cvm_10k.htm

FORM 10-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 30, 2012.

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____________ to _____________.

Commission file number 1-11889

CEL-SCI CORPORATION

(Exact name of registrant as specified in its charter)

| COLORADO |

|

84-0916344 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

|

8229 Boone Blvd., Suite 802

Vienna, Virginia

|

|

22182 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (703) 506-9460

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.01 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o

Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

o |

|

Accelerated filer |

þ |

|

| |

|

|

|

|

|

| Non-accelerated filer |

o |

(Do not check if a smaller reporting company)

|

Smaller reporting company |

o |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): o Yes þ No

The aggregate market value of the voting stock held by non-affiliates of the Registrant, based upon the closing sale price of the common stock on March 31, 2012, as quoted on the NYSE MKT, was $120,199,660.

As of December 4, 2012, the Registrant had 273,213,332 issued and outstanding shares of common stock.

Documents Incorporated by Reference: None

PART I

CEL-SCI Corporation (CEL-SCI) is dedicated to research and development directed at improving the treatment of cancer and other diseases by utilizing the immune system, the body's natural defense system. Its lead investigational therapy is Multikine (Leukocyte Interleukin, Injection), currently being studied in a pivotal global Phase III clinical trial. CEL-SCI is also investigating an immunotherapy (LEAPS-H1N1-DC) as a possible treatment for H1N1 hospitalized patients and as a vaccine (CEL-2000) for Rheumatoid Arthritis (currently in preclinical testing) using its LEAPS technology platform. The investigational immunotherapy LEAPS-H1N1-DC treatment involves non-changing regions of H1N1 Pandemic Flu, Avian Flu (H5N1), and the Spanish Flu, as CEL-SCI scientists are very concerned about the possible emergence of a new more virulent hybrid virus through the combination of H1N1 and Avian Flu, or maybe Spanish Flu. The Company has operations in Vienna, Virginia, and in/near Baltimore, Maryland.

CEL-SCI was formed as a Colorado corporation in 1983. CEL-SCI’s principal office is located at 8229 Boone Boulevard, Suite 802, Vienna, VA 22182. CEL-SCI’s telephone number is 703-506-9460 and its web site is www.cel-sci.com. We do not incorporate the information on our website into this report, and you should not consider it part of this report.

CEL-SCI makes its electronic filings with the Securities and Exchange Commission (SEC), including its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports available on its website free of charge as soon as practicable after they are filed or furnished to the SEC.

CEL-SCI’S PRODUCTS

CEL-SCI’s product pipeline consists of the following:

|

|

1)

|

Multikine® (Leukocyte Interleukin, Injection) investigational cancer therapy;

|

|

|

2)

|

LEAPS technology, with two investigational therapies, pandemic flu treatment for hospitalized patients and CEL-2000, a rheumatoid arthritis treatment vaccine in development.

|

MULTIKINE

CEL-SCI’s lead investigational therapy, Multikine, is currently being developed as a potential therapeutic agent directed at using the immune system to produce an anti-tumor immune response. Data from Phase I and Phase II clinical trials suggest that Multikine simulates the activities of a healthy person's immune system, enabling it to use the body's own anti-tumor immune response. Multikine (Leukocyte Interleukin, Injection) is the full name of this investigational therapy, which, for simplicity, is referred to in the remainder of this document as Multikine. Multikine is the trademark that CEL-SCI has registered for this investigational therapy, and this proprietary name is subject to FDA review in connection with CEL-SCI’s future anticipated regulatory submission for approval. Multikine has not been licensed or approved for sale, barter or exchange by the FDA or any other regulatory agency. Neither has its safety or efficacy been established for any use.

Multikine has been cleared by the regulators in nine countries around the world, including the U.S. FDA, for a global Phase III clinical trial in advanced primary (not yet treated) head and neck cancer patients. This trial is expected to be the largest head and neck cancer clinical study ever conducted.

The trial will test the hypothesis that Multikine treatment administered prior to the current standard therapy for head and neck cancer patients (surgical resection of the tumor and involved lymph nodes followed by radiotherapy or radiotherapy and concurrent chemotherapy) will extend the overall survival, enhance the local/regional control of the disease and reduce the rate of disease progression in patients with advanced oral squamous cell carcinoma.

The primary clinical endpoint in CEL-SCI's ongoing Phase III clinical trial is that a 10% improvement in overall survival in the Multikine treatment arm, plus the current standard of care (SOC - consisting of surgery + radiotherapy or surgery + radiochemotherapy), over that which can be achieved in the SOC arm alone (in the well-controlled Phase III clinical trial currently ongoing) must be achieved. Based on what is presently known about the current survival statistics for this population, CEL-SCI believes that achievement of this endpoint should enable CEL-SCI, subject to further consultations with FDA, to move forward, prepare and submit a Biologic License Application to FDA for Multikine.

This clinical trial is thought to be the first Phase III study in the world in which immunotherapy is given to cancer patients first, i.e., prior to their receiving any conventional treatment for cancer, including surgery, radiation and/or chemotherapy. This could be shown to be important because conventional therapy may weaken the immune system, and may compromise the potential effect of immunotherapy. Because Multikine is given before conventional cancer therapy, when the immune system may be more intact, CEL-SCI believes the possibility exists for it to have a greater likelihood of activating an anti-tumor immune response under these conditions. This likelihood is one of the clinical aspects being evaluated in the ongoing global Phase III clinical trial.

Multikine is a different kind of investigational therapy in the fight against cancer; Multikine is a defined mixture of cytokines. It is a combination immunotherapy, possessing both active and passive properties.

In the recent interim review of the safety data from the Phase III study, an Independent Data Monitoring Committee (IDMC) raised no safety concerns. The IDMC also indicated that no safety signals were found that would call into question the benefit/risk of continuing the study. CEL-SCI considers the results of the IDMC review to be important since studies have shown that up to 30% of Phase III trials fail due to safety considerations and the IDMC’s safety findings from this interim review were similar to those reported by investigators during CEL-SCI’s Phase I-II trials. Ultimately, the decision as to whether a drug is safe is made by the FDA based on an assessment of all of the data from a trial.

During the early investigational phase, in Phase I and Phase II clinical trials in over 220 subjects who received the investigational therapy Multikine in doses of 200 to 3200 IU (international units) as IL-2, no serious adverse events were reported as being expressly due to administration of this investigational therapy, and subjects in those clinical trials and the treating physicians reported that this investigational therapy was well tolerated in those early-stage clinical trials. Adverse events which were reported included pain at the injection site, local minor bleeding and edema at the injection site, diarrhea, headache, nausea, and constipation. No "abnormal" laboratory results were reported following Multikine treatment - other than those commonly seen by treating physicians in this patient population - regardless of Multikine administration. Similarly, in these early-phase clinical studies in patients, there was no reported increased toxicity of follow-on treatments as a result of Multikine administration. No complications following surgery (such as increased time for wound healing) were reported. No definitive conclusions can be drawn from these data about the safety or efficacy profile of this investigational therapy, further research is required and the global Phase III study is ongoing in an effort to confirm these results.

