UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| þ | Preliminary Proxy Statement | ||||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ¨ | Definitive Proxy Statement | ||||

| ¨ | Definitive Additional Materials | ||||

| ¨ | Soliciting Material under § 240.14a-12 | ||||

Accelerate Diagnostics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the boxes that apply):

| þ | No fee required. | ||||

| ¨ | Fee paid previously with preliminary materials. | ||||

[PRELIMINARY COPY - SUBJECT TO COMPLETION]

ACCELERATE DIAGNOSTICS, INC.

3950 South Country Club Road, Suite 470

Tucson, Arizona 85714

(520) 365-3100

Notice of 2022 Annual Meeting of Shareholders

Dear Accelerate Diagnostics Shareholders:

You are invited to attend Accelerate Diagnostics, Inc. 2022 Annual Meeting of Stockholders (the “Annual Meeting”).

Date: May 12, 2022 (Thursday)

Time: 10:30 a.m., Mountain Standard Time

Virtual

Location: You can attend the Annual Meeting online, including to vote and/or submit questions, at www.virtualshareholdermeeting.com/AXDX2022. See page 1 of the accompanying proxy statement for additional information regarding participation in the virtual meeting.

Items of At the Annual Meeting, shareholders will be asked to vote:

Business:

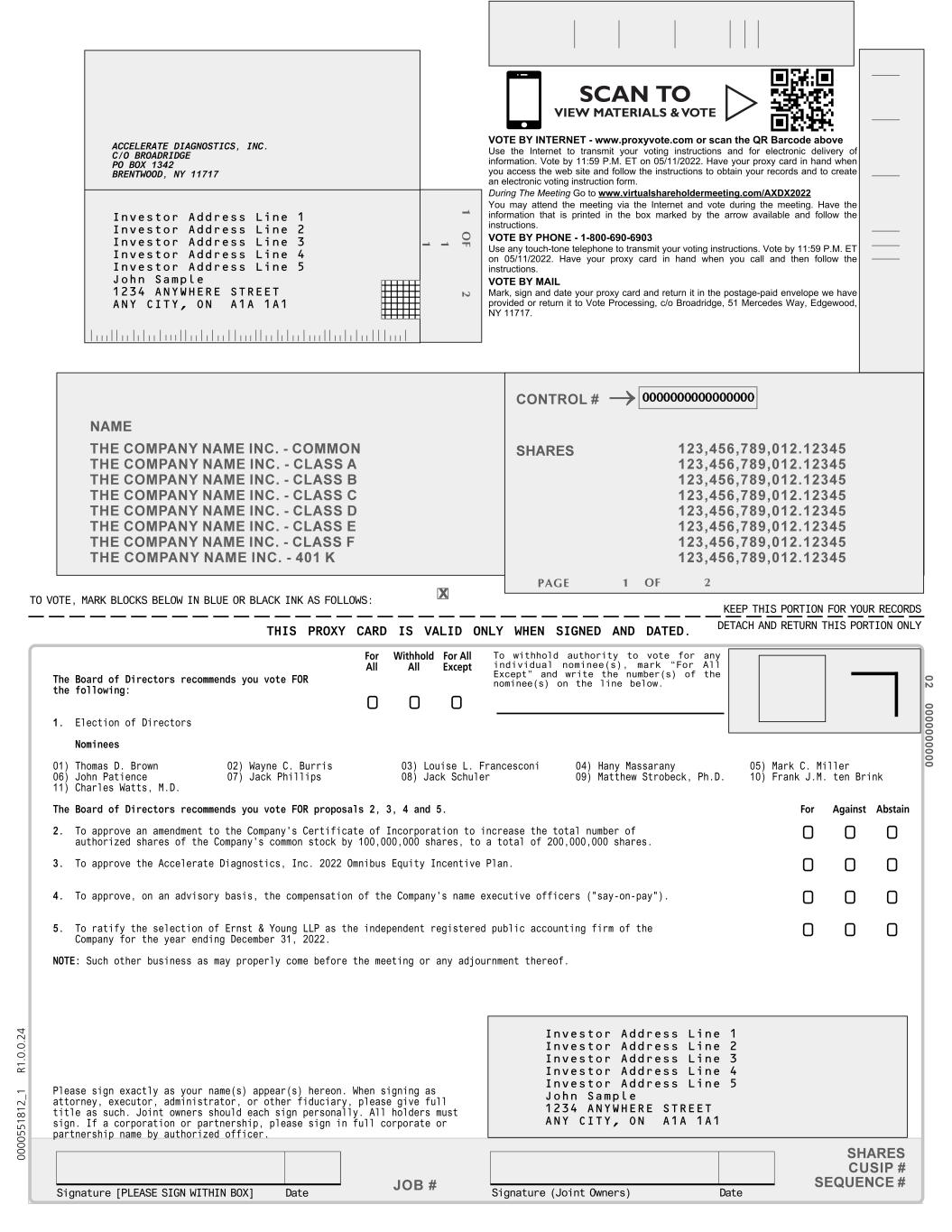

1.to elect the following 11 persons to serve as directors of the Company until the 2023 Annual Meeting of Shareholders and thereafter until their successors have been elected and qualified: John Patience, Jack Phillips, Mark C. Miller, Jack Schuler, Matthew W. Strobeck, Ph.D., Frank J.M. ten Brink, Charles Watts, M.D., Thomas D. Brown, Louise L. Francesconi, Hany Massarany, and Wayne Burris;

2.to approve an amendment to the Company’s Certificate of Incorporation to increase the total number of authorized shares of the Company’s common stock by 100,000,000 shares, to a total of 200,000,000 shares;

3.to approve the Accelerate Diagnostics, Inc. 2022 Omnibus Equity Incentive Plan;

4.to approve, on an advisory basis, the compensation of the Company’s named executive officers (“say-on-pay”);

5.to ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2022; and

6.to transact such other business as may properly come before the meeting or any continuation, postponement or adjournment thereof.

Record

Date: You are entitled to notice of the Annual Meeting, and can participate and vote at the Annual Meeting if you were a shareholder of record as of the close of business on March 16, 2022.

Voting: Your vote is very important to us. Whether or not you plan to attend the virtual Annual Meeting, please ensure your shares are represented by voting promptly. For instructions on how to vote your shares, please refer to the instructions included with this proxy statement or on your proxy card or voting instruction form.

| By order of the Board of Directors, | |||||

| /s/ Jack Phillips | |||||

| Jack Phillips | |||||

| President and Chief Executive Officer | |||||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON THURSDAY, MAY 12, 2022: The proxy statement for the Annual Meeting and the combined Annual Report to Shareholders and Annual Report on Form 10-K for the year ended December 31, 2021, are available at www.proxyvote.com. | ||||||||||||||

TABLE OF CONTENTS

[PRELIMINARY COPY - SUBJECT TO COMPLETION]

ACCELERATE DIAGNOSTICS, INC.

3950 South Country Club Road, Suite 470

Tucson, Arizona 85714

(520) 365-3100

PROXY STATEMENT

Dated April [], 2022

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 12, 2022

GENERAL

This proxy statement (“Proxy Statement”) is being furnished to the shareholders (the “Shareholders”) of Accelerate Diagnostics, Inc., a Delaware corporation (the “Company”), in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) from the Shareholders for use at the 2022 Annual Meeting of Shareholders to be held at 10:30 a.m., Mountain Standard Time, on Thursday, May 12, 2022, and any continuations, postponements or adjournments thereof (the “Annual Meeting”). Because of the unprecedented COVID-19 pandemic, the Annual Meeting will be held virtually. To participate in the virtual meeting, click on wwW.virtualshareholdermeeting.com/AXDX2022. This Proxy Statement and the accompanying Notice and proxy card are first being mailed to Shareholders on or about April [], 2022.

INFORMATION ABOUT THE ANNUAL MEETING

When and where is the Annual Meeting?

The Annual Meeting will be held at 10:30 a.m., Mountain Standard Time, on Thursday, May 12, 2022. Because of the ongoing COVID-19 pandemic, the Annual Meeting will be held virtually. To participate in the virtual meeting, click on www.virtualshareholdermeeting.com/AXDX2022.

