EXHIBIT 99

CEL-SCI CORPORATION

Common

Stock

THESE

SECURITIES INVOLVE A HIGH DEGREE OF RISK. SEE "RISK

FACTORS".

THESE

SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES

AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, NOR HAS

THE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE

ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE

CONTRARY IS A CRIMINAL OFFENSE.

This

Prospectus relates to shares (the "Shares") of common stock (the

"Common Stock") of CEL-SCI Corporation which may be issued pursuant

to certain employee compensation plans adopted by CEL-SCI. The

employee compensation plans provide for the grant, to selected

employees of CEL-SCI and other persons, of either shares of

CEL-SCI’s common stock or options to purchase shares of

CEL-SCI’s common stock. Persons who received Shares pursuant

to the Plans and who are offering such shares to the public by

means of this Prospectus are referred to as the "Selling

Shareholders".

CEL-SCI

has Incentive Stock Option Plans, Non-Qualified Stock Option Plans,

Stock Bonus Plans, Stock Compensation Plans and a 2014 Incentive

Stock Bonus Plan. In some cases these plans are collectively

referred to as the "Plans". The terms and conditions of any stock

grants and the terms and conditions of any options, including the

price of the shares of Common Stock issuable on the exercise of

options, are governed by the provisions of the respective Plans and

any particular agreements between CEL-SCI and the Plan

participants.

The

Selling Shareholders may offer the shares from time to time in

negotiated transactions in the over-the-counter market, at fixed

prices which may be changed from time to time, at market prices

prevailing at the time of sale, at prices related to such

prevailing market prices or at negotiated prices. The Selling

Shareholders may effect such transactions by selling the Shares to

or through securities broker/dealers, and such broker/dealers may

receive compensation in the form of discounts, concessions, or

commissions from the Selling Shareholders and/or the purchasers of

the Shares for whom such broker/dealers may act as agent or to whom

they sell as principal, or both (which compensation as to a

particular broker/dealer might be in excess of customary

commissions). See "Selling Shareholders" and "Plan of

Distribution".

None of

the proceeds from the sale of the Shares by the Selling

Shareholders will be received by CEL-SCI. CEL-SCI has agreed to

bear all expenses (other than underwriting discounts, selling

commissions and fees and expenses of counsel and other advisers to

the Selling Shareholders). CEL-SCI has agreed to indemnify the

Selling Shareholders against certain liabilities, including

liabilities under the Securities Act of 1933, as amended (the

"Securities Act").

1

The

purchase of the securities offered by this prospectus involves a

high degree of risk. Risk factors include the lack of revenues and

history of loss, need for additional capital and need for FDA

approval. See the “Risk Factors” section of this

prospectus, beginning on page 17, for additional Risk

Factors.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or has

passed upon the accuracy or adequacy of this prospectus. Any

representation to the contrary is a criminal offense.

The

date of this Prospectus is February __, 2018.

2

AVAILABLE INFORMATION

CEL-SCI

is subject to the information requirements of the Securities

Exchange Act of 1934 (the "Exchange Act") and in accordance

therewith, files reports and other information with the Securities

and Exchange Commission (the "Commission"). Proxy statements,

reports and other information concerning CEL-SCI can be inspected

and copied at the Commission's office at 100 F Street, NE,

Washington, D.C. 20549. Certain information concerning CEL-SCI is

also available at the Internet Web Site maintained by the

Securities and Exchange Commission at www.sec.gov. This Prospectus

does not contain all information set forth in the Registration

Statement of which this Prospectus forms a part and exhibits

thereto which CEL-SCI has filed with the Commission under the

Securities Act and to which reference is hereby made.

DOCUMENTS INCORPORATED BY REFERENCE

The

following documents filed with the Commission by CEL-SCI

(Commission File No. 001-11889) are incorporated by reference into

this prospectus:

●

our Annual Report

on Form 10-K for the fiscal year ended September 30,

2017;

●

our Current Reports

on Form 8-K filed with the SEC on October 6, 2017, November 3,

2017, November 22, 2017, December 1, 2017, December 12, 2017,

December 20, 2017, December 21, 2017, January 4, 2018 and January

16, 2018;

●

the description of

our common stock contained in our Registration Statement on Form

8-A filed with the SEC on July 2, 1996 and all amendments and

reports updating that description; and the description of our

Series S warrants contained in our Registration Statement on Form

8-A filed with the SEC on January 3, 2014 and all amendments and

reports updating that description.

CEL-SCI

will provide, without charge, to each person to whom a copy of this

Prospectus is delivered, including any beneficial owner, upon the

written or oral request of such person, a copy of any or all of the

documents incorporated by reference herein (other than exhibits to

such documents, unless such exhibits are specifically incorporated

by reference into this Prospectus). Requests should be directed

to:

CEL-SCI

Corporation

8229

Boone Blvd., Suite 802

Vienna,

Virginia 223l4

(703)

506-9460

Attention:

Secretary

3

All

documents filed with the Commission by CEL-SCI pursuant to Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the

date of this prospectus and prior to the termination of this

offering shall be deemed to be incorporated by reference into this

prospectus and to be a part of this prospectus from the date of the

filing of such documents. Any statement contained in a document

incorporated or deemed to be incorporated by reference shall be

deemed to be modified or superseded for the purposes of this

prospectus to the extent that a statement contained in this

prospectus or in any subsequently filed document which also is or

is deemed to be incorporated by reference in this prospectus

modifies or supersedes such statement. Such statement so modified

or superseded shall not be deemed, except as so modified or

superseded, to constitute a part of this prospectus.

Investors are

entitled to rely upon information in this prospectus or

incorporated by reference at the time it is used by CEL-SCI to

offer and sell securities, even though that information may be

superseded or modified by information subsequently incorporated by

reference into this prospectus.

CEL-SCI

has filed with the Securities and Exchange Commission a

Registration Statement under the Securities Act of l933, as

amended, with respect to the securities offered by this prospectus.

This prospectus does not contain all of the information set forth

in the Registration Statement. For further information with respect

to CEL-SCI and such securities, reference is made to the

Registration Statement and to the exhibits filed with the

Registration Statement. Statements contained in this prospectus as

to the contents of any contract or other documents are summaries

which are not necessarily complete, and in each instance reference

is made to the copy of such contract or other document filed as an

exhibit to the Registration Statement, each such statement being

qualified in all respects by such reference. The Registration

Statement and related exhibits may also be examined at the

Commission’s internet site (www.sec.gov).

4

TABLE OF CONTENTS

|

|

Page

|

|

|

|

|

THE COMPANY

|

6

|

|

|

|

|

FORWARD LOOKING STATEMENTS

|

16

|

|

|

|

|

RISK FACTORS

|

17

|

|

|

|

|

COMPARATIVE SHARE DATA

|

41

|

|

|

|

|

DILUTION

|

43

|

|

|

|

|

USE OF PROCEEDS

|

43

|

|

|

|

|

MARKET FOR CEL-SCI’S COMMON STOCK

|

44

|

|

|

|

|

SELLING SHAREHOLDERS

|

45

|

|

|

|

|

PLAN OF DISTRIBUTION

|

49

|

|

|

|

|

DESCRIPTION OF SECURITIES

|

50

|

5

THE COMPANY

CEL-SCI

Corporation was formed as a Colorado corporation in 1983.

CEL-SCI’s principal office is located at 8229 Boone

Boulevard, Suite 802, Vienna, VA 22182. CEL-SCI’s

telephone number is 703-506-9460 and its web site is

www.cel-sci.com. CEL-SCI does not incorporate the

information on its website into this prospectus, and you should not

consider it part of this prospectus.

