Exhibit 99.1

CULP ANNOUNCES RESULTS FOR FOURTH QUARTER AND FISCAL 2024,

PROVIDES UPDATE ON RESTRUCTURING INITIATIVES

HIGH POINT, N.C. (June 27, 2024) ─ Culp, Inc. (NYSE: CULP) (together with its consolidated subsidiaries, “CULP”) today reported financial and operating results for the fourth quarter and fiscal year ended April 28, 2024.

Fiscal 2024 Fourth Quarter Financial Summary

Fiscal 2024 Full Year Financial Summary

Restructuring Plan Update

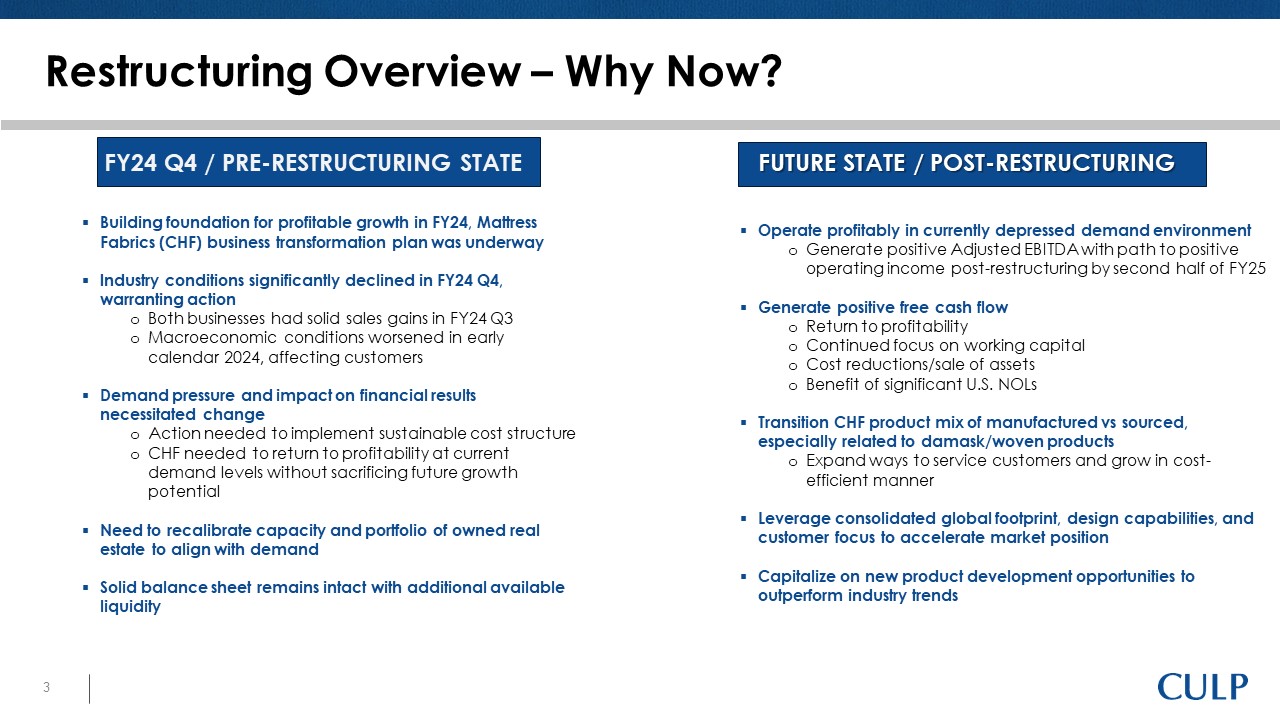

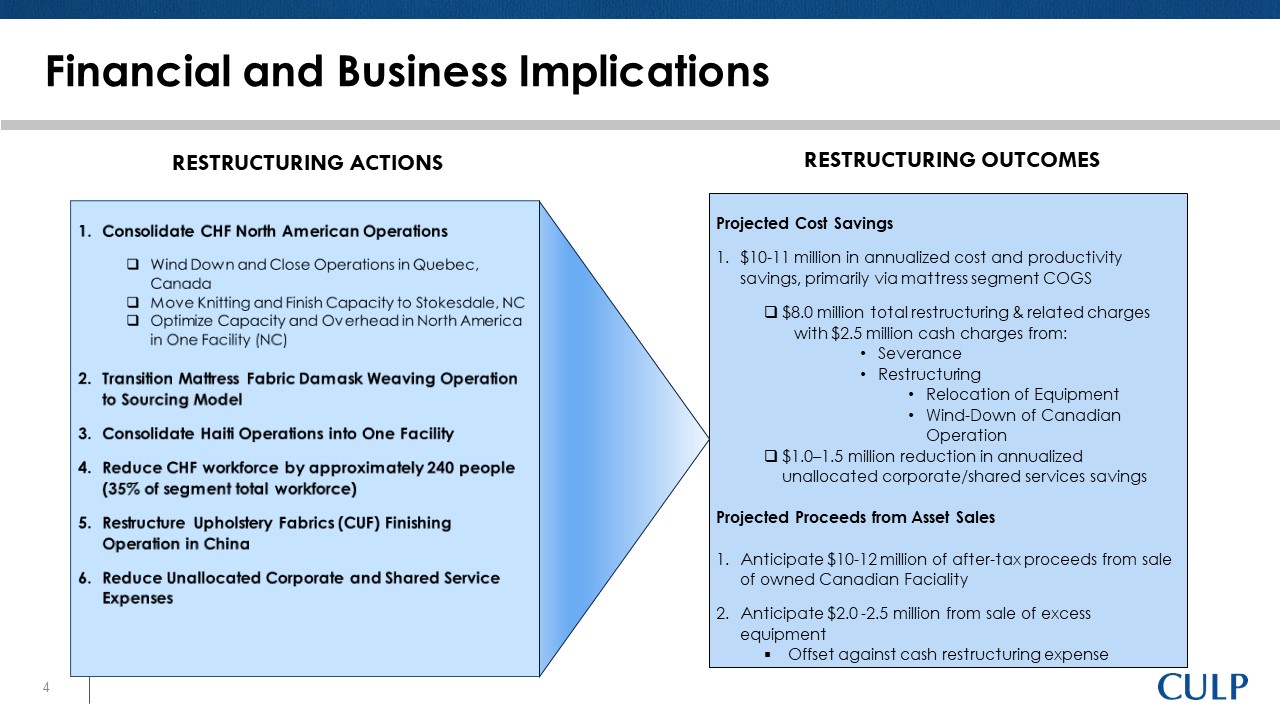

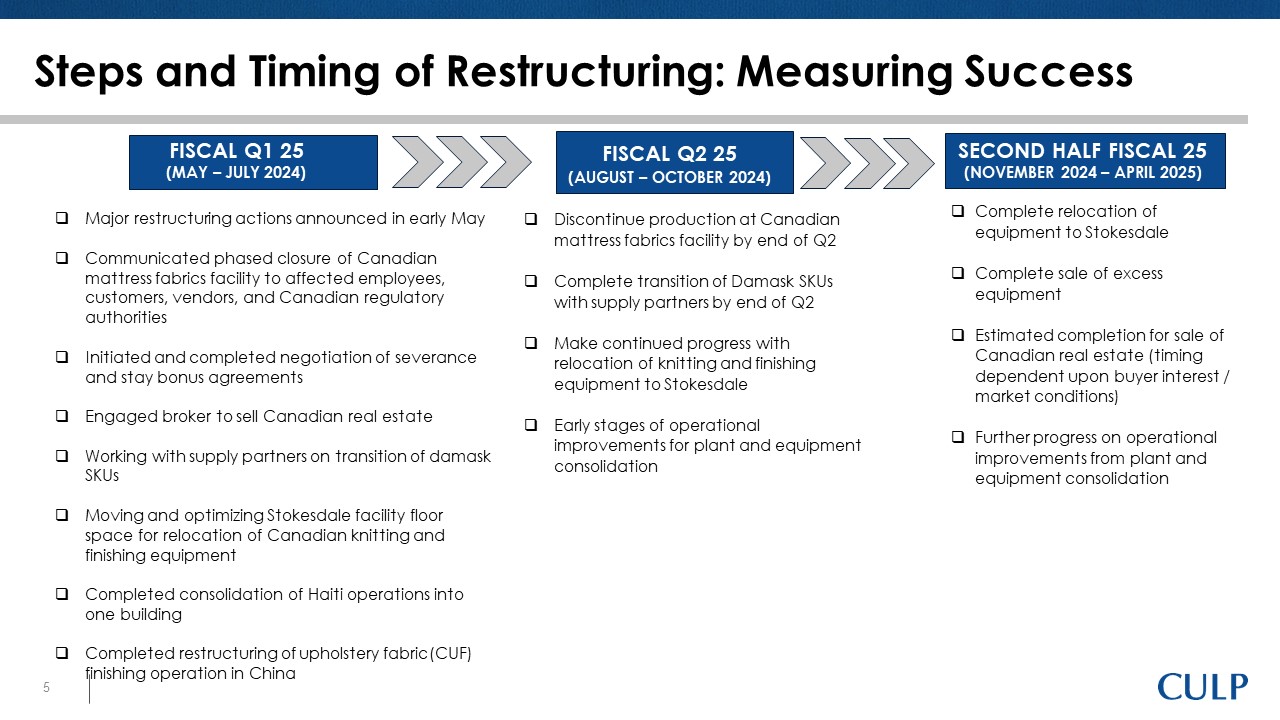

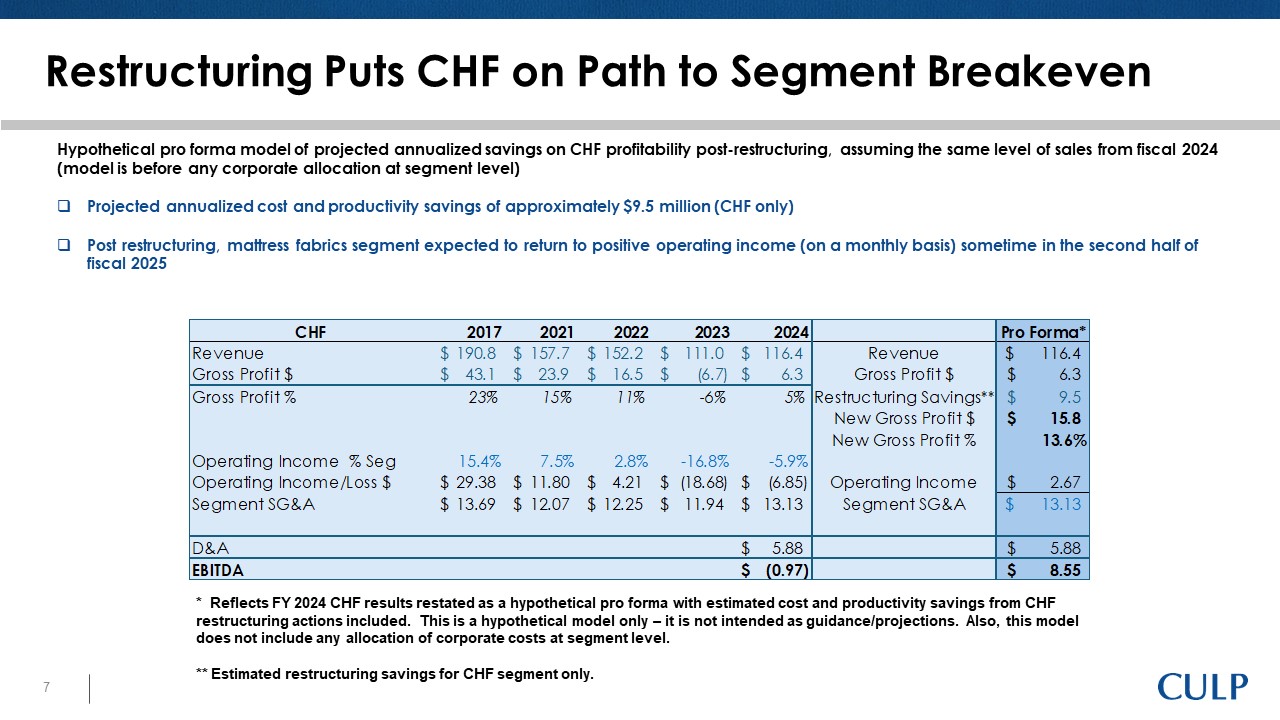

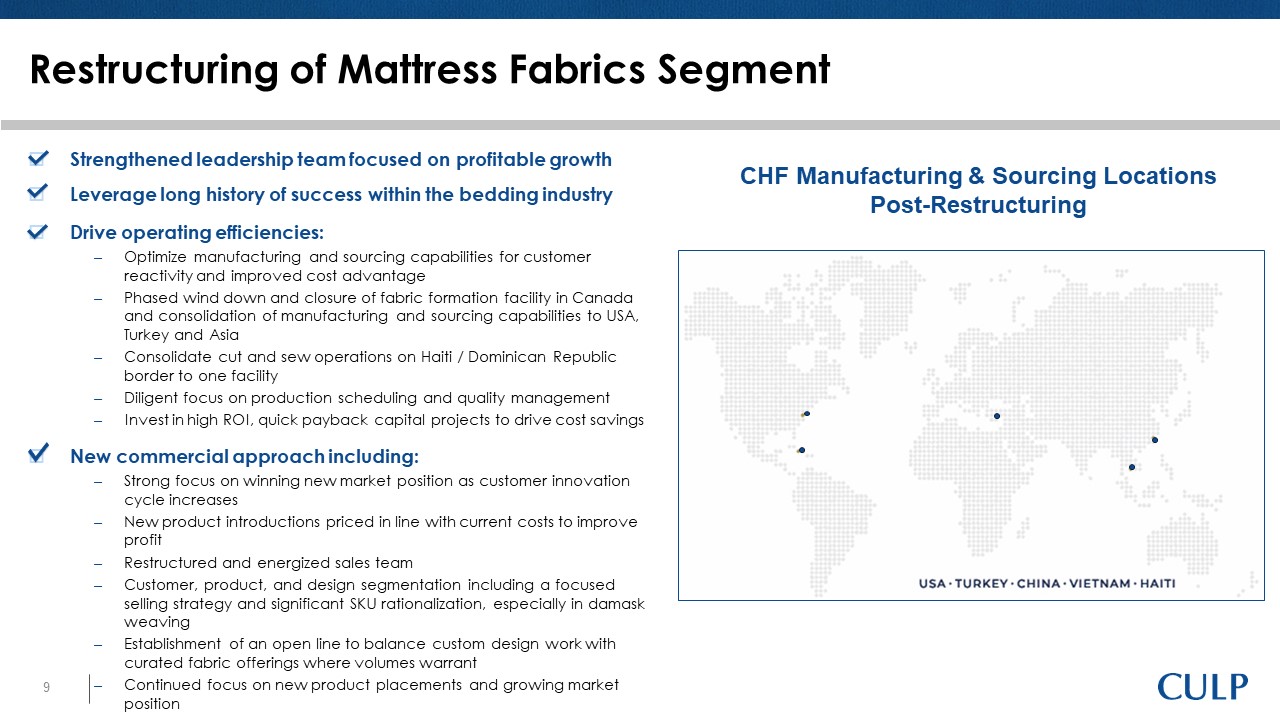

The restructuring plan announced on May 1, 2024, primarily focused on the company's mattress fabrics segment, is progressing as planned.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 2

June 27, 2024

CEO Commentary

