PAYX-05.31.15-10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2015

Commission file number 0-11330

____________________________

Paychex, Inc.

911 Panorama Trail South

Rochester, New York 14625-2396

(585) 385-6666

A Delaware Corporation

IRS Employer Identification Number: 16-1124166

|

| | |

Securities registered pursuant to Section 12(b) of the Act: | | Common Stock, $0.01 Par Value |

Name of exchange on which registered: | | NASDAQ Global Select Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer þ | | Accelerated filer ¨ | | Non-accelerated filer o | | Smaller reporting company o |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

As of November 30, 2014, the last business day of the most recently completed second fiscal quarter, shares held by non-affiliates of the registrant had an aggregate market value of $15,395,911,785 based on the closing price reported for such date on the NASDAQ Global Select Market.

As of June 30, 2015, 361,206,331 shares of the registrant’s common stock, $.01 par value, were outstanding.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement to be issued in connection with its Annual Meeting of Stockholders to be held on or about October 14, 2015, to the extent not set forth herein, are incorporated by reference into Part III, Items 10 through 14, inclusive.

PAYCHEX, INC.

INDEX TO FORM 10-K

For the fiscal year ended May 31, 2015

|

| | | |

| | |

| Description | Page |

|

| PART I | |

| Cautionary Note Regarding Forward-Looking Statements Pursuant to the United States Private Securities Litigation Reform Act of 1995 | 1 |

|

Item 1 | Business | 2 |

|

Item 1A | Risk Factors | 7 |

|

Item 1B | Unresolved Staff Comments | 9 |

|

Item 2 | Properties | 10 |

|

Item 3 | Legal Proceedings | 10 |

|

Item 4 | Mine Safety Disclosures | 10 |

|

| PART II | |

Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 11 |

|

Item 6 | Selected Financial Data | 13 |

|

Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 13 |

|

Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 27 |

|

Item 8 | Financial Statements and Supplementary Data | 29 |

|

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 58 |

|

Item 9A | Controls and Procedures | 58 |

|

Item 9B | Other Information | 59 |

|

| PART III | |

Item 10 | Directors, Executive Officers and Corporate Governance | 59 |

|

Item 11 | Executive Compensation | 60 |

|

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 60 |

|

Item 13 | Certain Relationships and Related Transactions, and Director Independence | 60 |

|

Item 14 | Principal Accounting Fees and Services | 60 |

|

| PART IV | |

Item 15 | Exhibits and Financial Statement Schedules | 61 |

|

| Signatures | 63 |

|

i

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS PURSUANT TO THE UNITED STATES PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Certain written and oral statements made by management of Paychex, Inc. and its wholly owned subsidiaries (“we,” “our,” “us,” “Paychex,” or the “Company”) may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the United States (“U.S.”) Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by such words and phrases as “we expect,” “expected to,” “estimates,” “estimated,” “current outlook,” “we look forward to,” “would equate to,” “projects,” “projections,” “projected to be,” “anticipates,” “anticipated,” “we believe,” “could be,” and other similar phrases. Examples of forward-looking statements include, among others, statements we make regarding operating performance, events, or developments that we expect or anticipate will occur in the future, including statements relating to revenue growth, earnings, earnings-per-share growth, or similar projections.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict, many of which are outside our control. Our actual results and financial conditions may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance upon any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

| |

• | general market and economic conditions including, among others, changes in U.S. employment and wage levels, changes to new hiring trends, legislative changes to stimulate the economy, changes in short- and long-term interest rates, changes in the fair value and the credit rating of securities held by us, and accessibility of financing; |

| |

• | changes in demand for our services and products, ability to develop and market new services and products effectively, pricing changes and the impact of competition; |

| |

• | changes in the availability of skilled workers, in particular those supporting our technology and product development; |

| |

• | changes in the laws regulating collection and payment of payroll taxes, professional employer organizations, and employee benefits, including retirement plans, workers’ compensation, health insurance (including health care reform legislation), state unemployment, and section 125 plans; |

| |

• | changes in health insurance and workers’ compensation rates and underlying claim trends; |

| |

• | changes in technology that adversely affect our products and services and impact our ability to provide timely enhancements to services and products; |

| |

• | the possibility of a security breach that disrupts operations or exposes client confidential data; |

| |

• | the possibility of failure of our operating facilities, computer systems, and communication systems during a catastrophic event; |

| |

• | the possibility of third-party service providers failing to perform their functions; |

| |

• | the possibility of a failure of internal controls or our inability to implement business processing improvements; |

| |

• | the possibility that we may be subject to liability for violations of employment or discrimination laws by our clients and acts or omissions of client employees who may be deemed to be our agents, even if we do not participate in any such acts or violations; and |

| |

• | potentially unfavorable outcomes related to pending legal matters. |

Any of these factors, as well as such other factors as discussed in Part I, Item 1A Risk Factors and throughout Part II, Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report on Form 10-K (“Form 10-K”), as well as in our periodic filings with the Securities and Exchange Commission (“SEC” or “Commission”), could cause our actual results to differ materially from our anticipated results. The information provided in this Form 10-K is based upon the facts and circumstances known at this time, and any forward-looking statements made by us in this Form 10-K speak only as of the date on which they are made. Except as required by law, we undertake no obligation to update these forward-looking statements after the date of filing this Form 10-K with the SEC to reflect events or circumstances after such date, or to reflect the occurrence of unanticipated events.

Incorporated in Delaware in 1979, we are a leading provider of payroll, human resource, insurance, and benefits outsourcing solutions for small- to medium-sized businesses. As of May 31, 2015, we serviced approximately 590,000 payroll clients. We maintain our corporate headquarters in Rochester, New York, and serve clients throughout the U.S. and Germany. We report our results of operations and financial condition as one business segment. Our fiscal year ends May 31st.

Company Strategy

Our mission is to be the leading provider of payroll, human resource and employee benefit services for small- to medium-sized businesses by being an essential partner with America’s businesses. We believe that success in this mission will lead to strong, long-term financial performance. Our strategy focuses on the following:

•flexible, convenient service;

•industry-leading, integrated technology;

•solid sales execution;

•comprehensive suite of value-added human capital management (“HCM”) services;

•continued service penetration; and

•strategic acquisitions.

Services and Products

We offer a comprehensive portfolio of HCM services and products that allow our clients to meet their diverse payroll and human resource needs. Clients can select services on an á la carte basis or as part of various product bundles. Our payroll-related ancillary services and Human Resource Service (“HRS”) offerings often leverage the information gathered in the base payroll processing service, allowing us to provide comprehensive outsourcing services covering the HCM spectrum. We also offer professional employer organization (“PEO”) services and provide insurance offerings through the Paychex Insurance Agency, Inc. (“PIA”) that allow employers to expand their employee benefit offerings at an affordable cost. We mainly earn our revenue through recurring fees for services performed. Service revenue is primarily driven by the number of clients, checks or transactions per client per pay period, and utilization of ancillary services.

Paychex FlexSM is our HCM software-as-a-service (“SaaS”) platform through which we provide an integrated product suite that covers the employee life cycle from recruiting and hiring to retirement. Paychex Flex streamlines workforce management through innovative technology and flexible choice of service. The platform uses a single cloud-based platform, with single client and employee records, and single sign-on, including self-service options and mobility applications. The HCM product suite integrates recruiting and applicant tracking, employee onboarding, payroll, employee benefits and human resource administration, time and attendance, performance management, and retirement services. Paychex Flex also provides technology-enabled service, with options that include self-service, a 24/7 dedicated service center, individual payroll specialist, and integrated service via the multi-product service center. In addition, large clients can utilize a relationship manager for more personalized service. This flexible platform services our small-business clients, mid-market clients, and our PEO business.

