UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended

OR

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to ______________.

Commission File Number

| ||

State or other jurisdiction incorporation |

| (IRS) Employer Identification Number |

Address of principal executive offices

(

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Trading Symbol(s) |

| Name of Each Exchange on Which Registered |

|

|

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) had been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Exchange Act).

Yes

Class of Stock |

| No. Shares Outstanding |

| Date |

Common |

|

| February 7, 2024 |

TABLE OF CONTENTS

PART I FINANCIAL INFORMATION

| 2 |

| Table of Contents |

CEL-SCI CORPORATION | ||||||||

CONDENSED BALANCE SHEETS | ||||||||

|

|

|

|

|

|

| ||

|

| DECEMBER 31, |

|

| SEPTEMBER 30, |

| ||

ASSETS |

| 2023 |

|

| 2023 |

| ||

|

| (UNAUDITED) |

|

|

|

| ||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ |

|

| $ |

| ||

Prepaid expenses |

|

|

|

|

|

| ||

Supplies used for R&D and manufacturing |

|

|

|

|

|

| ||

Deposits |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Finance lease right of use assets |

|

|

|

|

|

| ||

Operating lease right of use assets |

|

|

|

|

|

| ||

Property and equipment, net |

|

|

|

|

|

| ||

Patent costs, net |

|

|

|

|

|

| ||

Deposits |

|

|

|

|

|

| ||

Supplies used for R&D and manufacturing |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total assets |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ |

|

| $ |

| ||

Accrued expenses |

|

|

|

|

|

| ||

Due to employees |

|

|

|

|

|

| ||

Finance lease obligation, current portion |

|

|

|

|

|

| ||

Operating lease obligation, current portion |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Finance lease obligations, net of current portion |

|

|

|

|

|

| ||

Operating lease obligations, net of current portion |

|

|

|

|

|

| ||

Other liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Commitments and contingencies (refer to Note E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Preferred stock, $ |

|

|

|

|

|

| ||

Common stock, $ |

|

|

|

|

|

| ||

Additional paid-in capital |

|

|

|

|

|

| ||

Accumulated deficit |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Total stockholders' equity |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

See notes to condensed financial statements. | ||||||||

| 3 |

| Table of Contents |

CEL-SCI CORPORATION | ||||||||

CONDENSED STATEMENTS OF OPERATIONS | ||||||||

THREE MONTHS ENDED DECEMBER 31, 2023 and 2022 | ||||||||

(UNAUDITED) | ||||||||

|

|

|

|

|

|

| ||

|

| 2023 |

|

| 2022 |

| ||

|

|

|

|

|

|

| ||

Operating expenses: |

|

|

|

|

|

| ||

Research and development |

| $ |

|

| $ |

| ||

General and administrative |

|

|

|

|

|

| ||

Total operating expenses |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Operating loss |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

| ( | ) |

|

| ( | ) |

Other expense |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Net loss |

|

| ( | ) |

|

| ( | ) |

Modification of warrants |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

Net loss available to common shareholders |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

Net loss per common share – basic and diluted |

| $ | ( | ) |

| $ | ( | ) |

Weighted average common shares outstanding – basic and diluted |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

See notes to condensed financial statements. | ||||||||

| 4 |

| Table of Contents |

CEL-SCI CORPORATION

STATEMENTS OF STOCKHOLDERS’ EQUITY

(UNAUDITED)

|

|

|

|

|

|

|

|

| Additional |

|

|

|

|

|

|

| ||||||

|

|

| Common Stock |

|

| Paid-In |

|

| Accumulated |

|

|

|

| |||||||||

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Total |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

BALANCES AT SEPTEMBER 30, 2023 |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

401(k) contributions paid in common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Stock issued to nonemployees for service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Proceeds from the sale of common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Equity based compensation – employees |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Share issuance costs |

|

|

| - |

|

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | |||

Net loss |

|

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

BALANCES AT DECEMBER 31, 2023 |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||

|

|

| Common Stock |

|

| Additional Paid-In |

|

| Accumulated |

|

|

|

| |||||||||

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Total |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

BALANCES AT SEPTEMBER 30, 2022 |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Warrant exercises |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

401(k) contributions paid in common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Stock issued to nonemployees for service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

2014 incentive stock forfeited |

|

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

| ( | ) | ||

Equity based compensation – employees |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Net loss |

|

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

BALANCES AT DECEMBER 31, 2022 |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||

See notes to condensed financial statements.

| 5 |

| Table of Contents |

CEL-SCI CORPORATION | ||||||||

CONDENSED STATEMENTS OF CASH FLOWS | ||||||||

THREE MONTHS ENDED DECEMBER 31, 2023 and 2022 | ||||||||

(UNAUDITED) | ||||||||

|

|

|

|

|

|

| ||

|

| 2023 |

|

| 2022 |

| ||

|

|

|

|

|

|

| ||

Net loss |

| $ | ( | ) |

| $ | ( | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

| ||

Non-cash lease expense |

|

|

|

|

|

| ||

Share-based payments for services |

|

|

|

|

|

| ||

Equity-based compensation |

|

|

|

|

|

| ||

Common stock contributed to 401(k) plan |

|

|

|

|

|

| ||

(Increase)/decrease in assets: |

|

|

|

|

|

|

|

|

Prepaid expenses |

|

| ( | ) |

|

|

| |

Supplies used for R&D and manufacturing |

|

| ( | ) |

|

|

| |

Deposits |

|

| ( | ) |

|

|

| |

Increase/(decrease) in liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

| ( | ) |

|

| ( | ) |

Accrued expenses |

|

| ( | ) |

|

|

| |

Due to employees |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Net cash used in operating activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

| ( | ) |

|

| ( | ) |

Expenditures for patent costs |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

|

|

|

|

| ||

Payments of stock issuance costs |

|

| ( | ) |

|

| ( | ) |

Proceeds from the exercise of warrants |

|

|

|

|

|

| ||

Payments on obligations under finance leases |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS, END OF PERIOD |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

See notes to condensed financial statements. | ||||||||

| 6 |

| Table of Contents |

CEL-SCI CORPORATION | ||||||||

CONDENSED STATEMENTS OF CASH FLOWS | ||||||||

THREE MONTHS ENDED DECEMBER 31, 2023 and 2022 | ||||||||

(UNAUDITED) | ||||||||

|

|

|

|

|

|

| ||

|

| 2023 |

|

| 2022 |

| ||

SUPPLEMENTAL SCHEDULE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

|

| ||

Property and equipment purchases included in current liabilities |

| $ |

|

| $ |

| ||

Finance lease obligation included in accounts payable |

| $ |

|

| $ |

| ||

Prepaid consulting services paid with issuance of common stock |

| $ |

|

| $ |

| ||

Financing costs included in current liabilities |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

Cash paid for interest |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

See notes to condensed financial statements. | ||||||||

| 7 |

| Table of Contents |

CEL-SCI CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

THREE MONTHS ENDED DECEMBER 31, 2023 AND 2022 (UNAUDITED)

A. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying condensed financial statements of CEL-SCI Corporation (the “Company”) are unaudited and certain information and footnote disclosures normally included in the annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted pursuant to the rules and regulations of the Securities and Exchange Commission. While management of the Company believes that the disclosures presented are adequate to make the information presented not misleading, these interim condensed financial statements should be read in conjunction with the financial statements and notes included in the Company’s annual report on Form 10-K for the year ended September 30, 2023.

