UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

| or |

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition Period from __________to__________ |

| Commission file number |

J.B. HUNT TRANSPORT SERVICES, INC.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| (ZIP Code) | |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| |

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

The aggregate market value of 84,485,328 shares of the registrant’s $0.01 par value common stock held by non-affiliates as of June 30, 2019, was $

As of February 18, 2020, the number of outstanding shares of the registrant’s common stock was

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the Notice and Proxy Statement for the Annual Meeting of Stockholders, to be held April 23, 2020, are incorporated by reference in Part III of this Form 10-K.

J.B. HUNT TRANSPORT SERVICES, INC.

Form 10-K

For The Fiscal Year Ended December 31, 2019

Table of Contents

| Page | ||

|

|

PART I | |

| Item 1. |

Business |

2 |

| Item 1A. |

Risk Factors |

6 |

| Item 1B. |

Unresolved Staff Comments |

9 |

| Item 2. |

Properties |

9 |

| Item 3. |

Legal Proceedings |

10 |

| Item 4. |

Mine Safety Disclosures |

10 |

|

|

PART II | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

11 |

| Item 6. |

Selected Financial Data |

13 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

14 |

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

24 |

| Item 8. |

Financial Statements and Supplementary Data |

25 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

25 |

| Item 9A. |

Controls and Procedures |

25 |

| Item 9B. |

Other Information |

26 |

|

|

PART III | |

| Item 10. |

Directors, Executive Officers and Corporate Governance |

26 |

| Item 11. |

Executive Compensation |

26 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

26 |

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

27 |

| Item 14. |

Principal Accounting Fees and Services |

27 |

|

|

PART IV | |

| Item 15. |

Exhibits, Financial Statement Schedules |

28 |

| Signatures |

30 |

|

FORWARD-LOOKING STATEMENTS

This report, including documents which are incorporated by reference and other documents which we file periodically with the Securities and Exchange Commission (SEC), contains statements that may be considered to be “forward-looking statements.” Such statements relate to our predictions concerning future events or operations and are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are inherently uncertain, subject to risks, and should be viewed with caution. These statements are based on our belief or interpretation of information currently available. Stockholders and prospective investors are cautioned that actual results and future events may differ materially from these forward-looking statements as a result of many factors. Some of the factors and events that are not within our control and that could have a material impact on future operating results include the following: general economic and business conditions; competition and competitive rate fluctuations; excess capacity in the intermodal or trucking industries; a loss of one or more major customers; cost and availability of diesel fuel; interference with or termination of our relationships with certain railroads; rail service delays; disruptions to U.S. port-of-call activity; ability to attract and retain qualified drivers, delivery personnel, independent contractors, and third-party carriers; retention of key employees; insurance costs and availability; litigation and claims expense; determination that independent contractors are employees; new or different environmental or other laws and regulations; volatile financial credit markets or interest rates; terrorist attacks or actions; acts of war; adverse weather conditions; disruption or failure of information systems; operational disruption or adverse effects of business acquisitions; increased costs for new revenue equipment; increased tariffs assessed on or disruptions in the procurement of imported revenue equipment; decreases in the value of used equipment; and the ability of revenue equipment manufacturers to perform in accordance with agreements for guaranteed equipment trade-in values.

You should understand that many important factors, in addition to those listed above, could impact us financially. Our operating results may fluctuate as a result of these and other risk factors or events as described in our filings with the SEC. Some important factors that could cause our actual results to differ from estimates or projections contained in the forward-looking statements are described under “Risk Factors” in Item 1A. We assume no obligation to update any forward-looking statement to the extent we become aware that it will not be achieved for any reason.

PART I

ITEM 1. BUSINESS

OVERVIEW

We are one of the largest surface transportation, delivery, and logistics companies in North America. J.B. Hunt Transport Services, Inc. is a publicly held holding company that, together with our wholly owned subsidiaries, provides safe and reliable transportation and delivery services to a diverse group of customers and consumers throughout the continental United States, Canada, and Mexico. Unless otherwise indicated by the context, “we,” “us,” “our,” the “Company”, and “JBHT” refer to J.B. Hunt Transport Services, Inc. and its consolidated subsidiaries. We were incorporated in Arkansas on August 10, 1961, and have been a publicly held company since our initial public offering in 1983. Our service offerings include transportation of full-truckload containerized freight, which we directly transport utilizing our company-controlled revenue equipment and company drivers or independent contractors. We have arrangements with most of the major North American rail carriers to transport freight in containers or trailers. We also provide customized freight movement, revenue equipment, labor, systems, and delivery services that are tailored to meet individual customers’ requirements and typically involve long-term contracts. These arrangements are generally referred to as dedicated services and may include multiple pickups and drops, local and home deliveries, freight handling, specialized equipment, and freight network design. Our local and home delivery services typically are provided through a network of cross-dock service centers throughout the continental United States. We also provide comprehensive transportation and logistics services with a network of thousands of reliable third-party carriers. In addition to full-load, dry-van operations, these unrelated outside carriers also provide flatbed, refrigerated, less-than-truckload (LTL), and other specialized equipment, drivers, and services. Our customers, who include many Fortune 500 companies, have extremely diverse businesses. Many of them are served by J.B. Hunt 360○®, an online platform that offers shippers and carriers greater access, visibility and transparency of the supply chain.

We believe our ability to offer multiple services, utilizing our four business segments and a full complement of logistics services through third parties, represents a competitive advantage. These segments include Intermodal (JBI), Dedicated Contract Services® (DCS), Integrated Capacity Solutions™ (ICS), and Truckload (JBT). Our business usually involves slightly higher freight volumes in August through early November. Meanwhile, DCS is subject to less seasonal variation than our other segments.

Additional general information about us is available at jbhunt.com. We make a number of reports and other information available free of charge on our website, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. Our website also contains corporate governance guidelines, our code of ethics, our whistleblower policy, Board committee charters, and other corporate policies. The information on our website is not, and shall not be deemed to be, a part of this annual report on Form 10-K or incorporated into any other filings we make with the SEC.

Our Mission and Strategy

We forge long-term relationships with key customers that include supply-chain management as an integral part of their strategies. Working in concert, we strive to drive out excess cost, add value and function as an extension of their enterprises. Our strategy is based on utilizing an integrated, multimodal approach to provide capacity-oriented solutions centered on delivering customer value and industry-leading service. We believe our unique operating strategy can add value to customers and increase our profits and returns to stockholders.

We continually analyze opportunities for additional capital investment and where management’s resources should be focused to provide more benefits to our customers. These actions should, in turn, yield increasing returns to our stockholders.

Increasingly, our customers are seeking energy-efficient transportation solutions to reduce both cost and greenhouse-gas emissions. Our Company’s mission, to create the most efficient transportation network in North America, focuses on delivering both for our customers across all of our business segments. We seek to accomplish this by maintaining a modern fleet to maximize fuel efficiency, converting loads from truck to rail with our intermodal service, and introducing technologies to optimize freight flows in the supply chain by eliminating waste. Additionally, we continue to test and explore the usage of alternative fuel vehicles. Efforts to improve fleet fuel efficiency and reduce greenhouse gas emissions are ongoing. We are an Environmental Protection Agency (EPA) SmartWay® Transport Partner, and proud to have been awarded the EPA’s SmartWay® Excellence Award each of the last twelve years.

As always, we continue to ingrain safety into our corporate culture and strive to conduct all of our operations as safely as possible.

operating segments

Segment information is also included in Note 14 to our Consolidated Financial Statements.

