As filed with the Securities and Exchange Commission on March 15, 2011

Registration No. 333-37980

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

POST-EFFECTIVE AMENDMENT NO. 9

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_________________

Merrill Lynch, Pierce, Fenner & Smith Incorporated

Initial Depositor

(Exact name of registrant as specified in charter)

_________________

Market 2000+ HOLDRSSM Trust

[Issuer with respect to the receipts]

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

6211

(Primary Standard Industrial Classification Code Number)

|

13-5674085

(I.R.S. Employer Identification Number)

|

_________________

One Bryant Park

New York, New York 10036

(212) 449-1000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

_________________

Copies to:

|

Merrill Lynch, Pierce, Fenner & Smith Incorporated

One Bryant Park

New York, New York 10036

(212) 449-1000

Attn: Corporate Secretary

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

Abigail Arms, Esq.

Shearman & Sterling LLP

801 Pennsylvania Avenue, NW, Suite 900

Washington, D.C. 20004

(202) 508-8000

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. S

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

PROSPECTUS

1,000,000,000 Depositary Receipts

Market 2000+ HOLDRSSM Trust

___________________________

The Market 2000+ HOLDRSSM Trust issues Depositary Receipts called Market 2000+ HOLDRSSM representing your undivided beneficial ownership in the common stock or American depositary shares of a group of specified companies that, when the Market 2000+ HOLDRSSM were initially issued on August 29, 2000, were among the 50 largest companies whose common stock or American depositary shares were listed for trading on the New York Stock Exchange (including the NYSE Arca) or the NASDAQ Stock Market, as measured in terms of worldwide market capitalization on July 7, 2000. The Bank of New York Mellon is the trustee. You only may acquire, hold or transfer Market 2000+ HOLDRSSM in a round-lot amount of 100 Market 2000+ HOLDRSSM or round-lot multiples. Market 2000+ HOLDRSSM are separate from the underlying deposited common stock or American depositary shares that are represented by the Market 2000+ HOLDRSSM. For a list of the names and the number of shares of the companies that are represented by a Market 2000+ HOLDRSM, see “Highlights of Market 2000+ HOLDRS—The Market 2000+ HOLDRS” in this prospectus. The Market 2000+ HOLDRSSM Trust will issue Market 2000+ HOLDRSSM on a continuous basis.

Investing in Market 2000+ HOLDRSSM involves significant risks. See “Risk Factors” starting on page 4.

Market 2000+ HOLDRSSM are neither interests in nor obligations of Merrill Lynch, Pierce, Fenner & Smith Incorporated or any of its affiliates. Market 2000+ HOLDRSSM are not interests in The Bank of New York Mellon, as trustee. Please see “Description of the Depositary Trust Agreement” in this prospectus for a more complete description of the duties and responsibilities of the trustee, including the obligation of the trustee to act without negligence or bad faith.

The Market 2000+ HOLDRSSM are listed on the NYSE Arca under the symbol “MKH.” On March 11, 2011, the last reported sale price of the Market 2000+ HOLDRSSM on the NYSE Arca was $51.77.

______________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

______________

The date of this prospectus is March 15, 2011.

“HOLDRS” and “HOLding Company Depositary ReceiptS” are service marks of Bank of America Corporation.

|

3

|

|

|

4

|

|

|

9

|

|

|

16

|

|

|

16

|

|

|

16

|

|

|

19

|

|

|

22

|

|

|

27

|

|

|

27

|

|

|

27

|

|

|

27

|

This prospectus contains information you should consider when making your investment decision. We have not authorized any person to provide you with any information or to make any representations not contained in this prospectus. We do not take any responsibility for, and can provide no assurances as to, the reliability of any information that others may provide you. We are not making an offer to sell Market 2000+ HOLDRS in any jurisdiction where the offer or sale is not permitted. For information on where you may find more information about the issuers of the underlying securities, see “Where You Can Find More Information.”

The Market 2000+ HOLDRS are not registered for public sale outside of the United States. Non-U.S. receipt holders should refer to “U.S. Federal Income Tax Consequences—Non-U.S. receipt holders” and we recommend that non-U.S. receipt holders consult their tax advisors regarding U.S. withholding and other taxes which may apply to ownership of the Market 2000+ HOLDRS or of the underlying securities through an investment in the Market 2000+ HOLDRS.

The Market 2000+ HOLding Company Depositary ReceiptS or HOLDRS Trust was formed under the depositary trust agreement, dated as of July 26, 2000, among The Bank of New York Mellon, as trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, other depositors and the owners of the Market 2000+ HOLDRS. The depositary trust agreement was amended on August 18, 2000. The trust is not a registered investment company under the Investment Company Act of 1940.

The number of shares of each company’s common stock or American depositary shares currently held by the trust with respect to each round-lot of Market 2000+ HOLDRS is specified under “Highlights of Market 2000+ HOLDRS—The Market 2000+ HOLDRS.” This group of common stock or American depositary shares, and the securities of any company that may be added to the Market 2000+ HOLDRS, are collectively referred to in this prospectus as the common stock, the securities or the underlying securities. The companies included in the Market 2000+ HOLDRS may change as a result of reconstitution events, distributions of securities by underlying issuers, or other events. See “Description of the Depositary Trust Agreement—Reconstitution events” for an explanation of these events. The Market 2000+ HOLDRS are separate from the underlying deposited common stock or American depositary shares that are represented by the Market 2000+ HOLDRS. On March 11, 2011, there were 248,800 Market 2000+ HOLDRS outstanding.

An investment in Market 2000+ HOLDRS involves risks similar to investing directly in each of the underlying securities outside of the Market 2000+ HOLDRS.

General Risk Factors

|

|

·

|

Loss of investment. Because the value of Market 2000+ HOLDRS directly relates to the value of the underlying securities, you may lose all or a substantial portion of your investment in the Market 2000+ HOLDRS if the underlying securities decline in value.

|

|

|

·

|

Discount trading price. Market 2000+ HOLDRS may trade at a discount to the aggregate value of the underlying securities.

|

|

|

·

|

Ownership of only fractional shares in the underlying securities. As a result of distributions of securities by companies included in the Market 2000+ HOLDRS or other corporate events, such as mergers, a Market 2000+ HOLDR may represent an interest in a fractional share of an underlying security. You will only be entitled to voting, distribution and other beneficial ownership rights in the underlying securities in which you own only fractional shares to the extent that the depositary aggregates your fractional shares with other fractional shares of such underlying securities included in the Market 2000+ HOLDRS and passes on beneficial ownership rights, including distribution and voting rights, to you based on your proportional, fractional share ownership in the underlying securities. In addition, if you surrender your Market 2000+ HOLDRS to receive the underlying securities and other property represented by your Market 2000+ HOLDRS, you will receive cash in lieu of your fractional shares. You will not be entitled to any securities if your interest in an underlying security is only a fraction of a share.

|

|

|

·

|

Not necessarily consisting of the companies with the largest market capitalization. At the time of the initial offering, on August 29, 2000, the companies included in the Market 2000+ HOLDRS were the largest companies whose securities were traded on a U.S. stock market, as measured by worldwide market capitalization on July 7, 2000. One or more of the companies whose common stock or American depositary shares are included in the Market 2000+ HOLDRS may no longer have a market capitalization that is among the companies with the largest market capitalization of companies whose securities are traded on a U.S. stock market. In addition, as a result of a merger, acquisition or stock distribution of one or more of the companies included in the Market 2000+ HOLDRS, the securities of a company that is not presently part of the Market 2000+ HOLDRS may be included in the Market 2000+ HOLDRS. In this case, the Market 2000+ HOLDRS may no longer consist solely of securities issued by companies with the largest market capitalization.