In the opinion of management, the accompanying unaudited condensed financial statements contain all adjustments (all of which are of a normal recurring nature) and disclosures necessary for a fair presentation of the Company’s financial position as of December 31, 2023 and the results of its operations for the three months then ended. The condensed balance sheet as of September 30, 2023 is derived from the September 30, 2023 audited financial statements.

Due to recurring losses from operations and future liquidity needs, there is substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. Refer to discussion in Note B.

Summary of Significant Accounting Policies:

Cash and Cash Equivalents – Cash and cash equivalents consist principally of unrestricted cash on deposit and short-term money market funds. The Company considers all highly liquid investments with a maturity when purchased of less than three months to be cash equivalents.

Property and Equipment – Property and equipment is recorded at cost and depreciated using the straight-line method over estimated useful lives of five to seven years. Leasehold improvements are depreciated over the shorter of the estimated useful life of the asset or the term of the lease. Repairs and maintenance which do not extend the life of the asset are expensed when incurred. Property and equipment is reviewed on a quarterly basis to determine if any of the assets are impaired.

Supplies used for R&D and manufacturing – Supplies are consumable items kept on hand to support the Company’s R&D and manufacturing operations. Supplies are recorded at cost and are charged to expense as they are used in operations.

Patents - Patent expenditures are capitalized and amortized using the straight-line method over the shorter of the expected useful life or the legal life of the patent (17 years). In the event changes in technology or other circumstances impair the value or life of the patent, appropriate adjustments to the asset value and period of amortization are made. An impairment loss is recognized when estimated future undiscounted cash flows expected to result from the use of the asset, and from its disposition, are less than the carrying value of the asset. The amount of the impairment loss would be the difference between the estimated fair value of the asset and its carrying value.

Leases – The Company accounts for contracts that convey the right to control the use of identified property, plant or equipment over a period of time in exchange for consideration as leases upon inception. The Company leases certain real estate, machinery, laboratory equipment and office equipment over varying periods. Many of these leases include an option to either renew or terminate the lease. For purposes of calculating lease liabilities, these options are included in the lease term when it is reasonably certain that the Company will exercise such options. The incremental borrowing rate utilized to calculate the lease liabilities is based on the information available at the commencement date, as most of the leases do not provide an implicit borrowing rate. Short-term leases, defined as leases with initial terms of 12 months or less, are not reflected on the balance sheet. Lease expense for such short-term leases is not material.

| 8 |

| Table of Contents |

Share-Based Compensation – Compensation cost for all share-based awards is measured at fair value as of the grant date in accordance with the provisions of ASC 718, Compensation – Stock Compensation (“ASC 718”). The fair value of stock options is calculated using the Black-Scholes option pricing model. The Black-Scholes model requires various judgmental assumptions including volatility and expected option life. The share-based compensation cost is recognized using the straight-line method as expense over the requisite service or vesting period.

The Company has Incentive Stock Option Plans, Non-Qualified Stock Option Plans, Stock Compensation Plans, Stock Bonus Plans and an Incentive Stock Bonus Plan. These Plans are collectively referred to as the "Plans". All Plans have been approved by the Company’s stockholders.

The Company’s stock options are not transferable, and the actual value of the stock options that an employee may realize, if any, will depend on the excess of the market price on the date of exercise over the exercise price. For options issued with service conditions only, the Company has based its assumption for stock price volatility on the variance of daily closing prices of the Company’s stock. The risk-free interest rate assumption is based on the U.S. Treasury rate at the date of grant with the term equal to the expected life of the option. Forfeitures are accounted for when they occur. The expected term of options represents the period that options granted are expected to be outstanding and has been determined based on an analysis of historical exercise behavior. If any of the assumptions used in the Black-Scholes model change significantly, share-based compensation expense for new awards may differ materially in the future from that recorded in the current period.

Restricted stock granted under the Incentive Stock Bonus Plan and options granted under the Non-Qualified Stock Option Plans are subject to service, performance and market conditions and meet the classification of equity awards. These awards were measured at fair value on the grant dates using a Monte Carlo simulation for issuances where the attainment of performance criteria is uncertain. The total compensation cost will be expensed over the estimated requisite service period.

Research and Development Costs - Research and development costs are expensed as incurred. Management accrues Clinical Research Organization (“CRO”) expenses and clinical trial study expenses based on services performed and relies on the CROs to provide estimates of those costs applicable to the completion stage of a study. Estimated accrued CRO costs are subject to revisions as such studies progress to completion. The Company records revisions to estimated expense in the period in which the facts that give rise to the revision become known.

Net Loss Per Common Share – The Company calculates net loss per common share in accordance with ASC 260, Earnings Per Share. Basic and diluted net loss per common share was determined by dividing net loss applicable to common shareholders by the weighted average number of common shares outstanding during the period. The Company’s potentially dilutive shares, which include outstanding common stock options, unvested restricted stock and common stock warrants, have not been included in the computation of diluted net loss per share for all periods as the result would be anti-dilutive.

Income Taxes – The Company accounts for income taxes in accordance with the provisions of ASC 740, Income Taxes, on a tax jurisdiction basis. Deferred tax assets and liabilities are recognized for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating and tax loss carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company records a valuation allowance to reduce the deferred tax assets to the amount that is more likely than not to be recognized. A full valuation allowance was recorded against the deferred tax assets as of December 31, 2023 and September 30, 2023.

| 9 |

| Table of Contents |

Impairment of long-lived assets – CEL-SCI’s fixed assets are made up of leasehold improvements, furniture, and equipment. ASC 360-10 requires that a long-lived asset group be reviewed for impairment only when events or changes in circumstances indicate that the carrying amount of the long-lived asset (group) might not be recoverable. CEL-SCI’s recurring losses are a triggering event that could indicate impairment of long-lived assets such as fixed assets. CEL-SCI reviews these assets to determine if events or changes in circumstances indicate the existence of impairment. If indicators of impairment exist, the Company tests for recoverability, then, if necessary, measures and records the impairment. The amount of the impairment loss would be the amount by which the carrying amount of the asset (group) exceeds its fair value.

Use of Estimates – The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and the accompanying disclosures. These estimates are based on management’s best knowledge of current events and actions the Company may undertake in the future. Estimates are used in accounting for, among other items, inventory obsolescence, accruals, stock options, useful lives for depreciation and amortization of long-lived assets, right of use assets and lease liabilities, deferred tax assets and the related valuation allowance. Actual results could differ from estimates, although management does not generally believe such differences would materially affect the financial statements in any given year. Additionally, in calculating the right of use assets and lease liabilities, estimates and assumptions were used to determine the incremental borrowing rates and the expected lease terms. The Company considers the estimates used in valuing the stock options and the lease assets and liabilities to be significant.

