UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1O-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 3, 2015

Commission File No. 1-12597

CULP, INC.

(Exact name of registrant as specified in its charter)

|

NORTH CAROLINA

(State or other jurisdiction of

incorporation or other organization)

|

56-1001967

(I.R.S. Employer Identification No.)

|

|

1823 Eastchester Drive, High Point, North Carolina

(Address of principal executive offices)

|

27265

(zip code)

|

|

(336) 889-5161

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange

On Which Registered

|

|

Common Stock, par value $.05/ Share

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to the filing requirements for at least the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer, accelerated filer, and smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer o

|

Accelerated Filer x

|

Non-Accelerated Filer o |

|

|

Smaller Reporting Company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO x

As of May 3, 2015, 12,219,121 shares of common stock were outstanding. As of November 2, 2014, the aggregate market value of the voting stock held by non-affiliates of the registrant on that date was $198,300,713 based on the closing sales price of such stock as quoted on the New York Stock Exchange (NYSE), assuming, for purposes of this report, that all executive officers and directors of the registrant are affiliates.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement to be filed pursuant to Regulation 14A of the Securities and Exchange Commission in connection with its Annual Meeting of Shareholders to be held on September 16, 2015 are incorporated by reference into Part III of this Form 10-K.

CULP, INC.

FORM 10-K REPORT

TABLE OF CONTENTS

| Item No. | Page |

| Item No. | Page |

| 15. |

89

|

|

| 89 | ||

| 91 | ||

| 91 | ||

| 92 | ||

| Exhibit Index | 93 |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

Parts I and II of this report contain “forward-looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995 (Section 27A of the Securities Act of 1933 and Section 27A of the Securities and Exchange Act of 1934). Such statements are inherently subject to risks and uncertainties. Further, forward-looking statements are intended to speak only as of the date on which they are made, and we disclaim any duty to update or alter such statements whether as a result of new information, future events or otherwise. Forward-looking statements are statements that include projections, expectations or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often but not always characterized by qualifying words such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “depend” and their derivatives, and include but are not limited to statements about expectations for our future operations, production levels, sales, gross profit margins, operating income, capital expenditures, income taxes, SG&A or other expenses, earnings, cash flow, and other performance measures, as well as any statements regarding future economic or industry trends or future developments. Factors that could influence the matters discussed in such statements include the level of housing starts and sales of existing homes, consumer confidence, trends in disposable income, and general economic conditions. Decreases in these economic indicators could have a negative effect on our business and prospects. Likewise, increases in interest rates, particularly home mortgage rates, and increases in consumer debt or the general rate of inflation, could affect the company adversely. Changes in consumer tastes or preferences toward products not produced by us could erode demand for our products. Changes in the value of the U.S. dollar versus other currencies could affect our financial results because a significant portion of our operations are located outside the United States. Strengthening of the U.S. dollar against other currencies could make our products less competitive on the basis of price in markets outside the United States, and strengthening of currencies in Canada and China can have a negative impact on our sales in the U.S. of products produced in those places. Also, economic and political instability in international areas could affect our operations or sources of goods in those areas, as well as demand for our products in international markets. Further information about these factors, as well as other factors that could affect our future operations or financial results and the matters discussed in forward-looking statements are included in the “Risk Factors” section of this report in Item 1A. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances that may not occur.

Culp, Inc. manufacturers, sources, and markets mattress fabrics and sewn covers used for covering mattresses and box springs, and upholstery fabrics, including cut and sewn kits, primarily used in production of upholstered furniture. The company competes in a fashion-driven business, and we strive to differentiate our products by placing sustained focus on innovation and design creativity. In addition, Culp places great emphasis on providing excellent and dependable service to our customers. Our focused efforts to protect our financial strength have allowed us to maintain our position as a financially stable and trusted supplier of innovative fabrics to bedding and furniture manufacturers.

We believe Culp is the largest producer of mattress fabrics in North America and one of the largest marketers of upholstery fabrics for furniture in North America, measured by total sales. We have two operating segments — mattress fabrics and upholstery fabrics. The mattress fabrics business markets primarily knitted and woven fabrics, and sewn covers made from those fabrics, which are used in the production of bedding products, including mattresses, box springs, and mattress sets. The upholstery fabrics business markets a variety of fabric products that are used principally in the production of residential and commercial upholstered furniture, including sofas, recliners, chairs, loveseats, sectionals, sofa-beds and office seating. Culp primarily markets fabrics that have broad appeal in the “good” and “better” priced categories of furniture and bedding.

Culp markets a variety of fabrics in different categories to a global customer base, including fabrics produced at our manufacturing facilities and fabrics produced by other suppliers. We had thirteen active manufacturing plants and distribution facilities as of the end of fiscal 2015, located in North and South Carolina; Quebec, Canada; and Shanghai, China. We also source fabrics from other manufacturers, located primarily in China and Turkey, with almost all of those fabrics produced specifically for Culp and created by Culp designers. We operate distribution centers in North Carolina and Shanghai, China, to facilitate distribution of our products.

Total net sales in fiscal 2015 were $310.2 million. The mattress fabrics segment had net sales of $179.7 million (58% of total net sales), while the upholstery fabrics segment had net sales of $130.4 million (42% of total net sales).

During fiscal 2015, both segments continued to build upon strategic initiatives and structural changes over the last several years. The flexible manufacturing and sourcing platform created through these changes has allowed Culp to place a greater emphasis on product innovation and the introduction of new designs to keep current with industry trends and differentiate our products. This approach has helped us drive consistent sales growth, with fiscal 2015 representing our sixth consecutive year of higher net sales.

Both the strength of furniture and mattress industries demand for our products has improved during the past several years, however overall sales have still not returned to the levels seen before the economic downturn. During the same period, we have experienced positive responses from customers to our innovative designs and new products introduced during these years, and our profits have responded accordingly. Pre-tax income reported for fiscal 2015 was $23.0 million, the highest level in Culp's history. An increasing percentage of our sales are now based on new product introductions.

2

The mattress fabrics segment has made strategic investments in capital projects and expansion initiatives in recent years, to maintain a more flexible approach to fabric sourcing, in line with challenging industry conditions. These expenditures included a record capital expenditure level for the segment in fiscal 2015 for expansion projects to provide increased manufacturing capacity and more efficient equipment for this segment, following several successful acquisitions. The mattress fabrics segment has also expanded its design capabilities with additional personnel and product software to enhance innovation. During fiscal 2013, this segment announced a new joint marketing agreement to market sewn mattress covers, which involved the establishment of a new production facility. Early in fiscal 2014, we completed an asset purchase and related consulting agreement that provided for, among other things, the purchase of equipment and certain other assets and the restructuring of prior consulting and non-compete agreements. These initiatives have allowed for further expansion of our mattress fabrics business.

Our upholstery fabrics segment underwent major changes over the past decade, transforming from a primarily U.S.-based manufacturing operation with large amounts of fixed assets, to a more flexible variable cost model, with most fabrics sourced in Asia. At the same time, we have maintained control over the key components of fabric production such as design, finishing, quality control, and distribution. These changes involved a multi-year restructuring process that ended in fiscal 2009, during which time our upholstery fabric sales declined considerably. This multi-year trend of declining upholstery revenues has reversed, and sales in this segment have now increased for each of the past six fiscal years. Since the end of the multi-year restructuring, we have focused on product innovation and marketing, including the exploration of new markets.

Additional information about trends and developments in each of our business segments is provided in the “Segments” discussion below.

Culp, Inc. was organized as a North Carolina corporation in 1972 and made its initial public offering in 1983. Since 1997, our stock has been listed on the New York Stock Exchange and traded under the symbol “CFI.” Our fiscal year is the 52 or 53 week period ending on the Sunday closest to April 30. Our executive offices are located in High Point, North Carolina. References in this document to “Culp,” the “company,” “we,” “our,” and “us” refer to Culp, Inc. and its consolidated subsidiaries.

