Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 28, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15059

NORDSTROM, INC.

(Exact name of registrant as specified in its charter)

| Washington | 91-0515058 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1617 Sixth Avenue, Seattle, Washington | 98101 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code 206-628-2111

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common stock, without par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES þ NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer þ | Accelerated filer ¨ | |||

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO þ

As of July 29, 2011 the aggregate market value of the Registrant’s voting and non-voting stock held by non-affiliates of the Registrant was approximately $8.9 billion using the closing sales price on that day of $50.16. On March 9, 2012, 207,923,668 shares of common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2012 Annual Meeting of Shareholders scheduled to be held on May 9, 2012 are incorporated into Part III.

Nordstrom, Inc. and subsidiaries 1

Table of Contents

[This page intentionally left blank.]

2

Table of Contents

|

|

||||

| Page | ||||

| Item 1. |

4 | |||

| Item 1A. |

6 | |||

| Item 1B. |

9 | |||

| Item 2. |

10 | |||

| Item 3. |

14 | |||

| Item 4. |

14 | |||

| Item 5. |

15 | |||

| Item 6. |

17 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

19 | ||

| Item 7A. |

36 | |||

| Item 8. |

37 | |||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. |

65 | ||

| Item 9A. |

65 | |||

| Item 9B. |

67 | |||

| Item 10. |

67 | |||

| Item 11. |

67 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters. |

68 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence. |

68 | ||

| Item 14. |

68 | |||

| Item 15. |

68 | |||

| 69 | ||||

| 70 | ||||

| 71 | ||||

Nordstrom, Inc. and subsidiaries 3

Table of Contents

DESCRIPTION OF BUSINESS

Founded in 1901 as a retail shoe business in Seattle, Nordstrom later incorporated in the state of Washington in 1946. We are one of the nation’s leading fashion specialty retailers, with 225 U.S. stores located in 30 states as of March 16, 2012. The west and east coasts of the United States are the areas in which we have the largest presence. We have two reportable segments: Retail and Credit.

As of March 16, 2012, the Retail segment includes our 116 ‘Nordstrom’ branded full-line stores and our online store at www.nordstrom.com, our 105 off-price ‘Nordstrom Rack’ stores and our other retail channels including our online private sale subsidiary ‘HauteLook,’ our two ‘Jeffrey’ boutiques, one philanthropic ‘treasure&bond’ store and one clearance store that operates under the name ‘Last Chance.’ Through these multiple retail channels, we offer our customers a wide selection of high-quality brand name and private label merchandise focused on apparel, shoes, cosmetics and accessories. Our integrated Nordstrom full-line stores and online store allow us to provide our customers with a seamless shopping experience across all channels. Purchases within our stores are primarily fulfilled from that store’s inventory, but may also be shipped to our customers from our fulfillment center in Cedar Rapids, Iowa, or from other Nordstrom full-line stores for inventory unavailable at the original store. Online purchases are primarily shipped to our customers from our Cedar Rapids fulfillment center, but may also be shipped from our Nordstrom full-line stores. Our customers also have the option to pick up online orders in our Nordstrom full-line stores if inventory is available at that location. These capabilities allow us to better serve customers across various channels and improve sales. The Nordstrom Rack stores purchase high-quality name brand merchandise directly from vendors and also serve as outlets for clearance merchandise from our Nordstrom stores. In the first quarter of 2011, we acquired HauteLook, an online private sale retailer offering limited-time sale events on fashion and lifestyle brands. This acquisition enables us to participate in the fast-growing private sale marketplace. See Note 2: HauteLook in Item 8: Financial Statements and Supplementary Data for further discussion. In the third quarter of 2011, we opened treasure&bond, a philanthropic store in New York.

Our Credit segment includes our wholly owned federal savings bank, Nordstrom fsb, through which we provide a private label credit card, two Nordstrom VISA credit cards and a debit card. The credit and debit cards feature a shopping-based loyalty program designed to increase customer visits and spending. Although the primary purpose of our Credit business is to foster greater customer loyalty and drive more sales, we also generate revenues through finance charges and other fees on these cards.

For more information about our business and our reportable segments, see Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 16: Segment Reporting in Item 8.

FISCAL YEAR

We operate on a 52/53-week fiscal year ending on the Saturday closest to January 31st. References to 2011, 2010 and 2009 relate to the 52-week fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010, respectively. References to 2012 relate to the 53-week fiscal year ending February 2, 2013.

TRADEMARKS

We have 135 trademarks, each of which is the subject of one or more trademark registrations and/or trademark applications. Our most notable trademarks include Nordstrom, Nordstrom Rack, Halogen, Caslon, Classiques Entier and John W. Nordstrom. Each of our trademarks is renewable indefinitely provided that it is still used in commerce at the time of the renewal.

RETURN POLICY

We offer our customers a liberal return policy at our Nordstrom full-line stores and online at www.nordstrom.com. In general, our return policy is considered to be more generous than industry standards. Our Nordstrom Rack stores accept returns up to 30 days from the date of purchase with the original price tag and sales receipt. HauteLook accepts returns of certain specific merchandise categories within 21 days from the date of shipment.

SEASONALITY

Due to our Anniversary Sale in July, the holidays in December and the half-yearly sales that occur in the second and fourth quarters, our sales are typically higher in the second and fourth quarters of the fiscal year than in the first and third quarters. In 2012, our Anniversary Sale will shift to the last week of July and the first week of August, which will move one week of event sales to the third quarter.

INVENTORY

We plan our merchandise purchases and receipts to coincide with expected sales trends. For instance, our merchandise purchases and receipts increase prior to our Anniversary Sale, which has historically extended over the last two weeks of July. As discussed above, in 2012, this will shift to the last week of July and the first week of August. Also, we purchase and receive a larger amount of merchandise in the fall as we prepare for the holiday shopping season (from late November through December). We pay for our merchandise purchases under the terms established with our vendors.

In order to offer merchandise that our customers want, we purchase merchandise from a wide variety of high-quality suppliers, including domestic and foreign businesses. We also have arrangements with agents and contract manufacturers to produce our private label merchandise. We expect our suppliers to meet our “Nordstrom Partnership Guidelines,” which address our corporate social responsibility standards for matters such as legal and regulatory compliance, labor, health and safety and the environment.

4

Table of Contents

COMPETITIVE CONDITIONS

We operate in a highly competitive business environment. We compete with other national, regional and local retailers that may carry similar lines of merchandise, including department stores, specialty stores, off-price stores, boutiques and Internet businesses. Our specific competitors vary from market to market. We believe the keys to competing in our industry include, first and foremost, customer service, the shopping experience across all channels, fashion newness, quality of product, breadth of selection, store environment, convenience and location.

EMPLOYEES

During 2011, we employed approximately 56,500 employees on a full- or part-time basis. Due to the seasonal nature of our business, employment increased to approximately 58,000 employees in July 2011 and 61,500 in December 2011. Substantially all of our employees are non-union. We believe our relationship with our employees is good.