JBI Segment

The transportation service offerings of our JBI segment utilize arrangements with most major North American rail carriers to provide intermodal freight solutions for our customers throughout the continental United States, Canada, and Mexico. Our JBI segment began operations in 1989, forming a unique partnership with what is now the BNSF Railway Company (BNSF); this was a watershed event in the industry and the first agreement that linked major rail and truckload carriers in a joint service environment. JBI draws on the intermodal services of rail carriers for the underlying linehaul movement of its equipment between rail ramps. The origin and destination pickup and delivery services (drayage) are handled by our company-owned tractors for the majority of our intermodal loads, while third-party dray carriers are used where economical. By performing our own drayage services, we are able to provide a cost-competitive, seamless coordination of the combined rail and dray movements for our customers.

JBI operates 96,743 pieces of company-owned trailing equipment systemwide. The fleet primarily consists of 53-foot, high-cube containers and is designed to take advantage of intermodal double-stack economics and superior ride quality. We own and maintain our own chassis fleet, consisting of 82,731 units. The containers and chassis are uniquely designed so that they may only be paired together, which we feel creates an operational competitive advantage. JBI also manages a fleet of 4,989 company-owned tractors, 570 independent contractor trucks, and 6,376 company drivers. At December 31, 2019, the total JBI employee count was 7,281. Revenue for the JBI segment in 2019 was $4.74 billion.

DCS Segment

DCS focuses on private fleet conversion and creation in replenishment, specialized equipment, and final-mile delivery services. We specialize in the design, development, and execution of supply-chain solutions that support a variety of transportation networks. Our final-mile delivery services are supported with a network of approximately 120 cross-dock and other delivery system network locations nationwide, with 98% of the continental U.S. population living within 150 miles of a network location. Contracts with our customers are long-term, ranging from three to 10 years, with the average being approximately five years. Pricing of our contracts typically involves cost-plus arrangements, with our fixed costs being recovered regardless of equipment utilization, but is customized based on invested capital and duration.

At December 31, 2019, this segment operated 10,542 company-owned trucks, 505 customer-owned trucks, and 40 independent contractor trucks. DCS also operates 20,860 owned pieces of trailing equipment and 7,258 customer-owned trailers. The DCS segment employed 15,019 people, including 12,181 drivers, at December 31, 2019. DCS revenue for 2019 was $2.69 billion.

ICS Segment

ICS provides traditional freight brokerage and transportation logistics solutions to customers through relationships with thousands of third-party carriers and integration with our owned equipment. By leveraging the J.B. Hunt brand, systems, and network, we provide a broader service offering to customers by providing flatbed, refrigerated, expedited, and LTL, as well as a variety of dry-van and intermodal solutions. Furthermore, we offer an online multimodal marketplace via J.B. Hunt 360 that matches the right load with the right carrier and the best mode. ICS also provides single-source logistics management for customers desiring to outsource their transportation functions and utilize our proven supply-chain technology and design expertise to improve efficiency. ICS operates 37 remote sales offices or branches, as well as on-site logistics personnel working in direct contact with customers.

At December 31, 2019, the ICS segment employed 1,213 people, with a carrier base of approximately 84,400. ICS revenue for 2019 was $1.35 billion.

JBT Segment

The service offering in this segment is full-load, dry-van freight, utilizing tractors operating over roads and highways. We typically pick up freight at the dock or specified location of the shipper and transport the load directly to the location of the consignee. We use our company-owned tractors and employee drivers or independent contractors who agree to transport freight in our trailers.

At December 31, 2019, the JBT segment operated 845 company-owned tractors and employed 1,102 people, 868 of whom were drivers. At December 31, 2019, we had 986 independent contractors operating in the JBT segment. JBT revenue for 2019 was $389 million.

Marketing and Operations

We transport, or arrange for the transportation of, a wide range of freight, including general merchandise, specialty consumer items, appliances, forest and paper products, food and beverages, building materials, soaps and cosmetics, automotive parts, agricultural products, electronics, and chemicals. Our customer base includes a large number of Fortune 500 companies. We provide many transportation services that meet the supply-chain logistics needs of shippers.

We generally market all of our service offerings through a nationwide sales and marketing network. We use a specific sales force in DCS due to the length, complexity, and specialization of the sales cycle. In addition to our sales teams, J.B. Hunt 360 offers instant access to a wide array of technology-driven solutions for customers and carriers. Through the platform, businesses of all sizes can quote and book shipments, view analytics, and gain visibility into freight movement. In accordance with our typical arrangements, we bill the customer for all services, and we, in turn, pay all third parties for their portion of transportation services provided.

People

We believe that one of the factors differentiating us from our competitors is our service-oriented people. As of December 31, 2019, we had 29,056 employees, which consisted of 19,425 company drivers, 8,292 office personnel, 1,137 maintenance technicians, and 202 delivery and material assistants. We also had arrangements with approximately 1,596 independent contractors to transport freight in our trailing equipment. None of our employees are represented by unions or covered by collective bargaining agreements.

Revenue Equipment

Our JBI segment utilizes uniquely designed high-cube containers and chassis, which can only be paired with each other and can be separated to allow the containers to be double-stacked on rail cars. The composition of our DCS trailing fleet varies with specific customer requirements and may include dry-vans, flatbeds, temperature-controlled, curtain-side vans, straight trucks, and dump trailers. We primarily utilize third-party carriers’ tractor and trailing equipment for our ICS segment. Our JBT segment operates primarily 53-foot dry-van trailers.

As of December 31, 2019, our company-owned tractor and truck fleet consisted of 16,376 units. In addition, we had 1,596 independent contractors who operate their own tractors but transport freight in our trailing equipment. We operate with standardized tractors in as many fleets as possible, particularly in our JBI and JBT fleets. Due to our customers’ preferences and the actual business application, our DCS fleet is extremely diversified. We believe operating with relatively newer revenue equipment provides better customer service, attracts quality drivers, and lowers maintenance expense. At December 31, 2019, the average age of our combined tractor fleet was 2.3 years, while our containers averaged 7.0 years of age and our trailers averaged 6.5 years. We perform routine servicing and preventive maintenance on our equipment at our regional terminal facilities.

Competition and the Industry

The freight transportation markets in which we operate are frequently referred to as highly fragmented and competitive. Our JBI segment competes with other intermodal marketing companies; other full-load carriers that utilize railroads for a portion of the transportation service; and, to a certain extent, some railroads directly. The diversified nature of the services provided by our DCS segment attracts competition from customers’ private fleets, other private fleet outsourcing companies, equipment leasing companies, local and regional delivery service providers, and some truckload carriers. Our ICS segment utilizes the fragmented nature of the truck industry and competes with other non-asset-based logistics companies and freight brokers, as well as full-load carriers. The full-load freight competition of our JBT segment includes thousands of carriers, many of which are very small. While we compete with a number of smaller carriers on a regional basis, only a limited number of companies represent competition in all markets across the country.

We compete with other transportation service companies primarily in terms of price, on-time pickup and delivery service, availability and type of equipment capacity, and availability of carriers for logistics services.

Regulation

Our operations as a for-hire motor carrier are subject to regulation by the U.S. Department of Transportation (DOT) and the Federal Motor Carrier Safety Administration (FMCSA), and certain business is also subject to state rules and regulations. The DOT periodically conducts reviews and audits to ensure our compliance with federal safety requirements, and we report certain accident and other information to the DOT. Our operations into and out of Canada and Mexico are subject to regulation by those countries. We are also subject to a variety of requirements of national, state, and local governments, including the U.S. Environmental Protection Agency and the Occupational Safety and Health Administration.

We continue to monitor the actions of the FMCSA and other regulatory agencies, and evaluate all proposed rules to determine their impact on our operations.

ITEM 1A. RISK FACTORS

In addition to the factors outlined previously in this Form 10-K regarding forward-looking statements and other comments regarding risks and uncertainties, the following risk factors should be carefully considered when evaluating our business. Our business, financial condition or financial results could be materially and adversely affected by any of these risks.