The following is a summary of results from CEL-SCI’s last Phase II study conducted with Multikine. This study used the same treatment protocol as is being used in CEL-SCI’s Phase III study:

|

●

|

In the final Phase II clinical study, using the same dosage and treatment regimen as is being used in the Phase III study, head and neck cancer patients with locally advanced primary disease who received the investigational therapy Multikine as first-line investigational therapy followed by surgery and radiotherapy were reported by the clinical investigators to have had a 63.2% overall survival (OS) rate at 3.5 years from surgery. This percentage OS was arrived at as follows: of the 22 subjects enrolled in this final Phase II study, the consent for the survival follow-up portion of the study was received from 19 subjects. One subject did not consent to the follow-up portion of the study. The other 2 subjects did not have squamous cell carcinoma of the oral cavity and were thus not evaluable per the protocol. The overall survival rate of subjects receiving the investigational therapy in this study was compared to the overall survival rate that was calculated based upon a review of 55 clinical trials conducted in the same cancer population (with a total of 7,294 patients studied), and reported in the peer reviewed scientific literature between 1987 and 2007. Review of this literature showed an approximate survival rate of 47.5% at 3.5 year from treatment. Therefore, the results of CEL-SCI's final Phase II study were considered to be potentially favorable in terms of overall survival recognizing the limitations of this early-phase study. It should be noted that an earlier investigational therapy Multikine study appears to lend support to the overall survival findings described above -Feinmesser et al Arch Otolaryngol. Surg. 2003. However, no definitive conclusions can be drawn from these data about the potential efficacy or safety profile of this investigational therapy. Moreover, further research is required, and these results must be confirmed in the well-controlled Phase III clinical trial of this investigational therapy that is currently in progress. Subject to completion of that Phase III trial and FDA's review and acceptance of CEL-SCI's entire data set on this investigational therapy, CEL-SCI believes that these early-stage clinical trial results indicate the potential for this investigational therapy to become a treatment for advanced primary head and neck cancer.

|

|

●

|

Reported average of 50% reduction in tumor cells in Phase II trials: The clinical investigators who administered the three week Multikine treatment regimen used in Phase II studies reported that, as was determined in a controlled pathology study, Multikine administration appeared to have caused, on average, the disappearance of about half of the cancer cells present at surgery (as determined by histopathology assessing the area of Stroma/Tumor (Mean+/- Standard Error of the Mean of the number of cells counted per filed)) even before the start of standard therapy such as radiation and chemotherapy (Timar et al JCO 2005).

|

|

●

|

Reported 12% complete response in the final Phase II trial: The clinical investigators who administered the three week Multikine investigational treatment regimen used in the final Phase II study reported that, as was determined in a controlled pathology study, the tumor apparently was no longer present (as determined by histopathology) in approximately 12 % of patients (2 of 17 evaluable by pathology). This determination was made by three pathologists blinded to the study from the surgical specimen after a three week treatment with Multikine (Timar et al JCO 2005).

|

|

●

|

Adverse events reported in clinical trials: In clinical trials conducted to date with the Multikine investigational therapy, adverse events which have been reported by the clinical investigators as possibly or probably related to Multikine administration included pain at the injection site, local minor bleeding and edema at the injection site, diarrhea, headache, nausea, and constipation.

|

The clinical significance of these and other data, to date, from the multiple Multikine clinical trials is not yet known. These preliminary clinical data do suggest the potential to demonstrate a possible improvement in the clinical outcome for patients treated with Multikine.

Subject to completion of CEL-SCI's global Phase III clinical trial and FDA's review of CEL-SCI’s entire data set on this investigational therapy, if the FDA were to conclude that the safety and efficacy of this investigational therapy is established, the early-phase clinical data is encouraging in suggesting the potential that approximately 60-66% (2/3) of head and neck cancer patients with primary disease could be candidates for this investigational therapy if it were to be approved by FDA.

CEL-SCI has an agreement with Teva Pharmaceutical Industries, Ltd., which provides Teva with the exclusive license to market and distribute Multikine in Israel, Turkey, and in August 2011, added Serbia and Croatia. Pursuant to the agreement, Teva will participate in CEL-SCI’s upcoming Phase III clinical trial and will fund a portion of the Phase III trial in Israel.

CEL-SCI has an agreement with Orient Europharma of Taiwan which provides Orient Europharma with the exclusive marketing rights to Multikine for all cancer indications in Taiwan, Singapore, Hong Kong, Malaysia, South Korea, the Philippines, Australia and New Zealand. The agreement requires Orient Europharma to fund the clinical trials needed to obtain marketing approvals in these countries for head and neck cancer, naso-pharyngeal cancer and potentially cervical cancer.

CEL-SCI has a licensing agreement with Byron Biopharma LLC (“Byron”) under which CEL-SCI granted Byron an exclusive license to market and distribute Multikine in the Republic of South Africa.

Pursuant to the agreement, Byron will be responsible for registering the product in South Africa. Once Multikine has been approved for sale, CEL-SCI will be responsible for manufacturing the product, while Byron will be responsible for sales in South Africa. Revenues will be divided equally between CEL-SCI and Byron.

In August 2011, CEL-SCI entered into an exclusive Sales, Marketing and Distribution agreement with IDC-GP Pharm LLC (“IDC-GP Pharm”) under which CEL-SCI has granted IDC-GP Pharm an exclusive license to market Multikine in the countries of Argentina and Venezuela (the “Territory”). IDC-GP Pharm is a joint venture between two groups of experienced pharmaceutical entrepreneurs with expertise in the registration and commercialization of pharmaceutical products in South America, among other regions. One of these two groups represents former employees of a large pharmaceutical company, while the other group is GP Pharm, headquartered in Barcelona, Spain, with operations in each major country in Latin America either directly or through local partners. Pursuant to the agreement, IDC-GP Pharm will be responsible for receiving regulatory approval to use Multikine in the territory. Once Multikine has been approved in any of the two countries, CEL-SCI will be responsible for manufacturing the product, while IDC-GP Pharm will be responsible for sales in the Territory. Revenues will be split 50/50 between CEL-SCI and IDC-GP Pharm after payment to CEL-SCI for the manufacturing costs of Multikine. If IDC-GP Pharma does not receive governmental permission to distribute Multikine in Argentina or Venezuela by August 31, 2013, CEL-SCI has the right to cancel the agreement.

CEL-SCI estimates the total cost of the Phase III trial, with the exception of the parts that will be paid by its licensees, Teva Pharmaceuticals and Orient Europharma, to be approximately $32,000,000 of which approximately $7,000,000 has been paid as of September 30, 2012. Out of the planned 48 sites, 36 sites have completed their site initiation visits and patients are being screened/enrolled in multiple locations. It should be noted that this estimate is only an estimate based on the information currently available in CEL-SCI’s contracts with the Clinical Research Organization responsible for managing the Phase III trial. This number can be affected by the speed of enrollment, foreign currency exchange rates and many other factors, some of which cannot be foreseen today. It is therefore possible that the cost of the Phase III trial will be higher than currently estimated.

Before starting the Phase III trial, CEL-SCI needed to build a dedicated manufacturing facility to produce Multikine. This facility has been completed and validated, and has produced several clinical lots for the Phase III clinical trial.

CEL-SCI completed validation of its new manufacturing facility in January 2010. The state-of-the-art facility is being used to manufacture Multikine for CEL-SCI’s Phase III clinical trial. In addition to using this facility to manufacture Multikine, CEL-SCI, only if the facility is not being used for Multikine, may offer the use of the facility as a service to pharmaceutical companies and others, particularly those that need to “fill and finish” their drugs in a cold environment (4 degrees Celsius, or approximately 39 degrees Fahrenheit). However, priority will always be given to Multikine. Fill and finish is the process of filling injectable drugs in a sterile manner and is a key part of the manufacturing process for many medicines.

