Table of Contents

As filed with the Securities and Exchange Commission on March 24, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Tribune Media Company*

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 4833 | 36-1880355 | ||

| (State or other jurisdiction of incorporation) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

435 North Michigan Avenue

Chicago, Illinois 60611

(212) 210-2786

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Edward Lazarus

Executive Vice President, General Counsel, Chief Strategy Officer and Corporate Secretary

Tribune Media Company

685 Third Avenue, 30th Floor

New York, NY 10017

(312) 222-3934

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

With a copy to:

Peter J. Loughran, Esq.

Debevoise & Plimpton LLP

919 Third Avenue

New York, New York 10022

(212) 909-6000

| * | Information regarding additional registrants is contained in the Table of Additional Registrants on the following page. |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Table of Contents

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per unit (1) |

Proposed maximum aggregate offering price |

Amount of registration fee (2) | ||||

| 5.875% Senior Notes due 2022 issued by Tribune Media Company |

$1,100,000,000 | 100% | $1,100,000,000 | $110,770(2) | ||||

| Guarantees of 5.875% Senior Notes due 2022 (3) |

— | — | — | None | ||||

| Total |

$1,100,000,000 | 100% | $1,100,000,000 | $110,770 | ||||

|

| ||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) promulgated under the Securities Act of 1933, as amended. |

| (2) | The registration fee has been calculated under Rule 457(f) of the Securities Act. |

| (3) | See the following page for a table of guarantor registrants. Pursuant to Rule 457(n) under the Securities Act, no separate fee for the guarantees is payable. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

