Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTIONS 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-7977

NORDSON CORPORATION

(Exact name of Registrant as specified in its charter)

| Ohio | 34-0590250 | |

| (State of incorporation) | (I.R.S. Employer Identification No.) | |

| 28601 Clemens Road Westlake, Ohio |

44145 | |

| (Address of principal executive offices) | (Zip Code) | |

| (440) 892-1580 | ||

| (Registrant’s Telephone Number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act:

Common Shares, without par value

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||||

| (Do not check if smaller reporting company) | ||||||||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of Common Shares, no par value per share, held by nonaffiliates (based on the closing sale price on the Nasdaq Stock Market) as of April 30, 2014 was approximately $4,713,344,000.

There were 62,211,946 Common Shares outstanding as of November 28, 2014.

Documents incorporated by reference:

Portions of the Proxy Statement for the 2015 Annual Meeting — Part III

Table of Contents

Table of Contents

Table of Contents

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 75 | ||||||

| Item 9A. | Controls and Procedures | 75 | ||||||

| Item 9B. | Other Information | 75 | ||||||

| 75 | ||||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 75 | ||||||

| Item 11. | Executive Compensation | 76 | ||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 76 | ||||||

| Equity Compensation Table | 76 | |||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 76 | ||||||

| Item 14. | Principal Accountant Fees and Services | 76 | ||||||

| 77 | ||||||||

| Item 15. | Exhibits and Financial Statement Schedule | 77 | ||||||

| (a) 1. Financial Statements | 77 | |||||||

| (a) 2. Financial Statement Schedule | 77 | |||||||

| (a) 3. Exhibits | 77 | |||||||

| Signatures | 78 | |||||||

| Schedule II — Valuation and Qualifying Accounts and Reserves | 80 | |||||||

| Index to Exhibits | 81 | |||||||

| Subsidiaries of the Registrant | 85 | |||||||

| Consent of Independent Registered Public Accounting Firm | 88 | |||||||

| Certifications | 89 | |||||||

Table of Contents

NOTE REGARDING AMOUNTS AND FISCAL YEAR REFERENCES

In this annual report, all amounts related to United States dollars and foreign currency and to the number of Nordson Corporation’s common shares, except for per share earnings and dividend amounts, are expressed in thousands. Unless the context otherwise indicates, all references to “we” or the “Company” mean Nordson Corporation.

Unless otherwise noted, all references to years relate to our fiscal year ending October 31.

| Item 1. | Business |

General Description of Business

Nordson engineers, manufactures and markets differentiated products and systems used to dispense, apply and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids, to test and inspect for quality, and to treat and cure surfaces. These products are supported with extensive application expertise and direct global sales and service. We serve a wide variety of consumer non-durable, consumer durable and technology end markets including packaging, nonwovens, electronics, medical, appliances, energy, transportation, building and construction, and general product assembly and finishing.

Our strategy for long-term growth is based on solving customers’ needs globally. We are headquartered in Westlake, Ohio, and our products are marketed through a network of direct operations in more than 30 countries. Consistent with this global strategy, approximately 70 percent of our revenues were generated outside the United States in 2014.

We have 5,966 employees worldwide. Principal manufacturing facilities are located in the United States, Belgium, the People’s Republic of China, Germany, India, the Netherlands, Thailand and the United Kingdom.

We strive to be a vital, self-renewing, worldwide organization that, within the framework of ethical behavior and enlightened citizenship, grows and produces wealth for our customers, employees, shareholders and communities.

We operate for the purpose of creating balanced, long-term benefits for all of our constituencies.

Although every quarter may not produce increased sales, net income and earnings per share, or exceed the comparative prior year’s quarter, we do expect to produce long-term gains. When short-term swings occur, we do not intend to alter our basic objectives in efforts to mitigate the impact of these natural occurrences.

We drive organic growth by continually introducing new products and technology, providing high levels of customer service and support, capturing rapidly expanding opportunities in emerging geographies, and by leveraging existing technology into new applications. Additional growth comes through the acquisition of companies that serve international growth markets, share our business model characteristics and can leverage our global infrastructure.

We create benefits for our customers through a Package of Values®, which includes carefully engineered, durable products; strong service support; the backing of a well-established, worldwide company with financial and technical strengths; and a corporate commitment to deliver what was promised.

We strive to provide genuine customer satisfaction; it is the foundation upon which we continue to build our business.

Complementing our business strategy is the objective to provide opportunities for employee self-fulfillment, growth, security, recognition and equitable compensation. This goal is met through the Human Resources department’s facilitation of employee training and leadership training and the creation of on-the-job growth opportunities. The result is a highly qualified and professional global team capable of meeting corporate objectives.

We recognize the value of employee participation in the planning process. Strategic and operating plans are developed by all business units, resulting in a sense of ownership and commitment on the part of employees in accomplishing our objectives. In addition, employees participate in Lean and Six Sigma initiatives to continuously improve our processes.

1

Table of Contents

We are an equal opportunity employer.

We are committed to contributing approximately five percent of domestic pretax earnings to human welfare services, education and other charitable activities, particularly in communities where we have significant operations.

Financial Information About Operating Segments, Foreign and Domestic Operations and Export Sales

In accordance with generally accepted accounting standards, we have reported information about our three operating segments, including information about our foreign and domestic operations. This information is contained in Note 15 of Notes to Consolidated Financial Statements, which can be found in Part II, Item 8 of this Annual Report.

We engineer, manufacture and market differentiated products and systems used to dispense, apply and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids, to test and inspect for quality, and to treat and cure surfaces. Our technology-based systems can be found in manufacturing facilities around the world producing a wide range of goods for consumer durable, consumer non-durable and technology end markets. Equipment ranges from single-use components to manual, stand-alone units for low-volume operations to microprocessor-based automated systems for high-speed, high-volume production lines.

We market our products globally, primarily through a direct sales force, and also through qualified distributors and sales representatives. We have built a worldwide reputation for creativity and expertise in the design and engineering of high-technology application equipment that meets the specific needs of our customers. We create value for our customers by developing solutions that increase uptime, enable faster line speeds and reduce consumption of materials.

The following is a summary of the products and markets served by our operating segments:

| 1. | Adhesive Dispensing Systems |

This segment delivers our proprietary precision dispensing and processing technology to diverse markets for applications that commonly reduce material consumption, increase line efficiency and enhance product strength, durability, brand and appearance.

| • | Nonwovens — Dispensing, coating and laminating systems for applying adhesives, lotions, liquids and fibers to disposable products and continuous roll goods. Key strategic markets include adult incontinence products, baby diapers and child-training pants, feminine hygiene products and surgical drapes, gowns, shoe covers and face masks. |

| • | Packaging — Automated adhesive dispensing systems used in the rigid packaged goods industries. Key strategic markets include food and beverage packaging, pharmaceutical packaging, and other consumer goods packaging. |

| • | Polymer Processing — Components and systems used in the thermoplastic melt stream in plastic extrusion, injection molding, compounding, polymerization and recycling processes. Key strategic markets include flexible packaging, electronics, medical, building and construction, transportation and aerospace, and general consumer goods. |

| • | Product Assembly — Dispensing, coating and laminating systems for the assembly of plastic, metal and wood products, for paper and paperboard converting applications and for the manufacturing of continuous roll goods. Key strategic markets include appliances, automotive components, building and construction materials, electronics, furniture, solar energy, and the manufacturing of bags, sacks, books, envelopes and folding cartons. |

