Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED] |

For the transition period from to

Commission file number 1-9511

THE COAST DISTRIBUTION SYSTEM, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 94-2490990 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 350 Woodview Avenue, Morgan Hill, California | 95037 | |

| (Address of principal executive offices) | (Zip Code) | |

(408) 782-6686

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, par value, $.001 per share Preferred Share Purchase Rights, $0.001 per share |

American Stock Exchange American Stock Exchange | |

| (Title of Class) | (Name of Each Exchange on Which Registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of 15(d) of the Act. YES ¨ NO x.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the outstanding shares of Common Stock held by non-affiliates of Registrant as of June 30, 2010, the last day of the second quarter of fiscal 2010, which was determined on the basis of the closing price of Registrant’s shares on that date, was approximately $14,694,000.

As of March 18, 2011, a total of 4,541,596 shares of Registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Except as otherwise stated therein, Part III of the Form 10-K is incorporated by reference from Registrant’s Definitive Proxy Statement expected to be filed on or before April 30, 2011 for its Annual Meeting.

Table of Contents

THE COAST DISTRIBUTION SYSTEM, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2010

TABLE OF CONTENTS

(i)

Table of Contents

Statements contained in this Annual Report that are not historical facts or that discuss our expectations, beliefs or views regarding our future operations or future financial performance, or financial or other trends in our business or markets, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “1933 Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “1934 Act”). Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Often, they include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” The expectations, beliefs or views regarding our future financial condition or financial performance or trends in our business or markets that are contained in this Report are based on current information and are subject to a number of risks and uncertainties that could cause our financial condition or operating results in the future to differ, possibly significantly, from those expected at the current time. Those risks and uncertainties are described in Item 1A of Part I of this Report in the Section entitled “RISK FACTORS” and some of the factors and uncertainties that can affect our business, financial condition and results of operations also are set forth in Part II of this Report in the Section entitled “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. Readers of this Report are urged to read the cautionary statements contained in those Sections of this Report.

Due to these risks and uncertainties, readers are cautioned not to place undue reliance on forward-looking statements contained in this Report, which speak only as of the date of this Annual Report. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may otherwise be required by applicable law or the rules of the American Stock Exchange.

| ITEM 1. | BUSINESS |

References in this Annual Report to “Coast,” “we,” “us,” or “our” or to the “Company” shall mean The Coast Distribution System, Inc and its subsidiaries taken as a whole.

Overview of Our Business

The Coast Distribution System, Inc. is, we believe, one of the largest wholesale suppliers of replacement parts, supplies and accessories for recreational vehicles (“RVs”), and boats in North America. We supply almost 11,000 products and serve more than 15,000 customers throughout the United States and Canada, from 13 regional distribution centers in the United States that are located in California, Texas, Oregon, Arizona, Colorado, Utah, Indiana, Pennsylvania, New York, Georgia, Florida and Wisconsin and 4 regional distribution centers in Canada located, respectively, in Montreal, Toronto, Calgary and Vancouver. Our customers are comprised primarily of RV and boat dealers, supply stores and service centers (“Aftermarket Customers”), which resell the products they purchase from us, at retail, to consumers. Reference is made to Note G to our Consolidated Financial Statements, contained in Item 8 of this Report, for certain information regarding the respective operating results of the Company’s operations in the United States and Canada.

We have introduced into the marketplace a number of products that have been designed specifically for us by independent product design firms or product manufacturers and are manufactured for us, generally on an exclusive basis, by a number of different independent manufacturers. We market these products (which are referred to in this Annual Report as either “proprietary products” or “Coast branded products”) under our own brand-names in competition with or, in some cases that are complementary to, products from traditional suppliers of RV and boating parts, supplies and accessories. Due to differences in costs, we generally are able to generate higher margins on sales of proprietary products than we are able to realize on sales of competing products. For additional information regarding our proprietary products, see “Products — Proprietary Products Strategy and Sales” below.

The Company was incorporated in California in June 1977, and reincorporated in Delaware in April 1998.

Table of Contents

The RV and Boating Parts, Supplies and Accessories Aftermarkets

Many manufacturers of RV and boating replacement parts, supplies and accessories rely on independent distributors, such as the Company, to market and distribute their products or to augment their own product distribution operations. Distributors relieve manufacturers of a portion of the costs associated with distribution of their products while providing geographically dispersed selling, order processing and delivery capabilities. At the same time, distributors offer retailers access to a broad line of products and the convenience of rapid delivery of orders which reduces the amount of product inventories that retailers must carry and, therefore, their costs of operations.

The market for RV parts, supplies and accessories distributed by the Company is comprised of RV dealers and RV supply stores and service centers. The RV products that we sell include optional equipment and accessories, such as trailer hitches, air conditioning units, water heaters, portable generators, outdoor furniture, and other accessories, and replacement and repair parts and maintenance supplies. The market for the boating parts, supplies and accessories that we sell is comprised primarily of independent boat dealers that sell boats and boating parts, supplies and accessories at retail. Independent boat dealers primarily purchase replacement parts, boating supplies and smaller accessories from us.

Products

General. We carry a full line of almost 11,000 RV and boating parts, supplies and accessories which we purchase from more than 400 manufacturers. The RV products that we distribute include antennae, vents, electrical items, towing equipment and hitches, appliances such as air conditioners, refrigerators, ranges and generators, LP gas equipment, portable toilets and plumbing parts, hardware and tools, specialized recreational vehicle housewares, chemicals and supplies, and various accessories, such as ladders, jacks, fans, load stabilizers, outdoor furniture, mirrors and compressors. Boating and marine products that we distribute include boat covers, stainless steel hardware, depth sounders, anchors, life jackets and other marine safety equipment and fishing equipment that are designed primarily for use on trailer-towable boats.

Proprietary Products Strategy and Sales. We have introduced into the RV and boating aftermarkets a growing number of proprietary products, which are products that are manufactured specifically for us, often on an exclusive basis, by a number of different independent manufacturers, based primarily, but not exclusively, in Asia. The proprietary products primarily include products that are needed or used by RV and boating customers on a regular or recurring basis, such as trailer hitches, plastic wastewater tanks, vent lids, stabilizing jacks and battery boxes. These products have been designed for us by independent professional product design firms or by the independent manufacturers that we have retained to manufacture the products for us. We market these proprietary products under our own brand-names in competition with brand name products from traditional suppliers, which usually sell their products to a number of different distributors and sometimes into other markets.

Generally, the costs to us of purchasing proprietary products are lower than the costs of purchasing competitive products from traditional suppliers based in the United States. As a result, our proprietary products strategy has enabled us, over the years, to offer our customers lower-priced products, without compromising quality, and at the same time has enabled us to increase our gross profit margins. However, the costs of marketing our proprietary products generally are greater than for established brand-name products, which can offset some of the margin advantage we gain on sales of those products.

Expansion into New Markets. During the past several years we have begun to source from overseas manufacturers, and market and sell in the United States and Canada, products that have applications not only in the RV and boating markets, but also in other markets. We intend to continue our efforts to source additional products from independent manufacturers, primarily in Asia, that we can sell into multiple markets domestically, in order to increase our sales and gross margins and reduce our dependence on the RV and boating markets. It is too early to predict if this strategy will prove to be successful. Among other things, we have encountered stiff competition in those new markets from manufacturers and distributors of competing products. A number of those manufacturers and distributors are larger and have more marketing and capital resources than we do and are better known in those markets than we are. Additionally, we expect that it will be necessary for us to assume primary responsibility for marketing these foreign sourced products to consumers and, in some instances, for providing warranty service for such products, the costs of which could offset the margin advantage we enjoy on sales of these products.

