UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| (Mark One) |

| | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

|

| Vaxart, Inc. |

|

|

| (Exact Name of Registrant as Specified in its Charter) |

|

|

| |

| |

|

|

| (State or other jurisdiction of incorporation or organization) |

| (IRS Employer Identification No.) |

|

|

| |

| ( |

|

|

| (Address of principal executive offices, including zip code) |

| (Registrant’s telephone number, including area code) |

|

Securities registered pursuant to Section 12(b) of the Act:

|

| Title of each class |

| Trading symbol |

| Name of each exchange on which registered | |

|

|

|

| The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| | Smaller reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The Registrant had

FOR THE QUARTER ENDED March 31, 2024

TABLE OF CONTENTS

| Page |

||||

| Part I |

1 | |||

| Item 1. |

1 | |||

| Condensed Consolidated Balance Sheets as of March 31, 2024 and December 31, 2023 |

1 | |||

| 2 | ||||

| 3 | ||||

| Condensed Consolidated Statements of Cash Flows for the three months ended March 31, 2024 and 2023 |

5 | |||

| 6 | ||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 | ||

| Item 3. |

27 | |||

| Item 4. |

28 | |||

| Part II |

29 | |||

| Item 1. |

29 | |||

| Item 1A. |

29 | |||

| Item 2. |

30 | |||

| Item 3. |

30 | |||

| Item 4. |

30 | |||

| Item 5. |

30 | |||

| Item 6. |

31 | |||

| 33 | ||||

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Quarterly Report”) for the quarterly period ended March 31, 2024, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections, concerning our business, operations, and financial performance and condition as well as our plans, objectives, and expectations for business operations and financial performance and condition. Any statements contained herein that are not of historical facts may be deemed to be forward-looking statements. You can identify these statements by words such as “anticipate,” “assume,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “should,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends. These forward-looking statements are based on current expectations, estimates, forecasts, and projections about our business and the industry in which we operate and management’s beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Quarterly Report may turn out to be inaccurate. Factors that could materially affect our business operations and financial performance and condition include, but are not limited to, those risks and uncertainties described herein under “Item 1A. Risk Factors.” and those described in our Annual Report on Form 10-K for the year ended December 31, 2023, under “Item 1A. Risk Factors.” You are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. The forward-looking statements are based on information available to us as of the filing date of this Quarterly Report. Unless required by law, we do not intend to publicly update or revise any forward-looking statements to reflect new information or future events or otherwise. You should, however, review the risk factors we describe in the reports we will file from time to time with the Securities and Exchange Commission (the “SEC”) after the date of this Quarterly Report.

This Quarterly Report also contains market data related to our business and industry. These market data include projections that are based on a number of assumptions. If these assumptions turn out to be incorrect, actual results may differ from the projections based on these assumptions. As a result, our markets may not grow at the rates projected by these data, or at all. The failure of these markets to grow at these projected rates may harm our business, results of operations, financial condition and the market price of our common stock.

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

(Unaudited)

| March 31, 2024 | December 31, 2023 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Short-term investments | ||||||||

| Accounts receivable | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Right-of-use assets, net | ||||||||

| Intangible assets, net | ||||||||

| Goodwill | ||||||||

| Other long-term assets | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities and Stockholders’Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | $ | ||||||

| Other accrued current liabilities | ||||||||

| Current portion of operating lease liability | ||||||||

| Current portion of liability related to sale of future royalties | ||||||||

| Total current liabilities | ||||||||

| Operating lease liability, net of current portion | ||||||||

| Liability related to sale of future royalties, net of current portion | ||||||||

| Other long-term liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies (Note 8) | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock: $ par value; shares authorized; issued and outstanding as of March 31, 2024 and December 31, 2023 | ||||||||

| Common stock: $ par value; shares authorized as of March 31, 2024 and December 31, 2023; shares issued and shares outstanding as of March 31, 2024 and shares issued and shares outstanding as of December 31, 2023 | ||||||||

| Additional paid-in capital | ||||||||

| Treasury stock at cost, shares as of March 31, 2024 and shares as of December 31, 2023 | ( | ) | ( | ) | ||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Total stockholders’ equity | ||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2024 |

2023 |

|||||||

| Revenue: |

||||||||

| Non-cash royalty revenue related to sale of future royalties |

$ | $ | ||||||

| Revenue from government contracts |

||||||||

| Grant revenue |

||||||||

| Total revenue |

||||||||

| Operating expenses: |

||||||||

| Research and development |

||||||||

| General and administrative |

||||||||

| Total operating expenses |

||||||||

| Operating loss |

( |

) | ( |

) | ||||

| Other income (expense): |

||||||||

| Interest income |

||||||||

| Non-cash interest expense related to sale of future royalties |

( |

) | ( |

) | ||||

| Other expense, net |

( |

) | ( |

) | ||||

| Loss before income taxes |

( |

) | ( |

) | ||||

| Provision for income taxes |

||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| Net loss per share - basic and diluted |

$ | ( |

) | $ | ( |

) | ||

| Shares used to compute net loss per share - basic and diluted |

||||||||

| Comprehensive loss: |

||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| Unrealized (loss) gain on available-for-sale investments, net of tax |

( |

) | ||||||

| Comprehensive loss |

$ | ( |

) | $ | ( |

) | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Condensed Consolidated Statements of Stockholders’ Equity

For the Three Months Ended March 31, 2024

(In thousands, except share amounts)

(Unaudited)

| Accumulated | ||||||||||||||||||||||||||||||||

| Additional | Other | Total | ||||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | Paid-in | Accumulated | Comprehensive | Stockholders’ | |||||||||||||||||||||||||||

| Three Months Ended March 31, 2024 | Shares | Amount | Shares | Amount | Capital | Deficit | (Loss) Gain | Equity | ||||||||||||||||||||||||

| Balances as of December 31, 2023 | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

| Issuance of common stock under the September 2021 ATM, net of offering costs of $ | ||||||||||||||||||||||||||||||||

| Issuance of common stock under the 2024 Securities Purchase Agreement, net of offering costs of $ | ||||||||||||||||||||||||||||||||

| Issuance of common stock upon exercise of stock options | ||||||||||||||||||||||||||||||||

| Release of common stock for vested restricted stock units | ||||||||||||||||||||||||||||||||

| Repurchase of common stock to satisfy tax withholding | — | — | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||

| Stock-based compensation | — | — | ||||||||||||||||||||||||||||||

| Unrealized loss on available-for-sale investments | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Net loss | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Balances as of March 31, 2024 | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

VAXART, INC.

