (1.6 | )% | (0.7 | )% | (1.2 | )% | 0.3 | % | (1.0 | )% | |||||

Electric C&I | 0.1 | (1.0 | ) | 1.5 | 2.5 | 0.2 | |||||||||

Total retail electric sales | (0.4 | ) | (1.0 | ) | 0.9 | 1.8 | (0.2 | ) | |||||||

Firm natural gas sales | 0.6 | 4.7 | N/A | 5.7 | 2.2 | ||||||||||

2017 vs. 2016 (Excluding Leap Day) (b) | |||||||||||||||

PSCo | NSP-Minnesota | SPS | NSP-Wisconsin | Xcel Energy | |||||||||||

Weather-normalized - adjusted for leap day | |||||||||||||||

Electric residential (a) | (1.3 | )% | (0.5 | )% | (1.0 | )% | 0.6 | % | (0.8 | )% | |||||

Electric C&I | 0.3 | (0.8 | ) | 1.8 | 2.7 | 0.4 | |||||||||

Total retail electric sales | (0.2 | ) | (0.7 | ) | 1.1 | 2.1 | 0.1 | ||||||||

Firm natural gas sales | 1.1 | 5.2 | N/A | 6.3 | 2.7 | ||||||||||

(a) | Extreme weather variations, windchill and cloud cover may not be reflected in weather-normalized and actual growth (decline) estimates. |

(b) | Estimated impact of the 2016 leap day is excluded to present a more comparable year-over-year presentation. Estimated impact of the additional day of sales in 2016 was approximately 0.3% for retail electric and 0.5% for firm natural gas for the twelve months ended. |

• | PSCo’s decline in residential sales reflects lower use per customer, partially offset by customer additions. C&I growth was mainly due to an increase in customers and higher use for large C&I customers that support the mining, oil and natural gas industries, partially offset by lower use for the small C&I class. |

• | NSP-Minnesota’s residential sales decrease was a result of lower use per customer, partially offset by customer growth. The decline in C&I sales was largely due to reduced usage, which offset an increase in the number of customers. Declines in services more than offset increased sales to large customers in manufacturing and energy industries. |

• | SPS’ residential sales fell largely due to lower use per customer. The increase in C&I sales reflects customer additions and greater use for large C&I customers driven by the oil and natural gas industry in the Permian Basin. |

• | NSP-Wisconsin’s residential sales increase was primarily attributable to higher use per customer and customer additions. C&I growth was largely due to higher use per customer and increased sales to customers in the sand mining industry and large customers in the energy and manufacturing industries. |

• | Higher natural gas sales reflect an increase in the number of customers, partially offset by a decline in customer use. |

(Millions of Dollars) | 2018 | 2017 | 2016 | |||||||||

Electric revenues before TCJA impact | $ | 10,046 | $ | 9,676 | $ | 9,500 | ||||||

Electric fuel and purchased power before TCJA impact | (3,867 | ) | (3,757 | ) | (3,718 | ) | ||||||

Electric margin before TCJA impact | $ | 6,179 | $ | 5,919 | $ | 5,782 | ||||||

TCJA impact (offset as a reduction in income tax) | (314 | ) | — | — | ||||||||

Electric margin | $ | 5,865 | $ | 5,919 | $ | 5,782 | ||||||

(Millions of Dollars) | 2018 vs. 2017 | |||

Estimated impact of weather (net of Minnesota decoupling) | $ | 63 | ||

Retail sales growth (net of Minnesota decoupling and sales true-up) | 52 | |||

Non-fuel riders | 45 | |||

Purchased capacity costs | 38 | |||

Wholesale transmission revenue (net) | 31 | |||

Retail rate increase (Wisconsin, New Mexico and Michigan) | 20 | |||

Other (net) | 11 | |||

Total increase in electric margin before TCJA impact | $ | 260 | ||

TCJA impact (offset as a reduction in income tax) | (314 | ) | ||

Total decrease in electric margin | $ | (54 | ) | |

(Millions of Dollars) | 2017 vs. 2016 | |||

Retail rate increases (Texas, Minnesota, New Mexico and Wisconsin) | $ | 123 | ||

