UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply): | ||||||

☑ | | | No fee required | | ||

☐ | | | Fee paid previously with preliminary materials | | ||

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | | ||

Dear Shareholders:

I am pleased to invite you to attend the annual meeting of shareholders of Casey’s General Stores, Inc., to be held at 8:30 a.m. Central Time on August 28, 2024. The annual meeting will be held online in virtual format only, via live audio webcast at:

www.virtualshareholdermeeting.com/CASY2024

The Notice of Annual Meeting and Proxy Statement describe the matters to be considered and voted upon. At the virtual annual meeting, you will have an opportunity to vote and submit your questions through the webcast site.

Whether or not you attend the virtual annual meeting, it is important that your shares are represented. If you request a paper copy of the proxy materials, please promptly complete and return the proxy card or voter instruction form. Alternatively, you may vote by telephone or through the Internet as described below in the Proxy Statement.

On behalf of the Board of Directors and Casey’s leadership team, thank you for your support.

Sincerely,

Darren M. Rebelez

Board Chair, President and Chief Executive Officer

July 17, 2024

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

August 28, 2024

8:30 a.m. Central Time

www.virtualshareholdermeeting.com/CASY2024

The 2024 annual shareholders’ meeting (the “Annual Meeting”) of Casey’s General Stores, Inc. will be held as follows:

| | Date and Time | | | Location – Virtual Meeting Only | | | Record Date | | | Mailing Date | |

| | August 28, 2024 8:30 a.m. Central Time | | | www.virtualshareholdermeeting.com/CASY2024 | | | June 26, 2024 | | | On or around July 17, 2024 | |

| | We encourage you to access the Annual Meeting webcast prior to the start time. | | | The Annual Meeting is virtual only via live audio webcast – there is no physical location for the meeting. You can ask questions and vote during the meeting. | | | Shareholders of record at the close of business on the record date are entitled to vote at the Annual Meeting. | | | Proxy materials are first being distributed or made available as of the mailing date. | |

At the meeting, the following items will be considered and acted upon, as described further in the Proxy Statement:

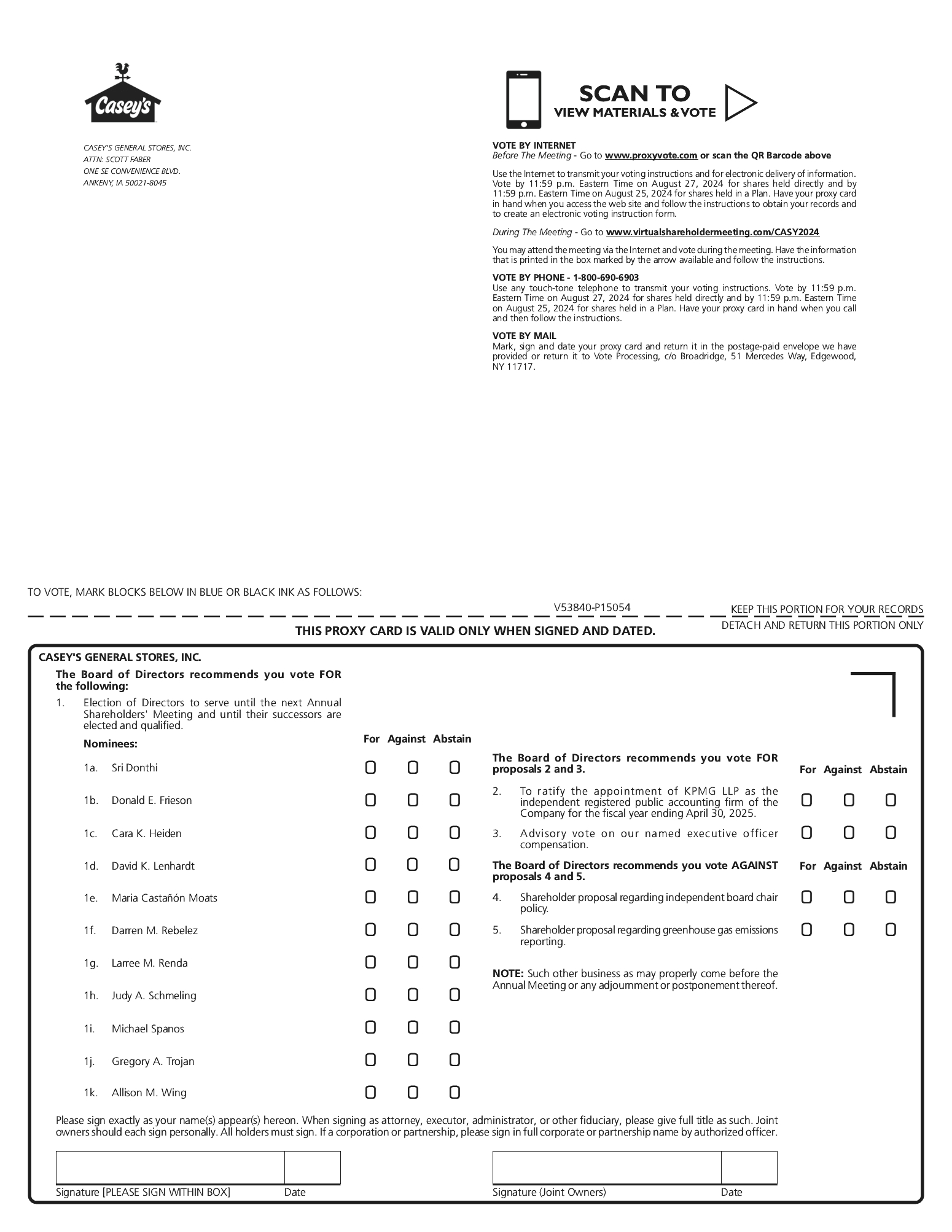

| | 1 | | | To elect eleven directors to serve until the next annual shareholders’ meeting and until their successors are elected and qualified | |

| | 2 | | | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2025 | |

| | 3 | | | To hold an advisory vote on our named executive officer compensation | |

| | 4 | | | Shareholder proposal regarding independent board chair policy, if properly presented at the Annual Meeting | |

| | 5 | | | Shareholder proposal regarding greenhouse gas emissions reporting, if properly presented at the Annual Meeting | |

| | 6 | | | To transact such other business as may properly come before the Annual Meeting or at any adjournment or postponement thereof | |

Your vote is important. It is important that your shares be represented and voted, whether or not you plan to attend the Annual Meeting. You can vote by any of the following methods:

| | Internet | | | Telephone | | | Mail | | | At the Annual Meeting | |

| | You may vote on the Internet at www.proxyvote.com. | | | You may vote by touch-tone telephone by calling 1-800-690-6903 or the number on your voter instruction form. | | | If you received/requested paper proxy materials, return your completed/signed proxy card or voter instruction form in the postage-paid envelope provided. | | | | |

| | You will need the 16-digit control number included in your notice, proxy card or voter instruction form in order to vote. | | |||||||||

By Order of the Board of Directors,

Scott Faber

Vice President, Deputy General Counsel and

Corporate Secretary

July 17, 2024

| | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on August 28, 2024 | |

| | The Notice of Annual Meeting of Shareholders, the Proxy Statement and Annual Report are available at http://materials.proxyvote.com/147528 | |

TABLE OF CONTENTS

| | SECTION | | | PG. | |

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | |

| | SECTION (cont.) | | | PG. | |

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | | ||

| | | | |

Casey’s is the third largest convenience store retailer in the United States – highlights include:

| | Casey’s – At-a-Glance | | ||||||||||||

| | 2,658 Stores | | | 17 U.S. States | | | 45,000 Team Members | | | $14.9 billion FY24 Revenue | | | 7.9 million Rewards Members | |

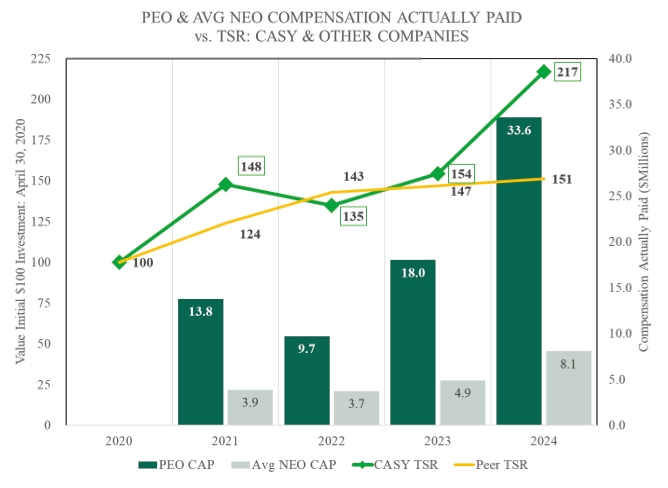

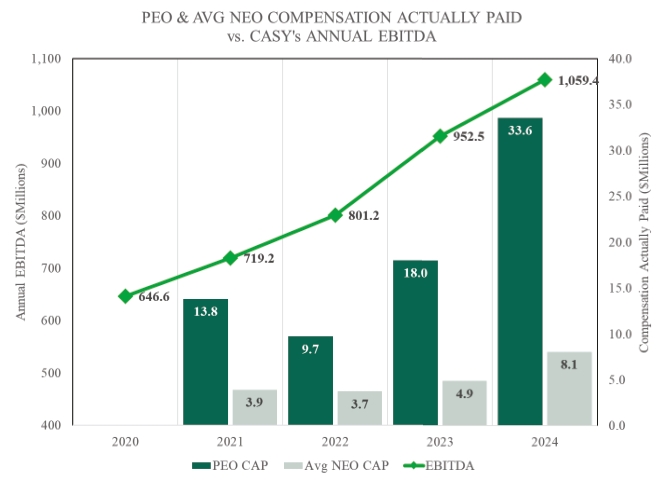

Casey’s once again delivered exceptional performance for its shareholders during the 2024 fiscal year – highlights include (as compared to the 2023 fiscal year-end):