CAUTIONARY STATEMENT

Certain statements in this Annual Report on Form 10-K contain or may suggest “forward-looking” information (as defined in the Private Securities Litigation Reform Act of 1995) that involve risks and uncertainties, including, but not limited to, anticipated financial results (such as our anticipated total and same-store sales results, credit card revenues, gross profit rate, selling, general and administrative expenses, net interest expense, effective tax rate, diluted shares outstanding, earnings per diluted share, 53rd week impact to net sales and diluted earnings per share, operating cash flows, dividend payout, Return on Invested Capital (“ROIC”)), anticipated store openings, capital expenditures, trends in our operations, compliance with debt covenants and outcome of claims and litigation. Such statements are based upon the current beliefs and expectations of the company’s management and are subject to significant risks and uncertainties. Actual future results may differ materially from historical results or current expectations depending upon factors including, but not limited to:

| — | the impact of economic and market conditions and the resultant impact on consumer spending patterns, |

| — | our ability to respond to the business environment, fashion trends and consumer preferences, including changing expectations of service and experience in stores and online, |

| — | effective inventory management, |

| — | successful execution of our growth strategy, including possible expansion into new markets, technological investments and acquisitions, including our ability to realize the anticipated benefits from such acquisitions, and the timely completion of construction associated with newly planned stores, relocations and remodels, which may be impacted by the financial health of third parties, |

| — | our ability to maintain relationships with our employees and to effectively attract, develop and retain our future leaders, |

| — | successful execution of our multi-channel strategy, |

| — | our compliance with applicable banking and related laws and regulations impacting our ability to extend credit to our customers, |

| — | impact of the current regulatory environment and financial system and health care reforms, |

| — | the impact of any systems failures, cybersecurity and/or security breaches, including any security breaches that result in the theft, transfer or unauthorized disclosure of customer, employee or company information or our compliance with information security and privacy laws and regulations in the event of such an incident, |

| — | our compliance with employment laws and regulations and other laws and regulations applicable to us, |

| — | availability and cost of credit, |

| — | our ability to safeguard our brand and reputation, |

| — | successful execution of our information technology strategy, |

| — | our ability to maintain our relationships with vendors, |

| — | trends in personal bankruptcies and bad debt write-offs, |

| — | changes in interest rates, |

| — | efficient and proper allocation of our capital resources, |

| — | weather conditions, natural disasters, health hazards or other market disruptions, or the prospects of these events and the impact on consumer spending patterns, |

| — | disruptions in our supply chain, |

| — | the geographic locations of our stores, |

| — | the effectiveness of planned advertising, marketing and promotional campaigns, |

| — | our ability to control costs, and |

| — | the timing and amounts of share repurchases by the company, if any, or any share issuances by the company, including issuances associated with option exercises or other matters. |

These and other factors could affect our financial results and cause actual results to differ materially from any forward-looking information we may provide. We undertake no obligation to update or revise any forward-looking statements to reflect subsequent events, new information or future circumstances.

SEC FILINGS

We file annual, quarterly and current reports, proxy statements and other documents with the Securities and Exchange Commission (“SEC”). All material we file with the SEC is publicly available at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Nordstrom, Inc. and subsidiaries 5

Table of Contents

WEBSITE ACCESS

Our website address is www.nordstrom.com. We make available free of charge on or through our website our annual and quarterly reports on Form 10-K and 10-Q (including related filings in eXtensible Business Reporting Language (“XBRL”) format), current reports on Form 8-K, proxy statements, statements of changes in beneficial ownership of securities on Form 4 and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file the report with or furnish it to the SEC. Interested parties may also access a webcast of quarterly earnings conference calls and other financial events through our website.

CORPORATE GOVERNANCE

We have a long-standing commitment to upholding a high level of ethical standards. In addition, as required by the listing standards of the New York Stock Exchange (“NYSE”) and the rules of the SEC, we have adopted Codes of Business Conduct and Ethics for our employees, officers and directors (“Codes of Ethics”) and Corporate Governance Guidelines. We have posted on our website our Codes of Ethics, our Corporate Governance Guidelines and our Committee Charters for the Audit, Compensation, Corporate Governance and Nominating, and Finance Committees. Any amendments and waivers to these will also be available on our website.

These items are also available in print to any person, without charge, upon request to:

Nordstrom Investor Relations

PO Box 2737

Seattle, Washington 98111-2737

(206) 233-6564

invrelations@nordstrom.com

Our business faces many risks. We believe the risks described below outline the items of most concern to us. However, these are not the only risks we face.

ECONOMIC CONDITIONS

We sell high-quality apparel, shoes, cosmetics and accessories, which many consumers consider to be discretionary items. During economic downturns, fewer customers may shop in our stores and on our website, and those who do shop may limit the amount of their purchases, all of which may lead to lower sales, higher markdowns and increased marketing and promotional spending in response to lower demand. Deterioration of economic conditions and consumer confidence may also adversely affect our credit customers’ payment patterns and delinquency rates, increasing our bad debt expense. Some macroeconomic indicators suggest that a modest economic recovery has begun, however key factors such as employment levels, consumer credit and housing market conditions remain weak. A sluggish economic recovery or a renewed downturn could have a significant adverse effect on our business.

IMPACT OF COMPETITIVE MARKET FORCES

The fashion specialty retail industry is highly competitive. We compete with other national, regional, local and online retailers that may carry similar lines of merchandise, including department stores, specialty stores, off-price stores, boutiques and Internet businesses. Online retail shopping is rapidly evolving and we expect competition in the e-commerce market to intensify in the future as the Internet facilitates competitive entry and comparison shopping. If we are unable to remain competitive in the key areas of customer service, the shopping experience across all channels, fashion newness, quality of products, depth of selection, store environment and location, we may lose market share to our competitors and our sales and profitability could suffer.

We believe owning our credit business allows us to fully integrate our loyalty program and drive more sales. Many of our competitors also offer general-purpose credit card products with a variety of loyalty programs. Our Credit segment faces competition from other retailers, large banks and other credit card companies, some of which have substantial financial resources. In addition, there is intense competition for cardholders with “prime” credit ratings who make up a significant portion of our credit portfolio. If we do not effectively anticipate or respond to the competitive banking and credit card environment, we could lose market share to our competitors, which could have an adverse effect on our credit business.

6

Table of Contents

ABILITY TO ANTICIPATE AND RESPOND TO CONSUMER PREFERENCES AND FASHION TRENDS

We strive to ensure the merchandise we offer and our shopping experience, both in store and online, remain current and compelling to our customers. We make decisions regarding inventory purchases well in advance of the season in which it will be sold. Therefore, our ability to predict or respond to constantly changing fashion trends, consumer preferences and spending patterns, and to match our merchandise levels, mix and shopping experience to sales trends and consumer tastes, significantly impacts our sales and operating results. If we do not identify and respond to emerging trends in consumer spending and preferences quickly enough, we may harm our ability to retain our existing customers or attract new customers. If we purchase too much inventory, we may be forced to sell our merchandise at higher average markdown levels and lower average margins, which could harm our business. Conversely, if we fail to purchase enough merchandise, we may lose opportunities for additional sales and damage our relationships with our customers.

GROWTH STRATEGY

Our strategic growth plan focuses on both our stores and on e-commerce. There are risks associated with opening new stores. The availability and cost of suitable locations for our stores depends on a number of factors, including competition from other retailers and businesses, local land use and other regulations, new shopping center construction and developers’ financial condition. New store openings also involve certain risks, including constructing, furnishing and supplying a store in a timely and cost effective manner and accurately assessing the demographic or retail environment for a particular location. Our sales at new, relocated or remodeled stores may not meet our projections, which could adversely affect our return on investment. As part of our growth strategy, we also intend to open stores in new and international markets. Expansion will require management attention and resources and may ultimately be unsuccessful, which could harm our future business development. In addition, competition from strong local competitors, compliance with foreign and local laws and regulatory requirements and potentially unfavorable tax consequences may cause our business to be adversely impacted.

We are also pursuing a heightened focus on technology to enhance our website and mobile capabilities, broaden the selection of our online merchandise offering and improve the speed and quality of our delivery of merchandise to customers. In addition, other growth opportunities may include acquisitions of, or investments in, other businesses, as well as new technologies or other investments to improve the customer shopping experience in our stores and online. If these technologies and investments do not perform as expected, our profitability and growth could be adversely affected.

LEADERSHIP DEVELOPMENT AND SUCCESSION PLANNING

The training and development of our future leaders is important to our long-term success. If we do not effectively implement our strategic and business planning processes to attract, retain, train and develop future leaders, our business may suffer. We rely on the experience of our senior management, who have specific knowledge relating to us and our industry that is difficult to replace. If unexpected leadership turnover occurs without adequate succession plans, the loss of the services of any of these individuals, or any negative perceptions of our business as a result of those losses, could damage our brand image and our business.