CEL-SCI makes its

electronic filings with the Securities and Exchange Commission

(SEC), including its annual reports on Form 10-K, quarterly reports

on Form 10-Q, current reports on Form 8-K and amendments to these

reports available on its website free of charge as soon as

practicable after they are filed or furnished to the

SEC.

In this

prospectus, unless otherwise specified or the context requires

otherwise, the terms “CEL-SCI,” the

“Company,” “we,” “us” and

“our” to refer to CEL-SCI Corporation. Our fiscal year

ends on September 30.

CEL-SCI’S PRODUCTS

We are

dedicated to research and development directed at improving the

treatment of cancer and other diseases by using the immune system,

the body’s natural defense system. We are currently focused

on the development of the following product candidates and

technologies:

1)

Multikine®

(Leukocyte Interleukin, Injection), or Multikine, an

investigational immunotherapy under development for

the potential treatment of certain head and neck

cancers;

2)

L.E.A.P.S. (Ligand

Epitope Antigen Presentation System) technology, or LEAPS, with two

investigational therapies, LEAPS-H1N1-DC, a product candidate under

development for the potential treatment of pandemic influenza in

hospitalized patients, and CEL-2000 and CEL-4000, vaccine product

candidates under development for the potential treatment of

rheumatoid arthritis.

MULTIKINE

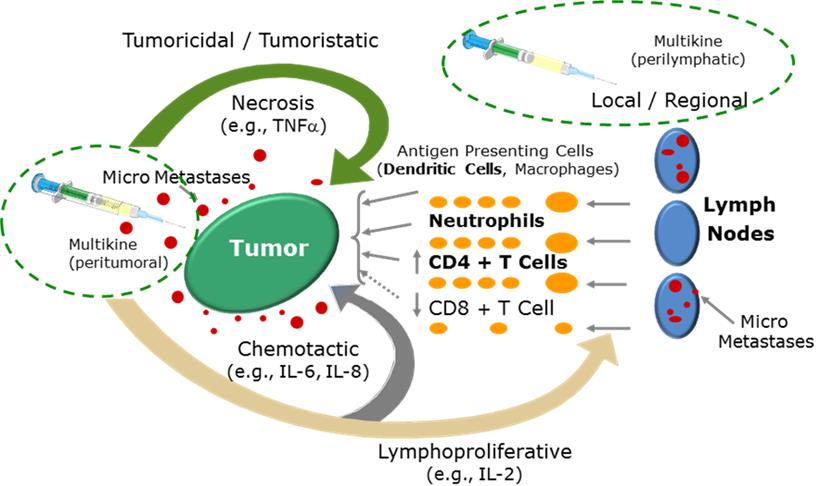

Our

lead investigational therapy, Multikine, is currently being

developed as a potential therapeutic agent directed at using the

immune system to produce an anti-tumor immune response. Data from

Phase 1 and Phase 2

clinical trials suggest that Multikine may help the immune system

“see” the tumor and then attack it, enabling the

body’s own anti-tumor immune response to fight the tumor.

Multikine is the trademark we have registered for this

investigational therapy, and this proprietary name is subject to

review by the U.S. Food and Drug Administration, or FDA, in

connection with our future anticipated regulatory submission for

approval. Multikine

has not been licensed or approved for sale, barter or exchange by

the FDA or any other regulatory agency, such as the European

Medicine Agency, or EMA. Neither has its safety or efficacy been

established for any use.

Multikine is an

immunotherapy product candidate comprised of a patented defined

mixture of 14 human natural cytokines and is manufactured in a

proprietary manner in our manufacturing facility. We spent over 10

years and more than $80 million developing and validating the

manufacturing process for Multikine. The pro-inflammatory cytokine

mixture includes interleukins, interferons, chemokines and

colony-stimulating factors, which contain elements of the

body’s natural mix of defenses against cancer.

6

Multikine is

designed to be used in a different way than immune therapy is

generally being used. Generally, immunotherapy is given to patients

who have already failed other treatments of such as surgery,

radiation and/or chemotherapy and most of the time it is

administered systemically. Multikine on the other hand is

administered locally to treat tumors and their microenvironments

before any other therapy has been administered because it is

believed that is the time when the immune system is thought to be

most amenable to activation against the tumor. For example, in the Phase 3 clinical trial,

Multikine is injected locally at the site of the tumor and near the

adjacent draining lymph nodes as a first line of treatment before

surgery, radiation and/or chemotherapy because that is when the

immune system is thought to be strongest. The goal is to help the

intact immune system recognize and kill the tumor micro metastases

that usually cause recurrence of the cancer. In short, we believe

that the local administration and administration of Multikine and

its administration before weakening of the immune system by

chemotherapy and radiation will result in better anti-tumor

response than if Multikine were administered as a second- or

later-line therapy. In clinical studies of Multikine,

administration of the investigational therapy to head and neck

cancer patients has demonstrated the potential for lesser or no

appreciable toxicity.

Source: Adapted from Timar et al., Journal of Clinical Oncology

23(15) May 20, 2005

7

The

first indication CEL-SCI is pursuing for its investigational drug

product candidate Multikine is an indication for the neoadjuvant

therapy in patients with squamous cell carcinoma of the head and

neck, or SCCHN (hereafter also referred to as advanced primary head

and neck cancer).

SCCHN

is a type of head and neck cancer, and CEL-SCI believes that, in

the aggregate, there is a large, unmet medical need among head and

neck cancer patients. CEL-SCI believes the last FDA approval of a

therapy indicated for the treatment of advanced primary head and

neck cancer was over 50 years ago. In the aggregate, head and neck

cancer represents about 6% of the world’s cancer cases, with

approximately over 650,000 patients diagnosed worldwide each year,

and nearly 60,000 patients diagnosed annually in the United States.

Multikine investigational immunotherapy was granted Orphan Drug

designation for neoadjuvant therapy in patients with SCCHN by the

FDA in the United States.

8

CEL-SCI’s

Phase 3 clinical trial is currently primarily under the management

of two clinical research organizations, or CROs: ICON Inc., or

ICON, and Ergomed Clinical Research Limited, or

Ergomed.

The

Phase 3 study was designed with the objective that if the study

endpoint, which is an improvement in overall survival of the

subjects treated with the Multikine treatment regimen plus the

current standard of care (SOC) as compared to subjects treated with

the current SOC only, is satisfied, the study results are expected

to be used to support applications that we plan to submit to

regulatory agencies in order to seek commercial marketing approvals

for Multikine in major markets around the world. This assessment

can only be made when a certain number of deaths have occurred in

the two main comparator groups of the study.

The

primary endpoint for the protocol for this Phase 3 head and neck

cancer study required that a 10% increase in overall survival be

obtained in the Multikine group which also is administered CIZ (CIZ

= low dose (non-chemotherapeutic) of cyclophosphamide, indomethacin

and Zinc-multivitamins) all of which are thought to enhance

Multikine activity), plus Standard of Care (Surgery + Radiotherapy

or Chemoradiotherapy) arm of the study over the Control comparator

(Standard of Care alone) arm. As the study was designed, the final

determination of whether this endpoint had been successfully

reached could only be determined when 298 events (deaths) had

occurred in the combined comparator arms of the study.