|

|

|

·

|

No investigation of underlying securities. The underlying securities initially included in the Market 2000+ HOLDRS were selected by Merrill Lynch, Pierce, Fenner & Smith Incorporated based on the market capitalization of issuers with securities traded on a U.S. stock market, without regard for the value, price performance, volatility or investment merit of the underlying securities. The Market 2000+ HOLDRS Trust, the trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, and each of their respective affiliates, have not performed, and will not in the future perform, any investigation or review of the selected companies, including the public filings by the companies. Investors and market participants should not conclude that the inclusion of a company is any form of investment recommendation by the trust, the trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, or their respective affiliates.

|

|

|

·

|

Concentration of investment. As a result of market fluctuations, reconstitution events, distributions of securities by an underlying issuer or other events which may result in distributions of securities from, or the inclusion of additional securities in the Market 2000+ HOLDRS, an investment in Market 2000+ HOLDRS may represent a concentrated investment in one or more of the underlying securities or one or more industries. A concentrated investment will reduce the diversification of the Market 2000+ HOLDRS and increase your exposure to the risks of concentrated investments.

|

|

|

·

|

Conflicting investment choices. In order to sell one or more of the underlying securities individually or to participate in a tender offer relating to one or more of the underlying securities or any form of stock repurchase program by an issuer of an underlying security, you will be required to cancel your Market 2000+ HOLDRS and receive delivery of each of the underlying securities, including those underlying securities that you may not want to sell or are not subject to a tender offer or repurchase offer. The cancellation of your Market 2000+ HOLDRS will allow you to sell the individual underlying securities or to deliver the individual underlying securities in a tender offer or any form of stock repurchase program. The cancellation of Market 2000+ HOLDRS will involve payment of a cancellation fee to the trustee.

|

|

|

·

|

Trading halts. Trading in Market 2000+ HOLDRS on the NYSE Arca may be halted if (i) the Market 2000+ HOLDRS has fewer than the required number of record and/or beneficial holders for 30 or more consecutive trading days; (ii) the number of Market 2000+ HOLDRS issued and outstanding falls below levels prescribed by the NYSE Arca; (iii) the market value of all Market 2000+ HOLDRS issued and outstanding falls below levels prescribed by the NYSE Arca; or (iv) any other event shall occur or conditions exists which, in the opinion of the NYSE Arca, makes further dealings on the NYSE Arca inadvisable. If trading is halted in Market 2000+ HOLDRS, you will not be able to trade Market 2000+ HOLDRS and you will only be able to trade the underlying securities if you cancel your Market 2000+ HOLDRS and receive each of the underlying securities.

|

|

|

·

|

Delisting from the NYSE Arca. The NYSE Arca may consider delisting the Market 2000+ HOLDRS if (i) the Market 2000+ HOLDRS has fewer than the required number of record and/or beneficial holders for 30 or more consecutive trading days; (ii) the number of Market 2000+ HOLDRS issued and outstanding falls below levels prescribed by the NYSE Arca; (iii) the market value of all Market 2000+ HOLDRS issued and outstanding falls below levels prescribed by the NYSE Arca; or (iv) any other event shall occur or conditions exists which, in the opinion of the NYSE Arca, makes further listing of the Market 2000+ HOLDRS on the NYSE Arca inadvisable. If the Market 2000+ HOLDRS are delisted by the NYSE Arca, a termination event will result unless the Market 2000+ HOLDRS are listed for trading on another U.S. national securities exchange within five business days from the date the Market 2000+ HOLDRS are delisted.

|

|

|

·

|

Possible conflicts of interest. Merrill Lynch, Pierce, Fenner & Smith Incorporated, as initial depositor, selected the underlying securities that were originally included in the Market 2000+ HOLDRS and may face possible conflicts of interest as Merrill Lynch, Pierce, Fenner & Smith Incorporated and its affiliates may engage in investment banking or may provide services for issuers of the underlying securities in connection with its business.

|

|

|

·

|

Delays in distributions. The depositary trust agreement provides that the trustee will use its reasonable efforts to distribute any cash or other distributions paid in respect of the underlying securities to you as soon as practicable after receipt of such distribution. You may, however, receive such cash or other distributions later than you would if you owned the underlying securities outside of the Market 2000+ HOLDRS. In addition, you will not be entitled to any interest on any distribution by reason of any delay in distribution by the depositary.

|

Risk Factors Specific to Companies Included in the Market 2000+ HOLDRS

|

|

·

|

The stock prices of some of the companies included in the Market 2000+ HOLDRS have been and will likely continue to be volatile, which will directly affect the price volatility of the Market 2000+ HOLDRS, and you could lose all or a substantial part of your investment. The trading prices of the securities of some companies included in the Market 2000+ HOLDRS have been volatile. These stock prices could be subject to wide fluctuations in response to a variety of factors, including the following:

|

|

|

·

|

general market fluctuations;

|

|

|

·

|

actual or anticipated variations in companies’ quarterly operating results;

|

|

|

·

|

announcements of technological innovations by competitors of the companies included in the Market 2000+ HOLDRS;

|

|

|

·

|

changes in financial estimates by securities analysts;

|

|

|

·

|

legal or regulatory developments affecting the companies included in the Market 2000+ HOLDRS or in the industries in which they operate;

|

|

|

·

|

announcements by competitors of the companies included in the Market 2000+ HOLDRS of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

|

·

|

changes in financial estimates by securities analysts;

|

|

|

·

|

additions or departures of key personnel; and

|

|

|

·

|

difficulty in obtaining additional financing.

|

In addition, the trading prices of some of the companies included in the Market 2000+ HOLDRS have experienced price and volume fluctuations. These fluctuations often have been and may in the future be unrelated or disproportionate to the operating performance of these companies. The valuations of many of the underlying stocks are high when measured by conventional valuation standards such as price-to-earnings and price-to-sales ratios. Some of the companies do not or in the future might not have earnings. As a result, these trading prices may decline substantially and valuations may not be sustained. Any negative change in the public’s perception of the prospects of the underlying companies, generally, could depress their stock prices regardless of the companies’ results. Other broad market and industry factors may decrease the stock price of the underlying stocks, regardless of their operating results. Market fluctuations, as well as general political and economic conditions such as recession, war or interest rate or currency rate fluctuations, also may decrease the market price of these stocks.

As a result of fluctuations in the trading prices of the companies included in the Market 2000+ HOLDRS, the trading price of Market 2000+ HOLDRS has fluctuated significantly. The initial offering price of a Market 2000+ HOLDR on August 29, 2000 was $97.55 and during 2010, the price of a Market 2000+ HOLDR reached a high of $50.77 and a low of $42.38.

|

|

·

|

The international operations of some domestic and foreign companies included in the Market 2000+ HOLDRS expose them to risks associated with instability and changes in economic, legal and political conditions, foreign currency fluctuations, changes in foreign regulations and other risks inherent to international business. Some domestic and foreign companies included in the Market 2000+ HOLDRS have international operations, which are essential parts of their businesses. The risks of international business that these companies are exposed to include the following:

|

|

|

·

|

volatility in general economic, social and political conditions;

|

|

|

·

|

the difficulty of enforcing intellectual property rights, agreements and collecting receivables through certain foreign legal systems;

|

|

|

·

|

differing tax rates, tariffs, exchange controls or other similar restrictions;

|

|

|

·

|

currency fluctuations;

|

|

|

·

|

changes in, and compliance with, domestic and foreign laws and regulations which impose a range of restrictions on operations, trade practices, foreign trade and international investment decisions; and

|

|

|

·

|

reduction in the number or capacity of personnel in international markets.

