UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

|

|

|

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

J.B. HUNT TRANSPORT SERVICES, INC.

615 J.B. Hunt Corporate Drive

Lowell, Arkansas 72745

479-820-0000

Internet Site: jbhunt.com

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 27, 2023

The Annual Meeting of Stockholders of J.B. Hunt Transport Services, Inc. (the Company) will be held April 27, 2023, at 10 a.m. (CDT) at the Company’s headquarters, located at 615 J.B. Hunt Corporate Drive in Lowell, Arkansas, for the following purposes:

To elect Directors for a term of one (1) year |

To consider and approve an advisory resolution regarding the Company’s compensation of its named executive officers |

To consider and act upon an advisory vote to determine the frequency with which stockholders will consider and approve an advisory vote on the Company’s compensation of its named executive officers |

||

To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the 2023 calendar year |

To transact such other business as may properly come before the Annual Meeting or any adjournments thereof |

Only stockholders of record on February 21, 2023, will be entitled to vote at the meeting or any adjournments thereof.

The stock transfer books will not be closed.

The 2022 Annual Report to Stockholders is included in this publication.

|

By Order of the Board of Directors

JENNIFER R. BOATTINI Corporate Secretary Lowell, Arkansas March 16, 2023 |

|

J.B. HUNT TRANSPORT SERVICES, INC. Notice of Annual Meeting |

|

2022 Proxy Statement Summary |

YOUR VOTE IS IMPORTANT

PLEASE EXECUTE YOUR PROXY WITHOUT DELAY

J.B. HUNT TRANSPORT SERVICES, INC.

615 J.B. Hunt Corporate Drive

Lowell, Arkansas 72745

479-820-0000

Internet Site: jbhunt.com

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by J.B. Hunt Transport Services, Inc. (the Company), on behalf of its Board of Directors (the Board), for the 2023 Annual Meeting of Stockholders (the Annual Meeting). The Proxy Statement and the related proxy materials are being released to our stockholders on or about March 16, 2023.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERS MEETING TO BE HELD APRIL 27, 2023

This Proxy Statement and our 2022 Annual Report to Stockholders, which includes our Annual Report on Form 10-K, are available at jbhunt.com.

On or about March 16, 2023, we will mail a Notice of Internet Availability of Proxy Materials to our stockholders containing instructions on how to access our proxy materials, including this Proxy Statement and our 2022 Annual Report to Stockholders, and voting instructions on the internet, as well as instructions on how stockholders may obtain a paper copy of the proxy materials by mail. You may follow the instructions on the Notice of Internet Availability of Proxy Materials, then access our proxy materials and vote your shares over the internet. If you request a paper copy of the proxy materials and choose to vote by mail, please complete, sign, date and promptly return the accompanying proxy card in the enclosed addressed postage-paid envelope that will be provided to you in response to your request, even if you plan to attend the Annual Meeting. Please keep the Notice of Internet Availability of Proxy Materials for your reference through the meeting date.

PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING

|

Item |

Board Recommendations |

Further |

|

Election of Directors |

FOR |

Page 17 |

|

Advisory Vote on Executive Compensation |

FOR |

Page 75 |

|

Advisory Vote on Frequency of Approval of Executive Compensation |

ONE YEAR |

Page 77 |

|

Ratification of Independent Registered Public Accounting Firm |

FOR |

Page 80 |

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

1 |

| Proxy Statement Summary |

YOU SHOULD CAREFULLY READ THIS PROXY STATEMENT IN ITS ENTIRETY

The summary information provided above is for your convenience only and is merely a brief description of material information contained in this Proxy Statement.

YOUR VOTE IS IMPORTANT

IF YOU ARE A REGISTERED OWNER, YOU MAY VOTE BY INTERNET OR BY REQUESTING A COPY OF PROXY MATERIALS AND COMPLETING, SIGNING, AND DATING A PROXY CARD AND RETURNING IT TO US AS PROMPTLY AS POSSIBLE IN THE ACCOMPANYING ENVELOPE OR USING THE TELEPHONE OPTION THAT WILL BE PROVIDED IN RESPONSE TO YOUR REQUEST

IF YOU ARE A BENEFICIAL OWNER, PLEASE FOLLOW THE VOTING INSTRUCTIONS OF YOUR BROKER, BANK, OR OTHER NOMINEE AS PROVIDED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

DIRECTOR NOMINEES

|

Name |

Occupation |

Age |

Director Since |

Independent |

Other Current Directorships with Publicly Held Companies |

Committees Upon Election |

|

Francesca M. Edwardson |

American Red Cross of Chicago & Northern Illinois (retired) |

65 |

2011 |

Yes |

Duluth Holdings, Inc. |

Audit |

|

Wayne Garrison |

J.B. Hunt Transport Services, Inc. (retired) |

70 |

1981 |

No |

||

|

Sharilyn S. Gasaway |

Alltel Corp. (retired) |

54 |

2009 |

Yes |

Genesis Energy, LP |

Audit (Chair) Corporate Governance |

|

Thad Hill |

Calpine Corporation |

55 |

2021 |

Yes |

Compensation (Chair) |

|

|

Bryan Hunt, Jr. |

Hunt Automotive Group |

64 |

1991 |

No |

||

|

Persio Lisboa |

Navistar, Inc. (retired) |

57 |

— |

Yes |

James Hardie Industries plc |

Audit Corporate Governance |

|

John N. Roberts, III |

Chief Executive Officer |

58 |

2010 |

No |

||

|

James L. Robo |

Private Investor |

60 |

2002 |

Yes |

Compensation |

|

|

Kirk Thompson

|

Chairman of the Board |

69 |

1985 |

No |

| 2 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

| Proxy Statement Summary |

Compensation Objectives, Principles and Practices

Compensation Objectives, Principles and Practices

We believe the ability to attract, retain and provide appropriate incentives for the senior executive officers and other key employees of the Company is essential to maintaining the company’s leading competitive position, thereby providing for the long-term success of the Company. The overall compensation philosophy of the Company’s Board of Directors and management is guided by the following principles:

|

Recruitment and Retention |

Short-term Incentive |

|

The Company aims to attract, motivate and retain high-performing diverse talent to achieve and maintain a leading position in our industry. Our total compensation package should be strongly competitive with other transportation and logistics companies. |

A large portion of total compensation should be tied to Company performance, and therefore at risk, as position and responsibility increase. Individuals with greater roles and the ability to directly impact strategic direction and long-term results should bear a greater portion of the risk. |

|

Performance and Responsibility |

Long-term Incentive |

|

Total compensation should be tied to and vary with performance and responsibility, both at the Company and individual levels, in achieving financial, operational and strategic objectives. Differentiated pay for high-performing individuals should be proportional to their contributions to the Company’s success. |

Awards of long-term compensation encourage participating employees to focus on the Company’s long-range growth and development and incent them to manage from the perspective of stockholders with a meaningful stake in the Company, as well as focus on long-term career orientation. |

