United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM

| Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| For the fiscal year ended |

or

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

| For the transition period from to |

Commission File No.

Perspective Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| |

| |

| (State of incorporation) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| |

|

|

| |

| |

| (Address of principal executive offices) |

| (Zip code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| | Smaller reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes

As of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the approximate aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $

As of March 22, 2024, the number of shares outstanding of the registrant’s common stock, $0.001 par value per share, was

PERSPECTIVE THERAPEUTICS, INC.

|

|

|

Page |

| PART I |

|

|

| ITEM 1 – |

4 | |

| ITEM 1A – |

34 | |

| ITEM 1B – |

53 | |

| ITEM 1C – | CYBERSECURITY | 53 |

| ITEM 2 – |

54 | |

| ITEM 3 – |

54 | |

| ITEM 4 – |

55 | |

| PART II | ||

| ITEM 5 – |

55 | |

| ITEM 6 – |

55 | |

| ITEM 7 – |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

56 |

| ITEM 7A – |

64 | |

| ITEM 8 – |

64 | |

| ITEM 9 – |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

64 |

| ITEM 9A – |

64 | |

| ITEM 9B – |

65 | |

| ITEM 9C – | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 65 |

| PART III | ||

| ITEM 10 – |

65 | |

| ITEM 11 – |

68 | |

| ITEM 12 – |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

74 |

| ITEM 13 – |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

76 |

| ITEM 14 – |

77 | |

| PART IV | ||

| ITEM 15 – |

78 | |

| ITEM 16 – | FORM 10-K SUMMARY | 79 |

| 80 | ||

NOTE REGARDING COMPANY REFERENCES

Unless the context requires otherwise, references to “Perspective,” "the Company,” “our company,” “we,” “us” and “our” refer to Perspective Therapeutics, Inc., and, as the context requires, its subsidiaries. References to “Viewpoint” refer to Viewpoint Molecular Targeting, Inc., a wholly owned subsidiary, and references to “Isoray” refer to Isoray Medical, Inc., a wholly owned subsidiary.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

In addition to historical information, this Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"). This statement is included for the express purpose of availing Perspective Therapeutics, Inc., of the protections of the safe harbor provisions of the PSLRA.

All statements contained in this Form 10-K, other than statements of historical facts, regarding our future financial condition, results of operations, business strategy and plans and objectives of management for future operations, industry trends and other future events are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “may,” “could,” “might,” “plan,” “project,” “should,” “will,” “would” or the negative of these terms and other similar expressions, although not all forward-looking statements contain these identifying terms. Forward-looking statements in this Form 10-K include, among other things:

| ● | the timing, progress and results of our preclinical studies and clinical trials of our current and future program candidates, including statements regarding the timing of our planned regulatory communications, submissions and approvals, initiation and completion of studies or trials and related preparatory work and the period during which the results of the trials will become available, and our research and development programs; |

| ● | our ability to obtain and maintain regulatory approvals for our future program candidates; |

| ● | our manufacturing capabilities and strategy, including the scalability and commercial viability of our manufacturing methods and processes; |

| ● | our ability to identify patients with the diseases treated by our program candidates and to enroll these patients in our clinical trials; |

| ● | our expectations regarding the potential functionality, capabilities and benefits of our program candidates, if approved for commercial use; |

| ● | the potential size of the commercial market for our program candidates; |

| ● | our expectations regarding the scope of any approved indication for any program candidate; |

| ● | our ability to successfully commercialize our program candidates; |

| ● | our ability to leverage technology to identify and develop future program candidates; |

| ● | our estimates of our expenses, ongoing losses, future revenue, capital requirements and our need for or ability to obtain additional funding before we can expect to generate any revenue from product sales; |

| ● | our belief regarding the sufficiency of our cash resources to fund our operating expenses and capital expenditure requirements into 2026; |

| ● | our competitive position and expectations regarding developments and projections relating to our competitors or our industry; and |

| ● | expectations, beliefs, intentions and strategies regarding the future. |

These statements are based on certain assumptions and analyses made by us in light of our experience and our assessment of historical trends, current conditions and expected future developments as well as other factors we believe are appropriate under the circumstances. However, whether actual results will conform to the expectations and predictions of management is subject to a number of risks and uncertainties as updated in this Form 10-K in Item 1A under the heading “Risk Factors” beginning on page 34 below that may cause actual results to differ materially.

Consequently, all of the forward-looking statements made in this Form 10-K are qualified by these cautionary statements and there can be no assurance that the actual results anticipated by management will be realized or, even if substantially realized, that they will have the expected consequences to or effects on our business operations. Readers are cautioned not to place undue reliance on such forward-looking statements as they speak only of the Company’s views as of the date the statement was made (or any earlier date indicated in such statement). While we may update certain forward-looking statements from time to time, we undertake no obligation to do so, whether as a result of new information, future events or otherwise, except as required by applicable law.

Summary of Risk Factors

Investing in our common stock involves significant risks. Some of the principal risks related to our business include the following. These risks are discussed more fully under “Item 1A - Risk Factors” of this Annual Report.

Risks Related to Our Business, Financial Results and Need for Additional Capital

| ● | We are a clinical-stage biopharmaceutical company and have a limited operating history upon which to base an investment decision. |

| ● | We will require substantial additional capital to fund our operations. Additional funds may be dilutive to shareholders or impose operational restrictions. Further, if additional capital is not available, we may need to delay, limit or eliminate our research, development and commercialization programs and modify our business strategy. |

| ● | We have incurred losses in nearly every year since our inception, and we anticipate that we will not achieve profits for the foreseeable future. To date, we have had no product revenues other than from our brachytherapy business, which is expected to be divested in the first half of 2024. |

Risks Related to Our Business and Industry

| ● | Coverage and adequate reimbursement may not be available for our products, if commercialized, which could make it difficult for us to sell our products profitably. |

| ● | Our program candidates are in early stages of development and must go through clinical trials, which are very expensive, time consuming and difficult to design and implement. The outcomes of clinical trials are uncertain, and delays in the completion of or the termination of any clinical trial of our program candidates could harm our business, financial condition and prospects. |

| ● | We obtain our supply of Thorium-228 from a single supplier. |

| ● | If we encounter difficulties enrolling patients in our clinical trials, our clinical development activities could be delayed or otherwise adversely affected. |

| ● | Because the results of preclinical studies and early clinical trials are not necessarily predictive of future results, any program candidate we advance into clinical trials may not have favorable results in later clinical trials, if any, or receive regulatory approval. |

| ● | Delays in the commencement or completion of our clinical trials could result in increased costs and delay our ability to pursue regulatory approval and commercialization of our program candidates. |

| ● | We may be required to suspend, repeat or terminate our clinical trials if they are not conducted in accordance with regulatory requirements, the results are negative or inconclusive, or the trials are not well designed. |

| ● | The approval processes of regulatory authorities are lengthy, time consuming, expensive and inherently unpredictable; if we experience unanticipated delays or are unable to obtain approval for our program candidates from applicable regulatory authorities, we will not be able to market and sell those program candidates in those countries or regions and our business will be substantially harmed. |

| ● | We intend to rely on third-party collaborators to market and sell our programs, and those third-party collaborators may not have the resources to pursue approvals, which in turn could severely limit our potential markets and ability to generate revenue. |

| ● | Our program candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of the approved labeling, or result in significant negative consequences following marketing approval, if any. |

| ● | If we are unable to execute our sales and marketing strategy for our programs and are unable to gain market acceptance, we may be unable to generate sufficient revenue to sustain our business. |

| ● | Because we license some of our program candidates from third parties, any dispute with our licensors or non-performance by us or by our licensors may adversely affect our ability to develop and commercialize the applicable program candidates. |

| ● | We may form or seek strategic alliances or enter into additional licensing arrangements in the future, and we may not realize the benefits of such alliances or licensing arrangements. |

| ● | We may rely partially on third parties to manufacture our clinical pharmaceutical supplies and could continue to rely on third parties to produce commercial supplies of any approved program candidate, and our dependence on third party suppliers could adversely impact our business. |

| ● | We rely on third parties to conduct our clinical trials and if these third parties do not meet their deadlines or otherwise conduct the trials as required, our clinical development programs could be delayed or unsuccessful, and we may not be able to obtain regulatory approval for or commercialize our program candidates when expected or at all. |

| ● | We may seek orphan drug designation, rare pediatric disease designation or other United States Food and Drug Administration ("FDA") designations but may not receive such designation. Even if the FDA grants the designation, we may not receive orphan drug exclusivity or a priority review voucher, if the program candidate does not meet the FDA requirements at the time of approval or licensure. |

| ● | We have received Fast Track designation for VMT-α-NET, but such designation may not actually lead to a faster development or regulatory review or approval process. Additionally, the FDA may rescind the designation if it determines the program candidate no longer meets the qualifying criteria for Fast Track. |

| ● | We will face intense competition and may not be able to compete successfully. |

| ● | Our success will depend upon intellectual property, proprietary technologies and regulatory market exclusivity periods, and we may be unable to protect our intellectual property. |

| ● | We intend to rely on market exclusivity periods that may not be or remain available to us. |

| ● | We must deploy our sales and marketing capabilities to market, distribute and sell our programs if any of our program candidates are approved, and may not be effective in doing so. |

| ● | If any program candidate that we successfully develop does not achieve broad market acceptance among physicians, patients, healthcare payors and the medical community, the revenues that it generates from their sales will be limited. |

| ● | Due to the significant resources required for the development of our drug candidates, we must prioritize development of certain drug candidates and/or certain disease indications and may expend our limited resources on candidates or indications that do not yield a successful program and fail to capitalize on drug candidates or indications that may be more profitable or for which there is a greater likelihood of success. |

| ● | If we fail to attract and retain key management and clinical development personnel, we may be unable to successfully develop or commercialize our program candidates. |

| ● | Our ability to compete may decline if we do not adequately protect our proprietary rights. |