|

|

|

·

|

It may be impossible to initiate legal proceedings or enforce judgments against some of the companies included in the Market 2000+ HOLDRS. Many of the companies included in the Market 2000+ HOLDRS may be incorporated under the laws of a jurisdiction other than the United States and a substantial portion of their assets may be located outside the United States. As a result, it may be impossible to effect service of process within the United States on many of the companies included in the Market 2000+ HOLDRS or enforce judgments made against them in courts in the United States based on the civil liability provisions of the securities laws of the United States. In addition, awards of punitive damages obtained in courts in the United States may not be enforceable in foreign countries.

|

|

|

·

|

Potential voting impediments may exist with respect to the ownership of some American depositary shares included in the Market 2000+ HOLDRS. Holders of American depositary shares, including those that may, from time to time, be included in the Market 2000+ HOLDRS, may only exercise voting rights with respect to the securities represented by American depositary shares in accordance with the provisions of deposit agreements entered into in connection with the issuance of the American depositary shares. These deposit agreements may not permit holders of American depositary shares to exercise voting rights that attach to the securities underlying the American depositary shares without the issuer first instructing the depositary to send voting information to the holder of the American depositary share. Also, holders of American depositary shares may not exercise voting rights unless they take a variety of steps, which include registration in the share registry of the company that has issued the securities underlying the American depositary shares. The cumulative effect of these steps may make it impractical for holders of American depositary shares to exercise the voting rights attached to the underlying securities.

|

|

|

·

|

Many of the companies included in the Market 2000+ HOLDRS are companies that are involved in the technology and telecommunications industries and are subject to the risks associated with an investment in companies in those industries. The valuations of many technology and telecommunications companies are extraordinarily high based on conventional valuation standards such as price-to-earnings ratios. As a result, the valuations of companies in these industries, and the trading prices for their stock, may not be sustained. In addition, a company that operates in these industries is exposed to other risks, which include the following:

|

|

|

·

|

the need to keep pace with rapid technological change in order to remain competitive and to prevent the obsolescence of their products and services;

|

|

|

·

|

an inability to adequately protect proprietary rights;

|

|

|

·

|

changes in the regulatory environment in which telecommunications companies operate that could affect their ability to offer new or existing products and services; and

|

|

|

·

|

the need to create and employ new technologies and to offer new services derived from these new technologies to remain competitive.

|

An investment in the Market 2000+ HOLDRS may be particularly vulnerable to these risks because of the significant number of technology and telecommunications companies included in the Market 2000+ HOLDRS.

|

|

·

|

Companies whose securities are included in the Market 2000+ HOLDRS may need additional financing, which may be difficult to obtain. Failure to obtain necessary financing or doing so on unattractive terms could adversely affect development and marketing efforts and other operations of companies whose securities are included in the Market 2000+ HOLDRS. Companies whose securities are included in the Market 2000+ HOLDRS may need to raise additional capital in order to fund the continued development and marketing of their products or to fund strategic acquisitions or investments. Their ability to obtain additional financing will depend on a number of factors, including market conditions, operating performance and investor interest. These factors may make the timing, amount and terms and conditions of any financing unattractive. If adequate funds are not available or are not available on acceptable terms, companies whose securities are included in the Market 2000+ HOLDRS may have to forego strategic acquisitions or investments, reduce or defer their development activities, delay their introduction of new

|

|

|

|

products and services, or terminate operations completely. Any of these actions may reduce the market price of the underlying securities in the Market 2000+ HOLDRS.

|

This discussion highlights information regarding Market 2000+ HOLDRS. We present certain information more fully in the rest of this prospectus. You should read the entire prospectus carefully before you purchase Market 2000+ HOLDRS.

|

Issuer

|

Market 2000+ HOLDRS Trust.

|

|

The trust

|

The Market 2000+ HOLDRS Trust was formed under the depositary trust agreement, dated as of July 26, 2000, among The Bank of New York Mellon, as trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, other depositors and the owners of the Market 2000+ HOLDRS. The depositary trust agreement was amended on August 18, 2000. The trust is not a registered investment company under the Investment Company Act of 1940.

|

|

Initial depositor

|

Merrill Lynch, Pierce, Fenner & Smith Incorporated.

|

|

Trustee

|

The Bank of New York Mellon, a New York state-chartered banking organization, is the trustee and receives compensation as set forth in the depositary trust agreement. The trustee is responsible for receiving deposits of underlying securities and delivering Market 2000+ HOLDRS representing the underlying securities issued by the trust. The trustee holds the underlying securities on behalf of the holders of Market 2000+ HOLDRS.

|

|

Purpose of Market 2000+ HOLDRS

|

Market 2000+ HOLDRS were designed to achieve the following:

Diversification. Market 2000+ HOLDRS were initially designed to allow you to diversify your investments by holding the securities of companies that are traded on a U.S. stock market, through a single, exchange-listed instrument representing your undivided beneficial ownership of the underlying securities. At the time of the initial offering on August 29, 2000, the Market 2000+ HOLDRS consisted of the securities of the largest companies whose common stock or American depositary shares were traded on a U.S. stock market, as measured by worldwide market capitalization on July 7, 2000. See “Risk Factors—General Risk Factors.”

Flexibility. The beneficial owners of Market 2000+ HOLDRS have undivided beneficial ownership interests in each of the underlying securities represented by the Market 2000+ HOLDRS, and can cancel their Market 2000+ HOLDRS to receive each of the underlying securities represented by the Market 2000+ HOLDRS.

Transaction costs. The expenses associated with buying and selling Market 2000+ HOLDRS in the secondary market are expected to be less than separately buying and selling each of the underlying securities in a traditional brokerage account with transaction-based charges.

|

|

Trust assets

|

The trust holds shares of securities issued by specified companies that, when initially selected, were the largest companies with securities traded on a U.S. stock market, as measured in terms of worldwide market capitalization on July 7, 2000. Except when a reconstitution event, distribution of securities by an underlying issuer or other event occurs, the underlying securities will not change and the securities of a new company will not be added to the securities underlying the Market 2000+ HOLDRS. Reconstitution events are described in this prospectus under the heading “Description of the Depositary Trust Agreement—Distributions” and “—Reconstitution events.”

|

| The trust’s assets may increase or decrease as a result of in-kind deposits and withdrawals of the underlying securities during the life of the trust. | |

|

The Market 2000+ HOLDRS

|

The trust has issued and may continue to issue Market 2000+ HOLDRS that represent an undivided beneficial ownership interest in the shares of U.S.-traded securities that are held by the trust on your behalf. The Market 2000+ HOLDRS themselves are separate from the underlying securities that are represented by the Market 2000+ HOLDRS.

|

|

The following table provides:

|

|

·

|

the names of the issuers of the underlying securities currently represented by a Market 2000+ HOLDR; | |

|

·

|

the stock ticker symbols; | |

|

·

|

the share amounts currently represented by a round-lot of 100 Market 2000+ HOLDRS; and | |

|

·

|

the primary U.S. market on which the underlying securities of the selected companies are traded. |

|

Name of Company(1)

|

Ticker

|

Share

Amounts |

Primary

Trading Market |

|||

|

Alcatel-Lucent

|

ALU

|

0.7808

|

NYSE

|

|||

|

American International Group, Inc.

|

AIG

|

0.1000

|

NYSE

|

|||

|

AOL Inc.

|

AOL

|

0.1818

|

NYSE

|

|||

|

AstraZeneca PLC *

|

AZN

|

4.0000

|

NYSE

|

|||

|

AT&T Inc.

|

T

|

11.5603

|

NYSE

|

|||

|

BP p.l.c. *

|

BP

|

3.0000

|

NYSE

|

|||

|

Bristol-Myers Squibb Company

|

BMY

|

3.0000

|

NYSE

|

|||

|

Brocade Communications Systems, Inc.

|

BRCD

|

0.0552

|

NASDAQ GS

|

|||

|

BT Group plc

|

BT

|

2.0000

|

NYSE

|

|||

|

CBS Corporation Class B

|

CBS

|

1.5000

|

NYSE

|

|||

|

Cisco Systems, Inc.