2

Table of Contents

| 2. | Advanced Technology Systems |

This segment integrates our proprietary product technologies found in progressive stages of a customer’s production process, such as surface treatment, precisely controlled automated, semi-automated or manual dispensing of material, and post-dispense bond testing and X-ray inspection to ensure quality. Related single-use plastic molded syringes, cartridges, tips, tubing and fluid connection components are used to dispense or control fluids in production processes or within customers’ end products. This segment primarily serves the specific needs of electronics, medical and related high-tech industries.

| • | Electronic Systems — Automated dispensing systems for high-speed, accurate application of a broad range of attachment, protection and coating fluids, and related gas plasma treatment systems for cleaning and conditioning surfaces prior to dispense. Key strategic markets include mobile phones, tablets, personal computers, wearable technology, liquid crystal displays, micro hard drives, microprocessors, printed circuit boards, micro-electronic mechanical systems (MEMS), and semiconductor packaging. |

| • | Fluid Management — Precision manual and semi-automated dispensers, highly engineered single-use plastic molded syringes, cartridges and tips, and fluid connection components, tubing and catheters. Products are used for applying and controlling the flow of adhesives, sealants, lubricants, and biomaterials in critical industrial production processes and within medical equipment and related surgical procedures. Key strategic markets include consumer goods, electronics, industrial assembly, solar, and medical. |

| • | Test and Inspection — Bond testing and automated optical and x-ray inspection systems used in the semiconductor and printed circuit board industries. Key strategic markets include mobile phones, tablets, personal computers, wearable technology, liquid crystal displays, micro hard drives, microprocessors, printed circuit boards, MEMS, and semiconductor packaging. |

| 3. | Industrial Coating Systems |

This segment provides both standard and highly-customized equipment used primarily for applying coatings, paint, finishes, sealants and other materials, and for curing and drying of dispensed material. This segment primarily serves the consumer durables market.

| • | Cold Materials — Automated and manual dispensing products and systems used to apply multiple component adhesive and sealant materials in the general industrial and transportation manufacturing industries. Key strategic markets include aerospace, alternative energy, appliances, automotive, building and construction, composites, electronics and medical. |

| • | Container Coating — Automated and manual dispensing and curing systems used to coat and cure containers. Key strategic markets include beverage containers and food cans. |

| • | Curing and Drying Systems — Ultraviolet equipment used primarily in curing and drying operations for specialty coatings, semiconductor materials and paints. Key strategic markets include electronics, containers, and durable goods products. |

| • | Liquid Finishing — Automated and manual dispensing systems used to apply liquid paints and coatings to consumer and industrial products. Key strategic markets include automotive components, agriculture, construction, metal shelving and drums. |

| • | Powder Coating — Automated and manual dispensing systems used to apply powder paints and coatings to a variety of metal, plastic and wood products. Key strategic markets include agriculture and construction equipment, appliances, automotive components, home and office furniture, lawn and garden equipment, pipe coating, and wood and metal shelving. |

3

Table of Contents

Manufacturing and Raw Materials

Our production operations include machining, molding and assembly. We manufacture specially designed parts and assemble components into finished equipment. Many components are made in standard modules that can be used in more than one product or in combination with other components for a variety of models. We have principal manufacturing operations and sources of supply in the United States in Ohio, Georgia, California, Colorado, Michigan, Minnesota, New Jersey, North Carolina, Pennsylvania, Rhode Island, Virginia and Wisconsin; as well as in Belgium, the People’s Republic of China, Germany, India, Mexico, the Netherlands, Thailand and the United Kingdom.

Principal materials used to make our products are metals and plastics, typically in sheets, bar stock, castings, forgings, tubing and pellets. We also purchase many electrical and electronic components, fabricated metal parts, high-pressure fluid hoses, packings, seals and other items integral to our products. Suppliers are competitively selected based on cost, quality and service. All significant raw materials that we use are available through multiple sources.

Senior operating executives supervise an extensive quality control program for our equipment, machinery and systems.

Natural gas and other fuels are our primary energy sources. However, standby capacity for alternative sources is available if needed.

We maintain procedures to protect our intellectual property (including patents, trademarks and copyrights) both domestically and internationally. Risk factors associated with our intellectual property are discussed in Item 1A. Risk Factors.

Our intellectual property portfolios include valuable patents, trade secrets, know-how, domain names, trademarks and trade names. As of October 31, 2014, we held 534 United States patents and 1,181 foreign patents and had 241 United States patent applications pending and 990 foreign patent applications pending, but there is no assurance that any patent application will be issued. We continue to apply for and obtain patent protection for new products on an ongoing basis.

Patents covering individual products extend for varying periods according to the date of filing or grant and legal term of patents in various countries where a patent is obtained. Our current patent portfolio has expiration dates ranging from November 2014 to July 2039. The actual protection a patent provides, which can vary from country to country, depends upon the type of patent, the scope of its coverage, and the availability of legal remedies in each country. We believe, however, that the duration of our patents generally exceeds the life cycles of the technologies disclosed and claimed in the patents.

We believe our trademarks are important assets and we aggressively manage our brands. We also own a number of trademarks in the United States and foreign countries, including registered trademarks for Nordson, Asymtek, Dage, EFD, Micromedics, Value Plastics, and Xaloy and various common law trademarks which are important to our business, inasmuch as they identify Nordson and our products to our customers. As of October 31, 2014, we had a total of 1,633 trademark registrations in the United States and in various foreign countries.

We rely upon a combination of nondisclosure and other contractual arrangements and trade secret laws to protect our proprietary rights and also enter into confidentiality and intellectual property agreements with our employees that require them to disclose any inventions created during employment, convey all rights to inventions to us, and restrict the distribution of proprietary information.

We protect and promote our intellectual property portfolio and take those actions we deem appropriate to enforce our intellectual property rights and to defend our right to sell our products. Although in aggregate our intellectual property is important to our operations, we do not believe that the loss of any one patent, trademark, or group of related patents or trademarks would have a material adverse effect on our results of operations or financial position of our overall business.

4

Table of Contents

Seasonal Variation in Business

Generally, the highest volume of sales occurs in our fourth quarter due in large part to the timing of customers’ capital spending programs. Accordingly, first quarter sales volume is typically the lowest of the year due to timing of customers’ capital spending programs and customer holiday shutdowns.

No special or unusual practices affect our working capital. We generally require advance payments as deposits on customized equipment and systems and, in certain cases, require progress payments during the manufacturing of these products. We continue to initiate new processes focused on reduction of manufacturing lead times, resulting in lower investment in inventory while maintaining the capability to respond promptly to customer needs.

We serve a broad customer base, both in terms of industries and geographic regions. In 2014, no single customer accounted for ten percent or more of sales.

Our backlog of open orders increased to approximately $223,000 at October 31, 2014 from approximately $211,000 at October 31, 2013. The amounts for both years were calculated based upon exchange rates in effect at October 31, 2014. The increase is primarily due to orders within the Advanced Technology segment, as well as from 2014 acquisitions. All orders in the 2014 year-end backlog are expected to be shipped to customers in 2015.

Our business neither includes nor depends upon a significant amount of governmental contracts or subcontracts. Therefore, no material part of our business is subject to renegotiation or termination at the option of the government.

Our equipment is sold in competition with a wide variety of alternative bonding, sealing, finishing, coating, processing, testing, inspecting, and fluid control techniques. Potential uses for our equipment include any production processes that require preparation, modification or curing of surfaces; dispensing, application, processing or control of fluids and materials; or testing and inspecting for quality.