Why did I receive these materials?

Our Board has provided these proxy materials to you, in connection with our Board’s solicitation of proxies for use at the Annual Meeting. As a Shareholder, you are invited to attend the Annual Meeting virtually and vote per the virtual meeting instructions or you may vote by proxy on the proposals described in this Proxy Statement.

What is included in the proxy materials?

The proxy materials include:

•this Proxy Statement;

•the proxy card or voting instruction form; and

•our Annual Report on Form 10-K for the year ended December 31, 2021 (the "Annual Report").

What is being considered at the Annual Meeting?

At the Annual Meeting, our Shareholders will be acting on the following proposals:

1.to elect the following 11 persons to serve as directors of the Company until the 2022 Annual Meeting of Shareholders and thereafter until their successors have been elected and qualified: John Patience, Jack Phillips, Mark C. Miller, Jack Schuler, Matthew W. Strobeck, Ph.D., Frank J.M. ten Brink, Charles Watts, M.D., Thomas D. Brown, Louise L. Francesconi, Hany Massarany, and Wayne Burris;

1

2.to approve an amendment to the Company’s Certificate of Incorporation to increase the total number of authorized shares of the Company's common stock, par value $0.001 per share (“Common Stock”) by 100,000,000 shares, to a total of 200,000,000 shares;

3.to approve the Accelerate Diagnostics, Inc. 2022 Omnibus Equity Incentive Plan (the “2022 Incentive Plan”);

4.to approve, on an advisory basis, the compensation of the Company’s named executive officers (“say-on-pay”);

5.to ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2022; and

6.to transact such other business as may properly come before the meeting or any continuation, postponement or adjournment thereof.

In addition, our management will report on our progress and respond to your questions.

Who is entitled to vote at the Annual Meeting?

You may vote at the Annual Meeting if you owned shares of Common Stock as of the close of business on the record date, which was March 16, 2022 (the "Record Date"). You are entitled to one vote for each share of Common Stock that you held as of the record date.

How many shares are eligible to be voted at the Annual Meeting?

There were 69,661,265 shares of Common Stock issued and outstanding as of the Record Date, each of which entitles the holder thereof to one vote at the Annual Meeting.

How do I vote?

You can vote in the following ways:

•by attending the virtual Annual Meeting and voting per the virtual meeting instructions;

•over the Internet or by telephone using the instructions on the enclosed proxy card;

•by completing, signing, dating and returning the enclosed proxy card (applicable only to Shareholders of record); or

•by following the instructions on the voting instruction form (applicable only to beneficial holders of shares of Common Stock held in “street name”).

What if I return my proxy card but do not include voting instructions?

Proxies that are signed and returned but do not include voting instructions will be voted in accordance with the Board’s recommendations, which are as follows:

•FOR the election of the 11 director nominees (Proposal 1);

•FOR the approval of the proposed amendment to the Company’s Certificate of Incorporation to increase the total number of authorized shares of Common Stock (Proposal 2);

•FOR the approval of the 2022 Incentive Plan (Proposal 3);

•FOR the say-on-pay resolution approving, on an advisory basis, the compensation of our named executive officers (Proposal 4); and

•FOR the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022 (Proposal 5).

2

How do I vote if I hold shares registered in “street name”?

If, on the Record Date, your shares were not held in your name, but rather were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the proxy materials were forwarded to you by that organization. The organization holding your account is considered to be the Shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares held in your account. You will receive a voting instruction form from your broker or other agent asking you how your shares should be voted. Please complete the form and return it as provided in the instructions.

You are also invited to attend the virtual Annual Meeting. However, since you are not the Shareholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent. If you want to attend the virtual Annual Meeting, you must provide proof of beneficial ownership as of the Record Date, such as your voting instruction card with your control number provided by your broker or other agent, or other similar evidence of ownership. Whether or not you plan to attend the virtual Annual Meeting, we urge you to provide voting instructions to your broker or other agent in advance of the Annual Meeting to ensure your vote is counted. Your broker or other agent will furnish you with additional information regarding the submission of such voting instructions.

Will my shares be voted if I do not provide my proxy?

If you hold your shares directly in your own name, they will not be voted if you do not provide a proxy or attend the Annual Meeting and vote in accordance with the virtual meeting instructions.

If, however, you hold your shares in street name, your shares may be voted under certain circumstances. Brokers and other agents generally have the authority to vote customers’ un-voted shares on certain “routine” matters. The ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022 (Proposal 5) is the only proposal at the Annual Meeting that we believe is routine. Accordingly, brokers and other agents that do not receive voting instructions from beneficial owners may vote on this proposal in their discretion. A “broker non-vote” occurs when the broker or other agent is unable to vote on a proposal because the proposal is non-routine and the beneficial owner does not provide instructions.

Can I change my mind after I return my proxy?

Yes. You may change your vote or revoke your proxy at any time before your proxy is voted at the Annual Meeting. If you are a Shareholder of record, you can do this by giving written notice to the corporate secretary, by submitting another proxy with a later date, or by attending the Annual Meeting and voting in accordance with the virtual meeting instructions. If you hold your shares in street name, you should consult with your broker or other agent regarding the procedures for changing your voting instructions.

How many votes must be present to hold the Annual Meeting?

Your shares are counted as present at the Annual Meeting if you attend the meeting and vote in accordance with the virtual meeting instructions or if you properly return a proxy by mail or the other methods described in these materials. In order for us to conduct business at the Annual Meeting, one third (1/3) of the shares of Common Stock entitled to vote as of the Record Date must be present in person or by proxy at the Annual Meeting. This is referred to as a quorum. In order to ensure that there is a quorum, it may be necessary for certain directors, officers, regular employees and other representatives of the Company to solicit proxies by telephone, facsimile or in person. These persons will receive no extra compensation for their services.

If a quorum is not present, then either the Chairman of the Annual Meeting or the Shareholders may adjourn the meeting until a later time. Abstentions and broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum.

3

What vote is required to approve each item of business to be considered at the Annual Meeting?

The following table describes the voting requirement for each proposal (assuming a quorum is present):

| Proposal 1: Election of Directors | Election of a director requires the affirmative vote of the holders of a plurality of the shares for which votes are cast. The 11 persons receiving the greatest number of votes will be elected as directors. Since only affirmative votes count for this purpose, a properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Broker non-votes will not be treated as votes cast, and therefore will have no effect on the outcome of the proposal. Shareholders may not cumulate votes in the election of directors. | ||||

| Proposal 2: Amendment of Certificate of Incorporation | Pursuant to applicable Delaware law, approval of the amendment of our Certificate of Incorporation requires the affirmative vote of the holders of a majority of the outstanding shares of Common Stock. Abstentions and broker non-votes will have the same effect as a vote cast against the proposal. | ||||

| Proposal 3: Approval of the 2022 Incentive Plan | The proposal will be approved if a majority of the votes cast are voted in favor of the proposal. Abstentions and broker non-votes will not be treated as votes cast for or against the proposal, and therefore will have no effect on the outcome of the proposal. | ||||

| Proposal 4: Say-on-pay resolution approving, on an advisory basis, the compensation of our named executive officers | The proposal will be approved if a majority of the votes cast are voted in favor of the proposal. Abstentions and broker non-votes will not be treated as votes cast for or against the proposal, and therefore will have no effect on the outcome of the proposal. | ||||

| Proposal 5: Ratification of Independent Registered Public Accounting Firm | The proposal will be approved if a majority of the votes cast are voted in favor of the proposal. Abstentions and broker non-votes will not be treated as votes cast for or against the proposal, and therefore will have no effect on the outcome of the proposal. | ||||

How will voting on any other business be conducted?

Although we do not know of any business to be conducted at the Annual Meeting other than the proposals described in this Proxy Statement, if any other business comes before the Annual Meeting, your signed proxy card gives authority to the proxy holder(s) to vote on those matters at their discretion.

Can I dissent or exercise rights of appraisal?

Under Delaware law, shareholders are not entitled to dissenters’ rights in connection with any of the proposals to be presented at the Annual Meeting or to demand appraisal of their shares as a result of the approval of any of the proposals.