Recently Adopted Accounting Standards

In June 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). ASU 2016-13 requires a financial asset (or a group of financial assets) measured at amortized cost basis to be presented at the net amount expected to be collected. The amendments in ASU 2016-13 replace the incurred loss impairment methodology in current U.S. GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information. ASU 2016-13 was effective for SEC filers, excluding smaller reporting companies, for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. As a smaller reporting company, the Company was permitted to adopt the new standard for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. Effective October 1, 2023, the Company adopted ASU 2016-13 using a modified retrospective transition method. The adoption of ASU 2016-13 had no impact on the Company’s financial position, results of operations, or cash flows.

New Accounting Pronouncements – The Company has considered all recently issued accounting pronouncements and does not believe the adoption of such pronouncements will have a material impact on its financial statements.

B. LIQUIDITY

The Company has incurred significant costs since its inception for the acquisition of certain proprietary technology and scientific knowledge relating to the human immunological defense system, patent applications, research and development, administrative costs, construction and expansion of manufacturing and laboratory facilities and conducting clinical trials. The Company has funded such costs primarily with proceeds from loans and the public and private sale of its securities. The Company will be required to raise additional capital or find additional long-term financing to continue with its efforts to bring Multikine, the Company’s lead investigational therapy, to market. The ability to raise capital may be dependent upon market conditions that are outside the control of the Company. The ability of the Company to obtain approval from any regulatory agency for the sale of products to be developed on a commercial basis is uncertain. Ultimately, the Company must complete the development of its products, obtain the appropriate regulatory approvals and obtain sufficient revenues to support its cost structure.

To finance the Company through marketing approval, the Company plans to raise additional capital in the form of corporate partnerships, and debt and/or equity financings. The Company believes that it will be able to obtain additional financing because it has done so consistently in the past and because Multikine showed great survival benefit in the Phase 3 study in one of the two treatment arms for advanced primary head and neck cancer. However, there can be no assurance that the Company will be successful in raising additional funds on a timely basis or that the funds will be available to the Company on acceptable terms or at all. If the Company does not raise the necessary amounts of money, it may have to curtail its operations until such time as it is able to raise the required funding.

| 10 |

| Table of Contents |

Due to the Company’s recurring losses from operations and future liquidity needs, there is substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

C. STOCKHOLDERS’ EQUITY

Proceeds from the Sale of Common Stock

In November 2023, the Company sold

Equity Compensation

Underlying share information for equity compensation plans as of December 31, 2023 is as follows:

Name of Plan |

| Total Shares Reserved Under Plans |

| |

Incentive Stock Option Plans |

|

|

| |

Non-Qualified Stock Option Plans |

|

|

| |

Stock Bonus Plans |

|

|

| |

Stock Compensation Plans |

|

|

| |

Incentive Stock Bonus Plan |

|

|

| |

Stock option activity:

|

| Three Months Ended December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Options granted |

|

| - |

|

|

|

| |

Options exercised |

|

| - |

|

|

| - |

|

Options forfeited |

|

|

|

|

|

| ||

Options expired |

|

| - |

|

|

|

| |

Share-Based Compensation Expense:

|

| Three Months Ended December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Employees |

| $ |

|

| $ |

| ||

Non-employees |

| $ |

|

| $ |

| ||

Employee compensation expense includes the expense related to options and restricted stock that is expensed over the vesting periods. Non-employee expense includes the expense related to options and stock issued to consultants expensed over the period of the related service contracts.

| 11 |

| Table of Contents |

Warrants and Non-Employee Options

The following chart represents the warrants and non-employee options outstanding at December 31, 2023:

Warrant/ Options |

| Issue Date |

| Shares Issuable upon Exercise of Warrants/ Options |

|

| Exercise Price |

|

| Expiration Date | |||

Series N |

|

|

|

|

| $ |

|

| |||||

Series UU |

|

|

|

|

| $ |

|

| |||||

Series X |

|

|

|

|

| $ |

|

| |||||

Series Y |

|

|

|

|

| $ |

|

| |||||

Series MM |

|

|

|

|

| $ |

|

| |||||

Series NN |

|

|

|

|

| $ |

|

| |||||

Series RR |

|

|

|

|

| $ |

|

| |||||

Consultant Options |

|

|

|

|

| $ |

|

| |||||

1. Equity Warrants

Changes in Equity Warrants

No warrants recorded as equity were exercised during the three months ended December 31, 2023. The following warrants recorded as equity were exercised during the three months ended December 31, 2022.

Warrants |

| Warrants Exercised |

|

| Exercise Price |

|

| Proceeds |

| |||

Series RR |

|

|

|

| $ |

|

| $ |

| |||

Series SS |

|

|

|

| $ |

|

|

|

| |||

|

|

|

|

|

|

|

|

| $ |

| ||

No warrants recorded as equity expired or were extended during the three months ended December 31, 2023. On October 28, 2022, the expiration date of the Series RR warrants was extended two years from October 30, 2022 to October 30, 2024. The incremental cost of this extension was approximately $

2. Options and Shares Issued to Consultants

During the three months ended December 31, 2023 and 2022, the Company issued

No options were issued to a consultant during the three months ended December 31, 2023. During the three months ended December 31, 2022,

During the three months ended December 31, 2023 and 2022, the Company recorded total expense of approximately $

D. RELATED PARTY TRANSACTIONS

During the three months ended December 31, 2023, no restricted shares of the Company’s common stock were purchased by related parties.

On October 28, 2022, the expiration date of the Series RR warrants was extended two years from October 30, 2022 to October 30, 2024 (Note C). The incremental cost of this extension was approximately $

| 12 |

| Table of Contents |

E. COMMITMENTS AND CONTINGENCIES

Clinical Research Agreement

Under co-development and revenue sharing agreements with Ergomed, Ergomed agreed to contribute up to $

Lease Agreements

The Company leases a manufacturing facility near Baltimore, Maryland (the San Tomas lease). The building was remodeled in accordance with the Company’s specifications so that it can be used by the Company to manufacture Multikine for the Company’s Phase 3 clinical trial and sales of the drug if approved by any regulatory agency. The lease is for a term of twenty years and requires annual base rent to escalate each year at 3%. The Company is required to pay all real estate and personal property taxes, insurance premiums, maintenance expenses, repair costs and utilities. The lease allows the Company, at its election, to extend the lease for two ten-year periods or to purchase the building at the end of the 20-year lease, which expires in October 2028. The renewal options are not included in the calculation of the right of use asset and lease liability because exercise of those options is not reasonably certain.

