United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM

| | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended |

or

| | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the transition period from __________ to __________ |

Commission File No.

Isoray, Inc.

(Exact name of registrant as specified in its charter)

| |

| |

| (State of incorporation) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| |

|

|

| |

| |

| (Address of principal executive offices) |

| (Zip code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| | Smaller reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter – $

The number of shares outstanding of the registrant’s common stock, $0.001 par value per share, as of September 23, 2022 was

Documents incorporated by reference – none.

ISORAY, INC.

|

|

|

Page |

|

|

|

|

| ITEM 1 – |

1 |

|

| ITEM 1A – |

25 |

|

| ITEM 1B – |

40 |

|

| ITEM 2 – |

40 |

|

| ITEM 3 – |

40 |

|

| ITEM 4 – |

41 |

|

| ITEM 5 – |

41 |

|

| ITEM 6 – |

43 |

|

| ITEM 7 – |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

44 |

| ITEM 7A – |

52 |

|

| ITEM 8 – |

52 |

|

| ITEM 9 – |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

52 |

| ITEM 9A – |

52 |

|

| ITEM 9B – |

53 |

|

| ITEM 9C – | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 53 |

| ITEM 10 – |

53 |

|

| ITEM 11 – |

57 |

|

| ITEM 12 – |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

61 |

| ITEM 13 – |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

62 |

| ITEM 14 – |

63 |

|

| ITEM 15 – |

64 | |

| ITEM 16 – | FORM 10-K SUMMARY | 92 |

| 93 |

||

Caution Regarding Forward-Looking Information

In addition to historical information, this Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA). This statement is included for the express purpose of availing Isoray, Inc. of the protections of the safe harbor provisions of the PSLRA.

All statements contained in this Form 10-K, other than statements of historical facts, that address future activities, events or developments are forward-looking statements, including, but not limited to, statements containing the words “believe,” “expect,” “anticipate,” “intends,” “estimate,” “forecast,” “project,” and similar expressions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products, services, developments or industry rankings; any statements regarding future revenue, economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. These statements are based on certain assumptions and analyses made by us in light of our experience and our assessment of historical trends, current conditions and expected future developments as well as other factors we believe are appropriate under the circumstances. However, whether actual results will conform to the expectations and predictions of management is subject to a number of risks and uncertainties described under Item 1A – Risk Factors beginning on page 25 below that may cause actual results to differ materially.

Consequently, all of the forward-looking statements made in this Form 10-K are qualified by these cautionary statements and there can be no assurance that the actual results anticipated by management will be realized or, even if substantially realized, that they will have the expected consequences to or effects on our business operations. Readers are cautioned not to place undue reliance on such forward-looking statements as they speak only of the Company’s views as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

As used in this Form 10-K, unless the context requires otherwise, “we” or “us” or “Isoray” or the “Company” means Isoray, Inc. and its subsidiaries.

As used in this Form 10-K, unless the context requires otherwise, “fiscal year” or “fiscal” means the Company’s financial year that begins on July 1 and ends on June 30 of the following year (for example: fiscal year 2022 is equivalent to the year ended June 30, 2022).

General

Isoray, Inc. (formerly known as Century Park Pictures Corporation) was incorporated in Minnesota in 1983, and reincorporated to Delaware on December 28, 2018. On July 28, 2005, Isoray Medical, Inc. (“Medical”) became a wholly-owned subsidiary of Isoray, Inc. pursuant to a merger. Medical was formed under Delaware law on June 15, 2004 and on October 1, 2004 acquired two affiliated predecessor companies that began operations in 1998. Medical, a Delaware corporation, develops, manufactures and sells isotope-based medical products and devices for the treatment of cancer and other malignant diseases. Medical is headquartered in Richland, Washington.

Isoray International LLC (“International”), a Washington limited liability company, was formed on November 27, 2007 and is a wholly-owned subsidiary of the Company. International has entered into various international distribution agreements.

Available Information

Our website address is www.Isoray.com. Information on this website is not a part of this Form 10-K (this “Report”). Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Forms 3, 4, and 5 filed on behalf of directors and executive officers, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (Exchange Act) are available free of charge on our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (SEC). You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

Information regarding our corporate governance, including the charters of our audit committee, our nominations and corporate governance committee and our compensation committee, and our Codes of Conduct and Ethics is available on our website (www.Isoray.com). We will provide copies of any of the foregoing information without charge upon request to Mark Austin, Vice President of Finance and Corporate Controller, 350 Hills Street, Suite 106, Richland, WA, 99354.

Business Operations

Overview

In 2003, Isoray obtained clearance from the Food and Drug Administration (FDA) for the use of Cesium-131 (Cesium-131) radioisotope in the treatment of all malignant tumors. The FDA clearance granted in August 2009 permits loading Cesium-131 seeds into bio-absorbable braided sutures or “braided strands” giving the Company the ability to treat brain, lung, head and neck, colorectal, and chest wall cancers. As of the date of this Report, such applications include prostate cancer, brain cancer, colorectal cancer, gynecological cancer, lung cancer, ocular melanoma and pancreatic cancer. The brachytherapy seed form (a sealed source) of Cesium-131 may be used in surface, interstitial and intra-cavity applications for tumors with known radio-sensitivity.

The Company’s core product is its Cesium-131 sealed source brachytherapy “seed.” These seeds can be inserted individually or in combination into various locations in the body until the physician is satisfied with the radiation dose delivered. The Company also sells seeds in strands to keep them from individually moving and to allow the physician to put multiple seeds in a row as desired. In addition, “pre-loaded” needles may have Cesium-131 brachytherapy seeds inserted in them, or a strand with seeds in the strand, inserted into the needle. Seeds can be sold with our Blu Build™ loading device that allows clinicians to efficiently customize and configure strands in the operating room. Seeds can also be loaded into suture material, which can be sewn by Isoray into a piece of bio-absorbable mesh which can be sewn or stapled into tissue by the physician for use in lung, pelvic floor and other cancer locations. These options provide the physician the ability to deliver a personalized, targeted dose of radiation to the site of the tumor. Under a manufacturing agreement with GT Medical Technologies, Inc. (“GT Med Tech”), Isoray inserts Cesium-131 seeds into a collagen matrix which GT Med Tech’s customers place in the brain.

Brachytherapy seeds are small devices that deliver a personalized targeted therapeutic dose of radiation used in an interstitial radiation procedure. The procedure has become one of the primary treatments for prostate cancer. The brachytherapy procedure places radioactive seeds as close as possible to (in or near) the cancerous tumor (the word “brachytherapy” is derived from Greek and means close therapy). A primary advantage of seed brachytherapy is the ability of the seeds to deliver therapeutic radiation thereby killing the cancerous tumor cells while minimizing exposure (damage) to adjacent healthy tissue. This procedure allows doctors to administer a high dose of radiation directly to the tumor. A seed contains a radioisotope sealed within a titanium capsule. The number of seeds used varies based on the size of the cancerous area being treated, the isotope used and the activity level specified by the physician. When brachytherapy is combined with another treatment method (dual-therapy), fewer seeds are used in the procedure. Recently, Cesium-131 seeds have been used in conjunction with drugs to treat hard-to-treat cancers such as head and neck cancers and metastatic melanomas. This treatment is termed immunotherapy (e.g. immune checkpoint inhibition) and, like brachytherapy, is providing targeted personalized treatment to patients. The isotope decays over time (half-life) and eventually the seeds become inert (typically over 6 half-lives). The seeds may be used as a primary treatment (monotherapy) or as an adjunct therapy with other treatment modalities, or as treatment for residual disease after excision of primary tumors. The number of seeds for treatment sites vary widely (as few as 8 seeds to more than 100 seeds) depending on the type of cancer, the tumor location, the prescribed activity level and any additional type of therapy being utilized.

