As filed with the Securities and Exchange Commission on March 15, 2011

Registration No. 333-44286

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

POST-EFFECTIVE AMENDMENT NO. 9

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_________________

Merrill Lynch, Pierce, Fenner & Smith Incorporated

Initial Depositor

(Exact name of registrant as specified in charter)

_________________

Europe 2001 HOLDRSSM Trust

[Issuer with respect to the receipts]

|

Delaware

|

6211

|

13-5674085

|

|

(State or other jurisdiction of

incorporation or organization) |

(Primary Standard Industrial

Classification Code Number) |

(I.R.S. Employer Identification Number)

|

_________________

One Bryant Park

New York, New York 10036

(212) 449-1000

(Address, including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

_________________

Copies to:

|

Merrill Lynch, Pierce, Fenner & Smith Incorporated

One Bryant Park

New York, New York 10036

(212) 449-1000

Attn: Corporate Secretary

(Name, address, including zip code, and telephone number, including

area code, of agent for service) |

Abigail Arms, Esq.

Shearman & Sterling LLP

801 Pennsylvania Avenue, NW, Suite 900

Washington, D.C. 20004

(202) 508-8000

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. S

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

PROSPECTUS

1,000,000,000 Depositary Receipts

Europe 2001 HOLDRSSM Trust

The Europe 2001 HOLDRSSM Trust issues Depositary Receipts called Europe 2001 HOLDRSSM representing your undivided beneficial ownership in the equity securities of a group of specified companies that, when the Europe 2001 HOLDRSSM were initially issued on January 17, 2001, were among the largest European companies whose equity securities were listed for trading on a U.S. stock market, as measured in terms of worldwide market capitalization on November 14, 2000. The Bank of New York Mellon is the trustee. You only may acquire, hold or transfer Europe 2001 HOLDRSSM in a round-lot amount of 100 Europe 2001 HOLDRSSM or round-lot multiples. Europe 2001 HOLDRSSM are separate from the underlying deposited equity securities that are represented by the Europe 2001 HOLDRSSM. For a list of the names and the number of shares of the companies that make up a Europe 2001 HOLDRSM, see “Highlights of Europe 2001 HOLDRS—The Europe 2001 HOLDRS” in this prospectus. The Europe 2001 HOLDRSSM Trust will issue Europe 2001 HOLDRSSM on a continuous basis.

Investing in Europe 2001 HOLDRSSM involves significant risks. See “Risk Factors” starting on page 4.

Europe 2001 HOLDRSSM are neither interests in nor obligations of Merrill Lynch, Pierce, Fenner & Smith Incorporated or any of its affiliates. Europe 2001 HOLDRSSM are not interests in The Bank of New York Mellon, as trustee. Please see “Description of the Depositary Trust Agreement” in this prospectus for a more complete description of the duties and responsibilities of the trustee, including the obligation of the trustee to act without negligence or bad faith.

The Europe 2001 HOLDRSSM are listed on the NYSE Arca under the symbol “EKH.” On March 11, 2011, the last reported sale price of the Europe 2001 HOLDRSSM on the NYSE Arca was $66.58.

_________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

_________________

The date of this prospectus is March 15, 2011.

“HOLDRS” and “HOLding Company Depositary ReceiptS” are service marks of Bank of America Corporation.

Page

|

3

|

|

|

4

|

|

|

9

|

|

|

17

|

|

|

17

|

|

|

18

|

|

|

20

|

|

|

23

|

|

|

28

|

|

|

28

|

|

|

28

|

|

|

28

|

_________________

This prospectus contains information you should consider when making your investment decision. We have not authorized any person to provide you with any information or to make any representations not contained in this prospectus. We do not take any responsibility for, and can provide no assurances as to, the reliability of any information that others may provide you. We are not making an offer to sell Europe 2001 HOLDRS in any jurisdiction where the offer or sale is not permitted. For information on where you may find more information about the issuers of the underlying securities, see “Where You Can Find More Information.”

The Europe 2001 HOLDRS are not registered for public sale outside of the United States. Non-U.S. receipt holders should refer to “U.S. Federal Income Tax Consequences—Non-U.S. receipt holders” and we recommend that non-U.S. receipt holders consult their tax advisors regarding U.S. withholding and other taxes which may apply to ownership of the Europe 2001 HOLDRS or of the underlying securities through an investment in the Europe 2001 HOLDRS.

The Europe 2001 HOLding Company Depositary ReceiptS or HOLDRS Trust was formed under the depositary trust agreement, dated as of January 4, 2001, among The Bank of New York Mellon, as trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, other depositors and the owners of the Europe 2001 HOLDRS. The trust is not a registered investment company under the Investment Company Act of 1940.

The number of shares of each company’s equity securities currently held by the trust with respect to each round-lot of Europe 2001 HOLDRS is specified under “Highlights of Europe 2001 HOLDRS―The Europe 2001 HOLDRS.” The securities included in the Europe 2001 HOLDRS consist of American depositary shares, New York registered shares, global shares or ordinary shares. This group of securities, and the securities of any company that may be added to the Europe 2001 HOLDRS, are collectively referred to in this prospectus as the common stock, the securities or the underlying securities. The companies included in the Europe 2001 HOLDRS may change as a result of reconstitution events, distributions of securities by underlying issuers or other events. See “Description of the Depositary Trust Agreement—Reconstitution events” for an explanation of these events. The Europe 2001 HOLDRS are separate from the deposited underlying securities that are represented by the Europe 2001 HOLDRS. On March 11, 2011, there were 74,600 Europe 2001 HOLDRS outstanding.

An investment in Europe 2001 HOLDRS involves risks similar to investing directly in each of the underlying securities outside of the Europe 2001 HOLDRS.

General Risk Factors

|

|

·

|

Loss of investment. Because the value of Europe 2001 HOLDRS directly relates to the value of the underlying securities, you may lose all or a substantial portion of your investment in the Europe 2001 HOLDRS if the underlying securities decline in value.

|

|

|

·

|

Discount trading price. Europe 2001 HOLDRS may trade at a discount to the aggregate value of the underlying securities.

|

|

|

·

|

Ownership of only fractional shares in the underlying securities. As a result of distributions of securities by companies included in the Europe 2001 HOLDRS or other corporate events, such as mergers, a Europe 2001 HOLDR may represent an interest in a fractional share of an underlying security. You will only be entitled to voting, distribution and other beneficial ownership rights in the underlying securities in which you own only fractional shares to the extent that the depositary aggregates your fractional shares with the other fractional shares of such underlying securities included in the Europe 2001 HOLDRS and passes on beneficial ownership rights, including distribution and voting rights, to you based on your proportional, fractional share ownership in the underlying securities. In addition, if you surrender your Europe 2001 HOLDRS to receive the underlying securities and other property represented by your Europe 2001 HOLDRS, you will receive cash in lieu of your fractional shares. You will not be entitled to any securities if your interest in an underlying security is only a fraction of a share.

|

|

|

·

|

Not necessarily consisting of the European companies with the largest market capitalization. At the time of the initial offering on January 17, 2001, the companies included in the Europe 2001 HOLDRS were among the largest European companies whose securities are traded on a U.S. stock market, as measured by worldwide market capitalization on November 14, 2000. One or more of the companies whose equity securities are included in the Europe 2001 HOLDRS may no longer be one of the largest European companies whose securities are traded on a U.S. stock market. In addition, as a result of a merger, acquisition or stock distribution of one or more of the companies included in the Europe 2001 HOLDRS, the securities of a company that is not presently part of the Europe 2001 HOLDRS may be included in the Europe 2001 HOLDRS. In this case, the Europe 2001 HOLDRS may no longer consist solely of securities issued by European companies with the largest market capitalization and, as a result of mergers, acquisitions and stock distributions, the Europe 2001 HOLDRS may in the future include the securities of companies that are not European.

