UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3785

Fidelity Advisor Series I

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | October 31, 2015 |

Item 1.

Reports to Stockholders

|

Fidelity Advisor® Floating Rate High Income Fund Class A, Class T, Class B and Class C Annual Report October 31, 2015 |

|

Contents

|

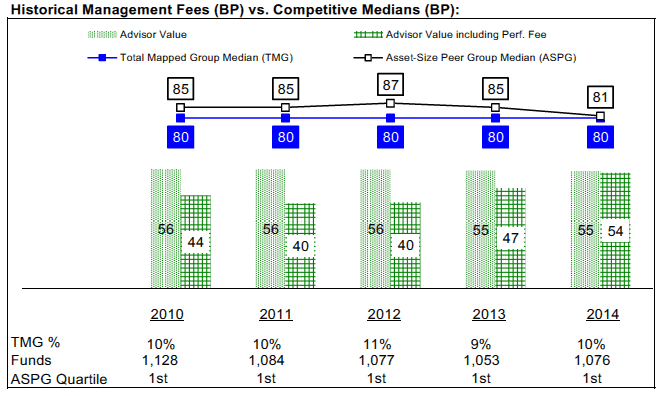

Board Approval of Investment Advisory Contracts and Management Fees |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

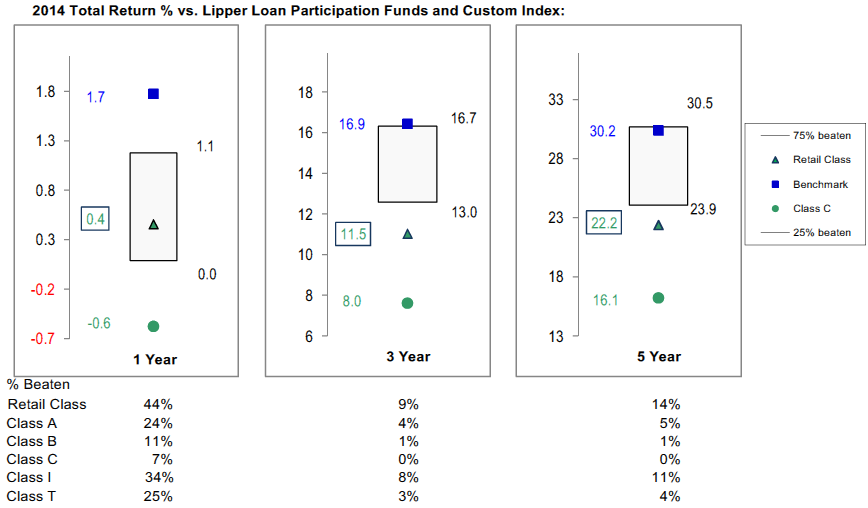

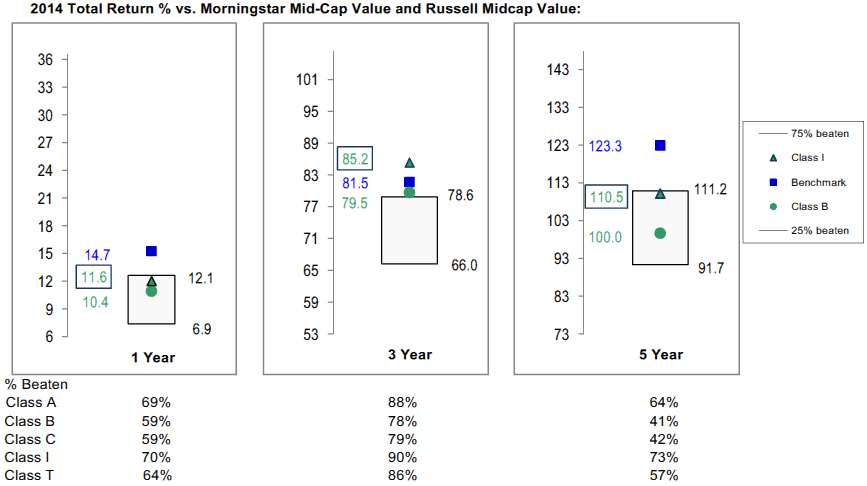

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year.

The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred.

How a fund did yesterday is no guarantee of how it will do tomorrow.

Returns reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

Average Annual Total Returns

| For the periods ended October 31, 2015 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 2.75% sales charge) | (3.26)% | 2.10% | 3.29% |

| Class T (incl. 2.75% sales charge) | (3.45)% | 2.02% | 3.24% |

| Class B (incl. contingent deferred sales charge) | (4.36)% | 1.88% | 3.20% |

| Class C (incl. contingent deferred sales charge) | (2.33)% | 1.91% | 2.82% |

Class B shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 3.5%, 1.5% and 0%, respectively.