The San Tomas lease is classified as a finance lease on the Company’s balance sheet, as well as several other smaller finance leases for office equipment. The finance right of use assets are being depreciated using the straight-line method over the underlying lease terms. Total cash paid related to finance leases during the three months ended December 31, 2023 and 2022 was approximately $

On January 11, 2023, the Company was required to deposit approximately $

Approximate future minimum lease payments under finance leases as of December 31, 2023 are as follows:

Nine months ending September 30, 2024 |

| $ |

| |

Year ending September 30, |

|

|

|

|

2025 |

|

|

| |

2026 |

|

|

| |

2027 |

|

|

| |

2028 |

|

|

| |

2029 |

|

|

| |

Thereafter |

|

|

| |

Total future minimum lease obligation |

|

|

| |

Less imputed interest on finance lease obligations |

|

| ( | ) |

Net present value of financing lease obligations |

|

|

| |

Less net present value of financing lease obligations – current portion |

|

| ( | ) |

Net present value of financing lease obligations - non-current portion |

| $ |

|

| 13 |

| Table of Contents |

The Company leases two facilities under operating leases. The lease for the Company’s office headquarters will expire on November 30, 2025. The lease for its research and development laboratory was renewed in September 2021 for an additional ten years and will expire on February 29, 2032. The renewal was considered a modification for accounting purposes and the right of use asset and liability were remeasured as of the date of the renewal. The operating leases include escalating rental payments. The Company is recognizing the related rent expense on a straight-line basis over the terms of the leases. The Company incurred lease expense for operating leases of approximately $

As of December 31, 2023, future minimum lease payments on operating leases are as follows:

Nine months ending September 30, 2024 |

| $ |

| |

Year ending September 30, |

|

|

|

|

2025 |

|

|

| |

2026 |

|

|

| |

2027 |

|

|

| |

2028 |

|

|

| |

2029 |

|

|

| |

Thereafter |

|

|

| |

Total future minimum lease obligation |

|

|

| |

Less imputed interest on operating lease obligation |

|

| ( | ) |

Net present value of operating lease obligations |

|

|

| |

Less net present value of operating lease obligations - current portion |

|

| ( | ) |

Net present value of operating lease obligations - non-current portion |

| $ |

|

G. PATENTS

During the three months ended December 31, 2023 and 2022, there was no impairment of patent costs. The weighted average amortization period for patents is approximately

Nine months ending September 30, 2024 |

| $ |

| |

Year ending September 30, |

|

|

|

|

2025 |

|

|

| |

2026 |

|

|

| |

2027 |

|

|

| |

2028 |

|

|

| |

2029 |

|

|

| |

Thereafter |

|

|

| |

Total |

| $ |

|

H. LOSS PER COMMON SHARE

Basic loss per share is computed by dividing net loss available to common stockholders by the weighted average number of common shares outstanding during the period. The Company’s potentially dilutive shares, which include outstanding common stock options, common stock warrants and unveseted restricted stock are not included in the computation of diluted net loss per share if their effect would be anti-dilutive.

| 14 |

| Table of Contents |

The following table provides a reconciliation of the numerators and denominators of the basic and diluted loss per-share computations:

|

| Three months ended December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Loss per share – basic and diluted |

|

|

|

|

|

| ||

Net loss available to common – basic and diluted |

| $ | ( | ) |

| $ | ( | ) |

Weighted average shares outstanding – basic and diluted |

|

|

|

|

|

| ||

Basic and diluted loss per common share |

| $ | ( | ) |

| $ | ( | ) |

In accordance with the contingently issuable shares guidance of ASC 260, Earnings Per Share, the calculation of diluted net earnings (loss) per share excludes the following securities because their inclusion would have been anti-dilutive as of December 31:

|

| 2023 |

|

| 2022 |

| ||

Options and Warrants |

|

|

|

|

|

| ||

Unvested Restricted Stock |

|

|

|

|

|

| ||

Total |

|

|

|

|

|

| ||

J. SUBSEQUENT EVENTS

On February 9, 2024, the Company sold

| 15 |

| Table of Contents |

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Company Overview

CEL-SCI Corporation is a clinical-stage biotechnology company dedicated to research and development directed at improving the treatment of cancer and other diseases by using the immune system, the body’s natural defense system. CEL-SCI is currently focused on the development of the following product candidates and technologies:

| 1) | Multikine, an investigational immunotherapy under development for the potential treatment of certain head and neck cancers; and |

|

|

|

| 2) | L.E.A.P.S. (Ligand Epitope Antigen Presentation System) technology, or LEAPS, with several product candidates, under development for the potential treatment of rheumatoid arthritis. |

Multikine (Leukocyte Interleukin, Injection) is the full name of this investigational therapy, which, for simplicity, is referred to in this report as Multikine. Multikine is the trademark that the Company has registered for this investigational therapy, and this proprietary name is subject to FDA review under the Company’s future anticipated regulatory submission for approval. None of the Company’s product candidates have been approved for sale, barter or exchange by the Food and Drug Administration (FDA) or any other regulatory agency for any use to treat disease in humans nor has the safety or efficacy of these products been established for any use. There can be no assurance that obtaining marketing approval from the FDA in the United States and by comparable agencies in most foreign countries will be granted.

MULTIKINE AND THE PHASE III CLINICAL TRIAL RESULTS

Immunotherapy is a large, high growth market. Immunotherapies use the patient’s own immune system to fight disease. These “targeted therapies” are at the forefront of modern cancer research. A recent Bloomberg report from January 2023 asserted that:

The global cancer immunotherapy market is expected to reach USD $196.45 billion by 2030, registering CAGR of 7.2% during the forecast period, according to a new report by Grand View Research, Inc. The rising adoption of immunotherapy over other therapy options for cancer owing to its targeted action is anticipated to increase the adoption during the forecast period. Moreover, increasing regulatory approvals from authoritarian establishments for novel immunotherapy used for oncology is also expected to further fuel the market growth. (https://www.bloomberg.com/press-releases/2023-01-18/cancer-immunotherapy-market-worth-196-45-billion-by-2030-grand-view-research-inc) |

CEL-SCI hopes to participate in this growing market with its lead investigational therapy Multikine® (Leukocyte Interleukin, Injection). Multikine has already been tested in approximately 750 human patients in multiple clinical trials, including a well-controlled, multicenter, global, 928 patient Phase III randomized controlled trial. Multikine is unique among approved cancer immunotherapies because it is given first, right after diagnosis and before surgery. CEL-SCI believes that the Phase III clinical trial demonstrated that Multikine caused tumors to reduce in size and/or caused the disease to “downstage” within just a few weeks of treatment before surgery. Importantly, patients with these reductions and/or downstages had their risk of death cut in half at five years of follow up. CEL-SCI is in discussions with regulators in Europe, the U.K., the U.S., and Canada with a view to obtaining marketing authorization and approval for immediate patient access to Multikine without waiting for the results of a confirmatory trial.