|

CSCO

|

3.0000

|

NASDAQ GS

|

|||

|

Citigroup Inc.

|

C

|

3.0000

|

NYSE

|

|||

|

Comcast Corporation

|

CMCSA

|

2.9115

|

NASDAQ GS

|

|||

|

Dell Inc.

|

DELL

|

5.0000

|

NASDAQ GS

|

|||

|

Discover Financial Services

|

DFS

|

1.0000

|

NYSE

|

|||

|

Eli Lilly and Company

|

LLY

|

2.0000

|

NYSE

|

|||

|

EMC Corporation

|

EMC

|

2.0000

|

NYSE

|

|||

|

LM Ericsson Telephone Company *

|

ERIC

|

1.8000

|

NASDAQ GS

|

|||

|

Exxon Mobil Corporation

|

XOM

|

4.0000

|

NYSE

|

|||

|

France Telecom *

|

FTE

|

2.0000

|

NYSE

|

|||

|

Frontier Communications Corporation(2)

|

FTR

|

0.9602

|

NYSE

|

|||

|

General Electric Company

|

GE

|

3.0000

|

NYSE

|

|||

|

GlaxoSmithKline plc

|

GSK

|

3.0000

|

NYSE

|

|||

|

Hewlett-Packard Company

|

HPQ

|

4.0000

|

NYSE

|

|||

|

The Home Depot, Inc.

|

HD

|

4.0000

|

NYSE

|

|||

|

Intel Corporation

|

INTC

|

2.0000

|

NASDAQ GS

|

|||

|

International Business Machines Corporation

|

IBM

|

2.0000

|

NYSE

|

|||

|

JDS Uniphase Corporation

|

JDSU

|

0.2500

|

NASDAQ GS

|

|||

|

Johnson & Johnson

|

JNJ

|

4.0000

|

NYSE

|

|||

|

LSI Corporation

|

LSI

|

0.2379

|

NYSE

|

|

Medco Health Solutions, Inc.

|

MHS

|

0.7236

|

NYSE

|

|||

|

Merck & Co., Inc.

|

MRK

|

3.0000

|

NYSE

|

|||

|

Microsoft Corporation

|

MSFT

|

6.0000

|

NASDAQ GS

|

|||

|

Morgan Stanley

|

MS

|

2.0000

|

NYSE

|

|||

|

Nippon Telegraph and Telephone Corporation *

|

NTT

|

3.0000

|

NYSE

|

|||

|

Nokia Corp. *

|

NOK

|

4.0000

|

NYSE

|

|||

|

Novartis AG *

|

NVS

|

5.0000

|

NYSE

|

|||

|

Oracle Corporation

|

ORCL

|

4.0000

|

NASDAQ GS

|

|||

|

Pfizer Inc.

|

PFE

|

4.0000

|

NYSE

|

|||

|

Qwest Communications International Inc.

|

Q

|

4.0000

|

NYSE

|

|||

|

Sony Corporation *

|

SNE

|

2.0000

|

NYSE

|

|||

|

Syngenta AG

|

SYT

|

1.0386

|

NYSE

|

|||

|

Texas Instruments Incorporated

|

TXN

|

3.0000

|

NYSE

|

|||

|

The Coca-Cola Company

|

KO

|

3.0000

|

NYSE

|

|||

|

The Travelers Companies, Inc.

|

TRV

|

0.1716

|

NYSE

|

|||

|

Time Warner Cable Inc.

|

TWC

|

0.5020

|

NYSE

|

|||

|

Time Warner Inc.

|

TWX

|

2.0000

|

NYSE

|

|||

|

TOTAL S.A. *

|

TOT

|

4.0000

|

NYSE

|

|||

|

Toyota Motor Corporation *

|

TM

|

2.0000

|

NYSE

|

|||

|

Verizon Communications Inc.(2)

|

VZ

|

4.0000

|

NYSE

|

|||

|

Viacom Inc. Class B

|

VIA.B

|

1.5000

|

NYSE

|

|||

|

Vodafone Group Public Limited Company*

|

VOD

|

4.3750

|

NASDAQ GS

|

|||

|

Wal-Mart Stores, Inc.

|

WMT

|

4.0000

|

NYSE

|

|||

|

Zimmer Holdings, Inc.

|

ZMH

|

0.3000

|

NYSE

|

*The securities of this non-U.S. company trade in the United States as American depositary receipts.

(1) Effective June 21, 2010 (the “delisting date”), Deutsche Telekom AG, an underlying constituent of the Market 2000+ HOLDRS Trust (the “Trust”), was delisted from trading on the NYSE. Pursuant to the prospectus for the Trust, as Deutsche Telekom AG was not listed for trading on another national securities exchange within five business days from the delisting date, it was distributed by The Bank of New York Mellon. The rate of distribution was 0.05 Deutsche Telekom AG shares per Market 2000+ HOLDRS. The record date and pay date for the distribution was July 1, 2010 and July 7, 2010, respectively

(2) As a result of the spin-off of Frontier Communications Corporation from Verizon Communications Inc., a component of the Market 2000+ HOLDRS Trust, Frontier Communications Corporation was added as an underlying security of the Market 2000+ HOLDRS Trust effective July 8, 2010. Shareholders of Verizon Communications Inc. received 0.2400397313 shares of Frontier Communications Corporation. The Bank of New York Mellon received 0.9601589252 shares of Frontier Communications Corporation for the 4 shares of Verizon Communications Inc. per 100 share round-lot of Market 2000+ HOLDRS. Effective July 8, 2010, 0.9601589252 shares of Frontier Communications Corporation were required for creations/cancellations per 100 share round-lot of Market 2000+ HOLDRS.

|

The companies whose securities were initially included in the Market 2000+ HOLDRS at the time Market 2000+ HOLDRS were originally issued on August 29, 2000 were generally considered to be among the 50 largest and most liquid companies, measured by worldwide market capitalization on July 7, 2000, with securities traded on a U.S. stock market. The market capitalization of a company is determined by multiplying the market price of its securities by the number of its outstanding securities.

|

|

|

The trust will only issue and cancel, and you may only obtain, hold, trade or surrender, Market 2000+ HOLDRS in a round-lot of 100 Market 2000+ HOLDRS and round-lot multiples. The trust will only issue Market 2000+ HOLDRS upon the deposit of the whole shares represented by a round-lot of 100 Market 2000+ HOLDRS. In the event that a fractional share comes to be represented by a round-lot of Market 2000+ HOLDRS, the trust may require a minimum of more than one round-lot of 100 Market 2000+ HOLDRS for an issuance so that the trust will always receive whole share amounts for

|

| issuance of Market 2000+ HOLDRS. | |

|

The number of outstanding Market 2000+ HOLDRS will increase and decrease as a result of in-kind deposits and withdrawals of the underlying securities. The trust will stand ready to issue additional Market 2000+ HOLDRS on a continuous basis when an investor deposits the required number of securities with the trustee.

|

|

|

Purchases

|

You may acquire Market 2000+ HOLDRS in two ways:

|

|

·

|

through an in-kind deposit of the required number of shares of securities of the underlying issuers with the trustee; or

|

|

|

·

|

through a cash purchase in the secondary trading market. |

|

Issuance and cancellation fees

|

If you wish to create Market 2000+ HOLDRS by delivering to the trust the requisite number of securities represented by a round-lot of 100 Market 2000+ HOLDRS, The Bank of New York Mellon, as trustee, will charge you an issuance fee of up to $10.00 for each round-lot of 100 Market 2000+ HOLDRS. If you wish to cancel your Market 2000+ HOLDRS and withdraw your underlying securities, The Bank of New York Mellon, as trustee, will charge you a cancellation fee of up to $10.00 for each round-lot of 100 Market 2000+ HOLDRS.