Non-fuel riders | 33 | |||

Conservation and DSM revenues (offset by expenses) | 23 | |||

Decoupling (weather portion — Minnesota) | 18 | |||

Purchased capacity costs | 8 | |||

Wholesale transmission revenue (net of costs) | (38 | ) | ||

Estimated impact of weather | (30 | ) | ||

Conservation incentive | (18 | ) | ||

Other (net) | 18 | |||

Total increase in electric margin | $ | 137 | ||

(Millions of Dollars) | 2018 | 2017 | 2016 | |||||||||

Natural gas revenues before TCJA impact | $ | 1,778 | $ | 1,650 | $ | 1,531 | ||||||

Cost of natural gas sold and transported | (843 | ) | (823 | ) | (733 | ) | ||||||

Natural gas margin before TCJA impact | $ | 935 | $ | 827 | $ | 798 | ||||||

TCJA impact (offset as a reduction in income tax) | (39 | ) | — | — | ||||||||

Natural gas margin | $ | 896 | $ | 827 | $ | 798 | ||||||

(Millions of Dollars) | 2018 vs. 2017 | |||

Retail rate increase (Colorado, Wisconsin and Michigan) | $ | 58 | ||

Estimated impact of weather | 24 | |||

Infrastructure and integrity riders | 13 | |||

Sales growth | 6 | |||

Conservation revenue (offset by expenses) | 3 | |||

Other (net) | 4 | |||

Total increase in natural gas margin before TCJA impact | $ | 108 | ||

TCJA impact (offset as a reduction in income tax) | (39 | ) | ||

Total increase in natural gas margin | $ | 69 | ||

(Millions of Dollars) | 2017 vs. 2016 | |||

Infrastructure and integrity riders | $ | 18 | ||

Retail sales growth, excluding weather impact | 7 | |||

Estimated impact of weather | 1 | |||

Other (net) | 3 | |||

Total increase in natural gas margin | $ | 29 | ||

(Millions of Dollars) | 2018 vs. 2017 | |||

Business systems and contract labor | $ | 39 | ||

Distribution costs | 19 | |||

Natural gas systems damage prevention and other remediation | 12 | |||

Generation plant costs (including increased wind O&M) | 11 | |||

Nuclear plant operations and amortization | (9 | ) | ||

Other (net) | 10 | |||

Total increase in O&M expenses | $ | 82 | ||

• | Business systems and contract labor costs increased due to growing network and storage needs, cybersecurity, initiatives to support our customer strategy, and initiatives to improve business processes; |

• | Distribution costs reflect higher maintenance expenses, including vegetation management; and, |

• | Nuclear plant operations and amortization are lower largely reflecting savings initiatives and reduced refueling outage costs. |

(Millions of Dollars) | 2017 vs. 2016 | |||

Nuclear plant operations and amortization | $ | (27 | ) | |

Plant generation costs | (23 | ) | ||

Transmission costs | (2 | ) | ||

Employee benefits expense | 17 | |||

Texas 2016 electric rate case cost deferral | 16 | |||

Electric distribution costs | 2 | |||

Other (net) | (6 | ) | ||

Total decrease in O&M expenses | $ | (23 | ) | |

• | Nuclear plant operations and amortization expenses are lower mostly due to reduced refueling outage costs and operating efficiencies. |

• | Plant generation costs decreased as a result of lower expenses associated with planned outages and overhauls at a number of generation facilities. |

• | Employee benefits expense includes the recognition of an $8 million pension settlement expense in the fourth quarter of 2017. |

Contribution (Millions of Dollars) | ||||||||||||

2018 | 2017 | 2016 | ||||||||||

Xcel Energy Inc. financing costs | $ | (110 | ) | $ | (79 | ) | $ | (71 | ) | |||

Eloigne (a) | — | 2 | 1 | |||||||||

Xcel Energy Inc. taxes and other results | (5 | ) | (35 | ) | (6 | ) | ||||||

Total Xcel Energy Inc. and other costs | $ | (115 | ) | $ | (112 | ) | $ | (76 | ) | |||

