0000726728DEF 14AFALSE00007267282023-01-012023-12-31iso4217:USDiso4217:USDxbrli:shares00007267282022-01-012022-12-3100007267282021-01-012021-12-3100007267282020-01-012020-12-310000726728o:DeductionForAmountsReportedMemberecd:PeoMember2023-01-012023-12-310000726728o:DeductionForAmountsReportedMemberecd:NonPeoNeoMember2023-01-012023-12-310000726728o:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2023-01-012023-12-310000726728ecd:NonPeoNeoMembero:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310000726728o:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310000726728o:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000726728ecd:PeoMembero:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310000726728ecd:NonPeoNeoMembero:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310000726728o:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310000726728ecd:NonPeoNeoMembero:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310000726728ecd:PeoMembero:IncreaseBasedOnDividendsPaidOnAwardsDuringApplicableFiscalYearPriorToVestingDateNotOtherwiseReflectedInTotalCompensationMember2023-01-012023-12-310000726728ecd:NonPeoNeoMembero:IncreaseBasedOnDividendsPaidOnAwardsDuringApplicableFiscalYearPriorToVestingDateNotOtherwiseReflectedInTotalCompensationMember2023-01-012023-12-310000726728ecd:PeoMember2023-01-012023-12-310000726728ecd:NonPeoNeoMember2023-01-012023-12-31xbrli:pure000072672812023-01-012023-12-31000072672822023-01-012023-12-31000072672832023-01-012023-12-31000072672842023-01-012023-12-31000072672852023-01-012023-12-31000072672862023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

REALTY INCOME CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11.

April 15, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Realty Income Corporation (“Realty Income,” the “Company,” “we,” “our,” or “us”) to be held virtually at 9:00 a.m. Pacific Time, on May 30, 2024. You can attend the Annual Meeting at www.virtualshareholdermeeting.com/realty2024 by using the control number that appears on your proxy card and the instructions provided as part of your Proxy Materials. Stockholders may submit questions during the Annual Meeting through the meeting website. The items of business that will be reviewed at the Annual Meeting are described in the Notice of the 2024 Annual Meeting of Stockholders and Proxy Statement.

In 2023, Realty Income continued to deliver attractive operating results. Since Realty Income’s public listing in 1994, our objective has remained consistent: to deliver dependable monthly dividends that increase over time, supported by cash flow from long-term net lease agreements. In 2023, we paid 12 monthly dividends, and stockholders realized a 2.8% increase in the amount of dividends paid per share. We generated net income per share of $1.26 and grew Adjusted Funds From Operations (“AFFO”) per share by 2.0% to $4.00. Underpinning these results, we achieved a number of significant accomplishments in 2023. Most notably, in October the company announced the acquisition of public net-lease REIT Spirit Realty Capital, Inc. (“Spirit”) in an all-stock transaction valued at an enterprise value of $9.3 billion, which closed on January 23, 2024. With assets that are highly complementary to our existing portfolio, the Spirit portfolio enhances the diversification and depth of our real estate portfolio and will allow us to deepen our longstanding relationships with existing clients and curate new ones. In the fourth quarter of 2023, we announced our first investment in the data center property type through the acquisition of an 80% interest in a joint venture to support the development of two build-to-suit data centers in Northern Virginia with Digital Realty Trust, Inc. (“Digital Realty”). This new vertical represents another avenue of growth for the Company. We delivered on these accomplishments while maintaining an industry leading balance sheet, ending the year with a fixed charge coverage ratio of 4.7x, Net Debt-to-Annualized Pro Forma Adjusted EBITDAre of 5.5x, and liquidity of $4.1 billion. Our portfolio continues to exhibit strong internal growth, as well. At the end of 2023, we maintained a high occupancy rate of 98.6%, and in the fourth quarter of 2023, we generated same store revenue growth of 2.6%. Realty Income’s ability to provide investors stability in a variety of economic environments remains one of our greatest attributes, predicated on the quality of our properties and clients. I’m grateful to our dedicated One Team colleagues who made this successful year possible through their ongoing contributions. Furthermore, I would like to thank Ronald L. Merriman for his 19 years of impactful service to our Company and Board of Directors, as he plans to retire following the Annual Meeting. Ron’s leadership and guidance supported Realty Income during a period of significant evolution. On behalf of the entire Board of Directors and all of my colleagues at Realty Income, I want to thank Ron for his dedication. Jeff A. Jacobson joined Realty Income's Board of Directors in February 2024. Jeff is the retired Global Chief Executive Officer of LaSalle Investment Management. His extensive leadership experience and relationships in the industry will be a tremendous asset to the company.

When Realty Income was founded in 1969 by Bill and Joan Clark, it was predicated on the philosophy of helping businesses grow. Sadly, Bill Clark passed away in 2023. His legacy will continue to be honored at Realty Income, as we remain committed to our founding principles. Because of Bill’s vision, Realty Income is now real estate partner to the world’s leading companies.

Later this year, we will publish our annual Sustainability Report for 2023 (the “Sustainability Report”), which will include details of our corporate responsibility initiatives. Previous sustainability reports can be found in the sustainability section of our corporate website, and I encourage you to review them to understand the significant emphasis we place on these initiatives for the communities we serve, the environment and our future.(1) Additionally, we encourage you to review the information contained in the Proxy Statement. It is meant to provide an overview of our achievements during the year, including information on the Company’s compensation program and corporate governance practices. After your review, we hope you will vote in accordance with the Board of Directors’ recommendations. Your vote is important to us, and we appreciate your continued support of our Company.

Sincerely,

Sumit Roy

President, Chief Executive Officer, and Member of the Board of Directors

1.The Sustainability Report will not be deemed to be incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent Realty Income specifically incorporates the same by reference.

| | | | | |

| 2024 Proxy Statement | Realty Income i |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | NOTICE OF THE 2024 ANNUAL MEETING OF STOCKHOLDERS NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Realty Income Corporation, a Maryland corporation (“Realty Income,” the “Company,” “we,” “our,” or “us”), will be held as follows: | |

| | | | | | | |

MEETING INFORMATION

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

DATE Thursday, May 30, 2024 | | TIME 9:00 a.m. Pacific Time | | VIRTUAL MEETING ACCESS Vote your shares at www.virtualshareholdermeeting.com/realty2024 on May 30, 2024 | | RECORD DATE You may vote if you were a holder of record of shares of our common stock, par value $0.01 per share, at the close of business on March 21, 2024. |

ITEMS OF BUSINESS

| | | | | | | | |

| 1 | The election of 11 directors to serve until the 2025 annual meeting of stockholders and until their respective successors are duly elected and qualified. | |

| 2 | The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. | |

| 3 | A non-binding advisory proposal to approve the compensation of our named executive officers, as described in this Proxy Statement. | |

| | |

| 4 | The transaction of such other business, as may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting. | |

The Proxy Statement following this Notice describes these matters in detail. We have not received other proposals that are expected to be presented at the Annual Meeting. During the Annual Meeting, management will report on the current activities of the Company and comment on its future plans. Stockholders will be able to vote electronically and submit questions electronically both before and during the meeting. All presentation materials shared at the Annual Meeting will be made available in the investors section of the Company’s website at www.realtyincome.com.

| | | | | |

ii Realty Income | 2024 Proxy Statement |

PROXY VOTING

Your vote is important. Whether or not you plan to participate in our virtual Annual Meeting, we urge you to submit your proxy as soon as possible to ensure your shares are represented and voted at the Annual Meeting. You may authorize a proxy to vote your shares by telephone, via the Internet, or – if you have received and/or requested paper copies of our Proxy Materials by mail – by signing, dating, and returning the proxy card in the envelope provided. If you participate in our virtual Annual Meeting, you may, if you wish, vote your shares (or withdraw your proxy) at www.virtualshareholdermeeting.com/realty2024.

No person is authorized to make any representation with respect to the matters described in this Proxy Statement other than those contained herein, and, if given or made, such information or representation must not be relied upon as having been authorized by us or any other person.

You are encouraged to read this Proxy Statement in its entirety before voting or authorizing a proxy to vote on your behalf.

By Order of the Board of Directors,

Michelle Bushore

Executive Vice President, Chief Legal Officer, General Counsel and Secretary

April 15, 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on May 30, 2024.

This Proxy Statement and our 2023 Annual Report are available at www.proxyvote.com.

Whether or not you plan to attend the Annual Meeting, please carefully read the proxy statement and other proxy materials and authorize a proxy to vote your shares as soon as possible. You may authorize your proxy by telephone, over the Internet, or by mail by completing your proxy card, even if you plan to attend the virtual Annual Meeting. If you received a Notice of Availability of Proxy Materials, you may also request a paper or an e-mail copy of our proxy materials and a paper proxy card at any time. If you virtually attend the Annual Meeting, you may vote at the meeting if you wish, even if you previously have submitted your proxy.