2

Table of Contents

Marketing and Sales

Our Customers. Our customers include primarily (i) RV dealers, which purchase optional equipment and accessories for new recreational vehicles and replacement and repair parts for their service departments, (ii) independent RV supply stores and service centers that purchase parts, supplies and accessories for resale to owners of RVs and for their service centers, and (iii) independent boat dealers that purchase small accessories for new boats and replacement parts and boating supplies for resale to boat owners and operators. We are not dependent on any single customer for any material portion of our business and no single customer accounted for more than 2% of our sales in 2010, 2009 or 2008.

We have begun to market and sell portable generators and certain other products, including some of our proprietary products, to other distributors, national and regional home improvement and home accessories chains, catalogue stores, hardware stores and agricultural equipment outlets, which operate within the outdoor power equipment market. However, to date, our sales to those customers have not been material in relation to our sales of such products to RV and boating Aftermarket customers and there is no assurance that we will be successful in penetrating the outdoor power equipment market.

Our Customer Service Center and Electronic Order Entry and Warehousing System. We have designed and implemented a computer-based order entry and warehousing system which enables our customers to transmit orders electronically to our central computers and also enables us, subject to product availability, to prepare and invoice most customer orders within 24 hours of receipt.

We operate a national customer sales and service center through which our customers can obtain product information and place orders by telephone using toll-free telephone numbers. Our customer sales and service center is staffed by sales personnel who are trained to promote the sale of our products and to handle customer service issues. We also maintain web sites where our customers can submit orders electronically.

Orders transmitted by customers either electronically, or via telephone to the national customer sales and service center, are entered into our computer system and then are electronically transmitted to the regional distribution center selected by the customer, where the products are picked, packed and shipped. At the time the order is received, the customer is informed, either by electronic confirmation or by the sales person handling the customer’s call at the customer service center, that the order has been accepted and whether any items are not currently in stock.

Distribution

General. Our regional distribution and warehouse centers in North America carry an inventory of up to approximately 12,000 RV and boating parts, supplies and accessories, although the nature and number of products at each distribution and warehouse center does vary, based primarily on the historical product sales of each distribution center to customers in their respective geographic regions. We rely primarily on independent freight companies to ship our products to our customers.

We have implemented an inventory management and deployment system that we designed to improve our ability to fill customer orders from the distribution centers closest to the customer and, thereby, improve our responsiveness to the customer and at the same time reduce our costs of service. We track product sales from each of our distribution and warehouse centers and stock at each such center only the products which are in relatively high demand from customers in the region serviced by that distribution center. At the same time we offer our customers a program by which we ship products that are not available at the Company’s distribution center closest to the customer from the next closest of the Company’s distribution centers which stocks those products. This program reduces back-orders that could adversely affect service levels to our customers and, at the same time, reduces our costs because it eliminates the need to stock duplicative products at all of our warehouses.

3

Table of Contents

Arrangements with Manufacturers

General. The products which we distribute are purchased from more than 400 different manufacturers. As is typical in the industry, in most instances we acquire those products on a purchase order basis and we have no long term supply contracts or guaranteed price or delivery agreements with manufacturers, including the manufacturers that produce proprietary products for us. As a result, short-term inventory shortages can occur. We sometimes choose to carry only a single manufacturer’s products for certain of the brand-name product lines that we sell, although comparable products usually are available from multiple sources. In addition, generally we obtain each of our proprietary products from a single source manufacturer, although in many instances we own the tooling required for their manufacture.

Dependence on a single manufacturer for any product or line of related products, however, presents some risks, including the risk that we will be unable to readily obtain products from alternative suppliers in the event that a single source supplier encounters production problems or decides either to enter into an exclusive supply arrangement or alliance with a competing distributor or to vertically integrate its operations to include the distribution of its products. Termination of a single source supply relationship could adversely affect our sales and operating income, possibly to a significant extent. See “Risk Factors” in Item 1A of Part I of this Report.

Our increased purchases of foreign sourced products subjects us to foreign currency risks that could reduce the margin advantage we would be able to realize on the sales of those products to our customers in North America. See “RISK FACTORS — Our financial performance can be adversely affected by currency fluctuations associated with our operations in Canada and our increased reliance on foreign product suppliers.

During the year ended December 31, 2010, none of our suppliers accounted for more than 5% of our product purchases, except Airexcel, Inc., which manufacturers and supplies us with Coleman® brand RV air conditioners. The dollar volume of our purchases of air conditioners from Airexcel accounted for 20% of the total dollar volume of our product purchases in 2010. By comparison, product purchases from Airexcel accounted for 18% and 15% of the total dollar volume of our product purchases in 2009 and 2008, respectively. Product purchases from Thule Towing Systems (formerly Valley Industries), which supplied us with towing products, accounted for 5% and 6% of the total dollar volume of our product purchases in each of 2009 and 2008, respectively. Purchases of portable and standby generators from Wuxi Kipor Power Co., Ltd. (“Kipor”), accounted for 6% of the total dollar volume of our product purchases in 2008. No other product suppliers accounted for as much as 5% of our product purchases in 2009 or 2008.

During 2009, we significantly reduced our purchases of generators from Kipor as we began transitioning to a new supplier of portable and standby generators, sales of which commenced in the first quarter of 2010. Additionally, we have arranged for a number of towing products of the types formerly supplied to us by Thule to be manufactured for us by other suppliers. As a result, our purchases of towing products from Thule declined significantly in 2010. We also have designed and arranged for the manufacture, by other suppliers, of and have begun selling a new line of hitch products and a new line of electric jacks, primarily for use on travel trailers. We believe that these products offer price, performance and ease of use advantages to consumers over competing hitch and electric jack products that are currently available in the market. Moreover, these new products will broaden the range of towing products that we offer to our RV and boating customers and we believe have applications in other markets, as well.

Product Warranties and Product Liability Insurance. We generally do not independently warrant the products that we distribute and sell. Instead, product manufacturers generally warrant the products they sell to us and allow us to return defective products for credit or replacement, including those that have been returned to us by our customers. However, we do sell portable generators under a product supply arrangements with the manufacturer which provide for us to share the costs of providing warranty services for these products. The warranty period is 24 months following the sale of a generator to a retail customer. At December 31, 2010 and 2009, we had established reserves of $469,000 and $358,000, respectively, for potential warranty claims with respect to those products. However, there is no assurance that warranty claims in the future will not exceed these amounts.

4

Table of Contents

We also maintain insurance to protect us against product liability claims relating to all of the products we distribute and sell. Additionally, we often are able to obtain indemnification agreements from our product suppliers to protect us against product liability claims that may arise out of the use of the products they manufacture and supply to us for resale.