Our business is significantly impacted by economic conditions, customer business cycles and seasonal factors.

Our business is dependent on the freight shipping needs of our customers, which can be heavily impacted by economic conditions and other factors affecting their businesses. Recessionary economic cycles and downturns in customers’ business cycles, particularly in market segments and industries where we have a significant concentration of customers, may substantially reduce freight volumes for which our customers need transportation services and lead to excess capacity in the industry and resulting pressure on the rates we are able to obtain for our services. Adverse economic conditions may also require us to increase our reserve for bad debt losses. In addition, our results of operations may be affected by seasonal factors. Customers tend to reduce shipments after the winter holiday season, and our operating expenses tend to be higher in the winter months, primarily due to colder weather, which causes higher fuel consumption from increased idle time and higher maintenance costs. Any of these factors could have a significant adverse effect on our financial condition and results of operations.

We depend on third parties in the operation of our business.

Our JBI business segment utilizes railroads in the performance of its transportation services. The majority of these services are provided pursuant to contractual relationships with the railroads. While we have agreements with a number of Class I railroads, the majority of our business travels on the BNSF and the Norfolk Southern railways. A material change in the relationship with, the ability to utilize one or more of these railroads or the overall service levels provided by these railroads could have a material adverse effect on our business and operating results. In addition, a portion of the freight we deliver is imported to the United States through ports of call that are subject to labor union contracts. Work stoppages or other disruptions at any of these ports could have a material adverse effect on our business.

We also utilize independent contractors and third-party carriers to complete our services. These third parties are subject to similar regulation requirements, which may have a more significant impact on their operations, causing them to exit the transportation industry. Aside from when these third parties may use our trailing equipment to fulfill loads, we do not own the revenue equipment or control the drivers delivering these loads. The inability to obtain reliable third-party carriers and independent contractors could have a material adverse effect on our operating results and business growth.

Rapid changes in fuel costs could impact our periodic financial results.

Fuel costs can be very volatile. We have a fuel surcharge revenue program in place with the majority of our customers, which has historically enabled us to recover the majority of higher fuel costs. Most of these programs automatically adjust weekly depending on the cost of fuel. However, there can be timing differences between a change in our fuel cost and the timing of the fuel surcharges billed to our customers. In addition, we incur additional costs when fuel price increases cannot be fully recovered due to our engines being idled during cold or warm weather and empty or out-of-route miles that cannot be billed to customers. Rapid increases in fuel costs or shortages of fuel could have a material adverse effect on our operations or future profitability. As of December 31, 2019, we had no derivative financial instruments to reduce our exposure to fuel-price fluctuations.

Insurance and claims expenses could significantly reduce our earnings.

Our future insurance and claims expenses might exceed historical levels, which could reduce our earnings. If the number or severity of claims for which we are self-insured increases, our operating results could be adversely affected. We have policies in place for 2020 with substantially the same terms as our 2019 policies for personal injury, property damage, workers’ compensation, and cargo loss or damage. We purchase insurance coverage for the amounts above which we are self-insured. If these expenses increase and we are unable to offset the increase with higher freight rates, our earnings could be materially and adversely affected.

We derive a significant portion of our revenue from a few major customers, the loss of one or more of which could have a material adverse effect on our business.

For the calendar year ended December 31, 2019, our top 10 customers, based on revenue, accounted for approximately 32% of our revenue. Our JBI, ICS, and JBT segments typically do not have long-term contracts with their customers. While our DCS segment business may involve long-term written contracts, those contracts may contain cancellation clauses, and there is no assurance that our current customers will continue to utilize our services or continue at the same levels. A reduction in or termination of our services by one or more of our major customers could have a material adverse effect on our business and operating results.

We operate in a regulated industry, and increased direct and indirect costs of compliance with, or liability for violation of, existing or future regulations could have a material adverse effect on our business.

The DOT, FMCSA, and various state agencies exercise broad powers over our business, generally governing matters including authorization to engage in motor carrier service, equipment operation, safety, and financial reporting. We are audited periodically by the DOT to ensure that we are in compliance with various safety, hours-of-service, and other rules and regulations. If we were found to be out of compliance, the DOT could restrict or otherwise impact our operations. Our failure to comply with any applicable laws, rules or regulations to which we are subject, whether actual or alleged, could expose us to fines, penalties or potential litigation liabilities, including costs, settlements and judgments. Further, these agencies could institute new laws, rules or regulations or issue interpretation changes to existing regulations at any time. Compliance with new laws, rules or regulations could substantially impair labor and equipment productivity, increase our costs or impact our ability to offer certain services.

Difficulty in attracting and retaining drivers and delivery personnel could affect our profitability and ability to grow.

If we are unable to attract and retain the necessary quality and number of employees, we could be required to significantly increase our employee compensation package, let revenue equipment sit idle, dispose of the equipment altogether, or rely more on higher-cost third-party carriers, which could adversely affect our growth and profitability. In addition, our growth could be limited by an inability to attract third-party carriers upon whom we rely to provide transportation services.

A determination that independent contractors are employees could expose us to various liabilities and additional costs.

Federal and state legislation as well as tax and other regulatory authorities have sought to assert that independent contractors in the transportation service industry are employees rather than independent contractors. An example of such legislation recently enacted in California is currently under a judicial stay with respect to trucking companies while a legal challenge to the law is pending. There can be no assurance that interpretations that support the independent contractor status will not change, that other federal or state legislation will not be enacted or that various authorities will not successfully assert a position that re-classifies independent contractors to be employees. If our independent contractors are determined to be our employees, that determination could materially increase our exposure under a variety of federal and state tax, workers’ compensation, unemployment benefits, labor, employment and tort laws, as well as our potential liability for employee benefits. In addition, such changes may be applied retroactively, and if so, we may be required to pay additional amounts to compensate for prior periods. Any of the above increased costs would adversely affect our business and operating results.

We may be subject to litigation claims that could result in significant expenditures.

We by the nature of our operations are exposed to the potential for a variety of litigation, including personal injury claims, vehicular collisions and accidents, alleged violations of federal and state labor and employment laws, such as class-action lawsuits alleging wage and hour violations and improper pay, commercial and contract disputes, cargo loss and property damage claims. While we purchase insurance coverage at levels we deem adequate, future litigation may exceed our insurance coverage or may not be covered by insurance. We accrue a provision for a litigation matter according to applicable accounting standards based on the ongoing assessment of the strengths and weaknesses of the litigation, its likelihood of success, and an evaluation of the possible range of loss. Our inability to defend ourselves against a significant litigation claim, could have a material adverse effect on our financial results.

We rely significantly on our information technology systems, a disruption, failure or security breach of which could have a material adverse effect on our business.

We rely on information technology throughout all areas of our business to initiate, track, and complete customer orders; process financial and nonfinancial data; compile results of operations for internal and external reporting; and achieve operating efficiencies and growth. We have also invested significantly in the development of our Marketplace for J.B. Hunt 360 online freight matching platform, through which we are generating an increasing amount of revenue. Each of our information technology systems may be susceptible to various interruptions, including equipment or network failures, failed upgrades or replacement of software, user error, power outages, natural disasters, cyber-attacks, terrorist attacks, computer viruses, hackers, or other security breaches. We have mitigated our exposure to these risks through the establishment and maintenance of technology security programs and disaster recovery plans, but these mitigating activities may not be sufficient. A significant disruption, failure or security breach in our information technology systems could have a material adverse effect on our business, which could include operational disruptions, loss of confidential information, external reporting delays or errors, legal claims, or damage to our business reputation.

We operate in a competitive and highly fragmented industry. Numerous factors could impair our ability to maintain our current profitability and to compete with other carriers and private fleets.