Condensed Consolidated Statements of Stockholders’ Equity

For the Three Months Ended March 31, 2023

(In thousands, except share amounts)

(Unaudited)

| Accumulated |

| |||||||||||||||||||||||||||||||

| Additional | Other | Total | ||||||||||||||||||||||||||||||

| Common Stock | Treasury Stock | Paid-in | Accumulated | Comprehensive | Stockholders’ | |||||||||||||||||||||||||||

| Three Months Ended March 31, 2023 | Shares | Amount | Shares | Amount | Capital | Deficit | (Loss) Gain | Equity | ||||||||||||||||||||||||

| Balances as of December 31, 2022 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||||||

| Issuance of common stock under the September 2021 ATM, net of offering costs of $ | ||||||||||||||||||||||||||||||||

| Release of common stock for vested restricted stock units | ||||||||||||||||||||||||||||||||

| Repurchase of common stock to satisfy tax withholding | — | — | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||

| Stock-based compensation | — | — | ||||||||||||||||||||||||||||||

| Unrealized gain on available-for-sale investments | — | — | ||||||||||||||||||||||||||||||

| Net loss | — | — | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Balances as of March 31, 2023 | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | $ | ||||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2024 |

2023 |

|||||||

| Cash flows from operating activities: |

||||||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Depreciation and amortization |

||||||||

| Amortization of discount on investments, net |

( |

) | ( |

) | ||||

| Stock-based compensation |

||||||||

| Non-cash interest expense related to sale of future royalties |

||||||||

| Non-cash revenue related to sale of future royalties |

( |

) | ( |

) | ||||

| Change in operating assets and liabilities: |

||||||||

| Accounts receivable |

( |

) | ||||||

| Prepaid expenses and other assets |

( |

) | ||||||

| Accounts payable |

( |

) | ||||||

| Deferred grant revenue |

( |

) | ||||||

| Other accrued liabilities |

( |

) | ( |

) | ||||

| Net cash used in operating activities |

( |

) | ( |

) | ||||

| Cash flows from investing activities: |

||||||||

| Purchases of property and equipment |

( |

) | ( |

) | ||||

| Purchases of investments |

( |

) | ||||||

| Proceeds from maturities of investments |

||||||||

| Net cash (used in) provided by investing activities |

( |

) | ||||||

| Cash flows from financing activities: |

||||||||

| Net proceeds from issuance of common stock through at-the-market facilities |

||||||||

| Net proceeds from issuance of common stock through the 2024 Securities Purchase Agreement |

||||||||

| Proceeds from issuance of common stock upon exercise of stock options |

||||||||

| Shares acquired to settle employee tax withholding liabilities |

( |

) | ( |

) | ||||

| Net cash provided by financing activities |

||||||||

| Net (decrease) increase in cash, cash equivalents and restricted cash |

( |

) | ||||||

| Cash, cash equivalents and restricted cash at beginning of the period |

||||||||

| Cash, cash equivalents and restricted cash at end of the period |

$ | $ | ||||||

| Supplemental reconciliation of cash, cash equivalents and restricted cash in the condensed consolidated balance sheets: | ||||||||

| Cash and cash equivalents |

$ | $ | ||||||

| Restricted cash |

||||||||

| Cash, cash equivalents and restricted cash shown in the condensed consolidated statements of cash flows at the end of the period |

$ | $ |

| Supplemental disclosure of non-cash investing and financing activity: |

||||||||

| Operating lease liabilities arising from obtaining right-of-use assets |

$ | $ | ||||||

| Acquisition of property and equipment included in accounts payable and accrued expenses |

$ | $ |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

NOTE 1. Organization and Nature of Business

General

Vaxart Biosciences, Inc. was originally incorporated in California in March 2004, under the name West Coast Biologicals, Inc. The Company changed its name to Vaxart, Inc. (“Private Vaxart”) in July 2007, and reincorporated in the state of Delaware. In February 2018, Private Vaxart completed a business combination with Aviragen Therapeutics, Inc. (“Aviragen”), pursuant to which Aviragen merged with Private Vaxart, with Private Vaxart surviving as a wholly-owned subsidiary of Aviragen (the “Merger”). Pursuant to the terms of the Merger, Aviragen changed its name to Vaxart, Inc. (together with its subsidiaries, the “Company” or “Vaxart”) and Private Vaxart changed its name to Vaxart Biosciences, Inc.

In January 2024, the Company entered into a securities purchase agreement (the “2024 Securities Purchase Agreement”) with RA Capital Healthcare Fund, L.P. pursuant to which

On September 15, 2021, the Company entered into a Controlled Equity Offering Sales Agreement (the “September 2021 ATM”), pursuant to which it may offer and sell, from time to time through sales agents, shares of its common stock having an aggregate offering price of up to $

The Company’s principal operations are based in South San Francisco, California, and it operates in reportable segment, which is the discovery and development of oral recombinant protein vaccines, based on its proprietary oral vaccine platform.

NOTE 2. Summary of Significant Accounting Policies

Basis of Presentation, Liquidity and Going Concern – The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and pursuant to the accounting and disclosure rules and regulations of the SEC assuming the Company will continue as a going concern.

The Company is a clinical-stage biotechnology company with no product sales. Its primary source of capital is from the sale and issuance of common stock and common stock warrants. As of March 31, 2024, the Company had cash, cash equivalents and investments of $

Based on management's current plan, the Company expects to have enough cash runway into late fourth quarter of 2024. If the Company is unable to raise additional capital in sufficient amounts or on acceptable terms, management’s plans include further reducing or delaying operating expenses. These conditions raise substantial doubt about the Company’s ability to continue as a going concern for a period of one year from the date of the issuance of these condensed consolidated financial statements. The accompanying condensed consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

The condensed consolidated balance sheet as of December 31, 2023, included in this filing, was derived from audited financial statements, but does not include all disclosures required by U.S. GAAP. Certain information and footnote disclosures normally included in consolidated financial statements have been condensed or omitted pursuant to these rules and regulations. These condensed consolidated financial statements should be read in conjunction with the Company’s audited financial statements and footnotes related thereto for the year ended December 31, 2023, included in the Company’s Annual Report on Form 10-K filed with the SEC on March 14, 2024 (the “Annual Report”). Unless noted below, there have been no material changes to the Company’s significant accounting policies described in Note 2 to the consolidated financial statements included in the Annual Report. In the opinion of management, the unaudited condensed consolidated financial statements include all adjustments (consisting only of normal recurring adjustments) necessary to present fairly the Company’s financial position and the results of its operations and cash flows. The results of operations for such interim periods are not necessarily indicative of the results to be expected for the full year or any future periods.

Basis of Consolidation – The unaudited condensed consolidated financial statements include the financial statements of Vaxart, Inc. and its subsidiaries. All significant transactions and balances between Vaxart, Inc. and its subsidiaries have been eliminated in consolidation.

Use of Estimates – The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and disclosure of contingent assets and liabilities in the financial statements and accompanying notes. Actual results and outcomes could differ from these estimates and assumptions.

Concentration of Credit Risk – Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash, cash equivalents, available-for-sale investments and accounts receivable. The Company places its cash, cash equivalents and available-for-sale investments at financial institutions that management believes are of high credit quality. The Company is exposed to credit risk in the event of default by the financial institutions holding the cash and cash equivalents to the extent such amounts are in excess of the federally insured limits. Losses incurred or a lack of access to such funds could have a significant adverse impact on the Company’s financial condition, results of operations, and cash flows.

The primary focus of the Company’s investment strategy is to preserve capital and meet liquidity requirements. The Company’s investment policy addresses the level of credit exposure by limiting the concentration in any one corporate issuer or sector and establishing a minimum allowable credit rating.

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

Recent Accounting Pronouncements

The Company has reviewed all significant newly-issued accounting pronouncements that are not yet effective and concluded that they are either not applicable to its operations or their adoption is not expected to have a material impact on its financial position or results of operations.

NOTE 3. Fair Value of Financial Instruments

Fair value accounting is applied for all financial assets and liabilities and nonfinancial assets and liabilities that are recognized or disclosed at fair value in the consolidated financial statements on a recurring basis (at least annually). Financial instruments include cash and cash equivalents, marketable securities, accounts receivable, accounts payable and accrued liabilities that approximate fair value due to their relatively short maturities.