Who will bear the costs of this solicitation?

We will bear the entire cost of solicitation of proxies, including the preparation, assembly, printing and mailing of the proxy materials. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to the beneficial owners. We may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to the beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile or personal solicitation by our directors, officers or other regular employees. These persons will receive no extra compensation for their services.

4

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors, Director Nominees and Executive Officers

The following table sets forth certain information with respect to the current directors, director nominees and executive officers of our Company:

Name | Age as of Annual Meeting | Position | ||||||

Thomas D. Brown | 74 | Director | ||||||

| Wayne C. Burris | 67 | Director | ||||||

Louise L. Francesconi | 69 | Director | ||||||

| Hany Massarany | 60 | Director | ||||||

Mark C. Miller | 66 | Director | ||||||

John Patience | 74 | Chairman of the Board of Directors | ||||||

Jack Phillips | 56 | President, Chief Executive Officer and Director | ||||||

Jack Schuler | 81 | Director | ||||||

Matthew W. Strobeck, Ph.D. | 49 | Director | ||||||

Frank J.M. ten Brink | 65 | Director | ||||||

Charles Watts, M.D. | 79 | Director | ||||||

Steve Reichling | 43 | Chief Financial Officer | ||||||

Ron Price | 58 | Chief Commercial Officer, Americas | ||||||

Thomas D. Brown has served as a Director of the Company since March 14, 2017. Mr. Brown has more than 30 years’ experience in the clinical diagnostics industry. Beginning his career with the Abbott Laboratories Diagnostics Division (ADD) in 1974, Mr. Brown held numerous sales, marketing and general management positions of increasing responsibility. He served in various positions there including Divisional Vice President of Sales within the United States and Divisional Vice President and General Manager of the Western Hemisphere, and by 1993 he was Corporate Vice President of Worldwide Diagnostic Commercial Operations. He was named Senior Vice President before becoming President of the Diagnostic Division, the role he served until his retirement in 2002. Mr. Brown has previously served on the boards of Cepheid, Inc., Ventana Medical Systems, Inc., Quidel Corporation (NASDAQ: QDEL), and Stericycle, Inc. (NASDAQ: SRCL). He received a Bachelor of Arts degree from the State University of New York at Buffalo.

We believe that Mr. Brown is qualified to serve on our board of directors because of his experience in leadership and management roles, and experience as a board member, in the healthcare industry.

Wayne C. Burris has served as a Director of the Company since February 2, 2022. Mr. Burris served as the Senior Vice President and Chief Financial Officer (CFO) at Roche Diagnostics Corporation from 1996 through his retirement in July 2019. He was a member of the Global Roche Diagnostics Finance Executive Committee where he was recognized as one of their top senior leaders. Before joining Roche Diagnostics, Mr. Burris was a senior manager for Price Waterhouse LLP. Mr. Burris currently serves as a director of Orthofix Medical Inc. (NASDAQ: OFIX). Mr. Burris is a Certified Public Accountant and has a Bachelor of Science in Accounting and Finance from Butler University.

We believe that Mr. Burris is qualified to serve on our board of directors because of his experience in leadership and management roles in the healthcare industry as well as his experience holding finance-related roles of increasing responsibility.

Louise L. Francesconi has served as a Director of the Company since December 2, 2019. Before retiring, Ms. Francesconi served as President of Raytheon Missile Systems, a defense electronics corporation, from 1997 to 2008. During her tenure at Raytheon, Ms. Francesconi was named three times by Fortune Magazine to its 50 Most Powerful Women in Business list. Ms. Francesconi currently serves as a director of US Energy Corporation (NASDAQ: USEG) and as Chairman of the Board of Trustees for Tucson Medical Center, a regional hospital. Ms.

5

Francesconi has previously served as a director of Stryker Corporation, a medical technology company. Ms. Francesconi received a B.S. degree in Economics from Scripps College and an M.B.A. from the University of California, Los Angeles.

We believe that Ms. Francesconi is qualified to serve on our board of directors because of her experience in leadership and management roles, and experience as a board member in a variety of industries, including as a director in the healthcare industry.

Hany Massarany has served as a Director of the Company since May 20, 2020. Mr. Massarany was President and Chief Executive Officer of GenMark Diagnostics, Inc. (NASDAQ: GNMK), a provider of multiplex molecular diagnostic solutions, from April 2011 to March 2020. From February 2009 to April 2011, Mr. Massarany served as President at Ventana and Head of Roche Tissue Diagnostics, a division of F. Hoffman-La Roche Ltd. focused on manufacturing instruments and reagents that automate tissue processing and slide staining diagnostics for cancer. From 1999 to 2009, Mr. Massarany held various global leadership positions with Ventana, including Chief Operating Officer, Executive Vice President, Worldwide Operations, Senior Vice President, Corporate Strategy and Development, and Vice President, North American Commercial Operations. Mr. Massarany also held executive management positions with Bayer Diagnostics and Chiron Diagnostics, working in both the Asia Pacific region and the United States. Mr. Massarany served on the board of directors of GenMark Diagnostics, Inc. from May 2011 to February 2020. Mr. Massarany currently serves as a director of Biodesix, Inc. (NASDAQ: BDSX), a medical diagnostics company. Mr. Massarany earned a B.S. in Microbiology and Immunology from Monash University in Australia and an M.B.A. from Melbourne University.

We believe that Mr. Massarany is qualified to serve on our board of directors because of his experience in leadership and management roles, and experience as a board member, in the healthcare industry.

Mark C. Miller has served as a Director of the Company since November 5, 2013. Before retiring, Mr. Miller served as Chief Executive Officer of Stericycle (NASDAQ: SRCL) from 1992 to 2012. Prior to joining Stericycle, Mr. Miller served as Vice President for the Pacific, Asia and Africa in the international division of Abbott Laboratories, a diversified health care company, which he joined in 1976 and where he held a number of management and marketing positions. Mr. Miller formerly served as a director of Stericycle and Ventana Medical Systems, Inc., a developer and supplier of automated diagnostic systems. He received a B.S. degree in computer science from Purdue University, where he graduated Phi Beta Kappa.

We believe that Mr. Miller is qualified to serve on our board of directors because of his experience in leadership and management roles, and experience as a board member, in the healthcare industry.

John Patience has served as a Director of the Company and board chairman since June 26, 2012. Mr. Patience also serves as a director and chairman of the board of Biodesix, Inc. (NASDAQ: BDSX), another medical diagnostics company. Mr. Patience is a founding partner of Crabtree Partners, a private equity investment firm. Mr. Patience served as a director of Ventana Medical Systems, Inc. from 1989 and as Vice Chairman from 1999 until Ventana’s acquisition by Roche in 2008. Mr. Patience served as a director of Stericycle, Inc. (NASDAQ: SRCL) since its founding in 1989 until June of 2018. Mr. Patience was previously a partner of a venture capital investment firm that provided both Ventana and Stericycle with early stage funding. Mr. Patience also was previously a partner in the consulting firm of McKinsey & Co., Inc., specializing in health care. Mr. Patience holds a B.A. in Liberal Arts and an L.L.B. from the University of Sydney, Australia, and an M.B.A. from the University of Pennsylvania’s Wharton School of Business.

We believe that Mr. Patience is qualified to serve on our board of directors because of his experience in leadership and management roles in the field of medicine, as well as his experience as a board member and investor in companies in the healthcare industry.

Jack Phillips has served as a Director of the Company and as the Company’s President and Chief Executive Officer since February 1, 2020. From August 2019 to January 2020, Mr. Phillips served as the Company’s Chief Operating Officer. Prior to joining the Company, Mr. Phillips served as President and Chief Executive Officer of Roche Diagnostics Corporation, a division of Roche Holding AG, a biotech company, from January 2010 through August 2019. As President and Chief Executive Officer of Roche Diagnostics Corporation, Mr. Phillips was accountable for commercial operations, performance and strategy of approximately 4,200 employees in the United States and Canada. He also served as a member of Roche’s global Diagnostics

6

Leadership Team. Prior to his role as President and Chief Executive Officer of Roche Diagnostics Corporation, Mr. Phillips held senior leadership roles at Ventana Medical Systems, a cancer diagnostic company and a member of the Roche Group, including Senior Vice President of Commercial Operations for North America and Japan from July 1999 to December 2009. Before joining Ventana Medical Systems, Mr. Phillips worked at Bayer Diagnostics and Motorola. Mr. Phillips holds a B.S. in marketing from Northern Kentucky University.