Contribution (Diluted Earnings (Loss) Per Share) | ||||||||||||

2018 | 2017 | 2016 | ||||||||||

Xcel Energy Inc. financing costs | $ | (0.21 | ) | $ | (0.15 | ) | $ | (0.14 | ) | |||

Eloigne (a) | — | — | — | |||||||||

Xcel Energy Inc. taxes and other results | (0.01 | ) | (0.07 | ) | (0.01 | ) | ||||||

Total Xcel Energy Inc. and other costs | $ | (0.22 | ) | $ | (0.22 | ) | $ | (0.15 | ) | |||

(a) | Amounts include gains or losses associated with sales of properties held by Eloigne. |

Operating Company | Utility Service | Approval Date | Additional Information | |||

NSP-Minnesota | Electric and Natural Gas | August 2018 | Minnesota — In 2018, the MPUC ordered NSP-Minnesota to refund the 2018 impacts of TCJA, including $135 million to electric customers and low income program funding, and $6 million to natural gas customers. | |||

NSP-Minnesota | Electric | July 2018 | South Dakota — In July 2018, the SDPUC approved a settlement providing a one-time customer refund of $11 million for the 2018 impact of the TCJA, while NSP-Minnesota would retain the TCJA benefits in 2019 and 2020 in exchange for a two-year rate case moratorium. | |||

NSP-Minnesota | Natural Gas | November 2018 | North Dakota — In November 2018, the NDPSC approved a TCJA settlement in which NSP-Minnesota will amortize $1 million annually of the regulatory asset for the remediation of the MGP site in Fargo, ND and retain the TCJA savings to offset the MGP amortization expense. | |||

NSP-Minnesota | Electric | February 2019 | North Dakota — In February 2019, the NDPSC approved a settlement including a one-time customer refund of $10 million for 2018, while NSP-Minnesota would retain the TCJA benefits in 2019 and 2020 in exchange for a two-year rate case moratorium. | |||

NSP-Wisconsin | Electric and Natural Gas | May 2018 | Wisconsin — In May 2018, the PSCW approved customer refunds of $27 million and deferrals of approximately $5 million until NSP-Wisconsin’s next rate case proceeding. | |||

NSP-Wisconsin | Electric and Natural Gas | May 2018 | Michigan — In May 2018, the MPSC approved electric and natural gas TCJA settlement agreements. Most of the electric TCJA benefits were reflected in NSP-Wisconsin’s approved Michigan 2018 electric base rate case. | |||

PSCo | Natural Gas | December 2018 | In February 2018, the ALJ recommended approval of a TCJA settlement agreement, which included a $20 million reduction to PSCo’s provisional rates effective March 1, 2018. In September 2018, PSCo revised its 2018 TCJA benefit estimate to $24 million and requested an equity ratio of 56% to offset the negative impact of the TCJA on credit metrics. In December 2018, the CPUC approved an equity ratio of 54.6% and utilized the remainder of the TCJA benefit to reduce an existing prepaid pension asset. The CPUC also ordered 2018 excess non-plant ADIT benefits of $11.1 million be utilized to accelerate amortization of the prepaid pension asset. | |||

PSCo | Electric | June 2018 October 2018 | In 2018, the CPUC approved a TCJA settlement agreement that included a customer refund of $42 million in 2018, with the remainder of the $59 million of TCJA benefits to be used to accelerate the amortization of an existing prepaid pension asset. For 2019, the expected customer refund is estimated to be $67 million, and amortization of the prepaid pension asset is estimated to be $34 million. Impacts of the TCJA for 2020 and future years are expected to be addressed in a future electric rate case. | |||

SPS | Electric | December 2018 | Texas - In December 2018, the PUCT approved a rate settlement which fully reflects the TCJA cost impacts and results in no change in customer rates or refunds and SPS’ actual capital structure, which SPS has informed the parties it intends to be up to a 57% equity ratio to offset the negative impacts on its credit metrics and potentially its credit ratings. | |||