Assets and liabilities recorded at fair value on a recurring basis in the consolidated balance sheets are categorized based upon the level of judgment associated with inputs used to measure their fair values. The accounting guidance for fair value provides a framework for measuring fair value and requires certain disclosures about how fair value is determined. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the reporting date. The accounting guidance also establishes a three-level valuation hierarchy that prioritizes the inputs to valuation techniques used to measure fair value based upon whether such inputs are observable or unobservable. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect market assumptions made by the reporting entity.

The three-level hierarchy for the inputs to valuation techniques is briefly summarized as follows:

Level 1 – Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date;

Level 2 – Inputs are observable, unadjusted quoted prices in active markets for similar assets or liabilities, unadjusted quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the related assets or liabilities; and

Level 3 – Unobservable inputs that are significant to the measurement of the fair value of the assets or liabilities that are supported by little or no market data.

The following table sets forth the fair value of the Company’s financial assets that are measured on a recurring basis as of March 31, 2024 and December 31, 2023 (in thousands):

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| March 31, 2024 | ||||||||||||||||

| Financial assets: | ||||||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| U.S. Treasury securities | ||||||||||||||||

| Total assets | $ | $ | $ | $ | ||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| December 31, 2023 | ||||||||||||||||

| Financial assets: | ||||||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| U.S. Treasury securities | ||||||||||||||||

| Total assets | $ | $ | $ | $ | ||||||||||||

The Company held

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

NOTE 4. Balance Sheet Components

| (a) | Cash, Cash Equivalents and Investments |

Cash, cash equivalents and investments consisted of the following (in thousands):

| Amortized | Gross Unrealized | Estimated | Cash and | Short-Term | ||||||||||||||||||||

| Cost | Gains | Losses | Fair Value | Cash Equivalents | Investments | |||||||||||||||||||

| March 31, 2024 | ||||||||||||||||||||||||

| Cash at banks | $ | $ | — | $ | — | $ | $ | $ | — | |||||||||||||||

| Money market funds | — | — | — | |||||||||||||||||||||

| U.S. Treasury securities | — | ( | ) | |||||||||||||||||||||

| Total | $ | $ | — | $ | ( | ) | $ | $ | $ | |||||||||||||||

| Amortized | Gross Unrealized | Estimated | Cash and | Short-Term | ||||||||||||||||||||

| Cost | Gains | Losses | Fair Value | Cash Equivalents | Investments | |||||||||||||||||||

| December 31, 2023 | ||||||||||||||||||||||||

| Cash at banks | $ | $ | — | $ | — | $ | $ | — | ||||||||||||||||

| Money market funds | — | — | — | |||||||||||||||||||||

| U.S. Treasury securities | — | ( | ) | — | ||||||||||||||||||||

| Total | $ | $ | — | $ | ( | ) | $ | $ | $ | |||||||||||||||

As of March 31,2024 and December 31, 2023, all investments were available-for-sale debt securities with remaining maturities of 12 months or less.

| (b) | Accounts Receivable |

Accounts receivable comprises royalties receivable of $

| (c) | Prepaid Expenses and Other Current Assets |

Prepaid expenses and other current assets consists of the following (in thousands):

| March 31, 2024 | December 31, 2023 | |||||||

| Prepaid clinical and manufacturing expenses | $ | $ | ||||||

| Unbilled revenue from government contracts | | |||||||

| Prepaid insurance | ||||||||

| Prepaid rent | ||||||||

| Interest receivable | ||||||||

| Other | ||||||||

| Prepaid expenses and other current assets | $ | $ | ||||||

| (d) | Property and Equipment, Net |

Property and equipment, net consists of the following (in thousands):

| March 31, 2024 | December 31, 2023 | |||||||

| Laboratory equipment | $ | $ | ||||||

| Office and computer equipment | ||||||||

| Leasehold improvements | ||||||||

| Construction in progress | ||||||||

| Total property and equipment | ||||||||

| Less: accumulated depreciation | ( | ) | ( | ) | ||||

| Property and equipment, net | $ | $ | ||||||

Depreciation expense was $

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

| (e) | Right-of-Use Assets, Net |

Right-of-use assets, net comprises facilities of $

| (f) | Intangible Assets, Net |

Intangible assets comprise developed technology and intellectual property. Intangible assets are carried at cost less accumulated amortization. As of March 31, 2024, developed technology and intellectual property had remaining lives of

| March 31, 2024 | December 31, 2023 | |||||||

| Developed technology | $ | $ | ||||||

| Intellectual property | ||||||||

| Total cost | ||||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Intangible assets, net | $ | $ | ||||||

Intangible asset amortization expense was $

As of March 31, 2024, the estimated future amortization expense by year is as follows (in thousands):

| Year Ending December 31, | Amount | |||

| 2024 (nine months remaining) | $ | |||

| 2025 | ||||

| 2026 | ||||

| 2027 | ||||

| 2028 | ||||

| Thereafter | ||||

| Total | $ | |||

| (g) | Goodwill |

Goodwill, which represents the excess of the purchase price over the fair value of assets acquired, comprises million as of March 31, 2024 and December 31, 2023. As of March 31, 2024, there have been indicators of impairment.

| (h) | Other Accrued Current Liabilities |

Other accrued current liabilities consist of the following (in thousands):

| March 31, 2024 | December 31, 2023 | |||||||

| Accrued compensation | $ | $ | ||||||

| Accrued clinical and manufacturing expenses | ||||||||

| Accrued professional and consulting services | ||||||||

| Other liabilities, current portion | ||||||||

| Total | $ | $ |

| |||||

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

NOTE 5. Revenue

Royalty Revenue Related to Sale of Future Royalties

The Company generates royalty revenue from the sale of Inavir in Japan, pursuant to a collaboration and license agreement that Aviragen entered into with Daiichi Sankyo Company, Limited (“Daiichi Sankyo”) in 2009. In September 2010, laninamivir octanoate was approved for sale by the Japanese Ministry of Health and Welfare for the treatment of influenza in adults and children, which Daiichi Sankyo markets as Inavir. Under the agreement, the Company currently receives a

Revenue from Government Contracts

On January 12, 2024, the Company was awarded a contract (the “2024 ASPR-BARDA Contract”) by the Biomedical Advanced Research and Development Authority (“BARDA”), a division of the Administration for Strategic Preparedness and Response (“ASPR”) within the U.S. Department of Health and Human Services with a base and all options value of $

Grant Revenue

In November 2022, the Company accepted a $

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

NOTE 6. Liabilities Related to Sale of Future Royalties

In April 2016, Aviragen entered into a Royalty Interest Acquisition Agreement (the “RIAA”) with HealthCare Royalty Partners III, L.P. (“HCRP”). Under the RIAA, HCRP made a $

For avoidance of doubt, the RIAA states, in the event there is a remaining cumulative remaining shortfall amount as of December 24, 2029, the Company shall not be obligated to pay HCRP any royalty payment beyond what the Company is paid from Daiichi Sankyo. The cumulative remaining shortfall amount is the aggregate amount of the remaining shortfall for each annual period, which was $

Under the relevant accounting guidance, due to a limit on the amount of royalties that HCRP can earn under the RIAA, this transaction was accounted for as a liability that is being amortized using the effective interest method over the life of the arrangement. The Company has no obligation to pay any amounts to HCRP other than to pass through to HCRP its share of royalties as they are received from Daiichi Sankyo. To record the amortization of the liability, the Company is required to estimate the total amount of future royalty payments to be received under the License Agreement and the payments that will be passed through to HCRP over the life of this agreement. Consequently, the Company imputes interest on the unamortized portion of the liability and records non-cash interest expense using an estimated effective interest rate. The royalties earned in each period that will be passed through to HCRP are recorded as non-cash royalty revenue related to sale of future royalties, with any excess not subject to pass-through being recorded as royalty revenue. When the pass-through royalties are paid to HCRP in the following quarter, the imputed liability related to sale of future royalties is commensurately reduced. The Company periodically assesses the expected royalty payments, and to the extent such payments are greater or less than the initial estimate, the Company adjusts the amortization of the liability and interest rate. As a result of this accounting, even though the Company does not retain HCRP’s share of the royalties, it will continue to record non-cash revenue related to those royalties until the amount of the associated liability, including the related interest, is fully amortized.