| | Net Income | | | EBITDA* | | | Share Price | | | Diluted EPS | |

| | $501.9 million ↑ $446.7 million (FY23) | | | $1.06 billion ↑ $952.5 million (FY23) | | | $319.58 ↑ $228.82 (FY23) | | | $13.43 ↑ $11.91 (FY23) | |

| | 12.4% increase | | | 11.2% increase | | | 39.7% increase | | | 12.8% increase | |

| | *EBITDA is a non-GAAP measure defined as net income before net interest expense, income taxes, depreciation and amortization. See Appendix A for reconciliation of net income to EBITDA. | | |||||||||

| | August 28, 2024 8:30 a.m. CT | | | www.virtualshareholdermeeting.com/CASY2024 (virtual only – there is no physical meeting location) | | | Record Date: June 26, 2024 | |

| | Proposals | | | Description | | | Board’s Voting Recommendation | |

| | 1. Election of Directors | | | To elect eleven directors to serve until the next annual shareholders’ meeting and until their successors are elected and qualified | | | ✔ FOR each nominee | |

| | 2. Ratify Auditors | | | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2025 | | | ✔ FOR | |

| | 3. “Say on Pay” | | | To hold an advisory vote on our named executive officer compensation | | | ✔ FOR | |

| | 4. Shareholder Proposal | | | Shareholder proposal regarding independent board chair policy, if properly presented at the Annual Meeting | | | ☒ AGAINST | |

| | 5. Shareholder Proposal | | | Shareholder proposal regarding greenhouse gas emissions reporting, if properly presented at the Annual Meeting | | | ☒ AGAINST | |

Notice & Proxy Statement | | | 1 | | |  |

Proposal 1 Summary: Election of Directors

**The Board recommends a vote FOR all director nominees**

Nominees | | | Div. | | | Age | | | Director Since | | | Current Committees | | | Nominee Composition* / Highlights | | |||||||||||||

| | A | | | NCG | | | C/HC | | |||||||||||||||||||||

| Darren M. Rebelez Board Chair President and CEO, Casey’s General Stores, Inc. | | | ✔ | | | 58 | | | 2019 | | | | | | | | | | | Gender Diversity = 5 of 11 female (45%) Racial/Ethnic Diversity = 4 of 11 diverse (36%) Average Age = 61 years Average Tenure = 5 years | | | | |||||

| Judy A. Schmeling (I) Lead Independent Director Former COO, HSN, Inc. and President, Cornerstone Brands | | | ✔ | | | 64 | | | 2018 | | | | | M | | | | |||||||||||

| Sri Donthi (I) Executive VP and Chief Technology Officer, Advance Auto Parts, Inc. | | | ✔ | | | 57 | | | 2022 | | | M | | | | | | | | | Governance Practices ✔ Annual election of directors ✔ Majority voting in uncontested elections ✔ Robust Lead Independent Director duties ✔ All directors independent other than CEO ✔ All committee members are independent ✔ Regular executive sessions ✔ Meaningful stock ownership requirements ✔ Proxy access (3/3/20/20) ✔ Single voting class of securities ✔ Robust code of conduct/ethics ✔ Regular board/committee self-assessments ✔ Director over-boarding limits ✔ Strong corporate governance guidelines ✔ ESG oversight by the Nom./Gov. Committee | | | | ||||

| Donald E. Frieson (I) Retired Executive VP, Supply Chain, Lowe’s Companies, Inc. | | | ✔ | | | 66 | | | 2018 | | | | | M | | | M | | ||||||||||

| Cara K. Heiden (I) Retired Co-President, Wells Fargo Home Mortgage | | | ✔ | | | 68 | | | 2017 | | | C* | | | | | | |||||||||||

| David K. Lenhardt (I) Former President and CEO, PetSmart, Inc. | | | | | 55 | | | 2018 | | | M* | | | C | | | | |||||||||||

| Maria Castañón Moats (I) Retired Partner, PricewaterhouseCoopers, LLP | | | ✔ | | | 56 | | | 2024 | | | M* | | | | | | | | | (I) = Independent Div. = Diversity (gender, race, or ethnicity) C = Chair M = Member A = Audit * = Audit Committee Financial Expert NCG = Nominating and Corporate Gov. C/HC = Compensation and Human Capital | | | | ||||

| Larree M. Renda (I) Retired Executive VP, Safeway, Inc. | | | ✔ | | | 66 | | | 2014 | | | | | | | C | | |||||||||||

| Michael Spanos (I) COO, Delta Air Lines, Inc. | | | | | 59 | | | 2022 | | | M* | | | | | | ||||||||||||

| Gregory A. Trojan (I) Former CEO, BJ’s Restaurants, Inc. | | | | | 65 | | | 2021 | | | | | | | M | | | | ||||||||||

| Allison M. Wing (I) CEO, Oobli, Inc. | | | ✔ | | | 57 | | | 2018 | | | | | | | M | | |||||||||||

Notice & Proxy Statement | | | 2 | | |  |

Proposal 2 Summary: Ratify Independent Registered Public Accounting Firm

**The Board recommends a vote FOR ratification of KPMG**

| | Summary Information About KPMG | |

| | The Audit Committee has selected KPMG LLP to act as its independent registered public accounting firm for the fiscal year ending April 30, 2025, and seeks ratification of the selection. KPMG has been the Company’s auditor since 1987. | |

Proposal 3 Summary: “Say on Pay”

**The Board recommends a vote FOR its NEO compensation**

| | FY24 Named Executive Officers | | | Compensation Governance | | |||

| |  | | | Darren M. Rebelez President and CEO | | | What We Do – Best Practices ✔ Strong pay for performance ✔ Incentive pay with multiple metrics tied to long-term shareholder value ✔ Meaningful stock ownership requirements for officers ✔ Double-trigger change of control provisions ✔ Independent compensation consultant ✔ Annual “say on pay” vote What We Don’t Do ☒ No guaranteed incentive payments ☒ No uncapped incentive compensation opportunities ☒ No hedging or pledging of Company stock ☒ No tax gross-ups ☒ No excessive benefits or perquisites ☒ No single-trigger change of control provisions “Say on Pay” Results: 2021: 97.9%, 2022: 97.0%, 2023: 97.6% ⯀ Pay program in FY24 was substantially the same as FY23, which as noted, our shareholders overwhelmingly supported | |

| |  | | | Stephen P. Bramlage, Jr. Chief Financial Officer | | |||

| |  | | | Ena Williams Chief Operating Officer | | |||

| |  | | | Thomas P. Brennan Chief Merchandising Officer | | |||

| |  | | | Chad M. Frazell Chief Human Resources Officer | | |||

| | FY24 Direct Compensation Elements | | ||||||

| | Element | | | Purpose | | | FY24 Metrics | |

| | Base Salary | | | Attracts and retains executives by providing competitive fixed annual cash compensation | | | Evaluated annually based on market and peer group data and individual and Company performance | |

| | Annual Incentive Program (“AIP”) | | | Performance based pay that delivers annual cash incentives when key financial/operating targets are met or exceeded | | | ⯀ 60% - EBITDA ⯀ 40% - same store sales growth (inside sales) | |

| | Long-Term Incentive Program (“LTIP”) | | | Performance and time-based equity compensation to attract, retain and reward executives when key financial/operating targets are met or exceeded over a three-year performance period | | | ⯀ 75% PSUs (1/2 ROIC, ½ EBITDA) (+/- 25% rTSR modifier based on top/bottom quartile TSR) ⯀ 25% time-based RSUs | |

| | FY24 Overall Pay Mix | | | Incentive Highlights | | ||||||||||||

| | Target Direct Comp. Mix (CEO): | | | FY24 AIP Payout: Due to the exceptional financial performance of the Company during the 2024 fiscal year, including record EBITDA, the 2024 AIP achieved a payout of 157% of target. | | ||||||||||||

| | | | | | | | | | | ||||||||

| | | | Sal. | | | AIP | | | LTIP | | | = 88% at-risk | | ||||

| | | | 12% | | | 19% | | | 69% | | |||||||

| | Target Direct Comp. Mix (other NEO avg.): | | | FY22-FY24 LTIP Payout: Due to the continued long-term financial success of the Company, the LTIP PSU awards granted during the 2022 fiscal year vested at 200% of target for the ROIC PSUs and 200% of target for the EBITDA PSUs, for a total LTIP payout at 200% of target. | | ||||||||||||

| | | | | | | | | | | ||||||||

| | | | Sal. | | | AIP | | | LTIP | | | = 76% at-risk | | ||||

| | | | 24% | | | 22% | | | 54% | | |||||||

| | | | | | | | | | | ||||||||

Notice & Proxy Statement | | | 3 | | |  |

Proposals 4 and 5: Shareholder Proposals

**The Board recommends a vote AGAINST both shareholder proposals**

| | Shareholder Proposal Regarding Independent Board Chair Policy (Proposal 4) Shareholder Proposal Regarding Greenhouse Gas Emissions Reporting (Proposal 5) | |

| | The Board recommends a vote against both shareholder proposals. | |

Notice & Proxy Statement | | | 4 | | |  |

Why am I receiving these materials?

