Exhibit 99.1

Franklin Financial Services Corporation Subordinated Notes Offering Presentation July 2020

Forward-Looking Disclaimer This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the financial condition, liquidity, results of operations, future performance, and business of the Company. These forward-looking statements are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that are not historical facts. Forward-looking statements include statements with respect to beliefs, plans, objectives, goals, expectations, anticipations, estimates, and intentions that are subject to significant risks and uncertainties and are subject to change based on various factors (some of which are beyond our control). Forward-looking statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook,” or similar expressions, or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Such known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from the statements include, but are not limited to: (i) changes in general business, industry or economic conditions, or competition; (ii) changes in any applicable law, rule, regulation, policy, guideline, or practice governing or affecting financial holding companies and their subsidiaries or with respect to tax or accounting principles or otherwise; (iii) adverse changes or conditions in capital and financial markets; (iv) changes in interest rates; (v) higher-than-expected costs or other difficulties related to integration of combined or merged businesses; (vi) the inability to realize expected cost savings or achieve other anticipated benefits in connection with business combinations and other acquisitions; (vii) changes in the quality or composition of our loan and investment portfolios; (viii) adequacy of loan loss reserves; (ix) increased competition; (x) loss of certain key officers; (xi) continued relationships with major customers; (xii) deposit attrition; (xiii) rapidly changing technology; (xiv) unanticipated regulatory or judicial proceedings and liabilities and other costs; (xv) changes in the cost of funds, demand for loan products, or demand for financial services; (xvi) other economic, competitive, governmental, or technological factors affecting our operations, markets, products, services, and prices; (xvii) the impact of the COVID-19 pandemic, and the micro, macro, and industry-specific economic effects thereof; and (xviii) our success at managing the foregoing items, as well as those items discussed under Item 1A - Risk Factors in our Annual Report on Form 10-K, as supplemented or amended by our subsequent filings with the Securities and Exchange Commission. Such developments could have an adverse impact on our financial position and our results of operations. Investment in the securities offered herein involves a high degree of risk. You should carefully consider the following risk factors related to this offering: (1) the notes will be unsecured and subordinated to any future senior indebtedness; (2) the notes will not be insured or guaranteed by the FDIC, any other governmental agency or any of our subsidiaries. The notes will be structurally subordinated to the indebtedness and other liabilities of our subsidiaries, which means that creditors of our subsidiaries generally will be paid from those subsidiaries’ assets before holders of the notes would have any claims to those assets; (3) the notes do not contain any limitations on our ability to incur additional indebtedness, grant or incur a lien on our assets, sell or otherwise dispose of assets, pay dividends or repurchase our capital stock; (4) payments on the notes will depend on receipt of dividends and distributions from our subsidiaries; (5) we may not be able to generate sufficient cash to service all of our debt, including the notes; (6) regulatory guidelines may restrict our ability to pay the principal of, and accrued and unpaid interest on, the notes, regardless of whether we are the subject of an insolvency proceeding; (7) holders of the notes will have limited rights, including limited rights of acceleration, if there is an event of default. The forward-looking statements are based upon management’s beliefs and assumptions. Any forward-looking statement made herein speaks only as of the date of this presentation. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward- looking statement, whether as a result of new information, future developments, or otherwise, except as may be required by law. Potential investors should not rely on forward-looking statements as predictions of future performance. The securities described in this presentation will not be deposits of the Bank nor any of our affiliates or other subsidiaries. The securities described in this presentation will be offered only to select potential investors without a general solicitation in reliance on exemptions from registration under state and federal securities laws. This presentation is confidential in nature and is not to be provided to any person other than the original potential investor to whom it was directed and to that person’s personnel and advisers who have a need to access this information for purposes of a possible investment by the original recipient of this presentation. The securities described in this presentation will be offered only by a definitive purchase agreement, and only the representations, warranties and agreements contained in that agreement are to be relied upon by a potential investor. The securities described in this presentation will not be registered for public sale and will be subject to restrictions on resale and will be subject to significant limitations on their liquidity. Only potential investors who can bear the risk of an unregistered illiquid investment should consider investment in the securities described herein. Franklin Financial Services Corporation 2

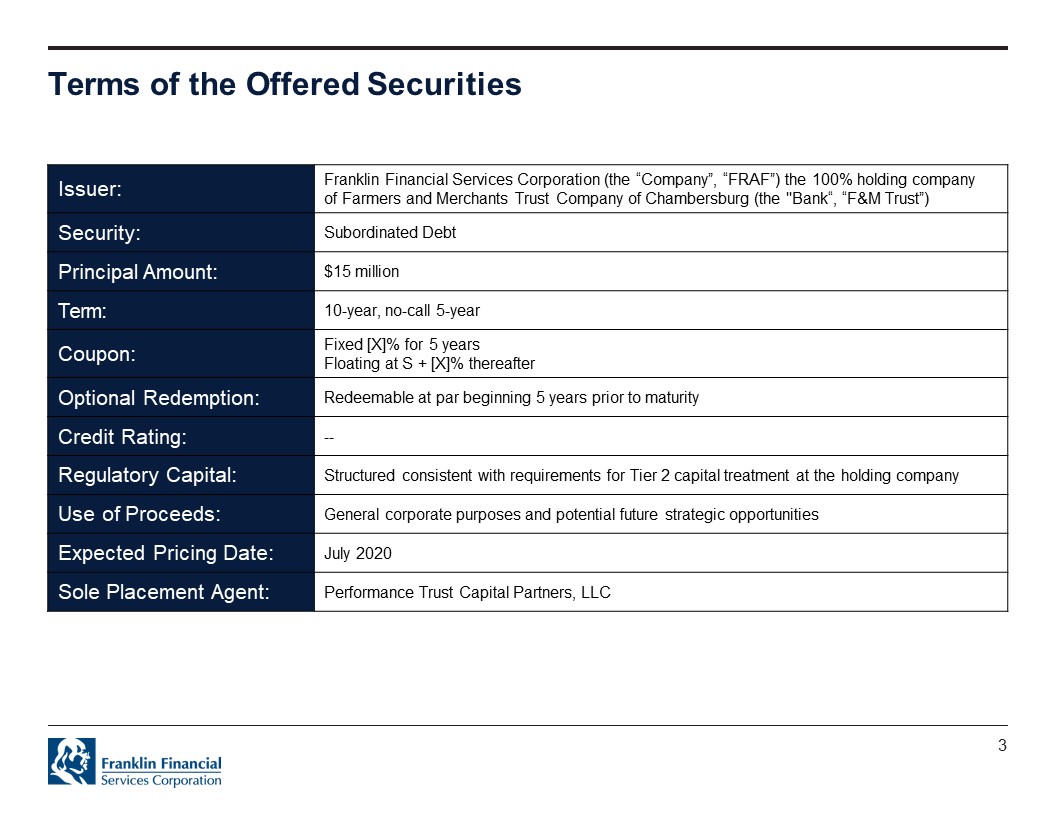

Terms of the Offered Securities Issuer: Franklin Financial Services Corporation (the “Company”, “FRAF”) the 100% holding company of Farmers and Merchants Trust Company of Chambersburg (the "Bank“, “F&M Trust”) Security: Subordinated Debt Principal Amount: $15 million Term: 10-year, no-call 5-year Coupon: Fixed [X]% for 5 years Floating at S + [X]% thereafter Optional Redemption: Redeemable at par beginning 5 years prior to maturity Credit Rating: -- Regulatory Capital: Structured consistent with requirements for Tier 2 capital treatment at the holding company Use of Proceeds: General corporate purposes and potential future strategic opportunities Expected Pricing Date: July 2020 Sole Placement Agent: Performance Trust Capital Partners, LLC Franklin Financial Services Corporation 3

Pro Forma Capital Structure and Regulatory Capital Ratios Note: For illustrative purposes, bank capital ratios assumes 90% ($13.5 million) of $15 million in proceeds raised is down-streamed to the bank. At March 31, 2020 $124,349 $10,637 Pro Forma $124,349 $15,000 $10,637 Common Equity Tier Capital Sub Debt ALLL Consolidated Pro Forma Regulatory Capital Actual 03/31/20 Sub Debt Adj. Pro Forma 03/31/20 Common Equity Before Adjustments $129,006 $ - $129,005 Less: Goodwill Net of DTLs 9,016 – 9,016 Less: Def Ben Postretirement Plans (6,171) – (6,171) Less: AOCI - Unrealized Gains 1,811 – 1,811 Common Equity Tier 1 Capital Pre-Deductions 124,349 – 124,349 Additional Tier 1 Capital - - - Total Tier 1 Capital S 124.349 S 124.349 Tier 2 Capital Instruments $ - $ 15,000 $ 15,000 ALLL Includable in Tier 2 Capital Total Tier 2 Capital 10,637 – 10,637 10,637 15,000 25,637 Total Capital $134,986 $149,986 Average Total Consolidated Assets 1,266,130 15,000 1,281,130 Less: Deductions from CET1 and Additional T1 9,016 – 9,016 Less: Other Deductions from Leverage Ratio (6,171) – (6,171) Total Assets for Leverage Ratio 1,263,285 1,278,285 Total Risk-Weighted Assets 844,560 3,000 847,560 Common Equity Tier 1 Ratio 14.72% 14.67% Leverage Ratio 9.84% 9.73% Tier 1 Risk-Based Ratio 14.72% 14.67% Total Risk-Based Capital Ratio 15.98% 17.70% Bank Level Pro Forma Regulatory Capital Actual 03/31/20 Sub Debt Adj. Pro Forma 03/31/20 Common Equity Before Adjustments $ 127,267 $ 13,500 4 140,767 Less: Goodwill & Intangible Assets Net of DTLs 9.016 – 9.016 Less: Def Ben Postretirement Plans (6,171) – (6,171) Less: AOCI – Unrealized Gains 1,811 – 1,811 Common Equity Tier 1 Capital 122,611 13,500 136,111 Additional Tier 1 Capital - - Total Tier 1 Capital $ 122,611 $ 136,111 Tier 2 Capital Instruments $ - $ - ALLL Includable in Tier 2 Capital 10,637 – 10,637 Total Tier 2 Capital 10,637 10,637 Total Capital $133,248 $146,748 Average Total Assets 1,266,130 13,500 1,279,630 Less: Deductions from CET1 and Additional T1 9,016 – 9,016 Less: Other Deductions from Leverage Ration 1,263,285 1,276,785 Total Risk Weighted Assets 844,560 2,700 847,260 Common Equity Tier 1 Ration 14.52% 16.06% Leverage Ratio 9.71% 10.66% Tier 1 Risk-Based Ratio 14.52% 16.06% Total Risk-Based Capital Ratio 15.78% 17.32% Source: S&P Global Market Intelligence Note: Invested proceeds from $15.0 million capital raise assumed to have 20% risk-weighting Franklin Financial Services Corporation 4