We believe that Mr. Phillips is qualified to serve on our board of directors because of his experience in leadership and management roles at our Company, as well as his experience as a senior executive in the healthcare and medical device industries.

Jack Schuler has served as a Director of the company since June 26, 2012. Mr. Schuler is a founding partner of Crabtree Partners, a private investment firm. Mr. Schuler served as a Director of Ventana Medical Systems, Inc. from 1991 and as Chairman of the Board from 1995 until Ventana’s acquisition by Roche in 2008. Mr. Schuler held various executive positions at Abbott Laboratories from December 1972 through August 1989, including President and Chief Operating Officer. Mr. Schuler previously served on the boards of Abbott Laboratories, Medtronic (Lead Director) and Stericycle (Chairman), and Quidel Corp. He is currently a director of Biodesix, Inc. (NASDAQ: BDSX). Mr. Schuler holds a B.S. in Mechanical Engineering from Tufts University and an M.B.A. from Stanford University.

We believe that Mr. Schuler is qualified to serve on our board of directors because of his experience in leadership and management roles in the healthcare industry, as well as his experience as a board member in the healthcare and medical device industries.

Matthew W. Strobeck, Ph.D. has served as a Director of the Company since July 7, 2012. Dr. Strobeck is currently the Managing Partner of Birchview Capital. Dr. Strobeck was a Partner and Member of the Management Committee and Advisory Board of Westfield Capital Management from 2008 until 2011, having served as a member of the investment team, specializing in healthcare and life sciences, from May 2003 to June 2008. Dr. Strobeck currently serves on the boards of Quidel Corporation (NASDAQ: QDEL), a provider of rapid diagnostic testing solutions, Biodesix (NASDAQ: BDSX), a medical diagnostic company, and Monteris Medical, a medical device company. Dr. Strobeck received his B.S. from St. Lawrence University, a Ph.D. from the University of Cincinnati, a S.M. from the Harvard University/MIT Health Sciences Technology Program, and a S.M. from the MIT Sloan School of Management.

We believe that Mr. Strobeck is qualified to serve on our board of directors because of his experience in leadership and management roles at medical technology companies, as well as his experience as a board member and investor in the medical technology industry.

Frank J.M. ten Brink has served as a Director of the Company since March 6, 2013. Mr. ten Brink served as an executive consultant to Stericycle, Inc. (NASDAQ: SRCL) until February 2021. Until October 2017 he was Senior Vice President of Mergers and Acquisitions at Stericycle where he also served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer from June 1997 to August 2014. He has over 16 years of finance experience in high growth environments, mergers and acquisitions. Prior to joining Stericycle, he was Senior Vice President and Chief Financial Officer with Telular Corporation. Between 1991 and 1995, he was Vice President and Chief Financial Officer of Hexacomb Corporation. Mr. ten Brink studied International Business at the Netherlands School of Business and received an M.B.A. degree in Finance from the University of Oregon.

We believe that Mr. ten Brink is qualified to serve on our board of directors because of his experience in leadership and management roles in a variety of industries, as well as his experience holding finance-related roles of increasing responsibility.

Charles Watts, M.D. has served as a Director of the Company since November 14, 2017. Until his retirement, Dr. Watts served as Chief Medical Officer at Northwestern Memorial Hospital (NMH) and Associate Dean for Clinical Affairs at the Feinberg School of Medicine, Northwestern University from 2001 to 2011. Prior to his tenure at Northwestern, Dr. Watts served as Chief of Clinical Affairs and Associate Dean at the University of Michigan Medical Center. He has also served as Executive in Residence for the Health Management Academy, as an active faculty member of a nationally based Physician Leadership Program. Dr. Watts has served as a Director of Providence Health and Services (Seattle, Washington) from 2012 to 2016 where he chaired the Quality and Patient Safety Improvement Committee, and recently served as a Trustee of Swedish Health Services, Inc. until

7

June 2021. He currently serves as a Trustee on the Institute for Systems Biology Board (Seattle, Washington). He received his undergraduate and medical degrees from the University of Michigan.

We believe that Mr. Watts is qualified to serve on our board of directors because of his experience in leadership and management roles in the field of medicine, as well as his experience as a board member in the healthcare industry.

Steve Reichling has served as the Company’s Chief Financial Officer since September 10, 2012. Prior to joining the Company, Mr. Reichling served as general manager of Spring Bioscience Corp., a subsidiary of Roche Tissue Diagnostics. From January 2003 to December 2009, Mr. Reichling held various finance, accounting and operations leadership roles at Roche Tissue Diagnostics and Ventana Medical Systems, Inc., including director of finance and operations, manager of business development finance, and head of Internal Audit and Sarbanes Oxley Compliance. From 2002 to 2003, Mr. Reichling was an auditor at Ernst & Young LLP. Mr. Reichling received his B.S. in accounting and entrepreneurship from the University of Arizona.

Ron Price has served as the Company's Chief Commercial Officer, Americas, since March 2020, and was previously Head of Commercial Operations, Americas since April 2015. Mr. Price has over 20 years of commercial operations experience and a proven track record of leading sales and marketing teams to achieve double-digit revenue growth and strong bottom-line performance. Prior to joining the Company, Mr. Price served as Vice President, Commercial Operations for Roche Point of Care managing all commercial responsibilities across three separate product lifecycles. In addition, Mr. Price held a number of sales, marketing, and leadership roles with Ventana Medical Systems from 2001 to 2012 following 5 years at Bayer Healthcare Diagnostics. Mr. Price holds a B.S. in Clinical Laboratory Sciences, Cytology from the University of Oklahoma.

There are no agreements or understandings for any of our executive officers or directors to resign at the request of another person and no officer or director is acting on behalf of nor will any of them act at the direction of any other person.

Directors are elected to serve until their successors are duly elected and qualified.

Pursuant to Mr. Phillips’ employment agreement entered into with the Company on January 31, 2020, so long as Mr. Phillips is employed as the Company’s Chief Executive Officer, the Company will use its reasonable efforts, subject to applicable law and the rules of NASDAQ and the Company’s Amended and Restated Bylaws, to cause Mr. Phillips to be nominated for election to the Board at the Company’s annual shareholder meeting.

8

Board Diversity

The table below provides information relating to certain voluntary self-identified characteristics of our directors. Each of the categories listed in the table below has the meaning as set forth in NASDAQ Rule 5605(f).

| Board Diversity Matrix (As of March 16, 2022) | ||||||||||||||

| Total Number of Directors | 11 | |||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 1 | 10 | 0 | 0 | ||||||||||

| Part II: Demographic Background | ||||||||||||||

| African American or Black | 0 | 1 | 0 | 0 | ||||||||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||||||||

| Asian | 0 | 0 | 0 | 0 | ||||||||||

| Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||||||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||||||||

| White | 1 | 9 | 0 | 0 | ||||||||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||||||||

| LGBTQ | 0 | |||||||||||||

| Did Not Disclose Demographic Background | 0 | |||||||||||||

Director Independence

The Board has affirmatively determined that directors Brown, Burris, Francesconi, Massarany, Miller, Patience, Schuler, Strobeck, ten Brink, and Watts (constituting a majority of the full Board) are “independent directors” under NASDAQ Listing Rule 5605(a)(2) and the related rules of the U.S. Securities and Exchange Commission (the “SEC”). In making this determination, our Board considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director. The Company’s independent directors conduct executive sessions at regularly scheduled meetings as required by NASDAQ Listing Rule 5605(b)(2).

Family Relationships

There are no family relationships among any of our directors and executive officers.

