10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 30, 2016

or

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to___________

Commission file number 001-15059

NORDSTROM, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Washington | | 91-0515058 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

1617 Sixth Avenue, Seattle, Washington | | 98101 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code 206-628-2111

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common stock, without par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES þ NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

| |

Large accelerated filer þ | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO þ

As of July 31, 2015 the aggregate market value of the Registrant’s voting and non-voting stock held by non-affiliates of the Registrant was approximately $11.7 billion using the closing sales price on that day of $76.31. On March 11, 2016, 172,920,293 shares of common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2016 Annual Meeting of Shareholders scheduled to be held on May 19, 2016 are incorporated into Part III.

Nordstrom, Inc. and subsidiaries 1

[This page intentionally left blank.]

|

| | |

TABLE OF CONTENTS | |

| | Page |

| |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| |

| |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| |

| |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| |

| |

Item 15. | | |

| |

| |

| |

| |

Nordstrom, Inc. and subsidiaries 3

PART I

Item 1. Business.

DESCRIPTION OF BUSINESS

Founded in 1901 as a retail shoe business in Seattle, Nordstrom later incorporated in Washington state in 1946 and went on to become one of the leading fashion specialty retailers based in the U.S. As of March 14, 2016, we operate 323 U.S. stores located in 39 states as well as a robust ecommerce business through Nordstrom.com, Nordstromrack.com/HauteLook and TrunkClub.com. We also operate three Nordstrom full-line stores in Canada. The west and east coasts of the U.S. are the areas in which we have the largest presence. We have two reportable segments, which include Retail and Credit.

As of March 14, 2016, the Retail segment includes our 118 Nordstrom-branded full-line stores in the U.S. and Nordstrom.com, 197 off-price Nordstrom Rack stores, three Canada full-line stores, Nordstromrack.com/HauteLook, five Trunk Club clubhouses and TrunkClub.com, our two Jeffrey boutiques and one clearance store that operates under the name “Last Chance.” Through these multiple retail channels, we strive to deliver the best customer experience possible. We offer an extensive selection of high-quality brand-name and private label merchandise focused on apparel, shoes, cosmetics and accessories. Our integrated Nordstrom full-line stores and online store allow us to provide our customers with a seamless shopping experience. In-store purchases are primarily fulfilled from that store’s inventory, but when inventory is unavailable at that store it may also be shipped to our customers from our fulfillment centers in Cedar Rapids, Iowa and Elizabethtown, Pennsylvania, or from other Nordstrom full-line stores. Online purchases are primarily shipped to our customers from our Cedar Rapids and East Coast fulfillment centers, but may also be shipped from our Nordstrom full-line stores. Our customers can also pick up online orders in our Nordstrom full-line stores if inventory is available at one of our locations. These capabilities allow us to better serve customers across various channels and improve sales. Nordstrom Rack stores purchase merchandise primarily from the same vendors carried in Nordstrom full-line stores and also serve as outlets for clearance merchandise from our Nordstrom stores and other retail channels. Nordstromrack.com/HauteLook offers a persistent selection of off-price merchandise, as well as limited-time sale events on fashion and lifestyle brands and are integrated with a single customer log-in, shared shopping cart and streamlined checkout process. Nordstromrack.com combines the technology expertise of HauteLook with the merchant expertise of Nordstrom Rack. Online purchases are primarily shipped to our customers from our San Bernardino fulfillment center. Furthermore, we can accommodate returns from these sites by mail or at any Nordstrom Rack location.

Through our Credit segment, our customers can access a variety of payment products and services, including a Nordstrom-branded private label card, two Nordstrom-branded Visa credit cards and a debit card for Nordstrom purchases. The credit and debit cards feature a loyalty program designed to increase customer visits and spending. Although the primary purposes of our Credit segment are to foster greater customer loyalty and drive more sales, through our program agreement with TD Bank, N.A. (“TD”) (see Note 2: Credit Card Receivable Transaction in Item 8), we also receive credit card revenue. In addition, we save on interchange fees that the Retail segment would incur if our customers used non-Nordstrom-branded cards.

For more information about our business and our reportable segments, see Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 17: Segment Reporting in Item 8.

FISCAL YEAR

We operate on a 52/53-week fiscal year ending on the Saturday closest to January 31st. References to 2015 and all years within this document are based on a 52-week fiscal year, except 2012, which is based on a 53-week fiscal year.

TRADEMARKS

We have 147 trademarks, each of which is the subject of one or more trademark registrations and/or trademark applications. Our most notable trademarks include Nordstrom, Nordstrom Rack, HauteLook, Trunk Club, Halogen, BP., Zella, 14th & Union, Tucker+Tate and Caslon. Each of our trademarks is renewable indefinitely, provided that it is still used in commerce at the time of the renewal.

RETURN POLICY

We have a fair and liberal approach to returns as part of our objective to provide high-quality customer service. We do not have a formal return policy at our Nordstrom full-line stores or online at Nordstrom.com. Our goal is to take care of our customers, which includes making returns and exchanges easy, whether in stores or online, where we offer free shipping on purchases and returns. Our Nordstrom Rack stores generally accept returns up to 90 days from the date of purchase with the original price tag and sales receipt, and also accept returns of Nordstromrack.com/HauteLook merchandise. Nordstromrack.com/HauteLook generally accept returns of apparel, footwear and accessories within 90 days from the date of shipment.

SEASONALITY

Our business, like that of other retailers, is subject to seasonal fluctuations. Due to our Anniversary Sale in July and the holidays in the fourth quarter, our sales are typically higher in the second and fourth quarters than in the first and third quarters of the fiscal year. In 2016, our Anniversary Sale will shift to the last week of July and the first week of August, which will move one week of event sales to the third quarter.

COMPETITIVE CONDITIONS

We operate in a highly competitive business environment. We compete with other national, regional, local and online retailers that may carry similar lines of merchandise, including department stores, specialty stores, off-price stores, boutiques and Internet businesses. Our specific competitors vary from market to market. We believe the keys to competing in our industry are providing great customer service and customer experiences in stores and online, which includes compelling price and value, fashion newness, quality of products, selection, convenience, technology, product fulfillment, personalization and appealing, relevant store environments in top locations.

INVENTORY

We plan our merchandise purchases and receipts to coincide with expected sales trends. For instance, our merchandise purchases and receipts increase prior to our Anniversary Sale, which has historically extended over the last two weeks of July. We also purchase and receive a larger amount of merchandise in the fall as we prepare for the holiday shopping season (from late November through December). At Nordstrom Rack we invest in pack and hold inventory which involves the strategic purchase of merchandise from some of our full-line stores’ top brands in advance of the upcoming selling seasons to take advantage of favorable buying opportunities. This inventory is typically held for six months on average and has been an important component of Nordstrom Rack’s inventory strategy. We pay for our merchandise purchases under the terms established with our vendors.

In order to offer merchandise that our customers want, we purchase from a wide variety of high-quality suppliers, including domestic and foreign businesses. We also have arrangements with agents and contract manufacturers to produce our private label merchandise. We expect our suppliers to meet our “Nordstrom Partnership Guidelines,” which address our corporate social responsibility standards for matters such as legal and regulatory compliance, labor, health and safety and the environment, and are available on our website at Nordstrom.com.

EMPLOYEES

During 2015, we employed approximately 72,500 employees on a full- or part-time basis. Due to the seasonal nature of our business, employment increased to approximately 74,000 employees in July 2015 and 78,000 in December 2015. All of our employees are non-union. We believe our relationship with our employees is good.