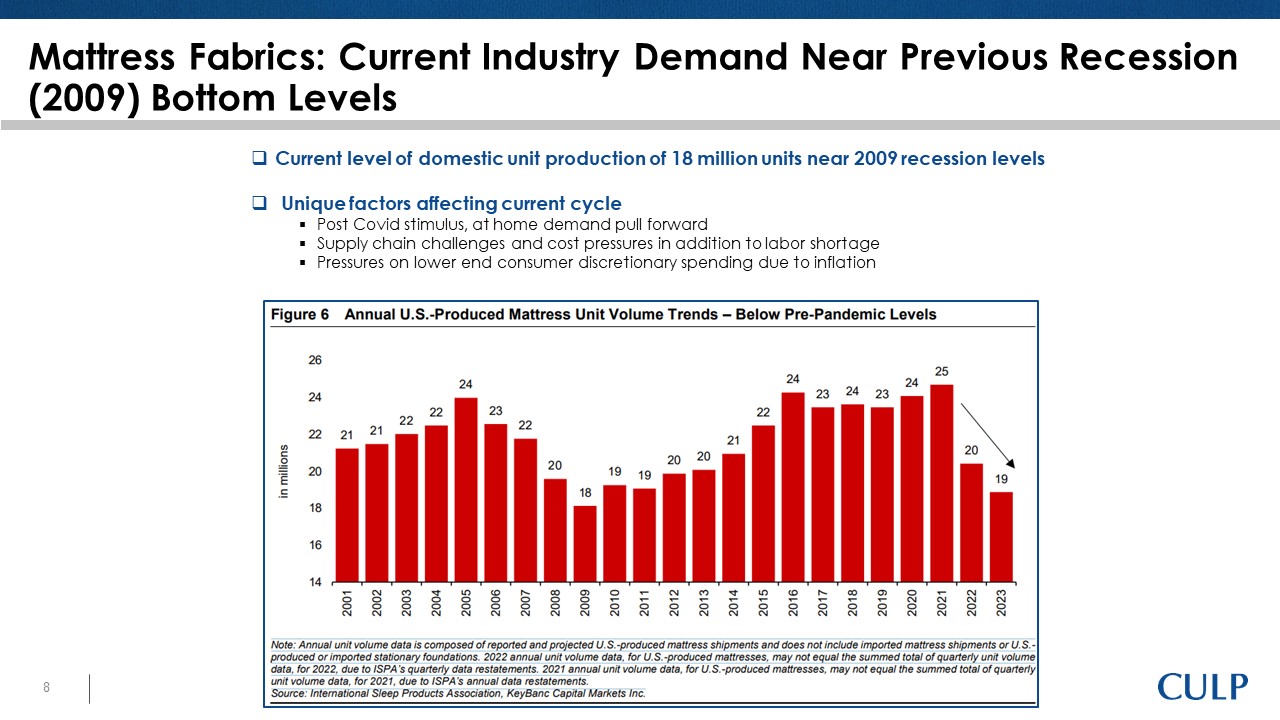

Commenting on the results, Iv Culp, president and chief executive officer of Culp, Inc., said, “Our sales and operating results for the fourth quarter were in line with our expectations announced on May 1, 2024. These results reflected weakness in industry demand in both of our businesses, driven primarily by ongoing macro-economic headwinds. Our sales performance for the fourth quarter was also affected to some degree by the timing of orders, as many of our larger customers experienced extremely slow conditions beginning in January. We posted solid year-over-year sales gains in both businesses during our fiscal third quarter, and we were making progress towards our stated improvement goals. However, we faced a significant decline in order levels during our fourth quarter, related to demand pressures our customers faced early in the calendar year.