Table of Contents

Table of Additional Registrants

| Exact Name of Registrant |

State or Other Jurisdiction of Formation |

I.R.S. Employer Identification Number | ||||

| Baseline Acquisitions, LLC |

Subsidiary Guarantor | Delaware | 30-0701482 | |||

| Baseline, LLC |

Subsidiary Guarantor | Delaware | 61-1661620 | |||

| CastTV Inc. |

Subsidiary Guarantor | Delaware | 20-8548742 | |||

| Chicagoland Television News, LLC |

Subsidiary Guarantor | Delaware | 36-3801352 | |||

| Classified Ventures Holdco, LLC |

Subsidiary Guarantor | Delaware | 37-1702523 | |||

| FoxCo Acquisition, LLC |

Subsidiary Guarantor | Delaware | 26-1621964 | |||

| FoxCo Acquisition Finance Corporation |

Subsidiary Guarantor | Delaware | 26-2663860 | |||

| FoxCo Acquisition Sub, LLC |

Subsidiary Guarantor | Delaware | 26-1621807 | |||

| Gracenote, Inc. |

Subsidiary Guarantor | Delaware | 35-2052662 | |||

| KDAF, LLC |

Subsidiary Guarantor | Delaware | 36-4736969 | |||

| KIAH, LLC |

Subsidiary Guarantor | Delaware | 76-0484014 | |||

| KPLR, Inc. |

Subsidiary Guarantor | Missouri | 43-0737943 | |||

| KRCW, LLC |

Subsidiary Guarantor | Delaware | 32-0381772 | |||

| KSTU, LLC |

Subsidiary Guarantor | Delaware | 26-2467066 | |||

| KSTU License, LLC |

Subsidiary Guarantor | Delaware | 26-2467494 | |||

| KSWB, LLC |

Subsidiary Guarantor | Delaware | 94-2457035 | |||

| KTLA, LLC |

Subsidiary Guarantor | Delaware | 95-1743404 | |||

| KTVI, LLC |

Subsidiary Guarantor | Delaware | 26-2466669 | |||

| KTVI License, LLC |

Subsidiary Guarantor | Delaware | 26-2466730 | |||

| KTXL, LLC |

Subsidiary Guarantor | Delaware | 68-0183844 | |||

| KWGN, LLC |

Subsidiary Guarantor | Delaware | 84-0565347 | |||

| Local TV, LLC |

Subsidiary Guarantor | Delaware | 20-8182582 | |||

| Local TV Aircraft, Inc. |

Subsidiary Guarantor | Delaware | 27-2793325 | |||

| Local TV Finance, LLC |

Subsidiary Guarantor | Delaware | 20-8613926 | |||

| Local TV Finance Corporation |

Subsidiary Guarantor | Delaware | 20-8849384 | |||

| Local TV Holdings, LLC |

Subsidiary Guarantor | Delaware | 11-3841144 | |||

| Local TV Norfolk Real Estate, LLC |

Subsidiary Guarantor | Delaware | 27-3219274 | |||

| Magic T Music Publishing Company, LLC |

Subsidiary Guarantor | Delaware | 36-3716522 | |||

| Media by Numbers, LLC |

Subsidiary Guarantor | Delaware | 80-0274967 | |||

| Oak Brook Productions, LLC |

Subsidiary Guarantor | Delaware | 36-4012598 | |||

| Riverwalk Holdco, LLC |

Subsidiary Guarantor | Delaware | 80-0852493 | |||

| Riverwalk Holdco II, LLC |

Subsidiary Guarantor | Delaware | 90-0938767 | |||

| Studio Systems, LLC |

Subsidiary Guarantor | Delaware | 80-0274968 | |||

| Tower Distribution Company, LLC |

Subsidiary Guarantor | Delaware | 73-1539066 | |||

| Towering T Music Publishing Company, LLC |

Subsidiary Guarantor | Delaware | 36-4202470 | |||

| Tribune (FN) Cable Ventures, LLC |

Subsidiary Guarantor | Delaware | 36-3909782 | |||

| Tribune Broadcasting Company, LLC |

Subsidiary Guarantor | Delaware | 36-3082568 | |||

| Tribune Broadcasting Company II, LLC |

Subsidiary Guarantor | Delaware | 36-4766010 | |||

| Tribune Broadcasting Denver, LLC |

Subsidiary Guarantor | Delaware | 26-2466053 | |||

| Tribune Broadcasting Denver License, LLC |

Subsidiary Guarantor | Delaware | 26-2466204 | |||

| Tribune Broadcasting Fort Smith, LLC |

Subsidiary Guarantor | Delaware | 20-8614038 | |||

| Tribune Broadcasting Fort Smith License, LLC |

Subsidiary Guarantor | Delaware | 20-8614064 | |||

| Tribune Broadcasting Hartford, LLC |

Subsidiary Guarantor | Delaware | 06-1501268 | |||

| Tribune Broadcasting Indianapolis, LLC |

Subsidiary Guarantor | Delaware | 90-0866434 | |||

| Tribune Broadcasting Kansas City, Inc. |

Subsidiary Guarantor | Delaware | 13-3771990 | |||

| Tribune Broadcasting Norfolk, LLC |

Subsidiary Guarantor | Delaware | 20-8614526 | |||

| Tribune Broadcasting Oklahoma City, LLC |

Subsidiary Guarantor | Delaware | 20-8614282 | |||

Table of Contents

| Exact Name of Registrant |

State or Other Jurisdiction of Formation |

I.R.S. Employer Identification Number | ||||||

| Tribune Broadcasting Oklahoma City License, LLC |

Subsidiary Guarantor | Delaware | 20-8614407 | |||||

| Tribune Broadcasting Seattle, LLC |

Subsidiary Guarantor | Delaware | 62-1172975 | |||||

| Tribune Digital Ventures, LLC |

Subsidiary Guarantor | Delaware | 32-0420944 | |||||

| Tribune Entertainment Company, LLC |

Subsidiary Guarantor | Delaware | 36-2596232 | |||||

| Tribune Management Holdings, LLC |

Subsidiary Guarantor | Delaware | 90-0866362 | |||||

| Tribune Media Services, LLC |

Subsidiary Guarantor | Delaware | 13-0571080 | |||||

| Tribune National Marketing Company, LLC |

Subsidiary Guarantor | Delaware | 36-3166231 | |||||

| Tribune Television New Orleans, Inc. |

Subsidiary Guarantor | Delaware | 36-3234055 | |||||

| WDAF License, Inc. |

Subsidiary Guarantor | Delaware | 13-3771993 | |||||

| WDAF Television, Inc. |

Subsidiary Guarantor | Delaware | 13-3818215 | |||||

| WDCW, LLC |

Subsidiary Guarantor | Delaware | 36-4308300 | |||||

| WGHP, LLC |

Subsidiary Guarantor | Delaware | 26-2466872 | |||||

| WGHP License, LLC |

Subsidiary Guarantor | Delaware | 26-2466914 | |||||

| WGN Continental Broadcasting Company, LLC |

Subsidiary Guarantor | Delaware | 36-1919530 | |||||

| WHNT, LLC |

Subsidiary Guarantor | Delaware | 20-8613971 | |||||

| WHNT License, LLC |

Subsidiary Guarantor | Delaware | 20-8614006 | |||||

| WHO License, LLC |

Subsidiary Guarantor | Delaware | 20-8614152 | |||||

| WHO Television, LLC |

Subsidiary Guarantor | Delaware | 20-8614129 | |||||

| WITI License, LLC |

Subsidiary Guarantor | Delaware | 26-2468215 | |||||

| WITI Television, LLC |

Subsidiary Guarantor | Delaware | 26-2468187 | |||||

| WJW License, LLC |

Subsidiary Guarantor | Delaware | 26-2467026 | |||||

| WJW Television, LLC |

Subsidiary Guarantor | Delaware | 26-2466979 | |||||

| WNEP, LLC |

Subsidiary Guarantor | Delaware | 20-8614437 | |||||

| WPHL, LLC |

Subsidiary Guarantor | Delaware | 36-4736896 | |||||

| WPIX, LLC |

Subsidiary Guarantor | Delaware | 36-3110191 | |||||

| WPMT, LLC |

Subsidiary Guarantor | Delaware | 90-0867040 | |||||

| WQAD, LLC |

Subsidiary Guarantor | Delaware | 20-8614101 | |||||

| WQAD License, LLC |

Subsidiary Guarantor | Delaware | 20-8614115 | |||||

| WREG, LLC |

Subsidiary Guarantor | Delaware | 20-8614480 | |||||

| WREG License, LLC |

Subsidiary Guarantor | Delaware | 20-8614509 | |||||

| WSFL, LLC |

Subsidiary Guarantor | Delaware | 65-0085256 | |||||

| WTVR, LLC |

Subsidiary Guarantor | Delaware | 26-2465879 | |||||

| WTVR License, LLC |

Subsidiary Guarantor | Delaware | 26-2465943 | |||||

| WXMI, LLC |

Subsidiary Guarantor | Delaware | 30-0743068 | |||||

| Tribune Real Estate Holdings, LLC |

Subsidiary Guarantor | Delaware | 30-0757120 | |||||

| Tribune Real Estate Holdings II, LLC |

Subsidiary Guarantor | Delaware | 32-0479404 | |||||

| 501 N. Orange Holdco, LLC |

Subsidiary Guarantor | Delaware | 47-4939275 | |||||

| AL-Huntsville-200 Holmes Avenue, LLC |

Subsidiary Guarantor | Delaware | 61-1725110 | |||||

| AR-Fort Smith-318 North 13th Street, LLC |

Subsidiary Guarantor | Delaware | 46-4156120 | |||||

| AR-Van Buren-179 Gladewood Road, LLC |

Subsidiary Guarantor | Delaware | 61-1725310 | |||||

| CA-4655 Fruitridge Road, LLC |

Subsidiary Guarantor | Delaware | 90-0914160 | |||||

| CA-LATS South, LLC |

Subsidiary Guarantor | Delaware | 47-4781358 | |||||

| CA-Olympic Plant, LLC |

Subsidiary Guarantor | Delaware | 80-0874953 | |||||

| CA-Los Angeles Times Square, LLC |

Subsidiary Guarantor | Delaware | 80-0874068 | |||||

| CO-1006 Lookout Mountain Road, LLC |

Subsidiary Guarantor | Delaware | 90-0917909 | |||||

| CO-Clear Creek County-Argentine Pass, LLC |

Subsidiary Guarantor | Delaware | 36-4774509 | |||||

| CO-Denver-100 East Speer Boulevard, LLC |

Subsidiary Guarantor | Delaware | 36-4774128 | |||||

| CO-Golden-21214 Cedar Lake Road, LLC |

Subsidiary Guarantor | Delaware | 61-1725529 | |||||

| CT-121 Wawarme Avenue, LLC |

Subsidiary Guarantor | Delaware | 90-0919378 | |||||

| CT-285 Broad Street, LLC |

Subsidiary Guarantor | Delaware | 80-0878639 | |||||

| CT-WTIC, LLC |

Subsidiary Guarantor | Delaware | 80-0878932 | |||||

| FL-633 North Orange Avenue, LLC |

Subsidiary Guarantor | Delaware | 38-3894443 | |||||

Table of Contents

| Exact Name of Registrant |

State or Other Jurisdiction of Formation |

I.R.S. Employer Identification Number | ||||

| FL-Deerfield Plant, LLC |

Subsidiary Guarantor | Delaware | 90-0920858 | |||

| FL-Orlando Sentinel, LLC |

Subsidiary Guarantor | Delaware | 90-0921481 | |||

| IA-Alleman Polk County, LLC |

Subsidiary Guarantor | Delaware | 37-1745762 | |||

| IA-Des Moines-1801 Grand Avenue, LLC |

Subsidiary Guarantor | Delaware | 30-0803227 | |||

| IL-11201 Franklin Avenue, LLC |

Subsidiary Guarantor | Delaware | 80-0880621 | |||

| IL-16400 South 105th Court, LLC |

Subsidiary Guarantor | Delaware | 37-1710096 | |||

| IL-2501 West Bradley Place, LLC |

Subsidiary Guarantor | Delaware | 80-0881370 | |||

| IL-3249 North Kilpatrick, LLC |

Subsidiary Guarantor | Delaware | 32-0398410 | |||

| IL-3722 Ventura Drive, LLC |

Subsidiary Guarantor | Delaware | 36-4750750 | |||

| IL-720 Rohlwing Road, LLC |

Subsidiary Guarantor | Delaware | 30-0760389 | |||

| IL-777 West Chicago Avenue, LLC |

Subsidiary Guarantor | Delaware | 80-0883760 | |||

| IL-Henry County-Rustic Hill, LLC |

