Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

5

|

||

|

10

|

||

|

14

|

||

|

|

14

|

|

|

|

15

|

|

|

|

16

|

|

|

17

|

||

|

|

18

|

|

|

|

18

|

|

|

|

18

|

|

|

|

19

|

|

|

19

|

||

|

|

19

|

|

|

|

20

|

|

|

|

21

|

|

|

|

22

|

|

|

|

23

|

|

|

|

23

|

|

|

|

24

|

|

|

|

25

|

|

|

|

26

|

|

|

|

26

|

|

|

|

26

|

|

|

1.

|

26

|

|

|

|

27

|

|

|

|

27

|

|

|

|

29

|

|

|

2.

|

29

|

|

|

|

29

|

|

|

|

30

|

|

|

|

30

|

|

|

|

30

|

|

|

|

31

|

|

|

|

31

|

|

|

|

31

|

|

|

3.

|

31

|

|

|

|

31

|

|

|

|

32

|

|

|

|

32

|

|

|

|

34

|

|

|

|

34

|

|

|

4.

|

35

|

|

|

|

35

|

|

|

|

36

|

|

|

|

37

|

|

|

|

40

|

|

|

|

44

|

|

|

|

46

|

|

|

|

47

|

|

|

|

49

|

|

|

5.

|

50

|

|

|

|

51

|

|

|

|

51

|

|

|

|

52

|

|

|

6.

|

53

|

|

|

|

53

|

|

|

|

54

|

|

|

|

54

|

|

|

|

56

|

|

|

|

56

|

|

|

|

56

|

|

|

|

56

|

|

|

7.

|

57

|

|

|

|

58

|

|

|

|

58

|

|

|

|

58

|

|

|

|

59

|

|

|

8.

|

59

|

|

|

|

59

|

|

|

|

59

|

|

|

|

60

|

|

|

9.

|

61

|

|

|

10.

|

64

|

|

|

|

65

|

|

|

|

67

|

|

|

|

67

|

|

|

|

67

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

11.

|

68

|

|

|

|

68

|

|

|

|

68

|

|

|

|

70

|

|

|

|

70

|

|

|

|

70

|

|

|

|

70

|

|

|

|

70

|

|

|

|

72

|

|

|

|

72

|

|

|

|

72

|

|

|

|

72

|

|

|

|

73

|

|

|

|

73

|

|

|

|

73

|

|

|

|

75

|

|

|

|

75

|

|

|

|

75

|

|

|

|

76

|

|

|

|

76

|

|

|

|

76

|

|

|

|

76

|

|

|

|

76

|

|

|

12.

|

76

|

|

|

|

76

|

|

|

|

77

|

|

|

|

77

|

|

|

|

77

|

|

|

|

78

|

|

|

|

79

|

|

|

|

79

|

|

|

|

79

|

|

13.

|

79

|

|

|

|

79

|

|

|

|

84

|

|

|

|

95

|

|

|

|

95

|

|

|

|

95

|

|

|

14.

|

103

|

|

|

104

|

||

|

|

104

|

|

|

|

104

|

|

|

|

105

|

|

|

|

105

|

|

|

|

106

|

|

|

107

|

||

|

110

|

||

|

111

|

||

|

|

111

|

|

|

|

111

|

|

|

114

|

||

|

115

|

||

|

Back Cover

|

||

|

|

Back Cover

|

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Glossary

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Important Information You Should Consider About the Contract

|

|

FEES AND

EXPENSES

|

Prospectus

Location

|

||

|

Charges

for Early

Withdrawals

|

Your Contract is subject to withdrawal charges that

differ depending on when you

purchased the Contract.

•If you purchase the Contract on or after May 1, 2024, and you withdraw money from

the Contract within six years of your last Purchase Payment, you will

be assessed a

withdrawal charge of up to 8% of the Purchase Payment withdrawn, declining to

0%

over that time period.

•If you purchased the Contract on or before April 30, 2024, and you withdraw money

from the Contract within six years of your last

Purchase Payment, you will be

assessed a withdrawal charge of up to 8.5% of the

Purchase Payment withdrawn,

declining to 0% over that time period.

|

Fee Tables

4. Valuing Your

Contract

6. Expenses

Appendix B –

Daily

Adjustment

|

||

|

|

For example, for Contracts issued on or after May 1,

2024, if you invest $100,000 in the

Contract and make an early withdrawal, you could pay a

withdrawal charge of up to $8,000

(or $8,500 for Contracts issued on or before April 30,

2024).

In addition, if you take a full or partial withdrawal

(including financial adviser fees that you

choose to have us pay from this Contract) from an Index

Option on a date other than the

Term End Date, a Daily Adjustment will apply to the

Index Option Value that is available for

withdrawal. The Daily Adjustment also applies if before

the Term End Date you execute a

Performance Lock, you annuitize the Contract, we pay a

death benefit, or we deduct

Contract fees and expenses. The Daily Adjustment may be

negative depending on the

applicable Crediting Method. You will lose money if the

Daily Adjustment is negative.

•Index Dual Precision Strategy, Index Precision Strategy, Index Guard Strategy,

and Index Performance Strategy. Daily Adjustments under these Crediting Methods

may be positive, negative, or equal to zero. A

negative Daily Adjustment will result in a

loss. In extreme circumstances, a negative Daily

Adjustment could result in a loss

beyond the protection of the 10%, 20%, or 30% Buffer;

or -10% Floor, as applicable.

The maximum potential loss from a negative Daily

Adjustment is: -99% for the Index

Dual Precision Strategy, Index Precision Strategy, and

Index Performance Strategy;

and -35% for the Index Guard Strategy.

•Index Protection Strategy with Trigger. Daily Adjustments under this

Crediting

Method may be positive or equal to zero, but cannot be

negative.

|

|

||

|

Transaction

Charges

|

Other than withdrawal charges and Daily Adjustments

that may apply to withdrawals and

other transactions under the Contract, there are no

other transaction charges.

|

Not Applicable

|

||

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

|

FEES AND

EXPENSES

|

Prospectus

Location

|

||

|

Ongoing

Fees and

Expenses

(annual

charges)

|

The table below describes the fees and expenses that

you may pay each year, depending

on the options you choose. Please refer to your

Contract specifications page for information

about the specific fees you will pay each year based on the options

you have elected.

These ongoing fees and expenses do not reflect any

financial adviser fees paid to a

Financial Professional from your Contract Value or

other assets of the Owner. If such

charges were reflected, these ongoing fees and expenses

would be higher.

|

Fee Tables

6. Expenses

Appendix E –

Fund Available

Under the

Contract

|

||

|

Annual Fee

|

Minimum

|

Maximum

|

||

|

Base Contract(1)

|

0.01%

|

0.01%

|

||

|

Investment Options(2)

(Fund fees and expenses)

|

0.88%

|

0.88%

|

||

|

Optional Benefits Available for an Additional

Charge(3)

(for a single optional benefit, if elected)

|

0.20%

|

0.20%

|

||

|

|

(1)

An amount attributable to the estimated contract

maintenance charge based on expected Contract sales.

|

|

||

|

|

(2)

As a percentage of the AZL Government Money

Market Fund's average daily net assets.

|

|

||

|

|

(3)

As a percentage of the Charge Base. This is the current

charge for the Maximum Anniversary Value Death

Benefit.

|

|

||

|

|

Because your Contract is customizable, the choices you

make affect how much you will

pay. To help you understand the cost of owning your

Contract, the following table shows the

lowest and highest cost you could pay each year, based

on current charges. This estimate

assumes that you do not take withdrawals from the

Contract, which could be subject to a

withdrawal charge, and if taken from

the Index Dual Precision Strategy, Index

Precision Strategy, Index Guard

Strategy, and Index Performance Strategy Index

Options could result in substantial

losses due to the application of negative Daily

Adjustments.