|

|

|

·

|

No investigation of underlying securities. The underlying securities initially included in the Europe 2001 HOLDRS were selected by Merrill Lynch, Pierce, Fenner & Smith Incorporated based on the market capitalization of European issuers with securities traded on a U.S. stock market, without regard for the value, price performance, volatility or investment merit of the underlying securities. The Europe 2001 HOLDRS Trust, the trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, and each of their respective affiliates, have not performed, and will not in the future perform, any investigation or review of the selected companies, including the public filings by the companies. Investors and market participants should not conclude that the inclusion of a company is any form of investment recommendation by the trust, the trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, or their respective affiliates.

|

|

|

·

|

Concentration of investment. As a result of market fluctuations, reconstitution events, distributions of securities by an underlying issuer or other events which may result in the distribution of securities from, or the inclusion of additional securities in, the Europe 2001 HOLDRS, an investment in Europe 2001 HOLDRS may represent a more concentrated investment in one or more of the underlying securities or one or more industries. A concentrated investment will reduce the diversification of the Europe 2001 HOLDRS and increase your exposure to the risks of concentrated investments.

|

|

|

·

|

Conflicting investment choices. In order to sell one or more of the underlying securities individually, participate in any form of stock repurchase program by an issuer of an underlying security or participate in a tender offer relating to one or more of the underlying securities, you will be required to cancel your Europe 2001 HOLDRS and receive delivery of each of the underlying securities, including those underlying securities that you may not want to sell or are not subject to a tender offer or repurchase offer. The cancellation of your Europe 2001 HOLDRS will allow you to sell the individual underlying securities or to deliver the individual underlying securities in a tender offer or any form of stock repurchase program. The cancellation of Europe 2001 HOLDRS will involve payment of a cancellation fee to the trustee.

|

|

|

·

|

Trading halts. Trading in Europe 2001 HOLDRS on the NYSE Arca may be halted if (i) the Europe 2001 HOLDRS has fewer than the required number of record and/or beneficial holders for 30 or more consecutive trading days; (ii) the number of Europe 2001 HOLDRS issued and outstanding falls below levels prescribed by the NYSE Arca; (iii) the market value of all Europe 2001 HOLDRS issued and outstanding falls below levels prescribed by the NYSE Arca; or (iv) any other event shall occur or conditions exists which, in the opinion of the NYSE Arca, makes further dealings on the NYSE Arca inadvisable. If trading is halted in Europe 2001 HOLDRS, you will not be able to trade Europe 2001 HOLDRS and you will only be able to trade the underlying securities if you cancel your Europe 2001 HOLDRS and receive each of the underlying securities.

|

|

|

·

|

Delisting from the NYSE Arca. The NYSE Arca may consider delisting the Europe 2001 HOLDRS if (i) the Europe 2001 HOLDRS has fewer than the required number of record and/or beneficial holders for 30 or more consecutive trading days; (ii) the number of Europe 2001 HOLDRS issued and outstanding falls below levels prescribed by the NYSE Arca; (iii) the market value of all Europe 2001 HOLDRS issued and outstanding falls below levels prescribed by the NYSE Arca; or (iv) any other event shall occur or conditions exists which, in the opinion of the NYSE Arca, makes further listing of the Europe 2001 HOLDRS on the NYSE Arca inadvisable. If the Europe 2001 HOLDRS are delisted by the NYSE Arca, a termination event will result unless the Europe 2001 HOLDRS are listed for trading on another U.S. national securities exchange within five business days from the date the Europe 2001 HOLDRS are delisted.

|

|

|

·

|

Possible conflicts of interest. Merrill Lynch, Pierce, Fenner & Smith Incorporated, as initial depositor, selected the underlying securities that were originally included in the Europe 2001 HOLDRS and may face possible conflicts of interest as Merrill Lynch, Pierce, Fenner & Smith Incorporated and its affiliates may provide investment banking or other services for issuers of the underlying securities in connection with its business.

|

|

|

·

|

Delays in distributions. The depositary trust agreement provides that the trustee will use its reasonable efforts to distribute any cash or other distributions paid in respect of the underlying securities to you as soon as practicable after receipt of such distribution. You may, however, receive such cash or other distributions later than you would if you owned the underlying securities outside of the Europe 2001 HOLDRS. In addition, you will not be entitled to any interest on any distribution by reason of any delay in distribution by the depositary.

|

Risk Factors Specific to Companies Included in the Europe 2001 HOLDRS

|

|

·

|

The stock prices of some of the companies included in the Europe 2001 HOLDRS have been and will likely continue to be volatile, which will directly affect the price volatility of the Europe 2001 HOLDRS, and you could lose all or a substantial part of your investment. The trading prices of the securities of some companies included in the Europe 2001 HOLDRS have been volatile. These stock prices could be subject to wide fluctuations in response to a variety of factors, including the following:

|

|

|

§

|

general market fluctuations;

|

|

|

§

|

interest rate and currency fluctuations;

|

|

|

§

|

general political and economic conditions, in Europe and throughout the world;

|

|

|

§

|

actual or anticipated variations in companies’ quarterly operating results;

|

|

|

§

|

announcements of technological innovations or new services offered by competitors of the companies included in the Europe 2001 HOLDRS;

|

|

|

§

|

changes in financial estimates by securities analysts;

|

|

|

§

|

legal or regulatory developments affecting the companies included in the Europe 2001 HOLDRS or in the industries in which they operate;

|

|

|

§

|

announcements by competitors of the companies included in the Europe 2001 HOLDRS of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

|

§

|

additions or departures of key personnel;

|

|

|

§

|

sales of securities of companies included in Europe 2001 HOLDRS in the open market; and

|

|

|

§

|

difficulty in obtaining additional financing.

|

In addition, the trading prices of securities of some of the companies included in the Europe 2001 HOLDRS have experienced price and volume fluctuations. These fluctuations often have been and may in the future be unrelated or disproportionate to the operating performance of these companies. The valuations of many of the underlying securities are high when measured by conventional valuation standards such as price to earnings and price to sales ratios. Some of the companies do not or in the future might not have earnings. As a result, these trading prices may decline substantially and valuations may not be sustained. Any negative change in the public’s perception of the prospects of the underlying companies, generally, could depress their securities’ prices regardless of the companies’ results. Other broad market and industry factors may decrease the price of the underlying securities, regardless of their operating results. Market fluctuations, as well as general political and economic conditions such as recession, war or interest rate or currency rate fluctuations, also may decrease the market price of these equity securities.

As a result of fluctuations in the trading prices of the companies included in the Europe 2001 HOLDRS, the trading price of Europe 2001 HOLDRS has fluctuated significantly. The initial offering price of a Europe 2001 HOLDR on January 17, 2001 was $98.12 and during 2010, the price of a Europe 2001 HOLDR reached a high of $62.87 and a low of $48.96.

|

|

·

|

The international operations of the companies included in the Europe 2001 HOLDRS expose them to risks associated with instability and changes in economic, legal and political conditions, foreign currency fluctuations, changes in foreign regulations and other risks inherent to international business. The companies included in the Europe 2001 HOLDRS have international operations which are essential parts of their businesses. The risks of international business that these companies are exposed to include the following:

|

|

|

§

|

volatility in general economic, social and political conditions;

|

|

|

§

|

the difficulty of enforcing intellectual property rights, agreements and collecting receivables through certain foreign legal systems;

|

|

|

§

|

differing tax rates, tariffs, exchange controls or other similar restrictions;

|

|

|

§

|

currency fluctuations;

|

|

|

§

|

changes in, and compliance with, domestic and foreign laws and regulations which impose a range of restrictions on operations, trade practices, foreign trade and international investment decisions; and

|

|

|

§

|

reduction in the number or capacity of personnel in international markets.