Risks Related to Our Discontinued Brachytherapy Industry and Operations

| ● | Continuing regulatory liability may exist from our discontinued operations. |

| ● | We are subject to the risk that certain third parties may mishandle our product. |

Legal and Regulatory Risks Related to the Our Operations

| ● | Significant disruptions of information technology systems or breaches of data security could materially adversely affect our business, results of operations and financial condition. |

| ● | Our employees and independent contractors, including principal investigators, consultants, commercial collaborators, service providers and other vendors may engage in misconduct or other improper activities, including noncompliance with regulatory pricing standards and requirements, which could have an adverse effect on our results of operations. |

| ● | If we fail to comply with applicable healthcare regulations, we could face substantial penalties and our business, operations and financial condition could be adversely affected. |

| ● | We are subject to U.S. and foreign anti-corruption and anti-money laundering laws with respect to our operations, and noncompliance with such laws can subject us to criminal and/or civil liability and harm our business. |

| ● | Healthcare reform measures could hinder our programs’ commercial success. |

| ● | If, once we offer commercialized drug products, we participate in the Medicaid Drug Rebate Program and other governmental pricing programs, failure to comply with obligations under these programs could result in additional price concession requirements, penalties, sanctions and fines, which could have a material adverse effect on our business, operations and financial condition. |

| ● | Pending and future patent litigation could be costly and disruptive and may have an adverse effect on our financial condition and results of operations. |

| ● | The value of our granted patents, and our patents pending, is uncertain. |

| ● | Failure to comply with government regulations could harm our business. |

| ● | Our business exposes us to product liability claims. |

| ● | Our business involves environmental risks. |

Risks Related to Ownership of Shares of Common Stock and Public Company Status

| ● |

Our reporting obligations as a public company are costly. |

| ● |

Our common stock price is likely to be volatile and may be adversely affected by the future issuance and sale of shares of our stock or other equity interests. |

| ● |

We do not expect to pay any dividends for the foreseeable future. |

Change in Fiscal Year

As previously reported, on February 6, 2023, we changed our fiscal year end from June 30 to December 31, effective December 31, 2022. This Annual Report on Form 10-K ("Annual Report" or "Form 10-K") is for the 12-month period from January 1, 2023 through December 31, 2023.

Overview

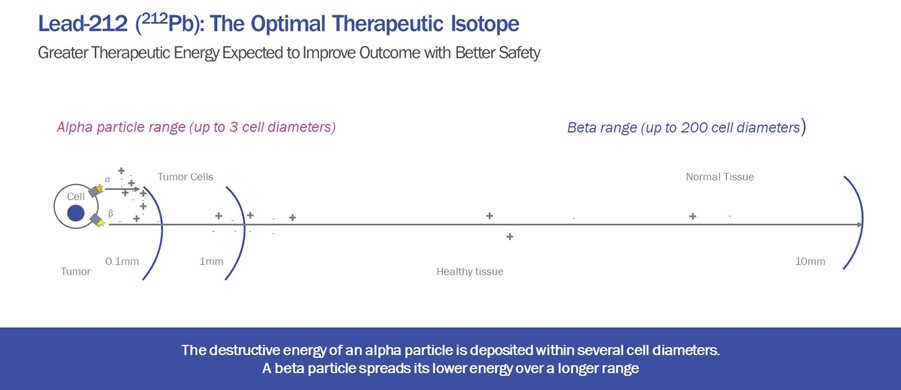

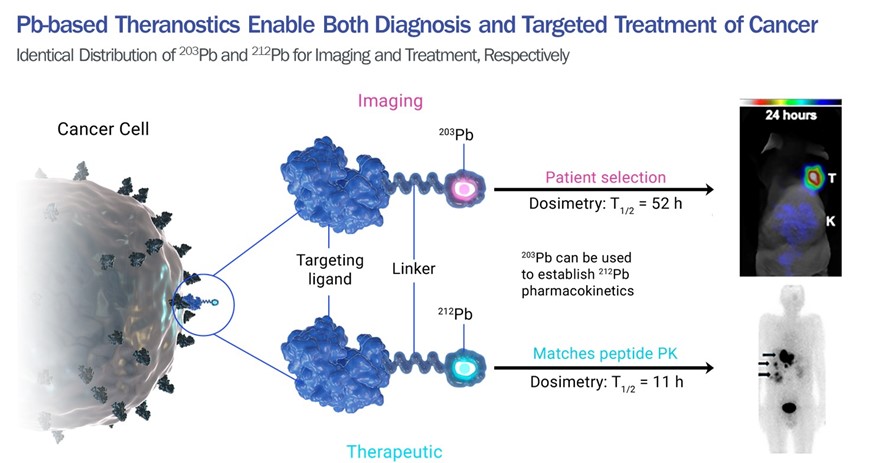

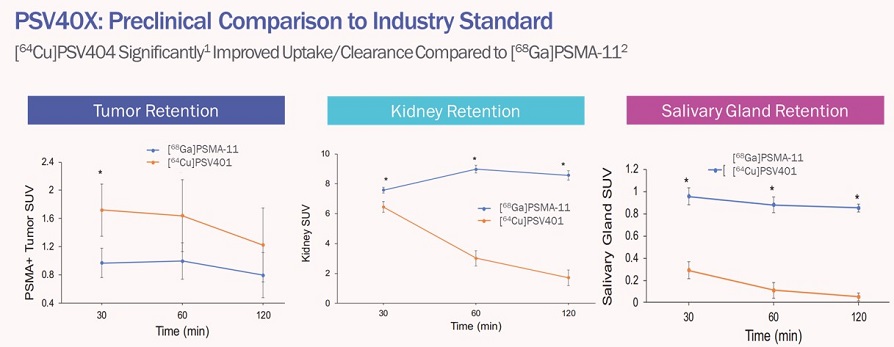

Perspective is developing the next generation of precision-targeted alpha therapies (“TAT”) for oncology that have the potential to treat a large population of cancer patients across multiple tumor types, including those with metastatic disease. By leveraging its proprietary TAT platform, Perspective aims to develop alpha-emitting radiopharmaceuticals that can be attached to targeting peptides to deliver the radioactive payload directly to difficult-to-treat tumors. The foundation of Perspective’s TAT platform is its Pb-specific chelator ("PSC") and peptide linker technology, which is designed to enable Perspective to connect Perspective’s alpha-emitting isotope of choice, Lead-212 (“212Pb” or “Pb-212”), to a desired targeting peptide to deliver radiation directly to cancer cells. Unlike commercially available chelators and linkers, Perspective’s proprietary PSC and peptide linker have shown in preclinical studies the differentiated ability to promote enhanced clearance of the non-tumor localized 212Pb payload without sacrificing the uptake of the alpha particle into the tumor. Rapid clearance of the alpha-emitting isotope from normal tissues is important to enhance tolerability and widen the therapeutic window of Perspective’s program candidates. Perspective is also developing complementary diagnostics that utilize the same targeting peptide and imaging isotopes such as Lead-203 (“203Pb” or “Pb-203”), Gallium-68 (“68Ga” or “Ga-68”), or Copper-64 (“64Cu” or “Cu-64”) to provide the opportunity to understand which patients may respond to its targeted therapy.

Perspective’s platform generates TATs that are comprised of three components: (i) a targeting peptide that is designed to selectively target ligands that are unique to, or preferentially expressed on, cancer cells throughout the body; (ii) the alpha-emitting medical isotope 212Pb designed to kill cancer cells; and (iii) Perspective’s proprietary linker that attaches the targeting molecule to the radioactive payload.

Perspective utilized its TAT platform to discover, design and develop its initial programs, VMT-α-NET and VMT01, which are currently in ongoing Phase 1 clinical trials, and Perspective plans to continue to leverage its platform to assess the potential of, and develop, multiple additional pipeline programs. Using our proprietary platform technology, VMT-α-NET and VMT01 are engineered to target cancer-specific receptors on tumor cells. [212Pb]VMT-α-NET is a TAT in development for patients with unresectable or metastatic somatostatin receptor type 2 ("SSTR2")-expressing tumors who have not previously received peptide-targeted radiopharmaceutical therapy, such as Lutathera, a beta-emitting therapy marketed by Novartis. [212Pb]VMT01 is a TAT in development for second-line or later treatment of patients with progressive melanocortin 1 receptor ("MC1R")-positive metastatic melanoma.