Many factors influence our competitive position, including pricing, product quality and service. We maintain a leadership position in our business segments by delivering high-quality, innovative products and technologies, as well as service and technical support. Working with customers to understand their processes and developing the application solutions that help them meet their production requirements also contributes to our leadership position. Our worldwide network of direct sales and technical resources also is a competitive advantage.

Investments in research and development are important to our long-term growth, enabling us to keep pace with changing customer and marketplace needs through the development of new products and new applications for existing products. We place strong emphasis on technology developments and improvements through internal engineering and research teams. Research and development expenses were approximately $47,536 in 2014, compared with approximately $47,973 in 2013 and $36,535 in 2012. As a percentage of sales, research and development expenses were approximately 2.8, 3.1 and 2.6 percent in 2014, 2013 and 2012, respectively.

We are subject to extensive federal, state, local and foreign environmental, safety and health laws and regulations concerning, among other things, emissions to the air, discharges to land and water and the generation, handling, treatment and disposal of hazardous waste and other materials. Under certain of these laws, we can be held strictly liable for hazardous substance contamination of any real property we have ever owned, operated or used as a disposal site or for natural resource damages associated with such contamination. We are also required to maintain various related permits and licenses, many of which require periodic modification and renewal. The operation of manufacturing plants unavoidably entails environmental, safety and health risks, and we could incur material unanticipated costs or liabilities in the future if any of these risks were realized in ways or to an extent that we did not anticipate.

5

Table of Contents

We believe that we operate in compliance, in all material respects, with applicable environmental laws and regulations. Compliance with environmental laws and regulations requires continuing management effort and expenditures. We have incurred, and will continue to incur, costs and capital expenditures to comply with these laws and regulations and to obtain and maintain the necessary permits and licenses. We believe that the cost of complying with environmental laws and regulations will not have a material effect on our earnings, liquidity or competitive position but cannot assure that material compliance-related costs and expenses may not arise in the future. For example, future adoption of new or amended environmental laws, regulations or requirements or newly discovered contamination or other circumstances that could require us to incur costs and expenses that may have a material effect, but cannot be presently anticipated.

We believe that policies, practices and procedures have been properly designed to prevent unreasonable risk of material environmental damage arising from our operations. We accrue for estimated environmental liabilities with charges to expense and believe our environmental accrual is adequate to provide for our portion of the costs of all such known environmental liabilities. Compliance with federal, state and local environmental protection laws during 2014 had no material effect on our capital expenditures, earnings or competitive position. Based upon consideration of currently available information, we believe liabilities for environmental matters will not have a material adverse affect on our financial position, operating results or liquidity, but we cannot assure that material environmental liabilities may not arise in the future.

As of October 31, 2014, we had 5,966 full-time and part-time employees, including 146 at our Amherst, Ohio, facility who are represented by a collective bargaining agreement that expires on October 30, 2016 and 64 at our New Castle, Pennsylvania facility who are represented by collective bargaining agreements that expire on August 31, 2017 and September 30, 2017. No work stoppages have been experienced at any of our facilities during any of the periods covered by this report.

Our proxy statement, annual report to the Securities and Exchange Commission (Form 10-K), quarterly reports (Form 10-Q) and current reports (Form 8-K) and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge at http://www.nordson.com/investors as soon as reasonably practical after such material is electronically filed with, or furnished to, the SEC. Copies of these reports may also be obtained free of charge by sending written requests to Corporate Communications, Nordson Corporation, 28601 Clemens Road, Westlake, Ohio 44145.

6

Table of Contents

| Item 1A. | Risk Factors |

In an enterprise as diverse as ours, a wide range of factors could affect future performance. We discuss in this section some of the risk factors that, if they actually occurred, could materially and adversely affect our business, financial condition, value and results of operations. You should consider these risk factors in connection with evaluating the forward-looking statements contained in this Annual Report on Form 10-K because these factors could cause our actual results and financial condition to differ materially from those projected in forward-looking statements.

The significant risk factors affecting our operations include the following:

Changes in United States or international economic conditions could adversely affect the profitability of any of our operations.

In 2014, approximately 30 percent of our revenue was derived from domestic customers, while approximately 70 percent was derived from international customers. Our largest markets include appliance, automotive, construction, container, electronics assembly, food and beverage, furniture, life sciences and medical, metal finishing, nonwovens, packaging, paper and paperboard converting, plastics processing and semiconductor. A slowdown in any of these specific end markets could directly affect our revenue stream and profitability.

A portion of our product sales is attributable to industries and markets, such as the semiconductor, mobile electronics and metal finishing industries, which historically have been cyclical and sensitive to relative changes in supply and demand and general economic conditions. The demand for our products depends, in part, on the general economic conditions of the industries or national economies of our customers. Downward economic cycles in our customers’ industries or countries may reduce sales of some of our products. It is not possible to predict accurately the factors that will affect demand for our products in the future.

Any significant downturn in the health of the general economy, globally, regionally or in the markets in which we sell products, could have an adverse effect on our revenues and financial performance, resulting in impairment of assets.

Our growth strategy includes acquisitions, and we may not be able to execute on our acquisition strategy or integrate acquisitions successfully.

Our recent historical growth has depended, and our future growth is likely to continue to depend, in part on our acquisition strategy and the successful integration of acquired businesses into our existing operations. We intend to continue to seek additional acquisition opportunities both to expand into new markets and to enhance our position in existing markets throughout the world. We cannot assure, however, that we will be able to successfully identify suitable acquisition opportunities, prevail against competing potential acquirers, negotiate appropriate acquisition terms, obtain financing that may be needed to consummate such acquisitions, complete proposed acquisitions, successfully integrate acquired businesses into our existing operations or expand into new markets. In addition, we cannot assure that any acquisition, once successfully integrated, will perform as planned, be accretive to earnings, or prove to be beneficial to our operations and cash flow.

The success of our acquisition strategy is subject to other risks and uncertainties, including:

| • | our ability to realize operating efficiencies, synergies or other benefits expected from an acquisition, and possible delays in realizing the benefits of the acquired company or products; |

| • | diversion of management’s time and attention from other business concerns; |

| • | difficulties in retaining key employees, customers or suppliers of the acquired business; |

| • | difficulties in maintaining uniform standards, controls, procedures and policies throughout acquired companies; |

| • | adverse effects on existing business relationships with suppliers or customers; |

| • | the risks associated with the assumption of contingent or undisclosed liabilities of acquisition targets; and |

| • | the ability to generate future cash flows or the availability of financing. |

7

Table of Contents

In addition, an acquisition could adversely impact our operating performance as a result of the incurrence of acquisition-related debt, pre-acquisition potential tax liabilities, acquisition expenses, the amortization of acquisition-acquired assets, or possible future impairments of goodwill or intangible assets associated with the acquisition.

We may also face liability with respect to acquired businesses for violations of environmental laws occurring prior to the date of our acquisition, and some or all of these liabilities may not be covered by environmental insurance secured to mitigate the risk or by indemnification from the sellers from which we acquired these businesses. We could also incur significant costs, including, but not limited to, remediation costs, natural resources damages, civil or criminal fines and sanctions and third-party claims, as a result of past or future violations of, or liabilities associated with environmental laws.

If we fail to develop new products, or our customers do not accept the new products we develop, our revenue and profitability could be adversely impacted.