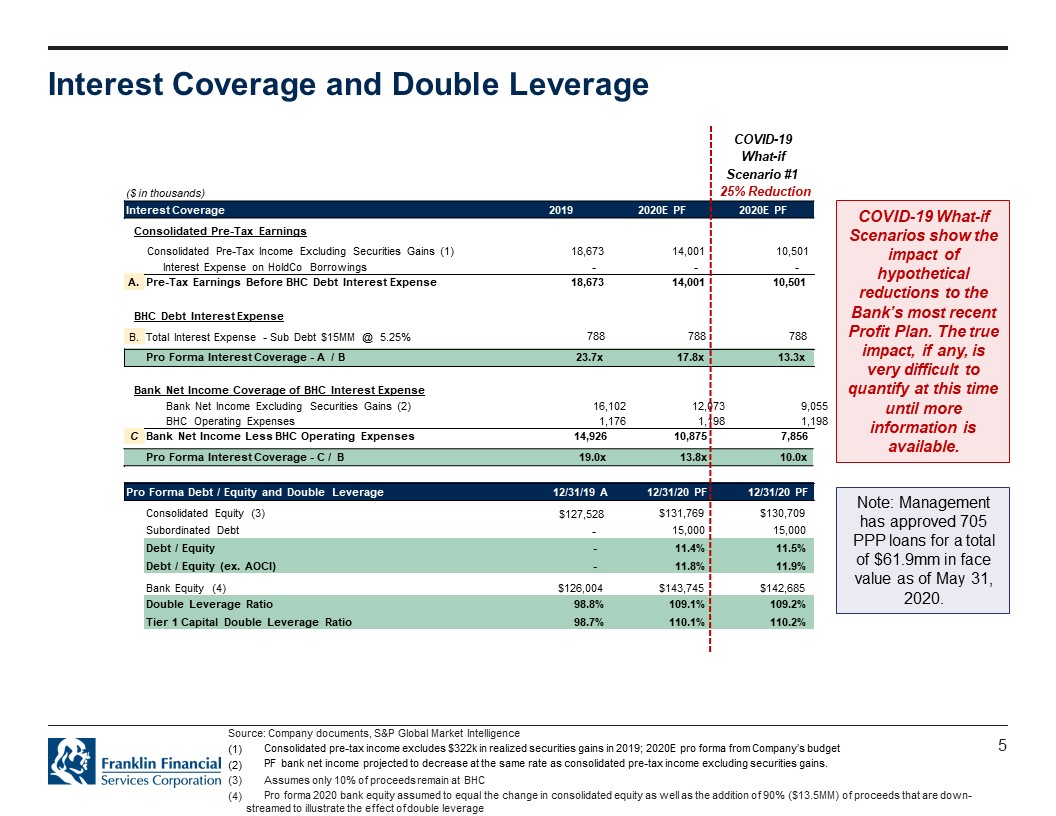

Interest Coverage and Double Leverage Franklin Financial Services Corporation 5 COVID-19 What-if Scenario #1 ($ in thousands) 25% Reduction Interest Coverage 2019 2020E PF 2020E PF Consolidated Pre-Tax Earnings Consolidated Pre-Tax Income Excluding Securities Gains (1) 18,673 14,001 10,501 Interest Expense on HoldCo Borrowings - - -Pre-Tax Earnings Before BHC Debt Interest Expense 18,673 14,001 10,501 BHC Debt Interest Expense Total Interest Expense - Sub Debt $15MM @ 5.25% 788 788 788 Pro Forma Interest Coverage – A / B 23.7x 17.8x 13.3x Bank Net Income Coverage of BHC Interest Expense Bank Net Income Excluding Securities Gains (2) 16,102 12,073, 9,055 BHC Operating Expenses 1,176 1,198, 1,198 C. Bank Net Income Less BHC Operating Expenses 14,926 10,875 7,856 Pro Forma Interest Coverage – C / B 19.0x 13.8x 10.0x Pro Forma Debt / Equity and Double Leverage 12/31/19 A 12/31/20 PF 12/31/20 PF Consolidated Equity (3) $127,528 $131,769 $130,709 Subordinated Debt – 15,000 15,000 Debt / Equity – 11.4% 11.5% Debt / Equity (ex. AOCI) – 11.8% 11.9% Bank Equity (4) $126,004 $143,745 $142,685 Double Leverage Ratio 98.8% 109.1% 109.2% Tier 1 Capital Double Leverage Ratio 98.7% 110.1% 110.2% COVID-19 What-if Scenarios show the impact of hypothetical reductions to the Bank’s most recent Profit Plan. The true impact, if any, is very difficult to quantify at this time until more information is available. Note: Management has approved 705 PPP loans for a total of $61.9mm in face value as of May 31, 2020. Source: Company documents, S&P Global Market Intelligence (1) Consolidated pre-tax income excludes $322k in realized securities gains in 2019; 2020E pro forma from Company’s budget (2) PF bank net income projected to decrease at the same rate as consolidated pre-tax income excluding securities gains. (3) Assumes only 10% of proceeds remain at BHC (4) Pro forma 2020 bank equity assumed to equal the change in consolidated equity as well as the addition of 90% ($13.5MM) of proceeds that are down- streamed to illustrate the effect of double leverage Franklin Financial Services Corporation 5

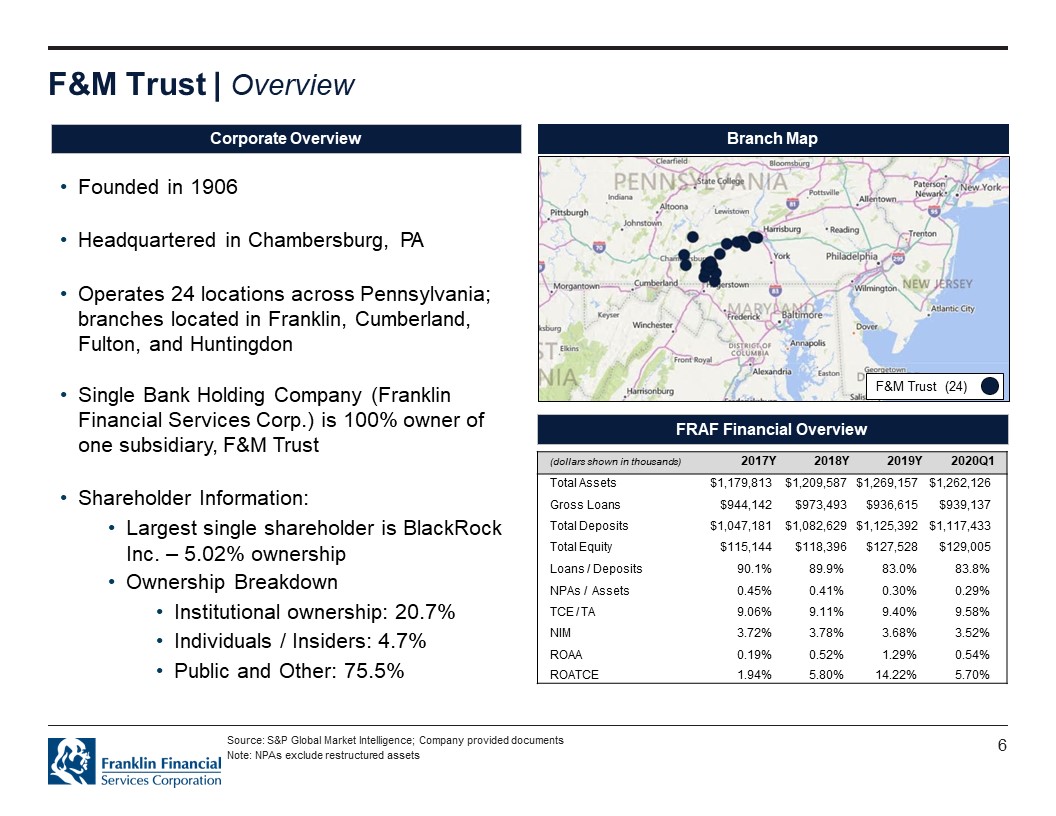

F&M Trust | Overview Corporate Overview Founded in 1906 Headquartered in Chambersburg, PA Operates 24 locations across Pennsylvania; branches located in Franklin, Cumberland, Fulton, and Huntingdon Single Bank Holding Company (Franklin Financial Services Corp.) is 100% owner of one subsidiary, F&M Trust Shareholder Information: Largest single shareholder is BlackRock Inc. – 5.02% ownership Ownership Breakdown Institutional ownership: 20.7% Individuals / Insiders: 4.7% Public and Other: 75.5% Brank Map F&M Trust (24) FRAF Financial Overview (dollars shown in thousands) 2017Y 2018Y 2019Y 2020Q1 Total Assets $1,179,813 $1,209,587 $1,269,157 $1,262,126 Gross Loans $944,142 $973,493 $936,615 $939,137 Total Deposits $1,047,181 $1,082,629 $1,125,392 $1,117,433 Total Equity $115,144 $118,396 $127,528 $129,005 Loans / Deposits 90.1% 89.9% 83.0% 83.8% NPAs / Assets 0.45% 0.41% 0.30% 0.29% TCE / TA 9.06% 9.11% 9.40% 9.58% NIM 3.72% 3.78% 3.68% 3.52% ROAA 0.19% 0.52% 1.29% 0.54% ROATCE 1.94% 5.80% 14.22% 5.70% Source: S&P Global Market Intelligence; Company provided documents Note: NPAs exclude restructured assets Franklin Financial Services Corporation 6