CAUTIONARY STATEMENT

Certain statements in this Annual Report on Form 10-K contain or may suggest “forward-looking” information (as defined in the Private Securities Litigation Reform Act of 1995) that involve risks and uncertainties, including, but not limited to, anticipated financial outlook for the fiscal year ending January 28, 2017, anticipated annual total and comparable sales rates, anticipated new store openings in existing, new and international markets, anticipated Return on Invested Capital and trends in our operations. Such statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. Actual future results may differ materially from historical results or current expectations depending upon factors including, but not limited to:

Strategic and Operational

| |

• | successful execution of our customer strategy, including expansion into new domestic and international markets, acquisitions, investments in our stores and online, our ability to realize the anticipated benefits from growth initiatives and our ability to provide a seamless experience across all channels, |

| |

• | timely and effective execution of our ecommerce initiatives and ability to manage the costs and organizational changes associated with this evolving business model, |

| |

• | timely completion of construction associated with newly planned stores, relocations and remodels, all of which may be impacted by the financial health of third parties, |

| |

• | our ability to maintain relationships with our employees and to effectively attract, develop and retain our future leaders, |

| |

• | effective inventory management processes and systems, fulfillment processes and systems, disruptions in our supply chain and our ability to control costs, |

| |

• | the impact of any systems failures, cybersecurity and/or security breaches, including any security breach of our systems or those of a third-party provider that results in the theft, transfer or unauthorized disclosure of customer, employee or Company information or compliance with information security and privacy laws and regulations in the event of such an incident, |

| |

• | successful execution of our information technology strategy, |

| |

• | our ability to effectively utilize data in strategic planning and decision making, |

| |

• | efficient and proper allocation of our capital resources, |

| |

• | our ability to realize the expected benefits, respond to potential risks and appropriately manage potential costs associated with our program agreement with TD, |

| |

• | our ability to safeguard our reputation and maintain our vendor relationships, |

| |

• | our ability to respond to the business environment, fashion trends and consumer preferences, including changing expectations of service and experience in stores and online, |

| |

• | the effectiveness of planned advertising, marketing and promotional campaigns in the highly competitive retail industry, |

| |

• | the timing, price, manner and amounts of share repurchases by the Company, if any, or any share issuances by the Company, including issuances associated with option exercises, acquisitions or other matters, |

Nordstrom, Inc. and subsidiaries 5

Economic and External

| |

• | the impact of economic and market conditions and the resultant impact on consumer spending patterns, |

| |

• | weather conditions, natural disasters, health hazards, national security or other market disruptions, or the prospects of these events and the resulting impact on consumer spending patterns, |

Legal and Regulatory

| |

• | our compliance with applicable domestic and international laws, regulations, and ethical standards, including those related to banking, employment and tax and the outcome of claims and litigation and resolution of such matters, |

| |

• | impact of the current regulatory environment and financial system and health care reforms, and |

| |

• | compliance with debt covenants, availability and cost of credit, changes in our credit rating, changes in interest rates, debt repayment patterns, and personal bankruptcies. |

These and other factors, including those factors described in Item 1A: Risk Factors, could affect our financial results and cause actual results to differ materially from any forward-looking information we may provide. We undertake no obligation to update or revise any forward-looking statements to reflect subsequent events, new information or future circumstances.

SEC FILINGS

We file annual, quarterly and current reports, proxy statements and other documents with the Securities and Exchange Commission (“SEC”). All the materials we file with the SEC are publicly available at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

WEBSITE ACCESS

Our website address is Nordstrom.com. Our annual and quarterly reports on Form 10-K and Form 10-Q (including related filings in eXtensible Business Reporting Language (“XBRL”) format), current reports on Form 8-K, proxy statements, our executives’ statements of changes in beneficial ownership of securities on Form 4 and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) are available for free on or through our website as soon as reasonably practicable after we electronically file the report with or furnish it to the SEC. Interested parties may also access a webcast of quarterly earnings conference calls and other financial events through our website.

CORPORATE GOVERNANCE

We have a long-standing commitment to upholding a high level of ethical standards. In addition, as the listing standards of the New York Stock Exchange (“NYSE”) and the rules of the SEC require, we have adopted Codes of Business Conduct and Ethics for our employees, officers and directors (“Codes of Ethics”) and Corporate Governance Guidelines. Our Codes of Ethics, Corporate Governance Guidelines and Committee Charters for the Audit, Compensation, Corporate Governance and Nominating, Finance and Technology Committees are posted on our website. Any amendments to these documents, or waivers of the requirements they contain, will also be available on our website.

For printed versions of these items or any other inquiries, please contact:

Nordstrom Investor Relations

PO Box 2737

Seattle, Washington 98111

(206) 303-3200

invrelations@nordstrom.com

Item 1A. Risk Factors.

Our business faces many risks. We believe the risks described below outline the items of most concern to us.

RISKS DUE TO STRATEGIC AND OPERATIONAL FACTORS

Our customer strategy focuses on providing a seamless and high-quality experience across all Nordstrom channels and failure to successfully execute our plans could negatively impact our current business and future profitability.

We are enhancing our customer shopping experience in our stores, online, and in mobile and social channels by pursuing a heightened focus on technology and ecommerce to fuel our growth. With the accelerated pace of change in the retail environment, we may not be able to meet our customers’ changing expectations in how they shop in stores or through ecommerce. If we target the wrong opportunities, fail to make investments at the right time or pace, fail to make the best investments in the right channels or make an investment commitment significantly above or below our needs, it may harm our competitive position. If these technologies and investments do not perform as expected, are not seamlessly integrated, or are not maintained properly, our profitability and growth could be adversely affected.

We are continuing our plan to accelerate the number of new Nordstrom Rack store openings. New store openings both at Nordstrom Rack and in our full-line stores involve certain risks, including the availability of suitable locations, constructing, furnishing and supplying a store in a timely and cost-effective manner and properly balancing our capital investments between new stores, remodels, technology and ecommerce. In addition, we may not accurately assess the demographic or retail environment for a particular location and sales at new, relocated or remodeled stores may not meet our projections, particularly in light of the changing trends between online and brick-and-mortar shopping channels, which could adversely affect our return on investment. We also intend to open stores in new and international markets, such as Canada and Manhattan, and expansion will require additional management attention and resources and may distract us from executing our core operations. In addition, competition from strong local competitors, compliance with foreign and local laws and regulatory requirements and potentially unfavorable tax consequences may cause our business to be adversely impacted.

As we execute our plans and continue to evolve and transform our strategy, we may not adequately manage the related organizational changes to align with our strategy or appropriately monitor, report or communicate the changes in an effective manner. In addition, we may not gather accurate and relevant data or effectively utilize that data, which may impact our strategic planning and decision making.

Our growth strategy as it relates to ecommerce could have adverse impacts on our results of operations if not successfully executed.

We are continuing our investment in ecommerce as advancements in technology have impacted shopping behaviors of consumers. Computers, mobile phones, tablets and other devices allow customers to browse and transact anywhere or anytime. Our growth strategies in this area span the development of applications for electronic devices, improvement of customer-facing technology, timely delivery of products purchased online, enhancement of inventory management systems, greater and more fluid inventory availability between online and retail locations, and greater consistency in marketing and pricing strategies. This business model has a high variable cost structure driven by fulfillment, marketing and technology costs and will continue to require investment in cross-channel operations and supporting technologies. If we do not implement and expand our ecommerce initiatives successfully or we do not realize our anticipated return on these investments, our profitability and growth could be adversely affected. In addition, if customers shift to ecommerce more quickly than we anticipate, we may need to accelerate our ecommerce initiatives and investments and may experience higher costs adversely impacting our profitability.

Our stores located in shopping malls may be adversely affected if the consumer traffic of malls decline.

Many of our stores are located in desirable locations within shopping malls and benefit from the abilities that we and other anchor tenants have to generate consumer traffic. A substantial decline in mall traffic, the development of new shopping malls, the availability of locations within existing or new shopping malls, the success of individual shopping malls and the success of other anchor tenants may negatively impact our ability to maintain or grow our sales in existing stores, as well as our ability to open new stores, which could have an adverse effect on our financial condition or results of operations.

Improvements to our merchandise buying and fulfillment processes and systems could adversely affect our business if not successfully executed.