The Company’s Board of Directors, through the Notice of Internet Availability of Proxy Materials, the Notice of Annual Meeting of Shareholders, this Proxy Statement and the proxy card, is soliciting your vote on matters being submitted for shareholder approval at the Company’s 2024 annual shareholders’ meeting (the “Annual Meeting”) and any adjournments or postponements thereof.

When is the Annual Meeting?

The 2024 Annual Meeting will be held at 8:30 a.m. Central Time on August 28, 2024.

Is the Annual Meeting being held in a virtual only format?

Yes. Due to strong virtual shareholder participation last year, and to provide the opportunity for shareholders in a broader geography to attend, the Annual Meeting will be virtual only, via live audio webcast at www.virtualshareholdermeeting.com/CASY2024. There is no in-person option to attend the Annual Meeting. We encourage you to access the webcast prior to the start time of 8:30 am Central Time. If you encounter any difficulties accessing the virtual meeting, please call: (844) 976-0738 (toll-free), or (303) 562-9301 (international).

Do I need anything to attend the Annual Meeting?

Yes. To participate in the Annual Meeting, you will need Internet access and the 16-digit control number included on your Notice, proxy card or voting instruction form. When accessing the meeting website, insert the control number where indicated.

Can I vote my shares at the virtual Annual Meeting format?

Yes. You will be able to vote your shares electronically during the Annual Meeting by following the voting prompts at www.virtualshareholdermeeting.com/CASY2024.

Can I ask questions through the virtual Annual Meeting format, and are there any rules for questions?

We are committed to ensuring that shareholders be afforded the same rights and opportunities to participate as they would at an in-person meeting, which includes the ability to ask questions of our Board, senior leadership team and a representative from our independent registered public accounting firm, KPMG LLP, during the allotted question and answer session that follows adjournment of the formal business of the Annual Meeting. The Board Chair (or designee) may exercise discretion as to the order in which questions are asked and the amount of time devoted to any one question, and we reserve the right to edit or reject questions we deem profane or otherwise inappropriate. In addition, we will not entertain questions that are (i) not pertinent to meeting matters or the business of the Company, (ii) related to material non-public information of the Company, (iii) related to personal grievances, (iv) derogatory references to individuals or that are otherwise in bad taste, (v) repetitious of statements made by another shareholder, or (vi) related to pending or threatened litigation (see the Annual Meeting rules and procedures on the meeting website).

To submit your question the day of the Annual Meeting, beginning at 8:15 a.m. Central Time, log into www.virtualshareholdermeeting.com/CASY2024, click on the Q&A button, type your question into the “Submit a Question” field, and click “Submit”. If time does not allow for all questions, or a shareholder has a question after the annual meeting, please direct those questions to Brian J. Johnson, Senior VP – Investor Relations and Business Development, Casey’s General Stores, Inc., One SE Convenience Blvd., Ankeny, Iowa 50021.

Do I need to be a shareholder to attend the Annual Meeting?

No. The Annual Meeting will be accessible to anyone who is interested by visiting www.virtualshareholdermeeting.com/CASY2024; however, non-shareholders will not be permitted to vote or submit questions through the meeting website.

What is the record date for the Annual Meeting?

The record date for the Annual Meeting is June 26, 2024 (the “Record Date”).

What is the mailing date for the Annual Meeting?

This Proxy Statement and the proxy card are first being provided and/or made available on or about July 17, 2024, to each holder of record of common stock, no par value per share (“Common Stock”), of the Company at the close of business on the Record Date.

Notice & Proxy Statement | | | 5 | | |  |

How many shares of Common Stock were issued and outstanding on the Record Date?

There were 37,111,457 shares of Common Stock issued and outstanding on the Record Date. Each share of Common Stock will be entitled to one vote on all matters.

What are the agenda items for the Annual Meeting?

At the Annual Meeting, shareholders will vote on the following matters (i) to elect eleven directors to serve until the next annual shareholders’ meeting and until their successors are elected and qualified; (ii) to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending April 30, 2025; (iii) to hold an advisory vote on our named executive officer compensation; (iv) to vote on two shareholder proposals, if properly presented at the Annual Meeting, and (v) to transact such other business as may properly come before the Annual Meeting or at any adjournment or postponement thereof.

Are there any other items of business to be conducted at the Annual Meeting?

The Board is not aware as of this date of any other matters proposed to be presented at the Annual Meeting other than those set forth herein. However, the persons named on the proxy card will have discretionary authority to vote on any other matter that is properly presented at the meeting, according to their best judgment.

Who is entitled to vote at the Annual Meeting?

The only securities eligible to vote at the Annual Meeting are shares of Common Stock. Only holders at the close of business on the Record Date of June 26, 2024, are entitled to vote. Each share represents one vote, and all shares vote together as a single class. A list of shareholders entitled to notice of the Annual Meeting is on file at the Company’s office located at One SE Convenience Blvd., Ankeny, Iowa 50021, and will be available electronically to shareholders on the virtual meeting website during the Annual Meeting.

How many shares are required for a quorum?

The presence in person or by proxy of shareholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum. Shareholders are entitled to one vote per share. Shares held by shareholders abstaining from voting but otherwise present at the meeting in person or by proxy (“abstentions”), and broker shares that are not voted on a particular proposal because the broker does not have discretionary voting power for that proposal and have not received voting instructions from the beneficial owner (“broker non-votes”), are included in determining whether a quorum is present.

What vote is required for Proposal 1 – election of directors?

For Proposal 1, every shareholder has the right to vote each share of Common Stock owned by such shareholder on the Record Date for as many persons as there are directors to be elected. Cumulative voting is not permitted. The Company’s Articles of Incorporation provide for a majority voting standard in uncontested elections, meaning that the number of votes cast “FOR” a director nominee must exceed the number of votes cast “AGAINST” that director nominee (a “Majority Vote”). Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of the vote for Proposal 1.

What if a director nominee does not receive a Majority Vote?

The Company’s Corporate Governance Guidelines provide that any director in an uncontested election who does not receive a Majority Vote is expected to tender his or her resignation as a director. All of the current directors have tendered irrevocable resignations to the Company that will be effective if that director does not receive a Majority Vote and the Board accepts such resignation.

What vote is required for Proposal 2 – ratification of independent registered public accounting firm?

Proposal 2 requires the affirmative vote of the majority of the votes cast on the proposal, meaning that the number of shares voted “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal. Abstentions will not be counted as votes cast and will have no effect on the results of the vote for Proposal 2. Broker non-votes are not expected for Proposal 2.

What vote is required for Proposal 3 – advisory vote on named executive officer compensation (“say-on-pay”)?

Proposal 3 requires the affirmative vote of the majority of the votes cast on the proposal, meaning that the number of shares voted “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of the vote for Proposal 3.

Notice & Proxy Statement | | | 6 | | |  |

What vote is required for Proposals 4 and 5 – shareholder proposals?

Proposals 5 and 6 each require the affirmative vote of the majority of the votes cast on the proposal, meaning that the number of shares voted “FOR” each proposal must exceed the number of shares voted “AGAINST” each proposal. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of the vote for either Proposal 4 or 5.

How do I vote my shares?

You may vote at the Annual Meeting through the virtual meeting website at www.virtualshareholdermeeting.com/CASY2024 or by submitting a completed proxy.

What is a proxy?

By submitting a proxy, you are legally authorizing another person to vote your shares. The proxy card designates Darren M. Rebelez and Judy A. Schmeling to vote your shares in accordance with the voting instructions you indicate on your proxy card. If you submit your proxy card designating Mr. Rebelez and Ms. Schmeling as the individuals authorized to vote your shares, but you do not indicate how your shares are to be voted, your shares will be voted by these individuals in accordance with the Board’s recommendations, which are described in this Proxy Statement. If any matters, other than those in this Proxy Statement, are properly raised at the Annual Meeting, these individuals will have the authority to vote your shares on those matters in accordance with their discretion and judgment.

How do I vote by submitting a completed proxy?

Mail: You can vote your shares by mail by requesting a paper copy of the proxy materials by following the instructions on the Notice and promptly returning your completed proxy card in the envelope provided. For your proxy to be validly submitted and your shares to be voted in accordance with your instructions, mail your proxy card in time for it to be received by the morning of August 28, 2024.

Telephone: You can vote your shares by calling the toll-free number indicated on your proxy card at any time on a touch-tone telephone and following the recorded instructions. If you vote by telephone, you may submit your voting instructions until 11:59 pm Eastern Time on August 27, 2024. If you are a beneficial owner, or you hold your shares in “street name,” contact your bank, broker or other holder of record to determine whether you will be able to vote by telephone.

Internet (prior to the Annual Meeting): You can vote your shares on the Internet by going to the website indicated on your proxy card and following the steps outlined. If you vote on the Internet, you may submit your voting instructions until 11:59 pm Eastern Time on August 27, 2024. If you are a beneficial owner, or you hold your shares in “street name,” contact your bank, broker or other holder of record to determine whether you will be able to vote on the Internet.