Nine

hundred twenty-eight (928) newly diagnosed head and neck cancer

patients have been enrolled in this Phase 3 cancer study and all

the patients who have completed treatment continue to be followed

for protocol-specific outcomes in accordance with the Study

Protocol. The last patient was enrolled in the study in September

2016. Approximately 135 patients were enrolled in the study from

2011 to 2013, about 195 were enrolled in 2014, about 340 in 2015,

and about 260 in 2016. The study protocol assumed an overall

survival rate of about 55% at 3 years for the SOC treatment group

alone. At this point in the study the 928 patients enrolled in the

study are being followed-up as required by the study

protocol.

Since

CEL-SCI launched its Phase 3 clinical trial for Multikine, CEL-SCI

has incurred expenses of approximately $45.9 million as of

September 30, 2017 on direct costs for the Phase 3 clinical trial.

CEL-SCI estimates it will incur additional expenses of

approximately $13.0 million for the remainder of the Phase 3

clinical trial. It should be noted that this estimate is based only

on the information currently available in CEL-SCI’s contracts

with the Clinical Research Organizations responsible for managing

the Phase 3 clinical trial and does not include other related

costs, e.g., the manufacturing of the drug. This number may be

affected by the rate of death accumulation in the study, foreign

currency exchange rates, and many other factors, some of which

cannot be foreseen today. It is therefore possible that the cost of

the Phase 3 clinical trial will be higher than currently

estimated.

Throughout the

course of the Phase 3 study, an Independent Data Monitoring

Committee, or IDMC, has met periodically to review safety data from

the Phase 3 study, and the IDMC is expected to continue doing so

throughout the remainder of the Phase 3 study. At various points in

the study at which the IDMC has completed review of the safety data

and has issued recommendations, it has recommended that the Phase 3

study may continue. However, on one occasion, in the spring of

2014, the IDMC made a recommendation that the study be closed. This

recommendation by the IDMC was reversed following review of

additional information submitted by us, and the IDMC recommended

that the study continue. In the spring of 2016, with close to 800

patients enrolled, the IDMC made a recommendation that enrollment

in the Phase 3 study should stop, but that patients already

enrolled in the study should continue treatment and follow-up. We

responded to this letter and indicated we would address the

remaining three requests, generally relating to study design

considerations that were not part of the IDMC recommendation in

follow-up correspondence. Subsequent to this correspondence, we

submitted a complete response to the IDMC addressing all of their

requests, as well as providing to them a copy of the suggested

protocol amendment which was sent to the FDA for review and

comment, as was requested by the IDMC. The IDMC did not provide any

additional response following the additional submission to

them.

9

On

September 26, 2016, we received notice from the FDA that the Phase

3 clinical trial in advanced primary head and neck cancer has been

placed on partial clinical hold. In August 2017, the FDA removed

the clinical hold on the Phase 3 study and informed us that all

clinical trial activities under this Investigational New Drug

application (IND) may resume.

In

September 2016, the last patient was accrued to the study. A total

of 928 randomized patients were enrolled in the study as of that

date. In December 2016, and again in February 2017 the IDMC

reviewed the data from the Study, but offered no recommendation as

they awaited the outcome of discussions with the FDA regarding the

clinical hold, which was subsequently removed by the FDA on August

10, 2017.

On

December 7, 2017 CEL-SCI announced that the IDMC had completed its

most recent review of the Phase 3 study data. The data from all 928

enrolled patients were provided to the IDMC by the clinical

research organization (CRO) responsible for data management of this

Phase 3 study. The IDMC made the following observation and

recommendation, a) the IDMC saw no evidence of any significant

safety questions and b) the IDMC recommends continuing the

study.

On

December 11, 2017 we announced that the Phase 3 clinical study was

fully enrolled and will not need to enroll more

patients.

Ultimately, the

decision as to whether our drug product candidate is safe and

effective can only be made by FDA and/or by other regulatory

authorities based upon an assessment of all of the data from an

entire drug development program submitted as part of an application

for marketing approval. As detailed elsewhere in this prospectus,

the current Phase 3 clinical study for our investigational drug may

or may not be able to be used as the pivotal study supporting a

marketing application in the United States, and, if not, at least

one entirely new Phase 3 pivotal study would need to be conducted

to support a marketing application in the United

States.

Prior

to starting the Phase 3 study, we had tested Multikine in over 200

patients. The following is a summary of results from our last Phase

2 study conducted with Multikine. This study employed the same

treatment protocol as is being followed in our Phase 3

study:

●

Reported potential for improved

survival: In a follow-up analysis of the Phase 2 clinical

study population, which used the same dosage and treatment regimen

as is being used in the Phase 3 study, head and neck cancer

patients with locally advanced primary disease who received the

investigational therapy Multikine as first-line investigational

therapy, followed by surgery and radiotherapy, were reported by the

clinical investigators to have had a 63.2% overall survival, or OS,

rate at a median of 3.33 years from surgery. This percentage of OS

was arrived at as follows: of the 21 subjects enrolled in the Phase

2 study, the consent for the survival follow-up portion of the

study was received from 19 subjects. OS was calculated using the

entire treatment population that consented to the follow-up portion

of the study (19 subjects), including two subjects who, as later

determined by three pathologists blinded to the study, did not have

oral squamous cell carcinoma, or OSCC. These two subjects were thus

not evaluable per the protocol and were not included in the

pathology portion of the study for purposes of calculating complete

response rate, as described below, but were included in the OS

calculation. The overall survival rate of subjects receiving the

investigational therapy in this study was compared to the overall

survival rate that was calculated based upon a review of 55

clinical trials conducted in the same cancer population (with a

total of 7,294 patients studied), and reported in the peer reviewed

scientific literature between 1987 and 2007. Review of this

literature showed an approximate survival rate of 47.5% at 3.5

years from treatment. Therefore, the results of our final Phase 2

study were considered to be potentially favorable in terms of

overall survival, recognizing the limitations of this early-phase

study. It should be noted that an earlier investigational therapy

Multikine study appears to lend support to the overall survival

findings described above - Feinmesser et al Arch Otolaryngol. Surg.

2003. However, no definitive conclusions can be drawn from these

data about the potential efficacy or safety profile of this

investigational therapy. Moreover, further research is required,

and these results must be confirmed in the Phase 3 clinical trial

of this investigational therapy that is currently in progress.

Subject to completion of that Phase 3 clinical trial and the

FDA’s review and acceptance of our entire data set on this

investigational therapy, we believe that these early-stage clinical

trial results indicate the potential for our Multikine product

candidate to become a treatment for advanced primary head and neck

cancer, if approved.

10

●

Reported average of 50% reduction in tumor

cells in Phase 2 trials (based on 19 patients evaluable by

pathology, having OSCC): The clinical investigators who

administered the three-week Multikine treatment regimen used in the

Phase 2 study reported that, as was determined in a controlled

pathology study, Multikine administration appeared to have caused,

on average, the disappearance of about half of the cancer cells

present at surgery (as determined by histopathology assessing the

area of Stroma/Tumor (Mean+/- Standard Error of the Mean of the

number of cells counted per filed)) even before the start of

standard therapy, which normally includes surgery, radiation and

chemotherapy (Timar et al JCO 2005).

●

Reported 10.5% complete response in the final

Phase 2 trial (based on 19 patients evaluable by pathology, having

OSCC): The

clinical investigators who administered the three-week Multikine

investigational treatment regimen used in the Phase 2 study

reported that, as was determined in a controlled pathology study,

the tumor apparently was no longer present (as determined by

histopathology) in approximately 10.5% of evaluable patients with

OSCC (Timar et al JCO 2005). In the original study, 21 subjects

received Multikine, two of which were later excluded, as subsequent

analysis by three pathologists blinded to the study revealed that

these two patients did not have OSCC. Two subjects in this study

had a complete response, leaving a reported complete response rate

of two out of 19 assessable subjects with OSCC (or 10.5%) (Timar et

al, JCO 2005).

