UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number | Registrants; State of Incorporation; Addresses; and Telephone Number | IRS Employer Identification No. | ||

1-8962 | PINNACLE WEST CAPITAL CORPORATION (An Arizona corporation) 400 North Fifth Street, P.O. Box 53999 Phoenix, Arizona 85072-3999 (602) 250-1000 | 86-0512431 | ||

1-4473 | ARIZONA PUBLIC SERVICE COMPANY (An Arizona corporation) 400 North Fifth Street, P.O. Box 53999 Phoenix, Arizona 85072-3999 (602) 250-1000 | 86-0011170 | ||

Securities registered pursuant to Section 12(b) of the Act:

Title Of Each Class | Name Of Each Exchange On Which Registered | |||

PINNACLE WEST CAPITAL CORPORATION | Common Stock, No Par Value | New York Stock Exchange | ||

ARIZONA PUBLIC SERVICE COMPANY | None | None | ||

Securities registered pursuant to Section 12(g) of the Act:

ARIZONA PUBLIC SERVICE COMPANY Common Stock, Par Value $2.50 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

PINNACLE WEST CAPITAL CORPORATION | Yes x No o |

ARIZONA PUBLIC SERVICE COMPANY | Yes x No o |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

PINNACLE WEST CAPITAL CORPORATION | Yes o No x |

ARIZONA PUBLIC SERVICE COMPANY | Yes o No x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

PINNACLE WEST CAPITAL CORPORATION | Yes x No o |

ARIZONA PUBLIC SERVICE COMPANY | Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

PINNACLE WEST CAPITAL CORPORATION | Yes x No o |

ARIZONA PUBLIC SERVICE COMPANY | Yes x No o |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or in any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

PINNACLE WEST CAPITAL CORPORATION | ||

Large accelerated filer x | Accelerated filer o | |

Non-accelerated filer o | Smaller reporting company o | |

(Do not check if a smaller reporting company) | ||

ARIZONA PUBLIC SERVICE COMPANY | ||

Large accelerated filer o | Accelerated filer o | |

Non-accelerated filer x | Smaller reporting company o | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether each registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of each registrant’s most recently completed second fiscal quarter:

PINNACLE WEST CAPITAL CORPORATION | $8,961,361,256 as of June 30, 2016 | |

ARIZONA PUBLIC SERVICE COMPANY | $0 as of June 30, 2016 | |

The number of shares outstanding of each registrant’s common stock as of February 17, 2017

PINNACLE WEST CAPITAL CORPORATION | 111,340,169 shares | |

ARIZONA PUBLIC SERVICE COMPANY | Common Stock, $2.50 par value, 71,264,947 shares. Pinnacle West Capital Corporation is the sole holder of Arizona Public Service Company’s Common Stock. | |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Pinnacle West Capital Corporation’s definitive Proxy Statement relating to its Annual Meeting of Shareholders to be held on May 17, 2017 are incorporated by reference into Part III hereof.

Arizona Public Service Company meets the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format allowed under that General Instruction.

TABLE OF CONTENTS

Page | ||

This combined Form 10-K is separately filed by Pinnacle West and APS. Each registrant is filing on its own behalf all of the information contained in this Form 10-K that relates to such registrant and, where required, its subsidiaries. Except as stated in the preceding sentence, neither registrant is filing any information that does not relate to such registrant, and therefore makes no representation as to any such information. The information required with respect to each company is set forth within the applicable items. Item 8 of this report includes Consolidated Financial Statements of Pinnacle West and Consolidated Financial Statements of APS. Item 8 also includes Combined Notes to Consolidated Financial Statements.

i

GLOSSARY OF NAMES AND TECHNICAL TERMS

4CA | 4C Acquisition, LLC, a wholly-owned subsidiary of Pinnacle West |

ac | Alternating Current |

ACC | Arizona Corporation Commission |

ADEQ | Arizona Department of Environmental Quality |

AFUDC | Allowance for Funds Used During Construction |

ANPP | Arizona Nuclear Power Project, also known as Palo Verde |

APS | Arizona Public Service Company, a subsidiary of the Company |

ARO | Asset retirement obligations |

ASU | Accounting Standards Update |

BART | Best available retrofit technology |

Base Fuel Rate | The portion of APS’s retail base rates attributable to fuel and purchased power costs |

BCE | Bright Canyon Energy Corporation, a subsidiary of the Company |

BHP Billiton | BHP Billiton New Mexico Coal, Inc. |

BNCC | BHP Navajo Coal Company |

CAISO | California Independent System Operator |

CCR | Coal combustion residuals |

Cholla | Cholla Power Plant |

dc | Direct Current |

distributed energy systems | Small-scale renewable energy technologies that are located on customers’ properties, such as rooftop solar systems |

DOE | United States Department of Energy |

DOI | United States Department of the Interior |

DOJ | United States Department of Justice |

DSM | Demand side management |

DSMAC | Demand side management adjustment charge |

EES | Energy Efficiency Standard |

El Dorado | El Dorado Investment Company, a subsidiary of the Company |

El Paso | El Paso Electric Company |

EPA | United States Environmental Protection Agency |

FERC | United States Federal Energy Regulatory Commission |

Four Corners | Four Corners Power Plant |

GWh | Gigawatt-hour, one billion watts per hour |

kV | Kilovolt, one thousand volts |

kWh | Kilowatt-hour, one thousand watts per hour |

LFCR | Lost Fixed Cost Recovery Mechanism |

MMBtu | One million British Thermal Units |

MW | Megawatt, one million watts |

MWh | Megawatt-hour, one million watts per hour |

Native Load | Retail and wholesale sales supplied under traditional cost-based rate regulation |

Navajo Plant | Navajo Generating Station |

NERC | North American Electric Reliability Corporation |

NRC | United States Nuclear Regulatory Commission |

NTEC | Navajo Transitional Energy Company, LLC |

OCI | Other comprehensive income |

OSM | Office of Surface Mining Reclamation and Enforcement |

Palo Verde | Palo Verde Nuclear Generating Station or PVNGS |

Pinnacle West | Pinnacle West Capital Corporation (any use of the words “Company,” “we,” and “our” refer to Pinnacle West) |

PSA | Power supply adjustor approved by the ACC to provide for recovery or refund of variations in actual fuel and purchased power costs compared with the Base Fuel Rate |

RES | Arizona Renewable Energy Standard and Tariff |

Salt River Project or SRP | Salt River Project Agricultural Improvement and Power District |

SCE | Southern California Edison Company |

TCA | Transmission cost adjustor |

VIE | Variable interest entity |

ii

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements based on current expectations. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project” and similar words. Because actual results may differ materially from expectations, we caution readers not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. In addition to the Risk Factors described in Item 1A and in Item 7 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” these factors include, but are not limited to:

• | our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; |

• | variations in demand for electricity, including those due to weather, seasonality, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; |

• | power plant and transmission system performance and outages; |

• | competition in retail and wholesale power markets; |

• | regulatory and judicial decisions, developments and proceedings; |

• | new legislation, ballot initiatives and regulation, including those relating to environmental requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric markets; |

• | fuel and water supply availability; |

• | our ability to achieve timely and adequate rate recovery of our costs, including returns on and of debt and equity capital investment; |

• | our ability to meet renewable energy and energy efficiency mandates and recover related costs; |

• | risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; |

• | current and future economic conditions in Arizona, including in real estate markets; |

• | the development of new technologies which may affect electric sales or delivery; |

• | the cost of debt and equity capital and the ability to access capital markets when required; |

• | environmental, economic and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; |

• | volatile fuel and purchased power costs; |

• | the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; |

• | the liquidity of wholesale power markets and the use of derivative contracts in our business; |

• | potential shortfalls in insurance coverage; |

• | new accounting requirements or new interpretations of existing requirements; |

• | generation, transmission and distribution facility and system conditions and operating costs; |

• | the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; |

• | the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and |

• | restrictions on dividends or other provisions in our credit agreements and ACC orders. |

These and other factors are discussed in the Risk Factors described in Item 1A of this report, which readers should review carefully before placing any reliance on our financial statements or disclosures. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

2

PART I

ITEM 1. BUSINESS

Pinnacle West

Pinnacle West is a holding company that conducts business through its subsidiaries. We derive essentially all of our revenues and earnings from our wholly-owned subsidiary, APS. APS is a vertically-integrated electric utility that provides either retail or wholesale electric service to most of the State of Arizona, with the major exceptions of about one-half of the Phoenix metropolitan area, the Tucson metropolitan area and Mohave County in northwestern Arizona.