Subsidiary Guarantor | Delaware | 32-0424158 | |||

| IL-Moline-3003 Park 16 Street, LLC |

Subsidiary Guarantor | Delaware | 36-4774789 | |||

| IL-Orion-2880 North 1100 Avenue, LLC |

Subsidiary Guarantor | Delaware | 46-4523419 | |||

| IL-Tribune Tower, LLC |

Subsidiary Guarantor | Delaware | 90-0925857 | |||

| IN-2350 Westlane Road, LLC |

Subsidiary Guarantor | Delaware | 36-4751449 | |||

| IN-6910 Network Place, LLC |

Subsidiary Guarantor | Delaware | 90-0926932 | |||

| IN-Trafalgar WTTV, LLC |

Subsidiary Guarantor | Delaware | 90-0927399 | |||

| IN-Windfall WTTV, LLC |

Subsidiary Guarantor | Delaware | 80-0886250 | |||

| MD-3400 Carlins Park Drive, LLC |

Subsidiary Guarantor | Delaware | 80-0887671 | |||

| MD-601 N. Calvert, LLC |

Subsidiary Guarantor | Delaware | 47-4925604 | |||

| MD-North Calvert Street, LLC |

Subsidiary Guarantor | Delaware | 80-0888076 | |||

| MI-3117 Plaza Drive, LLC |

Subsidiary Guarantor | Delaware | 36-4752474 | |||

| MI-Davis Road, LLC |

Subsidiary Guarantor | Delaware | 37-1712522 | |||

| MO-Kansas City-3020 Summit Street, LLC |

Subsidiary Guarantor | Delaware | 61-1726527 | |||

| MO-St Louis-Emil Avenue, LLC |

Subsidiary Guarantor | Delaware | 36-4775119 | |||

| NC-High Point-2005 Francis Street, LLC |

Subsidiary Guarantor | Delaware | 32-0429529 | |||

| NC-Sofia-4119 Old Courthouse Road, LLC |

Subsidiary Guarantor | Delaware | 38-3920837 | |||

| OH-Cleveland-5800 South Marginal Road, LLC |

Subsidiary Guarantor | Delaware | 46-4339437 | |||

| OH-Parma-4501 West Pleasant Valley Road, LLC |

Subsidiary Guarantor | Delaware | 46-4349988 | |||

| OK-Oklahoma City-East Britton Road, LLC |

Subsidiary Guarantor | Delaware | 46-4359609 | |||

| OR-10255 SW Arctic Drive, LLC |

Subsidiary Guarantor | Delaware | 90-0932076 | |||

| PA-2005 South Queen Street, LLC |

Subsidiary Guarantor | Delaware | 90-0932550 | |||

| PA-5001 Wynnefield Avenue, LLC |

Subsidiary Guarantor | Delaware | 80-0891131 | |||

| PA-550 East Rock Road, LLC |

Subsidiary Guarantor | Delaware | 35-2467596 | |||

| PA-Luzerne County-Penobscot Mountain, LLC |

Subsidiary Guarantor | Delaware | 46-4415654 | |||

| PA-Moosic-16 Montage Mountain Road, LLC |

Subsidiary Guarantor | Delaware | 46-4370430 | |||

| PA-Morning Call, LLC |

Subsidiary Guarantor | Delaware | 90-0934508 | |||

| PA-Ransom, LLC |

Subsidiary Guarantor | Delaware | 46-4419901 | |||

| PA-South Abington-Rt. 11 and Morgan Hwy, LLC |

Subsidiary Guarantor | Delaware | 46-4438744 | |||

| TN-Memphis-803 Channel 3 Drive, LLC |

Subsidiary Guarantor | Delaware | 46-4453048 | |||

| TREH CM Member 2, LLC |

Subsidiary Guarantor | Delaware | 47-5154408 | |||

| TREH Costa Mesa, LLC |

Subsidiary Guarantor | Delaware | 47-4915965 | |||

| TX-7700 Westpark Drive, LLC |

Subsidiary Guarantor | Delaware | 80-0893252 | |||

| TX-8001 John Carpenter Freeway, LLC |

Subsidiary Guarantor | Delaware | 90-0937113 | |||

| UT-Salt Lake City-Amelia Earhart Drive, LLC |

Subsidiary Guarantor | Delaware | 46-4467717 | |||

| VA-216 Ironbound Road, LLC |

Subsidiary Guarantor | Delaware | 90-0937543 | |||

| VA-Norfolk-720 Boush Street, LLC |

Subsidiary Guarantor | Delaware | 46-4484764 | |||

| VA-Portsmouth-1318 Spratley Street, LLC |

Subsidiary Guarantor | Delaware | 46-4493002 | |||

Table of Contents

| Exact Name of Registrant |

State or Other Jurisdiction of Formation |

I.R.S. Employer Identification Number | ||||

| VA-Richmond, LLC |

Subsidiary Guarantor | Delaware | 46-4537423 | |||

| VA-Suffolk-5277 Nansemond Parkway, LLC |

Subsidiary Guarantor | Delaware | 46-4509229 | |||

| WA-1813 Westlake Avenue, LLC |

Subsidiary Guarantor | Delaware | 90-0938179 | |||

| WI-Brown Deer-9001 North Green Bay Road, LLC |

Subsidiary Guarantor | Delaware | 46-4307199 | |||

| WI-Milwaukee-1100 East Capital Drive, LLC |

Subsidiary Guarantor | Delaware | 30-0801474 | |||

| * | The address including zip code and telephone number, including area code, for each Additional Registrant is c/o Tribune Media Company, 435 North Michigan Avenue, Chicago, Illinois 60611, (212) 210-2786. |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not complete this exchange offer or issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 24, 2016

PROSPECTUS

Tribune Media Company

Offer to Exchange

$1,100,000,000 Outstanding 5.875% Senior Notes due 2022

for

$1,100,000,000 Registered 5.875% Senior Notes due 2022

Tribune Media Company is offering to exchange the $1.1 billion aggregate principal amount of its outstanding 5.875% Senior Notes due 2022 (the “Old Notes”) for a like principal amount of registered 5.875% Senior Notes due 2022 (the “New Notes”).

The terms of the New Notes are identical in all material respects to the terms of the Old Notes, except that the New Notes are registered under the Securities Act of 1933, as amended (the “Securities Act”), and will not contain restrictions on transfer or provisions relating to additional interest, will bear a different CUSIP number from the Old Notes and will not entitle their holders to registration rights.

No public market currently exists for the Old Notes or the New Notes.

The exchange offer will expire at p.m., New York City time, on , 2016 (the “Expiration Date”) unless we extend the Expiration Date. You should read the section called “The Exchange Offer” for further information on how to exchange your Old Notes for New Notes.

See “Risk Factors” beginning on page 17 for a discussion of risk factors that you should consider prior to tendering your Old Notes in the exchange offer and risk factors related to ownership of the Notes.

Each broker-dealer that receives New Notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such New Notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of New Notes received in exchange for Old Notes where such Old Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 90 days after the Expiration Date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016

Table of Contents

| 1 | ||||

| 17 | ||||

| 23 | ||||

| 25 | ||||

| 33 | ||||

| 34 | ||||

| 37 | ||||

| 112 | ||||

| 115 | ||||

| 116 | ||||

| 117 | ||||

| 117 | ||||

| 118 | ||||

| Index to Consolidated Financial Statements (Tribune Media Company) |

F-1 | |||

| Index to Financial Statements (Television Food Network, G.P.) |

G-1 |

You should rely only on the information contained in, or incorporated by reference into, this prospectus or to which we have referred you. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus is accurate as of any date other than the date of this prospectus. Also, you should not assume that there has been no change in the affairs of Tribune Media Company and its subsidiaries since the date of this prospectus. Any information incorporated by reference herein is accurate only as of the date of the document incorporated by reference.

This prospectus incorporates important business and financial information about us that is not included in or delivered with this prospectus. See “Where You Can Find More Information.” You may obtain this information at no cost by calling us or writing to us at the following address:

Tribune Media Company

685 Third Avenue, 30th Floor

New York, NY 10017

Attention: Investor Relations

Tel: (212) 210-2786

If you would like to request copies of these documents, please do so by , 2016 (which is five business days before the scheduled expiration of the exchange offer) in order to receive them before the expiration of the exchange offer.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus or the documents incorporated by reference in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. You should read the following summary together with the entire prospectus, including the more detailed information regarding our company and the New Notes being exchanged in this offering appearing elsewhere in this prospectus or the documents incorporated by reference in this prospectus. You should also carefully consider, among other things, the matters discussed in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus or the documents incorporated by reference in this prospectus, and the consolidated financial statements and the related notes included elsewhere in this prospectus, before deciding to invest in the Notes.

In this prospectus, unless the context requires otherwise, (1) the terms “Tribune,” “Tribune Media,” the “Company,” “we,” “us” and “our” mean Tribune Media Company and its consolidated subsidiaries and (2) the term “Issuer” (and, in the section entitled “Description of Notes”, the term the “Company”) means Tribune Media Company and not any of its subsidiaries.

Company Overview

Tribune Media Company is a diversified media and entertainment business. It is comprised of 42 television stations, which we refer to as “our television stations,” that are either owned by us or owned by others, but to which we provide certain services, along with a national general entertainment cable network, a radio station, a production studio, a digital and data technology business (“Digital and Data”), a portfolio of real estate assets and investments in a variety of media, websites and other related assets. We believe our diverse portfolio of assets distinguishes us from traditional pure-play broadcasters through our ownership of high-quality original and syndicated programming, our ability to capitalize on revenue growth from our Digital and Data assets, cash distributions from our equity investments and revenues from our real estate assets.