|

|

||

|

|

Lowest Annual Cost:

$853

|

Highest Annual Cost:

$1,036

|

|

|

|

|

Assumes:

•Investment of $100,000 in the Variable

Option (even though you cannot select

the Variable Option for investment)

•5% annual appreciation

•Traditional Death Benefit

•No additional Purchase Payments,

transfers, or withdrawals

•No financial adviser fees

|

Assumes:

•Investment of $100,000 in the Variable

Option (even though you cannot select

the Variable Option for investment)

•5% annual appreciation

•Maximum Anniversary Value Death

Benefit with a 0.20% rider fee

•No additional Purchase Payments,

transfers, or withdrawals

•No financial adviser fees

|

|

|

|

|

RISKS

|

|

||

|

Risk of

Loss

|

You can lose money by investing in the Contract,

including loss of principal and previous

earnings.

|

Risk Factors

|

||

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

|

RISKS

|

Prospectus

Location

|

||

|

Not a

Short-Term

Investment

|

• This Contract is not a short-term investment and is not appropriate if you need ready

access to cash.

• Considering the benefits of tax deferral and long-term income, the Contract is generally

more beneficial to investors with a long investment

time horizon.

• Withdrawals are subject to income taxes, and may also be subject to a 10% additional

federal tax for amounts withdrawn before age 59 1∕2.

• If, within six years after we receive a Purchase Payment, you take a full or partial

withdrawal (including financial adviser fees that you

choose to have us pay from this

Contract), withdrawal charges will apply. A withdrawal

charge will reduce your Contract

Value or the amount of money that you actually

receive. Withdrawals may reduce or end

Contract guarantees.

• Amounts invested in an Index Option must be held in the Index Option for the full Term

before they can receive a Performance Credit. We apply

a Daily Adjustment if, before the

Term End Date, you take a full or partial withdrawal

(including financial adviser fees that

you choose to have us pay from this Contract), you

execute a Performance Lock, you

annuitize the Contract, we pay a death benefit, or we

deduct Contract fees and expenses.

• The Traditional Death Benefit may not be modified, but it will terminate if you take

withdrawals that reduce both the Contract Value and

Guaranteed Death Benefit Value to

zero. Withdrawals may reduce the Traditional Death

Benefit’s Guaranteed Death Benefit

Value by more than the value withdrawn and could end

the Traditional Death Benefit.

|

Risk Factors

4. Valuing Your

Contract

10. Death Benefit

Appendix B –

Daily Adjustment

|

||

|

Risks

Associated

with

Investment

Options

|

• An investment in the Contract is subject to the risk of poor investment performance and

can vary depending on the performance of the Variable

Option and the Index Options

available under the Contract.

• The Variable Option and each Index Option have their own unique risks.

• You should review the Fund’s prospectus and disclosures, including risk factors, before

making an investment decision.

|

Risk Factors

|

||

|

Insurance

Company

Risks

|

An investment in the Contract is subject to the risks

related to us. All obligations,

guarantees or benefits of the Contract are the

obligations of Allianz Life and are subject to

our claims-paying ability and financial strength. More

information about Allianz Life,

including our financial strength ratings, is available

upon request by visiting

www.allianzlife.com/about/financial-ratings, or contacting us at (800) 624-0197.

|

Risk Factors

|

||

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

|

RESTRICTIONS

|

Prospectus

Location

|

||

|

Investments

|

• Certain Index Options may not be available under your Contract.

• You cannot allocate Purchase Payments to the Variable Option. The sole purpose of the

Variable Option is to hold Purchase Payments until

they are transferred to your selected

Index Options.

• We restrict additional Purchase Payments during the Accumulation Phase. Each Index

Year, you cannot add more than your initial amount

(i.e., the total of all Purchase

Payments received before the first Quarterly Contract

Anniversary of the first Contract

Year) without our prior approval.

• We do not accept additional Purchase Payments during the Annuity Phase.

• We typically only allow assets to move into the Index Options on the Index Effective Date

and on subsequent Index Anniversaries as discussed in

section 3, Purchasing the

Contract – Allocation of Purchase Payments and

Contract Value Transfers. However, if

you execute an Early Reallocation, we will move assets

into an Index Option on the

Business Day we receive your Early Reallocation

request in Good Order.

• You can typically transfer Index Option Value only on Term End Dates. However, you can

transfer assets out of an Index Option before the Term

End Date by executing a

Performance Lock as discussed in section 4, Valuing

Your Contract – Performance Locks.

• We do not allow assets to move into an established Index Option until the Term End Date.

If you request to allocate a Purchase Payment into an

established Index Option on an

Index Anniversary that is not a Term End Date, we will

allocate those assets to the same

Index Option with a new Term Start Date.

• We reserve the right to substitute the Fund in which the Variable Option invests. We also

reserve the right to discontinue accepting new

allocations into specific Index Options and

to substitute Indexes either on a Term Start Date or

during a Term. We also reserve the

right to decline any or all Purchase Payments at any

time on a nondiscriminatory basis.

|

Risk Factors

3. Purchasing the

Contract

4. Valuing Your

Contract

5. Information

Related to the

Variable Option's

Underlying Fund

Appendix A –

Available Indexes

|

||

|

Optional

Benefits

|

• The optional Maximum Anniversary Value Death Benefit may not be modified.

Withdrawals may reduce the Maximum Anniversary Value

Death Benefit’s Guaranteed

Death Benefit Value by more than the value withdrawn

and will end the Maximum

Anniversary Value Death Benefit if the withdrawals

reduce both the Contract Value and

Guaranteed Death Benefit Value to zero.

|

10. Death Benefit

|

||

|

|

TAXES

|

|

||

|

Tax

Implications

|

• Consult with a tax professional to determine the tax implications of an investment in and

withdrawals from or payments received under the

Contract.

• If you purchased the Contract through a tax-qualified plan or individual retirement account

(IRA), you do not get any additional tax benefit under

the Contract.

• Generally, earnings under a Non-Qualified Contract are taxed at ordinary income rates

when withdrawn, and may also be subject to a 10%

additional federal tax for amounts

withdrawn before age 59 1∕2.

• Generally, distributions from Qualified Contracts are taxed at ordinary income tax rates

when withdrawn, and may also be subject to a 10%

additional federal tax for amounts

withdrawn before age 59 1∕2.

|

11. Taxes

|

||

|

|

CONFLICTS

OF INTEREST

|

|

||

|

Investment

Professional

Compensation

|

Your Financial Professional may receive compensation

for selling this Contract to you, in

the form of commissions, additional cash benefits

(e.g., cash bonuses), and non-cash

compensation. We and/or our wholly owned subsidiary

distributor may also make marketing

support payments to certain selling firms for marketing

services and costs associated with

Contract sales. This conflict of interest may influence

your Financial Professional to

recommend this Contract over another investment for

which the Financial Professional is

not compensated or compensated less.

|

12. Other

Information –

Distribution

|

||

|

Exchanges

|

Some Financial Professionals may have a financial

incentive to offer you a new contract in

place of one you already own. You should only exchange

your contract if you determine,

after comparing the features, fees, and risks of both

contracts, that it is better for you to

purchase the new contract rather than continue to own

your existing contract.

|

12. Other

Information –

Distribution

|

||

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Overview of the Contract

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

Currently Available

Crediting Methods, Term

Lengths, and

Negative Index Performance

Protection

|

Currently

Available Indexes

|

Positive Index Performance

Participation Limit

|

|

Index Protection Strategy

with Trigger 1-year Term with

100% downside protection

|

• S&P 500® Index

• Russell 2000® Index

• Nasdaq-100® Index

• EURO STOXX 50®

• iShares® MSCI Emerging Markets ETF

|

• 0.10% minimum Trigger Rate

|

|

Index Dual Precision Strategy

1-year Term with 10%, 20%, or

30% Buffer

• For Contracts issued from May 1, 2023,

to November 13, 2023, the Index Dual

Precision Strategy is not available.