The following table shows the activity within the liability account during the three months ended March 31, 2024 (in thousands):

| Total liability related to sale of future royalties, start of period | $ | |||

| Non-cash royalty revenue paid to HCRP | ( | ) | ||

| Non-cash interest expense recognized | ||||

| Total liability related to sale of future royalties, end of period | ||||

| Current portion | ( | ) | ||

| Long-term portion | $ |

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

The Company has obtained the right of use for office and manufacturing facilities under operating lease agreements with initial terms exceeding one year. The lease term at the commencement date is determined by considering whether renewal options and termination options are reasonably assured of exercise.

In September 2021, the Company executed a lease for a facility in South San Francisco, California, with an initial term expiring on March 31, 2029. This lease has two separate components, one commenced in the third quarter of 2022 and the other in the first quarter of 2023, resulting in an additional right of use asset $

As of March 31, 2024, the weighted average discount rate for operating leases with initial terms of more than one year was

The following table summarizes the Company’s undiscounted cash payment obligations for its operating lease liabilities with initial terms of more than 12 months as of March 31, 2024 (in thousands):

| Year Ending December 31, | ||||

| 2024 (nine months remaining) | $ | |||

| 2025 | ||||

| 2026 | ||||

| 2027 | ||||

| 2028 | ||||

| Thereafter | ||||

| Undiscounted total | ||||

| Less: imputed interest | ( | ) | ||

| Present value of future minimum payments | ||||

| Current portion of operating lease liability | ( | ) | ||

| Operating lease liability, net of current portion | $ |

The Company is also required to pay for operating expenses related to the leased space. The operating expenses are incurred separately and were not included in the present value of lease payments. Operating lease expenses for the three months ended March 31, 2024 and 2023, are summarized as follows (in thousands):

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Lease cost | ||||||||

| Operating lease cost | $ | $ | ||||||

| Short-term lease cost | ||||||||

| Variable lease cost | ||||||||

| Sublease income | ( | ) | ||||||

| Total lease cost | $ | $ | ||||||

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

NOTE 8. Commitments and Contingencies

| (a) | Purchase Commitments |

As of March 31, 2024, the Company had approximately $

| (b) | Indemnifications |

In the ordinary course of business, the Company enters into agreements that may include indemnification provisions. Pursuant to such agreements, the Company may indemnify, hold harmless and defend indemnified parties for losses suffered or incurred by the indemnified party. Some of the provisions will limit losses to those arising from third-party actions. In some cases, the indemnification will continue after the termination of the agreement. The maximum potential amount of future payments the Company could be required to make under these provisions is not determinable. The Company has also entered into indemnification agreements with certain officers and directors which provide, among other things, that the Company will indemnify and advance expenses incurred in connection with certain actions, suits or proceedings to such officer or director, under the circumstances and to the extent provided for therein, for expenses, damages, judgments, fines and settlements he or she may be required to pay in actions or proceedings which he or she is or may be made a party by reason of his or her position as a director, officer or other agent of the Company, and otherwise to the fullest extent permitted under Delaware law and the Company’s Bylaws. The Company currently has directors’ and officers’ insurance.

| (c) |

From time to time the Company may be involved in legal proceedings arising in connection with its business. Based on information currently available, the Company believes that the amount, or range, of reasonably possible losses in connection with any pending actions against it in excess of established reserves, in the aggregate, is indeterminable to its consolidated financial condition or cash flows. However, any current or future dispute resolution or legal proceeding, regardless of the merits of any such proceeding, could result in substantial costs and a diversion of management’s attention and resources that are needed to run the Company successfully, and could have a material adverse impact on its business, financial condition and results of operations.

In August and September 2020, two substantially similar securities class actions were filed in the U.S. District Court for the Northern District of California. The first action, titled Himmelberg v. Vaxart, Inc. et al. was filed on August 24, 2020. The second action, titled Hovhannisyan v. Vaxart, Inc. et al. was filed on September 1, 2020 (together, the “Putative Class Action”). By Order dated September 17, 2020, the two actions were deemed related. On December 9, 2020, the court appointed lead plaintiffs and lead plaintiffs’ counsel.

On January 29, 2021, lead plaintiffs filed their consolidated amended complaint. On July 8, 2021, all defendants moved to dismiss the consolidated amended complaint. On May 14, 2021, the court granted lead plaintiffs’ request to amend the consolidated amended complaint and denied defendants’ motions to dismiss as moot. On June 10, 2021, lead plaintiffs filed a first amended consolidated complaint, and on August 9, 2021, lead plaintiffs filed a corrected first amended consolidated complaint. The first amended consolidated complaint, as corrected, named certain of Vaxart’s current and former executive officers and directors, as well as Armistice Capital, LLC (“Armistice”), as defendants. It claimed three violations of federal civil securities laws; violation of Section 10(b) of the Exchange Act and SEC Rule 10b-5, as against the Company and all individual defendants; violation of Section 20(a) of the Exchange Act, as against Armistice and all individual defendants; and violation of Section 20A of the Exchange Act against Armistice. The first amended consolidated complaint, as corrected, alleged that the defendants violated securities laws by misstating and/or omitting information regarding the Company’s development of a norovirus vaccine, the vaccine manufacturing capabilities of a business counterparty, and the Company’s involvement with Operation Warp Speed (“OWS”); and by engaging in a scheme to inflate Vaxart’s stock price. The first amended consolidated complaint sought certification as a class action for similarly situated shareholders and sought, among other things, an unspecified amount of damages and attorneys’ fees and costs. On July 8, 2021, all defendants moved to dismiss the first amended consolidated complaint. By Order dated December 22, 2021, the court granted the motion to dismiss by Armistice with leave to amend and otherwise denied the motions to dismiss. On July 27, 2022, lead plaintiffs filed a notice announcing that they had reached a partial settlement (the “Partial Settlement”) to resolve all claims against the Company and its current or former officers and/or directors in their capacity as officers and/or directors of the Company (the “Settling Defendants”). Pursuant to the Partial Settlement, the Company agreed to a settlement amount of $

On October 23, 2020, a complaint was filed in the U.S. District Court for the Southern District of New York, entitled Roth v. Armistice Capital LLC, et al. The complaint names Armistice and certain Armistice-related parties as defendants, asserting a violation of Exchange Act Section 16(b) and seeking the disgorgement of short-swing profits. The complaint purports to bring the lawsuit on behalf of and for the benefit of the Company and names the Company as a “nominal defendant” for whose benefit damages are sought. Following discovery, a motion for summary judgment was filed by Armistice and the Armistice-related party defendants to dismiss the complaint. On March 27, 2024, the court granted the motion for summary judgment and dismissed all claims in the complaint in their entirety. On April 11, 2024, the Plaintiff timely filed a notice of appeal of the court’s decision to the Second Circuit Court of Appeals, commencing appellate proceedings.