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

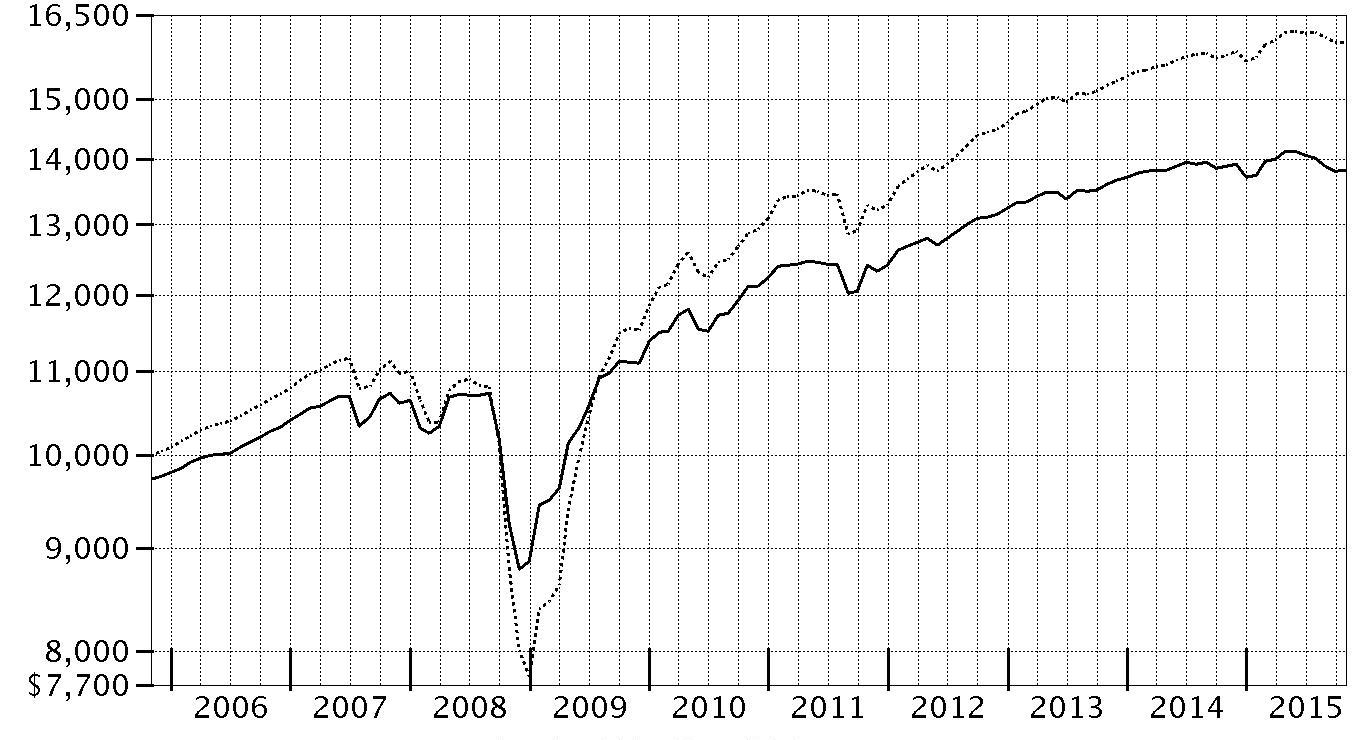

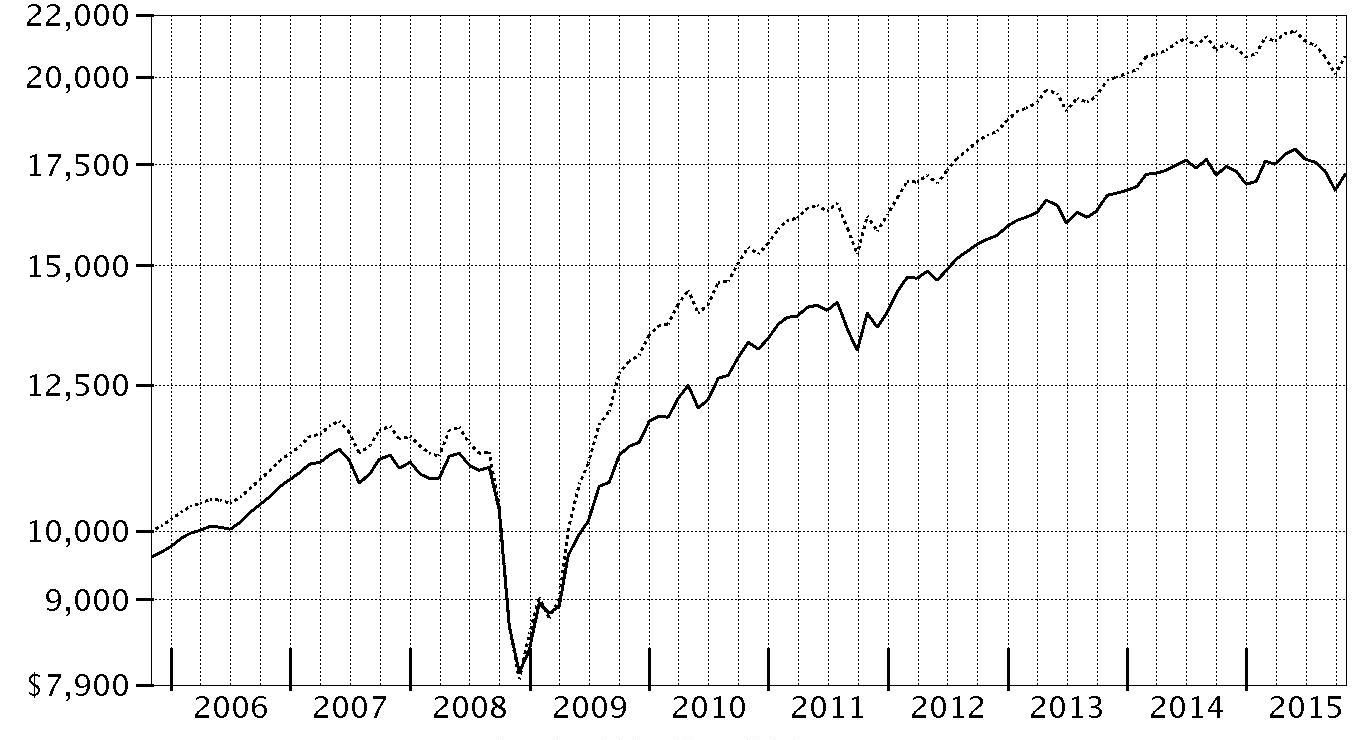