What if I hold shares through the Company’s 401(k) Plan?

If you hold shares through the Company’s 401(k) Plan (the “401K Plan”), the shares are not registered in your name, and your name will not appear in the Company’s register of shareholders. Instead, your shares are registered in the name of a trust, administered by Principal Trust Company (the “Trustee”). Only the Trustee will be able to vote your shares, even if you attend the Annual Meeting. You can direct the voting of the shares allocated to your account—including changing or revoking a previously submitted vote—on the Internet, by telephone or by mail on a proxy instruction card, but cannot direct the voting of your 401K Plan shares at the meeting. If voting instructions for shares in the 401K Plan are not returned, those shares will be voted by the Trustee in the same proportion as the shares for which voting instructions are returned by the other 401K Plan participants. To allow time for the Trustee to tabulate the vote of the 401K Plan shares, participant instructions must be received before 11:59 pm Eastern Time on August 25, 2024.

Can I change my vote?

Yes. If you have previously submitted a proxy card, you may change any vote you may have cast by following the instructions on the proxy card to vote by telephone or on the Internet, or by completing, signing, dating and returning a new proxy card, or by attending the Annual Meeting and voting your shares. If your shares are registered in the “street name” of a bank, broker or other holder of record, please contact the applicable bank, broker or record holder for instructions on how to change or revoke your vote.

Is my proxy revocable?

Yes. Your proxy is revocable. If you are a shareholder of record, you may revoke it by mail before the Annual Meeting by sending a written notice to Scott Faber, Corporate Secretary, Casey’s General Stores, Inc., One SE Convenience Blvd., Ankeny, Iowa 50021. If you wish to revoke your submitted proxy card and submit new voting instructions by mail, then you must sign, date and mail a new proxy card with your new voting instructions. Please mail any new proxy card in time for it to be received by the

Notice & Proxy Statement | | | 7 | | |  |

morning of August 27, 2024. If you are a shareholder of record and you voted your proxy card by telephone or on the Internet, you may revoke your submitted proxy and/or submit new voting instructions by that same method, which must be received by 11:59 pm Eastern Time on August 27, 2024. You also may revoke your proxy card by attending the Annual Meeting and voting your shares. Attending the Annual Meeting without taking one of the actions above will not revoke your proxy. If you are a beneficial owner, or you hold your shares in “street name” as described below, please contact your bank, broker or other holder of record for instructions on how to change or revoke your vote.

What if I hold my shares in “street name” through a bank or broker?

If your shares are not registered in your name but in the “street name” of a bank, broker or other holder of record (a “Nominee”), your name will not appear in the Company’s register of shareholders. Your Nominee, as the record holder of your shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to your Nominee, your Nominee will be entitled to vote the shares with respect to “discretionary” items but will not be permitted to vote the shares with respect to “non-discretionary” items—those shares are treated as broker non-votes. Proposal 1—election of directors, Proposal 3—executive officer compensation, and Proposals 4 and 5—shareholder proposals, are “non-discretionary” items for any Nominee holding shares on your behalf. As a result, if your shares are held in “street name” and you do not provide instructions as to how your shares are to be voted, your Nominee will not be able to vote your shares on these proposals. Note that even if you attend the virtual Annual Meeting, you cannot vote the shares that are held by your Nominee unless you have a proxy from your Nominee. If you do not provide instructions to your Nominee and your Nominee does not vote your shares on your behalf with respect to Proposal 2—ratification of the selection of the independent registered public accounting firm, which is a “discretionary” item, your shares will not be counted in determining whether a quorum is present for the Annual Meeting. If your Nominee exercises its “discretionary” authority to vote your shares on Proposal 2, your shares will be counted in determining whether a quorum is present for all matters presented at the Annual Meeting. We urge you to provide instructions to your Nominee so that your votes may be counted on these important matters. Please contact your Nominee for the deadlines for submission of your vote and for instructions on how to change or revoke your vote.

The Company’s principal executive office mailing address is One SE Convenience Blvd., Ankeny, Iowa 50021.

| | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on August 28, 2024 | |

| | To attend the virtual Annual Meeting, visit www.virtualshareholdermeeting.com/CASY2024. Information on how to vote at the virtual Annual Meeting is available by contacting Scott Faber, Corporate Secretary at (515) 963-3802, or by writing to us at: Casey’s General Stores, Inc., Corporate Secretary, One SE Convenience Blvd., Ankeny, Iowa 50021. The Notice of Annual Meeting of Shareholders, this Proxy Statement and the Annual Report to Shareholders for the year ended April 30, 2024, are available at http://materials.proxyvote.com/147528. The Company also makes available, free of charge through its website—www.caseys.com, under the “Investor Relations” link at the bottom of each page—this Proxy Statement, the Annual Report to Shareholders, the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after these documents are electronically filed with, or furnished to, the Securities and Exchange Commission (the “SEC”). | |

Notice & Proxy Statement | | | 8 | | |  |

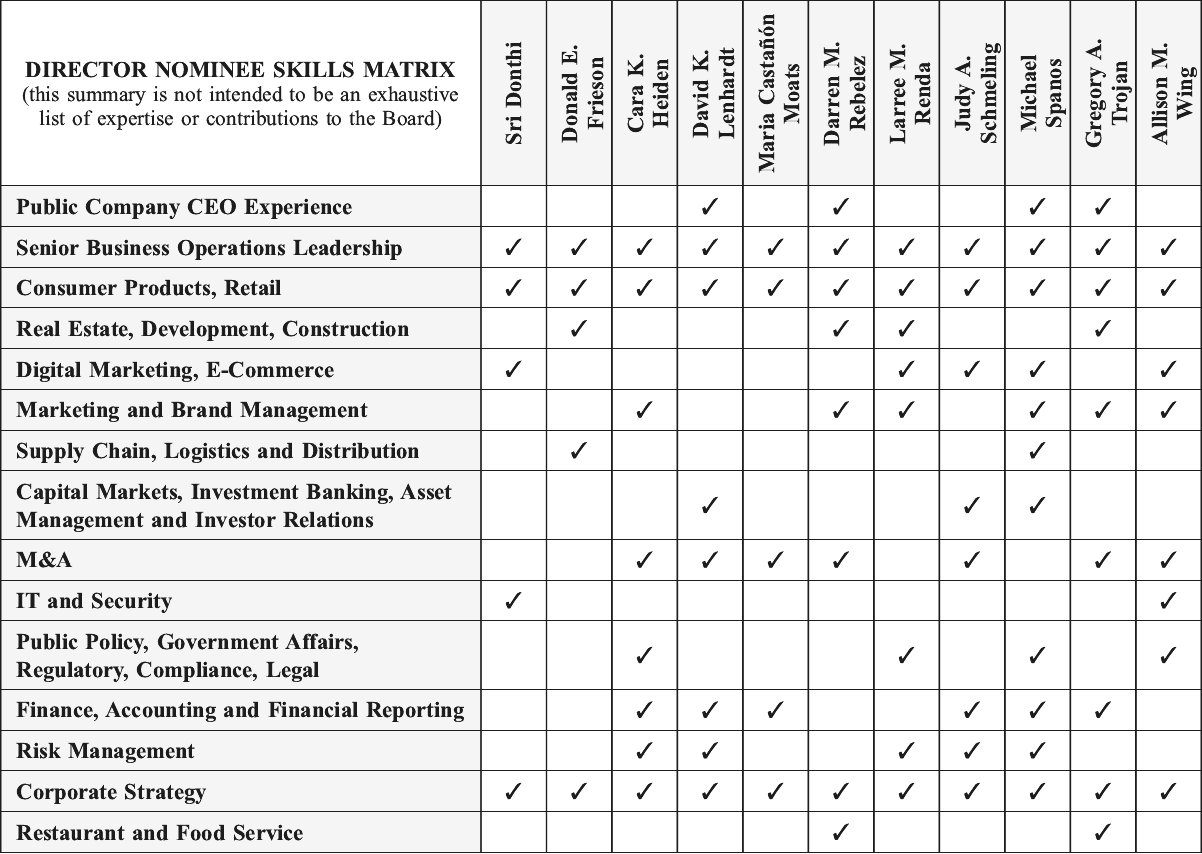

To ensure the Board is comprised of highly-talented and experienced individuals, the Nominating and Corporate Governance Committee (the “NCG Committee”) annually assesses the competencies and skills possessed by each director. The NCG Committee also considers the skills and competencies the Board as a whole should possess in order to provide effective oversight of the Company’s business. Based on that assessment and as otherwise deemed appropriate, the NCG Committee may establish search criteria for Board candidates, select suitable candidates for interviews and recommend appropriate candidates to the Board for consideration. Board candidates are considered based on various criteria, including relevant business and board skills and experiences, judgment and integrity, reputation in their profession, diversity of background, education, leadership ability, concern for the interests of shareholders and relevant regulatory guidelines. These considerations are made in light of the needs of the Board at the particular point in time.