Our business operates in the following two reportable segments:

| • | Television and Entertainment: Provides audiences across the country with news, entertainment and sports programming on Tribune Broadcasting local television stations and distinctive, high quality television series and movies on WGN America, including through content produced by Tribune Studios and its production partners, as well as news, entertainment and sports information via our websites and other digital assets. |

| • | Digital and Data: Provides innovative technology and services that collect, create and distribute video, music, sports and entertainment data primarily through wholesale distribution channels to consumers globally. |

We also hold a variety of investments in cable and digital assets, including equity investments in Television Food Network, G.P. (“TV Food Network”) and CareerBuilder, LLC (“CareerBuilder”). In addition, we report and include under Corporate and Other the management of certain of our real estate assets, including revenues from leasing office and production facilities and any gains or losses from the sales of our owned real estate, as well as certain administrative activities associated with operating our corporate office functions and managing our predominantly frozen company-sponsored defined benefit pension plans.

1

Table of Contents

Competitive Strengths

We believe that we benefit from the following competitive strengths:

Geographically diversified media properties in attractive U.S. markets.

We are one of the largest independent station owner groups in the United States based on household reach, and we own or operate local television stations in each of the nation’s top five markets and seven of the top ten markets by population. We have network affiliations with all of the major over-the-air networks, including American Broadcasting Company (“ABC”), CBS Corporation (“CBS”), FOX Broadcasting Company (“FOX”), National Broadcasting Company (“NBC”) and The CW Network, LLC (“CW”). We provide must-see programming, including the National Football League and other live sports, on many of our stations and local news to over 50 million U.S. households in the aggregate, as measured by Nielsen Media Research (“Nielsen”), representing approximately 44% of all U.S. households.

In addition, we own a national general entertainment cable network, WGN America, which is distributed to more than 75 million households nationally, as estimated by Nielsen. Such estimate does not fully reflect the additional subscribers resulting from the company’s multichannel video programming distributors (“MVPDs”) deals that became effective in January 2016. WGN America provides us with a platform for launching original programming and exclusive syndication content. We believe that the combination of our broadcast stations and WGN America creates a differentiated distribution platform.

Core competency in data and related technology.

Under the Gracenote brand, our Digital and Data businesses collect, create and distribute entertainment data that enables the discovery and consumption of content regarding music, TV, movies and sports. Gracenote data powers electronic program guides (“EPGs”) and digital video recorders (“DVRs”) for leading cable systems. Subscription music services use Gracenote data to power search and for browsing of albums and music tracks. Gracenote sports data powers statistics, game scores and biographies for top sports websites. In addition to technology that powers the ingestion and distribution of data, Gracenote has a core competency in content recognition.

The demand from consumers and distributors has grown for Gracenote’s data and related technology. Data is becoming more vital to businesses as it is used to make smarter decisions about investing in content and to provide enhanced measurement tools to drive advertising efficiency and effectiveness. We believe we are well positioned to take advantage of this trend.

Strong cash flow generation.

Our core businesses have historically generated strong cash flows from operations. For the three years ended December 31, 2015, our net cash provided by operating activities totaled $764 million, which includes $514 million of cash distributions received from our equity investments. In addition to the $514 million of cash distributions accounted for within the cash flows provided by operating activities, $245 million of cash distributions from our equity investments were accounted for within the cash flows from investing activities. Our equity investments have historically provided substantial cash distributions annually. These cash flows provide us with the financial flexibility to pursue our growth strategies both through organic investments in our existing businesses and through accretive acquisition opportunities, as well as to return capital to our stockholders. We are making investments across our businesses, including in the acquisition of original content and the expansion of our Digital and Data businesses.

2

Table of Contents

Opportunistically deploying capital to drive stockholder returns.

Our capital allocation policy is focused on driving returns for stockholders and investing in areas that are intended to drive growth in our profitability. On February 24, 2016, our board of directors (the “Board”) authorized a stock repurchase program, under which we may repurchase up to $400 million of our outstanding Class A common stock. Under the stock repurchase program, we may repurchase shares in open-market purchases in accordance with all applicable securities laws and regulations, including Rule 10b-18 of the Exchange Act. The extent to which we repurchase our shares and the timing of such repurchases, will depend upon a variety of factors, including market conditions, regulatory requirements and other corporate considerations, as determined by our management team. The repurchase program may be suspended or discontinued at any time. We expect to finance the purchases with available cash, cash flows from operations or debt facilities. The Company’s previously announced $400 million share repurchase program was completed during the fourth quarter of 2015. Under that program, the Company repurchased a total of 7,670,216 shares. See Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” in our annual report on Form 10-K for the year ended December 31, 2015 (the “2015 Form 10-K”), which is incorporated by reference in this prospectus. In addition, on February 24, 2016, our Board declared a quarterly cash dividend of $0.25 per share on our Class A common stock and Class B common stock to be paid on March 24, 2016 to holders of record of Class A common stock and Class B common stock as of March 10, 2016, which was the fourth quarterly dividend declared by the Board under the Company’s dividend program announced on March 6, 2015. During 2015, we paid a total of approximately $1.060 billion to our stockholders (including warrant holders) through dividends, including $649 million paid as a special dividend in April 2015.

Valuable investments and real estate holdings.

We currently hold a variety of investments in cable and digital assets, including equity interests in TV Food Network and Career Builder. TV Food Network, of which we have a 31% interest, operates two 24-hour television networks, Food Network and Cooking Channel, as well as their related websites. Food Network is a fully distributed network in the United States with content distributed internationally. Cooking Channel is a digital-tier network available nationally and airs popular off-Food Network programming as well as originally produced programming. CareerBuilder, of which we have a 32% interest, is a global leader in human capital solutions, helping companies target, attract and retain talent. Its website, CareerBuilder.com, is a leading job website in North America on the basis of both traffic and revenue. CareerBuilder operates websites in the United States, Europe, Canada, Asia and South America.

We also own attractive real estate in key markets, including development rights for certain of our real estate assets. We actively manage our portfolio of real estate assets to drive value through the following initiatives:

| • | Opportunistically dispose of properties, including select properties as part of an accelerated monetization program; |

| • | Maximize utility of our existing real estate footprint; |

| • | Generate revenues on excess space by leasing to third parties; and |

| • | Develop vacant properties or properties with redevelopment options. |

Experienced management team with demonstrated industry experience.

Our senior management team has broad and diverse experience across their respective disciplines, with proven track records of success in the industry. Peter Liguori, our President and Chief Executive Officer, is an experienced media industry leader with a background in developing successful programming. Our organization consists of talented executives with expertise across finance, strategy, operations, regulatory matters and human resources. Our management team has a unified vision for the Company, which includes capitalizing on our current strengths and strategically investing in new initiatives and businesses to generate increased value for our stockholders.

3

Table of Contents

Strategies

Our mission is to create, produce and distribute outstanding entertainment, news and sports content and digital data that inform, entertain, engage, and inspire millions of people every day. To achieve this mission, we are pursuing the following strategies:

Utilize the scale and quality of our operating businesses to increase value to our partners: advertisers, MVPDs, network affiliates and consumers.

Our television station group reaches over 50 million households nationally, as measured by Nielsen, representing approximately 44% of all U.S. households. WGN America, our national general entertainment cable network, reaches approximately 65% of U.S. households and the digital networks we operate, Antenna TV and THIS TV, collectively reach approximately 92% of U.S. households. We also operate approximately 50 websites primarily associated with our television stations, which, in 2015, reached an average of 50 million unique visitors monthly. Our data businesses feature information and content for approximately 8 million TV shows and movies and 229 million song tracks.