In the cases of brain and lung tumors (and other solid tumors), a surgeon will remove the tumor if it is medically prudent and this offers the patient some benefit in terms of controlling the growth of the cancer or its symptoms. In many cases, radiation therapy is added following the surgery; this is known as “adjuvant” radiation therapy. The Company believes that its form of adjuvant radiation therapy deployable in such cases offers advantages over external beam methods. However, external beam holds the vast majority of the market for adjuvant radiation therapy.

Prostate Cancer

Isoray began the production and sale of Cesium-131 brachytherapy seeds in October 2004 for the treatment of prostate cancer after receiving clearance of its premarket notification (510(k)) by the Food and Drug Administration. Prostate cancer treatment represents about 75% of the business of Isoray today.

When brachytherapy is the only treatment (monotherapy) used in the prostate, approximately 70 to 120 seeds are permanently implanted in the prostate during an outpatient procedure, depending on the size of the prostate gland. Typically, physicians use loose seeds in needles or in a cartridge or seeds loaded into strands which can also be loaded into needles for the treatment of prostate cancer. Seeds may be combined with another treatment method (dual therapy) when treating prostate cancer.

In late 2019, the first peer-reviewed report with long-term follow-up clinical outcomes for patients treated with Cesium-131 brachytherapy for prostate cancer patients was published in the journal “Brachytherapy”. Moran, B. J., et al., Long-term biochemical outcomes using Cesium-131 in prostate brachytherapy. Brachytherapy 18(6):800-805 (2019). In this observational study of 571 prostate cancer patients, long-term outcomes based on serum PSA were determined by the authors to be “…excellent and on par with…” other implantable brachytherapy seeds that had previously been the subject of long-term study.

Several months later, in the same journal, a second report was published that provided detailed, long-term PSA follow-up data for a group of Cesium-131 treated prostate cancer patients (Benoit, et al., Cesium-131 prostate brachytherapy: a single institutional long-term experience. Brachytherapy 19(3):298-304 (2020)). The authors, from the University of Pittsburgh School of Medicine, reported results from 669 men and likewise concluded “excellent long-term biochemical control” following treatment with Cesium-131 prostate brachytherapy.

From the same patient group as above, the University of Pittsburgh School of Medicine reported in 2020 an evaluation of the intermediate-risk group prostate cancer patients (Rodriguez-Lopez, J. L., et al, Report of a Large Cohort of Intermediate-Risk Prostate Cancer Patients Treated with Cs-131 Brachytherapy. International Journal of Radiation Oncology*Biology*Physics 108(3): e926 (2020)). The authors reported excellent outcomes for the favorable intermediate-risk subgroup treated with Cesium-131 prostate brachytherapy alone and excellent outcomes for the unfavorable intermediate-risk subgroup with combined external beam radiation and Cesium-131 prostate brachytherapy.

The results of a randomized trial comparing long-term cancer-specific outcomes of low- and intermediate-risk prostate cancer patients of Cesium-131 versus the more commonly used Iodine-125 were published in 2021 (Moran, et al., Long-term outcomes of a prospective randomized trial of 131Cs/125I permanent prostate brachytherapy. Brachtherapy 20(1):38-43 (2021)). The randomized arm of Cesium-131 patients in this study had not been included in earlier published series. The authors found no significant difference in biochemical relapse-free survival between the two groups at nine years (84% versus 87%, p=0.9). The authors also found no significant difference between urinary and sexual quality of life using the EPIC instrument over the study period, although two-month bowel related quality of life was worse with I-125.

In addition to the long-term cancer control data mentioned above, a report from 2017 describes favorable long-term quality of life outcomes following Cesium-131 brachytherapy in the treatment of prostate cancer (S.M. Glaser, et al., Long-Term Quality of Life in Prostate Cancer Patients Treated With Cesium-131, International Journal of Radiation Oncology*Biology*Physics 98(5):1053-1058 (2017)).

The Company continues to identify and support work that seeks to employ and study Cesium-131 brachytherapy seeds in combination with external beam radiation therapy (“EBRT”). Compelling evidence is emerging supporting the use of such combination brachytherapy and EBRT in intermediate and high-risk prostate cancer cases. (Sylvester J, Braccioforte M.H., Moran B.J., Intensity modulated radiation therapy (IMRT) followed by cesium-131 brachytherapy for intermediate and high risk localized prostate cancer. Brachytherapy 18(3):S72 (2019)).

For low-risk prostate cancer, studies are ongoing to evaluate the use of Cesium-131 in “focal,” or sub-total brachytherapy of the prostate. It is hypothesized that low-risk patients using focal brachytherapy may achieve rates of prostate cancer control comparable to that of full gland treatment while significantly reducing side effects. An early results study of a series of men treated with Cesium-131 focal therapy was presented at the 2021 Annual Meeting of the American Brachytherapy Society, Moran, B. J., et al., PO40: A Pilot Study of Cs-131 Focal Brachytherapy in a Prospectively-Followed Group of Low Risk Localized Prostate Cancer Patients Staged by Stereotactic Transperineal Prostate Biopsy. Brachytherapy. 20(3): S74-S75 (2021). The author concludes the average serum PSAs in these men declined in the short term.

Early results from another series of men treated with Cesium-131 focal therapy was presented at the 2018 Annual Meeting of the American Brachytherapy Society, Kalash, R., et al., Focal brachytherapy using Cesium-131 in low-risk prostate cancer. Brachytherapy 17 (Suppl):S89 (2018). The authors conclude that, while too early to estimate disease specific outcomes, serum PSAs in these men had declined in the short term and there was no residual effect on urinary, bowel or erectile symptoms. The Company will continue to monitor these series studying Cesium-131 based focal therapy of low risk prostate cancer.

A task force convened by the American Brachytherapy Society to address “key questions” related to low-dose rate prostate brachytherapy published their findings in 2021 (King, et al., Low dose rate brachytherapy for primary treatment of localized prostate cancer: a systematic review and executive summary of an evidence-based consensus statement. Brachytherapy 20(6)1114-1129 (2021).) The authors found Cesium-131 a radionuclide that can be used for LDR brachytherapy with a Strength of Recommendation of “High” and a Strength of Evidence as “High” – equaling the recommendations for the more conventional radionuclides Iodine-125 and Palladium-103.

Gynecologic Cancer

Individual seeds can also be placed via needle into the female reproductive tract for the treatment of various gynecologic cancers. While the company continues to supply Cesium-131 seeds for use in gynecologic cancers, the company is currently putting its focus on other cancers as discussed further in subsequent pages.

Brain Cancer

Stranded Cesium-131 Sources

Starting in 2012, multiple institutions began utilizing Cesium-131 brachytherapy seeds loaded in braided strands for treatment of a variety of brain cancers. The application of Cesium-131 brachytherapy seeds loaded in braided strands to date has been primarily in salvage cases as a re-treatment for metastatic brain cancers where aggressive tumors had reoccurred following standard of care treatment.