The fastest area of growth in the biopharmaceutical and pharmaceutical markets is biologics, and most recently stem cell products. These compounds and therapies are derived from or mimic human cells or proteins and other molecules (e.g., hormones, etc.). Nearly all of the major drugs developed for unmet medical needs (e.g., Avastin®, Erbitux®, Rituxan®, Herceptin®, Copaxon®, etc.) are biologics. Biologics are usually very sensitive to heat and quickly lose their biological activity if exposed to room or elevated temperature. Room or elevated temperatures may also affect the shelf-life of a biologic with the result that the product cannot be stored for as long as desired. However, these products do not generally lose activity when kept at 4 degrees Celsius.

The FDA and other regulatory agencies require a drug developer to demonstrate the safety, purity and potency of a drug being produced for use in humans. When filling a product at 4 degrees Celsius, minimal to no biological losses occur and therefore the potency of the drug is maintained throughout the final critical step of the drug’s manufacturing process. If the same temperature sensitive drug is instead aseptically filled at room temperature, expensive and time-consuming validation studies must be conducted, first, to be able to obtain a complete understanding of the product’s potency loss during the room temperature fill process, and second, to create solutions to the drug’s potency losses, which require further testing and validation.

CEL-SCI’s unique, cold aseptic filling suite can be operated at temperatures between 2 degrees Celsius and room temperatures, and at various humidity levels. CEL-SCI’s aseptic filling suites are maintained at FDA and EU ISO classifications of 5/6. CEL-SCI also has the capability to formulate, inspect, label and package biologic products at cold temperatures.

CEL-SCI’s lease on the manufacturing facility expires on October 31, 2028. Since October 2008, CEL-SCI has been required to make monthly base rent payments of $131,250. Beginning November 1, 2009, the annual base rent escalates each year at 3%. CEL-SCI is also required to pay all real and personal property taxes, insurance premiums, maintenance expenses, repair costs and utilities associated with the facility, which were approximately $39,000 per month as of September 30, 2012.

In August 2011, CEL-SCI paid a deposit of $1,670,917 to the landlord since CEL-SCI’s cash balances did not meet the minimum amount required by the lease. When CEL-SCI meets the minimum cash balance required by the lease, the deposit will be returned to CEL-SCI.

LEAPS

CEL-SCI’s patented T-cell Modulation Process, referred to as LEAPS (Ligand Epitope Antigen Presentation System), uses “heteroconjugates” to direct the body to choose a specific immune response. LEAPS is designed to stimulate the human immune system to more effectively fight bacterial, viral and parasitic infections as well as autoimmune, allergies, transplantation rejection and cancer, when it cannot do so on its own. Administered like a vaccine, LEAPS combines T-cell binding ligands with small, disease associated, peptide antigens and may provide a new method to treat and prevent certain diseases.

The ability to generate a specific immune response is important because many diseases are often not combated effectively due to the body’s selection of the “inappropriate” immune response. The capability to specifically reprogram an immune response may offer a more effective approach than existing vaccines and drugs in attacking an underlying disease.

Using the LEAPS technology, CEL-SCI has created a potential peptide treatment for H1N1 (swine flu) hospitalized patients. This LEAPS flu treatment is designed to focus on the conserved, non-changing epitopes of the different strains of Type A Influenza viruses (H1N1, H5N1, H3N1, etc.), including “swine”, “avian or bird”, and “Spanish Influenza”, in order to minimize the chance of viral “escape by mutations” from immune recognition. Therefore one should think of this treatment not really as an H1N1 treatment, but as a pandemic flu treatment. CEL-SCI’s LEAPS flu treatment contains epitopes known to be associated with immune protection against influenza in animal models.

In September 2009, the U.S. Food and Drug Administration advised CEL-SCI that it could proceed with its first clinical trial to evaluate the effect of LEAPS-H1N1 treatment on the white blood cells of hospitalized H1N1 patients. This followed an expedited initial review of CEL-SCI's regulatory submission for this study proposal.

In November 2009, CEL-SCI announced that The Johns Hopkins University School of Medicine had given clearance for CEL-SCI’s clinical study to proceed using LEAPS-H1N1. Soon after the start of the study, the number of hospitalized H1N1 patients dramatically declined and the study was unable to complete the enrollment of patients.

Additional work on this treatment for the pandemic flu work is being pursued in collaboration with the National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health, USA. In May 2011 NIAID scientists presented data at the Keystone Conference on “Pathogenesis of Influenza: Virus-Host Interactions” in Hong Kong, China, showing the positive results of efficacy studies in mice of L.E.A.P.S. H1N1 activated dendritic cells (DCs) to treat the H1N1 virus. Scientists at the NIAID found that H1N1-infected mice treated with LEAPS-H1N1 DCs showed a survival advantage over mice treated with control DCs. The work was performed in collaboration with scientists led by Kanta Subbarao, M.B.B.S., M.P.H, of the NIAID, part of the National Institutes of Health, USA.

With its LEAPS technology, CEL-SCI also developed a second peptide named CEL-2000, a potential rheumatoid arthritis vaccine. The data from animal studies of rheumatoid arthritis using the CEL-2000 treatment vaccine demonstrated that CEL-2000 is an effective treatment against arthritis with fewer administrations than those required by other anti-rheumatoid arthritis treatments, including Enbrel®. CEL-2000 is also potentially a more disease type-specific therapy, is calculated to be significantly less expensive and may be useful in patients unable to tolerate or who may not be responsive to existing anti-arthritis therapies.

In February 2010, CEL-SCI announced that its CEL-2000 vaccine demonstrated that it was able to block the progression of rheumatoid arthritis in a mouse model. The results were published in the scientific peer-reviewed Journal of International Immunopharmacology (online edition) in an article titled “CEL-2000: A Therapeutic Vaccine for Rheumatoid Arthritis Arrests Disease Development and Alters Serum Cytokine/Chemokine Patterns in the Bovine Collagen Type II Induced Arthritis in the DBA Mouse Model” with lead author Daniel Zimmerman, Ph.D, Senior Vice President of Research, Cellular Immunology at CEL-SCI. The study was co-authored by additional scientists from CEL-SCI, Washington Biotech, Northeastern Ohio Universities Colleges of Medicine and Pharmacy and Boulder BioPath.

In August 2012, Dr. Zimmerman gave a Keynote presentation at the OMICS 2nd International Conference on Vaccines and Vaccinations in Chicago. These presentations show how the LEAPS peptides administered altered only select cytokines specific for each disease model thereby improving the status of the test animals and even preventing death and morbidity effects. These results support the growing body of evidence that provides for its mode of action by a common format in these unrelated conditions by regulation of Th1 (e.g., IL12 and IFN-γ) and their action on reducing TNF-α and other inflammatory cytokines as well regulation of antibodies to these disease associated antigens. This was also illustrated by a schematic model showing how these pathways interact and result in the overall effect of protection and regulation of cytokines in a beneficial manner.

Even though the various LEAPS drug candidates have not yet been given to humans, they have been tested in vitro with human cells. They have induced similar cytokine responses that were seen in these animal models, which may indicate that the LEAPS technology might translate to humans. The LEAPS candidates have demonstrated protection against lethal herpes simplex virus (HSV1) and H1N1 influenza infection, as a prophylactic or therapeutic agent in animals. They have also shown efficacy in animals in two autoimmune conditions, curtailing and sometimes preventing disease progression in arthritis and myocarditis animal models. Our belief is that the LEAPS technology may be a significant alternative to the vaccines currently available on the market today for these diseases.