The integration of flexible service options and leading-edge technology allows us to meet our clients' diverse needs by providing them with information and products when, where, and how they want it. Our Paychex Mobile Applications add greater value and convenience for our clients and their employees by allowing them instant access and increased productivity. Paychex Flex allows for device independence, providing a consistent experience regardless of device. Our mobile apps are available for iOS® and AndroidTM tablets and smartphones, and allow our clients and their employees to have full access to our products, offering diverse capabilities for both the employer and employee.

Small-Business Clients

For our small-business clients, which we define as typically less than 50 employees, Paychex aides the client in reducing the complexity and risk of running their own payroll, while ensuring greater accuracy with up-to-date tax rates and regulatory information. We simplify their payroll with a combination of our dynamic products and customer service for a quick and easy pay day. Small-business payroll is provided via our core payroll, utilizing our robust Paychex Flex processing platform, or SurePayroll® products. Our core payroll clients can opt for our full-service customer service model through our branch operations or use Paychex Online Payroll®, our secure Internet portal. Paychex Online Payroll offers a suite of self-service and interactive services twenty-four hours a day, seven days a week. Both service models offer payroll processing, employee access online, general ledger service to provide payroll information to the client’s general ledger accounting software, and access to our industry-leading, web-based report center and robust report writer. Our SurePayroll SaaS solution offers “do-it-yourself,” self-service and mobile applications for small business.

Our small-business clients also benefit from our time and attendance products, which allow them to accurately and efficiently manage the gathering and recording of employee hours worked. Other Paychex solutions, such as our comprehensive human resource outsourcing solutions are also available for our small-business clients.

Mid-Market Clients

Our mid-market clients are defined as typically more than 50 employees and have more complex payroll and employee benefit needs. These clients are serviced through our Paychex Flex Enterprise solution set, which offers an integrated suite of HCM solutions tied together by the Paychex Flex platform, or through our traditional mid-market platform. Clients using Paychex Flex Enterprise are offered a SaaS solution that integrates payroll processing with human resource management, employee benefits administration, time and labor management, applicant tracking and onboarding solutions. Paychex Flex Enterprise allows our mid-market clients to choose the services and software they need to meet the complexity of the business and have them integrated through one HCM solution.

Mid-market clients also have the option to select from a number of á la carte payroll and human resource ancillary services and can opt for our comprehensive human resource and payroll outsourcing solutions, Paychex HR Services. This flexibility allows our clients to define the solution that best meets their particular needs.

Description of Services

Payroll processing: For both our small-business and mid-market clients, payroll processing is the backbone of our portfolio of HCM services. Payroll processing services include the calculation, preparation, and delivery of employee payroll checks; production of internal accounting records and management reports; preparation of payroll tax returns; and collection and remittance of clients’ payroll obligations. Along with payroll processing, clients can also select from the following payroll-related ancillary services:

| |

• | Payroll tax administration services: Our payroll tax administration services provide accurate preparation and timely filing of quarterly and year-end tax returns, as well as the electronic transfer of funds to the applicable tax or regulatory agencies (federal, state, and local). In connection with these services, we electronically collect payroll taxes from clients’ bank accounts, typically on payday, prepare and file the applicable tax returns, and remit taxes to the applicable tax or regulatory agencies on the respective due dates. These taxes are typically paid between one and 30 days after receipt of collections from clients, with some items extending to 90 days. We handle regulatory correspondence, amendments, and penalty and interest disputes, and we are subject to cash penalties imposed by tax or regulatory agencies for late filings and late or under payment of taxes. |

| |

• | Employee payment services: Our employee payment services provide an employer with the option of paying their employees by direct deposit, payroll debit card, a check drawn on a Paychex account (Readychex®), or a check drawn on the employer’s account and electronically signed by us. For each of the first three methods, we electronically collect net payroll from the clients’ bank accounts, typically one business day before payday, and provide payment to the employees on payday. Our Readychex service provides a cost-effective solution that offers the benefit of convenient, one-step payroll account reconciliation for employers. |

| |

• | Regulatory compliance services: We offer new-hire reporting services, which enable clients to comply with federal and state requirements to report information on newly hired employees. This information aids the government in enforcing child support orders and minimizes fraudulent unemployment and workers’ compensation insurance claims. Our garnishment processing service provides deductions from employees’ pay, forwards payments to third-party agencies, including those that require electronic payments, and tracks the obligations to fulfillment. These services enable employers to comply with legal requirements and reduce the risk of penalties. |

Human Resource Services: We offer complementary services for outsourcing of various human resource functions to our payroll clients. In addition, some of these services can be provided to clients who do not opt for payroll processing. Our complementary services are categorized as follows:

| |

• | Paychex HR Services: We offer comprehensive human resource outsourcing solutions that provide businesses a full-service approach to the outsourcing of employer and employee administrative needs. Our Paychex HR Services offering is available through Paychex HR Solutions, an administrative services organization (“ASO”), or Paychex PEO. Both options offer businesses a combined package of services that includes payroll, employer compliance, human resource and employee benefits administration, risk management outsourcing, and the on-site availability of a professionally trained human resource representative. These comprehensive bundles of services are designed to make it easier for businesses to manage their payroll and related benefit costs while providing a benefits package equal to that of larger companies. Our PEO differs from the ASO in that we serve as a co-employer of the clients’ employees, provide health care coverage to PEO employees, and assume the risks and rewards of workers’ compensation insurance and certain health insurance offerings. PEO services are sold through our registered and licensed subsidiary, Paychex Business Solutions, Inc. The integration of the sales and service models of the ASO and PEO under Paychex HR Services has reduced redundancies and created more flexible options for business owners to find the solution that best meets their needs. We also offer Paychex HR Essentials, which is an ASO product that provides support to our clients over the phone or online to help manage employee-related topics. As of May 31, 2015, Paychex HR Services was utilized by 31,000 clients with approximately 858,000 client worksite employees. |

| |

• | Retirement services administration: Our retirement services product line offers a variety of options to clients, including 401(k) plans, 401(k) SIMPLE plans, SIMPLE IRAs, 401(k) plans with safe harbor provisions, owner-only 401(k) plans, profit sharing plans, and money purchase plans. These services provide plan implementation, ongoing compliance with government regulations, employee and employer reporting, participant and employer online access, electronic funds transfer, and other administrative services. Auto enrollment is an optional plan feature that allows employers to automatically enroll employees in their company’s 401(k) plan and increase overall plan participation. Clients have the ability to choose from a group of pre-defined fund selections or to customize their investment options within their plan. We are the largest 401(k) recordkeeper for small businesses in the U.S. Our large-market retirement services clients include financial advisors. As of May 31, 2015, retirement services covered approximately 70,000 plans and the asset value of participants' funds externally managed totaled approximately $23.5 billion. |

| |

• | Insurance services: Our licensed insurance agency, PIA , provides insurance through a variety of carriers. Insurance offerings include property and casualty coverage such as workers’ compensation, business-owner policies, commercial auto, and health and benefits coverage, including health, dental, vision, and life. Our insurance services simplify the insurance process to make it easy to find plans with the features and affordability to meet the client’s needs. With access to numerous top national and regional insurance carriers, our professional insurance agents have access to a wide selection of plans from which they can best match the insurance needs of small businesses. Additionally, clients have the option to integrate their insurance plans with Paychex payroll processing for easy, accurate plan administration. |

We also offer new comprehensive solutions to help employers and employees with certain mandates under U.S. health care reform legislation. Our Paychex Employer Shared Responsibility(“ESR”) Service is aimed at helping clients: 1) determine if the ESR provision applies to them; 2) provide ongoing ESR analysis and monitoring, along with automatic alerts, of their employees and hours worked; 3) evaluate if their health care offering meets the minimum coverage requirement; and 4) prepare end-of-year reporting.