|

|

|

·

|

It may be impossible to initiate legal proceedings or enforce judgments against many of the companies included in the Europe 2001 HOLDRS. Many of the companies included in the Europe 2001 HOLDRS may be incorporated under the laws of a jurisdiction other than the United States and a substantial portion of their assets are located outside the United States. As a result, it may be impossible to effect service of process within the United States on many of the companies included in the Europe 2001 HOLDRS or enforce judgments made against them in courts in the United States based on civil liability provisions of the securities laws of the United States. In addition, judgments obtained in the United States, especially those awarding punitive damages, may not be enforceable in foreign countries.

|

|

|

·

|

Potential voting impediments may exist with respect to the ownership of some of the underlying securities included in the Europe 2001 HOLDRS. Holders of American depositary shares, including those that may, from time to time, be included in the Europe 2001 HOLDRS, may only exercise voting rights with respect to the securities represented by American depositary shares in accordance with the provisions of deposit agreements entered into in connection with the issuance of the American depositary shares. These deposit agreements may not permit holders of American depositary shares to exercise voting rights that attach to the securities underlying the American depositary shares without the issuer first instructing the depositary to send voting information to the holder of the American depositary share. Also, holders of American depositary shares may not exercise voting rights unless they take a variety of steps, which include registration in the share registry of the company that has issued the securities underlying the American depositary shares. The cumulative effect of these steps may make it impractical for holders of American depositary shares to exercise the voting rights attached to the underlying securities.

|

|

|

·

|

Some of the underlying securities included in the Europe 2001 HOLDRS are not U.S. shares or American depositary shares and, as a result, may be subject to different procedures relating to the repayment of taxes and the activities of the transfer agent. The securities of some companies included in the Europe 2001 HOLDRS are subject to withholding tax on dividends and distributions. Some companies may not have special arrangements in place for refunding these withheld taxes. In such case, the holders of these securities will have to apply independently to a foreign tax authority for repayment of withheld taxes. In addition, some of the companies included in the Europe 2001 HOLDRS may also have a non-U.S. transfer agent and may hold the securities outside of the United States. Non-U.S. transfer agents are not subject to procedures that govern the activities of transfer agents in the United States.

|

|

|

·

|

The primary trading market of most of the underlying securities of Europe 2001 HOLDRS are not U.S. stock exchanges; accordingly, the trading volume of some of the underlying securities may be very low, which could adversely affect the market price of the Europe 2001 HOLDRS. In some cases, the trading volume of some of the underlying securities on a U.S. stock exchange is or may become limited. A low trading volume or liquidity of any of the underlying securities on U.S. stock exchange may adversely affect the market price of an underlying security and of the Europe 2001 HOLDRS.

|

|

|

·

|

Exchange rate fluctuations could adversely affect the market price of the underlying securities included in the Europe 2001 HOLDRS and the value of the dividends paid by those companies. The result of operations and the financial position of some of the companies underlying Europe 2001 HOLDRS are reported in local currencies. Exchange rate fluctuations between these currencies and the U.S. dollar may adversely affect the market price of the U.S. exchange listed security and the Europe 2001 HOLDRS. In addition, any dividends that are declared, if any, will likely be set in terms of a currency other than U.S. dollars. As a result, exchange rate fluctuations may also negatively affect the value of dividends declared by many of the companies included in the Europe 2001 HOLDRS.

|

|

|

·

|

Companies whose securities are included in the Europe 2001 HOLDRS may need additional financing, which may be difficult to obtain. Failure to obtain necessary financing or doing so on unattractive terms could adversely affect development and marketing efforts and other operations of companies whose securities are included in the Europe 2001 HOLDRS. Companies whose securities are included in the Europe 2001 HOLDRS may need to raise additional capital in order to fund the continued

|

|

|

|

development and marketing of their products or to fund strategic acquisitions or investments. Their ability to obtain additional financing will depend on a number of factors, including market conditions, operating performance and investor interest. These factors may make the timing, amount, terms and conditions of any financing unattractive. If adequate funds are not available or are not available on acceptable terms, companies whose securities are included in the Europe 2001 HOLDRS may have to forego strategic acquisitions or investments, reduce or defer their development activities, delay their introduction of new products and services, or terminate operations completely. Any of these actions may reduce the market price of stocks included in the Europe 2001 HOLDRS.

|

|

|

·

|

Many of the companies included in the Europe 2001 HOLDRS are companies that are involved in the healthcare industry and are subject to the additional risks associated with an investment in companies in this industry. The stock prices of companies involved in the healthcare industry are subject to wide fluctuations in response to a variety of factors including:

|

|

|

§

|

announcements of technological innovations or new commercial products;

|

|

|

§

|

developments in patent or proprietary rights;

|

|

|

§

|

government regulatory initiatives;

|

|

|

§

|

government regulatory approval processes for product testing and commercialization; and

|

|

|

§

|

public concern as to the safety or other implications of healthcare products and services.

|

An investment in the Europe 2001 HOLDRS may also be particularly vulnerable to these additional risks because of the significant number of healthcare companies included in the Europe 2001 HOLDRS.

|

|

·

|

Many of the companies included in the Europe 2001 HOLDRS are companies that are involved in the technology and telecommunications industries and are subject to the risks associated with an investment in companies in those industries. The valuations of many technology and telecommunications companies are extraordinarily high based on conventional valuation standards, such as price to earnings and price to sales ratios. As a result, the valuations of companies in these industries, and the trading prices for their stock, may not be sustained. In addition, a company which operates in these industries is exposed to other risks which include the following:

|

|

|

§

|

the need to keep pace with rapid technological change in order to remain competitive and to prevent the obsolescence of their products and services;

|

|

|

§

|

an inability to adequately protect proprietary rights;

|

|

|

§

|

changes in the regulatory environment in which telecommunications companies operate could affect their ability to offer new or existing products and services; and

|

|

|

§

|

the need to create and employ new technologies and to offer new services derived from these new technologies to remain competitive.

|

An investment in the Europe 2001 HOLDRS may also be particularly vulnerable to these additional risks because of the significant number of technology and telecommunications companies included in the Europe 2001 HOLDRS.

This discussion highlights information regarding Europe 2001 HOLDRS. We present certain information more fully in the rest of this prospectus. You should read the entire prospectus carefully before you purchase Europe 2001 HOLDRS.

|

Issuer

|

Europe 2001 HOLDRS Trust.

|

|

The trust

|

The Europe 2001 HOLDRS Trust was formed under the depositary trust agreement, dated as of January 4, 2001, among The Bank of New York Mellon, as trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, other depositors and the owners of the Europe 2001 HOLDRS. The trust is not a registered investment company under the Investment Company Act of 1940.

|

|

Initial depositor

|

Merrill Lynch, Pierce, Fenner & Smith Incorporated.

|

|

Trustee

|

The Bank of New York Mellon, a New York state- chartered banking organization, is the trustee and receives compensation as set forth in the depositary trust agreement. The trustee is responsible for receiving deposits of underlying securities and delivering Europe 2001 HOLDRS representing the underlying securities issued by the trust. The trustee holds the underlying securities on behalf of the holders of Europe 2001 HOLDRS.

|

|

Purpose of Europe 2001 HOLDRS

|

Europe 2001 HOLDRS were designed to achieve the following:

|

|

Diversification. Europe 2001 HOLDRS were initially designed to allow you to diversify your investments by holding the equity securities of companies that were among the largest European companies with securities traded on a U.S. stock market, through a single, exchange-listed instrument representing your undivided beneficial ownership of the underlying securities. The companies whose securities were initially included in the Europe 2001 HOLDRS at the time Europe 2001 HOLDRS were originally issued on January 17, 2001 were generally considered to be among the largest European companies whose equity securities were listed for trading on a U.S. stock market, as measured by worldwide market capitalization on November 14, 2000. See “Risk Factors—General Risk Factors.”