Culp maintains an Internet website at www.culp.com. We will make this annual report and our other annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports available free of charge on our Internet site as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission. Information included on our website is not incorporated by reference into this annual report.

Our two operating segments are mattress fabrics and upholstery fabrics. The following table sets forth certain information for each of our segments.

|

Sales by Fiscal Year ($ in Millions) and Percentage of Total Company Sales

|

||||||||||||||||||||||||

|

Segment

|

Fiscal 2015

|

Fiscal 2014

|

Fiscal 2013

|

|||||||||||||||||||||

|

Mattress Fabrics

|

$ | 179.7 | (58 | %) | $ | 160.7 | (56 | %) | $ | 154.0 | (57 | %) | ||||||||||||

|

Upholstery Fabrics

|

||||||||||||||||||||||||

|

Non-U.S.-Produced

|

$ | 119.1 | (38 | %) | $ | 116.0 | (40 | %) | $ | 102.1 | (38 | %) | ||||||||||||

|

U.S.-Produced

|

$ | 11.3 | (4 | %) | $ | 10.5 | (4 | %) | $ | 12.7 | (5 | %) | ||||||||||||

|

Total Upholstery

|

$ | 130.4 | (42 | %) | $ | 126.5 | (44 | %) | $ | 114.8 | (43 | %) | ||||||||||||

|

Total company

|

$ | 310.2 | (100 | %) | $ | 287.2 | (100 | %) | $ | 268.8 | (100 | %) | ||||||||||||

3

Additional financial information about our operating segments can be found in Note 16 to the Consolidated Financial Statements included in Item 8 of this report.

Mattress Fabrics. The mattress fabrics segment, also known as Culp Home Fashions, manufactures and markets mattress fabric and mattress covers to bedding manufacturers. These products include woven jacquard fabrics, knitted fabrics, and some converted fabrics. Culp Home Fashions has manufacturing facilities located in Stokesdale and High Point, North Carolina, and St. Jerome, Quebec, Canada. One Stokesdale plant and the St. Jerome plant both manufacture and finish jacquard (damask) fabric. The main Stokesdale plant also finishes knitted fabric and houses the division offices and finished goods distribution capabilities, while the High Point and St. Jerome facilities house our knitted mattress fabrics manufacturing operations. During fiscal 2013, the mattress fabrics division established a second plant in Stokesdale to produce cut and sewn mattress covers, a growing product category that is used primarily by producers of specialty (non-innerspring) bedding. We have also maintained flexibility in our supply of the major categories of mattress fabrics with sourcing capacity located in Turkey and China. Most of our woven jacquard and knitted fabrics can be produced in multiple facilities (internal or external to the company), providing us with mirrored, reactive capacity involving state of the art capabilities across plant facilities.

Culp Home Fashions had capital expenditures during the past ten years totaling approximately $50 million, which primarily provided for increased knit machine capacity, faster and more efficient weaving machines, and the initial capital required for our sewn cover business. These capital expenditures also provided high technology finishing equipment for woven and knitted fabric and an improved platform for warehousing and distribution. In order to maintain our leading edge technology and support modernization and expansion projects, we significantly increased our capital investments in the mattress fabrics segment during fiscal 2015.

Asset acquisition transactions with Bodet & Horst USA, LP and Bodet & Horst GmbH & Co. KG, in fiscal 2009 and fiscal 2014, respectively, allowed us to enhance and secure our competitive position and to increase our mattress fabrics business. Prior to fiscal 2009, Bodet & Horst had been serving as our primary source of knitted mattress fabrics, and the two transactions allowed us to secure our supply for this important and growing product category, while also gaining control of product development and enhancing customer service. The transactions also involved consulting and non-compete agreements that enhanced our mattress fabrics product development and helped to secure our end markets. In addition to these transactions, we have continued to make further investments in knitting machines and finishing equipment, increasing our internal production capacity substantially.

Our sewn mattress cover business, established during fiscal 2013, participates in a joint marketing agreement for the production and marketing of sewn mattress covers and represents a further step in our efforts to respond to industry demands. The marketing venture is known as Culp-Lava Applied Sewn Solutions (CLASS), and is a joint marketing effort with A. Lava & Son Co. of Chicago, a leading provider of mattress covers. This manufacturing operation, located near our other plants in North Carolina, involves leased space and a limited capital investment in equipment. Teaming with A. Lava & Son allows us to have two mirrored manufacturing facilities and greater flexibility in meeting demand for mattress covers from bedding producers.

Upholstery Fabrics. The upholstery fabrics segment markets fabrics for residential and commercial furniture, including jacquard woven fabrics, velvets, microdenier suedes, woven dobbies, knitted fabrics, piece-dyed woven products, and polyurethane “leather look” fabrics. This segment operates fabric manufacturing facilities in Anderson, South Carolina, and Shanghai, China. We market fabrics produced in these two locations, as well as a variety of upholstery fabrics sourced from third party producers, mostly in China. In the past fiscal year, sales of non-U.S. produced upholstery accounted for approximately 90% of our upholstery fabric sales.

4

Our China facilities near Shanghai include fabric sourcing, finishing, warehousing, quality control and inspection operations, as well as a plant where sourced fabrics are cut and sewn into “kits” made to specifications of furniture manufacturing customers. More recent developments in our China operations include expansion of our product development and design capabilities in China and further strengthening of key strategic partnerships with mills. We also have expanded our marketing efforts to sell our China products in countries other than the U.S., including the Chinese local market. The U.S. facility in South Carolina produces a variety of woven upholstery fabrics, including velvets and certain decorative fabrics.

During fiscal 2015 we closed our distribution warehouse in Poland that had been established to support sales in Europe. We are currently reviewing the company’s best long-term strategy for marketing upholstery fabrics in Europe.

Over the past decade, we have moved our upholstery business from one that relied on a large fixed capital base that is difficult to adjust to a more flexible and scalable marketer of upholstery fabrics that meets changing levels of customer demand and style preferences. At the same time, we have maintained control of the most important “value added” aspects of our business, such as design, finishing, quality control, and logistics. This strategic approach has allowed us to limit our investment of capital in fixed assets and control the costs of our products, while continuing to leverage our design and finishing expertise, industry knowledge, and important relationships.

Our upholstery fabrics sales increased in fiscal 2015 for the sixth consecutive year. These gains reversed a ten-year trend of declining upholstery sales that ended with fiscal 2009, as we substantially overhauled our operating model during this time period. We believe our increased sales in the upholstery fabrics segment have been achieved primarily through implementation of a business strategy that included: 1) innovation in a low-cost environment, 2) speed-to-market execution, 3) consistent quality, 4) reliable service and lead times, and 5) increased recognition of and reliance on the Culp brand. Success in upholstery fabrics has been achieved through development of a unique business model that has enabled the upholstery segment to execute a strategy that we believe is clearly differentiated from our competitors. In this way, we have maintained our ability to provide furniture manufacturers with products from every category of fabric used to cover upholstered furniture, and to meet continually changing demand levels and consumer preferences.

Culp markets products primarily to manufacturers that operate in three principal markets. The mattress fabrics segment supplies the bedding industry, which produces mattress sets (mattresses, box springs, foundations and top of bed components). The upholstery fabrics segment supplies the residential furniture industry and, to a lesser extent, the commercial furniture industry. The residential furniture market includes upholstered furniture sold to consumers for household use, including sofas, sofa-beds, chairs, recliners and sectionals. The commercial furniture and fabrics market includes upholstered office seating and modular office systems sold primarily for use in offices and other institutional settings, fabrics used in the hospitality industry, and commercial textile wall coverings. The principal industries into which the company sells products are described below. Currently the vast majority of our products are sold to manufacturers for end use in the U.S., and thus the discussions below are focused on that market.

The bedding industry has contracted and expanded in recent years in accordance with the general economy, although traditionally the industry has been relatively mature and stable. This is due in part to the fact that a majority of bedding industry sales are replacement purchases, which are less volatile than sales based on economic growth and new household formations.