●

Adverse events reported in clinical

trials: In clinical trials conducted to date with the

Multikine investigational therapy, adverse events which have been

reported by the clinical investigators as possibly or probably

related to Multikine administration included pain at the injection

site, local minor bleeding and edema at the injection site,

diarrhea, headache, nausea, and constipation.

Subsequently, an

analysis on the 21 subjects originally treated with Multikine in

the study to evaluate overall survival was conducted, as described

above. In connection with the follow-up portion of the study for

overall survival, we also conducted an unreported post-hoc analysis

of complete response rate in the study population, which included

subjects who provided consent for the follow-up and who also had

OSCC. Two of the 21 subjects did not re-consent for follow-up, and

two of the remaining 19 subjects were excluded from the post-hoc

complete response rate analysis as they had previously been

determined by pathology analysis to not have OSCC. The two complete

responders with OSCC both consented to the follow-up study.

Therefore, the post-hoc analysis of complete response was based on

a calculation of the two complete responders out of 17 evaluable

subjects who consented to the follow-up analysis and who also had

OSCC (or 11.8%).

Furthermore, we

reported an overall response rate of 42.1% based on the number of

evaluable patients who experienced a favorable response to the

treatment, including those who experienced minor, major and

complete responses. Out of the 19 evaluable patients, two

experienced a complete response, two experienced a major response,

and four experienced a minor response to treatment. Thus, we

calculated the number of patients experiencing a favorable response

as eight patients out of 19 (or 42.1%) (Timar et al, JCO

2005).

11

The

clinical significance of these and other data, to date, from the

multiple Multikine clinical trials, is not yet known. These

preliminary clinical data do suggest the potential to demonstrate a

possible improvement in the clinical outcome for patients treated

with Multikine.

Peri-Anal Warts and Cervical Dysplasia in HIV/HPV Co-Infected

Patients

HPV is

a very common sexually transmitted disease in the United States and

other parts of the world. It can lead to cancer of the cervix,

penis, anus, esophagus and head and neck. Our focus in HPV,

however, is not on developing an antiviral for the potential

treatment or prevention of HPV in the general population. Instead,

our focus is on developing an immunotherapy product candidate

designed to be administered to patients who are immune-suppressed

by other diseases, such as HIV, and who are therefore less able or

unable to control HPV and its resultant or co-morbid diseases. Such

patients have limited treatment options available to

them.

One

condition that is commonly associated with both HIV and HPV is the

occurrence of anal intraepithelial dysplasia, or AIN, and anal and

genital warts. The incidence of AIN in HIV-infected people is

estimated to be about 25%. The incidence of anal HPV infection in

HIV-infected men who have sex with men, or MSM, is estimated to be

as high as 95%. In the aggregate, the United States and Europe have

about 875,000 HIV-infected patients with AIN (assuming AIN

prevalence of approximately 25% of the aggregate HIV-infected

population). Persistent HPV infection in the anal region is thought

to be responsible for up to 80% of anal cancers, and men and women

who are HIV positive have a 30-fold increase in their risk of anal

cancer. Persistent HPV infection can

also be a precursor to cervical cancer, as well as certain head and

neck cancers.

In

October 2013, we signed a cooperative research and development

agreement, or CRADA, with the U.S. Naval Medical Center, San Diego,

or the USNMC. Pursuant to this agreement, the USNMC was to conduct

a Phase 1 study, approved by the Human Subjects Institutional

Review Board, of our investigational immunotherapy, Multikine, in

HIV/HPV co-infected men and women with peri-anal warts. The purpose

of this study was to evaluate the safety and clinical impact of

Multikine as a potential treatment of peri-anal warts and assess

its effect on AIN in HIV/HPV co-infected men and

women.

In July

2015, we added a clinical site at the University of California, San

Francisco, or UCSF, and Key Opinion Leader, or KOL, to the ongoing

Phase 1 study. In August 2016, the U.S. Navy discontinued this

Phase 1 study because of difficulties in enrolling patients. UCSF

is continuing with the study. We will not continue with this

indication because 1) the patient enrollment is extremely slow and

2) we need to focus our resources on the Phase 3study.

In

October 2013, we entered into a co-development and profit sharing

agreement with Ergomed for development of Multikine as a potential

treatment of HIV/HPV co-infected men and women with peri-anal

warts.

The treatment

regimen for this Phase 1 study of up to 15 HIV/HPV co-infected

patient volunteers with peri-anal warts is identical to the regimen

that was used in an earlier Institutional Review Board-approved

Multikine Phase 1 study in HIV/HPV co-infected patients, which was

conducted at the University of Maryland. In that study, the Multikine

investigational therapy was administered to HIV/HPV co-infected

women with cervical dysplasia, resulting in visual and histological

evidence of clearance of lesions in three out of the eight

subjects.

12

Furthermore, in

this cervical dysplasia Phase 1 study, the number of HPV viral

sub-types in three volunteer subjects tested were reduced

post-treatment with Multikine, as opposed to pre-treatment, as

determined by in situ polymerase chain reaction performed on tissue

biopsy collected before and after Multikine treatment. As reported

by the investigators in the earlier study, the study volunteers,

except one subject volunteer, all appeared to tolerate the

treatment with no reported serious adverse events.

MANUFACTURING FACILITY

Before

starting the Phase 3 clinical trial, for reasons related to

regulatory considerations, the Company needed to build a dedicated

manufacturing facility to produce Multikine. This facility has been

completed and validated, and has produced multiple clinical lots

for the Phase 3 clinical trial. The facility has also passed review

by a European Union Qualified Person on several

occasions.

The

Company’s lease on the manufacturing facility expires on

October 31, 2028.

CEL-SCI

completed validation of its new manufacturing facility in January

2010. The state-of-the-art facility is being used to manufacture

Multikine for CEL-SCI’s Phase 3 clinical trial. In addition

to using this facility to manufacture Multikine, CEL-SCI, only if

the facility is not being used for Multikine, may offer the use of

the facility as a service to pharmaceutical companies and others,

particularly those that need to “fill and finish” their

drugs in a cold environment (4 degrees Celsius, or approximately 39

degrees Fahrenheit). Fill and finish is the process of filling

injectable drugs in a sterile manner and is a key part of the

manufacturing process for many medicines. However, priority will

always be given to Multikine as management considers the

preparation for a final marketing approval to be more important

than offering fill and finish services.

LEAPS

Our

patented T-cell Modulation Process, referred to as LEAPS (Ligand

Epitope Antigen Presentation System), uses

“heteroconjugates” to direct the body to choose a

specific immune response. LEAPS is designed to stimulate the human

immune system to more effectively fight bacterial, viral and

parasitic infections as well as autoimmune, allergies,

transplantation rejection and cancer, when it cannot do so on its

own. Administered like a vaccine, LEAPS combines T-cell binding

ligands with small, disease-associated peptide antigens, and may

provide a new method to treat and prevent certain

diseases.

The

ability to generate a specific immune response is important because

many diseases are often not combated effectively due to the

body’s selection of the “inappropriate” immune

response. The capability to specifically reprogram an immune

response may offer a more effective approach than existing vaccines

and drugs in attacking an underlying disease.