• For Contracts issued from November

14, 2023, to April 30, 2024, only the 10%

Buffer is available.

• For Contracts issued since May 1, 2024,

the 10%, 20%, and 30% Buffers are

available.

|

• S&P 500® Index

• Russell 2000® Index

• Nasdaq-100® Index

• EURO STOXX 50®

• iShares® MSCI Emerging Markets ETF

|

• 0.10% minimum Trigger Rate

|

|

Index Precision Strategy

1-year Term with 10% Buffer

|

• S&P 500® Index

• Russell 2000® Index

• Nasdaq-100® Index

• EURO STOXX 50®

• iShares® MSCI Emerging Markets ETF

|

• 0.10% minimum Trigger Rate

|

|

Index Guard Strategy

1-year Term with -10% Floor

|

• S&P 500® Index

• Russell 2000® Index

• Nasdaq-100® Index

• EURO STOXX 50®

• iShares® MSCI Emerging Markets ETF

|

• 0.10% minimum Cap

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

Currently Available

Crediting Methods, Term

Lengths, and

Negative Index Performance

Protection

|

Currently

Available Indexes

|

Positive Index Performance

Participation Limit

|

|

Index Performance Strategy

1-year Term with 10%, 20%, or

30% Buffer

• For Contracts issued from May 1, 2023,

to November 13, 2023, only the 10%

Buffer is available.

• For Contracts issued since November

14, 2023, the 10%, 20%, and 30% Buffers

are available.

|

• S&P 500® Index

• Russell 2000® Index

• Nasdaq-100® Index

• EURO STOXX 50®

• iShares® MSCI Emerging Markets ETF

|

• 0.10% minimum Cap

• Can be “uncapped” (i.e., we do not declare a

Cap for that Term)

|

|

Index Performance Strategy

3-year Term with 10% or 20%

Buffer

|

• S&P 500® Index

• Russell 2000® Index

|

• 2% minimum Cap

• Can be uncapped

• 100% minimum Participation Rate

|

|

Index Performance Strategy

6-year Term with 10% or 20%

Buffer

• For Contracts issued from May 1, 2023,

to November 13, 2023, only the 10%

Buffer is available.

• For Contracts issued since November

14, 2023, the 10% and 20% Buffers are

available.

|

• S&P 500® Index

• Russell 2000® Index

|

• 5% minimum Cap

• Can be uncapped

• 100% minimum Participation Rate

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Fee Tables

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

(as a percentage of each Purchase Payment withdrawn)(2)

|

Number of Complete

Years Since

Purchase Payment

|

Withdrawal Charge Amount

|

|

|

Contracts issued

on or before

April 30, 2024

|

Contracts issued

on or after

May 1, 2024

|

|

|

0

|

8.5%

|

8%

|

|

1

|

8%

|

8%

|

|

2

|

7%

|

7%

|

|

3

|

6%

|

6%

|

|

4

|

5%

|

5%

|

|

5

|

4%

|

4%

|

|

6 years or more

|

0%

|

0%

|

|

|

Index Protection Strategy

with Trigger

|

Index Dual Precision Strategy,

Index Precision Strategy,

and

Index Performance Strategy

|

Index

Guard

Strategy

|

|

Daily Adjustment Maximum Potential Loss

|

0%

|

99%

|

35%

|

|

(as a percentage of Index Option Value, applies for

distributions from an Index Option before any Term

End Date)(3)

|

|

|

|

|

Administrative Expenses (or contract

maintenance charge)(1)

(per year)

|

$50

|

|

Optional Benefit Expenses – Maximum

Anniversary Value Death Benefit

(as a percentage of the Charge Base)

|

0.20%

|

|

(expenses that are deducted from Fund assets, including management fees,

distribution and/or service (12b-1) fees, and other expenses)

|

0.88%

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Contracts issued on or before April 30, 2024

|

$9,597

|

$10,422

|

$10,933

|

$13,122

|

|

Contracts issued on or after May 1, 2024

|

$9,097

|

$10,422

|

$10,933

|

$13,122

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Contracts issued on or before April 30, 2024

|

N/A*

|

$3,422

|

$5,933

|

$13,122

|

|

Contracts issued on or after May 1, 2024

|

N/A*

|

$3,422

|

$5,933

|

$13,122

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Contracts issued on or before April 30, 2024

|

$1,097

|

$3,422

|

$5,933

|

$13,122

|

|

Contracts issued on or after May 1, 2024

|

$1,097

|

$3,422

|

$5,933

|

$13,122

|

Risk Factors

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

|

January 1, 2014 through December 31, 2023

|

||||

|

|

S&P 500®

Index

|

Nasdaq-100®

Index

|

Russell 2000®

Index

|

EURO

STOXX 50®

|

iShares® MSCI

Emerging Markets ETF

|

|

Returns without dividends

|

11.02

%

|

19.57

%

|

6.76

%

|

4.60

%

|

1.04

%

|

|

Returns with dividends

|

13.09

%

|

20.79

%

|

8.19

%

|

8.10

%

|

3.22

%

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

We will not provide

advice or notify you regarding whether you should execute a Performance Lock or Early

Reallocation or the

optimal time for doing so. We will not warn you if you execute a Performance Lock or Early

Reallocation at a

sub-optimal time. We are not responsible for any losses related to your decision whether or not to

execute a Performance

Lock or Early Reallocation.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

1. The Contract

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

Financial Adviser Fee

Withdrawal

|

Contract

Value

|

Guaranteed Death Benefit

Value for a Contract with the

Traditional Death Benefit

|

Guaranteed Death Benefit Value

for a Contract with the

Maximum Anniversary Value

Death Benefit

|

|

Prior to 1st years withdrawal

|

$ 100,000

|

$ 90,000

|

$ 105,000

|

|

$5,000 withdrawal (subject to an

|

|

|

|

|

8% withdrawal charge)

|

– [($5,000 ÷ (1 – 8%)]

|

|

|

|

Amount withdrawn

|

– $5,435

|

– [($5,435 ÷ 100,000) x 90,000]

|

– [($5,435 ÷ 100,000) x 105,000]

|

|

|

|

= - $4,892

|

= - $5,707

|

|

After 1st years withdrawal

|

$ 94,565

|

$ 85,108

|

$ 99,293

|

|

|

|

|

|

|

Prior to 2nd years withdrawal

|

$ 97,000

|

$ 85,108

|

$ 99,293

|

|

$5,000 withdrawal (not subject to a

|

|

|

|

|

withdrawal charge)

|

– $5,000

|

– [($5,000 ÷ 97,000) x 85,108]

|

– [($5,000 ÷ 97,000) x 99,293]

|

|

|

|

= - $4,388

|

= - $5,119

|

|

After 2nd years withdrawal

|

$ 92,000

|

$ 80,720

|

$ 94,174

|

|

|

|

|

|

|

Prior to 3rd years withdrawal

|

$ 80,000

|

$ 80,720

|

$ 94,174

|

|

$5,000 withdrawal (not subject to a

|

– $5,000

|

– [($5,000 ÷ 80,000) x 80,720]

|

– [($5,000 ÷ 80,000) x 94,174]

|

|

withdrawal charge)

|

|

= - $5,045

|

= - $5,886

|

|

After 3rd years withdrawal

|

$ 75,000

|

$ 75,675

|

$ 88,288

|

2. Ownership, Annuitant, Determining Life, Beneficiary, and Payee

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

UPON THE DEATH OF A SOLE OWNER

|

|

|

Action if the Contract is in the Accumulation Phase

|

Action if the Contract is in the Annuity Phase

|

|

• If this is an Inherited IRA Contract, the Beneficiary can either:

– continue to receive RMD payments based on the

remaining life expectancy of the deceased Inherited IRA

Owner and the Contract Value as of the Business Day we

receive a Valid Claim, until ten years after the Inherited

IRA Owner’s death at which time we make a lump sum

payment, or

– receive a lump sum payment of the Contract Value as of

the Business Day we receive a Valid Claim.