"This impact on fourth quarter revenue, along with ongoing macro-challenges, led us to take aggressive action to bring our manufacturing costs and capacity in line with current and expected demand. We announced a major restructuring plan in early May, with a primary focus on our mattress fabrics segment, and we are making steady progress on the execution of this restructuring initiative. The announced adjustments, once fully implemented, will enable us to grow more efficiently and profitably with a lower level of fixed costs. Importantly, these strategic steps do not limit our ability to grow the business, but instead allow us to better optimize our global mix of manufacturing capabilities and long-term sourcing partners. Also, we are extremely grateful for the support we have received from our valued customers, suppliers, and employees, and we are confident that the strength of these relationships will help drive our recovery.

“Despite the headwinds, there were some positive indicators within CULP’s business during fiscal 2024, including (1) significant year-over-year operating improvement (though still a loss and below intended targets); (2) consistent operating profits in our upholstery fabrics business; (3) year-over-year sales growth in our mattress fabrics segment; and (4) strong product innovation and placements in both segments, positioning us for a return to higher sales growth as macro conditions improve. We are encouraged by our solid market position in both businesses, and with our restructuring actions well underway, we believe we are on track to return to profitability post-restructuring even if market conditions remain at their currently depressed levels.

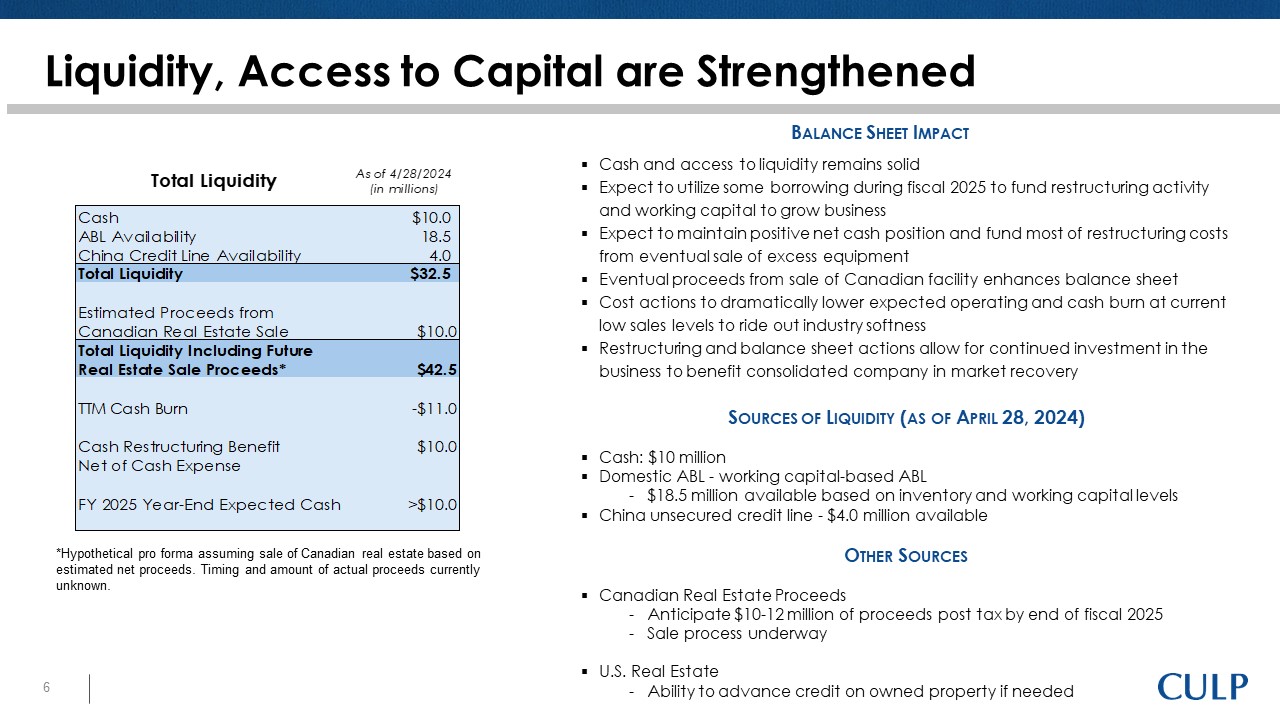

“We also maintained a solid balance sheet during the fourth quarter, with a focus on prudent financial management, and we are taking proactive steps to ensure the long-term success of our business. We are diligently focused on executing our restructuring initiatives, and therefore strengthening our balance sheet, optimizing our operations and cost structure, and supporting our customers, while also continuing to win new placements with our innovative product portfolio.

"As we look ahead to fiscal 2025, we expect industry conditions will remain pressured for some time, but we believe our fiscal 2024 fourth quarter revenue levels represented a bottom point for CULP. We believe the strategic actions we are taking will position us for profitable growth opportunities, and we remain committed to delivering sustainable results and enhancing value for our shareholders over the long term," added Culp.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 3

June 27, 2024

Business Segment Highlights

Mattress Fabrics Segment (“CHF”) Summary

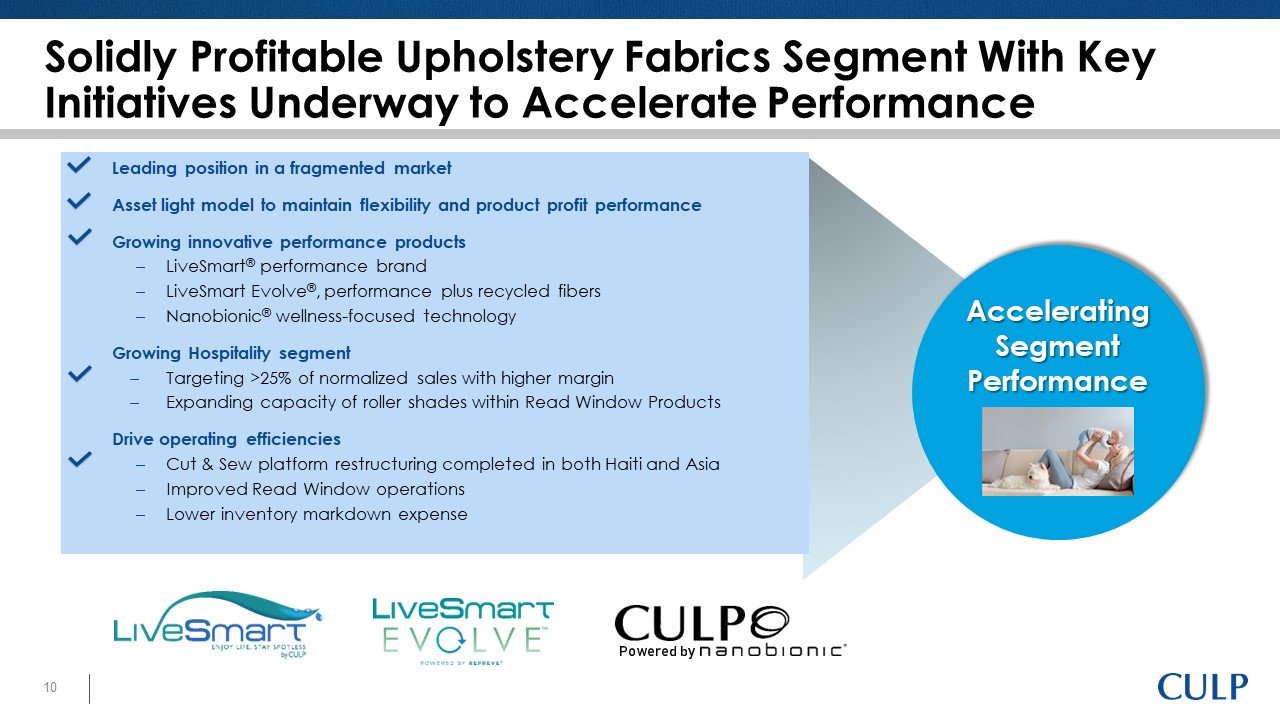

Upholstery Fabrics Segment (“CUF”) Summary

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 4

June 27, 2024

Balance Sheet, Cash Flow, and Liquidity

Financial Outlook

Conference Call

Culp, Inc. will hold a conference call to discuss financial results for the fourth quarter and fiscal 2024 year on Friday, June 28, 2024, at 11:00 a.m. Eastern Time. A live webcast of this call can be accessed on the “Upcoming Events” section on the investor relations page of the company’s website, www.culp.com. A replay of the webcast will be available for 30 days under the “Past Events” section on the investor relations page of the company’s website, beginning at 2:00 p.m. Eastern Time on June 28, 2024.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 5

June 27, 2024

Investor Relations Contact

Ken Bowling, Executive Vice President, Chief Financial Officer, and Treasurer:

(336) 881-5630

krbowling@culp.com

About the Company

Culp, Inc. is one of the largest marketers of mattress fabrics for bedding and upholstery fabrics for residential and commercial furniture in North America. The company markets a variety of fabrics to its global customer base of leading bedding and furniture companies, including fabrics produced at Culp’s manufacturing facilities and fabrics sourced through other suppliers. Culp has manufacturing and sourcing capabilities located in the United States, Canada, China, Haiti, Turkey, and Vietnam.