SPS | Electric | Pending | New Mexico - In September 2018, the NMPRC issued its final order in SPS’ 2017 electric rate case, which included a $10 million refund of the 2018 impact of the TCJA. SPS subsequently filed an appeal with the NMSC, including the order to refund retroactive TCJA savings. The NMSC granted a temporary stay to delay the implementation of the retroactive TCJA refund until a decision on the appeal occurs. On Feb. 15, 2019, SPS and the NMPRC filed a Joint Motion to Dismiss with the NMSC, requesting they remand the case back to the NMPRC to provide them the opportunity to revise its rate case order in accordance with the motion. This would require the NMPRC to replace the order issued in September 2018 and eliminate the retroactive TCJA refund. The revised order would be subject to further administrative or judicial review. | |||

Mechanism | Utility Service | Amount Requested (in millions) | Filing Date | Approval | Additional Information | |||||

NSP-Minnesota (MPUC) | ||||||||||

TCR | Electric | $98 | November 2017 | Pending | Reflects the revenue requirements for 2018 and a true-up for 2017 and is based on a proposed ROE of 10%. The MPUC decision is expected during the first quarter of 2019. | |||||

CIP Incentive | Electric & Natural Gas | $34 | March 2018 | Received | The MPUC approved 2017 CIP electric and natural gas financial incentives, effective October 2018, of $30 million and $4 million, respectively. | |||||

CIP Rider | Electric & Natural Gas | $57 | March 2018 | Received | The MPUC approved the forecasted 2018 electric and natural gas CIP riders with estimated 2019 recovery of $48 million and $9 million of electric and natural gas CIP expenses, respectively. | |||||

2018 GUIC | Natural Gas | $23 | November 2017 | Pending | Proposed ROE of 10%. The MPUC decision is expected during the first quarter of 2019. | |||||

2019 GUIC | Natural Gas | $29 | November 2018 | Pending | Proposed ROE of 10.25%. Timing of the MPUC decision is uncertain. | |||||

RDF | Electric | $42 | October 2018 | Received | The MPUC approved the 2019 RDF rate based on a net revenue requirement of $42 million, effective January 2019. | |||||

RES | Electric | $23 | November 2017 | Pending | Reflects the revenue requirements for 2018, 2017 true-up and a proposed ROE of 10%. The MPUC decision is expected in the first quarter of 2019. | |||||

PSCo (CPUC) | ||||||||||

Multi-Year Rate Case | Natural Gas | $139 | June 2017 | Received | Proposed annual revenue request of $139 million over three years, $63 million for 2018. Requested an ROE of 10.0% and an equity ratio of 55.25%. In August 2018, CPUC approved an increase of $46 million (prior to TCJA impacts). The interim decision included application of a 2016 HTY, a 13-month average rate base, an ROE of 9.35%, an equity ratio of 54.6% and provided no return on the prepaid pension asset. In December 2018, the CPUC issued the final ruling which upheld the interim decision and finalized the TCJA impacts. In October 2018, the CPUC approved a settlement to extend the PSIA rider through 2021. | |||||

DSM Incentive | Electric & Natural Gas | $11 | April 2018 | Received | PSCo earned an electric and natural gas DSM incentive of $9 million and $2 million, respectively, for achieving its 2017 savings goals. | |||||

SPS (PUCT) | ||||||||||

Rate Case | Electric | $54 | August 2017 | Received | In 2017, SPS filed a retail electric, non-fuel base rate increase case in Texas, which included an ROE of 9.5%. In December 2018, PUCT issued a final order approving a settlement, which results in no overall change to SPS’ revenues after adjusting for the impact of the TCJA and the lower costs of long-term debt. In November 2018, SPS filed an application with the PUCT requesting permission to recover $5.4 million in unbilled TCRF revenue from January 23, 2018 through June 9, 2018. Timing of a final order on this matter is uncertain. | |||||

SPS (NMPRC) | ||||||||||

Rate Case | Electric | $41 | November 2016 | Pending | In 2017, SPS filed a notice of appeal to the New Mexico Supreme Court. A decision is not expected until the second half of 2019. | |||||