From 2014 to present there have been numerous published reports, abstracts and society presentations which have been presented and support the effectiveness of treating recurrent metastatic brain cancers with Cesium-131. Dr. Gabriella Wernicke and co-investigators at Weill Cornell Medical College at the NY Presbyterian Hospital have published multiple papers on the efficacy, favorable side-effect profile and cost-effectiveness of Cesium-131 brachytherapy seeds in the treatment of metastatic brain cancer. (A. G. Wernicke, et al., Clinical Outcomes of Large Brain Metastases Treated With Neurosurgical Resection and Intraoperative Cesium-131 Brachytherapy: Results of a Prospective Trial, Int J Radiat Oncol Biol Phys. 98 (5):1059-1068 (2017); A. Pham, et al., Neurocognitive function and quality of life in patients with newly diagnosed brain metastasis after treatment with intra-operative Cesium-131 brachytherapy: a prospective trial, J Neurooncol 127(1):63-71 (2016); A.G. Wernicke, et al., Surgical technique and clinically relevant resection cavity dynamics following implantation of cesium-131 brachytherapy in patients with brain metastases, Operative Neurosurgery 12(1):49-60 (2016); A.G. Wernicke, et al., Cesium-131 brachytherapy for recurrent brain metastases: durable salvage treatment for previously irradiated metastatic disease, Journal of Neurosurgery 10.3171/2016.3.JNS152836 (Published online June 3, 2016); A.G. Wernicke, et al., The cost-effectiveness of surgical resection and cesium-131 intraoperative brachytherapy versus surgical resection and stereotactic radiosurgery in the treatment of metastatic brain tumors, J Neurooncol 127(1):145-53 (2016)).

In May 2021, a group of physicians from Weill Cornell Medical College published a retrospective study comparing outcomes between patients with surgically removed brain metastases treated with Cesium-131 brachytherapy or by stereotactic radiosurgery (SRS) as adjuvant radiation therapy (i.e. following surgical removal) (Julie, DA, et al., A matched-pair analysis of clinical outcomes after intracavitary cesium-131 brachytherapy versus stereotactic radiosurgery for resected brain metastases. Journal of Neurosurgery 134(5): 1447-1454. (2021)). While retrospective in nature, the authors of the study found a lower rate of local recurrence in the Cesium-131 treatment group (10% versus 28.3%). Toxicity from the Cesium-131 implant was not significantly different from SRS treatment. Such findings continue to support the notion that Cesium-131 brachytherapy can benefit the management of surgically addressable brain metastases.

During fiscal 2013, the Company began providing technical assistance and supported selling Cesium-131 brachytherapy seeds for embedding in collagen tiles developed by physicians at Barrow Neurological Institute (Barrow) to treat malignant meningioma, primary brain cancers and metastases of cancers to the brain. These physicians from Barrow formed a company, GammaTile LLC, now GT Medical Technologies, Inc. (“GT Med Tech”), and further refined this technology which integrates Cesium-131 brachytherapy seeds and has resulted in the issuance of multiple patents to GT Med Tech for the treatment of brain cancers.

In December 2018 a paper was published in the Journal of Neurosurgery describing outcomes of patients who had experienced multiple reoccurrences of a tumor type known as meningioma following previous surgeries in conjunction with external beam radiation. Following treatment with Cesium-131, 90% of the treated tumors had no evidence of regrowth at the operative site (local control). The incidence of radiation necrosis, a common side effect to the brain from Cesium-131 brachytherapy seeds occurred in only 2 of the 20 treatments. (D. Brachman, et al. Resection and permanent intracranial brachytherapy using modular, biocompatible cesium-131 implants: result in 20 recurrent, previously irradiated meningiomas. Journal of Neurosurgery 131(6), 1819-1828 (December 2018)).

This same group of physicians has presented clinical studies of GammaTile™ in the treatment of other brain cancers.

In June 2019, Dr. David Brachman presented to the American Brachytherapy Society in Miami a series of patients experiencing the recurrence of a variety of brain cancers including meningiomas, high grade gliomas, and brain metastases. (Brachman D., Youssef E., Dardis C., et al. Surgically Targeted Radiation Therapy: Safety Profile of Collagen Tile Brachytherapy in 79 Recurrent, Previously Irradiated Intracranial Neoplasms on a Prospective Clinical Trial. Brachytherapy 18(S3):S35 (2019)). Dr. Brachman, who was awarded the Judith Stittman Best Abstract Award for this work, described GammaTile™ therapy utilizing Cesium-131 as having an excellent safety profile that “could help expand treatment options for this difficult cohort of patients”. This work is important because recurrence of these hard-to-treat brain cancers leaves patients with very limited options due to their prior radiation treatments.

Clinical studies continue to demonstrate the safety and effectiveness of GammaTile™ in concert with surgery for the treatment of brain metastases (Nakaji, P., et al., Resection and Surgically Targeted Radiation Therapy for the Treatment of Larger Recurrent or Newly Diagnosed Brain Metastasis: Results From a Prospective Trial. Cureus 12(11): e11570 (2020)).

A 2022 report from the University of Minnesota of a group of 22 patients with recurrent glioblastoma multiforme (GBM) treated with resection and GammaTile brachytherapy found outcomes that compared favorably to both the published literature and a comparison cohort treated without GammaTile (Gessler D., et al. GammaTile® brachytherapy in the treatment of recurrent glioblastomas, Neuro-Oncology Advances 4(1), (2022)). The authors concluded that their original data supports GammaTile® brachytherapy as an option for patients with recurrent GBM.

Another 2022 report from Piedmont Brain Tumor Center reported 17 patients (8 with brain metastases, 7 with recurrent GBM and 2 with recurrent malignant meningioma found GammaTile therapy safe and effective when applied at brain tumor resection (Dunbar E, et al., Piedmont brain tumor center’s experience with GammaTile intracranial brachytherapy for malignant intracranial tumors, Neurology 98(18 Suppl) 2022).

In 2022 a group of authors from the University of Cincinnati, University of Texas M.D. Anderson Cancer Center, and the Lenox Hill Hospital (NYC) published a structured literature review of all available studies of Cesium-131 brachytherapy and brain cancer treatment, noting that the availability of Cesium-131 has led to a resurgence of brain brachytherapy in the treatment of brain cancers post-surgical resection. The authors included 27 studies published between 2014 and 2021, including both stranded Cesium-131 source and GammaTile® therapy, incorporating 279 patients into their analysis. Outcomes of patients following treatment of brain metastases, gliomas, and meningiomas were included. Based on the totality of the reviewed studies, the authors concluded that “initial data suggest that Cs-131 brachytherapy is safe and effective in newly diagnosed and recurrent primary or metastatic brain tumors, showing favorable locoregional FFP [freedom from progression] rates and rare radiation-induced complications”. (Palmisciano P., et al. The role of cesium-131 brachytherapy in brain tumors: a scoping review of the literature and ongoing clinical trials, Journal of Neuro-Oncology 159:117-133 (2022).

The Company collaborated with GT Med Tech to file an application with the U.S. FDA to clear GammaTile™ for clinical use and the FDA provided clearance on July 6, 2018. In January 2020 GammaTile™ Therapy launched full market release. Prior to fiscal 2021, total revenues from sales to GT Med Tech have been less than ten percent (10%) of sales but these sales exceeded 10% in fiscal 2021 and 2022. GT Med Tech has indicated it intends to increase sales and marketing efforts during the Company’s fiscal year 2023, but there is no assurance that this will occur.

Head and Neck Cancer

Cesium-131 brachytherapy is also used in the treatment of recurrent head and neck cancers. First reported by Bhupesh Parashar MD from Weill Cornell Medical College (A. Pham, et al. Cesium-131 brachytherapy in high risk and recurrent head and neck cancers: first report of long-term outcomes. J Contemp Brachytherapy 7(6):445-52 (2015), the appeal of Cesium-131 brachytherapy in the treatment of these cancers lies in the motivation by the practitioner to avoid delivering dose to critical structures in the head and neck, including blood vessels and the spinal cord. Since these patients have already been subjected to external beam radiation therapy and may not tolerate another course, brachytherapy with Cesium-131 offers a significant re-treatment option.

In June 2020 the Company announced that an agreement had been completed with a group of physicians based at the University of Cincinnati. The agreement related to support for a Phase I/IIa clinical study of recurrent or metastatic head and neck cancers treated by a combination of surgical resection, Cesium-131 brachytherapy, and blockade of the programmed cell death protein 1 (PD-1) checkpoint using pembrolizumab therapy (Keytruda® from Merck & Co., Inc.).