|

|

Commissions

|

If you choose to deposit underlying securities in order to receive Market 2000+ HOLDRS, you will be responsible for paying any sales commission associated with your purchase of the underlying securities that is charged by your broker in addition to the issuance fee charged by the trustee that is described above.

|

|

Custody fees

|

The Bank of New York Mellon, as trustee and as custodian, will charge you a quarterly custody fee of $2.00 for each round-lot of 100 Market 2000+ HOLDRS, to be deducted from any cash dividend or other cash distributions on underlying securities received by the trustee. With respect to the aggregate custody fee payable in any calendar year for each Market 2000+ HOLDR, the trustee will waive that portion of the fee which exceeds the total cash dividends and other cash distributions received, the record date for which falls in such calendar year.

|

|

Rights relating to Market 2000+ HOLDRS

|

You have the right to withdraw the underlying securities upon request by delivering a round-lot or integral multiple of a round-lot of Market 2000+ HOLDRS to the trustee, during the trustee’s business hours, and paying the cancellation fees, taxes and other charges. You should receive the underlying securities no later than the business day after the trustee receives a proper notice of cancellation. The trustee will not deliver fractional shares of underlying securities. To the extent that any cancellation of Market 2000+ HOLDRS would otherwise require the delivery of a fractional share, the trustee will sell the fractional share in the market and the trust, in turn, will deliver cash in lieu of the fractional share. Except with respect to the right to vote for dissolution of the trust, the Market 2000+ HOLDRS themselves will not have voting rights.

|

|

Rights relating to the underlying securities

|

Market 2000+ HOLDRS represents your beneficial ownership of the underlying securities. Owners of Market 2000+ HOLDRS have the same rights and privileges as if they beneficially owned the underlying securities in “street name” outside of Market 2000+ HOLDRS. These include the right to instruct the trustee to vote the underlying securities or attend the shareholder meetings yourself, to receive any dividends and other distributions on the

|

|

|

underlying securities that are declared and paid to the trustee by an issuer of an underlying security, the right to pledge Market 2000+ HOLDRS and the right to surrender Market 2000+ HOLDRS to receive the underlying securities and other property then represented by the Market 2000+ HOLDRS. See “Description of the Depositary Trust Agreement.” Market 2000+ HOLDRS does not change your beneficial ownership in the underlying securities under United States federal securities laws, including sections 13(d) and 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result, you have the same obligations to file insider trading reports that you would have if you held the underlying securities outside of Market 2000+ HOLDRS. However, due to the nature of Market 2000+ HOLDRS, you will not be able to participate in any dividend reinvestment program of an issuer of underlying securities unless you cancel your Market 2000+ HOLDRS (and pay the applicable fees) and receive all of the underlying securities. |

|

A holder of Market 2000+ HOLDRS is not a registered owner of the underlying securities. In order to become a registered owner, a holder of Market 2000+ HOLDRS would need to surrender their Market 2000+ HOLDRS, pay the applicable fees and expenses, receive all of the underlying securities and follow the procedures established by the issuers of the underlying securities for registering their securities in the name of such holder.

|

|

|

You retain the right to receive any reports and communications that the issuers of underlying securities are required to send to beneficial owners of their securities. As such, you will receive such reports and communications from the broker through which you hold your Market 2000+ HOLDRS in the same manner as if you beneficially owned your underlying securities outside of Market 2000+ HOLDRS in “street name” through a brokerage account. The trustee will not attempt to exercise the right to vote that attaches to, or give a proxy with respect to, the underlying securities other than in accordance with your instructions.

|

|

|

The depositary trust agreement entitles you to receive, subject to certain limitations and net of any fees and expenses of the trustee, any distributions of cash (including dividends), securities or property made with respect to the underlying securities. However, any distribution of securities by an issuer of underlying securities will be deposited into the trust and will become part of the underlying securities unless the distributed securities are not listed for trading on a U.S. national securities exchange. In addition, if the issuer of underlying securities offers rights to acquire additional underlying securities or other securities, the rights may be distributed to you, may be disposed of for your benefit, or may lapse.

|

|

|

There may be a delay between the time any cash or other distribution is received by the trustee with respect to the underlying securities and the time such cash or other distributions are distributed to you. In addition, you are not entitled to any interest on any distribution by reason of any delay in distribution by the trustee. If any tax or other governmental charge becomes due with respect to Market 2000+ HOLDRS or any underlying securities, you will be responsible for paying that tax or governmental charge.

|

|

|

If you wish to participate in a tender offer for any of the underlying securities, or any form of stock repurchase program by an issuer of an underlying security, you must surrender your Market 2000+ HOLDRS (and pay the applicable fees and expenses) and receive all of your underlying securities in

|

| exchange for your Market 2000+ HOLDRS, including those underlying securities not subject to a tender offer or repurchase offer. For specific information about obtaining your underlying securities, you should read the discussion under the caption “Description of the Depositary Trust Agreement—Withdrawal of underlying securities.” | |

|

Ownership rights in fractional shares in the underlying securities

|

As a result of distributions of securities by companies included in the Market 2000+ HOLDRS or other corporate events, such as mergers, a Market 2000+ HOLDR may represent an interest in a fractional share of an underlying security. You are entitled to receive distributions proportionate to your fractional shares.

|

|

In addition, you are entitled to receive proxy materials and other shareholder communications and you are entitled to exercise voting rights proportionate to your fractional shares. The trustee will aggregate the votes of all of the share fractions represented by Market 2000+ HOLDRS and will vote the largest possible number of whole shares. If, after aggregation, there is a fractional remainder, this fraction will be ignored, because the issuer will only recognize whole share votes. For example, if 100,001 round-lots of 100 Market 2000+ HOLDRS are outstanding and each round-lot of 100 Market 2000+ HOLDR represents 1.75 shares of an underlying security, there will be 175,001.75 votes of the underlying security represented by Market 2000+ HOLDRS. If holders of 50,000 round-lots of 100 Market 2000+ HOLDRS vote their underlying securities “yes” and holders of 50,001 round-lots of 100 Market 2000+ HOLDRS vote their underlying securities “no,” there will be 87,500 affirmative votes and 87,501.75 negative votes. The trustee will ignore the .75 negative votes and will deliver to the issuer 87,500 affirmative votes and 87,501 negative votes.

|

|

|

Reconstitution events

|

The depositary trust agreement provides for the automatic distribution of underlying securities from the Market 2000+ HOLDRS to you in the following four circumstances:

|

| A. |

If an issuer of underlying securities no longer has a class of securities registered under section 12 of the Exchange Act, then its securities will no longer be an underlying security and the trustee will distribute the shares of that company to the owners of the Market 2000+ HOLDRS.

|

|

| B. |

If the U.S. Securities Exchange Commission (the “SEC”) finds that an issuer of underlying securities should be registered as an investment company under the Investment Company Act of 1940, and the trustee has actual knowledge of the SEC finding, then its securities will no longer be an underlying security and the trustee will distribute the shares of that company to the owners of the Market 2000+ HOLDRS.

|

|

| C. |

If the underlying securities of an issuer cease to be outstanding as a result of a merger, consolidation, corporate combination or other event, the trustee will distribute the consideration received from the acquiring company to the beneficial owners of Market 2000+ HOLDRS, unless the consideration received consists of securities that are listed for trading on a U.S. national securities exchange. In this case, the securities received will be treated as additional underlying securities and will be deposited into the trust.