Pinnacle West’s other subsidiaries are El Dorado, BCE and 4CA. Additional information related to these subsidiaries is provided later in this report.

Our reportable business segment is our regulated electricity segment, which consists of traditional regulated retail and wholesale electricity businesses (primarily electric service to Native Load customers) and related activities, and includes electricity generation, transmission and distribution.

BUSINESS OF ARIZONA PUBLIC SERVICE COMPANY

APS currently provides electric service to approximately 1.2 million customers. We own or lease 6,236 MW of regulated generation capacity and we hold a mix of both long-term and short-term purchased power agreements for additional capacity, including a variety of agreements for the purchase of renewable energy. During 2016, no single purchaser or user of energy accounted for more than 1.1% of our electric revenues.

3

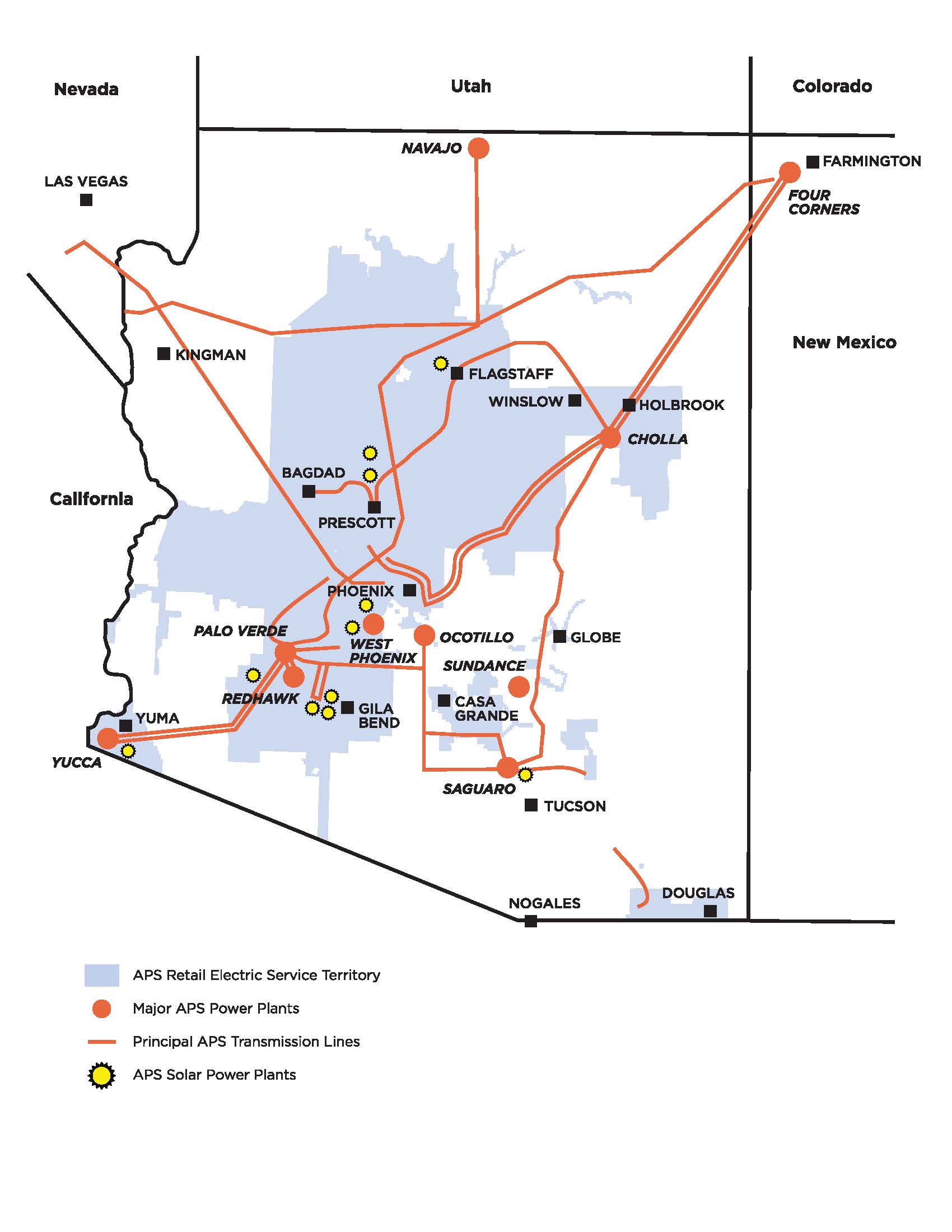

The following map shows APS’s retail service territory, including the locations of its generating facilities and principal transmission lines.

4

Energy Sources and Resource Planning

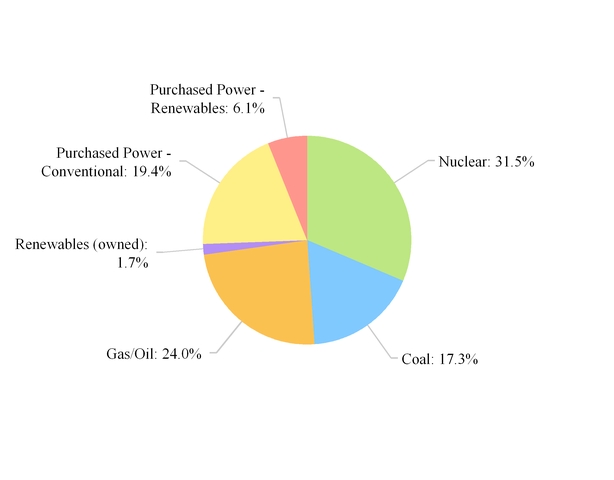

To serve its customers, APS obtains power through its various generation stations and through purchased power agreements. Resource planning is an important function necessary to meet Arizona’s future energy needs. APS’s sources of energy by type used to supply energy to Native Load customers during 2016 were as follows:

Generation Facilities

APS has ownership interests in or leases the coal, nuclear, gas, oil and solar generating facilities described below. For additional information regarding these facilities, see Item 2.

Coal-Fueled Generating Facilities

Four Corners — Four Corners is located in the northwestern corner of New Mexico, and was originally a 5-unit coal-fired power plant. APS owns 100% of Units 1, 2 and 3, which were retired as of December 30, 2013. APS operates the plant and owns 63% of Four Corners Units 4 and 5 following the acquisition of SCE’s interest in Units 4 and 5 described below. APS has a total entitlement from Four Corners of 970 MW. Additionally, 4CA, a wholly-owned subsidiary of Pinnacle West, owns 7% of Units 4 and 5 following its acquisition of El Paso's interest in these units described below.

On December 30, 2013, APS purchased SCE’s 48% interest in each of Units 4 and 5 of Four Corners. The final purchase price for the interest was approximately $182 million. In connection with APS’s prior retail

5

rate case with the ACC, the ACC reserved the right to review the prudence of the Four Corners transaction for cost recovery purposes upon the closing of the transaction. On December 23, 2014, the ACC approved rate adjustments related to APS’s acquisition of SCE’s interest in Four Corners resulting in a revenue increase of $57.1 million on an annual basis. On February 23, 2015, the ACC decision approving the rate adjustments was appealed. APS has intervened and is actively participating in the proceeding. The Arizona Court of Appeals suspended the appeal pending the Arizona Supreme Court's decision in the System Improvement Benefits ("SIB") matter discussed in Note 3. On August 8, 2016, the Arizona Supreme Court issued its opinion in the SIB matter, and the Arizona Court of Appeals has now ordered supplemental briefing on how that SIB decision should affect the challenge to the Four Corners rate adjustment. We cannot predict when or how this matter will be resolved.

Concurrently with the closing of the SCE transaction, BHP Billiton, the parent company of BNCC, the coal supplier and operator of the mine that serves Four Corners, transferred its ownership of BNCC to NTEC, a company formed by the Navajo Nation to own the mine and develop other energy projects. BHP Billiton was retained by NTEC under contract as the mine manager and operator through 2016. Also occurring concurrently with the closing, the Four Corners’ co-owners executed a long-term agreement for the supply of coal to Four Corners from July 2016 through 2031 (the "2016 Coal Supply Agreement"). El Paso, a 7% owner in Units 4 and 5 of Four Corners, did not sign the 2016 Coal Supply Agreement. Under the 2016 Coal Supply Agreement, APS agreed to assume the 7% shortfall obligation. On February 17, 2015, APS and El Paso entered into an asset purchase agreement providing for the purchase by APS, or an affiliate of APS, of El Paso’s 7% interest in each of Units 4 and 5 of Four Corners. 4CA purchased the El Paso interest on July 6, 2016. The purchase price was immaterial in amount, and 4CA assumed El Paso's reclamation and decommissioning obligations associated with the 7% interest.

