make a recommendation to the Board that it either accept or reject such resignation based

on relevant considerations. The Board will act on the resignation, taking into consideration the Governance Committee’s recommendation, and will publicly disclose its decision and the rationale behind its decision within 90 days of the

certification of the election results. If the Board does not accept the resignation, the Director may continue to serve until his or her successor is duly elected or any earlier resignation, removal or separation. If the Board accepts the

nominee’s resignation, then the Board may, in its sole discretion, fill any resulting vacancy or decrease the size of the Board pursuant to the Company’s Bylaws.

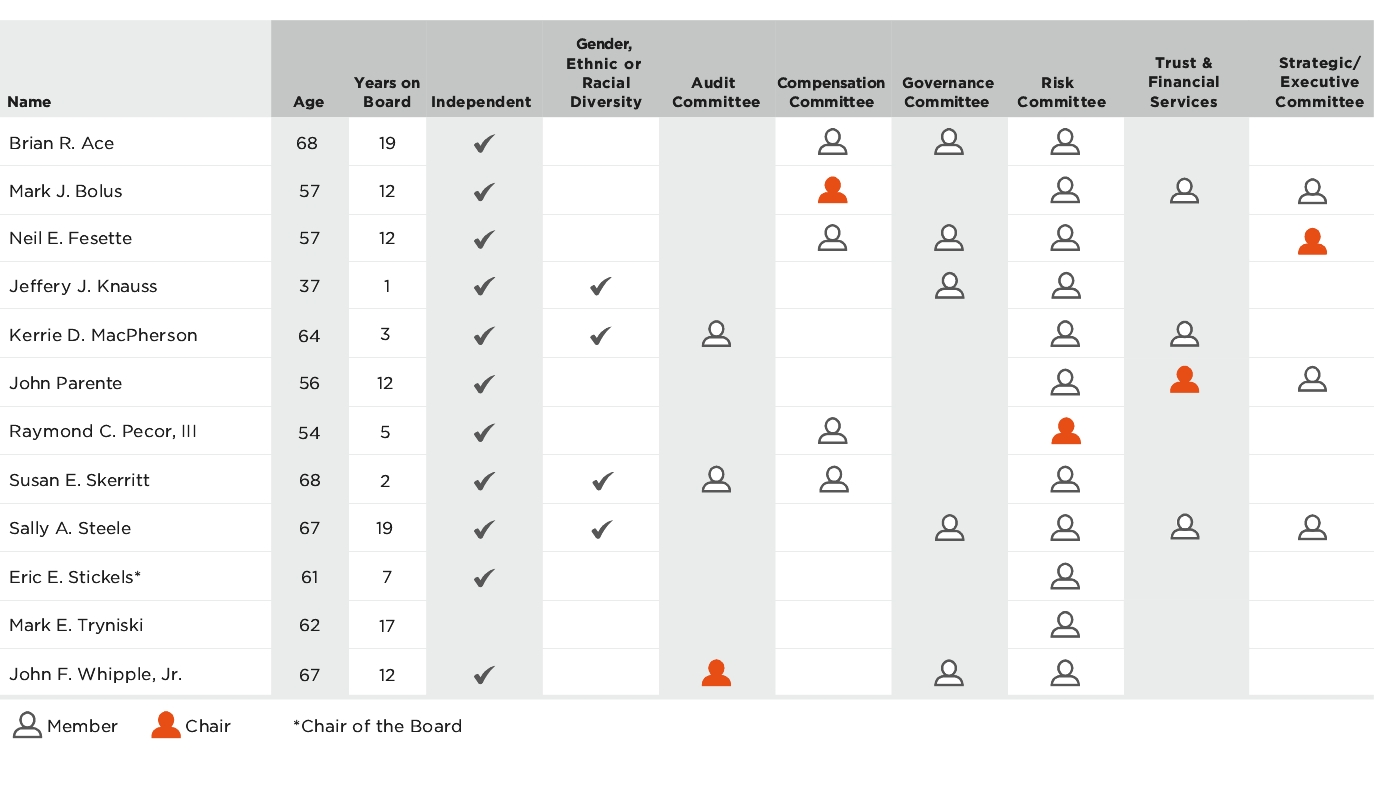

The New York Stock Exchange (“NYSE”) listing standards and the Company’s Corporate