• For all other Contracts, we pay a death benefit to the

Beneficiary unless the Beneficiary is the surviving spouse and

continues the Contract.

• If the deceased Owner was a Determining Life and the

surviving spouse Beneficiary continues the Contract:

– we increase the Contract Value to equal the Guaranteed

Death Benefit Value if greater and available, and the

death benefit ends,

– the surviving spouse becomes the new Owner,

– the Accumulation Phase continues, and

– upon the surviving spouse’s death, his or her

Beneficiary(ies) receives the Contract Value.

• If the deceased Owner was not a Determining Life, the

Traditional Death Benefit or Maximum Anniversary Value Death

Benefit are not available and the Beneficiary(ies) receives the

Contract Value.

|

• The Beneficiary becomes the Payee. If we are still required to

make Annuity Payments under the selected Annuity Option, the

Beneficiary also becomes the new Owner.

• If the deceased was not an Annuitant, Annuity Payments to the

Payee continue. No death benefit is payable.

• If the deceased was the only surviving Annuitant, Annuity

Payments end or continue as follows.

– Annuity Option A or C, payments end when the

guaranteed period ends.

– Annuity Option B, F, or G, payments end.

– For more information on the Annuity Options, please see

section 8.

• If the deceased was an Annuitant and there is a surviving joint

Annuitant, Annuity Payments to the Payee continue during the

lifetime of the surviving joint Annuitant. No death benefit is

payable.

• For a Qualified Contract, the Annuity Payments must end ten

years after the Owner’s death.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

• FOR JOINTLY OWNED CONTRACTS: The sole primary

Beneficiary is the surviving Joint Owner regardless of

any other named primary Beneficiaries. If both Joint Owners

die within 120 hours of each other, we pay the death

benefit to the named surviving primary Beneficiaries. If

there are no named surviving primary Beneficiaries, we pay

the death benefit to the named surviving contingent

Beneficiaries, or equally to the estate of the Joint Owners if there

are no named surviving contingent Beneficiaries.

|

|

• NAMING AN ESTATE AS A BENEFICIARY: If an estate is

the Beneficiary, the estate must be the sole primary

Beneficiary, unless the Spouse is the sole primary

Beneficiary. If the Spouse is the sole primary Beneficiary, then an

estate can be a contingent beneficiary.

|

|

• An assignment may be a taxable event. In addition, there are other

restrictions on changing the ownership of a

Qualified Contract and Qualified Contracts generally cannot

be assigned absolutely or on a limited basis. You should

consult with your tax

adviser before assigning this Contract.

|

|

• An assignment will only change the Determining Life (Lives) if it involves removing a Joint Owner due to

divorce, replacing Joint Owners with a

Trust, or adding a Joint Owner if that person is a spouse within the

meaning of federal tax law of the existing

Owner.

|

3. Purchasing the Contract

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

We do not accept additional Purchase

Payments if you have an Inherited IRA, or Inherited Roth IRA Contract.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

On your application if you select…

|

Your Index Effective Date will be either…

|

|

the earliest Index Effective Date

|

• your Issue Date, or

• the first Business Day of the next month if the Issue Date is the 29th, 30th, or 31st of a

month

|

|

the deferred Index Effective Date

|

• your first Quarterly Contract Anniversary, or

• the next Business Day if the first Quarterly Contract Anniversary occurs on a non-Business

Day, or the first Business Day of the next month if the

first Quarterly Contract Anniversary

is the 29th, 30th, or 31st of a month

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

• In order to apply Purchase Payments we receive after the Index Effective Date to your selected Index Option(s) on

the next Index Anniversary, we must receive them before the end of the Business Day on the Index Anniversary (or

before the end of the prior Business Day if the anniversary is a non-Business Day).

|

|

• Purchase Payments we hold in the Variable Option before transferring them to your selected Index Options are

subject to Contract fees

and expenses (e.g. contract maintenance charge), and market risk and may lose value.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

4. Valuing Your Contract

|

Variable Account Value increases when….

|

Variable Account Value decreases when….

|

|

• we hold assets in the Variable Option on an interim basis

before transferring them to your selected Index

Option(s), or

due to a Contract Value increase associated with the

death of

a Determining Life, or

• there is positive Fund performance

|

• you take assets out of the Variable Option by withdrawal

(including financial adviser fees that you choose to have

us

pay from this Contract),

• we transfer assets held in the Variable Option on an interim

basis to your selected Index Option(s) according to

allocation

instructions,

• there is negative Fund performance, or

• we deduct Contract fees and expenses

|

|

Contract fees and

expenses we deduct from the Variable Option include the rider fee, contract maintenance charge, and

withdrawal charge as described in section

6, Expenses. Financial

adviser fees that you choose to have us pay from this

Contract are described in section 1, The

Contract.

|

|

|

Index Option Values increase when….

|

Index Option Values decrease when….

|

|

• you add assets to an Index Option by Purchase Payment,

make allocation instruction changes that transfer

Contract

Value, or request an Early Reallocation into the Index

Option,

• we transfer assets held in the Variable Option on an interim

basis to your selected Index Option according to

allocation

instructions, or

• you receive a positive Performance Credit or Daily Adjustment

|

• you take assets out of an Index Option by

withdrawal (including any financial adviser fees that you

choose to have us pay from this Contract), make

allocation

instruction changes that transfer Contract Value, or

request an

Early Reallocation out of the Index Option,

• you receive a negative Performance Credit or Daily

Adjustment, or

• we deduct Contract fees and expenses

|

|

Contract fees and

expenses we deduct from the Index Options include the rider fee, contract maintenance charge, and

withdrawal charge as described in section

6, Expenses. Financial adviser fees that you choose to have us pay from this

Contract are described in section 1, The

Contract.

|

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

• The Index Dual Precision Strategy, Index Precision Strategy, Index Guard Strategy, and Index Performance

Strategy allow negative Performance

Credits. A negative Performance Credit means you can lose principal and

previous earnings. The

maximum potential negative Performance Credit is: -90% with a 10% Buffer; -80% with a

20% Buffer; -70% with a

30% Buffer; and -10% with the Floor.

|

|

• Because we calculate Index Returns only on a single date in time, you may experience negative or flat

performance even though the Index you

selected for a given Crediting Method experienced gains through

some, or most, of the Term.

|

|

• If an Index Performance Strategy Index Option is “uncapped” for one Term (i.e., we do not declare a Cap for

that Term) it does not mean that we will

not declare a Cap for it on future Term Start Dates. On the next Term

Start Date we can declare a Cap for the next Term, or

declare it to be uncapped.

|

|

What is the asset protection?

|

|

|

Index Protection

Strategy with Trigger

|

• Most protection.