Through our extensive distribution network, we can deliver content through a multitude of channels. This ability to reach consumers across a broad geographical footprint is valuable for advertisers, MVPDs and affiliates alike as we connect consumers with their messaging and quality content.

To ensure our media and brands reach an increasing number of audiences enabling advertisers to reach such audiences in the most effective way across screens, we are dedicated toward building and managing strong editorial, digital marketing and technology capabilities that help us source, optimize, distribute and monetize our content online.

In November 2015, WGN America completed the transformation from a superstation to a highly distributed general entertainment cable network. As a result of such transformation, WGN America is now available through a dual feed, meaning that the network’s shows are available for linear viewing in their intended times slots on both the East and West coasts. Our strategy is to build a network that combines high quality, original programming as well as exclusive, highly-rated syndicated programming and feature films.

Be the most valued source of local news and information in the markets in which we operate.

Local news is a cornerstone of our local television stations. We believe local news enjoys a competitive advantage relative to national news outlets due to its ability to generate immediate reporting, which is especially valuable when a breaking news story develops in a local market. We are also able to utilize our breadth of coverage to distribute local content on a national scale by sharing news stories on-air and digitally across Tribune-covered markets. Annually, we produce approximately 79,000 hours of news in our 33 U.S. markets. We also operate approximately 50 websites and approximately 125 mobile applications.

Continue to shift to a content ownership model that results in the retention of a greater share of advertising revenue and participation in the longer tail of programming monetization.

As competition for media advertising spend continues to increase, we are focused on developing our Tribune Studios business to drive future growth by creating original content to be distributed across our WGN America and television station platforms, as well as on streaming platforms such as Hulu, Amazon and Netflix. We believe that retaining the rights associated with our content will provide us with a competitive advantage relative to broadcasters that rely primarily on licensed programming acquired from third-party syndicators. A shift away from licensing content from third parties to content ownership will provide us with new

4

Table of Contents

outlets, such as over-the-top (“OTT”), subscription video on demand (“SVOD”) and international rights through which to monetize programming. Owned programming that airs across our station group further allows us to retain a greater share of overall advertising revenue generated from such content.

Further develop a leading global data and technology business.

Having started decades ago with core assets in video, we have expanded into more markets and additional data sets – music and sports – by acquiring eight companies since January 2014 to create a global data business that capitalizes on our core competency in data and technology by driving increased scale in our business and providing deeper and richer global content solutions. We believe scaling data operations provides a key competitive advantage and cost efficiencies. Scale provides unique cross-platform and global solutions for next generation entertainment platforms. For example, consumer electronics companies turn to Gracenote as one of the few companies able to power music and video services on every continent.

Disciplined management of operating costs and capital investment.

Our management team is focused on maintaining a disciplined cost management program, while ensuring that the Company is investing in the areas that are expected to continue to drive profitability growth.

Exploration of strategic and financial alternatives to enhance shareholder value.

On February 29, 2016, we announced that the Board and the Company have retained financial advisors and initiated a process to explore a full range of strategic and financial alternatives to enhance shareholder value. The strategic and financial alternatives under consideration include, but are not limited to, the sale or separation of select lines of business or assets, strategic partnerships, programming alliances and return of capital initiatives.

Monetization of our real estate assets.

We intend to accelerate the monetization of our real estate assets while continuing the value maximization process. We do this by continuously assessing the market conditions and executing on what we believe are the best strategies for each of the properties, including divestitures or forming strategic partnerships with local developers. We have already begun marketing processes and/or sales processes for 14 properties, including such marquee properties as Tribune Tower in Chicago, IL, the north block of our Los Angeles Times Square property in downtown Los Angeles, CA and the Olympic Printing Plant facility in the Arts District of downtown Los Angeles, CA. We expect to broaden this sales activity to other properties depending on market conditions.

Corporate Information

We are incorporated in Delaware and our corporate offices are located at 435 North Michigan Avenue, Chicago, Illinois 60611. Our website address is www.tribunemedia.com, and our corporate telephone number is (212) 210-2786. Copies of our key corporate governance documents, code of ethics, and charters of our audit, compensation, and nominating and corporate governance committees are also available on our website www.tribunemedia.com under the heading “Investor Relations.” None of the information contained on, or that may be accessed through, our websites or any other website identified in this prospectus or the documents incorporated by reference in this prospectus, is part of, or incorporated into, this prospectus. All website addresses in this offering memorandum are intended to be inactive textual references only.

5

Table of Contents

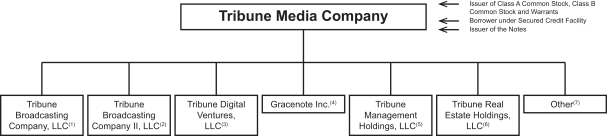

Tribune Media Company is a holding company that does business through its direct and indirect operating subsidiaries. The following chart illustrates our organizational structure as of the date hereof:

| (1) | This entity and its direct and indirect subsidiaries hold our broadcasting businesses, (with the exception of the broadcasting business that we acquired through our acquisition of Local TV) including WGN America, and our equity method investment in TV Food Network. |

| (2) | This entity and its direct and indirect subsidiaries hold our broadcasting businesses that we acquired through our acquisition of Local TV. |

| (3) | This entity and its direct and indirect subsidiaries hold our Digital and Data Video businesses. |

| (4) | This entity and its direct and indirect subsidiaries hold our Gracenote Music business. |

| (5) | This entity and its direct and indirect subsidiaries hold certain of our other equity method investments, including our investment in CareerBuilder. |

| (6) | This entity and its direct and indirect subsidiaries hold the majority of our real estate assets. |

| (7) | Other direct and indirect subsidiaries that hold our North American and European sports data and technology businesses and various broadcasting and other Company assets, including our cost method investments and international businesses. |

Each of our direct and indirect domestic subsidiaries that is a borrower under or that guarantees our obligations under our senior secured credit facility entered into by us and certain of our operating subsidiaries as guarantors, with a syndicate of lenders led by JPMorgan Chase Bank, N.A., as administrative agent, in connection with the acquisition of Local TV on December 27, 2013 (the “Secured Credit Facility”) is a guarantor of the Notes.

Market and Industry Data

Information in this prospectus and the documents incorporated by reference in this prospectus about the media industry, including our general expectations concerning the industry and our position and share of the various media and entertainment markets in which we operate, are based on estimates prepared using data from various sources and on assumptions made by us. We believe data regarding the media industry and our position and share within the media markets in which we operate are inherently imprecise, but generally indicate our size and position and market share within the industry. Although we believe that the information provided by third parties is generally accurate, we have not independently verified any of that information. While we are not aware of any misstatements regarding any industry data presented in this prospectus and the documents incorporated by reference in this prospectus, our estimates, in particular as they relate to our general expectations concerning the media industry, involve risks and uncertainties and are subject to change based on various factors, including those discussed under the caption “Risk Factors” included elsewhere in this prospectus.

Trademarks and Service Marks

Tribune Broadcasting, WGN, WPIX, KTLA, Gracenote, Zap2it, and other trademarks or service marks of Tribune Media Company and its subsidiaries appearing in this prospectus and the documents incorporated by reference in this prospectus are the property of Tribune Media Company or one of its subsidiaries. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus and the documents incorporated by reference in this prospectus are listed without the ™, ® and © symbols, but such references do not constitute a waiver of any rights that might be associated with the respective trademarks,

6

Table of Contents

service marks, trade names and copyrights included or referred to in this prospectus. Trade names, trademarks and service marks of other companies appearing in this prospectus or the documents incorporated by reference in this prospectus are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply relationships with, or endorsements of us by, these other companies.