The director nominees have a broad skillset across areas that are directly relevant to the long-term success of the Company:

The Company is proud of its long-standing and ongoing commitment to diversity on its Board:

| | Board Diversity Matrix (as of July 17, 2024)* | | ||||||||||||

| | Total Numbers of Directors | | | 11 | | |||||||||

| | | | Female | | | Male | | | Non-Binary | | | Did Not Disclose Gender | | |

| | Part 1: Gender Identity | | | | | | | | | | ||||

| | Directors | | | 5 | | | 6 | | | — | | | — | |

| | Part 2: Demographic Background | | | | | | | | | | ||||

| | African American or Black | | | — | | | 1 | | | — | | | — | |

| | Alaskan Native or Native American | | | — | | | — | | | — | | | — | |

Notice & Proxy Statement | | | 9 | | |  |

| | Board Diversity Matrix (as of July 17, 2024)* | | ||||||||||||

| | Total Numbers of Directors | | | 11 | | |||||||||

| | | | Female | | | Male | | | Non-Binary | | | Did Not Disclose Gender | | |

| | Asian | | | — | | | 1 | | | — | | | — | |

| | Hispanic or Latinx | | | 1 | | | 1 | | | — | | | — | |

| | Native Hawaiian or Pacific Islander | | | — | | | | | — | | | — | | |

| | White | | | 4 | | | 3 | | | — | | | — | |

| | Two or More Races or Ethnicities | | | — | | | — | | | — | | | — | |

| | LGBTQ+ | | | — | | |||||||||

| | Did Not Disclose Demographic Background | | | — | | |||||||||

* | To see our Board Diversity Matrix from last year, as of July 26, 2023, please see pages 9-10 of our proxy statement filed with the SEC on July 26, 2023. |

The Board may consist of between seven and twelve persons, and individuals may be elected by the Board to fill any vacancies or to occupy any new directorships. The person filling a vacancy or a newly-created directorship serves until the next annual shareholders’ meeting following their election and until their successor is elected and qualified. All director nominees stand for annual election.

On June 5, 2024, the Board, based on a recommendation of the NCG Committee, increased the number of directors from ten to eleven, and appointed Ms. Castañón Moats to the Board effective July 1, 2024. Ms. Castañón Moats, who brings a wealth of public accounting, governance and leadership experience to the Board, is standing for annual election by the shareholders for the first time at the Annual Meeting – her detailed biography is set forth below.

The Board has no fixed policy with respect to the combination of the positions of Board Chair and CEO, as the Board believes that it is in the best interests of the Company and its shareholders for the Board to assess the Board leadership structure in light of the circumstances then existing. If the Board Chair is not an independent director, the independent directors will designate a lead independent director, selected from the independent directors, who will carry out those duties as set forth in the Company’s Corporate Governance Guidelines (the “Guidelines”).

Over the course of its 2023 fiscal year, the NCG Committee and the Board conducted a detailed analysis and thoroughly discussed the relative benefits of combining the Board Chair and CEO roles versus retaining separate roles. After considering the perspectives of our independent directors, peer company practices and governance considerations, the Board unanimously elected Mr. Rebelez, our President and CEO, as Board Chair effective June 2, 2023, in anticipation of the approaching retirement of the Company’s prior Board Chair, H. Lynn Horak. The Board believes that Mr. Rebelez’s inclusive leadership style, exceptional track record of success since his appointment as President and CEO in 2019, and deep understanding of the Company’s business, growth opportunities and challenges, makes him uniquely qualified to provide strong and effective leadership to the Board, foster a collaborative relationship between the Board and management, and promote alignment of the Company’s long-term strategic plan with its operational and financial execution.

In addition, the independent directors reaffirmed the Board’s commitment to empowered and active independent Board leadership by unanimously electing Ms. Schmeling as Lead Independent Director (“LID”), also effective June 2, 2023. Ms. Schmeling was elected after a detailed, thorough and formal evaluation and selection process, led by the NCG Committee. The NCG Committee determined that her exceptional mix of strategic management skills and executive and outside board leadership experience (including outside board chair experience) was ideal for the role and responsibilities of LID and to serve as the primary liaison between the Board and management going forward.

Notice & Proxy Statement | | | 10 | | |  |

The position of LID at Casey’s will be evaluated by the NCG Committee, and elected by the independent directors, on an annual basis, taking into consideration the needs of the Board and the Company at such time. The role itself has a clear mandate, significant authority and well-defined and robust responsibilities/duties under the Guidelines, which were significantly enhanced as part of the analysis and evaluation process set forth above. The LID responsibilities/duties, as set forth in the Guidelines, include the following:

Board Leadership

• | Preside at all executive sessions of the independent directors and at any other meetings of the Board at which the Board Chair is not present, or otherwise at the Board Chair’s request |

• | Serve as interim Board Chair if the Board Chair is unable to perform his or her duties |

• | Participate in establishing, soliciting input from the independent directors for, and approving Board meeting agendas and the Board meeting calendar and schedule, and establish agendas for the executive sessions of the independent directors |

• | Call meetings of the independent directors, if and as appropriate |

• | Provide feedback regarding the quality, quantity, appropriateness and timeliness of information provided to the Board |

• | Advise and recommend outside advisors and consultants who report to the Board, and authorize the retention of those who report directly to the independent directors |

• | Where appropriate, consult with the Chief Legal Officer for advice and counsel in the course of fulfilling the LID’s duties |

• | Serve as an independent contact for independent directors on matters deemed to be best discussed initially with the LID or in other situations where the Board Chair is unavailable |

• | Collaborate with the Board Chair and the NCG Committee, and as appropriate, the Board, to develop and implement the procedures governing the Board’s work |

Board Culture

• | Facilitate the efficient and effective functioning and performance of the Board and its committees, as appropriate |

• | Along with the Board Chair, encourage and facilitate active and candid participation of all directors, including by fostering an environment of open dialogue and constructive feedback among the independent directors that ensures diverse viewpoints of all directors are heard |

• | Facilitate discussion among the independent directors on key issues and concerns outside of Board meetings, in an effort to develop consensus between the independent directors |

Internal Communication

• | Serve as the principal liaison between the independent directors and the Board Chair/CEO to facilitate clear communication, respect, and trust |

• | Ensure smooth information flow by providing feedback to the Board Chair regarding issues discussed, views expressed, decisions made, etc. during executive sessions of the independent directors |

• | Participate in discussions with the Board Chair regarding the results of the annual CEO, Board and committee performance evaluations |

• | Meet regularly with the Board Chair outside of Board meetings |

• | Review with the Corporate Secretary the LID responsibilities on an annual basis, and recommend to the Board for approval of any modifications or changes |

Stakeholder Engagement

• | As deemed appropriate by the Board, be available for consultation and serve as a point of contact for direct communication with shareholders and other key constituents who request communication with independent directors |

Notice & Proxy Statement | | | 11 | | |  |

• | Act as a spokesperson on behalf of the Board in circumstances where it is appropriate for the Board to have a voice independent of management |

Succession Planning, Performance Evaluations, Compensation and Development

• | Help facilitate, and participate in discussions with, the Compensation and Human Capital Committee, and as appropriate the independent directors and the Board, regarding: (i) CEO succession planning, (ii) the annual performance evaluation of the CEO, and (iii) CEO compensation |

• | Help facilitate, and participate in discussions with, the NCG Committee, and as appropriate the independent directors and the Board, regarding: (i) recommendations for Board and committee composition, leadership and development, and Board succession, including the interview and selection process for Board candidates and the chair position for each Board committee; conduct interviews, along with the NCG Chair, of candidates for such positions, and (ii) the Board, committee and director self-assessment process |

The NCG Committee has recommended, and the Board has nominated, each of the eleven director nominees below to stand for election at the Annual Meeting, each for an annual term expiring in 2025. The Board believes that each nominee has demonstrated outstanding achievement in their careers, possesses personal and professional integrity and independent judgment, and has the necessary skills and qualifications to provide effective oversight, strategic guidance and contribute to the future success and growth of the Company.

It is intended that all proxies, unless contrary instructions are given thereon, will be voted FOR the election of the eleven director nominees. In the event of death or disqualification of any nominee, or the refusal or inability of any nominees to serve as a director, the proxy may be voted with discretionary authority for the election of a substitute nominee approved by the Board.

*THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF

EACH OF THE ELEVEN DIRECTOR NOMINEES*

Notice & Proxy Statement | | | 12 | | |  |

| | Information About the Director Nominees | |

| | I = Independent, A = Audit Committee, * = Audit Committee Financial Expert, NCG = Nominating and Corporate Governance Committee, C/HC = Compensation and Human Capital Committee | |

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Darren M. Rebelez, 58 Board Chair President and CEO, Casey’s General Stores, Inc. | | | Casey’s General Stores, Inc. President/CEO (2019-Present) IHOP Restaurants (unit of Dine Brands Global) President (2015-2019) 7-Eleven, Inc. EVP/COO (2007-2014) | | | ⯀ Public Company CEO Experience ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Real Estate, Development, Construction ⯀ Marketing, Brand Management ⯀ M&A ⯀ Restaurant and Food Service ⯀ Corporate Strategy | |

| | Mr. Rebelez, the Company’s President, CEO and Board Chair, brings a wealth of experience as an executive in the convenience store and restaurant industries, most recently as the President of IHOP Restaurants, a unit of Dine Brands Global, Inc., which franchises and operates restaurants under the Applebee’s and IHOP brands. Prior to joining Dine Brands, Mr. Rebelez was employed by 7-Eleven, Inc., a convenience store chain, as Executive VP and COO. Before 7-Eleven, Mr. Rebelez held numerous management roles within ExxonMobil. In 2024, Mr. Rebelez was named by CSP as its “Retailer Leader of the Year.” His wide-ranging experience enables Mr. Rebelez to provide important insights to the Board regarding operations, marketing, digital engagement, product development, management and strategic planning. | | |||||||||

| | Director since: 2019, Committees: None, Other public boards: Genuine Parts Company (since 2023), Globe Life (2010-2023) | | |||||||||

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Judy A. Schmeling, 64 (I) Lead Independent Director Former COO, HSN, Inc. and Former President, Cornerstone Brands | | | HSN, Inc. COO (2013-2017) EVP/CFO (2008-2017) EVP/CFO (2002-2008; when known as IAC Retailing) Financial/leadership positions (1994-2002) Cornerstone Brands (a division of HSN) President (2016-2017) | | | ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Digital Marketing, E-Commerce ⯀ Capital Markets, Investment Banking, Asset Management, IR ⯀ M&A ⯀ Finance, Accounting, Financial Reporting ⯀ Risk Management ⯀ Corporate Strategy | |

| | Ms. Schmeling, the Company’s Lead Independent Director, is a seasoned executive, bringing over 20 years of financial, operational and leadership experience with her from HSN, a leading interactive multichannel retailer and the first television shopping network. She has also served in various roles through multiple corporate transitions, including the spin-off of HSN from IAC and HSN’s integration of additional businesses. Throughout her career as an executive and a director at other public companies, Ms. Schmeling has been at the forefront of new and emerging industries and has developed extensive expertise in accounting/finance, and has significant experience with operations, treasury functions, tax, investor relations and corporate strategy. Ms. Schmeling was also named to the 2020 NACD Directorship 100, a list of directors who promote exemplary board leadership and oversight. | | |||||||||

| | Director since: 2018, Committees: NCG, Other public boards: Constellation Brands, Inc. (since 2013), Canopy Growth (since 2018) | | |||||||||

Notice & Proxy Statement | | | 13 | | |  |

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Sri Donthi, 57 (I) Executive VP and Chief Technology Officer, Advance Auto Parts, Inc. | | | Advance Auto Parts, Inc. EVP, CTO (2018-Present) PepsiCo, Inc. SVP/CIO, Frito-Lay, Global e-Commerce (2017-2018), AMENA, Global e-Commerce (2014-2017), Corporate Functions, Global Groups and Technology Services (2011-2014) CIO, PepsiCo Int’l Transformation (2008-2011) Global CTO (2006-2008) VP, Global Infrastructure Management (2004-2006) Motorola Information Technology Management/leadership positions (1994-2004) | | | ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Digital Marketing, E-Commerce ⯀ IT, Security ⯀ Corporate Strategy | |

| | Mr. Donthi is a seasoned technology executive, bringing more than 20 years of experience leading and developing technology functions and IT infrastructure, and overseeing cybersecurity programs, in the retail and consumer products industries. He has served as Executive VP, Chief Technology Officer of Advance Auto Parts, Inc. a leading automotive aftermarket parts provider, since 2018, where he is responsible for its overall IT organization, technology platforms and related strategic initiatives. Previously, he worked at PepsiCo, Inc. for 14 years in a number of leadership roles, most recently as SVP, CIO – Frito-Lay where his team led a comprehensive effort to digitize their core business, and SVP, CIO – PepsiCo Asia, Middle East and North Africa, where he was responsible for all IT-related services. Before PepsiCo, Mr. Donthi spent 10 years at Motorola in various IT leadership and operational roles. | | |||||||||

| | Director since: 2022, Committees: Audit, Other public boards: None | | |||||||||

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Donald E. Frieson, 66 (I) Retired Executive Vice President, Supply Chain, Lowe’s Companies, Inc. | | | Lowe’s Companies, Inc. EVP, Supply Chain (2018-2024) Sam’s Club (division of Walmart) EVP, Operations (2014-2017) SVP, Replenishment, Planning & Real Estate (2012-2014) Massmart Holdings (subsidiary of Walmart) Chief Integration Officer (2011-2012) Walmart, Inc. SVP, Supply Chain Eastern U.S. (2010) President, Central Division (2007-2010) Operational/management positions (1999-2007) | | | ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Real Estate, Development, Construction ⯀ Supply Chain, Logistics, Distribution ⯀ Corporate Strategy | |

| | Mr. Frieson has over 30 years of sophisticated operations, logistics and supply chain experience, most recently as Executive VP, Supply Chain, of Lowe’s Companies, Inc., the world’s second largest home improvement retailer, where, prior to his retirement in 2024, he was responsible for its distribution centers, logistics, replenishment and planning, transportation and delivery services. Previously, he spent 19 years within the Walmart organization where he was Executive VP of Operations at Sam’s Club, responsible for all club operations, including supply chain, for more than 650 locations in the U.S. and Puerto Rico, and Senior VP of Supply Chain, where he led more than 30 distribution centers that supplied nearly 1,600 stores, supercenters and neighborhood markets. | | |||||||||

| | Director since: 2018, Committees: C/HC, NCG, Other public boards: None | | |||||||||

Notice & Proxy Statement | | | 14 | | |  |

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Cara K. Heiden, 68 (I) Retired Co-President, Wells Fargo Home Mortgage | | | Wells Fargo Home Mortgage Co-President (2004-2011) Head of National Consumer Lending (1998-2004) Head of Loan Administration (1994-1997) VP/CFO (1992-1994) Wells Fargo Bank Iowa SVP/CFO (1988-1992) Financial leadership positions (1981-1988) | | | ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Marketing and Brand Management ⯀ M&A ⯀ Public Policy, Government Affairs, Regulatory, Compliance, Legal ⯀ Finance, Accounting, Financial Reporting ⯀ Risk Management ⯀ Corporate Strategy | |

| | Ms. Heiden has over 20 years of executive leadership experience in the financial services industry, serving in both regional and national roles in the Wells Fargo organization. Her successful financial services career led to her being named multiple times to U.S. Banker magazine’s list of “25 Most Powerful Women in Banking,” and she was elected to the Iowa Business Hall of Fame in 2019. Ms. Heiden’s extensive financial, strategy, marketing, operational, and consumer policy expertise will provide the Board with valuable insight in those key areas. | | |||||||||

| | Director since: 2017, Committees: A* (Chair), Other public boards: None | | |||||||||

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | David K. Lenhardt, 55 (I) Former President and Chief Executive Officer, PetSmart, Inc. | | | PetSmart, Inc. President/CEO (2013-2015) President/COO (2012-2013) Management/leadership positions (2000-2012) Bain & Company, Inc. Manager (1996-2000) | | | ⯀ Public Company CEO Experience ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Capital Markets, Investment Banking, Asset Management, IR ⯀ M&A ⯀ Finance, Accounting, Financial Reporting ⯀ Risk Management ⯀ Corporate Strategy | |

| | Mr. Lenhardt is a seasoned executive, bringing over 15 years of operations, services and leadership experience with him from PetSmart, a leading specialty retailer of pet products and services, where he served three years as President and two years as President and CEO. During that time, Mr. Lenhardt successfully completed PetSmart’s strategic review process in 2014, which resulted in the sale of PetSmart to BC Partners for $8.7 billion in 2015, representing the highest equity valuation in its history. Prior to PetSmart, Mr. Lenhardt served as manager of Bain & Company, Inc., where he led consulting teams for retail, technology and e-commerce clients. | | |||||||||

| | Director since: 2018, Committees: A*, NCG (Chair), Other public boards: None | | |||||||||

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Maria Castañón Moats, 56 (I) Retired Partner, PricewaterhouseCoopers, LLP | | | PricewaterhouseCoopers, LLC Partner (2004-2024) Leader, Governance Insights Center (2021-2024) Vice-Chair, Mexico & US Assurance Leader (2016-2019) Chief Diversity Officer (2011-2016) Associate/Manager positions (1994-2004) | | | ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ M&A ⯀ Finance, Accounting, Financial Reporting ⯀ Corporate Strategy | |

| | Ms. Castañón Moats is a seasoned public accounting and governance leader, bringing over 30 years of experience from PricewaterhouseCoopers, LLP (PwC), an international accounting and professional services firm. As a partner in the firm for over 20 years, Ms. Castañón Moats led PwC’s Governance Insights Center from 2021 to 2024, and held previous leadership roles as its Vice-Chair, Mexico & US Assurance Leader from 2016 to 2019, where she oversaw PwC’s national assurance practice and served on its US and Global Assurance Executive leadership teams, and was PwC’s Chief Diversity Officer from 2011 to 2016. Throughout her career, Ms. Castañón Moats regularly provided accounting, financial reporting, investigations and M&A services to both private and public clients across the retail, consumer and industrial products industries, and was named as number two on Fortune magazine’s inaugural “50 Most Powerful Latina’s List.” | | |||||||||

| | Director since: 2024, Committees: A*, Other public boards: None | | |||||||||