Board Leadership Structure

The Board does not have an express policy regarding the separation of the roles of Chief Executive Officer (“CEO”) and Board Chairman, as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. Currently, Jack Phillips serves as the Company’s President and CEO and John Patience serves as the Chairman of the Board. The Board believes that its current leadership structure best serves the objectives of the Board’s oversight of management; the ability of the Board to carry out its roles and responsibilities on behalf of the shareholders; and the Company’s overall corporate governance. The Board also believes that the current separation of the Chairman and CEO roles allows the CEO to focus his time and energy on operating and managing the Company and leverages the experience and perspectives of the Chairman.

Board Oversight of Risk Management

The full Board has responsibility for general oversight of risks facing the Company. The Board is informed by senior management on areas of risk facing the Company and periodically conducts discussions regarding risk assessment and risk management. The Board believes that evaluating how the executive team manages the

9

various risks confronting the Company is one of its most important areas of oversight. While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. For example, the Audit Committee reviews and assesses the Company’s processes to manage financial reporting risk and to manage investment, tax, and other financial risks; the Compensation Committee oversees risks relating to the compensation and incentives provided to our executive officers; and the Nominating and Governance Committee oversees risks associated with our overall compliance and corporate governance practices, as well as the independence and composition of our Board. Finally, management periodically reports to the Board or relevant committee, which provides guidance on risk assessment and mitigation.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, requires the Company’s directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of securities ownership and changes in such ownership with the SEC.

Based solely upon a review of such forms filed electronically with the SEC or written representations that no Form 5s were required, the Company believes that all Section 16(a) filing requirements were timely met during the year ended December 31, 2021, except for two Form 4s filed by Jack Phillips reporting three transactions; one Form 4 filed by Ron Price reporting two transactions; one Form 4 filed by Steven Reichling reporting two transactions; two Form 4s filed by Matthew Strobeck reporting two transactions; two Form 4s filed by Jack Schuler reporting four transactions; one Form 4 filed by Thomas Brown reporting one transaction; one Form 4 filed by Mark Miller reporting one transaction; and one Form 4 filed by John Patience reporting one transaction.

Code of Ethics

The Company has adopted a code of ethics for its principal executive officer and senior financial officers and a code of ethics and standards of conduct that is applicable to all directors, officers and employees, a copy of which is available online at https://ir.axdx.com/governance-documents. Shareholders may also request a free copy of these documents from: ACCELERATE DIAGNOSTICS, INC., 3950 South Country Club Road, Suite 470, Tucson, Arizona 85714, Attn: Corporate Secretary.

Director Meeting Attendance

During the year ended December 31, 2021, the Board held six meetings of the full Board, The Board also took action by written consent on six occasions. During the year ended December 31, 2021, each member of the Board attended at least 75% of the aggregate of all meetings of the Board and the meetings of the committees on which he or she served (during the periods for which he or she served).

The Company does not have a written policy requiring directors to attend the annual meeting, but attendance is encouraged. Last year three of the directors attended our 2021 Annual Meeting of Shareholders.

Board Committees

Our board of directors has established an audit committee, a compensation committee and a nominating and governance committee. Our board of directors may establish other committees to facilitate the management of our business. The composition and functions of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors. The charter of each committee is available on our corporate website at https://ir.axdx.com/corporate-governance.

10

Committee Composition

The following table provides current membership for each committee of our board of directors:

| Name: | Audit Committee | Compensation Committee | Nominating and Governance Committee | ||||||||

| John Patience | X | ||||||||||

| Wayne C. Burris | X | ||||||||||

| Thomas D. Brown | Chair | ||||||||||

| Louise L. Francesconi | X | ||||||||||

| Hany Massarany | X | ||||||||||

| Mark C. Miller | X | Chair | |||||||||

| Jack Schuler | X | ||||||||||

| Matthew W. Strobeck Ph.D. | X | ||||||||||

| Frank J.M. ten Brink | Chair | ||||||||||

| Charles Watts M.D. | X | X | |||||||||

Audit Committee

The Board maintains a standing Audit Committee comprised of Messrs. ten Brink (Chairman), Burris, Miller and Dr. Strobeck. Each member of the Audit Committee satisfies the applicable independence standards specified in the NASDAQ Listing Rules and the related rules of the SEC pertaining to audit committees and has been determined by the Board to be “financially literate” with accounting or related financial management experience. The Board has also determined that Messrs. ten Brink and Burris are “audit committee financial experts” as defined under SEC rules and regulations and qualify as financially sophisticated audit committee members as required under Rule 5605(c)(2)(A) of the NASDAQ Listing Rules. The Audit Committee met six times during the year ended December 31, 2021.

The Audit Committee's responsibilities include overseeing the qualifications, independence and performance of our independent registered public accounting firm; evaluating the Company’s accounting policies and system of internal controls; and reviewing significant financial transactions. In carrying out this purpose, the Audit Committee maintains and facilitates free and open communication between the Board, the independent registered public accounting firm, and our management.

Compensation Committee

The Board maintains a standing Compensation Committee comprised of Messrs. Brown (Chairman), Massarany, and Patience, Ms. Francesconi and Dr. Watts. Each member of the Compensation Committee satisfies the applicable independence standards specified in the NASDAQ Listing Rules and the related rules of the SEC pertaining to compensation committees. All members of the Compensation Committee also qualify as non-employee directors under Exchange Act Rule 16b-3 and as outside directors under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). The Compensation Committee met five times and took action by written consent on four occasions during the year ended December 31, 2021.

The Compensation Committee’s responsibilities include reviewing the compensation arrangements for the Company’s executive officers, including the CEO; administering the Company’s equity compensation plans; and reviewing the compensation of the Board. In its discretion, the Compensation Committee may delegate certain of its authority and responsibilities to one or more subcommittees comprised entirely of members of the Compensation Committee.

11

Nominating and Governance Committee

The Board maintains a standing Nominating and Governance Committee comprised of Messrs. Miller (Chairman), Schuler and Dr. Watts. Each member of the Nominating and Governance Committee satisfies the applicable independence standards specified in the NASDAQ Listing Rules. The Nominating and Governance Committee met three times during the year ended December 31, 2021.

The Nominating and Governance Committee’s responsibilities include determining the qualifications, qualities, skills, and other expertise required to be a director; recommending to the criteria to be considered in selecting director nominees; identifying and screening individuals qualified to become members of the Board; making recommendations to the Board regarding the selection and approval of director nominees; overseeing the Company’s corporate governance policies, practices and procedures; assisting the Board in assessing director independence; and reviewing the structure and composition of Board committees and recommending to the Board, if desirable, changes in their number, responsibilities and membership.

Director Nominations

The Nominating and Governance Committee is responsible for identifying and screening potential candidates and recommending qualified candidates to the Board for nomination. The Nominating and Governance Committee seeks to ensure that the Board is composed of members whose particular experience, qualifications, attributes and skills, when taken together, will allow the Board to satisfy its oversight obligations effectively. The Nominating and Governance Committee typically solicits recommendations for nominees from the persons the committee believes are likely to be familiar with (i) the needs of the Company and (ii) qualified candidates. These persons may include members of the Board and management of the Company. The Nominating and Governance Committee may also engage a professional search firm to assist in identifying qualified candidates. In selecting Board candidates, the Nominating and Governance Committee’s goal is to identify persons who it believes have appropriate expertise and experience to contribute to the oversight of a company of the Company’s nature while also reviewing other appropriate factors, including those discussed below under “Qualifications of Director Nominees.”

The Nominating and Governance Committee will consider director candidates recommended by shareholders in the same manner in which it evaluates candidates it identified, if such recommendations are properly submitted to the Company pursuant to the Company's Amended and Restated Bylaws. The Company’s Amended and Restated Bylaws contains provisions relating to certain timing and information requirements for shareholder nominations for election to the Board brought before a meeting of the shareholders. See Section 2.12 of the Company’s Amended and Restated Bylaws and the section entitled “Shareholder Proposals and Director Nominations for the 2023 Annual Meeting” in this Proxy Statement for additional information.