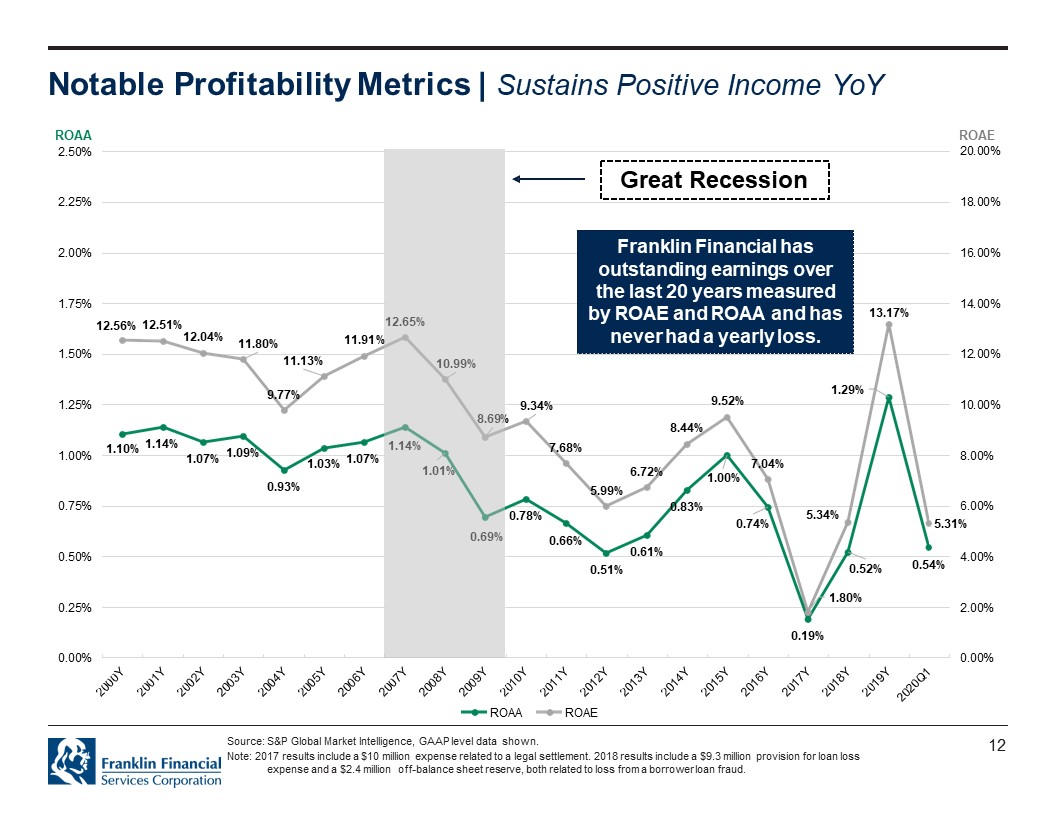

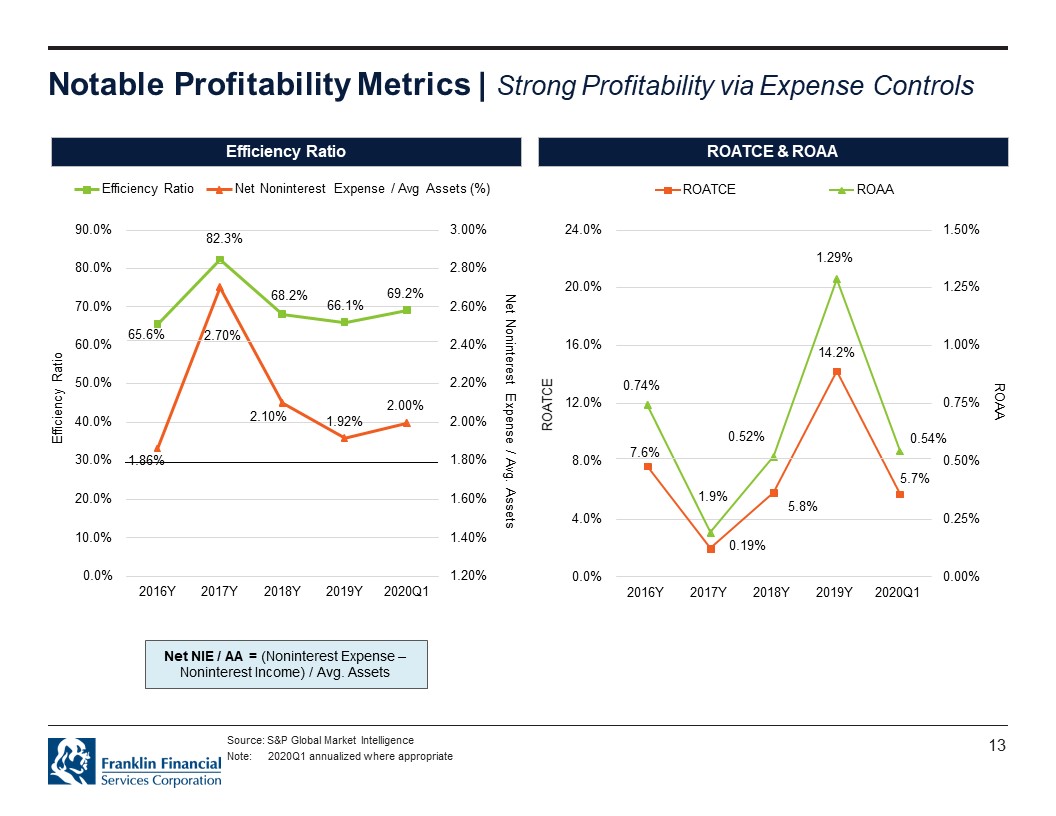

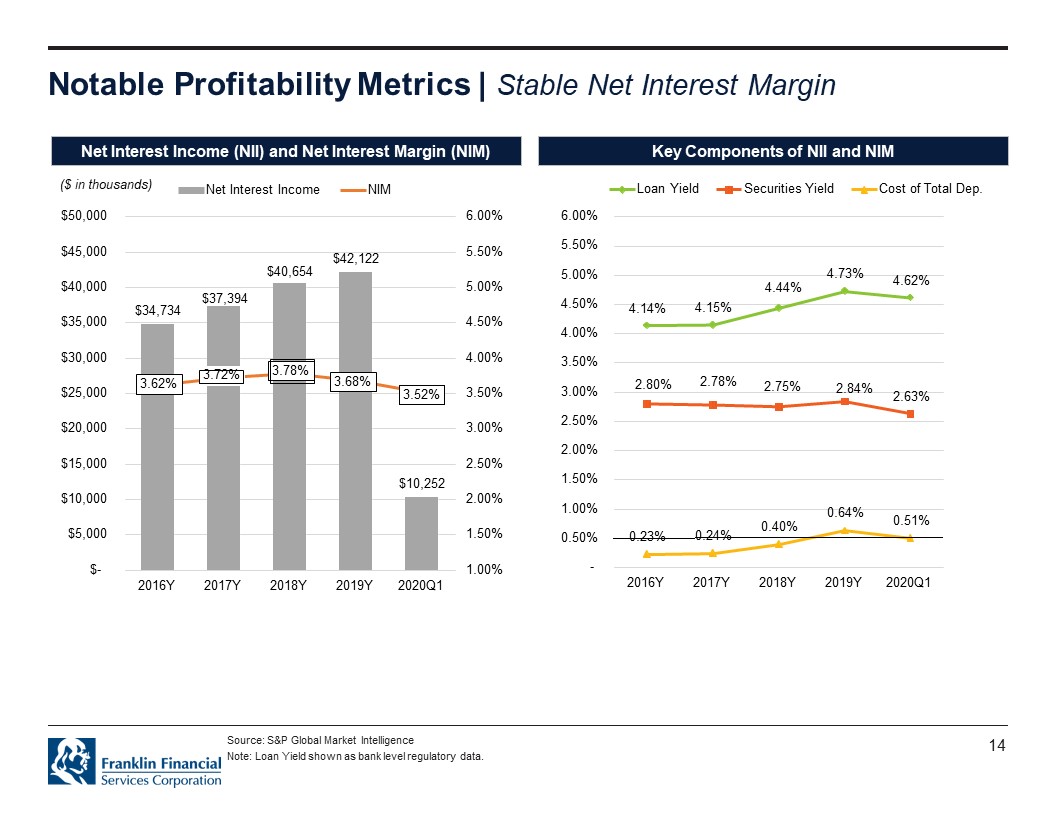

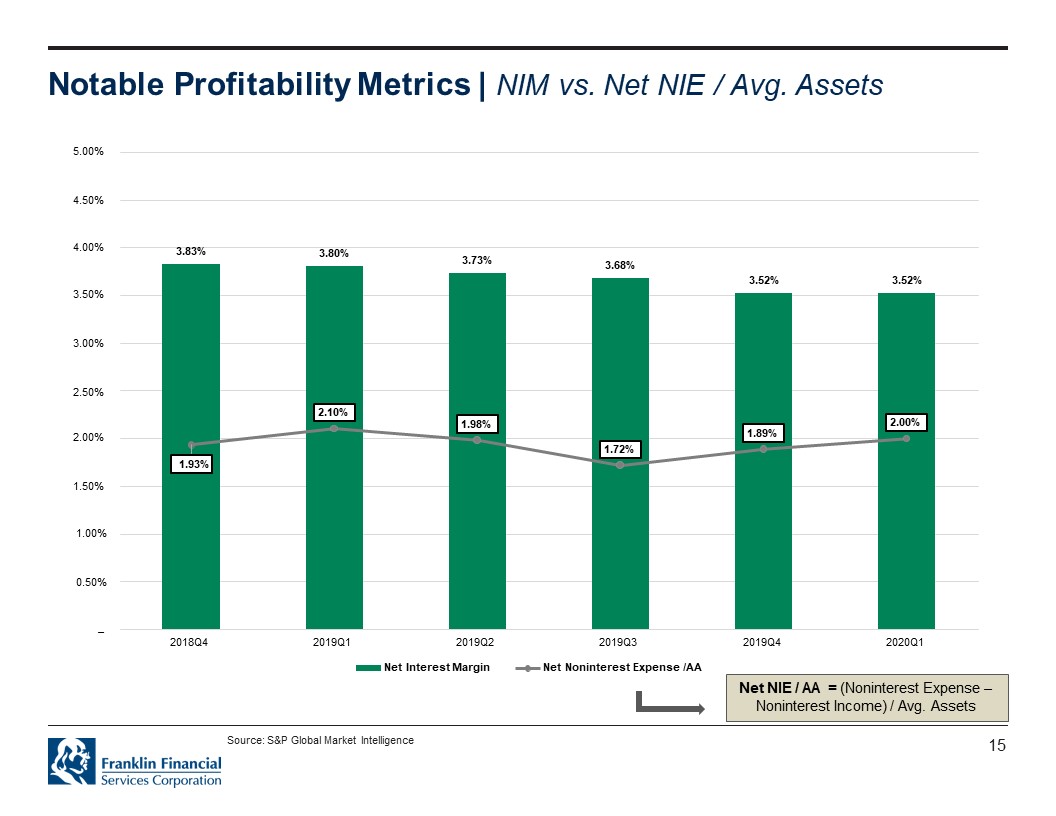

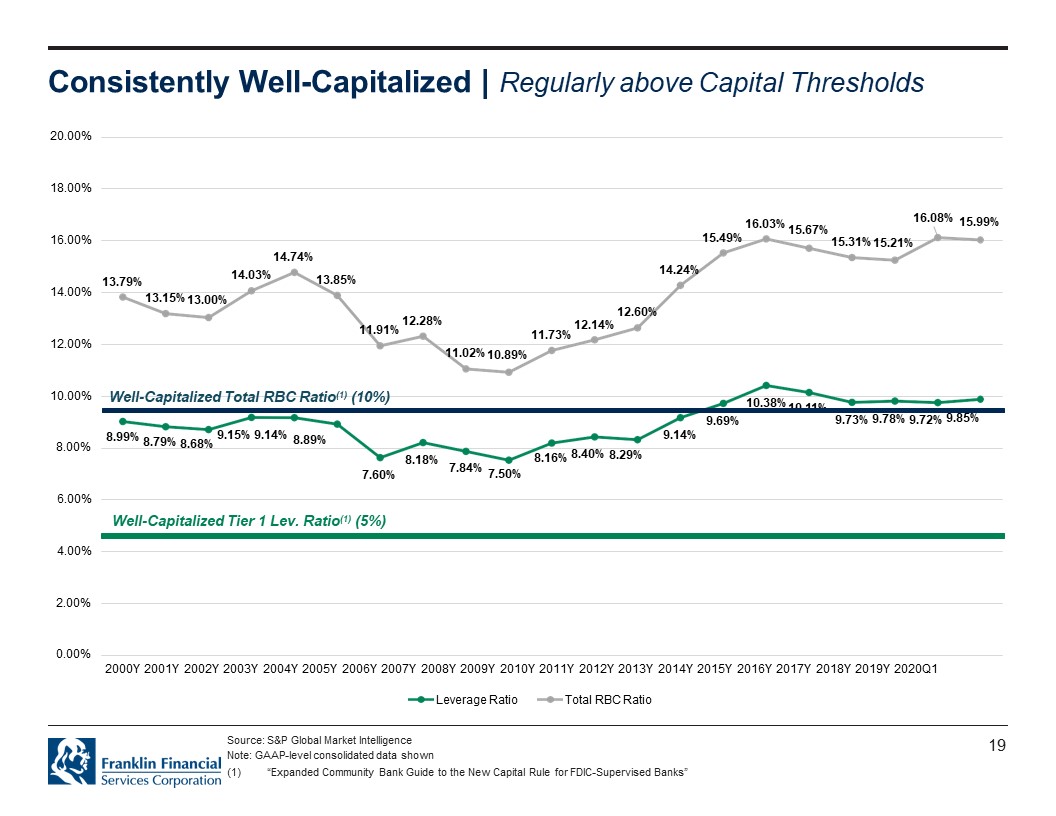

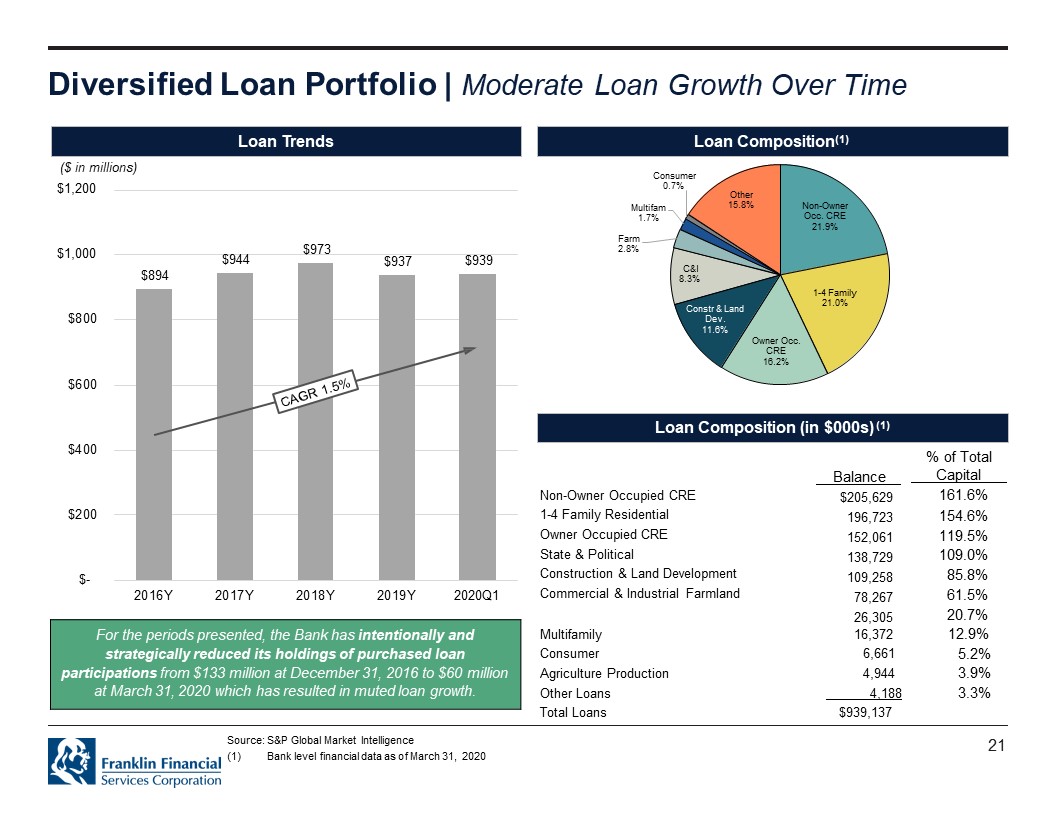

Investment Highlights Experienced Management Team Senior management has decades of experience in the community banking industry and both the CEO & CFO have been banking in the Mid- Atlantic for the entirety of their careers Tim Henry, President & CEO of FRAF, is a well-respected figure in Pennsylvania community banking Prior to joining the Bank, Tim has held positions at various other banks which has allowed him to establish extensive relationships throughout Pennsylvania and Maryland Notable Profitability Metrics History of profitability with positive bank-level net income reported every year since 2000 Stable 2020Q1 Profitability Metrics including: Net interest margin of 3.52% and Cost of Funds of 0.51% 2020Q1 Fee Income / Operating Revenue of 23.9% helps to hedge against low-interest rate environments. Net Noninterest Expense / Average Assets of 0.98% in 2020Q1 illustrates the continued success of cost control initiatives. Cost control strategy has improved efficiency ratio from its high in 2017 to 66.1% for the year ended December 31, 2019. Diversified Loan Portfolio & Improved Asset Quality Farmers and Merchants Trust Company of Chambersburg’s portfolio is well-diversified among asset concentrations and boasts a yield on loans of 4.62% for the first quarter-ended March 31, 2020 A trend of declining nonperforming asset totals exhibited in the Bank’s NPAs excluding Restructured Loans /Assets of 0.29% Conservative provisioning with Reserves/ Total Loans of 1.57% as of March 31, 2020. Consistently Well-Capitalized Farmers and Merchants Trust Company of Chambersburg has regularly remained above “well-capitalized” levels as defined