|

|

|

Flexibility. The beneficial owners of Europe 2001 HOLDRS have undivided beneficial ownership interests in each of the underlying securities represented by the Europe 2001 HOLDRS, and can cancel their Europe 2001 HOLDRS to receive each of the underlying securities represented by the Europe 2001 HOLDRS.

|

|

|

Transaction costs. The expenses associated with buying and selling Europe 2001 HOLDRS in the secondary market are expected to be less than separately buying and selling each of the underlying securities in a traditional brokerage account with transaction-based charges.

|

|

|

Trust assets

|

The trust holds the equity securities issued by specified companies that, when initially selected, were among the largest European companies with equity securities traded on a U.S. stock market, as measured in terms of worldwide market capitalization on

|

| November 14, 2000. Except when a reconstitution event, distribution of securities by an underlying issuer or other event occurs, the underlying securities will not change and the securities of a new company will not be added to the securities underlying the Europe 2001 HOLDRS. Reconstitution events are described in this prospectus under the heading “Description of the Depositary Trust Agreement—Distributions” and “—Reconstitution events.” | |

|

The trust’s assets may increase or decrease as a result of in-kind deposits and withdrawals of the underlying securities during the life of the trust.

|

|

|

The Europe 2001 HOLDRS

|

The trust has issued, and may continue to issue Europe 2001 HOLDRS that represent an undivided beneficial ownership interest in the shares of U.S.-traded securities that are held by the trust on your behalf. The Europe 2001 HOLDRS themselves are separate from the underlying securities that are represented by the Europe 2001 HOLDRS.

The following table provides:

|

|

·

|

the names of the issuers of the underlying securities currently represented by the Europe 2001 HOLDRS; | |

|

·

|

the stock ticker symbols; | |

|

·

|

the share amounts currently represented by a round-lot of 100 Europe 2001 HOLDRS; and | |

|

·

|

the primary U.S. market on which the underlying securities of the selected companies are traded. |

|

Name of Company (1)(2)(3)(6)

|

Ticker

|

Share Amounts

|

Primary U.S. Trading Market

|

|||

|

AEGON N.V.

|

AEG

|

5.2000

|

NYSE

|

|||

|

Alcatel-Lucent*

|

ALU

|

3.0000

|

NYSE

|

|||

|

Amdocs Limited

|

DOX

|

3.0000

|

NYSE

|

|||

|

ARM Holdings, plc*

|

ARMH

|

8.0000

|

NASDAQ GS

|

|||

|

ASM International N.V.

|

ASMI

|

13.0000

|

NASDAQ GS

|

|||

|

ASML Holding N.V.*

|

ASML

|

6.2222

|

NASDAQ GS

|

|||

|

AstraZeneca PLC.*

|

AZN

|

4.0000

|

NYSE

|

|||

|

BP p.l.c.*

|

BP

|

4.0000

|

NYSE

|

|||

|

Diageo p.l.c.*

|

DEO

|

5.0000

|

NYSE

|

|||

|

Elan Corporation, p.l.c.*

|

ELN

|

4.0000

|

NYSE

|

|||

|

LM Ericsson Telephone Company*

|

ERIC

|

3.2000

|

NASDAQ GS

|

|||

|

GlaxoSmithKline p.l.c.*

|

GSK

|

6.0000

|

NYSE

|

|||

|

ING Groep N.V.*

|

ING

|

4.0000

|

NYSE

|

|||

|

Koninklijke Philips Electronics N.V.

|

PHG

|

5.0000

|

NYSE

|

|||

|

Millicom International Cellular S.A.*

|

MICC

|

8.0000

|

NASDAQ GS

|

|||

|

Nokia Corporation*

|

NOK

|

5.0000

|

NYSE

|

|||

|

Novartis AG*

|

NVS

|

5.0000

|

NYSE

|

|||

|

Oclaro Inc. (4)

|

OCLR

|

0.2400

|

NASDAQ GM

|

|

Qiagen N.V.

|

QGEN

|

6.0000

|

NASDAQ GS

|

|||

|

Ryanair Holdings p.l.c.*

|

RYAAY

|

16.0000

|

NASDAQ GS

|

|||

|

Sanofi-Aventis SA*

|

SNY

|

4.6956

|

NYSE

|

|||

|

SAP AG*

|

SAP

|

4.0000

|

NYSE

|

|||

|

Shire plc*

|

SHPGY

|

4.0000

|

NASDAQ GS

|

|||

|

STMicroelectronics N.V.

|

STM

|

4.0000

|

NYSE

|

|||

|

Telefonica S.A.* (5)

|

TEF

|

4.5558

|

NYSE

|

|||

|

Total S.A.*

|

TOT

|

6.0000

|

NYSE

|

|||

|

UBS AG

|

UBS

|

6.3000

|

NYSE

|

|||

|

Unilever N.V.*

|

UN

|

9.0000

|

NYSE

|

|||

|

Vodafone Group Public Limited Company*

|

VOD

|

5.2500

|

NASDAQ GS

|

|||

|

WPP Group plc*

|

WPPGY

|

3.0000

|

NASDAQ GS

|

________________

* The securities of this non-U.S. company trade in the United States as American depositary shares. Please see “Risk Factors” and “Federal Income Tax Consequences ― Special considerations with respect to underlying securities of foreign issuers” for additional information relating to an investment in a non-U.S. company.

(1) On May 27, 2010, the acquisition of SkillSoft PLC by SSI Investments III Limited became effective. As a result, SkillSoft PLC will no longer be an underlying constituent of the Europe 2001 HOLDRS Trust. In connection with the acquisition, SkillSoft PLC shareholders received $11.20 in cash for each share of SkillSoft PLC held. The Bank of New York Mellon received $67.20 for the 6 shares of SkillSoft PLC per 100 shares round-lot of Europe 2001 HOLDRS. The Bank of New York Mellon distributed the cash at a rate of $0.672 for each depositary share of Europe 2001 HOLDRS. The record date for the distribution was June 8, 2010.

(2) Effective June 7, 2010 (the “delisting date”), Daimler AG, an underlying constituent of the Europe 2001 HOLDRS Trust, was delisted from trading on the NYSE. As Daimler AG was not listed for trading on another national securities exchange within five business days from the delisting date, it was distributed by The Bank of New York Mellon. The rate of distribution was 0.04 Daimler AG shares per Europe 2001 HOLDR. The record date and pay date for the distribution were June 17, 2010 and June 22, 2010, respectively.

(3) Effective June 21, 2010 (the “delisting date”), Deutsche Telekom AG, an underlying constituent of the Europe 2001 HOLDRS Trust (the “Trust”), was delisted from trading on NYSE. As Deutsche Telekom AG was not listed for trading on another national securities exchange within five business days from the delisting date, it was distributed by The Bank of New York Mellon. The rate of distribution was 0.05 Deutsche Telekom AG shares per Europe 2001 HOLDRS. The record date and pay date for the distribution were July 1, 2010 and July 7, 2010, respectively.

(4) Effective May 28, 2010, Oclaro Inc., an underlying constituent of the Europe 2001 HOLDR Trust, changed its ticker symbol to “OCLR.” The name and CUSIP will remain the same.

(5) On January 26, 2011, the 3-for-1 stock split of Telefonica S.A., an underlying constituent of the Europe 2001 HOLDRS Trust, became effective. As a result, the quantity of shares of Telefonica S.A. represented by each 100 share round-lot of Europe 2001 HOLDRS Trust increased from 4.5558 shares to 13.6675 shares. As a result, deposits of shares of Telefonica S.A. for creations of Europe 2001 HOLDRS increased from 4.5558 shares to 13.6675 shares per round-lot of 100 Europe 2001 HOLDRS.