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995 (Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934). Such statements are inherently subject to risks and uncertainties that may cause actual events and results to differ materially from such statements. Further, forward looking statements are intended to speak only as of the date on which they are made, and we disclaim any duty to update such statements to reflect any changes in management’s expectations or any change in the assumptions or circumstances on which such statements are based, whether due to new information, future events, or otherwise. Forward-looking statements are statements that include projections, expectations, or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often but not always characterized by qualifying words such as “expect,” “believe,” “anticipate,” “estimate,” “intend,” “plan,” “project,” and their derivatives, and include but are not limited to statements about expectations, projections, or trends for our future operations, strategic initiatives and plans, restructurings, production levels, new product launches, sales, profit margins, profitability, operating (loss) income, capital expenditures, working capital levels, cost savings (including, without limitation, anticipated cost savings from restructuring actions), income taxes, SG&A or other expenses, pre-tax (loss) income, earnings, cash flow, and other performance or liquidity measures, as well as any statements regarding dividends, share repurchases, liquidity, use of cash and cash requirements, borrowing capacity, investments, potential acquisitions, restructuring and restructuring-related charges, expenses, and/or credits, future economic or industry trends, public health epidemics, or future developments. There can be no assurance that we will realize these expectations or meet our guidance, or that these beliefs will prove correct.

Factors that could influence the matters discussed in such statements include the level of housing starts and sales of existing homes, consumer confidence, trends in disposable income, and general economic conditions. Decreases in these economic indicators could have a negative effect on our business and prospects. Likewise, increases in interest rates, particularly home mortgage rates, and increases in consumer debt or the general rate of inflation, could affect us adversely. The future performance of our business depends in part on our success in conducting and finalizing acquisition negotiations and integrating acquired businesses into our existing operations. Changes in consumer tastes or preferences toward products not produced by us could erode demand for our products. Changes in tariffs or trade policy, including changes in U.S. trade enforcement priorities, or changes in the value of the U.S. dollar versus other currencies, could affect our financial results because a significant portion of our operations are located outside the United States. Strengthening of the U.S. dollar against other currencies could make our products less competitive on the basis of price in markets outside the United States, and strengthening of currencies in Canada and China can have a negative impact on our sales of products produced in those places. In addition, because our foreign operations use the U.S. dollar as their functional currency, changes in the exchange rate between the local currency of those operations and the U.S dollar can affect our reported profits from those foreign operations. Also, economic or political instability in international areas could affect our operations or sources of goods in those areas, as well as demand for our products in international markets. The impact of public health epidemics on employees, customers, suppliers, and the global economy, such as the recent coronavirus pandemic, could also adversely affect our operations and financial performance. In addition, the impact of potential asset impairments, including impairments of property,

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 6

June 27, 2024

plant, and equipment, inventory, or intangible assets, as well as the impact of valuation allowances applied against our net deferred income tax assets, could affect our financial results. Increases in freight costs, labor costs, and raw material prices, including increases in market prices for petrochemical products, can also significantly affect the prices we pay for shipping, labor, and raw materials, respectively, and in turn, increase our operating costs and decrease our profitability. Also, our success in diversifying our supply chain with reliable partners to effectively service our global platform could affect our operations and adversely affect our financial results. Finally, the future performance of our business also depends on our ability to successfully restructure our mattress fabrics operation and return the segment to profitability. Further information about these factors, as well as other factors that could affect our future operations or financial results and the matters discussed in forward-looking statements, is included in Item 1A “Risk Factors” in our most recent Form 10-K and Form 10-Q reports filed with the Securities and Exchange Commission. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. Additional risks and uncertainties that we do not presently know about or that we currently consider to be immaterial may also affect our business operations and financial results.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 7

June 27, 2024

CULP, INC.

CONSOLIDATED STATEMENTS OF NET LOSS

FOR THE THREE MONTHS ENDED APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands, Except for Per Share Data)

|

|

THREE MONTHS ENDED |

|

|||||||||||||||||

|

|

Amount |

|

|

|

|

|

Percent of Sales |

|

|||||||||||

|

|

(1) |

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

April 28, |

|

|

April 30, |

|

|

% Over |

|

|

April 28, |

|

|

April 30, |

|

|||||

|

|

2024 |

|

|

2023 |

|

|

(Under) |

|

|

2024 |

|

|

2023 |

|

|||||

Net sales |

|

$ |

49,528 |

|

|

$ |

61,426 |

|

|

|

(19.4 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

Cost of sales |

|

|

(44,327 |

) |

|

|

(54,538 |

) |

|

|

(18.7 |

)% |

|

|

89.5 |

% |

|

|

88.8 |

% |

Gross profit |

|

|

5,201 |

|

|

|

6,888 |

|

|

|

(24.5 |

)% |

|

|

10.5 |

% |

|

|

11.2 |

% |

Selling, general and administrative |

|

|

(9,245 |

) |

|

|

(10,845 |

) |

|

|

(14.8 |

)% |

|

|

18.7 |

% |

|

|

17.7 |

% |

Restructuring expense (2) (3) |

|

|

(204 |

) |

|

|

(70 |

) |

|

|

191.4 |

% |

|

|

0.4 |

% |

|

|

0.1 |

% |

Loss from operations |

|

|

(4,248 |

) |

|

|

(4,027 |

) |

|

|

5.5 |

% |

|

|

(8.6 |

)% |

|

|

(6.6 |

)% |

Interest expense |

|

|

(11 |

) |

|

|

— |

|

|

|

100.0 |

% |

|

|

(0.0 |

)% |

|

|

— |

|

Interest income |

|

|

263 |

|

|

|

239 |

|

|

|

10.0 |

% |

|

|

0.5 |

% |

|

|

0.4 |

% |

Other expense |

|

|

(64 |

) |

|

|

(95 |

) |

|

|

(32.6 |

)% |

|

|

(0.1 |

)% |

|

|

(0.2 |

)% |

Loss before income taxes |

|

|

(4,060 |

) |

|

|

(3,883 |

) |

|

|

4.6 |

% |

|

|

(8.2 |

)% |

|

|

(6.3 |

)% |

Income tax expense (4) |

|

|

(805 |

) |

|

|

(798 |

) |

|

|

0.9 |

% |

|

|

(19.8 |

)% |

|

|

(20.6 |

)% |

Net loss |

|

$ |

(4,865 |

) |

|

$ |

(4,681 |

) |

|

|

3.9 |

% |

|

|

(9.8 |

)% |

|

|

(7.6 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net loss per share - basic |

|

$ |

(0.39 |

) |

|

$ |

(0.38 |

) |

|

|

2.6 |

% |

|

|

|

|

|

|

||

Net loss per share - diluted |

|

$ |

(0.39 |

) |

|

$ |

(0.38 |

) |

|

|

2.6 |

% |

|

|

|

|

|

|

||

Average shares outstanding-basic |

|

|

12,470 |

|

|

|

12,316 |

|

|

|

1.3 |

% |

|

|

|

|

|

|

||

Average shares outstanding-diluted |

|

|

12,470 |

|

|

|

12,316 |

|

|

|

1.3 |

% |

|

|

|

|

|

|

||

Notes

(1) See page 14 for a Reconciliation of Selected Income Statement Information to Adjusted Results for the three months ending April 28, 2024, and April 30, 2023.

(2) Restructuring expense of $204,000 for the three months ending April 28, 2024, represents employee termination benefits related to the rationalization of the upholstery fabrics finishing operation located in Shanghai, China.

(3) Restructuring expense of $70,000 for the three months ending April 30, 2023, represents employee termination benefits of $39,000 and other associated costs $31,000 related to the consolidation of certain leased facilities located in Ouanaminthe, Haiti.

(4) Percent of sales column for income tax expense is calculated as a percent of loss before income taxes.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 8

June 27, 2024

CULP, INC.

CONSOLIDATED STATEMENTS OF NET LOSS

FOR THE TWELVE MONTHS ENDED APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands, Except for Per Share Data)

|

|

TWELVE MONTHS ENDED |

|

|||||||||||||||||

|

|

Amount |

|

|

|

|

|

Percent of Sales |

|

|||||||||||

|

|

(1) |

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

April 28, |

|

|

April 30, |

|

|

% Over |

|

|

April 28, |

|

|

April 30, |

|

|||||

|

|

2024 |

|

|

2023 |

|

|

(Under) |

|

|

2024 |

|

|

2023 |

|

|||||

Net sales |

|

$ |

225,333 |

|

|

$ |

234,934 |

|

|

|

(4.1 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

Cost of sales (2) (3) |

|

|

(197,394 |

) |

|

|

(224,038 |

) |

|

|

(11.9 |

)% |

|

|

87.6 |

% |

|

|

95.4 |

% |

Gross profit |

|

|

27,939 |

|

|

|

10,896 |

|

|

|

156.4 |

% |

|

|

12.4 |

% |

|

|

4.6 |

% |

Selling, general and administrative |

|

|

(38,611 |

) |

|

|

(37,978 |

) |

|

|

1.7 |

% |

|

|

17.1 |

% |

|

|

16.2 |

% |

Restructuring expense (4) (5) |

|

|

(636 |

) |

|

|

(1,396 |

) |

|

|

(54.4 |

)% |

|

|

0.3 |

% |

|

|

0.6 |

% |

Loss from operations |

|

|

(11,308 |

) |

|

|

(28,478 |

) |

|

|

(60.3 |

)% |

|

|

(5.0 |

)% |

|

|

(12.1 |

)% |

Interest expense |

|

|

(11 |

) |

|

|

— |

|

|

|

100.0 |

% |

|

|

— |

% |

|

|

— |

|

Interest income |

|

|

1,174 |

|

|

|

531 |

|

|

|

121.1 |

% |

|

|

0.5 |

% |

|

|

0.2 |

% |

Other expense |

|

|

(625 |

) |

|

|

(443 |

) |

|

|

41.1 |

% |

|

|

0.3 |

% |

|

|

0.2 |

% |

Loss before income taxes |

|

|

(10,770 |

) |

|

|

(28,390 |

) |

|

|

(62.1 |

)% |

|

|

(4.8 |

)% |

|

|

(12.1 |

)% |

Income tax expense (6) |

|

|

(3,049 |

) |

|

|

(3,130 |

) |

|

|

(2.6 |

)% |

|

|

(28.3 |

)% |

|

|

(11.0 |

)% |

Net loss |

|

$ |

(13,819 |

) |

|

$ |

(31,520 |

) |

|

|

(56.2 |

)% |

|

|

(6.1 |

)% |

|

|

(13.4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net loss per share - basic |

|

$ |

(1.11 |

) |

|

$ |

(2.57 |

) |

|

|

(56.8 |

)% |

|

|

|

|

|

|

||

Net loss per share - diluted |

|

$ |

(1.11 |

) |

|

$ |

(2.57 |

) |

|

|

(56.8 |

)% |

|

|

|

|

|

|

||

Average shares outstanding-basic |

|

|

12,432 |

|

|

|

12,283 |

|

|

|

1.2 |

% |

|

|

|

|

|

|

||

Average shares outstanding-diluted |

|

|

12,432 |

|

|

|

12,283 |

|

|

|

1.2 |

% |

|

|

|

|

|

|

||

Notes

(1) See page 15 for the Reconciliation of Selected Income Statement Information to Adjusted Results for the twelve months ending April 28, 2024, and April 30, 2023.