We are making investments to improve our merchandise planning, procurement, allocation and fulfillment capabilities through changes in personnel, processes, location logistics and technology over a period of several years. If we encounter challenges associated with change management, the ability to hire and retain key personnel involved in these efforts, implementation of associated information technology or adoption of new processes, our ability to continue to successfully execute our strategy or evolve our strategy as the retail environment changes could be adversely affected. As a result, we may not derive the expected benefits to our sales and profitability, or we may incur increased costs relative to our current expectations.

If we do not effectively design and implement our strategic and business planning processes to attract, retain, train and develop talent and future leaders, our business may suffer.

We rely on the experience of our senior management, who have specific knowledge relating to us and our industry that is difficult to replace, and the talents of our workforce to execute our business strategies and objectives. If unexpected turnover occurs without adequate succession plans, the loss of the services of any of these individuals, or any resulting negative perceptions of our business, could damage our reputation and our business.

Nordstrom, Inc. and subsidiaries 7

Even if we take appropriate measures to safeguard our information security and privacy environment from security breaches, our customers and our business could still be exposed to risk.

Our Retail and Credit segments involve the collection, storage and transmission of customers’ personal information, consumer preferences and credit card information. In addition, our operations involve the collection, storage and transmission of employee information and Company financial and strategic data. Any measures we implement to prevent a security or cybersecurity threat may not be totally effective and may have the potential to harm relations with our customers or decrease activity on our websites by making them more difficult to use. In addition, the regulatory environment surrounding information security, cybersecurity and privacy is increasingly demanding, with new and constantly changing requirements. Security breaches and cyber incidents and their remediation, whether at our Company, our third-party providers or other retailers, could expose us to a risk of loss or misappropriation of this information, litigation, potential liability, reputation damage and loss of customers’ trust and business, which could adversely impact our sales. Any such breaches or incidents could subject us to investigation, notification and remediation costs, and if there is additional information that is later discovered related to such security breach or incident, there could be further loss of customers’ trust and business based upon their reactions to this additional information. Additionally, we could be subject to credit card fraud losses due to external credit card fraud.

If we fail to appropriately manage our capital, we may negatively impact our operations and shareholder return.

We utilize capital to finance our operations, make capital expenditures and acquisitions, manage our debt levels and return value to our shareholders through dividends and share repurchases. If our access to capital is restricted or our borrowing costs increase, our operations and financial condition could be adversely impacted. Further, if we do not properly allocate our capital to maximize returns, our operations, cash flows and returns to shareholders could be adversely affected.

Ownership and leasing real estate exposes us to possible liabilities and losses.

We own or lease the land and/or building for all of our stores and are therefore subject to all of the risks associated with owning and leasing real estate. In particular, the value of the assets could decrease and their operating costs could increase, due to changes in the real estate market, demographic trends, site competition and overall economic trends. Additionally, we are potentially subject to liability for environmental conditions, exit costs associated with disposal of a store, commitments to pay base rent for the entire lease term or operate a store for the duration of an operating covenant.

Our customer and employee relationships could be negatively affected if we fail to maintain our corporate culture and reputation.

We have a well-recognized culture and reputation that consumers may associate with a high level of integrity, customer service and quality merchandise, and it is one of the reasons customers shop with us and employees choose us as a place of employment. Any significant damage to our reputation could negatively impact sales, diminish customer trust, reduce employee morale and productivity and lead to difficulties in recruiting and retaining qualified employees.

The transaction related to the sale of our credit card receivables and resulting program agreement with TD could adversely impact our business.

In October 2015, we completed the sale of a substantial majority of our U.S. Visa and private label credit card portfolio to TD. While this transaction was consummated on terms that allow us to maintain customer-facing activities, if we fail to meet certain service levels under the program agreement with TD, TD has the right to assume certain individual servicing functions. If we lose control of such activities and functions, if we do not successfully respond to potential risks and appropriately manage potential costs associated with the program agreement with TD, or if this transaction negatively impacts the customer service associated with our cards, our operations, cash flows and returns to shareholders could be adversely affected, which could also harm our business reputation and competitive positioning.

The concentration of stock ownership in a small number of our shareholders could limit your ability to influence corporate matters.

We have regularly reported in our annual proxy statements the holdings of members of the Nordstrom family, including Bruce A. Nordstrom, our former Co-President and Chairman of the Board, his sister Anne E. Gittinger and members of the Nordstrom family within our Executive Team. In our proxy statement as of March 11, 2016, for the 2016 Annual Meeting of Shareholders, these individuals beneficially owned an aggregate of approximately 30% of our common stock. As a result, either individually or acting together, they may be able to exercise considerable influence over matters requiring shareholder approval. As reported in our periodic filings, our Board of Directors has from time to time authorized share repurchases. While these share repurchases may be offset in part by share issuances under our equity incentive plans and as consideration for acquisitions, the repurchases may nevertheless have the effect of increasing the overall percentage ownership held by these shareholders. The corporate law of the State of Washington, where the Company is incorporated, provides that approval of a merger or similar significant corporate transaction requires the affirmative vote of two-thirds of a company’s outstanding shares. The beneficial ownership of these shareholders may have the effect of discouraging offers to acquire us, delay or otherwise prevent a significant corporate transaction because the consummation of any such transaction would likely require the approval of these shareholders. As a result, the market price of our common stock could be affected.

Investment and partnerships in new business strategies and acquisitions could disrupt our core business.

We have invested in or are pursuing strategic growth opportunities, which may include acquisitions of, or investments in, other businesses, as well as new technologies or other investments to provide a superior customer shopping experience in our stores and online. Additionally, our business model will continue to rely more on partnerships with third parties for certain strategic initiatives and technologies. If these investments, acquisitions or partnerships do not perform as expected or create operational difficulties, we may record impairment charges and our profitability and growth could be adversely affected.

RISKS DUE TO ECONOMIC AND EXTERNAL MARKET FACTORS

A downturn in economic conditions could have a significant adverse effect on our business.

During economic downturns, fewer customers may shop for the high-quality items in our stores and on our websites as they may be seen as discretionary and those who do shop may limit the amount of their purchases. This reduced demand may lead to lower sales, higher markdowns, an overly promotional environment and increased marketing and promotional spending.

Our business could suffer if we do not appropriately assess and react to competitive market forces and changes in customer behavior.

We compete with other international, national, regional, local and online retailers that may carry similar lines of merchandise, including department stores, specialty stores, off-price stores, boutiques and Internet businesses. The retail environment is rapidly evolving with customer shopping preferences continuing to shift online and we expect competition in the ecommerce market to intensify in the future as the Internet facilitates competitive entry and comparison shopping. We may lose market share to our competitors and our sales and profitability could suffer if we are unable to remain competitive. Our financial model is changing to match customer shopping preferences, but if we do not properly allocate our capital between the store and online environment, or adjust the effectiveness and efficiency of our stores and online channels, our overall sales and profitability could suffer.

Our Credit segment faces competition from other retailers who also offer credit card products with associated loyalty programs, large banks and other credit card companies, some of which have substantial financial resources. If we do not effectively anticipate or respond to the competitive banking and credit card environments, we could lose market share to our competitors.

Our sales and customer relationships may be negatively impacted if we do not anticipate and respond to consumer preferences and fashion trends appropriately.

Our ability to predict or respond to constantly changing fashion trends, consumer preferences and spending patterns significantly impacts our sales and operating results. If we do not identify and respond to emerging trends in consumer spending and preferences quickly enough, we may harm our ability to retain our existing customers or attract new customers. If we purchase too much inventory, we may be forced to sell our merchandise at lower average margins, which could harm our business. Conversely, if we fail to purchase enough merchandise, we may lose opportunities for additional sales and potentially harm relationships with our customers.

The results of our Credit operations could be adversely affected by changes in market conditions.

Our credit card revenues, net and profitability are subject in large part to economic and market conditions that are beyond our control, including, but not limited to, interest rates, consumer credit availability, consumer debt levels, unemployment trends and other factors. These economic and market conditions could impair our revenues and the profitability of our Credit segment due to factors such as lower demand for credit, unfavorable payment patterns and higher delinquency rates. Additionally, our results may be negatively impacted if there are changes to the credit card risk management policies implemented under our program agreement with TD.