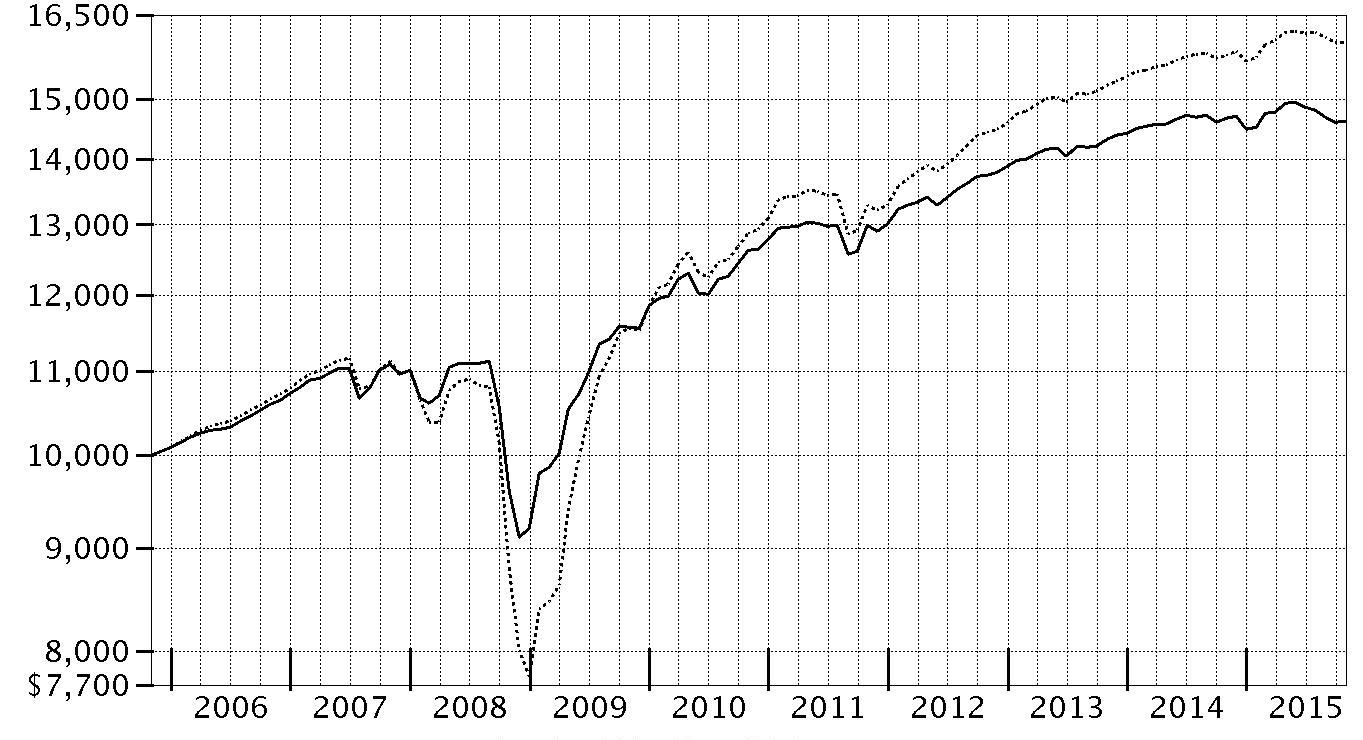

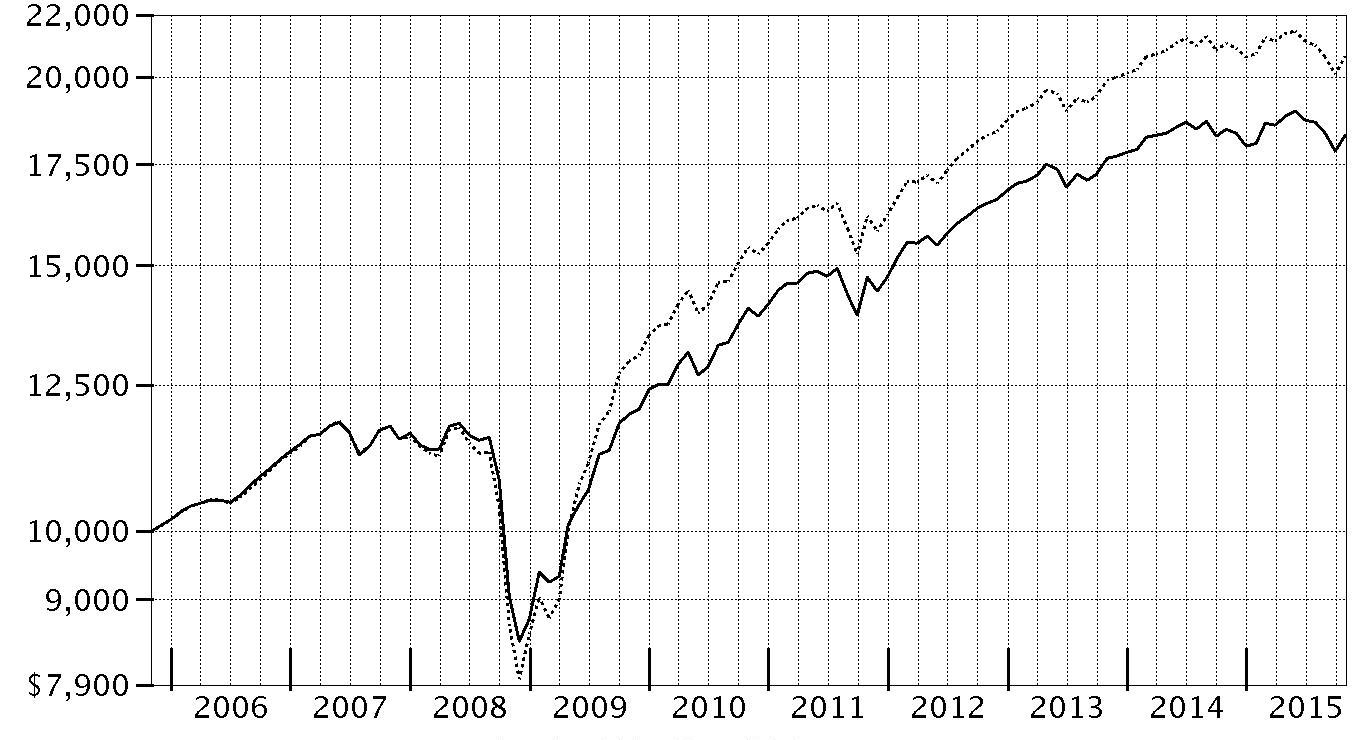

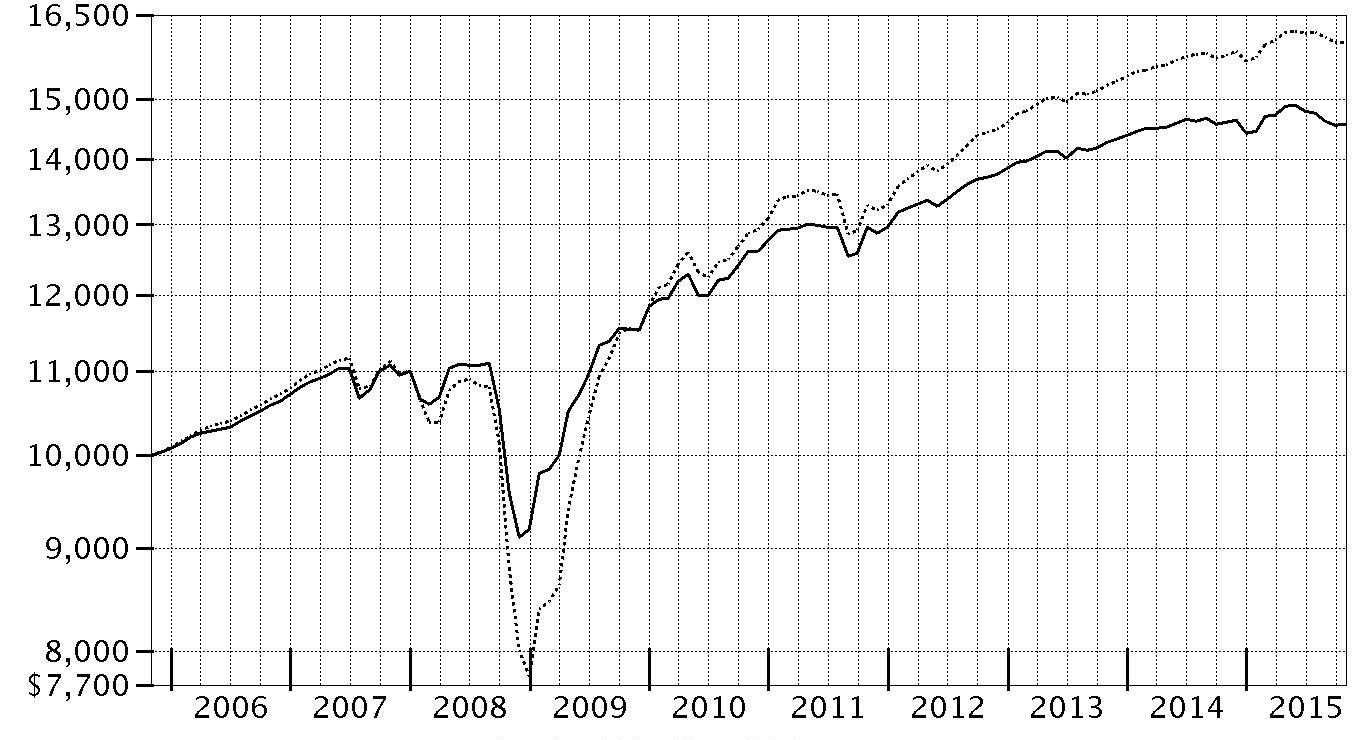