(2) Cost of sales for the twelve months ending April 28, 2024, includes a restructuring related charge totaling $40,000 representing markdowns of inventory related to the discontinuation of production of cut and sewn upholstery kits at the company's facility in Ouanaminthe, Haiti.

(3) Cost of sales for the twelve months ending April 30, 2023, includes a restructuring related charge totaling $98,000, which pertained to a loss on disposal and markdowns of inventory related to the exit of the company's cut and sew upholstery fabrics operation located in Shanghai, China.

(4) Restructuring expense of $636,000 for the twelve months ending April 28, 2024, represents impairment charges related to equipment of $329,000 and employee termination benefits of $103,000 related to the discontinuation of production of cut and sewn upholstery kits at the company's facility in Ouanaminthe, Haiti. In addition, during the fourth quarter of fiscal 2024, restructuring expense of $204,000 was incurred for employee termination benefits related to the rationalization of the upholstery fabrics finishing operation located in Shanghai, China.

(5) Restructuring expense of $1.4 million for the twelve months ending April 30, 2023, relates to restructuring activities for both the company's cut and sew upholstery fabrics operations located in Shanghai, China, which occurred during the second quarter of fiscal 2023, and located in Ouananminthe, Haiti, which occurred during the third and fourth quarters of fiscal 2023. Restructuring expense represents employee termination benefits of $507,000, lease termination costs of $481,000, impairment losses totaling $357,000 that relate to leasehold improvements and equipment, and $51,000 for other associated costs.

(6) Percent of sales column for income tax expense is calculated as a percent of loss before income taxes.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 9

June 27, 2024

CONSOLIDATED BALANCE SHEETS

APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands)

|

|

Amounts |

|

|

|

|

|

|

|

|||||||

|

|

(Condensed) |

|

|

(Condensed) |

|

|

|

|

|

|

|

||||

|

|

April 28, |

|

|

*April 30, |

|

|

Increase (Decrease) |

|

|||||||

|

|

2024 |

|

|

2023 |

|

|

Dollars |

|

|

Percent |

|

||||

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash and cash equivalents |

|

$ |

10,012 |

|

|

|

20,964 |

|

|

|

(10,952 |

) |

|

|

(52.2 |

)% |

Short-term investments - rabbi trust |

|

|

903 |

|

|

|

1,404 |

|

|

|

(501 |

) |

|

|

(35.7 |

)% |

Accounts receivable, net |

|

|

21,138 |

|

|

|

24,778 |

|

|

|

(3,640 |

) |

|

|

(14.7 |

)% |

Inventories |

|

|

44,843 |

|

|

|

45,080 |

|

|

|

(237 |

) |

|

|

(0.5 |

)% |

Short-term note receivable |

|

|

264 |

|

|

|

219 |

|

|

|

45 |

|

|

|

20.5 |

% |

Current income taxes receivable |

|

|

350 |

|

|

|

— |

|

|

|

350 |

|

|

|

100.0 |

% |

Other current assets |

|

|

3,371 |

|

|

|

3,071 |

|

|

|

300 |

|

|

|

9.8 |

% |

Total current assets |

|

|

80,881 |

|

|

|

95,516 |

|

|

|

(14,635 |

) |

|

|

(15.3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Property, plant & equipment, net |

|

|

33,182 |

|

|

|

36,111 |

|

|

|

(2,929 |

) |

|

|

(8.1 |

)% |

Right of use assets |

|

|

6,203 |

|

|

|

8,191 |

|

|

|

(1,988 |

) |

|

|

(24.3 |

)% |

Intangible assets |

|

|

1,876 |

|

|

|

2,252 |

|

|

|

(376 |

) |

|

|

(16.7 |

)% |

Long-term investments - rabbi trust |

|

|

7,102 |

|

|

|

7,067 |

|

|

|

35 |

|

|

|

0.5 |

% |

Long-term note receivable |

|

|

1,462 |

|

|

|

1,726 |

|

|

|

(264 |

) |

|

|

(15.3 |

)% |

Deferred income taxes |

|

|

518 |

|

|

|

480 |

|

|

|

38 |

|

|

|

7.9 |

% |

Other assets |

|

|

830 |

|

|

|

840 |

|

|

|

(10 |

) |

|

|

(1.2 |

)% |

Total assets |

|

$ |

132,054 |

|

|

|

152,183 |

|

|

|

(20,129 |

) |

|

|

(13.2 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Accounts payable - trade |

|

|

25,607 |

|

|

|

29,442 |

|

|

|

(3,835 |

) |

|

|

(13.0 |

)% |

Accounts payable - capital expenditures |

|

|

343 |

|

|

|

56 |

|

|

|

287 |

|

|

|

512.5 |

% |

Operating lease liability - current |

|

|

2,061 |

|

|

|

2,640 |

|

|

|

(579 |

) |

|

|

(21.9 |

)% |

Deferred compensation - current |

|

|

903 |

|

|

|

1,404 |

|

|

|

(501 |

) |

|

|

(35.7 |

)% |

Deferred revenue |

|

|

1,495 |

|

|

|

1,192 |

|

|

|

303 |

|

|

|

25.4 |

% |

Accrued expenses |

|

|

6,726 |

|

|

|

8,533 |

|

|

|

(1,807 |

) |

|

|

(21.2 |

)% |

Income taxes payable - current |

|

|

972 |

|

|

|

753 |

|

|

|

219 |

|

|

|

29.1 |

% |

Total current liabilities |

|

|

38,107 |

|

|

|

44,020 |

|

|

|

(5,913 |

) |

|

|

(13.4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating lease liability - long-term |

|

|

2,422 |

|

|

|

3,612 |

|

|

|

(1,190 |

) |

|

|

(32.9 |

)% |

Income taxes payable - long-term |

|

|

2,088 |

|

|

|

2,675 |

|

|

|

(587 |

) |

|

|

(21.9 |

)% |

Deferred income taxes |

|

|

6,379 |

|

|

|

5,954 |

|

|

|

425 |

|

|

|

7.1 |

% |

Deferred compensation - long-term |

|

|

6,929 |

|

|

|

6,842 |

|

|

|

87 |

|

|

|

1.3 |

% |

Total liabilities |

|

|

55,925 |

|

|

|

63,103 |

|

|

|

(7,178 |

) |

|

|

(11.4 |

)% |

Shareholders' equity |

|

|

76,129 |

|

|

|

89,080 |

|

|

|

(12,951 |

) |

|

|

(14.5 |

)% |

Total liabilities and shareholders' |

|

$ |

132,054 |

|

|

|

152,183 |

|

|

|

(20,129 |

) |

|

|

(13.2 |

)% |

Shares outstanding |

|

|

12,470 |

|

|

|

12,327 |

|

|

|

143 |

|

|

|

1.2 |

% |

* Derived from audited financial statements.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 10

June 27, 2024

CULP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE TWELVE MONTHS ENDED APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands)