Competition

We face significant competition. There are a number of national and regional distributors of RV and boating parts, supplies and accessories that compete with us. There also are mass merchandisers, web retailers, catalog houses and national and regional retail chains specializing in the sale of RV or boating parts, supplies and accessories that purchase such products directly from manufacturers. The mass merchandisers, web retailers, and national and regional chains compete directly with the RV and boating supply stores and service centers that purchase products from us. This competition affects both the volume of our sales and the prices we are able to charge our customers for those products. Additionally, there is no assurance that changes in supply relationships or new alliances within the RV or boating products industry will not occur that would further increase competition.

We compete on the basis of the quality, speed and reliability of our service, the breadth of our product lines and on price. We believe that we are highly competitive in each of these areas.

As discussed earlier in this Report, we sell portable generators and certain other products, not only in the RV and boating markets, but also in other markets, such as the outdoor power equipment market, in which we have not previously sold products. We also intend to seek additional products that we can source from overseas suppliers for resale into other markets in the United States and Canada. We expect to encounter intensive competition from manufacturers and distributors of competing products in those other markets. Many of those companies are larger and have greater marketing and financial resources than we do and are better known than us in these markets. Therefore, there is no assurance that we will be successful in competing against those companies.

Seasonality

Sales of RV and boating parts, supplies and accessories are seasonal. Generally, we have significantly higher sales during the six-month period from March through August than we do during the remainder of the year when winter weather conditions result in reductions in the purchase and in the usage of RVs and boats and, therefore, also in the demand for our products, by consumers. Because a substantial portion of our expenses are fixed, operating income declines and we sometimes incurs losses and must rely more heavily on borrowings to fund our operations in the winter months when sales are lower.

Employees

At December 31, 2010, we had approximately 265 full-time employees, which include employees in Canada. During the peak summer months, we also employ part-time workers at our regional distribution and warehouse centers. None of our employees is represented by a labor union and we believe that relations with our employees are good.

Our Website

Our internet website address is www.coastdistribution.com. Our Annual Report to Stockholders and all of our SEC filings are available on our website, without charge. Copies of these filings also are available as soon as reasonably practicable after we have filed or furnished these documents to the SEC at its website, which is www.sec.gov.

5

Table of Contents

| ITEM 1A. | RISK FACTORS |

Statements contained in this Annual Report that are not historical facts or that discuss our expectations, beliefs or views regarding our future operations or future financial performance or future financial condition or trends in our business or markets constitute “forward-looking statements.” Forward-looking statements contain estimates, predictions and our expectations, beliefs and views about our future financial performance or future financial condition, or regarding financial or market trends that may affect our future results of operations. Such statements are based on current information available to us and our business is subject to a number of risks, market conditions and uncertainties that could cause our actual operating results or our financial performance or financial condition in future periods to differ, possibly significantly, from our current expectations and the estimates that are set forth in the forward looking statements contained in this Annual Report. Set forth below is a discussion of those risks and uncertainties. However, readers of this Report are cautioned that it is not possible to predict all of the events or circumstances that might occur and might adversely affect our financial performance or operating results in the future and, therefore, there may be other risks to which our business is subject that are not addressed below.

Our business and financial performance are affected by economic conditions that affect consumers.

Our sales are affected directly by the level of purchases and the usage by consumers of RVs and boats which, in turn, are dependent on the ability and willingness of consumers to spend money to make purchases of and to use their RVs and boats. As a result, our sales are affected primarily by (i) the discretionary income that consumers have to spend, (ii) their confidence about economic conditions which determines their willingness to spend their discretionary income, (iii) the availability of and the interest rates payable on borrowings, including credit card debt, on which consumers generally rely to finance their purchases of and the costs of using RVs and boats, and (iv) the availability and prices of gasoline, which affect the ability and cost of operating and using their RVs and boats. As a result, our sales and earnings in the past have been, and our future sales and earnings can be, adversely affected by the following conditions:

| • | Economic downturns and recessions and rising unemployment, which result in declines in discretionary income of and a loss of confidence among consumers about economic conditions and their own economic well-being and security, which cause them to reduce their purchases and usage of RVs and boats; |

| • | A tightening in the availability and increases in the costs of borrowings and consumer credit on which consumers rely to supplement their own funds when purchasing new and used RVs and boats and paying to maintain and purchase supplies and accessories for their RVs and boats; and |

| • | Increases in the prices and shortages in the supply of gasoline, which increase the costs and sometimes even the ability and, therefore, the willingness of consumers to purchase and use RVs and boats. |

Our results of operations in 2010, 2009 and 2008 illustrate the impact that adverse economic and market conditions can have on our business and financial performance. The current economic recession, which is reported to have begun in late 2007, became quite severe during the second half of 2008 and has continued through 2010 and has had wide-ranging consequences for the economy as a whole and has created serious and unprecedented difficulties for the RV and boating industries in particular. The recession began with dramatic declines in home prices and increases in mortgage loan delinquencies and home foreclosures that, in turn, led banks and other lending institutions to significantly curtail the availability of credit to both businesses and consumers. Those conditions resulted in a considerable decline in economic activity throughout the country and sharp and rapid drops in the prices of stocks and bonds, which led to rapid increases in unemployment and significant declines in the retirement savings of consumers that significantly reduced their discretionary income and caused them to lose confidence in the economy and in their own economic security. As a result, consumers have significantly curtailed their purchases and usage of RVs and boats that significantly reduced their need for and their purchases of the products we sell.

Although economic conditions began to improve in 2010, unemployment remains high and considerable uncertainties remain with respect to the strength and sustainability of an economic recovery. As a result, we expect that consumers will continue to be reluctant to increase their spending generally or their purchases and usage of RVs and boats, in particular, at least during the first half of 2011. Consequently, we have been diligent in our programs

6

Table of Contents

designed to enable us to gain market share, increase our profit margins and reduce our costs in order to offset the effects that these economic and market conditions could have on our results of operations during 2011. However, due those uncertainties, it is not possible to predict, with any degree of accuracy, whether or not these programs will enable us to achieve improvements in our operating results in 2011, as compared to 2010 and we could incur losses in 2011.

For a more detailed discussion of how these economic conditions affected our results of operation and financial condition in 2010, see “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” below, in Part II of this Report.

The economic recession and credit crisis could have longer term adverse consequences for our business and future financial performance.

The economic recession and credit crisis have led to the closure or bankruptcies of many RV and boating dealers and a number of well-known RV manufacturers which could significantly reduce the size of the RV and boating markets and the number of our Aftermarket Customers and, therefore, adversely affect our business, sales, gross profit margins and future financial performance. In addition, the spending habits of consumers who purchase and use RVs and boats may change as a result of the current economic recession and credit crisis, because consumers may choose, even after the economy recovers, to reduce their spending and use of consumer credit, which could result in a decline in their purchases and usage of RVs and boats and, therefore, in their need for and purchases of the products we sell. Also, owners of RVs and boats may increasingly choose to purchase RV and boating parts, supplies and accessories from lower cost sellers, such as mass merchandisers and web-based retailers, instead of from independent dealers, supply stores and service centers that comprise our Aftermarket customers that purchase products from us, which could adversely affect our market share, pricing, and sales revenues and, as a result, our future financial performance.

From time to time we may have to restructure our business to react to worsening economic conditions, a decline in the RV or boating industries (or the softening of those industries) and/or to changing technology, products and markets. If we are not able to continue to improve our business processes, our financial and/or our information technology systems, or if we are not able to restructure our business in response to the deteriorating economic conditions, we may not be able to achieve our financial objectives.