MERCHANDISE PLANNING

We are making investments to improve our multi-channel merchandise planning, procurement and allocation capabilities. These efforts involve changes in personnel, processes and technology over a period of several years. If we encounter challenges associated with change management, the ability to hire and retain key personnel involved in these efforts, implementation of associated information technology or adoption of new processes, our ability to continue to successfully execute our strategy could be adversely affected. As a result, we may not derive the expected benefits to our sales and profitability, or we may incur increased costs relative to our current projections.

INFORMATION SECURITY AND PRIVACY

The protection of our customer, employee and company data is vitally important to us. As we operate in multiple retail channels and maintain our own credit operations, we are subject to privacy, security and cybersecurity risks and incidents. Our business involves the storage and transmission of customers’ personal information, consumer preferences and credit card information, in addition to employee information and company financial and strategic data. In addition, we use mobile devices, social networking and other online activities to connect with our customers. Some of our critical systems also depend upon third party providers.

As techniques used to obtain unauthorized access, sabotage systems or otherwise attack our services change frequently and often are unforeseen, we may be unable to anticipate these techniques or to implement adequate preventive measures and they may remain undetected for some period. Concurrently, measures that we may take to prevent risks of fraud and breaches of privacy, security and cybersecurity have the potential to harm relations with our customers or decrease activity on our websites by making them more difficult to use or restricting the ability to meet customers’ expectations in terms of shopping experience. Any measures we implement to prevent a security or cybersecurity risk may not be totally effective. In addition, the regulatory environment surrounding information security, cybersecurity and privacy is increasingly demanding, with new and constantly changing requirements across our business units. Security breaches and cyber incidents and their remediation, whether at our company or our third party providers, could expose us to a risk of loss or misappropriation of this information, litigation, potential liability, reputation damage and loss of customers’ trust and business.

We have expended, and will continue to expend, significant resources to protect our customers and ourselves against these breaches and to ensure an effective response to an internal or external security or cybersecurity breach, either actual or perceived.

Nordstrom, Inc. and subsidiaries 7

Table of Contents

CAPITAL MANAGEMENT AND LIQUIDITY

Our access to debt and equity capital, and our ability to invest capital to maximize the total returns to our shareholders, is critical to our long-term success. We utilize capital to finance our operations, make capital expenditures and acquisitions, manage our debt levels and return value to our shareholders through dividends and share repurchases. Our ability to obtain capital and the cost of the capital depend on company performance, financial market conditions and independent rating agencies’ short- and long-term debt ratings, which are based largely on our performance as measured by credit metrics including interest coverage and leverage ratios. If our access to capital is restricted or if our cost of capital increases, our operations and financial condition could be adversely impacted. Further, if we do not properly allocate our capital to maximize returns, our operations, cash flows and returns to shareholders could be adversely affected.

BRAND AND REPUTATION

We have a well-recognized brand that consumers may associate with a high level of customer service and quality merchandise, and is one of the reasons employees choose Nordstrom as a place of employment. Any significant damage to our brand or reputation could negatively impact sales, diminish customer trust, reduce employee morale and productivity and lead to difficulties in recruiting and retaining qualified employees, any of which would harm our business.

INFORMATION TECHNOLOGY STRATEGY

We make investments in information technology and systems developments to advance our competitive position, and we believe they are key to our growth. We must monitor and choose the right investments and implement them at the right pace. Excessive technological change could impact the effectiveness of adoption, and could make it more difficult for us to realize benefits from the technology. Targeting the wrong opportunities, failing to make the best investments or making an investment commitment significantly above or below our needs may result in the loss of our competitive position. In addition, if we do not maintain our current systems, we may see interruptions to our business and increase our costs in order to bring our systems up to date.

LAWS, REGULATIONS AND LITIGATION

Our policies, procedures and practices are designed to comply with federal, state, local and foreign laws, rules and regulations, including those imposed by the SEC, the marketplace, the banking industry and foreign countries, which may change from time to time. These obligations are complex, continuously evolving and the related enforcement is increasingly aggressive, particularly in the state of California, which has increased the cost of compliance. Significant legislative changes, including those that relate to employment matters and health care reform, could impact our relationship with our workforce, which could increase our expenses and adversely affect our operations. Possible legislative changes include changes to an employer’s obligation to recognize collective bargaining units. Recent health care reform could materially increase our employee-related costs and if it is necessary to make changes to the health benefits provided to our employees as a result of health care reform, we may not be able to offer competitive health care benefits to attract and retain employees. In addition, if we fail to comply with applicable laws and regulations we could be subject to damage to our reputation, class action lawsuits, legal and settlement costs, civil and criminal liability, increased cost of regulatory compliance, restatements of our financial statements, disruption of our business and loss of customers. Any required changes to our employment practices could result in the loss of employees, reduced sales, increased employment costs, low employee morale and harm to our business and results of operations. In addition, political and economic factors could lead to unfavorable changes in federal and state tax laws which may increase our tax liabilities. An increase in our tax liabilities could adversely affect our results of operations. We are also regularly involved in various litigation matters that arise in the ordinary course of business. Litigation or regulatory developments could adversely affect our business and financial condition.

FINANCIAL SYSTEM REFORMS

The recent financial crisis resulted in increased legislative and regulatory changes affecting the financial industry. The Credit Card Accountability Responsibility and Disclosure Act of 2009 included new rules and restrictions on credit card pricing, finance charges and fees, customer billing practices and payment application. These rules required us to make changes to our credit card business practices and systems, and we expect more regulations and interpretations of the new rules to emerge. Depending on the nature and extent of the full impact from these rules, and any interpretations or additional rules, the revenues and profitability of our Credit segment could be adversely affected.

In addition, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted in July 2010. It significantly restructures regulatory oversight and other aspects of the financial industry, creates a new federal agency to supervise and enforce consumer lending laws and regulations and expands state authority over consumer lending. Numerous regulations will be issued in the near future to implement the requirements of this Act. The final regulatory details remain uncertain at this time. Depending on the nature and extent of these regulations, and the enforcement approach of regulators under the new law, there could be an adverse impact to our Credit segment.

AVAILABILITY AND COST OF MERCHANDISE

Our relationships with our merchandise vendors have been a significant contributor to our success and our position as a retailer of high-quality fashion merchandise. We have no guaranteed supply arrangements with our key vendors, many of whom limit the number of retail channels they use to sell their merchandise. Competition to obtain and sell this merchandise is intense. Nearly all of the brands of our top vendors are sold by competing retailers, and many of our top vendors also have their own dedicated retail stores and websites. If one or more of our top vendors were to limit or reduce our access to their merchandise, our business could be adversely affected. Further, if our merchandise costs increase due to increased raw material or labor costs or other factors, our ability to respond or the effect of our response could adversely affect our sales or gross margins.

8

Table of Contents

CONSUMER CREDIT

Our credit card operations help drive sales in our stores, allow our stores to avoid third-party transaction fees and generate additional revenues from extending credit. Our credit card revenues and profitability are subject in large part to economic and market conditions that are beyond our control, including, but not limited to, interest rates, consumer credit availability, consumer debt levels, unemployment trends, laws and regulations and other factors. Elevated levels of unemployment have historically corresponded with increased credit card delinquencies and write-offs, which may continue in the future. Further, these economic conditions could impair our ability to assess the creditworthiness of our customers if the criteria and/or models we use to underwrite and manage our customers become less predictive of future losses. This could cause our losses to rise and have a negative impact on our results of operations.