Our Strategy

Perspective’s goal is to advance innovative precision medicines for the treatment of cancer by developing and commercializing its TATs. The key elements of its strategy are to:

Advance its initial drug candidate, VMT-α-NET, through clinical development for the treatment of neuroendocrine tumors expressing SSTR2. [203Pb]VMT-α-NET is in an ongoing diagnostic Phase 1 clinical trial in patients with SSTR2-positive neuroendocrine tumors ("NETs"). Perspective has received FDA's permission to enter into an open label Phase 1 therapeutic trial to assess [212Pb]VMT-α-NET safety, tolerability and pharmacokinetics as well as to identify the maximum tolerated dose and the recommended Phase 2 dose in patients with SSTR2-positive NETs who have not received prior radiotherapy. Secondary endpoints assess efficacy using imaging criteria, best and overall response, progression-free survival and overall survival. This trial includes patients with NETs of gastrointestinal, pancreatic and lung origin, as well as pheochromocytoma and paraganglioma. Perspective has received a Fast Track designation from the FDA under this investigational new drug ("IND") application. Perspective intends to leverage this accelerated approval pathway to design and seek approval for an adaptive registrational trial as data becomes available in the dose escalation study. This strategy, which is commonly employed for drugs showing effectiveness in life-threatening oncological disease states, has the opportunity to provide a path to a new drug application and commercial approval in one more NET cancer subtypes without first executing a traditional Phase 3, double-blind, randomized and placebo-controlled clinical trial. As information on the tolerability and radiation exposure to normal tissues is defined in its Phase 1/2a study, Perspective intends to seek approval for expanding its indication to patients who have received prior radiotherapy and are experiencing recurrence.

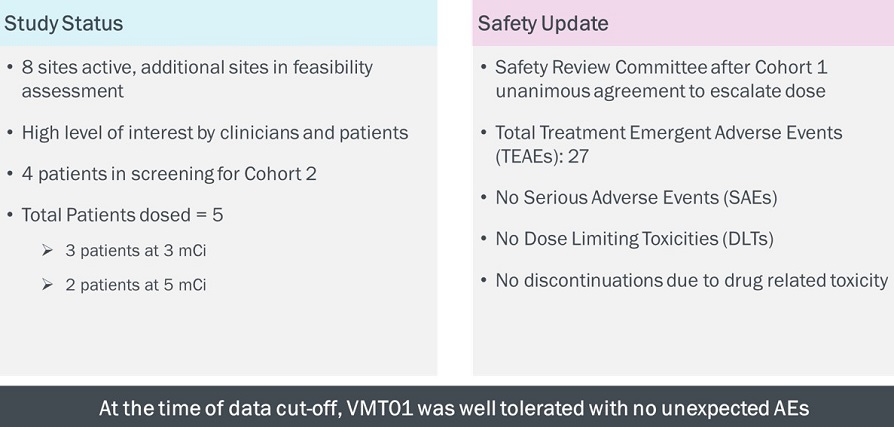

Advance its second drug candidate, [203/212Pb]VMT01, through clinical development for the treatment of melanoma tumors expressing MC1R. [203Pb]VMT01 and [68Ga]VMT02 imaging tracers are in an ongoing diagnostic Phase 1 clinical trial in patients with stage IV metastatic melanoma. Perspective has received an IND "safe to proceed" letter from the FDA to evaluate the therapeutic [212Pb]VMT01 in patients with advanced and progressive melanoma. Perspective has begun enrollment and has completed the first cohort in October 2023. The second cohort is currently enrolling. The opening study under this IND is a Phase 1/2a trial utilizing a modified 3+3 dose-ranging design to evaluate approximately 30 subjects with previously treated inoperable stage III and stage IV melanoma. The primary endpoints of this study are safety and tolerability, determination of a recommended dose for subsequent study and tumor targeting as determined by imaging. Secondary endpoints assess efficacy using imaging criteria, best and overall response, progression-free survival and overall survival. Perspective may design and seek approval for an adaptive registrational trial in refractory or uveal melanoma as data becomes available in the dose escalation study. However, [212Pb]VMT01 has shown strong synergy with immune-oncology drugs including PD-1 and CTLA-4 inhibitors in preclinical studies. Perspective intends to present this information to the FDA in a Fast Track Application for use of [212Pb]VMT01 in combination with one or more immune oncology drugs as first-line therapy of inoperable stage III or stage IV melanoma, thus creating opportunity for parallel paths to approval.

Continue to leverage its TAT platform to expand its pipeline of program candidates. Perspective’s technology allows it to create novel TATs by combining 212Pb encased within its Pb-specific chelator ("PSC") with a wide variety of targeting peptides and other delivery vehicles. Targeting molecules can come from discontinued programs, novel molecules currently in development, approved molecules or other proprietary targeting agents. As such, Perspective is continuously evaluating opportunities to acquire or in-license additional new targeting molecules such as those recently licensed from the Mayo Foundation for Medical Education and Research ("Mayo Clinic") and Stony Brook University that Perspective believes can be utilized with its platform to create a potent alpha therapeutic agent. Perspective is leveraging its platform to progress its existing program candidates into clinical development for additional indications, including breast and pancreatic cancers, as well as the development of new program candidates.

Expand the potential of its program candidates in additional indications and as combination therapies in current and additional indications. SSTR2, the molecular target of [212Pb]VMT-α-NET, is overexpressed in a number of cancers that are not classified as NETs, including meningioma and neuroblastoma. Both of these cancers can be difficult to treat when advanced and inoperable, but this is especially true for advanced neuroblastoma, a rare and orphan pediatric disease that is one of the most morbid of pediatric cancers. Perspective intends to prioritize seeking regulatory approval to test [212Pb]VMT-α-NET in advanced pediatric neuroblastoma as soon as adult experience in NETs provides a basis for determining safety and tolerability. Perspective will leverage the unique capability of [203Pb]VMT-α-NET quantitative imaging to arrive at individualized [212Pb]VMT-α-NET starting doses for the children by calculating the expected radiation delivery to the tumors and normal tissues before treatment begins.

In preclinical studies, Perspective also observed a synergistic effect on anti-tumor activity when its TATs are used in combination with approved checkpoint inhibitors. Perspective believes that the synergies it has observed could expand the addressable patient populations for [212Pb]VMT01 and allow for potential use in earlier lines of treatment, if approved, after completing the initial evaluation of [212Pb]VMT01 in a relapsed or refractory patient population. Perspective is currently evaluating [212Pb]VMT01 in preclinical studies in combination with approved checkpoint inhibitors and deoxyribonucleic acid ("DNA") damage response inhibitors, such as poly-ADP ribose polymerase inhibitors. Perspective may also explore other combination therapies that it believes may improve response rates in immune oncology-responsive tumors as compared to monotherapies of approved oncology therapeutics across Perspective's development pipeline.

Utilize a precision medicine approach by leveraging its imaging diagnostics. In order to enrich the patient population for its trials, Perspective created an imaging analogue of each of its program candidates by replacing 212Pb with the radioactive imaging isotope 203Pb while retaining the same targeting peptide. This allows Perspective to assess the uptake of the imaging isotope into the targeted tumor and radiation doses to key organs. Using this data, Perspective is able to enroll only those patients who meet predefined tumor uptake and dosimetry standards and are, therefore, more likely to respond to treatment. Perspective believes this strategy will allow it to enrich the patient population of its clinical trials and enable the use of a precision medicine approach for the treatment of multiple tumor types.

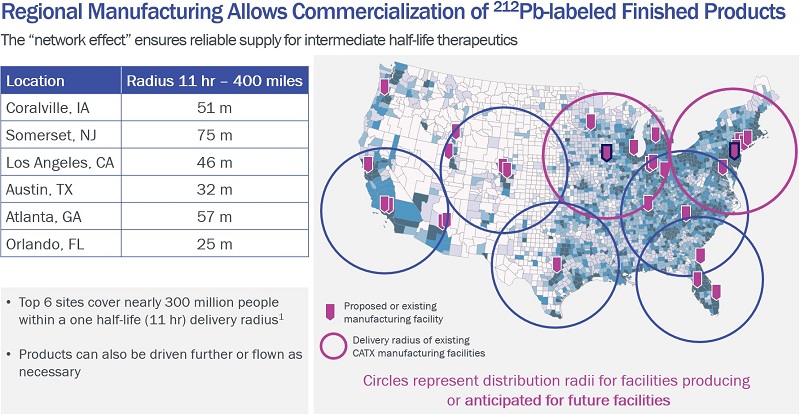

Continue to strengthen and scale its internal manufacturing capabilities. Perspective believes the quality, reliability and scalability of the manufacturing process for its program candidates will be a core competitive advantage and better enable its long-term success. Perspective has developed its proprietary VMT-α-GEN isotope delivery system (generator) to deliver its therapeutic isotope 212Pb for supply to patients. Perspective has a license to possess radioactive materials and distribute our radiopharmaceuticals from the Iowa Department of Health and Human Services, Radioactive Materials Program at our Coralville, IA site. In January 2021, we entered into a 10-year feedstock contract with the National Isotope Development Center of the Department of Energy's ("DoE") Isotope Program. Perspective has scaled manufacturing of the supply of VMT-α-GEN systems for research purposes and is developing its supply capabilities in an effort to support the clinical development of its drug candidates. Perspective believes that by controlling its own therapeutic isotope supply, Perspective can solve the many supply chain risks that have slowed alpha-particle therapy clinical adoption to date. In March 2024, Perspective acquired the assets and associated lease of Lantheus Holdings, Inc.'s ("Lantheus") radiopharmaceutical manufacturing facility in Somerset, NJ. This site has three production suites that Perspective intends to utilize to supply drug product for the northeastern half of the United States. Perspective plans to continue to invest resources to further develop its internal manufacturing process and capabilities in addition to collaborating with contract drug manufacturers.