Volatility of gasoline prices could affect our sales and future financial performance.

Increases in the costs of and shortages in the supplies of gasoline can lead consumers to reduce their usage of, and may discourage some consumers from purchasing, RVs and boats which, in turn, would result in decreases in their purchases of the products we sell. In particular, during the last few years there has been increased volatility in the prices of gasoline due to concerns about the supplies available to or within the United States, due to (i) the growth in demand and competition for oil and gasoline from emerging and high growth economies, such as China and India, (ii) conflicts and political unrest in the middle east and (iii) natural and human-made disasters, such as the recent gulf oil spill. It is also difficult to predict whether uncertainties regarding and increases in gasoline prices will have short or longer term effects on the use and purchases by consumers of RVs and boats. As a result these conditions and uncertainties also may increase cyclical swings in and make it more difficult to predict our future operating results.

Our business is seasonal and our financial performance can be adversely affected by unusual weather conditions.

Our business is seasonal, because consumers generally increase their purchases and usage of RVs and boats and, therefore, increase their purchases of the products we sell, primarily in the spring and summer months, which coincide with our second and third fiscal quarters; whereas, such purchases and usage declines in the late fall and in the winter months, which coincide with the fourth and first quarters of our fiscal year. As a result, as a general rule our sales are higher and our financial performance is better in our second and third fiscal quarters than in our fourth and first fiscal quarters, during which we often incur losses.

However, the occurrence of unusually severe or extended winter weather conditions can adversely affect our operating results in our second and third fiscal quarters, and can lead to more severe swings in our sales and

7

Table of Contents

financial performance, because such conditions can have the effect of reducing the usage of RV and boats for periods extending beyond the ordinary winter months or to regions that ordinarily encounter milder winter weather conditions. Additionally, extended periods of unusually severe weather conditions sometimes also occur during the winter months, which can cause year-over-year declines in our sales in the first or fourth quarters of the year.

We rely heavily on bank borrowings in the operation of our business, which makes us more vulnerable to adverse changes in economic conditions.

We rely heavily on bank borrowings to fund our working capital requirements and capital expenditures. Our outstanding borrowings create additional risks for our business. Among other things, we may find it more difficult to obtain additional financing to fund expansion or take advantage of other business opportunities, and we use a substantial portion of our cash flow from operations to pay the principal of and interest on our debt. Our existing debt also makes us more vulnerable to general economic downturns and competitive pressures, which could cause us to fail to meet financial covenants in our bank loan agreement or lead the bank to impose restrictions on the borrowings that will be made available to us. In either of those events, it could become necessary for us to reduce the size and scope of our business, which could hurt our financial condition and operating results.

Risks of our reliance on sole sources of supply for certain of our products.

We sometimes choose to carry only a single manufacturer’s products for certain of the brand-name product lines that we sell. In addition, we obtain each of our proprietary products from a single source manufacturer, although in many instances we own the tooling required for their manufacture. Dependence on a single manufacturer for any product or line of related products, however, presents some risks, including the risk that we will be unable to readily obtain alternative product supply sources in the event that a single source supplier (i) encounters quality or other manufacturing problems, or (ii) decides to enter into an exclusive supply arrangement or alliance with one of our competitors, or to vertically integrate its operations to include not only manufacturing, but also distribution, of its products. If any of our single source suppliers were to encounter any manufacturing problems or disruptions or terminate our supply relationship, our sales and earnings could decline, possibly to a significant extent.

Our financial results can be and sometimes have been adversely affected by changes in supply relationships in our markets.

As is the customary practice in our markets, in most instances we do not have long term supply contracts with our product suppliers. As a result, product suppliers are free to change the terms on which they sell us products or to discontinue supplying us with products altogether, because they may choose to distribute their products directly to aftermarket dealers or retailers or because they might choose to establish exclusive supply relationships with other distributors. Additionally, manufacturers of new RVs and boats may choose to incorporate optional equipment on their RVs and boats at the time of manufacture that, historically, were provided to their dealers by distributors such as the Company. Any of these occurrences could result in increased competition in our markets or could reduce the number of products we are able to offer our customers, which could cause our sales to decline and could result in lower margins and in reduced earnings.

Our financial performance is subject to risks arising out of our proprietary products strategy.

In order to increase our sales and reduce our costs of sales and, thereby increase our profitability, we have introduced into the RV and boating markets a growing number of products that have been designed by or for us and which are manufactured and sold to us, generally on an exclusive basis, by a number of different manufacturers. More recently, we have begun sourcing and purchasing, from overseas suppliers, and marketing and selling a number of new products, such as portable generators, into new markets. We have only limited experience in marketing and selling such products, and there is no assurance that these products will gain acceptance among customers in those markets. We also encounter considerable competition from companies that manufacture or sell competing products in those same markets. Many of those companies are larger, more established and better known and have greater financial and marketing resources than we have. Also, we have greater responsibilities for quality control and in marketing and providing warranty protection and service for these products, as compared to the products we source from traditional suppliers for resale in the RV or boating markets. There is no assurance that we will be successful in marketing and selling these products, and the costs we incur in doing so may reduce our earnings or possibly even cause us to incur losses and we could encounter liabilities for possible warranty claims related to the proprietary products we sell.

8

Table of Contents

Our financial performance and cash flows can be adversely affected by currency fluctuations associated with our operations in Canada and our increased reliance on foreign product suppliers.

Currency Risks Associated with our Canadian Operations. Our wholly-owned Canadian subsidiary accounts for approximately 26% of our annual net sales. That subsidiary purchases a substantial portion of the products it sells from manufacturers in the United States and pays for those products in U.S. dollars, but sells those products to its customers in Canadian dollars. In the event the Canadian dollar weakens in relation to the U.S. dollar, the costs of those products to our Canadian subsidiary would increase, thereby reducing its gross margin, unless it is able to pass the higher costs on to its customers by raising its prices without adversely affecting its sales volume. If our Canadian subsidiary is unable to pass the higher costs on to its customers, our gross profits, operating income and cash flows would decline during any periods when there are declines in the value of the Canadian dollar in relation to the U.S. dollar.

Currency and other Risks Associated with our Purchases of Foreign Sourced Products. As we increase our purchases of products from foreign suppliers, we may become increasingly vulnerable to the effects of political instability and adverse economic conditions in the countries in which those suppliers are located. Additionally, purchases of products in foreign countries create currency risks for us. In those instances when we pay for foreign sourced products in U.S. dollars, a weakening U.S. dollar may lead foreign suppliers to increase the prices they charge us for their products in order to mitigate their currency exchange risks. In those countries where we buy products in the local currency, to the extent it becomes necessary for us to convert U.S. dollars into the local currency in order to pay for those products, a weakening dollar would make the local currency more expensive for us, thereby increasing the costs to us of purchasing those products. Moreover, a devaluation of local currencies may lead foreign suppliers to increase the prices they charge us for their products. Any of these events or circumstances could reduce the margin advantage that we could otherwise realize on resales of foreign sourced products in North America, unless we are able to pass along the higher costs to our customers without adversely affecting our sales volume. If we are unable to pass such higher costs on to our customers, our gross profits and operating income and our cash flows would decline.