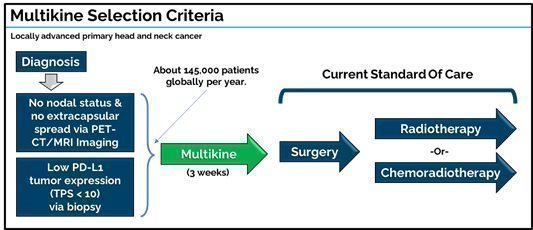

In 2023, the Multikine target patient population is estimated to include about 145,000 patients per year worldwide, with more than two-thirds of those outside the United States. Global growth rates of eligible cases are expected to rise 30% by 2030. (https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10304137)

What is Multikine and who is it for? Multikine is a biological medicinal immunotherapy comprised of a mixture of natural cytokines and small biological molecules. Multikine is injected around the tumor and adjacent lymph nodes for three weeks as a first-line treatment before the standard of care (SOC), which is surgery followed by either radiotherapy or chemoradiotherapy. Multikine’s rationale for use is to incite a locoregional immune response against the tumor before the local immune system has been compromised by the standard of care and/or disease progression.

| 16 |

| Table of Contents |

The Multikine target population is treatment-naïve adult patients with resectable locally advanced primary squamous cell carcinoma of the head and neck (SCCHN) in the oral cavity or soft palate and who have:

| · | No lymph node involvement (via PET scan) |

| · | Low PD-L1 tumor expression (TPS<10) (via biopsy) |

PD-L1 is a protein receptor on the tumor cell surface that helps the tumor repel the immune system. CEL-SCI believes that patients with tumors having low PD-L1 would be more likely to respond to Multikine because their tumors have lower defenses against the patient’s immune system. CEL-SCI estimates that patients with tumors having low PD-L1 represent about 70% of locally advanced primary SCCHN patients.

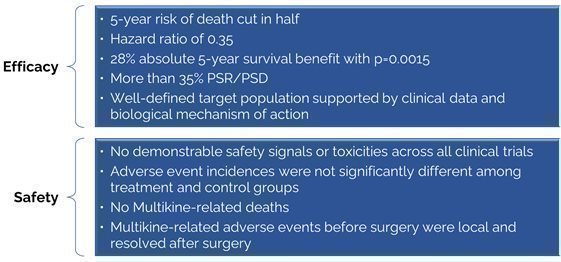

Multikine leads to longer survival with no safety issues. Clinical investigations of Multikine have demonstrated in the randomized controlled Phase III trial (RCT) the following in the target population:

| · | risk of death cut in half at five years versus the control; |

| · | 28.6% absolute 5-year overall survival benefit versus control (p=0.0015); |

| · | 0.349 hazard ratio vs control (95% CIs [0.18, 0.66], Wald p=0.0012); |

| · | >35% rate of pre-surgery reductions and/or downstages (p<0.01); and |

| · | low PD-L1 tumor expression (vs high PD-L1 where Keytruda and Opdivo work best). |

There were no demonstrable safety signals or toxicities observed in approximately 750 Multikine-treated subjects across multiple clinical trials. Adverse event (AE) and serious adverse event (SAE) incidences were not significantly different among treatment and control groups. There were no Multikine-related deaths and only two discontinuations. Multikine-related AEs before surgery were local and resolved after surgery. Although the literature reports that some of Multikine’s components may be toxic when administered systemically (e.g., TNFα, IFN γ, IL-1β), these toxicities did not emerge with Multikine, even at doses many times higher than those administered in the Phase III trial, primarily due to Multikine’s delivery by local injection and dosage.

CEL-SCI published its data as abstracts and posters at the annual conferences for the 2022 American Society of Clinical Oncology (ASCO), 2022 and 2023 European Society for Medical Oncology (ESMO), and the 2023 European Head and Neck Society’s (EHNS’s) annual European Conference On Head And Neck Oncology (ECHNO) and the 2023 European Society for Therapeutic Radiology and Oncology (ESTRO) and 2023 American Head and Neck Society (AHNS). These publications can be accessed at http://www.cel-sci.com/.

Multikine works by inducing pre-surgical responses. CEL-SCI observed statistically significant pre-surgical responses after Multikine treatment, and therefore CEL-SCI believes in the following:

| ➢ | Multikine causes pre-surgical responses; |

| ➢ | Pre-surgical responses lead to longer life; |

| ➢ | Therefore, selecting more patients predicted to have a pre-surgical response should lead to much better survival in the target population. |

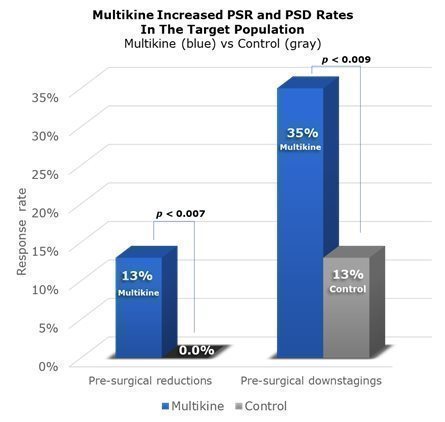

A “pre-surgical response” is a significant change in disease before surgery. CEL-SCI saw two kinds of responses in the Phase III trial. First, there were “reductions” in the size of the tumor—a reduction of 30% or more qualified as a “pre-surgical reduction” or “PSR” for short. Second, there were disease “downstages,” (e.g., the disease improved from Stage IV to Stage III) pre-surgery. CEL-SCI calls this a “pre-surgical downstaging” or “PSD” for short. CEL-SCI’s 2022 ESMO cancer conference presentation reported on PSR, and CEL-SCI’s new 2023 ESMO presentation reported on PSD.

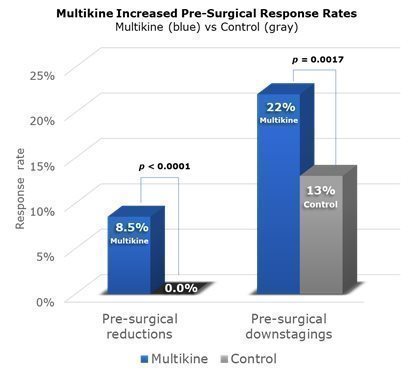

Across the whole Phase III trial, PSRs were seen in 8.5% of Multikine patients compared to none in the control group. PSDs were seen in 22% of Multikine patients as compared to 13% in the control group. Because Multikine was the only therapy given to these patients before surgery, it is CEL-SCI’s strong belief that Multikine had to be the cause of the higher rates of PSR and PSD. These data are presented visually below. The taller blue columns show PSR and PSD rates in all 529 Multikine-treated patients in the Phase III trial, and the gray columns show PSR and PSD rates for all 394 control patients. The p-values above the columns show comparisons between Multikine and the control groups. With Multikine, statistically speaking, CEL-SCI believes there is a better than 95% chance that the increases in PSR/PSD in the Phase III study were caused by Multikine.