NTEC has the option to purchase the 7% interest within a certain timeframe pursuant to an option granted to NTEC. On December 29, 2015, NTEC provided notice of its intent to exercise the option. The 2016 Coal Supply Agreement contains alternate pricing terms for the 7% shortfall obligations in the event NTEC does not purchase the interest.

APS, on behalf of the Four Corners participants, negotiated amendments to an existing facility lease with the Navajo Nation, which extends the Four Corners leasehold interest from 2016 to 2041. The Navajo Nation approved these amendments in March 2011. The effectiveness of the amendments also required the approval of the DOI, as did a related federal rights-of-way grant. A federal environmental review was undertaken as part of the DOI review process, and culminated in the issuance by DOI of a record of decision on July 17, 2015 justifying the agency action extending the life of the plant and the adjacent mine.

On April 20, 2016, several environmental groups filed a lawsuit against OSM and other federal agencies in the District of Arizona in connection with their issuance of the approvals that extended the life of Four Corners and the adjacent mine. The lawsuit alleges that these federal agencies violated both the Endangered Species Act ("ESA") and the National Environmental Policy Act ("NEPA") in providing the federal approvals necessary to extend operations at Four Corners and the adjacent Navajo Mine past July 6, 2016. APS filed a motion to intervene in the proceedings, which was granted on August 3, 2016. Briefing on the merits of this litigation is expected to extend through May 2017. On September 15, 2016, NTEC, the company that owns the adjacent mine, filed a motion to intervene for the purpose of dismissing the lawsuit based on NTEC's tribal sovereign immunity. Because the court has placed a stay on all litigation deadlines pending its decision regarding NTEC's motion to dismiss, the schedule for briefing and the anticipated timeline for completion of this litigation will likely be extended. We cannot predict the outcome of this matter or its potential effect on Four Corners.

Cholla — Cholla was originally a 4-unit coal-fired power plant, which is located in northeastern Arizona. APS operates the plant and owns 100% of Cholla Units 1, 2 and 3. PacifiCorp owns Cholla Unit 4,

6

and APS operates that unit for PacifiCorp. On September 11, 2014, APS announced that it would close its 260 MW Unit 2 at Cholla and cease burning coal at Units 1 and 3 by the mid-2020s if EPA approves a compromise proposal offered by APS to meet required environmental and emissions standards and rules. On April 14, 2015, the ACC approved APS's plan to retire Unit 2, without expressing any view on the future recoverability of APS's remaining investment in the Unit. (See Note 3 for details related to the resulting regulatory asset and Note 10 for details of the proposal.) APS believes that the environmental benefits of this proposal are greater in the long-term than the benefits that would have resulted from adding the emissions control equipment. APS closed Unit 2 on October 1, 2015. Following the closure of Unit 2, APS has a total entitlement from Cholla of 387 MW.

On January 13, 2017, EPA approved a final rule incorporating APS's compromise approach. Once the final rule is published in the Federal Register, parties have 60 days to file a petition for review in the Ninth Circuit Court of Appeals. APS cannot predict at this time whether such petitions will be filed or if they will be successful. In addition, under the terms of an executive memorandum issued on January 20, 2017, this final rule will not be published in the Federal Register until after it has been reviewed by an appointee of the President. We cannot predict when such review will occur and what may result from the additional review.

APS purchases all of Cholla’s coal requirements from a coal supplier, an affiliate of Peabody Energy Corporation, that mines all of the coal under long-term leases of coal reserves with the federal and state governments and private landholders. On April 13, 2016, Peabody Energy Corporation and certain affiliated entities filed a petition for relief under chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Eastern District of Missouri. Under the Coal Supply Agreement, dated December 21, 2005, Peabody supplied coal to APS and PacifiCorp (collectively, the “Buyers”) for use at Cholla. APS believes that the Coal Supply Agreement terminated automatically on April 13, 2016 as a result of Peabody's bankruptcy filing. The Buyers filed a motion requesting that the Bankruptcy Court enter an order determining that the Buyers are authorized to enforce the termination provisions in the Coal Supply Agreement.

On May 13, 2016, Peabody filed a complaint against the Buyers in the bankruptcy court in which Peabody alleged that the Buyers breached the Coal Supply Agreement. On January 27, 2017, the bankruptcy court approved a settlement between the parties, and on February 6, 2017 the parties executed an amendment to the Coal Supply Agreement that allows for continuation of the agreement with modified terms and conditions acceptable to the parties.

APS has a long-term coal transportation by rail contract that expires in 2017.

Navajo Generating Station — The Navajo Plant is a 3-unit coal-fired power plant located in northern Arizona. Salt River Project operates the plant and APS owns a 14% interest in Navajo Units 1, 2 and 3. APS has a total entitlement from the Navajo Plant of 315 MW. The Navajo Plant’s coal requirements are purchased from a supplier with long-term leases from the Navajo Nation and the Hopi Tribe. The Navajo Plant is under contract with its coal supplier through 2019, with extension rights through 2026. The Navajo Plant site is leased from the Navajo Nation and is also subject to an easement from the federal government. The current lease expires in 2019.

On February 13, 2017, the co-owners of the Navajo Plant voted not to pursue continued operation of the plant beyond December 2019, the expiration of the current lease term, and to pursue a new lease or lease extension with the Navajo Nation that would allow decommissioning activities to begin after December 2019 instead of later this year. Various stakeholders including regulators, tribal representatives and others interested in the continued operation of the plant intend to meet to determine if an alternate solution can be reached that would permit continued operation of the plant beyond 2019. We cannot predict whether any alternate solutions will be found that would be acceptable to all of the stakeholders and feasible to implement. APS is currently

7

recovering depreciation and a return on the net book value of its interest in the Navajo Plant. APS will seek continued recovery in rates for the book value of its remaining investment in the plant ($108 million as of December 31, 2016) plus a return on the net book value as well as other costs related to retirement and closure, which are still being assessed and which may be material. We cannot predict whether APS would obtain such recovery.

On February 14, 2017, the ACC opened a docket titled "ACC Investigation Concerning the Future of the Navajo Generating Station" with the stated goal of engaging stakeholders and negotiating a sustainable pathway for the Navajo Plant to continue operating in some form after December 2019. APS cannot predict the outcome of this proceeding.

These coal-fueled plants face uncertainties, including those related to existing and potential legislation and regulation, that could significantly impact their economics and operations. See “Environmental Matters” below and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Overview and Capital Expenditures” in Item 7 for developments impacting these coal-fueled facilities. See Note 10 for information regarding APS’s coal mine reclamation obligations.

Nuclear

Palo Verde Nuclear Generating Station — Palo Verde is a 3-unit nuclear power plant located approximately 50 miles west of Phoenix, Arizona. APS operates the plant and owns 29.1% of Palo Verde Units 1 and 3 and approximately 17% of Unit 2. In addition, APS leases approximately 12.1% of Unit 2, resulting in a 29.1% combined ownership and leasehold interest in that unit. APS has a total entitlement from Palo Verde of 1,146 MW.

Palo Verde Leases — In 1986, APS entered into agreements with three separate lessor trust entities in order to sell and lease back approximately 42% of its share of Palo Verde Unit 2 and certain common facilities. The leaseback was originally scheduled to expire at the end of 2015 and contained options to renew the leases or to purchase the leased property for fair market value at the end of the lease terms. On July 7, 2014, APS exercised the fixed rate lease renewal options. The exercise of the renewal options resulted in APS retaining the assets through 2023 under one lease and 2033 under the other two leases. At the end of the lease renewal periods, APS will have the option to purchase the leased assets at their fair market value, extend the leases for up to two years, or return the assets to the lessors. See Note 18 for additional information regarding the Palo Verde Unit 2 sale leaseback transactions.

Palo Verde Operating Licenses — Operation of each of the three Palo Verde Units requires an operating license from the NRC. The NRC issued full power operating licenses for Unit 1 in June 1985, Unit 2 in April 1986 and Unit 3 in November 1987, and issued renewed operating licenses for each of the three units in April 2011, which extended the licenses for Units 1, 2 and 3 to June 2045, April 2046 and November 2047, respectively.