BUSINESS CONTINUITY

Our business and operations could be materially and adversely affected by supply chain disruptions, severe weather patterns, natural disasters, widespread pandemics and other natural or man-made disruptions. We derive a significant amount of our total sales from stores located on the west and east coasts of the United States, particularly in California, which increases our exposure to conditions in these regions. These disruptions could cause, among other things, a decrease in consumer spending that would negatively impact our sales; staffing shortages in our stores, distribution centers or corporate offices; interruptions in the flow of merchandise to our stores; disruptions in the operations of our merchandise vendors or property developers; increased costs; and a negative impact on our reputation and long-term growth plans.

ANTI-TAKEOVER PROVISIONS

We are incorporated in the state of Washington and subject to Washington state law. Some provisions of Washington state law could interfere with or restrict takeover bids or other change-in-control events affecting us. For example, one provision prohibits us, except under specified circumstances, from engaging in any significant business transaction with any shareholder who owns 10% or more of our common stock (an “acquiring person”) for a period of five years following the time that the shareholder became an acquiring person.

Item 1B. Unresolved Staff Comments.

None.

Nordstrom, Inc. and subsidiaries 9

Table of Contents

The following table summarizes the number of retail stores owned or leased by us, and the percentage of total store square footage represented by each listed category as of January 28, 2012:

| Number of stores | % of total store square footage |

|||||||

| Leased stores on leased land |

128 | 32.3% | ||||||

| Owned stores on leased land |

60 | 43.8% | ||||||

| Owned stores on owned land |

36 | 23.2% | ||||||

| Partly owned and partly leased stores |

1 | 0.7% | ||||||

| Total |

225 | 100.0% | ||||||

The following table summarizes our store opening activity during the last three years:

| Fiscal year |

2011 | 2010 | 2009 | |||||||||

| Number of stores, beginning of year |

204 | 184 | 169 | |||||||||

| Stores opened |

22 | 20 | 16 | |||||||||

| Stores closed |

(1) | – | (1) | |||||||||

| Number of stores, end of year |

225 | 204 | 184 | |||||||||

| Nordstrom |

117 | 115 | 112 | |||||||||

| Nordstrom Rack and Other |

108 | 89 | 72 |

In 2011, we opened three Nordstrom full-line stores (Newark, Delaware; Nashville, Tennessee; and Saint Louis, Missouri), opened eighteen Nordstrom Rack stores (Aventura, Florida; Austin, Texas; Arlington, Texas; Fremont, California; Charlotte, North Carolina; Lakewood, Colorado; Cherry Hill, New Jersey; Washington, D.C.; Annapolis, Maryland; Redondo Beach, California; West Covina, California; Burlington, Massachusetts; Indianapolis, Indiana; Tigard, Oregon; Lenexa, Kansas; Sugar Land, Texas; Tucson, Arizona; and National City, California), relocated two Nordstrom Rack stores (Boulder, Colorado and Henderson, Nevada) and opened one treasure&bond store (New York, New York).

To date in 2012, we have opened one Nordstrom Rack store (Orange, California) and relocated one Nordstrom Rack store (Seattle, Washington). During the remainder of 2012, we have announced the future opening of one Nordstrom full-line store (Salt Lake City, Utah), the opening of eleven additional Nordstrom Rack stores (Boise, Idaho; Alpharetta, Georgia; Farmington, Connecticut; Temecula, California; Willow Grove, Pennsylvania; Phoenix, Arizona; Manchester, Missouri; San Diego, California; Huntington Beach, California; Warwick, Rhode Island; and Tysons Corner, Virginia) and the relocation of one Nordstrom Rack store (Long Island, New York).

We also own six merchandise distribution centers (Portland, Oregon; Dubuque, Iowa; Ontario, California; Newark, California; Upper Marlboro, Maryland; and Gainesville, Florida) and own one fulfillment center on leased land (Cedar Rapids, Iowa), which are utilized by our Retail segment. HauteLook, which is also included in our Retail segment, leases two administrative offices (Los Angeles, California and New York, New York) and two distribution centers (both in Commerce, California). Our administrative offices in Seattle, Washington are a combination of leased and owned space. We also lease an office building in the Denver, Colorado metropolitan area for our Credit segment.

10

Table of Contents

As of January 28, 2012, the total square footage of our Nordstrom full-line stores was 20,679,000, and the total square footage of our Nordstrom Rack and other stores was 4,066,000. The following table lists our retail store facilities as of January 28, 2012:

|

1This store has been subsequently relocated. |

Nordstrom, Inc. and subsidiaries 11

Table of Contents

|

1This store has been subsequently relocated. |

2This store has been subsequently closed. |

12

Table of Contents

|

1This store has been subsequently relocated. |

Nordstrom, Inc. and subsidiaries 13

Table of Contents

We are subject from time to time to various claims and lawsuits arising in the ordinary course of business including lawsuits alleging violations of state and/or federal wage and hour and other employment laws, privacy and other consumer-based claims. Some of these lawsuits purport or may be determined to be class or collective actions and seek substantial damages or injunctive relief, or both, and some may remain unresolved for several years. We believe the recorded reserves in our consolidated financial statements are adequate in light of the probable and estimable liabilities. As of the date of this report, we do not believe any currently identified claim, proceeding or litigation, either alone or in the aggregate, will have a material impact on our results of operations, financial position or cash flows. Since these matters are subject to inherent uncertainties, our view of them may change in the future.

Item 4. Mine Safety Disclosures.

None.

14

Table of Contents

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

MARKET, SHAREHOLDER AND DIVIDEND INFORMATION

Our common stock, without par value, is traded on the New York Stock Exchange under the symbol “JWN.” The approximate number of holders of common stock as of March 9, 2012 was 178,000, based upon the number of registered and beneficial shareholders, as well as the number of employee shareholders in the Nordstrom 401(k) Plan and Profit Sharing Plan. On this date we had 207,923,668 shares of common stock outstanding.

The high and low prices of our common stock and dividends declared for each quarter of 2011 and 2010 are presented in the table below:

| Common Stock Price | ||||||||||||||||||||||||||||||||

| 2011 | 2010 | Dividends per Share | ||||||||||||||||||||||||||||||

| High | Low | High | Low | 2011 | 2010 | |||||||||||||||||||||||||||

| 1st Quarter |

$48.70 | $40.03 | $46.22 | $32.78 | $0.23 | $0.16 | ||||||||||||||||||||||||||

| 2nd Quarter |

$52.15 | $41.88 | $44.00 | $30.75 | $0.23 | $0.20 | ||||||||||||||||||||||||||

| 3rd Quarter |

$53.35 | $37.28 | $39.99 | $28.44 | $0.23 | $0.20 | ||||||||||||||||||||||||||

| 4th Quarter |

$51.75 | $44.22 | $43.95 | $38.34 | $0.23 | $0.20 | ||||||||||||||||||||||||||

| Full Year |

$53.35 | $37.28 | $46.22 | $28.44 | $0.92 | $0.76 | ||||||||||||||||||||||||||

SHARE REPURCHASES

Dollar and share amounts in millions, except per share amounts

Following is a summary of our fourth quarter share repurchases:

| Total Number (or Units) |

Average Price Paid Per Share (or Unit) |

Total Number of Publicly Announced |

Maximum Number (or the Plans or Programs1 |

|||||||||||||

| November 2011 (October 30, 2011 to November 26, 2011) |

0.7 | $48.96 | 0.7 | $431 | ||||||||||||

| December 2011 (November 27, 2011 to December 31, 2011) |

1.6 | 2 | $48.10 | 1.4 | $363 | |||||||||||

| January 2012 (January 1, 2012 to January 28, 2012) |

1.1 | $49.17 | 1.1 | $310 | ||||||||||||

| Total |

3.4 | $48.65 | 3.2 | |||||||||||||

| 1 |

In August 2010, our Board of Directors authorized a program (the “2010 Program”) to repurchase up to $500 of our outstanding common stock, through January 28, 2012. In May 2011, our Board of Directors authorized a new program (the “2011 Program”) to repurchase up to $750 of our outstanding common stock, through February 2, 2013, in addition to the remaining amount available for repurchase under the 2010 Program. During 2011, we repurchased 18.5 shares of our common stock for an aggregate purchase price of $851. We completed our 2010 Program in the second quarter of 2011, and as of January 28, 2012, had $310 in remaining share repurchase capacity under the 2011 Program. Subsequent to year-end, in February 2012, our Board of Directors authorized a new program (the “2012 Program”) to repurchase up to $800 of our outstanding common stock, through February 1, 2014, in addition to the amount available for repurchase under the 2011 Program. The actual number and timing of future share repurchases, if any, will be subject to market and economic conditions and applicable Securities and Exchange Commission rules. |

| 2 |

Includes 0.2 of restricted stock units related to the HauteLook acquisition that were cancelled in connection with the HauteLook acquisition amendment. |