On

September 19, 2017, we announced that it has been awarded a Phase 2

Small Business Innovation Research (SBIR) grant in the amount of

$1.5 million from the National Institute of Arthritis Muscoskeletal

and Skin Diseases, which is part of the National Institutes of

Health (NIH). This grant will provide funding to allow us to

advance our first LEAPS product candidate, CEL-4000, towards an

Investigational New Drug (IND) application, by funding GMP

manufacturing, IND enabling studies, and additional mechanism of

action studies. The work is being conducted at our research

laboratory and Rush University Medical Center in Chicago, Illinois

in the laboratories of Tibor Glant, MD, Ph.D., The Jorge O. Galante

Professor of Orthopedic Surgery and Katalin Mikecz, MD, Ph.D.

Professor of Orthopedic Surgery & Biochemistry. The grant was

awarded based on published data described below by Dr. Glant's team

in collaboration with our showing that the administration of a

proprietary peptide using our LEAPS technology prevented the

development, and lessened the severity, including inflammation, of

experimental proteoglycan induced arthritis (PGIA or GIA) when it

was administered after the disease was induced in the

animals.

13

In July

2014, the Company announced that it has been awarded a Phase 1

Small Business Innovation Research (SBIR) grant in the amount of

$225,000 from the National Institute of Arthritis Muscoskeletal and

Skin Diseases, which is part of the National Institutes of Health.

The grant funded the development of our LEAPS technology as a

potential treatment for rheumatoid arthritis, an autoimmune disease

of the joints. The work was conducted at Rush University Medical

Center in Chicago, Illinois in the laboratories of Tibor Glant, MD,

Ph.D., The Jorge O. Galante Professor of Orthopedic Surgery;

Katalin Mikecz, MD, Ph.D. Professor of Orthopedic Surgery &

Biochemistry; and Allison Finnegan, Ph.D. Professor of

Medicine.

With

the support of the SBIR grant, CEL-SCI is developing two new drug

candidates, CEL-2000 and CEL-4000, as potential rheumatoid

arthritis therapeutic vaccines. The data from animal studies using

the CEL-2000 treatment vaccine demonstrated that it could be used

as an effective treatment against rheumatoid arthritis with fewer

administrations than those required by other anti-rheumatoid

arthritis treatments currently on the market for arthritic

conditions associated with the Th17 signature cytokine

TNF- . The data for

CEL-4000 indicates it could be effective against rheumatoid

arthritis cases where a Th1 signature cytokine (IFN-c) is dominant.

CEL-2000 and CEL-4000 have the potential to be a more

disease-specific therapy, significantly less expensive, act at an

earlier step in the disease process than current therapies and may

be useful in patients not responding to existing rheumatoid

arthritis therapies. CEL-SCI believes this represents a large unmet

medical need in the rheumatoid arthritis market.

In

February 2017 and November 2016, CEL-SCI announced new preclinical

data that demonstrate its investigational new drug candidate

CEL-4000 has the potential for use as a therapeutic vaccine to

treat rheumatoid arthritis. This efficacy study was supported in

part by the SBIR Phase I Grant and was conducted in collaboration

with Drs. Katalin Mikecz and Tibor Glant, and their research team

at Rush University Medical Center in Chicago, IL.

In

March 2015, CEL-SCI and its collaborators published a review

article on vaccine therapies for rheumatoid arthritis based in part

on work supported by the SBIR grant. The article is entitled

“Rheumatoid arthritis vaccine therapies: perspectives and

lessons from therapeutic Ligand Epitope Antigen Presentation System

vaccines for models of rheumatoid arthritis” and was

published in Expert Rev. Vaccines 1 - 18 and can be found at

http://www.ncbi.nlm.nih.gov/ pubmed/25787143.

In

August 2012, Dr. Zimmerman, CEL-SCI’s Senior Vice President

of Research, Cellular Immunology, gave a Keynote presentation at

the OMICS 2nd International Conference on Vaccines and Vaccinations

in Chicago. This presentation showed how the LEAPS peptides

administered altered only select cytokines specific for each

disease model, thereby improving the status of the test animals and

even preventing death and morbidity. These results support the

growing body of evidence that provides for its mode of action by a

common format in these unrelated conditions by regulation of Th1

(e.g., IL12 and IFN-c) and their action on reducing

TNF- and other

inflammatory cytokines as well as regulation of antibodies to these

disease associated antigens. This was also illustrated by a

schematic model showing how these pathways interact and result in

the overall effect of protection and regulation of cytokines in a

beneficial manner.

In

February 2010, CEL-SCI announced that its CEL-2000 vaccine

demonstrated that it was able to block the progression of

rheumatoid arthritis in a mouse model, where a Th17 signature

cytokine (TNF- ) is

dominant. The results were published in the scientific

peer-reviewed Journal of International Immunopharmacology (online

edition) in an article titled “CEL-2000: A Therapeutic

Vaccine for Rheumatoid Arthritis Arrests Disease Development and

Alters Serum Cytokine / Chemokine Patterns in the Bovine Collagen

Type II Induced Arthritis in the DBA Mouse Model” Int

Immunopharmacol. 2010 Apr; 10(4):412-21 http://www.

ncbi.nlm.nih.gov/pubmed/20074669.

14

Using

the LEAPS technology, CEL-SCI has created a potential peptide

treatment for H1N1 (swine flu) hospitalized patients. This LEAPS

flu treatment is designed to focus on the conserved, non-changing

epitopes of the different strains of Type A Influenza viruses

(H1N1, H5N1, H3N1, etc.), including “swine”,

“avian or bird”, and “Spanish Influenza”,

in order to minimize the chance of viral “escape by

mutations” from immune recognition. Therefore, one should

think of this treatment not really as an H1N1 treatment, but as a

potential pandemic flu treatment. CEL-SCI’s LEAPS flu

treatment contains epitopes known to be associated with immune

protection against influenza in animal models.

In

September 2009, the U.S. FDA advised CEL-SCI that it could proceed

with its first clinical trial to evaluate the effect of LEAPS-H1N1

treatment on the white blood cells of hospitalized H1N1 patients.

This followed an expedited initial review of CEL-SCI's regulatory

submission for this study proposal.

In

November 2009, CEL-SCI announced that The Johns Hopkins University

School of Medicine had given clearance for CEL-SCI’s first

clinical study to proceed using LEAPS-H1N1. Soon after the start of

the study, the number of hospitalized H1N1 patients dramatically

declined and the study was unable to complete the enrollment of

patients.

Additional work on

this treatment for the pandemic flu is being pursued in

collaboration with the National Institute of Allergy and Infectious

Diseases (NIAID), part of the National Institutes of Health, USA.

In May 2011 NIAID scientists presented data at the Keystone

Conference on “Pathogenesis of Influenza: Virus-Host

Interactions” in Hong Kong, China, showing the positive

results of efficacy studies in mice of LEAPS H1N1 activated

dendritic cells (DCs) to treat the H1N1 virus. Scientists at the

NIAID found that H1N1-infected mice treated with LEAPS-H1N1 DCs

showed a survival advantage over mice treated with control DCs. The

work was performed in collaboration with scientists led by Kanta

Subbarao, M.D., Chief of the Emerging Respiratory Diseases Section

in NIAID’s Division of Intramural Research, part of the

National Institutes of Health, USA.

In July

2013, CEL-SCI announced the publication of the results of influenza

studies by researchers from the NIAID in the Journal of Clinical

Investigation (www.jci.org/articles/view/67550). The studies

described in the publication show that when CEL-SCI’s

investigational J-LEAPS Influenza Virus treatments were used

“in vitro” to activate DCs, which when injected into

influenza infected mice, arrested the progression of lethal

influenza virus infection in these mice. The work was performed in

the laboratory of Dr. Subbarao.