When appropriate, we may attempt to limit our exposure to exchange rate changes by entering into currency exchange contracts. There is no assurance that we will hedge or will be able to hedge such foreign currency exchange risk or that our hedges will be successful. Our currency exchange gains or losses (net of hedges) may materially and adversely impact our cash flows and earnings.

We are subject to product liability risks and warranty claims.

Product Liability Risks. Although we do not manufacture any of the products we sell, it is not uncommon for us to be named as an additional defendant in product liability lawsuits brought against the manufacturers of the products we sell. To protect ourselves from liability, we have been able in many instances to obtain indemnification agreements from these manufacturers or to be named as additional insureds under their product liability insurance policies. Nevertheless, we also maintain our own product liability insurance. We also conduct quality control testing, at our own product testing laboratories in the United States, of many of the proprietary products that we sell. However, although we have never incurred any material product liabilities in excess of the insurance coverages that we have obtained under policies of insurance maintained either by product manufacturers or by us, there is no assurance that we will not incur, in the future, product liabilities in amounts that materially exceed the insurance coverage and indemnification protections that we have and which, as a result, could adversely affect our results of operations or financial condition. Moreover, the risks of incurring liabilities for product defects has increased as a result of our proprietary products strategy, because many of the suppliers of those products are located overseas, making us a more attractive target for product liability claims.

Warranty Claims Risks. In certain instances, we have assumed the responsibility for dealing with and resolving product warranty claims from customers. As a result, we have had to establish reserves for potential product warranty claims which has increased our costs of sales. In addition, the amount of those reserves are

9

Table of Contents

determined based not only on historical warranty claims experience, but also on estimates of the amount and costs to us of future warranty claims. If the actual number or the costs of warranty claims were to exceed our estimates, it could become necessary for us to increase those reserves, which would result in an increase in our costs of sales and which, as a result, could adversely affect our profit margins and our results of operations. See “MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – Critical Accounting Policies” below in this Annual Report.

Risks of patent infringement claims.

We design, or have independent product design firms or manufacturers, design and engineer a number of the proprietary that we introduce into the marketplace. From time to time manufacturers of competing products have threatened and on occasion have brought suits against us claiming that some of our proprietary or foreign sourced products infringe their patents. We retain a patent law firm to review all new products that we plan to introduce into the market for potential patent infringements and that firm works in concert with our product design engineers and independent design firms or manufacturers to ensure that our products do not infringe on patents or other proprietary rights held by competitors. To date we have not incurred any material liability as a result of any patent infringement claims that have been threatened or asserted against us. However, there can be no assurance that we will not incur liability for patent infringement in the future. Additionally, the filing of a patent infringement suit may require us to halt sales or to redesign newly introduced products to avoid patent infringement liability, which could reduce our sales and increase our costs and, thereby, adversely affect our results of operations.

We face substantial competition that could lead to declines in net sales or reductions in our gross profits.

We face significant competition in each of our markets which can adversely affect our sales, profit margins and operating results. In our RV and boating products markets we face competition not only from other wholesale distributors, but also from mass merchandisers, web retailers, catalog houses and national and regional retail chains that sell RV or boating parts, supplies and accessories. Moreover, due to their size and financial resources, some of those mass merchandisers and national or regional chains are able to purchase such products directly from manufacturers at prices comparable to the prices at which we are able to purchase such products from those same or competing manufacturers. The mass merchandisers, web retailers, and national and regional chains compete directly with the RV and boating dealers, supply stores and service centers that purchase products from us and, therefore, their pricing decisions and the breadth of the products they sell can affect both the volume of our sales and the prices we are able to charge our customers for the same or competing products. Additionally, price competition, particularly from such mass merchandisers and national chains, has been increasing as they seek to maintain and increase their market shares. As a result, in order to remain competitive it could become necessary for us to reduce our prices, including the prices at which we sell our proprietary and Coast branded products, in which event we could lose the price and margin advantages that we have gained from the sale of those products. If we match our competitors’ price reductions, our gross profits and gross margin could be adversely affected. Additionally, we face stiff competition in the sale of portable power generators and other products in the outdoor power equipment market from manufacturers and suppliers of competing products, some of which are larger, have greater marketing and capital resources and are better-known in that market, which could force us to reduce our prices for or prevent us from increasing our sales of those products and could cause us to incur losses as a result of our efforts to sell products in markets other than the RV and boating markets.

Risk that our deferred tax asset may not be fully realized.

We have recorded, on our balance sheet, a “deferred tax asset” which consists of tax credit and tax loss carryforwards and tax deductions (“tax benefits”) that are available to reduce income taxes that we would otherwise have to pay on the taxable income that we generate in future periods. Under applicable federal and state income tax laws and regulations, such tax benefits will expire at various dates in the future if not used to offset taxes on taxable income by such dates. Accordingly, our ability to fully use this deferred tax asset to reduce our tax liabilities in the future depends on the amount of taxable income that we are able to generate prior to such expiration dates. If we determine that it is no longer more likely, than not, that we will be able to fully utilize the deferred tax asset, we would be required to establish (or increase any existing) valuation allowance to reduce the recorded amount of the deferred tax asset on our balance sheet to the amount of the tax benefits we believe we will be able to use prior to their expiration dates. Such an allowance is established or increased by a non-cash operating charge that would

10

Table of Contents

increase the provision for income taxes or reduce any income tax benefit in the fiscal period in which that valuation allowance is established or increased. At December 31, 2010, we had a valuation allowance in the amount of nearly $1.2 million which has reduced the carrying value of our deferred tax asset to $2.7 million. There is no assurance, however, that we will be able to fully utilize this deferred tax asset as that will depend on our future operating results.

Moreover, if we are not able to generate taxable income in the future that will enable us to fully utilize this deferred tax asset, it could become necessary for us to increase the valuation allowance in future periods, which would have the effect of increasing our income tax provision or reducing any income tax benefit that we would record in our statements of operations. See “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – Critical Accounting Policies” below in this Annual Report.

Risk of unanticipated expenses upon new product introduction.

The introduction of new proprietary products is important to our future success. We may incur unexpected expenses, however, when we introduce new products. For example, we may experience unexpected engineering or design flaws that will force a recall of a new product. The costs resulting from these types of problems could be substantial, and could have a significant adverse effect on our earnings.

Loss of key management.

Our future performance is substantially dependent upon the continued services of certain members of our senior management. The loss of the services of any key members of senior management could have a material adverse effect upon us. In addition, our continued growth depends on our ability to attract and retain skilled executives. There can be no assurance that we will be able to retain our existing personnel or attract additional qualified executives in the future.

Rick of fluctuations in our share price.

The market price of our common stock may be subject to significant fluctuations in response to our operating results, our ability to meet market expectations and other factors. Variations in the market price of our common stock may also be the result of changes in the trading characteristics that prevail in the market for our common stock, including low trading volumes, trading volume fluctuations and other similar factors. These market fluctuations, as well as general economic conditions, may adversely affect the market price and the liquidity of our common stock. We cannot assure that the market price of our common stock will not fluctuate or decline significantly in the future.

Reliance on our information technology systems exposes us to potential risks.