Nordstrom, Inc. and subsidiaries 15

Table of Contents

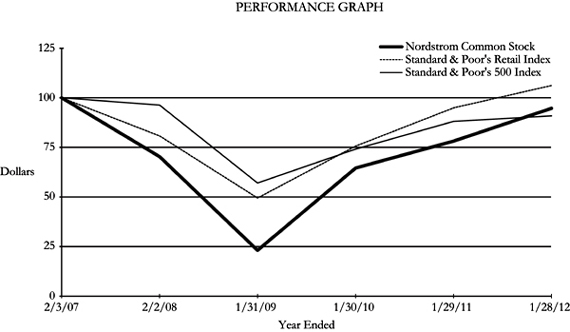

STOCK PRICE PERFORMANCE

The following graph compares for each of the last five fiscal years, ending January 28, 2012, the cumulative total return of Nordstrom common stock, Standard & Poor’s Retail Index and Standard & Poor’s 500 Index. The Retail Index is comprised of 32 retail companies, including Nordstrom, representing an industry group of the Standard & Poor’s 500 Index. The cumulative total return of Nordstrom common stock assumes $100 invested on February 3, 2007 in Nordstrom common stock and assumes reinvestment of dividends.

| End of fiscal year | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||||

| Nordstrom common stock |

100 | 70 | 23 | 65 | 78 | 95 | ||||||||||||||||||

| Standard & Poor’s Retail Index |

100 | 81 | 49 | 76 | 95 | 106 | ||||||||||||||||||

| Standard & Poor’s 500 Index |

100 | 96 | 57 | 74 | 88 | 91 | ||||||||||||||||||

16

Table of Contents

Item 6. Selected Financial Data.

Dollars in millions except per square foot and per share amounts

The following selected financial data are derived from the audited consolidated financial statements and should be read in conjunction with Item 1A: Risk Factors, Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations, and the consolidated financial statements and related notes included in Item 8 of this Annual Report on Form 10-K.

| Fiscal year | 2011 | 2010 | 2009 | 2008 | 20077 | |||||||||||||||

| Earnings Results | ||||||||||||||||||||

| Net sales |

$10,497 | $9,310 | $8,258 | $8,272 | $8,828 | |||||||||||||||

| Credit card revenues |

380 | 390 | 369 | 301 | 252 | |||||||||||||||

| Gross profit1 |

3,905 | 3,413 | 2,930 | 2,855 | 3,302 | |||||||||||||||

| Selling, general and administrative (“SG&A”) expenses: |

||||||||||||||||||||

| Retail |

(2,807) | (2,412) | (2,109) | (2,103) | (2,161) | |||||||||||||||

| Credit |

(229) | (273) | (356) | (274) | (198) | |||||||||||||||

| Earnings on investment in asset-backed securities, net2 |

– | – | – | – | 18 | |||||||||||||||

| Earnings before interest and income taxes (“EBIT”) |

1,249 | 1,118 | 834 | 779 | 1,247 | |||||||||||||||

| Interest expense, net |

(130) | (127) | (138) | (131) | (74) | |||||||||||||||

| Earnings before income taxes (“EBT”) |

1,119 | 991 | 696 | 648 | 1,173 | |||||||||||||||

| Net earnings |

683 | 613 | 441 | 401 | 715 | |||||||||||||||

|

Balance Sheet and Cash Flow Data |

||||||||||||||||||||

| Accounts receivable, net |

$2,033 | $2,026 | $2,035 | $1,942 | $1,788 | |||||||||||||||

| Merchandise inventories |

1,148 | 977 | 898 | 900 | 956 | |||||||||||||||

| Current assets |

5,560 | 4,824 | 4,054 | 3,217 | 3,361 | |||||||||||||||

| Land, buildings and equipment, net |

2,469 | 2,318 | 2,242 | 2,221 | 1,983 | |||||||||||||||

| Total assets |

8,491 | 7,462 | 6,579 | 5,661 | 5,600 | |||||||||||||||

| Current liabilities |

2,575 | 1,879 | 2,014 | 1,601 | 1,635 | |||||||||||||||

| Long-term debt, including current portion |

3,647 | 2,781 | 2,613 | 2,238 | 2,497 | |||||||||||||||

| Shareholders’ equity |

1,956 | 2,021 | 1,572 | 1,210 | 1,115 | |||||||||||||||

| Cash flow from operations |

1,177 | 1,177 | 1,251 | 848 | 312 | |||||||||||||||

|

Performance Metrics |

||||||||||||||||||||

| Same-store sales percentage change3 |

7.2% | 8.1% | (4.2%) | (9.0%) | 3.9% | |||||||||||||||

| Gross profit % of net sales |

37.2% | 36.7% | 35.5% | 34.5% | 37.4% | |||||||||||||||

| Retail SG&A % of net sales |

26.7% | 25.9% | 25.5% | 25.4% | 24.5% | |||||||||||||||

| Total SG&A % of net sales |

28.9% | 28.8% | 29.8% | 28.7% | 26.7% | |||||||||||||||

| EBIT % of total revenues |

11.5% | 11.5% | 9.7% | 9.1% | 13.7% | |||||||||||||||

| EBT % of total revenues |

10.3% | 10.2% | 8.1% | 7.6% | 12.9% | |||||||||||||||

| Net earnings % of total revenues |

6.3% | 6.3% | 5.1% | 4.7% | 7.9% | |||||||||||||||

| Return on shareholders’ equity |

34.3% | 34.1% | 31.7% | 34.5% | 43.6% | |||||||||||||||

| Return on assets |

8.7% | 8.6% | 7.1% | 7.0% | 13.1% | |||||||||||||||

| Return on invested capital (“ROIC”)4 |

13.3% | 13.6% | 12.1% | 11.6% | 19.4% | |||||||||||||||

| Sales per square foot5 |

$431 | $397 | $368 | $388 | $435 | |||||||||||||||

| Retail SG&A expense per square foot5 |

$115 | $103 | $94 | $99 | $106 | |||||||||||||||

| Inventory turnover rate6 |

5.56 | 5.56 | 5.41 | 5.20 | 5.16 | |||||||||||||||

|

Per Share Information |

||||||||||||||||||||

| Earnings per diluted share |

$3.14 | $2.75 | $2.01 | $1.83 | $2.88 | |||||||||||||||

| Dividends declared per share |

0.92 | 0.76 | 0.64 | 0.64 | 0.54 | |||||||||||||||

| Book value per share |

9.42 | 9.27 | 7.22 | 5.62 | 5.05 | |||||||||||||||

|

Store Information (at year-end) |

||||||||||||||||||||

| Nordstrom full-line stores |

117 | 115 | 112 | 109 | 101 | |||||||||||||||

| Nordstrom Rack and other stores |

108 | 89 | 72 | 60 | 55 | |||||||||||||||

| Total square footage |

24,745,000 | 23,838,000 | 22,773,000 | 21,876,000 | 20,502,000 | |||||||||||||||

1Gross profit is calculated as net sales less cost of sales and related buying and occupancy costs (for all segments).