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

3 |

| Proxy Statement Summary |

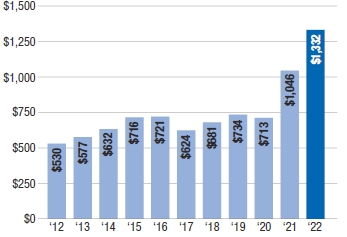

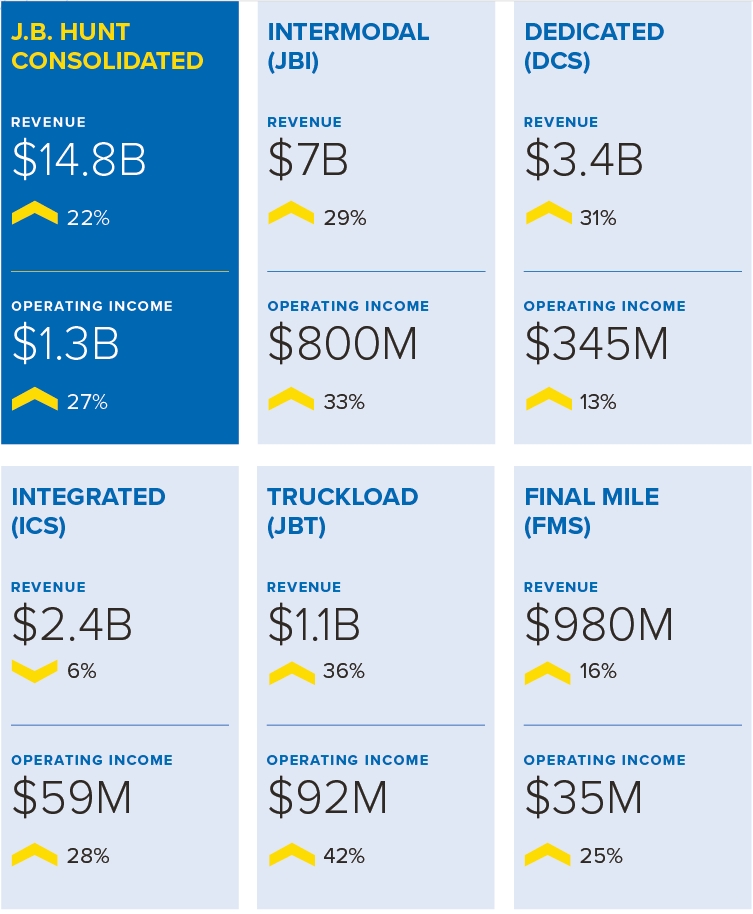

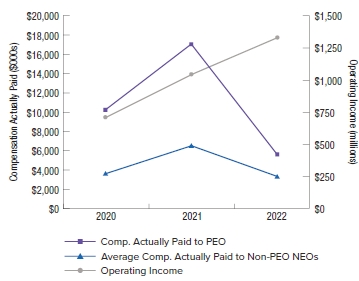

2022 BUSINESS HIGHLIGHTS

Consolidated Revenue

(in millions)

|

Consolidated Operating Income

|

Diluted EPS |

|

|

|

| 4 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

| Proxy Statement Summary |

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

5 |

| Proxy Statement Summary |

J.B. Hunt Corporate Responsibility

J.B. Hunt Corporate Responsibility

Overview/Mission Statement

2022 marked 61 years of doing business. Both reflection and foresight reveal that our success rests on our employees navigating the complexities of the supply chain and creating value for customers by eliminating waste, reducing costs, establishing strong relationships and delivering exceptional service. In the industry, we’re the people you trust with the technology that empowers and capacity to deliver. The Board and Management recognize that the balance of sound corporate governance combined with environmental and social responsibility is the soil where healthy, sustainable business grows. This model offers benefits for all stakeholders. Our priorities are apparent in our key areas of foundations - people, technology and capacity. We understand the honor of being an industry leader comes with the responsibility to keep roadways and employees safe, which we do not take for granted. It has also become increasingly important that we not only recognize the diversity throughout our value chain but create a lasting culture of inclusion that celebrates and encourages diversity in its many forms. Additionally, we feel the urgency to focus on reducing our carbon footprint and uphold our role as good stewards of the environment. Being at the forefront of the latest technology empowers us to significantly improve both our efficiency and safety. We believe that this work contributes to the success of our customers, raises the bar in our industry and gives our employees a shared purpose, which creates value for all our stakeholders. We aim to seek out and implement long-term strategies that positively shift the trajectory of the industry and, in turn, help us to accomplish our mission: to create the most efficient transportation network in North America.

Sustainability

We continued to make progress in our sustainability journey and explore sustainable solutions. Our willingness to embrace a spirit of curiosity and champion diverse perspectives fuels innovation while remaining customer-focused keeps us grounded. Our sustainability journey started before the word sustainability was popular and we continue to take steps to increase our efforts to share that story with our stakeholders. In 2019, the executive management team advanced these efforts with the establishment of our Sustainability Committee led by our then Chief Operations Officer, Craig Harper. Mr. Harper was named our Chief Sustainability Officer in November 2020. In 2021, under the direction of Mr. Harper and with the help of many others, J.B. Hunt was able to successfully launch its first ever Sustainability Report in accordance with the Global Reporting Initiative (GRI) Standard and in alignment with the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD) frameworks. The Sustainability Committee is comprised of a diverse group of employees responsible for identifying opportunities to advance our measurement, management and disclosure of our sustainability efforts. The work of this group helps identify and mitigate risks such as climate-related risks and other topics within the social and governance aspects of sustainability, including diversity and sustainable procurement. Members of the Committee regularly present to our Nominating and Corporate Governance Committee on the Company’s efforts and investments made to reduce our greenhouse gas (GHG) emissions as part of its oversight of fossil fuel efficiency and progress on reducing the Company’s environmental impact.

| 6 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

| Proxy Statement Summary |

Environmental Matters

The Company recognizes that reducing GHG emissions in our business is important to our stockholders, our customers, the communities we serve, the global environment and ultimately the future success of our Company. Increasingly, our customers are making environmental responsibility a priority in their business decision-making, and the same is true for the Company. We’ve worked hard to create solutions to reduce carbon emissions and maintain sound environmental and social responsibility while reducing costs and meeting or exceeding our customers’ operational needs. Our business strategy continues to work toward and prepare for the low carbon transition.

We remain encouraged by the advancements being made with alternative fuel vehicles and we believe that they have the potential to significantly reduce our Scope 1 emissions. However, until economically viable alternatives are available, challenges to further reduce our total carbon emissions include but are not limited to the availability of commercial diesel-powered equipment, a robust charging infrastructure and our ability to convert over-the-road (OTR) shipments to rail through our intermodal service offering, which on average reduces a shipment’s carbon footprint by 60% versus highway truck transportation.

As fossil fuels represent a significant component of operating costs, management is continually working to minimize the volume used, such as adopting the most advanced technologies provided from original equipment manufacturers (OEMs), utilizing aftermarket products to reduce fuel burn, adopting policies to incentivize reduced fuel burn and assisting manufacturers in developing commercially viable alternative fuel sources.

The Company recognizes that reducing our carbon footprint is a continuous journey, and we believe the following items support our commitment to reducing our environmental impact:

Ambitious Goal to Reduce Carbon Emission Intensity 32% by 2034

In November, J.B. Hunt announced a new goal to reduce our carbon emission intensity 32% by 2034 (baseline 2019). This goal advances the Company’s sustainability vision of moving the freight industry towards a low-carbon future while holding true to our customer commitment of providing efficient, quality-driven, competitive supply chain solutions for moving freight.

Specifically, we will focus on three key areas to reach our emission-reduction target by 2034:

|

● |

Incorporating alternative powered equipment into our fleet |

|

● |

Expanding the use of biogenic fuels |

|

● |

Improving fuel economy |

| Achieving the company’s ambitious target is dependent on significant progress with the development and availability of new industry technology and the infrastructure needed to enable day-to-day use on an industry-wide scale. The Company plans to encourage, support and monitor the advancements needed to achieve its goal. |

|

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

7 |

| Proxy Statement Summary |

Championing Intermodal Conversion

J.B. Hunt operates North America’s largest industry-leading intermodal business. Converting OTR shipments to intermodal service is safer, 2.5 times more fuel efficient than standard truck transport, cost effective and environmentally friendly. We estimate that in 2022, our intermodal segment helped to avoid 3.6 million MT CO2e* compared to transportation by truck alone – the equivalent of:

|

● |

95,585,384 urban tree seedlings planted and grown for 10 years* |

|

● |

794,094 passenger vehicles off the roads for one year* |

|

● |

470,574 average U.S. homes’ total annual energy consumption* |

* https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator#results

Based on analysis of Shipper 360°® transactions and our annual bid activity, J.B. Hunt estimates that an additional 7 to 11 million shipments could be converted to intermodal, generating further carbon reductions, while supporting long-term growth opportunities for our intermodal business.

|

In 2022, J.B. Hunt and BNSF Railway announced a joint effort to substantially improve capacity in the intermodal marketplace. As part of the initiative, J.B. Hunt announced plans to grow our intermodal fleet to as many as 150,000 containers in the next three to five years. We have surpassed 115,000 containers and are in a great position to commit more intermodal capacity and industry-leading service to our customers.

* The rail industry doesn’t release its operational efficiencies until April, which is after this report will be published. Our metric above for intermodal savings was calculated using its 2021 operating efficiencies. |

Carbon-Neutral Shipping Program

In 2022, J.B. Hunt launched CLEAN Transport™, a carbon-neutral program that provides our intermodal customers an easy and flexible method to acquire carbon offset credits equivalent to the emissions produced by their shipments. To extend the emissions reduction achieved through intermodal conversion, a shipment’s remaining emissions are offset with carbon offset credits. The program is designed to be highly customizable to fit each customer’s unique business and sustainability goals.