|

|

TWELVE MONTHS ENDED |

|

|||||

|

|

Amounts |

|

|||||

|

|

April 28, |

|

|

April 30, |

|

||

|

|

2024 |

|

|

2023 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

(13,819 |

) |

|

$ |

(31,520 |

) |

Adjustments to reconcile net loss to net cash (used in) |

|

|

|

|

|

|

||

Depreciation |

|

|

6,521 |

|

|

|

6,845 |

|

Non-cash inventory (credit) charge (1) (2) |

|

|

(1,628 |

) |

|

|

5,819 |

|

Amortization |

|

|

390 |

|

|

|

438 |

|

Stock-based compensation |

|

|

915 |

|

|

|

1,145 |

|

Deferred income taxes |

|

|

387 |

|

|

|

(2 |

) |

Gain on sale of equipment |

|

|

(299 |

) |

|

|

(314 |

) |

Non-cash restructuring expense |

|

|

330 |

|

|

|

791 |

|

Foreign currency exchange gain |

|

|

(593 |

) |

|

|

(537 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

3,559 |

|

|

|

(2,642 |

) |

Inventories |

|

|

1,593 |

|

|

|

15,370 |

|

Other current assets |

|

|

(329 |

) |

|

|

(297 |

) |

Other assets |

|

|

(115 |

) |

|

|

86 |

|

Accounts payable |

|

|

(2,926 |

) |

|

|

10,274 |

|

Deferred revenue |

|

|

303 |

|

|

|

672 |

|

Accrued expenses and deferred compensation |

|

|

(1,870 |

) |

|

|

853 |

|

Income taxes |

|

|

(643 |

) |

|

|

823 |

|

Net cash (used in) provided by operating activities |

|

|

(8,224 |

) |

|

|

7,804 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

||

Capital expenditures |

|

|

(3,711 |

) |

|

|

(2,108 |

) |

Proceeds from the sale of equipment |

|

|

385 |

|

|

|

468 |

|

Proceeds from note receivable |

|

|

330 |

|

|

|

15 |

|

Proceeds from the sale of investments (rabbi trust) |

|

|

1,449 |

|

|

|

2,058 |

|

Purchase of investments (rabbi trust) |

|

|

(884 |

) |

|

|

(1,185 |

) |

Net cash used in investing activities |

|

|

(2,431 |

) |

|

|

(752 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

||

Proceeds from line of credit - China |

|

|

4,166 |

|

|

|

— |

|

Payments associated with line of credit - China |

|

|

(4,146 |

) |

|

|

— |

|

Common stock surrendered for withholding taxes payable |

|

|

(146 |

) |

|

|

(33 |

) |

Payments of debt issuance costs |

|

|

— |

|

|

|

(403 |

) |

Net cash used in financing activities |

|

|

(126 |

) |

|

|

(436 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(171 |

) |

|

|

(202 |

) |

(Decrease) increase in cash and cash equivalents |

|

|

(10,952 |

) |

|

|

6,414 |

|

Cash and cash equivalents at beginning of year |

|

|

20,964 |

|

|

|

14,550 |

|

Cash and cash equivalents at end of year |

|

$ |

10,012 |

|

|

$ |

20,964 |

|

Free Cash Flow (3) |

|

$ |

(10,826 |

) |

|

$ |

6,850 |

|

(1) The non-cash inventory credit of $1.6 million for the twelve months ending April 28, 2024, mostly represents adjustments for inventory markdowns based on the company's policy for aged inventory. The $1.6 million is based on inventory on hand as of April 28, 2024, and relates to both the mattress fabrics and upholstery fabrics segments. In addition, the $1.6 million includes a $40,000 charge associated with the upholstery fabrics segment related to markdowns of inventory associated with the discontinuation of production of cut and sewn upholstery kits at the company's facility in Ouanaminthe, Haiti.

(2) The non-cash inventory charge of $5.8 million for the twelve months ending April 28, 2023, represents a $2.9 million charge for the write down of inventory to its net realizable value associated with the mattress fabrics segment, $2.8 million related to markdowns of inventory estimated based on the company's policy for aged inventory for both the mattress and upholstery fabrics segments, and $98,000 for the loss on disposal and markdowns of inventory related to the exit of the company's cut and sew upholstery fabrics operation located in Shanghai, China.

(3) See next page for Reconciliation of Free Cash Flow for the twelve-month periods ending April 28, 2024, and April 29, 2023.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 11

June 27, 2024

CULP, INC.

RECONCILIATION OF FREE CASH FLOW

FOR THE TWELVE MONTHS ENDED APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands)

|

|

TWELVE MONTHS ENDED |

|

|||||

|

|

Amounts |

|

|||||

|

|

April 28, |

|

|

April 30, |

|

||

|

|

2024 |

|

|

2023 |

|

||

A) Net cash (used in) provided by operating activities |

|

$ |

(8,224 |

) |

|

$ |

7,804 |

|

B) Minus: Capital expenditures |

|

|

(3,711 |

) |

|

|

(2,108 |

) |

C) Plus: Proceeds from the sale of equipment |

|

|

385 |

|

|

|

468 |

|

D) Plus: Proceeds from note receivable |

|

|

330 |

|

|

|

15 |

|

E) Plus: Proceeds from the sale of investments (rabbi trust) |

|

|

1,449 |

|

|

|

2,058 |

|

F) Minus: Purchase of investments (rabbi trust) |

|

|

(884 |

) |

|

|

(1,185 |

) |

G) Effects of exchange rate changes on cash and cash equivalents |

|

|

(171 |

) |

|

|

(202 |

) |

Free Cash Flow |

|

$ |

(10,826 |

) |

|

$ |

6,850 |

|

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 12

June 27, 2024

CULP, INC.

STATEMENTS OF OPERATIONS BY SEGMENT

FOR THE THREE MONTHS ENDED APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands)

|

|

THREE MONTHS ENDED |

|

|||||||||||||||||

|

|

Amounts |

|

|

|

|

|

Percent of Total Sales |

|

|||||||||||

|

|

April 28, |

|

|

April 30, |

|

|

% Over |

|

|

April 28, |

|

|

April 30, |

|

|||||

Net Sales by Segment |

|

2024 |

|

|

2023 |

|

|

(Under) |

|

|

2024 |

|

|

2023 |

|

|||||

Mattress Fabrics |

|

$ |

25,750 |

|

|

$ |

30,696 |

|

|

|

(16.1 |

)% |

|

|

52.0 |

% |

|

|

50.0 |

% |

Upholstery Fabrics |

|

|

23,778 |

|

|

|

30,730 |

|

|

|

(22.6 |

)% |

|

|

48.0 |

% |

|

|

50.0 |

% |

Net Sales |

|

$ |

49,528 |

|

|

$ |

61,426 |

|

|

|

(19.4 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Gross Profit |

|

|

|

|

|

|

|

|

|

|

Gross Margin |

|

||||||||

Mattress Fabrics |

|

$ |

292 |

|

|

$ |

591 |

|

|

|

(50.6 |

)% |

|

|

1.1 |

% |

|

|

1.9 |

% |

Upholstery Fabrics |

|

|

4,909 |

|

|

|

6,297 |

|

|

|

(22.0 |

)% |

|

|

20.6 |

% |

|

|

20.5 |

% |

Total Gross Profit |

|

|

5,201 |

|

|

|

6,888 |

|

|

|

(24.5 |

)% |

|

|

10.5 |

% |

|

|

11.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Selling, General and Administrative |

|

|

|

|

|

|

|

|

|

|

Percent of Sales |

|

||||||||

Mattress Fabrics |

|

$ |

3,221 |

|

|

$ |

3,121 |

|

|

|

3.2 |

% |

|

|

12.5 |

% |

|

|

10.2 |

% |

Upholstery Fabrics |

|

|

3,934 |

|

|

|

4,686 |

|

|

|

(16.0 |

)% |

|

|

16.5 |

% |

|

|

15.2 |

% |

Unallocated Corporate Expenses |

|

|

2,090 |

|

|

|

3,038 |

|

|

|

(31.2 |

)% |

|

|

4.2 |

% |

|

|

4.9 |

% |

Selling, General and Administrative |

|

$ |

9,245 |

|

|

$ |

10,845 |

|

|

|

(14.8 |

)% |

|

|

18.7 |

% |

|

|

17.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(Loss) Income from Operations |

|

|

|

|

|

|

|

|

|

|

Operating Margin |

|

||||||||

Mattress Fabrics |

|

$ |

(2,929 |

) |

|

$ |

(2,530 |

) |

|

|

15.8 |

% |

|

|

(11.4 |

)% |

|

|

(8.2 |

)% |

Upholstery Fabrics |

|

|

975 |

|

|

|

1,611 |

|

|

|

(39.5 |

)% |

|

|

4.1 |

% |

|

|

5.2 |

% |

Unallocated Corporate Expenses |

|

|

(2,090 |

) |

|

|

(3,038 |

) |

|

|

(31.2 |

)% |

|

|

(4.2 |

)% |

|

|

(4.9 |

)% |

Total Segment Loss from |

|

|

(4,044 |

) |

|

|

(3,957 |

) |

|

|

2.2 |

% |

|

|

(8.2 |

)% |

|

|

(6.4 |

)% |

Restructuring Expense (1) |

|

|

(204 |

) |

|

|

(70 |

) |

|

|

191.4 |

% |

|

|

(0.4 |

)% |

|

|

(0.1 |

)% |

Loss from Operations |

|

$ |

(4,248 |

) |

|

$ |

(4,027 |

) |

|

|

5.5 |

% |

|

|

(8.6 |

)% |

|

|

(6.6 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Depreciation Expense by Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Mattress Fabrics |

|

$ |

1,461 |

|

|

$ |

1,426 |

|

|

|

2.5 |

% |

|

|

|

|

|

|

||

Upholstery Fabrics |

|

|

162 |

|

|

|

193 |

|

|

|

(16.1 |

)% |

|

|

|

|

|

|

||

Depreciation Expense |

|

$ |

1,623 |

|

|

$ |

1,619 |

|

|

|

0.2 |

% |

|

|

|

|

|

|

||

Notes

(1) See page 14 for a Reconciliation of Selected Income Statement Information to Adjusted Results for the three months ending April 28, 2024, and April 30, 2023.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 13

June 27, 2024

CULP, INC.