Guidelines require the Board to be comprised of at least a majority of independent Directors. The Board has determined that 11 of the 12 Directors nominated to serve on the Board are independent under the NYSE standards and the Company’s

Corporate Governance Guidelines.

For a Director to be considered independent, the Board must determine that the Director

does not have any direct or indirect material relationship with the Company. To assist it in determining director independence, the Board uses standards which conform to, or are more exacting than, the NYSE independence requirements. Under these

standards, absent other material relationships, transactions or interests, a Director will be deemed to be independent unless, within the preceding three years: (i) the Director was employed by the Company or received more than $120,000 per year

in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation payments for prior service, (ii) the Director was a partner of or employed by the Company’s independent auditor,

(iii) the Director is part of an interlocking directorate in which an executive officer of the Company serves on the Compensation Committee of another company that employs the Director, (iv) the Director is an executive officer or employee of

another company that makes payments to, or receives payments from, the Company for property or services in an amount which, in any fiscal year, exceeds the greater of one million dollars or 2% of the other company’s consolidated gross revenues,

or (v) the Director had an immediate family member in any of the categories in (i) – (iv). In determining whether a Director is independent, the Board reviews the stated standards but also considers whether a Director has any direct or indirect

material relationships, transactions or interests with the Company that might be viewed as interfering with the exercise of his or her independent judgment.

Based on these independence standards, the Board determined that the following individuals

who served as Directors during all or part of the last fiscal year were independent Directors during such year and continue to be deemed independent by the Board: Brian R. Ace, Mark J. Bolus, Jeffrey L. Davis, Neil E. Fesette, Jeffery J. Knauss,

Kerrie D. MacPherson, John Parente, Raymond C. Pecor, III, Susan E. Skerritt, Sally A. Steele, Eric E. Stickels, and John F. Whipple, Jr.

RELATED PERSONS TRANSACTIONS

Various Directors, executive officers and other related persons of the Company and the

Bank (and members of their immediate families and corporations, trusts, and other entities with which these individuals are associated) may have loans with the Bank including business and consumer loans which are offered in the ordinary course of

business by the Bank. All such loans are made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Bank,

and do not involve more than the normal risk of collectability or present other unfavorable features. The Company expects that the Bank will continue to have banking transactions in the ordinary course of business with its Directors, executive

officers and other related persons on substantially the same terms, including interest rates and collateral, as those then prevailing for comparable transactions with others.

The Company also has a Related Party Transaction Policy, administered by the Audit

Committee, which provides procedures for the review and approval of related party transactions involving the Company’s Directors, executive officers, Director Nominees, and other related persons. In deciding whether to approve such related party

transactions, the Audit Committee will consider, among other factors it deems appropriate, whether the transaction is on terms comparable to those generally available to nonaffiliated parties and is consistent with the best interests of the

Company. For purposes of this policy, a “related party transaction” is a transaction, arrangement, or relationship or series of similar transactions, arrangements or relationships in which (i) the Company or one of its subsidiaries is involved,

(ii) the amount involved exceeds $100,000 in any calendar year, and (iii) a related party has a direct or indirect material interest. Related persons include executive officers, Directors, Director Nominees, beneficial owners of more than 5% of

the Company’s stock, immediate family members of any of the foregoing persons, and any firm, corporation or other entity in which any of the foregoing persons has a direct or indirect material interest. The Audit Committee reviews and approves

all related person transactions after its determination that such transactions are performed at market terms and consistent with the best interests of the Company.