None of the LEAPS investigational products have been approved for sale, barter or exchange by the FDA or any other regulatory agency for any use to treat disease in animals or humans. The safety or efficacy of these products has not been established for any use. Lastly, no definitive conclusions can be drawn from the early-phase, preclinical-trials data involving these investigational products. Before obtaining marketing approval from the FDA in the United States, and by comparable agencies in most foreign countries, these product candidates must undergo rigorous preclinical and clinical testing which is costly and time consuming and subject to unanticipated delays. There can be no assurance that these approvals will be granted.

RISK FACTORS

Investors should be aware of the risks described below, which could adversely affect the price of CEL-SCI’s common stock

Risks Related to CEL-SCI

Since CEL-SCI has earned only limited revenues and has a history of losses, CEL-SCI will require additional capital to remain in operation, complete its clinical trials and fund pre-marketing expenses.

CEL-SCI has had only limited revenues since it was formed in 1983. Since the date of its formation and through September 30, 2012, CEL-SCI incurred net losses of approximately $203 million. CEL-SCI has relied principally upon the proceeds of public and private sales of its securities to finance its activities to date.

If CEL-SCI cannot obtain additional capital, CEL-SCI may have to postpone development and research expenditures, which will delay CEL-SCI's ability to produce a competitive product. Delays of this nature may depress the price of CEL-SCI's common stock. In addition, although CEL-SCI is not aware of a direct competitor for Multikine, it is possible that one exists. There are many potential competitors of LEAPS. If competitors develop, any delay in the development of CEL-SCI’s products may provide opportunities to those competitors.

The condition of the overall economy may continue to affect both the availability of capital and CEL-SCI’s stock price. In addition, future capital raises, which will be necessary for CEL-SCI’s survival, will be further dilutive to current shareholders. There can be no assurance that CEL-SCI will be able to raise the capital it will need.

All of CEL-SCI's potential products, with the exception of Multikine, are in the early stages of development and any commercial sale of these products will be many years away.

Even potential product sales from Multikine are years away since cancer trials can be lengthy. Accordingly, CEL-SCI expects to incur substantial losses for the foreseeable future.

Since CEL-SCI does not intend to pay dividends on its common stock, any potential return to investors will result only from any increases in the price of CEL-SCI's common stock.

At the present time, CEL-SCI intends to use available funds to finance its operations. Accordingly, while payment of dividends rests within the discretion of CEL-SCI’s Directors, no common stock dividends have been declared or paid by CEL-SCI and CEL-SCI has no intention of paying any common stock dividends in the foreseeable future. Any gains for CEL-SCI’s investors will most likely result from increases in the price of CEL-SCI’s common stock, which has been volatile in the recent past. If CEL-SCI’s stock price does not increase, which likely will depend primarily upon the results of the Multikine clinical trials, an investor is unlikely to receive any return on an investment in CEL-SCI’s common stock.

The costs of CEL-SCI’s product development and clinical trials are difficult to estimate and will be very high for many years, preventing CEL-SCI from making a profit for the foreseeable future, if ever.

Clinical and other studies necessary to obtain approval of a new drug can be time consuming and costly, especially in the United States, but also in foreign countries. CEL-SCI's estimates of the costs associated with future clinical trials and research may be substantially lower than what CEL-SCI actually experiences. It is impossible to predict what CEL-SCI will face in the development of a product, such as LEAPS. The Multikine Phase III clinical trial may take longer and be more expensive than CEL-SCI has estimated. The purpose of clinical trials is to provide both CEL-SCI and regulatory authorities with safety and efficacy data in humans. It is relatively common to revise a trial or add subjects to a trial in progress. These examples of common vagaries in product development and clinical investigations demonstrate how predicted costs may exceed reasonable expectations. The different and often complex steps necessary to obtain regulatory approval, especially that of the United States Food and Drug Administration (“FDA”) and the European Union’s European Medicine’s Agency (“EMA”), involve significant costs and may require several years to complete. CEL-SCI expects that it will need substantial additional financing over an extended period of time in order to fund the costs of future clinical trials, related research, and general and administrative expenses.

The extent of CEL-SCI's clinical trials and research programs are primarily based upon the amount of capital available to CEL-SCI and the extent to which it receives regulatory approvals for clinical trials. CEL-SCI has established estimates of the future costs of the Phase III clinical trial for Multikine, but, as explained above, that estimate may not prove correct.

Compliance with changing regulations concerning corporate governance and public disclosure may result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure may create uncertainty regarding compliance matters. New or changed laws, regulations and standards are subject to varying interpretations in many cases. As a result, their application in practice may evolve over time. CEL-SCI is committed to maintaining high standards of corporate governance and public disclosure. Complying with evolving interpretations of new or changing legal requirements may cause CEL-SCI to incur higher costs as it revises current practices, policies and procedures, and may divert management time and attention from potential revenue-generating activities to compliance matters. If CEL-SCI’s efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, CEL-SCI’s reputation may also be harmed. Further, CEL-SCI’s board members, chief executive officer and president could face an increased risk of personal liability in connection with the performance of their duties. As a result, CEL-SCI may have difficulty attracting and retaining qualified board members and executive officers, which could harm its business.

CEL-SCI has not established a definite plan for the marketing of Multikine.

CEL-SCI has not established a definitive plan for marketing nor has it established a price structure for any of its products. However, CEL-SCI intends, if it is in a position to do so, to sell Multikine itself in certain markets and to enter into written marketing agreements with various major pharmaceutical firms with established sales forces. The sales forces in turn would, CEL-SCI believes, target CEL-SCI's products to cancer centers, physicians and clinics involved in head and neck cancer. CEL-SCI has already licensed Multikine to four companies, Teva Pharmaceuticals in Israel, Turkey, Serbia and Croatia, Orient Europharma in Taiwan, Singapore, Hong Kong, Malaysia, South Korea, the Philippines, Australia and New Zealand, Byron BioPharma, LLC in South Africa, and IDC-GP Pharm in Argentina and Venezuela. CEL-SCI believes that these companies have the resources to market Multikine appropriately in their respective territories, but there is no guarantee that they will. There is no assurance that CEL-SCI will find qualified parties willing to market CEL-SCI’s product in other areas.

CEL-SCI may encounter problems, delays and additional expenses in developing marketing plans with outside firms. In addition, even if Multikine is cost effective and proven to increase overall survival, CEL-SCI may experience other limitations involving the proposed sale of Multikine, such as uncertainty of third-party reimbursement. There is no assurance that CEL-SCI can successfully market any products which it may develop.

CEL-SCI hopes to expand its clinical development capabilities in the future, and any difficulties hiring or retaining key personnel or managing this growth could disrupt CEL-SCI’s operations.

CEL-SCI is highly dependent on the principal members of CEL-SCI’s management and development staff. If the Multikine clinical trial is successful, CEL-SCI expects to expand its clinical development and manufacturing capabilities, which will involve hiring additional employees. Future growth will require CEL-SCI to continue to implement and improve CEL-SCI’s managerial, operational and financial systems and to continue to retain, recruit and train additional qualified personnel, which may impose a strain on CEL-SCI’s administrative and operational infrastructure. The competition for qualified personnel in the biopharmaceutical field is intense. CEL-SCI is highly dependent on its ability to attract, retain and motivate highly qualified management and specialized personnel required for clinical development. Due to CEL-SCI’s limited resources, CEL-SCI may not be able to manage effectively the expansion of its operations or recruit and train additional qualified personnel. If CEL-SCI is unable to retain key personnel or manage its growth effectively, CEL-SCI may not be able to implement its business plan.