Renewable Technology

J.B. Hunt invests in renewable technology solutions. Company assets are equipped with solar-powered tracking units that allow us to optimize the usage of trailing equipment and other resources by providing the most accurate information regarding the location and status of the units. This technology allows J.B. Hunt to increase the efficiency of its assets, reduce empty miles and costs and gain better control over its operations.

Energy-Efficient Trucks and Equipment

We maintain a modern fleet with an average truck age of only 2.6 years as compared to the ~5.4-year industry average. Modernization ensures that we maintain the latest in emission reduction technologies. We also spec our equipment to maximize fuel efficiency with features including aerodynamic packages for both tractors and trailers, governor to limit speed and improve fuel efficiency, idle-reducing cab heaters and automatic manual transmissions (AMTs) that all contribute to improved fuel economy.

| 8 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

| Proxy Statement Summary |

Fuel Technology

Fuel is one of the largest sources of carbon emissions within the supply chain. We strive to find advanced fuel solutions for customers, including the use of biofuels and ensuring the fuel efficiency of our fleets. In 2022, 48% of all fuel purchased was a bio-blended diesel product or renewable diesel. The Company’s total weighted average of fuel from renewable sources was 17%.

Engineering for Efficiency

J.B. Hunt has a dedicated engineering team that helps customers optimize their shipping strategy to minimize total miles, maximize payload, and reduce carbon emissions per shipment.

CLEAN Transport™ Carbon Calculator

J.B. Hunt’s proprietary tool calculates a customer’s carbon footprint. We then offer mode conversion solutions, displaying how much carbon reduction can be achieved by converting a load to an intermodal shipment.

Carbon Diet

We provide support to customers with a company developed sustainability practice called the “Carbon Diet.” We educate customers on best practices in supply chain sustainability and supply the resources needed to be successful. The primary components include the use of biogenic fuels, mode conversion, route optimization, the optimized fuel efficiency of our diesel fleet and the exploration and calculated potential impact of alternative vehicles.

Alternative Vehicles

We continually seek and evaluate opportunities to utilize emerging technologies in the area of exhaust-free vehicles. In the fourth quarter of 2022, we took delivery of our first company-owned Class 8 electric Freightliner eCascadia truck. And in 2017, we were one of the first companies to place an order for an all-electric heavy-duty Class 8 truck. We continue to participate with the Daimler Electric Vehicle Council and the ACT Fleet Forum to contribute to further progress in the years ahead regarding the availability, commercial viability and infrastructure required to run alternative fuel trucks.

|

Advocacy and Education J.B. Hunt believes that by sharing knowledge, we can empower and encourage progress in the sustainability of our industry. In 2022, we participated in many sustainability-focused engagements, including the ACT Expo, General Electric’s Cutting Carbon podcast, the Road to Autonomy podcast, RILA’s panel discussion on creating sustainable supply chains, and the Arkansas Council on Future Mobility. These are just a few examples among the many ways we hope to support innovation and drive progress in sustainable transportation technology. |

|

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

9 |

| Proxy Statement Summary |

Social Matters

J.B. Hunt recognizes that operating a successful, sustainable business means acknowledging and addressing important and relevant social issues with sincerity. As a company, we support numerous initiatives in many ways that reflect the values most important to our employees, customers, and the communities where we operate. With over 37,000 J.B. Hunt employees across North America (~24,000 of which are our truck drivers), we believe our focus on safety, career development, fostering a diverse and inclusive workplace and giving back to the communities we serve are among our highest priorities.

Public Safety

Our commitment to safety, which is a cornerstone of our business, has empowered us to provide best-in-class service to our customers. Keeping the roads safe for our drivers and the motoring public is important to us as a key social responsibility and as a business concern. We train drivers extensively to understand and comply with all required safety measures. J.B. Hunt has made considerable investments in safety over the last two decades because first and foremost, it is the right thing to do, and it is an investment with almost immeasurable returns. We share the road with millions of people across the country every day, and our success depends on keeping those roads as safe as possible for everyone. In addition to complying with industry-relevant laws and mandates, J.B. Hunt makes its contribution to public road safety in a variety of ways — driver training, drug testing and investing in technologies that make drivers and equipment safer. We have continuously maintained a satisfactory safety rating from the Federal Motor Carrier Safety Administration (FMCSA) since 1992. Our out-of-service (OOS) rates for vehicle, driver and HAZMAT fall substantially below reported national averages in the FMCSA’s Safety and Fitness Electronic Records (SAFER) System. In CSA (Compliance, Safety, Accountability), our 2022 safety performance falls below the threshold of FMCSA’s on-road safety performance BASICs (Behavior Analysis and Safety Improvement Categories) in all categories. Public safety is further promoted through smart purchasing decisions. As new safety technologies are made available, we carefully evaluate each to determine the overall impact and benefit they could bring to our drivers, trucks and equipment.

Our commitment to safety, which is a cornerstone of our business, has empowered us to provide best-in-class service to our customers. Keeping the roads safe for our drivers and the motoring public is important to us as a key social responsibility and as a business concern. We train drivers extensively to understand and comply with all required safety measures. J.B. Hunt has made considerable investments in safety over the last two decades because first and foremost, it is the right thing to do, and it is an investment with almost immeasurable returns. We share the road with millions of people across the country every day, and our success depends on keeping those roads as safe as possible for everyone. In addition to complying with industry-relevant laws and mandates, J.B. Hunt makes its contribution to public road safety in a variety of ways — driver training, drug testing and investing in technologies that make drivers and equipment safer. We have continuously maintained a satisfactory safety rating from the Federal Motor Carrier Safety Administration (FMCSA) since 1992. Our out-of-service (OOS) rates for vehicle, driver and HAZMAT fall substantially below reported national averages in the FMCSA’s Safety and Fitness Electronic Records (SAFER) System. In CSA (Compliance, Safety, Accountability), our 2022 safety performance falls below the threshold of FMCSA’s on-road safety performance BASICs (Behavior Analysis and Safety Improvement Categories) in all categories. Public safety is further promoted through smart purchasing decisions. As new safety technologies are made available, we carefully evaluate each to determine the overall impact and benefit they could bring to our drivers, trucks and equipment.

Intermodal Conversion

J.B. Hunt leads the industry in converting OTR shipments to intermodal. We estimate the conversion of shipments from highway to rail has likely resulted in approximately 63 fewer truck-involved fatalities on our nation’s highways during 2022 (using industry average fatality rate per 100 million miles).

Defensive Driving Training

J.B. Hunt drivers are certified in a nationwide defensive driving program, involving classroom and in-vehicle training. All drivers are recertified on a regular basis.

Monthly and Quarterly Safety Training

Our drivers participate in regular web-based and classroom safety training. Ongoing driver development is designed to provide additional training for drivers, as well as keep them up to date on regulatory issues and company matters.

| 10 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

| Proxy Statement Summary |

Hair Testing

In 2006, J.B. Hunt implemented a policy requiring hair testing for the presence of controlled substances in addition to the U.S. Department of Transportation (DOT) required urine testing. In 2022, J.B. Hunt added Fentanyl to our hair testing panel. Management believes hair testing serves as a more accurate and stringent standard to base an individual’s habitual drug usage and has resulted in a material reduction in unfavorable results from random and post-accident drug tests.

Automatic Onboard Recording Devices/ELDs

We began implementing automatic onboard recording devices in 2007. As an early adopter of this technology, we have seen benefits in its ability to manage compliance with hours-of-service (HOS) regulations and reduce roadside inspection violations. J.B. Hunt remains compliant with the mandate requiring electronic logging devices in commercial vehicles.

Forward Collision Warning System

Installation of forward collision warning systems on our Class 8 tractors began in 2011. Currently, 95.8% of our company Class 8 fleet is deployed with this equipment, which includes an automatic emergency braking system. We have seen a significant reduction in rear-end collision frequency and costs since implementation of these systems.

Video Recording Technology

Installation of video-recording equipment began in 2016. Currently, 99.5% of our Class 8 fleet has forward-facing cameras installed. This equipment provides lane departure warnings and enhanced radar functionalities for some systems, such as braking on stationary objects and pedestrian detection. The primary benefit of this technology is improving driver safety performance.