Rate Case | Electric | $43 | October 2017 | Received/Pending | In September 2018, the NMPRC approved a revenue increase of approximately $8 million, effective Sept. 27, 2018, based on a ROE of 9.1% and a 51% equity ratio. The NMPRC also ordered a refund of $10 million associated with the TCJA impacts (retroactive Jan. 1, 2018 - Sept. 27, 2018). SPS recorded a regulatory liability for this amount in the third quarter of 2018. SPS subsequently filed an appeal of the order. The NMSC subsequently granted a temporary stay to delay the implementation of the retroactive TCJA refund until a decision on the appeal occurs. On Feb. 15, 2019, SPS and the NMPRC filed a Joint Motion to Dismiss with the NMSC, requesting they remand the case back to the NMPRC to provide them the opportunity to revise its rate case order in accordance with the motion. This would require the NMPRC to replace the order issued in September 2018 with the following: eliminating the retroactive refund associated with the TCJA, approving a ROE of 9.56% and approving an equity ratio of 53.97%. Annual revenue increase based on terms of the settlement agreement would be $12.5 million ($8 million from original order plus $4.5 million for changes in ROE and equity ratio). New rates would be effective as of the date provided by the revised NMPRC order (not retrospective to Sept. 26, 2018), which is expected in the second quarter of 2019. The revised order would be subject to further administrative or judicial review. | |||||

• | $309 million in 2018; |

• | $303 million in 2017; and, |

• | $304 million in 2016. |

• | $50 million in 2018; |

• | $61 million in 2017; and, |

• | $93 million in 2016. |

Pension Costs | ||||||||

(Millions of Dollars) | +1% | -1% | ||||||

Rate of return | $ | (17 | ) | $ | 17 | |||

Discount rate (a) | (6 | ) | 7 | |||||

(a) | These costs include the effects of regulation. |

APBO | Service and Interest Components | |||||||||||||||

(Millions of Dollars) | +1% | -1% | +1% | -1% | ||||||||||||

Health care cost trend | $ | 49 | $ | (42 | ) | $ | 3 | $ | (2 | ) | ||||||

• | $150 million in January 2019; |

• | $150 million in 2018; |

• | $162 million in 2017; and, |

• | $125 million in 2016 |

• | NSP-Minnesota recognizes pension expense in all regulatory jurisdictions using the aggregate normal cost actuarial method. Differences between aggregate normal cost and expense as calculated by pension accounting standards are deferred as a regulatory liability. |

• | In 2018, the PSCW approved NSP-Wisconsin’s request for deferred accounting treatment of the 2018 pension settlement accounting expense. |

• | Regulatory Commissions in Colorado, Texas, New Mexico and FERC jurisdictions allow the recovery of other postretirement benefit costs only to the extent that recognized expense is matched by cash contributions to an irrevocable trust. Xcel Energy has consistently funded at a level to allow full recovery of costs in these jurisdictions. |

• | PSCo and SPS recognize pension expense in all regulatory jurisdictions based on expense consistent with accounting guidance. The Texas and Colorado electric retail jurisdictions and the Colorado gas retail jurisdiction, each record the difference between annual recognized pension expense and the annual amount of pension expense approved in their last respective general rate case as a deferral to a regulatory asset. |

• | In 2018, PSCo was required to create a regulatory liability to adjust postretirement health care costs to zero in order to match the amounts collected in rates in the Colorado Gas retail jurisdiction. |

Futures / Forwards | |||||||||||||||||||||||

(Millions of Dollars) | Source of Fair Value | Maturity Less Than 1 Year | Maturity 1 to 3 Years | Maturity 4 to 5 Years | Maturity Greater Than 5 Years | Total Futures / Forwards Fair Value | |||||||||||||||||

NSP-Minnesota | 2 | $ | 3 | $ | 5 | $ | 2 | $ | 1 | $ | 11 | ||||||||||||

PSCo | 2 | 1 | — | — | — | 1 | |||||||||||||||||

$ | 4 | $ | 5 | $ | 2 | $ | 1 | $ | 12 | ||||||||||||||

Options | |||||||||||||||||||||||

(Millions) of Dollars) | Source of Fair Value | Maturity Less Than 1 Year | Maturity 1 to 3 Years | Maturity 4 to 5 Years | Maturity Greater Than 5 Years | Total Options Fair Value | |||||||||||||||||