Reliance on our information technology systems exposes us to potential risks such as interruptions due to natural disasters, such as earthquakes or fire, cyber-attacks, unplanned data center and system outages, fraud perpetrated by malicious individuals and other causes. Our information technology systems are hosted in two locations: our headquarters in Morgan Hill, California and at a co-location managed by a third-party provider.

Our ability to manage our inventory in a volatile market could adversely affect our profitability.

Our success also depends upon our ability to successfully manage our inventory and to anticipate and respond to purchasing trends and customer demands in a timely manner. The use, and therefore the purchases, by consumers of the products we sell can be volatile and uncertain because they can be affected by a number of factors, including general economic and market conditions, competition and consumer preferences, none of which are within our control. We usually must order inventory in advance of each year’s selling season. Moreover, the lead times for many of our purchases (particularly of foreign sourced products) may make it difficult for us to respond rapidly to new or changing product trends, increases or decreases in customer demand or changes in prices. If we misjudge either the market for our products or our customers’ purchasing habits, our revenues may decline significantly and we may have either insufficient quantities of products to satisfy customer demand or we may be required to write down excess inventory, either of which would result in lower earnings.

11

Table of Contents

Failure of our internal control over financial reporting could harm our business and financial results.

Our management is responsible for establishing and maintaining effective internal control over financial reporting. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting for external purposes in accordance with principles generally accepted in the United States (“GAAP”). Because of its inherent limitations, internal control over financial reporting is not intended to provide absolute assurance that we would prevent or detect a misstatement of our financial statements or fraud. Any failure to maintain an effective system of internal control over financial reporting could limit our ability to report our financial results accurately and timely or to detect and prevent fraud. The identification of a material weakness could indicate a lack of controls adequate to general accurate financial statements that, in turn, could cause a loss of investor confidence and decline in the market price of our common stock.

Other risks and uncertainties.

Additional risks and uncertainties that could affect our future financial performance or future financial condition are discussed below in Part II of this Report in the section entitled “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” and you are urged to read that section as well.

Due to these and other possible uncertainties and risks, readers are cautioned not to place undue reliance on forward-looking statements contained in this Report, which speak only as of the date of this Annual Report. We also disclaim any obligation to update forward-looking information contained in this Report, whether as a result of new information, future events or otherwise, except as may otherwise be required by applicable law or the rules of the American Stock Exchange.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None

12

Table of Contents

| ITEM 2. | PROPERTIES |

We operate 13 regional warehouse and distribution centers in 12 states in the United States and 4 regional warehouse and distribution centers, each located in a different Province, in Canada. All of these facilities are leased under triple net leases which require us to pay, in addition to rent, real property taxes, insurance and maintenance costs. The following table sets forth certain information regarding those facilities.

| Locations |

Square Footage |

Lease | ||||

| United States: |

||||||

| Wilsonville, Oregon |

57,000 | December 31, 2011 | ||||

| Visalia, California |

230,300 | December 31, 2016 | ||||

| Fort Worth, Texas |

58,700 | October 31, 2011 | ||||

| San Antonio, Texas |

27,300 | October 31, 2013 | ||||

| Denver, Colorado |

50,000 | January 31, 2016 | ||||

| Elkhart, Indiana |

109,700 | January 31, 2017 | ||||

| Lancaster, Pennsylvania |

54,900 | December 31, 2011 | ||||

| Atlanta, Georgia |

65,800 | August 31, 2014 | ||||

| Tampa, Florida |

38,000 | June 30, 2013 | ||||

| Gilbert, Arizona |

34,700 | March 31, 2012 | ||||

| Salt Lake City, Utah |

30,400 | October 31, 2013 | ||||

| Johnstown, New York |

52,500 | November 30, 2012 | ||||

| Eau Claire, Wisconsin |

17,300 | January 31, 2012 | ||||

| Canada: |

||||||

| St. Bruno, Quebec |

59,600 | January 31, 2021 | ||||

| Orillia, Ontario |

36,500 | November 30, 2011 | ||||

| Calgary, Alberta |

41,200 | January 31, 2016 | ||||

| Langley, British Columbia |

22,800 | December 31, 2016 | ||||

As indicated in the above table, certain of the warehouse and distribution center leases are scheduled to expire within the next seven to twelve months. While we currently expect to renew most of these leases, we could decide, instead, either to relocate or close one or more of these distribution centers.

We also lease 18,100 square feet of space in Elkhart, Indiana where we maintain a product testing facility.

Our executive offices are located in Morgan Hill, California, a suburb of San Jose, where we lease 13,700 square feet of office space. Our address at that location is 350 Woodview Avenue, Morgan Hill, California 95037, where our telephone number is (408) 782-6686.

| ITEM 3. | LEGAL PROCEEDINGS |

From time to time we are named as a defendant, sometimes along with product manufacturers and others, in product liability and personal injury litigation. We believe that this type of litigation is incidental to our operations, and we have our own product liability insurance policies, and in many instances also indemnities from the manufacturers from which we obtain our products, to protect us from liabilities that could arise from such claims. On two occasions, we were named as a defendant in patent infringement litigation brought against manufacturers of certain of our proprietary products. To date we have not incurred any material liabilities in any product liability, personal injury or patent litigation and there is no legal action presently pending against us that we believe is likely to have a material adverse effect on our financial condition or results of operations. However, there is no assurance that we will not incur product liabilities in the future that exceed our product liability coverage. See “RISK FACTORS — We are subject to product liability risks and warranty claims” above.

13

Table of Contents

EXECUTIVE OFFICERS OF REGISTRANT

| Name |

Age | Positions with Company | ||||

| James Musbach |

60 | President, Chief Executive Officer and a Director | ||||

| Thomas R. McGuire |

67 | Executive Chairman and Chairman of the Board of Directors | ||||

| Sandra A. Knell |

53 | Executive Vice President, Chief Financial Officer and Secretary | ||||

| David A. Berger |

56 | Executive Vice President — Operations | ||||

| Dennis A. Castagnola |

63 | Executive Vice President — Proprietary Products |

Set forth below is certain information regarding the Company’s executive officers.

JAMES MUSBACH. Mr. Musbach, who had served as President of Coast from 1994 to 1995, rejoined the Company in September 2006 as its President and Chief Operating Officer. Mr. Musbach was promoted to the position of Chief Executive Officer of the Company effective April 2008. Between 1995 and his return to Coast, Mr. Musbach held various management positions with Raytek Corporation, a manufacturer of infrared non-contact temperature measurement tools, sensors and systems, most recently serving as an Executive Vice President of Raytek and the General Manager of Raytek’s Portable Products Division.

THOMAS R. MCGUIRE. Mr. McGuire is a founder of the Company and has been its Chairman of the Board since the Company’s inception in 1977. Mr. McGuire also served as the Company’s Chief Executive Officer from 1997 until April 2008, when he relinquished that position upon Mr. Musbach’s promotion to Chief Executive Officer. Mr. McGuire retains the position of Executive Chairman of the Company and continues as Chairman of the Board of Directors.

SANDRA A. KNELL. Mrs. Knell has been the Company’s Executive Vice President, Chief Financial Officer and Secretary since August 1985. From 1984 until she joined the Company, Mrs. Knell was an Audit Manager, and for the prior four years was a senior and staff accountant, with Grant Thornton LLP. Mrs. Knell is a Certified Public Accountant.