Notice & Proxy Statement | | | 15 | | |  |

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Larree M. Renda, 66 (I) Retired Executive VP, Safeway, Inc. | | | Safeway, Inc. EVP (1999-2015) SVP (1994-1999) Management/leadership positions (1974-1994) | | | ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Real Estate, Development, Construction ⯀ Digital Marketing, E-Commerce ⯀ Marketing, Brand Management ⯀ Public Policy, Government Affairs, Regulatory, Compliance, Legal ⯀ Risk Management ⯀ Corporate Strategy | |

| | Ms. Renda is a distinguished, 40-year veteran of the retail grocery industry, including over two decades in senior and executive leadership positions at Safeway, a U.S. supermarket chain. Her diverse responsibilities included retail strategy, labor relations, public affairs, communications, government relations, health initiatives, human resources, corporate social responsibility and sustainability, philanthropy, IT, construction and real estate. In her early career at Safeway, Ms. Renda earned the distinction of being the youngest store manager, district manager and retail operations manager in Safeway’s history. She was also the first female and youngest person promoted to Senior VP, and subsequently became Safeway’s first female Executive VP. Ms. Renda was twice voted as one of the “50 Most Influential Women in Business” by Fortune magazine. | | |||||||||

| | Director since: 2014, Committees: C/HC (Chair), Other public boards: International Speedway (2015-2019), Ross Stores, Inc. (2020-2024) | | |||||||||

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Michael Spanos, 59 (I) COO, Delta Air Lines, Inc. | | | Delta Air Lines, Inc. COO (2023-Present) Six Flags Entertainment, Inc. President/CEO (2019-2021) PepsiCo, Inc. CEO, Asia, Middle East and North Africa (2018-2019) President/CEO, Greater China Region (2014-2018) SVP/CCO, North America Beverages (2011-2014) Management/leadership positions (1993-2011) | | | ⯀ Public Company CEO Experience ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Digital Marketing, E-Commerce ⯀ Marketing, Brand Management ⯀ Supply Chain, Logistics, Distribution ⯀ Capital Markets, Investment Banking, Asset Management, IR ⯀ Public Policy, Government Affairs, Regulatory, Compliance, Legal ⯀ Finance, Accounting, Financial Reporting ⯀ Risk Management ⯀ Corporate Strategy | |

| | Mr. Spanos, currently COO of Delta Air Lines, Inc., one of the world’s largest airlines, is a seasoned global executive, bringing over 25 years of frontline leadership, strategy, operations, and retail consumer products experience to the Board. From 2019-2021, Mr. Spanos was the President and CEO of Six Flags Entertainment, Inc., a leading entertainment provider, where he guided the company through the pandemic and a digital and customer-focused transformation. Prior to Six Flags, Mr. Spanos served as the Chief Executive Officer, Asia, Middle East and North Africa, of PepsiCo, Inc., a leading global food and beverage company, from January 2018 to November 2019. Mr. Spanos previously served as interim head of PepsiCo, Inc.’s Asia, Middle East and North Africa division from October 2017 to January 2018 and as President and Chief Executive Officer, PepsiCo Greater China Region, from September 2014 to January 2018. Prior to that, Mr. Spanos served as Senior Vice President and Chief Customer Officer, PepsiCo North America Beverages from October 2011 to September 2014. Mr. Spanos previously held management roles of increasing responsibility at PepsiCo, Inc. since 1993 in North America, Europe, Asia, and the Middle East. | | |||||||||

| | Director since: 2022, Committees: C/HC, Other public boards: Six Flags Entertainment (2019-2021) | | |||||||||

Notice & Proxy Statement | | | 16 | | |  |

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Gregory A. Trojan, 65 (I) Former CEO, BJ’s Restaurants, Inc. | | | BJ’s Restaurants, Inc. CEO (2013-2022) President (2012-2018) Guitar Center, Inc. President/CEO (2010-2012) President/COO (2007-2010) House of Blues Entertainment, Inc. CEO (1998-2006) President (1996-1998) | | | ⯀ Public Company CEO Experience ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Restaurant and Food Service ⯀ Real Estate, Development, Construction ⯀ Marketing, Brand Management ⯀ M&A ⯀ Finance, Accounting, Financial Reporting ⯀ Corporate Strategy | |

| | Mr. Trojan has over 25 years of experience leading national restaurant, retail and consumer products companies. He most recently served as CEO, and is currently a director of, BJ’s Restaurants, Inc., the owner and operator of over 200 casual dining restaurants throughout the U.S., where he also served as President from 2012 through 2018. Mr. Trojan was previously employed by Guitar Center, Inc., a leading retailer of musical instrument products, where he served as President, CEO and director from 2010 to 2012 and as President, COO and director from 2007 to 2010. From 1998 to 2006, Mr. Trojan served as CEO of House of Blues Entertainment, Inc., an operator of restaurant and music venues, concerts and media properties, having served as President from 1996 to 1998. Prior to that, he held various positions with PepsiCo, Inc. from 1990 to 1996, including service as CEO of California Pizza Kitchen, Inc. when it was owned by PepsiCo. Earlier in his career, Mr. Trojan was a consultant at Bain & Company, the Wharton Small Business Development Center and Arthur Andersen & Company. | | |||||||||

| | Director since: 2021, Committees: C/HC, Other public boards: Oakley, Inc. (2005-2007), Domino’s Pizza, Inc. (2010-2017), BJ’s Restaurants, Inc. (Since 2012) | | |||||||||

| | Nominee | | | Career Highlights | | | Relevant Board Skills | | |||

| |  | | | Allison M. Wing, 57 (I) CEO, Oobli, Inc. | | | Oobli, Inc. CEO (2021-Present) Bright Health Chief Consumer Officer (2019-2021) Chief Marketing/Digital Officer (2018-2019) Ascena Retail Group, Inc. CMO and EVP, Digital (2014-2017) giggle, Inc. Founder, CEO and Chairperson (2004-2014) | | | ⯀ Senior Business Operations Leadership ⯀ Consumer Products, Retail ⯀ Digital Marketing, E-Commerce ⯀ Marketing, Brand Management ⯀ Public Policy, Government Affairs, Regulatory, Compliance, Legal ⯀ M&A ⯀ IT, Security ⯀ Corporate Strategy | |

| | Ms. Wing has over 25 years of experience leading growth, brand & strategy across consumer, retail & technology companies. Ms. Wing is currently CEO of Oobli, Inc., a venture-backed food biotechnology & consumer products company. Prior to Oobli, Ms. Wing was Chief Consumer Officer for Bright Health, a venture-backed health technology services company as the company grew from $200m to over $3B in revenues. Previously, at Ascena Retail Group, Ms. Wing was a Chief Marketing Officer & EVP of Digital for a public portfolio of retail brands with more than 5,000 stores. Ms. Wing founded & led giggle, Inc. a omni-channel retailer & manufacturer of consumer products with more than 750 retail locations. Early in her career, Ms. Wing worked for Nike progressing through marketing & corporate development roles followed by several years in Silicon Valley leading growth, brand & product across a variety of technology companies. Ms. Wing practiced law as a corporate securities attorney, has her JD & MBA from Northwestern University & has been recognized by Women’s, Inc. among its Top 100 Corporate Board of Directors. | | |||||||||

| | Director since: 2018, Committees: C/HC, Other public boards: Bazaarvoice, Inc. (2017-2018), Christopher & Banks Corporation (2019-2021) | | |||||||||

*THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF

EACH OF THE ELEVEN DIRECTOR NOMINEES*

Notice & Proxy Statement | | | 17 | | |  |

The Company is committed to strong corporate governance, which we believe promotes the long-term interests of our shareholders, strengthens Board and management accountability and fosters strong Company performance.

To help ensure the Company meets this commitment, the Board has approved the Guidelines to address key governance practices and identify the framework for the operations of the Board and its committees. The Guidelines are reviewed on an annual basis and were most recently revised in June 2023, which included significant enhancements to our Lead Independent Director responsibilities/duties. A copy of the Guidelines is posted on the Company’s website (www.caseys.com) under the “Investor Relations” link, and the Lead Independent Director responsibilities/duties are set forth above in the section entitled “Proposal 1: Election of Directors–Board Leadership.”

The NCG Committee monitors developments in law and governance practices and recommends to the Board appropriate changes to the Guidelines and other governance practices. The NCG Committee also maintains Board-level oversight of ESG (environmental, social, governance) issues as they relate to the Company’s business and industry.