We compete with many other transportation service providers of varying sizes and, to a lesser extent, with LTL carriers and railroads, some of which have more equipment and greater capital resources than we do. Additionally, some of our competitors periodically reduce their freight rates to gain business, especially during times of reduced growth rates in the economy, which may limit our ability to maintain or increase freight rates or to maintain our profit margins.

In an effort to reduce the number of carriers it uses, a customer often selects so-called “core carriers” as approved transportation service providers, and in some instances, we may not be selected. Many customers periodically accept bids from multiple carriers for their shipping needs, and this process may depress freight rates or result in the loss of some business to competitors. Also, certain customers that operate private fleets to transport their own freight could decide to expand their operations, thereby reducing their need for our services.

Extreme or unusual weather conditions can disrupt our operations, impact freight volumes, and increase our costs, all of which could have a material adverse effect on our business results.

Certain weather conditions such as ice and snow can disrupt our operations. Increases in the cost of our operations, such as towing and other maintenance activities, frequently occur during the winter months. Natural disasters such as hurricanes and flooding can also impact freight volumes and increase our costs.

Our operations are subject to various environmental laws and regulations, including legislative and regulatory responses to climate change. Compliance with environmental requirements could result in significant expenditures and the violation of these regulations could result in substantial fines or penalties.

We are subject to various environmental laws and regulations dealing with the handling of hazardous materials, underground fuel storage tanks, and discharge and retention of storm water. We operate in industrial areas, where truck terminals and other industrial activities are located and where groundwater or other forms of environmental contamination have occurred. Our operations involve the risks of fuel spillage or seepage, environmental damage, and hazardous waste disposal, among others. We also maintain bulk fuel storage and fuel islands at several of our facilities. If a spill or other accident involving hazardous substances occurs, or if we are found to be in violation of applicable laws or regulations, it could have a material adverse effect on our business and operating results. If we should fail to comply with applicable environmental regulations, we could be subject to substantial fines or penalties and to civil and criminal liability.

We are also subject to existing and potential future laws and regulations with regards to public policy on climate change. If current regulatory requirements become more stringent or new environmental laws and regulations regarding climate change are introduced, we could be required to make significant expenditures or abandon certain activities, which could have a material adverse effect on our business and operating results.

Acquisitions or business combinations may disrupt or have a material adverse effect on our operations or earnings.

We could have difficulty integrating acquired companies’ assets, personnel and operations with our own. Regardless of whether we are successful in making an acquisition or completing a business combination, the negotiations could disrupt our ongoing business, distract our management and employees, and increase our operating costs. Acquisitions and business combinations are accompanied by a number of inherent risks, including, without limitation, the difficulty of integrating acquired companies and operations; potential disruption of our ongoing businesses and distraction of our management or the management of acquired companies; difficulties in maintaining controls, procedures and policies; potential impairment of relationships with employees and partners as a result of any integration of new management personnel; potential inability to manage an increased number of locations and employees; failure to realize expected efficiencies, synergies and cost savings; or the effect of any government regulations which relate to the businesses acquired.

Our business could be materially impacted if and to the extent that we are unable to succeed in addressing any of these risks or other problems encountered in connection with an acquisition or business combination, many of which cannot be presently identified.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We own our corporate headquarters in Lowell, Arkansas. In addition, we own or lease buildings in Lowell that we utilize for administrative support and warehousing. We also own or lease 46 other significant facilities across the United States where we perform maintenance on our equipment, provide bulk fuel, and employ personnel to support operations. These facilities vary in size from 2 to 39 acres. Each of our business segments utilizes these facilities. In addition, we have 117 leased or owned facilities in our DCS cross-dock and other delivery system networks, with the remaining three locations outsourced, and 37 leased or owned remote sales offices or branches in our ICS segment. We also own or lease multiple small facilities, offices, and parking yards throughout the country that support our customers’ business needs.

A summary of our principal facilities in locations throughout the U.S. follows:

| Type |

Acreage |

Maintenance Shop/ Cross-dock Facility (square feet) |

Office Space (square feet) |

||||||||||

| Maintenance and support facilities |

488 | 1,065,000 | 196,000 | ||||||||||

| Cross-dock and delivery system facilities |

20 | 3,348,000 | 125,000 | ||||||||||

| Corporate headquarters campus, Lowell, Arkansas |

119 | - | 600,000 | ||||||||||

| Branch sales offices |

- | - | 91,000 | ||||||||||

| Other facilities, offices, and parking yards |

335 | 129,000 | 253,000 | ||||||||||

ITEM 3. LEGAL PROCEEDINGS

In January 2017 we exercised our right to utilize the arbitration process to review the division of revenue collected beginning May 1, 2016, as well as to clarify other issues, under our Joint Service Agreement with BNSF. BNSF requested the same. In October 2018 we received the arbitrators’ Interim Award. For the determined components of the Interim Award, we recorded an $18.3 million pre-tax charge in the third quarter 2018 related to certain charges claimed by BNSF for specific services requested for customers from April 2014 through May 2018. In January 2019 the Panel issued its Second Interim Award ordering that $89.4 million is due from the Company to BNSF resulting from the adjusted revenue divisions relating to the 2016 period at issue ($52.1 million) and for calendar year 2017 ($37.3 million). We recorded pretax charges for contingent liabilities in the fourth quarter 2018 of $89.4 million claimed by the BNSF for the period May 1, 2016 through December 31, 2017 and $44.6 million for the period January 1, 2018 through December 31, 2018, for a total of $134 million. In October 2019 the arbitrators issued a Final Award. As a result, we recorded pre-tax charges in the third quarter 2019 of $26.8 million related to certain charges claimed by BNSF for the period January 1, 2018 through December 31, 2018 and no material adjustments for the period January 1, 2019 through September 30, 2019. In addition, we recorded a $17.4 million charge in the third quarter 2019 for legal fees, costs and interest claimed by BNSF, for a total of $44.2 million.

On January 17, 2020, we filed under seal in the United States District Court for the Western District of Arkansas a motion to confirm and enforce the Final Award, seeking the Court’s specific enforcement of certain confidential contractual rights the arbitrators decided in our favor. BNSF has moved to confirm the Final Award in the United States District Court for the District of Columbia.

We are involved in certain other claims and pending litigation arising from the normal conduct of business. Based on present knowledge of the facts and, in certain cases, opinions of outside counsel, we believe the resolution of these claims and pending litigation will not have a material adverse effect on our financial condition, results of operations or liquidity.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on the NASDAQ Global Select Market (NASDAQ) under the symbol “JBHT.” At December 31, 2019, we were authorized to issue up to 1 billion shares of our common stock, and 167.1 million shares were issued. We had 106.2 million and 108.7 million shares outstanding as of December 31, 2019 and 2018, respectively. On February 18, 2020, we had 1,011 stockholders of record of our common stock.

Dividend Policy

Our dividend policy is subject to review and revision by the Board of Directors, and payments are dependent upon our financial condition, liquidity, earnings, capital requirements, and any other factors the Board of Directors may deem relevant. On January 22, 2020, we announced an increase in our quarterly cash dividend from $0.26 to $0.27 per share, which will be paid February 21, 2020, to stockholders of record on February 7, 2020. We currently intend to continue paying cash dividends on a quarterly basis. However, no assurance can be given that future dividends will be paid.