PIA has a website, www.paychexinsurance.com, with information and interactive tools to help educate visitors on insurance and aid in making business insurance decisions. A section on this website is designed to provide answers, information, and solutions that employers can use to prepare for and take action to comply with health care reform.

| |

• | Online HR administration services: We offer online human resource administration software products for employee benefits management and administration, time and attendance solutions, and recruiting. Paychex HR Online offers powerful tools for managing employee benefits, personnel information, and human resource compliance and reporting. Our BeneTrac service manages the employee-benefit enrollment process. Our time and attendance products, including our Stratustime® software acquired in June 2014, help minimize the time spent compiling time sheet information. They allow the employer to handle multiple payroll scenarios, improving productivity, accuracy, and reliability in the payroll process. Our expense reporting solution is a web-based solution that provides clients with tools to manage and control the expense reporting process. The applicant tracking suite provides technology that streamlines, simplifies, and drives the applicant workflow and onboarding process for companies of all sizes. |

| |

• | Other human resource services and products: We offer the outsourcing of plan administration under section 125 of the Internal Revenue Code, allowing employees to use pre-tax dollars to pay for certain health insurance benefits and health and dependent care expenses not covered by insurance. All required implementation, administration, compliance, claims processing and reimbursement, and coverage tests are provided with these services. We offer state unemployment insurance services, which provide clients with prompt processing for all claims, appeals, determinations, change statements, and requests for separation documents. Other HRS products include employee handbooks, management manuals, and personnel and required regulatory forms. These products are designed to simplify clients’ office processes and enhance their employee benefits programs. |

Accounting and Financial Services: We offer various accounting and financial services to small- to medium-sized businesses. These services are in their infancy, but offer additional value-added benefits for small-business owners. These services include a cloud-based accounting service, payment processing services, payment distribution services, an a small-business loan resource center.

Sales and Marketing

We market and sell our services primarily through our direct sales force based in the metropolitan markets we serve. Our direct sales force includes sales representatives who have defined geographical territories and specialize within our portfolio of services. Within payroll we differentiate the markets we serve between small-business and mid-market companies. Within retirement services we have a dedicated, wholesale sales force focused solely on enhancing our relationships with financial advisors. Our sales representatives are also supported by marketing, advertising, public relations, trade shows, and telemarketing programs. We utilize a virtual sales force to service geographical areas where we may not have a local presence or for products for which we do not have a local sales force. We sell HRS products to both new clients and our existing client base.

In addition to our direct selling and marketing efforts, we utilize other indirect sales channels such as our relationships with existing clients, certified public accountants (“CPAs”), and banks for new client referrals. Approximately 50% of our new core payroll clients (excluding business acquisitions) come from these referral sources. Our dedicated business development group drives sales through banking, national association, and franchise channels.

We have a long-standing partnership with the American Institute of Certified Public Accountants (“AICPA”) as the preferred payroll provider for its AICPA Business SolutionsTM Program. More than half of the CPA firms in the U.S. are enrolled and actively participating in the Paychex Partner Program from AICPA Business Solutions. Our current partnership agreement with the AICPA is in place through September 2016. We also enhanced our relationships with CPAs by partnering with various state CPA society organizations.

Our website, which is available at www.paychex.com, includes online payroll sales presentations and service and product information. It also serves as a cost-efficient tool that serves as a source of leads and new sales, while complementing the efforts of our direct sales force. This online tool allows us to market to clients and prospective clients in other geographical areas where we do not have a direct sales presence. In addition, our insurance services website, which is available at www.paychexinsurance.com, provides information to help small businesses navigate the insurance industry, and generates leads by allowing interested parties to get in contact with one of our professional insurance agents.

Advantage Payroll Services Inc. (“Advantage”), a wholly owned subsidiary of Paychex, Inc., has license agreements with independently owned associate offices (“Associates”), which are responsible for selling and marketing Advantage Payroll Services® and performing certain operational functions, while Paychex and Advantage provide all centralized back-office payroll processing and payroll tax administration services. The marketing and selling by the Associates is conducted under their own logos.

Paychex also builds on its reputation as an expert in the payroll and human resources industry by providing education and assistance to clients and other interested parties. We provide free webinars, white papers, and other information on our website to aid existing and prospective clients with the impacts of regulatory change. We track current regulatory issues that impact the small business community and provide a monthly regulatory update. Our Paychex Accountant Knowledge Center is a free online resource available through our website that brings valuable information and time-saving online tools to accounting professionals. The BuildMyBiz® website, which is available at www.BuildMyBiz.com, provides tools and resources for starting, growing, and managing a business.

A section of both the Paychex website, www.paychex.com, and our insurance services website, www.paychexinsurance.com, is designated to the topic of health care reform to provide answers, information, and solutions that employers need to prepare for and take action relating to the Patient Protection and Affordable Care Act of 2010 (“PPACA”) and the Health Care and Education Reconciliation Act of 2010, together with the PPACA, the (“Act”). Paychex is positioned to assist our clients and their employees as they navigate the complexity of this legislation.

Markets and Competition

We remain focused on servicing small- to medium-sized businesses based upon the growth potential that we believe exists in the markets we serve. Our internal database source indicates that there are approximately 10 million addressable businesses in the geographic markets that we currently serve within the U.S. Of those businesses, greater than 99% have fewer than 100 employees and comprise our primary customers and target market. The average client size within our existing client base is approximately 17 employees. We believe that there is opportunity for us in the HCM market as the demand is moving down-market to smaller businesses.

We serve a diverse base of small- to medium-sized clients operating in a broad range of industries located throughout the U.S. and in Germany. Revenue from operations in Germany and long-lived assets in Germany are not material. We also have a joint-venture arrangement to provide payroll and human resource services in Brazil. We utilize service agreements and arrangements with clients that are generally terminable by the client at any time or upon relatively short notice. For the fiscal year ended May 31, 2015 (“fiscal 2015”), client retention reached record levels, rising to over 82% of our beginning of the year client base. No single client has a material impact on total service revenue or results of operations.

The market for payroll processing and human resource services is highly competitive and fragmented. We have one primary national competitor and we also compete with other national, regional, local, and online service providers, all of which we believe have significantly fewer clients than us. In addition to traditional payroll processing and human resource service providers, we compete with in-house payroll and human resource systems and departments. Payroll and human resource systems and software are sold by many vendors. HRS products also compete with a variety of providers of human resource services, such as retirement services companies, insurance companies, and human resources and benefits consulting firms.

Competition in the payroll processing and human resource services industry is primarily based on service responsiveness, product quality and reputation, including ease of use and accessibility of technology, breadth of service and product offerings, and price. We believe we are competitive in each of these areas. We believe that our excellent customer service, together with our leading-edge technology and mobility applications, distinguishes us from our competitors.

Software Maintenance and Development

The ever-changing mandates of federal, state, and local tax and regulatory agencies require us to regularly update our proprietary software to provide payroll and human resource services to our clients. We are continually engaged in developing enhancements to and the maintenance of our various software platforms to meet the changing requirements of our clients and the marketplace. We continue to enhance our SaaS solutions and mobility applications to offer our users an integrated and unified experience. Continued enhancement of the client and client employee experience is important to our future success.