Background of Radiation-Based Therapies and Radiopharmaceuticals

External beam radiation, or ExB, is one of the most widely used treatments for cancer, with approximately 50% of all cancer patients receiving radiation therapy during the course of treatment. To deliver ExB, a radiation therapy device is used to aim a beam of ionizing radiation into the tumor to kill cancer cells. Based on advances in radiation technology, ExB is highly effective in killing cancer cells and this treatment modality contributes towards approximately 40% of curative treatment for cancer. However, despite the successes of ExB treatment, only a limited number of sites in the body can be irradiated at any time by this treatment due to the off-target effects of radiation that can damage normal tissues. In addition, not all types of cancers can be treated with ExB, as certain organs or tumor types may be difficult to access with radiation beams. As a result, ExB use has generally been restricted to treating localized tumors and is not typically used as a monotherapy to treat patients who have metastatic disease.

Radiopharmaceuticals have been developed to precisely apply the tumor-killing power of radiation to a wider array of cancers, including for patients who have metastatic disease. Radiopharmaceuticals are drugs that contain medical isotopes, which are unstable elements that emit radiation and can be used to diagnose and treat cancers. To create radiopharmaceuticals, radiation-emitting medical isotopes are typically attached to targeting molecules and administered via intravenous injection. Once administered, the radiopharmaceuticals selectively target tumor antigens that are unique to, or preferentially expressed on, cancer cells throughout the body. Currently available targeted radiopharmaceuticals have demonstrated the ability to simultaneously bind to and kill multiple tumors. By precisely delivering alpha radiation directly to cancer cells, Perspective believes the power of radiotherapy can be realized while reducing the off-target effects.

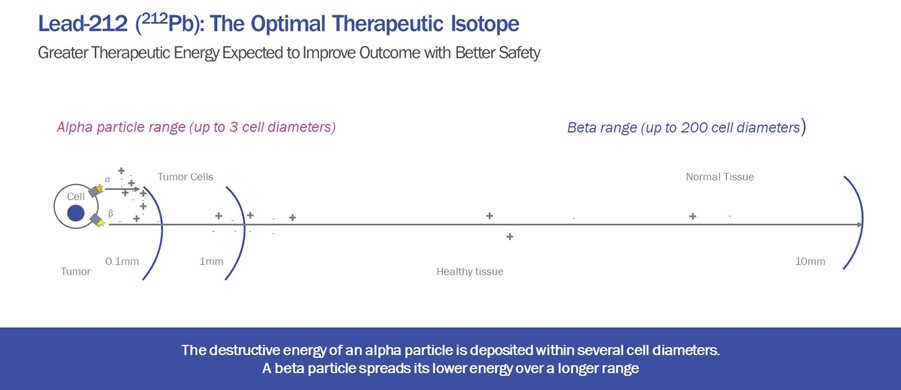

Targeted radiopharmaceuticals are drugs that contain a radionuclide payload and a targeting moiety, which are unstable elements that emit radiation and can be used to diagnose and treat cancers. To create targeted radiopharmaceuticals, radiation-emitting medical isotopes are typically attached to targeting molecules, which are then administered via intravenous injection. Once administered, the radiopharmaceuticals selectively target tumor receptors that are unique to, or preferentially expressed on, cancer cells throughout the body. There are two main classes of therapeutic radiopharmaceuticals, which differ based on the types of particles that are emitted - beta-emitting isotopes and alpha-emitting isotopes. Beta-emitting isotopes kill cancer cells primarily by creating free radicals that damage cellular machinery and cause single-stranded DNA breaks, which can be repaired by the cell. In contrast, alpha particles cause greater physical damage to cancer cells than beta particles, including multiple double-stranded DNA breaks, which are highly lethal. Alpha particles are larger (over 7,000-fold greater atomic mass) and have higher energy transfer rates than beta particles. This higher energy transfer rate allows alpha particles to deposit a greater amount of tumor-killing energy over a short distance of one to five cells (<0.1 mm), compared to the relatively long distance of up to 200 cells (12 mm) for beta particles, allowing alpha particles to cause damage only to cancer cells in close proximity while reducing off-target radiation risk.

Targeted radiopharmaceuticals as a class have achieved clear clinical benefit over non-radioactive standard-of-care agents in the treatment of gastroenteropancreatic neuroendocrine tumors and castration-resistant metastatic prostate cancer and they possess characteristics that many believe may improve upon the profiles of current antibody-drug conjugates ("ADCs").

Perspective is leveraging its proprietary TAT platform to build on the successes of currently available radiation therapies and create the next generation of precision oncology alpha radiopharmaceuticals. Perspective’s TATs are comprised of three components: (i) a targeting peptide, that is designed to selectively target receptors that are unique to, or preferentially expressed on, cancer cells throughout the body; (ii) the alpha-emitting medical isotope 212Pb, designed to kill cancer cells, that is encased in its proprietary lead-specific chelator; and (iii) its proprietary linker that attaches the targeting molecule to the radioactive payload.

Perspective believes that its TAT platform and program candidates, if approved, could provide several potential advantages over currently available radiopharmaceuticals, including:

| ● | enhanced tumor-killing power by using 212Pb alpha-particle radiation in an outpatient setting; |

| ● | ability to use multiple targets and classes of targeting molecules; |

| ● | broad applicability across multiple tumor types, including neuroendocrine, metastatic melanomas and other cancers; |

| ● | increased tolerability and therapeutic window associated with its lead-based TATs; |

| ● | exploitation of multiple mechanisms of action, including direct DNA damage and an alpha particle-mediated enhanced anti-tumor immune response; |

| ● | an established manufacturing process and supply chain using its proprietary VMT-α-GEN isotope delivery system (colloquially called a “generator”); and |

| ● | ability to use its 203Pb imaging diagnostics to enrich its targeted patient populations and determine treatment therapeutic suitability. |

Perspective believes the multiple mechanisms of action of its TATs may give them the ability to treat hard-to-treat tumors and the potential to work synergistically with other approved oncology therapies. The primary mechanism of action of 212Pb is direct cell damage through the induction of multiple double-stranded DNA breaks. A secondary mechanism, which would likely expand the effective direct cell kill range of the alpha particles, is referred to as the Bystander Effect. This effect has been shown to be as significant to the overall efficacy in killing cancer cells as the direct DNA breaks. The Bystander Effect has been shown to propagate alpha particle-induced cell death from irradiated dying cells to kill adjacent non-irradiated cells up to 1,000 µm away in a three-dimensional solid tumor model.

Alpha vs Beta Radiopharmaceuticals

There are two main classes of therapeutic radiopharmaceuticals, which differ based on the types of particles that are emitted - beta-emitting isotopes and alpha-emitting isotopes. Historically, due to the readily available supply of beta-emitting isotopes and the better understanding of their chemistry and biology, they were more widely used than alpha-emitting isotopes. As a result, first-generation-targeted therapeutic radiopharmaceuticals were based on beta-emitting isotopes, which kill cancer cells primarily by creating free radicals that damage cellular machinery and cause single-stranded DNA breaks, which can be repaired by the cell. As a result, certain cancers are refractory to beta particle-based radiopharmaceutical treatment. Products based on beta-emitting isotopes have been developed successfully, but as the development of radiopharmaceuticals continued to evolve, a deeper understanding of the potential of alpha-emitting isotopes for treating cancer has emerged.

Compared to beta particles, alpha particles cause greater physical damage to cancer cells, including multiple double-stranded DNA breaks, for which there is no viable resistance mechanism, unlike in the case of single-stranded DNA breaks. Rather, double-stranded DNA breaks are highly lethal, with even a single double-stranded break being sufficient to cause cancer cell death. Alpha particles are over 7,000 times more massive than beta particles with an approximately 4,000-fold higher energy transfer rate, providing alpha particles the advantage of depositing a high amount of tumor-killing energy over a short distance of one to two cells, compared to the relatively long distance of up to 12 mm for beta particles. The amount of energy produced by alpha particles is high enough such that only a small number of alpha particles are required to cause cell death. This feature, when combined with their short path length, enables alpha particles to cause damage only to cancer cells in close proximity, reducing the risk of off-target radiation and normal cell damage that can occur with beta particles. However, because of the short travel distance, alpha particles need to be delivered into or on the surface of tumor cells to achieve the desired therapeutic effect.

The graphic below is management’s illustration of the comparison of the key differences between beta particles and alpha particles.