Qualifications of Director Nominees

The Board and the Nominating and Governance Committee believe that each of the persons nominated for election at the Annual Meeting have the experience, qualifications, attributes and skills that, when taken as a whole, will enable the Board to satisfy its oversight responsibilities effectively. The Board and the Nominating and Governance Committee consider the following for each candidate, among other qualifications deemed appropriate, when evaluating the suitability of candidates for nomination as director: independence; integrity; personal and professional ethics; business judgment; ability and willingness to commit sufficient time to the Board; qualifications, attributes, skills and/or experience relevant to the Company’s business; educational and professional background; personal accomplishment; and national, gender, age, and ethnic diversity.

Shareholder Communications with the Board

Shareholders who wish to communicate with the Board of Directors or with a particular director may do so by sending a letter to the Corporate Secretary, 3950 South Country Club Road, Suite 470, Tucson, Arizona 85714. The Corporate Secretary will review all correspondence and regularly forward to the Board copies of all such correspondence that, in the opinion of the Corporate Secretary, deals with the functions of the Board or committees thereof or that the Corporate Secretary otherwise determines requires attention.

12

Hedging, Short Sales and Related Policies

Pursuant to the Company’s insider trading policy, all directors, officers and employees of the Company (collectively, “Team Members”), as well as their spouses, minor children, other persons living in their household and entities over which they exercise control, are prohibited from engaging in the following transactions in the Company’s securities unless advance unanimous approval is obtained from members of the compliance committee designated by the Board:

•Hedging. Team Members may not enter into hedging or monetization transactions or similar arrangements with respect to the Company’s securities.

•Short sales. Team Members may not sell the Company’s securities short;

•Options trading. Team Members may not buy or sell puts or calls or other derivative securities on the Company’s securities; and

•Trading on margin. Team Members may not hold the Company’s securities in a margin account or pledge the Company’s securities as collateral for a loan.

13

AUDIT COMMITTEE REPORT

The Audit Committee oversees the financial reporting process of our company on behalf of our Board. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in our Annual Report on Form 10-K for the year ended December 31, 2021 with management, including a discussion of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee has discussed with Ernst & Young, LLP (“Ernst & Young”), our independent registered public accounting firm that was responsible for expressing an opinion on the conformity of those audited financial statements with U.S. generally accepted accounting principles, its judgments about our accounting principles and the other matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) and the SEC. The Audit Committee has received from Ernst & Young the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with Ernst & Young their independence. The Audit Committee has considered the effect of non-audit fees on the independence of Ernst & Young and has concluded that such non-audit services are compatible with the independence of Ernst & Young.

The Audit Committee discussed with Ernst & Young the overall scope and plans for its audits. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of its audits and quarterly reviews, its observations regarding our internal controls, and the overall quality of our financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial statements for the year ended December 31, 2021, be included in the Annual Report on Form 10-K for the year ended December 31, 2021 for filing with the SEC.

This report has been furnished by the members of the Audit Committee.

| THE AUDIT COMMITTEE | |||||

| Frank J.M. ten Brink, Chairman | |||||

| Wayne C. Burris | |||||

| Mark C. Miller | |||||

| Matthew W. Strobeck, Ph.D. | |||||

14

COMPENSATION OVERVIEW

The purpose of this Compensation Overview section is to provide material information about the Company’s compensation philosophy, objectives and other relevant policies and to explain and put into context the material elements of the disclosure that follows in this Proxy Statement with respect to the compensation of our named executive officers (“NEOs”). For the year ended December 31, 2021, our NEOs were:

Jack Phillips, President and Chief Executive Officer

Steve Reichling, Chief Financial Officer

Ron Price, Senior Vice President and Head of Commercial Operations, Americas

Determining Executive Compensation

On an ongoing basis, the Compensation Committee reviews the performance and compensation of our President and CEO and the Company’s other executive officers.

Our President and CEO provides input to the Compensation Committee regarding the performance of the other NEOs and offers recommendations regarding their compensation packages in light of such performance. The Compensation Committee is ultimately responsible, however, for determining the compensation of the NEOs, including our President and CEO.

Compensation Philosophy and Objectives

The Compensation Committee and the Board believe that the Company’s executive compensation programs for its executive officers should reflect the Company’s performance and the value created for its shareholders. In addition, we believe our executive compensation programs should support the goals and values of the Company and should reward individual contributions to the Company’s success. Specifically, the Company’s executive compensation program is intended to, among other things:

•attract and retain the highest caliber executive officers;

•drive achievement of business strategies and goals;

•motivate performance in an entrepreneurial, incentive-driven culture;

•closely align the interests of executive officers with the interests of the Company’s shareholders;

•promote and maintain high ethical standards and business practices; and

•reward results and the creation of shareholder value.

Factors Considered in Determining Compensation; Elements of Compensation

The Compensation Committee makes executive compensation decisions on the basis of total compensation, rather than on individual components of compensation. We attempt to create an integrated total compensation program structured to balance both short and long-term financial and strategic goals. Our compensation should be competitive enough to attract and retain the highest caliber executive officers. In this regard, we utilize a combination of between two to three of the following types of compensation to compensate our executive officers:

•base salary;

•annual cash performance bonuses payable as equity awards; and

•long-term equity compensation, consisting of stock options, time-based restricted stock units ("RSUs"), and performance stock units ("PSUs"). RSUs and stock options are typically granted with a multiple year vesting schedule to promote long-term retention. PSUs may be tied to the achievement of a variety of performance metrics, including long-term revenue targets. Each vested RSU and PSU will be settled in one share of Common Stock.

15

The Compensation Committee's philosophy regarding the mix of the three components of compensation is that equity awards should be emphasized over base salaries. The Compensation Committee believes this approach preserves the Company's cash and strongly aligns executive officer incentives with shareholder interests.

The Compensation Committee periodically reviews each executive officer’s base salary and makes appropriate recommendations to the Board. Base salaries are based on the following factors:

•the Company’s performance for the prior fiscal years and subjective evaluation of each executive’s contribution to that performance;

•the performance of the particular executive in relation to established goals or strategic plans;

•competitive levels of compensation for executive positions based on information drawn from informal internal benchmark analysis of base salaries for executive officers at similarly sized, public medical technology companies and other relevant information; and

•our obligations under the applicable executive officer’s employment agreement or offer letter (if any).

Performance bonuses and equity compensation are awarded based upon the recommendation of the Compensation Committee. These grants are made with a view to linking executives’ compensation to the long-term financial success of the Company and its shareholders.

Role of Say-On-Pay Votes

As selected by our Shareholders at the 2019 Annual Meeting of Shareholders and approved by our Board, an advisory vote to approve the compensation of our NEOs (say-on-pay proposal) is held every three years. At the 2019 Annual Meeting of Shareholders, more than 97.8% of the votes cast on the say-on-pay proposal were voted in favor of the proposal. At the Annual Meeting, Shareholders will have an opportunity to vote on the say-on-pay proposal (Proposal 4). The Compensation Committee carefully considers the level of voting support from our Shareholders on our say-on-pay vote and will continue to consider the outcome of votes on say-on-pay proposals when making future compensation decisions for our NEOs.

Other Compensation Policies and Considerations; Tax Issues and Risk Management

As part of its role, the Compensation Committee reviews and considers the deductibility of executive compensation under the Code and historically, the intention of the Committee has been to compensate our NEOs in a manner that maximizes the Company’s ability to deduct compensation for federal income tax purposes (although no assurances have ever been made nor can be made or given with respect to our ability to deduct any compensatory payment to any of our executives).

Section 162(m) of the Code, as in effect for tax years beginning prior to December 31, 2017, provided that we could not deduct compensation of more than $1,000,000 paid in any year to the executives designated as “covered employees” under Section 162(m) of the Code, unless the compensation in excess of $1,000,000 qualified as “performance-based compensation” under Section 162(m) of the Code. Although the Compensation Committee historically considered the implications of Section 162(m) on its ability to deduct compensation, the Compensation Committee has always retained the discretion to award compensation that is not “performance-based compensation” under Section 162(m) of the Code if it determined that providing such compensation was appropriate with respect to the achievement of our business objectives and in the best interests of the Company and its shareholders. The Tax Cuts and Jobs Act (the “Tax Act”), which was signed into law in December 2017, eliminated the exception for “performance-based compensation” with respect to 2018 and future years. As a result, we expect that, except to the extent that compensation is eligible for limited transition relief applicable to binding contracts in effect on November 2, 2017 and not materially modified thereafter, compensation that is paid or provided to our Section 162(m) “covered employees” that exceeds $1,000,000 per year will be nondeductible under Section 162(m).