Palo Verde Fuel Cycle — The Palo Verde participants are continually identifying their future nuclear fuel resource needs and negotiating arrangements to fill those needs. The fuel cycle for Palo Verde is comprised of the following stages:

•mining and milling of uranium ore to produce uranium concentrates;

•conversion of uranium concentrates to uranium hexafluoride;

•enrichment of uranium hexafluoride;

•fabrication of fuel assemblies;

•utilization of fuel assemblies in reactors; and

•storage and disposal of spent nuclear fuel.

8

The Palo Verde participants have contracted for 100% of Palo Verde’s requirements for uranium concentrates and conversion services through 2018 and 45% of its requirements in 2019-2025. The participants have also contracted for 100% of Palo Verde’s enrichment services through 2020 and 20% of its enrichment services for 2021-2026; and all of Palo Verde’s fuel assembly fabrication services through 2024.

Spent Nuclear Fuel and Waste Disposal — The Nuclear Waste Policy Act of 1982 (“NWPA”) required the DOE to accept, transport, and dispose of spent nuclear fuel and high level waste generated by the nation’s nuclear power plants by 1998. The DOE’s obligations are reflected in a contract for Disposal of Spent Nuclear Fuel and/or High-Level Radioactive Waste (the “Standard Contract”) with each nuclear power plant. The DOE failed to begin accepting spent nuclear fuel by 1998. APS is directly and indirectly involved in several legal proceedings related to DOE’s failure to meet its statutory and contractual obligations regarding acceptance of spent nuclear fuel and high level waste.

APS Lawsuit for Breach of Standard Contract — In December 2003, APS, acting on behalf of itself and the participant owners of Palo Verde, filed a lawsuit against DOE in the United States Court of Federal Claims ("Court of Federal Claims") for damages incurred due to DOE’s breach of the Standard Contract. The Court of Federal Claims ruled in favor of APS and the Palo Verde participants in October 2010 and awarded $30.2 million in damages to APS and the Palo Verde participants for costs incurred through December 2006.

On December 19, 2012, APS, acting on behalf of itself and the participant owners of Palo Verde, filed a second breach of contract lawsuit against the DOE in the Court of Federal Claims. This lawsuit sought to recover damages incurred due to DOE’s breach of the Standard Contract for failing to accept Palo Verde’s spent nuclear fuel and high level waste from January 1, 2007 through June 30, 2011, as it was required to do pursuant to the terms of the Standard Contract and the Nuclear Waste Policy Act. On August 18, 2014, APS and DOE entered into a settlement agreement, stipulating to a dismissal of the lawsuit and payment of $57.4 million by DOE to the Palo Verde owners for certain specified costs incurred by Palo Verde during the period January 1, 2007 through June 30, 2011. APS’s share of this amount is $16.7 million. Amounts recovered in the lawsuit and settlement were recorded as adjustments to a regulatory liability and had no impact on the amount of reported net income. In addition, the settlement agreement provides APS with a method for submitting claims and getting recovery for costs incurred through December 31, 2016, which has been extended to December 31, 2019.

APS has submitted two claims pursuant to the terms of the August 18, 2014 settlement agreement, for two separate time periods during July 1, 2011 through June 30, 2015. The DOE has approved and paid $53.9 million for these claims (APS’s share is $15.7 million). The amounts recovered were primarily recorded as adjustments to a regulatory liability and had no impact on reported net income. APS's next claim pursuant to the terms of the August 18, 2014 settlement agreement was submitted to the DOE on October 31, 2016, and approved on February 1, 2017, in the amount $11.3 million (APS's share is $3.3 million). Payment for the claim is expected in the second quarter of 2017.

The One-Mill Fee — In 2011, the National Association of Regulatory Utility Commissioners and the Nuclear Energy Institute challenged DOE’s 2010 determination of the adequacy of the one tenth of a cent per kWh fee (the “one-mill fee”) paid by the nation’s commercial nuclear power plant owners pursuant to their individual obligations under the Standard Contract. This fee is recovered by APS in its retail rates. In June 2012, the U.S. Court of Appeals for the District of Columbia Circuit (the “D.C. Circuit”) held that DOE failed to conduct a sufficient fee analysis in making the 2010 determination. The D.C. Circuit remanded the 2010 determination to the Secretary of the DOE (“Secretary”) with instructions to conduct a new fee adequacy determination within six months. In February 2013, upon completion of DOE’s revised one-mill fee adequacy determination, the D.C. Circuit reopened the proceedings. On November 19, 2013, the D.C. Circuit found that the DOE did not conduct a legally adequate fee assessment and ordered the Secretary to notify Congress of his

9

intent to suspend collecting annual fees for nuclear waste disposal from nuclear power plant operators, as he is required to do pursuant to the NWPA and the D.C. Circuit’s order. On January 3, 2014, the Secretary notified Congress of his intention to suspend collection of the one-mill fee, subject to Congress’ disapproval. On May 16, 2014, the DOE notified all commercial nuclear power plant operators who are party to a Standard Contract that it reduced the one-mill fee to zero, thus effectively terminating the one-mill fee.

DOE’s Construction Authorization Application for Yucca Mountain — The DOE had planned to meet its NWPA and Standard Contract disposal obligations by designing, licensing, constructing, and operating a permanent geologic repository at Yucca Mountain, Nevada. In June 2008, the DOE submitted its Yucca Mountain construction authorization application to the NRC, but in March 2010, the DOE filed a motion to dismiss with prejudice the Yucca Mountain construction authorization application. Several interested parties have also intervened in the NRC proceeding. Additionally, a number of interested parties filed a variety of lawsuits in different jurisdictions around the country challenging the DOE’s authority to withdraw the Yucca Mountain construction authorization application and NRC’s cessation of its review of the Yucca Mountain construction authorization application. The cases have been consolidated into one matter at the D.C. Circuit. In August 2013, the D.C. Circuit ordered the NRC to resume its review of the application with available appropriated funds.

On October 16, 2014, the NRC issued Volume 3 of the safety evaluation report developed as part of the Yucca Mountain construction authorization application. This volume addresses repository safety after permanent closure, and its issuance is a key milestone in the Yucca Mountain licensing process. Volume 3 contains the staff’s finding that the DOE’s repository design meets the requirements that apply after the repository is permanently closed, including but not limited to the post-closure performance objectives in NRC’s regulations.

On December 18, 2014, the NRC issued Volume 4 of the safety evaluation report developed as part of the Yucca Mountain construction authorization application. This volume covers administrative and programmatic requirements for the repository. It documents the staff’s evaluation of whether the DOE’s research and development and performance confirmation programs, as well as other administrative controls and systems, meet applicable NRC requirements. Volume 4 contains the staff’s finding that most administrative and programmatic requirements in NRC regulations are met, except for certain requirements relating to ownership of land and water rights.

Publication of Volumes 3 and 4 does not signal whether or when the NRC might authorize construction of the repository.

Waste Confidence and Continued Storage — On June 8, 2012, the D.C. Circuit issued its decision on a challenge by several states and environmental groups of the NRC’s rulemaking regarding temporary storage and permanent disposal of high level nuclear waste and spent nuclear fuel. The petitioners had challenged the NRC’s 2010 update to the agency’s Waste Confidence Decision and temporary storage rule (“Waste Confidence Decision”).

The D.C. Circuit found that the agency’s 2010 Waste Confidence Decision update constituted a major federal action, which, consistent with NEPA, requires either an environmental impact statement or a finding of no significant impact from the agency’s actions. The D.C. Circuit found that the NRC’s evaluation of the environmental risks from spent nuclear fuel was deficient, and therefore remanded the 2010 Waste Confidence Decision update for further action consistent with NEPA.

On September 6, 2012, the NRC Commissioners issued a directive to the NRC staff to proceed directly with development of a generic environmental impact statement to support an updated Waste Confidence

10

Decision. The NRC Commissioners also directed the staff to establish a schedule to publish a final rule and environmental impact study within 24 months of September 6, 2012.

In September 2013, the NRC issued its draft Generic Environmental Impact Statement (“GEIS”) to support an updated Waste Confidence Decision. On August 26, 2014, the NRC approved a final rule on the environmental effects of continued storage of spent nuclear fuel. Renamed as the Continued Storage Rule, the NRC’s decision adopted the findings of the GEIS regarding the environmental impacts of storing spent fuel at any reactor site after the reactor’s licensed period of operations. As a result, those generic impacts do not need to be re-analyzed in the environmental reviews for individual licenses. Although Palo Verde had not been involved in any licensing actions affected by the D.C. Circuit’s June 8, 2012, decision, the NRC lifted its suspension on final licensing actions on all nuclear power plant licenses and renewals that went into effect when the D.C. Circuit issued its June 2012 decision. The final Continued Storage Rule was subject to continuing legal challenges before the NRC and the Court of Appeals. In June 2016, the D.C. Circuit issued its final decision, rejecting all remaining legal challenges to the Continued Storage Rule. On August 8, 2016, the D.C. Circuit denied a petition for rehearing.