Employees

As of May 31, 2015, we employed approximately 13,000 people. None of our employees were covered by collective bargaining agreements.

Intellectual Property

We own or license and use a number of trademarks, trade names, copyrights, service marks, trade secrets, computer programs and software, and other intellectual property rights. Taken as a whole, our intellectual property rights are material to the conduct of our business. Where it is determined to be appropriate, we take measures to protect our intellectual property rights, including, but not limited to, confidentiality/non-disclosure agreements or policies with employees, vendors, and others; license agreements with licensees and licensors of intellectual property; and registration of certain trademarks. We believe that the “Paychex” name, trademark, and logo are of material importance to us.

Seasonality

There is no significant seasonality to our business. However, during our third fiscal quarter, which ends in February, the number of new payroll clients, new retirement services clients, and new Paychex HR Services worksite employees tends to be higher than during the rest of the fiscal year, primarily because many new clients prefer to start using our services at the beginning of a calendar year. In addition, calendar year-end transaction processing and client funds activity are traditionally higher during our third fiscal quarter due to clients paying year-end bonuses and requesting additional year-end services. Historically, as a result of these factors, our total revenue has been slightly higher in our third fiscal quarter, with greater sales commission expenses also reported in that quarter.

Available Information

We are subject to the informational and reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Therefore, we file periodic reports, proxy statements, and other information with the SEC. Such reports may be read and copied at the SEC’s Public Reference Room at 100 F Street NE, Washington, D.C. 20549. Information regarding the operation of the Public Reference Room may be obtained by calling the SEC at (800) SEC-0330. The SEC also maintains a website (www.sec.gov) that includes our reports, proxy statements, and other information.

Our corporate website, www.paychex.com, provides materials for investments and information about our services. Our Form 10-Ks, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings, as well as any amendments to such reports and filings, are made available, free of charge, on our website as soon as reasonably practicable after such reports have been filed with or furnished to the SEC. Also, copies of our Annual Report to Stockholders and Proxy Statement, to be issued in connection with our 2015 Annual Meeting of Stockholders, will be made available, free of charge, upon written request submitted to Paychex, Inc., c/o Corporate Secretary, 911 Panorama Trail South, Rochester, New York 14625-2396.

Our future results of operations are subject to a number of risks and uncertainties. These risks and uncertainties could cause actual results to differ materially from historical and current results, and from our projections. The risk factors described below represent our current view of some of the most important risks facing our business and are important to understanding our business. The risks described below are not the only risks we face. Additional factors not presently known to us or that we currently deem to be immaterial also may adversely affect, possibly to a material extent, our business, cash flows, financial condition, or results of operations in future periods. In addition, you should refer to the description of forward-looking statements at the beginning of Part I of this Form 10-K.

Our services may be adversely impacted by changes in government regulations and policies: Many of our services, particularly payroll tax administration services and employee benefit plan administration services, are designed according to government regulations that continually change. Changes in regulations could affect the extent and type of benefits employers are required, or may choose, to provide employees or the amount and type of taxes employers and employees are required to pay. Such changes could reduce or eliminate the need for some of our services and substantially decrease our revenue. Added requirements could also increase our cost of doing business. Failure to educate and assist our clients regarding new or revised legislation that impacts them could have an adverse impact on our reputation. Failure by us to modify our services in a timely fashion in response to regulatory changes could have a material adverse effect on our business and results of operations.

Our clients and our business could be adversely impacted by health care reform: The Act was enacted in March 2010 and entails sweeping health care reforms with staggered effective dates from 2010 through 2018. Many provisions of the Act require the issuance of additional guidance from the U.S. Departments of Labor and Health & Human Services, the Internal Revenue Service (the “IRS”), and the States.

As a service provider, we have a responsibility to our clients to help them understand their increased obligations under the federal and state regulations facing employers under the Act. Failure to provide clients with appropriate information or solutions to effectively manage their health care benefits and related costs could have an adverse impact on our reputation and a negative impact on our client base. There is no guarantee that solutions we have developed to help clients navigate health care legislation will continue to be readily accepted by clients, which could have a material adverse impact on our insurance services business. Insurance services revenue is at risk for lower commission revenue from underwriters if clients move away from traditional insurance policies utilized in the past or as a result of pressure on commission rates, driven by restrictions on insurers as to use of premiums. Refer to the discussion on the next page regarding changes in health insurance and workers' compensation insurance rates and underlying claim trends for discussion of health care reform as it impacts our PEO.

We may not be able to keep pace with changes in technology or provide timely enhancements to our products and services: To maintain our growth strategy, we must adapt and respond to technological advances and technological requirements of our clients. Our future success will depend on our ability to enhance capabilities and increase the performance of our internal systems, particularly our systems that meet our clients’ requirements. We continue to make significant investments related to the development of new technology. If our systems become outdated, we may be at a disadvantage when competing in our industry. There can be no assurance that our efforts to update and integrate systems will be successful. If we do not integrate and update our systems in a timely manner, or if our investments in technology fail to provide the expected results, there could be a material adverse effect to our business and results of operations.

Our business and reputation may be affected by security breaches and other disruptions to our information technology infrastructure, which could compromise Company and personal customer information: We rely upon information technology networks and systems to process, transmit, and store electronic information, and to support a variety of business processes. If we experience a problem with the functioning of key systems or a security breach of our systems, the resulting disruptions could have a material adverse effect on our business.

We also collect, use, and retain large amounts of personal information about our clients and their employees that is critical to the accurate and timely provision of services to our clients. This information includes bank account numbers, credit card numbers, tax return information, social security numbers, health care information, retirement account information, payroll information, and Paychex system passwords. In addition, we also collect and maintain personal information on our employees in the ordinary course of our business. As many of our services are web-based and mobile-application-based, the amount of data we store for our users on our servers has been increasing. Vulnerabilities, threats, and more sophisticated and targeted computer crime pose a risk to the security of our systems and networks, and the confidentiality, availability, and integrity of our data. We have security systems and information technology infrastructure in place designed to detect and protect against unauthorized access to such information. However, there is no guarantee that our systems and processes are adequate to protect against all security breaches. Third parties, including vendors that provide services for our operations, could also be a source of security risk to us in the event of a failure of their own security systems and infrastructure.

If our systems are disrupted or fail for any reason, or if our systems are infiltrated by unauthorized persons, both the Company and our clients could experience data loss, financial loss, harm to reputation, or significant business interruption. We may be required to incur significant costs to protect against damage caused by disruptions or security breaches in the future. Such events may expose us to unexpected liability, litigation, regulatory investigation and penalties, loss of clients’ business, unfavorable impact to business reputation, and there could be a material adverse effect on our business and results of operations.

In the event of a catastrophe, our business continuity plan may fail, which could result in the loss of client data and adversely interrupt operations: Our operations are dependent on our ability to protect our infrastructure against damage from catastrophe or natural disaster, severe weather including events resulting from climate change, unauthorized security breach, power loss, telecommunications failure, terrorist attack, or other events that could have a significant disruptive effect on our operations. We have a business continuity plan in place in the event of system failure due to any of these events. Our business continuity plan has been tested in the past by circumstances of severe weather, including hurricanes, floods, and snowstorms, and has been successful. However, these past successes are not an indicator of success in the future. If the business continuity plan is unsuccessful in a disaster recovery scenario, we could potentially lose client data or experience material adverse interruptions to our operations or delivery of services to our clients.