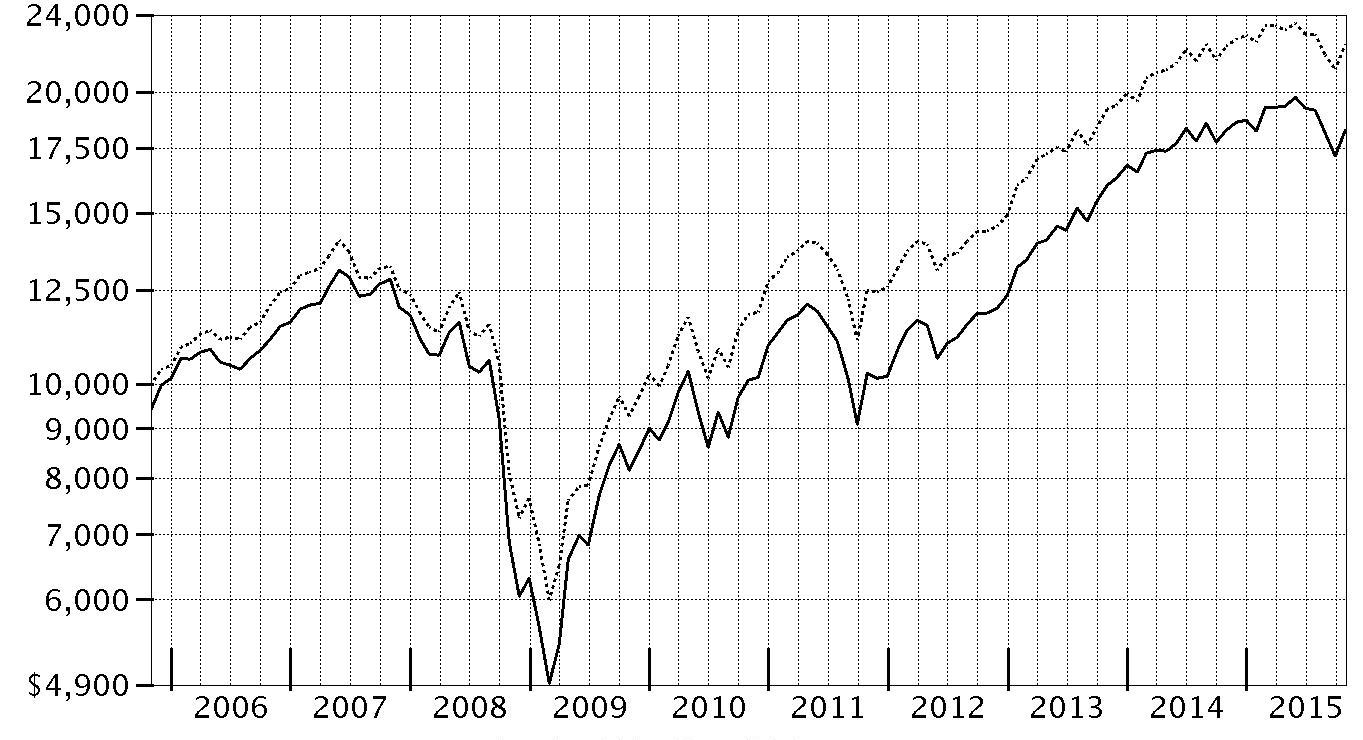

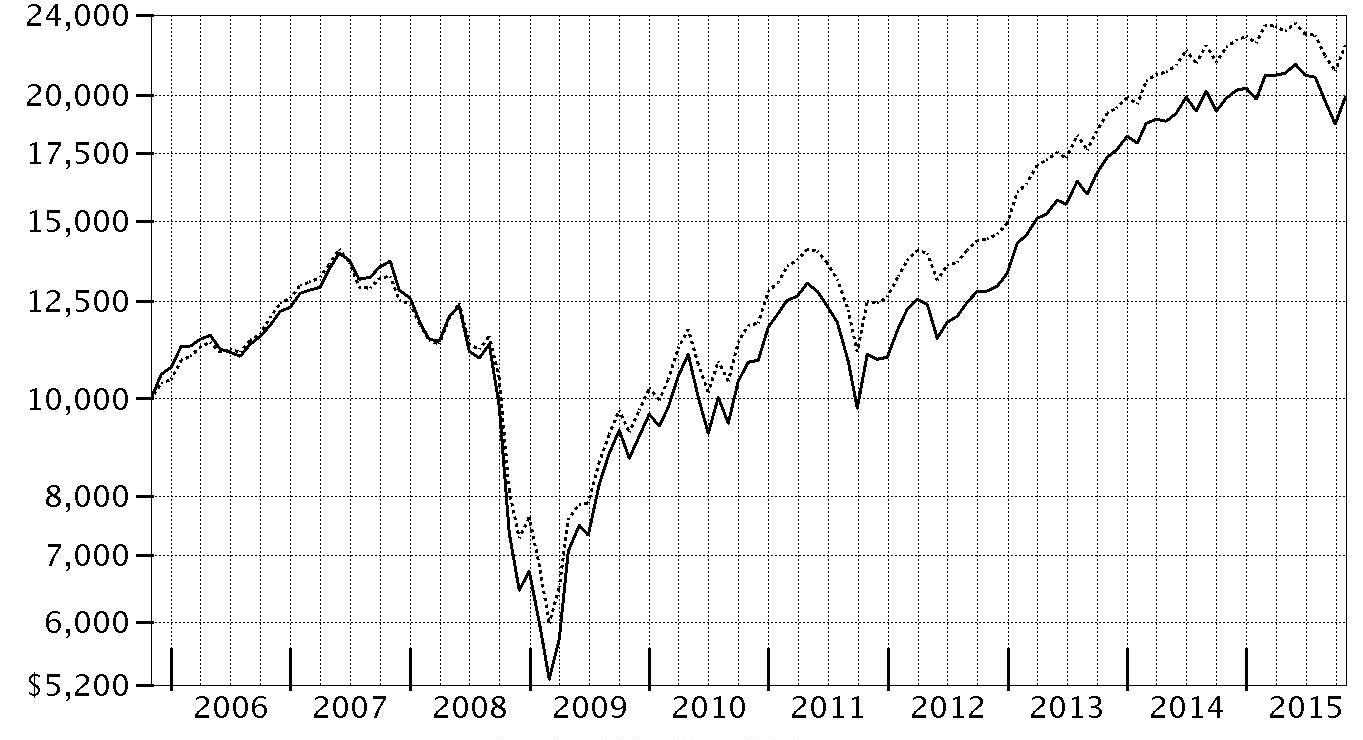

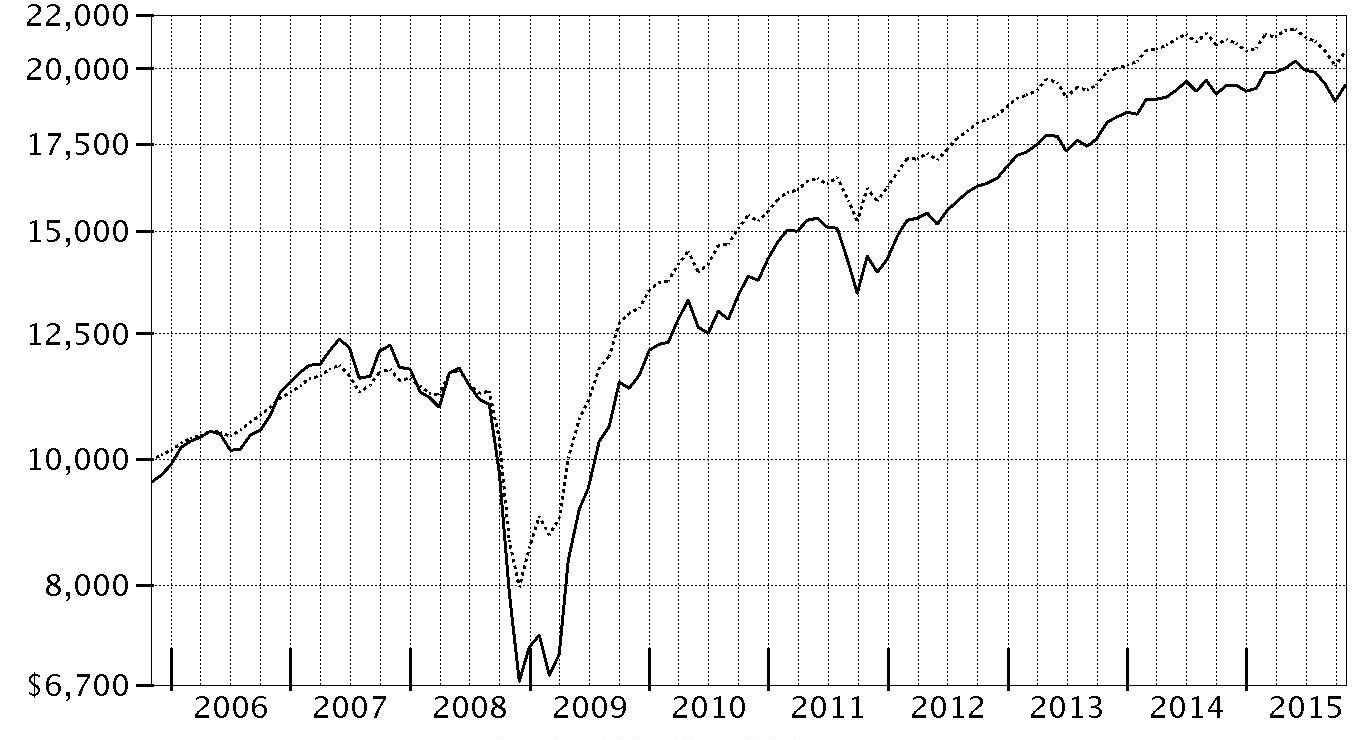

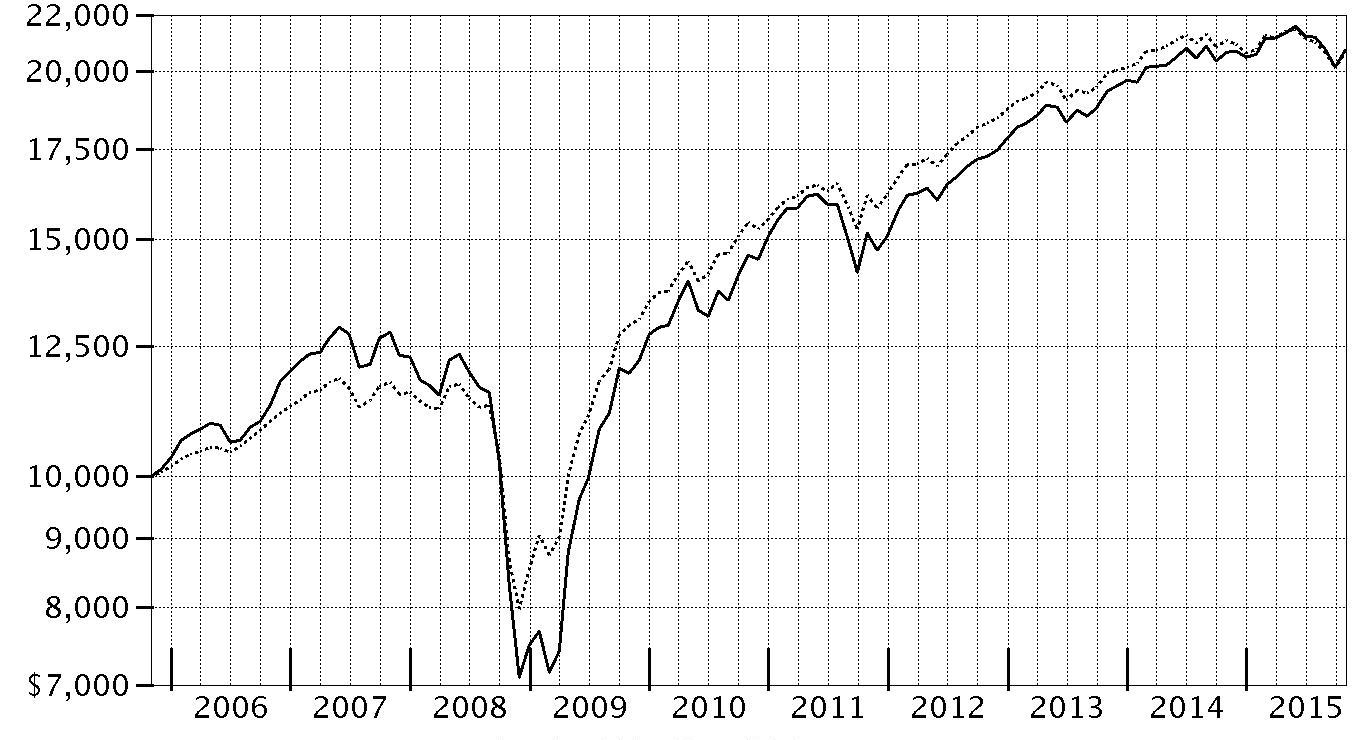

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Floating Rate High Income Fund - Class A on October 31, 2005, and the current 2.75% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the S&P®/LSTA Leveraged Performing Loan Index performed over the same period.