Even

though the various LEAPS drug candidates have not yet been given to

humans, they have been tested in vitro with human cells. They have

induced similar cytokine responses that were seen in these animal

models, which may indicate that the LEAPS technology might

translate to humans. The LEAPS candidates have demonstrated

protection against lethal herpes simplex virus (HSV1) and H1N1

influenza infection, as a prophylactic or therapeutic agent in

animals. They have also shown some level of efficacy in animals in

two autoimmune conditions, curtailing and sometimes preventing

disease progression in arthritis and myocarditis animal models.

CEL-SCI’s belief is that the LEAPS technology may be a

significant alternative to the vaccines currently available on the

market for these diseases.

None of

the LEAPS investigational products have been approved for sale,

barter or exchange by the FDA or any other regulatory agency for

any use to treat disease in animals or humans. The safety or

efficacy of these products has not been established for any use.

Lastly, no definitive conclusions can be drawn from the

early-phase, preclinical-trials data involving these

investigational products. Before obtaining marketing approval from

the FDA in the United States, and by comparable agencies in most

foreign countries, these product candidates must undergo rigorous

preclinical and clinical testing which is costly and time consuming

and subject to unanticipated delays. There can be no assurance that

these approvals will be granted.

15

FORWARD LOOKING STATEMENTS

This

prospectus and the documents that are incorporated or deemed to be

incorporated by reference into this prospectus, contain or

incorporate by reference “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. You

can generally identify these forward-looking statements by

forward-looking words such as “anticipates,”

“believes,” “expects,”

“intends,” “future,” “could,”

“estimates,” “plans,” “would,”

“should,” “potential,”

“continues” and similar words or expressions (as well

as other words or expressions referencing future events, conditions

or circumstances). These forward-looking statements involve risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements, including, but not

limited to:

●

the progress and

timing of, and the amount of expenses associated with, our

research, development and commercialization activities for our

product candidates, including Multikine;

●

our expectations

regarding the timing, costs and outcome of any pending or future

litigation matters, lawsuits or arbitration proceedings, including

but not limited to the pending arbitration proceeding we initiated

against our former clinical research organization, or

CRO;

●

the success of our

clinical studies for our product candidates;

●

our ability to

obtain U.S. and foreign regulatory approval for our product

candidates and the ability of our product candidates to meet

existing or future regulatory standards;

●

our expectations

regarding federal, state and foreign regulatory

requirements;

●

the therapeutic

benefits and effectiveness of our product candidates;

●

the safety profile

and related adverse events of our product candidates;

●

our ability to

manufacture sufficient amounts of Multikine or our other product

candidates for use in our clinical studies or, if approved, for

commercialization activities following such regulatory

approvals;

●

our plans with

respect to collaborations and licenses related to the development,

manufacture or sale of our product candidates;

●

our expectations as

to future financial performance, expense levels and liquidity

sources;

●

our ability to

compete with other companies that are or may be developing or

selling products that are competitive with our product

candidates;

●

anticipated trends

and challenges in our potential markets; and

●

our ability to

attract, retain and motivate key personnel.

16

All

forward-looking statements contained herein are expressly qualified

in their entirety by this cautionary statement, the risk factors

set forth under the heading “Risk Factors” and

elsewhere in this prospectus and in the documents incorporated or

deemed to be incorporated by reference into this prospectus. The

forward-looking statements contained in this prospectus and any

document incorporated or deemed to be incorporated by reference in

this prospectus, speak only as of their respective

dates. Except to the extent required by applicable laws

and regulations, we undertake no obligation to update these

forward-looking statements to reflect new information, events or

circumstances after the date of this prospectus or to reflect the occurrence of

unanticipated events. In light of these risks and uncertainties,

the forward-looking events and circumstances described in this

prospectus and the documents that are incorporated by reference

into this prospectus may not occur and actual results could differ

materially from those anticipated or implied in such

forward-looking statements. Accordingly, you are cautioned not to

place undue reliance on these forward-looking

statements.

RISK FACTORS

Investors should be

aware that this offering involves the risks described below, which

could adversely affect the price of our common stock. In

addition to the other information contained in this prospectus, the

following factors should be considered carefully in evaluating an

investment in the securities offered by this

prospectus. The risks and uncertainties we described are

not the only ones facing us. Additional risks not

presently known to us, or that we currently deem immaterial, may

also impair our business operations. If any of these

risks were to occur, our business, financial condition, results of

operations and liquidity would likely suffer. In that

event, the trading price of our common stock would decline, and you

could lose all or part of your investment. Some

statements in this Prospectus, including statements in the

following risk factors, constitute forward-looking statements. See

“Forward-Looking Statements.”

Risks Related to CEL-SCI

CEL-SCI has identified material weaknesses in its internal control

over financial reporting which could, if not remediated, result in

material misstatements in CEL-SCI’s financial

statements.

CEL-SCI’s

management is responsible for establishing and maintaining adequate

internal control over its financial reporting, as defined in Rule

13a-15(f) under the Exchange Act. CEL-SCI’s management

identified material weaknesses in the internal control over

financial reporting as of September 30, 2016. A material weakness

is a deficiency, or a combination of deficiencies, in internal

control over financial reporting, such that there is a reasonable

possibility that a material misstatement of CEL-SCI’s annual

or interim financial statements will not be prevented or detected

on a timely basis.

17

CEL-SCI

discovered an error in the way it accounted for the lease for its

manufacturing facility. The accounting error was determined to be a

material weakness in CEL-SCI’s internal control over

financial reporting as of September 30, 2016 relating to

CEL-SCI’s financial close process for non-routine

transactions including the accounting for leases and the assessment

of impairment of long-lived assets. The errors were identified

during the course of the preparation of its financial statements

and other financial data for its fiscal year ended September 30,

2017, as well as its assessment of its disclosure controls and

procedures and internal control over financial reporting as of that

date. This resulted in CEL-SCI filing an amended 10-K/A for the

year ended September 30, 2016, that disclosed these material

weaknesses and the impact of the restatement to the previously

issued financial statements. In addition, as part of the

Company’s audit of the financial statements for the year

ended September 30, 2017, there was an error noted in how the

Company accounted for certain warrants issued in a financing

transaction. These warrants were initially recorded as liability

instruments but met the criteria under ASC 815 to be treated as

equity instruments. These material weaknesses continue to exist at

September 30, 2017 and CEL-SCI is in the process of remediating

these material weaknesses.

If the

remedial measures CEL-SCI has begun implementing that are designed

to address these material weaknesses are insufficient to address

these material weaknesses, or if additional material weaknesses or

significant deficiencies in CEL-SCI’s internal control are

discovered or occur in the future, the financial statements may

contain material misstatements and CEL-SCI could be required to

restate its financial results.

We have incurred significant losses since inception, and we

anticipate that we will continue to incur significant losses for

the foreseeable future and may never achieve or maintain

profitability.

We have

a history of net losses, expect to incur substantial losses and

have negative operating cash flow for the foreseeable future, and

may never achieve or maintain profitability. Since the date of our

formation and through September 30, 2017, we incurred net losses of

approximately $300 million. We have relied principally upon the

proceeds from the public and private sales of our securities to

finance our activities to date. To date, we have not commercialized

any products or generated any revenue from the sale of products,

and we do not expect to generate any product revenue for the

foreseeable future. We do not know whether or when we will generate

product revenue or become profitable.