Right-Side Blind Spot Detection

Based on positive driver feedback from testing potential new equipment features, J.B. Hunt has begun spec’ing equipment with right-side blind spot detection. We expect this technology to aid our drivers in avoiding right lane change, sideswipe and right turn collisions.

Truckers Against Trafficking

As the eyes and ears of the road, we want to empower everyone in the transportation industry to be part of the solution to combat human trafficking. J.B. Hunt launched Truckers Against Trafficking training in 2014 and has trained over 159,900 people to recognize and report signs of human trafficking. In 2021, the two organizations led a combatting human trafficking workshop at the University of Arkansas. Additionally, the Company became a signatory of the DOT’s Transportation Leaders Against Human Trafficking Pledge in 2020.

Million Mile Program

Million Mile Program

Our Million Mile Celebration has been a J.B. Hunt tradition since 2001, when we celebrate our company drivers who have reached one, two, three, four and five million accident-free miles. The company offers a safe-driving bonus, hosts several days of events and honors drivers in the Walk of Fame. Over the course of 2022, we recognized a total of 369 J.B. Hunt drivers for achieving 1, 2, 3, 4 and 5 million miles driven without a preventable accident.

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

11 |

| Proxy Statement Summary |

People Matters

Despite operating over 180,000 pieces of transportation equipment, our single greatest asset is our people. J.B. Hunt strives to provide a supportive and safe work environment for its employees where diverse and innovative ideas can be fostered to solve problems and provide value-added services for our customers. In addition to our employees, our customers, vendors and the communities where we operate also share diverse backgrounds and an equally diverse range of interests and passions. J.B. Hunt puts forth its best effort to support initiatives reflecting the company values that are shared with its stakeholders. In 2022, we renamed our Human Resources teams to People teams as a reflection of our people-first thinking.

Company Giving

Traditional philanthropic strategies often times rule out organizations that do not meet certain privileged criteria. J.B. Hunt is proud to promote disruptive philanthropy, which fractures existing giving values and applies new technologies and competitive charitable models to raise awareness about exclusion within traditional philanthropic strategies. J.B. Hunt is a champion for advocating for organizations that, in the past, have not received the recognition or opportunities that they may deserve. In 2022, company and employee contributions toward J.B. Hunt’s company pillars of Healthcare, Veterans, Crisis Management and Education exceeded $6.6 million.

Veterans Hiring and Support

J.B. Hunt remains committed to hiring and supporting military members. In 2020, the company achieved a six-year goal of hiring 10,000 veterans and has since pledged to hire 1,600 veterans per year. We also implemented several training and development programs, like our mentorship initiatives and our work with the Department of Defense’s SkillBridge Internship program, to provide support and resources for transitioning service members and their spouses. In 2021, J.B. Hunt was one of 15 recipients of the 2021 Secretary of Defense Employer Support Freedom Award, in recognition of our exemplary support for National Guard and Reserve employees. The Company was also ranked a top Military Friendly® Employer by VIQTORY for the 16th consecutive year in 2022. It was also our ninth consecutive year participating in Wreaths Across America, where J.B. Hunt delivered approximately 287,000 wreaths to veteran cemeteries nationwide. Additionally, we participated in a VETS Employer Roundtable in Washington, D.C. at the invitation of the Department of Labor.

J.B. Hunt remains committed to hiring and supporting military members. In 2020, the company achieved a six-year goal of hiring 10,000 veterans and has since pledged to hire 1,600 veterans per year. We also implemented several training and development programs, like our mentorship initiatives and our work with the Department of Defense’s SkillBridge Internship program, to provide support and resources for transitioning service members and their spouses. In 2021, J.B. Hunt was one of 15 recipients of the 2021 Secretary of Defense Employer Support Freedom Award, in recognition of our exemplary support for National Guard and Reserve employees. The Company was also ranked a top Military Friendly® Employer by VIQTORY for the 16th consecutive year in 2022. It was also our ninth consecutive year participating in Wreaths Across America, where J.B. Hunt delivered approximately 287,000 wreaths to veteran cemeteries nationwide. Additionally, we participated in a VETS Employer Roundtable in Washington, D.C. at the invitation of the Department of Labor.

Employee Healthcare

J.B. Hunt is committed to supporting the health of its workforce, which includes access to high quality benefits. In 2022, our selection of resources available was expanded to support the unique needs of our people and their families. To create a better work-life balance and enhance the experience of working mothers and fathers, we introduced new maternity and parental leave options that provided more flexibility to adoptive parents, expectant mothers and spouses. We know that expanding a family can look different for everyone, so fertility-specific benefits were added to all medical plans. By connecting employees and their families with Spring Health, confidential therapy sessions, personalized mental wellness plans and medication management with in-network providers were easily available. Ensuring that all members of our team feel supported is crucial to our culture, so alternative options for short-term and long-term disability were implemented for company drivers. J.B. Hunt benefit plans comply with all applicable laws.

| 12 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

| Proxy Statement Summary |

Office of Inclusion

J.B. Hunt actively seeks to build an inclusive workplace because we recognize the benefits that a broad spectrum of ideas, perspectives, skills, values, and beliefs bring to our operations every day. J.B. Hunt’s Office of Inclusion has four pillars that guide their work (connection & wellbeing, enablement, empowerment and brand & reach) and a multi-pronged strategy (office, driver, shop/warehouse). The team works to expand and lead our Enterprise Inclusion strategy and help foster a more inclusive culture at J.B. Hunt, including the formation of the Inclusion Council. The Inclusion Council, a group of influential senior leaders from across the company with a passion for inclusion, was established in 2022. The work of this group aims to ensure that inclusion remains a key component of creating an exceptional employee experience and drives how we do business.

Information Privacy Protection Program (IP3)

J.B. Hunt’s Information Privacy Protection Program (IP3) is designed to ensure the privacy of J.B. Hunt’s workers, customers, vendors, and other proprietary corporate information. Its mission is to employ privacy best practices in collection, usage, storage and disposal of information in compliance with applicable regulations and to foster a culture that values privacy through awareness. All non-driver personnel are required to complete IP3 training.

Employee Resource Groups (ERGs)

Our ERGs offer opportunities for employee professional development, community engagement, and networking. We were thrilled to continue to drive inclusion in 2022 with the launch of our sixth employee resource group, CAAPITAL, Cultivating Asian American Pacific Islanders Together as Leaders. By adding this group, we’re able to create a place for our Asian American and Pacific Islander employees to share ideas, experiences and mentorship. Comprised of groups for women, Latinos, veterans, African Americans and the LGBTQIA+ community and their allies, our ERGs promote camaraderie within the workforce and allow employees with similar interests to build meaningful work relationships that drive our strategy and impact business. We have more than 4,800 members of our ERGs.

Our ERGs offer opportunities for employee professional development, community engagement, and networking. We were thrilled to continue to drive inclusion in 2022 with the launch of our sixth employee resource group, CAAPITAL, Cultivating Asian American Pacific Islanders Together as Leaders. By adding this group, we’re able to create a place for our Asian American and Pacific Islander employees to share ideas, experiences and mentorship. Comprised of groups for women, Latinos, veterans, African Americans and the LGBTQIA+ community and their allies, our ERGs promote camaraderie within the workforce and allow employees with similar interests to build meaningful work relationships that drive our strategy and impact business. We have more than 4,800 members of our ERGs.

Elevating Employee Voices

Created in 2015, our ELEVATION initiative is a process to find, foster, and follow the ideas that make our company a better place by listening to our employees. Employees at any level, in any business group, or in any geographic location can submit ideas on any topic that they believe will make J.B. Hunt a better organization. All ideas are evaluated through a formal review process and since the program’s inception, more than 25,000 ideas have been submitted with over 1,000 being selected for implementation.

Shaping the Future of the Supply Chain Through Education

In 2022, we advanced our collaboration with the Walton College of Business at the University of Arkansas. In addition to the completion of a multiyear gift to the college, the program for studying supply chain was officially named the J.B. Hunt Transport Department of Supply Chain Management. These investments are creating opportunity for the next generation within our industry and beyond.

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

13 |

| Proxy Statement Summary |

J.B. Hunt and Walton College have worked closely together since the department was established, beginning with the J.B. Hunt Supply Chain University in 2014. In 2017 the two, along with the University of Arkansas College of Engineering created the J.B. Hunt Innovation Center of Excellence, made possible through a $2.75 million grant from J.B. Hunt. The combined effort brought researchers and students together with J.B. Hunt employees to develop solutions through innovative design and technology. In 2020, the two announced a $2.25 million collaboration to increase awareness of inclusion and diversity in transportation and logistics, and last year, J.B. Hunt created a $1 million endowed scholarship fund to encourage students to pursue supply chain careers and contribute to the college’s diverse educational environment.