• If the Index loses value, the Performance Credit is zero. You do not receive a negative Performance

Credit.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

What is the asset protection?

|

|

|

Index Dual Precision

Strategy

|

• Less protection than the Index Protection Strategy with Trigger and Index Guard Strategy. Protection

is equal to or greater than what is available with the

Index Precision Strategy depending on the Index

Option. Offers the same protection levels as the Index

Performance Strategy.

• Buffer absorbs 10%, 20%, or 30% of loss, but you receive a negative Performance Credit for losses

greater than the Buffer.

• Potential for large losses in any Term.

• More sensitive to large negative market movements because small or moderate negative market

movements within the applicable 10%, 20%, or 30% Buffer

result in a positive Performance Credit. In

a period of extreme negative market performance, the risk

of loss is greater with the Index Dual

Precision Strategy than with the Index Guard Strategy.

|

|

Index Precision Strategy

|

• Less protection than the Index Protection Strategy with Trigger and Index Guard Strategy. Protection

may be equal to or less than what is available with the

Index Dual Precision Strategy and Index

Performance Strategy depending on the Index Option.

• Buffer absorbs 10% of loss, but you receive a negative Performance Credit for losses greater than

10%.

• Potential for large losses in any Term.

• More sensitive to large negative market movements because small negative market movements are

absorbed by the 10% Buffer. In a period of extreme

negative market performance, the risk of loss is

greater with the Index Precision Strategy than with the

Index Guard Strategy.

|

|

Index Guard Strategy

|

• Less protection than the Index Protection Strategy with Trigger, but more than Index Dual Precision

Strategy, Index Precision Strategy, and Index Performance

Strategy.

• Permits a negative Performance Credit down to the -10% Floor.

• Protection from significant losses.

• More sensitive to smaller negative market movements that persist over time because the -10% Floor

reduces the impact of large negative market movements.

• In an extended period of smaller negative market returns, the risk of loss is greater with the Index

Guard Strategy than with the Index Dual Precision

Strategy, Index Precision Strategy, and Index

Performance Strategy.

• Provides certainty regarding the maximum loss in any Term.

|

|

Index Performance

Strategy

|

• Less protection than the Index Protection Strategy with Trigger and Index Guard Strategy. Index

Options with a 10% Buffer provide the same protection as

the Index Precision Strategy. The 20% and

30% Buffers provide more protection than what is

available with the Index Precision Strategy. Offers

the same protection levels as the Index Dual Precision

Strategy.

• Buffer absorbs 10%, 20%, or 30% of loss depending on the Index Option you select, but you receive

a negative Performance Credit for losses greater than the

Buffer.

• Potential for large losses in any Term.

• More sensitive to large negative market movements because small or moderate negative market

movements are absorbed by the Buffer. In a period of

extreme negative market performance, the risk

of loss is greater with the Index Performance Strategy

than with the Index Guard Strategy.

• In extended periods of moderate to large negative market performance, 3-year and 6-year Terms may

provide less protection than the 1-year Terms because, in

part, the Buffer is applied over a longer

period of time.

|

|

What is the growth opportunity?

|

|

|

Index Protection

Strategy with Trigger

|

• Growth opportunity limited by the Trigger Rates.

• May perform best in periods of small positive market movements relative to the other Crediting

Methods, because such small positive market movements may

result in positive Performance Credits

that are greater than the Index Return while also

providing complete protection from any Index losses.

• These Trigger Rates will generally be less than Caps, and Index Precision Strategy's Trigger Rates.

Growth opportunity may be more or less than the Index

Dual Precision Strategy depending on Trigger

Rates.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

What is the growth opportunity?

|

|

|

Index Dual Precision

Strategy

|

• Growth opportunity limited by the Trigger Rates.

• May perform best in periods of small or moderate negative market movements as it provides a

positive Performance Credit in these environments while

other Crediting Methods do not.

• Generally less growth opportunity than the Index Precision Strategy and Index Performance Strategy.

• Growth opportunity may be more or less than the Index Protection Strategy with Trigger and Index

Guard Strategy depending on Trigger Rates and Caps.

|

|

Index Precision Strategy

|

• Growth opportunity limited by the Trigger Rates.

• May perform best in periods of small positive market movements.

• Generally more growth opportunity than the Index Protection Strategy with Trigger and Index Dual

Precision Strategy. However, less growth opportunity than

the Index Dual Precision Strategy during

periods of small or moderate negative market movements.

• Growth opportunity may be more or less than the Index Guard Strategy or Index Performance

Strategy depending on Trigger Rates and Caps.

|

|

Index Guard Strategy

|

• Growth opportunity limited by the Caps.

• May perform best in a strong market.

• Growth opportunity that generally may be matched or exceeded only by the Index Performance

Strategy. However, growth opportunity may be more or less

than the Index Dual Precision Strategy,

Index Precision Strategy, or Index Performance Strategy

depending on Trigger Rates and Caps.

|

|

Index Performance

Strategy

|

• Growth opportunity limited by the Caps and/or Participation Rates. If we do not declare a Cap for an

Index Option, there is

no maximum limit on the positive Index Return for that Index Option. In

addition, you can

receive more than the positive Index Return if the Participation Rate applies

and is greater than

its 100% minimum. However, the Participation Rate cannot boost Index

Returns beyond a

declared Cap.

• May perform best in a strong market.

• 1-year Term with 10% Buffer Index Options, 3-year Term with 10% or 20% Buffer Index Options, and

6-year Term with 10% or 20% Buffer Index Options have the

most growth opportunity.

• Growth opportunity for the 1-year Term with 20% or 30% Buffer may be less than the Index Dual

Precision Strategy, Index Precision Strategy, and Index

Guard Strategy depending on Trigger Rates

and Caps.

|

|

What can change within a Crediting

Method?

|

|

|

Index Protection

Strategy with Trigger

|

• Renewal and Early Reallocation Trigger Rates for existing Contracts can change on each Term Start

Date.

– 1-year Term has a 0.10% minimum Trigger Rate.

|

|

Index Dual Precision

Strategy

|

• Renewal and Early Reallocation Trigger Rates for existing Contracts can change on each Term Start

Date.

– 1-year Term with a 10%, 20%, or 30% Buffer has a 0.10% minimum Trigger Rate.

• The 10%, 20%, or 30% Buffers for the currently available Index Options cannot change. However, if

we add a new Index Option to your Contract after the

Issue Date, we establish the Buffer for it on the

date we add the Index Option to your Contract. The

minimum Buffer is 5% for a new Index Option.

|

|

Index Precision Strategy

|

• Renewal and Early Reallocation Trigger Rates for existing Contracts can change on each Term Start

Date.

– 1-year Term has a 0.10% minimum Trigger Rate.

• The 10% Buffers for the currently available Index Options cannot change. However, if we add a new

Index Option to your Contract after the Issue Date, we

establish the Buffer for it on the date we add

the Index Option to your Contract. The minimum Buffer is

5% for a new Index Option.

|

|

Index Guard Strategy

|

• Renewal and Early Reallocation Caps for existing Contracts can change on each Term Start Date.

– 1-year Term has a 0.10% minimum Cap.

• The -10% Floors for the currently available Index Options cannot change. However, if we add a new

Index Option to your Contract after the Issue Date, we

establish the Floor for it on the date we add the

Index Option to your Contract. The minimum Floor is -25%

for a new Index Option.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

What can change within a Crediting

Method?

|

|

|

Index Performance

Strategy

|

• Renewal and Early Reallocation Caps and/or Participation Rates for existing Contracts can change on

each Term Start Date.