Commercially Available Radiopharmaceuticals

Two of the earliest antibody-targeted radiopharmaceuticals, Bexxar, marketed by GlaxoSmithKline, and Zevalin, marketed by Acrotech Biopharma, LLC, are beta-emitting therapies whose market acceptance was hampered by several issues, including handling and administration difficulties, supply chain challenges and reimbursement complications. Next-generation radiopharmaceuticals that have overcome the challenges faced by first-generation radiopharmaceuticals have since been developed and approved. One such approved, next-generation targeted radiopharmaceutical therapy is Lutathera, a beta-emitting therapy marketed by Novartis. Novartis reported that fiscal year 2023 sales revenue from Lutathera was $605 million, up 28% from fiscal year 2022, despite only being approved for a subset of neuroendocrine cancers that affect the pancreas or gastrointestinal tract, known as GEP-NETs. Recently, in March 2022, Pluvicto, a beta-emitting radioligand therapy marketed by Novartis, was approved to treat progressive, prostate-specific membrane antigen ("PSMA") positive metastatic castration-resistant prostate cancer. Pluvicto is being further developed by Novartis for other prostate cancer indications. Novartis reported that fiscal year 2023 sales revenue for Pluvicto were $980 million, up 262% from fiscal year 2022.

Over the past decade the global radiopharmaceutical market has been growing rapidly. Radiotherapeutics have been projected to grow at a compound annual growth rate ("CAGR") of 39.0% from 2022-2032, and radiodiagnostics have been projected to grow at CAGR of 7.2% from 2022-2032 (Source: 2023 MEDraysintell Nuclear Medicine Report).

Perspective's TAT Platform

Through the use of proprietary, specialized targeting peptides, Perspective is able to diagnose and then deliver a powerful alpha-particle radiotherapy directly to the tumor, while potentially limiting damage to healthy tissue. Utilizing a radioactive imaging agent that emits gamma rays, 203Pb, connected to a specific targeting peptide, Perspective has the ability to diagnose the tumor. Following diagnosis, Perspective links its alpha-particle radioactive isotope, 212Pb, to the same targeting peptide to treat and potentially kill the tumor. This two-step, personalized medicine approach, as depicted below, offers the ability to understand which patients may respond to its therapy and potentially improve efficacy while minimizing toxicity associated with many other types of cancer treatments.

Perspective’s image-guided TAT leverages a specialized targeting peptide to deliver cancer-killing 212Pb directly to the tumor. Targets are carefully selected to ensure they are overexpressed in cancer cells and minimally expressed on normal healthy cells. When the peptide is radiolabeled with 203Pb, the patient can be imaged (i.e., single-photon emission computed tomography ("SPECT") and computed tomography ("CT")) to reveal cancer cells in the body. When the peptide is radiolabeled with 212Pb, the target-peptide binding delivers powerful, yet locally deposited, cancer-killing alpha-particle radiation directly to cancer cells. This targeting mechanism allows for maximized therapeutic effects while minimizing off-target toxicities and may be used as a monotherapy or in combination with other precision treatments, such as targeted intracellular pathway inhibitors and immune checkpoint inhibitors.

Perspective’s TAT platform is highlighted by research and insights into the underlying biology of alpha-emitting radiopharmaceuticals as well as its differentiated capabilities in target identification, candidate generation, manufacturing and supply chain, and the development of imaging diagnostics. Perspective’s TAT platform was primarily developed over 15 years at the University of Iowa. Perspective believes that its TATs have the potential to be broadly applicable across multiple targets and tumor types and transform the treatment landscape of radiopharmaceuticals for the treatment of cancer.

Perspective’s next-generation radiopharmaceutical technology has been recognized by many prestigious organizations and has received numerous awards and grants. Over the past 10 years, through December 2023, approximately $13 million has been awarded to Perspective and over $4 million to Co-Founder Michael Schultz’s laboratory at the University of Iowa. Grant support has been for the Company’s TAT development activities, including the advancement of preclinical diagnostic and therapeutic studies for both VMT-α-NET and VMT01, Phase 1 diagnostic clinical trials for both VMT-α-NET and VMT01, and its VMT-α-GEN in-house radioisotope production technologies. These grants have been received primarily from the National Institutes of Health ("NIH"), National Cancer Institute ("NCI") and state-funded programs.

212Pb (Lead-212)

Although there are many alpha-emitting isotopes, Perspective believes that the ideal therapeutic isotope should emit alpha particles in rapid succession in order to maximize damage to cancer cells and increase efficacy. Alpha particles kill tumors through multiple mechanisms. The primary mechanism of action is direct cell damage through the induction of multiple double-stranded DNA breaks. As alpha particles traverse the nucleus of a cell, they create a linear track of direct chromosomal damage, leaving behind multiple clusters of double-stranded DNA breaks. These direct alpha particles can kill cells up to a distance of 100 µm, which is equal to a depth of a few cells. A secondary mechanism, which would expand effective direct cell kill range of the alpha particle, is referred to as the Bystander Effect. This effect has been shown to be as significant to the overall efficacy in killing cancer cells as the direct DNA breaks. The Bystander Effect has been shown to propagate alpha particle-induced cell death from irradiated dying cells to kill adjacent non-irradiated cells up to 1,000 µm away in a three-dimensional solid tumor model. A third mechanism by which alpha-particle therapy enhances the body’s own anti-tumor immune response is less well understood but has been widely observed and reported. In Perspective’s own preclinical studies, Perspective has observed a vaccine-like effect that prevented the regrowth of tumors upon re-challenge. This is an area of ongoing investigation by Perspective and the international scientific community. Our findings are reported by Perspective senior scientist Dr. Mengshi Li, et.al. in the peer-reviewed journal Cancers 2021, 13: 3676, 2021.

Perspective believes 212Pb is an optimal therapeutic isotope as compared to currently commercially available radiopharmaceuticals as well as other alpha therapies in development. With a half-life of 10.6 hours, 212Pb is ideally suited to deliver powerful alpha-particle therapy to cancerous tumors, while representing a lower risk for off-target unintended effects. The decay properties of the 212Pb isotope and the rapid excretion of drug that has not bound to the tumor target provide the potential for treatment on an outpatient basis.

212Pb is an alpha-emitting nuclide that acts as the therapeutic in Perspective’s innovative theranostic approach. The higher linear-energy transfer of alpha particles, compared to beta particles, results in an increased incidence of double-stranded DNA breaks and improved localized cancer-cell damage. Perspective believes 212Pb half-life of 10.6 hours provides many significant advantages over other radiotherapies, including faster clearance and the potential for reduced off-site toxicity. Its decay chain includes the short-lived isotopes bismuth-212, polonium-212 and thallium-208, which all emit either alpha or beta during decay over about another hour. The end of the decay chain is the stable element lead-208.

In order to maximize the potential clinical benefit of radiopharmaceuticals to patients and minimize potential toxicity issues, Perspective believes that TATs must selectively localize and remain within the tumor while the portions of the TAT that are not localized within the tumor are rapidly cleared from the body. Nearly 15 years of work by Perspective’s co-founder, Dr. Michael Schultz, and colleagues at the University of Iowa and Perspective resulted in Perspective’s proprietary TAT, PSC and peptide linker technology to enable the delivery of isotopes to tumor cells while simultaneously promoting enhanced clearance of the non-tumor localized isotopes.

Due to the short half-life of 212Pb and the small size of the compounds, when Perspective’s TATs are not bound to targeted cancer cells, they rapidly clear from the body through the urinary system, along with any isotopes bound to the linker. This results in lower total body radiation exposure when compared to radiopharmaceuticals designed with longer lived isotopes or larger molecular weight targeting moieties such as antibodies or antibody fragments. Perspective believes that its TAT's ability to promote clearance without compromising the tumor’s uptake of the alpha particle overcomes a longstanding challenge of radiopharmaceutical drug development.

Perspective’s Chemistry and Biology Expertise with 212Pb

Perspective believes that its experience working with alpha-emitting radiopharmaceuticals positions it to build on the success of currently approved radiopharmaceuticals. By utilizing the advantages of 212Pb and its proprietary chelator, Perspective has the ability to develop next-generation radiopharmaceutical therapies. 212Pb has complex chemistry and requires extensive experience and expertise to develop and properly characterize 212Pb radiopharmaceuticals with regard to the required tumor targeting, shelf-life, in vivo stability and potential for commercial-scale manufacturing. For example, the high energy emitted from 212Pb can cause program candidates to prematurely degrade. Perspective believes it has the experience and know-how to develop molecules and formulations of 212Pb to maximize the shelf-life of its program candidates and allow for regional production and distribution. In addition to a deep understanding of the chemistry of 212Pb, Perspective has differentiated knowledge of the underlying biology of 212Pb and its mechanisms of directly damaging the DNA of tumors through single- and double-stranded DNA breaks, causing the Bystander Effect and using the immune system’s adaptive response to attack non-target expressing tumors in order to stimulate a vaccine effect.

Imaging Diagnostics – 203Pb (Lead-203)

For each of its program candidates, Perspective creates an imaging analogue that utilizes the same linker and targeting molecule but replaces 212Pb with the radioactive imaging isotope 203Pb. This allows Perspective to assess uptake of the imaging analogue into the targeted tumor and to determine radiation doses to key organs. The imaging analogue versions of Perspective’s program candidates are leveraged in both preclinical and clinical development and are used to enrich the patient population in its clinical trials by identifying the patients and tumor types more likely to respond to therapy.