Purchases of Equity Securities

The following table summarizes purchases of our common stock during the three months ended December 31, 2019:

| Period |

Number of Common Shares Purchased |

Average Price Paid Per Common Share Purchased |

Total Number of Shares Purchased as Part of a Publicly Announced Plan (1) |

Maximum Dollar Amount of Shares That May Yet Be Purchased Under the Plan (in millions) (1) |

||||||||||||

| October 1 through October 31, 2019 |

- | $ | - | - | $ | 145 | ||||||||||

| November 1 through November 30, 2019 |

- | - | - | 145 | ||||||||||||

| December 1 through December 31, 2019 |

441,097 | 113.30 | 441,097 | 95 | ||||||||||||

| Total |

441,097 | $ | 113.30 | 441,097 | $ | 95 | ||||||||||

(1) On April 20, 2017, our Board of Directors authorized the purchase of up to $500 million of our common stock. On January 22, 2020, our Board of Directors authorized an additional purchase of up to $500 million of our common stock.

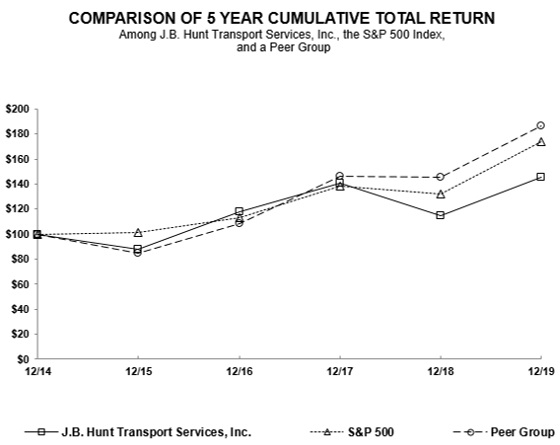

Stock Performance Graph

The following graph compares the cumulative 5-year total return of stockholders of our common stock with the cumulative total returns of the S&P 500 index and a customized peer group. The peer group consists of 14 companies: C.H. Robinson Worldwide Inc., CSX Corporation, Expeditors International of Washington Inc., Hub Group Inc., Kansas City Southern, Knight-Swift Transportation Holdings Inc., Norfolk Southern Corporation, Old Dominion Freight Line Inc., Republic Services Inc., Ryder System Inc., Schneider National Inc., Stericycle Inc., Waste Management Inc., and XPO Logistics Inc. The graph assumes the value of the investment in our common stock, in the index, and in the peer group (including reinvestment of dividends) was $100 on December 31, 2014 and tracks it through December 31, 2019. The stock price performance included in this graph is not necessarily indicative of future stock price performance.

| Years Ended December 31, |

||||||||||||||||||||||||

| 2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|||||||||||||||||||

| J.B. Hunt Transport Services, Inc. |

$ | 100.00 | $ | 87.97 | $ | 117.70 | $ | 140.76 | $ | 114.85 | $ | 145.58 | ||||||||||||

| S&P 500 |

100.00 | 101.38 | 113.51 | 138.29 | 132.23 | 173.86 | ||||||||||||||||||

| Peer Group |

100.00 | 84.66 | 108.63 | 146.15 | 145.42 | 186.63 | ||||||||||||||||||

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with the Consolidated Financial Statements and notes thereto, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and other financial data included elsewhere in this annual report.

(Dollars in millions, except per share amounts)

| Earnings data for the years ended December 31, |

2019 |

2018 |

2017 |

2016 |

2015 |

|||||||||||||||

| Operating revenues |

$ | 9,165 | $ | 8,615 | $ | 7,190 | $ | 6,555 | $ | 6,188 | ||||||||||

| Operating income |

734 | 681 | 624 | 721 | 716 | |||||||||||||||

| Net earnings |

516 | 490 | 686 | 432 | 427 | |||||||||||||||

| Basic earnings per share |

4.81 | 4.48 | 6.24 | 3.84 | 3.69 | |||||||||||||||

| Diluted earnings per share |

4.77 | 4.43 | 6.18 | 3.81 | 3.66 | |||||||||||||||

| Cash dividends per share |

1.04 | 0.96 | 0.92 | 0.88 | 0.84 | |||||||||||||||

| Operating expenses as a percentage of operating revenues: |

||||||||||||||||||||

| Rents and purchased transportation |

49.4 | % |

51.5 | % |

50.8 | % |

49.7 | % |

48.4 | % |

||||||||||

| Salaries, wages and employee benefits |

23.7 | 22.4 | 22.4 | 22.4 | 22.5 | |||||||||||||||

| Depreciation and amortization |

5.4 | 5.1 | 5.3 | 5.5 | 5.5 | |||||||||||||||

| Fuel and fuel taxes |

5.1 | 5.3 | 4.8 | 4.3 | 5.1 | |||||||||||||||

| Operating supplies and expenses |

3.6 | 3.5 | 3.6 | 3.6 | 3.6 | |||||||||||||||

| General and administrative expenses, net of asset dispositions |

2.1 | 1.8 | 1.8 | 1.3 | 1.1 | |||||||||||||||

| Insurance and claims |

1.7 | 1.5 | 1.7 | 1.2 | 1.2 | |||||||||||||||

| Operating taxes and licenses |

0.6 | 0.6 | 0.6 | 0.7 | 0.7 | |||||||||||||||

| Communication and utilities |

0.4 | 0.4 | 0.3 | 0.3 | 0.3 | |||||||||||||||

| Total operating expenses |

92.0 | 92.1 | 91.3 | 89.0 | 88.4 | |||||||||||||||

| Operating income |

8.0 | 7.9 | 8.7 | 11.0 | 11.6 | |||||||||||||||

| Net interest expense |

0.6 | 0.5 | 0.4 | 0.4 | 0.4 | |||||||||||||||

| Earnings before income taxes |

7.4 | 7.4 | 8.3 | 10.6 | 11.2 | |||||||||||||||

| Income taxes |

1.8 | 1.7 | (1.2 | ) |

4.0 | 4.3 | ||||||||||||||

| Net earnings |

5.6 | % |

5.7 | % |

9.5 | % |

6.6 | % |

6.9 | % |

||||||||||

| Balance sheet data as of December 31, |

2019 |

2018 |

2017 |

2016 |

2015 |

|||||||||||||||

| Working capital ratio |

1.43 | 1.11 | 1.45 | 1.65 | 1.61 | |||||||||||||||

| Total assets (millions) |

$ | 5,471 | $ | 5,092 | $ | 4,465 | $ | 3,951 | $ | 3,630 | ||||||||||

| Stockholders’ equity (millions) |

$ | 2,267 | $ | 2,101 | $ | 1,839 | $ | 1,414 | $ | 1,300 | ||||||||||

| Current portion of long-term debt (millions) |

- | $ | 251 | - | - | - | ||||||||||||||

| Total debt (millions) |

$ | 1,296 | $ | 1,149 | $ | 1,086 | $ | 986 | $ | 998 | ||||||||||

| Total debt to equity |

0.57 | 0.55 | 0.59 | 0.70 | 0.77 | |||||||||||||||

| Total debt as a percentage of total capital |

36 | % |

35 | % |

37 | % |

41 | % |

43 | % |

||||||||||

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our results of operations and financial condition should be read in conjunction with our financial statements and related notes in Item 8. This discussion contains forward-looking statements. Please see “Forward-looking Statements” and “Risk Factors” for a discussion of items, uncertainties, assumptions and risks associated with these statements.

Critical Accounting Policies and Estimates

The preparation of our financial statements in accordance with U.S. generally accepted accounting principles requires us to make estimates and assumptions that impact the amounts reported in our Consolidated Financial Statements and accompanying notes. Therefore, the reported amounts of assets, liabilities, revenues, expenses and associated disclosures of contingent liabilities are affected by these estimates. We evaluate these estimates on an ongoing basis, utilizing historical experience, consultation with third parties and other methods considered reasonable in the particular circumstances. Nevertheless, actual results may differ significantly from our estimates. Any effects on our business, financial position or results of operations resulting from revisions to these estimates are recognized in the accounting period in which the facts that give rise to the revision become known. We consider our critical accounting policies and estimates to be those that require us to make more significant judgments and estimates when we prepare our financial statements and include the following:

Workers’ Compensation and Accident Costs

We purchase insurance coverage for a portion of expenses related to employee injuries, vehicular collisions, accidents, and cargo damage. Certain insurance arrangements include a level of self-insurance (deductible) coverage applicable to each claim. We have umbrella policies to limit our exposure to catastrophic claim costs. We are substantially self-insured for loss of and damage to our owned and leased revenue equipment.