Innovation is critical to our success. We believe that we must continue to enhance our existing products and to develop and manufacture new products with improved capabilities in order to continue to be a leading provider of precision technology solutions for the industrial equipment market. We also believe that we must continue to make improvements in our productivity in order to maintain our competitive position. Difficulties or delays in research, development or production of new products or failure to gain market acceptance of new products and technologies may reduce future sales and adversely affect our competitive position. We continue to invest in the development and marketing of new products. There can be no assurance that we will have sufficient resources to make such investments, that we will be able to make the technological advances necessary to maintain competitive advantages or that we can recover major research and development expenses. If we fail to make innovations, launch products with quality problems or the market does not accept our new products, our financial condition, results of operations, cash flows and liquidity could be adversely affected. In addition, as new or enhanced products are introduced, we must successfully manage the transition from older products to minimize disruption in customers’ ordering patterns, avoid excessive levels of older product inventories and ensure that we can deliver sufficient supplies of new products to meet customers’ demands.

Increased IT security threats and more sophisticated and targeted computer crime could pose a risk to our systems, networks, products, solutions and services.

Increased global IT security threats and more sophisticated and targeted computer crime pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. While we attempt to mitigate these risks by employing a number of measures, including employee training, comprehensive monitoring of our networks and systems, and maintenance of backup and protective systems, our systems, networks, products, solutions and services remain potentially vulnerable to advanced persistent threats. Depending on their nature and scope, such threats could potentially lead to the compromising of confidential information, improper use of our systems and networks, manipulation and destruction of data, defective products, production downtimes and operational disruptions, which in turn could adversely affect our reputation, competitiveness and results of operations.

If our intellectual property protection is inadequate, others may be able to use our technologies and tradenames and thereby reduce our ability to compete, which could have a material adverse effect on us, our financial condition and results of operations.

We regard much of the technology underlying our products and the trademarks under which we market our products as proprietary. The steps we take to protect our proprietary technology may be inadequate to prevent misappropriation of our technology, or third parties may independently develop similar technology. We rely on a combination of patents, trademark, copyright and trade secret laws, employee and third-party non-disclosure agreements and other contracts to establish and protect our technology and other intellectual property rights. The agreements may be breached or terminated, and we may not have adequate remedies for any breach, and existing trade secrets, patent and copyright law afford us limited protection. Policing unauthorized use of our intellectual property is difficult. A third party could copy or otherwise obtain and use our products or technology without authorization. Litigation may be necessary for us to defend against claims of infringement or to protect our intellectual property rights and could result in substantial cost to us and diversion of our efforts. Further, we might not prevail in such litigation, which could harm our business.

8

Table of Contents

Our products could infringe on the intellectual property of others, which may cause us to engage in costly litigation and, if we are not successful, could cause us to pay substantial damages and prohibit us from selling our products.

Third parties may assert infringement or other intellectual property claims against us based on their patents or other intellectual property claims, and we may have to pay substantial damages, possibly including treble damages, if it is ultimately determined that our products infringe. We may have to obtain a license to sell our products if it is determined that our products infringe upon another party’s intellectual property. We might be prohibited from selling our products before we obtain a license, which, if available at all, may require us to pay substantial royalties. Even if infringement claims against us are without merit, defending these types of lawsuits takes significant time, may be expensive and may divert management attention from other business concerns.

Any impairment in the value of our intangible assets, including goodwill, would negatively affect our operating results and total capitalization.

Our total assets reflect substantial intangible assets, primarily goodwill. The goodwill results from our acquisitions and represents the excess of cost over the fair value of the identifiable net assets we acquired. We assess at least annually whether there has been any impairment in the value of our intangible assets. If future operating performance at one or more of our business units were to fall significantly below current levels, if competing or alternative technologies emerge, if market conditions for acquired businesses decline, if significant and prolonged negative industry or economic trends exist, if our stock price and market capitalization declines, or if future cash flow estimates decline, we could incur under current applicable accounting rules, a non-cash charge to operating earnings for goodwill impairment. Any determination requiring the write-off of a significant portion of unamortized intangible assets would negatively affect our results of operations and equity book value, the effect of which could be material.

Significant movements in foreign currency exchange rates or change in monetary policy may harm our financial results.

We are exposed to fluctuations in foreign currency exchange rates, particularly with respect to the euro, the yen, the pound sterling and the Chinese yuan. Any significant change in the value of the currencies of the countries in which we do business against the United States dollar could affect our ability to sell products competitively and control our cost structure, which could have a material adverse effect on our business, financial condition and results of operations. For additional detail related to this risk, see Item 7A, Quantitative and Qualitative Disclosure About Market Risk.

The majority of our consolidated revenues in 2014 were generated in currencies other than the United States dollar, which is our reporting currency. We recognize foreign currency transaction gains and losses arising from our operations in the period incurred. As a result, currency fluctuations between the United States dollar and the currencies in which we do business have caused and will continue to cause foreign currency transaction and translation gains and losses, which historically have been material and could continue to be material. We cannot predict the effects of exchange rate fluctuations upon our future operating results because of the number of currencies involved, the variability of currency exposures and the potential volatility of currency exchange rates. We take actions to manage our foreign currency exposure, such as entering into hedging transactions, where available, but we cannot assure that our strategies will adequately protect our consolidated operating results from the effects of exchange rate fluctuations.

We also face risks arising from the imposition of exchange controls and currency devaluations. Exchange controls may limit our ability to convert foreign currencies into United States dollars or to remit dividends and other payments by our foreign subsidiaries or customers located in or conducting business in a country imposing controls. Currency devaluations diminish the United States dollar value of the currency of the country instituting the devaluation and, if they occur or continue for significant periods, could adversely affect our earnings or cash flow.

9

Table of Contents

We may be exposed to liabilities under the Foreign Corrupt Practices Act (FCPA), which could have a material adverse effect on our business.

We are subject to compliance with various laws and regulations, including the FCPA and similar worldwide anti-bribery laws, which generally prohibit companies and their intermediaries from engaging in bribery or making other improper payments to foreign officials for the purpose of obtaining or retaining business or gaining an unfair business advantage. The FCPA also requires proper record keeping and characterization of such payments in our reports filed with the SEC. Our employees are trained and required to comply with these laws, and we are committed to legal compliance and corporate ethics. Violations of these laws could result in severe criminal or civil sanctions and financial penalties and other consequences that may have a material adverse effect on our business, reputation, financial condition or results of operations.

Inability to access capital could impede growth or the repayment or refinancing of existing indebtedness.

The limits imposed on us by the restrictive covenants contained in our credit facilities could prevent us from making acquisitions or cause us to lose access to these facilities.

Our existing credit facilities contain restrictive covenants that limit our ability to, among other things:

| • | borrow money or guarantee the debts of others; |

| • | use assets as security in other transactions; |

| • | make restricted payments or distributions; and |

| • | sell or acquire assets or merge with or into other companies. |

In addition, our credit facilities require us to meet financial ratios, including a “Leverage Ratio” and an “Interest Coverage Ratio”, both as defined in the credit facilities.

These restrictions could limit our ability to plan for or react to market conditions or meet extraordinary capital needs and could otherwise restrict our financing activities.

Our ability to comply with the covenants and other terms of our credit facilities will depend on our future operating performance. If we fail to comply with such covenants and terms, we may be in default and the maturity of the related debt could be accelerated and become immediately due and payable. We may be required to obtain waivers from our lenders in order to maintain compliance under our credit facilities, including waivers with respect to our compliance with certain financial covenants. If we are unable to obtain necessary waivers and the debt under our credit facilities is accelerated, we would be required to obtain replacement financing at prevailing market rates.