Palo Verde has sufficient capacity at its on-site independent spent fuel storage installation (“ISFSI”) to store all of the nuclear fuel that will be irradiated during the initial operating license period, which ends in December 2027. Additionally, Palo Verde has sufficient capacity at its on-site ISFSI to store a portion of the fuel that will be irradiated during the period of extended operation, which ends in November 2047. If uncertainties regarding the United States government’s obligation to accept and store spent fuel are not favorably resolved, APS will evaluate alternative storage solutions that may obviate the need to expand the ISFSI to accommodate all of the fuel that will be irradiated during the period of extended operation.

Nuclear Decommissioning Costs — APS currently relies on an external sinking fund mechanism to meet the NRC financial assurance requirements for decommissioning its interests in Palo Verde Units 1, 2 and 3. The decommissioning costs of Palo Verde Units 1, 2 and 3 are currently included in APS’s ACC jurisdictional rates. Decommissioning costs are recoverable through a non-bypassable system benefits charge (paid by all retail customers taking service from the APS system). Based on current nuclear decommissioning trust asset balances, site specific decommissioning cost studies, anticipated future contributions to the decommissioning trusts, and return projections on the asset portfolios over the expected remaining operating life of the facility, we are on track to meet the current site specific decommissioning costs for Palo Verde at the time the units are expected to be decommissioned. See Note 19 for additional information about APS’s nuclear decommissioning trusts.

Palo Verde Liability and Insurance Matters — See “Palo Verde Nuclear Generating Station — Nuclear Insurance” in Note 10 for a discussion of the insurance maintained by the Palo Verde participants, including APS, for Palo Verde.

Natural Gas and Oil Fueled Generating Facilities

APS has six natural gas power plants located throughout Arizona, consisting of Redhawk, located near Palo Verde; Ocotillo, located in Tempe (discussed below); Sundance, located in Coolidge; West Phoenix, located in southwest Phoenix; Saguaro, located north of Tucson; and Yucca, located near Yuma. Several of the units at Yucca run on either gas or oil. APS has one oil-only power plant, Douglas, located in the town of Douglas, Arizona. APS owns and operates each of these plants with the exception of one oil-only combustion turbine unit and one oil and gas steam unit at Yucca that are operated by APS and owned by the Imperial Irrigation District. APS has a total entitlement from these plants of 3,179 MW. Gas for these plants is financially hedged up to three years in advance of purchasing and the gas is generally purchased one month prior to delivery. APS has long-term gas transportation agreements with three different companies, some of

11

which are effective through 2024. Fuel oil is acquired under short-term purchases delivered primarily to West Phoenix, where it is distributed to APS’s other oil power plants by truck.

Ocotillo is a 330 MW 4-unit gas plant located in the metropolitan Phoenix area. In early 2014, APS announced a project to modernize the plant, which involves retiring two older 110 MW steam units, adding five 102 MW combustion turbines and maintaining two existing 55 MW combustion turbines. In total, this increases the capacity of the site by 290 MW, to 620 MW, with completion targeted by summer 2019. (See Note 3 for proposed rate recovery in our current retail rate case.) On September 9, 2016, Maricopa County issued a final permit decision that authorizes construction of the Ocotillo modernization project and construction will begin in early 2017.

Solar Facilities

APS developed utility scale solar resources through the 170 MW ACC-approved AZ Sun Program. APS invested approximately $675 million in its AZ Sun Program. These facilities are owned by APS and are located in multiple locations throughout Arizona. In 2016, APS developed the 40MW Red Rock Solar Plant, which it owns and operates. Two of our large customers will purchase renewable energy credits from APS that is equivalent to the amount of renewable energy that Red Rock is projected to generate.

Additionally, APS owns and operates more than forty small solar systems around the state. Together they have the capacity to produce approximately 4 MW of renewable energy. This fleet of solar systems includes a 3 MW facility located at the Prescott Airport and 1 MW of small solar in various locations across Arizona. APS has also developed solar photovoltaic distributed energy systems installed as part of the Community Power Project in Flagstaff, Arizona. The Community Power Project, approved by the ACC on April 1, 2010, is a pilot program through which APS owns, operates and receives energy from approximately 1 MW of solar photovoltaic distributed energy systems located within a certain test area in Flagstaff, Arizona. Additionally, APS owns 12 MW of solar photovoltaic systems installed across Arizona through the ACC-approved Schools and Government Program.

In December 2014, the ACC voted that it had no objection to APS implementing an APS-owned rooftop solar research and development program aimed at learning how to efficiently enable the integration of rooftop solar and battery storage with the grid. The first stage of the program, called the "Solar Partner Program," placed 8 MW of residential rooftop solar on strategically selected distribution feeders in an effort to maximize potential system benefits, as well as made systems available to limited-income customers who could not easily install solar through transactions with third parties. The second stage of the program, which included an additional 2 MW of rooftop solar and energy storage, placed two energy storage systems sized at 2 MW on two different high solar penetration feeders to test various grid-related operation improvements and system interoperability, and was in operation by the end of 2016. The ACC expressly reserved that any determination of prudency of the residential rooftop solar program for rate making purposes would not be made until the project was fully in service, and APS has requested cost recovery for the project in its currently pending rate case. On September 30, 2016, APS presented its preliminary findings from the residential rooftop solar program in a filing with the ACC.

Purchased Power Contracts

In addition to its own available generating capacity, APS purchases electricity under various arrangements, including long-term contracts and purchases through short-term markets to supplement its owned or leased generation and hedge its energy requirements. A portion of APS’s purchased power expense is netted against wholesale sales on the Consolidated Statements of Income. (See Note 16.) APS continually assesses its need for additional capacity resources to assure system reliability.

12

Purchased Power Capacity — APS’s purchased power capacity under long-term contracts as of December 31, 2016 is summarized in the table below. All capacity values are based on net capacity unless otherwise noted.

Type | Dates Available | Capacity (MW) | |||

Purchase Agreement (a) | Year-round through June 14, 2020 | 60 | |||

Exchange Agreement (b) | May 15 to September 15 annually through February 2021 | 480 | |||

Tolling Agreement | Year-round through May 2017 | 514 | |||

Tolling Agreement | Summer seasons through October 2019 | 560 | |||

Demand Response Agreement (c) | Summer seasons through 2024 | 25 | |||

Tolling Agreement (d) | Summer seasons from Summer 2020 through Summer 2025 | 565 | |||

Renewable Energy (e) | Various | 629 | |||

(a) | Up to 60 MW of capacity is available; however, the amount of electricity available to APS under this agreement is based in large part on customer demand and is adjusted annually. |

(b) | This is a seasonal capacity exchange agreement under which APS receives electricity during the summer peak season (from May 15 to September 15) and APS returns a like amount of electricity during the winter season (from October 15 to February 15). |

(c) | The capacity under this agreement may be increased in 5 MW increments in each of 2015 and 2016 and 10 MW increments in years 2017 through 2024, up to a maximum of 50 MW. |

(d) | This agreement was signed in response to APS's 2016 all source request for proposal seeking capacity resources. |

(e) | Renewable energy purchased power agreements are described in detail below under “Current and Future Resources — Renewable Energy Standard — Renewable Energy Portfolio.” |

Current and Future Resources

Current Demand and Reserve Margin

Electric power demand is generally seasonal. In Arizona, demand for power peaks during the hot summer months. APS’s 2016 peak one-hour demand on its electric system was recorded on June 19, 2016 at 7,051 MW, compared to the 2015 peak of 7,031 MW recorded on August 15, 2015. APS’s reserve margin at the time of the 2016 peak demand, calculated using system load serving capacity, was 30%. For 2017, due to expiring purchase contracts, APS is procuring market resources to maintain its minimum 15% planning reserve criteria.