In fiscal 2022 a group from Thomas Jefferson University and the University of Cincinnati reported a multii-institutional series of 49 patients with recurrent head and neck cancers treated with surgery and Cesium-131 brachytherapy (A. Luginbuhl, et al. Multi-Institutional Study Validates Safety of Intraoperative Cesium-131 Brachytherapy for Treatment of Recurrent Head and Neck Cancer. Frontiers in Oncology 26 November 2021). The authors of this study concluded that surgery and Cesium-131 brachytherapy demonstrated acceptable safety and compelling oncologic outcomes.

Management believes that as immunotherapies (e.g. immune checkpoint inhibition) become more prevalent in the treatment of human cancers, the optimal combination with more conventional cancericidal therapies will be a key area of research interest. The Company has a collaboration agreement with MIM Software to deliver a treatment solution to more accurately target the placement of Cesium-131 for recurrent head and neck cancers.

Approval of Billing Codes for the Intraoperative Use of Cesium-131

In May 2020, the Centers for Medicare and Medicaid Services (CMS) approved 64 ICD-10-PCS billing codes used for reimbursement of Cesium-131 for the hospital in-patient DRG setting. The codes allow hospitals to bill Medicare and other health insurers for specific surgical procedures that would benefit from the addition of Cesium-131. DRG, or diagnostic related groups, are designed for Medicare and other health insurers to set payment levels for hospital in-patient services.

The 64 ICD-10-PCS codes are important for the growing surgical applications of Cesium-131 in treating a significant range of hard to treat cancers including brain, lung, head and neck, abdominal, breast, gynecological, pelvic, and colorectal cancers. The new codes took effect on October 1, 2020 and management believes they have provided greater impetus for usage as now CMS is able to track the additional cost of the Cesium-131 seed itself and reimburse the hospital through the DRG payment system for this additional costs when an in-patient brachytherapy procedure is performed.

Industry Information

Prostate Cancer Treatment

According to the American Cancer Society, one in eight men will be diagnosed with prostate cancer during his lifetime. It is the most common form of cancer in men, and the second leading cause of cancer deaths in men following lung cancer. The American Cancer Society estimates there will be about 268,490 new cases of prostate cancer diagnosed and an estimated 34,500 deaths associated with the disease in the United States in 2022.

Prostate cancer treatment remains a key focus of the Company. Most doctors use the American Joint Committee on Cancer (AJCC) TNM system to stage prostate cancer. This system is based on three key pieces of information:

| ■ |

The extent of the main tumor (T category); |

| ■ |

Whether the cancer has spread to nearby lymph nodes (N category); and |

| ■ | Whether the cancer has metastasized (spread) to other parts of the body (M category). |

These factors are combined to determine an overall stage, using Roman numerals I through IV (1-4). The lower the number, the less the cancer has spread. A higher number, such as stage IV, means a more advanced cancer.

Once diagnosed, prostate cancer can generally be divided into either localized or advanced disease. Further, within the localized category the disease can be further categorized to one of the three “risk groups”: low, intermediate and high risk. As the risk increases so does the probability of advanced cancer at diagnosis and the probability of failing treatment with cancer progression or recurrence.

Low Dose Rate Permanent Brachytherapy (LDR). Isoray’s Cesium-131 brachytherapy seeds are an option in the treatment of prostate cancers of all risk levels of localized disease. In this approach, seeds of radioactive material are placed inside thin needles, which are inserted through the skin in the area between the scrotum and anus and into the prostate. The seeds are left in place as the needles are removed and give off low doses of radiation for weeks. Radiation from the seeds travels a very short distance, so the seeds can give off a large amount of radiation in a very small area. This limits the amount of damage to nearby healthy tissues.

Isoray’s Cesium-131 brachytherapy seeds are an option in the treatment of prostate cancers of all risk levels of localized disease. The diagnosis of prostate cancer – and especially low risk prostate cancer – has been potentially reduced with the introduction of guidelines dissuading the use of serum PSA screening at the general practitioner level as a means to detect prostate cancer early in men with no symptoms of prostate cancer. Effective July 2012, the U.S. Preventative Services Task Force (USPSTF) recommended against the use of the PSA test as a screening tool. As a result of the recommendation, prostate cancer diagnosis dropped by 12.2% the month after the recommendation and has continued to drop. (D.A. Barocas, et al., Effect of the USPSTF Grade D Recommendation against Screening for Prostate Cancer on Incident Prostate Cancer Diagnoses in the United States, J Urol 194(6) The Journal of Urology (2015)).

In 2018, the USPSTF finalized its recommendation from advising against screening to the position that the decision for men between 55 and 69 to undergo PSA-based screening should be made by a man in consultation with his doctor. This change may contribute to an increased incidence of prostate screening (and therefore more prostate cancer cases) as opposed to an unscreened population – although this conclusion will await future trending information. To the knowledge of management, this is the latest information available.

Furthermore, the deferral of potentially cancer-eradicating (definitive) prostate cancer treatments such as surgery and radiation therapy has become more popular as some men with prostate cancer have decided to “watch” the cancer using a variety of diagnostic tools – a trend known as “active surveillance.”

As such, the industry has experienced an overall decrease in the number of low risk cases of prostate cancer diagnosed due to reduced PSA screening, as well as a larger number of men who are deferring treatment altogether at a higher rate than seen historically. Intense competition in the space due to numerous established treatment options along with added entrants such as robotic surgery and proton therapy has further eroded the overall brachytherapy market share. The industry continues to focus on the significant data that supports the use of brachytherapy in treating prostate cancer. Management believes the current review of cost effective treatment comparisons with other treatment options, the aging population worldwide and the efficacy of treatment has recently contributed to the revitalization of brachytherapy treatment for prostate cancer.

Minimally invasive brachytherapy such as that provided by the Company’s Cesium-131 brachytherapy seeds provides significant advantages over competing treatments including lower cost, equal or better survival data, fewer side effects, faster recovery time and the convenience of a single outpatient implant procedure that generally lasts less than one hour (Grimm, et al., Comparative analysis of prostate-specific antigen free survival outcomes for patients with low, intermediate and high risk prostate cancer treatment by radical therapy. Results from the Prostate Cancer Results Study Group, British Journal of Urology International, Vol. 109 (Suppl 1), (2012); Merrick, et al., Effect of prostate size and isotope selection on dosimetric quality following permanent seed implantation, Techniques in Urology Vol. 7 (2001); Potters, et al., 12-Year Outcomes Following Permanent Prostate Brachytherapy in Patients with Clinically Localized Prostate Cancer, Journal of Urology (May 2005); Sharkey, et al., Brachytherapy versus radical prostatectomy in patients with clinically localized prostate cancer, Current Urology Reports, (2002)).

In addition to permanent, LDR brachytherapy, such as Cesium-131, localized prostate cancer can be treated with prostatectomy surgery (RP for radical prostatectomy), external beam radiation therapy (EBRT), three-dimensional conformal radiation therapy (3D-CRT), intensity modulated radiation therapy (IMRT), dual or combination therapy, high dose rate brachytherapy (HDR), cryosurgery, hormone therapy, proton therapy and active surveillance (watchful waiting). The success of any treatment is measured by the feasibility of the procedure for the patient, morbidities associated with the treatment, overall survival, and cost. When the cancerous tissue is not completely eliminated, the cancer typically returns to the primary site, often with metastases to other areas of the body.