We may need new or additional financing in the future to expand our business or refinance existing indebtedness. If we are unable to access capital on satisfactory terms and conditions, we may not be able to expand our business or meet our payment requirements under our existing credit facilities. Our ability to obtain new or additional financing will depend on a variety of factors, many of which are beyond our control. We may not be able to obtain new or additional financing because we have substantial debt or because we may not have sufficient cash flow to service or repay our existing or future debt. In addition, depending on market conditions and our financial performance, neither debt nor equity financing may be available on satisfactory terms or at all. Finally, as a consequence of worsening financial market conditions, our credit facility providers may not provide the agreed credit if they become undercapitalized.

Changes in interest rates could adversely affect us.

Any period of interest rate increases may also adversely affect our profitability. At October 31, 2014, we had $799,800 of total debt and notes payable outstanding, of which 68 percent was priced at interest rates that float with the market. A one percent increase in the interest rate on the floating rate debt in 2014 would have resulted in approximately $4,201 of additional interest expense. A higher level of floating rate debt would increase the exposure to changes in interest rates. For additional detail related to this risk, see Item 7A, Quantitative and Qualitative Disclosure About Market Risk.

10

Table of Contents

Failure to retain our existing senior management team or the inability to attract and retain qualified personnel could hurt our business and inhibit our ability to operate and grow successfully.

Our success will continue to depend to a significant extent on the continued service of our executive management team and the ability to recruit, hire and retain other key management personnel to support our growth and operational initiatives and replace executives who retire or resign. Failure to retain our leadership team and attract and retain other important management and technical personnel could place a constraint on our global growth and operational initiatives, possibly resulting in inefficient and ineffective management and operations, which would likely harm our revenues, operations and product development efforts and eventually result in a decrease in profitability.

The level of returns on pension plan assets and changes in the actuarial assumptions used could adversely affect us.

Our operating results may be positively or negatively impacted by the amount of expense we record for our defined benefit pension plans. U.S. GAAP requires that we calculate pension expense using actuarial valuations, which are dependent upon our various assumptions including estimates of expected long-term rate of return on plan assets, discount rates for future payment obligations, and the expected rate of increase in future compensation levels. Our pension expense and funding requirements may also be affected by our actual return on plan assets and by legislation and other government regulatory actions. Changes in assumptions, laws or regulations could lead to variability in operating results and could have a material adverse impact on liquidity.

New regulations related to conflict-free minerals may result in additional expenses that could affect our financial condition and business operations.

Pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act, the SEC promulgated final rules regarding disclosure of the use of certain minerals, known as conflict minerals, which are mined from the Democratic Republic of the Congo and adjoining countries, as well as procedures regarding a manufacturer’s efforts to prevent the sourcing of such minerals and metals produced from those minerals. These new disclosure obligations will require continuing due diligence efforts to support our future disclosure requirements. We incurred and will continue to incur costs associated with complying with such disclosure requirements, including costs associated with canvassing our supply chain to determine the source country of any conflict minerals incorporated in our products, in addition to the cost of remediation and other changes to products, processes, or sources of supply as a consequence of such verification activities. In addition, the implementation of these rules could adversely affect the sourcing, supply, and pricing of materials used in our products.

Political conditions in foreign countries in which we operate could adversely affect us.

We conduct our manufacturing, sales and distribution operations on a worldwide basis and are subject to risks associated with doing business outside the United States. In 2014, approximately 70 percent of our total sales were to customers outside the United States. We expect that international operations and United States export sales will continue to be important to our business for the foreseeable future. Both sales from international operations and export sales are subject in varying degrees to risks inherent in doing business outside the United States. Such risks include, but are not limited to, the following:

| • | risks of economic instability; |

| • | unanticipated or unfavorable circumstances arising from host country laws or regulations; |

| • | threats of war, terrorism or governmental instability; |

| • | significant foreign and U.S. taxes on repatriated cash; |

| • | restrictions on the transfer of funds into or out of a country; |

| • | currency exchange rate fluctuations; |

| • | potential negative consequences from changes to taxation policies; |

| • | the disruption of operations from labor and political disturbances; |

| • | the imposition of tariffs, import or export licensing requirements; and |

| • | exchange controls or other trade restrictions including transfer pricing restrictions when products produced in one country are sold to an affiliated entity in another country. |

11

Table of Contents

Any of these events could reduce the demand for our products, limit the prices at which we can sell our products, or otherwise have an adverse effect on our operating performance.

Our international operations also depend upon favorable trade relations between the U.S. and those foreign countries in which our customers, subcontractors and materials suppliers have operations. A protectionist trade environment in either the U.S. or those foreign countries in which we do business, such as a change in the current tariff structures, export compliance or other trade policies, may materially and adversely affect our ability to sell our products in foreign markets.

Our business and operating results may be adversely affected by natural disasters or other catastrophic events beyond our control.

While we have taken precautions to prevent production and service interruptions at our global facilities, severe weather conditions such as hurricanes or tornadoes, as well major earthquakes and other natural disasters, in areas in which we have manufacturing facilities or from which we obtain products may cause physical damage to our properties, closure of one or more of our manufacturing or distribution facilities, lack of an adequate work force in a market, temporary disruption in the supply of inventory, disruption in the transport of products and utilities, and delays in the delivery of products to our customers. Any of these factors may disrupt our operations and adversely affect our financial condition and results of operations.

The insurance that we maintain may not fully cover all potential exposures.

We maintain property, business interruption and casualty insurance but such insurance may not cover all risks associated with the hazards of our business and is subject to limitations, including deductibles and maximum liabilities covered. We are potentially at risk if one or more of our insurance carriers fail. Additionally, severe disruptions in the domestic and global financial markets could adversely impact the ratings and survival of some insurers. In the future, we may not be able to obtain coverage at current levels, and our premiums may increase significantly on coverage that we maintain.

| Item 1B. | Unresolved Staff Comments |

None.

12

Table of Contents

| Item 2. | Properties |

The following table summarizes our principal properties as of October 31, 2014:

| Location |

Description of Property |

Approximate Square Feet |

||||

| Amherst, Ohio 2, 3 |

A manufacturing, laboratory and office complex | 521,000 | ||||

| Duluth, Georgia 1 |

A manufacturing, laboratory and office building | 176,000 | ||||

| Swainsboro, Georgia1 |

A manufacturing building (leased) | 136,000 | ||||

| East Providence, Rhode Island 2 |

A manufacturing, warehouse and office building | 116,000 | ||||

| Pulaski, Virginia 1 |

A manufacturing, warehouse and office building | 101,000 | ||||

| Carlsbad, California 2 |

Two manufacturing and office buildings (leased) | 88,000 | ||||

| Robbinsville, New Jersey 2 |

A manufacturing, warehouse and office building (leased) | 88,000 | ||||

| Chippewa Falls, Wisconsin 1 |

A manufacturing, warehouse and office building (leased) | 86,000 | ||||

| New Castle, Pennsylvania 1 |

A manufacturing, warehouse and office building | 76,000 | ||||

| Youngstown, Ohio 1 |

A manufacturing, warehouse and office building (leased) | 58,000 | ||||

| Chippewa Falls, Wisconsin 1 |

A manufacturing, warehouse and office building (leased) | 45,000 | ||||

| Ft. Collins, Colorado 2 |

A manufacturing, warehouse and office building (leased) | 42,000 | ||||

| Vista, California 2 |

A manufacturing building (leased) | 41,000 | ||||

| Hickory, North Carolina 1 |

A manufacturing, warehouse and office building (leased) | 41,000 | ||||

| Eagan, Minnesota 2 |

A manufacturing, warehouse and office building (leased) | 35,000 | ||||

| Plymouth, Michigan 3 |

Two manufacturing, warehouse and office buildings (leased) | 35,000 | ||||

| Westlake, Ohio |

Corporate headquarters | 28,000 | ||||

| Chippewa Falls, Wisconsin 1 |

An engineering and laboratory building (leased) | 20,000 | ||||

| Shanghai, China 1, 3 |

A manufacturing, warehouse and office building (leased) | 134,000 | ||||

| Lüneburg, Germany 1 |

A manufacturing and laboratory building | 129,000 | ||||

| Shanghai, China 1, 2, 3 |

An office and laboratory building | 86,000 | ||||

| Bangalore, India 1, 2, 3 |

A manufacturing, warehouse and office building | 56,000 | ||||

| Maastricht, Netherlands 1, 2, 3 |

A manufacturing, warehouse and office building | 54,000 | ||||

| Shanghai, China 1 |

A manufacturing, warehouse and office building (leased) | 53,000 | ||||

| Chonburi, Thailand1 |

A manufacturing, warehouse and office building | 52,000 | ||||

| Münster, Germany1 |

A manufacturing, warehouse and office building (leased) | 51,000 | ||||

| Erkrath, Germany 1, 2, 3 |

An office, laboratory and warehouse building (leased) | 48,000 | ||||

| Deurne, Netherlands 2 |

A manufacturing, warehouse and office building (leased) | 46,000 | ||||

| Temse, Belgium 1 |

A manufacturing, warehouse and office building (leased) | 43,000 | ||||

| Münster, Germany1 |

A manufacturing, warehouse and office building (leased) | 43,000 | ||||

| Suzhou, China 2 |

A manufacturing, warehouse and office building (leased) | 42,000 | ||||

| Tokyo, Japan 1, 2, 3 |

An office, laboratory and warehouse building (leased) | 42,000 | ||||

| Aylesbury, U.K. 1, 2 |

A manufacturing, warehouse and office building (leased) | 36,000 | ||||

| Shanghai, China 1 |

An engineering and laboratory building | 24,000 | ||||

| El Marques, Mexico 1, 2, 3 |

A warehouse and office building (leased) | 22,000 | ||||

| Singapore 1, 2, 3 |

A warehouse and office building (leased) | 16,000 | ||||

| Lagny Sur Marne, France 1, 3 |

An office building (leased) | 6,000 | ||||

| Segrate, Italy 1, 3 |

An office, laboratory and warehouse building (leased) | 5,000 | ||||

Business Segment — Property Identification Legend

1 — Adhesive Dispensing Systems

2 — Advanced Technology Systems

3 — Industrial Coating Systems

13

Table of Contents

The facilities listed have adequate, suitable and sufficient capacity (production and nonproduction) to meet present and foreseeable demand for our products.

Other properties at international subsidiary locations and at branch locations within the United States are leased. Lease terms do not exceed 25 years and generally contain a provision for cancellation with some penalty at an earlier date. Information about leases is reported in Note 10 of Notes to Consolidated Financial Statements that can be found in Part II, Item 8 of this document.

| Item 3. | Legal Proceedings |

We are involved in pending or potential litigation regarding environmental, product liability, patent, contract, employee and other matters arising from the normal course of business. Including the environmental matter discussed below, it is our opinion, after consultation with legal counsel, that resolutions of these matters are not expected to result in a material effect on our financial condition, quarterly or annual operating results or cash flows.

Environmental — We have voluntarily agreed with the City of New Richmond, Wisconsin and other Potentially Responsible Parties to share costs associated with the remediation of the City of New Richmond municipal landfill (the “Site”) and constructing a potable water delivery system serving the impacted area down gradient of the Site. At October 31, 2014 and 2013, our accrual for the ongoing operation, maintenance and monitoring obligation at the Site was $615 and $668, respectively.

The liability for environmental remediation represents management’s best estimate of the probable and reasonably estimable undiscounted costs related to known remediation obligations. The accuracy of our estimate of environmental liability is affected by several uncertainties such as additional requirements that may be identified in connection with remedial activities, the complexity and evolution of environmental laws and regulations, and the identification of presently unknown remediation requirements. Consequently, our liability could be different than our current estimate. However, we do not expect that the costs associated with remediation will have a material adverse effect on our financial condition or results of operations.

| Item 4. | Mine Safety Disclosures |

None.

14

Table of Contents

Executive Officers of the Company

Our executive officers as of October 31, 2014, were as follows:

| Name |

Age | Officer Since | Position or Office with The Company and Business Experience During the Past Five (5) Year Period | |||||||

| Michael F. Hilton |

60 | 2010 | President and Chief Executive Officer, 2010 Senior Vice President and General Manager-Electronics and Performance Materials Segment of Air Products and Chemicals, Inc., 2007 | |||||||

| John J. Keane |

53 | 2003 | Senior Vice President, 2005 | |||||||

| Gregory P. Merk |

43 | 2006 | Senior Vice President, 2013 Vice President, 2006 | |||||||

| Gregory A. Thaxton |

53 | 2007 | Senior Vice President, Chief Financial Officer, 2012 | |||||||

| Vice President, Chief Financial Officer, 2008 | ||||||||||

| Douglas C. Bloomfield |

55 | 2005 | Vice President, 2005 | |||||||

| James E. DeVries |

55 | 2012 | Vice President, 2012 Vice President, Global Continuous Improvement, 2011 Vice President, North America and China, Engineering (Adhesive Dispensing Systems), 2010 | |||||||

| Vice President, Adhesive Dispensing Systems, North America, 2009 | ||||||||||

| Shelly M. Peet |

49 | 2007 | Vice President, 2009 | |||||||

| Robert E. Veillette |

62 | 2007 | Vice President, General Counsel and Secretary, 2007 | |||||||

15

Table of Contents

| Item 5. | Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information and Dividends

(a) Our common shares are listed on the Nasdaq Global Select Market under the symbol NDSN. As of November 28, 2014, there were 1,577 registered shareholders. The table below is a summary of dividends paid per common share and the range of closing market prices during each quarter of 2014 and 2013.

| Dividend Paid |

Common Share Price |

|||||||||||

| Quarters |

High | Low | ||||||||||

| 2014: |

||||||||||||

| First |

$ | .18 | $ | 75.02 | $ | 69.14 | ||||||

| Second |

.18 | 74.54 | 67.98 | |||||||||

| Third |

.18 | 84.30 | 74.08 | |||||||||

| Fourth |

.22 | 81.50 | 67.75 | |||||||||

| 2013: |

||||||||||||

| First |

$ | .15 | $ | 67.62 | $ | 58.89 | ||||||

| Second |

.15 | 70.60 | 61.33 | |||||||||

| Third |

.15 | 75.00 | 67.26 | |||||||||

| Fourth |

.18 | 74.90 | 66.65 | |||||||||

Source: NASDAQ OMX

While we have historically paid dividends to shareholders of our common stock on a quarterly basis, the declaration and payment of future dividends will depend on many factors, including but not limited to, our earnings, financial condition, business development needs and regulatory considerations, and are at the discretion of our board of directors.