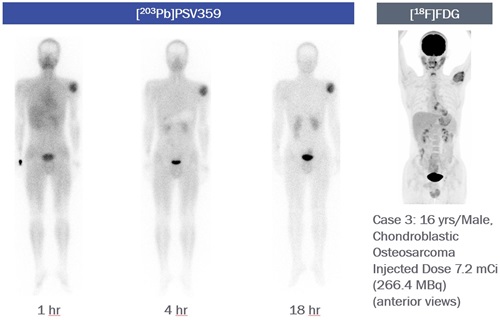

203Pb is a gamma-emitting nuclide that acts as the diagnostic in Perspective’s innovative theranostic approach. 203Pb has a long enough half-life to facilitate radiopharmaceutical preparation and gamma-ray imaging (e.g., SPECT or planar gamma camera) at time points up to 24 hours and, potentially, 48 hours post administration. The ability to collect data on the biodistribution of 203Pb over this period allows for a more detailed understanding of tumor and other organ accumulation, retention and clearance that can be used as part of a treatment planning process for determining appropriately administered radioactivity levels of 212Pb for alpha-particle therapy.

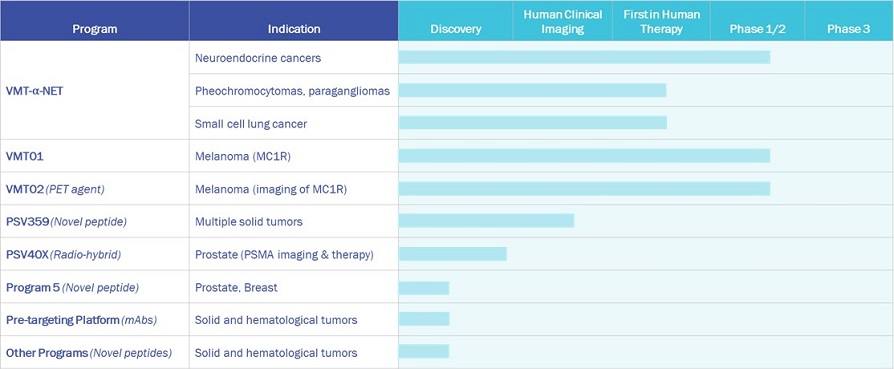

Perspective’s Pipeline

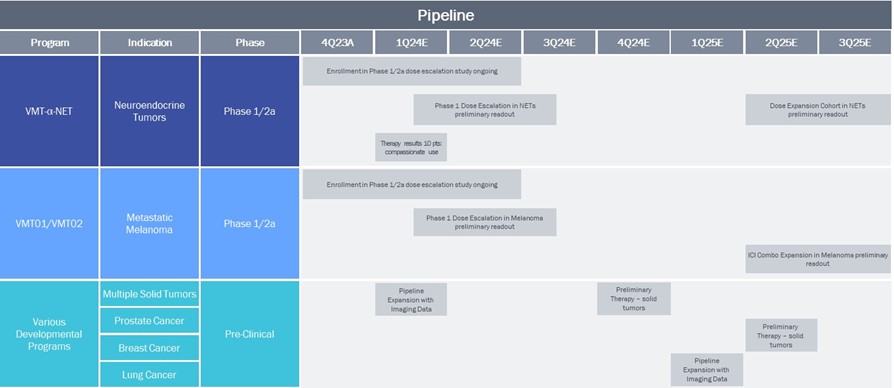

Perspective is leveraging its TAT platform to advance a pipeline of alpha-based therapeutic programs to treat various cancers. The figure below details its current pipeline of TATs. To date, Perspective has retained global development and commercialization rights to all its program candidates. In January 2024, Perspective announced it had entered into a strategic agreement with Lantheus whereby in exchange for an upfront payment of $28 million (less certain withholding amounts), Lantheus obtained an exclusive option to negotiate for an exclusive license to Perspective's [212Pb]VMT-α-NET and a right to co-fund the IND-enabling studies for early-stage therapeutic candidates targeting PSMA and gastrin-releasing peptide receptor and, prior to IND filing, a right to negotiate for an exclusive license to such candidates.

The table below shows Perspective’s two lead programs in clinic and its broad proprietary pipeline:

Perspective anticipates multiple near-term data readouts on its clinical and preclinical assets as follows:

Programs

VMT-α-NET: A Targeted Alpha Therapy Targeting SSTR2

Overview

Perspective is leveraging its TAT platform with one of its two initial program candidates, VMT-α-NET, that is currently in Phase 1/2a clinical trials. Perspective designed VMT-α-NET to target and deliver 212Pb to tumor sites expressing somatostatin receptor subtype 2 ("SSTR2"), a protein that is overexpressed in neuroendocrine tumors ("NETs") and other cancers. Using our proprietary platform technology, VMT-α-NET and VMT01 are engineered to target cancer-specific receptors on tumor cells. [212Pb]VMT-α-NET is a TAT in development for patients with unresectable or metastatic SSTR2-expressing tumors who have not previously received peptide-targeted radiopharmaceutical therapy, such as Lutathera. [212Pb]VMT01 is a TAT in development for second-line or later treatment of patients with progressive MC1R-positive metastatic melanoma.

NETs are a group of rare, heterogeneous tumors that develop in different organs of the body and arise from specialized cells in the neuroendocrine system. Both the incidence and prevalence of NETs have continued to rise globally over several decades, primarily due to improvements in the diagnosis and surveillance of disease. The worldwide incidence of NETs is projected to reach 118,475 new cases in 2024 (source: Global Data). In the U.S. alone, the incidence of NETs has increased more than 6-fold over the last four decades to an anticipated 34,592 new cases in 2024 (source: Dasari A, Shen C, Halperin D, et al. Trends in the Incidence, Prevalence, and Survival Outcomes in Patients with Neuroendocrine Tumors in the United States. JAMA Oncol. 2017;3(10):1335-1342. doi:10.1001/jamaoncol.2017.0589). Earlier detection has not only given rise to an increase in localized disease diagnoses but also improvements in staging, disease classification, management and survival. Despite these advancements, delayed diagnosis is still common due to asymptomatic presentation or nonspecific symptoms. Gastroenteropancreatic NETs, or GEP NETs, represent the most common NET subtype, comprising 55–70% of all NETs followed by lung (22-27%) (source: Patel N, Benipal B. Incidence of Neuroendocrine Tumors in the United States from 2001-2015: A United States Cancer Statistics Analysis of 50 States. Cureus. 2019;11(3):e4322. Published 2019 Mar 26. doi:10.7759/cureus.4322). Current prevalence of NETs in the U.S approximates at 170,000 patients per year. As NETs display a wide variety of biologic behavior, the prognosis differs immensely between indolent limited disease grade 1 tumors and widely spread grade 3 carcinomas.

The median overall survival also varies widely in the highly heterogeneous NET populations and is based on site, stage and grade of disease. It is estimated that 80% of NETs over-express SSRT2. For this reason, somatostatin analogues are a cornerstone of the treatment of most NETs. In addition to SSTR2 analogs, low-grade and/or localized disease is amenable to surgical intervention and carries a good prognosis in terms of five-year overall survival (>90%), but there remains recurrence risk (source: Chan H, Zhang L, Choti MA, et al. Recurrence Patterns After Surgical Resection of Gastroenteropancreatic Neuroendocrine Tumors: Analysis From the National Comprehensive Cancer Network Oncology Outcomes Database. Pancreas. 2021;50(4):506-512. doi:10.1097/MPA.0000000000001791). High-grade and/or distant disease is more difficult to treat and carries lower median survival rates typically measured in months (source: Das S, Dasari A. Epidemiology, Incidence, and Prevalence of Neuroendocrine Neoplasms: Are There Global Differences?. Curr Oncol Rep. 2021;23(4):43. Published 2021 Mar 14. doi:10.1007/s11912-021-01029-7). Radioligand therapy has emerged as a promising therapeutic option for GEP NETs in late stage and is being evaluated for earlier lines of treatment. Perspective believes there is additional opportunity for radioligand therapy in earlier lines of treatment and other somatostatin-expressing NET indications, such as lung and pheochromocytoma/paraganglioma NETs, where there remains significant unmet medical need. Worldwide sales for systemic NET treatments are estimated to reach $3.2 billion by end of 2025, of which the U.S. sales represents over 60% (source: Global Data).

Using a specialized peptide, VMT-α-NET is designed to target and bind to the SSTR2 on tumor cells. As a diagnostic, Perspective links 203Pb, a radioactive imaging agent that emits gamma rays, to its SSTR2-targeting peptide. Through the use of imaging scans, Perspective is able to characterize the tumor to confirm the patient’s cancer expresses SSTR2. This confirms the patient may be a candidate for treatment. As a therapeutic, Perspective links 212Pb, its alpha-particle radioactive isotope, to the same SSTR2 targeting peptide which has been shown to bind to the cancerous cell, to treat and potentially kill the tumor.