Prostatectomy Surgery Options. Laparoscopic and robotic prostatectomy surgeries are currently primarily used to remove all or portions of the prostate gland and seminal vesicles and tissue around it in order to minimize the damage that leads to impotence and incontinence, but these techniques require a high degree of surgical skill. To the knowledge of management, this is a common treatment choice.

External Radiation Therapy. Primary External Beam Radiation Therapy (EBRT), Three-dimensional Conformal Radiation Therapy (3D-CRT), Stereotactic Radiotherapy (SBRT), Intensity Modulated Radiation Therapy (IMRT) and Proton Therapy all involve directing a beam of radiation from outside the body at the prostate gland to destroy cancerous tissue. Treatments are received on an outpatient basis with the patient usually receiving five treatments per week over a period of several weeks (up to nine). While the treatments each last only a few minutes, getting the patient and equipment in place for each treatment takes longer. To the knowledge of management, this is the predominant treatment modality when using radiation therapy.

Proton beam radiation therapy. Proton beam therapy focuses beams of protons instead of x-rays on the cancer. Unlike x-rays, which release energy both before and after they hit their target, protons cause little damage to tissues they pass through and release their energy only after traveling a certain distance. This means that proton beam radiation can, in theory, deliver more radiation to the prostate while doing less damage to nearby normal tissues. Proton beam radiation can be aimed with techniques similar to 3D-CRT and IMRT.

Although in theory proton beam therapy might be more effective than using x-rays, so far studies have not shown if this is true. The machines needed to make protons are very expensive, and they are not available in many centers in the United States. Management believes proton beam radiation is not covered by all insurance companies.

Dual or Combination Therapy. Dual therapy is the combination of IMRT or 3-dimensional conformal external beam radiation and seed brachytherapy to treat extra-prostatic disease or high-risk prostate cancers. Combination therapy treats high risk patients with a course of IMRT or EBRT over a period of several weeks. When this initial treatment is completed, the patient must then wait for several more weeks to months to have the prostate seed implant. The process could also involve the seed implant being performed first, followed by the course of external radiation. As of the filing of this Form 10-K, management estimates that at least 25% of all U.S. prostate implants are now dual therapy cases.

High Dose Rate Temporary Brachytherapy (HDR). HDR temporary brachytherapy involves placing soft nylon tubes (catheters) into the prostate gland and then giving a series of radiation treatments through these catheters. The catheters are then removed and no radioactive material is left in the prostate gland. A radioactive source typically containing Iridium-192 is placed into the catheters. This procedure is typically repeated multiple times over a period of several days while the patient is hospitalized.

Watchful Waiting and Active Surveillance. Because prostate cancer often grows very slowly, some men (especially those who are older or who have other major health problems) may never need treatment for their cancer. Instead, their doctor may suggest watchful waiting or active surveillance, terms physicians may use differently or interchangeably.

| ■ | Active surveillance is often used to mean watching the cancer closely with PSA blood tests, digital rectal exams (DREs), and ultrasounds at regular intervals to see if the cancer is growing. Prostate biopsies may be done as well to see if the cancer is starting to grow faster. If there is a change in a patient’s test results, the doctor would then talk to the patient about treatment options. |

| ■ | Watchful waiting (observation) is sometimes used to describe a less intense type of follow-up that may mean fewer tests and relying more on changes in a man’s symptoms to decide if treatment is needed. |

So far, no large randomized studies have compared active surveillance to treatments such as surgery or radiation therapy.

Additional Treatments. Additional, but less frequently used, treatments include high-intensity focused ultrasound (HIFU), cryotherapy, hormone therapy, and chemotherapy.

Clinical Series for Prostate Low Dose Rate Brachytherapy

Studies have demonstrated durably high rates of control following permanent implant brachytherapy for localized prostate cancer out to 15 years post-treatment (J. Sylvester, et al., 15-year biochemical relapse free survival in clinical stage T1-T3 prostate cancer following combined external beam radiotherapy and brachytherapy; Seattle experience International Journal of Radiation Oncology Biology Physics, Vol. 67, Issue 1, 57-64 (2007)). The cumulative effect of these studies has been the conclusion by leaders in the field that brachytherapy offers a disease control rate as high as surgery, though with a lesser side-effect profile than surgery (J.P. Ciezki, Prostate brachytherapy for localized prostate cancer, Current Treatment Options in Oncology Volume 6, 389-393 (2005)).

Long-term survival data for brachytherapy with I-125 and Pd-103 supports the efficacy of brachytherapy in the treatment of clinically localized cancer of the prostate gland. Clinical data indicate that brachytherapy offers success rates for early-stage prostate cancer treatment that are equal to or better than those of RP or EBRT. While historically clinical studies of brachytherapy have focused primarily on results from brachytherapy with I-125 and Pd-103, management believes that these data are also relevant for brachytherapy with Cesium-131. In fact, it appears that Cesium-131 offers comparable and potentially improved clinical symptom outcomes over I-125 and Pd-103, perhaps due to its shorter half-life. (A.B. Shah, et al., A comparison of AUA symptom scores following permanent low dose rate prostate brachytherapy with iodine-125 and cesium-131, Brachytherapy 12 (Suppl. 1) S64 (2013)). In addition, a report from 2017 describes favorable long-term quality of life outcomes following Cesium-131 brachytherapy in the treatment of prostate cancer (S.M. Glaser, et al., Long-Term Quality of Life in Prostate Cancer Patients Treated With Cesium-131, Int J Radiat Oncol Biol Phys. 98(5):1053-1058 (2017)).

In May 2017 a collaborative group of Canadian researchers published the results of a study that randomized intermediate- to high-risk localized prostate cancer to an external beam dose escalation or permanent implant brachytherapy boost (W. J. Morris, et al. Androgen Suppression Combined with Elective Nodal and Dose Escalated Radiation Therapy (the ASCENDE-RT Trial): An Analysis of Survival Endpoints for a Randomized Trial Comparing a Low-Dose-Rate Brachytherapy Boost to a Dose-Escalated External Beam Boost for High- and Intermediate-risk Prostate Cancer, International Journal of Radiation Oncology, Biology, Physics Volume 98, 275-285, 2017). These patients all underwent standard external beam radiation therapy and hormonal therapy. This study, known as the “ASCENDE-RT” study, demonstrated a significant therapeutic advantage to the patients who underwent permanent implant brachytherapy boost, reporting a 20% advantage (83% versus 63%) in biochemical relapse-free survival at nine years following treatment.

This study is the first in many years to successfully randomize a group of newly diagnosed, localized prostate cancer patients and demonstrate a statistically significant advantage to one treatment over another – in this case iodine-125 brachytherapy boost over external beam radiation therapy boost. The impact on the number of patients considered for “combination therapy” (external beam and brachytherapy) could be substantial, especially once men are informed of these study results.

Sexual impotence and urinary incontinence are two major concerns men face when choosing among various forms of treatment for prostate cancer. Studies have shown that brachytherapy with iodine and palladium resulted in lower rates of impotence and incontinence than surgery (C. Buron, et al., Brachytherapy versus prostatectomy in localized prostate cancer: results of a French multicenter prospective medico-economic study, International Journal of Radiation Oncology, Biology, Physics Volume 67, 812-822 (2007)). Combined with the high disease control rates described in many studies, these findings have driven the adoption of brachytherapy as a front-line therapy for localized prostate cancer.