Client Names, Logos and Photos

Realty Income is not affiliated or associated with, is not endorsed by, does not endorse, and is not sponsored by or a sponsor of the clients or of their products or services pictured or mentioned. The names, logos and all related product and service names, design marks and slogans are the trademarks or service marks of their respective companies.

| | | | | |

| 2024 Proxy Statement | Realty Income iii |

TABLE OF CONTENTS

| | | | | |

iv Realty Income | 2024 Proxy Statement |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | PROXY SUMMARY The Board of Directors (or, the “Board”) of Realty Income Corporation, a Maryland corporation (“Realty Income,” the “Company,” “we,” “our,” or “us”), is soliciting proxies for its 2024 Annual Meeting of Stockholders and any postponement or adjournment thereof (the “Annual Meeting”). This Proxy Summary provides an overview of the proposals to be considered and voted on at the Annual Meeting and of the information contained in the Proxy Statement, but does not contain all of the information that should be considered before voting. We encourage you to read the Proxy Statement in its entirety before voting. | |

| | | | | | | |

MEETING INFORMATION

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

DATE Thursday, May 30, 2024 | | TIME 9:00 a.m. Pacific Time | | PLACE To attend the virtual Annual Meeting, log in at www.virtualshareholdermeeting.com/realty2024. | | RECORD DATE You may vote if you were a holder of record of shares of our common stock, par value $0.01 per share, at the close of business on March 21, 2024. |

HOW TO VOTE

On or about April 15, 2024, the Notice of the Annual Meeting, Proxy Statement, proxy card, and 2023 Annual Report (collectively, the “Proxy Materials”) will be either mailed or made available over the Internet to our stockholders of record as of the close of business on the record date. Some of our stockholders will be mailed a Notice of Availability of Proxy Materials, which contains instructions on how to request and receive a paper or e-mail copy of our Proxy Materials. We encourage you to vote your shares prior to the Annual Meeting. You may vote by telephone, over the Internet, or by mail by completing and mailing your proxy card, even if you plan to attend the virtual Annual Meeting. All methods of communication will provide stockholders with instructions on how to vote or authorize a proxy to vote using any of the following methods:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

BY INTERNET www.proxyvote.com 24/7 through May 29, 2024 | | BY TOLL-FREE TELEPHONE 1-800-690-6903 24/7 through May 29, 2024 | | BY MAIL Request, complete and return a proxy card by pre-paid mail | | VIRTUAL MEETING ACCESS Vote your shares at www.virtualshareholdermeeting.com/realty2024 on May 30, 2024 |

This Proxy Statement and our 2023 Annual Report are available in the investors section of the Company’s website at www.realtyincome.com. You may also view the Proxy Materials at www.proxyvote.com prior to the day of the virtual Annual Meeting or at www.virtualshareholdermeeting.com/realty2024 on the day of and during the virtual Annual Meeting by using the control number provided to you either on your proxy card, in your e-mailed Proxy Materials, or on your Notice of Availability of Proxy Materials. We encourage you to access and review all of the information contained in the Proxy Materials before voting.

| | | | | |

| 2024 Proxy Statement | Realty Income 1 |

Beneficial Stockholders: If your shares of common stock are held through a bank, broker or other holder of record, please follow the instructions you receive from your bank, broker or other nominee on how to vote your shares at our Annual Meeting. Since a beneficial owner is not the stockholder of record, you may not vote these shares online at our Annual Meeting unless you obtain a legal proxy from the bank, broker or other holder of record that holds your shares, giving you the right to vote the shares at the Annual Meeting. Obtaining a legal proxy may take several days.

VIRTUAL STOCKHOLDER MEETING

In order to allow broad-based access to our employees, stockholders, and community to the Annual Meeting, the Board has again decided to continue to hold the Annual Meeting virtually. Our directors will participate in the virtual Annual Meeting.

Date and Time: The Annual Meeting will be held virtually through a live audio webcast on Thursday, May 30, 2024, at 9:00 a.m. Pacific Time. There will be no physical meeting location. The meeting will only be conducted via an audio webcast.

Access to the Audio Webcast of the Annual Meeting: The live audio webcast of the Annual Meeting will begin promptly at 9:00 a.m. Pacific Time. Online access to the audio webcast will open approximately 15 minutes prior to the start of the Annual Meeting to allow time for you to log in and test the computer audio system. We encourage our stockholders to access the meeting prior to the start time.

Log in Instructions: To attend the virtual Annual Meeting, log in at www.virtualshareholdermeeting.com/realty2024. Stockholders will need their unique control number, which appears on the Notice and the instructions that accompanied the Proxy Materials. In the event you do not have a control number, please contact your broker, bank, or other nominee as soon as possible and no later than Thursday, May 23, 2024, so that you can be provided with a control number and gain access to the meeting.

Submitting Questions at the Virtual Annual Meeting: Stockholders may submit questions in writing during the Annual Meeting at www.virtualshareholdermeeting.com/realty2024. Stockholders will need their unique control number which appears on their Notice, the proxy card, and the instructions that accompanied the Proxy Materials.

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted during the meeting in accordance with the Annual Meeting’s Rules of Conduct that are pertinent to the Company and the meeting matters, as time permits. Answers to any such questions that are not addressed during the Annual Meeting (if any) will be published following the meeting in the investors section of the Company’s website at www.realtyincome.com.

Technical Assistance: Beginning 15 minutes prior to the start of and during the virtual Annual Meeting, we will have a support team ready to assist stockholders with any technical difficulties they may have in accessing or hearing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Stockholder Meeting login page.

Voting Shares: Stockholders may vote their shares at www.proxyvote.com prior to the day of the virtual Annual Meeting or at www.virtualshareholdermeeting.com/realty2024 on the day of and during the virtual Annual Meeting. If your shares of common stock are held by a bank, broker, or other holder of record, you may not vote these shares online at our Annual Meeting unless you obtain a “legal proxy” from the bank, broker, or other holder of record that holds your shares, giving you the right to vote the shares at the Annual Meeting.

Availability of Live Webcast: The live audio webcast will be available to not only our stockholders, but also our employee team members and other constituents.

| | | | | |

2 Realty Income | 2024 Proxy Statement |

PROPOSAL GUIDE

| | | | | | | | | | | |

| PROPOSAL | | PAGE | VOTE RECOMMENDATION |

| 1 | ELECTION OF DIRECTORS Our Board of Directors believes that the 11 director nominees named herein contribute the breadth and diversity of knowledge and experience needed for the advancement of our business strategies and objectives. | | FOR |

| 2 | RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Audit Committee of our Board of Directors has appointed KPMG LLP (“KPMG”) as the independent registered public accounting firm for the fiscal year ending December 31, 2024, and requests stockholders to ratify the appointment. | | FOR |

| 3 | ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS Our Board of Directors believes our compensation program is appropriately structured to reward our named executive officers for the continued performance of the Company, encourage a disciplined approach to management, and maintain focus on the creation of long-term value for our stockholders. | | FOR |