| 2 |

On May 1, 2007, we combined our Nordstrom private label credit card and Nordstrom VISA credit card programs into one securitization program. At that time, the Nordstrom VISA credit card receivables were brought on-balance sheet. |

| 3 |

Same-store sales include sales from stores that have been open at least one full year at the beginning of the year. We also include sales from our Nordstrom online store in same-store sales because of the substantial integration of our Nordstrom full-line stores and online store. |

| 4 |

See Non-GAAP Financial Measure beginning on the following page for additional information and reconciliation to the most directly comparable GAAP financial measure. |

| 5 |

Sales per square foot and Retail SG&A expense per square foot are calculated as net sales and Retail SG&A expense, respectively, divided by weighted-average square footage. |

| Weighted-average square footage includes a percentage of year-end square footage for new stores equal to the percentage of the year during which they were open. |

| 6 |

Inventory turnover rate is calculated as annual cost of sales and related buying and occupancy costs (for all segments) divided by 4-quarter average inventory. |

| 7 |

During the third quarter of 2007, we completed the sale of our Façonnable business and realized a gain on sale of $34 ($21, net of tax). Results of operations for fiscal year 2007 include the international Façonnable boutiques through August 31, 2007 and the domestic Façonnable boutiques through October 31, 2007. |

Nordstrom, Inc. and subsidiaries 17

Table of Contents

NON-GAAP FINANCIAL MEASURE

Return on Invested Capital (“ROIC”)

We define ROIC as follows:

| ROIC = | Net Operating Profit After Taxes |

|||

| Average Invested Capital |

We believe that ROIC is a useful financial measure for investors in evaluating our operating performance. When analyzed in conjunction with our net earnings and total assets and compared with return on assets (net earnings divided by average total assets), it provides investors with a useful tool to evaluate our ongoing operations and our management of assets from period to period. ROIC is one of our key financial metrics, and we also incorporate it into our executive incentive measures. We believe that overall performance as measured by ROIC correlates directly to shareholders’ return over the long term. ROIC is not a measure of financial performance under GAAP, should not be considered a substitute for return on assets, net earnings or total assets as determined in accordance with GAAP, and may not be comparable with similarly titled measures reported by other companies. The closest measure calculated using GAAP amounts is return on assets. The following is a comparison of return on assets to ROIC:

| 12 fiscal months ended | ||||||||||||||||||||

| January 28, 2012 | January 29, 2011 | January 30, 2010 | January 31, 2009 | February 2, 2008 | ||||||||||||||||

| Net earnings |

$683 | $613 | $441 | $401 | $715 | |||||||||||||||

| Add: income tax expense |

436 | 378 | 255 | 247 | 458 | |||||||||||||||

| Add: interest expense |

132 | 128 | 138 | 131 | 74 | |||||||||||||||

| Earnings before interest and income tax expense |

1,251 | 1,119 | 834 | 779 | 1,247 | |||||||||||||||

| Add: rent expense |

78 | 62 | 43 | 37 | 48 | |||||||||||||||

| Less: estimated depreciation on capitalized operating leases1 |

(42 | ) | (32 | ) | (23 | ) | (19 | ) | (26 | ) | ||||||||||

| Net operating profit |

1,287 | 1,149 | 854 | 797 | 1,269 | |||||||||||||||

| Estimated income tax expense2 |

(501 | ) | (439 | ) | (313 | ) | (303 | ) | (497 | ) | ||||||||||

| Net operating profit after tax |

$786 | $710 | $541 | $494 | $772 | |||||||||||||||

| Average total assets3 |

$7,890 | $7,091 | $6,197 | $5,768 | $5,455 | |||||||||||||||

| Less: average non-interest-bearing current liabilities4 |

(2,041 | ) | (1,796 | ) | (1,562 | ) | (1,447 | ) | (1,506 | ) | ||||||||||

| Less: average deferred property incentives3 |

(504 | ) | (487 | ) | (462 | ) | (400 | ) | (359 | ) | ||||||||||

| Add: average estimated asset base of capitalized operating leases5 |

555 | 425 | 311 | 322 | 395 | |||||||||||||||

| Average invested capital |

$5,900 | $5,233 | $4,484 | $4,243 | $3,985 | |||||||||||||||

| Return on assets |

8.7% | 8.6% | 7.1% | 7.0% | 13.1% | |||||||||||||||

| ROIC |

13.3% | 13.6% | 12.1% | 11.6% | 19.4% | |||||||||||||||

| 1 |

Capitalized operating leases is our best estimate of the asset base we would record for our leases that are classified as operating if they had met the criteria for a capital lease, or we purchased the property. Asset base is calculated as described in footnote 5 below. |

| 2 |

Based upon our effective tax rate multiplied by the net operating profit for the 12 fiscal months ended January 28, 2012, January 29, 2011, January 30, 2010, January 31, 2009 and February 2, 2008. |

3Based upon the trailing 12-month average, including cash and cash equivalents.

4Based upon the trailing 12-month average for accounts payable, accrued salaries, wages and related benefits, and other current liabilities.

| 5 |

Based upon the trailing 12-month average of the monthly asset base, which is calculated as the trailing 12-months rent expense multiplied by eight. The multiple of eight times rent expense is a commonly used method of estimating the asset base we would record for our capitalized operating leases described in footnote 1. |

18

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Dollar, share and square footage amounts in millions except percentages, per share and per square foot amounts

OVERVIEW

Nordstrom is a fashion specialty retailer offering high-quality apparel, shoes, cosmetics and accessories for women, men and children. We offer a wide selection of brand name and private label merchandise through various channels: our ‘Nordstrom’ branded full-line stores and website, our off-price ‘Nordstrom Rack’ stores, our online private sale subsidiary ‘HauteLook,’ our ‘Jeffrey’ boutiques and our philanthropic ‘treasure&bond’ store. Our stores are located in 30 states throughout the United States. In addition, we offer our customers a variety of payment products and services, including credit and debit cards with an associated loyalty program.

In 2011, we achieved record total net sales of $10,497, an increase of 12.7%, while growing earnings before interest and taxes (“EBIT”) by 11.7%. This reflects our ongoing efforts to improve the customer experience across all channels, combined with consistent execution and various growth initiatives. As customers’ expectations of service evolve, the consistency of the customer experience across all channels becomes more important, including factors such as expanded selection, multi-channel capabilities, personalization, speed, convenience and price.

To enhance the customer experience online, we have accelerated our investments in e-commerce. We acquired HauteLook, a leader in the online private sale marketplace. We believe this acquisition will help us further develop our mobile and e-commerce capabilities and enable us to participate in the fast-growing private sales channel. In the third quarter, we began offering free standard shipping and free returns for online purchases and did limited testing of same-day delivery. We also made enhancements to our website and mobile website. We believe these changes make it easier and more convenient to shop with us. Our combined efforts to enhance the online experience led to a meaningful sales increase in the online channel, which is where we expect to have the strongest percentage growth in the future.

Our strong financial position enables us to continue to make investments in the customer experience to improve our store and online business while also growing through new stores, remodels and other initiatives. During 2011, we opened three Nordstrom full-line stores, eighteen Nordstrom Rack stores and remodeled six Nordstrom full-line stores. We also opened a philanthropic store in New York called treasure&bond. In 2012, we plan to open one Nordstrom full-line store and have announced twelve new Nordstrom Rack stores. In addition, we have announced plans to relocate two existing Nordstrom Rack stores and remodel eight Nordstrom full-line stores.

Our overall goals are to achieve high single-digit total sales growth and mid-teens Return on Invested Capital (“ROIC”). We believe that top-line growth and ROIC correlate strongly with shareholders’ return. As we continue to invest in new stores and remodels, we also want to enhance the customer experience through increased spending on e-commerce and technology. These investments flow through our expenses at a faster pace than other investments in previous years. We believe they will increase our ROIC through high growth in sales dollars and EBIT, as opposed to EBIT margin, with an incrementally productive capital base.