5

Unlike the residential furniture industry, which continues to face intense competition from imports, the U.S. bedding industry has largely remained a North American-based business with limited competition from imports. Imports of bedding into the U.S. have increased in recent years, but imported beds still represent only a small fraction of total U.S. bedding sales. The primary reasons for this fact include: 1) the short lead times demanded by mattress manufacturers and retailers due to their quick service delivery model, 2) the limited inventory carried by manufacturers and retailers requires “just-in-time” delivery of product, 3) the customized nature of each manufacturer’s and retailer’s product lines, 4) high shipping and import duty costs, 5) the relatively low direct labor content in mattresses, and 6) strong brand recognition and importance.

A key trend driving the bedding industry is increased awareness among consumers about the health benefits of better sleep, with a greater focus on the quality of bedding products and an apparent willingness on the part of consumers to upgrade their bedding. Another important trend is the strong and growing emphasis on the design knitted or woven into mattress fabrics to enhance visual appeal and perceived value of the mattress on the retail floor. Mattress fabric design efforts are based on current trends in home decor and fashion. Another trend has been the growth in non-traditional sources for retail mattress sales such as wholesale warehouse clubs and the internet. These sales channels have the potential to increase overall consumption of goods due to convenience and high traffic volume, which in turn results in higher turnover of product. Among fabric types, knitted fabrics have continued to increase in popularity. Knitted fabric was initially used primarily on premium mattresses, but these products are now being placed increasingly on mattresses at mid-range to lower retail price points.

Sales of residential and commercial furniture were both severely affected by the global economic downturn in 2008-2009, and have now been in recovery for several years along with the overall economy. The pace of recovery since 2010 has been relatively steady, but modest, as has the growth rate for the economy as a whole. Sales of residential furniture are influenced significantly by the housing industry and by trends in home sales and household formations, while demand for commercial furniture generally reflects economic trends affecting businesses.

The sourcing of components and fully assembled furniture from overseas continues to play a major role in the furniture industry. By far, the largest source for these imports continues to be China. Imports of upholstery fabric, both in roll and in “kit” form, have also had a significant impact on the market for upholstery fabrics in recent years. Fabrics entering the U.S. from China and other low labor cost countries have resulted in increased price competition in the upholstery fabric and upholstered furniture markets.

Supply shortages and higher prices for leather have created increased opportunities for suppliers of “leather look” and suede fabrics, and for suppliers of upholstery generally. The residential furniture industry has been consolidating for several years, resulting in fewer, but larger, customers for marketers of upholstery fabrics. Intense price competition continues to be an important consideration for both residential and commercial furniture.

As described above, our products include mattress fabrics and upholstery fabrics, which are the company’s identified operating segments. These fabrics are sold in roll form and as sewn mattress covers by the Mattress Fabrics segment, and in roll form and as cut and sewn kits by the Upholstery Fabrics segment.

6

Mattress Fabrics Segment

Mattress fabrics segment sales constituted 56% to 58% of our total net sales in each of the past three fiscal years. The company has emphasized fabrics that have broad appeal at prices generally ranging from $1.50 to more than $10.00 per yard.

Upholstery Fabrics Segment

Upholstery fabrics segment sales totaled 42% to 44% of our sales for each of the past three fiscal years. The company has emphasized fabrics that have broad appeal at “good” and “better” prices, generally ranging from $3.00 to $8.25 per yard.

Culp Fabric Categories by Segment

We market products in most categories of fabric that manufacturers currently use for bedding and furniture. The following table indicates the product lines within each segment, and a brief description of their characteristics.

|

Mattress Fabrics

|

|

|

Woven jacquards

|

Various patterns and intricate designs. Woven on complex looms using a variety of synthetic and natural yarns.

|

|

Converted

|

Suedes, pile and embroidered fabrics, and other specialty type products are sourced to offer diversity for higher end mattresses.

|

|

Knitted fabric

|

Various patterns and intricate designs produced on special-width circular knit machines utilizing a variety of synthetic and natural yarns. Knitted mattress fabrics have inherent stretching properties and spongy softness, which conforms well with layered foam packages.

|

|

Upholstery Fabrics

|

|

|

Woven jacquards

|

Elaborate, complex designs such as florals and tapestries in traditional, transitional, and contemporary styles. Woven on intricate looms using a wide variety of synthetic and natural yarns.

|

|

Woven dobbies

|

Fabrics that use straight lines to produce geometric designs such as plaids, stripes, and solids in traditional and country styles. Woven on less complicated looms using a variety of weaving constructions and primarily synthetic yarns.

|

|

Velvets

|

Soft fabrics with a plush feel. Woven or knitted in basic designs, using synthetic yarns which are yarn dyed or piece dyed.

|

|

Suedes

|

Fabrics woven or knitted using microdenier polyester yarns, which are piece dyed and finished, usually by sanding. The fabrics are typically plain or small jacquard designs, with some being printed. These are sometimes referred to as microdenier suedes.

|

|

Faux leathers

|

Sueded or knitted base cloths which are overprinted with polyurethane, and composite products consisting of a base fabric which is coated with a top layer of polyurethane, which simulate the look and feel of leather.

|

7

Mattress Fabrics Segment

Our mattress fabrics segment operates four manufacturing plants, with two located in Stokesdale, North Carolina, and one each in High Point, North Carolina, and St. Jerome, Quebec, Canada. Over the past ten fiscal years, we made capital expenditures of approximately $50 million to consolidate all of our production of woven jacquards, or damask fabric, to these plants, modernize both knit and weaving equipment, enhance and provide knit and woven finishing capabilities, and expand capacity in each of these facilities. The result has been an increase in manufacturing efficiency and reductions in operating costs, as well as expanded product offerings.

Jacquard mattress fabrics and knitted fabrics are produced at the St. Jerome plant, with further jacquard capacity at our main Stokesdale facility along with knitting capacity at our High Point facility. Most finishing and inspection processes for mattress fabrics are conducted at the main Stokesdale plant. In fiscal 2013, we announced a new joint marketing arrangement with a producer of sewn mattress covers for bedding. This effort resulted in the establishment of an additional manufacturing facility in Stokesdale to produce and market sewn mattress covers.

In addition to the mattress fabrics we manufacture, we have important supply arrangements in place that allow us to source mattress fabric from strategic suppliers. A portion of our woven jacquard fabric and knitted fabric is obtained from a supplier located in Turkey, based on designs and a production schedule created by Culp. We are also sourcing some Culp-designed knitted fabrics from suppliers based in China, and we are sourcing certain converted fabric products (such as suedes, pile fabrics and embroidered fabrics) through our China platform.

Upholstery Fabrics Segment

We currently operate one upholstery manufacturing facility in the U.S. and four in China. The U.S. plant is located in Anderson, South Carolina, and mainly produces velvet upholstery fabrics with some production of certain decorative fabrics.

Our upholstery manufacturing facilities in China are all located within the same industrial area near Shanghai. At these facilities, we apply value-added finishing processes to fabrics sourced from a limited number of strategic suppliers in China, and we inspect sourced fabric there as well. In addition, the Shanghai operations include facilities where sourced fabric is cut and sewn to provide “kits” that are designed to be placed on specific furniture frames designated by our customers.

A large portion of our upholstery fabric products, as well as certain elements of our production processes, are being sourced from outside suppliers. The development of our facilities in China has provided a base from which to access a variety of products, including certain fabrics (such as microdenier suedes and polyurethane fabrics) that are not produced anywhere within the U.S. We have found opportunities to develop significant relationships with key overseas suppliers in China that allow us to source products on a cost-effective basis, while limiting our investment of capital in manufacturing assets. We source unfinished and finished fabrics, as well as a portion of our cut and sewn kits, from a limited number of strategic suppliers in China who are willing to commit significant capacity to meet our needs while working with our product development team to meet the demands of our customers. We also source a portion of our yarns for our U.S. operation through our China facilities. The remainder of our yarn is obtained from other suppliers around the world.