| Period Ending Values | ||

|

| $13,822 | Fidelity Advisor® Floating Rate High Income Fund - Class A |

|

| $15,994 | S&P®/LSTA Leveraged Performing Loan Index |

Management's Discussion of Fund Performance

Market Recap: Floating-rate bank loans registered a positive return for the 12 months ending October 31, 2015, amid an environment of declining interest rates, falling commodities prices and global macroeconomic uncertainty. For the period, the S&P®/LSTA Leveraged Performing Loan Index gained 1.51%, outpacing high-yield bonds but trailing the broad investment-grade fixed-income market. Bank loans rose early in the period, but sharply declined in December as oil prices continued to fall on concern about global oversupply. Loans rebounded during 2015’s first quarter, bolstered by renewed investor demand amid lower bond yields globally and light supply of new loans. The asset class continued to perform well in April, benefiting from reduced supply, robust demand from collateralized loan obligations and moderating retail fund outflows. Loans retreated in June, hampered by increased global volatility partly fueled by the debt crisis in Greece, but still held up better than most other asset classes. Loan performance was negative in August and September, as investors retreated from riskier assets due to concerns about slowing growth in China and the potential impact the slowdown there could have on other economies. Loans effectively were flat in October, as investors grappled with the relative value of the asset class versus high-yield bonds. Comments from Portfolio Manager Eric Mollenhauer: For the year, the fund's share classes (excluding sales charges, if applicable) trailed the benchmark, the S&P®/LSTA Leveraged Performing Loan Index. Performance versus the benchmark was hampered by security selection in nonferrous metals/minerals, primarily among coal companies, along with an overweighting in the lagging oil & gas industry, and adverse overall positioning in steel. The primary individual detractors were oil & gas exploration & production company Fieldwood Energy, bankrupt coal producer Walter Energy and iron ore mining firm Fortescue Metals Group. I reduced the fund's positions in Fieldwood Energy and Fortescue Metals Group. Concerning Walter Energy, since the fund's claim as a secured lender is impaired due to the firm's bankruptcy filing, we have exercised our rights as creditors, and continue to be involved in the restructuring, with the goal of maximizing the fund's recovery. On the plus side, not holding several poor-performing index components from the oil & gas group proved advantageous, as did largely avoiding drug-testing laboratory Millennium Health. I sold our small position in Millennium Health prior to period end.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Five Holdings as of October 31, 2015

| (by issuer, excluding cash equivalents) | % of fund's net assets | % of fund's net assets 6 months ago |

| Community Health Systems, Inc. | 3.1 | 3.1 |

| Albertson's LLC | 2.5 | 2.3 |

| Charter Communications Operating LLC | 1.9 | 1.1 |

| Dell International LLC | 1.8 | 1.5 |

| HCA Holdings, Inc. | 1.5 | 3.2 |

| 10.8 |

Top Five Market Sectors as of October 31, 2015

| % of fund's net assets | % of fund's net assets 6 months ago | |

| Technology | 11.5 | 9.5 |

| Healthcare | 10.4 | 10.7 |

| Telecommunications | 7.6 | 7.3 |

| Gaming | 6.8 | 6.7 |

| Cable/Satellite TV | 6.1 | 4.8 |

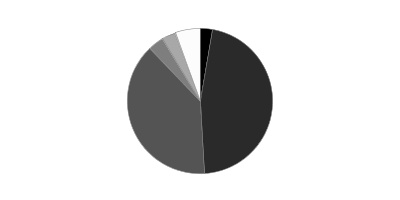

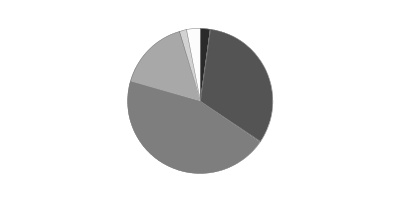

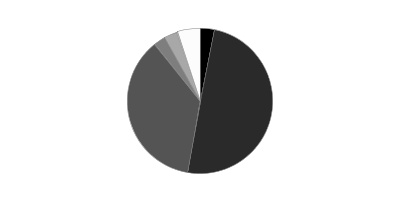

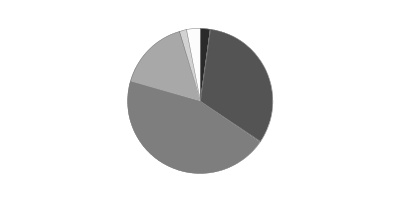

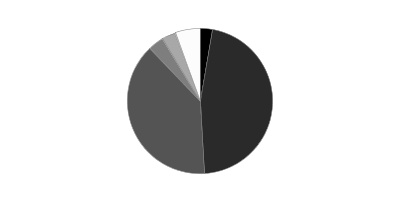

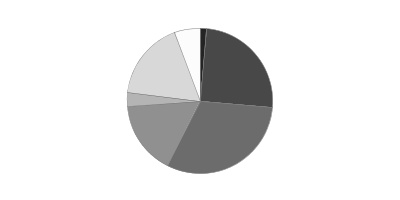

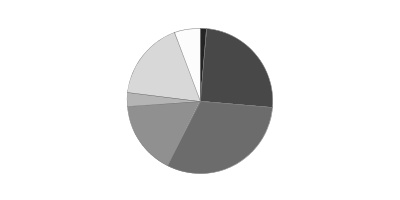

Quality Diversification (% of fund's net assets)