| | | |

PERFORMANCE HIGHLIGHTS

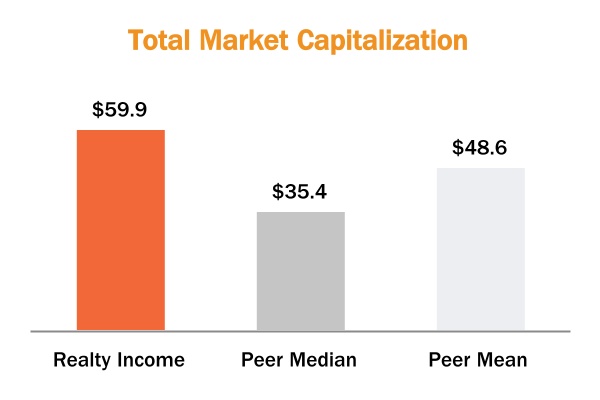

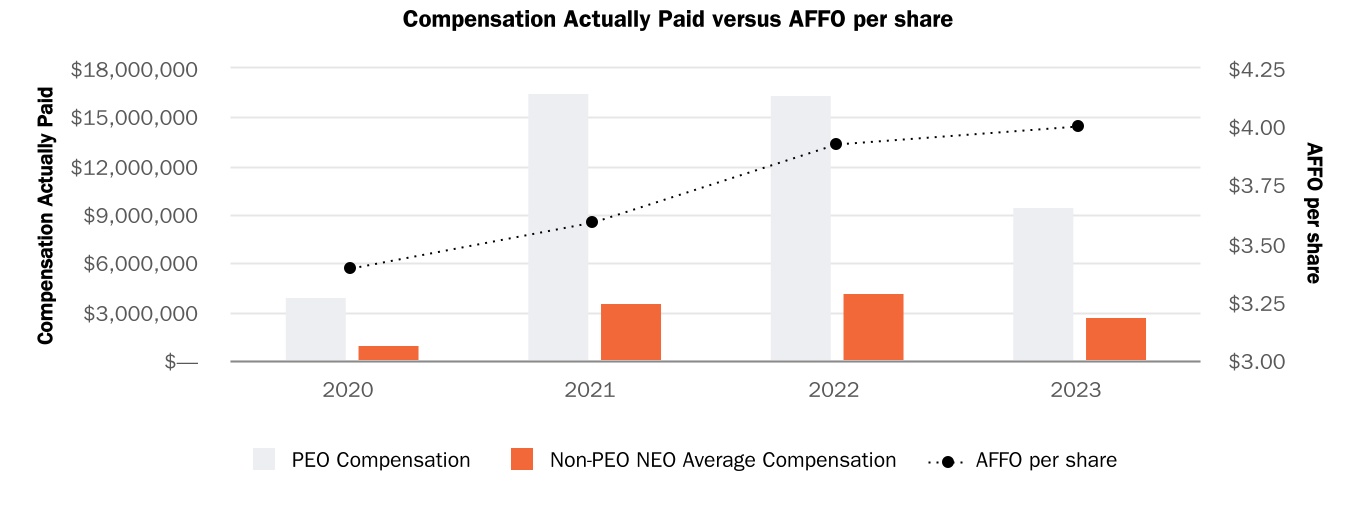

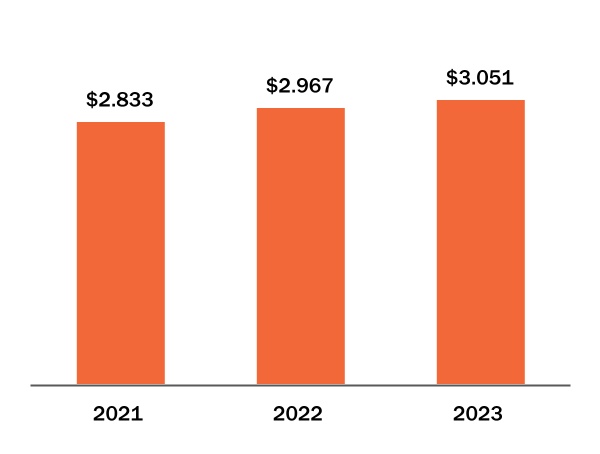

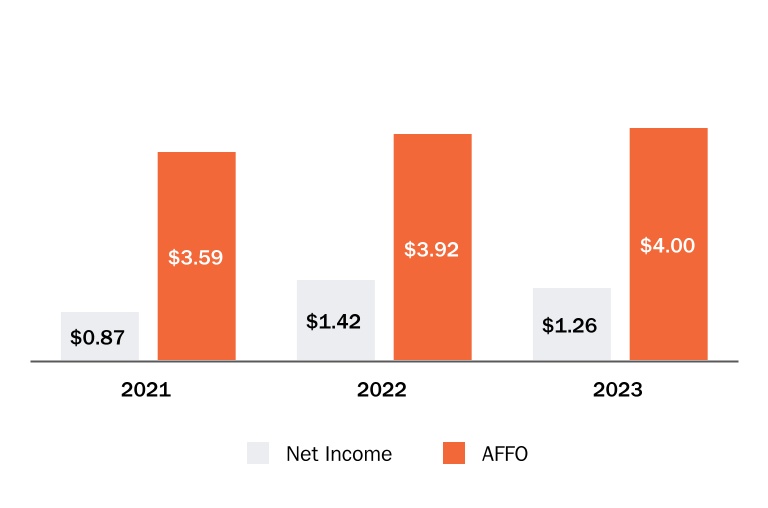

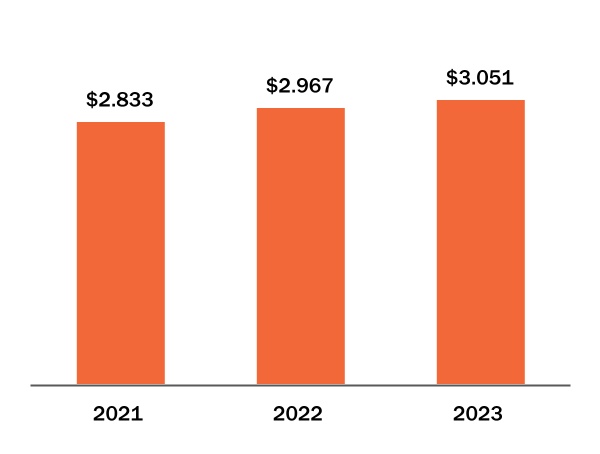

2023 was a year of outstanding operating performance for Realty Income. We realized a 2.8% increase in the amount of dividends paid per share, generated net income per share of $1.26, grew AFFO per share to $4.00, achieved total investment volume of $9.5 billion and achieved meaningful total shareholder return (“TSR”). All per share amounts in this Proxy Statement are on a diluted per common share basis unless stated otherwise.

Our 2023 investment volume was an annual record for property-level investments. As part of this activity, we expanded into the data center property type in a joint venture with Digital Realty supporting the development of two turnkey, build-to-suit properties located in Northern Virginia, and we continued to expand our presence in Europe, marked by entry into France, Germany, Ireland, and Portugal.

| | | | | | | | | | | | | | |

| Dividends per Share Growth | | AFFO per Share |

| | | | |

| +2.8% | | | $4.00 |

| | | | |

During 2023, the Company announced the acquisition of public net-lease REIT, Spirit, in an all-stock transaction valued at an enterprise value of $9.3 billion, which closed January 23, 2024. As a result of this transaction, we believe our enhanced size, scale, and diversification extends our runway for future growth, enabling us to acquire larger single-client assets and more sizable portfolios while solidifying our place as a leader in accessing debt and equity markets.

We maintained an industry-leading balance sheet, ending the year with a fixed charge coverage ratio of 4.7x, Net Debt-to-Annualized Pro Forma Adjusted EBITDAre of 5.5x, and liquidity of $4.1 billion. Our portfolio operating metrics remained healthy, as we finished the year with an occupancy rate of 98.6%, delivered same-store revenue growth of 1.9%, and achieved a recapture rate on properties renewed or released during the year of 104.1%, excluding restructurings associated with Cineworld.

2023 also marked a record year for capital raising amidst a challenging macroeconomic and interest rate backdrop. To support the financing of our investments, we raised approximately $5.5 billion of equity capital over the course of the year, and we issued $4.2 billion of fixed rate unsecured bonds during 2023, including an inaugural €1.1 billion Euro bond issuance in July 2023.

| | | | | |

| 2024 Proxy Statement | Realty Income 3 |

Over a three-year period from 2021 to 2023, we saw net income per share on a fully diluted basis increase from $0.87 per share to $1.26 per share primarily as a result of the increase in the size of our portfolio due to the merger with VEREIT which closed in November of 2021.

We achieved positive AFFO per share growth of 11.4% from 2021 to 2023, increasing to $4.00 per share from $3.59 per share, which has enabled us to continue to pay dependable monthly dividends that increase over time.

Net Income and AFFO

(per share)(1)

Dividends Paid

(per share)

1.AFFO is a non-GAAP measure. AFFO is adjusted for unique revenue and expense items, which management believes are not pertinent to the measurement of our ongoing operating performance. For a reconciliation of AFFO per share to net income available to common stockholders per share, see Appendix A on page 94 of this Proxy Statement. | | | | | | | | | | | | | | |

| Total Investments | | Property Level Occupancy |

| | | | |

| +$9.5B | | | 98.6% |

| | | | |

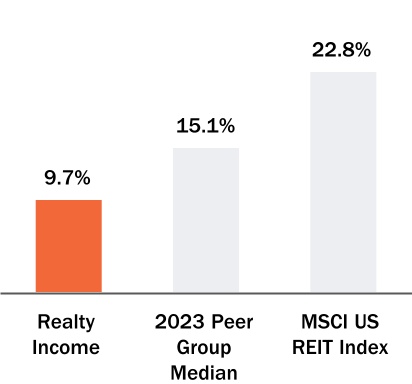

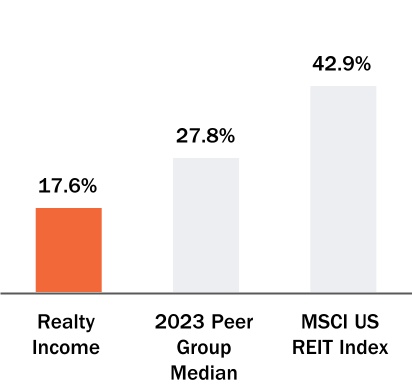

We invest in people and places to provide our stockholders with dependable monthly dividends that increase over time. The chart below sets forth the Company’s three-, five-, and seven-year TSR performance which demonstrates our absolute and relative returns. The Covid-19 pandemic and tightening monetary policy impacted our relative performance over the three-year and the five-year periods. Over the long term, the stability and perceived “defensiveness” of the Company’s business model amidst a turbulent macroeconomic, geopolitical, and uncertain monetary policy backdrop supported our relative outperformance versus our 2023 Peer Group (defined below) over the seven-year period.

| | | | | |

4 Realty Income | 2024 Proxy Statement |

3-Year Cumulative

Total Shareholder Return(1)

5-Year Cumulative

Total Shareholder Return(1)

7-Year Cumulative

Total Shareholder Return(1)

1.TSR is calculated assuming the contemporaneous reinvestment of dividends on the ex-dividend date. Companies comprising our 2023 Peer Group are listed below in “2023 Peer Group for 2023 Compensation Decisions.” Data is sourced from Bloomberg as of December 31, 2023.

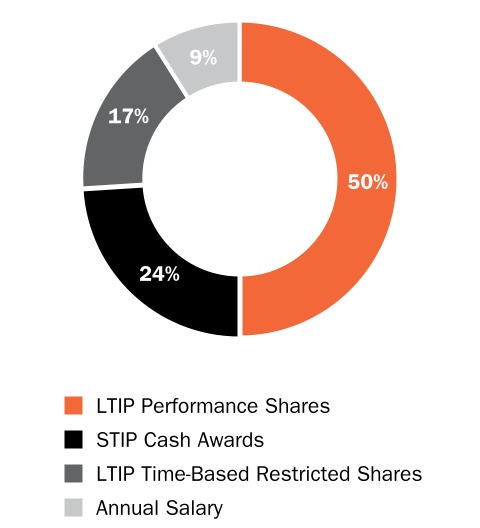

EXECUTIVE COMPENSATION HIGHLIGHTS

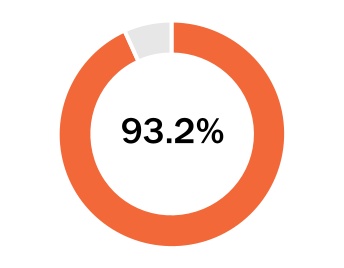

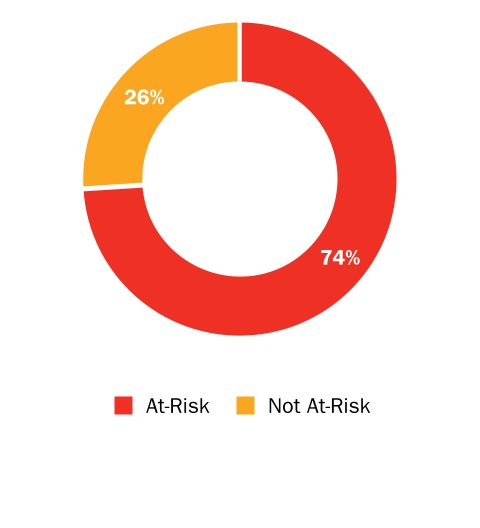

We believe our performance demonstrates the effectiveness, over time, of the execution of our strategic business plan and the alignment of our compensation program with our philosophy to reward executives for enhancing long-term stockholder value. Our compensation program focuses on pay-for-performance principles that are linked to short-term and long-term financial, operational, and relative TSR metrics. In 2023, we continued to receive favorable say-on-pay approval results with 93.2% of the votes cast on the proposal voting to approve. The following are the two primary components of the 2023 incentive compensation program:

| | | | | | | | | | | | | | | | | | | | |

| Short-Term Incentive Program (STIP) | | | | Long-Term Incentive Program (LTIP) | |

| | | | | | |

| Variable cash award based on the achievement of short-term operating and financial goals, as well as individual performance goals | | | | Equity compensation based on the achievement of long-term relative TSR performance as well as financial goals over a three-year period, and time-based restricted shares that vest over a four-year period | |

| | | | | | |

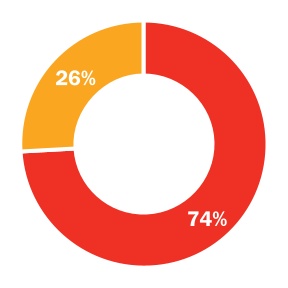

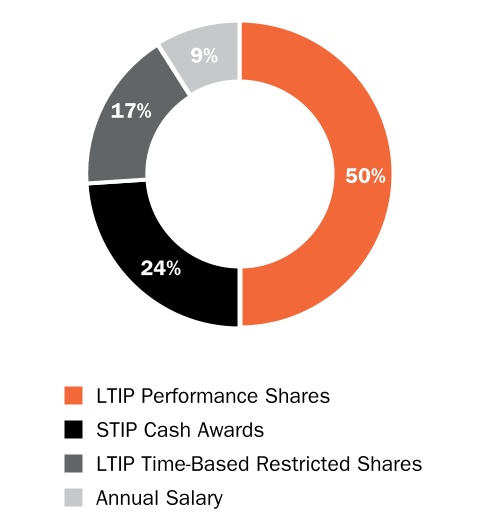

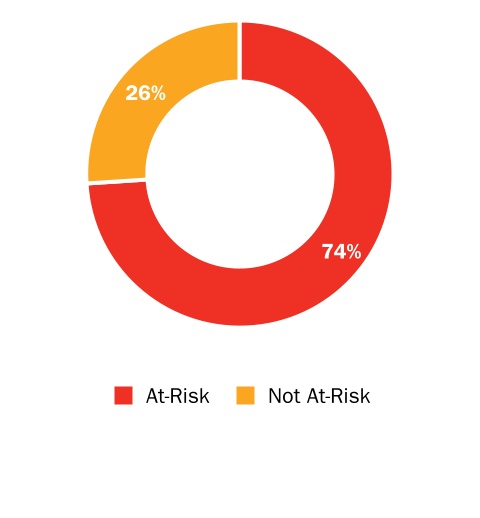

The majority of the compensation awarded under our programs is at-risk. Approximately 74% of our CEO’s total target direct compensation for the 2023 performance year consisted of compensation that was at-risk based on the achievement of certain performance metrics. Salary and time-based equity awards made up the remaining 26% of our CEO’s compensation.

| | | | | |

| 2024 Proxy Statement | Realty Income 5 |

CEO Compensation Mix

OUR BUSINESS PHILOSOPHY

As the Monthly Dividend Company®, we strive to invest in people and places to deliver dependable monthly dividends that grow over time. Our diversified portfolio of actively managed commercial properties under long-term net lease agreements seeks to generate consistent and predictable income while delivering favorable long-term risk-adjusted returns for our stockholders. In addition to creating value for our stockholders, we believe this strategy benefits all stakeholders, including our employees, clients, lenders, and the communities in which we operate. We prioritize building enduring relationships across all stakeholders and emphasize a collaborative “One Team” approach throughout our Company, working closely across departments for the benefit of our clients. We believe our clients’ success is our success.

Over time, we intend to continue growing our earnings and dividends by expanding existing operations and entering new businesses and industries, all without materially altering our risk profile. Our international expansion is an example of our deliberate approach, and we actively explore other growth initiatives. Our goal remains to acquire high-quality real estate leased to clients that already are or could become industry leaders, both in the U.S. and internationally. We believe our size, scale, access to and cost of capital, and reputation provide significant competitive advantages relative to peers. Moreover, we continue to invest in our technological infrastructure, including predictive analytics and machine learning, to enhance and fortify our competitive edge.

We further seek to create and maximize value through proactive portfolio and asset management strategies, including re-leasing, development, and/or sale of existing properties. Our long-term relationships and continuous engagement with clients and industry experts, together with our access to proprietary data derived from our real estate portfolio of over 15,450 properties (including properties acquired in the Spirit merger), ensure that we remain well informed on current and emerging trends.

We focus on delivering consistent growth across economic cycles and are, therefore, highly selective in the transactions we pursue. We have established long-standing relationships with clients, owners, developers, brokers, and advisers, while consistently developing new relationships. We analyze all potential transactions in depth, enabling us to identify properties, clients, and geographies that best fit our portfolio. In keeping with our long-term investment focus, we actively monitor the health of our clients and locations post-acquisition throughout the asset-ownership period. We do this through a combination of communication with clients, local market experts, and industry experts, by reviewing client and asset-level financials, and by using a variety of analytical approaches and tools.

| | | | | |

6 Realty Income | 2024 Proxy Statement |

STRATEGIC PLANNING

Our goal is to continue managing the Company in a manner that supports sustainable, long-term value creation for our stockholders. The Board of Directors frequently reviews and discusses the Company’s strategy during regularly scheduled Board meetings. These discussions allow the Board of Directors to assess further potential opportunities and threats to the business and position the Company to continue to perform in the future. The Company’s named executive officers and members of senior management engage in discussions on topics such as e-commerce, artificial intelligence, predictive analytics, and machine learning and the extent to which these tools can inform the Company’s investment strategy, and consider trends such as changing demographics, the global macroeconomic and political landscape, the impacts from pandemics, climate change and other sustainability considerations, and their implications to our Company. From time to time, experts on various topics are invited to the discussions to challenge thinking and invite healthy discourse. The Company also supports management’s and directors’ participation at various conferences and speaking engagements in order to introduce new topics and materials for discussion and further broaden long-term views on the business. We will continue to incorporate similar strategic reviews in our Board of Directors meetings and strive to stay proactive in responding to emerging trends by adjusting our strategy as needed.

CORPORATE GOVERNANCE HIGHLIGHTS

We remain committed to managing the Company for the benefit of our stockholders and maintaining good corporate governance practices. We continue to maintain the following corporate governance practices to enhance the Company’s reputation for integrity and serving our stockholders responsibly:

| | | | | | | | | | | | | | |

| | | | |

| All directors, with the exception of our CEO, are independent, and all Board committee members are independent. | | | We have a Chairman of the Board who is separate from and independent of our Chief Executive Officer. |

| | | | |

| | | | |

| | | | |

| All directors are subject to annual election with a majority voting standard in uncontested elections. | | | Our directors, officers, and other employees are subject to a Code of Business Ethics. |

| | | | |

| | | | |

| | | | |

| An Enterprise Risk Management (“ERM”) evaluation is conducted annually to identify and assess Company risk. | | | Our directors, officers, and employees are subject to anti-hedging and anti-pledging policies. |

| | | | |

| | | | |

| | | | |

| Anonymous reporting is available through our whistleblower hotline, which is tested annually and reported quarterly to our Audit Committee or Nominating/Corporate Governance Committee, as appropriate. | | | The time-based equity awards for our named executive officers have “double-trigger” acceleration provisions. |

| | | | |

| | | | |

| | | | |

| Cash and equity incentive compensation is subject to a formal clawback policy. | | | Our Compensation and Talent Committee oversees our human capital and talent management programs. |

| | | | |

| | | | |

| | | | |

| No stockholder rights plan is in effect. | | | Our Bylaws permit stockholders to propose amendments to our Bylaws. |

| | | | |

| | | | |

| | | | |

| Our directors and executive officers have minimum stock ownership requirements. | | | Our Bylaws permit stockholders to request the calling of a special meeting and include market-standard proxy access nominating provisions. |

| | | | |

| | | | |

| | | | |

| Our Board of Directors conducts regular executive sessions of independent directors. | | | We annually submit our executive compensation to a “say-on-pay” advisory vote by our stockholders. |

| | | | |

| | | | | |

| 2024 Proxy Statement | Realty Income 7 |

| | | | | | | | | | | | | | |

| | | | |

| Our Board of Directors focuses on board refreshment and recruitment and has appointed four new directors since 2021. | | | Our Board’s Nominating/Corporate Governance Committee maintains direct oversight of the Company’s environmental, social, and governance (“ESG”) or other corporate initiatives, and the Audit Committee maintains direct oversight of quantitative public disclosures related to ESG. |

| | | | |

| | | | |

| | | | |

| Pursuant to our Corporate Governance Guidelines, our directors may not sit on more than five public company boards (including the Company’s Board), or, to the extent a director is a chairman or lead independent director of a public company board, then not more than four public company boards (including the Company’s Board). | | | Our directors conduct annual self-evaluations and participate in orientation and continuing education programs. |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

We integrate our corporate responsibility initiatives into our organization and decision-making.