8

Consumer tastes and preferences related to bedding and upholstered furniture change over time. The use of new fabrics and creative designs remains an important consideration for manufacturers to distinguish their products at retail and to capitalize on changes in preferred colors, patterns and textures. Culp’s success is largely dependent on our ability to market fabrics with appealing designs and patterns. The process of developing new designs involves maintaining an awareness of broad fashion and color trends both in the United States and internationally.

Mattress Fabrics Segment

Design innovation is an increasingly important element of producing mattress fabrics. Price point delineation is accomplished through fabric quality as well as variation in design. Additionally, consumers are drawn to the mattress that is most visually appealing when walking into a retail showroom. Fiber differentiation also plays an important part in design. For example, rayon, organic cotton and other special fibers are incorporated into the design process to allow the retailer to offer consumers additional benefits related to their sleeping experience. Similarly, many fabrics contain special production finishes that enhance fabric performance.

Mattress fabric designs are not routinely introduced on a scheduled season. Designs are typically introduced upon the request of the customer as they plan introduction to their retailers. Additionally, we work closely with our customers on new design offerings around the major furniture markets such as High Point, North Carolina, and Las Vegas, Nevada.

Upholstery Fabrics Segment

The company has developed an upholstery fabrics design and product development team (with staff located in the U.S. and in China) with focus on designing for value primarily on body cloths, while promoting style leadership with pillow fabrics and color. The team searches continually for new ideas and for the best sources of raw materials, yarns, and fabrics, utilizing a supply network located mostly in China. Using these design elements, they develop product offerings using ideas and materials which take both fashion trends and cost considerations into account to offer products designed to meet the needs of furniture manufacturers and ultimately the desires of consumers.

Upholstery fabric designs are introduced at major fabric trade conferences that occur twice a year in the United States (June and December). In recent years we have become more aggressive in registering copyrights for popular fabric patterns and taking steps to discourage the illegal copying of our proprietary designs.

Mattress Fabrics Segment

The vast majority of our shipments of mattress fabrics originate from our facilities in Stokesdale, North Carolina. Through arrangements with major customers and in accordance with industry practice, we maintain a significant inventory of mattress fabrics at our distribution facility in Stokesdale (“make to stock”), so that products may be shipped to customers with short lead times and on a “just in time” basis.

Upholstery Fabrics Segment

A majority of our upholstery fabrics are marketed on a “make to order” basis and are shipped directly from our distribution facilities in Burlington, North Carolina, and Shanghai, China. In addition to “make to order” distribution, an inventory comprised of a limited number of fabric patterns is held at our distribution facilities in Burlington and Shanghai from which our customers can obtain quick delivery of sourced fabrics through a program known as “Culp Express.” Beginning in fiscal 2010 and continuing through fiscal 2015, market share opportunities have been expanded through strategic selling partnerships.

9

Mattress Fabrics Segment

Raw materials account for approximately 60%-70% of mattress fabric production costs. The mattress fabrics segment purchases synthetic yarns (polyester, polypropylene, and rayon), certain greige (unfinished) goods, latex adhesives, laminates, dyes, and other chemicals. Most of these materials are available from several suppliers and prices fluctuate based on supply and demand, the general rate of inflation, and particularly on the price of petrochemical products. The mattress fabrics segment has generally not had significant difficulty in obtaining raw materials.

Upholstery Fabrics Segment

Raw materials account for approximately 60%-70% of upholstery fabric manufacturing costs for products the company manufactures. This segment purchases synthetic yarns (polypropylene, polyester, acrylic, and rayon), acrylic staple fiber, latex adhesives, dyes and other chemicals from various suppliers.

Increased reliance by both our U.S. and China upholstery operations on outside suppliers for basic production needs such as base fabrics, yarns, and finishing services has caused the upholstery fabrics segment to become more vulnerable to price increases, delays, or production interruptions caused by problems within businesses that we do not control.

Both Segments

Many of our basic raw materials are petrochemical products or are produced from such products. For this reason, our material costs can be sensitive to changes in prices for petrochemicals and the underlying price of oil. During fiscal 2015, our profitability was aided somewhat by lower raw material prices due to lower oil prices, although raw material prices appeared to stabilize later in the year.

Mattress Fabrics Segment

The mattress fabrics business and the bedding industry in general are slightly seasonal, with sales being the highest in early spring and late summer, with another peak in mid-winter.

Upholstery Fabrics Segment

The upholstery fabrics business is somewhat seasonal, with sales often higher during our first and fourth fiscal quarters. In the past, seasonality resulted from one-week closings of our manufacturing facilities and the facilities of most of our customers in the United States during our first and third fiscal quarters for the holiday weeks of July 4th and Christmas. This effect has become less pronounced as a larger portion of our fabrics are produced or sold in locations outside of the U.S. The timing of the Chinese National Holiday in October and the Chinese New Year (which occurs in January or February each year) now have a more significant impact on upholstery sales than the effects of U.S. holiday periods.

10

Competition for our products is high and is based primarily on price, design, quality, timing of delivery, and service.

Mattress Fabrics Segment

The mattress fabrics market is concentrated in a few relatively large suppliers. We believe our principal mattress fabric competitors are Bekaert Textiles B.V., Global Textile Alliance, and several smaller companies producing knitted and other fabric.

Upholstery Fabrics Segment

In the upholstery fabric market, we compete against a large number of companies, ranging from a few large manufacturers comparable in size to Culp to small producers, and a growing number of “converters” of fabrics (companies who buy and re-sell, but do not manufacture fabrics). We believe our principal upholstery fabric competitors are Richloom Fabrics, Merrimack Fabrics, Morgan Fabrics, and Specialty Textile, Inc. (or STI), plus a large number of smaller competitors (both manufacturers and converters).

The trend in the upholstery fabrics industry to greater overseas competition and the entry of more converters has caused the upholstery fabrics industry to become substantially more fragmented in recent years, with lower barriers to entry. This has resulted in a larger number of competitors selling upholstery fabrics, with an increase in competition based on price.

We are subject to various federal and state laws and regulations, including the Occupational Safety and Health Act (“OSHA”) and federal and state environmental laws, as well as similar laws governing our manufacturing facilities in China and Canada. We periodically review our compliance with these laws and regulations in an attempt to minimize the risk of violations.

Our operations involve a variety of materials and processes that are subject to environmental regulation. Under current law, environmental liability can arise from previously owned properties, leased properties and properties owned by third parties, as well as from properties currently owned and leased by the company. Environmental liabilities can also be asserted by adjacent landowners or other third parties in toxic tort litigation.

In addition, under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (“CERCLA”), and analogous state statutes, liability can be imposed for the disposal of waste at sites targeted for cleanup by federal and state regulatory authorities. Liability under CERCLA is strict as well as joint and several.

The U.S. Congress is currently considering legislation to address climate change that is intended to reduce overall greenhouse gas emissions, including carbon dioxide. In addition, the U.S. Environmental Protection Agency has made a determination that greenhouse gas emissions may be a threat to human health and the environment. International agreements may also result in new regulations on greenhouse gas emissions. It is uncertain if, when, and in what form, a mandatory carbon dioxide emissions reduction program may be enacted either through legislation or regulation. However, if enacted, this type of program could materially increase our operating costs, including costs of raw materials, transportation, and electricity. It is difficult to predict the extent to which any new rules or regulations would affect our business, but we would expect the effect on our operations to be similar to that for other manufacturers, particularly those in our industry.

11

We are periodically involved in environmental claims or litigation and requests for information from environmental regulators. Each of these matters is carefully evaluated, and the company provides for environmental matters based on information presently available. Based on this information, we do not believe that environmental matters will have a material adverse effect on either the company’s financial condition or results of operations. However, there can be no assurance that the costs associated with environmental matters will not increase in the future. See the discussion of an environmental claim against the company that was settled late in fiscal 2014 in Note 11 to the financial statements contained in Item 8 hereof.