Our business and operations could be materially and adversely affected by supply chain disruptions, port disruptions, severe weather patterns, natural disasters, widespread pandemics and other natural or man-made disruptions.

We derive a significant amount of our total sales from stores located on the west and east coasts of the United States, particularly in California, which increases our exposure to market-disrupting conditions in these regions. These disruptions could cause, among other things, a decrease in consumer spending that would negatively impact our sales, staffing shortages in our stores, distribution centers or corporate offices, interruptions in the flow of merchandise to our stores, disruptions in the operations of our merchandise vendors or property developers, increased costs, and a negative impact on our reputation and long-term growth plans.

Nordstrom, Inc. and subsidiaries 9

RISKS DUE TO LEGAL AND REGULATORY FACTORS

We are subject to certain laws, litigation, regulatory matters and ethical standards, and our failure to comply with or adequately address developments as they arise could adversely affect our reputation and operations.

Our policies, procedures and practices and the technology we implement are designed to comply with federal, state, local and foreign laws, rules and regulations, including those imposed by the SEC and other regulatory agencies, the marketplace, the banking industry and foreign countries, as well as responsible business, social and environmental practices, all of which may change from time to time. Significant legislative changes, including those that relate to employment matters and health care reform, could impact our relationship with our workforce, which could increase our expenses and adversely affect our operations. In addition, if we fail to comply with applicable laws and regulations or implement responsible business, social, environmental and supply chain practices, we could be subject to damage to our reputation, class action lawsuits, legal and settlement costs, civil and criminal liability, increased cost of regulatory compliance, restatements of our financial statements, disruption of our business and loss of customers. Any required changes to our employment practices could result in the loss of employees, reduced sales, increased employment costs, low employee morale and harm to our business and results of operations. In addition, political and economic factors could lead to unfavorable changes in federal, state and foreign tax laws, which may increase our tax liabilities. An increase in our tax liabilities could adversely affect our results of operations. We are also regularly involved in various litigation matters that arise in the ordinary course of business. Litigation or regulatory developments could adversely affect our business and financial condition.

We continue to face uncertainties due to financial services industry regulation and supervision that could have an adverse affect on our operations.

Federal and state regulation and supervision of the financial industry has increased in recent years due to implementation of consumer protection and financial reform legislation such as the Credit Card Accountability Responsibility and Disclosure Act of 2009 (“CARD Act”) and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Financial Reform Act”). The Financial Reform Act significantly restructured regulatory oversight and other aspects of the financial industry, created the Consumer Financial Protection Bureau (“CFPB”) to supervise and enforce consumer lending laws and regulations, and expanded state authority over consumer lending. The CARD Act included new and revised rules and restrictions on credit card pricing, finance charges and fees, customer billing practices and payment application. We anticipate more regulation and interpretations of the new rules to continue, and we may be required to make changes, or TD may be required to make changes in connection with the program agreement, to credit card practices and systems which could adversely impact the revenues and profitability of our Credit segment. Compliance with applicable laws and regulations could limit or restrict the activities of our business, whether conducted by us or TD, and any potential enforcement actions by those agencies for failure to comply could have an adverse impact on us.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

The following table summarizes the number of retail stores we own or lease, and the percentage of total store square footage represented by each listed category as of January 30, 2016: |

| | | | | | | | | |

| | Number of stores | | |

| | Nordstrom Full-Line Stores - U.S. and Canada |

| | Nordstrom Rack and Other1 |

| | % of total store

square footage |

|

Leased stores on leased land | | 22 |

| | 201 |

| | 40 | % |

Owned stores on leased land | | 62 |

| | — |

| | 39 | % |

Owned stores on owned land | | 36 |

| | 1 |

| | 20 | % |

Partly owned and partly leased store | | 1 |

| | — |

| | 1 | % |

Total | | 121 |

| | 202 |

| | 100 | % |

1 Other includes Trunk Club clubhouses, Jeffrey boutiques and our Last Chance store.

The following table summarizes our store activity during the last three years: |

| | | | | | | | |

Fiscal year | 2015 |

|

| 2014 |

|

| 2013 |

|

Number of stores, beginning of year | 292 |

| | 260 |

| | 240 |

|

Stores opened | 32 |

| | 31 |

| | 22 |

|

Stores acquired | — |

|

| 4 |

|

| — |

|

Stores closed | (1 | ) | | (3 | ) | | (2 | ) |

Number of stores, end of year | 323 |

| | 292 |

| | 260 |

|

| | | | | |

Nordstrom full-line stores - U.S. | 118 |

| | 116 |

| | 117 |

|

Nordstrom full-line stores - Canada | 3 |

| | 1 |

| | — |

|

Nordstrom Rack | 194 |

| | 167 |

| | 140 |

|

Other1 | 8 |

| | 8 |

| | 3 |

|

1 Other includes Trunk Club clubhouses, Jeffrey boutiques and our Last Chance store.

In 2015, we opened five Nordstrom full-line stores (Ottawa, Ontario; San Juan, Puerto Rico; Vancouver, British Columbia; Minneapolis, Minnesota; and Wauwatosa, Wisconsin) and 27 Nordstrom Rack stores (Bakersfield, California; Redlands, California; Reno, Nevada; Princeton, New Jersey; Westwood, Massachusetts; Webster, Texas; Laguna Niguel, California; Miami, Florida; Springfield, Virginia; St. Louis Park, Minnesota; Dublin, California; Albany, New York; Anchorage, Alaska; Buffalo, New York; Clearwater, Florida; Mount Pleasant, South Carolina; Baton Rouge, Louisiana; Long Beach, California; Newark, Delaware; Rockaway, New Jersey; Thousand Oaks, California; Cerritos, California; Eatontown, New Jersey; Emeryville, California; Fort Collins, Colorado; Syracuse, New York; and Wayne, New Jersey). Additionally, in 2015, we closed one Nordstrom full-line store in Buford, Georgia.

To date in 2016, we have opened three Nordstrom Rack stores (Lafayette, Louisiana; Orem, Utah; and Virginia Beach, Virginia). During the remainder of 2016, we have announced the opening of three additional Nordstrom full-line stores (two in Toronto, Ontario and one in Austin, Texas) and the opening of 18 additional Nordstrom Rack stores (Colorado Springs, Colorado; Folsom, California; Tucson, Arizona; Albuquerque, New Mexico; Allentown, Pennsylvania; Fort Lauderdale, Florida; Honolulu, Hawaii; La Jolla, California; Novi, Michigan; Pittsburgh, Pennsylvania; Santa Rosa, California; Staten Island, New York; Rosemont, Illinois; Tustin, California; New Orleans, Louisiana; Braintree, Massachusetts; Algonquin, Illinois; and Langhorne, Pennsylvania).

We also own six merchandise distribution centers (Portland, Oregon; Dubuque, Iowa; Ontario, California; Newark, California; Upper Marlboro, Maryland; and Gainesville, Florida) and we own two fulfillment centers, one on leased land (Cedar Rapids, Iowa) and one on owned land (Elizabethtown, Pennsylvania), all of which are utilized by our Retail segment. Trunk Club and Nordstromrack.com/HauteLook, which are included in our Retail segment, lease three administrative offices (Chicago, Illinois; Los Angeles, California and New York City, New York) and one fulfillment center (San Bernardino, California). We lease two office buildings (Centennial, Colorado and Scottsdale, Arizona) for use by our Credit segment. Our administrative offices in Seattle, Washington are a combination of leased and owned space. We also lease a data center in Centennial, Colorado.