|

|

| D. |

If an issuer’s underlying securities are delisted from trading on a U.S. national securities exchange and are not listed for trading on another U.S. national securities exchange within five business days from the date the

|

| securities are delisted. |

|

To the extent a distribution of underlying securities from the Market 2000+ HOLDRS is required as a result of a reconstitution event, the trustee will deliver the underlying security to you as promptly as practicable after the date that the trustee has knowledge of the occurrence of a reconstitution event. However, any distribution of securities that are listed for trading on a U.S. national securities exchange will be deposited into the trust and will become part of the Market 2000+ HOLDRS.

|

|

Termination events

|

A. |

The Market 2000+ HOLDRS are delisted from the NYSE Arca and are not listed for trading on another U.S. national securities exchange within five business days from the date the Market 2000+ HOLDRS are delisted.

|

| B. |

The trustee resigns and no successor trustee is appointed within 60 days from the date the trustee provides notice to Merrill Lynch, Pierce, Fenner & Smith Incorporated, as initial depositor, of its intent to resign.

|

|

| C. |

Beneficial owners of at least 75% of outstanding Market 2000+ HOLDRS, other than Merrill Lynch, Pierce, Fenner & Smith Incorporated, vote to dissolve and liquidate the trust.

|

|

If a termination event occurs, the trustee will distribute the underlying securities to you as promptly as practicable after the termination event.

|

|

|

Upon termination of the depositary trust agreement and prior to distributing the underlying securities to you, the trustee will charge you a cancellation fee of up to $10.00 per round-lot of 100 Market 2000+ HOLDRS surrendered, along with any taxes or other governmental charges, if any.

|

|

|

U.S. federal income tax consequences

|

The U.S. federal income tax laws will treat a U.S. receipt holder of Market 2000+ HOLDRS as directly owning the underlying securities. The Market 2000+ HOLDRS themselves will not result in any U.S. federal income tax consequences separate from the tax consequences associated with ownership of the underlying securities. See “U.S. Federal Income Tax Consequences.”

|

|

Listing

|

The Market 2000+ HOLDRS are listed on the NYSE Arca under the symbol “MKH.”

|

|

Trading

|

Investors are only able to acquire, hold, transfer and surrender a round-lot of 100 Market 2000+ HOLDRS. Bid and ask prices, however, are quoted per single Market 2000+ HOLDRS.

|

|

Clearance and settlement

|

Market 2000+ HOLDRS have been issued in book-entry form. Market 2000+ HOLDRS are evidenced by one or more global certificates that the trustee has deposited with The Depository Trust Company, referred to as DTC. Transfers within DTC will be in accordance with DTC’s usual rules and operating procedures. For further information see “Description of Market 2000+ HOLDRS.”

|

General. This discussion highlights information about the Market 2000+ HOLDRS Trust. You should read this information, information about the depositary trust agreement, the depositary trust agreement and the amendment to the depositary trust agreement in addition to other information included in this prospectus and the publicly available information about the issuers of the underlying securities, before you purchase Market 2000+ HOLDRS. The material terms of the depositary trust agreement are described in this prospectus under the heading “Description of the Depositary Trust Agreement.”

The Market 2000+ HOLDRS Trust. The trust was formed pursuant to the depositary trust agreement, dated as of July 26, 2000. The depositary trust agreement was amended on August 18, 2000. The Bank of New York Mellon is the trustee. The Market 2000+ HOLDRS Trust is not a registered investment company under the Investment Company Act of 1940.

The Market 2000+ HOLDRS Trust is intended to hold deposited shares for the benefit of owners of Market 2000+ HOLDRS. The trustee will perform only administrative and ministerial acts. The property of the trust consists of the underlying securities and all monies or other property, if any, received by the trustee. The trust will terminate on December 31, 2040, or earlier if a termination event occurs.

The trust has issued Market 2000+ HOLDRS under the depositary trust agreement described in this prospectus under the heading “Description of the Depositary Trust Agreement.” The trust may issue additional Market 2000+ HOLDRS on a continuous basis when an investor deposits the requisite underlying securities with the trustee.

You may only acquire, hold, trade and surrender Market 2000+ HOLDRS in a round-lot of 100 Market 2000+ HOLDRS and round-lot multiples. The trust will only issue Market 2000+ HOLDRS upon the deposit of the whole shares of underlying securities that are represented by a round-lot of 100 Market 2000+ HOLDRS. In the event of a stock split, reverse stock split or other distribution by the issuer of an underlying security that results in a fractional share becoming represented by a round-lot of Market 2000+ HOLDRS, the trust may require a minimum of more than one round-lot of 100 Market 2000+ HOLDRS for an issuance so that the trust will always receive whole share amounts for issuance of Market 2000+ HOLDRS.

Market 2000+ HOLDRS will represent your individual and undivided beneficial ownership interest in the specified underlying securities. The companies selected as part of this receipt program are listed above in the section entitled “Highlights of Market 2000+ HOLDRS—The Market 2000+ HOLDRS.”

Beneficial owners of Market 2000+ HOLDRS will have the same rights and privileges as they would have if they beneficially owned the underlying securities in “street name” outside of the trust. These include the right of investors to instruct the trustee to vote the underlying securities, to attend the shareholder’s meetings and to receive dividends and other distributions on the underlying securities, if any are declared and paid to the trustee by an issuer of an underlying security, as well as the right to pledge Market 2000+ HOLDRS or cancel Market 2000+ HOLDRS to receive the underlying securities. See “Description of the Depositary Trust Agreement.” Market 2000+ HOLDRS are not intended to change your beneficial ownership in the underlying securities under U.S. federal securities laws, including sections 13(d) and 16(a) of the Exchange Act.

The trust will not publish or otherwise calculate the aggregate value of the underlying securities represented by a receipt. Market 2000+ HOLDRS may trade in the secondary market at prices that are lower than the aggregate value of the corresponding underlying securities. If, in such case, an owner of Market 2000+ HOLDRS wishes to realize the dollar value of the underlying securities, that owner will have to cancel the Market 2000+ HOLDRS. Such cancellation will require payment of fees and expenses as described in “Description of the Depositary Trust Agreement—Withdrawal of underlying securities.”

Market 2000+ HOLDRS are evidenced by one or more global certificates that the trustee has deposited with DTC and registered in the name of Cede & Co., as nominee for DTC. Market 2000+ HOLDRS are available only in book-entry form. Owners of Market 2000+ HOLDRS may hold their Market 2000+ HOLDRS through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC.

Selection criteria. The underlying securities of the Market 2000+ HOLDRS were, when the Market 2000+ HOLDRS were initially issued on August 29, 2000, the shares of common stock and American depositary shares of a group of 50 specified companies that, at the time of selection, were among the largest companies whose securities

were traded on a U.S. stock market, as measured in terms of worldwide market capitalization on July 7, 2000. The market capitalization of a company is determined by multiplying the market price of its securities by the number of its outstanding securities.

Due to distributions of securities by underlying issuers, reconstitution events or other events, one or more of the issuers of the underlying securities may no longer have a market capitalization which ranks among the 50 companies with the largest market capitalization whose securities are traded on a U.S. stock market. In this case, the Market 2000+ HOLDRS may consist of securities issued by companies that do not have the largest market capitalization.

Underlying securities. For a list of the underlying securities represented by Market 2000+ HOLDRS, please refer to “Highlights of Market 2000+ HOLDRS—The Market 2000+ HOLDRS.” The underlying securities may change as a result of a reconstitution event, a distribution of securities by an underlying issuer or other event.

No investigation. The trust, the trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, and any affiliate of these entities have not performed any investigation or review of the selected companies, including the public filings by the companies. Accordingly, before you acquire Market 2000+ HOLDRS, you should consider publicly available financial and other information about the issuers of the underlying securities. See “Risk Factors” and “Where You Can Find More Information.” Investors and market participants should not conclude that the inclusion of a company in the list is any form of investment recommendation of that company by the trust, the trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated or any of their respective affiliates.