NSP-Minnesota | 2 | $ | — | $ | 4 | $ | 1 | $ | — | $ | 5 | ||||||||||||

(Millions of Dollars) | 2018 | 2017 | ||||||

Fair value of commodity trading net contract assets outstanding at Jan. 1 | $ | 16 | $ | 10 | ||||

Contracts realized or settled during the period | (10 | ) | (5 | ) | ||||

Commodity trading contract additions and changes during the period | 11 | 11 | ||||||

Fair value of commodity trading net contract assets outstanding at Dec. 31 | $ | 17 | $ | 16 | ||||

(Millions of Dollars) | Year Ended Dec. 31 | VaR Limit | Average | High | Low | |||||||||||||||

2018 | $ | 4.83 | $ | 6.00 | $ | 0.62 | $ | 5.63 | $ | 0.06 | ||||||||||

2017 | 0.18 | 3.00 | 0.21 | 0.66 | 0.04 | |||||||||||||||

(Millions of Dollars) | 2018 | 2017 | 2016 | |||||||||

Net cash provided by operating activities | $ | 3,122 | $ | 3,126 | $ | 3,052 | ||||||

(Millions of Dollars) | 2018 | 2017 | 2016 | |||||||||

Net cash used in investing activities | $ | (3,986 | ) | $ | (3,296 | ) | $ | (3,261 | ) | |||

(Millions of Dollars) | 2018 | 2017 | 2016 | |||||||||

Net cash provided by financing activities | $ | 928 | $ | 168 | $ | 209 | ||||||

Payments Due by Period | ||||||||||||||||||||

(Millions of Dollars) | Total | Less than 1 Year | 1 to 3 Years | 3 to 5 Years | After 5 Years | |||||||||||||||

Long-term debt, principal and interest payments | $ | 27,538 | $ | 1,062 | $ | 2,910 | $ | 2,711 | $ | 20,855 | ||||||||||

Capital lease obligations | 286 | 14 | 28 | 24 | 220 | |||||||||||||||

Operating leases (a) | 2,174 | 239 | 469 | 429 | 1,037 | |||||||||||||||

Unconditional purchase obligations (b) | 6,700 | 1,457 | 1,990 | 1,432 | 1,821 | |||||||||||||||

Other long-term obligations, including current portion | 716 | 57 | 98 | 64 | 497 | |||||||||||||||

Other short-term obligations | 405 | 405 | — | — | — | |||||||||||||||

Short-term debt | 1,038 | 1,038 | — | — | — | |||||||||||||||

Total contractual cash obligations | $ | 38,857 | $ | 4,272 | $ | 5,495 | $ | 4,660 | $ | 24,430 | ||||||||||

(a) | Included in operating lease payments are $207 million, $418 million, $383 million and $0.9 billion, for the less than 1 year, 1 - 3 years, 3 - 5 years and after 5 years categories, respectively, pertaining to PPAs that were accounted for as operating leases. |

(b) | Xcel Energy Inc. and its subsidiaries have contracts providing for the purchase and delivery of a significant portion of its coal, nuclear fuel and natural gas requirements. Additionally, the utility subsidiaries of Xcel Energy Inc. have entered into non-lease purchase power agreements. Certain contractual purchase obligations are adjusted on indices. Effects of price changes are mitigated through cost of energy adjustment mechanisms. |

Capital Forecast | ||||||||||||||||||||||||

(Millions of Dollars) | 2019 | 2020 | 2021 | 2022 | 2023 | 2019 - 2023 Total | ||||||||||||||||||

By Subsidiary | ||||||||||||||||||||||||

NSP-Minnesota | $ | 2,825 | $ | 1,290 | $ | 1,540 | $ | 1,300 | $ | 1,380 | $ | 8,335 | ||||||||||||