Appreciation Bonuses to Frontline Employees

Our drivers and frontline employees go the extra mile to honor our commitments and meet the needs of customers. To express our gratitude, J.B. Hunt awarded nearly $9 million total in appreciation bonuses to full-time company drivers and full-time hourly maintenance and office employees as a way to recognize the contributions of these employees throughout 2022. In 2021, J.B. Hunt provided nearly $10 million in appreciation bonuses to company drivers, maintenance technicians and full-time hourly employees.

Career and Personal Development

J.B. Hunt provides many opportunities for career growth and professional development. In 2022, we implemented an expansive online library of courses from LinkedIn Learning, an industry leader in online training. This is in addition to our tuition reimbursement program, which allows employees to pursue relevant degree programs from accredited colleges or universities without. For employees or members of their families seeking to attain their CDL-A license, J.B. Hunt provides access to a CDL Tuition Assistance Program, allowing them to pursue a role as part of our fleet of world class drivers. With tuition reimbursement opportunities for full-time employees to paid internships, we’re proud to support development opportunities for our employees.

J.B. Hunt Scholarship Program for Families

We are proud to have launched our J.B. Hunt Scholarship Program for Families, which awarded a total of $250,000 in scholarships to 100 children and grandchildren of our employees from 60 locations across the country. The application-based scholarship program is available to dependent children or grandchildren of J.B. Hunt employees who currently attend or plan to attend an accredited two or four-year college, trade school or vocational school. Awards are renewable each year for up to four years as long as the recipient maintains a 2.5 GPA and full-time enrollment. Applications are open to family members of J.B. Hunt employees (director level and below) who have been employed by the company for at least one year.

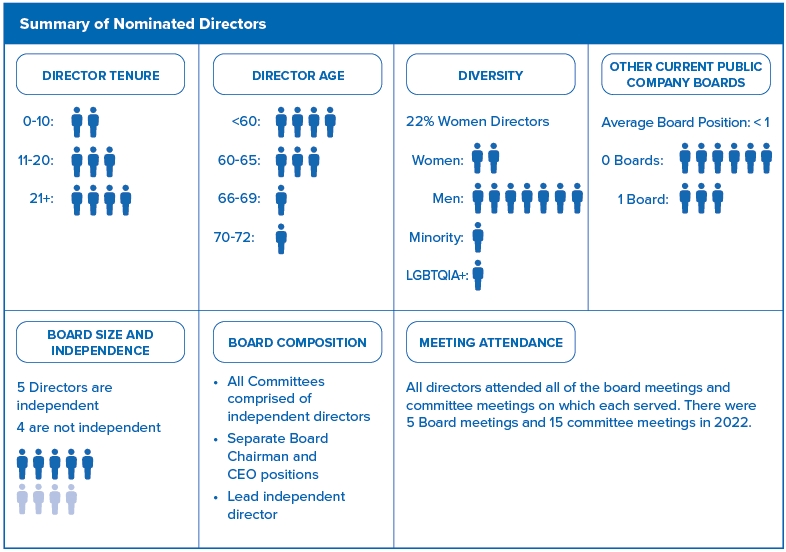

Governance Highlights

We believe that good corporate governance helps to ensure the Company is managed for the long-term benefit of all of our stakeholders and accordingly observe the following key corporate governance principles:

Director Independence

The Company maintains a Board of Directors comprised of a majority of individuals who satisfy the criteria for independence under the Nasdaq listing standards.

Lead Director and Independent Director Executive Sessions

Independent directors generally meet in executive session as part of each regularly scheduled Board meeting, with the position of Independent Lead Director being established to direct these executive sessions and authority to call additional meetings of independent directors as deemed necessary.

| 14 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

| Proxy Statement Summary |

Board Committees

The Company requires all committees of the Board be comprised solely of independent directors, and formal charters have been established outlining the purpose, composition, and responsibility of each committee, with all having authority to retain outside, independent advisors and consultants as needed.

Board Qualifications

The Board has established qualification guidelines for director nominees and performs continual evaluation of current director performance and qualifications.

Board Attendance and Overboarding

The Board has adopted formal Corporate Governance Guidelines, including director attendance expectations and requires limitations and preapproval of director membership on other corporate boards.

Board Diversity

The Board maintains diversity in both gender and ethnic representation by identifying nominees whose backgrounds, attributes and experiences taken as a whole will contribute to the high standards of Board service to the Company.

Code of Conduct

The Company has adopted a formal Code of Ethical and Professional Standards applicable to all directors, officers and employees of the Company.

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

15 |

| Proxy Statement Summary |

Accolades

J.B. Hunt operates in a highly competitive industry which requires an intense focus on continuous improvement across all aspects of the business. From introducing innovative and disruptive technologies that drive efficiencies in operations, to championing for enhancements to industry safety standards, we remain committed to our mission to create the most efficient transportation network in North America. In 2022, J.B. Hunt is proud to have been recognized with the following:

Recognitions

|

● |

Named Top Food Chain Provider by Food Chain Digest |

|

● |

Named Top 100 3PL for the thirteenth consecutive year by Inbound Logistics |

|

● |

Named Top 100 Trucker by Inbound Logistics for thirteenth consecutive year |

|

● |

Received multiple Quest for Quality Awards from Logistics Management |

|

● |

Ranked 1st on Transport Topics Top Dedicated Contract Carriers |

|

● |

Ranked 5th on Transport Topics Top 100 Logistics Companies |

|

● |

Ranked 4th on the Transport Topics’ Top 100 List of Largest For-Hire Carriers |

|

● |

Named Top 3PL & Cold Storage Provider from Food Logistics for tenth time |

|

● |

Named to the FreightTech 25 list for 2022 by FreightWaves |

|

● |

Ranked 2nd on Investor’s Business Daily’s Best ESG Companies list for 2022 |

|

● |

Named one of the World’s Most Admired Companies 2022 by Fortune Magazine |

|

● |

Named one of America’s Best Employers for Diversity 2022 by Forbes |

|

● |

Named one of America’s Best In-State Employers 2022 by Forbes |

|

● |

Named one of the Most Admired Arkansas Companies 2022 by Arkansas Money & Politics |

|

● |

Recognized again as a Top Company for Women to Work for in Transportation by Women In Trucking |

|

● |

Named Military Friendly Employer by VIQTORY for sixteenth consecutive year |

|

● |

Recognized for our sustainability efforts as part of BNSF’s 2022 Sustainability Awards |

|

● |

Received Norfolk Southern Thoroughbred Sustainability Partner Award |

|

● |

Named Top 75 Green Supply Chain Partner (G75) for twelfth consecutive year by Inbound Logistics |

| 16 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING

Proposal Number One

Election of Directors Election of Directors |

Our Board nominates Francesca M. Edwardson, Wayne Garrison, Sharilyn S. Gasaway, Thad Hill, Bryan Hunt, Persio Lisboa, John N. Roberts, III, James L. Robo, and Kirk Thompson as directors to hold office for a term of one year, expiring at the close of the 2024 Annual Meeting of Stockholders or until their successors are elected and qualified or until their earlier resignation or removal. The Board believes that these director nominees are well-qualified and experienced to direct and manage the Company’s operations and business affairs and will represent the interests of the stockholders as a whole. Biographical information on each of these nominees is set forth below in “Nominees for Director.”

Three of our current directors, Douglas G. Duncan, Gary C. George, and Gale V. King, will not stand for re-election to the Board upon the expiration of their terms at the 2023 Annual Meeting. The Board has reduced the number of director positions to nine, effective upon the election of directors at the Annual Meeting, and has nominated Persio Lisboa as a candidate to fill the resulting open position. If any director nominee becomes unavailable for election, which is not anticipated, the named proxies will vote for the election of such other person as the Board may nominate, unless the Board resolves to reduce the number of directors to serve on the Board and thereby reduce the number of directors to be elected at the Annual Meeting.

|

The Board of Directors unanimously recommends a vote FOR each of the director nominees listed herein

|

INFORMATION YOU NEED TO MAKE AN INFORMED DECISION

DIRECTORS AND EXECUTIVE OFFICERS OF THE COMPANY

Number of Directors and Term of Directors and Executive Officers

The Second Amended and Restated Bylaws of J.B. Hunt Transport Services, Inc., as amended (the Bylaws), provide that the number of directors shall not be less than three or more than 12, with the exact number to be fixed by the Board. In 2022, the Board consisted of eleven directors. On February 8, 2023, the Board voted to reduce the number of directors constituting the whole Board to nine directors, effective upon the election of directors at the 2023 Annual Meeting. Directors serve a term of one year from their election date to the Annual Meeting.