On January 8, 2021, a purported shareholder, Phillip Chan, commenced a pro se lawsuit in the U.S. District Court for the Northern District of California titled Chan v. Vaxart, Inc. et al. (the “Opt-Out Action”), opting out of the consolidated Himmelberg v. Vaxart, Inc. et al. and Hovhannisyan v. Vaxart, Inc. et al. class actions, (together, the “Putative Class Action”). Because this complaint is nearly identical to an earlier version of a complaint filed in the Putative Class Action, the Opt-Out Action has been stayed while the Putative Class Action is pending.

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

| (a) | Preferred Stock |

The Company is authorized to issue

| (b) |

As of March 31, 2024, the Company was authorized to issue

In January 2024, the Company entered into the 2024 Securities Purchase Agreement with RA Capital Healthcare Fund, L.P. pursuant to which

In the event of the Company’s voluntary or involuntary liquidation, dissolution, distribution of assets or winding-up, the holders of the common stock will be entitled to receive an equal amount per share of all the Company’s assets of whatever kind available for distribution to stockholders, after the rights of the holders of the preferred stock have been satisfied. There are no sinking fund provisions applicable to the common stock.

The Company had shares of common stock reserved for issuance as follows:

| March 31, 2024 | December 31, 2023 | |||||||

| Options issued and outstanding | ||||||||

| RSUs issued and outstanding | ||||||||

| 2019 Equity Incentive Plan available for future grant | ||||||||

| 2024 Inducement Award Plan available for future grant | ||||||||

| Common stock warrants | ||||||||

| 2022 Employee Stock Purchase Plan available for issuance | ||||||||

| Total | ||||||||

| (c) | Warrants |

The following warrants were outstanding as of March 31, 2024, all of which contain standard anti-dilution protections in the event of subsequent rights offerings, stock splits, stock dividends or other extraordinary dividends, or other similar changes in the Company’s common stock or capital structure, and none of which have any participating rights for any losses:

| Securities into which warrants are convertible | Warrants Outstanding | Exercise Price | Expiration Date | ||||||

| Common Stock | $ | April 2024 | |||||||

| Common Stock | $ | April 2024 | |||||||

| Common Stock | $ | March 2025 | |||||||

| Common Stock | $ | February 2025 | |||||||

| Common Stock | $ | December 2026 | |||||||

| Total | |||||||||

In April 2024,

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

NOTE 10. Equity Incentive Plans

On April 23, 2019, the Company’s stockholders approved the adoption of the 2019 Equity Incentive Plan (the “2019 Plan”), under which the Company is authorized to issue incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock awards, restricted stock units (“RSUs”), other stock awards and performance awards that may be settled in cash, stock, or other property. The 2019 Plan is designed to secure and retain the services of employees, directors and consultants, provide incentives for the Company’s employees, directors and consultants to exert maximum efforts for the success of the Company and its affiliates, and provide a means by which employees, directors and consultants may be given an opportunity to benefit from increases in the value of the Company’s common stock. Following adoption of the 2019 Plan, all previous plans were frozen, and on forfeiture, cancellation and expiration, awards under those plans are not assumed by the 2019 Plan.

The aggregate number of shares of common stock authorized for issuance under the 2019 Plan was initially

On February 27, 2024, the Company's board of directors adopted the Vaxart, Inc. 2024 Inducement Award Plan (the “2024 Inducement Plan”). The 2024 Inducement Plan was adopted without stockholder approval pursuant to Nasdaq Listing Rule 5635(c)(4) and is administered by the Compensation Committee of the board of directors or the independent members of the board of directors. The board of directors reserved

A summary of stock option and RSU transactions in the three months ended March 31, 2024, is as follows:

| Weighted | Weighted | |||||||||||||||||||

| Shares | Number of | Option Average | Unvested | RSU Average | ||||||||||||||||

| Available | Options | Exercise | RSU Shares | Grant Date | ||||||||||||||||

| For Grant | Outstanding | Price | Outstanding | Fair Value | ||||||||||||||||

| Balance as of January 1, 2024 | $ | $ | ||||||||||||||||||

| Authorized under 2024 Inducement Plan | | |||||||||||||||||||

| Granted | ( | ) | | $ | $ | |||||||||||||||

| Exercised | ( | ) | $ | |||||||||||||||||

| Released | ( | ) | $ | |||||||||||||||||

| Forfeited |

| | ( | ) | $ | ( | ) | $ | ||||||||||||

| Canceled | ( | ) | $ | |||||||||||||||||

| Balance as of March 31, 2024 | $ | $ | ||||||||||||||||||

As of March 31, 2024, there were

The Company received $

The weighted average grant date fair value of options awarded in the three months ended March 31, 2024 and 2023, was $

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Risk-free interest rate | % | % | ||||||

| Expected term (in years) | ||||||||

| Expected volatility | % | % | ||||||

| Dividend yield | % | % | ||||||

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

The Company measures the fair value of all stock-based awards on the grant date and records the fair value of these awards, net of estimated forfeitures, to compensation expense over the service period. Total stock-based compensation recognized for options, RSUs and ESPP was as follows (in thousands):

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Research and development | $ | $ | ||||||

| General and administrative | ||||||||

| Total stock-based compensation | $ | $ | ||||||

As of March 31, 2024, the unrecognized stock-based compensation cost related to outstanding unvested stock options and RSUs expected to vest was $

On August 4, 2022, the 2022 Employee Stock Purchase Plan (the “2022 ESPP”) was approved by the Company’s stockholders. The Company reserved

The estimated fair value used for the six-month offering period beginning December 1, 2023 and ending May 31, 2024, was $

| Six-Month Offering Period Ending May 31, 2024 | Six-Month Offering Period Ended May 31, 2023 | |||||||

| Risk-free interest rate | % | % | ||||||

| Expected term (in years) | ||||||||

| Expected volatility | % | % | ||||||

| Dividend yield | % | % | ||||||

NOTE 11. Net Loss Per Share Attributable to Common Stockholders

The following table presents the calculation of basic and diluted net loss per share (in thousands, except share and per share amounts):

| Three Months Ended March 31, |

||||||||

| 2024 |

2023 |

|||||||

| Net loss |

$ | ( |

) | $ | ( |

) | ||

| Shares used to compute net loss per share – basic and diluted |

||||||||

| Net loss per share – basic and diluted |

$ | ( |

) | $ | ( |

) | ||

No adjustment has been made to the net loss in the three months ended March 31, 2024 and 2023, as the effect would be anti-dilutive due to the net loss.

The following potentially dilutive weighted average securities were excluded from the computation of weighted average shares outstanding because they would have been antidilutive:

| Three Months Ended March 31, |

||||||||

| 2024 |

2023 |

|||||||

| Options to purchase common stock |

||||||||

| Restricted stock units to purchase common stock |

||||||||

| Warrants to purchase common stock |

||||||||

| Employee Stock Purchase Plan |

||||||||

| Total potentially dilutive securities excluded from denominator of the diluted earnings per share computation |

||||||||

VAXART, INC.