PSCo | 1,370 | 1,380 | 1,335 | 1,395 | 1,530 | 7,010 | ||||||||||||||||||

SPS | 1,130 | 770 | 460 | 530 | 635 | 3,525 | ||||||||||||||||||

NSP-Wisconsin | 240 | 240 | 300 | 305 | 275 | 1,360 | ||||||||||||||||||

Other (a) | (50 | ) | (70 | ) | (25 | ) | 10 | 15 | (120 | ) | ||||||||||||||

Total capital expenditures | $ | 5,515 | $ | 3,610 | $ | 3,610 | $ | 3,540 | $ | 3,835 | $ | 20,110 | ||||||||||||

Capital Forecast | ||||||||||||||||||||||||

(Millions of Dollars) | 2019 | 2020 | 2021 | 2022 | 2023 | 2019 - 2023 Total | ||||||||||||||||||

By Function | ||||||||||||||||||||||||

Electric distribution | $ | 775 | $ | 865 | $ | 1,150 | $ | 1,245 | $ | 1,270 | $ | 5,305 | ||||||||||||

Electric transmission | 580 | 560 | 950 | 870 | 1,055 | 4,015 | ||||||||||||||||||

Renewables | 2,315 | 1,105 | 240 | — | — | 3,660 | ||||||||||||||||||

Electric generation | 1,070 | 310 | 480 | 560 | 545 | 2,965 | ||||||||||||||||||

Natural gas | 430 | 415 | 420 | 510 | 595 | 2,370 | ||||||||||||||||||

Other (b) | 345 | 355 | 370 | 355 | 370 | 1,795 | ||||||||||||||||||

Total capital expenditures | $ | 5,515 | $ | 3,610 | $ | 3,610 | $ | 3,540 | $ | 3,835 | $ | 20,110 | ||||||||||||

(a) | Other category includes intercompany transfers for safe harbor wind turbines. |

(b) | Amounts in other category are net of intercompany transfers. |

(Millions of Dollars) | ||||

Funding Capital Expenditures | ||||

Cash from Operations* | $ | 13,070 | ||

New Debt** | 6,190 | |||

Equity through the DRIP and Benefit Program | 390 | |||

Equity through forward equity agreements | 460 | |||

Base Capital Expenditures 2019 - 2023 | $ | 20,110 | ||

Maturing Debt | $ | 3,645 | ||

• | Projected cash generation; |

• | Projected capital investment; |

• | A reasonable rate of return on shareholder investment; and, |

• | The impact on Xcel Energy’s capital structure and credit ratings. |

(Millions of Dollars) | Dec. 31, 2018 | Dec. 31, 2017 | ||||||

Fair value of pension assets | $ | 2,742 | $ | 3,088 | ||||

Projected pension obligation (a) | 3,477 | 3,828 | ||||||

Funded status | $ | (735 | ) | $ | (740 | ) | ||

(a) | Excludes non-qualified plan of $33 million and $37 million at Dec. 31, 2018 and 2017, respectively. |

Pension Assumptions | 2018 | 2017 | ||||

Discount rate | 4.31 | % | 3.63 | % | ||

Expected long-term rate of return | 6.87 | 6.87 | ||||

• | $1 billion for Xcel Energy Inc.; |

• | $700 million for PSCo; |

• | $500 million for NSP-Minnesota; |

• | $400 million for SPS; and, |

• | $150 million for NSP-Wisconsin. |

(Amounts in Millions, Except Interest Rates) | Three Months Ended Dec. 31, 2018 | |||

Borrowing limit | $ | 3,250 | ||

Amount outstanding at period end | 1,038 | |||

Average amount outstanding | 500 | |||

Maximum amount outstanding | 1,038 | |||

Weighted average interest rate, computed on a daily basis | 2.76 | % | ||

Weighted average interest rate at end of period | 2.97 | |||

(Amounts in Millions, Except Interest Rates) | Year Ended Dec. 31, 2018 | Year Ended Dec. 31, 2017 | Year Ended Dec. 31, 2016 | |||||||||

Borrowing limit | $ | 3,250 | $ | 3,250 | $ | 2,750 | ||||||

Amount outstanding at period end | 1,038 | 814 | 392 | |||||||||

Average amount outstanding | 788 | 644 | 485 | |||||||||

Maximum amount outstanding | 1,349 | 1,247 | 1,183 | |||||||||

Weighted average interest rate, computed on a daily basis | 2.34 | % | 1.35 | % | 0.74 | % | ||||||