(6) Effective March 7, 2011 (the “delisting date”) Repsol YPF, S.A., an underlying constituent of the Europe 2001 HOLDRS Trust, was delisted from trading on NYSE. As Repsol YPF, S.A. was not listed for trading on another national securities exchange within five business days from the delisting date, it was distributed by The Bank of New York Mellon. The rate of distribution will be 0.11 Repsol YPF, S.A. shares per Europe 2001 HOLDRS. The record date and payment date for the distribution will be March 18, 2011 and March 23, 2011, respectively.

________________

|

At the time of the initial offering, on January 17, 2001, the companies whose securities were included in the Europe 2001 HOLDRS were generally considered to be among the largest European companies with equity securities traded on a U.S. stock market, as measured in terms of worldwide market capitalization on November 14, 2000. The market capitalization of a company is determined by multiplying the market

|

| price of its securities by the number of its outstanding securities. | |

|

The trust will only issue and cancel, and you may only obtain, hold, trade or surrender Europe 2001 HOLDRS in a round-lot of 100 Europe 2001 HOLDRS and round-lot multiples. The trust will only issue Europe 2001 HOLDRS upon the deposit of the whole shares represented by a round-lot of 100 Europe 2001 HOLDRS. In the event that a fractional share comes to be represented by a round-lot of Europe 2001 HOLDRS, the trust may require a minimum of more than one round-lot of 100 Europe 2001 HOLDRS for an issuance so that the trust will always receive whole share amounts for issuance of Europe 2001 HOLDRS.

|

|

|

The number of outstanding Europe 2001 HOLDRS will increase and decrease as a result of in- kind deposits and withdrawals of the underlying securities. The trust will stand ready to issue additional Europe 2001 HOLDRS on a continuous basis when an investor deposits the required number of securities with the trustee.

|

|

|

Purchases

|

You may acquire Europe 2001 HOLDRS in two ways:

|

|

·

|

through an in-kind deposit of the required number of securities of the underlying issuers with the trustee; or | |

|

·

|

through a cash purchase in the secondary trading market. |

|

Issuance and cancellation fees

|

If you wish to create Europe 2001 HOLDRS by delivering to the trust the requisite securities represented by a round-lot of 100 Europe 2001 HOLDRS, The Bank of New York Mellon, as trustee, will charge you an issuance fee of up to $10.00 for each round-lot of 100 Europe 2001 HOLDRS. If you wish to cancel your Europe 2001 HOLDRS and withdraw your underlying securities, The Bank of New York Mellon, as trustee, will charge you a cancellation fee of up to $10.00 for each round-lot of 100 Europe 2001 HOLDRS.

|

|

Commissions

|

If you choose to deposit underlying securities in order to receive Europe 2001 HOLDRS, you will be responsible for paying any sales commission associated with your purchase of the underlying securities that is charged by your broker in addition to the issuance fee charged by the trustee that is described above.

|

|

Custody fees

|

The Bank of New York Mellon, as trustee and as custodian, will charge you a quarterly custody fee of $2.00 for each round-lot of 100 Europe 2001 HOLDRS, to be deducted from any cash dividend or other cash distributions on underlying securities received by the trustee. With respect to the aggregate custody fee payable in any calendar year for each Europe 2001 HOLDR, the trustee will waive that portion of the fee which exceeds the total cash dividends and other cash distributions received, or to be received, and payable with respect to such calendar year.

|

|

Rights relating to

Europe 2001 HOLDRS

|

You have the right to withdraw the underlying securities upon request by delivering a round-lot or integral multiple of a round-lot of Europe 2001 HOLDRS to the trustee, during the trustee’s business hours, and paying the cancellation fees, taxes, and other charges. You should receive the underlying securities no later than the business day after the trustee receives a proper notice of cancellation. The trustee will not

|

| deliver fractional shares of underlying securities. To the extent that any cancellation of Europe 2001 HOLDRS would otherwise require the delivery of a fractional share, the trustee will sell the fractional share in the market and the trust, in turn, will deliver cash in lieu of such fractional share. Except with respect to the right to vote for dissolution of the trust, the Europe 2001 HOLDRS themselves will not have voting rights. | |

|

Rights relating to

the underlying securities

|

Europe 2001 HOLDRS represents your beneficial ownership of the underlying securities. Owners of Europe 2001 HOLDRS have the same rights and privileges as if they beneficially owned the underlying securities in “street name” outside of Europe 2001 HOLDRS. These include the right to instruct the trustee to vote the underlying securities or attend shareholder meetings yourself, the right to receive any dividends and other distributions on the underlying securities that are declared and paid to the trustee by an issuer of an underlying security, the right to pledge Europe 2001 HOLDRS and the right to surrender Europe 2001 HOLDRS to receive the underlying securities. See “Description of the Depositary Trust Agreement.” Europe 2001 HOLDRS does not change your beneficial ownership in the underlying securities under United States federal securities laws, including sections 13(d) and 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result, you have the same obligations to file insider trading reports that you would have if you held the underlying securities outside of Europe 2001 HOLDRS. However, due to the nature of Europe 2001 HOLDRS, you will not be able to participate in any dividend reinvestment program of an issuer of underlying securities unless you cancel your Europe 2001 HOLDRS (and pay the applicable fees) and receive all of the underlying securities.

|

|

A holder of Europe 2001 HOLDRS is not a registered owner of the underlying securities. In order to become a registered owner, a holder of Europe 2001 HOLDRS would need to surrender their Europe 2001 HOLDRS, pay the applicable fees and expenses, receive all of the underlying securities and follow the procedures established by the issuers of the underlying securities for registering their securities in the name of such holder.

|

|

|

You retain the right to receive any reports and communications that the issuers of underlying securities are required to send to beneficial owners of their securities. As such, you will receive such reports and communications from the broker through which you hold your Europe 2001 HOLDRS in the same manner as if you beneficially owned your underlying securities outside of Europe 2001 HOLDRS in “street name” through a brokerage account. The trustee will not attempt to exercise the right to vote that attaches to, or give a proxy with respect to, the underlying securities other than in accordance with your instructions.

|

|

|

The depositary trust agreement entitles you to receive, subject to certain limitations and net of any fees and expenses of the trustee, any distributions of cash (including dividends), securities or property made with respect to the underlying securities. However, any distribution of securities by an issuer of underlying securities will be deposited into the trust and will become part of the underlying securities unless the distributed securities are not listed for trading on a U.S. national securities exchange. In addition, if the issuer of underlying securities

|

| offers rights to acquire additional underlying securities or other securities, the rights may be distributed to you, may be disposed of for your benefit, or may lapse. | |

|

There may be a delay between the time any cash or other distribution is received by the trustee with respect to the underlying securities and the time such cash or other distributions are distributed to you. In addition, you are not entitled to any interest on any distribution by reason of any delay in distribution by the trustee. If any tax or other governmental charge becomes due with respect to Europe 2001 HOLDRS or any underlying securities, you will be responsible for paying that tax or governmental charge.

|

|

|

If you wish to participate in a tender offer for any of the underlying securities, or any form of stock repurchase program by an issuer of an underlying security, you must surrender your Europe 2001 HOLDRS (and pay the applicable fees and expenses) and receive all of your underlying securities in exchange for your Europe 2001 HOLDRS, including those underlying securities not subject to a tender offer or repurchase offer. For specific information about obtaining your underlying securities, you should read the discussion under the caption “Description of the Depositary Trust Agreement—Withdrawal of underlying securities.”

|

|

|

Ownership rights in fractional shares

in the underlying securities

|

As a result of distributions of securities by companies included in the Europe 2001 HOLDRS or other corporate events, such as mergers, a Europe 2001 HOLDR may represent an interest in a fractional share of an underlying security. You are entitled to receive distributions proportionate to your fractional shares.