We are

heavily dependent on the success of Multikine which is under

clinical development. We cannot be certain that Multikine will

receive regulatory approval or be successfully commercialized even

if we receive regulatory approval. Multikine is our only product

candidate in late-stage clinical development, and our business

currently depends heavily on its successful development, regulatory

approval and commercialization. We have no drug products for sale

currently and may never be able to develop approved and marketable

drug products.

Even if

we succeed in developing and commercializing one or more of our

product candidates, we expect to incur significant operating and

capital expenditures as we:

●

continue to

undertake preclinical development and clinical trials for product

candidates;

●

seek regulatory

approvals for product candidates; and

●

implement

additional internal systems and infrastructure.

18

To

become and remain profitable, we must succeed in developing and

commercializing our product candidates, which must generate

significant revenue. This will require us to be successful in a

range of challenging activities, including completing preclinical

testing and clinical trials of our product candidates, discovering

or acquiring additional product candidates, obtaining regulatory

approval for these product candidates and manufacturing, marketing

and selling any products for which we may obtain regulatory

approval. We are only in the preliminary stages of most of these

activities. We may never succeed in these activities and, even if

we do, may never generate revenue that is significant enough to

achieve profitability.

Even if

we do achieve profitability, we may not be able to sustain or

increase profitability on a quarterly or annual basis. Our failure

to become and remain profitable could depress the value of our

company and could impair our ability to raise capital, expand our

business, maintain our research and development efforts, diversify

our product offerings or even continue our operations. A decline in

the value of our company could cause our stockholders to lose all

or part of their investment.

We will require substantial additional capital to remain in

operation. A failure to obtain this necessary capital when needed

could force us to delay, limit, reduce or terminate our product

candidates’ development or commercialization

efforts.

As of

September 30, 2017, we had cash and cash equivalents of

approximately $2.4 million. We believe that we will continue to

expend substantial resources for the foreseeable future developing

Multikine, LEAPS and any other product candidates or technologies

that we may develop or acquire. These expenditures will include

costs associated with research and development, potentially

obtaining regulatory approvals and having our products

manufactured, as well as marketing and selling products approved

for sale, if any. In addition, other unanticipated costs may arise.

Because the outcome of our current and anticipated clinical trials

is highly uncertain, we cannot reasonably estimate the actual

amounts necessary to successfully complete the development and

commercialization of our product candidates.

Our

future capital requirements depend on many factors,

including:

●

the rate of

progress of, results of and cost of completing Phase 3 clinical

development of Multikine for the treatment of certain head and neck

cancers;

●

the results of our

applications to and meetings with the FDA, the EMA and other

regulatory authorities and the consequential effect on our

operating costs;

●

assuming favorable

Phase 3 clinical results, the cost, timing and outcome of our

efforts to obtain marketing approval for Multikine in the United

States, Europe and in other jurisdictions, including the

preparation and filing of regulatory submissions for Multikine with

the FDA, the EMA and other regulatory authorities;

●

the scope,

progress, results and costs of additional preclinical, clinical, or

other studies for additional indications for Multikine, LEAPS and

other product candidates and technologies that we may develop or

acquire;

●

the timing of, and

the costs involved in, obtaining regulatory approvals for LEAPS if

clinical studies are successful;

19

●

the cost and timing

of future commercialization activities for our products, if any of

our product candidates are approved for marketing, including

product manufacturing, marketing, sales and distribution

costs;

●

the revenue, if

any, received from commercial sales of our product candidates for

which we receive marketing approval;

●

the cost of having

our product candidates manufactured for clinical trials and in

preparation for commercialization;

●

our ability to

establish and maintain strategic collaborations, licensing or other

arrangements and the financial terms of such

agreements;

●

the costs involved

in preparing, filing and prosecuting patent applications and

maintaining, defending and enforcing our intellectual property

rights, including litigation costs, and the outcome of such

litigation; and

●

the extent to which

we acquire or in-license other products or

technologies.

Based on the current operating plan, and absent

any future financings or strategic partnerships, CEL-SCI believes

that its existing cash and cash equivalents and investments will be

sufficient to fund its projected operating expenses and capital

expenditure requirements into March 2018. However, CEL-SCI’s

operating plan may change as a result of many factors currently

unknown to CEL-SCI, and CEL-SCI may need additional funds sooner

than planned. Additional funds may not be available when we

need them on terms that are acceptable to us, or at all. If

adequate funds are not available to us on a timely basis, we may be

required to delay, limit, reduce or terminate preclinical studies,

clinical trials or other development activities for Multikine,

LEAPS, or any other product candidates or technologies that we

develop or acquire, or delay, limit, reduce or terminate our sales

and marketing capabilities or other activities that may be

necessary to commercialize our product candidates. Due to recurring losses

from operations and future liquidity needs, there is substantial

doubt about our ability to continue as a going concern without

additional capital becoming available. The doubt about our

ability to continue as a going concern could have an adverse impact

on our ability to execute our business plan, result in the

reluctance on the part of certain suppliers to do business with us,

or adversely affect our ability to raise additional debt or equity

capital.

The costs of our product candidates development and clinical trials

are difficult to estimate and will be very high for many years,

preventing us from making a profit for the foreseeable future, if

ever.

Clinical and other

studies necessary to obtain approval of a new drug can be time

consuming and costly, especially in the United States, but also in

foreign countries. Our estimates of the costs associated with

future clinical trials and research may be substantially lower than

what we actually experience. It is impossible to predict what we

will face in the development of a product candidate, such as

Multikine. The purpose of clinical trials is to provide both us and

regulatory authorities with safety and efficacy data in humans. It

is relatively common to revise a trial or add subjects to a trial

in progress. The difficult and often complex steps necessary to

obtain regulatory approval, especially that of the FDA, and the

EMA, involve significant costs and may require several years to

complete. We expect that we will need substantial additional

financing over an extended period of time in order to fund the

costs of future clinical trials, related research, and general and

administrative expenses.

20

The

extent of our clinical trials and research programs are primarily

based upon the amount of capital available to us and the extent to

which we receive regulatory approvals for clinical trials. We have

established estimates of the future costs of the Phase 3 clinical

trial for Multikine, but, as explained above, our estimates may not

prove correct.

An adverse determination in any current or future lawsuits or

arbitration proceedings to which we are a party could have a

material adverse effect on us.

We are

currently involved in a pending arbitration proceeding, CEL-SCI

Corporation v. inVentiv Health Clinical, LLC (f/k/a PharmaNet LLC)

and PharmaNet GmbH (f/k/a PharmaNet AG). We initiated the

proceedings against inVentiv Health Clinical, LLC, or inVentiv, the

former third-party CRO, and are seeking payment for damages related

to inVentiv’s prior involvement in the Phase 3 clinical trial

of Multikine. The arbitration claim, initiated under the Commercial

Rules of the American Arbitration Association, alleges (i) breach

of contract, (ii) fraud in the inducement, and (iii) common law

fraud. Currently, we are seeking at least $50 million in damages in

our amended statement of claim.

In an

amended statement of claim, we asserted the claims set forth above

as well as an additional claim for professional malpractice. The

arbitrator subsequently granted inVentiv’s motion to dismiss

the professional malpractice claim based on the “economic

loss doctrine” which, under New Jersey law, is a legal

doctrine that, under certain circumstances, prohibits bringing a

negligence-based claim alongside a claim for breach of contract.