| 17 |

| Table of Contents |

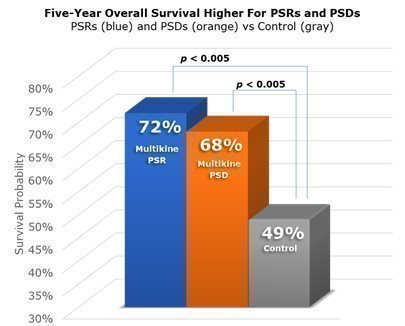

It was not enough for us to show that Multikine likely leads to PSRs and PSDs as compared to a control group, CEL-SCI also had to test if PSRs and PSDs lead to improved survival. CEL-SCI’s Phase III trial demonstrated that PSR patients were 72% likely to be alive after five years, whereas control patients were only about 49% likely to be alive after five years. Patients with PSD saw similar improvement in CEL-SCI’s Phase III trial. Their five-year chance of survival was approximately 68%. Therefore, CEL-SCI’s Phase III trial demonstrated statistically that those patients who had PSR or PSD resulting from Multikine lived longer than those who were not treated with Multikine. It is important to note that these results are from the entire Phase III study population, not from a subgroup. The p-values of less than 0.005 means there was at least a 99.5% chance that these results are due to Multikine rather than random chance. The likelihood of living at least five years is shown in the graphic below for patients with PSR (blue), patients with PSD (orange) and patients who did not receive Multikine (gray).

| 18 |

| Table of Contents |

CEL-SCI’s target population can be readily selected by doctors upon diagnoses using standard tests. Having shown a potential causal link supported by strong statistics between Multikine and survival benefit, CEL-SCI believes that Multikine should be approved quickly. But recall that the Phase III study’s primary endpoint of 10% survival benefit was not met. How then can we say that Multikine actually benefits patients? The answer is that while Multikine has shown that it can help patients with PSR/PSD, there were not enough PSR/PSD in the Phase III study population to yield a 10% survival benefit for the whole population. In other words, the benefits from PSR/PSD were too diluted when averaged with the other patients in the study.

None of this changes the fact that CEL-SCI observed statistical significance when analyzing Multikine’s ability to cause PSR/PSD and that these PSR/PSD statistically appear to lead to a higher chance of living five years or longer—CEL-SCI simply had to define a target population who would have a larger number of PSR/PSD. To do so, CEL-SCI analyzed Multikine’s biological mechanism of action, talked to regulators and physicians who knew best, and were guided by the Phase III data, including patient-specific data down to the cellular level. All this of course took time, but CEL-SCI believes it has succeeded and is ready to move forward.

One of the first things we reported from the Phase III study was that Multikine was shown to work best in patients who were deemed “low risk” after surgery, about 40% of the study population. These patients saw a significant 14.1% absolute 5‑year survival benefit vs the “low risk” control group not receiving Multikine. It made sense biologically that these patients would benefit most from Multikine, because they tended to have immune systems that were not yet compromised by the disease. “High risk” patients, by contrast, typically had lymph nodes invaded by the tumor, and needed chemotherapy after surgery. Because their lymph nodes were compromised, this made it harder for their immune systems to work, and they needed surgery as soon as possible without waiting an extra three weeks to receive Multikine. CEL-SCI initially developed criteria for selecting “low-risk” patients at diagnosis—i.e., those having no lymph nodes invaded by the tumor (N0) or only one lymph node invaded by the tumor (N1) as well as no extracapsular spread as determined by PET scan. CEL-SCI published these criteria at the ASCO conference in 2022. However, after discussions with regulators and physicians, CEL-SCI saw that outcomes could be improved further if the N1 patients were excluded, and only the N0 patients were included in the target population.

CEL-SCI also saw from the Phase III data that Multikine was more effective for patients with low PD-L1 tumor expression than for patients with high PD-L1 expression. This analysis was pre-specified in the statistical analysis plan. Targeting low PD-L1 also differentiates Multikine from other immunotherapies. For example, checkpoint inhibitors like Keytruda and Opdivo appear to best serve patients having high PD-L1, because these drugs work by blocking PD1/PD-L1 receptors interactions; when this interaction (PD1/PD-L1) happens it leads to inactivation/death of the immune cells attacking the tumor. While none of these drugs are currently approved as a first-line treatment before surgery, even if such approvals were to come in the future, the large majority of patients in this group having low PD-L1 would still be expected to need Multikine.

| 19 |

| Table of Contents |

CEL-SCI’s target population is now directed to patients who present at diagnosis with N0 nodal involvement and also with low PD-L1 tumor expression (defined as tumor proportions score (TPS) < 10). These patients can be readily identified upon diagnosis with tests that physicians routinely use in cancer screening, a crucial achievement towards Multikine becoming available for use. For instance, a PET scan should be used to determine the N0 nodal status and a screening tumor biopsy should be used to determine the low PD-L1 expression. Doctors already routinely screen head and neck cancer patients using PET scans and biopsy. Therefore, doctors can screen for Multikine patients without new tests or new costs.

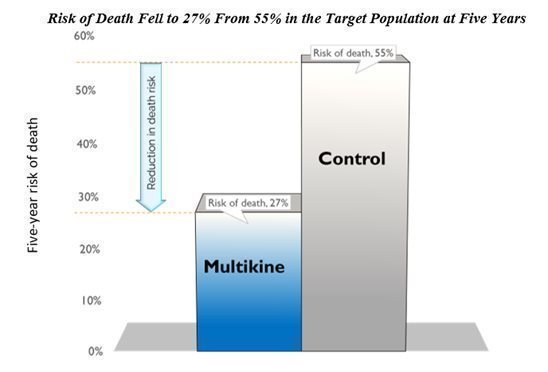

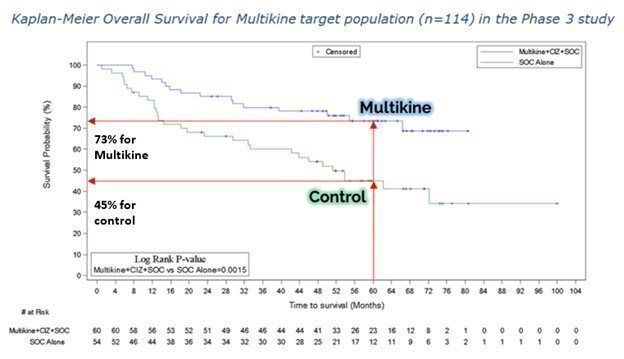

Multikine cut the 5-year risk of death in half in the target population. CEL-SCI’s results show that Multikine can cut the risk of death in half at five years versus the control group in the finalized target population. Survival increased from 45% in the control group to 73% in the Multikine group, at five years. This means the risk of death fell to 27% in the Multikine group from 55% in the control, shown below.

| 20 |

| Table of Contents |

Another way to see the survival benefit of Multikine in the target population is the Kaplan-Meier curve from our ESMO ’23 poster, shown below. On the vertical axis is the probability of survival and the horizontal axis is time in months. The blue Multikine line is far above the green control line, meaning the chance of survival is much higher in the Multikine group at every point in time compared to the control. These results had a low p-value of 0.0015, which is very significant as a statistical matter.