– 1-year Term with 10%, 20%, or 30% Buffer has a 0.10% minimum Cap.

– 3-year Term with 10% or 20% Buffer has a 2% minimum Cap, and 100% minimum Participation Rate.

– 6-year Term with 10% or 20% Buffer has a 5% minimum Cap, and 100% minimum Participation Rate.

• The 10%, 20%, and 30% Buffers for the currently available Index Options cannot change. However, if

we add a new Index Option to your Contract after the

Issue Date, we establish the Buffer for it on the

date we add the Index Option to your Contract. The

minimum Buffer is 5% for a new Index Option.

|

|

• For any Index Option with the Index Dual Precision Strategy, Index Precision Strategy, or Index Performance

Strategy, you participate in any negative Index Return in excess of the Buffer, which reduces your Contract Value.

For example, for a 10% Buffer we absorb the first -10% of

Index Return and you could lose up to 90% of the Index

Option Value. However, for any Index Option with the Index Guard Strategy, we absorb any negative Index Return

in excess of the -10%

Floor, so your maximum loss is limited to -10% of the Index Option Value due to negative

Index Returns.

|

|

• Trigger Rates, Caps, and Participation Rates as set by us from time-to-time may vary substantially based on market

conditions. However, in extreme market environments, it is possible that all Trigger Rates, Caps, and Participation

Rates will be reduced

to their respective minimums of 0.10%, 2%, 5%, or 100% as stated in the table above.

|

|

• If your Contract is within its free look period you may be able to take advantage of any increase in initial Trigger

Rates, Caps, and/or Participation Rates by cancelling

your Contract and purchasing a new Contract.

|

|

• If the initial Trigger Rates, Caps, and/or Participation Rates available on the Index Effective Date are not acceptable

you have the following options.

|

|

– Cancel your Contract if you are still within the free look period. If you took a withdrawal that was subject to a

withdrawal charge (including financial adviser fees that

you choose to have us pay from this Contract) we will refund

any previously deducted withdrawal charge upon a free look

cancellation.

|

|

– Request to extend your Index Effective Date if you have not reached your first Quarterly Contract Anniversary.

|

|

– If the free look period has expired, request a full withdrawal and receive the Cash

Value. This withdrawal is subject to

withdrawal charges, income taxes, and may also be subject

to a 10% additional federal tax for amounts withdrawn

before age 59 1∕2. If this occurs on or before the Index

Effective Date, the Daily Adjustment does not apply. If this

occurs after the Index Effective Date, you are

subject to the Daily Adjustment.

|

|

• Trigger Rates, Caps, and Participation Rates can be different from Index Option to Index Option. For example,

Caps for the Index Performance Strategy 1-year Terms can

be different between the S&P 500® Index and the

Nasdaq-100® Index; and

Caps for the S&P 500® Index can be different between 1-year, 3-year, and 6-year Terms on

the Index Performance Strategy, and between the 1-year

Terms for the Index Guard Strategy and Index Performance

Strategy. Initial, renewal, and Early Reallocation rates may also be different from Contract-to-Contract. For

example, assume that on August 3, 2023 we set Caps for

the Index Performance Strategy 1-year Term with 10% Buffer

using the S&P 500® Index as

follows:

|

|

– 13% initial rate and 12% Early Reallocation rate for new Contracts issued in 2023,

|

|

– 14% renewal rate and 14% Early Reallocation rate for existing Contracts issued in 2022, and

|

|

– 12% renewal rate and 13% Early Reallocation rate for existing Contracts issued in 2021.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

|

First Index Option

|

Second Index Option

|

||

|

|

Index Option Value

|

Index Option Base

|

Index Option Value

|

Index Option Base

|

|

Prior to partial withdrawal

|

$ 75,000

|

$ 72,000

|

$ 25,000

|

$ 22,000

|

|

$10,000 partial withdrawal

|

– $7,500

|

– $7,200

|

– $2,500

|

– $2,200

|

|

|

|

|

|

|

|

After partial withdrawal

|

$ 67,500

|

$ 64,800

|

$ 22,500

|

$ 19,800

|

|

• Amounts removed from the Index Options during the Term for partial withdrawals you take (including any

financial adviser fees that you choose to

have us pay from this Contract) and deductions we make for Contract

fees and expenses do not receive a

Performance Credit on the Term End Date. However, the remaining amount

in the Index Options is eligible for a Performance Credit

on the Term End Date.

|

|

• You cannot specify from which Index Option or the Variable Option we deduct Contract fees and expenses; we

deduct Contract fees and expenses from each Index Option

and the Variable Option proportionately based on its

percentage of Contract Value.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

Crediting Method

and Term Length

|

If Index Value is less than it was

on the

Term Start Date

(i.e., Index Return is negative):

|

If Index Value is equal to or greater

than it was

on the Term Start Date

(i.e., Index Return is zero or positive):

|

|

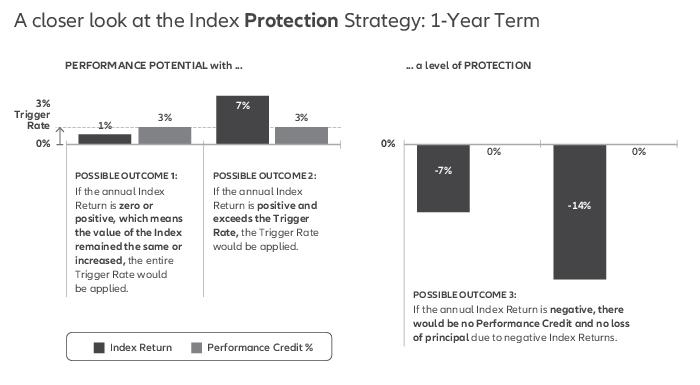

Index Protection

Strategy with Trigger

1-year Term

|

Performance Credit is zero.

|

Performance Credit is equal to the Trigger Rate set

on the Term Start Date.

|

|

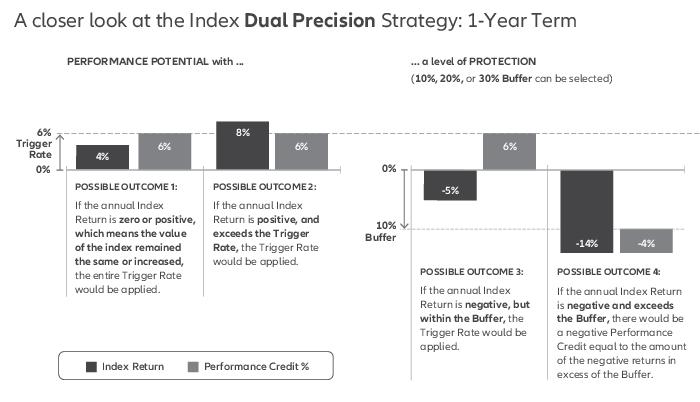

Index Dual Precision

Strategy 1-year Term

• For Contracts issued

from May 1, 2023, to

November 13, 2023, the

Index Dual Precision

Strategy is not available.

• For Contracts issued

from November 14, 2023,

to April 30, 2024, only

the 10% Buffer is

available.

• For Contracts issued

since May 1, 2024, the

10%, 20%, and 30%

Buffers are available.

|

Performance Credit is equal to the Trigger Rate if the

negative Index Return is less than or equal to the

10%, 20%, or 30% Buffer. However, if the negative

Index Return is greater than the 10%, 20%, or 30%

Buffer you receive a Performance Credit equal to the

negative Index Return in excess of the applicable

Buffer.