7

Table of Contents

Summary of the Terms of the Exchange Offer

| The Notes |

On June 24, 2015 (the “Issuance Date”), the Issuer issued and privately placed $1,100,000,000 aggregate principal amount of 5.875% Senior Notes due 2022 pursuant to exemptions from the registration requirements of the Securities Act. The Initial Purchasers for the Old Notes were Deutsche Bank Securities Inc. and Citigroup Global Markets Inc. (the “Initial Purchasers”). When we use the term “Old Notes” in this prospectus, we mean the 5.875% Senior Notes due 2022 that were privately placed with the Initial Purchasers on June 24, 2015, and were not registered with the SEC. |

| When we use the term “New Notes” in this prospectus, we mean the 5.875% Senior Notes due 2022 registered with the SEC and offered hereby in exchange for the Old Notes. When we use the term “Notes” in this prospectus, the related discussion applies to both the Old Notes and the New Notes. |

| The terms of the New Notes are identical in all material respects to the terms of the Old Notes, except that the New Notes are registered under the Securities Act and will not be subject to restrictions on transfer or contain provisions relating to additional interest, will bear a different CUSIP and ISIN number than the Old Notes, will not entitle their holders to registration rights and will be subject to terms relating to book-entry procedures and administrative terms relating to transfers that differ from those of the Old Notes. |

| The CUSIP numbers for the Old Notes are 896047 AG2 (Rule 144A) and U8958Q AA2 (Regulation S). The CUSIP number for the New Notes is 896047 AH0. |

| The Exchange Offer |

You may exchange Old Notes for a like principal amount of New Notes. The consummation of the exchange offer is not conditioned upon any minimum or maximum aggregate principal amount of Old Notes being tendered for exchange. |

| Resale of New Notes |

We believe the New Notes that will be issued in the exchange offer may be resold by most investors without compliance with the registration and prospectus delivery provisions of the Securities Act, subject to certain conditions. You should read the discussions under the headings “The Exchange Offer” and “Plan of Distribution” for further information regarding the exchange offer and resale of the New Notes. |

| Exchange and Registration Rights Agreement |

We have undertaken the exchange offer pursuant to the terms of the Exchange and Registration Rights Agreement we entered into with the Initial Purchasers, dated as of June 24, 2015 (the “Exchange and Registration Rights Agreement”). Pursuant to the Exchange and Registration Rights Agreement, we agreed to consummate an exchange offer for the Old Notes pursuant to an effective registration |

8

Table of Contents

| statement or to cause resales of the Old Notes to be registered. We have filed this registration statement to meet our obligations under the Exchange and Registration Rights Agreement. If we fail to satisfy certain obligations under the Exchange and Registration Rights Agreement, we will pay special interest to holders of the Old Notes under specified circumstances. See “Exchange Offer; Registration Rights.” |

| Consequences of Failure to Exchange the Old Notes |

You will continue to hold Old Notes that remain subject to their existing transfer restrictions if: |

| • | you do not tender your Old Notes; or |

| • | you tender your Old Notes and they are not accepted for exchange. |

| We will have no obligation to register the Old Notes after we consummate the exchange offer. See “The Exchange Offer—Terms of the Exchange Offer; Period for Tendering Old Notes.” |

| Expiration Date |

The exchange offer will expire at p.m., New York City time, on , 2016 (the “Expiration Date”), unless we extend it, in which case Expiration Date means the latest date and time to which the exchange offer is extended. |

| Interest on the New Notes |

The New Notes will accrue interest from the most recent date to which interest has been paid or provided for on the Old Notes or, if no interest has been paid on the Old Notes, from the date of original issue of the Old Notes. |

| Conditions to the Exchange Offer |

The exchange offer is subject to several customary conditions. We will not be required to accept for exchange, or to issue New Notes in exchange for, any Old Notes, and we may terminate or amend the exchange offer, if we determine in our reasonable judgment at any time before the Expiration Date that the exchange offer would violate applicable law or any applicable interpretation of the staff of the SEC. The foregoing conditions are for our sole benefit and may be waived by us at any time. In addition, we will not accept for exchange any Old Notes tendered, and no New Notes will be issued in exchange for any such Old Notes, if at any time any stop order is threatened or in effect with respect to: |

| • | the registration statement of which this prospectus constitutes a part; or |

| • | the qualification of the Indenture under the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”). |

| See “The Exchange Offer—Conditions to the Exchange Offer.” We reserve the right to terminate or amend the exchange offer at any time prior to the Expiration Date upon the occurrence of any of the foregoing events. If we make a material change to the terms of the exchange offer, we will, to the extent required by law, disseminate additional offer materials and will extend the exchange offer. |

9

Table of Contents

| Procedures for Tendering Old Notes |

If you wish to accept the exchange offer, you must tender your Old Notes and do the following on or prior to the Expiration Date, unless you follow the procedures described under “The Exchange Offer—Guaranteed Delivery Procedures.” |

| • | if Old Notes are tendered in accordance with the book-entry procedures described under “The Exchange Offer—Book-Entry Transfer,” transmit an Agent’s Message to the Exchange Agent through the Automated Tender Offer Program (“ATOP”) of The Depository Trust Company (“DTC”), or |

| • | transmit a properly completed and duly executed letter of transmittal, or a facsimile copy thereof, to the Exchange Agent, including all other documents required by the letter of transmittal. |

| See “The Exchange Offer—Procedures for Tendering Old Notes.” |

| Guaranteed Delivery Procedures |

If you wish to tender your Old Notes, but cannot properly do so prior to the Expiration Date, you may tender your Old Notes according to the guaranteed delivery procedures set forth under “The Exchange Offer—Guaranteed Delivery Procedures.” |

| Withdrawal Rights |

Tenders of Old Notes may be withdrawn at any time prior to p.m., New York City time, on the Expiration Date. To withdraw a tender of Old Notes, a notice of withdrawal must be actually received by the Exchange Agent at its address set forth in “The Exchange Offer—Exchange Agent” prior to p.m., New York City time, on the Expiration Date. See “The Exchange Offer—Withdrawal Rights.” |

| Acceptance of Old Notes and Delivery of New Notes |

Except in some circumstances, any and all Old Notes that are validly tendered in the exchange offer prior to p.m., New York City time, on the Expiration Date will be accepted for exchange. The New Notes issued pursuant to the exchange offer will be delivered promptly after such acceptance. See “The Exchange Offer—Acceptance of Old Notes for Exchange; Delivery of New Notes.” |

| Certain U.S. Federal Tax Considerations |

We believe that the exchange of the Old Notes for the New Notes will not constitute a taxable exchange for U.S. federal income tax purposes. See “Material United States Federal Income Tax Considerations.” |

| Exchange Agent |

The Bank of New York Mellon Trust Company, N.A. is serving as the Exchange Agent (the “Exchange Agent”). |

10

Table of Contents

Summary of the Terms of the Notes

The terms of the New Notes offered in the exchange offer are identical in all material respects to the Old Notes, except that the New Notes:

| • | are registered under the Securities Act and therefore will not be subject to restrictions on transfer; |

| • | will not be subject to provisions relating to additional interest; |

| • | will bear a different CUSIP number; |

| • | will not entitle their holders to registration rights; and |

| • | will be subject to terms relating to book-entry procedures and administrative terms relating to transfers that differ from those of the Old Notes. |

| Issuer |

Tribune Media Company |

| Offering Price |

100%. |

| Maturity Date |

July 15, 2022. |

| Interest Rate |

Interest on the Notes accrues at a rate of 5.875% per annum. |

| Interest Payment Dates |

Interest on the Notes is payable on January 15 and July 15 of each year. |

| Guarantees |

The Notes are guaranteed on a senior unsecured basis by all of our existing and future domestic restricted subsidiaries that guarantee our Secured Credit Facility. Under certain circumstances, guarantors may be released from their guarantees without the consent of the holders of the Notes. See “Description of Notes—Guarantees.” |

| Ranking |

The Notes and the guarantees are our and the guarantors’ senior unsecured obligations and: |

| • | rank senior in right of payment to all of our and the guarantors’ future subordinated indebtedness; |

| • | rank equally in right of payment with all of our and the guarantors’ existing and future senior indebtedness (including the Secured Credit Facility); |

| • | are effectively subordinated to any of our and the guarantors’ existing and future secured debt (including the Secured Credit Facility) to the extent of the value of the assets securing such debt; and |

| • | are structurally subordinated to all of the existing and future liabilities (including trade payables) of each of our subsidiaries that do not guarantee the Notes. |

| Optional Redemption |

The Notes will be redeemable at our option, in whole or in part, at any time on or after July 15, 2018, at the redemption prices set forth in this prospectus, together with accrued and unpaid interest, if any, to (but excluding) the date of redemption. |