by the FDIC The bank has positioned itself to be well-suited in economic downturns with excess capital A strong capital position has given Farmers and Merchants Trust Company of Chambersburg insurance and optionality, as it pertains to the future of the institution Focus on Measured Growth & Risk Mitigation Consistent balance sheet growth over the past 4 years; Total asset CAGR of 3.5% since 2016 Geographically located in smaller but economically growing counties in southern central Pennsylvania, which allows the Bank to maintain close depository relationships and strong deposit market share Source: S&P Global Market Intelligence; Company provided documents Note: Net Noninterest Expense is equal to Noninterest expense less of noninterest income. Franklin Financial Services Corporation 7

2nd Quarter 2020 Preliminary Performance Q2 2020 Guidance Estimated Q2 2020 balance sheet highlights (include $61 million of PPP loans): Total assets of approximately $1.4 billion compared to $1.3 billion at Q1 2020 Gross loans of approximately $1.0 billion compared to $936 million at Q1 2020 Investment portfolio approximately $280 million compared to $208 million at Q1 2020 Total deposits of approximately $1.3 billion compared to $1.1 billion at Q1 2020 No wholesale or brokered deposits No OREO Estimated Q2 2020 financial performance: Increased net income versus Q1 2020 due in part to a lower loan loss provision expense in Q2 2020 Q2 2020 loan loss provision expense in the range of $1.5 to $2. 5 million due to elevated COVID-19 qualitative risk factors. Q1 2020 provision expense was $3.0 million. Expected income statement benefit in Q2 2020 from the net operating loss carryback feature provided by the CARES Act Accretion of approximately $2.4 million of PPP loans fees over the life of the loans began in Q2 2020 Source: Company provided documents Franklin Financial Services Corporation 8