16

Table of Contents

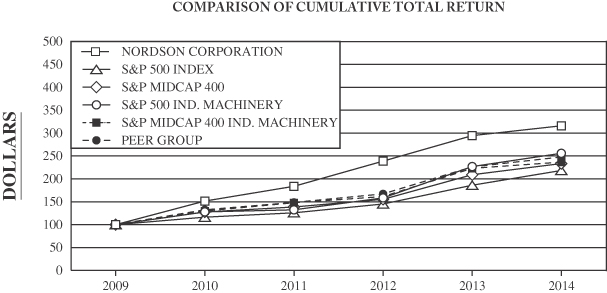

The following is a graph that compares the five-year cumulative return, calculated on a dividend-reinvested basis, from investing $100 on November 1, 2009 in Nordson common shares, the S&P 500 Index, the S&P MidCap 400 Index, the S&P 500 Industrial Machinery Index, the S&P MidCap 400 Industrial Machinery Index and our Proxy Peer Group. Our Proxy Peer Group includes: AIN, AME, ATU, B, CLC, DCI, ENTG, ESL, FLIR, GGG, GTI, GTLS, IEX, LECO, ROP, VECO, WTS, and WWD.

| Company/Market/Peer Group | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||||

|

Nordson Corporation |

$ | 100.00 | $ | 151.62 | $ | 183.67 | $ | 238.70 | $ | 294.28 | $ | 315.68 | ||||||||||||

|

S&P 500 Index |

$ | 100.00 | $ | 116.52 | $ | 125.94 | $ | 145.09 | $ | 186.11 | $ | 218.25 | ||||||||||||

|

S&P MidCap 400 |

$ | 100.00 | $ | 127.64 | $ | 138.55 | $ | 155.32 | $ | 209.02 | $ | 233.38 | ||||||||||||

|

S&P 500 Ind. Machinery |

$ | 100.00 | $ | 127.95 | $ | 132.38 | $ | 158.43 | $ | 226.75 | $ | 255.70 | ||||||||||||

|

S&P MidCap 400 Ind. Machinery |

$ | 100.00 | $ | 129.98 | $ | 147.82 | $ | 161.44 | $ | 223.07 | $ | 236.39 | ||||||||||||

|

Peer Group |

$ | 100.00 | $ | 132.42 | $ | 148.68 | $ | 167.11 | $ | 226.13 | $ | 247.78 | ||||||||||||

Source: Zack’s Investment Research

17

Table of Contents

| (b) | Use of Proceeds. Not applicable. |

| (c) | Issuer Purchases of Equity Securities |

| Total Number of Shares Repurchased(1) |

Average Price Paid per Share |

Total Number of Shares Repurchased as Part of Publicly Announced Plans or Programs(2) |

Maximum Value of Shares That May Yet Be Purchased Under the Plans or Programs(2) |

|||||||||||||

| August 1, 2014 to August 31, 2014 |

238 | $ | 76.87 | 238 | $ | 86,147 | ||||||||||

| September 1, 2014 to September 30, 2014 |

143 | $ | 78.38 | 142 | $ | 75,008 | ||||||||||

| October 1, 2014 to October 31, 2014 |

595 | $ | 71.49 | 595 | $ | 32,446 | ||||||||||

|

|

|

|

|

|||||||||||||

| Total |

976 | 975 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| (1) | Includes shares purchased as part of a publicly announced program, as well as shares tendered for taxes related to stock option exercises and vesting of restricted shares. |

| (2) | In August 2013, the board of directors approved a repurchase program of up to $200,000. Uses for repurchased shares include the funding of benefit programs, including stock options, restricted stock and 401(k) matching. Shares purchased are treated as treasury shares until used for such purposes. The repurchase program is being funded using cash from operations and proceeds from borrowings under our credit facilities. |

Subsequent to October 31, 2014, the board of directors authorized a new $300,000 share repurchase program, effective December 16, 2014. This new program replaced the $200,000 program approved by the board in August 2013.

18

Table of Contents

| Item 6. | Selected Financial Data |

Five-Year Summary

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| (In thousands except for per-share amounts) |

||||||||||||||||||||

| Operating Data(a) |

||||||||||||||||||||

| Sales |

$ | 1,704,021 | $ | 1,542,921 | $ | 1,409,578 | $ | 1,233,159 | $ | 1,041,551 | ||||||||||

| Cost of sales |

758,923 | 676,777 | 586,289 | 484,727 | 419,937 | |||||||||||||||

| % of sales |

45 | 44 | 42 | 39 | 40 | |||||||||||||||

| Selling and administrative expenses |

577,993 | 542,295 | 487,809 | 431,078 | 386,781 | |||||||||||||||

| % of sales |

34 | 35 | 35 | 35 | 37 | |||||||||||||||

| Long-lived asset impairments |

— | — | — | 1,811 | — | |||||||||||||||

| Operating profit |

367,105 | 323,849 | 335,480 | 315,543 | 234,833 | |||||||||||||||

| % of sales |

22 | 21 | 24 | 26 | 23 | |||||||||||||||

| Net income |

246,773 | 221,817 | 224,829 | 222,364 | 168,048 | |||||||||||||||

| % of sales |

14 | 14 | 16 | 18 | 16 | |||||||||||||||

| Financial Data(a) |

||||||||||||||||||||

| Working capital |

$ | 301,815 | $ | 365,269 | $ | 242,939 | $ | 294,796 | $ | 259,117 | ||||||||||

| Net property, plant and equipment and other non-current assets |

1,607,447 | 1,451,113 | 1,242,892 | 827,493 | 535,323 | |||||||||||||||

| Total capital(b) |

1,662,283 | 1,498,082 | 1,261,962 | 853,071 | 567,323 | |||||||||||||||

| Total assets |

2,280,130 | 2,053,179 | 1,829,515 | 1,304,450 | 986,354 | |||||||||||||||

| Long-term liabilities |

1,004,465 | 928,519 | 816,061 | 550,966 | 289,368 | |||||||||||||||

| Shareholders’ equity |

904,797 | 887,863 | 669,770 | 571,323 | 505,072 | |||||||||||||||

| Return on average total capital — %(c) |

17 | 18 | 23 | 35 | 32 | |||||||||||||||

| Return on average shareholders’ equity — %(d) |

27 | 29 | 38 | 39 | 40 | |||||||||||||||

| Per-Share Data (a)(e) |

||||||||||||||||||||

| Average number of common shares |

63,656 | 64,214 | 64,407 | 67,616 | 67,610 | |||||||||||||||

| Average number of common shares and common share equivalents |

64,281 | 64,908 | 65,103 | 68,425 | 68,442 | |||||||||||||||

| Basic earnings per share |

$ | 3.88 | $ | 3.45 | $ | 3.49 | $ | 3.29 | $ | 2.49 | ||||||||||

| Diluted earnings per share |

3.84 | 3.42 | 3.45 | 3.25 | 2.46 | |||||||||||||||

| Dividends per common share |

0.76 | 0.63 | 0.525 | 0.44 | 0.39 | |||||||||||||||

| Book value per common share |

14.49 | 13.83 | 10.42 | 8.71 | 7.44 | |||||||||||||||

| (a) | See accompanying Notes to Consolidated Financial Statements. |

| (b) | Notes payable, plus current portion of long-term debt, plus long-term debt, minus cash and marketable securities, plus shareholders’ equity. |

| (c) | Net income plus after-tax interest expense on borrowings as a percentage of the average of quarterly borrowings (net of cash) plus shareholders’ equity over five accounting periods. |

| (d) | Net income as a percentage of average quarterly shareholders’ equity over five accounting periods. |

| (e) | Amounts adjusted for 2-for-1 stock split effective April 12, 2011. |

19

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

NOTE REGARDING AMOUNTS AND FISCAL YEAR REFERENCES

In this annual report, all amounts related to United States dollars and foreign currency and to the number of Nordson Corporation’s common shares, except for per share earnings and dividend amounts, are expressed in thousands. Unless the context otherwise indicates, all references to “we” or the “Company” mean Nordson Corporation.