Multikine is made from components of human blood, which involves inherent risks that may lead to product destruction or patient injury.

Multikine is made, in part, from components of human blood. There are inherent risks associated with products that involve human blood such as possible contamination with viruses, including Hepatitis or HIV. Any possible contamination could require CEL-SCI to destroy batches of Multikine or cause injuries to patients who receive the product, thereby subjecting CEL-SCI to possible financial losses, lawsuits, and harm to its business.

Although CEL-SCI has product liability insurance for Multikine, the successful prosecution of a product liability case against CEL-SCI could have a materially adverse effect upon its business if the amount of any judgment exceeds CEL-SCI's insurance coverage. Such a suit also could damage the reputation of Multikine and make successful marketing of the product less likely. CEL-SCI commenced the Phase III clinical trial for Multikine in December 2010. Although no claims have been brought to date, participants in CEL-SCI's clinical trials could bring civil actions against CEL-SCI for any unanticipated harmful effects arising from the use of Multikine or any drug or product that CEL-SCI may attempt to develop.

Risks Related to Government Approvals

CEL-SCI's product candidates must undergo rigorous preclinical and clinical testing and regulatory approvals, which could be costly and time-consuming and subject CEL-SCI to unanticipated delays or prevent CEL-SCI from marketing any products.

Therapeutic agents, drugs and diagnostic products are subject to approval, prior to general marketing, from the FDA in the United States, the EMA in the European Union, and by comparable agencies in most foreign countries. Before obtaining marketing approval, these product candidates must undergo costly and time consuming preclinical and clinical testing which could subject CEL-SCI to unanticipated delays and may prevent CEL-SCI from marketing its product candidates. There can be no assurance that such approvals will be granted.

CEL-SCI cannot be certain when or under what conditions it will undertake clinical trials. A variety of issues may delay CEL-SCI’s Phase III clinical trial for Multikine or preclinical and early clinical trials for other products. For example, early trials, or the plans for later trials, may not satisfy the requirements of regulatory authorities, such as the FDA. CEL-SCI may fail to find subjects willing to enroll in CEL-SCI’s trials. CEL-SCI manufactures Multikine, but relies on third party vendors for managing the trial process and other activities, and these vendors may fail to meet appropriate standards. Accordingly, the clinical trials relating to CEL-SCI's product candidates may not be completed on schedule, the FDA or foreign regulatory agencies may order CEL-SCI to stop or modify its research, or these agencies may not ultimately approve any of CEL-SCI's product candidates for commercial sale. Varying interpretations of the data obtained from pre-clinical and clinical testing could delay, limit or prevent regulatory approval of CEL-SCI's product candidates. The data collected from CEL-SCI's clinical trials may not be sufficient to support regulatory approval of its various product candidates, including Multikine. CEL-SCI's failure to adequately demonstrate the safety and efficacy of any of its product candidates would delay or prevent regulatory approval of its product candidates in the United States, which could prevent CEL-SCI from achieving profitability. Although CEL-SCI had positive results in its Phase II trials for Multikine, those results were for a very small sample set, and CEL-SCI will not know definitively how Multikine will perform until CEL-SCI is well into, or completes, its Phase III clinical trial.

The requirements governing the conduct of clinical trials, manufacturing, and marketing of CEL-SCI's product candidates, including Multikine, outside the United States vary from country to country. Foreign approvals may take longer to obtain than FDA approvals and can require, among other things, additional testing and different trial designs. Foreign regulatory approval processes include all of the risks associated with the FDA approval process. Some of those agencies also must approve prices for products approved for marketing. Approval of a product by the FDA or the EMA does not ensure approval of the same product by the health authorities of other countries. In addition, changes in regulatory requirements for product approval in any country during the clinical trial process and regulatory agency review of each submitted new application may cause delays or rejections.

CEL-SCI has only limited experience in filing and pursuing applications necessary to gain regulatory approvals. CEL-SCI’s lack of experience may impede its ability to obtain timely approvals from regulatory agencies, if at all. CEL-SCI will not be able to commercialize Multikine and other product candidates until it has obtained regulatory approval. In addition, regulatory authorities may also limit the types of patients to which CEL-SCI or others may market Multikine or CEL-SCI's other products. Any failure to obtain or any delay in obtaining required regulatory approvals may adversely affect the ability of CEL-SCI or potential licensees to successfully market CEL-SCI’s products.

Even if CEL-SCI obtains regulatory approval for its product candidates, CEL-SCI will be subject to stringent, ongoing government regulation.

If CEL-SCI's products receive regulatory approval, either in the United States or internationally, CEL-SCI will continue to be subject to extensive regulatory requirements. These regulations are wide-ranging and govern, among other things:

|

●

|

product design, development and manufacture;

|

|

●

|

product application and use

|

|

●

|

adverse drug experience;

|

|

●

|

product advertising and promotion;

|

|

●

|

product manufacturing, including good manufacturing practices

|

|

●

|

record keeping requirements;

|

|

●

|

registration and listing of CEL-SCI's establishments and products with the FDA, EMA and other state and national agencies;

|

|

●

|

product storage and shipping;

|

|

●

|

drug sampling and distribution requirements;

|

|

●

|

electronic record and signature requirements; and

|

|

●

|

labeling changes or modifications.

|

CEL-SCI and any third-party manufacturers or suppliers must continually adhere to federal regulations setting forth requirements, known as current Good Manufacturing Practices, or cGMPs, and their foreign equivalents, which are enforced by the FDA, the EMA and other national regulatory bodies through their facilities inspection programs. If CEL-SCI's facilities, or the facilities of CEL-SCI’s contract manufacturers or suppliers, cannot pass a pre-approval plant inspection, the FDA, EMA, or other national regulators will not approve the marketing applications of CEL-SCI's product candidates. In complying with cGMP and foreign regulatory requirements, CEL-SCI and any of its potential third-party manufacturers or suppliers will be obligated to expend time, money and effort in production, record-keeping and quality control to ensure that CEL-SCI’s products meet applicable specifications and other requirements.

If CEL-SCI does not comply with regulatory requirements at any stage, whether before or after marketing approval is obtained, CEL-SCI may be subject to license suspension or revocation, criminal prosecution, seizure, injunction, fines, be forced to remove a product from the market or experience other adverse consequences, including restrictions or delays in obtaining regulatory marketing approval for such products or for other products for which it seeks approval. This could materially harm CEL-SCI's financial results, reputation and stock price. Additionally, CEL-SCI may not be able to obtain the labeling claims necessary or desirable for product promotion. CEL-SCI may also be required to undertake post-marketing trials, which will be evaluated by applicable authorities to determine if CEL-SCI’s products may remain on the market. If CEL-SCI or other parties identify adverse effects after any of CEL-SCI's products are on the market, or if manufacturing problems occur, regulatory approval may be suspended or withdrawn. CEL-SCI may be required to reformulate its products, conduct additional clinical trials, make changes in product labeling or indications of use, or submit additional marketing applications to support any changes. If CEL-SCI encounters any of the foregoing problems, its business and results of operations will be harmed and the market price of its common stock may decline.

CEL-SCI cannot predict the extent of adverse government regulations which might arise from future legislative or administrative action. Without government approval, CEL-SCI will be unable to sell any of its products.