|

|

In addition, you are entitled to receive proxy materials and other shareholder communications and you are entitled to exercise voting rights proportionate to your fractional shares. The trustee will aggregate the votes of all of the share fractions represented by Europe 2001 HOLDRS and will vote the largest possible number of whole shares. If, after aggregation, there is a fractional remainder, this fraction will be ignored, because the issuer will only recognize whole share votes. For example, if 100,001 round-lots of 100 Europe 2001 HOLDRS are outstanding and each round-lot of 100 Europe 2001 HOLDRS represents 1.75 shares of an underlying security, there will be 175,001.75 votes of the underlying security represented by Europe 2001 HOLDRS. If holders of 50,000 round-lots of 100 Europe 2001 HOLDRS vote their underlying securities “yes” and holders of 50,001 round-lots of 100 Europe 2001 HOLDRS vote their underlying securities “no,” there will be 87,500 affirmative votes and 87,501.75 negative votes. The trustee will ignore the .75 negative votes and will deliver to the issuer 87,500 affirmative votes and 87,501 negative votes.

|

|

|

Reconstitution events

|

The depositary trust agreement provides for the automatic distribution of underlying securities from the Europe 2001 HOLDRS to you in the following four circumstances:

|

| A. |

If an issuer of underlying securities no longer has a class of securities registered under section 12 of the Exchange Act, then its securities will no longer be an underlying security and the trustee will distribute the shares of that company to the owners of the

|

| Europe 2001 HOLDRS. | ||

| B. |

If the Securities and Exchange Commission (the “SEC”) finds that an issuer of underlying securities should be registered as an investment company under the Investment Company Act of 1940, and the trustee has actual knowledge of the SEC finding, then its securities will no longer be an underlying security and the trustee will distribute the shares of that company to the owners of the Europe 2001 HOLDRS.

|

|

| C. |

If the underlying securities of an issuer cease to be outstanding as a result of a merger, consolidation, corporate combination or other event, the trustee will distribute the consideration paid by and received from the acquiring company to the beneficial owners of Europe 2001 HOLDRS; provided that any securities received as consideration will be distributed unless the consideration received consists of securities that are listed for trading on a U.S. national securities exchange. In this case, the securities received as consideration will be treated as additional underlying securities and will be deposited into the trust.

|

|

| D. |

If an issuer’s underlying securities are delisted from trading on a U.S. national securities exchange and are not listed for trading on another U.S. national securities exchange within five business days from the date the securities are delisted.

|

| To the extent a distribution of underlying securities from the Europe 2001 HOLDRS is required as a result of a reconstitution event, the trustee will deliver the underlying security to you as promptly as practicable after the date that the trustee has knowledge of the occurrence of a reconstitution event. However, any distribution of securities that are listed for trading on a U.S. national securities exchange will be deposited into the trust and will become part of the Europe 2001 HOLDRS. | ||

|

Termination events

|

A. |

The Europe 2001 HOLDRS are delisted from the NYSE Arca and are not listed for trading on another U.S. national securities exchange within five business days from the date the Europe 2001 HOLDRS are delisted.

|

| B. |

The trustee resigns and no successor trustee is appointed within 60 days from the date the trustee provides notice to Merrill Lynch, Pierce, Fenner & Smith Incorporated, as initial depositor, of its intent to resign.

|

|

| C. |

Beneficial owners of at least 75% of outstanding Europe 2001 HOLDRS, other than Merrill Lynch, Pierce, Fenner & Smith Incorporated, vote to dissolve and liquidate the trust.

|

|

|

If a termination event occurs, the trustee will distribute the underlying securities to you as promptly as practicable after the termination event.

|

|

|

Upon termination of the depositary trust agreement and prior to distributing the underlying securities to you, the trustee will charge you a cancellation fee of up to $10.00 per round-lot of 100 Europe 2001 HOLDRS surrendered, along with any taxes or other governmental

|

| charges, if any. | |

|

U.S. federal income tax consequences

|

The U.S. federal income tax laws will treat a U.S. receipt holder of Europe 2001 HOLDRS as directly owning the underlying securities. The Europe 2001 HOLDRS themselves will not result in any U.S. federal income tax consequences separate from the tax consequences associated with ownership of the underlying securities. See “U.S. Federal Income Tax Consequences.”

|

|

Listing

|

The Europe 2001 HOLDRS are listed on the NYSE Arca under the symbol “EKH.”

|

|

Trading

|

Investors are only able to acquire, hold, transfer and surrender a round-lot of 100 Europe 2001 HOLDRS. Bid and ask prices, however, are quoted per single Europe 2001 HOLDR.

|

|

Clearance and settlement

|

Europe 2001 HOLDRS have been issued only in book-entry form. Europe 2001 HOLDRS are evidenced by one or more global certificates that the trustee has deposited with The Depository Trust Company, referred to as DTC. Transfers within DTC will be in accordance with DTC’s usual rules and operating procedures. For further information see “Description of Europe 2001 HOLDRS.”

|

General. This discussion highlights information about the Europe 2001 HOLDRS Trust. You should read this information, information about the depositary trust agreement and the depositary trust agreement itself, in addition to other information included in this prospectus and the publicly available information about the issuers of the underlying securities, before you purchase Europe 2001 HOLDRS. The material terms of the depositary trust agreement are described in this prospectus under the heading “Description of the Depositary Trust Agreement.”

The Europe 2001 HOLDRS Trust. The trust was formed pursuant to the depositary trust agreement, dated as of January 4, 2001. The Bank of New York Mellon is the trustee. The Europe 2001 HOLDRS Trust is not a registered investment company under the Investment Company Act of 1940.

The Europe 2001 HOLDRS Trust is intended to hold deposited shares for the benefit of owners of Europe 2001 HOLDRS. The trustee will perform only administrative and ministerial acts. The property of the trust consists of the underlying securities and all monies or other property, if any, received by the trustee. The trust will terminate on December 31, 2041, or earlier if a termination event occurs.

The trust has issued Europe 2001 HOLDRS under the depositary trust agreement described in this prospectus under the heading “Description of the Depositary Trust Agreement.” The trust may issue additional Europe 2001 HOLDRS on a continuous basis when an investor deposits the requisite underlying securities with the trustee.

You may only acquire, hold, trade and surrender Europe 2001 HOLDRS in a round-lot of 100 Europe 2001 HOLDRS and round-lot multiples. The trust will only issue Europe 2001 HOLDRS upon the deposit of the whole shares of underlying securities that are represented by a round-lot of 100 Europe 2001 HOLDRS. In the event of a stock split, reverse stock split, or other distribution by the issuer of an underlying security that results in a fractional share becoming represented by a round-lot of Europe 2001 HOLDRS, the trust may require a minimum of more than one round-lot of 100 Europe 2001 HOLDRS for an issuance so that the trust will always receive whole share amounts for issuance of Europe 2001 HOLDRS.

Europe 2001 HOLDRS will represent your individual and undivided beneficial ownership interest in the specified underlying securities. The companies selected as part of this receipt program are listed above in the section entitled “Highlights of Europe 2001 HOLDRS—The Europe 2001 HOLDRS.”

Beneficial owners of Europe 2001 HOLDRS will have the same rights and privileges as they would have if they beneficially owned the underlying securities in “street name” outside of the trust. These include the right of investors to instruct the trustee to vote the underlying securities, to attend shareholder’s meetings and to receive dividends and other distributions on the underlying securities, if any are declared and paid to the trustee by an issuer of an underlying security, as well as the right to pledge Europe 2001 HOLDRS or cancel Europe 2001 HOLDRS to receive the underlying securities. See “Description of the Depositary Trust Agreement.” Europe 2001 HOLDRS are not intended to change your beneficial ownership in the underlying securities under U.S. federal securities laws, including sections 13(d) and 16(a) of the Exchange Act.