Fashion Rewards plays an important part in building customer loyalty, and our Fashion Rewards members shop more frequently and spend more with us on average than non-members. Approximately one-third of our sales are from Fashion Rewards customers and the program continues to grow as more members use our tender as a convenient way to shop and earn rewards. During the year, customer payment rates continued to improve, resulting in decreasing delinquency and write-off trends, while our credit and debit card volumes increased. In January 2012, we enhanced our Fashion Rewards program, giving customers more control over how and when they can earn rewards and extending more benefits to our cardholders.

As we look forward to 2012, we remain focused on improving customer service and providing a superior shopping experience. We have a customer-driven strategy, allowing us to execute our current operating plans across all channels while targeting investments in e-commerce and technology to enhance our platform for sustainable, profitable growth.

RESULTS OF OPERATIONS

Our reportable segments are Retail and Credit. Our Retail segment includes our Nordstrom branded full-line stores and website, our Nordstrom Rack stores, and our other retail channels including HauteLook, our Jeffrey stores and our treasure&bond store. For purposes of discussion and analysis of our results of operations, we combine our Retail segment results with revenues and expenses in the “Corporate/Other” column of our segment reporting footnote (collectively, the “Retail Business”). We analyze our results of operations through earnings before interest and income taxes for our Retail Business and earnings before income taxes for Credit, while interest expense and income taxes are discussed on a total company basis.

Nordstrom, Inc. and subsidiaries 19

Table of Contents

Retail Business

Summary

The following table summarizes the results of our Retail Business for the fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010:

| Fiscal year | 2011 | 2010 | 2009 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Amount | % of net sales |

Amount | % of net sales |

Amount | % of net sales |

|||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Net sales |

$10,497 | 100.0% | $9,310 | 100.0% | $8,258 | 100.0% | ||||||||||||||||||

| Cost of sales and related buying and occupancy costs |

(6,517) | (62.1%) | (5,831) | (62.6%) | (5,273) | (63.9%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Gross profit |

3,980 | 37.9% | 3,479 | 37.4% | 2,985 | 36.1% | ||||||||||||||||||

| Other revenues |

– | N/A | – | N/A | (1) | N/A | ||||||||||||||||||

| Selling, general and administrative expenses |

(2,807) | (26.7%) | (2,412) | (25.9%) | (2,109) | (25.5%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Earnings before interest and income taxes |

$1,173 | 11.2% | $1,067 | 11.5% | $875 | 10.6% | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

Retail Business Net Sales

| Fiscal year | 2011 | 2010 | 2009 | |||||||||||

| Net sales by channel: |

||||||||||||||

| Nordstrom |

$8,426 | $7,700 | $6,923 | |||||||||||

| Nordstrom Rack |

2,045 | 1,691 | 1,411 | |||||||||||

| Other retail1 |

185 | 29 | 29 | |||||||||||

| Total Retail segment |

10,656 | 9,420 | 8,363 | |||||||||||

| Corporate/Other |

(159 | ) | (110 | ) | (105) | |||||||||

| Total net sales | $10,497 | $9,310 | $8,258 | |||||||||||

|

Net sales increase (decrease) |

12.7% | 12.7% | (0.2%) | |||||||||||

|

Same-store sales increase (decrease) by channel: |

||||||||||||||

| Nordstrom |

8.2% | 9.3% | (5.0%) | |||||||||||

| Nordstrom Rack |

3.7% | 0.7% | 2.5% | |||||||||||

| Total | 7.2% | 8.1% | (4.2%) | |||||||||||

|

Sales per square foot |

$431 | $397 | $368 | |||||||||||

|

Percentage of net sales by merchandise category: |

||||||||||||||

| Women’s apparel |

33% | 34% | 34% | |||||||||||

| Shoes |

23% | 23% | 22% | |||||||||||

| Men’s apparel |

15% | 15% | 15% | |||||||||||

| Women’s accessories |

12% | 12% | 12% | |||||||||||

| Cosmetics |

11% | 10% | 11% | |||||||||||

| Children’s apparel |

3% | 3% | 3% | |||||||||||

| Other |

3% | 3% | 3% | |||||||||||

| Total | 100% | 100% | 100% | |||||||||||

1Other retail includes our HauteLook online private sale subsidiary, our Jeffrey stores and our treasure&bond store.

NET SALES – 2011 VS 2010

Net sales for 2011 increased 12.7% compared with 2010 driven by the strength of our Nordstrom full-line stores, rapid growth in our online business and improving results at Nordstrom Rack. During the year, we opened three Nordstrom full-line stores, eighteen Nordstrom Rack stores and one treasure&bond store, relocated two Nordstrom Rack stores and acquired HauteLook. These additions represented 4.0% of our total net sales for 2011, and increased our gross square footage by 3.8%. Same-store sales increased 7.2%, with increases of 8.2% at Nordstrom and 3.7% at Nordstrom Rack.

Nordstrom net sales for 2011 were $8,426, an increase of 9.4% compared with 2010, with same-store sales up 8.2%. Our sales growth was due in large part to our investments and efforts to build stronger relationships with customers and to improve the shopping experience across all channels. In addition, our merchandising, inventory management and multi-channel initiatives continue to drive our sales growth. Both the average selling price and the number of items sold increased in 2011 compared with 2010. Category highlights included Designer, Handbags and Shoes. The South and Midwest were the top-performing geographic regions for 2011. The Direct channel continued to outpace the overall Nordstrom increase, with a net sales increase of 29.5% in 2011 compared with 2010.

Nordstrom Rack net sales were $2,045, an increase of 21.0% compared with 2010, while same-store sales increased 3.7% for the year. Shoes, Dresses and Accessories were the strongest performing categories for the year. Both the average selling price and the number of items sold increased in 2011 compared with 2010.

20

Table of Contents

NET SALES – 2010 VS 2009

Net sales for 2010 increased 12.7% compared with 2009, while same-store sales increased 8.1%. During the year, we opened three Nordstrom full-line stores, relocated one Nordstrom full-line store, opened seventeen Nordstrom Rack stores and relocated one Nordstrom Rack store. These stores represented 3.3% of our total net sales for 2010, and increased our gross square footage by 4.7%.

Nordstrom net sales were $7,700, up 11.2% compared with 2009, with same-store sales up 9.3%. The number of items sold increased in 2010 compared with 2009, while the average selling price of Nordstrom merchandise was approximately flat. Category highlights included Jewelry, Shoes and Dresses. The Midwest and South were the top-performing geographic regions for 2010. Our sales growth was due in large part to the success of our merchandising, inventory management and multi-channel initiatives, including an updated inventory platform that allowed for shared inventory across all of our Nordstrom full-line stores and our website. These enhancements increased sales and led to significant improvements in our sell-through and inventory turnover rates beginning in the second half of 2009 and continuing throughout 2010.

Nordstrom Rack net sales were $1,720, up 19.5% compared with 2009, while same-store sales increased 0.7% for the year. Cosmetics and Shoes were the strongest performing categories for the year. The number of items sold increased in 2010 compared with 2009, partially offset by declines in the average selling price of Nordstrom Rack merchandise.

Retail Business Gross Profit

| Fiscal year | 2011 | 2010 | 2009 | |||||||||

| Gross profit1 |

$3,980 | $3,479 | $2,985 | |||||||||

| Gross profit rate |

37.9% | 37.4% | 36.1% | |||||||||

| Average inventory per square foot |

$48.71 | $45.31 | $43.96 | |||||||||

| Inventory turnover rate2 |

5.56 | 5.56 | 5.41 | |||||||||

| 1 |

Retailers do not uniformly record the costs of buying and occupancy and supply chain operations (freight, purchasing, receiving, distribution, etc.) between gross profit and selling, general and administrative expense. As such, our gross profit and selling, general and administrative expenses and rates may not be comparable to other retailers’ expenses and rates. |

| 2 |

Inventory turnover rate is calculated as annual cost of sales and related buying and occupancy costs (for all segments) divided by 4-quarter average inventory. |

GROSS PROFIT – 2011 VS 2010

Retail gross profit increased $501 in 2011 compared with 2010 due to higher sales and merchandise margin, partially offset by an increase in occupancy costs for stores opened during both 2011 and 2010. Our gross profit rate improved 54 basis points compared with 2010 primarily due to leveraging buying and occupancy costs on higher net sales.