Notes to the Condensed Consolidated Financial Statements (Unaudited)

Note 12. Subsequent Events

Since March 31, 2024, the Company has issued

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our condensed consolidated financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q and with our audited consolidated financial statements included in our Annual Report on Form 10-K filed with the SEC on March 14, 2024. This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “goal,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential” and similar expressions intended to identify forward-looking statements and reflect our beliefs and opinions on the relevant subject. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and in this Quarterly Report on Form 10-Q. The forward-looking statements included in this Quarterly Report on Form 10-Q are made only as of the date hereof. These statements are based upon information available to us as of the filing date of this Quarterly Report on Form 10-Q, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and we caution investors against unduly relying upon these statements. In all events, we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, change in circumstances, future events or otherwise, and you are advised to consult any additional disclosures that we may make directly to you or through reports that we, in the future, may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

Company Overview and Background

We are a clinical-stage biotechnology company primarily focused on the development of oral recombinant vaccines based on our Vector-Adjuvant-Antigen Standardized Technology (“VAAST”) proprietary oral vaccine platform. We are developing prophylactic vaccine candidates that target a range of infectious diseases, including norovirus (a widespread cause of acute gastroenteritis), coronavirus including SARS-CoV-2 (the virus that causes coronavirus disease 2019 (“COVID-19”)), and influenza. In addition, we have generated preclinical data for our first therapeutic vaccine candidate targeting cervical cancer and dysplasia caused by human papillomavirus (“HPV”). Our oral vaccines are designed to generate broad and durable immune responses that may protect against a wide range of infectious diseases and may be useful for the treatment of chronic viral infections and cancer. Our investigational vaccines are administered using a room temperature-stable tablet, rather than by injection.

Vaxart Biosciences, Inc. was originally incorporated in California under the name West Coast Biologicals, Inc. in March 2004 and changed its name to Vaxart, Inc. (“Private Vaxart”) in July 2007, when it reincorporated in the state of Delaware. On February 13, 2018, Private Vaxart completed a reverse merger (the “Merger”) with Aviragen Therapeutics, Inc. (“Aviragen”), pursuant to which Private Vaxart survived as a wholly owned subsidiary of Aviragen. Under the terms of the Merger, Aviragen changed its name to Vaxart, Inc. and Private Vaxart changed its name to Vaxart Biosciences, Inc.

Our Product Pipeline

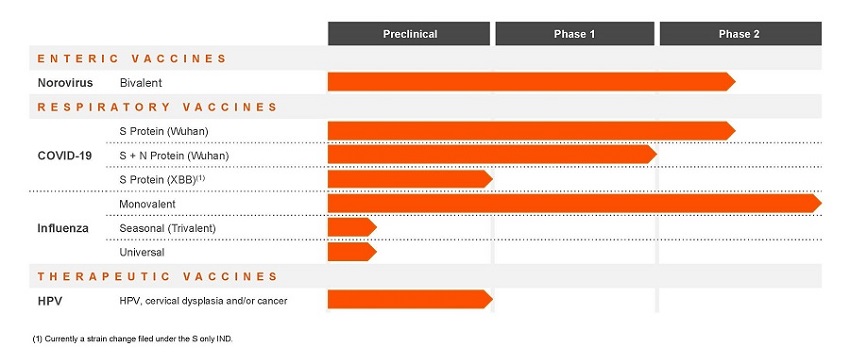

Figure 1. The following table outlines the status of our oral vaccine development programs:

We are developing the following tablet vaccine candidates, which are all based on our proprietary platform:

|

|

● |

Norovirus Vaccine. Norovirus is the leading cause of acute gastroenteritis symptoms, such as vomiting and diarrhea, among people of all ages in the United States. Each year, on average in the United States, norovirus causes 19 to 21 million cases of acute gastroenteritis and contributes to 109,000 hospitalizations and 900 deaths, mostly among young children and older adults. Virtually all norovirus disease is caused by norovirus GI and GII genotypes, and we are developing a bivalent vaccine candidate designed to protect against both. |

In September 2023, we announced that our Phase 2 GI.1 norovirus challenge study evaluating the safety, immunogenicity, and clinical efficacy of the GI.1 component of our bivalent norovirus vaccine candidate met five of six primary endpoints based on preliminary topline data. The study achieved its primary endpoints of a statistically significant 29% relative reduction in the rate of norovirus infection between the vaccinated and placebo arms, a strong induction of norovirus-specific immunoglobulin A (IgA) and immunoglobulin G (IgG) antibodies, and other immune response endpoints. Vaccination also led to a 21% relative reduction in norovirus acute gastroenteritis in the vaccine arm compared to placebo, but this was not statistically significant. In prespecified analyses, the study also showed an 85% relative decrease in viral shedding in the vaccine arm compared with placebo and no statistically significant difference in disease severity in the vaccinated cohort compared with placebo. The vaccine candidate was also safe and well tolerated with no vaccine-related serious adverse events.

In July 2023, we announced our Phase 2 placebo-controlled dose-ranging trial evaluating the safety and immunogenicity of our bivalent norovirus vaccine candidate met all primary endpoints and our bivalent norovirus vaccine candidate was well-tolerated with robust immunogenicity based on preliminary topline data. Preliminary results showed robust increases in serum antibody responses across both doses at Day 29 relative to Day 1. Placebo subjects did not have a measurable increase in the antibody response. The vaccine candidate also had a favorable safety profile that included no vaccine-related serious adverse events and no dose limiting toxicity. Adverse event rates for both doses were similar to placebo.

We expect to meet with the Food and Drug Administration (“FDA”) in the middle of 2024 to discuss data on correlates of protection, which will inform potential next steps, such as conducting a Phase 2b study and potentially a GII.4 challenge study. We expect the Phase 2b study would generate sufficient safety data to enable us to have an end of Phase 2 meeting with the FDA. The end of Phase 2 meeting will allow us to gain concurrence on the scope and design of the Phase 3 pivotal efficacy study in adults over 18 years of age.

In the Fall of 2022, we announced a Phase 1 study that would receive significant funding and support from the Bill and Melinda Gates Foundation to evaluate whether our bivalent norovirus vaccine candidate induces antibodies in the breast milk of lactating mothers and whether infants up to six months of age can acquire those antibodies by breastfeeding. Passive transfer of antibodies from mother to infant that are induced in milk may protect breastfeeding infants from infectious pathogens. We initiated this study in the fourth quarter of 2023 and announced positive top line results in April 2024. Top line results showed antibodies rose in lactating mothers who received the high dose of our bivalent vaccine candidate. Specifically, serum antibodies to norovirus rose on average 5.6 fold in response to the GI.1 virus strain and 4.4 fold in response to the GII.4 virus strain and breast milk antibodies to norovirus rose on average 4.0 fold in response to the GI.1 virus strain and 6.0 fold in response to the GII.4 virus strain. The vaccine was well tolerated with no vaccine-related serious adverse events and no dose-limiting pharmacotoxicity. As a grant recipient from the Bill and Melinda Gates Foundation, Vaxart has agreed to a global access commitment for use of its bivalent norovirus vaccine candidate, if proven effective and approved, in breastfeeding mothers from low- and middle-income countries.