Future Resources and Resource Plan

APS filed its preliminary 2017 Integrated Resource Plan on March 1, 2016 and an updated preliminary 2017 Integrated Resource Plan on September 30, 2016. APS also held stakeholder meetings in February and November 2016 in addition to an ACC-led Integrated Resource Plan workshop in July 2016. The preliminary Integrated Resource Plan and associated stakeholder meetings are part of a modified planning process that allows time to incorporate implications of the Clean Power Plan as well as input from stakeholder meetings. The final Integrated Resource Plan will be submitted by or on April 3, 2017 and the ACC is expected to complete its review by February 1, 2018.

On September 11, 2014, APS announced that it would close Cholla Unit 2 and cease burning coal at the other APS-owned units (Units 1 and 3) at the plant by the mid-2020s, if EPA approves a compromise proposal offered by APS to meet required environmental and emissions standards and rules. On April 14, 2015, the ACC approved APS's plan to retire Unit 2, without expressing any view on the future recoverability of APS's remaining investment in the Unit. APS closed Unit 2 on October 1, 2015. Previously, APS estimated Cholla

13

Unit 2’s end of life to be 2033. APS is currently recovering a return on and of the net book value of the unit in base rates and is seeking recovery of the unit’s decommissioning and other retirement-related costs over the remaining life of the plant in its current retail rate case. APS believes it will be allowed recovery of the remaining net book value of Unit 2 ($116 million as of December 31, 2016), in addition to a return on its investment. In accordance with GAAP, in the third quarter of 2014, Unit 2’s remaining net book value was reclassified from property, plant and equipment to a regulatory asset. If the ACC does not allow full recovery of the remaining net book value of Cholla Unit 2, all or a portion of the regulatory asset will be written off and APS’s net income, cash flows, and financial position will be negatively impacted. (See "Business of Arizona Public Service Company - Energy Sources and Resource Planning - Generation Facilities - Coal-Fueled Generating Facilities - Cholla" above for details regarding the status of the EPA's rule related to Cholla.)

See "Business of Arizona Public Service Company - Energy Sources and Resource Planning - Generation Facilities - Coal-Fueled Generating Facilities - Navajo Generating Station" above for information regarding future plans for the Navajo Plant.

Energy Imbalance Market

In 2015, APS and the CAISO, the operator for the majority of California's transmission grid, signed an agreement for APS to begin participation in the Energy Imbalance Market (“EIM”). APS's participation in the EIM began on October 1, 2016. The EIM allows for rebalancing supply and demand in 15-minute blocks with dispatching every five minutes before the energy is needed, instead of the traditional one hour blocks. APS expects that its participation in EIM will lower its fuel costs, improve visibility and situational awareness for system operations in the Western Interconnection power grid, and improve integration of APS’s renewable resources.

Renewable Energy Standard

In 2006, the ACC adopted the RES. Under the RES, electric utilities that are regulated by the ACC must supply an increasing percentage of their retail electric energy sales from eligible renewable resources, including solar, wind, biomass, biogas and geothermal technologies. The renewable energy requirement is 7% of retail electric sales in 2017 and increases annually until it reaches 15% in 2025. In APS’s 2009 retail rate case settlement agreement (the “2009 Settlement Agreement”), APS committed to have 1,700 GWh of new renewable resources in service by year-end 2015 in addition to its RES renewable resource commitments. APS met its settlement commitment and RES target for 2016.

A component of the RES is focused on stimulating development of distributed energy systems. Accordingly, under the RES, an increasing percentage of that requirement must be supplied from distributed energy resources. This distributed energy requirement is 30% of the overall RES requirement of 7% in 2017. The following table summarizes the RES requirement standard (not including the additional commitment required by the 2009 Settlement Agreement) and its timing:

2017 | 2020 | 2025 | |||

RES as a % of retail electric sales | 7% | 10% | 15% | ||

Percent of RES to be supplied from distributed energy resources | 30% | 30% | 30% | ||

On April 21, 2015, the RES rules were amended to require utilities to report on all eligible renewable resources in their service territory, irrespective of whether the utility owns renewable energy credits associated with such renewable energy. The rules allow the ACC to consider such information in determining whether APS has satisfied the requirements of the RES.

14

Renewable Energy Portfolio. To date, APS has a diverse portfolio of existing and planned renewable resources totaling 1,480 MW, including solar, wind, geothermal, biomass and biogas. Of this portfolio, 1,440 MW are currently in operation and 40 MW are under contract for development or are under construction. Renewable resources in operation include 239 MW of facilities owned by APS, 629 MW of long-term purchased power agreements, and an estimated 539 MW of customer-sited, third-party owned distributed energy resources.

APS’s strategy to achieve its RES requirements includes executing purchased power contracts for new facilities, ongoing development of distributed energy resources and procurement of new facilities to be owned by APS. See "Energy Sources and Resource Planning - Generation Facilities - Solar Facilities" above for information regarding APS-owned solar facilities.

15

The following table summarizes APS’s renewable energy sources currently in operation and under development. Agreements for the development and completion of future resources are subject to various conditions, including successful siting, permitting and interconnection of the projects to the electric grid.

Location | Actual/ Target Commercial Operation Date | Term (Years) | Net Capacity In Operation (MW AC) | Net Capacity Planned/Under Development (MW AC) | ||||||||||

APS Owned | ||||||||||||||

Solar: | ||||||||||||||

AZ Sun Program: | ||||||||||||||

Paloma | Gila Bend, AZ | 2011 | 17 | |||||||||||

Cotton Center | Gila Bend, AZ | 2011 | 17 | |||||||||||

Hyder Phase 1 | Hyder, AZ | 2011 | 11 | |||||||||||

Hyder Phase 2 | Hyder, AZ | 2012 | 5 | |||||||||||

Chino Valley | Chino Valley, AZ | 2012 | 19 | |||||||||||

Hyder II | Hyder, AZ | 2013 | 14 | |||||||||||

Foothills | Yuma, AZ | 2013 | 35 | |||||||||||

Gila Bend | Gila Bend, AZ | 2014 | 32 | |||||||||||

Luke AFB | Glendale, AZ | 2015 | 10 | |||||||||||

Desert Star | Buckeye, AZ | 2015 | 10 | |||||||||||

Subtotal AZ Sun Program | 170 | — | ||||||||||||

Multiple Facilities | AZ | Various | 4 | |||||||||||

Red Rock | Red Rock, AZ | 2016 | 40 | |||||||||||

Distributed Energy: | ||||||||||||||

APS Owned (a) | AZ | Various | 25 | |||||||||||

Total APS Owned | 239 | — | ||||||||||||

Purchased Power Agreements | ||||||||||||||

Solar: | ||||||||||||||

Solana | Gila Bend, AZ | 2013 | 30 | 250 | ||||||||||

RE Ajo | Ajo, AZ | 2011 | 25 | 5 | ||||||||||

Sun E AZ 1 | Prescott, AZ | 2011 | 30 | 10 | ||||||||||

Saddle Mountain | Tonopah, AZ | 2012 | 30 | 15 | ||||||||||

Badger | Tonopah, AZ | 2013 | 30 | 15 | ||||||||||

Gillespie | Maricopa County, AZ | 2013 | 30 | 15 | ||||||||||

Wind: | ||||||||||||||

Aragonne Mesa | Santa Rosa, NM | 2006 | 20 | 90 | ||||||||||

High Lonesome | Mountainair, NM | 2009 | 30 | 100 | ||||||||||

Perrin Ranch Wind | Williams, AZ | 2012 | 25 | 99 | ||||||||||

Geothermal: | ||||||||||||||

Salton Sea | Imperial County, CA | 2006 | 23 | 10 | ||||||||||

Biomass: | ||||||||||||||

Snowflake | Snowflake, AZ | 2008 | 15 | 14 | ||||||||||

Biogas: | ||||||||||||||

Glendale Landfill | Glendale, AZ | 2010 | 20 | 3 | ||||||||||

NW Regional Landfill | Surprise, AZ | 2012 | 20 | 3 | ||||||||||

Total Purchased Power Agreements | 629 | — | ||||||||||||

Distributed Energy | ||||||||||||||

Solar (b) | ||||||||||||||

Third-party Owned | AZ | Various | 539 | 40 | ||||||||||

Agreement 1 | Bagdad, AZ | 2011 | 25 | 15 | ||||||||||

Agreement 2 | AZ | 2011-2012 | 20-21 | 18 | ||||||||||

Total Distributed Energy | 572 | 40 | ||||||||||||

Total Renewable Portfolio | 1,440 | 40 | ||||||||||||

16

(a) | Includes Flagstaff Community Power Project, APS School and Government Program and APS Solar Partner Program. |

(b) | Includes rooftop solar facilities owned by third parties. Distributed generation is produced in DC and is converted to AC for reporting purposes. |

Demand Side Management

In December 2009, Arizona regulators placed an increased focus on energy efficiency and other demand side management programs to encourage customers to conserve energy, while incentivizing utilities to aid in these efforts that ultimately reduce the demand for energy. The ACC initiated its Energy Efficiency rulemaking, with a proposed Energy Efficiency Standard (“EES”) of 22% cumulative annual energy savings by 2020. This standard was adopted and became effective on January 1, 2011. This standard will likely impact Arizona’s future energy resource needs. (See Note 3 for energy efficiency and other demand side management obligations).