Our merchandising efforts enabled us to manage inventory levels consistent with our sales trends, with an increase in our average inventory per square foot of 7.5% on an 8.5% increase in sales per square foot. Our inventory turnover rate remained in-line with the high rate achieved in 2010, reflecting the strong execution and discipline of our buying organization and the ongoing benefits from our multi-channel capabilities that contributed to a flow of fresh merchandise throughout the year.

GROSS PROFIT – 2010 VS 2009

Retail gross profit increased $494 in 2010 compared with 2009 primarily due to higher sales and merchandise margin, partially offset by increases in occupancy costs for Nordstrom full-line and Nordstrom Rack stores opened during both 2010 and 2009. Our gross profit rate improved 123 basis points compared with 2009 primarily due to improvement in our merchandise margin, as well as leveraging buying and occupancy costs on higher net sales. Both our regular-priced selling and inventory turnover rate increased in 2010 compared with 2009, and our average inventory per square foot increased 3.1%.

Nordstrom, Inc. and subsidiaries 21

Table of Contents

Retail Business Selling, General and Administrative Expenses

| Fiscal year | 2011 | 2010 | 2009 | |||||||||

| Selling, general and administrative expenses |

$2,807 | $2,412 | $2,109 | |||||||||

| Selling, general and administrative rate |

26.7% | 25.9% | 25.5% | |||||||||

| Selling, general and administrative expense per square foot1 |

$115 | $103 | $94 | |||||||||

| 1 |

Retail SG&A expense per square foot is calculated as Retail SG&A expense divided by weighted-average square footage. Weighted-average square footage includes a percentage of year-end square footage for new stores equal to the percentage of the year during which they were open. |

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES – 2011 VS 2010

Our Retail selling, general and administrative expenses (“Retail SG&A”) increased $395 in 2011 compared with 2010. This increase reflects initiatives to improve the shopping experience across all channels and specifically to grow our e-commerce business. These include HauteLook operating and purchase accounting expenses, planned increases in marketing and technology spending and increased fulfillment expenses associated with the introduction of free standard shipping and free returns for online purchases in the third quarter of 2011. The increase was also due in part to higher sales volume and the opening of twenty-two stores in 2011. As a result, our Retail SG&A rate increased 84 basis points for 2011 compared with 2010. We continue to leverage SG&A expense in our stores, with improvements of approximately 35 basis points in 2011, compared with 2010.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES – 2010 VS 2009

Our Retail selling, general and administrative expenses increased $303 in 2010 compared with 2009. The majority of the increase in expense dollars was due to higher sales volume and expenses for new stores. Our Retail SG&A rate increased 38 basis points for 2010 compared with 2009. The increase was in part due to planned increases in marketing and technology expenses in areas such as online marketing and social media. The increased Retail SG&A rate also reflects higher fulfillment costs as we shipped more items to our customers.

22

Table of Contents

Credit Segment

The Nordstrom credit and debit card products are designed to strengthen customer relationships and grow retail sales by providing valuable services, loyalty benefits and payment products. We believe that owning all aspects of our credit business allows us to fully integrate our rewards program with our retail stores and provide better service to our customers, thus deepening our relationship with them and driving greater customer loyalty. Our cardholders tend to visit our stores more frequently and spend more with us than non-cardholders, and we believe the Nordstrom Fashion Rewards® program helps drive sales in our Retail segment. Our Nordstrom private label credit and debit cards can be used only in Nordstrom stores and on our website (“inside volume”), while our Nordstrom VISA cards also may be used for purchases outside of Nordstrom (“outside volume”). Cardholders participate in the Fashion Rewards program, through which they accumulate points based on their level of spending (generally two points per dollar spent at Nordstrom and one point per dollar spent outside of Nordstrom). Upon reaching two thousand points, customers receive twenty dollars in Nordstrom Notes®, which can be redeemed for goods or services in our stores or online. Starting in January 2012, all Fashion Rewards customers receive a credit for complimentary alterations and personal triple points days, in addition to early access to sales events. As part of these changes, Nordstrom Rack is also now included with all bonus points events and the spend requirements for customers to achieve our two highest benefit levels have been lowered. With increased spending, Fashion Rewards customers can receive additional amounts of these benefits as well as access to exclusive fashion and shopping events.

The table below provides a detailed view of the operational results of our Credit segment, consistent with the segment disclosure provided in the Notes to Consolidated Financial Statements. In order to better reflect the economic contribution of our credit and debit card program, intercompany merchant fees are also included in the table below. Intercompany merchant fees represent the estimated intercompany income of our Credit segment from the usage of our cards in the Retail segment. To encourage the use of Nordstrom cards in our stores, the Credit segment does not charge the Retail segment an intercompany interchange merchant fee. On a consolidated basis, we avoid costs that would be incurred if our customers used third-party cards.

Interest expense is assigned to the Credit segment in proportion to the amount of estimated capital needed to fund our credit card receivables, which assumes a mix of 80% debt and 20% equity. The average credit card receivable investment metric included in the following table represents our best estimate of the amount of capital for our Credit segment that is financed by equity. Based on our research, debt as a percentage of credit card receivables for other credit card companies ranges from 70% to 90%. We believe that debt equal to 80% of our credit card receivables is appropriate given our overall capital structure goals.

| Fiscal year | 2011 | 2010 | 2009 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Amount | % of credit card receivables |

Amount | % of credit card receivables |

Amount | % of credit card receivables |

|||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Credit card revenues |

$380 | 18.6% | $390 | 18.7% | $370 | 17.6% | ||||||||||||||||||

| Interest expense |

(13) | (0.7%) | (21) | (1.0%) | (41) | (2.0%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Net credit card income |

367 | 17.9% | 369 | 17.7% | 329 | 15.7% | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Cost of sales and related buying and occupancy costs – loyalty program |

(75) | (3.7%) | (66) | (3.2%) | (55) | (2.6%) | ||||||||||||||||||

| Selling, general and administrative expenses |

(229) | (11.2%) | (273) | (13.1%) | (356) | (17.0%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Total expense |

(304) | (14.9%) | (339) | (16.3%) | (411) | (19.6%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Credit segment earnings (loss) before income taxes, as presented in segment disclosure |

63 | 3.1% | 30 | 1.4% | (82) | (3.9%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Intercompany merchant fees |

71 | 3.5% | 58 | 2.8% | 50 | 2.4% | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Credit segment contribution (loss), before income taxes |

$134 | 6.6% | $88 | 4.2% | $(32) | (1.5%) | ||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Credit and debit card volume: |

||||||||||||||||||||||||

| Outside |

$4,101 | $3,838 | $3,603 | |||||||||||||||||||||

| Inside |

3,596 | 2,953 | 2,521 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

| Total volume |

$7,697 | $6,791 | $6,124 | |||||||||||||||||||||

| Average credit card receivables |

$2,047 | $2,088 | $2,099 | |||||||||||||||||||||

| Average credit card receivable investment (assuming 80% of accounts receivable is funded with debt) |

$409 | $418 | $420 | |||||||||||||||||||||

| Credit segment contribution (loss), net of tax, as a percentage of average credit card receivable investment |

20.0% | 12.8% | (4.7%) | |||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

Nordstrom, Inc. and subsidiaries 23

Table of Contents

Credit Card Revenues

| Fiscal year | 2011 | 2010 | 2009 | |||||||||