Nordstrom, Inc. and subsidiaries 11

The following table lists our U.S. and Canada retail store count and facility square footage by state/province as of January 30, 2016:

|

| | | | | | | | | | | | | | | |

Retail stores by channel | | Nordstrom Full-Line Stores - U.S. and Canada | | Nordstrom Rack and Other1 | | Total |

State/Province | | Count |

| Square Footage (000’s) |

| | Count |

| Square Footage (000’s) |

| | Count |

| Square Footage (000’s) |

|

U.S. | | | | | | | | | |

Alabama | | — |

| — |

| | 1 |

| 35 |

| | 1 |

| 35 |

|

Alaska | | 1 |

| 97 |

| | 1 |

| 35 |

| | 2 |

| 132 |

|

Arizona | | 2 |

| 384 |

| | 7 |

| 262 |

| | 9 |

| 646 |

|

California2 | | 32 |

| 5,477 |

| | 46 |

| 1,743 |

| | 78 |

| 7,220 |

|

Colorado | | 3 |

| 559 |

| | 5 |

| 182 |

| | 8 |

| 741 |

|

Connecticut | | 1 |

| 189 |

| | 1 |

| 36 |

| | 2 |

| 225 |

|

Delaware | | 1 |

| 127 |

| | 1 |

| 32 |

| | 2 |

| 159 |

|

Florida2 | | 9 |

| 1,389 |

| | 14 |

| 484 |

| | 23 |

| 1,873 |

|

Georgia | | 2 |

| 383 |

| | 5 |

| 165 |

| | 7 |

| 548 |

|

Hawaii | | 1 |

| 211 |

| | 1 |

| 44 |

| | 2 |

| 255 |

|

Idaho | | — |

| — |

| | 1 |

| 37 |

| | 1 |

| 37 |

|

Illinois | | 4 |

| 947 |

| | 11 |

| 402 |

| | 15 |

| 1,349 |

|

Indiana | | 1 |

| 134 |

| | 1 |

| 35 |

| | 2 |

| 169 |

|

Iowa | | — |

| — |

| | 1 |

| 35 |

| | 1 |

| 35 |

|

Kansas | | 1 |

| 219 |

| | 1 |

| 35 |

| | 2 |

| 254 |

|

Kentucky | | — |

| — |

| | 1 |

| 33 |

| | 1 |

| 33 |

|

Louisiana | | — |

| — |

| | 1 |

| 30 |

| | 1 |

| 30 |

|

Maine | | — |

| — |

| | 1 |

| 30 |

| | 1 |

| 30 |

|

Maryland | | 4 |

| 765 |

| | 4 |

| 156 |

| | 8 |

| 921 |

|

Massachusetts | | 4 |

| 595 |

| | 6 |

| 229 |

| | 10 |

| 824 |

|

Michigan | | 3 |

| 552 |

| | 4 |

| 145 |

| | 7 |

| 697 |

|

Minnesota | | 2 |

| 380 |

| | 3 |

| 108 |

| | 5 |

| 488 |

|

Missouri | | 2 |

| 342 |

| | 2 |

| 69 |

| | 4 |

| 411 |

|

Nevada | | 1 |

| 207 |

| | 3 |

| 101 |

| | 4 |

| 308 |

|

New Jersey | | 5 |

| 991 |

| | 7 |

| 248 |

| | 12 |

| 1,239 |

|

New York | | 2 |

| 460 |

| | 13 |

| 407 |

| | 15 |

| 867 |

|

North Carolina | | 2 |

| 300 |

| | 2 |

| 74 |

| | 4 |

| 374 |

|

Ohio | | 3 |

| 549 |

| | 6 |

| 224 |

| | 9 |

| 773 |

|

Oklahoma | | — |

| — |

| | 2 |

| 67 |

| | 2 |

| 67 |

|

Oregon | | 4 |

| 555 |

| | 5 |

| 190 |

| | 9 |

| 745 |

|

Pennsylvania | | 2 |

| 381 |

| | 3 |

| 120 |

| | 5 |

| 501 |

|

Puerto Rico | | 1 |

| 143 |

| | — |

| — |

| | 1 |

| 143 |

|

Rhode Island | | 1 |

| 206 |

| | 1 |

| 38 |

| | 2 |

| 244 |

|

South Carolina | | — |

| — |

| | 3 |

| 101 |

| | 3 |

| 101 |

|

Tennessee | | 1 |

| 145 |

| | 1 |

| 36 |

| | 2 |

| 181 |

|

Texas2 | | 8 |

| 1,431 |

| | 16 |

| 527 |

| | 24 |

| 1,958 |

|

Utah | | 2 |

| 277 |

| | 3 |

| 96 |

| | 5 |

| 373 |

|

Virginia | | 5 |

| 894 |

| | 6 |

| 234 |

| | 11 |

| 1,128 |

|

Washington | | 7 |

| 1,392 |

| | 7 |

| 276 |

| | 14 |

| 1,668 |

|

Washington D.C. | | — |

| — |

| | 3 |

| 80 |

| | 3 |

| 80 |

|

Wisconsin | | 1 |

| 150 |

| | 2 |

| 67 |

| | 3 |

| 217 |

|

Canada | | | | | | | | | |

Alberta | | 1 |

| 142 |

| | — |

| — |

| | 1 |

| 142 |

|

British Columbia | | 1 |

| 231 |

| | — |

| — |

| | 1 |

| 231 |

|

Ontario | | 1 |

| 158 |

| | — |

| — |

| | 1 |

| 158 |

|

Total | | 121 |

| 21,362 |

| | 202 |

| 7,248 |

| | 323 |

| 28,610 |

|

1 Other includes five Trunk Club clubhouses, two Jeffrey boutiques and one Last Chance store.

2 California, Texas and Florida had the highest square footage, with a combined 11,051 square feet, representing 39% of the total Company square footage.

Item 3. Legal Proceedings.

We are subject from time to time to various claims and lawsuits arising in the ordinary course of business, including lawsuits alleging violations of state and/or federal wage and hour and other employment laws, privacy and other consumer-based claims. Some of these lawsuits include certified classes of litigants, or purport or may be determined to be class or collective actions and seek substantial damages or injunctive relief, or both, and some may remain unresolved for several years. We believe the recorded reserves in our Consolidated Financial Statements are adequate in light of the probable and estimable liabilities. As of the date of this report, we do not believe any currently identified claim, proceeding or litigation, either alone or in the aggregate, will have a material impact on our results of operations, financial position or cash flows. Since these matters are subject to inherent uncertainties, our view of them may change in the future.

Item 4. Mine Safety Disclosures.

None.

Nordstrom, Inc. and subsidiaries 13

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities.

MARKET, SHAREHOLDER AND DIVIDEND INFORMATION

Our common stock, without par value, is traded on the New York Stock Exchange under the symbol “JWN.” The approximate number of holders of common stock as of March 11, 2016 was 260,000 based upon the number of registered and beneficial shareholders and the number of employee shareholders in the Nordstrom 401(k) Plan and Profit Sharing Plan. On this date we had 172,920,293 shares of common stock outstanding.

The high and low prices of our common stock and dividends declared for each quarter of 2015 and 2014 are presented in the table below: |

| | | | | | | | | | | | |

| | Common Stock Price | | | | |

| | 2015 | | 2014 | | Dividends per Share |

| | High | | Low | | High | | Low | | 2015 | | 2014 |

1st Quarter | | $83.16 | | $74.51 | | $64.19 | | $54.90 | | $0.37 | | $0.33 |

2nd Quarter | | $80.23 | | $72.01 | | $70.71 | | $60.20 | | $0.37 | | $0.33 |

3rd Quarter | | $79.98 | | $63.73 | | $73.74 | | $64.92 | | $5.22 | | $0.33 |

4th Quarter | | $67.27 | | $44.49 | | $80.54 | | $70.21 | | $0.37 | | $0.33 |

Full Year | | $83.16 | | $44.49 | | $80.54 | | $54.90 | | $6.33 | | $1.32 |

SHARE REPURCHASES

Dollar and share amounts in millions, except per share amounts

The following is a summary of our fourth quarter share repurchases: |

| | | | | | | | | | | | | |

| Total Number of Shares Purchased |

| | Average Price Paid Per Share |

| | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

| | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs1 |

|

November 2015

(November 1, 2015 to

November 28, 2015) | 1.8 |

| |

| $57.44 |

| | 1.8 |

| |

| $1,381 |

|

December 2015

(November 29, 2015 to

January 2, 2016) | 10.2 |

| |

| $55.86 |

| | 10.2 |

| |

| $811 |

|

January 2016

(January 3, 2016 to

January 30, 2016) | — |

| |

| $— |

| | — |

| |

| $811 |

|

Total | 12.0 |

| |

| $56.10 |

| | 12.0 |

| | |

1 In September 2014, our Board of Directors authorized a program to repurchase up to $1,000 of our outstanding common stock, through March 1, 2016. As of January 30, 2016, there is no capacity remaining on the September 2014 authorization. On October 1, 2015, our Board of Directors authorized a program to repurchase up to $1,000 of our outstanding common stock, through March 1, 2017. The actual number, price, manner and timing of future share repurchases, if any, will be subject to market and economic conditions and applicable SEC rules.