We may be adversely impacted by any failure of third-party service providers to perform their functions: As part of providing services to clients, we rely on a number of third-party service providers. These service providers include, but are not limited to, couriers used to deliver client payroll checks and banks used to electronically transfer funds from clients to their employees. Failure by these service providers, for any reason, to deliver their services in a timely manner could result in material interruptions to our operations, impact client relations, and result in significant penalties or liabilities to us.

We may be exposed to additional risks related to our co-employment relationship within our PEO business: Many federal and state laws that apply to the employer-employee relationship do not specifically address the obligations and responsibilities of the “co-employment” relationship. As a result, there is a possibility that we may be subject to liability for violations of employment or discrimination laws by our clients and acts or omissions of client employees, who may be deemed to be our agents, even if we do not participate in any such acts or violations. Although our agreements with clients provide that they will indemnify us for any liability attributable to their own or their employees’ conduct, we may not be able to effectively enforce or collect such contractual obligations. In addition, we could be subject to liabilities with respect to our employee benefit plans if it were determined that we are not the “employer” under any applicable state or federal laws.

We may be adversely impacted by changes in health insurance and workers’ compensation rates and underlying claims trends: Within our PEO business, we maintain health and workers’ compensation insurance covering worksite employees. The insurance costs are impacted by claim experience and are a significant portion of our PEO costs. If we experience a sudden or unexpected increase in claim activity, our costs could increase. In addition, in the event of expiration or cancellation of existing contracts, we may not be able to secure replacement contracts on competitive terms. Also, as a co-employer in the PEO, we assume or share many of the employer-related responsibilities associated with health care reform, which may result in increased costs. Increases in costs not incorporated into service fees timely or fully could have a material adverse effect on our results of operations. Incorporating cost increases into service fees could also impact our ability to attract and retain clients.

Our interest earned on funds held for clients may be impacted by changes in government regulations mandating the amount of tax withheld or timing of remittance: We receive interest income from investing client funds collected but not yet remitted to applicable tax or regulatory agencies or to client employees. A change in regulations either decreasing the amount of taxes to be withheld or allowing less time to remit taxes to applicable tax or regulatory agencies could adversely impact interest income.

We may be adversely impacted by volatility in the financial and economic environment: During periods of weak economic conditions, employment levels tend to decrease and interest rates may become more volatile. These conditions may impact our business due to lower transaction volumes or an increase in the number of clients going out of business. Current or potential clients may decide to reduce their spending on payroll and other outsourcing services. In addition, new business formation may be affected by an inability to obtain credit. The interest we earn on funds held for clients may decrease as a result of a decline in funds available to invest and lower interest rates. In addition, during periods of volatility in the credit markets, certain types of investments may not be available to us or may become too risky for us to invest in, further reducing the interest we may earn on client funds. Constriction in the credit markets may impact the availability of financing, even to borrowers with the highest credit ratings. Historically, we have rarely borrowed against available credit arrangements to meet liquidity needs. However, should we require additional short-term liquidity during days of large outflows of client funds, a credit constriction may limit our ability to access those funds or the flexibility to obtain them at interest rates that would be acceptable to us. If all of these financial and economic circumstances were to remain in effect for an extended period of time, there could be a material adverse effect on our results of operations and financial condition.

Quantitative and qualitative disclosures about market risk: Refer to Item 7A of this Form 10-K for a discussion on Market Risk Factors, which could have a material adverse effect on our business and results of operations.

|

| |

Item 1B. | Unresolved Staff Comments |

None.

We owned and leased the following properties as of May 31, 2015:

|

| | |

| Square feet |

Owned facilities: | |

Rochester, New York | 721,000 |

|

Other U.S. locations | 65,000 |

|

Total owned facilities | 786,000 |

|

| |

Leased facilities: | |

Rochester, New York | 189,000 |

|

Other U.S. locations | 2,032,000 |

|

International locations | 28,000 |

|

Total leased facilities | 2,249,000 |

|

| |

Our facilities in Rochester, New York house various distribution, processing, and technology functions, certain ancillary functions, a telemarketing unit, and other back-office functions. Facilities outside of Rochester, New York are at various locations throughout the U.S. and house our regional, branch, and sales offices and data processing centers. These locations are concentrated in metropolitan areas. Our international locations are primarily in Germany and house our German branch and sales locations. We believe that adequate, suitable lease space will continue to be available to meet our needs.

We are subject to various claims and legal matters that arise in the normal course of our business. These include disputes or potential disputes related to breach of contract, tort, breach of fiduciary duty, employment-related claims, tax claims, and other matters.

Our management currently believes that resolution of outstanding legal matters will not have a material adverse effect on our financial position or results of operations. However, legal matters are subject to inherent uncertainties and there exists the possibility that the ultimate resolution of these matters could have a material adverse impact on the Company’s financial position and the results of operations in the period in which any such effect is recorded.

|

| |

Item 4. | Mine Safety Disclosures |

Not applicable.

PART II

|

| |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our common stock trades on the NASDAQ Global Select Market under the symbol “PAYX.” Dividends have historically been paid on our common stock in August, November, February, and May. The level and continuation of future dividends are dependent on our future earnings and cash flows, and are subject to the discretion of our Board of Directors (the “Board.”)

As of June 30, 2015, there were 13,351 holders of record of our common stock, which includes registered holders and participants in the Paychex, Inc. Dividend Reinvestment and Stock Purchase Plan. There were also 6,948 participants in the Paychex, Inc. Employee Stock Purchase Plan and 5,043 participants in the Paychex, Inc. Employee Stock Ownership Plan.

The high and low sale prices for our common stock as reported on the NASDAQ Global Select Market and dividends for fiscal 2015 and the fiscal year ended May 31, 2014 (“fiscal 2014”) are as follows:

|

| | | | | | | | | | | | |

| | Fiscal 2015 | | Fiscal 2014 |

| | Sales prices | | Cash dividends declared per share | | Sales prices | | Cash dividends declared per share |

| | High | | Low | | | High | | Low | |

First quarter | | $42.66 | | $40.10 | | $0.38 | | $40.84 | | $35.75 | | $0.35 |

Second quarter | | $48.20 | | $41.59 | | $0.38 | | $44.01 | | $36.80 | | $0.35 |

Third quarter | | $50.19 | | $44.52 | | $0.38 | | $45.95 | | $39.86 | | $0.35 |

Fourth quarter | | $51.72 | | $48.00 | | $0.38 | | $43.56 | | $39.80 | | $0.35 |

The closing price of our common stock as of May 29, 2015, as reported on the NASDAQ Global Select Market, was $49.41 per share.

In May 2014, the Board approved a program to repurchase up to $350 million of its common stock with authorization expiring on May 31, 2017. Shares of stock repurchased during the three months ended May 31, 2015 were purchased pursuant to the program and were retired.