Assume you select a 1-year Term Index Option with

10% Buffer. If the Index Return for the year is…

• -8%, the Performance Credit is equal to the Trigger

Rate set on the Term Start Date.

• -12%, the Performance Credit is -2%.

Instead assume you

select a 1-year Term Index

Option with 20%

Buffer, and the Index Return for

the Term is…

• -19%, the Performance Credit is equal to the

Trigger Rate set on the Term Start Date.

• -24%, the Performance Credit is -4%.

Instead assume you

select a 1-year Term Index

Option with 30%

Buffer, and the Index Return for

the Term is…

• -29%, the Performance Credit is equal to the

Trigger Rate set on the Term Start Date.

• -36%, the Performance Credit is -6%.

|

Performance Credit is equal to the Trigger Rate set

on the Term Start Date.

|

|

Index Precision

Strategy 1-year Term

|

Performance Credit is equal to the negative Index

Return in excess of the 10% Buffer.

If the Index Return is…

• -8%, the Performance Credit is zero.

• -12%, the Performance Credit is -2%.

|

Performance Credit is equal to the Trigger Rate set

on the Term Start Date.

|

|

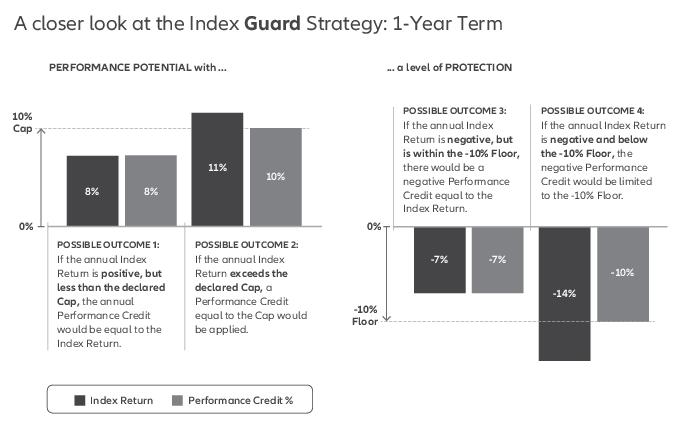

Index Guard Strategy

1-year Term

|

Performance Credit is equal to the negative Index

Return subject to the -10% Floor.

If the Index Return is…

• -8%, the Performance Credit is -8%.

• -12%, the Performance Credit is -10%.

|

Performance Credit is equal to the Index Return up

to the Cap set on the Term Start Date.

Assume the Cap is 8%. If the Index Return is…

• 0%, the Performance Credit is zero.

• 6%, the Performance Credit is 6%.

• 12%, the Performance Credit is 8%.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

Crediting Method

and Term Length

|

If Index Value is less than it was

on the

Term Start Date

(i.e., Index Return is negative):

|

If Index Value is equal to or greater

than it was

on the Term Start Date

(i.e., Index Return is zero or positive):

|

|

Index Performance

Strategy 1-year Term

• For Contracts issued

from May 1, 2023, to

November 13, 2023, only

the 10% Buffer is

available.

• For Contracts issued

since November 14,

2023, the 10%, 20%, and

30% Buffers are

available.

|

Performance Credit is equal to the negative Index

Return in excess of the 10%, 20%, or 30% Buffer.

Assume you select a 1-year Term Index Option with

10% Buffer. If the Index Return for the year is…

• -8%, the Performance Credit is zero.

• -12%, the Performance Credit is -2%.

Instead assume you

select a 1-year Term Index

Option with 20%

Buffer, and the Index Return for

the Term is…

• -19%, the Performance Credit is 0%.

• -24%, the Performance Credit is -4%.

Instead assume you

select a 1-year Term Index

Option with 30%

Buffer, and the Index Return for

the Term is…

• -29%, the Performance Credit is 0%.

• -36%, the Performance Credit is -6%.

|

Performance Credit is equal to the Index Return up

to any Cap set on the Term Start Date.

Assume the Cap for the 1-year Term is 8%. If the

Index Return for the year is…

• 0%, the Performance Credit is zero.

• 6%, the Performance Credit is 6%.

• 12%, the Performance Credit is 8%. If instead the

1-year Term is

uncapped, the Performance

Credit is 12%.

|

|

Index Performance

Strategy 3-year Term

|

Performance Credit is equal to the negative Index

Return in excess of the 10% or 20% Buffer.

Assume you select a 3-year Term Index Option with

10% Buffer. If the Index Return for the Term is…

• -19%, the Performance Credit is -9%.

• -24%, the Performance Credit is -14%.

Instead assume you

select a 3-year Term Index

Option with 20%

Buffer, and the Index Return for

the Term is…

• -19%, the Performance Credit is 0%.

• -24%, the Performance Credit is -4%.

|

Performance Credit is equal to the Index Return

multiplied by the Participation Rate, up to any Cap

set on the Term Start Date.

Assume the Participation Rate is 100% and the Cap

is 80%. If the Index Return for the Term is…

• 0%, the Performance Credit is zero.

• 65%, the Performance Credit is 65%.

• 90%, the Performance Credit is 80%.

If instead the

Participation Rate is 110% and the

3-year Term is uncapped, and the Index Return for

the Term is…

• 0%, the Performance Credit is zero.

• 65%, the Performance Credit is 71.5%.

• 90%, the Performance Credit is 99%.

|

|

Index Performance

Strategy 6-year Term

• For Contracts issued

from May 1, 2023, to

November 13, 2023, only

the 10% Buffer is

available.

• For Contracts issued

since November 14,

2023, the 10% and 20%

Buffers are available.

|

Performance Credit is equal to the negative Index

Return in excess of the 10% or 20% Buffer.

If the Index Return for the Term is…

• -19%, the Performance Credit is -9%.

• -24%, the Performance Credit is -14%.

Instead assume you

select a 6-year Term Index

Option with 20%

Buffer, and the Index Return for

the Term is…

• -19%, the Performance Credit is 0%.

• -24%, the Performance Credit is -4%.

|

Performance Credit is equal to the Index Return

multiplied by the Participation Rate, up to any Cap

set on the Term Start Date.

Assume the Participation Rate is 100% and the Cap

is 85%. If the Index Return for the Term is…

• 0%, the Performance Credit is zero.

• 65%, the Performance Credit is 65%.

• 90%, the Performance Credit is 85%.

If instead the

Participation Rate is 110% and the

6-year Term is uncapped, and the Index Return for

the Term is…

• 0%, the Performance Credit is zero.

• 65%, the Performance Credit is 71.5%.

• 90%, the Performance Credit is 99%.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

We will not provide

advice or notify you regarding whether you should execute a Performance Lock or Early

Reallocation or the

optimal time for doing so. We will not warn you if you execute a Performance Lock or Early

Reallocation at a

sub-optimal time. We are not responsible for any losses related to your decision whether or not to

execute a Performance

Lock or Early Reallocation.

|

5. Information Related to the Variable Option's Underlying Fund

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

Currently the Contract does not offer any variable

investment options to which you can allocate money. As such, and

given the design of the Contract, we do not believe there

to be a risk of excessive trading and market timing. However, if

we were to offer multiple variable investment options in

the future, they would be subject to the following provisions.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

This Contract is not designed for professional market

timing organizations, or other persons using programmed, large, or

frequent transfers, and we may restrict excessive or

inappropriate transfer activity.

|

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

6. Expenses

|

Issue Date

|

Non-Quarterly Contract Anniversaries

|

Quarterly Contract Anniversaries*

|

|

• The Charge Base is

equal to your initial

Purchase Payment.