DAVID A. BERGER. Mr. Berger has served as an Executive Vice President of the Company since May 1988. From August 1986 to May 1988, Mr. Berger was Senior Vice President — Purchasing of the Company. For the prior 14 years he held various management positions with C/P Products Corp., a distributor of recreational vehicle parts and accessories that we acquired in 1985.

DENNIS A. CASTAGNOLA. Mr. Castagnola was appointed to his current position of Executive Vice President — Proprietary Products in August 2007. From November 2000 to August 2007, he served as Executive Vice President — Sales and, for the prior 25 years, he held various management positions with the Company, including Vice President/Division Manager of the Company’s Portland, Oregon distribution center.

14

Table of Contents

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCK HOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our shares of common stock are listed and trade on the American Stock Exchange under the trading symbol “CRV.”

The following table sets forth, for the calendar quarters indicated, the range of the high and low per share sales prices of our common stock as reported by the American Stock Exchange.

| Sales Prices Per Share | ||||||||

| High | Low | |||||||

| 2010 |

||||||||

| First Quarter |

$ | 4.48 | $ | 3.75 | ||||

| Second Quarter |

4.55 | 4.00 | ||||||

| Third Quarter |

4.25 | 3.60 | ||||||

| Fourth Quarter |

4.07 | 3.33 | ||||||

| 2009 |

||||||||

| First Quarter |

$ | 1.63 | $ | 0.67 | ||||

| Second Quarter |

3.27 | 0.87 | ||||||

| Third Quarter |

3.80 | 1.75 | ||||||

| Fourth Quarter |

4.57 | 2.89 | ||||||

On March 18, 2011 the closing per share price of our common stock on the American Stock Exchange was $4.25 and there were approximately 700 holders of record of the Company’s shares.

Dividend Policy

In 2005, our Board of Directors adopted a cash dividend policy that provided for the payment of quarterly cash dividends. In November 2008, the Board decided to suspend the payment of cash dividends in order to preserve cash for the Company’s operations in response to the economic recession and the credit crisis. In addition, our bank line of credit agreement contains restrictions on the payment by us of cash dividends. As a result, we do not expect to pay cash dividends at least for the foreseeable future.

No cash dividends were paid in 2010 or 2009. Cash dividends paid to our stockholders in 2008 totaled $578,000.

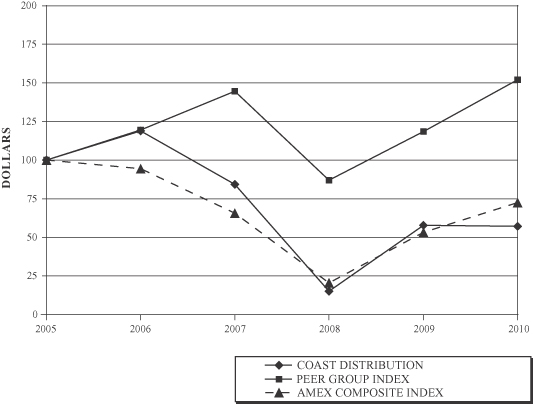

Stock Price Performance Graph

The graph that follows presents a five-year comparison of cumulative total returns for (i) Coast, (ii) an index comprised of companies within the recreational products markets that were selected by us (the “Peer Group”), and (iii) the NYSE American Stock Exchange composite index (the “AMEX Composite”). The Peer Group consists of Brunswick Corporation, Thor Industries, and Winnebago Industries, Inc., which, during the past five years, were manufacturers of recreational vehicles or boats, TriMas Corporation, which manufactures RV and trailer products, and West Marine Inc. which sells boating parts, supplies and accessories both at wholesale and at retail. The data for the graph was obtained from Research Data Group, Inc.

15

Table of Contents

The following stock performance graph assumes that $100 was invested, at the end of fiscal 2005, in Coast’s shares and in the shares of the companies comprising the Peer Group Index and the Amex Composite Index and that any dividends issued for the indicated periods were reinvested. Stockholder returns shown in the performance graph are not necessarily indicative of future stock performance.

| At December 31, | ||||||||||||||||||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||

| Coast Distribution |

100.00 | 118.96 | 84.31 | 15.23 | 57.82 | 57.23 | ||||||||||||||||||

| Peer Group Index |

100.00 | 119.54 | 144.62 | 87.02 | 118.50 | 152.13 | ||||||||||||||||||

| Amex Composite Index |

100.00 | 94.49 | 65.64 | 20.57 | 53.36 | 72.54 | ||||||||||||||||||

Equity Compensation Plans

Certain information, as of December 31, 2010, with respect to our equity compensation plans is set forth in Item 12, in Part III, of this Report and is incorporated herein by this reference.

16

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The selected operating data set forth below for the fiscal years ended December 31, 2010, 2009 and 2008, and the selected balance sheet data at December 31, 2010 and 2009, are derived from the Company’s audited consolidated financial statements included elsewhere in this Report and should be read in conjunction with those financial statements and “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” set forth in Item 7 of this Report. The selected operating data for the fiscal years ended December 31, 2007 and 2006, and the selected balance sheet data at December 31, 2008, 2007 and 2006, are derived from the Company’s audited consolidated financial statements which are not included in this Report.

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||

| Operating Data: |

||||||||||||||||||||

| Net Sales |

$ | 108,600 | $ | 103,201 | $ | 132,237 | $ | 164,293 | $ | 179,103 | ||||||||||

| Cost of sales (including distribution costs)(1) |

88,985 | 83,754 | 107,625 | 133,578 | 145,501 | |||||||||||||||

| Gross margin |

19,615 | 19,447 | 24,612 | 30,715 | 33,602 | |||||||||||||||

| Selling, general and administrative expenses |

18,330 | 18,552 | 26,559 | 28,065 | 27,160 | |||||||||||||||

| Operating income (loss) |

1,285 | 895 | (1,947 | ) | 2,650 | 6,442 | ||||||||||||||

| Equity in net earnings of affiliated companies |

57 | 201 | 147 | 179 | 147 | |||||||||||||||

| Other income (expense) |

||||||||||||||||||||

| Interest expense |

(579 | ) | (624 | ) | (1,409 | ) | (2,098 | ) | (1,617 | ) | ||||||||||

| Other |

(194 | ) | (268 | ) | (8 | ) | (156 | ) | (141 | ) | ||||||||||

| (773 | ) | (892 | ) | (1,417 | ) | (2,254 | ) | (1,758 | ) | |||||||||||

| Earnings (loss) before income taxes |

569 | 204 | (3,217 | ) | 575 | 4,831 | ||||||||||||||

| Income tax provision (benefit) |

417 | 105 | (1,378 | ) | 360 | 1,858 | ||||||||||||||

| Net earnings (loss) |

$ | 152 | $ | 99 | $ | (1,839 | ) | $ | 215 | $ | 2,973 | |||||||||

| Net earnings (loss) per diluted share(2) |

$ | 0.03 | $ | 0.02 | $ | (0.41 | ) | $ | 0.05 | $ | 0.64 | |||||||||

| Shares used in computation of net earnings (loss) per share |

4,574 | 4,494 | 4,446 | 4,526 | 4,616 | |||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (In thousands, except per share data) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Working Capital |