STOCK PRICE PERFORMANCE

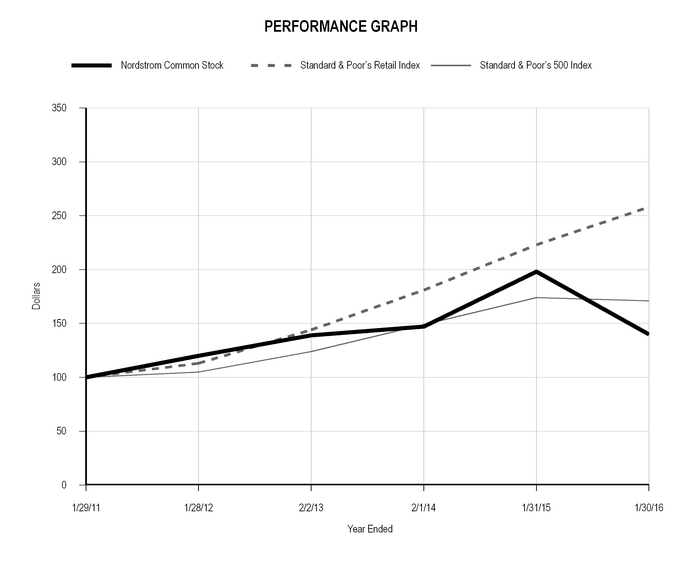

The following graph compares the cumulative total return of Nordstrom common stock, Standard & Poor’s Retail Index (“S&P Retail”) and Standard & Poor’s 500 Index (“S&P 500”) for each of the last five fiscal years, ending January 30, 2016. The Retail Index is composed of 31 retail companies, including Nordstrom, representing an industry group of the S&P 500. The following graph assumes an initial investment of $100 each in Nordstrom common stock, the S&P Retail and the S&P 500 on January 29, 2011 and assumes reinvestment of dividends on the Nordstrom common stock as well as the S&P Retail and S&P 500 Indexes.

|

| | | | | | | | | | | | | | | | | |

End of fiscal year | 2010 |

| | 2011 |

| | 2012 |

| | 2013 |

| | 2014 |

| | 2015 |

|

Nordstrom common stock | 100 |

| | 120 |

| | 139 |

| | 147 |

| | 198 |

| | 140 |

|

Standard & Poor’s Retail Index | 100 |

| | 113 |

| | 144 |

| | 181 |

| | 223 |

| | 258 |

|

Standard & Poor’s 500 Index | 100 |

| | 105 |

| | 124 |

| | 149 |

| | 174 |

| | 171 |

|

Nordstrom, Inc. and subsidiaries 15

Item 6. Selected Financial Data.

Dollars in millions except per square foot and per share amounts

The following selected financial data are derived from the audited Consolidated Financial Statements and should be read in conjunction with Item 1A: Risk Factors, Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8: Financial Statements and Supplementary Data of this Annual Report on Form 10-K. |

| | | | | | | | | | | | | | | | | | | |

Fiscal year | 2015 |

| | 2014 |

| | 2013 |

| | 2012 |

| | 2011 |

|

Earnings Results | | | | | | | | | |

Net sales |

| $14,095 |

|

|

| $13,110 |

|

|

| $12,166 |

| |

| $11,762 |

| |

| $10,497 |

|

Credit card revenues, net (see Note 2 in Item 8) | 342 |

|

| 396 |

|

| 374 |

| | 372 |

| | 363 |

|

Gross profit | 4,927 |

|

| 4,704 |

|

| 4,429 |

| | 4,330 |

| | 3,905 |

|

Selling, general and administrative (“SG&A”) expenses | (4,168 | ) | | (3,777 | ) | | (3,453 | ) | | (3,357 | ) | | (3,019 | ) |

Earnings before interest and income taxes (“EBIT”) | 1,101 |

|

| 1,323 |

|

| 1,350 |

| | 1,345 |

| | 1,249 |

|

Net earnings | 600 |

|

| 720 |

|

| 734 |

| | 735 |

| | 683 |

|

| | | | | | | | | |

Balance Sheet and Cash Flow Data | | | | | | | | | |

Cash and cash equivalents |

| $595 |

| |

| $827 |

| |

| $1,194 |

| |

| $1,285 |

| |

| $1,877 |

|

Merchandise inventories | 1,945 |

|

| 1,733 |

| | 1,531 |

| | 1,360 |

| | 1,148 |

|

Land, property and equipment, net | 3,735 |

|

| 3,340 |

| | 2,949 |

| | 2,579 |

| | 2,469 |

|

Total assets (see Note 2 in Item 8) | 7,698 |

|

| 9,245 |

| | 8,574 |

| | 8,089 |

| | 8,491 |

|

Total long-term debt (see Note 9 in Item 8) | 2,805 |

|

| 3,131 |

| | 3,113 |

| | 3,131 |

| | 3,647 |

|

Cash flow from operations (see Note 2 in Item 8) | 2,451 |

|

| 1,220 |

| | 1,320 |

| | 1,110 |

| | 1,177 |

|

Capital expenditures | 1,082 |

| | 861 |

| | 803 |

| | 513 |

| | 511 |

|

| | | | | | | | | |

Performance Metrics | | | | | | | | | |

Comparable sales increase | 2.7 | % | | 4.0 | % | | 2.5 | % | | 7.3 | % | | 7.2 | % |

Gross profit % of net sales | 35.0 | % | | 35.9 | % | | 36.4 | % | | 36.8 | % | | 37.2 | % |

Total SG&A % of net sales | 29.6 | % | | 28.8 | % | | 28.4 | % | | 28.5 | % | | 28.8 | % |

EBIT % of net sales | 7.8 | % | | 10.1 | % | | 11.1 | % | | 11.4 | % | | 11.9 | % |

Capital expenditures % of net sales | 7.7 | % | | 6.6 | % | | 6.6 | % | | 4.4 | % | | 4.9 | % |

Return on assets | 6.6 | % |

| 8.1 | % |

| 8.7 | % |

| 8.9 | % |

| 8.7 | % |

Return on invested capital (“ROIC”)1 | 10.7 | % |

| 12.6 | % |

| 13.6 | % |

| 13.9 | % |

| 13.3 | % |

Sales per square foot |

| $507 |

| |

| $493 |

| |

| $474 |

| |

| $470 |

| |

| $431 |

|

4-wall sales per square foot |

| $410 |

|

|

| $413 |

|

|

| $408 |

| |

| $417 |

| |

| $394 |

|

Inventory turnover rate | 4.54 |

| | 4.67 |

| | 5.07 |

| | 5.37 |

| | 5.56 |

|

| | | | | | | | | |

Per Share Information | | | | | | | | | |

Earnings per diluted share |

| $3.15 |

|

|

| $3.72 |

|

|

| $3.71 |

| |

| $3.56 |

| |

| $3.14 |

|

Dividends declared per share (see Note 13 in Item 8) | 6.33 |

| | 1.32 |

| | 1.20 |

| | 1.08 |

| | 0.92 |

|

| | | | | | | | | |

Store Information (at year-end) | | | | | | | | | |

Nordstrom full-line stores - U.S. and Canada | 121 |

| | 117 |

| | 117 |

| | 117 |

| | 117 |

|

Nordstrom Rack and other2 | 202 |

| | 175 |

| | 143 |

| | 123 |

| | 108 |

|

Total square footage | 28,610,000 |

| | 27,061,000 |

| | 26,017,000 |

| | 25,290,000 |

| | 24,745,000 |

|

1 See ROIC (Non-GAAP financial measure) on page 26 for additional information and reconciliation to the most directly comparable GAAP financial measure.