The trust will not publish or otherwise calculate the aggregate value of the underlying securities represented by a receipt. Europe 2001 HOLDRS may trade in the secondary market at prices that are lower than the aggregate value of the corresponding underlying securities. If, in such case, an owner of Europe 2001 HOLDRS wishes to realize the dollar value of the underlying securities, that owner will have to cancel the Europe 2001 HOLDRS. Such cancellation will require payment of fees and expenses as described in “Description of the Depositary Trust Agreement—Withdrawal of underlying securities.”

Europe 2001 HOLDRS are evidenced by one or more global certificates that the trustee has deposited with DTC and registered in the name of Cede & Co., as nominee for DTC. Europe 2001 HOLDRS are available only in book-entry form. Owners of Europe 2001 HOLDRS may hold their Europe 2001 HOLDRS through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC.

Selection criteria. The underlying securities of the Europe 2001 HOLDRS were, when the Europe 2001 HOLDRS were initially issued on January 17, 2001, the equity securities of a group of specified companies which, at the time of selection, were among the largest European companies whose securities are traded on a U.S. stock market, as measured in terms of worldwide market capitalization on November 14, 2000. The market capitalization of a company is determined by multiplying the market price of its securities by the number of its outstanding securities.

Due to distributions of securities by underlying issuers, reconstitution events or other events, one or more of the issuers of the underlying securities may no longer have a market capitalization which ranks among the European companies with the largest market capitalization whose securities are traded on a U.S. stock market. In this case, the Europe 2001 HOLDRS may consist of securities issued by European companies that do not have the largest market capitalization. In addition, as a result of a reconstitution event, a distribution of securities by an underlying issuer or other events, the securities of a non-European company may be included in the Europe 2001 HOLDRS.

Underlying securities. For a list of the underlying securities represented by Europe 2001 HOLDRS, please refer to “Highlights of Europe 2001 HOLDRS—The Europe 2001 HOLDRS.” The underlying securities may change as a result of a reconstitution event, a distribution of securities by an underlying issuer or other event.

No investigation. The trust, the trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated, and any affiliate of these entities, have not performed any investigation or review of the selected companies, including the public filings by the companies. Accordingly, before you acquire Europe 2001 HOLDRS, you should consider publicly available financial and other information about the issuers of the underlying securities. See “Risk Factors” and “Where You Can Find More Information.” Investors and market participants should not conclude that the inclusion of a company in the list is any form of investment recommendation of that company by the trust, the trustee, Merrill Lynch, Pierce, Fenner & Smith Incorporated or any of their respective affiliates.

General background and historical information. For a brief description of the business of each of the issuers of the underlying securities and monthly pricing information showing the historical performance of each underlying issuer’s securities see “Annex A.”

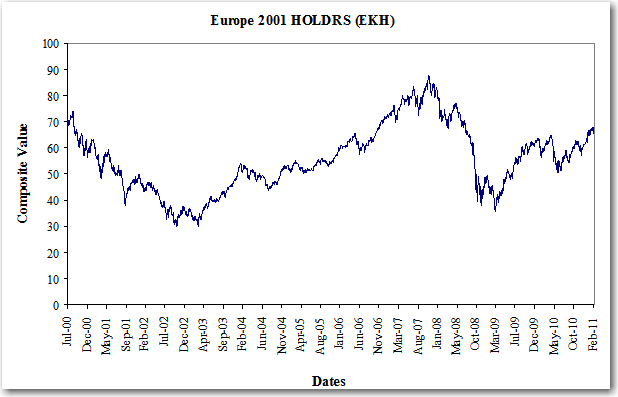

The following table and graph set forth the composite performance of all of the underlying securities currently represented by a single Europe 2001 HOLDR, measured at the close of the business day as of the end of each month from July 31, 2000 to February 28, 2011. The performance table and graph data are adjusted for any splits that may have occurred over the measurement period. Past performance of the underlying securities are not necessarily indicative of future values.