Experienced Management Team Franklin Financial Services Corporation 9

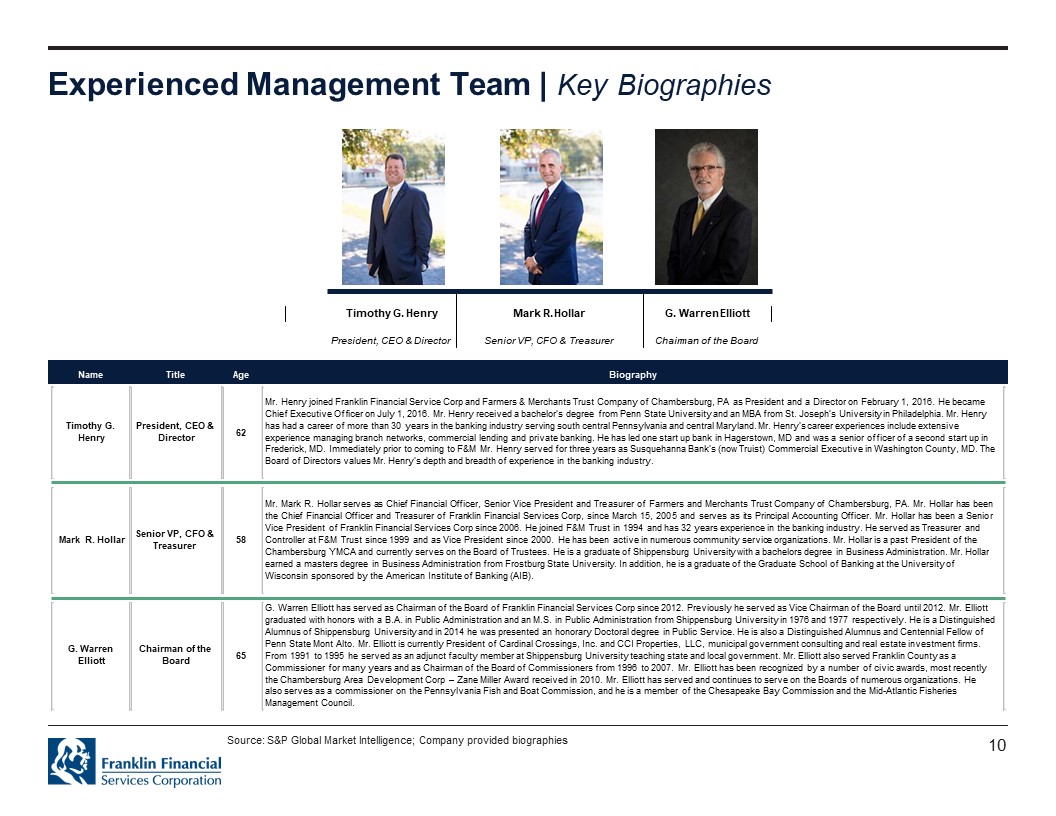

Experienced Management Team | Key Biographies Name Title Age Biography Timothy G. Henry President, CEO & Director 62 Mr. Henry joined Franklin Financial Service Corp and Farmers & Merchants Trust Company of Chambersburg, PA as President and a Director on February 1, 2016. He became Chief Executive Officer on July 1, 2016. Mr. Henry received a bachelor’s degree from Penn State University and an MBA from St. Joseph’s University in Philadelphia. Mr. Henry has had a career of more than 30 years in the banking industry serving south central Pennsylvania and central Maryland. Mr. Henry’s career experiences include extensive experience managing branch networks, commercial lending and private banking. He has led one start up bank in Hagerstown, MD and was a senior officer of a second start up in Frederick, MD. Immediately prior to coming to F&M Mr. Henry served for three years as Susquehanna Bank’s (now Truist) Commercial Executive in Washington County, MD. The Board of Directors values Mr. Henry’s depth and breadth of experience in the banking industry. Mark R. Hollar Senior VP, CFO & Treasurer 58 Mr. Mark R. Hollar serves as Chief Financial Officer, Senior Vice President and Treasurer of Farmers and Merchants Trust Company of Chambersburg, PA. Mr. Hollar has been the Chief Financial Officer and Treasurer of Franklin Financial Services Corp, since March 15, 2005 and serves as its Principal Accounting Officer. Mr. Hollar has been a Senior Vice President of Franklin Financial Services Corp since 2006. He joined F&M Trust in 1994 and has 32 years experience in the banking industry. He served as Treasurer and Controller at F&M Trust since 1999 and as Vice President since 2000. He has been active in numerous community service organizations. Mr. Hollar is a past President of the Chambersburg YMCA and currently serves on the Board of Trustees. He is a graduate of Shippensburg University with a bachelors degree in Business Administration. Mr. Hollar earned a masters degree in Business Administration from Frostburg State University. In addition, he is a graduate of the Graduate School of Banking at the University of Wisconsin sponsored by the American Institute of Banking (AIB). G. Warren Elliott Chairman of the Board 65 G. Warren Elliott has served as Chairman of the Board of Franklin Financial Services Corp since 2012. Previously he served as Vice Chairman of the Board until 2012. Mr. Elliott graduated with honors with a B.A. in Public Administration and an M.S. in Public Administration from Shippensburg University in 1976 and 1977 respectively. He is a Distinguished Alumnus of Shippensburg University and in 2014 he was presented an honorary Doctoral degree in Public Service. He is also a Distinguished Alumnus and Centennial Fellow of Penn State Mont Alto. Mr. Elliott is currently President of Cardinal Crossings, Inc. and CCI Properties, LLC, municipal government consulting and real estate investment firms. 65 From 1991 to 1995 he served as an adjunct faculty member at Shippensburg University teaching state and local government. Mr. Elliott also served Franklin County as a Commissioner for many years and as Chairman of the Board of Commissioners from 1996 to 2007. Mr. Elliott has been recognized by a number of civic awards, most recently the Chambersburg Area Development Corp – Zane Miller Award received in 2010. Mr. Elliott has served and continues to serve on the Boards of numerous organizations. He also serves as a commissioner on the Pennsylvania Fish and Boat Commission, and he is a member of the Chesapeake Bay Commission and the Mid-Atlantic Fisheries Management Council. Source: S&P Global Market Intelligence; Company provided biographies Franklin Financial Services Corporation 10

Notable Profitability Metrics Franklin Financial Services Corporation 11

Notable Profitability Metrics | Sustains Positive Income YoY Great Recession Franklin Financial has outstanding earnings over the last 20 years measured by ROAE and ROAA and has never had a yearly loss. ROAA 2.50% 2.25% 2.00% 1.75% 1.50% 1.25% 1.00% 0.75% 0.50% 0.25% 0.00% ROAE 20.00% 18.00% 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 12.56% 12.51% 12.04% 11.80% 9.77% 11.13% 11.91% 12.65% 10.99% 8.69% 9.34% 7.68% 5.99% 6.72% 8.44% 9.52% 7.04% 0.19% 5.34% 1.29% 13.17% 5.31% 1.10% 1.14% 1.07% 1.09% 0.93% 1.03% 1.07% 1.14% 1.01% 0.69% 0.78% 0.66% 0.51% 0.61% 0.83% 1.00% 0.74% 0.19% 1.80% 0.52% 0.54% 2000Y 2001Y 2002Y 2003Y 2004Y 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Q1 Source: S&P Global Market Intelligence, GAAP level data shown. Note: 2017 results include a $10 million expense related to a legal settlement. 2018 results include a $9.3 million provision for loan loss expense and a $2.4 million off-balance sheet reserve, both related to loss from a borrower loan fraud. Franklin Financial Services Corporation 12

Notable Profitability Metrics | Strong Profitability via Expense Controls Efficiency Ratio Efficiency Ratio Net Noninterest Expense / Avg Assets (%) Efficiency Ratio 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% Net Noninterest Expense / Avg. Assets 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 2.60% 2.80% 3.00% 2016Y 2017Y 2018Y 2019Y 2020Q1 1.86% 2.70% 2.10% 1.92% 2.00% 65.6% 82.3% 68.2% 66.1% 69.2% ROATCE & ROAA ROATCE 0.00% 4.0% 8.0% 12.0% 16.0% 20.0% 24.0% 2016Y 2017Y 2018Y 2019Y 2020Q1 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% ROAA Net NIE / AA = (Noninterest Expense – Noninterest Income) / Avg. Assets Source: S&P Global Market Intelligence Note: 2020Q1 annualized where appropriate Franklin Financial Services Corporation 13

Notable Profitability Metrics | Stable Net Interest Margin Net Interest Income (NII) and Net Interest Margin (NIM) (S in thousands) ^ Net interest Income NIM $50,000 $45,000 $40,000 $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $- $34,734 $37,394 $40,654 $42,122 $10,252 3.62% 3.72% 3.78% 3.68% 3.52% 6.00% 5.50% 5.00% 4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 2016Y 2017Y 2018Y 2019Y 2020Q1 Key Components of Nil and NIM Loan Yield Securities Yield Cost of Total Dep.6.00% 5.50% 5.00% 4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 4.14% 4.15% 4.44%4.73% 4.62% 2.80% 2.78% 2.75% 2. 84% 2.63% 0.23% 0.24% 0.40% 0.64% 0.51% 2016Y 2017Y 2018Y 2019Y 2020Q1 Source: S&P Global Market Intelligence Note: Loan Yield shown as bank level regulatory data. Franklin Financial Services Corporation 14

Notable Profitability Metrics | NIM vs. Net NIE / Avg. Assets 5.00% 4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 3.83% 3.80% 3.73% 3.68% 3.52% 3.52% 1.93% 2.10% 1.98% 1.72% 1.89% 2.00% 2018Q4 2019QA 2019Q2 2019Q3 2019Q4 2020Q1 Net Interest Margin Net Noninterest Expense/AA Net NIE / AA = (Noninterest Expense – Noninterest Income) / Avg. Assets Source: S&P Global Market Intelligence Franklin Financial Services Corporation 15

Notable Profitability Metrics | Core Revenue Detail (S in thousands) Total Revenue Noninterest Expense «Noninterest Income $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $- $43,874 $21,104 $11,630 2015Y $46,312 $33,206 $11,578 2016Y $49,606 $43,198 $12,212 2017Y $53,223 $37,374 $12,569 2018Y $56,113 $13,991 $37,988 $13,466 $9,528 $3,214 2020Q1 FRAF has a uniquely robust investment and trust services department with ~$800 million AUM, generating recurring fees in excess of $5 million per annum. Source: S&P Global Market Intelligence Franklin Financial Services Corporation 16