Our Sustainability Department reports to the Executive Vice President, Chief Legal Officer, General Counsel & Secretary and has oversight from the Nominating/Corporate Governance Committee of the Board of Directors on ESG matters, and the Audit Committee of the Board of Directors has oversight with respect to quantitative public disclosures related to ESG.

Our commitment is infused within all levels of our organization and in our partnerships with stakeholders. Our Chief Executive Officer and Board of Directors have given their support to our Sustainability Department and our employees so we can maximize our potential through operational initiatives and employee-driven initiatives, such as our voluntary Team Building Committees and Green Team. The Team Building Committees are comprised of volunteer employees across the Company’s offices, departments and seniority levels that organizes employee-driven, team-building events and activities to promote involvement, communication, and organizational continuity to foster strong interconnected relationships. We complement the Team Building Committee in support of our ESG efforts with the Green Team, a volunteer-based, employee-driven team that focuses on sustainability-related matters at our offices and in our communities. These teams foster employee engagement and morale and provide our team members an outlet to work towards our sustainability efforts.

Sustainability Highlights

Environmental Responsibility – We remain committed to sustainable business practices and encourage a culture of environmental responsibility within the Company and our communities. We foster relationships with our clients and suppliers to promote environmental stewardship. As possible, we have leveraged our size and business relationships to expand our client engagement to help us achieve our sustainability objectives. Highlights of our accomplishments include:

Environmental Responsibility – We remain committed to sustainable business practices and encourage a culture of environmental responsibility within the Company and our communities. We foster relationships with our clients and suppliers to promote environmental stewardship. As possible, we have leveraged our size and business relationships to expand our client engagement to help us achieve our sustainability objectives. Highlights of our accomplishments include:•Operating from green-certified buildings as our San Diego headquarters is Energy Star Certified and our Phoenix Office is LEED Platinum certified.

•Upgraded our San Diego headquarters with a building-wide LED retrofit and installation of lighting control system with light-harvesting technology, a building management system that monitors and controls energy use, an adaptive and intelligent irrigation system, energy efficient PVC roofing, electric vehicle charging stations, and carport photovoltaic panel system.

•Continuing client engagement to understand our client’s sustainability goals and initiatives, while seeking collaboration opportunities for utility data sharing, installation of renewable energy, and electric vehicle charging infrastructure, as well as other energy efficiency projects.

•Managing building performance and energy efficiency standards across our global portfolio.

•Working with strategic real estate partners to survey existing site-level environmental characteristics of our U.S. and international portfolio properties to continue to inventory low carbon initiatives.

| | | | | |

8 Realty Income | 2024 Proxy Statement |

•Expanding our green leasing practices utilizing sale-leaseback transactions, lease roll-overs, lease amendments, and other client collaborations to share asset-level operational data and improve the environmental performance across the portfolio.

•Broadened the scope of responsibilities of our management led ESG Reporting Task Force to support the increased U.S. and international reporting landscape. Evaluated and implemented leading technologies for ESG data collection and reporting.

•Established a Global ESG Committee led by our Chief Legal Officer and comprised of executives across the Company that is tasked with guiding the Company’s sustainability objectives, providing oversight of the changing ESG landscape, identifying priority opportunities and risks in the short-, medium- and long-term, and managing the Company’s ESG performance.

•Evaluated physical and transitional climate-related risks within our strategic enterprise-level risk assessment process. Our robust and comprehensive risk management plan continues to evaluate evolving physical and transitional climate-related risks. We also provide detailed discussion of our climate-related risks and opportunities in our Task Force on Climate-Related Financial Disclosures (“TCFD”) and SASB Standards aligned response, which is available in our larger Sustainability Report. The Sustainability Report is not incorporated into this proxy statement by reference.

Social Responsibility and Human Capital – We remain focused on our employees and the people within our communities. We:

Social Responsibility and Human Capital – We remain focused on our employees and the people within our communities. We:•Develop our people at their point of hire and continue this development throughout an employee’s tenure through training and ongoing skill-development opportunities.

•Hire talent from our local communities and provide early career professional insight into the value of a real estate career with us, utilizing targeted job advertisements and fostering employee referrals, to ensure we continually attract and embrace a diverse pool of candidates.

•Invest in our “Education to Employment” program to build relationships with local schools to provide internship opportunities for interested high school students.

•Provide assistance and support to employees who are working towards obtaining job-related licenses and relevant certifications, as well as continuing education. Opportunities to participate in professional and technical education are also available to employees who are looking to further develop and grow within the Company.

•Recognize that internal mobility within our organization unlocks yet another great source of talent. By encouraging our current employees to expand their skills and take on new challenges, we tap into a rich reservoir of potential that enhances our workforce’s capabilities and reinforces our corporate culture.

•Offer inclusion-related training for all employees and managers and provide employee learning programs aimed at continuing to build knowledge and facilitate open and safe conversations regarding critical inclusion topics, such as anti-discrimination and harassment, allyship, generational differences, race diversity, and gender equity both in our hybrid and remote office environments.

•Empower team leaders to establish department and/or team employee experience goals that are specific and measurable.

•Provide compensation and benefits packages that we believe are competitive with that of our peers and talent competitors.

•Recognize the value of tenured employees and offer a retirement policy to reward long-term commitment.

•Annually evaluate pay equity amongst our employees to ensure employees who perform similar job functions working under similar work conditions are paid similar wages regardless of gender, ethnicity, and race and identified no issues.

•Conduct regular employee engagement surveys, in addition to empowering employees to proactively address employee engagement and other matters through confidential and non-confidential means.

Our Injury and Illness Prevention Program helps us meet our goal of maintaining a safe and healthy working environment for our employees by focusing on ensuring the health and safety of our workforce through our injury and illness prevention program.

Our Injury and Illness Prevention Program helps us meet our goal of maintaining a safe and healthy working environment for our employees by focusing on ensuring the health and safety of our workforce through our injury and illness prevention program. | | | | | |

| 2024 Proxy Statement | Realty Income 9 |

Our “O”verall Wellbeing Program provides opportunities for our people to participate in various in-person and virtual activities and educational programs to enhance their personal and professional lives. Our wellbeing model is to engage employees covering five pillars of wellness: Purpose, Social, Financial, Community, and Physical. We support work-life fulfillment and integration by offering flexible work schedules, access to discounted fitness programs, on-site dry-cleaning pickup, car wash services, paid family leave, generous parental leave, lactation rooms, and an infant-at-work program for new parents. Employees also have access to a robust employee assistance program.

Our “O”verall Wellbeing Program provides opportunities for our people to participate in various in-person and virtual activities and educational programs to enhance their personal and professional lives. Our wellbeing model is to engage employees covering five pillars of wellness: Purpose, Social, Financial, Community, and Physical. We support work-life fulfillment and integration by offering flexible work schedules, access to discounted fitness programs, on-site dry-cleaning pickup, car wash services, paid family leave, generous parental leave, lactation rooms, and an infant-at-work program for new parents. Employees also have access to a robust employee assistance program. Governance – We are committed to maintaining good corporate governance. As it relates to ESG, our Board is briefed on ESG performance and disclosures and plays an active role in assessing risks and identifying opportunities for building a more resilient portfolio. In addition, an ERM evaluation is conducted annually to identify and assess our risks, including climate-related risks. Our Board’s Compensation and Talent Committee’s annual compensation reviews for our executive officers also includes discussions of ESG matters. For additional information on our governance practices, please see the “Board of Directors and Corporate Governance” section of this proxy statement.

Governance – We are committed to maintaining good corporate governance. As it relates to ESG, our Board is briefed on ESG performance and disclosures and plays an active role in assessing risks and identifying opportunities for building a more resilient portfolio. In addition, an ERM evaluation is conducted annually to identify and assess our risks, including climate-related risks. Our Board’s Compensation and Talent Committee’s annual compensation reviews for our executive officers also includes discussions of ESG matters. For additional information on our governance practices, please see the “Board of Directors and Corporate Governance” section of this proxy statement. Sustainability Report – Later this year, we will publish our annual Sustainability Report, which will include details of our corporate responsibility initiatives, and will include disclosures against the TCFD Recommendations, SASB Standards, and the Global Reporting Initiative (“GRI”) standards. Our sustainability reports are available in the sustainability section of our website at www.realtyincome.com. We encourage our stockholders to review our sustainability reports to better understand the significant emphasis we place on all of our corporate responsibility initiatives. The sustainability reports are not incorporated into this proxy statement by reference.

Sustainability Report – Later this year, we will publish our annual Sustainability Report, which will include details of our corporate responsibility initiatives, and will include disclosures against the TCFD Recommendations, SASB Standards, and the Global Reporting Initiative (“GRI”) standards. Our sustainability reports are available in the sustainability section of our website at www.realtyincome.com. We encourage our stockholders to review our sustainability reports to better understand the significant emphasis we place on all of our corporate responsibility initiatives. The sustainability reports are not incorporated into this proxy statement by reference. EEO-1 Report – Our EEO-1 Report, which is a report filed with the U.S. Equal Employment Opportunity Commission and presents workforce data from employers with more than 100 U.S. employees, is available in the social responsibility section of our website at www.realtyincome.com. The EEO-1 Report and website are not incorporated into this proxy statement by reference.