We have also created additional norovirus GI.1 and GII.4 constructs that may be more potent than the constructs being evaluated in clinical trials. Regulatory feedback from our FDA meeting in the middle of 2024, along with the clinical data on current constructs, and preclinical data generated on new constructs will assist us in determining the best way to progress our norovirus program.

|

|

● |

Coronavirus Vaccine. COVID-19, a severe respiratory tract infection caused by the virus SARS-CoV-2, is a major cause of hospitalization and death in the U.S. and worldwide. According to the CDC, an outbreak of COVID-19 began in Wuhan, China, in late 2019 and rapidly spread worldwide. While most COVID-19 restrictions, such as stay-at-home orders, have been lifted, COVID-19 continues to spread and remains a public health threat, not least due to the continuing emergence of new variants. |

In September 2022, we announced the results from the first part of a two-part Phase 2 clinical study evaluating the safety and immunogenicity of our oral COVID-19 (spike (“S”) protein only) vaccine candidate VXA-CoV2-1.1-S met both its primary and secondary endpoints based on topline data. VXA-CoV2-1.1-S was able to boost the serum antibody responses for volunteers that previously received an mRNA vaccine (either Pfizer/BioNTech or Moderna). Serum neutralizing antibody responses to SARS-CoV-2 (Wuhan), a recognized correlate of protection, were boosted in this population from a geometric mean of 481 to 778, a fold rise of 1.6. Volunteers that had lower starting titers had larger increases than subjects that had higher titers. There were also substantial increases in the neutralizing antibody responses to the SARS-CoV-2 Omicron BA4/5 in these volunteers as measured by sVNT assay. Increases in the mucosal IgA antibody responses (antibodies in the nose and mouth) were observed in approximately 50% of subjects. Subjects that had an increase in the mucosal IgA response to SARS-CoV-2 Wuhan S had an increase in IgA responses to other coronaviruses including SARS-CoV-2 Omicron BA4/5, SARS-CoV-1, and MERS-CoV, demonstrating the cross-reactive nature of these immune readouts. We are not proceeding with the second part of the study.

In February 2021, we announced our Phase 1 study evaluating the safety and immunogenicity of our oral COVID-19 (S and nucleocapsid (“N”) proteins) vaccine candidate VXA-CoV2-1 met both its primary and secondary endpoints based on preliminary data. Initial results showing cross-reactive mucosal antibody responses were published in Science Translational Medicine. Additional detailed study results and mucosal durability data were reported in medRxiv in July 2022.

We have made a COVID-19 vaccine candidate that expresses only the S protein from the SARS-CoV-2 XBB strain. Based on preclinical data, our XBB COVID-19 vaccine candidate is more potent than our prior COVID-19 vaccine constructs. In January 2024, we were awarded a contract (the “2024 ASPR-BARDA Contract”) by the Biomedical Advanced Research and Development Authority (“BARDA”), a division of the Administration for Strategic Preparedness and Response (“ASPR”) within the U.S. Department of Health and Human Services, in an amount of $9.3 million to fund preparation for a Phase 2b clinical study involving 10,000 patients. This study will evaluate our XBB COVID-19 vaccine candidate compared to an approved mRNA vaccine comparator to measure efficacy for symptomatic and asymptomatic disease, systemic and mucosal immune induction, and adverse events.

We expect to initiate the Phase 2b clinical trial as early as the second quarter of 2024.

|

|

● |

Influenza Vaccine. Flu is a contagious respiratory illness caused by influenza viruses that infect the nose, throat, and sometimes the lungs. An estimated one billion cases of seasonal influenza occur annually worldwide, of which three to five million cases are considered severe, causing 290,000 to 650,000 deaths per year. In the United States, between 9,000,000 to 41,000,000 people catch influenza annually, between 140,000 and 710,000 people are hospitalized with complications of influenza, and between 12,000 and 52,000 people die from influenza and its complications each year. |

In September 2018, we completed a $15.7 million contract with BARDA under which a Phase 2 challenge study of our H1N1 flu vaccine candidate was conducted. We announced that, in healthy volunteers immunized and then experimentally infected with H1 influenza, our H1 influenza oral tablet vaccine candidate reduced clinical disease by 39% relative to placebo. Fluzone, the market-leading injectable quadrivalent influenza vaccine, reduced clinical disease by 27%. Our tablet vaccine candidate also showed a favorable safety profile, indistinguishable from placebo.

In October 2018, we presented data from the study demonstrating that our vaccine candidate elicited a significant expansion of mucosal homing receptor plasmablasts to approximately 60% of all activated B cells. We believe these mucosal plasmablasts are a key indicator of a protective mucosal immune response and a unique feature of our vaccine candidates.

We have also initiated early-stage development on novel vaccine constructs containing our own antigens to develop a universal influenza vaccine candidate. We had previously produced a non-GMP oral vaccine candidate containing certain proprietary antigens from Janssen Vaccines & Prevention B.V. (“Janssen”) and tested the candidate in a preclinical challenge model. The preclinical study has been completed and we have submitted a report to Janssen. In August 2023, Janssen announced it would exit all vaccine and infectious disease R&D programs aside from an E. coli preventive vaccine and continuing to provide access to marketed HIV products.

The Company intends to work with governments around the world to create pandemic monovalent influenza vaccines for emergency use or stockpiling, if requested. We are also continuing development of our preclinical seasonal and universal influenza vaccine candidates.

|

|

● |

HPV Therapeutic Vaccine. Cervical cancer is the fourth most common cancer in women worldwide and in the United States with about 13,000 new cases diagnosed annually in the United States according to the National Cervical Cancer Coalition. Our first therapeutic oral vaccine candidate targets HPV 16 and HPV 18, the two strains responsible for 70% of cervical cancers and precancerous cervical dysplasia. |

We have tested our HPV 16 vaccine candidate in two different HPV 16 solid tumor models in mice. The HPV 16 vaccine candidate elicited T cell responses and promoted migration of the activated T cells into the tumors, leading to tumor cell killing. Mice that received our HPV 16 vaccine candidate showed a significant reduction in volume of their established tumors.

In October 2018, we filed a pre-IND meeting request with the FDA for our first therapeutic vaccine candidate targeting HPV 16 and HPV 18 and we subsequently submitted our pre-IND briefing package. We received feedback from the FDA in January 2019 to support submission of an IND application to support initiation of clinical testing.

The Company remains engaged in discussions with regulatory agencies, governments, non-governmental organizations and other potential strategic parties to determine the best way to progress its HPV program.

Antivirals

|

|

● |

Through the Merger, we acquired two royalty earning products, Relenza and Inavir. We also acquired three Phase 2 clinical stage antiviral compounds and subsequently discontinued independent development of these compounds. However, for one of these, Vapendavir, we entered into an exclusive worldwide license agreement with Altesa Biosciences, Inc. (“Altesa”) in July 2021, permitting Altesa to develop and commercialize this capsid-binding broad-spectrum antiviral. In May 2022, Altesa announced its intention to initiate clinical trials. |

|

|

● |

Relenza and Inavir are antivirals for the treatment of influenza, marketed by GlaxoSmithKline, plc (“GSK”) and Daiichi Sankyo Company, Limited (“Daiichi Sankyo”), respectively. We have earned royalties on the net sales of Relenza and Inavir in Japan. The last patent for Relenza expired in July 2019 and the last patent for Inavir expires in August 2036. Sales of these antivirals vary significantly by quarter, because influenza virus activity displays strong seasonal cycles, and by year depending on the intensity and duration of the flu season, the impact COVID-19 has had, and may continue to have, on seasonal influenza, and competition from other antivirals such as Tamiflu and Xofluza. |

Financial Operations Overview

Revenue

Non-Cash Royalty Revenue Related to Sale of Future Royalties

In April 2016, Aviragen sold certain royalty rights related to Inavir in the Japanese market for $20.0 million to HealthCare Royalty Partners III, L.P. (“HCRP”). Under the terms of our agreement with HCRP, during the first royalty interest period of April 1, 2016 through March 31, 2025, HCRP is entitled to the first $3.0 million and any cumulative remaining shortfall amount plus 15% of the next $1.0 million in royalties earned in each year commencing on April 1, with any excess revenue being retained by us. Further, during the second royalty interest period beginning April 1, 2025 and ending on December 24, 2029, HCRP is entitled to the first $2.7 million and any cumulative remaining shortfall amount plus 15% of the next $1.0 million in royalties, with any excess revenue being retained by us. A shortfall occurs when, during an annual period ending on March 31st, for the first royalty interest period of April 1, 2016 through March 31, 2025, royalty payments fall below $3.0 million; and $2.7 million for the second royalty interest period of April 1, 2025 and ending on December 24, 2029, excluding the period of April 1, 2028 through December 24, 2029. In the event there is a remaining cumulative remaining shortfall amount as of December 24, 2029, then, for so long as the Company continues to receive royalties from Daiichi Sankyo Company Limited (“Daiichi Sankyo”), the sum of those royalties will be paid to HCRP until the cumulative remaining shortfall amount has been paid in full.