As of May 3, 2015, we had 1,188 employees, compared with 1,167 at the end of fiscal 2014. Overall, our total number of employees has remained fairly steady over the past five years, with increases in the mattress fabrics segment and decreases in the upholstery segment during that period.

The hourly employees at our manufacturing facility in Canada (approximately 13% of the company’s workforce) are represented by a local, unaffiliated union. The collective bargaining agreement for these employees expires on February 1, 2017. We are not aware of any efforts to organize any more of our employees, and we believe our relations with our employees are good.

The following table illustrates the changes in the location of our workforce and number of employees, as of year-end, over the past five fiscal years.

|

Number of Employees

|

||||||||||||||||||||

|

Fiscal

2015

|

Fiscal

2014

|

Fiscal

2013

|

Fiscal

2012

|

Fiscal

2011

|

||||||||||||||||

|

Mattress Fabrics Segment

|

631 | 592 | 577 | 492 | 466 | |||||||||||||||

|

Upholstery Fabrics Segment

|

||||||||||||||||||||

|

United States

|

129 | 129 | 121 | 113 | 130 | |||||||||||||||

|

Poland

|

- | 4 | 5 | 8 | 6 | |||||||||||||||

|

China

|

424 | 438 | 464 | 497 | 543 | |||||||||||||||

|

Total Upholstery Fabrics Segment

|

553 | 571 | 590 | 618 | 679 | |||||||||||||||

|

Unallocated corporate

|

4 | 4 | 4 | 4 | 4 | |||||||||||||||

|

Total

|

1,188 | 1,167 | 1,171 | 1,114 | 1,149 | |||||||||||||||

Mattress Fabrics Segment

Major customers for our mattress fabrics include the leading bedding manufacturers: Serta-Simmons Bedding (SSB), Tempur + Sealy International, and Corsicana Bedding. The loss of one or more of these customers would have a material adverse effect on the company. Our two largest customers in the mattress fabrics segment are (1) SSB, accounting for approximately 23% of the company’s overall sales in fiscal 2015, and (2) Tempur + Sealy International, Inc., accounting for approximately 8% of our overall sales in fiscal 2015. The loss of either of these customers would have a material adverse effect on the company. Our mattress fabrics customers also include many small and medium-size bedding manufacturers.

12

Upholstery Fabrics Segment

Our major customers for upholstery fabrics are leading manufacturers of upholstered furniture, including Ashley, Bassett, Best Home Furnishings, Flexsteel, Heritage Home Group (Broyhill and Lane), Jackson Furniture, Jonathan Louis, La-Z-Boy (La-Z-Boy Residential and England), and Southern Motion. Major customers for the company’s fabrics for commercial furniture include HON Industries. Our largest customer in the upholstery fabrics segment is La-Z-Boy Incorporated, the loss of which would have a material adverse effect on the company. Our sales to La-Z-Boy accounted for approximately 13% of the company’s total net sales in fiscal 2015.

The following table sets forth our net sales by geographic area by amount and percentage of total net sales for the three most recent fiscal years.

(dollars in thousands)

|

Fiscal 2015

|

Fiscal 2014

|

Fiscal 2013

|

||||||||||||||||||||||

|

United States

|

$ | 242,833 | 78.3 | % | $ | 232,078 | 80.8 | % | $ | 207,201 | 77.1 | % | ||||||||||||

|

North America

|

30,758 | 10.0 | 15,556 | 5.4 | 11,900 | 4.4 | ||||||||||||||||||

|

(Excluding USA)(1)

|

||||||||||||||||||||||||

|

Far East and Asia(2)

|

31,855 | 10.3 | 33,487 | 11.7 | 43,907 | 16.3 | ||||||||||||||||||

|

All other areas

|

4,720 | 1.5 | 6,041 | 2.1 | 5,806 | 2.2 | ||||||||||||||||||

|

Subtotal (International)

|

67,333 | 21.7 | 55,084 | 19.2 | 61,613 | 22.9 | ||||||||||||||||||

|

Total

|

$ | 310,166 | 100 | % | $ | 287,162 | 100 | % | $ | 268,814 | 100 | % | ||||||||||||

(1) Of this amount, $24.1 million are attributable to shipments to Mexico in fiscal 2015, with corresponding amounts of $9.3 million in fiscal 2014 and $3.2 million in fiscal 2013. Sales are attributed to individual countries based upon the location that the company ships its products to for delivery to customers.

(2) Of this amount, $26.5 million are attributable to shipments to China in fiscal 2015, with corresponding amounts of $32.2 million in fiscal 2014 and $42.1 million in fiscal 2013.

For additional segment information, including the geographic location of long-lived assets, see Note 16 in the consolidated financial statements.

Mattress Fabrics Segment

The backlog for mattress fabric is not a reliable predictor of future shipments because the majority of sales are on a just-in-time basis.

Upholstery Fabrics Segment

Although it is difficult to predict the amount of backlog that is “firm,” we have reported the portion of the upholstery fabric backlog from customers with confirmed shipping dates within five weeks of the end of the fiscal year. On May 3, 2015 the portion of the upholstery fabric backlog with confirmed shipping dates prior to June 7, 2015, was $9.4 million, all of which are expected to be filled early during fiscal 2016, as compared to $9.1 million as of the end of fiscal 2014 (for confirmed shipping dates prior to June 1, 2014).

13

Our business is subject to risks and uncertainties. In addition to the matters described above under “Cautionary Statement Concerning Forward-Looking Information,” set forth below are some of the risks and uncertainties that could cause a material adverse change in our results of operations or financial condition.

Continued economic weakness could negatively affect our sales and earnings.

Overall demand for our products depends upon consumer demand for furniture and bedding, which is subject to variations in the general economy. Because purchases of furniture or bedding are discretionary purchases for most individuals and businesses, demand for these products is sometimes more easily influenced by economic trends than demand for other products. Economic downturns can affect consumer spending habits and demand for home furnishings, which reduces the demand for our products and therefore can cause a decrease in our sales and earnings. Continuing weak economic conditions have caused a decrease in consumer spending and demand for home furnishings, including goods that incorporate our products. If these conditions persist, our business will be negatively affected.

It has been challenging to maintain and increase sales levels in the upholstery fabrics segment.

Increased competition and fragmentation of the upholstery fabrics business, including a dramatic shift to imported fabrics and resulting price deflation for upholstery fabrics, have led to a significant reduction in the size of our upholstery business. Opportunities for growth and profitability gains for this segment are encouraging, but there is no assurance that we will be able to maintain or consistently grow this business in the future.

Greater reliance on offshore operations and foreign sources of products or raw materials increases the likelihood of disruptions to our supply chain or our ability to deliver products to our customers on a timely basis.

We rely significantly on operations in distant locations, particularly China, and in addition we have been purchasing a significant share of our products and raw materials from offshore sources. At the same time, our domestic manufacturing capacity for the upholstery fabrics segment has been greatly reduced. These changes have caused us to rely on a much longer supply chain and on a larger number of suppliers that we do not control, both of which are inherently subject to greater risks of delay or disruption. In addition, operations and sourcing in foreign areas are subject to the risk of changing local governmental rules, taxes, changes in import rules or customs, potential political unrest, or other threats that could disrupt or increase the costs of operating in foreign areas or sourcing products overseas. Changes in the value of the U.S. dollar versus other currencies can affect our financial results because a significant portion of our operations are located outside the United States. Strengthening of the U.S. dollar against other currencies can have a negative impact on our sales of products produced in those countries. Any of the risks associated with foreign operations and sources could cause unanticipated increases in operating costs or disruptions in business, which could negatively impact our ultimate financial results.

14

We may have difficulty managing the outsourcing arrangements being used for products and services.