STATEMENTS OF OPERATIONS BY SEGMENT

FOR THE TWELVE MONTHS ENDED APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands)

|

|

TWELVE MONTHS ENDED |

|

|||||||||||||||||

|

|

Amounts |

|

|

|

|

|

Percent of Total Sales |

|

|||||||||||

|

|

April 28, |

|

|

April 30, |

|

|

% Over |

|

|

April 28, |

|

|

April 30, |

|

|||||

Net Sales by Segment |

|

2024 |

|

|

2023 |

|

|

(Under) |

|

|

2024 |

|

|

2023 |

|

|||||

Mattress Fabrics |

|

$ |

116,370 |

|

|

$ |

110,995 |

|

|

|

4.8 |

% |

|

|

51.6 |

% |

|

|

47.2 |

% |

Upholstery Fabrics |

|

|

108,963 |

|

|

|

123,939 |

|

|

|

(12.1 |

)% |

|

|

48.4 |

% |

|

|

52.8 |

% |

Net Sales |

|

$ |

225,333 |

|

|

$ |

234,934 |

|

|

|

(4.1 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Gross Profit (Loss): |

|

|

|

|

|

|

|

|

|

|

Gross Margin |

|

||||||||

Mattress Fabrics |

|

$ |

6,289 |

|

|

$ |

(6,739 |

) |

|

|

(193.3 |

)% |

|

|

5.4 |

% |

|

|

(6.1 |

)% |

Upholstery Fabrics |

|

|

21,690 |

|

|

|

17,733 |

|

|

|

22.3 |

% |

|

|

19.9 |

% |

|

|

14.3 |

% |

Total Segment Gross Profit |

|

|

27,979 |

|

|

|

10,994 |

|

|

|

154.5 |

% |

|

|

12.4 |

% |

|

|

4.7 |

% |

Restructuring Related Charge (1) |

|

|

(40 |

) |

|

|

(98 |

) |

|

|

(59.2 |

)% |

|

|

(0.0 |

)% |

|

|

(0.0 |

)% |

Gross Profit |

|

$ |

27,939 |

|

|

$ |

10,896 |

|

|

|

156.4 |

% |

|

|

12.4 |

% |

|

|

4.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Selling, General and Administrative |

|

|

|

|

|

|

|

|

|

|

Percent of Sales |

|

||||||||

Mattress Fabrics |

|

$ |

13,134 |

|

|

$ |

11,942 |

|

|

|

10.0 |

% |

|

|

11.3 |

% |

|

|

10.8 |

% |

Upholstery Fabrics |

|

|

15,903 |

|

|

|

15,739 |

|

|

|

1.0 |

% |

|

|

14.6 |

% |

|

|

12.7 |

% |

Unallocated Corporate Expenses |

|

|

9,574 |

|

|

|

10,297 |

|

|

|

(7.0 |

)% |

|

|

4.2 |

% |

|

|

4.4 |

% |

Selling, General and Administrative |

|

$ |

38,611 |

|

|

$ |

37,978 |

|

|

|

1.7 |

% |

|

|

17.1 |

% |

|

|

16.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

(Loss) Income from Operations |

|

|

|

|

|

|

|

|

|

|

Operating Margin |

|

||||||||

Mattress Fabrics |

|

$ |

(6,845 |

) |

|

$ |

(18,681 |

) |

|

|

(63.4 |

)% |

|

|

(5.9 |

)% |

|

|

(16.8 |

)% |

Upholstery Fabrics |

|

|

5,787 |

|

|

|

1,994 |

|

|

|

190.2 |

% |

|

|

5.3 |

% |

|

|

1.6 |

% |

Unallocated Corporate Expenses |

|

|

(9,574 |

) |

|

|

(10,297 |

) |

|

|

(7.0 |

)% |

|

|

(4.2 |

)% |

|

|

(4.4 |

)% |

Total Segment Loss from |

|

|

(10,632 |

) |

|

|

(26,984 |

) |

|

|

(60.6 |

)% |

|

|

(4.7 |

)% |

|

|

(11.5 |

)% |

Restructuring Related Charge (1) |

|

|

(40 |

) |

|

|

(98 |

) |

|

|

(59.2 |

)% |

|

|

(0.0 |

)% |

|

|

(0.0 |

)% |

Restructuring Expense (1) |

|

|

(636 |

) |

|

|

(1,396 |

) |

|

|

(54.4 |

)% |

|

|

(0.3 |

)% |

|

|

(0.6 |

)% |

Loss from Operations |

|

$ |

(11,308 |

) |

|

$ |

(28,478 |

) |

|

|

(60.3 |

)% |

|

|

(5.0 |

)% |

|

|

(12.1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Return on Capital Employed (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Mattress Fabrics |

|

|

(10.8 |

)% |

|

|

(25.8 |

)% |

|

|

(58.1 |

)% |

|

|

|

|

|

|

||

Upholstery Fabrics |

|

|

62.5 |

% |

|

|

11.2 |

% |

|

|

458.0 |

% |

|

|

|

|

|

|

||

Unallocated Corporate |

|

N.M. |

|

|

N.M. |

|

|

N.M. |

|

|

|

|

|

|

|

|||||

Consolidated |

|

|

(13.9 |

)% |

|

|

(28.7 |

)% |

|

|

(51.6 |

)% |

|

|

|

|

|

|

||

Capital Employed (2) (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Mattress Fabrics |

|

$ |

62,257 |

|

|

$ |

64,107 |

|

|

|

(2.9 |

)% |

|

|

|

|

|

|

||

Upholstery Fabrics |

|

|

7,259 |

|

|

|

9,489 |

|

|

|

(23.5 |

)% |

|

|

|

|

|

|

||

Unallocated Corporate |

|

|

4,999 |

|

|

|

3,197 |

|

|

|

56.4 |

% |

|

|

|

|

|

|

||

Consolidated |

|

$ |

74,515 |

|

|

$ |

76,793 |

|

|

|

(3.0 |

)% |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Depreciation Expense by Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Mattress Fabrics |

|

$ |

5,883 |

|

|

$ |

6,050 |

|

|

|

(2.8 |

)% |

|

|

|

|

|

|

||

Upholstery Fabrics |

|

|

638 |

|

|

|

795 |

|

|

|

(19.7 |

)% |

|

|

|

|

|

|

||

Depreciation Expense |

|

$ |

6,521 |

|

|

$ |

6,845 |

|

|

|

(4.7 |

)% |

|

|

|

|

|

|

||

Notes

(1) See page 15 for a Reconciliation of Selected Income Statement Information to Adjusted Results for the twelve months ending April 28, 2024, and April 30, 2023.

(2) See pages 17 through 20 for calculation of Return on Capital Employed by Segment for the twelve months ending April 28, 2024, and April 30, 2023, and a reconciliation to information from our U.S. GAAP financial statements.

(3) The capital employed balances are as of April 28, 2024, and April 30, 2023.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 14

June 27, 2024

CULP, INC.

RECONCILIATION OF SELECTED INCOME STATEMENT INFORMATION TO ADJUSTED RESULTS

FOR THREE MONTHS ENDED APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands)

|

|

As Reported |

|

|

|

|

|

Adjusted Results |

|

|||

|

|

April 28, |

|

|

|

|

|

April 28, |

|

|||

|

|

2024 |

|

|

Adjustments |

|

|

2024 |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Net sales |

|

$ |

49,528 |

|

|

|

— |

|

|

$ |

49,528 |

|

Cost of sales |

|

|

(44,327 |

) |

|

|

— |

|

|

|

(44,327 |

) |

Gross profit |

|

|

5,201 |

|

|

|

— |

|

|

|

5,201 |

|

Selling, general and administrative |

|

|

(9,245 |

) |

|

|

— |

|

|

|

(9,245 |

) |

Restructuring expense (1) |

|

|

(204 |

) |

|

|

204 |

|

|

|

— |

|

Loss from operations |

|

$ |

(4,248 |

) |

|

|

204 |

|

|

$ |

(4,044 |

) |

Notes

(1) Restructuring expense of $204,000 for the three months ending April 28, 2024, represents employee termination benefits related to the rationalization of the upholstery fabrics finishing operation located in Shanghai, China.

|

|

As Reported |

|

|

|

|

|

Adjusted Results |

|

|||

|

|

April 30, |

|

|

|

|

|

April 30, |

|

|||

|

|

2023 |

|

|

Adjustments |

|

|

2023 |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Net sales |

|

$ |

61,426 |

|

|

|

— |

|

|

$ |

61,426 |

|

Cost of sales |

|

|

(54,538 |

) |

|

|

— |

|

|

|

(54,538 |

) |

Gross profit |

|

|

6,888 |

|

|

|

— |

|

|

|

6,888 |

|

Selling, general and administrative |

|

|

(10,845 |

) |

|

|

— |

|

|

|

(10,845 |

) |

Restructuring expense (1) |

|

|

(70 |

) |

|

|

70 |

|

|

|

— |

|

Loss from operations |

|

$ |

(4,027 |

) |

|

|

70 |

|

|

$ |

(3,957 |

) |

Notes

(1) Restructuring expense of $70,000 for the three-months ending April 30, 2023, represents employee termination benefits of $39,000 and other associated costs of $31,000 that related to the consolidation of certain leased facilities located in Ouanaminthe, Haiti.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 15

June 27, 2024

CULP, INC.

RECONCILIATION OF SELECTED INCOME STATEMENT INFORMATION TO ADJUSTED RESULTS

FOR TWELVE MONTHS ENDED APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands)

|

|

As Reported |

|

|

|

|

|

Adjusted Results |

|

|||

|

|

April 28, |

|

|

|

|

|

April 28, |

|

|||

|

|

2024 |

|

|

Adjustments |

|

|

2024 |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Net sales |

|

$ |

225,333 |

|

|

|

— |

|

|

$ |

225,333 |

|

Cost of sales (1) |

|

|

(197,394 |

) |

|

40 |

|

|

|

(197,354 |

) |

|

Gross profit |

|

|

27,939 |

|

|

|

40 |

|

|

|

27,979 |

|

Selling, general and administrative |

|

|

(38,611 |

) |

|

|

— |

|

|

|

(38,611 |

) |

Restructuring expense (2) |

|

|

(636 |

) |

|

|

636 |

|

|

|

— |

|

Loss from operations |

|

$ |

(11,308 |

) |

|

|

676 |

|

|

$ |

(10,632 |

) |

Notes

(1) Cost of sales for the twelve months ending April 28, 2024, includes a restructuring related charge totaling $40,000 representing markdowns of inventory related to the discontinuation of production of cut and sewn upholstery kits at the company's facility in Ouanaminthe, Haiti.