11

Table of Contents

| At any time prior to July 15, 2018, we may redeem up to 40% of the original aggregate principal amount of the Notes with the proceeds of certain equity offerings at a redemption price of 105.875% of the principal amount of the Notes, together with accrued and unpaid interest, if any, to (but excluding) the date of redemption; provided that at least 50% of the original aggregate principal amount of the Notes (including any additional notes of such series) remains outstanding after each such redemption and the redemption occurs within 120 days of the closing date of such equity offering. |

| At any time prior to July 15, 2018, we may also redeem some or all of the Notes at a price equal to 100% of the principal amount of the Notes, plus accrued and unpaid interest, if any, to (but excluding) the date of redemption, plus a “make-whole premium.” |

| See “Description of Notes—Optional redemption.” |

| Change of Control Offer |

Upon the occurrence of a change of control triggering event (as defined under “Description of Notes”), you will have the right, as holders of the Notes, to cause us to repurchase some or all of your Notes at 101% of their face amount, plus accrued and unpaid interest, if any, to (but excluding) the repurchase date. See “Description of Notes—Change of control triggering event.” We may not be able to pay you the required price for Notes you present to us at the time of a change of control, because: |

| • | we may not have enough funds at that time; or |

| • | the terms of the Secured Credit Facility may prevent us from making such payment. |

| See “Description of Notes—Change of control triggering event.” |

| Asset Disposition Offer |

If we or our restricted subsidiaries sell assets, under certain circumstances, we will be required to use the net cash proceeds to make an offer to purchase Notes at an offer price in cash in an amount equal to 100% of the principal amount of the Notes plus accrued and unpaid interest, if any, to (but excluding) the repurchase date. In the event that we sell or otherwise dispose of our real estate assets, equity investments in CareerBuilder and, subject to compliance with certain leverage ratios, our equity investments in TV Food Network, we will not be required to use the net cash proceeds from such sales or dispositions to offer to repurchase the Notes or invest in replacement assets, and those cash proceeds will be available to make restricted payments, including dividends to our stockholders. See “Description of Notes—Certain covenants—Asset sales.” |

| Certain Covenants |

The Indenture contains covenants that, among other things, limit our ability and the ability of our restricted subsidiaries to: |

| • | incur additional indebtedness, guarantee indebtedness or issue disqualified stock or preferred stock; |

12

Table of Contents

| • | pay dividends on or make other distributions in respect of, or repurchase or redeem, our capital stock; |

| • | prepay, redeem or repurchase subordinated indebtedness; |

| • | make loans and investments; |

| • | sell or otherwise dispose of assets; |

| • | incur liens securing indebtedness; |

| • | enter into transactions with affiliates; |

| • | enter into agreements restricting our subsidiaries’ ability to pay dividends to us or the guarantors or make other intercompany transfers; |

| • | consolidate, merge or sell all or substantially all of our assets; and |

| • | designate our subsidiaries as unrestricted subsidiaries. |

| These covenants are subject to a number of important exceptions and qualifications. For me details, see “Description of Notes—Certain covenants.” |

| If the Notes are assigned an investment grade rating by Moody’s Investors Service, Inc. and Standard & Poor’s Ratings Group Inc. and no default has occurred and is continuing, certain covenants will be suspended with respect to the Notes. If either rating on the Notes should subsequently decline to below investment grade, the suspended covenants will be reinstated. See “Description of Notes—Certain covenants.” |

| Governing Law |

The indenture and the Notes are governed by the laws of the State of New York. |

| Trustee and Paying Agent |

The Bank of New York Mellon Trust Company, N.A. |

13

Table of Contents

Summary Historical Consolidated Financial Data

The following table sets forth certain summary historical financial data as of the dates and for the periods indicated. The summary historical financial data as of December 31, 2015 and December 28, 2014 and for each of the three years in the period ended December 31, 2015 and for December 31, 2012 have been derived from our audited consolidated financial statements and related notes included elsewhere in this prospectus. The summary historical financial data as of December 29, 2013 and December 31, 2012 have been derived from our consolidated financial statements and related notes not included or incorporated by reference in this prospectus. The summary historical financial data are qualified in their entirety by, and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included elsewhere in this prospectus. For a discussion of the distinction between Predecessor and Successor, see Note 3 to our audited consolidated financial statements included elsewhere in this prospectus.

On August 4, 2014, we completed a separation transaction (the “Publishing Spin-off”), resulting in the spinoff of the assets and certain liabilities of the businesses primarily related to our principal publishing operations, other than owned real estate and certain other assets (the “Publishing Business”), through a tax-free, pro rata dividend to our stockholders and warrantholders of 98.5% of the shares of common stock of Tribune Publishing Company (“Tribune Publishing”), and we retained 1.5% of the outstanding common stock of Tribune Publishing. The Publishing Business consisted of newspaper publishing and local news and information gathering functions that operated daily newspapers and related websites, as well as a number of ancillary businesses that leveraged certain of the assets of those businesses. The results of operations for the Publishing Business included in the Publishing Spin-off are presented within discontinued operations in our consolidated statements of operations for all periods presented.

| Successor | Predecessor | |||||||||||||||

| As of and for the years ended |

As of and for | |||||||||||||||

| Dec. 31, 2015 |

Dec. 28, 2014 |

Dec. 29, 2013 |

Dec. 31, 2012 (1) |

|||||||||||||

| (in thousands) | ||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||

| Operating Revenues |

||||||||||||||||

| Television and Entertainment |

$ | 1,749,635 | $ | 1,725,641 | $ | 1,021,586 | $ | — | ||||||||

| Digital and Data |

211,527 | 168,926 | 72,055 | — | ||||||||||||

| Corporate and Other |

49,298 | 54,792 | 53,599 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating revenues |

$ | 2,010,460 | $ | 1,949,359 | $ | 1,147,240 | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating (Loss) Profit |

||||||||||||||||

| Television and Entertainment |

$ | (174,955 | ) | $ | 337,431 | $ | 196,899 | $ | — | |||||||

| Digital and Data |

8,409 | 2,899 | 15,538 | — | ||||||||||||

| Corporate and Other |

(96,143 | ) | (39,148 | ) | (13,397 | ) | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating (Loss) Profit(2) |

$ | (262,689 | ) | $ | 301,182 | $ | 199,040 | $ | — | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) Income from Continuing Operations(2) |

$ | (319,918 | ) | $ | 463,111 | $ | 162,942 | $ | 7,214,125 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance Sheet Data: |

||||||||||||||||

| Total Assets |

$ | 9,758,535 | $ | 11,396,455 | $ | 11,476,009 | $ | 8,673,280 | ||||||||

| Total Non-Current Liabilities |

$ | 5,379,396 | $ | 5,516,844 | $ | 5,751,611 | $ | 3,308,899 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

14

Table of Contents

| (1) | Operating results for December 31, 2012 include only (i) reorganization adjustments which resulted in a net gain of $4.739 billion before taxes ($4.543 billion after taxes), including a $5 million gain ($9 million loss after taxes) recorded in income from discontinued operations, net of taxes and (ii) fresh-start reporting adjustments which resulted in a net loss of $3.372 billion before taxes ($2.567 billion after taxes, including a loss of $178 million ($95 million after taxes) reflected in income from discontinued operations, net of taxes). See Notes 1, 2 and 4 to our audited consolidated financial statements included elsewhere in this prospectus, for further information. |

| (2) | Consolidated operating loss and loss from continuing operations for the year ended December 31, 2015 include an impairment charge of $385 million related to goodwill and other intangible assets. See Note 8 to our audited consolidated financial statements included elsewhere in this prospectus for additional information. |