Competitive Environment and Regulatory Oversight

Retail

The ACC regulates APS’s retail electric rates and its issuance of securities. The ACC must also approve any significant transfer or encumbrance of APS’s property used to provide retail electric service and approve or receive prior notification of certain transactions between Pinnacle West, APS and their respective affiliates.

APS is subject to varying degrees of competition from other investor-owned electric and gas utilities in Arizona (such as Southwest Gas Corporation), as well as cooperatives, municipalities, electrical districts and similar types of governmental or non-profit organizations. In addition, some customers, particularly industrial and large commercial customers, may own and operate generation facilities to meet some or all of their own energy requirements. This practice is becoming more popular with customers installing or having installed products such as rooftop solar panels to meet or supplement their energy needs.

On April 14, 2010, the ACC issued a decision holding that solar vendors that install and operate solar facilities for non-profit schools and governments pursuant to a specific type of contract that calculates payments based on the energy produced are not “public service corporations” under the Arizona Constitution, and are therefore not regulated by the ACC. APS cannot predict when, and the extent to which, additional electric service providers will enter or re-enter APS’s service territory.

On May 9, 2013, the ACC voted to re-examine the facilitation of a deregulated retail electric market in Arizona. The ACC subsequently opened a docket for this matter and received comments from a number of interested parties on the considerations involved in establishing retail electric deregulation in the state. One of these considerations was whether various aspects of a deregulated market, including setting utility rates on a “market” basis, would be consistent with the requirements of the Arizona Constitution. On September 11, 2013, after receiving legal advice from the ACC staff, the ACC voted 4-1 to close the current docket and await full Arizona Constitutional authority before any further examination of this matter. The motion approved by the ACC also included opening one or more new dockets in the future to explore options to offer more rate choices to customers and innovative changes within the existing cost-of-service regulatory model that could include elements of competition. The ACC opened a docket on November 4, 2013 to explore technological advances and innovative changes within the electric utility industry. A series of workshops in this docket were held in 2014 and another in February of 2015. No further workshops are scheduled and no actions were taken as a result of these workshops.

17

Wholesale

FERC regulates rates for wholesale power sales and transmission services. (See Note 3 for information regarding APS’s transmission rates.) During 2016, approximately 3.5% of APS’s electric operating revenues resulted from such sales and services. APS’s wholesale activity primarily consists of managing fuel and purchased power supplies to serve retail customer energy requirements. APS also sells, in the wholesale market, its generation output that is not needed for APS’s Native Load and, in doing so, competes with other utilities, power marketers and independent power producers. Additionally, subject to specified parameters, APS hedges both electricity and fuels. The majority of these activities are undertaken to mitigate risk in APS’s portfolio.

Subpoena from Arizona Corporation Commissioner Robert Burns

On August 25, 2016, Commissioner Burns, individually and not by action of the ACC as a whole, filed subpoenas in APS’s current retail rate proceeding to APS and Pinnacle West for the production of records and information relating to a range of expenditures from 2011 through 2016. The subpoenas requested information concerning marketing and advertising expenditures, charitable donations, lobbying expenses, contributions to 501(c)(3) and (c)(4) nonprofits and political contributions. The return date for the production of information was set as September 15, 2016. The subpoenas also sought testimony from Company personnel having knowledge of the material, including the Chief Executive Officer.

On September 9, 2016, APS filed with the ACC a motion to quash the subpoenas or, alternatively to stay APS's obligations to comply with the subpoenas and decline to decide APS's motion pending court proceedings. Contemporaneously with the filing of this motion, APS and Pinnacle West filed a complaint for special action and declaratory judgment in the Superior Court of Arizona for Maricopa County, seeking a declaratory judgment that Commissioner Burns’ subpoenas are contrary to law. On September 15, 2016, APS produced all non-confidential and responsive documents and offered to produce any remaining responsive documents that are confidential after an appropriate confidentiality agreement is signed.

On February 7, 2017, Commissioner Burns opened a new ACC docket and indicated that its purpose is to study and rectify problems with transparency and disclosure regarding financial contributions from regulated monopolies or other stakeholders who may appear before the ACC that may directly or indirectly benefit an ACC Commissioner, a candidate for ACC Commissioner, or key ACC staff. As part of this docket, Commissioner Burns set March 24, 2017 as a deadline for APS to produce all information previously requested through the subpoenas. Commissioner Burns has also scheduled a workshop in this matter for March 17, 2017. APS and Pinnacle West cannot predict the outcome of this matter.

Environmental Matters

Climate Change

Legislative Initiatives. There have been no recent attempts by Congress to pass legislation that would regulate greenhouse gas ("GHG") emissions, and it is doubtful whether the 115th Congress will consider a climate change bill. In the event climate change legislation ultimately passes, the actual economic and operational impact of such legislation on APS depends on a variety of factors, none of which can be fully known until a law is written, enacted and the specifics of the resulting program are established. These factors include the terms of the legislation with regard to allowed GHG emissions; the cost to reduce emissions; in the event a cap-and-trade program is established, whether any permitted emissions allowances will be allocated to source operators free of cost or auctioned (and, if so, the cost of those allowances in the marketplace) and

18

whether offsets and other measures to moderate the costs of compliance will be available; and, in the event of a carbon tax, the amount of the tax per pound of carbon dioxide (“CO2”) equivalent emitted.

In addition to federal legislative initiatives, state-specific initiatives may also impact our business. While Arizona has no pending legislation and no proposed agency rule regulating GHGs in Arizona, the California legislature enacted AB 32 and SB 1368 in 2006 to address GHG emissions. In October 2011, the California Air Resources Board approved final regulations that established a state-wide cap on GHG emissions beginning on January 1, 2013 and established a GHG allowance trading program under that cap. The first phase of the program, which applies to, among other entities, importers of electricity, commenced on January 1, 2013. Under the program, entities selling electricity into California, including APS, must hold carbon allowances to cover GHG emissions associated with electricity sales into California from outside the state. APS is authorized to recover the cost of these carbon allowances through the PSA.

Regulatory Initiatives. In 2009, EPA determined that GHG emissions endanger public health and welfare. As a result of this “endangerment finding,” EPA determined that the Clean Air Act required new regulatory requirements for new and modified major GHG emitting sources, including power plants. APS will generally be required to consider the impact of GHG emissions as part of its traditional New Source Review ("NSR") analysis for new major sources and major modifications to existing plants.

On June 2, 2014, EPA issued two proposed rules to regulate GHG emissions from modified and reconstructed electric generating units ("EGUs") pursuant to Section 111(b) of the Clean Air Act and existing fossil fuel-fired power plants pursuant to Clean Air Act Section 111(d).

On August 3, 2015, EPA finalized carbon pollution standards for existing, new, modified, and reconstructed EGUs. EPA’s final rules require newly built fossil fuel-fired EGUs, along with those undergoing modification or reconstruction, to meet CO2 performance standards based on a combination of best operating practices and equipment upgrades. EPA established separate performance standards for two types of EGUs: stationary combustion turbines, typically natural gas; and electric utility steam generating units, typically coal.

With respect to existing power plants, EPA’s recently finalized “Clean Power Plan” imposes state-specific goals or targets to achieve reductions in CO2 emission rates from existing EGUs measured from a 2012 baseline. In a significant change from the proposed rule, EPA’s final performance standards apply directly to specific units based upon their fuel-type and configuration (i.e., coal- or oil-fired steam plants versus combined cycle natural gas plants). As such, each state’s goal is an emissions performance standard that reflects the fuel mix employed by the EGUs in operation in those states. The final rule provides guidelines to states to help develop their plans for meeting the interim (2022-2029) and final (2030 and beyond) emission performance standards, with three distinct compliance periods within that timeframe. States were originally required to submit their plans to EPA by September 2016, with an optional two-year extension provided to states establishing a need for additional time; however, this timing will be impacted by the court-imposed stay described below.