The following table provides information relating to our repurchase of common stock during the three months ended May 31, 2015:

|

| | | | | | | | | | | |

Period | | Total number of shares purchased | | Average price paid per share | | Approximate dollar value of shares that may yet be purchased under the program |

March 1, 2015 - March 31, 2015 | | — |

| | $ | — |

| | $ | 279,566,285 |

|

April 1, 2015 - April 30, 2015 | | 1,718,724 |

| | $ | 49.18 |

| | $ | 195,038,017 |

|

May 1, 2015 - May 31, 2015 | | 560,458 |

| | $ | 48.95 |

| | $ | 167,604,108 |

|

Total for the period | | 2,279,182 |

| | $ | 49.12 |

| | $ | 167,604,108 |

|

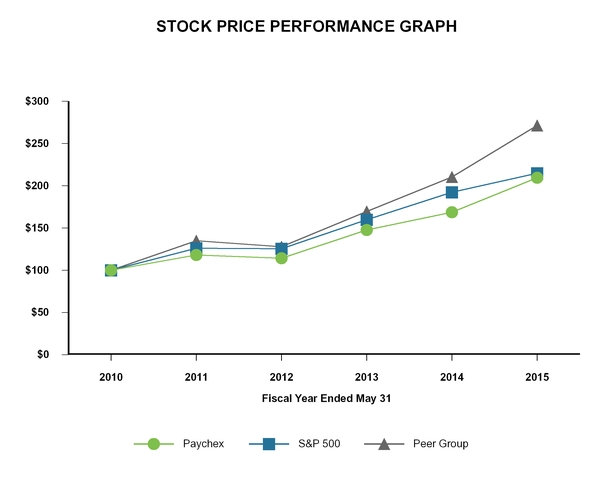

The following graph shows a five-year comparison of the total cumulative returns of investing $100 on May 31, 2010, in Paychex common stock, the S&P 500 Index, and a Peer Group Index. All comparisons of stock price performance shown assume reinvestment of dividends. We are a participant in the S&P 500 Index, a market group of companies with a larger than average market capitalization. Our Peer Group is a group of companies with comparable revenue and net income, who are in a comparable industry, or who are direct competitors of Paychex (as detailed on the following page).

|

| | | | | | | | | | | | |

May 31, | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 |

Paychex | | $100.00 | | $118.03 | | $114.27 | | $147.67 | | $168.69 | | $209.61 |

S&P 500 | | $100.00 | | $125.95 | | $125.43 | | $159.64 | | $192.28 | | $214.98 |

Peer Group | | $100.00 | | $135.03 | | $127.75 | | $169.40 | | $210.42 | | $271.24 |

There can be no assurance that our stock performance will continue into the future with the same or similar trends depicted in the graph above. We will neither make nor endorse any predictions as to future stock performance.

Our Peer Group is comprised of the following companies:

|

| | |

Automatic Data Processing, Inc. (direct competitor) | | Broadridge Financial Solutions, Inc. |

Fiserv, Inc. | | Robert Half International Inc. |

The Western Union Company | | Intuit Inc. |

Total Systems Services, Inc. | | Iron Mountain Incorporated |

Global Payments Inc. | | Moody’s Corporation |

The Brink’s Company | | H&R Block, Inc. |

DST System, Inc. | | TD AMERITRADE Holding Corporation |

The Dun & Bradstreet Corporation | | |

|

| |

Item 6. | Selected Financial Data |

|

| | | | | | | | | | | | | | | | | | | | |

In millions, except per share amounts Year ended May 31, | | 2015 | | 2014 (1) | | 2013 (2) | | 2012 | | 2011 |

Service revenue | | $ | 2,697.5 |

| | $ | 2,478.2 |

| | $ | 2,285.2 |

| | $ | 2,186.2 |

| | $ | 2,036.2 |

|

Interest on funds held for clients | | 42.1 |

| | 40.7 |

| | 41.0 |

| | 43.6 |

| | 48.1 |

|

Total revenue | | $ | 2,739.6 |

| | $ | 2,518.9 |

| | $ | 2,326.2 |

| | $ | 2,229.8 |

| | $ | 2,084.3 |

|

Operating income | | $ | 1,053.6 |

| | $ | 982.7 |

| | $ | 904.8 |

| | $ | 853.9 |

| | $ | 786.4 |

|

Net income | | $ | 674.9 |

| | $ | 627.5 |

| | $ | 569.0 |

| | $ | 548.0 |

| | $ | 515.3 |

|

Diluted earnings per share | | $ | 1.85 |

| | $ | 1.71 |

| | $ | 1.56 |

| | $ | 1.51 |

| | $ | 1.42 |

|

Cash dividends per common share | | $ | 1.52 |

| | $ | 1.40 |

| | $ | 1.31 |

| | $ | 1.27 |

| | $ | 1.24 |

|

Purchases of property and equipment | | $ | 102.8 |

| | $ | 84.1 |

| | $ | 98.7 |

| | $ | 89.6 |

| | $ | 100.5 |

|

Cash and total corporate investments | | $ | 936.4 |

| | $ | 936.8 |

| | $ | 874.6 |

| | $ | 790.0 |

| | $ | 671.3 |

|

Total assets | | $ | 6,482.5 |

| | $ | 6,370.1 |

| | $ | 6,163.7 |

| | $ | 6,479.6 |

| | $ | 5,393.8 |

|

Total debt | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Stockholders’ equity | | $ | 1,785.5 |

| | $ | 1,777.0 |

| | $ | 1,773.7 |

| | $ | 1,604.5 |

| | $ | 1,496.2 |

|

Return on stockholders’ equity | | 36 | % | | 35 | % | | 34 | % | | 34 | % | | 35 | % |

| |

(1) | With the introduction of a new health care offering within the PEO, the Company began to recognize certain PEO direct costs as operating expenses rather than as a reduction in service revenue. In the table above, this impacted service revenue and total revenue, but had no impact on operating income. |

| |

(2) | In the fourth quarter of fiscal 2013, the Company increased its tax provision related to the settlement of a state income tax matter. This reduced diluted earnings per share by approximately $0.04 per share. |

|

| |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Management’s Discussion and Analysis of Financial Condition and Results of Operations reviews the operating results of Paychex, Inc. and its wholly owned subsidiaries (“Paychex,” “we,” “our,” or “us”) for each of the three fiscal years ended May 31, 2015 (“fiscal 2015”), May 31, 2014 (“fiscal 2014”), and May 31, 2013 (“fiscal 2013”), and our financial condition as of May 31, 2015. This review should be read in conjunction with the accompanying consolidated financial statements and the related notes to consolidated financial statements contained in Item 8 of this Annual Report on Form 10-K (“Form 10-K”) and the “Risk Factors” discussed in Item 1A of this Form 10-K. Forward-looking statements in this review are qualified by the cautionary statement under the heading “Cautionary Note Regarding Forward-Looking Statements Pursuant to the United States Private Securities Litigation Reform Act of 1995” contained at the beginning of Part I of this Form 10-K.

Overview

We are a leading provider of payroll, human resource, insurance, and benefits outsourcing solutions for small- to medium-sized businesses. We offer a comprehensive portfolio of human capital management (“HCM”) services and products that allow our clients to meet their diverse payroll and human resource needs. Our payroll processing services, the foundation of our service model, include:

| |

• | payroll tax administration services; |

| |

• | employee payment services; and |

| |

• | regulatory compliance services (new-hire reporting and garnishment processing). |

We support small-business companies through our core payroll, utilizing our robust Paychex FlexSM platform, and our software-as-a-service (“SaaS”) SurePayroll® products. Mid-market companies typically have more sophisticated payroll and benefits needs, and are primarily serviced through our Paychex Flex Enterprise solution set, which offers an integrated suite of HCM solutions tied together by the Paychex Flex platform, or through our traditional mid-market platform. Our SaaS solution through Paychex Flex Enterprise integrates payroll processing with human resource management, employee benefits administration, time and labor management, and applicant tracking and onboarding solutions.