We rely on outside sources for various products and services, including yarn and other raw materials, greige (unfinished) fabrics, finished fabrics, and services such as weaving and finishing. Increased reliance on outsourcing lowers our capital investment and fixed costs, but it decreases the amount of control that we have over certain elements of our production capacity. Interruptions in our ability to obtain raw materials or other required products or services from our outside suppliers on a timely and cost effective basis, especially if alternative suppliers cannot be immediately obtained, could disrupt our production and damage our financial results.

Write-offs or write-downs of assets would result in a decrease in our earnings and shareholders’ equity.

The company has long-lived assets, consisting mainly of property, plant and equipment and goodwill. ASC Topic 360 establishes an impairment accounting model for long-lived assets such as property, plant, and equipment and requires the company to assess for impairment whenever events or changes in circumstances indicate that the carrying value of the asset may not be recovered. ASC Topic 350 requires that goodwill be tested at least annually for impairment or whenever events or changes in circumstances indicate that the carrying value of the asset may not be recovered. Although no material write-downs were experienced in the past several fiscal years, there is no assurance that future write-downs of fixed assets or goodwill will not occur if business conditions deteriorate.

Changes in the price, availability, and quality of raw materials could increase our costs or cause production delays and sales interruptions, which would result in decreased earnings.

We depend upon outside suppliers for most of our raw material needs, and we rely upon outside suppliers for component materials such as yarn and unfinished fabrics, as well as for certain services such as finishing and weaving. Fluctuations in the price, availability, and quality of these goods and services could have a negative effect on our production costs and ability to meet the demands of our customers, which would affect our ability to generate sales and earnings. In many cases, we are not able to pass through increased costs of raw materials or increased production costs to our customers through price increases. In particular, many of our basic raw materials are petrochemical products or are produced from such products. For this reason, our material costs are especially sensitive to changes in prices for petrochemicals and the underlying price of oil. Increases in prices for oil, petrochemical products or other raw materials and services provided by outside suppliers could significantly increase our costs and negatively affect earnings. Increases in market prices for certain fibers and yarns had a material adverse impact on our profit margins during fiscal 2011 and 2012. Although our raw material costs were lower during our three most recent fiscal years, higher raw material prices could have a negative effect on our profits in the future.

Increases in energy costs would increase our operating costs and could adversely affect earnings.

Higher prices for electricity, natural gas, and fuel increase our production and shipping costs. A significant shortage, increased prices, or interruptions in the availability of these energy sources would increase the costs of producing and delivering products to our customers, and would be likely to adversely affect our earnings. In many cases, we are not able to pass along the full extent of increases in our production costs to customers through price increases. Energy costs have varied significantly during recent fiscal years, and remain a volatile element of our costs. Further increases in energy costs could have a negative effect on our earnings.

15

Business difficulties or failures of large customers could result in a decrease in our sales and earnings.

We currently have several customers that account for a substantial portion of our sales. In the mattress fabrics segment, several large bedding manufacturers have large market shares and comprise a significant portion of our mattress fabric sales, with Serta Simmons Holdings, LLC accounting for approximately 23% of consolidated net sales, and Tempur Sealy International, Inc. accounting for approximately 8% of consolidated net sales, in fiscal 2015. In the upholstery fabrics segment, La-Z-Boy Incorporated accounted for approximately 13% of consolidated net sales during fiscal 2015, and several other large furniture manufacturers comprised a significant portion of sales. A business failure or other significant financial difficulty by one or more of our major customers, or the loss of one or more of these customers, could cause a significant loss in sales, an adverse effect on our earnings, and difficulty in collection of our trade accounts receivable.

Loss of market share due to competition would result in declines in sales and could result in losses or decreases in earnings.

Our business is highly competitive, and in particular the upholstery fabric industry is fragmented and is experiencing an increase in the number of competitors. As a result, we face significant competition from a large number of competitors, both foreign and domestic. We compete with many other manufacturers of fabric, as well as converters who source fabrics from various producers and market them to manufacturers of furniture and bedding. In many cases, these fabrics are sourced from foreign suppliers who have a lower cost structure than the company. The highly competitive nature of our business means we are constantly subject to the risk of losing market share. As a result of increased competition, there have been deflationary pressures on the prices for many of our products, which make it more difficult to pass along increased operating costs such as raw materials, energy or labor in the form of price increases and puts downward pressure on our profit margins. Also, the large number of competitors and wide range of product offerings in our business can make it more difficult to differentiate our products through design, styling, finish, and other techniques.

If we fail to anticipate and respond to changes in consumer tastes and fashion trends, our sales and earnings may decline.

Demand for various types of upholstery fabrics and mattress coverings changes over time due to fashion trends and changing consumer tastes for furniture and bedding. Our success in marketing our fabrics depends upon our ability to anticipate and respond in a timely manner to fashion trends in home furnishings. If we fail to identify and respond to these changes, our sales of these products may decline. In addition, incorrect projections about the demand for certain products could cause the accumulation of excess raw material or finished goods inventory, which could lead to inventory mark-downs and decreases in earnings.

Increasing dependence on information technology systems comes with specific risks, including cybersecurity breaches and data leaks, which could have an adverse effect on our business.

We increasingly rely on technology systems and infrastructure. Greater dependence on such systems heightens the risk of potential vulnerabilities from system failure and malfunction, breakdowns due to natural disasters, human error, unauthorized access, power loss, and other unforeseen events. Data privacy breaches by employees and others with or without authorized access to our systems poses risks that sensitive data may be permanently lost or leaked to the public or other unauthorized persons. With the growing use and rapid evolution of technology, not limited to cloud-based computing and mobile devices, there are additional risks of unintentional data leaks. There is also the risk of our exposure to theft of confidential information, intentional vandalism, industrial espionage, and a variety of cyber-attacks that could compromise our internal technology system and infrastructure, or result in data leakage in-house or at our third-party providers and business partners. Failures of technology or related systems, or an improper release of confidential information, could damage our business or subject us to unexpected liabilities.

16

We are subject to litigation and environmental regulations that could adversely impact our sales and earnings.

We have been, and in the future may be, a party to legal proceedings and claims, including environmental matters, product liability, and employment disputes, some of which claim significant damages. We face the continual business risk of exposure to claims that our business operations have caused personal injury or property damage. We maintain insurance against product liability claims and in some cases have indemnification agreements with regard to environmental claims, but there can be no assurance that these arrangements will continue to be available on acceptable terms or that such arrangements will be adequate for liabilities actually incurred. Given the inherent uncertainty of litigation, there can be no assurance that claims against the company will not have a material adverse impact on our earnings or financial condition. We are also subject to various laws and regulations in our business, including those relating to environmental protection and the discharge of materials into the environment. We could incur substantial costs as a result of noncompliance with or liability for cleanup or other costs or damages under environmental laws or other regulations.

We must comply with a number of governmental regulations applicable to our business, and changes in those regulations could adversely affect our business.

Our products and raw materials are and will continue to be subject to regulation in the United States by various federal, state, and local regulatory authorities. In addition, other governments and agencies in other jurisdictions regulate the manufacture, sale, and distribution of our products and raw materials. Also, rules and restrictions regarding the importation of fabrics and other materials, including custom duties, quotas and other regulations, are continually changing. Environmental laws, labor laws, tax regulations, and other regulations continually affect our business. All of these rules and regulations can and do change from time to time, which can increase our costs or require us to make changes in our manufacturing processes, product mix, sources of products and raw materials, or distribution. Changes in the rules and regulations applicable to our business may negatively impact our sales and earnings.

None.

17

Our headquarters are located in High Point, North Carolina. As of the end of fiscal 2015, we owned or leased fourteen active manufacturing, and distribution facilities and our corporate headquarters. The following is a list of our principal administrative, manufacturing and distribution facilities. The manufacturing facilities and distribution centers are organized by segment.

| Location | Principal Use |

Approx.