The Compensation Committee continues to monitor the impact that the repeal of the “performance-based compensation” exception to Section 162(m) will have on the Company’s compensation plans, awards, and arrangements, including whether and to what extent our existing agreements and programs qualify for the transition relief described above.

Section 409A of the Code imposes an additional 20% federal income tax and penalties upon employees who receive “non-qualified deferred compensation” that does not comply with Section 409A. The Compensation

16

Committee takes into account the impact of Section 409A in designing our executive compensation plans and programs that provide for “non-qualified deferred compensation” and, as a general rule, these plans and programs are designed either to comply with the requirements of Section 409A or to qualify for an applicable exception to Section 409A so as to avoid possible adverse tax consequences that may result from failure to comply with Section 409A. We cannot, however, guarantee that the compensation will comply with the requirements of Section 409A or an applicable exception thereto.

On an annual basis, the Compensation Committee evaluates the Company’s compensation policies and practices for its employees, including the NEOs, to assess whether such policies and practices create risks that are reasonably likely to have a material adverse effect on the Company. Based on its evaluation, the Compensation Committee has determined that the Company’s compensation policies and practices do not create such risks.

Stock Ownership Guidelines

In order to promote a meaningful, permanent level of ownership in the Company and alignment of interests of the Board and NEOs with shareholders, in February 2021 the Board adopted stock ownership guidelines (the "Stock Ownership Guidelines") for Board members and NEOs. The Stock Ownership Guidelines identify the minimum level of stock ownership expected of Board members (3 x annual retainer), the CEO (5 x annual base salary), and other NEOs (3 x annual base salary). Individuals are expected to achieve their respective minimum ownership level within five years of becoming subject to the Stock Ownership Guidelines. The Stock Ownership Guidelines are available online at https://ir.axdx.com/governance-documents.

Nonqualified Executive Deferred Compensation Plan

Our NEOs and other executive officers are eligible to participate in the Accelerate Diagnostics, Inc. Nonqualified Deferred Compensation Plan (the “Deferred Compensation Plan”), pursuant to which certain of our highly compensated employees are permitted to defer up to 70% of their annual base salary into such plan. The Deferred Compensation Plan was adopted effective January 1, 2020. We do not make any contributions to the Deferred Compensation Plan on behalf of any participant, including any NEO, so each participant is fully vested in his or her account balances at all times. Investment gains or losses credited to a participant's account in the Deferred Compensation Plan are based on investment elections made by the participant from prescribed mutual fund investment options. Each participant in the Deferred Compensation Plan makes his or her own individual investment elections and may change any such investment election during the annual enrollment window.

As of the date of this Proxy Statement, only Mr. Phillips has made deferred elections pursuant to the Deferred Compensation Plan whereby Mr. Phillips elected to defer 70% of his annual base salary for 2020, 2021 and 40% for 2022.

Hedging, Short Sales and Related Policies

See “Directors, Executive Officers and Corporate Governance-Hedging, Short Sales and Related Policies” for information regarding the Company’s policies relating to hedging, short sales and related matters.

2020 Salary Waiver and Nonqualified Stock Options Grant Plan

In December 2019, the Compensation Committee approved the 2020 Salary Waiver and Nonqualified Stock Option Grant Plan (the “2020 Sub-Plan”), which was established pursuant to the Accelerate Diagnostics, Inc. 2012 Omnibus Equity Incentive Plan (the “2012 Incentive Plan”). Pursuant to the 2020 Sub-Plan, eligible employees, including our executive officers, were permitted to irrevocably waive a portion of their base compensation (e.g. salary) scheduled to be paid to them in 2020 in exchange for a grant of nonqualified stock options, which were awarded January 1, 2020 under the 2012 Incentive Plan. The maximum election possible was 50% of the eligible employee’s base compensation. In accordance with the 2020 Sub-Plan, Mr. Phillips irrevocably waived $100,000 of his 2020 base compensation in exchange for 25,268 of such options, and Mr. Reichling irrevocably waived $50,000 of his 2020 base compensation in exchange for 12,634 of such options.

The number of nonqualified stock options awarded to each participant was determined by multiplying the amount of salary forfeited by four (4) and dividing such amount by the 30-day trailing average closing price of the Common Stock as of December 19, 2019, with such amount rounded to the nearest whole share. Subject to

17

continued full-time employment, the options vested and became exercisable in equal monthly installments, on the last day of each month, over 12 months, with the first installment vesting on January 31, 2020 and the last installment vesting on December 31, 2020. Upon termination of employment for any reason other than death or disability, the vested portion of the option, if any, may generally be exercised for 90 days following termination of employment. Upon termination of employment by reason of death or disability, the vested portion of the option, if any, may generally be exercised for 12 months following termination of employment.

The Compensation Committee decided not to adopt a salary waiver and equity plan for 2021 for various reasons including that the Company implemented temporary 20% salary reductions for Company management in 2020, including NEOs, because of the COVID-19 crisis and its impact on the operations on the Company.

2020 COVID-19 Salary Reduction

On June 29, 2020, the Compensation Committee approved temporary 20% salary reductions for Company management and other employees with a base salary over $100,000, including NEOs because of the ongoing COVID-19 crisis and its impact on the operations on the Company. Salary reductions took effect for the period from June 29, 2020 through December 16, 2020. To compensate impacted employees, the Compensation Committee approved awards of RSUs under the 2012 Incentive Plan. The number of RSUs for each award was calculated based on the individual’s aggregate salary reduction amount, divided by the average closing price of the Company’s common stock over the 30 trading days prior to the internal announcement of the salary reductions on June 19, 2020. The RSUs vested in full on December 16, 2020.

2020 Performance Incentive Program

In February 2020, the Compensation Committee approved a 2020 performance incentive program (“2020 Performance Program”). The 2020 Performance Program consisted of two commercial performance goals and one financial performance goal. Because the ongoing COVID-19 pandemic significantly limited the Company's ability throughout 2020 to sell and implement its products at hospitals that were focussed on responding to the COVID-19 pandemic, the Compensation Committee in September 2020 modified all three performance goals. In the first quarter of 2021, the Compensation Committee determined that the Company had achieved a level of performance under the 2020 Performance Program of 115%. The Compensation Committee elected to pay the 2020 Performance Program in restricted stock units in lieu of cash.

2020 Long-Term Incentive Program

In February 2020, the Compensation Committee approved a long-term incentive program ("2020 LTI Program"). The 2020 LTI Program consisted of one commercial annual goal to be achieved by by the end of 2022. The Company made grants of PSUs in March 2020 under the 2020 LTI Program to certain employees, including the NEOs.

2020 Employee Equity Retention Program

In December 2020, the Compensation Committee approved an equity retention program ("2020 Retention Program") designed to retain employees given that many employees had little or no Company equity that was "in the money." The grants under the 2020 Retention Program were in the form of RSUs with monthly vesting over 12 months beginning January 2023. With the exception of Mr. Phillips, the named executive officers received grants under the 2020 Retention Program.The Compensation Committee further decided not to approve a separate 2021 long-term incentive program since it would be largely duplicative of the 2020 Retention Program.

2021 Performance Incentive Program

In March 2021, the Compensation Committee approved a long-term incentive program ("2021 Performance Program"). The 2021 Performance Program consisted of two commercial and three research and development goals to be achieved during 2021. Because the COVID-19 pandemic continued to significantly limit the Company's ability throughout 2021 to sell and implement its products at hospitals that were focused on responding to the COVID-19 pandemic, the Compensation Committee modified all three performance goals in September 2021. In the first quarter of 2022, the Compensation Committee determined that the Company had achieved a level of performance under the 2021 Performance Program of 75%. The Compensation Committee elected to pay the 2021 Performance Program in RSUs in lieu of cash.