Notable Profitability Metrics | Solid Investment Portfolio Asset Class Breakdown US Treasury and Agency Secs 7.4% Other Debt Secs 1.7% State & Political Subdiv Secs 46.7% RMBS 24.7% ABS CMBS 9.2% 10.3% Portfolio Management Statistics The securities portfolio, largely consisting of mortgage backed securities, municipal bonds and agency securities, has been managed with a focus on stable returns and supplementing the rest of the balance sheet. Historical investment portfolio total returns(1): 1 year: 3.54%, 55th percentile 3 year: 2.92%, 62nd percentile 5 year: 2.54%, 74th percentile Other portfolio information(2): Yield to Call: 2.72% Source: S&P Global Market Intelligence Note: Bank level financial data as of March 31st, 2020. Total return calculations based on Performance Trust Total Return calculations as of March 31, 2020. Past performance is not indicative of future returns. Other portfolio information based on securities portfolio as of May 31, 2020 Franklin Financial Services Corporation 17

Consistently Well-Capitalized Franklin Financial Services Corporation 18

Consistently Well-Capitalized | Regularly above Capital Thresholds 20.00% 18.00% 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 13.79% 13.15% 13.00% 14.03% 14.74% 13.85% 11.91% 12.28% 11.02% 10.89% 11.73% 12.14% 12.60% 14.24% 15.49% 16.03% 15.67% 15.31% 15.21% 16.08% 15.99% Well-Capitalized Total RBC Ratio (1) (10%) 8.99% 8.79% 8.68% 9.15% 9.14% 8.89% 7.60% 8.18% 7.84% 7.50% 8.16% 8.40% 8.29% 9.14% 9.69% 10.38% 10.11% 9.73% 9.78% 9.72% 9.85% Well-Capitalized Tier 1 Lev. Ration (5%) 2000Y 2001Y 2002Y 2003Y 2004Y 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Q1 Leverage Ratio Total RBC Ratio Source: S&P Global Market Intelligence Note: GAAP-level consolidated data shown (1) “Expanded Community Bank Guide to the New Capital Rule for FDIC-Supervised Banks” Franklin Financial Services Corporation 19

Diversified Loan Portfolio & Asset Quality Franklin Financial Services Corporation 20

Diversified Loan Portfolio | Moderate Loan Growth Over Time Loan Trends ($ in millions) $1,000 $800 $600 $400 $200 $- $894 2016Y $944 2017Y $973 2018Y $937 2019Y $939 2020Q1 Loan Composition(1) Consumer 0.7% Other 15.8 % Non-Owner Occ. CRE 21.9% 1-4 Family 21.0% Owner Occ. CRE 16.2% Constr & Land Dev. 11.6% C&I 8.3% Farm 2.8% Multifam 1.7% Loan Composition (in $000s) (1) Non-Owner Occupied CRE 1-4 Family Residential Owner Occupied CRE State & Political Construction & Land Development Commercial & Industrial Farmland Balance $205,629 196,723 152,061 138,729 109,258 78,267 26,305 % of Total Capital 161.6% 154.6% 119.5% 109.0% 85.8% 61.5% 20.7% Multifamily 16,372 12.9% Consumer 6,661 5.2% Agriculture Production 4,944 3.9% Other Loans 4,188 3.3% Total Loans $939,137 For the periods presented, the Bank has intentionally and strategically reduced its holdings of purchased loan participations from $133 million at December 31, 2016 to $60 million at March 31, 2020 which has resulted in muted loan growth. Source: S&P Global Market Intelligence (1) Bank level financial data as of March 31, 2020 Franklin Financial Services Corporation 21

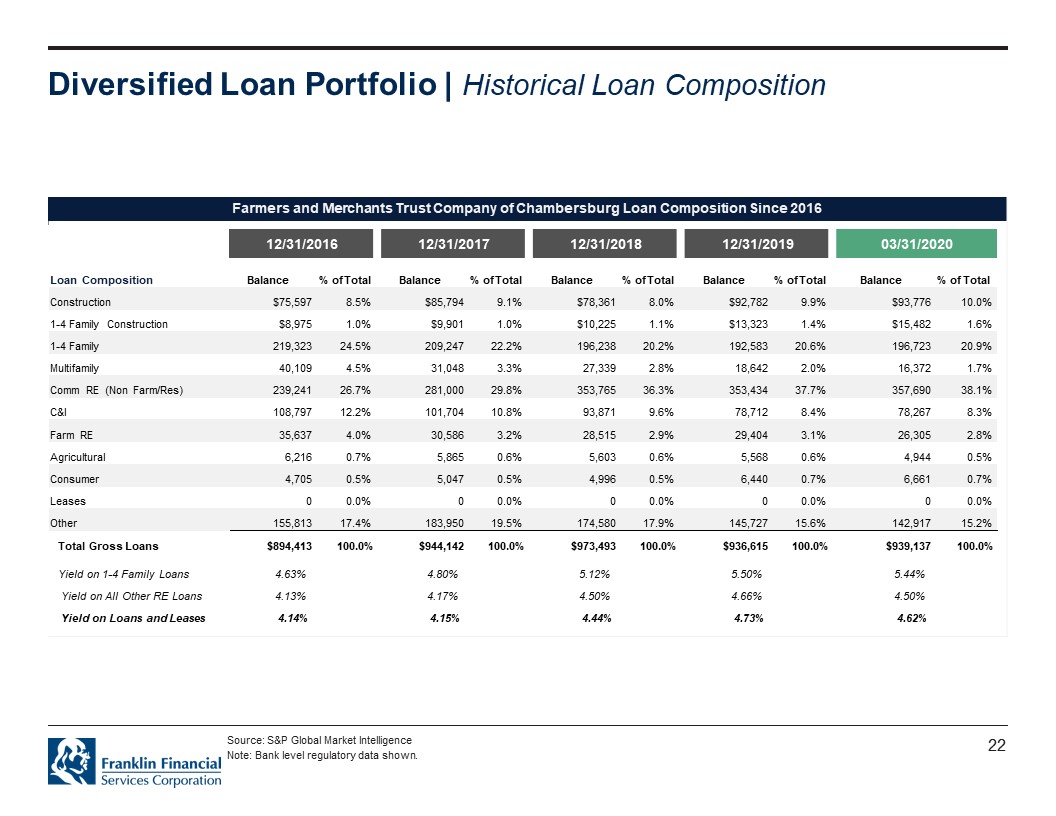

Diversified Loan Portfolio | Historical Loan Composition Farmers and Merchants Trust Company of Chambersburg Loan Composition Since 2016 12/31/2016 12/31/2017 12/31/2018 12/31/2019 03/31/2020 Loan Composition Balance % of Total Balance % of Total Balance % of Total Balance % of Total Balance % of Total Construction $75,597 8.5% $85,794 9.1% $78,361 8.0% $92,782 9.9% $93,776 10.0% 1-4 Family Construction $8,975 1.0% $9,901 1.0% $10,225 1.1% $13,323 1.4% $15,482 1.6% 1-4 Family 219,323 24.5% 209,247 22.2% 196,238 20.2% 192,583 20.6% 196,723 20.9% Multifamily 40,109 4.5% 31,048 3.3% 27,339 2.8% 18,642 2.0% 16,372 1.7% Comm RE (Non Farm/Res) 239,241 26.7% 281,000 29.8% 353,765 36.3% 353,434 37.7% 357,690 38.1% C&I 108,797 12.2% 101,704 10.8% 93,871 9.6% 78,712 8.4% 78,267 8.3% Farm RE 35,637 4.0% 30,586 3.2% 28,515 2.9% 29,404 3.1% 26,305 2.8% Agricultural 6,216 0.7% 5,865 0.6% 5,603 0.6% 5,568 0.6% 4,944 0.5% Consumer 4,705 0.5% 5,047 0.5% 4,996 0.5% 6,440 0.7% 6,661 0.7% Leases 0 0.0% 0 0.0% 0 0.0% 0 0.0% 0 0.0% Other 155,813 17.4% 183,950 19.5% 174,580 17.9% 145,727 15.6% 142,917 15.2% Total Gross Loans $894,413 100.0% $944,142 100.0% $973,493 100.0% $936,615 100.0% $939,137 100.0% Yield on 1-4 Family Loans 4.63% 4.80% 5.12% 5.50% 5.44% Yield on All Other RE Loans 4.13% 4.17% 4.50% 4.66% 4.50% Yield on Loans and Leases 4.14% 4.15% 4.44% 4.73% 4.62% Source: S&P Global Market Intelligence Note: Bank level regulatory data shown. Franklin Financial Services Corporation 22

Asset Quality | Nonperforming Assets Dwindling Since 2012 NPAs/Assets Reserves/Loans 8.00% 7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% 1.75% 1.50% 1.25% 1.00% 0.75% 0.50% 0.25% 1.28% 1.32% 1.34% 1.08% 1.38% 1.36% 1.29% 1.29% 1.09% 1.21% 1.18% 1.27% 1.38% 1.34% 1.25% 1.29% 1.24% 1.25% 1.28% 1.28% 1.57% 0.42% 0.63% 0.81% 0.15% 0.06% 0.03% 0.15% 0.54% 0.32% 1.11% 2.44% 2.94% 5.15% 4.50% 3.09% 2.41% 1.93% 1.43% 1.20% 1.12% 1.03% 2000Y 2001Y 2002Y 2003Y 2004Y 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Q1 Source: S&P Global Market Intelligence Note: NPAs include restructured assets Franklin Financial Services Corporation 23