• We begin calculating

and accruing the

daily rider fee, on

the day after the

Issue Date.

|

• First we calculate and accrue the daily rider fee,

using the Charge Base. If this is a non-Business

Day we use the Charge Base from the end of the

prior Business Day.

• Then if this is a Business Day we

increase/decrease the Charge Base as follows.

– If we receive an additional Purchase

Payment, we increase the Charge Base by

the dollar amount we receive.

– If you take a partial withdrawal (including any

financial adviser fees that you choose to have

us pay from this Contract), or we deduct

Contract fees and expenses other than the

withdrawal charge, we decrease the Charge

Base by the percentage of Contract Value

withdrawn (including any withdrawal charge).

All withdrawals you take reduce the Charge

Base, even Penalty-Free Withdrawals.

|

• First we process all daily transactions and

determine your Contract Value. Daily

transactions include any gains/losses due to AZL

Government Money Market Fund performance or

application of any Daily Adjustment (or

Performance Credit if this is also the Term End

Date), any additional Purchase Payment, any

partial withdrawals you take (including financial

adviser fees that you choose to have us pay from

this Contract and any withdrawal charge), and

deductions we make for other Contract fees and

expenses (including deduction of the accrued

daily rider fee for

the prior quarter). All partial

withdrawals you take reduce the Charge Base,

even Penalty-Free Withdrawals.

– We deduct the accrued rider fee for the prior

quarter on a dollar for dollar basis from the

Contract Value, and proportionately from each

Index Option and the Variable Option.

• Then we set the Charge Base equal to this

Contract Value and we calculate and accrue the

next quarter’s daily rider fee using the newly set

Charge Base.

* Or the next Business Day if the Quarterly Contract

Anniversary is a non-Business Day.

|

|

Example: Contract Value is $125,000; Charge

Base is $127,000; a $10,000 partial

withdrawal (including any withdrawal charge)

would decrease the Charge Base by $10,160.

[($10,000 ÷ $125,000) x $127,000]

Any increase/decrease to the Charge Base

will increase/decrease the daily rider fee we

calculate and accrue on the next day.

|

||

|

Examples of how we

calculate the rider fee are included in Appendix C.

|

||

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

• When calculating the Maximum Anniversary Value, we deduct all Contract fees and expenses on the Index

Anniversary (including the accrued rider fee if this is

also a Quarterly Contract Anniversary) before we capture any

annual investment gains. However, we do not treat the

deduction of the accrued rider fee as a withdrawal when

calculating the Maximum Anniversary Value (see section 10).

|

|

• If on a Quarterly Contract Anniversary (or the next Business Day if the Quarterly Contract Anniversary is a

non-Business Day) the Contract Value is less than the

accrued rider fee, we deduct your total remaining Contract

Value to cover the accrued rider fee and reduce your

Contract Value to zero.

|

|

Calculating a Withdrawal Charge

|

Example

|

|||

|

For purposes of calculating any withdrawal charge, we

withdraw

Purchase Payments on a “first-in-first-out” (FIFO) basis

and we

process withdrawal requests as follows.

|

You make an initial Purchase Payment of $55,000 and make

another Purchase Payment in the first month of the second

Contract Year of $45,000. In the third month of the third

Contract Year, your Contract Value is $110,000 and you

request a $70,000 withdrawal. We withdraw money and

compute the withdrawal charge as follows.

|

|||

|

1. First, we withdraw from Purchase Payments that we have had

for six or more complete years, which is your Contract’s

withdrawal charge period. This withdrawal is not subject

to a

withdrawal charge and it reduces the Withdrawal Charge

Basis

dollar for dollar.

|

1. Purchase Payments beyond the withdrawal charge

period. All payments are still within the withdrawal charge

period, so this does not apply.

|

|||

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

Calculating a Withdrawal Charge

|

Example

|

|||

|

2. Amounts available as a Penalty-Free Withdrawal. This includes

partial withdrawals you take during the Accumulation Phase

under the free withdrawal privilege or waiver of

withdrawal

charge benefit, and RMD payments you take under our

minimum distribution program. Penalty-Free Withdrawals are

not subject to a withdrawal charge, and they do not reduce

the

Withdrawal Charge Basis.

|

2. Amounts available as a Penalty-Free Withdrawal. You did

not take any other withdrawals this year, so the entire

free

withdrawal privilege (10% of your total Purchase Payments,

or $10,000) is available to you without incurring a

withdrawal

charge.

|

|||

|

3. Next, on a FIFO basis, we withdraw from Purchase Payments

within your Contract’s withdrawal charge period and assess

a

withdrawal charge. Withdrawing payments on a FIFO basis

may help reduce the total withdrawal charge because the

charge declines over time. We determine your total

withdrawal

charge by multiplying each payment by its applicable

withdrawal charge percentage and then totaling the

charges.

These withdrawals reduce the Withdrawal Charge Basis.

The withdrawal charge as a percentage of each Purchase

Payment withdrawn is as follows.

|

3. Purchase Payments within the withdrawal charge period

on a FIFO basis. The total amount we withdraw from the

first Purchase Payment is $55,000, which is subject to a

7%

withdrawal charge, and you receive $51,150. We determine

this amount as follows:

(amount withdrawn) x (1 – withdrawal charge) = the

amount you receive, or:

$55,000 x 0.93 = $51,150

The total amount we withdraw from the second Purchase

Payment is $9,620, which is subject to an 8% withdrawal

charge, and you receive $8,850. We determine this amount

as follows:

(amount withdrawn) x (1 – withdrawal charge) = the

amount you receive, or:

$9,620 x 0.92 = $8,850

|

|||

|

Number of

Complete Years

Since Purchase

Payment

|

Withdrawal Charge Amount

|

|

||

|

Contracts issued

on or before

April 30,2024

|

Contracts issued

on or after

May 1,2024

|

|

||

|

0

1

2

3

4

5

6 years or more

|

8.5%

8%

7%

6%

5%

4%

0%

|

8%

8%

7%

6%

5%

4%

0%

|

|

|

|

4. Finally, we withdraw any Contract earnings. This withdrawal is

not subject to a withdrawal charge and it does not reduce

the

Withdrawal Charge Basis.

|

4. Contract earnings. We already withdrew your requested

amount, so this does not apply.

In total we withdrew $74,620 from your

Contract, of

which you received $70,000 and paid a

withdrawal

charge of $4,620. We also reduced the 1st

Purchase

Payment from $55,000 to $0, and your 2nd

Purchase

Payment from $45,000 to $35,380 ($45,000

– $9,620).

Please note that this

example may differ from your

actual results due to

rounding.

|

|||

Allianz Index Advantage+ NF® Variable Annuity Prospectus – May 1, 2024

|

• Upon a full withdrawal, the free withdrawal privilege is not available to you, and we apply a withdrawal charge

against Purchase Payments that are still within the

withdrawal charge period, including amounts previously

withdrawn under the free withdrawal privilege. On a full withdrawal, your Withdrawal Charge Basis may be

greater than your Contract Value because

the following reduce your Contract Value, but do not reduce your

Withdrawal Charge Basis:

|

|

– prior Penalty-Free Withdrawals,

|

|

– deductions we make for Contract fees and expenses other than the withdrawal charge, and/or

|

|

– poor performance.

|

|

This also means that

upon a full withdrawal you may not receive any money.

|

|

• Withdrawals (including any financial adviser fees that you choose to have us pay from this Contract) are subject to

ordinary income taxes, and may also be

subject to a 10% additional federal tax for amounts withdrawn before

age 59 1∕2. The amount of Contract Value available for withdrawal is also affected by the Daily Adjustment

(which can be negative)