18

CEO Retention Grants

Separately from the above programs, in order to properly incentivize and ensure the retention of Mr. Phillips, the Compensation Committee made the following grants to Mr. Phillips:

•June 2020 - 93,530 PSUs tied to a commercial goal to be achieved by the end of 2022, and 124,320 RSUs with a three-year annual vesting period.

•May 2021 - 103,299 PSUs based upon a commercial goal and various product development goals, and 206,597 RSUs to vest monthly starting in January 2023.

19

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to our NEOs for services rendered in all capacities during the noted periods. The fiscal years ended December 31, 2020 and December 31, 2021 are indicated below by “2020” and “2021,” respectively.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(8) | Option Awards ($)(8) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||||||||

| Jack Phillips, President and CEO (1) | 2021 | 595,000 | (2) | — | 2,186,207 | (6) | — | 108,015 | (9) | 2,889,222 | ||||||||||||||||||||||||||||

| 2020 | 554,923 | (3)(4)(5) | — | 3,146,563 | (7) | 105,963 | 65,039 | (10) | 3,872,488 | |||||||||||||||||||||||||||||

| Steve Reichling, CFO | 2021 | 340,000 | — | 1,265,602 | — | — | 1,605,602 | |||||||||||||||||||||||||||||||

| 2020 | 324,077 | (11)(12) | — | 44,679 | (13) | 326,000 | — | 694,756 | ||||||||||||||||||||||||||||||

| Ron Price, Senior Vice President and Head of Commercial Operations, America | 2021 | 240,000 | — | 1,112,594 | — | — | 1,352,594 | |||||||||||||||||||||||||||||||

| 2020 | 225,231 | (14) | — | 36,986 | (15) | 192,718 | — | 454,935 | ||||||||||||||||||||||||||||||

(1)The Board appointed Mr. Phillips as the Company’s President and CEO, effective February 1, 2020. Mr. Phillips had been serving as the Company’s Chief Operating Officer since August 2019 when he joined the Company.

(2)Mr. Phillips made deferred elections pursuant to the Deferred Compensation Plan whereby Mr. Phillips elected to defer 70% of his 2021 annual base salary in the amount of $416,500, which was included in the Salary column. Unrealized investment gains credited to Mr. Phillips’ account in the Deferred Compensation Plan was $38,080 and is not included in the Salary column. Investment income credited to Mr. Phillips’ account in the Deferred Compensation Plan was $28,986 and is not included in the Salary column. See “Compensation Overview - Nonqualified Deferred Compensation Plan” for additional information.

(3)In accordance with the 2020 Sub-Plan, Mr. Phillips irrevocably waived $100,000 of his 2020 salary in exchange for options to purchase 25,268 shares of Common Stock. The fair value of the options upon being granted was $205,963 of which the amount in excess of the $100,000 was $105,963 and is a component of the Option Awards column. See “Compensation Overview - 2020 Salary Waiver and Nonqualified Stock Options Grant Plan” and “2021 Outstanding Equity Awards at Fiscal Year-End” for additional information regarding such options.

(4)Mr. Phillips’ 2020 salary reflects a temporary reduction in the amount of $49,500 approved by the Compensation Committee because of the ongoing COVID-19 crisis. To compensate impacted employees, the Compensation Committee approved a grant of 5,363 shares RSUs to Mr. Phillips in June 2020. The fair value of the RSUs was $76,262 and is a component of the Stock Awards column. See “Compensation Overview - 2020 COVID-19 Salary Reduction” and “2021 Outstanding Equity Awards At Fiscal Year-End” for additional information regarding such RSUs.

(5)Mr. Phillips made deferred elections pursuant to the Deferred Compensation Plan whereby Mr. Phillips elected to defer 70% of his 2020 annual base salary in the amount of $305,119, which was included in the Salary column. Unrealized investment gains credited to Mr. Phillips’ account in the Deferred Compensation Plan was $40,185 and is not included in the Salary column. Investment income credited to Mr. Phillips’ account in the Deferred Compensation Plan was $11,405 and is not included in the Salary column. See “Compensation Overview - Nonqualified Deferred Compensation Plan” for additional information.

(6)During 2021, 103,299 PSUs were granted to Mr. Phillips, which are subject to performance conditions. On the grant date, the performance conditions were not deemed probable and, therefore, the grant date value of the PSUs is not included in the “Stock Awards” column. The grant date value of the PSUs assuming that the highest level of performance conditions will be achieved was $732,390 (target level of performance as there are no threshold or maximum payout amounts).

(7)During 2020, 117,938 PSUs were granted to Mr. Phillips, which are subject to performance conditions. On the grant dates, the performance conditions were not deemed probable and, therefore, the grant date values of the PSUs are not included in the “Stock Awards” column. The aggregate grant date value of the

20

PSUs assuming that the highest level of performance conditions will be achieved was $1.3 million (target level of performance as there are no threshold or maximum payout amounts).

(8)The amount reflects the aggregate grant date fair value of RSU and option award during each year calculated in accordance with ASC Topic 718. Assumptions used in the calculation of these amounts are included in Note 13 to the financial statements set forth in the Annual Report. See “Compensation Overview” and “2021 Outstanding Equity Awards at Fiscal Year-End” for additional information regarding the rawards granted in 2021.

(9)The amounts reflect the aggregate value of housing and relocation expenses during the year.

(10)The amounts reflect the aggregate value of housing during the year.

(11)In accordance with the 2020 Sub-Plan, Mr. Reichling irrevocably waived $50,000 of his 2020 salary in exchange for options to purchase 12,634 shares of Common Stock. The fair value of the options upon being granted was $102,981 of which the amount in excess of the $50,000 was $52,981 and is a component of the Option Awards column. See “Compensation Overview - 2020 Salary Waiver and Nonqualified Stock Options Grant Plan” and “2021 Outstanding Equity Awards at Fiscal Year-End” for additional information regarding such options.

(12)Mr. Reichling’s 2020 salary reflects a temporary reduction in the amount of $29,000 approved by the Compensation Committee because of the ongoing COVID-19 crisis. To compensate impacted employees, the Compensation Committee approved a grant of 3,142 RSUs to Mr. Reichling in June 2020. The fair value of the RSUs was $44,679 and is a component of the Stock Awards column. See “Compensation Overview - 2020 COVID-19 Salary Reduction” and “2021 Outstanding Equity Awards at Fiscal Year-End” for additional information regarding such RSUs.

(13)During 2020 16,765 PSUs were granted to Mr. Reichling, which are subject to performance conditions. On the grant date, the performance conditions were not deemed probable and, therefore, the grant date value of the PSUs are not included in the “Stock Awards” column. The grant date value of the PSUs assuming that the highest level of performance conditions will be achieved was $99,416 (target level of performance as there are no threshold or maximum payout amounts).

(14)Mr. Price’s 2020 salary reflects a temporary reduction in the amount of $24,000 approved by the Compensation Committee because of the ongoing COVID-19 crisis. To compensate impacted employees, the Compensation Committee approved a grant of 2,601 RSUs to Mr. Price in June 2020. The fair value of the RSUs was $36,986 and is a component of the Stock Awards column. See “Compensation Overview - 2020 COVID-19 Salary Reduction" and “2021 Outstanding Equity Awards at Fiscal Year-End” for additional information regarding such RSUs.

(15)During 2020, 11,834 PSUs were granted to Mr. Price, which are subject to performance conditions. On the grant date, the performance conditions were not deemed probable and, therefore, the grant date value of the PSUs are not included in the “Stock Awards” column. The grant date value of the PSUs assuming that the highest level of performance conditions will be achieved was $70,176 (target level of performance as there are no threshold or maximum payout amounts).

21

2021 Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information concerning outstanding equity awards held by the NEOs at December 31, 2021:

| Option Awards | Stock Awards | ||||||||||||||||||||||||||||||||||||||||

| Number of Securities Underlying Unexercised Options | |||||||||||||||||||||||||||||||||||||||||

| Name | Grant Date | Number of securities underlying unexercised options (#) exercisable (#) | Number of securities underlying unexercised options (#) unexerciable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | ||||||||||||||||||||||||||||||||