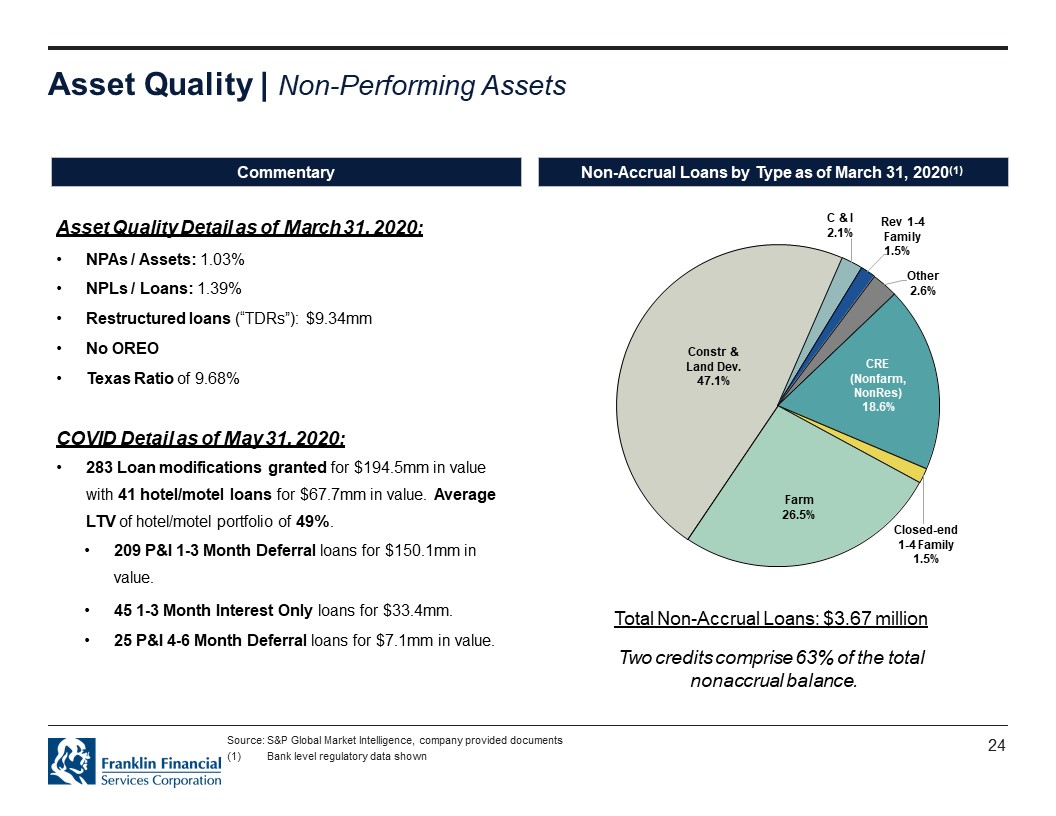

Asset Quality | Non-Performing Assets Commentary Non-Accrual Loans by Type as of March 31, 2020(1) Asset Quality Detail as of March 31, 2020: NPAs / Assets: 1.03% NPLs / Loans: 1.39% Restructured loans (“TDRs”): $9.34mm No OREO Texas Ratio of 9.68% COVID Detail as of May 31, 2020: 283 Loan modifications granted for $194.5mm in value with 41 hotel/motel loans for $67.7mm in value. Average LTV of hotel/motel portfolio of 49%. 209 P&I 1-3 Month Deferral loans for $150.1mm in value. 45 1-3 Month Interest Only loans for $33.4mm. 25 P&I 4-6 Month Deferral loans for $7.1mm in value. Constr & Land Dev. 47.1% C & I 2.1% Rev 1-4 Family 1.5% Other 2.6% CRE (Nonfarm, NonRes) 18.6% Closed-end 1-4 Family 1.5% Farm 26.5% Total Non-Accrual Loans: $3.67 million Two credits comprise 63% of the total nonaccrual balance. Source: S&P Global Market Intelligence, company provided documents (1) Bank level regulatory data shown Franklin Financial Services Corporation 24

Asset Quality | Strong Asset Quality & Reserve Coverage NPLs / Loans(1) 2.10% 1.88% 1.80% 1.50% 1.20% 0.90% 0.60% 0.30% 0.00% 1.88% 1.51% 1.21% 1.52% 1.39% 2016Y 2017Y 2018Y 2019Y 2020Q1 NCOs / Avg. Loans 1.20% 1.00% 0.80% 0.60% 0.40% 0.20% 0.00% -0.20% 0.33% -0.01% 0.97% 0.07% 0.10% 2016Y 2017Y 2018Y 2019Y 2020Q1 Loan Loss Reserves / NPLs (1) 140% 120% 100% 80% 60% 40% 20% 0%65.9%82.9% 105.3% 83.8% 113.2% 2016Y 2017Y 2018Y 2019Y 2020Q1 Loan Loss Reserves / Total Loans 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5%0.0% 1.24%-1.25% 1.28% 1.28% 1.57% 2016Y 2017Y 1.57% 1.28% 1.28% 2018Y 2019Y 2020Q1 Source: S&P Global Market Intelligence (1) Non-performing loans (“NPLs”) include performing troubled debt restructured loans Financial Services Corporation 25

Measured Growth & Risk Mitigation Financial Services Corporation 26

Measured Growth & Risk Mitigation | Balance Sheet Growth Total Assets ($ in millions) $2,000 $1,500 $1,000 $500 $- $1,127 $1,180 $1,210 $1,269 $1,262 CAGR: 3.5% 2016Y 2017Y 2018Y 2019Y 2020Q1 Total Loans ($ in millions) $1,600 $1,200 $800 $400 $- CAGR: 1.5% $894 $944 $973 $937 $939 2016Y 2017Y 2018Y 2019Y 2020Q1 Total Deposits ($ in millions) $1,600 $1,200 $800 $400 $- $982 2016Y $1,047 2017Y $1,083 2018Y $1,125 2019Y $1,117 2020Q1 CAGR: 4.1% Total Equity ($ in millions) $200 $150 $100 $50 $- $116 2016Y $115 2017Y $118 2018Y $128 2019Y $129 2020Q1 CAGR: 3.2% Source: S&P Global Market Intelligence Franklin Financial Services Corporation 27

Measured Growth & Risk Mitigation | Deposit Composition Deposit Composition(1) Retail Time 6.6% Jumbo Time 0.9% Money Market 38.5% Other Savings 36.6% Transaction Accts 17.3% MRQ Cost of Funds: 0.51% Total Deposits ($ in millions) $1,200 $900 $600 $300 $- $982 2016Y $1,047 2017Y $1,083 2018Y $1,125 2019Y $1,117 2020Q1 CAGR: 4.1% Source: S&P Global Market Intelligence Note: Deposit composition as of March 31, 2020 (1) Bank level regulatory data Franklin Financial Services Corporation 28

Measured Growth & Risk Mitigation | Liquidity Sources (Dollars in thousands) Liquidity Source Federal Home Loan Bank $ Federal Reserve Bank Discount Window Correspondent Banks Total $ Capacity' Outstanding Available 377,600 $ — S 377,600 21,000 — 21,000 21,000 — 21,000 419,600 $ — s 419,600 FRAF has untapped FHLB, Federal Reserve and Correspondent Bank lines, providing excess liquidity and funding when needed. Source: Company provided documents Franklin Financial Services Corporation 29

Measured Growth & Risk Mitigation | Strong Deposit Market Share Presence Franklin, PA 2019 2019 2019 2019 Deposits Market Rank Institution (ST) Branches ($000s) Share (%) 1 Franklin Financial Services (PA) 13 757,427 34.08% 2 Truist Financial Corp. (NC) 5 510,418 22.97% 3 Orrstown Financial Services (PA) 8 504,890 22.72% 4 M&T Bank Corp. (NY) 13 417,099 18.77% 5 ACNB Corp. (PA) 1 30,714 1.38% 6 Woodforest Financial Grp Inc. (TX) 1 1,775 0.08% Total For Institutions in Market 41 2,222,323 Cumberland, PA 2019 Rank Institution (ST) 2019 Branches 2019 Deposits ($000s) 2019 Market Share (%) 1 2 3 4 5 6 7 8 PNC Financial Services Group (PA) Orrstown Financial Services (PA) M&T Bank Corp. (NY) F.N.B. Corp. (PA) S&T Bancorp Inc. (PA) Citizens Financial Group Inc. (RI) Banco Santander Wells Fargo & Co. (CA) 9 7 14 6 2 4 5 3 4,516,375 847,774 778,028 543,284 364,344 289,072 282,038 275,537 50.03% 9.39% 8.62% 6.02% 4.04% 3.20% 3.12% 3.05% 9 Franklin Financial Services (PA) 8 263,273 2.92% 10 Centric Financial Corp. (PA) 2 248,953 2.76% Total For Institutions In Market 80 9,027,357 Fulton, PA 2019 Rank Institution (ST) 2019 Branches 2019 2019 Deposits Market ($000s) Share (%) 1 Orbisonia Community Bncp Inc. (PA) 2 82,192 38.31% 2 Franklin Financial Services (PA) 2 74,208 34.59% 3 Truist Financial Corp. (NC) 2 58,157 27.11% Total For Institutions in Market 6 214,557 Huntingdon, PA 2019 Rank Institution (ST) 2019 Branches 2019 Deposits ($000s) 2019 Market Share (%) 1 2 3 4 5 6 Orbisonia Community Bncp Inc. (PA) F.N.B. Corp. (PA) Kish Bancorp Inc. (PA) Riverview Financial Corp. (PA) Northwest Bancshares, Inc. (PA) Juniata Valley Financial Corp. (PA) 4 2 3 2 1 1 183,282 137,514 133,987 78,097 23,882 18,800 29.52% 22.15% 21.58% 12.58% 3.85% 3.03% 7 Franklin Financial Services (PA) 1 18,220 2.93% 8 9 MCS Bank (PA) Huntingdon Savings Bank (PA) 1 1 14,311 12,842 2.30% 2.07% Total For Institutions in Market 16 620,935 Source: S&P Global Market Intelligence; Deposit information as of June 30, 2019 Note: Counties listed in descending order by FRAF deposit totals Franklin Financial Services Corporation 30

Measured Growth & Risk Mitigation | Balanced Interest Rate Profile Net Interest Income Sensitivity Profile Interest Rate Scenario -100 Base 100 200 300 400 Net Interest Income Change - Next 12 Months -4.2% 0.0% 3.0% 6.5% 9.9% 13.4% Net Interest Income Change - Year 2 -11.6% 0.0% 5.9% 12.2% 18.1% 23.9% Economic Value Sensitivity Profile Interest Rate Scenario -100 Base 100 200 300 400 EVE Change 4.6% 0.0% 5.2% 8.5% 10.2% 11.7% Source: Company provided documents Franklin Financial Services Corporation 31