Certain highlights of our corporate governance practices include the following:

| | BOARD COMPOSITION – DIRECTOR NOMINEES | | ||||||||||||

| | 10 of 11 Director Nominees Independent | | | 45% Female Director Nominees | | | 36% Racial/Ethnic Diversity of Nominees | | | Comprehensive Board Enhancements | | | Robust Lead Independent Director Duties | |

| | Only non-independent director is Darren M. Rebelez, Board Chair and President/CEO | | | 5 of 11 director nominees female, including Audit and Comp./Human Capital Chairs and Lead Independent Director | | | 4 of 11 director nominees with racial/ethnic diversity, including Board Chair | | | 9 new directors since 2018, including Ms. Castañón Moats in July of 2024 | | | Significantly enhanced LID responsibilities/duties, as set forth in the Guidelines (see the “Board Leadership” section, above) | |

| | Additional Information | | ||||||||||||

| | Diversity: The Company has a long history of gender and racial/ethnic diversity on its Board and has been recognized several times by the Women’s Forum of New York and others as a leader in Board diversity. Board Enhancements: In July 2024, the Board added Ms. Castañón Moats as an independent director. Board Chair/Lead Independent Director: The Board has no fixed policy with respect to the combination of the positions of Board Chair and CEO, as the Board believes that it is in the best interests of the Company and its shareholders for the Board to assess the Board leadership structure in light of the circumstances then existing. If the Board Chair is not an independent director, the independent directors will designate a lead independent director, selected from the independent directors, who will carry out those duties as set forth in the Guidelines. Over the course of its 2023 fiscal year, the NCG Committee and the Board conducted a detailed analysis and thoroughly discussed the relative benefits of combining the Board Chair and CEO roles versus retaining separate roles. After considering the perspectives of our independent directors, peer company practices and governance considerations, the Board unanimously elected Mr. Rebelez, our President and CEO, as Board Chair effective June 2, 2023, in anticipation of the approaching retirement of the Company’s prior Board Chair, H. Lynn Horak. The Board believes that Mr. Rebelez’s inclusive leadership style, exceptional track record of success since his appointment as President and CEO in 2019, and deep understanding of the Company’s business, growth opportunities and challenges, makes him uniquely qualified to provide strong and effective leadership to the Board, foster a collaborative relationship between the Board and management, and promote alignment of the Company’s long-term strategic plan with its operational and financial execution. In addition, the independent directors reaffirmed the Board’s commitment to empowered and active independent Board leadership by unanimously electing Ms. Schmeling as LID, also effective June 2, 2023. Ms. Schmeling was elected after a detailed, thorough and formal evaluation and selection process, led by the NCG Committee. The NCG Committee determined that her exceptional mix of strategic management skills and executive and outside board leadership experience (including outside board chair experience) was ideal for the role and responsibilities of LID and to serve as the primary liaison between the Board and management going forward. The position of LID will be evaluated by the NCG Committee, and elected by the independent directors, on an annual basis, taking into consideration the needs of the Board and the Company at such time. The role itself has a clear mandate, significant authority and well-defined and robust responsibilities/duties under the Guidelines, which were significantly enhanced as part of the analysis and evaluation process set forth above, and which are set forth above in the section entitled “Proposal 1: Election of Directors–Board Leadership.” For more information on the Board leadership transition, see the “Board Leadership” section, above. | | ||||||||||||

Notice & Proxy Statement | | | 18 | | |  |

| | SHAREHOLDER RIGHTS | | ||||||||||||

| | Annual Elections | | | Majority Voting in Uncontested Elections | | | Proxy Access | | | Annual Say-On-Pay Advisory Vote | | | Single Voting Class of Securities | |

| | All nominees stand for annual election | | | Nominees are subject to a majority voting standard | | | 3/3/20/20 proxy access structure | | | Last year’s say-on-pay received 97.6% approval | | | No dual class or other preferred voting | |

| | Additional Information | | ||||||||||||

| | Mandatory Resignation Policy/Contested Elections: The Guidelines provide that any nominee in an uncontested election who does not receive more votes cast “for” than “against” election/re-election (a “Majority Vote”) is expected to tender his or her resignation as a director. In order to be nominated, candidates must agree to tender irrevocable resignations that will be effective upon (i) the failure to receive a Majority Vote at the next annual meeting at which they face re-election, and (ii) Board acceptance of such resignation. If an incumbent director fails to receive a Majority Vote, the NCG Committee will act on an expedited basis to determine whether to accept the resignation and will submit such recommendation for prompt consideration by the Board. Each of the NCG Committee and the Board may consider any factors they deem relevant. Thereafter, the Board will promptly disclose its decision-making process and decision regarding the resignation offer on a Form 8-K furnished to the SEC. In a contested election (i.e. the Company receives a notice that a shareholder has nominated a person for election to the Board in compliance with the requirements set forth in the Company’s Bylaws (the “Bylaws”), and such nomination has not been withdrawn on or prior to the day next preceding the date the Company first mails its notice for such meeting to the shareholders) directors will be elected by a plurality of the votes cast. Proxy Access: A shareholder or a group of up to 20 eligible shareholders owning 3% or more of the Company’s outstanding shares of Common Stock continuously for at least three years may nominate and include in the Company’s annual meeting proxy materials, for any annual meeting of shareholders at which directors are to be elected, director nominees constituting up to the greater of (i) 20% of the total number of directors of the Company, or (ii) two individuals; provided that the nominating shareholder(s) and nominee(s) satisfy the requirements described in the Bylaws. | | ||||||||||||

| | ACCOUNTABILITY | | |||||||||

| | Strong Anti-Hedging and Pledging Policy | | | Compensation Recovery Policy | | | Meaningful Stock Ownership Requirements | | | Robust Code of Conduct/Ethics | |

| | Hedging and pledging of Company stock is prohibited | | | Shall seek reimbursement of incentive payments in the case of certain financial restatements | | | Director: 5x cash retainer CEO: 5x base salary Chief/SVP: 3x base salary VP: 2x base salary | | | All directors and officers bound by a robust Code of Business Conduct and Ethics | |

| | Additional Information | | |||||||||

| | Hedging/Pledging: Directors, officers, designated key employees and those designated as “ Compensation Recovery (“Clawback”) Policy: In addition to any other remedies available under law, the Company shall recoup, in all appropriate circumstances and in accordance with applicable law, any incentive payment made to an executive officer or former executive officer whenever (i) the payment was based upon achieving certain financial results that were subsequently the subject of an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws (other than changes to historical financial statements that do not represent error corrections including a restatement caused by a change in applicable accounting rules or interpretations), and (ii) a lower payment would have been made to the executive officer or former executive officer based on the restated financial results. The Company will, to the extent practicable, recoup from the executive officer the amount by which the incentive payments for the recoverable period exceeded the lower payment that would have been made based on the restated financial results. Stock Ownership: Within five years of joining the Board, directors must accumulate share holdings of at least five times the annual cash retainer for non-Board Chair directors (excluding committee retainers) (the retainer for the 2024 fiscal year was $90,000, for a total ownership requirement of $450,000). Within five years of hire or promotion to their respective positions, the CEO and other all other officers must accumulate share holdings of a multiple of their base salary, as follows: CEO, 5x base salary; Chief/SVP, 3x base salary; and VP, 2x base salary. Restricted stock, unvested service-based restricted stock units (RSUs) and vested 401K Plan shares count towards the requirement, however performance-based restricted stock units (PSUs) and stock options do not count. All of the NEOs have met their respective ownership requirement. | | |||||||||

Notice & Proxy Statement | | | 19 | | |  |

| | BOARD PRACTICES | | ||||||||||||

| | Regular Board and Committee Self-Assessments | | | Director Over-Boarding Limits | | | Strong Corporate Governance Guidelines | | | Regular Executive Sessions | | | Meaningful Director Age/Tenure Limits | |

| | Comprehensive self-assessments during the 2024 fiscal year | | | May not serve on more than two other public company boards | | | Key governance practices/framework for the Board and committees | | | The Board held five executive sessions during the 2024 fiscal year | | | Absent good reason, tenure limit of 15 years and/or age limit of 75 years | |

| | Additional Information | | ||||||||||||

| | Over-Boarding: Under the Guidelines, directors may not serve on more than two other public company boards. In addition, service on the boards of not-for-profit organizations or other entities that may require a similar time commitment must be disclosed and be acceptable to the Board. In addition, outside board service is required to be disclosed to the Board Chair and NCG Committee Chair prior to acceptance in order to comply with these limits and avoid any conflicts of interest. Executive Sessions: The Guidelines require a minimum of two executive sessions, led by the LID, in which only the independent directors are present, to be held each year in conjunction with regularly scheduled Board meetings. It is the Board’s current practice to hold at least one executive session in conjunction with every regularly scheduled Board meeting. Age/Tenure Limits: Individual directors will generally not stand for re-election after completing 15 years of service on the Board or after reaching 75 years of age, subject to extension at the discretion of the Board. | | ||||||||||||

| | SHAREHOLDER ENGAGEMENT | | ||||||

| | Regular and Direct Shareholder Engagement | | | Regular Investor Conference Attendee and Participant | | | Director Attendance at the Annual Meeting | |

| | During the 2024 fiscal year, the Company directly engaged with shareholders representing over 50% of our outstanding shares | | | Participation and presentations are made available to the public via live webcast | | | All directors are required to attend the annual shareholders’ meeting and be available to answer questions | |

| | Additional Information | | ||||||

| | Engagement The Company embraces shareholder engagement as an important tenet of good corporate governance, which promotes the long-term interests of our shareholders. As part of this commitment, the Company regularly and actively engages with shareholders and other investors and stakeholders to solicit input, better understand their viewpoints, answer questions and discuss our performance and strategic plan. In addition, during the 2024 fiscal year, the Company directly engaged with the ESG/sustainability groups at a number of shareholders to discuss and solicit feedback on the Company’s ESG efforts, its ongoing carbon/GHG emissions calculations and its general ESG disclosure process and timeline. Director Attendance at Annual Meetings: The Company is committed to ensuring that shareholders be afforded the same rights and opportunities to participate at the virtual Annual Meeting as they would at an in-person meeting. As such, shareholders are able to submit questions to the Board during the Annual Meeting by following the question prompts on the meeting website and typing the question into the space provided therefor. | | ||||||

Notice & Proxy Statement | | | 20 | | |  |

| | SUSTAINABILITY | | ||||||

| | Fourth Annual Sustainability Report Published in July 2024 | | | Board-Level Oversight of ESG | | | Sustainability Committee | |