Comparing Cesium-131 to I-125 and Pd-103 Clinical Results

Management believes that the Cesium-131 brachytherapy seed has specific clinical advantages for treating cancer over I-125 and Pd-103, the other isotopes currently used in brachytherapy seeds. The table below highlights the key differences of the three isotopes.

|

|

|

Isotope Delivery Over Time |

|

| Isotope |

Half-Life |

Energy |

90% Dose |

| Cesium-131 |

9.7 days |

30.4 keV |

33 days |

| Pd-103 |

17 days |

20.8 keV |

58 days |

| I-125 |

60 days |

28.5 keV |

204 days |

In early 2021, the long-term follow-up data from a prospective randomized trial of Cesium-131 and Iodine-125 was published (Moran, B. J., et al., Long-term outcomes of a prospective randomized trial of (131)Cs/(125)I permanent prostate brachytherapy. Brachytherapy 20(1): 38-43 (2021)). This long-term data with a nine-year median follow-up concluded that “short- and long- term urinary, sexual, and bowel quality of life, as well as long-term biochemical control were comparable” between the two isotopes. The data supports Cesium-131 as an effective long-term solution for these patients and supports Cesium-131 as a viable choice for prostate cancer patients.

Improved side-effect profile.

In addition to the cancer-related outcomes described for prostate brachytherapy, a significant portion of patients who undergo I-125 or Pd-103 brachytherapy experience acute urinary irritative symptoms following treatment – more so than with surgery or external beam radiation therapy (S.J. Frank, et al., An assessment of quality of life following radical prostatectomy, high dose external beam radiation therapy, and brachytherapy Iodine implantation as monotherapies for localized prostate cancer, Journal of Urology Volume 177, 2151-2156 (2007)). These irritative symptoms can range from an increased frequency of urination to significant pain upon urination. Because the portion of the urethra that runs through the prostate takes high doses from the implant, these side effects are fairly common following prostate brachytherapy.

Studies show that Cesium-131, with the shortest available half-life of the commonly used implantable isotopes, results in a quicker resolution of these irritative symptoms based on the shorter time interval over which normal tissue receives radiation from the implanted sources than for longer lived isotopes such as I-125. (A. Shah, et al., A comparison of AUA symptom scores following permanent low-dose-rate prostate brachytherapy with Iodine-125 and Cesium-131, Brachytherapy 12(SI) S64 (2013)). These results are seemingly confirmed with long-term quality of life data as described by a study from UPMC, where it was suggested that patients treated with Cesium-131 prostate brachytherapy were able to recover and maintain their baseline quality of life in the long term. Glaser, S. M., et al. Long-Term Quality of Life in Prostate Cancer Patients Treated With Cesium-131. Int J Radiat Oncol Biol Phys 98(5): 1053-1058 (2017).

The Company has initiated a study with the University of Pittsburgh School of Medicine that seeks to study short-term urinary symptoms of men treated with Cesium-131 prostate brachytherapy in more detail than previously studied. This study will summarize patient-reported urinary symptoms on a monthly – rather than quarterly – basis in order to more carefully describe patients’ experiences with bothersome urinary morbidity.

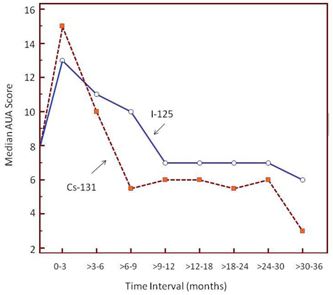

The advantage of the Company’s Cesium-131 brachytherapy seed is the resolution of urinary side effects as pictured in the graphic below has been observed in a second study, presented at the 2013 Annual Meeting of the American Brachytherapy Society (A.B. Shah, et al). The following graph is a comparison of elevated side effect (AUA) symptom scores following permanent low dose rate prostate brachytherapy with Iodine-125 and Cesium-131. (Brachytherapy 12(Suppl. 1) S64 (2013)):

As seen in the plot of these AUA scores, the duration of an elevated side effect score profile resolved to pre-treatment levels more quickly with the Cesium-131 group than with the Iodine-125 group. All patients were treated at the same institution by the same physicians, and the difference in the time to resolution was considered significant.

Further evidence of the favorable side effect profile of Cesium-131 was published by a group of physicians from the University of Pittsburgh Medical Center (UPMC) in August 2017 (Glaser Long-Term Quality of Life in Prostate Cancer Patients Treated With Cesium-131. International Journal of Radiation Oncology*Biology*Physics 2017 Aug 1;98(5):1053-1058. doi: 10.1016/j.ijrobp.2017.03.046. Epub 2017 Mar 31. PMID: 28721888). This report concluded that only minimal long-term changes were noted to the urinary and bowel quality of life measures, and that men treated with Cesium-131 for their prostate cancers are able to return to baseline measure of quality of life after treatment.

Brain Cancer Treatment Options

An estimated 25,050 new cases of malignant primary tumors of the brain or spinal cord are expected to be diagnosed in 2022. About 18,280 people are expected to die from brain and spinal cord tumors in 2022 (American Cancer Society, 2022). In addition to primary tumors, metastasis of brain tumors from other body sites are estimated at over 65,000 new cases per year.

On July 6, 2018, the Company and GT Med Tech received FDA 510(k) regulatory clearance for the brachytherapy technology, known as GammaTile™ Therapy that incorporates proprietary Cesium-131 seeds within customizable collagen-based carriers for the treatment of recurrent brain tumors. On January 27, 2020, GT Med Tech announced that it had received clearance from the FDA for an expanded indication that will allow patients of newly diagnosed malignant brain tumors to be treated by GammaTile™ Therapy.

Isoray Medical and GT Medical Technology executed a Collaborative Development Agreement and an exclusive ten-year supply agreement for GammaTile™ Therapy in fiscal year 2018. On April 26, 2019, the Company and GT Med Tech amended and restated the Manufacturing and Supply Agreement which now expires in April 2029. The amended and restated agreement requires GT Med Tech to provide a twelve-month rolling forecast on a monthly basis. The first calendar month of each rolling forecast becomes a binding purchase order and the remaining eleven months are a non-binding forecast. The amended and restated agreement also adjusted some pricing due to updated procedures, allows GT Med Tech to move the loading of the GammaTile™ to another non-Company facility provided GT Med Tech continues to purchase Cesium-131 seeds exclusively from the Company, and governs how GammaTile™ process improvement projects will be scoped and billed. GammaTile™ leverages Cesium-131’s unique ability to deliver a highly targeted dose of intense radiation treatment while limiting radiation exposure to surrounding tissue. On November 17, 2021, the parties entered into Amendment No. 3 to the Amended and Restated Manufacturing and Supply Agreement to change the nature of the services to be provided by Medical to GT Med Tech from preparation of GammaTiles containing Cesium-131 seeds to instead only supplying Cesium-131 seeds to GT Med Tech so that GT Med Tech may handle the assembly of GammaTiles in house. Pursuant to this amendment, Medical will manufacture and supply Cesium-131 brachytherapy seeds to GT Med Tech rather than GammaTiles. Additionally, the amendment modified the prices to be paid by GT Med Tech for rush orders and for Cesium-131 seeds and modified how order cancellations are processed.

CMS established an ICD-10-PCS code for GammaTile™, 00H004Z (insertion of radioactive element, Cesium-131 implant into brain, open approach). CMS also mapped GammaTile™’s ICD-10-PCS code to DRG 023. DRG 023 is the highest paying DRG for craniotomy procedures. ICD-10-PCS is a code set designed for use in the hospital in-patient setting in the United States. ICD-10-PCS codes can be used to identify and track differences in resource consumption, quality, and patient outcomes for different inpatient hospital procedures. ICD-10-PCS codes are distinguishable from the MS-DRG (Medicare Severity-Diagnosis Related Group) codes that are commonly used to assign payment levels to inpatient hospital admissions for use by Medicare and other health care insurers. Along with Medicare, commercial carriers and many Medicaid programs use the ICD-10-PCS and DRG code sets, including DRG 23.