2 Other includes Trunk Club clubhouses, Jeffrey boutiques and our Last Chance store.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Dollar, share and square footage amounts in millions except percentages, per share and per square foot amounts

OVERVIEW

Nordstrom is a leading fashion specialty retailer offering apparel, shoes, cosmetics and accessories for women, men, young adults and children. We offer an extensive selection of high-quality brand-name and private label merchandise through our various channels, including Nordstrom U.S. and Canada full-line stores, Nordstrom.com, Nordstrom Rack stores, Nordstromrack.com/HauteLook, Trunk Club clubhouses and TrunkClub.com, our Jeffrey boutiques and our Last Chance clearance store. As of January 30, 2016, our stores are located in 39 states throughout the United States and in three provinces in Canada. In addition, we offer our customers a Nordstrom Rewards™ loyalty program along with a variety of payment products and services, including credit and debit cards.

In 2015, we continued to grow our business despite a more challenging retail environment in the second half of the year. We added nearly $1 billion to our top line, delivering total net sales growth of 7.5% and a comparable sales increase of 2.7%. During the year, we achieved the following milestones in executing our customer strategy:

| |

• | opened our first international flagship store in Vancouver, British Columbia, the most successful opening in our Company history |

| |

• | grew Nordstromrack.com/HauteLook by 47%, reaching over $500 in sales |

| |

• | expanded our fulfillment network with our third fulfillment center in Elizabethtown, Pennsylvania, located within two-day delivery of approximately half the U.S. population |

| |

• | returned $2.4 billion to shareholders through share repurchase and dividends, of which $1.8 billion resulted from the sale of our credit card receivables |

From a merchandising perspective, we’re constantly pursuing newness and fashion to increase our relevance with customers. Brands like Topshop, Madewell, Brandy Melville and Charlotte Tilbury have contributed to the strength of our younger customer-focused departments and attracted new customers to Nordstrom. Additionally, we saw continued momentum in Beauty, which has been among our top-performing categories for the fourth straight year.

On October 1st, we completed the sale of our credit card portfolio to TD. Our mutual commitment to having Nordstrom employees serve our customers directly was paramount to this partnership. We are able to retain all aspects of customer-facing activities, aligning with our strategy of enhancing the customer experience while allowing for improvement in capital efficiency.

In addition, we consider our loyalty program as an enabler of growth to increase our engagement with customers and attract new customers. With sales to Rewards members representing 40% of our sales volume, we look forward to expanding our program with a tender-neutral offer in 2016.

Over the past several years, we’ve made significant investments to enable customers to shop seamlessly across stores and online as well as to grow our business through new markets. Our investments in HauteLook, Canada and Trunk Club added over $400 to our top-line growth in 2015, while Nordstrom Rack’s expansion of 27 new stores contributed nearly $230 to our top-line growth. These investments have resulted in market share gains, but also represent an evolution of our business resulting in expenses growing faster than sales in recent years.

As we look ahead to 2016, we continue to view 2015 as our peak investment year. While we have successfully increased market share, we are also committed to increasing efficiency, lowering costs while increasing effectiveness and gaining profitability. With our investments moderating, we expect 2016 to represent an inflection point of earnings growth improvement.

As our business evolves, our focus continues to be guided by customer expectations around speed, convenience and personalization. We believe that we are well positioned with the right strategies in place to successfully serve our customers, which will in turn lead to long-term profitable growth and top-quartile total shareholder return.

Nordstrom, Inc. and subsidiaries 17

RESULTS OF OPERATIONS

Our reportable segments are Retail and Credit. We analyze our results of operations through earnings before interest and income taxes for our Retail Business and Credit, while interest expense, income taxes, earnings per share and return on invested capital are discussed on a total Company basis.

RETAIL BUSINESS

Our Retail Business includes our Nordstrom-branded U.S. and Canada full-line stores and Nordstrom.com, Nordstrom Rack stores, Nordstromrack.com/HauteLook, Trunk Club, Jeffrey and our Last Chance clearance store. For purposes of discussion and analysis of our results of operations of our Retail Business, we combine our Retail segment results with revenues and expenses in the “Corporate/Other” column of Note 17: Segment Reporting in Item 8 (collectively, the “Retail Business”).

Certain metrics we use to evaluate the Retail Business may not be calculated in a consistent manner among industry peers. Provided below are definitions of metrics we present within our analysis of the Retail Business:

| |

• | Comparable Sales – sales from stores that have been open at least one full year at the beginning of the year. Total Company comparable sales include sales from our online channels (Nordstrom.com and Nordstromrack.com/HauteLook) because of the integration with our stores. |

| |

• | Gross Profit – net sales less cost of sales and related buying and occupancy costs. |

| |

• | Inventory Turnover Rate – annual cost of sales and related buying and occupancy costs (for all segments) divided by the trailing 4-quarter average inventory. |

| |

• | Total Sales Per Square Foot – net sales divided by weighted-average square footage. |

| |

• | 4-wall Sales Per Square Foot – sales for Nordstrom U.S. and Canada full-line stores, Nordstrom Rack stores, Trunk Club clubhouses, Jeffrey boutiques and our Last Chance store divided by their weighted-average square footage. |

Summary

The following table summarizes the results of our Retail Business for the past three years: |

| | | | | | | | | | | | | | | | | | | | | |

Fiscal year | | 2015 | | 2014 | | 2013 |

| | Amount |

| | % of net sales1 |

| | Amount |

| | % of net sales1 |

| | Amount |

| | % of net sales1 |

|

Net sales | |

| $14,095 |

| | 100.0 | % | |

| $13,110 |

| | 100.0 | % | |

| $12,166 |

| | 100.0 | % |

Cost of sales and related buying and occupancy costs | | (9,161 | ) | | (65.0 | %) | | (8,401 | ) | | (64.1 | %) | | (7,732 | ) | | (63.6 | %) |

Gross profit | | 4,934 |

| | 35.0 | % | | 4,709 |

| | 35.9 | % | | 4,434 |

| | 36.4 | % |

Selling, general and administrative expenses | | (4,016 | ) | | (28.5 | %) | | (3,588 | ) | | (27.4 | %) | | (3,272 | ) | | (26.9 | %) |