Weighted average interest rate at end of period | 2.97 | 1.90 | 0.95 | |||||||||

(Millions of Dollars) | Facility | Drawn (a) | Available | Cash | Liquidity | |||||||||||||||

Xcel Energy Inc. | $ | 1,500 | $ | 786 | $ | 714 | $ | — | $ | 714 | ||||||||||

PSCo | 700 | 224 | 476 | 1 | 477 | |||||||||||||||

NSP-Minnesota | 500 | 152 | 348 | 1 | 349 | |||||||||||||||

SPS | 400 | 128 | 272 | — | 272 | |||||||||||||||

NSP-Wisconsin | 150 | 29 | 121 | 1 | 122 | |||||||||||||||

Total | $ | 3,250 | $ | 1,319 | $ | 1,931 | $ | 3 | $ | 1,934 | ||||||||||

(a) | Includes outstanding commercial paper, term loan borrowings and letters of credit. |

• | Xcel Energy Inc. — approximately $700 million of senior notes and approximately $75 to $80 million of equity through the DRIP and benefit programs; |

• | NSP-Minnesota — approximately $900 million of first mortgage bonds; |

• | PSCo — approximately $800 million of first mortgage bonds; and, |

• | SPS — approximately $300 million of first mortgage bonds. |

• | Constructive outcomes in all rate case and regulatory proceedings. |

• | Normal weather patterns for the year. |

• | Weather-normalized retail electric sales are projected to be relatively consistent with 2018 levels. |

• | Weather-normalized retail natural gas sales are projected to be within a range of 0.0% to 1.0% over 2018 levels. |

• | Capital rider revenue is projected to increase $115 million to $125 million (net of PTCs) over 2018 levels. PTCs are flowed back to customers, primarily through capital riders as reductions to electric margin. |

• | Purchase capacity costs are expected to decline $25 million to $30 million compared with 2018 levels. |

• | O&M expenses are projected to be consistent with 2017 levels. |

• | Depreciation expense is projected to increase approximately $120 million to $130 million over 2018 levels. Depreciation expense includes $34 million for the amortization of a prepaid pension asset at PSCo, which is TCJA related and will not impact earnings. |

• | Property taxes are projected to increase approximately $15 million to $25 million over 2018 levels. |

• | Interest expense (net of AFUDC — debt) is projected to increase $90 million to $100 million over 2018 levels. |

• | AFUDC — equity is projected to decrease approximately $20 million to $30 million from 2018 levels. |

• | The ETR is projected to be approximately 6% to 8%. The ETR reflects benefits of PTCs which are flowed back to customers through electric margin. |

• | Assumptions do not include the impact for the upcoming adoption of the new lease accounting standard, effective 2019. Xcel Energy does not expect changes in the accounting for leases to impact earnings, but it may result in variations in certain line items within the statement of income. |

(a) | Ongoing earnings is calculated using net income and adjusting for certain nonrecurring or infrequent items that are, in management’s view, not reflective of ongoing operations. Ongoing earnings could differ from those prepared in accordance with GAAP for unplanned and/or unknown adjustments. Xcel Energy is unable to forecast if any of these items will occur or provide a quantitative reconciliation of the guidance for ongoing EPS to corresponding GAAP EPS. |

/s/ BEN FOWKE | /s/ ROBERT C. FRENZEL | |||

Ben Fowke | Robert C. Frenzel | |||

Chairman, President and Chief Executive Officer | Executive Vice President, Chief Financial Officer | |||

Feb. 22, 2019 | Feb. 22, 2019 | |||

/s/ DELOITTE & TOUCHE LLP |

Minneapolis, Minnesota |

February 22, 2019 |

We have served as the Company’s auditor since 2002. |

XCEL ENERGY INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (amounts in millions, except per share data) | ||||||||||||

Year Ended Dec. 31 | ||||||||||||

2018 | 2017 | 2016 | ||||||||||

Operating revenues | ||||||||||||

Electric | $ | 9,719 | $ | 9,676 | $ | 9,500 | ||||||