EEO-1 Report – Our EEO-1 Report, which is a report filed with the U.S. Equal Employment Opportunity Commission and presents workforce data from employers with more than 100 U.S. employees, is available in the social responsibility section of our website at www.realtyincome.com. The EEO-1 Report and website are not incorporated into this proxy statement by reference.SUPPORTING OUR COMMUNITY

We are continuing to build enduring relationships and brighter financial futures through continuously renewing our connection with the community by serving others and supporting nonprofits whose aim is to sustainably improve and uplift our communities. We encourage our employees to give back where we live and work by volunteering time and making financial donations.

During 2023, we took the following actions to support, build, and improve our community:

•Continued a program enacted in 2023, whereby employees are able to receive up to eight (8) hours of paid time off during an employee’s regular schedule to volunteer at a nonprofit;

•Continued to offer the financial matching donations made by employees to nonprofits up to $500 per employee;

•Continued to offer a financial contribution up to $400 per employee who volunteers their time outside of their regular schedule (normal working hours) at a nonprofit, excluding volunteer paid time off policy hours;

•Made corporate financial donations to 50/50 Women on Board, The CLE Foundation, American Red Cross, Habitat for Humanity (San Diego, Atlanta, Phoenix, and Great Britain), Cristo Rey San Diego, Clean the World, Save the Children, Coastal Roots, Green National Forests, and Marine Toys for Tots Foundation; and

•Encouraged employees across our organization to support various nonprofits, including The Animal Pad, Alzheimer’s San Diego, Susan G Komen Breast Cancer Foundation, National Kidney Foundation, Veterans of Foreign Wars of the United States, Big Brothers Big Sisters of San Diego, and many more.

| | | | | |

10 Realty Income | 2024 Proxy Statement |

STOCKHOLDER ENGAGEMENT

We believe engaging with our stockholders on an ongoing basis is essential to understanding what is important to our investors and ensuring best practices are maintained across our business. In addition to maintaining active communication with stockholders throughout the year, we engage with stockholder governance teams annually in anticipation of each annual meeting of our stockholders.

| | | | | | | | | | | | | | | | | | | | |

| Outreach and Engagement | | à | | Evaluate and Respond | |

| | | | | |

| •In connection with the 2023 Annual Meeting of Stockholders, we reached out to stockholders collectively representing approximately 69% of our shares outstanding and engaged with stockholders collectively representing approximately 60% of our shares outstanding. We continued outreach efforts in connection with the Annual Meeting. •Our Board of Directors’ Independent Chairman participates in our stockholder engagement process, providing stockholders direct access to our Board of Directors. •Discussion covers various topics, including environmental, social and governance considerations, executive compensation, Board refreshment, composition and structure of our Board, and company culture. | | | •We provide the Board of Directors and its committees, as applicable, periodic updates of outreach activities. •We consider input provided by our stockholders to current and proposed governance practices and public disclosures. •The Nominating/Corporate Governance Committee oversees the Company’s ESG initiatives and strategies. •We continue to enhance our ESG initiatives and disclosures, including issuing our annual Sustainability Report. •Refresh and monitor the composition of the Board to achieve optimal Board structure and composition. | |

| | | | | |

| | | | | |

| 2024 Proxy Statement | Realty Income 11 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Proposals to

be voted on | | |

| | | | |

| | at the 2024 annual meeting. | | |

| | | | |

| | Proposal One Election of Directors | | Proposal Two Ratification of Appointment of Independent Registered Public Accounting Firm | | Proposal Three Advisory Vote to Approve the Compensation of Our Named Executive Officers | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | PROPOSAL ONE Election of Directors We believe that our 11 director nominees contribute the breadth of knowledge and experience necessary for the advancement of our business strategies and objectives. | |

| | | | | | | |

DIRECTOR NOMINEES

Our Board of Directors currently consists of 12 directors. Ronald L. Merriman has decided to retire from the Board and will not stand for re-election to our Board of Directors at the Annual Meeting. Mr. Merriman intends to continue to serve on the Board and on the Company’s Audit and Nominating/Corporate Governance Committees until the expiration of his current term at the Annual Meeting. Accordingly, the size of the Board will reduce to 11 directors effective upon Mr. Merriman’s retirement.

The Board of Directors, upon the recommendation of the Nominating/Corporate Governance Committee, has nominated the below 11 current directors for election at the Annual Meeting, each to serve for a one-year term expiring at our annual meeting of stockholders in 2025 and until their respective successors are duly elected and qualified. The information presented below highlights what led our Board of Directors to the conclusion that each nominee should serve as a director. We believe that all of our director nominees have a reputation for integrity, honesty, and adherence to high ethical standards. Each of our director nominees has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Realty Income and our Board of Directors. We also value the additional perspective that comes from serving on other companies’ boards of directors and board committees.

We continue to review the composition of the Board of Directors in an effort to assemble a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in various areas. Further, directors are not automatically re-nominated annually. Rather, on an annual basis, in making a recommendation to the Board in connection with a director’s nomination for election to the Board, the Nominating/Corporate Governance Committee reviews each candidate’s: (i) business and professional background, including any changes, (ii) contributions to the Board, (iii) skill sets and expertise, (iv) understanding of applicable laws and regulations and other elements thought to be relevant to the success of the Company, (v) time constraints including other board service, (vi) tenure with the Board, and (vii) diversity of background. The Nominating/Corporate Governance Committee formulates its recommendation on each individual candidate in the context of the Board as a whole, taking into consideration feedback from the Board’s most recent evaluation.

| | | | | |

| 2024 Proxy Statement | Realty Income 13 |

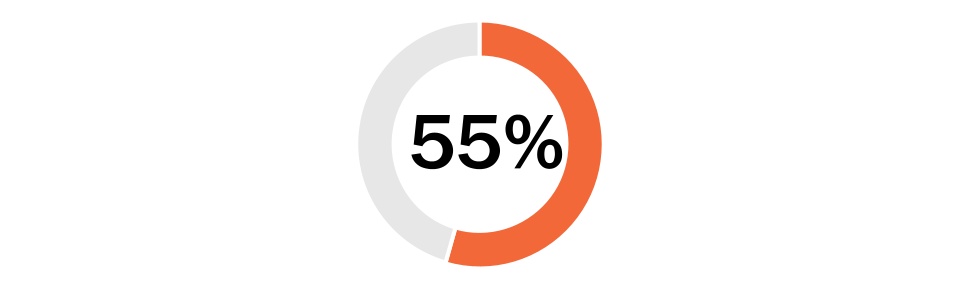

Certain Key Board Characteristics

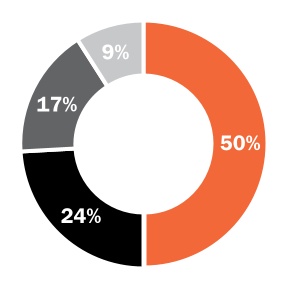

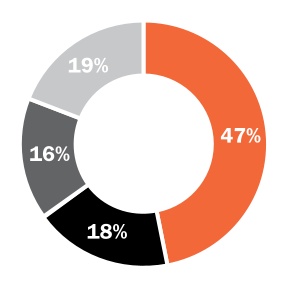

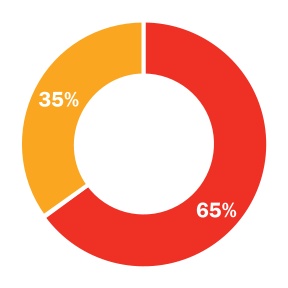

We seek to ensure our Board of Directors has diversity of background, expertise, perspective, age, gender identity, ethnicity, and tenure on the Board. As of April 15, 2024, our Board of Directors standing for re-election was comprised of the following:

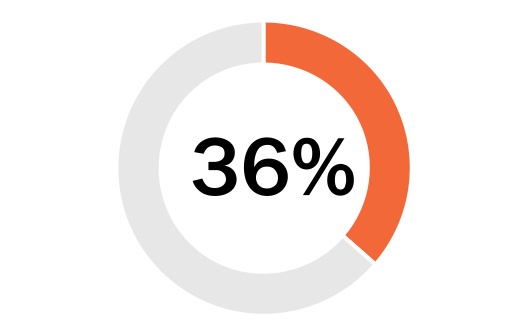

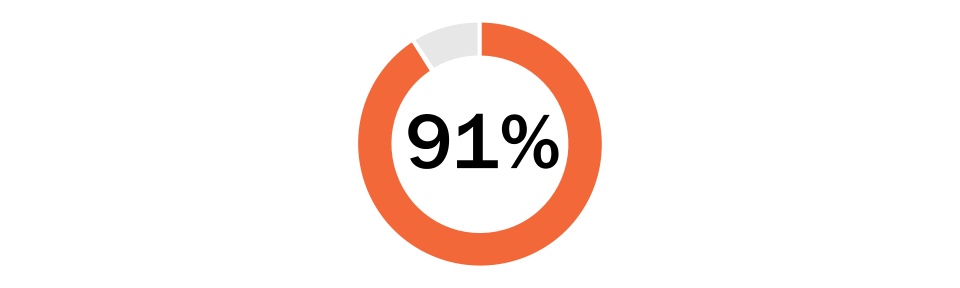

Female

Percentage of Board Members that identify as female

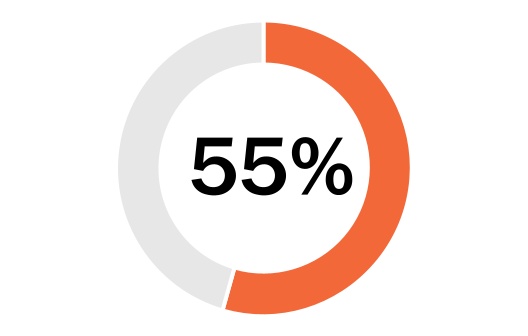

Underrepresented Community(1)