|

2000

|

Closing Price

|

2001

|

Closing Price

|

2002

|

Closing Price

|

2003

|

Closing Price

|

||||||||||||

|

July 31

|

70.51 |

January 31

|

63.14 |

January 31

|

45.64 |

January 31

|

34.15 | ||||||||||||

|

August 31

|

72.38 |

February 28

|

55.51 |

February 28

|

43.98 |

February 28

|

32.56 | ||||||||||||

|

September 29

|

65.56 |

March 30

|

50.64 |

March 28

|

46.05 |

March 31

|

32.54 | ||||||||||||

|

October 31

|

64.97 |

April 30

|

57.94 |

April 30

|

43.50 |

April 30

|

36.60 | ||||||||||||

|

November 30

|

56.93 |

May 31

|

54.69 |

May 31

|

41.40 |

May 30

|

39.14 | ||||||||||||

|

December 29

|

59.52 |

June 29

|

52.67 |

June 28

|

38.86 |

June 30

|

39.21 | ||||||||||||

|

July 31

|

52.32 |

July 31

|

36.10 |

July 31

|

39.89 | ||||||||||||||

|

August 31

|

49.01 |

August 30

|

35.86 |

August 29

|

41.60 | ||||||||||||||

|

September 28

|

41.49 |

September 30

|

31.53 |

September 30

|

40.95 | ||||||||||||||

|

October 31

|

44.10 |

October 31

|

34.41 |

October 31

|

45.09 | ||||||||||||||

|

November 30

|

46.61 |

November 29

|

36.95 |

November 28

|

46.90 | ||||||||||||||

|

December 31

|

48.38 |

December 31

|

34.53 |

December 31

|

50.28 | ||||||||||||||

|

2004

|

Closing Price

|

2005

|

Closing Price

|

2006

|

Closing Price

|

2007

|

Closing Price

|

||||||||||||

|

January 30

|

50.71 |

January 31

|

52.46 |

January 31

|

60.92 |

January 31

|

72.91 | ||||||||||||

|

February 27

|

51.55 |

February 28

|

53.88 |

February 28

|

59.98 |

February 28

|

72.79 | ||||||||||||

|

March 31

|

50.01 |

March 31

|

52.12 |

March 31

|

62.82 |

March 30

|

74.71 | ||||||||||||

|

April 30

|

49.06 |

April 29

|

50.40 |

April 28

|

64.21 |

April 30

|

78.14 | ||||||||||||

|

May 28

|

49.20 |

May 31

|

51.23 |

May 31

|

61.93 |

May 31

|

79.01 | ||||||||||||

|

June 30

|

49.36 |

June 30

|

51.06 |

June 30

|

61.82 |

June 29

|

79.81 | ||||||||||||

|

July 30

|

46.08 |

July 29

|

53.73 |

July 31

|

61.83 |

July 31

|

78.05 | ||||||||||||

|

August 31

|

45.07 |

August 31

|

54.33 |

August 31

|

63.41 |

August 31

|

78.37 | ||||||||||||

|

September 30

|

46.51 |

September 30

|

55.12 |

September 29

|

64.46 |

September 28

|

81.54 | ||||||||||||

|

October 29

|

48.19 |

October 31

|

54.04 |

October 31

|

67.16 |

October 31

|

87.61 | ||||||||||||

|

November 30

|

51.79 |

November 30

|

54.54 |

November 30

|

70.60 |

November 30

|

84.01 | ||||||||||||

|

December 31

|

53.37 |

December 30

|

57.05 |

December 29

|

71.86 |

December 31

|

82.05 | ||||||||||||

|

2008

|

Closing Price

|

2009

|

Closing Price

|

2010

|

Closing Price

|

2011

|

Closing Price

|

|||||||||||

|

January 31

|

73.53 |

January 30

|

42.39 |

January 29

|

58.47 |

January 31

|

65.27 | |||||||||||

|

February 29

|

72.00 |

February 27

|

38.48 |

February 26

|

59.29 |

February 28

|

67.24 | |||||||||||

|

March 31

|

69.92 |

March 31

|

40.03 |

March 31

|

62.41 | |||||||||||||

|

April 30

|

74.38 |

April 30

|

44.46 |

April 30

|

61.22 | |||||||||||||

|

May 30

|

74.80 |

May 29

|

50.00 |

May 28

|

53.41 | |||||||||||||

|

June 30

|

70.61 |

June 30

|

49.39 |

June 30

|

50.92 | |||||||||||||

|

July 31

|

65.76 |

July 31

|

54.91 |

July 30

|

57.33 | |||||||||||||

|

August 29

|

64.57 |

August 31

|

56.20 |

August 31

|

54.55 | |||||||||||||

|

September 30

|

57.31 |

September 30

|

58.91 |

September 30

|

59.65 | |||||||||||||

|

October 31

|

46.00 |

October 30

|

57.78 |

October 29

|

61.55 | |||||||||||||

|

November 28

|

44.18 |

November 30

|

60.83 |

November 30

|

57.05 | |||||||||||||

|

December 31

|

48.03 |

December 31

|

62.04 |

December 31

|

62.64 | |||||||||||||

General. The depositary trust agreement, dated as of January 4, 2001, among Merrill Lynch, Pierce, Fenner & Smith Incorporated, The Bank of New York Mellon, as trustee, other depositors and the owners of the Europe 2001 HOLDRS, provides that Europe 2001 HOLDRS will represent an owner’s undivided beneficial ownership interest in the securities of the underlying companies.

The trustee. The Bank of New York Mellon serves as trustee for Europe 2001 HOLDRS. On July 1, 2007, the Bank of New York Company, Inc. and Mellon Financial Corporation merged into The Bank of New York Mellon Corporation or The Bank of New York Mellon. The Bank of New York Mellon, a New York state-chartered banking organization, is a provider of financial services for institutions, corporations and high net-worth individuals, providing asset and wealth management, asset servicing, issuer services, clearing and execution services and treasury services.

Issuance, transfer and surrender of Europe 2001 HOLDRS. You may create and cancel Europe 2001 HOLDRS only in round-lots of 100 Europe 2001 HOLDRS. You may create Europe 2001 HOLDRS by delivering to the trustee the requisite underlying securities. The trust will only issue Europe 2001 HOLDRS upon the deposit of the whole shares represented by a round-lot of 100 Europe 2001 HOLDRS. In the event that a fractional share comes to be represented by a round-lot of Europe 2001 HOLDRS, the trust may require a minimum of more than one round-lot of 100 Europe 2001 HOLDRS for an issuance so that the trust will always receive whole share amounts for issuance of Europe 2001 HOLDRS. Similarly, you must surrender Europe 2001 HOLDRS in integral multiples of 100 Europe 2001 HOLDRS to withdraw deposited shares from the trust. The trustee will not deliver fractional shares of underlying securities, and to the extent that any cancellation of Europe 2001 HOLDRS would otherwise require the delivery of fractional shares, the trust will deliver cash in lieu of such shares. You may request withdrawal of your deposited shares during the trustee’s normal business hours. The trustee expects that in most cases it will deliver your deposited shares within one business day of your withdrawal request.

Voting rights. You will receive proxy soliciting materials provided by issuers of the deposited shares so as to permit you to give the trustee instructions as to how to vote on matters to be considered at any annual or special meetings held by issuers of the underlying securities.

Under the depositary trust agreement, any beneficial owner of Europe 2001 HOLDRS, other than Merrill Lynch, Pierce, Fenner & Smith Incorporated, owning Europe 2001 HOLDRS for its own proprietary account as principal, will have the right to vote to dissolve and liquidate the trust.

Distributions. You will be entitled to receive, net of trustee fees, distributions of cash, including dividends, securities or property, if any, made with respect to the underlying securities. The trustee will use its reasonable efforts to ensure that it distributes these distributions as promptly as practicable after the date on which it receives the distribution. Therefore, you may receive your distributions substantially later than you would have had you held the underlying securities directly. Any distributions of securities by an issuer of underlying securities will be deposited into the trust and will become part of the Europe 2001 HOLDRS unless such securities are not listed for trading on a U.S. national securities exchange. In addition, if the issuer of underlying securities offers rights to acquire additional underlying securities or other securities, the rights will be distributed to you through the trustee, if practicable, and if the rights and the securities that those rights relate to are exempt from registration or are registered under the Securities Act of 1933, as amended (the “Securities Act”). Otherwise, if practicable, the rights will be disposed of and the net proceeds distributed to you by the trustee. In all other cases, the rights will lapse.

You will be obligated to pay any tax or other charge that may become due with respect to Europe 2001 HOLDRS. The trustee may deduct the amount of any tax or other governmental charge from a distribution before making payment to you. In addition, the trustee will deduct its quarterly custody fee of $2.00 for each round-lot of 100 Europe 2001 HOLDRS from quarterly dividends, if any, paid to the trustee by the issuers of the underlying securities. With respect to the aggregate custody fee payable in any calendar year for each Europe 2001 HOLDR, the trustee will waive that portion of the fee which exceeds the total cash dividends and other cash distributions received, or to be received, and payable with respect to such calendar year.

Record dates. With respect to dividend payments and voting instructions, the trustee expects to fix the trust’s record dates as close as possible to the record date fixed by the issuer of the underlying securities.

Shareholder communications. The trustee promptly will forward to you all shareholder communications that it receives from issuers of the underlying securities.

Withdrawal of underlying securities. You may surrender your Europe 2001 HOLDRS and receive underlying securities during the trustee’s normal business hours and upon the payment of applicable fees, taxes or governmental charges, if any. You should receive your underlying securities no later than the business day after the trustee receives your request. If you surrender Europe 2001 HOLDRS in order to receive underlying securities, you will pay to the trustee a cancellation fee of up to $10.00 per round-lot of 100 Europe 2001 HOLDRS.

Further issuances of Europe 2001 HOLDRS. The depositary trust agreement provides for further issuances of Europe 2001 HOLDRS on a continuous basis without your consent.

Reconstitution events. The depositary trust agreement provides for the automatic distribution of underlying securities from Europe 2001 HOLDRS to you in the following four circumstances:

|

|

A.

|

If an issuer of underlying securities no longer has a class of securities registered under section 12 of the Exchange Act, then its securities will no longer be an underlying security and the trustee will distribute the shares of that company to the owners of the Europe 2001 HOLDRS.

|

|

|

B.

|

If the SEC finds that an issuer of underlying securities should be registered as an investment company under the Investment Company Act of 1940, and the trustee has actual knowledge of the SEC finding, then the trustee will distribute the shares of that company to the owners of the Europe 2001 HOLDRS.

|

|

|

C.

|

If the underlying securities of an issuer cease to be outstanding as a result of a merger, consolidation, corporate combination or other event, the trustee will distribute the consideration paid by and received from the acquiring company to the beneficial owners of Europe 2001 HOLDRS, unless the consideration received is securities that are listed for trading on a U.S. national securities exchange. In any other case, the additional securities received as consideration will be deposited into the trust.

|

|

|

D.

|

If an issuer’s underlying securities are delisted from trading on a U.S. national securities exchange and are not listed for trading on another U.S. national securities exchange within five business days from the date such securities are delisted.

|

To the extent a distribution of underlying securities from the Europe 2001 HOLDRS is required as a result of a reconstitution event, the trustee will deliver the underlying security to you as promptly as practicable after the date that the trustee has knowledge of the occurrence of a reconstitution event.