The arbitrator denied the remainder of inVentiv’s motion,

which had sought to dismiss certain other aspects of the amended

statement of claim. In particular, the arbitrator rejected

inVentiv’s argument that several aspects of the amended

statement of claim were beyond the arbitrator’s

jurisdiction.

In

connection with the pending arbitration proceedings, inVentiv has

asserted counterclaims against us for (i) breach of contract,

seeking at least $2 million in damages for services allegedly

performed by inVentiv; (ii) breach of contract, seeking at least $1

million in damages for the alleged use of inVentiv’s name in

connection with publications and promotions in violation of the

parties’ contract; (iii) opportunistic breach, restitution

and unjust enrichment, seeking at least $20 million in disgorgement

of alleged unjust profits allegedly made by us as a result of the

purported breaches referenced in subsection (ii); and (iv)

defamation, seeking at least $1 million in damages for allegedly

defamatory statements made about inVentiv. We believe

inVentiv’s counterclaims are meritless and intend to

vigorously defend against them. However, if such defense is

unsuccessful, and inVentiv successfully asserts any of its

counterclaims, such an adverse determination could have a material

adverse effect on our business, results, financial condition and

liquidity.

In

October 2015, we signed an arbitration funding agreement with a

company established by Lake Whillans Litigation Finance, LLC, a

firm specializing in funding litigation expenses. Pursuant to the

agreement, an affiliate of Lake Whillans provided us with $5

million in funding for litigation expenses to support our

arbitration claims against inVentiv. The funding will only be

repaid if we receive proceeds from the arbitration.

The hearing

(the “trial”) started on September 26, 2016 and was

originally scheduled to end in November/December of 2016.

On November 13, 2017, CEL-SCI

announced that the last witness in the arbitration hearing

testified on November 8, 2017, and no further witnesses or

testimony are expected. With that final witness, the testimony

phase of the arbitration concluded. All that remained after

November 8, 2017 at the trial level were closing statements and

post-trial submissions.

21

Additionally, we

may be the target of claims asserting violations of securities

fraud and derivative actions, or other litigation or arbitration

proceedings in the future. Any future litigation could result in

substantial costs and divert management’s attention and

resources. These lawsuits or arbitration proceedings may result in

large judgments or settlements against us, any of which could have

a material adverse effect on our business, operating results,

financial condition and liquidity.

Compliance with changing regulations concerning corporate

governance and public disclosure may result in additional

expenses.

Changing laws,

regulations and standards relating to corporate governance and

public disclosure may create uncertainty regarding compliance

matters. New or changed laws, regulations and standards are subject

to varying interpretations in many cases. As a result, their

application in practice may evolve over time. We are committed to

maintaining high standards of corporate governance and public

disclosure. Complying with evolving interpretations of new or

changing legal requirements may cause us to incur higher costs as

we revise current practices, policies and procedures, and may

divert management time and attention from potential

revenue-generating activities to compliance matters. If our efforts

to comply with new or changed laws, regulations and standards

differ from the activities intended by regulatory or governing

bodies due to ambiguities related to practice, our reputation may

also be harmed. Further, our board members, chief executive

officer, and other executive officers could face an increased risk

of personal liability in connection with the performance of their

duties. As a result, we may have difficulty attracting and

retaining qualified board members and executive officers, which

could harm our business.

We have not established a definite plan for the marketing of

Multikine, if approved.

We have

not established a definitive plan for marketing nor have we

established a price structure for any of our product candidates, if

approved. However, we intend, if we are in a position to do so, to

sell Multikine ourselves in certain markets where it is approved,

and or to enter into written marketing agreements with various

third parties with established sales forces in such markets. The

sales forces in turn would, we believe, focus on selling Multikine

to targeted cancer centers, physicians and clinics involved in the

treatment of head and neck cancer. We have already licensed future

sales of Multikine, if approved, to three companies: Teva

Pharmaceuticals in Israel, Turkey, Serbia and Croatia; Orient

Europharma in Taiwan, Singapore, Hong Kong, Malaysia, South Korea,

the Philippines, Australia and New Zealand; and Byron BioPharma,

LLC in South Africa. We believe that these companies will have the

resources to market Multikine appropriately in their respective

territories, if approved, but there is no guarantee that they will.

There is no assurance that we will be able to find qualified

third-party partners to market our product in other areas, on terms

that are favorable to us, or at all.

We may

encounter problems, delays and additional expenses in developing

marketing plans with third parties. In addition, even if Multikine,

if approved, is cost-effective and demonstrated to increase overall

patient survival, we may experience other limitations involving the

proposed sale of Multikine, such as uncertainty of third-party

coverage and reimbursement. There is no assurance that we can

successfully market Multikine, if approved, or any other product

candidates we may develop.

22

We

hope to expand our clinical development capabilities in the future,

and any difficulties hiring or retaining key personnel or managing

this growth could disrupt our operations.

We are

highly dependent on the principal members of our management and

development staff. If the Phase 3 Multikine clinical trial is

successful, we expect to expand our clinical development and

manufacturing capabilities, which will involve hiring additional

employees. Future growth will require us to continue to implement

and improve our managerial, operational and financial systems and

to continue to retain, recruit and train additional qualified

personnel, which may impose a strain on our administrative and

operational infrastructure. The competition for qualified personnel

in the biopharmaceutical field is intense. We are highly dependent

on our ability to attract, retain and motivate highly qualified

management and specialized personnel required for clinical

development. Due to our limited resources, we may not be able to

manage effectively the expansion of our operations or recruit and

train additional qualified personnel. If we are unable

to retain key personnel or manage our future growth effectively, we

may not be able to implement our business plan.

If

product liability or patient injury lawsuits are brought against

us, we may incur substantial liabilities and may be required to

limit clinical testing or future commercialization of Multikine or

our other product candidates.

We face

an inherent risk of product liability as a result of the clinical

testing of Multikine and other product candidates, and will face an

even greater risk if we commercialize any of our product

candidates. For example, we may be sued if our Multikine or LEAPS

product candidates, or any other future product candidates,

allegedly cause injury or are found to be otherwise unsuitable

during clinical testing, manufacturing or, if approved, marketing

or sale. Any such product liability claims may include allegations

of defects in manufacturing, defects in design, a failure to warn

of dangers inherent in the product candidate, negligence, strict

liability and a breach of warranties. Claims could also be asserted

under state consumer protection acts.

Furthermore,

Multikine is made, in part, from components of human blood. There

are inherent risks associated with products that involve human

blood such as possible contamination with viruses, including

hepatitis or HIV. Any possible contamination could cause injuries

to patients who receive contaminated Multikine, or could require us

to destroy batches of Multikine, thereby subjecting us to possible

financial losses, lawsuits and harm to our business.

If we

cannot successfully defend ourselves against product liability

claims, we may incur substantial liabilities or be required to

limit or cease the clinical testing or commercialization of our

product candidates, if approved. Even a successful defense would

require significant financial and management resources. Regardless

of the merits or eventual outcome, liability claims may result

in:

●

decreased demand

for Multikine or our other product candidates, if

approved;

●

injury to our

reputation;

●

withdrawal of

existing, or failure to enroll additional, clinical trial

participants;

●

costs to defend any

related litigation;

●

a diversion of

management’s time and our resources;

23

●

substantial

monetary awards to trial participants or patients;

●

product candidate

recalls, withdrawals or labeling, marketing or promotional

restrictions;

●

loss of

revenue;

●

inability to

commercialize Multikine or our other product candidates;

and

●

a decline in the