GT Med Tech has reimbursement for GammaTile™ under ICD-10PCS-00H004Z and MS-DRG 023 which reimburses hospitals in the inpatient setting and will continue to roll out its sales and marketing strategy for release of GammaTile™. In January 2020, GammaTile™ Therapy launched a full market release. Prior to fiscal 2021, total revenues from sales to GT Med Tech have been less than ten percent (10%) of sales but these sales exceeded 10% in fiscal 2021 and 2022. GT Med Tech has indicated it intends to increase sales and marketing efforts during the Company’s fiscal year 2023, but there is no assurance that this will occur.

In addition to GammaTile™ Therapy, the Company’s customers can also use braided strands containing Cesium-131 brachytherapy seeds for the treatment of brain cancer. Cesium-131 brachytherapy seeds deliver 90% of their dose in 33 days and are therefore well-suited to use with bioabsorbable mesh, single seed applications, implantable strands, and by implantable device.

Gynecological Cancer Treatment Options (Cervical, Vaginal and Vulvar Cancer)

An estimated 29,300 new cases of cervical (14,100), vaginal (8,870) and vulva (6,330) cancers are expected to be diagnosed in the United States in 2022. A combined estimate of 7,470 deaths are expected to occur from cervical, vaginal and vulvar cancers in the United States in 2022 (American Cancer Society, 2022). In addition to brachytherapy to treat gynecological cancers such as cervical, vaginal and vulvar cancers, other treatment options include surgery, laser surgery, radiation therapy, chemotherapy, and topical treatments.

During 2016, two abstracts (J. Feddock, et al., Permanent interstitial re-irradiation with cesium-131: a highly successful second chance for cure in recurrent pelvic malignancies, Brachytherapy 15(S1):S78-9 (2016); J. Feddock, et al., Outpatient interstitial implants - integrating cesium-131 permanent interstitial brachytherapy into definitive treatment for gynecologic malignancies, Brachytherapy 15(S1):S93-4 (2016)) and presentations were presented at the World Brachytherapy Conference in San Francisco on the treatment of Re-Irradiation with Cesium-131 in recurrent pelvic malignances in women who have recurrent cancers. Physicians at the University of Kentucky, College of Medicine reported local control in 80.7% after Cesium-131 implantation for the recurrent patients and reported successful control of 22 women with pelvic cancer that had not had previous treatment. Based upon the positive results seen in the Cesium-131 treatment of recurrent gynecological cancers, physicians at the University of Kentucky are currently moving Cesium-131 treatment into the primary treatment of these cancers.

In April 2017, the group of physicians from the University of Kentucky published a paper in the journal Brachytherapy that described the early experience with a template-based approach using Cesium-131 in the treatment of gynecologic cancers. Although reporting on only five patients, the University of Kentucky physicians demonstrated the feasibility and safety of replacing a high dose-rate isotope (Iridium-192) with Cesium-131. This report builds on the earlier published and presented work that strongly suggests a role for Cesium-131 in the treatment of gynecologic cancers.

Head and Neck Cancer Treatment Options

An estimated 54,000 new cases of head and neck cancer are expected to be diagnosed in the United States in 2022 (American Cancer Society, 2022).

Surgery is the most common option to treat head and neck cancers. Chemotherapy is often used in conjunction with surgery or radiation therapy depending on the type and stage of the cancer. External beam radiation therapy and brachytherapy have been used together or in combination with surgery or chemotherapy. Immunotherapy is a newer treatment option for advanced or recurrent cancer (American Cancer Society, 2021).

Cesium-131 brachytherapy seeds allow oncologists to add targeted radiation treatment to head and neck cancers after surgical resection. This targeted radiation treatment is especially needed in patients whose neck cancer has recurred following previous radiation therapy. Often these patients cannot tolerate further external beam radiation therapy for fear of over radiating critical head and neck structures.

Management believes Cesium-131 brachytherapy seeds continue to represent an improved approach to brachytherapy treatment of specific head and neck cancers.

Lung Cancer Treatment Options

An estimated 236,740 new cases of lung cancer are expected in 2022, accounting for 12% of all cancer diagnoses in the United States. Lung cancers are expected to account for more deaths in 2022 than any other single type of cancer in both sexes combined. In the United States, an estimated 130,180 deaths will result from lung cancer in 2022 (American Cancer Society, 2022).

Lung cancer has historically been treated utilizing surgery, radiation therapy, chemotherapy, immunotherapy and targeted therapy including LDR brachytherapy. More than one kind of treatment may be used in combination with others, depending on the stage of the patient’s cancer and other factors. (American Cancer Society, 2022).

The Company believes that Cesium-131, with its shorter half-life (faster rate of decay) and relatively high energy, is better suited for treating lung cancer in Stages I and II than I-125. The bioabsorbable mesh used in this procedure to apply the Cesium-131 brachytherapy seeds generally dissolves after about 45 days. Cesium-131 delivers 90% of its dose in 33 days and is therefore well-suited to use with bioabsorbable mesh. A report was published in May of 2015 describing outcomes from a series of 52 patients treated with a limited surgical resection and Cesium-131 brachytherapy. (B. Parashar, et al., Analysis of stereotactic radiation vs. wedge resection vs. wedge resection plus Cesium-131 brachytherapy in early stage lung cancer, Brachytherapy 14 (5):648-54 (2015)).

Our Strategy

The key elements of Isoray’s strategy for fiscal year 2023 include:

Continue to Invest in Sales and Marketing Development Activities. Prostate cancer treatment represents the original and core business for the Company’s Cesium-131 product. With long-term follow-up data relating to biochemical (PSA) control of prostate cancer now presented to the prostate cancer field, Isoray plans to aggressively increase the number of centers using Cesium-131 through its direct sales force and through its international distributors. Because intermediate- to long-term follow-up data is required to convince clinicians and patients to consider any particular therapy for localized prostate cancer, the availability of long-term data with Cesium-131 in the treatment of prostate cancer represents a significant milestone. Isoray hopes to capture more of the incremental market growth if and when seed implant brachytherapy recovers market share from other treatments, take market share from existing competitors, and expand the use of Cesium-131 as a dual therapy option where it has experienced success. In 2022, the Company continues to evolve in the new post-COVID era. New sales and marketing initiatives are focused on new sites of care outside the traditional hospital outpatient (HOPD) setting. This results in expanded patient access to care and treatment efficiencies, that have become more difficult in the hospital setting due to ongoing staffing shortages. The marketing team works in conjunction with the local sales team members to deliver value to customers through several channels. Although the Company continues to invest in digitally integrated, data-focused, and virtual learning platforms that align our products and services with our clinicians' needs, in fiscal year 2023 the Company will return to in-person training programs as well. The Company believes using both virtual and in-person training will result in increased awareness to customers and patients, and to faster adoption of Cesium-131 by clinical teams.

Isoray recently invested in supporting ZERO Cancer, the largest not-for-profit prostate cancer patient support service in the United States. ZERO Cancer started in 1996 with a group of physicians and patients who also started the National Prostate Cancer Coalition (“NPCC”). The NPCC was formed to reach out to patients who had prostate cancer and encouraged them to become a political force for a cure. Since then, the organization has evolved into ZERO with a focus on public awareness and a collective voice for the prostate cancer movement. In 2021, ZERO merged with Us TOO International, the nation’s first prostate cancer support group network with an international presence as well. With the ZERO and Us TOO merger, patients now have access to a single prostate cancer support powerhouse. Isoray is excited to work with ZERO bringing support and hope to prostate cancer patients and their families.

Isoray recently added the Proximie virtual communication platform to our digital resources to enhance our physician training efforts. This technology is specifically designed to assist clinicians by sharing all aspects of a medical procedure in real time as well as having the ability to review sessions that have been archived in a library. We are working to achieve greater engagement with US leading teaching and research institutions in these efforts. The Company believes this may help us get back to our pre-pandemic training levels. In addition, the Company is partnering with the American Brachytherapy Society (ABS) to support ABS’ training initiative 300 in 10 which is designed to train 300 teams in brachytherapy in 10 years.