(2) Restructuring expense of $636,000 for the twelve months ending April 28, 2024, represents impairment charges related to equipment of $329,000 and employee termination benefits of $103,000 related to the discontinuation of production of cut and sewn upholstery kits at the company's facility in Ouanaminthe, Haiti. In addition, during the fourth quarter of fiscal 2024, restructuring expense of $204,000 was incurred for employee termination benefits related to the rationalization of the upholstery fabrics finishing operation located in Shanghai, China.

|

|

As Reported |

|

|

|

|

|

Adjusted Results |

|

|||

|

|

April 30, |

|

|

|

|

|

April 30, |

|

|||

|

|

2023 |

|

|

Adjustments |

|

|

2023 |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Net sales |

|

$ |

234,934 |

|

|

|

— |

|

|

$ |

234,934 |

|

Cost of sales (1) |

|

|

(224,038 |

) |

|

98 |

|

|

|

(223,940 |

) |

|

Gross profit |

|

|

10,896 |

|

|

|

98 |

|

|

|

10,994 |

|

Selling, general and administrative |

|

|

(37,978 |

) |

|

|

— |

|

|

|

(37,978 |

) |

Restructuring expense (2) |

|

|

(1,396 |

) |

|

|

1,396 |

|

|

|

— |

|

Loss from operations |

|

$ |

(28,478 |

) |

|

|

1,494 |

|

|

$ |

(26,984 |

) |

Notes

(1) Cost of sales for the twelve months ending April 28, 2024, includes a restructuring related charge totaling $98,000, which pertained to a loss on disposal and markdowns of inventory related to the exit of the company's cut and sew upholstery fabrics operation located in Shanghai, China.

(2) Restructuring expense of $1.4 million for the twelve months ending April 30, 2023, relates to restructuring activities for both the company's cut and sew upholstery fabrics operations located in Shanghai, China, which occurred during the second quarter of fiscal 2023, and located in Ouananminthe, Haiti, which occurred during the third and fourth quarters of fiscal 2023. Restructuring expense represents employee termination benefits of $507,000, lease termination costs of $481,000, impairment losses totaling $357,000 that relate to leasehold improvements and equipment, and $51,000 for other associated costs.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 16

June 27, 2024

CULP, INC.

CONSOLIDATED STATEMENTS OF ADJUSTED EBITDA

FOR THE TWELVE MONTHS ENDED APRIL 28, 2024, AND APRIL 30, 2023

Unaudited

(Amounts in Thousands)

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

Trailing |

|

|||||

|

|

July 30, |

|

|

October 29, |

|

|

January 28, |

|

|

April 28, |

|

|

April 28, |

|

|||||

|

|

2023 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|||||

Net loss |

|

$ |

(3,342 |

) |

|

$ |

(2,424 |

) |

|

$ |

(3,188 |

) |

|

$ |

(4,865 |

) |

|

$ |

(13,819 |

) |

Income tax expense |

|

|

701 |

|

|

|

516 |

|

|

|

1,027 |

|

|

|

805 |

|

|

|

3,049 |

|

Interest income, net |

|

|

(345 |

) |

|

|

(282 |

) |

|

|

(284 |

) |

|

|

(252 |

) |

|

|

(1,163 |

) |

Depreciation expense |

|

|

1,635 |

|

|

|

1,617 |

|

|

|

1,646 |

|

|

|

1,623 |

|

|

|

6,521 |

|

Restructuring expense (credit) |

|

|

338 |

|

|

|

144 |

|

|

|

(50 |

) |

|

|

204 |

|

|

|

636 |

|

Restructuring related charge (credit) |

|

|

179 |

|

|

|

(78 |

) |

|

|

(61 |

) |

|

|

— |

|

|

|

40 |

|

Amortization expense |

|

|

96 |

|

|

|

97 |

|

|

|

98 |

|

|

|

99 |

|

|

|

390 |

|

Stock based compensation |

|

|

322 |

|

|

|

163 |

|

|

|

262 |

|

|

|

168 |

|

|

|

915 |

|

Adjusted EBITDA |

|

$ |

(416 |

) |

|

$ |

(247 |

) |

|

$ |

(550 |

) |

|

$ |

(2,218 |

) |

|

$ |

(3,431 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

% Net Sales |

|

|

(0.7 |

)% |

|

|

(0.4 |

)% |

|

|

(0.9 |

)% |

|

|

(4.5 |

)% |

|

|

(1.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

Trailing |

|

|||||

|

|

July 31, |

|

|

October 30, |

|

|

January 29, |

|

|

April 30, |

|

|

April 30, |

|

|||||

|

|

2022 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|||||

Net loss (1) |

|

$ |

(5,698 |

) |

|

$ |

(12,173 |

) |

|

$ |

(8,968 |

) |

|

$ |

(4,681 |

) |

|

$ |

(31,520 |

) |

Income tax expense |

|

|

896 |

|

|

|

1,150 |

|

|

|

286 |

|

|

|

798 |

|

|

|

3,130 |

|

Interest income, net |

|

|

(17 |

) |

|

|

(79 |

) |

|

|

(196 |

) |

|

|

(239 |

) |

|

|

(531 |

) |

Depreciation expense |

|

|

1,768 |

|

|

|

1,719 |

|

|

|

1,739 |

|

|

|

1,619 |

|

|

|

6,845 |

|

Restructuring expense |

|

|

— |

|

|

|

615 |

|

|

|

711 |

|

|

|

70 |

|

|

|

1,396 |

|

Restructuring related charge |

|

|

— |

|

|

|

98 |

|

|

|

— |

|

|

|

— |

|

|

|

98 |

|

Amortization expense |

|

|

105 |

|

|

|

109 |

|

|

|

109 |

|

|

|

115 |

|

|

|

438 |

|

Stock based compensation |

|

|

252 |

|

|

|

313 |

|

|

|

322 |

|

|

|

258 |

|

|

|

1,145 |

|

Adjusted EBITDA (1) |

|

$ |

(2,694 |

) |

|

$ |

(8,248 |

) |

|

$ |

(5,997 |

) |

|

$ |

(2,060 |

) |

|

$ |

(18,999 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

% Net Sales |

|

|

(4.3 |

)% |

|

|

(14.1 |

)% |

|

|

(11.4 |

)% |

|

|

(3.4 |

)% |

|

|

(8.1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

% Over (Under) |

|

|

(84.6 |

)% |

|

|

(97.0 |

)% |

|

|

(90.8 |

)% |

|

|

7.7 |

% |

|

|

(81.9 |

)% |

(1) Net loss and adjusted EBITDA for the quarter ended October 30, 2022, and the twelve-month period ending April 30, 2023, includes a non-cash charge totaling $5.2 million, which represents a $2.9 million charge for the write down of inventory to its net realizable value associated with the mattress fabrics segment and $2.3 million related to markdowns of inventory estimated based on the company's policy for aged inventory for both the mattress and upholstery fabrics segments.

-MORE-

CULP Announces Results for Fourth Quarter and Fiscal 2024, Provides Update on Restructuring Initiatives

Page 17

June 27, 2024

CULP, INC.

RETURN ON CAPITAL EMPLOYED BY SEGMENT

FOR THE TWELVE MONTHS ENDED APRIL 28, 2024

Unaudited

(Amounts in Thousands)

|

Adjusted Operating |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Twelve Months |

|

Average |

|

Return on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

April 28, 2024 |

|

Employed (2) |

|

Employed (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Mattress Fabrics |

$ |

(6,845 |

) |

$ |

63,189 |

|

|

(10.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Upholstery Fabrics |

|

5,787 |

|

|

9,263 |

|

|

62.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Unallocated Corporate |

|

(9,574 |

) |

|

3,784 |

|

N.M. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Total |

$ |

(10,632 |

) |

$ |

76,235 |

|

|

(13.9 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Average Capital Employed |

As of the three Months April 28, 2024 |

|

|

As of the three Months January 28, 2024 |

|

|

As of the three Months October 29, 2023 |

|

||||||||||||||||||||||||||||||

|

Mattress |

|

Upholstery |

|

Unallocated |

|

|

|

|

Mattress |

|

Upholstery |

|

Unallocated |

|

|

|

|

Mattress |

|

Upholstery |

|

Unallocated |

|

|

|

||||||||||||

|

Fabrics |

|

Fabrics |

|

Corporate |

|

Total |

|

|

Fabrics |

|

Fabrics |

|

Corporate |

|

Total |

|

|

Fabrics |

|

Fabrics |

|

Corporate |

|

Total |

|

||||||||||||

Total assets (3) |

$ |

72,060 |

|

|

32,629 |

|

|

27,365 |

|

|

132,054 |

|

|

$ |

75,572 |

|

|

38,085 |

|

|

28,341 |

|

|

141,998 |

|

|

$ |

75,924 |

|

|

35,082 |

|

|

31,154 |

|

|

142,160 |

|

Total liabilities |

|

(9,803 |

) |

|

(25,370 |

) |

|

(20,752 |

) |

|

(55,925 |

) |

|

|

(8,234 |

) |

|

(32,201 |

) |

|

(20,767 |

) |

|

(61,202 |

) |

|

|

(14,739 |

) |

|

(23,758 |

) |

|

(20,035 |

) |

|

(58,532 |

) |

Subtotal |

$ |

62,257 |

|

$ |

7,259 |