Foreign governments often impose strict price controls, which may adversely affect CEL-SCI’s future profitability.

CEL-SCI intends to seek approval to market Multikine in both the United States and foreign jurisdictions. If CEL-SCI obtains approval in one or more foreign jurisdictions, CEL-SCI will be subject to rules and regulations in those jurisdictions relating to Multikine. In some foreign countries, particularly in the European Union, prescription drug pricing is subject to governmental control. In these countries, pricing negotiations with governmental authorities can take considerable time after the receipt of marketing approval for a drug candidate. To obtain reimbursement or pricing approval in some countries, CEL-SCI may be required to conduct a clinical trial that compares the cost-effectiveness of Multikine to other available therapies. If reimbursement of Multikine is unavailable or limited in scope or amount, or if pricing is set at unsatisfactory levels, CEL-SCI may be unable to achieve or sustain profitability.

Risks Related to Intellectual Property

CEL-SCI may not be able to achieve or maintain a competitive position, and other technological developments may result in CEL-SCI's proprietary technologies becoming uneconomical or obsolete.

CEL-SCI is involved in a biomedical field that is undergoing rapid and significant technological change. The pace of change continues to accelerate. The successful development of products from CEL-SCI's compounds, compositions and processes through CEL-SCI-financed research, or as a result of possible licensing arrangements with pharmaceutical or other companies, is not assured.

Many companies are working on drugs designed to cure or treat cancer or cure and treat viruses, such as H1N1. Many of these companies have financial, research and development, and marketing resources, which are much greater than CEL-SCI’s, and are capable of providing significant long-term competition either by establishing in-house research groups or by forming collaborative ventures with other entities. In addition, smaller companies and non-profit institutions are active in research relating to cancer and infectious diseases. CEL-SCI’s market share will be reduced or eliminated if CEL-SCI’s competitors develop and obtain approval for products that are safer or more effective than CEL-SCI’s products.

CEL-SCI's patents might not protect CEL-SCI's technology from competitors, in which case CEL-SCI may not have any advantage over competitors in selling any products which it may develop.

Certain aspects of CEL-SCI's technologies are covered by U.S. and foreign patents. In addition, CEL-SCI has a number of new patent applications pending. There is no assurance that the applications still pending or which may be filed in the future will result in the issuance of any patents. Furthermore, there is no assurance as to the breadth and degree of protection any issued patents might afford CEL-SCI. Disputes may arise between CEL-SCI and others as to the scope and validity of these or other patents. Any defense of the patents could prove costly and time consuming and there can be no assurance that CEL-SCI will be in a position, or will deem it advisable, to carry on such a defense. A suit for patent infringement could result in increasing costs, delaying or halting development, or even forcing CEL-SCI to abandon a product. Other private and public concerns, including universities, may have filed applications for, may have been issued, or may obtain additional patents and other proprietary rights to technology potentially useful or necessary to CEL-SCI. CEL-SCI currently is not aware of any such patents, but the scope and validity of such patents, if any, and the cost and availability of such rights are impossible to predict. Also, as far as CEL-SCI relies upon unpatented proprietary technology, there is no assurance that others may not acquire or independently develop the same or similar technology.

Much of CEL-SCI’s intellectual property is protected as a trade secret, not as a patent.

Much of CEL-SCI’s intellectual property pertains to its manufacturing system, certain aspects of which may not be suitable for patent filing and must be protected as a trade secret. Those trade secrets must be protected diligently by CEL-SCI to protect their disclosure to competitors, since legal protections after disclosure may be minimal or non-existent. Accordingly, much of CEL-SCI’s value is dependent upon its ability to keep its trade secrets confidential. Although CEL-SCI takes measures to ensure confidentiality, CEL-SCI may fail in that attempt. In addition, in some cases a regulator considering CEL-SCI’s application for product approval may require the disclosure of some or all of CEL-SCI’s proprietary information. In such a case, CEL-SCI must decide whether to disclose the information or forego approval in a particular country. If CEL-SCI is unable to market its products in key countries, CEL-SCI’s opportunities and value may suffer.

Risks Related to CEL-SCI's Common Stock

Since the market price for CEL-SCI's common stock is volatile, investors may not be able to sell any of CEL-SCI's shares at a profit.

The market price of CEL-SCI's common stock, as well as the securities of other biopharmaceutical and biotechnology companies, have historically been highly volatile, and the market has from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. During the twelve months ended September 30, 2012, CEL-SCI's stock price has ranged from a low of $0.27 per share to a high of $0.65 per share. Factors such as fluctuations in CEL-SCI's operating results, announcements of technological innovations or new therapeutic products by CEL-SCI or its competitors, governmental regulation, developments in patent or other proprietary rights, public concern as to the safety of products developed by CEL-SCI or other biotechnology and pharmaceutical companies, publications by market analysts, law suits, and general market conditions may have a significant effect on the future market price of CEL-SCI's common stock.

Future sales of CEL-SCI’s securities may dilute the value of current investors’ holdings.

The provisions in CEL-SCI's Articles of Incorporation relating to CEL-SCI's preferred stock allow CEL-SCI's directors to issue preferred stock with rights to multiple votes per share and dividend rights which would have priority over any dividends paid with respect to CEL-SCI's common stock. The issuance of preferred stock with such rights may make more difficult the removal of management even if such removal would be considered beneficial to shareholders generally, and will have the effect of limiting shareholder participation in certain transactions such as mergers or tender offers if such transactions are not favored by incumbent management. In addition, CEL-SCI has issued warrants in the past and may do so in the future. These warrants, providing a future right to purchase shares of CEL-SCI’s common stock at an established price, may further dilute the ownership of current shareholders.

In order to raise additional capital, CEL-SCI may need to sell shares of its common stock, or securities convertible into common stock, at prices that may be below the prevailing market price of CEL-SCI's common stock at the time of sale. Since CEL-SCI’s stock price has been volatile, even a sale at market price one week may represent a substantial “discount” over the prior week’s price. Future sales of CEL-SCI’s securities will dilute CEL-SCI’s current stockholders and investors and may have a negative effect on the market price of its common stock.

Shares issuable upon the conversion of notes or upon the exercise of outstanding warrants and options may substantially increase the number of shares available for sale in the public market and may depress the price of CEL-SCI's common stock.

CEL-SCI has outstanding convertible debt, as well as options and warrants, which as of November 30, 2012 could potentially allow the holders to acquire a substantial number of shares of CEL-SCI’s common stock. Until the convertible debt is repaid, and the options and warrants expire, the holders will have an opportunity to profit from any increase in the market price of CEL-SCI's common stock without assuming the risks of ownership. Holders of options and warrants may exercise these securities at a time when CEL-SCI could obtain additional capital on terms more favorable than those provided by the options or warrants. The conversion of the notes or debt or the exercise of the options and warrants will dilute the voting interest of the current owners of outstanding shares by adding a substantial number of additional shares of common stock.

Substantially all of the shares of common stock that are issuable upon the conversions of the notes or debt, of the exercise of outstanding options and warrants, may be sold in the public market. The sale of common stock described above, or the perception that such sales could occur, may adversely affect the market price of CEL-SCI's common stock.