The amounts of self-insurance change from time to time based on measurement dates, policy expiration dates, and claim type. For 2017 and 2018, we were self-insured for $500,000 per occurrence for personal injury and property damage and self-insured for $100,000 per workers’ compensation claim. For 2019, we were self-insured for $500,000 per occurrence for personal injury and property damage and fully insured for workers’ compensation claims for nearly all states. We have policies in place for 2020 with substantially the same terms as our 2019 policies for personal injury, property damage, workers’ compensation, and cargo loss or damage.

Our claims accrual policy for all self-insured claims is to recognize a liability at the time of the incident based on our analysis of the nature and severity of the claims and analyses provided by third-party claims administrators, as well as legal, economic, and regulatory factors. Our safety and claims personnel work directly with representatives from the insurance companies to continually update the estimated cost of each claim. The ultimate cost of a claim develops over time as additional information regarding the nature, timing, and extent of damages claimed becomes available. Accordingly, we use an actuarial method to develop current claim information to derive an estimate of our ultimate claim liability. This process involves the use of loss-development factors based on our historical claims experience and includes a contractual premium adjustment factor, if applicable. In doing so, the recorded liability considers future claims growth and provides a reserve for incurred-but-not-reported claims. We do not discount our estimated losses. At December 31, 2019, we had an accrual of approximately $263 million for estimated claims. In addition, we record receivables for amounts expected to be reimbursed for payments made in excess of self-insurance levels on covered claims. At December 31, 2019, we have recorded $281 million of expected reimbursement for covered excess claims, other insurance deposits, and prepaid insurance premiums.

Revenue Equipment

We operate a significant number of tractors, trucks, containers, chassis, and trailers in connection with our business. This equipment may be purchased or acquired under lease agreements. In addition, we may rent revenue equipment from various third parties under short-term rental arrangements. Purchased revenue equipment is depreciated on the straight-line method over the estimated useful life to an estimated salvage or trade-in value. We periodically review the useful lives and salvage values of our revenue equipment and evaluate our long-lived assets for impairment. We have not identified any impairment to our assets at December 31, 2019.

We have agreements with our primary tractor suppliers for residual or trade-in values for certain new equipment. We have utilized these trade-in values, as well as other operational information such as anticipated annual miles, in accounting for depreciation expense.

Revenue Recognition

We record revenues on the gross basis at amounts charged to our customers because we control and are primarily responsible for the fulfillment of promised services. Accordingly, we serve as a principal in the transaction. We invoice our customers, and we maintain discretion over pricing. Additionally, we are responsible for selection of third-party transportation providers to the extent used to satisfy customer freight requirements.

We recognize revenue from customer contracts based on relative transit time in each reporting period and as other performance obligations are provided, with related expenses recognized as incurred. Accordingly, a portion of the total revenue that will be billed to the customer is recognized in each reporting period based on the percentage of the freight pickup and delivery performance obligation that has been completed at the end of the reporting period.

Our trade accounts receivable includes amounts due from customers that have been reduced by an allowance for uncollectible accounts and revenue adjustments. The allowance for uncollectible accounts and revenue adjustments is based on historical experience, as well as any known trends or uncertainties related to customer billing and account collectability. The adequacy of our allowance is reviewed quarterly.

Income Taxes

We account for income taxes under the liability method. Our deferred tax assets and liabilities represent items that will result in a tax deduction or taxable income in future years for which we have already recorded the related tax expense or benefit in our statement of earnings. Deferred tax accounts arise as a result of timing differences between when items are recognized in our Consolidated Financial Statements and when they are recognized in our tax returns. We assess the likelihood that deferred tax assets will be recovered from future taxable income or the reversal of temporary timing differences. To the extent we believe recovery does not meet the more-likely-than-not threshold, a valuation allowance is established. To the extent we establish a valuation allowance, we include an expense as part of our income tax provision.

The Tax Cuts and Jobs Act (the Act) was enacted in December 2017. Beginning in 2018, the Act reduced the U.S. federal corporate tax rate from 35% to 21%. At December 31, 2017, we made a reasonable estimate of the effects on our existing deferred tax assets and liabilities based on the rates at which they were expected to reverse in the future, which was generally 21%. The provisional amount recorded resulting from the remeasurement of our deferred tax balance was $309.2 million, which was included as a component of 2017 income tax from continuing operations. During 2018, we finalized our calculations for our 2017 federal income tax return, which was filed based on the law prior to the Act, resulting in no significant change to the initial measurement of these balances. Remaining aspects of the Act were not relevant to our operations.

Significant judgment is required in determining and assessing the impact of complex tax laws and certain tax-related contingencies on our provision for income taxes. As part of our calculation of the provision for income taxes, we assess whether the benefits of our tax positions are at least more likely than not to be sustained upon audit based on the technical merits of the tax position. For tax positions that are not more likely than not to be sustained upon audit, we accrue the largest amount of the benefit that is not more likely than not to be sustained in our Consolidated Financial Statements. Such accruals require us to make estimates and judgments, whereby actual results could vary materially from these estimates. Further, a number of years may elapse before a particular matter for which we have established an accrual is audited and resolved. See Note 7, Income Taxes, in our Consolidated Financial Statements for a discussion of our current tax contingencies.

RESULTS OF OPERATIONS

The following table sets forth items in our Consolidated Statements of Earnings as a percentage of operating revenues and the percentage increase or decrease of those items compared with the prior year.