Total Area

(Sq. Ft.)

|

Expiration

of Lease

|

|||||||

| ● | Administrative: | |||||||||

| High Point, North Carolina (1) |

Upholstery fabric division

offices and corporate

headquarters

|

29,812 | 2025 | |||||||

| ● |

Mattress Fabrics:

|

|

||||||||

| Stokesdale, North Carolina | Manufacturing, distribution,

and division offices

|

230,000 | Owned | |||||||

| Stokesdale, North Carolina | Warehouse | 56,950 | 2017 | |||||||

| High Point, North Carolina (1) | Manufacturing | 63,522 | 2023 | |||||||

| High Point, North Carolina | Warehouse and offices | 65,886 | 2017 | |||||||

| Summerfield, North Carolina | Manufacturing | 39,320 | 2018 | |||||||

| St. Jerome, Quebec, Canada | Manufacturing | 202,500 | Owned | |||||||

| ● | Upholstery Fabrics: | |||||||||

| Anderson, South Carolina | Manufacturing | 99,000 | Owned | |||||||

| Burlington, North Carolina | Finished goods distribution | 132,000 | 2016 | |||||||

| Shanghai, China | Manufacturing and offices | 68,677 | 2018 | |||||||

| Shanghai, China | Manufacturing and offices | 89,857 | 2018 | |||||||

| Shanghai, China | Manufacturing and warehousing | 89,861 | 2017 | |||||||

| Shanghai, China | Manufacturing and warehousing | 64,583 | 2017 | |||||||

| Shanghai, China | Warehouse | 48,610 | 2016 | |||||||

(1) Includes all options to renew.

We believe that our facilities are in good condition, well-maintained and suitable and adequate for present utilization. In the upholstery fabrics segment, we have the ability to source upholstery fabric from outside suppliers to meet current and expected demand trends and further increase our output of finished goods. This ability to source upholstery fabric is part of our long-term strategy to have a low-cost platform that is scalable, but not capital intensive. In the mattress fabrics segment, management has estimated that it is currently performing at near capacity. Also, we have the ability to source additional mattress fabric from outside suppliers to further increase our ultimate output of finished goods.

Our legal proceedings are described more fully in Note 11 in the notes to the consolidated financial statements.

Not applicable.

18

Registrar and Transfer Agent

Computershare Trust Company, N.A.

c/o Computershare Investor Services

Post Office Box 30170

College Station, TX 77842

(800) 254-5196

(781) 575-2879 (Foreign shareholders)

www.computershare.com/investor

Stock Listing

Culp, Inc. common stock is traded on the New York Stock Exchange (“NYSE”) under the symbol CFI. As of May 3, 2015, Culp, Inc. had approximately 2,890 shareholders based on the number of holders of record and an estimate of individual participants represented by security position listings.

Analyst Coverage

These analysts cover Culp, Inc.:

Raymond, James & Associates - Budd Bugatch, CFA

Value Line – Craig Sirois

Sidoti & Company, LLC – James Fronda

Stifel Financial Corp – John A. Baugh, CFA

Dividends and Share Repurchases; Sales of Unregistered Securities

Share Repurchases

ISSUER PURCHASES OF EQUITY SECURITIES

|

Period

|

(a)

Total Number

of Shares

Purchased

|

(b)

Average Price

Paid per Share

|

(c)

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs

|

(d)

Approximate Dollar

Value of Shares that

May Yet Be Purchased

Under the Plans or

Programs (1)

|

||||||||||||

|

February 2, 2015 to March 8, 2015

|

- | $ | - | - | $ | 4,256,235 | ||||||||||

|

March 9, 2015 to April 5, 2015

|

- | $ | - | - | $ | 4,256,235 | ||||||||||

|

April 6, 2015 to May 3, 2015

|

- | $ | - | - | $ | 4,256,235 | ||||||||||

|

Total

|

- | $ | - | - | $ | 4,256,235 | ||||||||||

|

(1)

|

On February 25, 2014, we announced that our board of directors approved an authorization for us to acquire up to $5.0 million of our common stock.

|

19

Dividends

Fiscal 2015

During fiscal 2015, dividend payments totaled $7.6 million, of which $4.9 million represented a special cash dividend payment in the first quarter of $0.40 per share, and $2.7 million represented our regularly quarterly cash dividend payments ranging from $0.05 to $0.06 per share.

Fiscal 2014

During fiscal 2014, we paid quarterly dividends totaling $2.2 million that ranged from $0.04 to $0.05 per share.

Fiscal 2013

During fiscal 2013, dividend payments totaled $7.6 million, of which $6.1 million represented a special cash dividend payment of $0.50 per share, and $1.5 million represented our regular quarterly dividend payments of $0.03 per share.

On June 18, 2015, we announced that our board of directors approved the payment of a special cash dividend of $0.40 per share and a regular cash dividend payment of $0.06 per share. These dividend payments are payable on July 15, 2015, to shareholders of record as of July 1, 2015.

Future dividend payments are subject to Board approval and may be adjusted at the Board’s discretion as business needs or market conditions change.

Sales of Unregistered Securities

There were no sales of unregistered securities during fiscal 2015, 2014, or 2013.

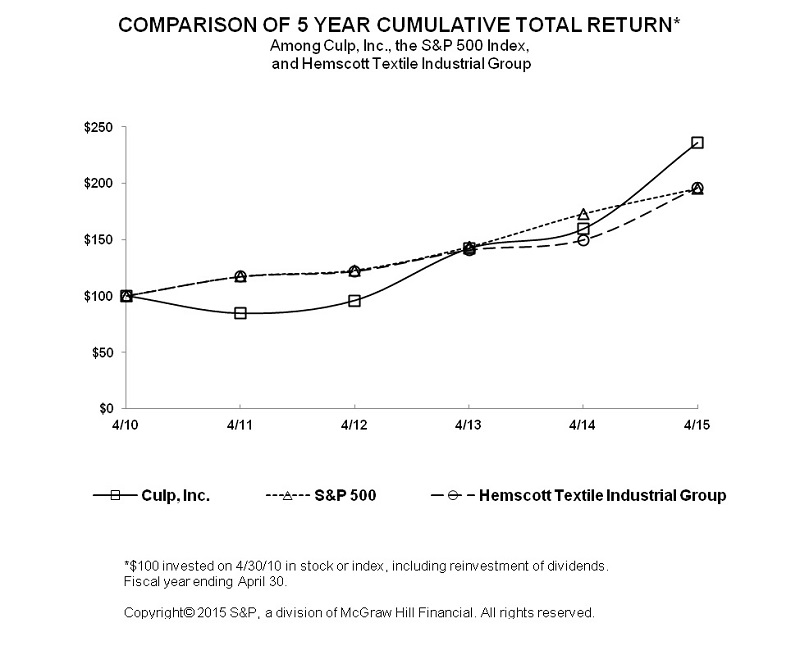

Performance Comparison

The following graph shows changes over the five fiscal years ending May 3, 2015 in the value of $100 invested in (1) the common stock of the company, (2) the Hemscott Textile Manufacturing Group Index reported by Standard and Poor’s, consisting of eight companies (including the company) in the textile industry, and (3) the Standard & Poor’s 500 Index.

The graph assumes an initial investment of $100 at the end of fiscal 2010 and the reinvestment of all dividends during the periods identified.

20

Market Information

See Item 6, Selected Financial Data, and Selected Quarterly Data in Item 8, for market information regarding the company’s common stock.