General background and historical information. For a brief description of the business of each of the issuers of the underlying securities and monthly pricing information showing the historical performance of each underlying issuer’s securities see “Annex A.”

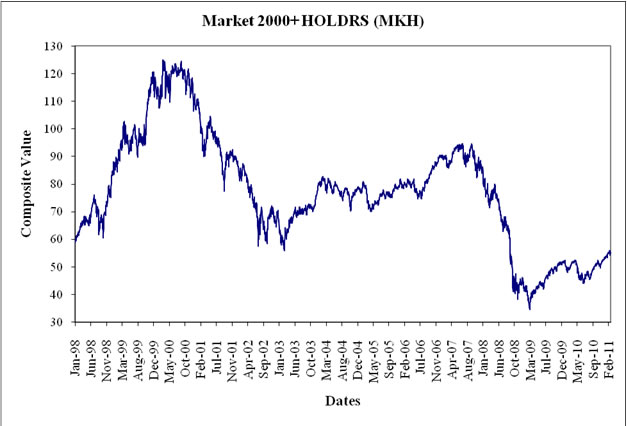

The following table and graph set forth the composite performance of all of the currently underlying securities currently represented by a single Market 2000+ HOLDR, measured at the close of the business day as of the end of each month from January 30, 1998 to February 28, 2011. The performance table and graph data are adjusted for any splits that may have occurred over the measurement period. Past performance of the underlying securities are not necessarily indicative of future values.

|

1998

|

Closing

Price

|

1999

|

Closing

Price

|

2000

|

Closing

Price

|

2001

|

Closing

Price

|

||||||||||||

|

January 30

|

58.39 |

January 29

|

89.67 |

January 31

|

112.88 |

January 31

|

109.45 | ||||||||||||

|

February 27

|

62.37 |

February 26

|

90.14 |

February 29

|

110.62 |

February 28

|

98.80 | ||||||||||||

|

March 31

|

65.43 |

March 31

|

96.47 |

March 31

|

123.21 |

March 30

|

94.44 | ||||||||||||

|

April 30

|

67.47 |

April 30

|

96.49 |

April 28

|

118.47 |

April 30

|

100.54 | ||||||||||||

|

May 29

|

65.18 |

May 28

|

92.85 |

May 31

|

114.09 |

May 31

|

98.86 | ||||||||||||

|

June 30

|

71.83 |

June 30

|

97.62 |

June 30

|

120.23 |

June 29

|

97.95 | ||||||||||||

|

July 31

|

73.34 |

July 30

|

95.25 |

July 31

|

120.53 |

July 31

|

96.26 | ||||||||||||

|

August 31

|

61.76 |

August 31

|

95.17 |

August 31

|

123.50 |

August 31

|

88.50 | ||||||||||||

|

September 30

|

65.83 |

September 30

|

94.96 |

September 29

|

120.47 |

September 28

|

85.83 | ||||||||||||

|

October 30

|

71.09 |

October 29

|

106.16 |

October 31

|

121.14 |

October 31

|

86.25 | ||||||||||||

|

November 30

|

76.79 |

November 30

|

111.75 |

November 30

|

112.69 |

November 30

|

90.72 | ||||||||||||

|

December 31

|

83.34 |

December 31

|

120.56 |

December 29

|

110.83 |

December 31

|

89.17 | ||||||||||||

|

2002

|

Closing

Price |

2003

|

Closing

Price |

2004

|

Closing

Price |

2005

|

Closing

Price |

||||||||||||

|

January 31

|

84.76 |

January 31

|

62.66 |

January 30

|

79.34 |

January 31

|

77.22 | ||||||||||||

|

February 28

|

83.98 |

February 28

|

59.52 |

February 27

|

81.19 |

February 28

|

78.70 | ||||||||||||

|

March 28

|

84.17 |

March 31

|

59.96 |

March 31

|

79.00 |

March 31

|

73.11 | ||||||||||||

|

April 30

|

77.70 |

April 30

|

66.67 |

April 30

|

78.63 |

April 29

|

70.67 | ||||||||||||

|

May 31

|

76.29 |

May 30

|

68.49 |

May 28

|

79.34 |

May 31

|

73.11 | ||||||||||||

|

June 28

|

73.06 |

June 30

|

68.03 |

June 30

|

78.97 |

June 30

|

73.68 | ||||||||||||

|

July 31

|

67.73 |

July 31

|

71.04 |

July 30

|

77.29 |

July 29

|

76.03 | ||||||||||||

|

August 30

|

67.21 |

August 29

|

69.55 |

August 31

|

77.47 |

August 31

|

75.40 | ||||||||||||

|

September 30

|

59.42 |

September 30

|

68.82 |

September 30

|

76.04 |

September 30

|

76.99 | ||||||||||||

|

October 31

|

67.56 |

October 31

|

72.07 |

October 29

|

74.02 |

October 31

|

76.93 | ||||||||||||

|

November 29

|

71.51 |

November 28

|

71.24 |

November 30

|

76.15 |

November 30

|

78.49 | ||||||||||||

|

December 31

|

65.44 |

December 31

|

77.48 |

December 31

|

78.85 |

December 30

|

78.87 | ||||||||||||

|

2006

|

Closing

Price |

2007

|

Closing

Price |

2008

|

Closing

Price |

2009

|

Closing

Price |

||||||||||||

|

January 31

|

79.17 |

January 31

|

89.46 |

January 31

|

81.67 |

January 30

|

41.01 | ||||||||||||

|

February 28

|

78.91 |

February 28

|

86.97 |

February 29

|

76.23 |

February 27

|

37.25 | ||||||||||||

|

March 31

|

80.17 |

March 30

|

87.36 |

March 31

|

74.22 |

March 31

|

39.58 | ||||||||||||

|

April 28

|

80.72 |

April 30

|

91.20 |

April 30

|

77.78 |

April 30

|

41.39 | ||||||||||||

|

May 31

|

77.53 |

May 31

|

93.72 |

May 30

|

74.51 |

May 29

|

43.48 | ||||||||||||

|

June 30

|

77.05 |

June 29

|

93.20 |

June 30

|

66.64 |

June 30

|

43.91 | ||||||||||||

|

July 31

|

78.65 |

July 31

|

88.85 |

July 31

|

65.83 |

July 31

|

46.40 | ||||||||||||

|

August 31

|

81.20 |

August 31

|

90.18 |

August 29

|

64.11 |

August 31

|

47.97 | ||||||||||||

|

September 29

|

83.35 |

September 28

|

92.80 |

September 30

|

52.06 |

September 30

|

48.83 | ||||||||||||

|

October 31

|

85.80 |

October 31

|

92.03 |

October 31

|

45.60 |

October 30

|

48.50 | ||||||||||||

|

November 30

|

87.47 |

November 30

|

87.26 |

November 28

|

43.71 |

November 30

|

50.77 | ||||||||||||

|

December 29

|

89.92 |

December 31

|

87.00 |

December 31

|

45.03 |

December 31

|

51.47 | ||||||||||||

|

2010

|

Closing

Price

|

2011

|

Closing

Price

|

|

|

|

|

||||||||||||

|

January 29

|

48.88 |

January 31

|

53.66 |

|

|

||||||||||||||

|

February 26

|

49.23 |

February 28

|

55.17 |

|

|

||||||||||||||

|

March 31

|

51.55 | ||||||||||||||||||

|

April 30

|

50.74 | ||||||||||||||||||

|

May 28

|

46.33 | ||||||||||||||||||

|

June 30

|

44.16 | ||||||||||||||||||

|

July 30

|

47.11 | ||||||||||||||||||

|

August 31

|

45.62 | ||||||||||||||||||

|

September 30

|

49.30 | ||||||||||||||||||

|

October 29

|

50.98 | ||||||||||||||||||

|

November 30

|

49.68 | ||||||||||||||||||

|

December 31

|

52.71 | ||||||||||||||||||

General. The depositary trust agreement, dated as of July 26, 2000, among Merrill Lynch, Pierce, Fenner & Smith Incorporated, The Bank of New York Mellon, as trustee, other depositors and the owners of the Market 2000+ HOLDRS, provides that Market 2000+ HOLDRS will represent an owner’s undivided beneficial ownership interest in the securities of the underlying companies. The depositary trust agreement was amended on August 18, 2000 to modify the reconstitution events, as described below.