Blu Build™ Loader. The Company believes that customers perform prostate brachytherapy procedures via one of several general procedure techniques, including (but not limited to): pre-plan techniques, intra-operative techniques, and real-time techniques. Further, the Company believes that customers are comfortable with their techniques, and want products to facilitate their preferred methods. Competitors to the Company provide a set of standard products (including loose seeds, seeds loaded in cartridges, and seeds pre-loaded in needles) to meet the customer needs. Further, Theragenics and Becton-Dickenson (BD), formerly Bard Brachytherapy, have products that support intra-operative and real-time techniques that allow for stranding or linking seeds together in custom configurations in the operating room. These products allow physicians to gain the benefits of stranded or linked seeds while still allowing for customization to the patient's anatomy, as determined at the time of the procedure. The Company believes that approximately 25% of procedures are performed with some level of customization in the operating room.

It is this segment of the market – customers looking to customize their procedures to the patient's anatomy at the time of the procedure – that the Company expects to address with its Blu Build™ loading device. The Blu Build™ loading device efficiently configures strands in the operating room, allowing the clinician to make determinations about the product configurations with the most recent picture of the patient’s anatomy. The Company believes that this technique may provide advantages in some brachytherapy products and will provide a better solution for this market segment.

During fiscal year 2019, the Company released the Blu Build™ loader in a limited market release. Based on feedback from the limited market release, the Company adjusted certain intricacies of the design. This is the first internally developed proprietary delivery device in the Company's history. The Company continues to refine the design of the Blu Build™ loader, however, the COVID-19 pandemic impacted the sourcing of parts and the ability to fully market the Blu Build™ loader to new accounts. In 2022, the Company conducted a review of the product and the parts required to manufacture the product and determined that a second generation of the Blu Build™ loader will be required to make improvements on the original design. The Company is in the process of investigating a redesign for the Blu Build™ loader.

Management believes the Company has enough inventory of the original design to support its current customers and new customers in the pipeline but is not actively marketing this device until a redesign is completed. Management believes that the Blu Build™ loader will be able to gain greater market acceptance once the redesign is complete, but there is no assurance that this will occur.

Commercialization of GammaTile™ Therapy for the treatment of primary and recurrent brain metastases. The utilization of the GammaTile™ system over the past five years has developed a product with consistent and repeatable results as evidenced by the June 2016 presentation at the Society of Neurologic Oncologists. Management intends to continue to support and facilitate the commercialization of the GammaTile™ Therapy by GT Medical Technologies product.

In fiscal 2021 and 2022, this product exceeded ten percent (10%) of total sales and with GT Med Tech’s significant expansion and funding of its sales force in 2022 it is committed to increasing its sales as fast as possible and if this occurs will result in added revenue to the Company as well.

Increase utilization of Cesium-131 in treatment of other solid tumor applications such as brain, gynecological, and other cancers. The Company has clearance from the FDA for its premarket notification (510(k)) for Cesium-131 brachytherapy seeds that are preloaded into bioabsorbable braided sutures and bioabsorbable braided sutures attached to bioabsorbable mesh. This FDA clearance allows commercial distribution for treatment of brain, gynecological, head and neck and lung tumors as well as tumors in other organs. The Company continues to sell Cesium-131 products to physicians treating brain, gynecological, head and neck and lung cancer while continuing to support the compilation of treatment outcomes for publication. Isoray will continue to explore licenses or joint ventures with other companies to develop the appropriate technologies and therapeutic delivery systems for treatment of other solid tumors.

Obtaining More Favorable Reimbursement Codes. In May 2020, CMS approved 64 ICD-10-PCS billing codes used for reimbursement of Cesium-131 for the hospital in-patient DRG setting. The codes allow hospitals to bill Medicare and other health insurers for specific surgical procedures that would benefit from the addition of Cesium-131. DRG, or diagnostic related groups, are designed for Medicare and other health insurers to set payment levels for hospital in-patient services.

The 64 ICD-10-PCS codes are important for the growing surgical applications of Cesium-131 in treating a significant range of hard to treat cancers including brain, lung, head and neck, abdominal, breast, gynecological, pelvic, and colorectal cancers. The new codes took effect on October 1, 2020.

Support Clinical Research And Sustained Product Development. The publication and presentation of speculative and real-world data contribute to the acceptability of Cesium-131 in the oncologic marketplace. Discussion in the medical-scientific community of established and novel Cesium-131 applications is considered a prerequisite to expansion into untapped markets. The Company structures and supports clinical studies on the therapeutic benefits of Cesium-131 for the treatment of solid tumors and other patient benefits. We are and will continue to support clinical studies with several leading radiation oncologists to clinically document patient outcomes, provide support for our product claims, and compare the performance of our seeds to competing seeds. Isoray plans to sustain long-term growth by implementing research and development programs with leading medical institutions in the U.S. and other countries to identify and develop other applications for Isoray’s core radioisotope technology. The Company has deployed a secure, regulatory environment compliant, online information system capable of large usable databases to participating investigators.

The Company also continues to consult with noted contributors from the medical physics community and expects that articles for professional journals regarding the benefits of and clinical trials involving Cesium-131 will continue to be submitted.

In addition, the Company continues to support the clinical findings of the various protocols and publications through presentations by respected thought leaders. The Company will continually review and update all marketing materials as more clinical information is gathered from the protocols and studies. Apart from clinical studies and papers sponsored by the Company, several physicians across the country have independently published papers and studies on the benefits of Cesium-131.

Targeted Expansion into International Markets. The Company believes that in addition to a significant domestic market for its products, there exists a potential international demand for Cesium-131. The current global market for permanent prostate brachytherapy is larger than the domestic market. Further, many of the surgical applications the Company is exploring domestically may also have significant international opportunities. Due to the pandemic most of these geographical regions have limited access, capacity or capability to introduce new products at this time. The Company will continue to monitor world-wide progress to open access to care for patients who would benefit from our products.

Historically, the Company has placed limited resources towards realizing these international opportunities instead keeping the focus of expanding our domestic market share. The Company has provided Cesium-131 product, when requested, to certain markets with potential distributors, however, this distribution has been limited. Instead of relying solely on perceived demand by a potential distributor which believes in the viability of the Company’s product in a given country, the Company will continue to consider international markets and only enter those markets based on a potential market meeting some or all of the following criteria:

| ● |

Investigating different geographical markets – In order to maximize return of international investments, the Company will need to understand the regulatory and reimbursement environment, as well as patient and market sizes. |

| ● |

Assessing potential physician / patient interest in Cesium-131 – In addition to reviewing the market receptiveness, the Company will work with its existing network of opinion leaders and partners to determine the clinical interest in Cesium-131, and where it may be most appropriate to assess the fit / adoption of Cesium-131. |

| ● |

Assessing geographical clinical and capital expense factors – It will be key to understand the alternative therapies available in a given foreign market. For example, in some regions large capital investments are difficult, making the use of permanent brachytherapy more attractive than other therapies. |

| ● |

Identifying potential partners / strategies – The Company will assess if there are strategic partners or other potential strategies for addressing a particular foreign market. |

On July 14, 2017, the Company entered into an agreement with a distributor in Russia that provides for the ability to sell the entire product line in the Russian Federation. While the agreement has been renewed and is still in place, there have been no sales during the past two fiscal years.

In fiscal year 2020, the Company entered into a three-year agreement with a distributor in India that provides for the ability to sell Cesium-131 brachytherapy seeds in different configurations within India. Due to the ongoing COVID-19 global pandemic, there have been no sales to date under this agreement.