Any decline in the price of CEL-SCI's common stock may encourage short sales, which could place further downward pressure on the price of CEL-SCI's common stock. Short selling is a practice of selling shares which are not owned by a seller at that time, with the expectation that the market price of the shares will decline in value after the sale, providing the short seller a profit.

|

ITEM 1B.

|

UNRESOLVED SEC COMMENTS

|

None

CEL-SCI leases office space at 8229 Boone Blvd., Suite 802, Vienna, Virginia at a monthly rental of approximately $8,000. The lease on the office space expires on June 30, 2015. CEL-SCI believes this arrangement is adequate for the conduct of its present business.

CEL-SCI has a 17,900 square foot laboratory located in Baltimore, Maryland. The laboratory is leased by CEL-SCI at a cost of approximately $11,200 per month. The laboratory lease expires on February 28, 2017.

In August 2007, CEL-SCI leased a building near Baltimore, Maryland. The building, which consists of approximately 73,000 square feet, has been remodeled in accordance with CEL-SCI’s specifications so that it can be used by CEL-SCI to manufacture Multikine for CEL-SCI’s Phase III clinical trial and sales of the drug if approved by the FDA. The lease expires on October 31, 2028 and requires annual base rent payments of approximately $1,768,000 during the twelve months ending September 30, 2013, in accordance with the lease agreement. The annual base rent escalates each year thereafter at 3% beginning on November 1st. CEL-SCI is also required to pay all real and personal property taxes, insurance premiums, maintenance expenses, repair costs and utilities. The lease allows CEL-SCI, at its election, to extend the lease for two ten-year periods or to purchase the building at the end of the 20-year lease. The lease required CEL-SCI to pay $3,150,000 towards the remodeling costs, which will be recouped by reductions in the annual base rent of $303,228 beginning in fiscal year 2014. In August 2011, the Company was required to deposit $1,670,917, the equivalent of one year of base rent. The $1,670,917 was required to be deposited when CEL-SCI’s cash had dropped below the amount stipulated in the lease and is included in non-current assets at September 30, 2012.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

Not Applicable.

|

ITEM 4.

|

MINE SAFETY DISCLOSURE

|

Not applicable.

|

ITEM 5.

|

MARKET FOR CEL-SCI'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

|

As of September 30, 2012, there were approximately 1,100 record holders of CEL-SCI’s common stock. CEL-SCI’s common stock is traded on the NYSE MKT under the symbol “CVM”. Set forth below are the range of high and low quotations for CEL-SCI’s common stock for the periods indicated as reported on the NYSE MKT. The market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions and may not necessarily represent actual transactions.

| Quarter Ending |

|

High |

|

|

Low

|

|

| |

|

|

|

|

|

|

| 12/31/11 |

|

$ |

0.42 |

|

|

$ |

0.27 |

|

| 3/31/12 |

|

$ |

0.65 |

|

|

$ |

0.28 |

|

| 6/30/12 |

|

$ |

0.58 |

|

|

$ |

0.33 |

|

| 9/30/12 |

|

$ |

0.47 |

|

|

$ |

0.31 |

|

| |

|

|

|

|

|

|

|

|

| 12/31/10 |

|

$ |

1.05 |

|

|

$ |

0.60 |

|

| 3/31/11 |

|

$ |

0.86 |

|

|

$ |

0.51 |

|

| 6/30/11 |

|

$ |

0.74 |

|

|

$ |

0.46 |

|

| 9/30/11 |

|

$ |

0.57 |

|

|

$ |

0.35 |

|

Holders of common stock are entitled to receive dividends as may be declared by the Board of Directors out of legally available funds and, in the event of liquidation, to share pro rata in any distribution of CEL-SCI’s assets after payment of liabilities. CEL-SCI’s Board of Directors is not obligated to declare a dividend. CEL-SCI has not paid any dividends on its common stock and CEL-SCI does not have any current plans to pay any common stock dividends.

The provisions in CEL-SCI’s Articles of Incorporation relating to CEL-SCI’s preferred stock would allow CEL-SCI’s directors to issue preferred stock with rights to multiple votes per share and dividend rights which would have priority over any dividends paid with respect to CEL-SCI’s Common Stock. The issuance of preferred stock with such rights may make more difficult the removal of management even if such removal would be considered beneficial to shareholders generally, and will have the effect of limiting shareholder participation in certain transactions such as mergers or tender offers if such transactions are not favored by incumbent management.

The market price of CEL-SCI’s common stock, as well as the securities of other biopharmaceutical and biotechnology companies, have historically been highly volatile, and the market has from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. Factors such as fluctuations in CEL-SCI’s operating results, announcements of technological innovations or new therapeutic products by CEL-SCI or its competitors, governmental regulation, developments in patent or other proprietary rights, public concern as to the safety of products developed by CEL-SCI or other biotechnology and pharmaceutical companies, and general market conditions may have a significant effect on the market price of CEL-SCI’s common stock.

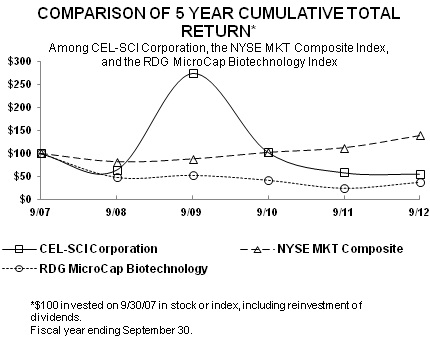

The graph below matches the cumulative 5-year total return of holders of CEL-SCI’s common stock with the cumulative total returns of the NYSE MTK Composite index and the RDG MicroCap Biotechnology index. The graph assumes that the value of an investment in CEL-SCI's common stock and in each of the indexes (including reinvestment of dividends) was $100 on 9/30/2007 and tracks it through 9/30/2012.

| |

|

|

9/07 |

|

|

|

9/08 |

|

|

|

9/09 |

|

|

|

9/10 |

|

|

|

9/11 |

|

|

|

9/12 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CEL-SCI Corporation

|

|

|

100.00 |

|

|

|

63.98 |

|

|

|

275.11 |

|

|

|

103.01 |

|

|

|

58.38 |

|

|

|

55.18 |

|

|

NYSE MKT Composite

|

|

|

100.00 |

|

|

|

81.14 |

|

|

|

87.54 |

|

|

|

102.19 |

|

|

|

112.75 |

|

|

|

139.99 |

|

|

RDG MicroCap Biotechnology

|

|

|

100.00 |

|

|

|

47.90 |

|

|

|

52.46 |

|

|

|

41.50 |

|

|

|

23.83 |

|

|

|

37.08 |

|

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

The following selected historical consolidated financial data are qualified by reference to, and should be read in conjunction with the consolidated financial statements and the related notes thereto, appearing elsewhere in this report, as well as Item 7 of this report.