In August 2022 Perspective received a “safe to proceed” decision on an Investigational New Drug (“IND”) application with the U.S. Food and Drug Administration (“FDA”) to evaluate [212Pb]VMT-α-NET therapy under IND #160357. The indication of the opening study is treatment of advanced SSTR2-positive NETs patients who are progressing on, symptomatic on, or intolerant of approved non-radiological therapies. On September 29, 2022, Perspective received Fast Track Designation for this program based on preclinical data for the indication of SSTR2-positive NETs regardless of prior treatment response.

Additionally, Perspective believes there is an opportunity for Orphan Drug Designations for VMT-α-NET for NET subtype indications. There is also potential for a priority review voucher if Perspective pursues the rare pediatric disease of advanced neuroblastoma as Perspective’s best path for drug approval after review of Phase 1 trial data.

Clinical Studies of 212Pb-VMT-α-NET

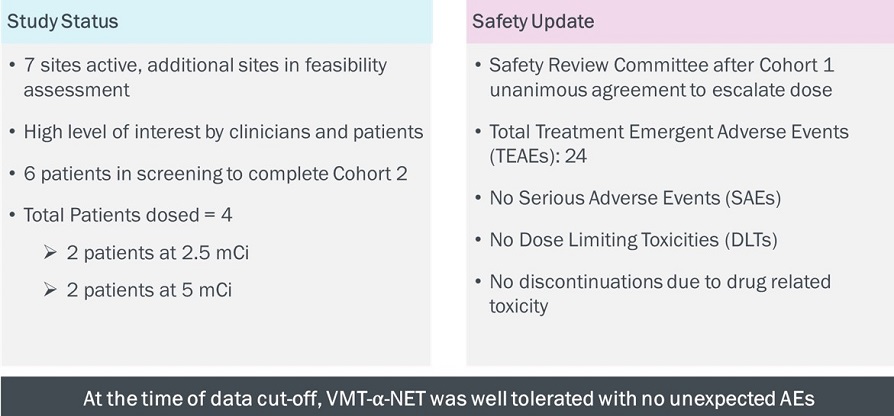

Perspective has a multi-center open-label study (clinicaltrials.gov identifier NCT05636618) of [212Pb]VMT-α-NET, a targeted alpha-particle therapy, for patients with advanced SSTR2-positive neuroendocrine tumors. This study is intended to utilize a mTPI-2, or modified toxicity probability interval 2, dose-ranging design to evaluate approximately 10 - 32 adult subjects with unresectable or metastatic NETs of gastrointestinal, lung, adrenal or neural tissue origin. The primary endpoints of this study are safety and tolerability, determination of a recommended dose for subsequent study and determination of pharmacokinetic ("PK") properties. Secondary endpoints are overall response rate by RECIST v.1.1, progression-free survival by RECIST v.1.1 and overall survival. The first part of the study involves dose escalation, designed to determine the maximum tolerated dose ("MTD") or maximum feasible dose ("MFD") following a single administration of [212Pb]VMT-α-NET. The first patient cohort received 111 MBq (3mCi) per dose. The second cohort, which is currently being recruited, will receive administered activities of 185 MBq (5mCi), with cohorts 3 and 4 receiving 370 MBq (10 mCi) and 555 MBq (15 mCi), respectively, if the MTD or MFD is not reached during escalation. According to the mTPI-2 study design, intermediate de-escalation doses are also possible to allow selection of the optimal activity dose to take forward into the dose expansion part of the study.

The second part of the study is a dose expansion phase based on the identified MTD/MFD. Patients with positive uptake on FDA-approved SSTR2 PET/CT will receive a fixed dose of [212Pb]VMT-α-NET IV administered at the recommended Phase 2 dose and schedule determined in the Phase 1 dose escalation.

In March 2024, Perspective provided the following update on the ongoing clinical trial (all data is as of March 7, 2024):

Preclinical Studies of 212Pb-VMT-α-NET

Perspective’s therapeutic [212Pb]VMT-α-NET has demonstrated positive clinical activity in preclinical studies using a mouse model of NETs, whereby [212Pb]VMT-α-NET significantly inhibited tumor growth and significantly improved survival compared to untreated mice controls.

Perspective’s diagnostic [203Pb]VMT-α-NET has produced strong SPECT/CT imaging and tumor contrast in multiple preclinical studies using mouse models of tumors expressing SSTR2, whereby [203Pb]VMT-α-NET has shown an 8-fold improved tumor uptake with decreased kidney retention as compared to 203Pb radiolabeled DOTATOC. DOTATOC is an established targeting compound for imaging SSTR2-expressing NETs when radiolabeled to positron emission tomography ("PET") isotopes.

The Company also presented mouse model data highlighting the efficacy of [203/212Pb]VMT-α-NET in treating metastatic neuroblastoma tumors. The study showed successful tumor uptake via sequential SPECT imaging and demonstrated a maximum tolerated dose of [212Pb]VMT-α-NET as 2.22 MBq without acute toxicity, with a 100% overall survival rate at 90 days observed in the group receiving three fractionated doses of 740 kBq of [212Pb]VMT-α-NET.

At the World Molecular Imaging Congress, the Company presented data highlighting the effectiveness of [212Pb]VMT-α-NET in treating neuroendocrine tumors in a tumor xenograft mouse model. The results highlighted the significant therapeutic efficacy of treatment with three fractionated doses of [212Pb]VMT-α-NET, which resulted in a 70% complete response rate and 80% survival at 120 days.

Perspective’s first-in-human experience with [203Pb]VMT-α-NET imaging occurred as an investigator-initiated trial ("IIT") at the University of Ulm in Dresden, Germany in 2021 in a patient with metastatic and refractory gastrointestinal NET. Imaging from this study using [203Pb]VMT-α-NET revealed favorable properties, including rapid tumor accumulation, rapid renal clearance and excellent tumor retention as seen by SPECT/CT imaging at 22 hours with high tumor conspicuity. There were no adverse signs or symptoms attributed to the imaging tracer. The pharmacokinetic and biodistribution properties of the imaging agent, based on medical physics analysis, suggest the potential for the chemically identical therapeutic agent, [212Pb]VMT-α-NET, to be administered without concurrent renal protective amino acid infusion in radiotherapy naïve patients. This would be a clinically relevant point of differentiation from the current practice using approved radiopharmaceutical products for NETs.

Investigator-Initiated Studies of 212Pb/203Pb-VMT-α-NET

An investigator-initiated Phase 1 imaging trial of [203Pb]VMT-α-NET is expected to begin at the University of Iowa to investigate the feasibility of using the agent to enable personalized, image-guided therapy dose calculations for [212Pb]VMT-α-NET therapy in patients with recurrent NETs after treatment with approved radiopharmaceutical therapy. An Imaging IND is open for this trial and IRB approval has been obtained. Perspective is uncertain when the provisional results will be available.

In December 2023, Perspective announced that the first patient was dosed at the University of Iowa in an investigator-initiated Phase 1 trial evaluating the safety of [212Pb]VMT-α-NET, in patients with unresectable or metastatic SSTR2-expressing neuroendocrine tumors. The patients being enrolled in the study have either progressed or relapsed after previous therapies, including currently approved peptide receptor radionuclide therapies ("PRRT"). This is a single site safety study (clinicaltrials.gov identifier NCT06148636) of [212Pb]VMT-α-NET targeted alpha-particle therapy for patients with refractory or relapsed SSTR2-positive neuroendocrine tumors. The first part of this Phase 1 trial is imaging with a surrogate tracer, [203Pb]VMT-α-NET, using SPECT/CT imaging. Each participant is assigned a radiation dose to the kidneys that cannot be exceeded. The second part of the study is a sequential 3 + 3 dose escalation phase of four cohorts based on the maximum allowed injected dose for an individual while keeping kidney exposure to less than a predetermined threshold. The study involves two treatments, about eight to ten weeks apart. The drug will be given by infusion once per treatment. Participants will also receive an infusion of amino acids to help protect the kidneys as well as medications to help protect against nausea. A participant who is administered [212Pb]VMT-α-NET will be monitored for at least six months for safety assessments. Participants will also have imaging at six months post-treatment to measure how their tumors responded to therapy and will have lifelong follow-up for this study. The preliminary data readout is expected in the second half of 2024.

In November 2023, Perspective announced the publication of the first human SPECT images utilizing the alpha-emitting isotope of 212Pb, which was labeled to the Company's proprietary theranostic VMT-α-NET program. The imaging was conducted as part of a series of four neuroendocrine tumor patients who were administered VMT-α-NET at a clinical study site in Germany. The patient received 90 MBq (2.4mCi) of [212Pb]VMT-α-NET intravenously, and whole-body scintigraphy and SPECT/CT images were acquired 2 hours, 5 hours, and 19 hours after injection. Images were collected on a Symbia Intevo T6 (Siemens Healthineers) using a high-energy collimator. The SPECT/CT images showed high accumulation of [212Pb]VMT-α-NET in liver metastases and were consistent with the previously acquired [68Ga]DOTATATE PET/CT. High tumor retention was observed in the planar and SPECT/CT images over time. Due to the short half-life of 212Pb (10.6 hours), the images acquired after 19 hours showed a high level of noise due to the low count statistics. The patient showed no early or acute side effects.