Measured Growth & Risk Mitigation | F&M Trust PT Score PT Score Overview 0 100 200 300 400 500 PT Score 110 National Median: 145 Capital Score 20 Asset Quality Score 52 Earnings Score 8 Liquidity Score 10 Sensitivity Score 20 National Median: 21 National Median: 42 National Median: 25 National Median: 14 National Median: 24 Very Low Risk Low Risk Moderate Risk Elevated Risk High Risk Asset Size Medians Peer Group Score 0-100M 133 100M-300M 135 300M-500M 146 500M-1B 151 1B-3B 163 3B+ 193 PT Score Over Time PT Score National Score Median Regional Score Median State Score Median Custom Peers Median 0 100 200 300 400 500 2010 Q1 2011 Q1 2012 Q1 2013 Q1 2014 Q1 2015 Q1 2016 Q1 2017 Q1 2018 Q1 2019 Q1 2020 Q1 Franklin Financial Services Corporation 32

Appendix Franklin Financial Services Corporation 33

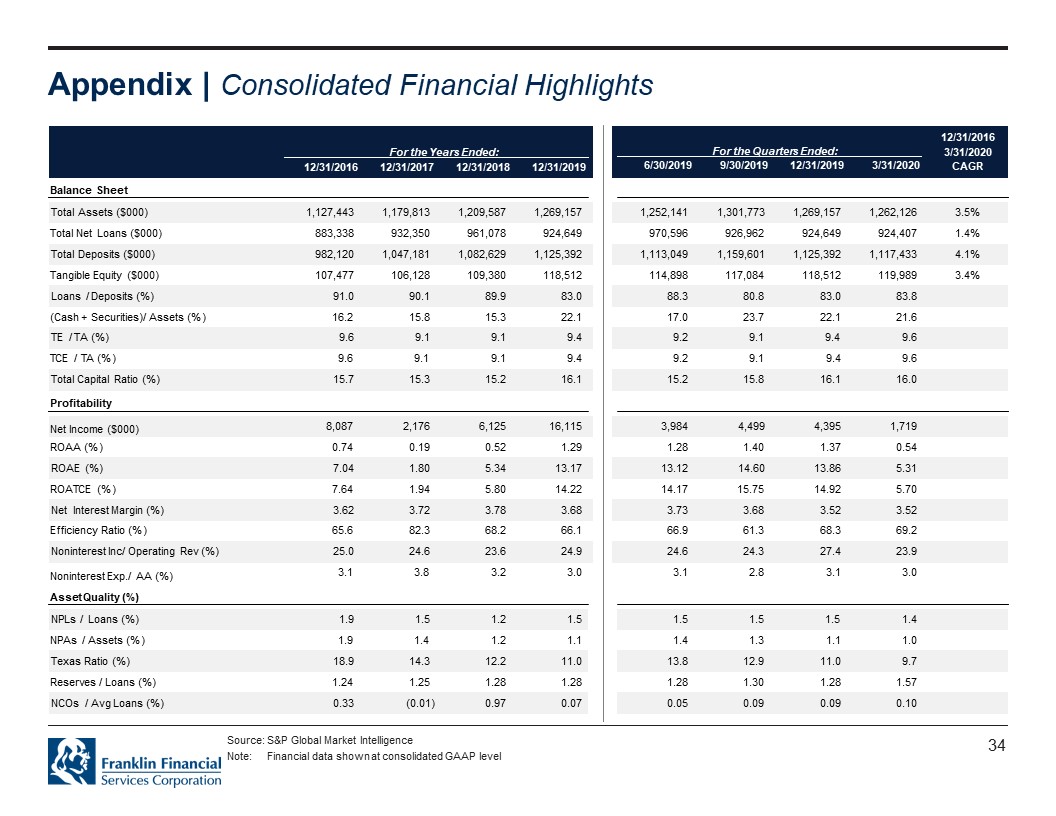

Appendix | Consolidated Financial Highlights For the Years Ended: 12/31/2016 12/31/2017 12/31/2018 12/31/2019 Total Assets ($000) 1,127,443 1,179,813 1,209,587 1,269,157 Total Net Loans ($000) 883,338 932,350 961,078 924,649 Total Deposits ($000) 982,120 1,047,181 1,082,629 1,125,392 Tangible Equity ($000) 107,477 106,128 109,380 118,512 Loans / Deposits (%) 91.0 90.1 89.9 83.0 (Cash + Securities)/ Assets (%) 16.2 15.8 15.3 22.1 TE / TA (%) 9.6 9.1 9.1 9.4 TCE / TA (%) 9.6 9.1 9.1 9.4 Total Capital Ratio (%) 15.7 15.3 15.2 16.1 Profitability Net Income ($000) ROAA (%) ROAE (%) ROATCE (%) Net Interest Margin (%) Efficiency Ratio (%) Noninterest Inc/ Operating Rev (%) Noninterest Exp./ AA (%) Asset Quality (%) NPLs / Loans (%) NPAs / Assets (%) Texas Ratio (%) Resents / Loans (%) NCOS / Avg Loans (%) 8,087 2,176 0.74 0.19 7.04 1.80 7.64 1.94 3.62 3.72 65.6 82.3 25.0 24.6 3.1 3.8 6,125 16,115 0.52 1.29 5.34 13.17 5.80 14.22 3.78 3.68 68.2 66.1 23.6 24.9 3.2 3.0 1.9 1.5 1.9 1.4 18.9 14.3 1.24 1.25 0.33 (0.01) 1.2 1.5 1.2 1.1 12.2 11.0 1.28 1.28 0.97 0.07 For the Quarters Ended: 6/30/2019 9/30/2019 12/31/2019 3/31/2020 12/31/2016 3/31/2020 CAGR 1,252,141 1,301,773 1,269,157 1,262,126 3.5% 970,596 926,962 924,649 924,407 1.4% 1,113,049 1,159,601 1,125,392 1,117,433 4.1% 114,898 117,084 118,512 119,989 3.4% 88.3 80.8 83.0 83.8 17.0 23.7 22.1 21.6 9.2 9.1 9.4 9.6 9.2 9.1 9.4 9.6 15.2 15.8 16.1 16.0 3,984 4,499 4,395 1,719 1.28 1.40 1.37 0.54 13.12 14.60 13.86 5.31 14.17 15.75 14.92 5.70 3.73 3.68 3.52 3.52 66.9 61.3 68.3 69.2 24.6 24.3 27.4 23.9 3.1 2.8 3.1 3.0 1.5 1.5 1.5 1.4 1.4 1.3 1.1 1.0 13.8 12.9 11.0 9.7 1.28 1.30 1.28 1.57 0.05 0.09 0.09 0.10 Source: S&P Global Market Intelligence Note: Financial data shown at consolidated GAAP level Franklin Financial Services Corporation 34

Appendix | Consolidated Balance Sheet Year-Ended December 31, March 31, (dollars show n in thousands) 2016 2017 2018 2019 2020 Assets Cash & Cash Equivalents $ 36,665 $ 58,603 $ 52,957 $ 92,574 $ 64,088 Securities $ 145,925 $ 128,053 132,499 188,533 209,011 Cash and Securities Investment in Non-Bank Subs. 182,590 - 186,656 - 185,456 - 281,107 273,099 - - Gross Loans (HFI & HFS) 894,413 944,142 973,493 936,615 939,137 Loan Loss Reserve 11,075 11,792 12,415 11,966 14,730 Net Loans (HFI & HFS) 883,338 932,350 961,078 924,649 924,407 OREO 4,915 2,598 2,684 - - Intangible Assets 9,016 9,016 9,016 9,016 9,016 Premises & Fixed Assets 14,058 13,741 13,521 18,977 18,835 Other Assets 33,526 30,413 30,581 36,766 32,925 Total Assets 1,127,443 1,179,813 1,209,587 1,269,157 1,262,126 Liabilities Deposits $ 982,120 $1,047,181 $1,082,629 $ 1,125,392 $ 1,117,433 Fed Funds & Repos – – – – – Other Borrowings 24,270 – – 5,161 5,159 Other Liabilites 4,560 17,488 8,562 11,076 10,529 Total Liabilities 1,010,950 1,064,669 1,091,191 1,141,629 1,133,121 Shareholders Equity Preferred Stock - - - - - Common Stock 116,493 115,144 118,396 127,528 129,005 Total Shareholders Equity 116,493 115,144 118,396 127,528 129,005 Total Liabilities and Shareholders Equity $1,127,443 $1,179,813 $1,209,587 $ 1,269,157 $ 1,262,126 Source: S&P Global Market Intelligence, company provided documents Franklin Financial Services Corporation 35

Appendix | Consolidated Income Statement Year-Ended December 31, Q1 (dollars show n in thousands) 2016 2017 2018 2019 2020 Total Interest and Dividend Income 36,979 39,885 44,868 49,235 11,665 Interest Expense: Deposits 2,212 2,475 4,190 7,077 1,413 Borrowings and Debt 33 16 24 36 - Total Interest Expense 2,245 2,491 4,214 7,113 1,413 Net Interest Income 34,734 37,394 40,654 42,122 10,252 Provision for Loan Losses 3,775 670 9,954 237 3,000 Net Interest Income after Provision for Loan Losses 30,959 36,724 30,700 41,885 7,252 Noninterest Income: Service Charges on Deposits 2,822 2,777 2,825 2,975 681 Trust Revenue 4,680 5,055 5,387 5,907 1,371 Insurance Revenue 671 652 610 624 129 Loan Fees and Charges 714 831 882 961 285 Other 2,691 2,897 2,865 3,524 748 Total Noninterest Income 11,578 12,212 12,569 13,991 3,214 Realized Gain on Securities (18) 3 65 322 (137) Nonrecurring Revenue 76 - - 785 812 Total Noninterest Expense 33,206 43,198 37,374 37,988 9,528 Pre-Tax Net Income $ 9,389 $ 5,741 $ 5,960 $ 18,995 $ 1,613 Income Tax Provision 1,302 3,565 (165) 2,880 (106) Net Income $ 8,087 $ 2,176 $ 6,125 $ 16,115 $ 1,719 Source: S&P Global Market Intelligence, company provided documents Franklin Financial Services Corporation 36