Directors are elected by a majority of votes cast with respect to each director, provided that the number of nominees does not exceed the number of directors to be elected.

At the Company’s Annual Meeting, the stockholders of the Company elect successors for directors whose terms have expired. The Board elects members to fill new membership positions and vacancies in unexpired terms on the Board. No director will be eligible to stand for re-election or be elected to a vacancy once he or she has reached 72 years of age. Executive officers are elected by the Board and hold office until their successors are elected and qualified or until their earlier death, retirement, resignation, or removal.

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

17 |

| Proposal 1 Election of Directors |

NOMINEES FOR DIRECTOR

Terms expire 2024

Francesca M. Edwardson

Francesca M. Edwardson

Age: 65

Director Since: 2011

Committees Upon Election: Audit Committee, Nominating and Corporate Governance Committee

Principal Occupation: American Red Cross of Chicago and Northern Illinois (retired)

Recommendation: The Board has determined that Ms. Edwardson continues to qualify to serve as a Director of the Company based on her lengthy and successful experience in both the transportation industry and legal environment, which provide respected insight and guidance to both the Board and management.

Experience: Ms. Edwardson retired as the Chief Executive Officer of the American Red Cross of Chicago and Northern Illinois, a business unit of the American Red Cross, in 2016, a position she held since 2005. She previously served as Senior Vice President and General Counsel for UAL Corporation, a predecessor company to United Airlines Holdings, Inc. She has also been a partner in the law firm of Mayer Brown and the Executive Director of the Illinois Securities Department. Ms. Edwardson is a graduate of Loyola University in Chicago, Illinois, holding degrees in economics and law.

Other Directorships - Publicly Held Companies (Prev. 5 Yrs.): Duluth Holdings, Inc. (Chair of Compensation Committee)

Other Directorships – Private Organizations: Rush University Medical Center, Lincoln Park Zoo (Chair of Nominating Committee, Board Chair- Elect)

Family Relationships: None

Wayne Garrison

Wayne Garrison

Age: 70

Director Since: 1981

Committees Upon Election: None

Principal Occupation: J.B. Hunt Transport Services, Inc. (retired)

Recommendation: The Board has determined that Mr. Garrison’s extensive experience in the industry and over 40 years with J.B. Hunt in multiple roles provides invaluable experience to the board and stockholders, qualifying him to continue to serve as a Director of the Company.

Experience: Mr. Garrison served as Chairman of the Board of the Company from 1995 to December 31, 2010, and continues to serve as a member of the Board of Directors. Joining the Company in 1976 as Plant Manager, Mr. Garrison has also served as Vice President of Finance in 1978, Executive Vice President of Finance in 1979, President in 1982, Chief Executive Officer in 1987 and Vice Chairman of the Board from January 1986 until May 1991.

Other Directorships - Publicly Held Companies (Prev. 5 Yrs.): None

Other Directorships – Private Organizations (Prev. 5 Yrs.): None

Family Relationships: None

| 18 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

|

Proposal 1

Election of Directors |

Sharilyn S. Gasaway

Sharilyn S. Gasaway

Age: 54

Director Since: 2009

Committees Upon Election: Audit Committee (Chair), Executive Compensation Committee, Nominating and Corporate Governance Committee

Principal Occupation: Alltel Corp. (retired)

Recommendation: The Board has determined that Ms. Gasaway’s experience in accounting, finance, mergers and acquisitions, and regulatory matters, all gained through her extended tenures within the financial environment, which provide unquestionable value to the Company, qualify her to continue to serve as a Director of the Company.

Experience: Ms. Gasaway served as Executive Vice President and Chief Financial Officer of Alltel Corp., the Little Rock, Arkansas-based Fortune 500 wireless carrier, from 2006 to 2009. She was part of the executive team that spearheaded publicly traded Alltel’s transition through the largest private equity buyout in the telecom sector and was an integral part of the successful combination of Alltel and Verizon. She also served as Alltel’s Corporate Controller and Principal Accounting Officer from 2002 to 2006. Joining Alltel in 1999, she served as Director of General Accounting, Controller, and Vice President of Accounting and Finance. Prior to joining Alltel, she worked for eight years at Arthur Andersen LLP. Ms. Gasaway has a degree in accounting from Louisiana Tech University and is a Certified Public Accountant.

Other Directorships - Publicly Held Companies (Prev. 5 Yrs.): Genesis Energy, LP (Chair of Audit Committee), Waddell & Reed Financial, Inc. (Chair of Audit Committee) (No longer publicly traded)

Other Directorships – Private Organizations (Prev. 5 Yrs.): Louisiana Tech University Foundation, Louisiana Tech University College of Business Advisory Board, Arkansas Children’s, Inc., Arkansas Children’s Foundation

Family Relationships: None

Thad (John B., III) Hill

Thad (John B., III) Hill

Age: 55

Director Since: 2021

Committees Upon Election: Executive Compensation Committee (Chair), Nominating and Corporate Governance Committee

Principal Occupation: Calpine Corporation

Recommendation: The Board has determined that Mr. Hill’s expertise in financial and capital markets and experience leading a diverse and geographically dispersed workforce qualify him to serve as a Director of the Company.

Experience: Mr. Hill is President and Chief Executive Officer for Calpine Corporation (Calpine), one of the nation’s largest independent competitive power companies, operating power plants and retail businesses in 22 states and Ontario, Canada. Mr. Hill has led Calpine since 2014, when he was promoted from President and Chief Operating Officer to his current position. Prior to joining Calpine, he was Executive Vice President of NRG Energy and President of NRG Texas, where he was responsible for NRG’s largest regional business. Mr. Hill received his bachelor of arts degree from Vanderbilt University magna cum laude and his master of business administration degree from the Amos Tuck School of Dartmouth College, where he was elected an Edward Tuck Scholar.

Other Directorships - Publicly Held Companies (Prev. 5 Yrs.): Calpine Corporation (No longer publicly traded)

Other Directorships – Private Organizations (Prev. 5 Yrs.): Amos Tuck School of Dartmouth College, Episcopal High School, Greater Houston Partnership

Family Relationships: None

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

19 |

|

Proposal 1

Election of Directors |

Bryan Hunt

Bryan Hunt

Age: 64

Director Since: 1991

Committees Upon Election: None

Principal Occupation: Hunt Automotive Group

Recommendation: The Board has determined that Mr. Hunt’s historical and current knowledge of the company and valuable contributions to the Board of J.B. Hunt since 1991 continue to qualify him to serve as a Director of the Company.

Experience: Mr. Hunt served as an employee of the Company from 1983 through 1997. He is the Managing Member of Progressive Car Finance, a private company that provides financing for automobile dealers; and 71B Auto Auction and 71B Mobile Auto Auction, both private companies engaged in the auction of automobiles, trucks, boats, and other motor vehicles to dealers and the general public in Arkansas and Kansas. A graduate of the University of Arkansas, he has degrees in marketing and transportation.

Other Directorships - Publicly Held Companies (Prev. 5 Yrs.): None

Other Directorships – Private Organizations (Prev. 5 Yrs.): The New School

Family Relationships: Son of co-founders J.B. and Johnelle Hunt

Persio Lisboa

Persio Lisboa

Age: 57

New Director Candidate

Committees Upon Election: Audit Committee, Nominating and Corporate Governance Committee

Principal Occupation: Navistar, Inc. (retired)

Recommendation: The Board has determined that Mr. Lisboa’s business and financial expertise and experience leading a large global company qualify him to serve as a Director of the Company.

Experience: Mr. Lisboa retired as President and CEO of Navistar, Inc., a global original equipment manufacturer in the transportation industry in October 2021. Prior to his ultimate leadership role of the company, Mr. Lisboa’s 35-year career with Navistar included management positions in sales and marketing, manufacturing, supply chain, and procurement within both domestic and international operations. Mr. Lisboa is a graduate of Pontifícia Universidade Católica de São Paulo where he received a Bachelor of Science degree in business administration with a marketing specialization.