In September 2023, the Company announced the presentation of encouraging early clinical results from an open-label, single-arm, investigator-initiated study in India investigating the safety and efficacy of [212Pb]VMT-α-NET in patients with NETs and medullary thyroid carcinomas. The early clinical findings were presented at the 36th Annual Congress of the European Association of Nuclear Medicine ("EANM") for the Phase 2a study of [212Pb]VMT-α-NET in pre- and post-Lutathera GEP-NET patients, being conducted at Fortis Healthcare, India. Ten adult patients with histologically confirmed NETs and metastatic medullary thyroid carcinomas who failed at least one prior line of treatment were treated as part of an IIT. All patients were planned to receive [212Pb]VMT-α-NET peptide at intervals of eight weeks up to four doses or until evidence of radiographic progression, unacceptable toxicity or the patient’s decision to discontinue. All patients were to be co-infused with an amino acid solution for renal protection. The primary objective of the study is to evaluate the safety of low doses of [212Pb]VMT-α-NET in this patient population. Secondary assessments will include objective response rate measured by RECIST 1.1 or PERCIST criteria, and the number of patients with treatment-related adverse events as assessed by CTCAE v.4.0. Both will be measured at 24 months after the last administered dose of [212Pb]VMT-α-NET. The isotope was supplied via the Company’s proprietary VMT-α-GEN isotope delivery system.

Highlights of the presented results at EANM included:

| ● | Ten patients who failed at least one prior line of standard of care therapy have received [212Pb]VMT-α-NET therapy to date, with initial responses observed in seven of nine evaluable patients. Responses were observed across both PRRT-naïve and PRRT-refractory disease. Of the 10 patients enrolled in the study, three presented with gastrointestinal NETs, five presented with pancreatic NETs, and two presented with medullary thyroid carcinoma. Four patients (one with gastrointestinal NETs; three with pancreatic NETs) were previously treated with [177Lu]DOTATATE PRRT, one of which also received three prior administrations of [225Ac]DOTATATE. |

| ● | Improvements in patients’ symptoms and quality of life trended strongly positive with consecutive [212Pb]VMT-α-NET doses. |

| ● | No significant renal or hepatic function adverse events have been observed to date. Most adverse events were mild and included Grade 1 anemias, alopecia and fatigue, which usually resolved within one week of [212Pb]VMT-α-NET administration. Two patients experienced serious adverse events that were deemed unrelated to [212Pb]VMT-α-NET treatment. One patient who developed myelodysplastic syndromes discontinued treatment and the other patient, who was heavily pre-treated, died (patient was deemed not evaluable). |

Three additional patients were enrolled in the second half of 2023 for a total of ten GEP-NET patients and two medullary thyroid cancer patients. All ongoing patients are expected to complete their fourth treatment cycle by end of March 2024. The updated results from the investigator-initiated study are expected to be presented at the Society of Nuclear Medicine and Molecular Imaging, or SNMMI, meeting in Toronto at the end of the second quarter in 2024.

Three patients were screened in 2023 in the IIT in post-Lutathera GEP-NET, and all three patients were located at the University of Iowa. All three patients received treatment in December 2023 for the completion of the first cohort. If all patients complete four cycles, then the end of fourth cycle of treatment is expected in June 2024.

The IIT for patients with advanced NETs and lack of further treatment options is underway at the University Dresden in Germany. Four patients were treated with [212Pb]VMT-α-NET and eight patients were imaged with [203Pb]VMT-α-NET during the second half of 2023, and investigators may plan additional treatments in 2024.

VMT01: A Targeted Alpha Therapy Targeting MC1R

Overview of VMT01and VMT02

Perspective is also leveraging its TAT platform with its second program candidate, VMT01, which is currently in Phase 1/2a clinical trials. Perspective designed VMT01 to target and deliver 212Pb to tumor sites expressing MC1R, a protein that is overexpressed in melanoma cancers. Review of market research by Grandview Research, Inc., and ForeSight Niche Assessment indicates metastatic melanoma represents over an $8.0 billion market opportunity.

Using a specialized peptide, VMT01 is designed to target MC1R on tumor cells. As a diagnostic, Perspective either links 203Pb or Gallium-68 to its MC1R-targeting peptide. MC1R is a G-protein coupled receptor that has been investigated as a target for metastatic melanoma drug delivery due to its overexpression on the surface of melanoma cells and relative absence in normal cells. MC1R-targeted radiolabeled peptides have been used as delivery vehicles for delivering radiometals to melanoma tumors in preclinical models for diagnostic imaging and therapy, as well as in clinical imaging studies that demonstrated the ability to identify MC1R-positive tumors by PET imaging.

Perspective also designed two imaging surrogates, the chemically identical [203Pb]VMT01 for SPECT imaging and dosimetric calculations and [68Ga]VMT02, a PET imaging tracer, for patient selection. [68Ga]VMT02 utilizes the same targeting peptide as VMT01 but differs in having a chelator optimized for PET radiotracers (DOTA). Through the use of the imaging scans, Perspective is able to characterize whether the patient’s cancer expresses MC1R. This confirms the patient may be a candidate for treatment. As a therapeutic, Perspective links 212Pb to the same MC1R targeting peptide which has been shown to bind to the cancerous cell, to treat and potentially kill the tumor. The melanoma program focuses primarily on development of the therapeutic compound. The rationale for the development of two imaging tracers is to provide flexibility in imaging a molecular target for which a validated and approved imaging tracer does not exist. Further commercialization of one or both of these imaging tracers will follow a separate regulatory path from the therapeutic compound and will proceed based on the potential for utility after a therapeutic efficacy signal is identified.

VMT01 and VMT02 peptides bind with high affinity and specificity to melanoma tumors (where MC1R is present) and do not bind to healthy cells (where MC1R is absent). Thus, the radioactive nuclide carried by the peptide is delivered primarily to tumor cells, while nonspecific binding to healthy cells is minimal. Treatment is carried out in two stages. In the first stage (i.e., the diagnostic stage), [203Pb]VMT01 or [68Ga]VMT02 is administered for SPECT or PET imaging, respectively. The decay of radionuclides 203Pb and 68Ga result in gamma radiation that can be detected by the imaging device. This detection can be used to pinpoint the presence of cancerous tumors expressing MC1R and illuminate the pharmacokinetic properties and biodistribution of the radiopharmaceutical. This information can be used to guide the second stage (i.e., the therapeutic stage) with [212Pb]VMT01, in which radionuclide 212Pb replaces 203Pb and 68Ga. [212Pb]VMT01 is designed to deliver alpha (α) radiation efficiently to melanoma tumors that express the MC1R receptor. This two-stage process is commonly referred to as image-guided receptor-targeted alpha-particle radionuclide therapy for cancer and is also referred to as a “theranostic” approach.

Nonclinical pharmacology, pharmacokinetics and toxicology studies utilizing in vitro and in vivo assays, SPECT and PET imaging and histopathology were conducted by the sponsor to support the first-in-human Phase 1/2a clinical development of [212Pb]VMT01 per recommendations in the United States Food and Drug Administration Guidance document titled “Oncology Therapeutic Radiopharmaceuticals: Nonclinical Studies and Labeling Recommendations Guidance for Industry.” Promising results have demonstrated an increase in progression-free survival, improvement in overall survival and, in some cases, complete remission in mice bearing murine and human melanoma tumors. Perspective has also observed significant synergy with checkpoint inhibitors in animal models that are resistant to immunotherapy alone and a subset of animals receiving the combination therapy demonstrate resistance to re-inoculation with naive melanoma cells.

Management believes that there are currently no FDA approved peptide-based receptor targeting approaches for the treatment of metastatic melanoma. The goal of the theranostic approach with [203Pb]VMT01 or [68Ga]VMT02 (diagnosis) and [212Pb]VMT01 (therapy) is to establish a new methodology to treat patients with MC1R-expressing tumors that has the potential to improve long-term outcomes.

Role of VMT01 in Advanced Melanoma Treatment

Melanoma is a cancer of the skin arising from uncontrollable growth of melanocytes, the melanin producing cells of the body. Melanoma generally originates on the epidermis (the outermost layer of skin). In rare instances, melanoma can originate in the eyes or mucosal membranes, as these are other locations where melanocytes are present. Metastatic melanoma is the result of melanoma that has progressed through the layers of skin, infiltrated the blood stream or lymphatic system and traveled to other areas of the body to metastasize.

The worldwide melanoma incidence is estimated to reach 335,160 new cases in 2024 (source: GlobalData) and the risk of melanoma increases as people age, with the average age of diagnosis being early to mid 60s. Melanoma is a global disease affecting all populations around the world. The risk of developing melanoma increases significantly in areas of high ultraviolet exposure and for people with fair complexion. Particularly high incidences are observed in North America, Northern Europe and New Zealand. The highest occurs in Australia, where annual rates are more than twice that of North America. In the U.S., there will be an estimated 107,879 new diagnoses of melanoma by 2025 (representing one-third of all cases worldwide) and approximately 7,868 deaths annually from metastatic melanoma (source: GloboCan). In most cases, metastatic melanoma cannot be cured but treatment can support a longer life.