CEL-SCI’s physician consultants tell it that the early separation of these two survival curves (e.g., at 12 months) adds validation to the potential positive effects of Multikine.

Another measure of survival benefit is called the “hazard ratio,” which compares the chances of dying between two different groups. Here, in the Multikine target population, the hazard ratio was 0.35, which means that deaths occurred in the Multikine group about one-third as frequently as in the control group. It is also important to note that the hazard ratio’s 95% confidence interval remained far below 1.0. In the case of Multikine, statistically speaking, there is a 95% chance that the hazard ratio would fall between 0.18 and 0.66 if Multikine were tested in the target population in another study. A hazard ratio of 0.66 as the “so called worst case scenario” is still below (better) than the hazard ratio required for most drug approvals.

These positive survival outcomes—increased overall survival, reduced risk of death, widely separated Kaplan-Meier curves with early separation, low hazard ratio, low p-values, low confidence intervals—CEL-SCI believes were driven by high PSR/PSD rates in the target population, as shown in the graphic below:

| 21 |

| Table of Contents |

CEL-SCI relies on all of these data together to support its plan to request accelerated/conditional approval in the new target population without waiting until the completion of another clinical trial.

CEL-SCI’s regulatory strategy going forward is to seek immediate approval of Multikine wherever possible. CEL-SCI intends to seek approval for Multikine based on the data generated to date, using a conditional approval pathway with a follow-on confirmatory study since the survival benefit is high and statistics are strong. This view is based on advice from regulators and consultants, and CEL-SCI believes that the accelerated/conditional approval regulatory pathways are specifically designed for our situation.

When the Phase III trial was designed, there was no evidentiary basis for excluding either of the low-risk or high-risk patient groups before surgery. Therefore, the study had to include a large percentage of high-risk patients with immune systems already compromised by disease. These subjects generally did not respond to Multikine. CEL-SCI has narrowed its target population as compared to the overall Phase III study population to focus on patients most likely to have PSR/PSD and to exclude the rest.

CEL-SCI acknowledges that efficacy in the target population has not been tested prospectively, but CEL-SCI believes that the data generated to date already presents a compelling patient need in the target population that justifies immediate access to Multikine. This is why the conditional approval pathways were created in the first place. CEL-SCI intends to base its request for regulatory approval, in part, on its view that patients should not have to wait many more years before gaining access to the benefits of Multikine PSRs/PSDs and increased survival, particularly given Multikine’s safety profile and data that mechanistically and empirically supports the target population definition.

The benefit-risk balance favoring immediate patient access to Multikine is described below:

An “unmet need” is a factor for approval considered by all major regulatory bodies worldwide. In the Multikine target population, there is also a tremendous unmet need for improved survival. The current standard of care provides only about a 50/50 chance of surviving five years, whereas Multikine could increase that survival rate to over 70% based on the Phase III data. Chemotherapy has improved outcomes for some head and neck patients, but chemotherapy is only indicated for high-risk patients, who are not likely to fall within the Multikine target population. Currently available immunotherapies are given after surgery or where surgery is not indicated, in contrast to Multikine, which is given before surgery to patients with resectable tumors. Available checkpoint inhibitors work best on tumors with high PD-L1 expression, whereas Multikine works best in tumors with low PD-L1 expression. Therefore, Multikine’s target population is underserved, and will continue to be underserved, by current therapies, but Multikine can meet the need for improved survival.

The major regulatory bodies with whom we are working, U.S. FDA, Health Canada, European Medicines Agency (EMA) and the Medicines and Healthcare products Regulatory Agency (MHRA) in the United Kingdom (UK) all have conditional approval pathways designed for situations where the target population has not been fully tested prospectively and there is strong data supporting clinical benefit for patients. The reason is that regulators understand that in many cases patients should not have to wait for additional data before being offered the chance to benefit from a new drug. Every situation is different and depends on the specific facts.

CEL-SCI had meetings with the FDA and Health Canada earlier in 2023, but they have not yet seen the new data presented for the first time on October 22, 2023 at the ESMO conference, and CEL-SCI plans to provide it to the FDA in Q1 2024. In Canada, CEL-SCI plans to ask for conditional approval under their Notice of Compliance with Conditions (NOC/C) pathway, as they had suggested in 2023. This permits approval of drugs based on safety and “promising” efficacy data while a post-market confirmatory study is ongoing. The approval can be given before the post-market study. In the U.S., the FDA has an accelerated approval pathway that is similar, but a new law in December 2022 requires enrollment in the confirmatory study to be underway before approval will be given in the U.S. Therefore, CEL-SCI plans to start this confirmatory trial as soon as possible in 2024 and will then seek accelerated approval using data from that study as well.

CEL-SCI’s first priority, however, is seeking approval in Europe and the UK, where CEL-SCI has submitted its final target population data. There are more than twice as many patients in the target population overseas than in North America. In Europe and the UK, CEL-SCI has submitted requests for Scientific Advice and are hopeful for meetings in H1 2024. Once a meeting date has been set, CEL-SCI will be able to discuss the data and gain advice on the path forward. It is possible that CEL-SCI may be advised at that time to proceed with a formal application.

| 22 |

| Table of Contents |

Liquidity and Capital Resources

Since inception, the Company has financed its operations through the issuance of equity securities, convertible notes, loans and certain research grants. The Company will likely continue to generate net operating losses as it continues the development of Multikine and brings other drug candidates into clinical trials. Until such time as the Company becomes profitable, any or all of these financing vehicles or others may be utilized to assist the Company’s capital requirements.

Capital raised by the Company has been expended primarily for patent applications, research and development, administrative costs, the construction and upgrade of the Company’s manufacturing and laboratory facilities and clinical trials. The Company does not anticipate realizing significant revenues until entering into licensing arrangements for its technology and know-how or until it receives regulatory approval to sell its products (which could take several years). Thus, the Company has been dependent upon the proceeds from the sale of its securities to meet all of the Company’s liquidity and capital requirements and anticipates having to do so in the future.

The Company will be required to raise additional capital or find additional long-term financing to continue with its research efforts. The ability to raise capital may be dependent upon market conditions that are outside the control of the Company. The ability of the Company to complete the necessary clinical trials and obtain FDA approval for the sale of products to be developed on a commercial basis is uncertain. Ultimately, the Company must complete the development of its products, obtain the appropriate regulatory approvals and obtain sufficient revenues to support its cost structure. However, there can be no assurance that the Company will be able to raise sufficient capital to support its operations. Due to recurring losses from operations and future liquidity needs, there is substantial doubt about the Company’s ability to continue as a going concern.

Since the Company launched its Phase 3 clinical trial for Multikine, the Company has incurred expenses of approximately $64.5 million as of December 31, 2023 on direct costs for the Phase 3 clinical trial and the filing of the clinical study report to the FDA. The Company estimates it will incur additional expenses of approximately $0.7 million for the remainder of the Phase 3 clinical trial and the filing of the clinical study report to the FDA. It should be noted that this estimate is based only on the information currently available from the CROs responsible for managing the Phase 3 clinical trial and does not include other related costs, e.g., the manufacturing of the drug.