Other Directorships - Publicly Held Companies (Prev. 5 Yrs.): James Hardie Industries plc (Chairman of Remuneration Committee), Broadwind Energy, Inc.

Other Directorships – Private Organizations (Prev. 5 Yrs.): None

Family Relationships: None

| 20 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

|

Proposal 1

Election of Directors |

John N. Roberts, III

John N. Roberts, III

Age: 58

Director Since: 2010

Committees Upon Election: None

Principal Occupation: J.B. Hunt Transport Services, Inc.

Recommendation: The Board has determined that Mr. Roberts continues to qualify to serve as a Director of the Company based on his continual success while serving as the Company’s current Chief Executive Officer.

Experience: Mr. Roberts is the Company’s Chief Executive Officer, a role he has held since 2010. A graduate of the University of Arkansas, he served as Chief Executive Officer and President of the Company from 2010 to 2022 and as Executive Vice President and President of Dedicated Contract Services from 1997 to December 31, 2010. Joining the Company in 1989, he began his career as a Management Trainee and subsequently served as an EDI Services Coordinator, Regional Marketing Manager for the Intermodal and Truckload business units, Business Development Executive for DCS, and Vice President of Marketing Strategy for the Company.

Other Directorships - Publicly Held Companies (Prev. 5 Yrs.): None

Other Directorships – Private Organizations (Prev. 5 Yrs.): Federal Reserve Bank of St. Louis, Arkansas Children’s Northwest

Family Relationships: None

James L. Robo

James L. Robo

Age: 60

Director Since: 2002

Committees Upon Election: Nominating and Corporate Governance Committee (Chair), Executive Compensation Committee, Independent Lead Director

Principal Occupation: Private Investor

Recommendation: The Board has determined that Mr. Robo’s financial expertise, leadership experience, and business experience gained through his leadership of a large complex corporation, qualify him to continue to serve as a Director of the Company.

Experience: Mr. Robo is a private investor and former Chairman and Chief Executive Officer of NextEra Energy, Inc., a leading clean energy company, and NextEra Energy Partners, LP, a growth-oriented limited partnership formed by NextEra Energy, Inc. to acquire, manage, and own contracted clean energy projects. Prior to joining NextEra Energy in 2002, Mr. Robo spent ten years at General Electric Company, serving as President and Chief Executive Officer of GE Mexico from 1997 until 1999 and as President and Chief Executive Officer of the GE Capital TIP/Modular Space division from 1999 until February 2002. From 1984 through 1992, Mr. Robo worked for Mercer Management Consulting. He received a BA summa cum laude from Harvard College and an MBA from Harvard Business School, where he was a Baker Scholar.

Other Directorships - Publicly Held Companies (Prev. 5 Yrs.): NextEra Energy, Inc., NextEra Energy Partners, LP

Other Directorships – Private Organizations (Prev. 5 Yrs.): Kayne Anderson BDC, Inc. (Chairman)

Family Relationships: None

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

21 |

|

Proposal 1

Election of Directors |

Kirk Thompson

Kirk Thompson

Age: 69

Director Since: 1985

Committees Upon Election: None

Principal Occupation: J.B. Hunt Transport Services, Inc.

Recommendation: The Board has determined that Mr. Thompson’s extensive experience in the industry and nearly 50 years with J.B. Hunt in multiple roles provides invaluable experience to the organization and qualify him to continue to serve as a Director of the Company.

Experience: Mr. Thompson is the Company’s Chairman of the Board. He served as President and Chief Executive Officer from 1987 to December 31, 2010. A graduate of the University of Arkansas and a Certified Public Accountant, Mr. Thompson joined the Company in 1973. He served as Vice President of Finance from 1979 until 1984, Executive Vice President and Chief Financial Officer until 1985, and President and Chief Operating Officer from 1986 until 1987, when he was elected President and Chief Executive Officer.

Other Directorships - Publicly Held Companies (Prev. 5 Yrs.): Rand Logistics, Inc. (No longer publicly traded)

Other Directorships – Private Organizations (Prev. 5 Yrs.): None

Family Relationships: None

| 22 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

|

Proposal 1

Election of Directors |

DIRECTOR COMPENSATION

Nonemployee Director Compensation Program

The Company pays only nonemployee directors for their services as directors. Directors who are also officers or employees of the Company are not eligible to receive any of the compensation described below.

For the annual period between the Company’s 2022 and 2023 Annual Meetings, compensation for nonemployee directors serving on the Board was as follows:

|

● |

an annual retainer of $255,000 paid in Company stock, cash or any combination thereof |

|

● |

an annual retainer of $20,000, paid in cash, to each member of the Audit Committee |

|

● |

an annual retainer of $15,000, paid in cash, to each member of the Executive Compensation Committee |

|

● |

an annual retainer of $10,000, paid in cash, to each member of the Nominating and Corporate Governance Committee |

|

● |

an additional annual retainer of $25,000, paid in cash, to the Audit Committee Chairperson |

|

● |

an additional annual retainer of $25,000, paid in cash, to the Executive Compensation Committee Chairperson |

|

● |

an additional annual retainer of $10,000, paid in cash, to the Nominating and Corporate Governance Committee Chairperson |

In January 2023, the Executive Compensation Committee reviewed a summary of various compensation packages awarded to directors of the Company’s peer group compiled by Meridian Compensation Partners, LLC. Based on this review, the Executive Compensation Committee recommended and the Board of Directors approved the following compensation for the annual period beginning after our 2023 Annual Meeting:

|

● |

an annual retainer of $267,500 paid in Company stock, cash or any combination thereof |

|

● |

an annual retainer of $20,000, paid in cash, to each member of the Audit Committee |

|

● |

an annual retainer of $15,000, paid in cash, to each member of the Executive Compensation Committee |

|

● |

an annual retainer of $10,000, paid in cash, to each member of the Nominating and Corporate Governance Committee |

|

● |

an additional annual retainer of $25,000, paid in cash, to the Audit Committee Chairperson |

|

● |

an additional annual retainer of $25,000, paid in cash, to the Executive Compensation Committee Chairperson |

|

● |

an additional annual retainer of $10,000, paid in cash, to the Nominating and Corporate Governance Committee Chairperson |

|

● |

an annual retainer of $25,000 paid in cash to the Independent Lead Director |

Process for Reviewing and Setting Nonemployee Director Compensation

The Executive Compensation Committee reviews the adequacy and competitiveness of the nonemployee director compensation program annually and makes recommendations to the full Board for approval. Each year, the Committee directs its compensation consultant to provide an independent assessment of the Company’s nonemployee director compensation program. The consultant analyzes and compares the Company’s program against the same peer group used to benchmark executive officer compensation (see page 46 for further details about the peer group). The Committee targets total nonemployee director compensation levels at a competitive range of peer group total compensation. The Committee also considers total aggregate Board compensation and other factors when making recommendations to the Board for approval.

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

23 |

|

Proposal 1

Election of Directors |

Chairman of the Board

The role of Chairman of the Board is an employed executive position of the Company. Therefore, the Chairman of the Board participates in all primary compensation components available to executive officers of the Company as discussed in our Compensation Discussion and Analysis of this Proxy Statement, with the exception of short-term cash incentive awards and long-term equity incentive awards. He does not receive any director fees for his service on the Company’s Board of Directors.

Board of Director Compensation Paid in Calendar Year 2022

|

Board Member |

Salary ($) |

Fees Paid ($) |

Fees Paid in Stock ($) |

Restricted Share or Stock Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

||||||||||||||||||||||||

|

Douglas G. Duncan |

— | 221,250 | 63,725 | — | — | — | — | 284,975 | ||||||||||||||||||||||||

|

Francesca M. Edwardson |

— | 30,000 | 254,901 | — | — | — | — | 284,901 | ||||||||||||||||||||||||

|

Wayne Garrison |

— | 255,000 | — | — | — | — | — | 255,000 | ||||||||||||||||||||||||

|

Sharilyn S. Gasaway |

— | 70,000 | 254,901 | — | — | — | — | 324,901 | ||||||||||||||||||||||||

|

Gary C. George |

— | 35,000 | 254,901 | — | — | — | — | 289,901 | ||||||||||||||||||||||||

|

Thad Hill |

— | 25,000 | 254,901 | — | — | — | — | 279,901 | ||||||||||||||||||||||||

|

Bryan Hunt |

— | 255,000 | — | — | — | — | — | 255,000 | ||||||||||||||||||||||||

|

Gale V. King |

— | 25,000 | 254,901 | — | — | — | — | 279,901 | ||||||||||||||||||||||||

|

James L. Robo |

— | 50,000 | 254,901 | — | — | — | — | 304,901 | ||||||||||||||||||||||||

|

Kirk Thompson |

421,539 | — | — | — | — | — | 15,753 | (1) | 437,292 | |||||||||||||||||||||||

(1) Includes $9,170 taxable allowance for financial counseling services, $260 taxable personal administrative support, and $6,323 Company contributions to 401(k) plan.