Unless otherwise noted, all references to years relate to our fiscal year ending October 31.

Critical Accounting Policies and Estimates

Our consolidated financial statements and accompanying notes have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires management to make estimates, judgments and assumptions that affect reported amounts of assets, liabilities, revenues and expenses. On an ongoing basis, we evaluate the accounting policies and estimates that are used to prepare financial statements. We base our estimates on historical experience and assumptions believed to be reasonable under current facts and circumstances. Actual amounts and results could differ from these estimates used by management.

Certain accounting policies that require significant management estimates and are deemed critical to our results of operations or financial position are discussed below. On a regular basis, critical accounting policies are reviewed with the Audit Committee of the board of directors.

Revenue Recognition — Most of our revenues are recognized upon shipment, provided that persuasive evidence of an arrangement exists, the sales price is fixed or determinable, collectibility is reasonably assured, and title and risk of loss have passed to the customer. The FASB has issued guidance on multiple deliverable arrangements that establishes a relative selling price hierarchy for determining the selling price of a deliverable based on vendor specific objective evidence (VSOE) if available, third-party evidence (TPE) if vendor-specific objective evidence is not available, or best estimated selling price (BESP) if neither vendor-specific objective evidence nor third-party evidence is available. Our multiple deliverable arrangements include installation, installation supervision, training, and spare parts, which tend to be completed in a short period of time, at an insignificant cost, and utilizing skills not unique to us, and, therefore, are typically regarded as inconsequential or perfunctory. Revenue for undelivered items is deferred and included within accrued liabilities in the accompanying balance sheet. Revenues deferred in 2014, 2013 and 2012 were not material.

Translation of Foreign Currency Financial Statements and Foreign Currency Transactions — Our reporting currency is the U.S. dollar. However, the functional currency for each of our foreign subsidiaries is its principal operating currency. We translate the amounts included in our Consolidated Statements of Income from our foreign subsidiaries into U.S. dollars at weighted-average exchange rates, which we believe are representative of the actual exchange rates on the dates of the transactions. Our foreign subsidiaries’ assets and liabilities are translated into U.S. dollars from local currency at the actual exchange rates as of the end of each reporting date, and we record the resulting foreign exchange translation adjustments in our Consolidated Balance Sheets as a component of accumulated other comprehensive income (loss). If the U.S. dollar strengthens, we reflect the resulting losses as a component of accumulated other comprehensive income (loss). Conversely, if the U.S. dollar weakens, foreign exchange translation gains result, which favorably impact accumulated other comprehensive income (loss). Translation adjustments may be included in net earnings in the event of a sale or liquidation of certain of our underlying foreign investments. If we determine that the functional currency of any of our foreign subsidiaries should be the U.S. dollar, our financial statements will be affected. Should this occur, we will adjust our reporting to appropriately account for any such changes.

As appropriate, we use permanently invested intercompany loans as a source of capital to reduce exposure to foreign currency fluctuations at our foreign subsidiaries. These loans, on a consolidated basis, are treated as being analogous to equity for accounting purposes. Therefore, foreign exchange gains or losses on these intercompany loans are recorded in accumulated other comprehensive income (loss).

20

Table of Contents

Goodwill — Goodwill is the excess of purchase price over the fair value of tangible and identifiable intangible net assets acquired in various business combinations. Goodwill is not amortized but is tested for impairment annually at the reporting unit level, or more often if indications of impairment exist. Our reporting units are the Adhesive Dispensing Systems segment, the Industrial Coating Systems segment and one level below the Advanced Technology Systems segment.

We test goodwill in accordance with Accounting Standards Codification (ASC) 350. The goodwill impairment test is a two-step process. In the first step, performed in the fourth quarter of each year, we estimate a reporting unit’s fair value using a combination of the discounted cash flow method of the Income Approach and the guideline public company method of the Market Approach and compare the result against the reporting unit’s carrying value of net assets. If the carrying value of a reporting unit exceeds its fair value, then a second step is performed to determine if goodwill is impaired. We use an independent valuation specialist to assist with refining our assumptions and methods used to determine fair values using these methods. In step one, the discounted cash flow method uses assumptions for revenue growth, operating margin, and working capital turnover that are based on general management’s strategic plans tempered by performance trends and reasonable expectations about those trends. Terminal value calculations employ a published formula known as the Gordon Growth Model Method that essentially captures the present value of perpetual cash flows beyond the last projected period assuming a constant Weighted Average Cost of Capital (WACC) methodology and growth rate. For each reporting unit, a sensitivity analysis is performed to vary the discount and terminal growth rates in order to provide a range of reasonableness for detecting impairment.

Discount rates are developed using a WACC methodology. The WACC represents the blended average required rate of return for equity and debt capital based on observed market return data and company specific risk factors. For 2014, the discount rates used ranged from 10 percent to 17 percent depending upon the reporting unit’s size, end market volatility, and projection risk. The calculated internal rate of return for the discounted cash flow method was 11 percent, the same as the calculated WACC for total Nordson. In the application of the guideline public company method, fair value is determined using transactional evidence for similar publicly traded equity. The comparable company guideline group is determined based on relative similarities to each reporting unit since exact correlations are not available. An indication of fair value for each reporting unit is based on the placement of each reporting unit within a range of multiples determined for its comparable guideline company group. Valuation multiples are derived by dividing latest twelve month performance for revenues and EBITDA into total invested capital, which is the sum of traded equity plus interest bearing debt less cash. These multiples are applied against the revenue and EBITDA of each reporting unit. While the implied indications of fair value using the guideline public company method yield meaningful results, the discounted cash flow method of the income approach includes management’s thoughtful projections and insights as to what the reporting units will accomplish in the near future. Accordingly, the reasonable, implied fair value of each reporting unit is a blend based on the relative strength of the approaches employed.

To test the reasonableness of the aggregate fair value, we performed the control premium test, which compares the sum of the implied fair values calculated for our reporting units (net of debt) to the market value of equity. The control premium was 7 percent as of the test date of August 1, 2014 and 5 percent as of October 31, 2014. The control premium indicated that the discounted cash flow valuation was reasonable.

In 2014 and 2013, the results of our step one testing indicated no impairment; therefore, the second step of impairment testing was not necessary.

21

Table of Contents

The excess of fair value (FV) over carrying value (CV) was compared to the carrying value for each reporting unit. Based on the results shown in the table below and based on our measurement date of August 1, 2014, our conclusion is that no indicators of impairment exist in 2014. Potential events or circumstances, such as a sustained downturn in global economies, could have a negative effect on estimated fair values.

| WACC | Excess of FV over CV |

Goodwill | ||||||||||

| Adhesive Dispensing Systems Segment |

10 | % | 365 | % | $ | 405,328 | ||||||

| Industrial Coating Systems Segment |

16 | % | 136 | % | $ | 24,058 | ||||||

| Advanced Technology Systems Segment — Electronics Systems |

13 | % | 562 | % | $ | 15,138 | ||||||

| Advanced Technology Systems Segment — Fluid Management |

12 | % | 113 | % | $ | 478,218 | ||||||

| Advanced Technology Systems Segment — Test & Inspection |

17 | % | 157 | % | $ | 14,397 | ||||||