| Percentage of Operating Revenues |

Percentage Change Between Years |

|||||||||||||||||||

| 2019 |

2018 |

2017 |

2019 vs. 2018 |

2018 vs. 2017 |

||||||||||||||||

| Operating revenues |

100.0 | % |

100.0 | % |

100.0 | % |

6.4 | % |

19.8 | % |

||||||||||

| Operating expenses: |

||||||||||||||||||||

| Rents and purchased transportation |

49.4 | 51.5 | 50.8 | 2.1 | 21.5 | |||||||||||||||

| Salaries, wages and employee benefits |

23.7 | 22.4 | 22.4 | 12.5 | 19.8 | |||||||||||||||

| Depreciation and amortization |

5.4 | 5.1 | 5.3 | 14.5 | 13.7 | |||||||||||||||

| Fuel and fuel taxes |

5.1 | 5.3 | 4.8 | 0.9 | 32.1 | |||||||||||||||

| Operating supplies and expenses |

3.6 | 3.5 | 3.6 | 9.7 | 18.0 | |||||||||||||||

| General and administrative expenses, net of asset dispositions |

2.1 | 1.8 | 1.8 | 17.6 | 29.7 | |||||||||||||||

| Insurance and claims |

1.7 | 1.5 | 1.7 | 21.5 | 4.7 | |||||||||||||||

| Operating taxes and licenses |

0.6 | 0.6 | 0.6 | 8.3 | 14.0 | |||||||||||||||

| Communication and utilities |

0.4 | 0.4 | 0.3 | 12.6 | 28.9 | |||||||||||||||

| Total operating expenses |

92.0 | 92.1 | 91.3 | 6.3 | 20.8 | |||||||||||||||

| Operating income |

8.0 | 7.9 | 8.7 | 7.8 | 9.2 | |||||||||||||||

| Net interest expense |

0.6 | 0.5 | 0.4 | 31.7 | 40.8 | |||||||||||||||

| Earnings before income taxes |

7.4 | 7.4 | 8.3 | 6.3 | 7.7 | |||||||||||||||

| Income taxes |

1.8 | 1.7 | (1.2 | ) |

8.8 | 266.1 | ||||||||||||||

| Net earnings |

5.6 | % |

5.7 | % |

9.5 | % |

5.5 | % |

(28.7 | %) |

||||||||||

2019 Compared With 2018

Consolidated Operating Revenues

Our total consolidated operating revenues increased 6.4% to $9.17 billion in 2019, compared to $8.61 billion in 2018, primarily due to increased revenue in DCS related to an increase in revenue producing trucks, higher truck productivity, defined as revenue per truck per week, and an acquisition in the first quarter 2019. The increase in revenue was further attributable to increased load volumes in ICS and higher revenue per load in JBI, partially offset by a decrease in JBI load volumes and a reduction in rates per loaded mile and the number of operating tractors in JBT. Fuel surcharge revenues decreased 1.4% to $1.04 billion in 2019, compared to $1.06 billion in 2018. If fuel surcharge revenues were excluded from both years, our 2019 revenue increased 7.5% over 2018.

Consolidated Operating Expenses

Our 2019 consolidated operating expenses increased 6.3% from 2018, while year-over-year revenue increased 6.4%, resulting in a 2019 operating ratio of 92.0% compared to 92.1% in 2018.

Rents and purchased transportation costs increased 2.1% in 2019, primarily due to increased rail and truck purchased transportation rates within JBI and ICS segments and JBI rail purchased transportation costs, including a $26.8 million charge in 2019, resulting from the issuance of an award regarding our arbitration with BNSF. The current year increase in rents and purchased transportation costs was partially offset by a $152.3 million BNSF arbitration related charge recorded by JBI in 2018. Salaries, wages and employee benefit costs increased 12.5% in 2019 from 2018. This increase was primarily related to increases in driver pay and office personnel compensation due to an increase in the number of employees and a tighter supply of qualified drivers. Depreciation and amortization expense increased 14.5% in 2019, primarily due to equipment purchased related to new DCS long-term customer contracts.

Fuel and fuel taxes expense increased 0.9% in 2019 compared with 2018, due primarily to an increase in road miles, partially offset by a decrease in the price of fuel during 2019. We have fuel surcharge programs in place with the majority of our customers. These programs typically involve a specified computation based on the change in national, regional, or local fuel prices. While these programs may address fuel cost changes as frequently as weekly, most also reflect a specified miles-per-gallon factor and require a certain minimum change in fuel costs to trigger a change in fuel surcharge revenue. As a result, some of these programs have a time lag between when fuel costs change and when this change is reflected in revenues. Due to these programs, this lag negatively impacts operating income in times of rapidly increasing fuel costs and positively impacts operating income when fuel costs decrease rapidly. It is not meaningful to compare the amount of fuel surcharge revenue or the change in fuel surcharge revenue between reporting periods to fuel and fuel taxes expense, or the change of fuel expense between periods, as a significant portion of fuel cost is included in our payments to railroads, dray carriers and other third parties. These payments are classified as purchased transportation expense.

Operating supplies and expenses increased 9.7%, driven primarily by higher equipment maintenance and tire expenses due to increased equipment counts, increased toll costs, higher travel costs, and higher facility maintenance expenses. General and administrative expenses increased 17.6% from 2018, primarily due to increased technology spend on the J.B. Hunt 360 platform and legacy system upgrades, higher Final Mile Services® (FMS) network facility costs, and increased advertising expenses. Additionally, net losses from sale or disposal of assets were $13.1 million in 2019, compared to net losses of $12.1 million in 2018. Insurance and claims expense increased 21.5% in 2019, primarily due to 2019 including a $17.4 million reserve charge for arbitration related legal fees, costs and interest claimed by BNSF and the inclusion of a $20.0 million FMS claim charge within DCS, partially offset by 2018 including specific reserve charges for the settlement of lawsuits with current and former drivers.

Net interest expense for 2019 increased by 31.7% compared with 2018, due to an increase in average debt levels and higher effective interest rates on our debt.

Our effective income tax rate was 24.2% in 2019 and 23.6% in 2018. The increase in 2019 was primarily due to a reduction in discreet tax benefits recognized related to share-based compensation vesting, partially offset by favorable settlements of state income tax audits during 2019.

Segments

We operated four business segments during calendar year 2019. The operation of each of these businesses is described in our Notes to Consolidated Financial Statements. The following tables summarize financial and operating data by segment:

| Operating Revenue by Segment |

||||||||||||

| Years Ended December 31, (in millions) |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| JBI |

$ | 4,745 | $ | 4,717 | $ | 4,084 | ||||||

| DCS |

2,695 | 2,163 | 1,719 | |||||||||

| ICS |

1,348 | 1,335 | 1,025 | |||||||||

| JBT |

389 | 417 | 378 | |||||||||

| Total segment revenues |

9,177 | 8,632 | 7,206 | |||||||||

| Intersegment eliminations |

(12 | ) |

(17 | ) |

(16 | ) |

||||||

| Total |

$ | 9,165 | $ | 8,615 | $ | 7,190 | ||||||

| Operating Income by Segment |

||||||||||||

| Years Ended December 31, (in millions) |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| JBI |