The trustee. The Bank of New York Mellon serves as trustee for Market 2000+ HOLDRS. On July 1, 2007, the Bank of New York Company, Inc. and Mellon Financial Corporation merged into The Bank of New York Mellon Corporation or The Bank of New York Mellon. The Bank of New York Mellon, a New York state-chartered banking organization, is a provider of financial services for institutions, corporations and high net-worth individuals, providing asset and wealth management, asset servicing, issuer services, clearing and execution services and treasury services.

Issuance, transfer and surrender of Market 2000+ HOLDRS. You may create and cancel Market 2000+ HOLDRS only in round-lots of 100 Market 2000+ HOLDRS. You may create Market 2000+ HOLDRS by delivering to the trustee the requisite underlying securities. The trust will only issue Market 2000+ HOLDRS upon the deposit of the whole shares represented by a round-lot of 100 Market 2000+ HOLDRS. In the event that a fractional share comes to be represented by a round-lot of Market 2000+ HOLDRS, the trust may require a minimum of more than one round-lot of 100 Market 2000+ HOLDRS for an issuance so that the trust will always receive whole share amounts for issuance of Market 2000+ HOLDRS. Similarly, you must surrender Market 2000+ HOLDRS in integral multiples of 100 Market 2000+ HOLDRS to withdraw deposited shares from the trust. The trustee will not deliver fractional shares of underlying securities, and to the extent that any cancellation of Market 2000+ HOLDRS would otherwise require the delivery of fractional shares, the trust will deliver cash in lieu of such shares. You may request withdrawal of your deposited shares during the trustee’s normal business hours. The trustee expects that in most cases it will deliver your deposited shares within one business day of your withdrawal request.

Voting rights. You will receive proxy soliciting materials provided by issuers of the deposited shares so as to permit you to give the trustee instructions as to how to vote on matters to be considered at any annual or special meetings held by issuers of the underlying securities.

Under the depositary trust agreement, any beneficial owner of Market 2000+ HOLDRS, other than Merrill Lynch, Pierce, Fenner & Smith Incorporated, owning Market 2000+ HOLDRS for its own proprietary account as principal, will have the right to vote to dissolve and liquidate the trust.

Distributions. You will be entitled to receive, net of trustee fees, distributions of cash, including dividends, securities or property, if any, made with respect to the underlying securities. The trustee will use its reasonable efforts to ensure that it distributes these distributions as promptly as practicable after the date on which it receives the distribution. Therefore, you may receive your distributions substantially later than you would have had you held the underlying securities directly. Any distributions of securities by an issuer of underlying securities will be deposited into the trust and will become part of the Market 2000+ HOLDRS if such securities are listed for trading on a U.S. national securities exchange. In addition, if the issuer of underlying securities offers rights to acquire additional underlying securities or other securities, the rights will be distributed to you through the trustee, if practicable, and if the rights and the securities that those rights relate to are exempt from registration or are registered under the Securities Act of 1933, as amended (the “Securities Act”). Otherwise, if practicable, the rights will be disposed of and the net proceeds distributed to you by the trustee. In all other cases, the rights will lapse.

You will be obligated to pay any tax or other charge that may become due with respect to Market 2000+ HOLDRS. The trustee may deduct the amount of any tax or other governmental charge from a distribution before making payment to you. In addition, the trustee will deduct its quarterly custody fee of $2.00 for each round-lot of 100 Market 2000+ HOLDRS from quarterly dividends, if any, paid to the trustee by the issuers of the underlying securities. With respect to the aggregate custody fee payable in any calendar year for each Market 2000+ HOLDR, the trustee will waive that portion of the fee which exceeds the total cash dividends and other cash distributions received, or to be received, and payable with respect to such calendar year.

Record dates. With respect to dividend payments and voting instructions, the trustee expects to fix the trust’s record dates as close as possible to the record date fixed by the issuer of the underlying securities.

Shareholder communications. The trustee promptly will forward to you all shareholder communications that it receives from issuers of the underlying securities.

Withdrawal of underlying securities. You may surrender your Market 2000+ HOLDRS and receive underlying securities during the trustee’s normal business hours and upon the payment of applicable fees, taxes or governmental charges, if any. You should receive your underlying securities no later than the business day after the trustee receives your request. If you surrender Market 2000+ HOLDRS in order to receive underlying securities, you will pay to the trustee a cancellation fee of up to $10.00 per round-lot of 100 Market 2000+ HOLDRS.

Further issuances of Market 2000+ HOLDRS. The depositary trust agreement provides for further issuances of Market 2000+ HOLDRS on a continuous basis without your consent.

Reconstitution events. The depositary trust agreement provides for the automatic distribution of underlying securities from Market 2000+ HOLDRS to you in the following four circumstances:

|

|

A.

|

If an issuer of underlying securities no longer has a class of common stock registered under section 12 of the Exchange Act, then its securities will no longer be an underlying security and the trustee will distribute the shares of that company to the owners of the Market 2000+ HOLDRS.

|

|

|

B.

|

If the SEC finds that an issuer of underlying securities should be registered as an investment company under the Investment Company Act of 1940, and the trustee has actual knowledge of the SEC finding, then the trustee will distribute the shares of that company to the owners of the Market 2000+ HOLDRS.

|

|

|

C.

|

If the underlying securities of an issuer cease to be outstanding as a result of a merger, consolidation, corporate combination or other event, the trustee will distribute the consideration paid by and received from the acquiring company to the beneficial owners of Market 2000+ HOLDRS, unless the consideration received is securities that are listed for trading on a U.S. national securities exchange. In any other case, the additional securities received as consideration will be deposited into the trust.

|

|

|

D.

|

If an issuer’s underlying securities are delisted from trading on a U.S. national securities exchange and are not listed for trading on another U.S. national securities exchange within five business days from the date such securities are delisted.

|

To the extent a distribution of underlying securities is required as a result of a reconstitution event, the trustee will deliver the underlying security to you as promptly as practicable after the date that the trustee has knowledge of the occurrence of a reconstitution event.

Termination of the trust. The trust will terminate if the trustee resigns and no successor trustee is appointed by Merrill Lynch, Pierce, Fenner & Smith Incorporated, as initial depositor, within 60 days from the date the trustee provides notice to the initial depositor of its intent to resign. Upon termination, the beneficial owners of Market 2000+ HOLDRS will surrender their Market 2000+ HOLDRS as provided in the depositary trust agreement, including payment of any fees of the trustee or applicable taxes or governmental charges due in connection with delivery to the owners of the underlying securities. The trust also will terminate if Market 2000+ HOLDRS are delisted from the NYSE Arca and are not listed for trading on another U.S. national securities exchange within five business days from the date the Market 2000+ HOLDRS are delisted. Finally, the trust will terminate if 75% of the owners of outstanding Market 2000+ HOLDRS, other than Merrill Lynch, Pierce, Fenner & Smith Incorporated, vote to dissolve and liquidate the trust.

If a termination event occurs, the trustee will distribute the underlying securities to you as promptly as practicable after the termination event occurs.

Amendment of the depositary trust agreement. The trustee and Merrill Lynch, Pierce, Fenner & Smith Incorporated, as initial depositor, may amend any provisions of the depositary trust agreement without the consent