15

Table of Contents

Ratio of Earnings to Fixed Charges

The following table sets forth the unaudited consolidated ratio of earnings to fixed charges for the periods shown:

| Successor | Predecessor | |||||||||||||||||||

| Years ended | Years ended | |||||||||||||||||||

| Dec. 31, 2015 |

Dec. 28, 2014 |

Dec. 29, 2013 |

Dec. 31, 2012 |

Dec. 30, 2012 |

Dec. 25, 2011 |

|||||||||||||||

| Ratio of earnings to fixed charges (a) |

(b) | 4.7 | 4.5 | N/A | 16.7 | 17.7 | ||||||||||||||

| (a) | We compute the ratio of earnings to fixed charges by dividing (i) earnings, which consist of income from continuing operations before income taxes plus fixed charges and amortization of capitalized interest, less interest capitalized during the period and adjusted for undistributed earnings in equity investments, by (ii) fixed charges, which consist of interest expense, amortization of debt issuance costs and original issue discount, capitalized interest and the portion of rental expense under operating leases estimated to be representative of the interest factor. Interest expense does not include interest related to uncertain tax positions and other non-third party indebtedness. |

Ratios of earnings to combined fixed charges and preferred stock dividends requirements are not presented because there was no outstanding preferred stock in any of the periods indicated.

| (b) | The ratio of earnings to fixed charges was less than 1:1 for the year ended December 31, 2015 as earnings were inadequate to cover fixed charges by $275 million. |

16

Table of Contents

Investing in the Notes involves a high degree of risk. Before you make your investment decision, you should carefully consider the risks described below and the other information contained in this prospectus and the documents incorporated by reference in this prospectus, including the risks and uncertainties discussed in “Item 1A. Risk Factors” in the 2015 Form 10-K which is incorporated by reference into this prospectus. If any of these risks actually occur, our business, financial condition, results of operations or cash flows could be materially adversely affected.

Risks Related to the Notes and the Exchange Offer

We may not have access to the cash flow and other assets of our subsidiaries that may be needed to make payments on the Notes.

Tribune Media Company is a holding company and we conduct substantially all of our operations through our subsidiaries, some of which do not guarantee the Notes and our Secured Credit Facility. Accordingly, repayment of our indebtedness, including the Notes, is dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment or otherwise. Unless they are guarantors of the Notes or our other indebtedness, our subsidiaries do not have any obligation to pay amounts due on the Notes or our other indebtedness or to make funds available for that purpose. Our subsidiaries may not be able to, or may not be permitted to, make distributions to enable us to make payments in respect of our indebtedness, including the Notes. Each subsidiary is a distinct legal entity, and, under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries. While the Notes and the Secured Credit Facility limit the ability of our subsidiaries to incur consensual restrictions on their ability to pay dividends or make other intercompany payments to us, these limitations are subject to qualifications and exceptions. In the event that we do not receive distributions from our subsidiaries, we may be unable to make required principal and interest payments on our indebtedness, including the Notes.

Because each guarantor’s liability under its guarantee of the Notes may be reduced to zero, avoided or released under certain circumstances, you may not receive any payments from some or all of the guarantors.

Each of our domestic wholly-owned subsidiaries that is a guarantor under the Secured Credit Facility is a guarantor of the Notes. However, the guarantees is limited to the maximum amount that the guarantors are permitted to guarantee under applicable law. As a result, a guarantor’s liability under a guarantee could be reduced to zero depending on the amount of other obligations of such entity. Further, under certain circumstances, a court under applicable fraudulent conveyance and transfer statutes or other applicable laws could void the obligations under a guarantee or subordinate the guarantee to other obligations of the guarantor. In addition, you will lose the benefit of a particular guarantee if it is released under the circumstances described under “Description of Notes—Guarantees.”

As a result, an entity’s liability under its guarantee could be materially reduced or eliminated depending upon the amounts of its obligations and upon applicable laws. In particular, in certain jurisdictions, a guarantee issued by a company that is not in the company’s corporate interests or where the burden of that guarantee exceeds the benefit to the company may not be valid and enforceable. It is possible that a creditor of an entity or the insolvency administrator in the case of an insolvency of an entity may contest the validity and enforceability of the guarantee and the applicable court may determine that the guarantee should be limited or voided. If any guarantees are deemed invalid or unenforceable, in whole or in part, or to the extent that agreed limitations on the guarantee apply, the Notes would be effectively subordinated to all liabilities of the applicable guarantor, including trade payables of such guarantor.

17

Table of Contents

If we or our subsidiaries default on our and their obligations to pay our and their indebtedness, we may not be able to make payments on the Notes.

Any default under the agreements governing our or our subsidiaries’ indebtedness, including a default under the Secured Credit Facility that is not waived by the required lenders, and the remedies sought by the holders of such indebtedness could make us unable to pay principal, premium, if any, and interest on the Notes when due and substantially decrease the market value of the Notes. If we or our subsidiaries are unable to generate sufficient cash flow and are otherwise unable to obtain funds necessary to meet required payments of principal, premium, if any, and interest on our indebtedness, or if we or they otherwise fail to comply with the various covenants in the instruments governing our or their indebtedness (including covenants in the Secured Credit Facility and the indenture governing the Notes), we or they could be in default under the terms of the agreements governing such indebtedness. In the event of such default, the holders of such indebtedness could elect to declare all the funds borrowed thereunder to be due and payable, together with accrued and unpaid interest, the lenders under the Secured Credit Facility could elect to terminate their commitments thereunder, cease making further loans and institute foreclosure proceedings against our assets, which could further result in a cross-default or cross-acceleration of our debt issued under other instruments, and we could be forced into bankruptcy or liquidation. If amounts outstanding under the Secured Credit Facility, the Notes or our other indebtedness is accelerated, all our non-guarantor subsidiaries’ debt and liabilities would be payable from our subsidiaries’ assets, prior to any distributions of our subsidiaries’ assets to pay interest and principal on the Notes, and we might not be able to repay or make any payments on the Notes.

The Notes are unsecured and subordinated to the rights of our and the guarantors’ existing and future secured creditors.

As of December 31, 2015, we had approximately $3.479 billion of secured indebtedness. Indebtedness under the Secured Credit Facility is secured by liens on substantially all of our assets. The indenture governing the Notes permits us to incur a significant amount of secured indebtedness, including indebtedness under the Secured Credit Facility. The Notes are unsecured and therefore do not have the benefit of such collateral. Accordingly, the Notes are effectively subordinated to all such secured indebtedness to the extent of the assets securing such indebtedness. If an event of default occurs under the Secured Credit Facility, the applicable secured lenders will have a prior right to our assets, to the exclusion of the holders of the Notes, even if we are in default under the Notes. In that event, our assets would first be used to repay in full all indebtedness and other obligations secured by them (including all amounts outstanding under the Secured Credit Facility), resulting in all or a portion of our assets being unavailable to satisfy the claims of the holders of the Notes and other unsecured indebtedness. Therefore, in the event of any distribution or payment of our assets in any foreclosure, dissolution, winding-up, liquidation, reorganization, or other bankruptcy proceeding, holders of Notes will participate in our remaining assets ratably with all holders of our unsecured indebtedness that is deemed to be of the same class as such Notes, and potentially with all of our other general creditors, based upon the respective amounts owed to each holder or creditor. Further, if the lenders foreclose and sell the pledged interests in any subsidiary guarantor under the Notes, then that guarantor will be released from its guarantee of the Notes automatically and immediately upon the sale. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the Notes. As a result, holders of Notes may receive less, ratably, than holders of secured indebtedness.

The Notes are effectively subordinated to the debt of our non-guarantor subsidiaries.