$ | 447 | $ | 401 | $ | 407 | ||||||

| DCS |

269 | 193 | 171 | |||||||||

| ICS |

(11 | ) |

50 | 23 | ||||||||

| JBT |

29 | 37 | 23 | |||||||||

| Total |

$ | 734 | $ | 681 | $ | 624 | ||||||

Operating Data by Segment

| Years Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| JBI |

||||||||||||

| Loads |

1,979,169 | 2,049,014 | 1,999,807 | |||||||||

| Average length of haul (miles) |

1,679 | 1,648 | 1,681 | |||||||||

| Revenue per load |

$ | 2,397 | $ | 2,302 | $ | 2,042 | ||||||

| Average tractors during the period(1) |

5,635 | 5,551 | 5,362 | |||||||||

| Tractors (end of period) |

||||||||||||

| Company-owned |

4,989 | 5,017 | 4,776 | |||||||||

| Independent contractor |

570 | 633 | 764 | |||||||||

| Total tractors |

5,559 | 5,650 | 5,540 | |||||||||

| Net change in trailing equipment during the period |

1,841 | 6,262 | 4,016 | |||||||||

| Trailing equipment (end of period) |

96,743 | 94,902 | 88,610 | |||||||||

| Average effective trailing equipment usage |

86,836 | 88,739 | 82,969 | |||||||||

| DCS |

||||||||||||

| Loads |

3,615,580 | 2,981,344 | 2,575,245 | |||||||||

| Average length of haul (miles) |

169 | 177 | 178 | |||||||||

| Revenue per truck per week(2) |

$ | 4,895 | $ | 4,534 | $ | 4,226 | ||||||

| Average trucks during the period(3) |

10,725 | 9,264 | 7,946 | |||||||||

| Trucks (end of period) |

||||||||||||

| Company-owned |

10,542 | 9,652 | 8,124 | |||||||||

| Independent contractor |

40 | 51 | 59 | |||||||||

| Customer-owned (DCS-operated) |

505 | 412 | 544 | |||||||||

| Total trucks |

11,087 | 10,115 | 8,727 | |||||||||

| Trailing equipment (end of period) |

28,118 | 26,710 | 25,811 | |||||||||

| Average effective trailing equipment usage |

28,147 | 26,806 | 24,550 | |||||||||

| ICS |

||||||||||||

| Loads |

1,243,992 | 1,234,632 | 992,834 | |||||||||

| Revenue per load |

$ | 1,084 | $ | 1,081 | $ | 1,032 | ||||||

| Gross profit margin |

13.1 | % |

15.4 | % |

13.3 | % |

||||||

| Employee count (end of period) |

1,213 | 1,142 | 954 | |||||||||

| Approximate number of third-party carriers (end of period) |

84,400 | 73,100 | 56,700 | |||||||||

| Marketplace for J.B. Hunt 360: |

||||||||||||

| Approximate carrier tractor count (end of period) |

682,000 | 529,000 | 312,000 | |||||||||

| Revenue (millions) |

$ | 839.8 | $ | 557.8 | $ | 125.8 | ||||||

| JBT |

||||||||||||

| Loads |

346,459 | 355,038 | 370,591 | |||||||||

| Average length of haul (miles) |

415 | 427 | 435 | |||||||||

| Loaded miles (000) |

143,511 | 151,322 | 160,932 | |||||||||

| Total miles (000) |

177,035 | 181,718 | 192,433 | |||||||||

| Average nonpaid empty miles per load |

96.9 | 85.5 | 85.1 | |||||||||

| Revenue per tractor per week(2) |

$ | 3,917 | $ | 4,148 | $ | 3,556 | ||||||

| Average tractors during the period(1) |

1,958 | 1,990 | 2,098 | |||||||||

| Tractors (end of period) |

||||||||||||

| Company-owned |

845 | 1,139 | 1,291 | |||||||||

| Independent contractor |

986 | 973 | 741 | |||||||||

| Total tractors |

1,831 | 2,112 | 2,032 | |||||||||

| Trailing equipment (end of period) |

6,975 | 6,800 | 7,120 | |||||||||

| Average effective trailing equipment usage |

6,497 | 6,513 | 7,066 | |||||||||

| (1) |

Includes company-owned and independent contractor tractors |

| (2) |

Using weighted workdays |

| (3) |

Includes company-owned, independent contractor, and customer-owned trucks |

JBI Segment

JBI segment revenue increased 1% to $4.74 billion in 2019, from $4.72 billion in 2018. This increase in revenue was primarily a result of a 4% increase in revenue per load, which is the combination of changes in freight mix, customer rates, and fuel surcharge revenue, partially offset by a 3% decrease in load volume. Eastern network load volumes decreased 9% and transcontinental loads increased 1% compared to 2018. Average length of haul increased 2% in 2019 when compared to 2018. Revenue per load excluding fuel surcharges increased approximately 6% compared to 2018.

Operating income of the JBI segment increased to $447 million in 2019, from $401 million in 2018. Benefits from customer rate increases and freight mix were partially offset by decreased volumes, which includes volume lost to rail rationalization, increased rail purchased transportation costs, higher equipment ownership and maintenance costs, increased technology modernization expenses, lower box turns, higher box repositioning costs and increased driver wages and recruiting costs. Current year operating income was further impacted by a $26.8 million charge to rail purchase transportation expense resulting from the issuance of an award regarding our arbitration with BNSF and a $17.4 million charge to insurance and claims expense, for arbitration related legal fees, costs and interest claimed by BNSF. JBI recorded $152.3 million of additional BNSF arbitration related charges in 2018. Excluding these 2018 charges and the 2019 arbitration related charges of $44.2 million, operating income for 2019, decreased 11% when compared to 2018.

DCS Segment

DCS segment revenue increased 25% to $2.69 billion in 2019, from $2.16 billion in 2018. Productivity, defined as revenue per truck per week, increased 8% when compared to 2018. Productivity excluding fuel surcharge revenue increased 9% from 2018. The increase in productivity was primarily a result of the acquisition of Cory 1st Choice Home Delivery (Cory), better integration of assets between customer accounts, customer rate increases, and increased customer supply chain fluidity during 2019 compared to 2018. In addition, the growth in DCS revenue includes an increase of $187 million in FMS revenue, the majority of which was derived from the first quarter 2019 Cory acquisition. DCS ended 2019 with a net additional 972 revenue-producing trucks when compared to 2018. Approximately 58% of these additions represent private fleet conversions and 15% represent FMS versus traditional dedicated capacity fleets. Customer retention rates remain above 98%.

Operating income of our DCS segment increased to $269 million in 2019, from $193 million in 2018. The increase is primarily due to increased productivity and additional trucks under contract, partially offset by higher insurance and claims costs, which included a $20.0 million FMS claim charge in the second quarter 2019, higher costs from the expanded FMS network, increased driver wages and recruiting costs, and additional non-cash amortization expense of $3.8 million compared to 2018.

ICS Segment

ICS segment revenue increased 1% to $1.35 billion in 2019, from $1.33 billion in 2018. Overall volumes increased 1%. Revenue per load remained flat when compared to 2018 primarily due to customer mix changes, a lower spot pricing market and a competitive pricing environment for contractual truckload business, when compared to 2018. Contractual business was approximately 71% of the total load volume and 59% of the total revenue in the 2019, compared to 70% of the total load volume and 48% of the total revenue in 2018.

ICS segment incurred an operating loss of $11 million in 2019, compared to operating income of $50 million in 2018. The decrease in operating income was primarily due to lower gross profit margins, increased expenses to expand capacity and functionality of the Marketplace for J.B. Hunt 360, higher personnel costs, and increased digital marketing expenses. Gross profit margin decreased to 13.1% in the current year versus 15.4% last year primarily due to weaker spot market activity and lower contractual rates on committed business compared to 2018. Approximately $840 million of ICS revenue for 2019 was executed through the Marketplace for J.B. Hunt 360 compared to $558 million in 2018. ICS’s carrier base increased 15%, and the employee count increased 6% when compared to 2018.

JBT Segment

JBT segment revenue decreased 7% to $389 million in 2019, from $417 million in 2018. Excluding fuel surcharges, revenue for 2019 decreased 6% compared to 2018, primarily due to a 1% decrease in rates per loaded mile, a 3% decrease in length of haul and a 2% decrease in load volumes, compared to 2018. At the end of 2019, JBT operated 1,831 tractors compared to 2,112 at the end of 2018.

JBT segment had operating income of $29 million in 2019 compared with $37 million in 2018. The decrease in operating income was driven primarily by lower spot market activity, higher empty miles per load, increased driver wages and recruiting costs, and the reduction in overall load volumes.

2018 Compared With 2017

Consolidated Operating Revenues

Our total consolidated operating revenues increased 19.8% to $8.61 billion in 2018, compared to $7.19 billion in 2017, primarily due to overall increased load volume and higher revenue per load in all four of our segments. Fuel surcharge revenues increased 40.2% to $1.1 billion in 2018, compared to $754 million in 2017. If fuel surcharge revenues were excluded from both years, our 2018 revenue increased 17.4% over 2017.

Consolidated Operating Expenses

Our 2018 consolidated operating expenses increased 20.8% from 2017, while year-over-year revenue increased 19.8%, resulting in a 2018 operating ratio of 92.1% compared to 91.3% in 2017.

Rents and purchased transportation costs increased 21.5% in 2018, primarily due to increased rail and truck purchased transportation rates and the increase in load volume, which increased services provided by third-party rail and truck carriers within JBI and ICS segments. In addition, our JBI segment incurred charges of $152.3 million to rail purchase transportation expense related to the arbitration with BNSF. Salaries, wages and employee benefit costs increased 19.8% in 2018 from 2017. This increase was primarily related to increases in driver pay and office personnel compensation due to an increase in the number of employees and a tighter supply of qualified drivers. Depreciation and amortization expense increased 13.7% in 2018, primarily due to additions to our JBI segment tractor, container and chassis fleets to support additional business demand and equipment purchased related to new DCS long-term customer contracts.