We offer a suite of complementary Human Resource Services (“HRS”) products including:

| |

• | comprehensive human resource outsourcing through Paychex HR Services, under which we offer Paychex HR Solutions, our administrative services organization (“ASO”), and Paychex PEO, our professional employer organization (“PEO”); |

| |

• | retirement services administration; |

| |

• | online HR administration services, including time and attendance, benefit enrollment, recruiting and onboarding; and |

| |

• | other human resource services and products. |

Our mission is to be the leading provider of payroll, human resource, and employee benefits services for small- and mid-sized companies by being an essential partner with America's businesses. We believe success in this mission will lead to strong long-term financial performance. Our strategy focuses on flexible, convenient service; industry-leading, integrated technology; solid sales execution; providing a comprehensive suite of value-added HCM services; continued service penetration; and engaging in strategic acquisitions.

We continue to drive growth in clients, revenue, and profits. We are managing our personnel costs and expenses while continuing to invest in our business, particularly in leading-edge technology. We believe these investments are critical to our success. Looking to the future, we believe that investing in our products, people, and service capabilities will position us to capitalize on opportunities for long-term growth.

Our financial results for fiscal 2015 reflected sustained growth in our business. Payroll service revenue continued to experience steady growth of 4% for fiscal 2015 as compared with fiscal 2014, driven by growth in revenue per check and clients. We achieved a milestone of $1 billion of HRS revenue for fiscal 2015, as strong demand for our comprehensive human resource outsourcing solutions drove double-digit growth. Our sales execution was strong as we achieved significant growth in new annualized revenue. For the third year in a row, we achieved record levels of client retention, ending fiscal 2015 in excess of 82% of the beginning of the year client base.

Our financial results continue to be impacted by the interest rate environment as interest rates available on high-quality financial instruments remain low, but steady. The Federal Funds rate has been at a range of zero to 0.25% since December 2008. Our combined funds held for clients and corporate investment portfolios earned an average rate of return of 1.0% for fiscal years 2015, 2014, and 2013.

Highlights of our financial results for fiscal 2015, compared to fiscal 2014, are as follows:

| |

• | Total service revenue increased 9% to $2.7 billion. |

| |

◦ | Payroll service revenue increased 4% to $1.7 billion. |

| |

◦ | HRS revenue increased 18% to $1.0 billion. |

| |

• | Interest on funds held for clients increased 3% to $42.1 million. |

| |

• | Total revenue increased 9% to $2.7 billion. |

| |

• | Operating income increased 7% to $1.1 billion. |

| |

• | Net income and diluted earnings per share each increased 8% to $674.9 million and $1.85 per share, respectively. |

| |

• | Dividends of $551.8 million were paid to stockholders, representing 82% of net income. |

Business Outlook

Our client base totaled approximately 590,000 clients as of May 31, 2015, compared to approximately 580,000 clients as of May 31, 2014, and approximately 570,000 clients as of May 31, 2013. Our client base increased approximately 2% for fiscal 2015 and fiscal 2014, up from growth of approximately 1% for fiscal 2013.

For fiscal 2015, payroll services client retention was at a record level in excess of 82% of our beginning of the year client base. Our client satisfaction results remained high, which we believe is a result of our focus on providing innovative technology solutions and outstanding personal service to our clients to maximize client retention.

While HRS provides services to employers and employees beyond payroll, they effectively leverage payroll processing data and, therefore, are beneficial to our operating margin. Our online HR administration services are often included as part of the SaaS solutions for mid-market clients. The following table illustrates the growth in selected HRS service offerings:

|

| | | | | | | | | | | | |

| | Balance at May 31, 2015 | | Growth rates for fiscal year |

| | 2015 | | 2014 | | 2013 |

Paychex HR Services client worksite employees | | 858,000 |

| | 12 | % | | 14 | % | | 9 | % |

Paychex HR Services clients | | 31,000 |

| | 11 | % | | 13 | % | | 10 | % |

Health and benefits services applicants | | 142,000 |

| | 6 | % | | 3 | % | | 8 | % |

Retirement services plans | | 70,000 |

| | 6 | % | | 5 | % | | 4 | % |

We continue to position ourselves to capitalize on the opportunities arising from the shift to SaaS solutions as we increase our investment in product development relating to our SaaS capabilities and mobile applications. In fiscal 2015, we broadened our portfolio of value-added services, offering the following new or upgraded payroll and human resource services:

| |

• | We introduced Paychex Flex, a solution that includes our leading-edge, cloud-based platform and mobility applications, with a multi-tiered service offering, which streamlines workforce management through innovative technology and flexible choice of service. This provides a unique blend of both service and software that we believe differentiates us from our competitors. The comprehensive, cloud-based Paychex Flex platform offers powerful capabilities in a simple user experience that is adaptive to the needs of users across the HCM spectrum – recruiters and recruits, HR and payroll stakeholders, benefits administrators, employees, contractors, financial advisors, and accounting partners. All Paychex services, including payroll, time and attendance, HR, benefits, training, and performance management, are accessible on a single cloud-based platform with Paychex Single Sign-On. The mobile apps within Paychex Flex give employers access to the fullest set of employee data available on-the-go, in addition to plan-level views of retirement, health, and benefit accounts. Likewise, employees receive visibility into a wide set of personal and benefits data and functionality, including the industry’s broadest set of retirement self-service features. |

| |

• | We also expanded our mobile applications by introducing mobile applications for our Paychex Accounting Online® services, time and attendance, and our expense management solution. The Paychex Accounting Online mobile application allows users to access their Paychex Accounting Online account from their iPad®, iPhone®, and iPod Touch® in order to keep track of their business finances anywhere and anytime. Paychex Time provides a mobile time punch app that offers the quickest mobile punch possible. The mobile interface for expense management provides clients and their employees with anytime, anywhere accessibility to view, review, and analyze expense reports, upload receipt images, and check on the status of an expense report. |

| |

• | We acquired nettime solutions, LLC, a leading cloud-based time and attendance solutions provider. This small- business acquisition pairs Paychex’s exceptional customer service with the SaaS time and attendance technology of a market leader. |

| |

• | We released the newest version of our applicant tracking system, myStaffingPro®, which has expanded mobility and new features. These new features are designed to enhance the candidate experience by reducing data entry, improving completion rates, and providing the ability to create candidate differentiators. The improved candidate experience helps our clients increase their applicant pools and they can also utilize enhanced tools to screen applicants. |

| |

• | Our full-service Paychex Employer Shared Responsibility (“ESR”) services are experiencing strong market acceptance. The Affordable Care Act (“ACA”) sets forth specific coverage and reporting requirements that employers must meet. Paychex ESR services help clients navigate the complexities of those requirements, avoid steep fines and penalties, and reduce ACA-related administrative work. |

We continue to strengthen our position as an expert in our industry by serving as a source of education and information to clients, small businesses, and other interested parties. We provide free webinars, white papers, and other information on our website to aid existing and prospective clients with the impact of regulatory changes. The Paychex Insurance Agency, Inc. website, www.paychexinsurance.com, helps small-business owners navigate the area of insurance coverage. Both this website and www.paychex.com have sections dedicated to the topic of health care reform.

Financial position and liquidity

Our financial position as of May 31, 2015 remained strong with cash and total corporate investments of $936.4 million and no debt. Our investment strategy focuses on protecting principal and optimizing liquidity. Yields on high quality financial instruments remain low, negatively impacting our income earned on funds held for clients and corporate investments. We invest predominately in municipal bonds including general obligation bonds, pre-refunded bonds that are secured by a United States (“U.S.”) government escrow, and essential services revenue bonds. During fiscal 2015, our primary short-term investment vehicles were high quality variable rate demand notes (“VRDNs”) and bank demand deposit accounts.