Each nonemployee member of the Board had the choice of receiving his or her annual retainer of $255,000 in Company stock, cash, or any combination thereof. Those directors choosing to receive their full retainer in Company stock received 1,460 shares based on the $174.59 closing market price on April 28, 2022. Douglas Duncan elected to receive 25% of his retainer in stock, totaling 365 shares based on the closing market price shown above. Wayne Garrison and Bryan Hunt elected to receive their annual retainer in cash.

To more closely align his or her interests with those of the stockholders, each Board member is required to own three times his or her estimated annual compensation in Company stock within five years of his or her initial stockholder election to the Board. All Board members comply with this requirement.

Nonemployee members of the Board did not participate in either a company-sponsored pension or deferred compensation plan in calendar year 2022.

| 24 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

|

Executive Officers of The Company |

Jennifer R. Boattini, 50, joined the Company in 2006 as Director of Litigation and Contract Management and currently serves as Senior Vice President of Legal and Litigation and General Counsel. She also serves as the Company’s Corporate Secretary.

Kevin Bracy, 52, joined the Company in 1998 as a Financial Analyst and currently serves as Senior Vice President of Finance and Treasurer.

Darren Field, 52, joined the company in 1994 as a Night Dispatcher and currently serves as President of Intermodal and Executive Vice President.

Spencer Frazier, 52, joined the Company in 1992 as a Management Trainee and currently serves as Executive Vice President of Sales & Marketing.

Craig Harper, 65, joined the Company in 1992 as Vice President of Marketing and currently serves as Chief Sustainability Officer and Executive Vice President. Prior to joining the Company, he worked for Rineco Chemical Industries as its Chief Executive Officer.

Bradley Hicks, 50, joined the Company in 1996 as a Management Trainee and currently serves as President of Highway Services and Executive Vice President of People.

Nicholas Hobbs, 60, joined the Company in 1984 as a Management Trainee and currently serves as Chief Operating Officer, President of Contract Services, and Executive Vice President.

David Keefauver, 50, joined the Company in 1995 as a Management Trainee and currently serves as Executive Vice President of Dedicated Contract Services.

John Kuhlow, 52, joined the Company in 2006 as Assistant Corporate Controller and currently serves as Chief Financial Officer, Chief Accounting Officer, and Executive Vice President. Prior to joining the Company, he was a Senior Audit Manager for KPMG LLP. Mr. Kuhlow is a Certified Public Accountant.

Eric McGee, 49, joined the Company in 1998 as a National Account Service Monitor and currently serves as Executive Vice President of Highway Services.

Stuart Scott, 56, joined the Company in 2016 as Chief Information Officer and Executive Vice President. Prior to joining the Company, he served as Chief Information Officer (CIO) at Tempur-Sealy International, CIO at Microsoft, and CIO for various General Electric businesses.

Shelley Simpson, 51, joined the Company in 1994 as an hourly Customer Service Representative and currently serves as the Company’s President.

Brian Webb, 54, joined the Company in 2002 as a Business Development Executive and currently serves as Executive Vice President of Final Mile Services.

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

25 |

|

Security Ownership of Management |

The following table sets forth the beneficial ownership of the Company’s common stock as of February 21, 2023, by each of its current and nominated directors, the Named Executive Officers (the NEOs), and all other executive officers and directors as a group. Unless otherwise indicated in the footnotes below, “beneficially owned” means the sole or shared power to vote or direct the voting of a security or the sole or shared power to dispose or direct the disposition of a security.

|

Owner |

Number of Shares Beneficially Owned Directly (1) |

Number of Shares Beneficially Owned Indirectly (2) |

Percent of Class (%) (3) |

|

|

Douglas G. Duncan |

11,626 |

2,600 |

* |

|

|

Francesca M. Edwardson |

25,737 |

— |

* |

|

|

Darren Field |

21,452 |

— |

* |

|

|

Wayne Garrison |

1,184,744 |

— |

1.1 |

|

|

Sharilyn S. Gasaway |

26,200 |

265 |

* |

|

|

Gary C. George |

25,162 |

994,799 |

(4) |

1.0 |

|

Thad Hill |

2,904 |

— |

* |

|

|

Nicholas Hobbs |

101,263 |

168 |

* |

|

|

Bryan Hunt |

70,697 |

— |

* |

|

|

Gale V. King |

4,019 |

— |

* |

|

|

John Kuhlow |

19,061 |

— |

* |

|

|

Persio Lisboa |

— |

— |

* |

|

|

John N. Roberts, III |

287,411 |

— |

* |

|

|

James L. Robo |

50,640 |

— |

* |

|

|

Shelley Simpson |

101,913 |

49,311 |

* |

|

|

Kirk Thompson |

35,038 |

— |

* |

|

|

All executive officers and directors as a group (25) |

2,152,106 |

1,055,388 |

3.1 |

| 26 |

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

*Less than 1 percent

(1) Includes shares owned by the director or executive officer that are:

(a) held in a 401(k) or deferred compensation account

(b) held in trusts for the benefit of an immediate family member for which the director or executive officer is the trustee

(c) pledged shares and corresponding outstanding loan balances are as shown below:

|

Pledged Shares |

Outstanding Balance |

|||||

|

Darren Field |

6,000 | $325,000 | ||||

|

John Kuhlow |

2,665 | $70,000 | ||||

|

John N. Roberts, III |

217,028 | $6,877,627 | ||||

|

Kirk Thompson |

8,000 | $600,000 | ||||

|

All executive officers and directors as a group |

241,292 | $8,407,627 |

Our share pledging policy is further discussed in the Stock Pledging section of the Compensation Discussion and Analysis on page 49.

(2) Indirect beneficial ownership includes shares owned by the director or executive officer:

(a) as beneficiary or trustee of a personal trust

(b) by a spouse or as trustee or beneficiary of a spouse’s trust

(c) held in trusts for the benefit of an immediate family member for which the director or executive officer’s spouse is the trustee

(d) in a spouse’s retirement account

(3) Calculated on the basis of 103,770,366 shares of common stock outstanding of the Company on February 21, 2023.

(4) The reporting person disclaims beneficial ownership of these shares, which are held in limited partnerships or trusts. This report shall not be deemed an admission that the reporting person is the beneficial owner of such securities for the purposes of Section 16 or for any other purposes.

|

J.B. HUNT TRANSPORT SERVICES, INC. Proxy Statement |

27 |

|

Corporate Governance |

We believe that good corporate governance helps to ensure that the Company is managed for the long-term benefit of our stockholders. We continually review and consider our corporate governance policies and practices, the SEC’s corporate governance rules and regulations, and the corporate governance listing standards of NASDAQ, the stock exchange on which our common stock is traded. Key corporate governance principles observed by the Board and Company include:

|

● |

maintaining a Board composed of a majority of directors who satisfy the criteria for independence under the NASDAQ listing standards, |

|

● |

establishment of the position of Independent Lead Director, |

|

● |

utilization of independent director executive session meetings, |

|

● |

requiring that all committees of the Board be comprised solely of independent directors, |

|

● |

establishment of formal charters outlining the purpose, composition, and responsibility of each committee of the Board, |

|

● |

granting authority to all committees of the Board to retain outside, independent advisors and consultants as needed, |

|

● |

establishment of qualification guidelines for director nominees, |

|

● |

continual evaluation of current director performance and qualifications, |

|

● |

limitation and preapproval of director membership on other corporate boards, |

|

● |

maintaining Board diversity in both gender and ethnic representation, |

|

● |

review of the Company’s plan for succession of management, |

|

● |

adoption of Corporate Governance Guidelines, including director attendance expectations, and |

|

● |

adoption of a formal Code of Ethical and Professional Standards applicable to all directors, officers, and employees of the Company. |