The Company uses two CROs to manage the global Phase 3 study; ICON and Ergomed, who are both international leaders in managing oncology trials.

Under a co-development agreement, Ergomed agreed to contribute up to $12 million towards the study where it will perform clinical services in exchange for a single digit percentage of milestone and royalty payments, up to a specified maximum amount. Approximately $11.9 million of the committed $12 million contribution has been realized as of December 31, 2023.

During the three months ended December 31, 2023, the Company’s cash decreased by approximately $0.9 million. Significant components of this decrease included cash used to fund the Company’s regular operations of approximately $4.9 million and approximately $0.4 million in payments on their finance lease obligations, offset by net proceeds from the November 2023 financing of approximately $4.5 million.

During the three months ended December 31, 2022, the Company’s cash decreased by approximately $4.7 million. The significant component of this decrease included cash used to fund the Company’s regular operations, including its Phase 3 clinical trial, of approximately $4.7 million.

During the three months ended December 31, 2023, no warrants were exercised. During the three months ended December 31, 2022, 217,752 warrants were exercised at a weighted average exercise price of $2.05 for total proceeds of approximately $0.5 million.

| 23 |

| Table of Contents |

Results of Operations and Financial Condition

The Company incurred a net operating loss of approximately $6.5 million for the three months ended December 31, 2023. This net operating loss consists of significant non-cash expenses including approximately $1.6 million in share-based compensation to employees and non-employees, and approximately $1.0 million in depreciation and amortization expense.

During the three months ended December 31, 2023, research and development expenses decreased by approximately $1.0 million, or 19%, compared to the three months ended December 31, 2022. Major components of this decrease include an approximately $0.2 million decrease in costs incurred to prepare for the potential commercial sale of Multikine, an approximately $0.6 million decrease in expenses related to the Phase 3 study and a decrease of approximately $0.2 million of employee stock compensation expense.

During the three months ended December 31, 2023, general and administrative expenses decreased by approximately $0.1 million, or 6%, compared to the three months ended December 31, 2022. This decrease is primarily due to a decrease in consulting fees of approximately $0.1 million, and a decrease of approximately $0.1 million of employee stock compensation expense. These decreases were offset by a net increase of approximately $0.1 million of other general and administrative expenses.

Net interest expense, which consists primarily of interest paid on lease liabilities, remained relatively constant at approximately $0.2 million for the three months ended December 31, 2023 and December 31, 2022, respectively.

Research and Development Expenses

The Company’s research and development efforts involve Multikine and LEAPS. The table below shows the research and development expenses associated with each project.

|

| Three Months Ended December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

MULTIKINE |

| $ | 4,329,252 |

|

| $ | 5,294,377 |

|

LEAPS |

|

| 23,257 |

|

|

| 98,169 |

|

TOTAL |

| $ | 4,352,509 |

|

| $ | 5,392,546 |

|

Clinical and other studies necessary to obtain regulatory approval of a new drug involve significant costs and require several years to complete. The extent of the Company’s clinical trials and research programs are primarily based upon the amount of capital available to the Company and the extent to which the Company has received regulatory approvals for clinical trials. The inability of the Company to conduct clinical trials or research, whether due to a lack of capital or regulatory approval, will prevent the Company from completing the studies and research required to obtain regulatory approval for any products which the Company is developing. Without regulatory approval, the Company will be unable to sell any of its products. Since all of the Company’s projects are under development, the Company cannot predict when it will be able to generate any revenue from the sale of any of its products.

Critical Accounting Estimates

Management’s discussion and analysis of the Company’s financial condition and results of operations is based on its unaudited condensed financial statements. The preparation of these financial statements is based on the selection of accounting policies and the application of significant accounting estimates, some of which require management to make judgments, estimates and assumptions that affect the amounts reported in the financial statements and notes.

The Company believes some of the more critical estimates that affect its financial condition and results of operations are in the areas of leases and share-based compensation.

The measurement of the finance and operating lease right-of-use asset and lease liabilities requires the determination of an estimated lease term and an incremental borrowing rate, which involves complex judgment by management. Significant judgment is required by management to develop inputs and assumptions used to determine the incremental borrowing rate for lease contracts. The fair value of the stock options is calculated using the Black-Scholes option pricing model which requires various judgmental assumptions including volatility and expected option life. The compensation cost is recognized as expense over the requisite service or vesting period. Performance-based options are valued using a Monte-Carlo simulation model, which requires inputs based on estimates, including the likelihood of the occurrence of performance and market conditions, volatility and expected option life.

| 24 |

| Table of Contents |

For more information regarding the Company’s critical accounting estimates, see Part II, Item 7 of the Company’s Annual Report on Form 10-K for the year ended September 30, 2023. The application of these critical accounting estimates has been discussed with the Audit Committee of the Company’s Board of Directors.

Item 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISKS

The Company does not believe that it has any significant exposure to market risk.

Item 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Under the direction and with the participation of the Company’s management, including the Company’s Chief Executive Officer and Chief Financial Officer, the Company carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures as of December 31, 2023. The Company maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in its periodic reports with the Securities and Exchange Commission is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and regulations, and that such information is accumulated and communicated to the Company’s management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Company’s disclosure controls and procedures are designed to provide a reasonable level of assurance of reaching its desired disclosure control objectives.

The Company’s Chief Executive Officer and Chief Financial Officer has concluded that the Company’s disclosure controls and procedures were not effective as of December 31, 2023 due to the material weaknesses described in the Company's Annual Report on Form 10-K for the year ended September 30, 2023.

Changes in Internal Control over Financial Reporting

There were no changes in the Company’s internal control over financial reporting that occurred during the three months ended December 31, 2023 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

| 25 |

| Table of Contents |

PART II

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

During the three months ended December 31, 2023, the Company issued 88,573 restricted shares of common stock to consultants for investor relations services.

The Company relied upon the exemption provided by Section 4(a)(2) of the Securities Act of 1933 with respect to the issuance of these shares. The individuals who acquired these shares were sophisticated investors and were provided full information regarding the Company’s business and operations. There was no general solicitation in connection with the offer or sale of these securities. The individuals who acquired these shares acquired them for their own accounts. The certificates representing these shares bear a restricted legend which provides they cannot be sold except pursuant to an effective registration statement or an exemption from registration. No commission or other form of remuneration was given to any person in connection with the issuance of these shares.

Item 5. Other Information

None of our directors or officers adopted or terminated a Rule 10b5-1 trading arrangement or a non-Rule 10b5-1 trading arrangement (as defined in item 408(c) of Regulation S-K) during the quarterly period ending December 31, 2023.

Item 6. Exhibits

Number |

| Exhibit |

|

|

|

| ||

|

|

|

|

| 26 |

| Table of Contents |

SIGNATURES