A substantial portion of our portfolio is invested in high credit quality securities with AAA and AA ratings and A-1/P-1 ratings on short-term securities. We limit the amounts that can be invested in any single issuer and invest in short- to intermediate-term instruments whose fair value is less sensitive to interest rate changes. We believe that our investments as of May 31, 2015 were not other-than-temporarily impaired, nor has any event occurred subsequent to that date that would indicate any other-than-temporary impairment.

Our primary source of cash is our ongoing operations. Cash flow from operations was $895.2 million for fiscal 2015. Historically, we have funded our operations, capital purchases, business acquisitions, share repurchases, and dividend payments from our operating activities. Our positive cash flows in fiscal 2015 allowed us to support our business growth and to pay substantial dividends to our stockholders. During fiscal 2015, dividends paid to stockholders were 82% of net income. It is anticipated that cash and total corporate investments as of May 31, 2015, along with projected operating cash flows, will support our normal business operations, capital purchases, business acquisitions, share repurchases, and dividend payments for the foreseeable future.

For further analysis of our results of operations for fiscal years 2015, 2014, and 2013, and our financial position as of May 31, 2015, refer to the tables and analysis in the “Results of Operations” and “Liquidity and Capital Resources” sections of this Item 7 and the discussion in the “Critical Accounting Policies” section of this Item 7.

Outlook

Our outlook for the fiscal year ending May 31, 2016 (“fiscal 2016”) is based upon current market, economic, and interest rate conditions continuing with no significant changes. Our expected fiscal 2016 payroll revenue growth rate is based upon anticipated client base growth and increases in revenue per check. Our anticipated HRS revenue growth for fiscal 2016 reflects the impact of the minimum premium plan offering within our PEO being in place for a full year in fiscal 2015.

Our fiscal 2016 guidance is as follows:

|

| | | | | | | | |

| | Low | | | | High |

Payroll service revenue | | 4 | % | | — | | 5 | % |

HRS revenue | | 10 | % | | — | | 13 | % |

Total service revenue | | 7 | % | | — | | 8 | % |

Net income | | 8 | % | | — | | 9 | % |

Operating income, net of certain items, as a percent of total service revenue, is expected to be approximately 38% for fiscal 2016. The effective income tax rate for fiscal 2016 is expected to be consistent with that experienced in fiscal 2015.

Interest on funds held for clients for fiscal 2016 is expected to be relatively flat. The average rate of return on our combined funds held for clients and corporate investment portfolios is expected to be approximately 1.0% for fiscal 2016. As of May 31, 2015, the long-term investment portfolio had an average yield-to-maturity of 1.6% and an average duration of 3.2 years.

Purchases of property and equipment for fiscal 2016 are expected to be in the range of $110 million to $120 million. This includes costs for internally developed software as we continue to invest in our service supporting technology. Fiscal 2016 depreciation expense is projected to be in the range of $95 million to $105 million, and we project amortization of intangible assets for fiscal 2016 to be in the range of $10 million to $15 million.

Results of Operations

Summary of Results of Operations for the Fiscal Years Ended May 31: |

| | | | | | | | | | | | | | | | | | |

In millions, except per share amounts | | 2015 | | Change | | 2014 | | Change | | 2013 |

Revenue: | | | | | | | | | | |

Payroll service revenue | | $ | 1,656.8 |

| | 4 | % | | $ | 1,599.3 |

| | 4 | % | | $ | 1,539.2 |

|

HRS revenue | | 1,040.7 |

| | 18 | % | | 878.9 |

| | 18 | % | | 746.0 |

|

Total service revenue | | 2,697.5 |

| | 9 | % | | 2,478.2 |

| | 8 | % | | 2,285.2 |

|

Interest on funds held for clients | | 42.1 |

| | 3 | % | | 40.7 |

| | (1 | )% | | 41.0 |

|

Total revenue | | 2,739.6 |

| | 9 | % | | 2,518.9 |

| | 8 | % | | 2,326.2 |

|

Combined operating and SG&A expenses | | 1,686.0 |

| | 10 | % | | 1,536.2 |

| | 8 | % | | 1,421.4 |

|

Operating income | | 1,053.6 |

| | 7 | % | | 982.7 |

| | 9 | % | | 904.8 |

|

Investment income, net | | 6.4 |

| | 17 | % | | 5.4 |

| | (18 | )% | | 6.6 |

|

Income before income taxes | | 1,060.0 |

| | 7 | % | | 988.1 |

| | 8 | % | | 911.4 |

|

Income taxes | | 385.1 |

| | 7 | % | | 360.6 |

| | 5 | % | | 342.4 |

|

Effective income tax rate | | 36.3 | % | | | | 36.5 | % | | | | 37.6 | % |

Net income | | 674.9 |

| | 8 | % | | $ | 627.5 |

| | 10 | % | | $ | 569.0 |

|

Diluted earnings per share | | $ | 1.85 |

| | 8 | % | | $ | 1.71 |

| | 10 | % | | $ | 1.56 |

|

We invest in highly liquid, investment-grade fixed income securities and do not utilize derivative instruments to manage interest rate risk. As of May 31, 2015, we had no exposure to high-risk or illiquid investments and had insignificant exposure to European investments. Details regarding our combined funds held for clients and corporate investment portfolios are as follows: |

| | | | | | | | | | | | |

| | Year ended May 31, |

$ in millions | | 2015 | | 2014 | | 2013 |

Average investment balances: | | | | | | |

Funds held for clients | | $ | 4,080.0 |

| | $ | 3,968.7 |

| | $ | 3,811.9 |

|

Corporate investments | | 1,011.5 |

| | 973.8 |

| | 834.7 |

|

Total | | $ | 5,091.5 |

| | $ | 4,942.5 |

| | $ | 4,646.6 |

|

| | | | | | |

Average interest rates earned (exclusive of net realized gains): | | | | | | |

Funds held for clients | | 1.0 | % | | 1.0 | % | | 1.1 | % |

Corporate investments | | 0.7 | % | | 0.7 | % | | 0.8 | % |

Combined funds held for clients and corporate investments | | 1.0 | % | | 1.0 | % | | 1.0 | % |

| | | | | | |

Total net realized gains | | $ | 0.3 |

| | $ | 0.6 |

| | $ | 0.9 |

|

|

| | | | | | | | | | | | |

$ in millions As of May 31, | | 2015 | | 2014 | | 2013 |

Net unrealized gains on available-for-sale securities(1) | | $ | 13.6 |

| | $ | 34.5 |

| | $ | 34.7 |

|

Federal Funds rate(2) | | 0.25 | % | | 0.25 | % | | 0.25 | % |

Total fair value of available-for-sale securities | | $ | 3,595.6 |

| | $ | 3,391.4 |

| | $ | 3,691.4 |

|

Weighted-average duration of available-for-sale securities in years(3) | | 3.2 |

| | 3.0 |

| | 3.1 |

|

Weighted-average yield-to-maturity of available-for-sale securities(3) | | 1.6 | % | | 1.6 | % | | 1.8 | % |

| |

(1) | The net unrealized gain on our investment portfolios was approximately $20.9 million as of July 16, 2015. |

| |

(2) | The Federal Funds rate was a range of zero to 0.25% as of May 31, 2015, 2014, and 2013. |

| |

(3) | These items exclude the impact of VRDNs, as they are tied to short-term interest rates. |