Prior to the court-imposed stay described below, ADEQ, with input from a technical working group comprised of Arizona utilities and other stakeholders, was working to develop a compliance plan for submittal to EPA. Since the imposition of the stay, ADEQ is continuing to assess alternatives while completing outreach and soliciting feedback from stakeholders. In addition to these ongoing state proceedings, EPA has taken public comments on proposed model rules and a proposed federal compliance plan, which included consideration as to how the Clean Power Plan will apply to EGUs on tribal land such as the Navajo Nation.

The legality of the Clean Power Plan is being challenged in the U.S. Court of Appeals for the D.C. Circuit; the parties raising this challenge include, among others, the ACC. On February 9, 2016, the U.S.

19

Supreme Court granted a stay of the Clean Power Plan pending judicial review of the rule, which temporarily delays compliance obligations under the Clean Power Plan. We cannot predict the extent of the delay.

With respect to our Arizona generating units, we are currently evaluating the range of compliance options available to ADEQ, including whether Arizona deploys a rate- or mass-based compliance plan. Based on the fuel-mix and location of our Arizona EGUs, and the significant investments we have made in renewable generation and demand-side energy efficiency, if ADEQ selects a rate-based compliance plan, we believe that we will be able to comply with the Clean Power Plan for our Arizona generating units in a manner that will not have material financial or operational impacts to the Company. On the other hand, if ADEQ selects a mass-based approach to compliance with the Clean Power Plan, our annual cost of compliance could be material. These costs could include costs to acquire mass-based compliance allowances.

As to our facilities on the Navajo Nation, EPA has yet to determine whether or to what extent EGUs on the Navajo Nation will be required to comply with the Clean Power Plan. EPA has proposed to determine that it is necessary or appropriate to impose a federal plan on the Navajo Nation for compliance with the Clean Power Plan. In response, we filed comments with EPA advocating that such a federal plan is neither necessary nor appropriate to protect air quality on the Navajo Nation. If EPA reaches a determination that is consistent with our preferred approach for the Navajo Nation, we believe the Clean Power Plan will not have material financial or operational impacts on our operations within the Navajo Nation.

Alternatively, if EPA determines that a federal plan is necessary or appropriate for the Navajo Nation, and depending on our need for future operations at our EGUs located there, we may be unable to comply with the federal plan unless we acquire mass-based allowances or emission rate credits within established carbon trading markets, or curtail our operations. Subject to the uncertainties set forth below, and assuming that EPA establishes a federal plan for the Navajo Nation that requires carbon allowances or credits to be surrendered for plan compliance, it is possible we will be required to purchase some quantity of credits or allowances, the cost of which could be material.

Because ADEQ has not issued its plan for Arizona, and because we do not know whether EPA will decide to impose a plan or, if so, what that plan will require, there are a number of uncertainties associated with our potential cost exposure. These uncertainties include: whether judicial review will result in the Clean Power Plan being vacated in whole or in part or, if not, the extent of any resulting compliance deadline delays; whether any plan will be imposed for EGUs on the Navajo Nation; the future existence and liquidity of allowance or credit compliance trading markets; the applicability of existing contractual obligations with current and former owners of our participant-owned coal-fired EGUs; the type of federal or state compliance plan (either rate- or mass-based); whether or not the trading of allowances or credits will be authorized mechanisms for compliance with any final EPA or ADEQ plan; and how units that have been closed will be treated for allowance or credit allocation purposes.

In the event that the incurrence of compliance costs is not economically viable or prudent for our operations in Arizona or on the Navajo Nation, or if we do not have the option of acquiring allowances to account for the emissions from our operations, we may explore other options, including reduced levels of output or potential plant closures, as alternatives to purchasing allowances. Given these uncertainties, our analysis of the available compliance options remains ongoing, and additional information or considerations may arise that change our expectations.

Company Response to Climate Change Initiatives. We have undertaken a number of initiatives that address emission concerns, including renewable energy procurement and development, promotion of programs and rates that promote energy conservation, renewable energy use, and energy efficiency. (See “Energy Sources and Resource Planning - Current and Future Resources” above for details of these plans and

20

initiatives.) APS currently has a diverse portfolio of renewable resources, including solar, wind, geothermal, biogas, and biomass, and we expect the percentage of renewable energy in our resource portfolio to increase over the coming years.

APS prepares an inventory of GHG emissions from its operations. This inventory is reported to EPA under the EPA GHG Reporting Program and is voluntarily communicated to the public in Pinnacle West’s annual Corporate Responsibility Report, which is available on our website (www.pinnaclewest.com). The report provides information related to the Company and its approach to sustainability and its workplace and environmental performance. The information on Pinnacle West’s website, including the Corporate Responsibility Report, is not incorporated by reference into or otherwise a part of this report.

EPA Environmental Regulation

Regional Haze Rules. In 1999, EPA announced regional haze rules to reduce visibility impairment in national parks and wilderness areas. The rules require states (or, for sources located on tribal land, EPA) to determine what pollution control technologies constitute the BART for certain older major stationary sources, including fossil-fired power plants. EPA subsequently issued the Clean Air Visibility Rule, which provides guidelines on how to perform a BART analysis.

The Four Corners and Navajo Plant participants’ obligations to comply with EPA’s final BART determinations (and Cholla’s obligations to comply with ADEQ’s and EPA’s determinations), coupled with the financial impact of potential future climate change legislation, other environmental regulations, and other business considerations, could jeopardize the economic viability of these plants or the ability of individual participants to continue their participation in these plants.

Cholla. APS believes that EPA’s original 2012 final rule establishing controls constituting BART for Cholla, which would require installation of selective catalytic reduction ("SCR") controls with a cost to APS of approximately $100 million is unsupported and that EPA had no basis for disapproving Arizona’s State Implementation Plan ("SIP") and promulgating a Federal Implementation Plan ("FIP") that is inconsistent with the state’s considered BART determinations under the regional haze program. Accordingly, on February 1, 2013, APS filed a Petition for Review of the final BART rule in the United States Court of Appeals for the Ninth Circuit. Briefing in the case was completed in February 2014.

In September 2014, APS met with EPA to propose a compromise BART strategy. Pending certain regulatory approvals, APS would permanently close Cholla Unit 2 and cease burning coal at Units 1 and 3 by the mid-2020s. (See Note 3 for details related to the resulting regulatory asset.) APS made the proposal with the understanding that additional emission control equipment is unlikely to be required in the future because retiring and/or converting the units as contemplated in the proposal is more cost effective than, and will result in increased visibility improvement over, the current BART requirements for NOx imposed on the Cholla units under EPA's BART FIP. APS’s proposal involves state and federal rulemaking processes. In light of these ongoing administrative proceedings, on February 19, 2015, APS, PacifiCorp (owner of Cholla Unit 4), and EPA jointly moved the court to sever and hold in abeyance those claims in the litigation pertaining to Cholla pending regulatory actions by the state and EPA. The court granted the parties' unopposed motion on February 20, 2015.

On October 16, 2015, ADEQ issued a revised operating permit for Cholla, which incorporates APS's proposal, and subsequently submitted a proposed revision to the SIP to the EPA, which would incorporate the new permit terms. On June 30, 2016, EPA issued a proposed rule approving a revision to the Arizona SIP that incorporates APS’s compromise approach for compliance with the Regional Haze program. EPA signed the final rule approving the Agency's proposal on January 13, 2017. Once the final rule is published in the Federal Register, parties have 60 days to file a petition for review in the Ninth Circuit Court of Appeals. APS cannot

21

predict at this time whether such petitions will be filed or if they will be successful. In addition, under the terms of an executive memorandum issued on January 20, 2017, this final rule will not be published in the Federal Register until after it has been reviewed by an appointee of the President. We cannot predict when such review will occur and what may result from the additional review.

Four Corners. Based on EPA’s final standards, APS estimates that its 63% share of the cost of required controls for Four Corners Units 4 and 5 would be approximately $400 million. In addition, APS and El Paso entered into an asset purchase agreement providing for the purchase by APS, or an affiliate of APS, of El Paso's 7% interest in Four Corners Units 4 and 5. 4CA purchased the El Paso interest on July 6, 2016. NTEC has the option to purchase the interest within a certain timeframe pursuant to an option granted to NTEC. In December 2015, NTEC provided notice of its intent to exercise the option. The cost of the pollution controls related to the 7% interest is approximately $45 million, which will be assumed by the ultimate owner of the 7% interest.