For avoidance of doubt, we are not obligated to pay HCRP any royalty payment beyond what we are paid by Daiichi Sankyo. The cumulative remaining shortfall amount is the aggregate amount of the shortfall for each annual period, which was $6.0 million as of March 31, 2024.

Revenue from Government Contracts

On January 12, 2024, we were awarded the 2024 ASPR-BARDA Contract providing for potential funding of up to $9.3 million. Under the 2024 ASPR-BARDA Contract, we received an award to support clinical trial planning activities for a Phase 2b clinical trial that would compare our XBB vaccine candidate to an mRNA comparator to evaluate efficacy for symptomatic and asymptomatic disease, systemic and mucosal immune induction, and adverse events. We recognized revenue from government contracts of $1.6 million for the three months ended March 31, 2024, based on the achievement of certain milestones under the 2024 ASPR-BARDA Contract.

Grant Revenue

In November 2022, we accepted a grant of $3.5 million to perform research and development work for the Bill & Melinda Gates Foundation (the “BMGF Grant”) and received $2.0 million in advance that was recorded as restricted cash and deferred revenue. We received an additional $1.5 million in July 2023 upon completion of certain milestones. We recognize revenue under research contracts only when a contract is executed and the contract price is fixed or determinable. Revenue from the BMGF Grant was recognized in the period during which the related costs were incurred and the related services rendered, as the applicable conditions under the contract were met. Costs of contract revenue were recorded as a component of operating expenses in the consolidated statements of operations and comprehensive loss. We fully recognized revenue from the BMGF Grant during the year ended December 31, 2023.

Research and Development Expenses

Research and development expenses represent costs incurred on conducting research, such as developing our tablet vaccine platform, and supporting preclinical and clinical development activities of our tablet vaccine candidates. We recognize all research and development costs as they are incurred. Research and development expenses consist primarily of the following:

| ● |

employee-related expenses, which include salaries, benefits and stock-based compensation; |

|

|

● |

expenses incurred under agreements with contract research organizations (“CROs”), that conduct clinical trials on our behalf; |

| ● |

expenses incurred under agreements with contract manufacturing organizations (“CMOs”), that manufacture product used in the clinical trials; |

| ● |

expenses incurred in procuring materials and for analytical and release testing services required to produce vaccine candidates used in clinical trials; |

| ● |

process development expenses incurred internally and externally to improve the efficiency and yield of the bulk vaccine and tablet manufacturing activities |

| ● |

laboratory supplies and vendor expenses related to preclinical research activities; |

| ● |

consultant expenses for services supporting our clinical, regulatory and manufacturing activities; and |

| ● |

facilities, depreciation and allocated overhead expenses. |

We do not allocate our internal expenses to specific programs. Our employees and other internal resources are not directly tied to any one research program and are typically deployed across multiple projects. Internal research and development expenses are presented as one total.

We have incurred significant external costs for CROs that conduct clinical trials on our behalf, and for CMOs that manufacture our tablet vaccine candidates, although these costs have decreased since 2022 since we now perform the majority of our manufacturing activities in-house. We have captured these external costs for each vaccine program. We do not allocate external costs incurred on preclinical research or process development to specific programs.

The following table shows our period-over-period research and development expenses, identifying external costs that were incurred in each of our vaccine programs and, separately, on preclinical research and process development (in thousands):

| Three Months Ended March 31, |

||||||||

| 2024 |

2023 |

|||||||

| External program costs: |

||||||||

| Norovirus program |

$ | 1,002 | $ | 2,704 | ||||

| COVID-19 program |

2,963 | 1,678 | ||||||

| Preclinical research |

723 | 465 | ||||||

| Process development |

35 | 520 | ||||||

| Total external costs |

4,723 | 5,367 | ||||||

| Internal costs |

14,290 | 14,255 | ||||||

| Total research and development |

$ | 19,013 | $ | 19,622 | ||||

We expect to incur significant research and development expenses in 2024 and beyond as we advance our tablet vaccine candidates into and through clinical trials, pursue regulatory approval of our tablet vaccine candidates and prepare for a possible commercial launch, all of which will also require a significant investment in manufacturing and inventory related costs. To the extent that we enter into licensing, partnering or collaboration agreements, a significant portion of such costs may be borne by third parties.

The process of conducting clinical trials necessary to obtain regulatory approval is costly and time consuming. We may never succeed in achieving marketing approval for our tablet vaccine candidates. The probability of successful commercialization of our tablet vaccine candidates may be affected by numerous factors, including clinical data obtained in future trials, competition, manufacturing capability and commercial viability. As a result, we are unable to determine the duration and completion costs of our research and development projects or when and to what extent we will generate revenue from the commercialization and sale of any of our tablet vaccine candidates.

General and Administrative Expense

General and administrative expenses consist of personnel costs, insurance, allocated expenses and expenses for outside professional services, including legal, audit, accounting, public relations, market research and other consulting services. Personnel costs consist of salaries, benefits and stock-based compensation. Allocated expenses consist of rent, depreciation and other facilities related expenses.

Results of Operations

The following table presents period-over-period changes in selected items in the condensed consolidated statements of operations and comprehensive loss for the three months ended March 31, 2024 and 2023 (in thousands, except percentages):

| Three Months Ended March 31, |

||||||||||||

| 2024 |

2023 |

% Change |

||||||||||

| Revenue |

$ | 2,181 | $ | 675 | * | |||||||

| Operating expenses |

26,251 | 26,247 | 0 | % | ||||||||

| Operating loss |

(24,070 | ) | (25,572 | ) | (6) | % | ||||||

| Net non-operating income (expense) |

(302 | ) | 461 | * | ||||||||

| Loss before income taxes |

(24,372 | ) | (25,111 | ) | (3) | % | ||||||

| Provision for income taxes |

45 | 29 | 55 | % | ||||||||

| Net loss |

$ | (24,417 | ) | $ | (25,140 | ) | (3) | % | ||||

* Percentages greater than 100% or not meaningful

Total Revenue

The following table summarizes the period-over-period changes in our revenues for the three months ended March 31, 2024 and 2023 (in thousands, except percentages):

| Three Months Ended March 31, |

||||||||||||

| 2024 |

2023 |

% Change |

||||||||||

| Non-cash royalty revenue related to sale of future royalties |

$ | 585 | $ | 278 | * | |||||||

| Revenue from government contracts |

1,596 | — | 100 | % | ||||||||

| Grant revenue |

— | 397 | (100 | )% | ||||||||

| Total revenue |