Earnings before interest and income taxes | |

| $918 |

| | 6.5 | % | |

| $1,121 |

| | 8.6 | % | |

| $1,162 |

| | 9.6 | % |

1 Subtotals and totals may not foot due to rounding.

Retail Business Net Sales

In our ongoing effort to enhance the customer experience, we are focused on providing customers with a seamless experience across our channels. While our customers may engage with us through multiple channels, we know they value the overall Nordstrom brand experience and view us simply as Nordstrom, which is ultimately how we view our business. To provide additional transparency into our net sales by channel, we present the following information for our Retail Business:

|

| | | | | | | | | | | |

Fiscal year | 2015 |

| | 2014 |

| | 2013 |

|

Net sales by channel: | | | | | |

Nordstrom full-line stores - U.S. |

| $7,633 |

| |

| $7,682 |

|

|

| $7,705 |

|

Nordstrom.com | 2,300 |

| | 1,996 |

|

| 1,622 |

|

Full-price | 9,933 |

| | 9,678 |

| | 9,327 |

|

| | | | | |

Nordstrom Rack | 3,533 |

| | 3,215 |

| | 2,738 |

|

Nordstromrack.com/HauteLook | 532 |

|

| 360 |

|

| 295 |

|

Off-price | 4,065 |

| | 3,575 |

| | 3,033 |

|

| | | | | |

Other retail1 | 378 |

| | 116 |

| | 35 |

|

Retail segment | 14,376 |

| | 13,369 |

| | 12,395 |

|

Corporate/Other | (281 | ) | | (259 | ) | | (229 | ) |

Total net sales |

| $14,095 |

| |

| $13,110 |

| |

| $12,166 |

|

| | | | | |

Net sales increase | 7.5 | % | | 7.8 | % | | 3.4 | % |

| | | | | |

Comparable sales increase (decrease) by channel: | | | | | |

Nordstrom full-line stores - U.S. | (1.1 | %) | | (0.5 | %) | | (2.1 | %) |

Nordstrom.com | 15.2 | % | | 23.1 | % | | 29.5 | % |

Full-price | 2.3 | % | | 3.6 | % | | 2.3 | % |

Nordstrom Rack | (1.0 | %) | | 3.8 | % | | 2.7 | % |

Nordstromrack.com/HauteLook | 47.4 | % | | 22.1 | % | | 27.3 | % |

Off-price | 4.3 | % | | 5.7 | % | | 4.9 | % |

Total Company | 2.7 | % | | 4.0 | % | | 2.5 | % |

| | | | | |

Sales per square foot: | | | | | |

Total sales per square foot |

| $507 |

| |

| $493 |

| |

| $474 |

|

4-wall sales per square foot | 410 |

| | 413 |

| | 408 |

|

Full-line sales per square foot - U.S. | 370 |

| | 371 |

| | 372 |

|

Nordstrom Rack sales per square foot | 523 |

| | 552 |

| | 553 |

|

1 Other retail includes Nordstrom Canada full-line stores, Trunk Club and Jeffrey boutiques.

Net Sales (2015 vs. 2014)

In 2015, total Company net sales increased 7.5%, while comparable sales increased 2.7%. During the year, we opened five Nordstrom full-line stores, including two in Canada, and 27 Nordstrom Rack stores. These additions increased our square footage by 6.4% and represented 2.8% of our total net sales for 2015.

Our full-price net sales, which consist of the U.S. full-line and Nordstrom.com channels, increased 2.6% compared with 2014, with comparable sales up 2.3%. These increases reflected continued momentum in our Nordstrom.com channel, which increased 15%, while U.S. full-line store net sales decreased 0.6% in 2015 compared with 2014. On a comparable basis, we experienced an increased volume of transactions partially offset by a decrease in the average number of items sold per transaction. Category leaders included Beauty and Women’s Apparel.

U.S. full-line store comparable sales decreased by 1.1%. The Northwest and Southwest were the top-performing full-line geographic regions.

Nordstrom, Inc. and subsidiaries 19

Within our off-price offering, Nordstrom Rack net sales increased 9.9%, compared with 2014, reflecting the accelerated expansion of new stores. Comparable sales decreased 1.0% for the year. Shoes and Cosmetics were the top-performing categories, while the South was the top-performing geographic region. Nordstrom Rack experienced an increase in the average retail price per item sold offset by a decrease in the total number of items sold. Sales per square foot of Nordstrom Rack decreased due to store expansion.

Nordstromrack.com/HauteLook experienced outsized growth, with a net sales increase of 47%.

Net Sales (2014 vs. 2013)

Total Company net sales for 2014 increased 7.8% compared with 2013, which was attributable to a comparable sales increase of 4.0%. During 2014, we opened three Nordstrom full-line stores, including our first store in Canada, 27 Nordstrom Rack stores and acquired Trunk Club. These additions represented 2.8% of our total net sales for 2014 and increased our square footage by 5.5%.

Full-price net sales for 2014 increased 3.8% compared with 2013, with comparable sales up 3.6%. These increases were largely due to the performance of our Nordstrom.com channel. Both the number of items sold and the average selling price increased on a comparable basis in 2014 compared with 2013. Category leaders included Accessories, Cosmetics and Men’s Apparel.

U.S. full-line store net sales for 2014 decreased 0.3% compared with 2013, which was primarily driven by a decrease in comparable sales. The top-performing geographic regions for 2014 were the Southeast and Southwest.

Our Nordstrom.com and Nordstromrack.com/HauteLook channels experienced outsized growth, with a net sales increase of 23% at Nordstrom.com and 22% at Nordstromrack.com/HauteLook compared with 2013. These increases were driven by both expanded merchandise selection and ongoing technology investments to enhance the customer experience.

Nordstrom Rack net sales increased 17% compared with 2013, reflecting incremental volume from existing stores and the impact of new store openings. On a comparable basis, the average selling price of Nordstrom Rack merchandise increased while the number of items sold was flat. Shoes and Accessories were the strongest-performing categories for 2014.

Retail Business Gross Profit

The following table summarizes the Retail Business gross profit: |

| | | | | | | | | | | |

Fiscal year | 2015 |

| | 2014 |

| | 2013 |

|

Retail gross profit |

| $4,934 |

| |

| $4,709 |

|

|

| $4,434 |

|

Retail gross profit as a % of net sales | 35.0 | % | | 35.9 | % |

| 36.4 | % |

Ending inventory per square foot |

| $67.97 |

| |

| $64.05 |

| |

| $58.84 |

|

Inventory turnover rate | 4.54 |

| | 4.67 |

| | 5.07 |

|

Gross Profit (2015 vs. 2014)

Our Retail gross profit rate decreased 92 basis points compared with 2014 primarily due to higher cost of sales driven by increased markdowns from lower than planned sales and in response to an elevated promotional environment during the second half of the year. Retail gross profit increased $225 in 2015 due to an increase in net sales, partially offset by increased markdowns.

Our inventory turnover rate decreased to 4.54 in 2015, from 4.67 in 2014, due to softer sales trends experienced during the second half of the year. Our ending inventory per square foot increased 6.1% in 2015, which outpaced our sales per square foot increase of 2.9%. As we continue to grow our online channels, we expect increases in inventory without corresponding increases in square footage.

Gross Profit (2014 vs. 2013)

Our Retail gross profit rate decreased 52 basis points compared with 2013 primarily due to increased markdowns and Nordstrom Rack’s accelerated store expansion. Retail gross profit increased $275 in 2014 compared with 2013 due to an increase in net sales, partially offset by increased markdowns.

Our inventory turnover rate decreased in 2014 and our ending inventory per square foot increased 8.8%. This increase in ending inventory per square foot outpaced our increase in sales per square foot of 3.9% primarily due to planned inventory growth related to Nordstrom Rack and Nordstromrack.com/HauteLook.

Retail Business Selling, General and Administrative Expenses

Retail Business selling, general and administrative expenses (“Retail SG&A”) are summarized in the following table: |

| | | | | | | | | | | |

Fiscal year | 2015 |

| | 2014 |

| | 2013 |

|

Selling, general and administrative expenses |

| $4,016 |

| |

| $3,588 |

| |

| $3,272 |

|

Selling, general and administrative expenses as a % of net sales | 28.5 | % | | 27.4 | % | | 26.9 | % |

Selling, General and Administrative Expenses (2015 vs. 2014)

Our Retail SG&A rate increased 112 basis points in 2015 compared with 2014 due to growth initiatives related to Trunk Club and Canada, higher fulfillment costs supporting online growth and asset impairment charges (see Note 1: Nature of Operations and Summary of Significant Accounting Policies in Item 8). Our Retail SG&A increased $428 in 2015 due primarily to increased sales and growth initiatives related to Canada and Trunk Club.

Selling, General and Administrative Expenses (2014 vs. 2013)

Our Retail SG&A rate increased 48 basis points in 2014 compared with 2013 due to expenses related to the acquisition of Trunk Club and ongoing fulfillment and technology investments. Our Retail SG&A expenses increased $316 in 2014 compared with 2013 due primarily to growth-related investments in fulfillment and technology.

CREDIT SEGMENT