Percentage of Board Members that identify as being from an under-represented community

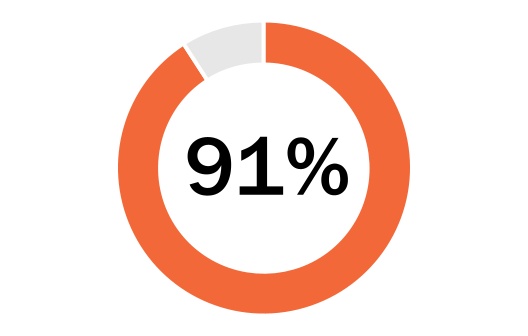

Independent

Percentage of Board Members that are independent

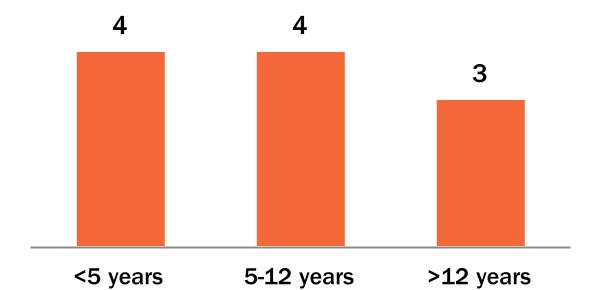

Tenure on the Board

1.We define a member of under-represented communities as an individual who self-identifies as Black, African American, Hispanic, Latino, Asian (inclusive of individuals who self-identify as South Asian or Indian), Pacific Islander, Native American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual, or transgender.

| | | | | |

14 Realty Income | 2024 Proxy Statement |

Based on the recommendation of our Nominating/Corporate Governance Committee, our Board of Directors has nominated the following 11 directors for election at the Annual Meeting, each to serve until our annual meeting of stockholders in 2025 and until their respective successors have been duly elected and qualified:

| | | | | | | | | | | | | | |

| Director Name | Independent | Audit Committee | Compensation and Talent Committee | Nominating/Corporate Governance Committee |

| | | | |

Michael D. McKee(1) | | | | |

Priscilla Almodovar | | | | |

Jacqueline Brady | | | | |

A. Larry Chapman | | | | |

Reginald H. Gilyard | | | | |

Mary Hogan Preusse | | | | |

Priya Cherian Huskins | | | | |

Jeff A. Jacobson(2) | | | | |

| Gerardo I. Lopez | | | | |

Gregory T. McLaughlin | | | | |

Sumit Roy | | | | |

– Committee Member – Committee Member |  – Committee Chair – Committee Chair | | | |

1.Non-Executive Independent Chairman of the Board of Directors.

2.On February 12, 2024, Ronald L. Merriman, notified the Board of Directors of his decision to retire and not stand for re-election at the Company’s Annual Meeting. Mr. Merriman intends to continue to serve on the Board and on the Company’s Audit and Nominating/Corporate Governance Committees until the expiration of his current term at the Annual Meeting. Mr. Jacobson was appointed to serve on the Audit Committee in connection with his appointment to the Board and both appointments were effective as of February 21, 2024.

For more information regarding our nominees, please see the “Board of Directors and Corporate Governance” section of this Proxy Statement beginning on page 17. | | | | | |

| 2024 Proxy Statement | Realty Income 15 |

The following chart highlights the specific experience, qualifications, attributes, and skills of our Board standing for re-election based on their education and prior experience. We believe the combination of the skills and qualifications shown below demonstrates how our Board is well positioned to provide strategic advice and effective oversight to our management. More detail is provided in each director nominee’s biography below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skill | Michael D.

McKee | Priscilla

Almodovar | Jacqueline

Brady | A. Larry

Chapman | Reginald

H. Gilyard | Mary

Hogan

Preusse | Priya

Cherian

Huskins | Jeff A. Jacobson | Gerardo

I. Lopez | Gregory T.

McLaughlin | Sumit

Roy |

| | | | | | | | | | | | |

| Governance Guidelines Criteria |

| Independent | | | | | | | | | | | |

| Senior Leadership Experience | | | | | | | | | | | |

| Global Exposure | | | | | | | | | | | |

| Board Experience | | | | | | | | | | | |

| Accounting &

Financial Expertise | | | | | | | | | | | |

| Investment Management | | | | | | | | | | | |

| Capital Markets | | | | | | | | | | | |

| Strategic Planning | | | | | | | | | | | |

| Risk Management | | | | | | | | | | | |

| Human Capital Management | | | | | | | | | | | |

| Environmental, Social & Governance | | | | | | | | | | | |

| Technology | | | | | | | | | | | |

| Industry Experience |

| Real Estate | | | | | | | | | | | |

| Demographic Background |

Tenure (years)(1) | 30 | 2 | 3 | 12 | 6 | 2 | 16 | — | 6 | 17 | 6 |

Average Tenure (years): 9 |

Gender Diversity(2) | | | | | | | | | | | |

| Age | 78 | 56 | 56 | 77 | 60 | 55 | 52 | 62 | 64 | 64 | 54 |

Average Age: 62 |

Underrepresented Community(3) | | | | | | | | | | | |

Veteran(4) | | | | | | | | | | | |

1.Tenure and age are as of April 15, 2024.

2.Based on each director’s self-identification and includes members who identify as female or non-binary.

| | | | | |

16 Realty Income | 2024 Proxy Statement |

3.Based on each director’s self-identification. We define a member of under-represented communities as an individual who self-identifies as Black, African American, Hispanic, Latino, Asian (inclusive of individuals who self-identify as South Asian or Indian), Pacific Islander, Native American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual, or transgender.

4.Based on each director’s self-identification.

Board Independence

Our Board of Directors has determined that each of our current directors and nominees, except for Mr. Roy, has no material relationship with us (either directly or indirectly through an immediate family member or as a partner, stockholder, or officer of an organization that has a relationship with us) and is “independent” within the meaning of our director independence standards and NYSE director independence standards. Our Board of Directors established and employed categorical standards, which mirror NYSE independence requirements, in determining whether a relationship is material and thus would disqualify a director from being independent.

Non-Executive Independent Chairman of the Board

The Nominating/Corporate Governance Committee evaluates the Board of Directors’ leadership structure. Since 1997, the positions of Non-Executive Chairman of the Board of Directors and CEO have been separate in recognition of the differences between the two roles. Mr. McKee serves as our Non-Executive Chairman of the Board of Directors and presides as lead independent director, while Mr. Roy serves as our CEO. The Board of Directors believes this is the most appropriate structure because it enables the independent directors to participate meaningfully in the leadership of our Board of Directors while utilizing most efficiently the leadership skills of both Messrs. McKee and Roy. In addition, separating the roles of Non-Executive Chairman and CEO allows our Non-Executive Chairman to serve as a liaison between the Board of Directors and executive management, while providing our CEO with the flexibility and focus needed to oversee our operations.

| | | | | | | | |

| | Priscilla Almodovar EXPERIENCE Priscilla Almodovar is the Chief Executive Officer and member of the Board of Directors of the Federal National Mortgage Association (“Fannie Mae”) since December 2022. Prior to joining Fannie Mae, Ms. Almodovar held the position of President and Chief Executive Officer of Enterprise Community Partners from September 2019 to December 2022. Ms. Almodovar held the position of Managing Director at JP Morgan Chase from January 2010 to September 2019, where she led its national real estate businesses which focused on commercial real estate and community development. From 2006 to 2009, she served as the President and Chief Executive Officer of the New York State Housing Finance Agency/State of New York Mortgage Agency. From 1990 to 2004, Ms. Almodovar practiced law at the global law firm, White & Case LLP, where she became a partner in 1998, and specialized in international project finance. Ms. Almodovar previously served as a member of the U.S. Secretary of Energy Advisory Board and as a director of VEREIT, Inc. from February 2021 through the closing of its merger with the Company in November 2021. Ms. Almodovar holds a Juris Doctorate degree from Columbia University School of Law and a Bachelor of Arts degree in economics from Hofstra University. QUALIFICATIONS Ms. Almodovar offers a valuable and knowledgeable perspective with her financial expertise and tenure in the real estate and legal industries. She has excelled in her career in executive roles across private, public, and nonprofit companies, bringing diverse experience and insights on operations, enterprise risk management and corporate social responsibility. |

Age: 56 | |

Director Since: 2021 | |

Committees: Audit (Chair) | |

Independent: Yes | |

| |

| | | | | |

| 2024 Proxy Statement | Realty Income 17 |

| | | | | | | | |

| | Jacqueline Brady EXPERIENCE Jacqueline Brady is a Managing Director at PGIM Private Alternatives and Head of Global Debt Solutions. PGIM Private Alternatives manages over $300 billion in private credit, private equity, and real estate debt and equity strategies globally. Prior to joining PGIM in July 2017, Ms. Brady held numerous executive roles in real estate investment management, investment banking and structured finance, at firms including JP Morgan, Nomura Securities, and Capmark Investments. In June 2011, Ms. Brady co-founded Canopy Investment Advisors, an SEC-registered investment advisor, where she served until June 2017. Since 2007, Ms. Brady has served on the Board of Managers of Haverford College and, since 2009, has served on its Investment Committee which has responsibility for the management of the college’s endowment. Previously, Ms. Brady served on the Board of Managers’ Audit, Property, and Finance Committees. Ms. Brady serves on the Council Leadership of the Urban Land Institute’s Global Exchange Council and Chairs the Publications Committee for the Pension Real Estate Association (“PREA”). Ms. Brady holds a master’s degree in international economics and international relations from the Johns Hopkins University and bachelor’s degree in political science from Haverford College. QUALIFICATIONS Ms. Brady brings beneficial knowledge with her diverse background in global real estate. Her collaborative style, international experience, investment management expertise, and capital markets background complements the talents of our Board of Directors as we continue to expand our industry-leading real estate platform both domestically and internationally. |