$ | 36,757 | $ | 34,524 | $ | 40,394 | $ | 52,575 | $ | 52,704 | ||||||||||

| Total assets |

47,782 | 45,472 | 52,459 | 69,307 | 69,494 | |||||||||||||||

| Long-term obligations(3) |

10,113 | 9,637 | 17,078 | 24,665 | 24,350 | |||||||||||||||

| Stockholders’ equity |

31,038 | 29,632 | 28,220 | 32,491 | 31,847 | |||||||||||||||

| Book value per share(4) |

$ | 6.79 | $ | 6.59 | $ | 6.35 | $ | 7.18 | $ | 6.90 | ||||||||||

| Dividends per share |

$ | 0.00 | $ | 0.00 | $ | 0.13 | $ | 0.28 | $ | 0.24 | ||||||||||

| (1) | Distribution costs consist primarily of warehouse rent, labor and supply costs and product shipping costs. |

| (2) | See Note I to the Company’s Consolidated Financial Statements. |

| (3) | Exclusive of current portion. For additional information regarding long-term obligations, see Note D to the Company’s Consolidated Financial Statements. |

| (4) | Based on the weighted average number of shares used in the computation of net earnings (loss) per share. See Note I to the Company’s Consolidated Financial Statements. |

17

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

We believe that Coast is one of the largest wholesale suppliers of replacement parts, supplies and accessories for recreational vehicles (“RVs”) and boats in North America. We supply more than 11,000 products and serve more than 15,000 customers throughout the United States and Canada, from 13 regional distribution centers in the United States and 4 regional distribution centers in Canada. Our sales are made to retail parts and supplies stores, service and repair establishments and new and used RV and boat dealers (collectively, “Aftermarket Customers”).

Factors Generally Affecting Sales of RV and Boating Products

Our sales are affected primarily by:

| • | The usage of RVs and boats by the consumers to whom our Aftermarket Customers sell our products, because such usage affects the consumers’ needs for and their purchases of replacement parts, repair services and supplies; and |

| • | Purchases of new and used RVs and boats by consumer, because they often “accessorize” their RVs and boats at or shortly after the time of purchase. |

The usage and the purchase, by consumers, of RVs and boats depend, in large measure, upon the extent of discretionary income available to consumers, their confidence about economic conditions and the availability and the costs to them of credit. As a result, recessionary conditions and a tightening in the availability or increases in the costs of borrowings to consumers often lead to declines in the purchase and, to a lesser extent, in the usage, of RVs and boats. Additionally, increases in the prices and shortages in the supply of gasoline can lead to declines in the usage and purchases of RVs and boats. Finally, the usage by consumers of RVs and boats and, therefore their need for and purchases of the products we sell are affected by weather conditions.

We experienced significant decreases both in our sales and gross profits in 2009 as a result of the economic recession and credit crisis which adversely affected consumer confidence and led to reductions in discretionary income and spending, and reduced the availability of credit which many consumers rely on to finance the purchase and the costs of using RVs and boats. In 2010, we experienced a modest increases in sales and gross profits, as compared to 2009, which we believe were due primarily to a stabilizing of the economy, an improving (albeit cautionary) economic outlook, some easing of consumer credit. However, we continue to see fluctuations, rather than sustained growth, in consumer demand and, due primarily to continued uncertainties about the strength of the economic recovery, and recent increases in the prices of gasoline which can adversely affect the willingness of consumers to use and purchase RVs and boats, we expect conditions in the RV and boating markets to remain unstable and difficult, until there is a more sustained economic recovery, employment levels begin steadily increasing and the availability and cost of consumer credit improve.

18

Table of Contents

Overview of Fiscal 2010 Operating Results

The following table provides information comparing our results of operations in the fiscal year ended December 31, 2010 to our results of operation in fiscal 2009 and fiscal 2008. Dollars are in thousands, except per share data.

| Years Ended December 31, | ||||||||||||||||||||||||||||

| 2010 | 2009 | 2008 | Increase (Decrease) 2010 vs. 2009 |

Increase (Decrease) 2009 vs. 2008 |

||||||||||||||||||||||||

| Amount | Amount | Amount | Amount | Percent | Amount | Percent | ||||||||||||||||||||||

| Net Sales |

$ | 108,600 | $ | 103,201 | $ | 132,237 | $ | 5,399 | 5.2 | % | $ | (29,036 | ) | (22.0 | )% | |||||||||||||

| Costs of products sold(1) |

88,985 | 83,754 | 107,625 | 5,231 | 6.2 | % | (23,871 | ) | (22.2 | )% | ||||||||||||||||||

| Gross profits |

19,615 | 19,447 | 24,612 | 168 | 0.9 | % | (5,165 | ) | (21.0 | )% | ||||||||||||||||||

| SG&A expenses |

18,330 | 18,552 | 26,559 | (222 | ) | (1.2 | )% | (8,007 | ) | (30.1 | )% | |||||||||||||||||

| Operating income (loss) |

1,285 | 895 | (1,947 | ) | 390 | 43.6 | % | 2,842 | 146.0 | % | ||||||||||||||||||

| Interest expense |

579 | 624 | 1,409 | (45 | ) | (7.2 | )% | (785 | ) | (55.7 | )% | |||||||||||||||||

| Earnings (loss) before income taxes |

569 | 204 | (3,217 | ) | 365 | 178.9 | % | 3,421 | 106.3 | % | ||||||||||||||||||

| Income tax provision (benefit) |

417 | 105 | (1,378 | ) | 312 | 297.1 | % | 1,483 | 107.6 | % | ||||||||||||||||||

| Net earnings (loss) |

152 | 99 | (1,839 | ) | 53 | 53.5 | % | 1,938 | 105.4 | % | ||||||||||||||||||

| Net earnings (loss) per share-diluted |

0.03 | 0.02 | (0.41 | ) | 0.01 | 50.0 | % | 0.43 | 104.9 | % | ||||||||||||||||||

| (1) | Inclusive of distribution costs. |

The economic recession and credit crisis, which began in the latter part of 2007 and worsened in 2008 and 2009, continued to adversely affect consumer confidence and discretionary spending in 2010. Nevertheless, as the above table indicates and as discussed below, we were able to increase our sales and reduce our selling, general and administrative (“SG&A”) expenses and interest expense, which enabled us to increase both our pre-tax earnings and net earnings in the year ended December 31, 2010, as compared to 2009.

| • | Increase in Sales. We were able to achieve a $5.4 million, or 5.2%, increase in our sales in 2010 to $108.6 million in 2010, from $103.2 million in 2009, primarily as a result of (i) a firming in the demand for the products we sell in the first half of 2010, as our After-Market Customers replenished their inventories in anticipation of the customary increases in usage and purchases of RVs and boats in the spring and summer months, and (ii) an increase in sales of air conditioners during the last half of 2010 as a result of a gain in the share of the RV air conditioner after-market that was primarily attributable to the withdrawal from the market of a manufacturer that had supplied air conditioners to some of the RV parts and accessories distributors with which we compete. |

| • | Reduction in SG&A Expenses. Due to cost saving measures which we began implementing in late 2008 in response to the onset of the economic recessions and credit crisis and which we continued in 2009 and 2010, we reduced our SG&A expenses by $222,000 in 2010 as compared to 2009. That reduction, coupled with the increase in net sales, enabled us to increase operating income by approximately $400,000 in 2010 as compared to 2009. |