|

Statements of Operations

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Grant revenue and other Operating expenses:

|

|

$ |

254,610 |

|

|

$ |

956,154 |

|

|

$ |

153,300 |

|

|

$ |

80,093 |

|

|

$ |

5,065 |

|

|

Research and development

|

|

|

10,368,695 |

|

|

|

11,745,629 |

|

|

|

11,911,626 |

|

|

|

6,011,750 |

|

|

|

4,101,563 |

|

|

Depreciation and Amortization

|

|

|

533,468 |

|

|

|

531,316 |

|

|

|

516,117 |

|

|

|

417,205 |

|

|

|

215,060 |

|

|

General and administrative

|

|

|

6,595,287 |

|

|

|

6,664,883 |

|

|

|

6,285,810 |

|

|

|

5,671,595 |

|

|

|

5,200,735 |

|

|

Gain (loss) on derivative instruments

|

|

|

1,911,683 |

|

|

|

4,432,148 |

|

|

|

28,843,772 |

|

|

|

(28,491,650 |

) |

|

|

1,799,393 |

|

|

Other expenses (3)

|

|

|

- |

|

|

|

(12,000,000 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Interest income

|

|

|

116,061 |

|

|

|

164,163 |

|

|

|

362,236 |

|

|

|

- |

|

|

|

483,252 |

|

|

Interest expense

|

|

|

(262,214 |

) |

|

|

(322,980 |

) |

|

|

(162,326 |

) |

|

|

(397,923 |

) |

|

|

(473,767 |

) |

|

Net income (loss)

|

|

|

(15,477,310 |

) |

|

|

(25,712,343 |

) |

|

|

10,483,429 |

|

|

|

(40,910,030 |

) |

|

|

(7,703,415 |

) |

|

Issuance of additional shares due to reset provision

|

|

|

(250,000 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Modification of warrants

|

|

|

(325,620 |

) |

|

|

(1,068,369 |

) |

|

|

(1,532,456 |

) |

|

|

(490,728 |

) |

|

|

(424,815 |

) |

|

Inducement warrants

|

|

|

(1,593,000 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net income (loss) available to common shareholders

|

|

$ |

(17,645,930 |

) |

|

$ |

(26,780,712 |

) |

|

$ |

8,950,973 |

|

|

$ |

(41,400,758 |

) |

|

$ |

(8,128,230 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(0.07 |

) |

|

$ |

(0.13 |

) |

|

$ |

0.04 |

|

|

$ |

(0.31 |

) |

|

$ |

(0.07 |

) |

|

Diluted

|

|

$ |

(0.07 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.31 |

) |

|

$ |

(0.07 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

251,836,540 |

|

|

|

208,488,987 |

|

|

|

202,102,859 |

|

|

|

133,535,050 |

|

|

|

117,060,866 |

|

|

Diluted (1)

|

|

|

251,836,540 |

|

|

|

208,488,987 |

|

|

|

202,102,859 |

|

|

|

133,535,050 |

|

|

|

117,060,866 |

|

| Balance Sheets |

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital

|

|

$ |

5,529,438 |

|

|

$ |

1,796,349 |

|

|

$ |

25,799,304 |

|

|

$ |

34,339,772 |

|

|

$ |

(2,492,555 |

) |

|

Total assets

|

|

|

16,067,450 |

|

|

|

18,625,440 |

|

|

|

37,804,985 |

|

|

|

46,027,598 |

|

|

|

14,683,672 |

|

|

Convertible note and derivative instruments - current (2)

|

|

|

- |

|

|

|

5,068,552 |

|

|

|

424,286 |

|

|

|

- |

|

|

|

3,018,697 |

|

|

Derivative instruments – noncurrent (2)

|

|

|

6,983,690 |

|

|

|

2,192,521 |

|

|

|

6,521,765 |

|

|

|

35,113,970 |

|

|

|

- |

|

|

Total liabilities

|

|

|

9,040,018 |

|

|

|

9,546,616 |

|

|

|

9,950,220 |

|

|

|

37,186,954 |

|

|

|

3,847,637 |

|

|

Stockholders' equity

|

|

|

7,027,432 |

|

|

|

9,078,824 |

|

|

|

27,854,765 |

|

|

|

8,840,644 |

|

|

|

10,836,035 |

|

____________

|

(1)

|

The calculation of diluted earnings per share for the years ended September 30, 2012, 2011, 2010, 2009 and 2008 excluded the potentially dilutive shares because their effect would have been anti-dilutive.

|

|

(2)

|

Included in total liabilities.

|

|

(3)

|

The $12 million other expenses in 2011 was the cost of the lawsuit settlement. See financial statement footnotes for discussion of the lawsuit settlement.

|

CEL-SCI's net loss available to common shareholders for each fiscal quarter during the two years ended September 30, 2012 were:

| |

|

Net income

|

|

|

Net income (loss) per share |

|

|

Quarter

|

|

(loss)

|

|

|

Basic

|

|

|

Diluted

|

|

| |

|

|

|

|

|

|

|

|

|

|

12/31/2011

|

|

$ |

(4,156,833 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.02 |

) |

|

3/31/2012

|

|

$ |

(10,086,959 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.04 |

) |

|

6/30/2012

|

|

$ |

(835,446 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

9/30/2012

|

|

$ |

(2,566,692 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.01 |

) |

|

12/31/2010

|

|

$ |

(6,250,952 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.03 |

) |

|

3/31/2011

|

|

$ |

(15,097,973 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.09 |

) |

|

6/30/2011

|

|

$ |

(3,114,255 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.02 |

) |

|

9/30/2011

|

|

$ |

(2,317,532 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.02 |

) |

CEL-SCI has experienced large swings in its quarterly gains and losses in 2012 and 2011. These swings are caused by the changes in the fair value of the convertible debt and outstanding warrants accounted for as derivatives each quarter. These changes in the fair value of the convertible debt and warrants are recorded on the consolidated statements of operations. The settlement of the lawsuit, discussed in Note 13 to the financial statements accompanying this report, resulted in a $12,000,000 charge to earnings in the second quarter of the fiscal year ended September 30, 2011.

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following discussion should be read in conjunction with the consolidated financial statements and the related notes thereto appearing elsewhere in this report.

CEL-SCI’s lead investigational therapy, Multikine, is cleared for a Phase III clinical trial in advanced primary head and neck cancer. It has received a go-ahead by the US FDA as well as the Canadian, Polish, Hungarian, Russian, Israeli, Indian, Taiwanese and Ukrainian regulators.

CEL-SCI also owns and is developing a pre-clinical technology called LEAPS (Ligand Epitope Antigen Presentation System).

All of CEL-SCI’s projects are under development. As a result, CEL-SCI cannot predict when it will be able to generate any revenue from the sale of any of its products.

Since inception, CEL-SCI has financed its operations through the issuance of equity securities, convertible notes, loans and certain research grants. CEL-SCI’s expenses will likely exceed its revenues as it continues the development of Multikine and brings other drug candidates into clinical trials. Until such time as CEL-SCI becomes profitable, any or all of these financing vehicles or others may be utilized to assist CEL-SCI’s capital requirements.

Results of Operations

Fiscal 2012

During the year ended September 30, 2012, grant income decreased by $701,544 compared to the year ended September 30, 2011. In November 2010, CEL-SCI received a $733,437 grant under The Patient Protection and Affordable Care Act of 2011 (PPACA). The grant was related to three of CEL-SCI’s projects, including the Phase III trial of Multikine. The PPACA provides small and mid-sized biotech, pharmaceutical and medical device companies with up to a 50% tax credit for investments in qualified therapeutic discoveries for tax years 2009 and 2011, or a grant for the same amount tax-free. The tax credit/grant program covers research and development costs from 2009 and 2011 for all qualified “therapeutic discovery projects.” CEL-SCI recognizes revenue as the expenses are incurred. CEL-SCI received the last of the funds under this grant in October for grant money earned before September 30, 2011.

During the year ended September 30, 2012, research and development expenses decreased by $1,376,934 compared to the year ended September 30, 2011. CEL-SCI is continuing the Phase III clinical trial and research and development expenses fluctuate based on the activity level of the clinical trial.

During the year ended September 30, 2012, general and administrative expenses decreased by $69,596 compared to the year ended September 30, 2011. This decrease was primarily caused by the legal fees related to litigation that was ongoing during fiscal 2011.