Age: 56 | |

Director Since: 2021 | |

Committees: Nominating/Corporate Governance | |

Independent: Yes | |

| |

| | | | | | | | |

| | A. Larry Chapman EXPERIENCE A. Larry Chapman is a retired 37-year veteran of Wells Fargo, having served as Executive Vice President and the Head of Commercial Real Estate from 2006 until his retirement in June 2011, and as a member of the Wells Fargo Management Committee. Mr. Chapman joined Wells Fargo in 1974 in its Houston Real Estate office. In 1987, he was promoted to President of Wells Fargo Realty Advisors, a wholly-owned subsidiary of Wells Fargo & Co. The subsidiary’s primary responsibility was managing Wells Fargo Mortgage and Equity Trust, which was formed in 1970 and sold in 1989. He remained President of Wells Fargo Realty Advisors until 1990 and was promoted to Group Head of the Wells Fargo Real Estate Group in 1993. Mr. Chapman managed the Wells Fargo Real Estate Group until his 2006 promotion to Executive Vice President and Head of Commercial Real Estate for Wells Fargo on a nationwide basis. Mr. Chapman is a former board member of the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley, past governor and trustee of the Urban Land Institute, former member of the National Association of Real Estate Investment Trusts (“Nareit”), and member and past trustee of the International Council of Shopping Centers (“ICSC”). He served on the board of directors of CBL & Associates Properties, Inc. (NYSE: CBL) from August 2013 to November 2021. Mr. Chapman is a graduate of Texas Tech University with an undergraduate degree in finance. QUALIFICATIONS Mr. Chapman’s financial acumen and extensive commercial real estate experience across many industries and tenant types provide valuable insight and expertise to the Board of Directors and our senior management team as we continue to expand our real estate portfolio. In addition, his background as a leader of a Fortune 500 company, and as a member of its management team, further enhances the quality of leadership and oversight provided by our Board of Directors. |

Age: 77 | |

Director Since: 2012 | |

Committees: Audit | |

Independent: Yes | |

| |

| | | | | |

18 Realty Income | 2024 Proxy Statement |

| | | | | | | | |

| | Reginald H. Gilyard EXPERIENCE Reginald H. Gilyard is a Senior Advisor at the Boston Consulting Group, Inc. (“BCG”) where he is a recognized leader in strategy development and execution and has served in this role since 2017. Prior to this role, Mr. Gilyard served as Dean of the Argyros School of Business and Economics at Chapman University from 2012 to 2017. Under Mr. Gilyard’s leadership, the school significantly increased its national rankings at the undergraduate and graduate levels. Prior to joining Chapman University, from 1996 to 2012, Mr. Gilyard served as Partner and Managing Director at BCG where he led national and multi-national engagements with large corporations in strategy, mergers and acquisitions, and business transformation. Prior to BCG, Mr. Gilyard served nine years in the U.S. Air Force as a Program Manager and was then promoted to Major in the U.S. Air Force Reserves where he served for an additional three years. Mr. Gilyard has served on the board of directors and as the Chairman of the board of directors of Orion Office REIT Inc. (NYSE:ONL) since November 2021. He has also served on the board of directors of First American Financial Corporation (NYSE:FAF) since May 2017 and of CBRE Group Inc. (NYSE: CBRE) since November 2018. He serves on the board for Pacific Charter School Development, a 501(c)(3) real estate development company serving low-income families in urban centers across the United States. Mr. Gilyard holds an M.B.A. from Harvard Business School, a Master of Science degree from the United States Air Force Institute of Technology, and a Bachelor of Science degree from the United States Air Force Academy. QUALIFICATIONS Mr. Gilyard offers valuable knowledge regarding strategy development and execution, having worked with management teams and boards to develop and implement successful strategies for over 25 years. His extensive consulting experience includes leading national and multi-national strategic engagements, pre-and post-merger and acquisitions activity, and business transformation. Mr. Gilyard’s skill set and experience in a broad array of industries allow him to provide diverse and valuable perspectives to our Board of Directors. |

Age: 60 | |

Director Since: 2018 | |

Committees: Nominating/Corporate Governance (Chair) | |

Independent: Yes | |

| |

| | | | | | | | |

| | Mary Hogan Preusse EXPERIENCE Mary Hogan Preusse has served on the board of directors of Kimco Realty Corporation (NYSE:KIM) since February 2017, Digital Realty Trust, Inc. (NYSE: DLR) since May 2017 serving as the Chair of the Board since June 2023, and Host Hotels & Resorts, Inc. (Nasdaq: HST) since June 2017. Since October 2021, she has also been a Senior Advisor to Fifth Wall, the venture capital firm. She is a member of Nareit’s Advisory Board of Governors and is a recipient of that organization’s Industry Achievement Award. Until her retirement in 2017, Ms. Hogan Preusse held the position of Managing Director and Co-Head of Americas Real Estate at APG Asset Management US, Inc. (“APG”), where she was responsible for managing the firm’s public real estate investments in the Americas. Prior to joining APG in 2000, she spent eight years as a sell side analyst covering the REIT sector, and she began her career at Merrill Lynch as an investment banking analyst. Ms. Hogan Preusse previously served as a director of VEREIT, Inc. from February 2017 through the closing of its merger with the Company in November 2021. Ms. Hogan Preusse holds an undergraduate degree in mathematics from Bowdoin College and is a member of Bowdoin’s Board of Trustees. QUALIFICATIONS Ms. Hogan Preusse offers extensive real estate experience, capital markets knowledge, and industry leadership. Her investment expertise, activism in the community by promoting diversity on corporate boards, and speaking on panels on topics such as environmental, social, and governance factors are valued insights that she brings to the Board of Directors. |

Age: 55 | |

Director Since: 2021 | |

Committees: Compensation and Talent | |

Independent: Yes | |

| |

| | | | | |

| 2024 Proxy Statement | Realty Income 19 |

| | | | | | | | |

| | Priya Cherian Huskins EXPERIENCE Priya Cherian Huskins has served as Senior Vice President and partner of Woodruff Sawyer & Co. (“Woodruff Sawyer”), a commercial insurance brokerage and consulting firm since 2003. Prior to joining Woodruff Sawyer, Ms. Huskins served as a corporate and securities attorney at the law firm of Wilson Sonsini Goodrich & Rosati from 1997 to 2003. She has served on the advisory board of the Stanford Rock Center for Corporate Governance since 2012. She has served on the board of directors of Woodruff Sawyer since 2016, including as the Presiding Director since 2023. She has also served on the boards of directors of NMI Holdings, Inc. (Nasdaq: NMIH) since 2021 and the Long Term Stock Exchange since 2022. She previously served as lead independent director of Anzu SPAC I (Nasdaq: ANZUU ) (n/k/a Envoy Medical, Inc. (Nasdaq: COCH)) from 2021 to 2023. She also previously served on the board of directors of the Silicon Valley Directors’ Exchange (SVDX) from 2013 to 2018. Ms. Huskins holds a Juris Doctorate degree from the University of Chicago Law School and an undergraduate degree from Harvard College. QUALIFICATIONS With her background in law, insurance, and risk management, Ms. Huskins brings a focus on these areas to our Board of Directors. As a recognized expert in directors and officers’ liability risk and its mitigation, Ms. Huskins provides valuable insight into our risk management strategy. In addition, she brings experience regarding corporate governance matters, including compensation best practices and ways that corporate governance can enhance stockholder value. Ms. Huskins’ experience makes her a valuable member of a well-rounded Board of Directors. |

Age: 52 | |

Director Since: 2007 | |

Committees: Compensation and Talent (Chair) and Nominating/Corporate Governance | |

Independent: Yes | |

| | | | | | | | |

| | Jeff A. Jacobson EXPERIENCE Mr. Jacobson is a retired Global Chief Executive Officer of LaSalle Investment Management (“LaSalle”), the real estate investment arm of Jones Lang LaSalle Inc. (NYSE: JLL), serving in such role from 2007 to 2021. Prior to this, he served as LaSalle’s European Chief Executive Officer from 2000 to 2006. During the period between 1986 and 1998, Mr. Jacobson served in various positions with LaSalle. From 1998 to 2000, he served in leadership positions with Security Capital Group, Inc., a real estate holding company. Mr. Jacobson has over 35 years of real estate investment experience, including that during his tenure at LaSalle he sat on three regional investment committees in North America, Europe, and Asia. He has investment expertise in a variety of geographic markets, asset sectors, investment structures, and risk/return strategies. Since 2022, he has served on the board of directors of Cadillac Fairview Corporation, an owner, operator, investor, and developer of office, retail, multi-family residential, industrial, and mixed-use properties in North America and is wholly-owned by the Ontario Teachers’ Pension Plan. Mr. Jacobson is also a Senior Adviser to The Vistria Group, a private investment firm focused on investing in essential industries, such as healthcare, financial services, and housing. Mr. Jacobson holds both a Bachelor of Arts degree in economics and a Master of Arts degree from the Food Research Institute of Stanford University. QUALIFICATIONS Mr. Jacobson offers extensive real estate and executive leadership experience with global real estate companies. His investment expertise in various geographies, assets and structures and experience in evaluating growth strategies are valued insights that he brings to the Board of Directors. |

Age: 62 | |

Director Since: 2024 | |

Committees: Audit | |

Independent: Yes | |

| |

| | | | | |

20 Realty Income | 2024 Proxy Statement |

| | | | | | | | |