21

|

percent

|

||||||||||||||||||||||||

|

fiscal

|

fiscal

|

fiscal

|

fiscal

|

fiscal

|

change

|

|||||||||||||||||||

|

(amounts in thousands, except per share, ratios & other, stock data)

|

2015

|

2014

|

2013

|

2012

|

2011

|

2015/2014 | ||||||||||||||||||

|

INCOME STATEMENT DATA

|

||||||||||||||||||||||||

|

net sales

|

$ | 310,166 | 287,162 | 268,814 | 254,443 | 216,806 | 8.0 | % | ||||||||||||||||

|

cost of sales

|

254,599 | 238,256 | 219,284 | 214,711 | 179,966 | 6.9 | % | |||||||||||||||||

|

gross profit

|

55,567 | 48,906 | 49,530 | 39,732 | 36,840 | 13.6 | % | |||||||||||||||||

|

selling, general, and administrative expenses

|

32,778 | 28,657 | 28,445 | 25,026 | 21,069 | 14.4 | % | |||||||||||||||||

|

restructuring expense

|

- | - | - | - | 28 | 0.0 | % | |||||||||||||||||

|

income from operations

|

22,789 | 20,249 | 21,085 | 14,706 | 15,743 | 12.5 | % | |||||||||||||||||

|

interest expense

|

64 | 427 | 632 | 780 | 881 | -85.0 | % | |||||||||||||||||

|

interest income

|

(622 | ) | (482 | ) | (419 | ) | (508 | ) | (240 | ) | 29.0 | % | ||||||||||||

|

other expense

|

391 | 1,261 | 583 | 236 | 40 | -69.0 | % | |||||||||||||||||

|

income before income taxes

|

22,956 | 19,043 | 20,289 | 14,198 | 15,062 | 20.5 | % | |||||||||||||||||

|

income taxes

|

7,885 | 1,596 | 1,972 | 902 | (1,102 | ) | 394.0 | % | ||||||||||||||||

|

net income

|

$ | 15,071 | 17,447 | 18,317 | 13,296 | 16,164 | -13.6 | % | ||||||||||||||||

|

depreciation

|

$ | 5,773 | 5,312 | 5,115 | 4,865 | 4,372 | 8.7 | % | ||||||||||||||||

|

weighted average shares outstanding

|

12,217 | 12,177 | 12,235 | 12,711 | 12,959 | 0.3 | % | |||||||||||||||||

|

weighted average shares outstanding, assuming dilution

|

12,422 | 12,414 | 12,450 | 12,866 | 13,218 | 0.1 | % | |||||||||||||||||

|

PER SHARE DATA

|

||||||||||||||||||||||||

|

net income per share - basic

|

$ | 1.23 | 1.43 | 1.50 | 1.05 | 1.25 | -13.9 | % | ||||||||||||||||

|

net income per share - diluted

|

1.21 | 1.41 | 1.47 | 1.03 | 1.22 | -13.7 | % | |||||||||||||||||

| dividends per share | $ | 0.62 | 0.18 | 0.62 | - | - | 244.4 | % | ||||||||||||||||

|

book value

|

$ | 9.77 | 9.12 | 7.82 | 7.00 | 6.06 | 7.1 | % | ||||||||||||||||

|

BALANCE SHEET DATA

|

||||||||||||||||||||||||

|

operating working capital (4)

|

$ | 41,829 | 41,120 | 39,228 | 30,596 | 23,921 | 1.7 | % | ||||||||||||||||

|

property, plant and equipment, net

|

36,078 | 31,376 | 30,594 | 31,279 | 30,296 | 15.0 | % | |||||||||||||||||

|

total assets

|

171,368 | 160,935 | 144,706 | 144,716 | 130,051 | 6.5 | % | |||||||||||||||||

|

capital expenditures

|

11,174 | 5,310 | 4,457 | 5,919 | 6,302 | 110.4 | % | |||||||||||||||||

| dividends paid | 7,579 | 2,204 | 7,593 | - | - | 243.9 | % | |||||||||||||||||

|

long-term debt, current maturities of long-term debt and line of credit (1)

|

2,200 | 4,986 | 7,161 | 10,012 | 11,547 | -55.9 | % | |||||||||||||||||

|

shareholders' equity

|

119,427 | 111,744 | 95,583 | 89,000 | 80,341 | 6.9 | % | |||||||||||||||||

|

capital employed (3)

|

79,184 | 77,394 | 72,699 | 67,887 | 62,521 | 2.3 | % | |||||||||||||||||

|

RATIOS & OTHER DATA

|

||||||||||||||||||||||||

|

gross profit margin

|

17.9 | % | 17.0 | % | 18.4 | % | 15.6 | % | 17.0 | % | ||||||||||||||

|

operating income margin

|

7.3 | % | 7.1 | % | 7.8 | % | 5.8 | % | 7.3 | % | ||||||||||||||

|

net income margin

|

4.9 | % | 6.1 | % | 6.8 | % | 5.2 | % | 7.5 | % | ||||||||||||||

|

effective income tax rate

|

34.3 | % | 8.4 | % | 9.7 | % | 6.4 | % | (7.3 | )% | ||||||||||||||

|

debt to total capital employed ratio (1)

|

2.8 | % | 6.4 | % | 9.9 | % | 14.7 | % | 18.5 | % | ||||||||||||||

|

operating working capital turnover (4)

|

7.7 | 7.0 | 7.4 | 8.9 | 8.8 | |||||||||||||||||||

|

days sales in receivables

|

34 | 35 | 31 | 36 | 34 | |||||||||||||||||||

|

inventory turnover

|

6.1 | 6.0 | 5.9 | 6.6 | 6.6 | |||||||||||||||||||

|

STOCK DATA

|

||||||||||||||||||||||||

|

stock price

|

||||||||||||||||||||||||

|

high

|

$ | 29.19 | 21.10 | 18.15 | 11.81 | 14.10 | ||||||||||||||||||

|

low

|

16.60 | 14.93 | 9.00 | 7.05 | 6.56 | |||||||||||||||||||

|

close

|

26.02 | 18.61 | 16.25 | 11.05 | 10.08 | |||||||||||||||||||

|

P/E ratio (2)

|

||||||||||||||||||||||||

|

high

|

24 | 15 | 12 | 11 | 12 | |||||||||||||||||||

|

low

|

14 | 11 | 6 | 7 | 5 | |||||||||||||||||||

|

daily average trading volume (shares)

|

38.6 | 27.5 | 40.9 | 30.6 | 58.0 | |||||||||||||||||||

|

(1) Debt includes long-term and current maturities of long-term debt and line of credit.

|

||||||||||||||||||||||||

|

(2) P/E ratios based on trailing 12-month net income per share.

|

||||||||||||||||||||||||

|

(3) Capital employed represents long-term and current maturities of long-term debt, lines of credit, current and noncurrent deferred income tax liabilities, current and long-term income taxes payable, stockholders' equity, offset by cash and cash equivalents, short-term and long-term investments, current and noncurrent deferred income tax assets, and income taxes receivable.

|

||||||||||||||||||||||||

|

(4) Operating working capital for this calculation is accounts receivable and inventories, offset by accounts payable-trade and account payable - capital expenditures.

|

||||||||||||||||||||||||

22

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following analysis of the financial condition and results of operations should be read in conjunction with the consolidated financial statements and notes and other exhibits included elsewhere in this report.

General

Our fiscal year is the 52 or 53 week period ending on the Sunday closest to April 30. Fiscal 2015 included 53 weeks. Fiscal 2014 and 2013 each included 52 weeks. Our operations are classified into two business segments: mattress fabrics and upholstery fabrics. The mattress fabrics segment manufactures, sources and sells fabrics and mattress covers to bedding manufacturers. The upholstery fabrics segment sources, manufacturers and sells fabrics primarily to residential furniture manufacturers.

We evaluate the operating performance of our segments based upon income from operations before certain unallocated corporate expenses, and other non-recurring items. Cost of sales in both segments include costs to manufacture or source our products, including costs such as raw material and finished good purchases, direct and indirect labor, overhead and incoming freight charges. Unallocated corporate expenses primarily represent compensation and benefits for certain executive officers, all costs related to being a public company, and other miscellaneous expenses.

Executive Summary

Results of Operations

| Twelve Months Ended | ||||||||||||

|

(dollars in thousands)

|

May 3, 2015

|

April 27, 2014

|

% Change

|

|||||||||

|

Net sales

|

$ | 310,166 | $ | 287,162 | 8.0 | % | ||||||

|

Gross profit

|

55,567 | 48,906 | 13.6 | % | ||||||||

|

Gross profit margin

|

17.9 | % | 17.0 | % | 5.3 | % | ||||||

|

SG&A expenses