| As of October 31, 2015 | ||

| BBB | 2.8% | |

| BB | 46.2% | |

| B | 38.9% | |

| CCC,CC,C | 3.4% | |

| Not Rated | 2.9% | |

| Equities | 0.3% | |

| Short-Term Investments and Net Other Assets | 5.5% | |

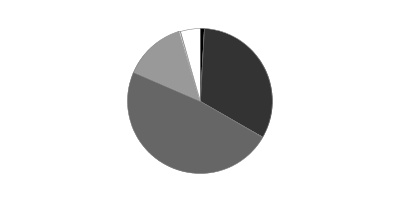

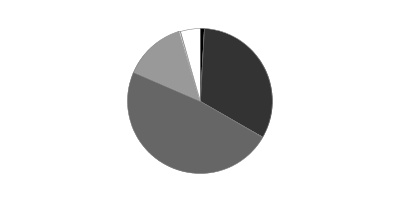

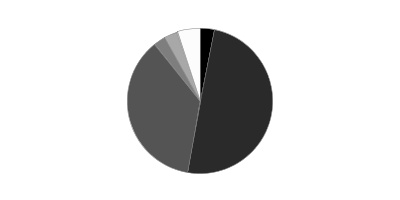

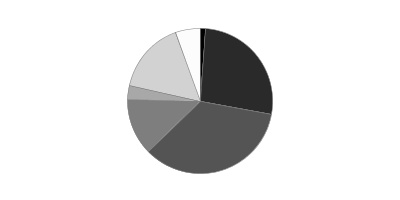

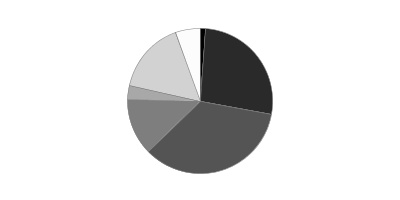

| As of April 30, 2015 | ||

| BBB | 3.2% | |

| BB | 49.5% | |

| B | 36.6% | |

| CCC,CC,C | 2.6% | |

| Not Rated | 2.8% | |

| Equities | 0.3% | |

| Short-Term Investments and Net Other Assets | 5.0% | |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

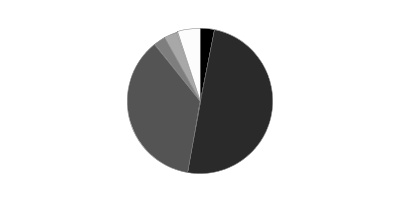

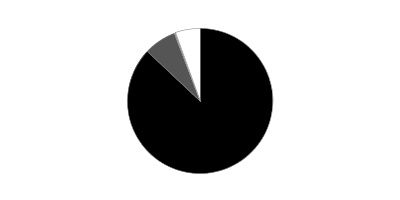

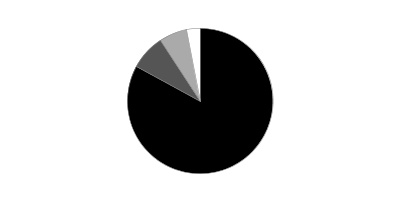

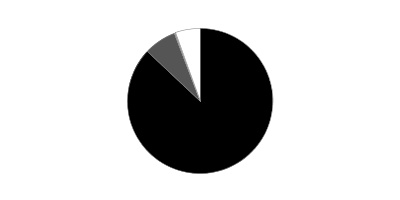

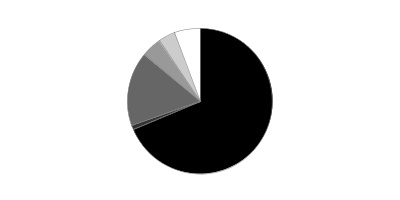

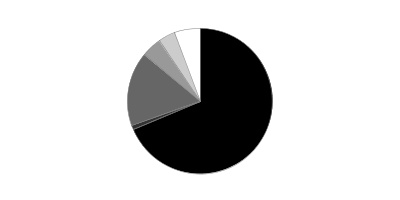

Asset Allocation (% of fund's net assets)

| As of October 31, 2015* | ||

| Bank Loan Obligations | 87.0% | |

| Nonconvertible Bonds | 7.2% | |

| Common Stocks | 0.3% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.5% | |

* Foreign investments - 10.9%

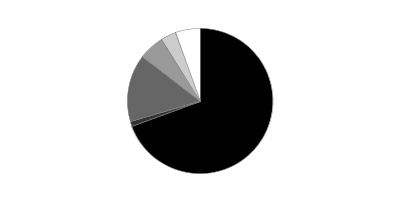

| As of April 30, 2015* | ||

| Bank Loan Obligations | 87.8% | |

| Nonconvertible Bonds | 6.9% | |

| Common Stocks | 0.3% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.0% | |

* Foreign investments - 11.9%

Investments October 31, 2015

Showing Percentage of Net Assets

| Bank Loan Obligations - 87.0%(a) | |||

| Principal Amount (000s) | Value (000s) | ||

| Aerospace - 1.1% | |||

| Gemini HDPE LLC Tranche B, term loan 4.75% 8/7/21 (b) | $9,321 | $9,286 | |

| TransDigm, Inc. Tranche C, term loan 3.75% 2/28/20 (b) | 111,369 | 109,790 | |

| TOTAL AEROSPACE | 119,076 | ||

| Automotive - 0.3% | |||

| Chrysler Group LLC Tranche B, term loan 3.5% 5/24/17 (b) | 33,631 | 33,584 | |

| Automotive & Auto Parts - 0.8% | |||

| Chrysler Group LLC term loan 3.25% 12/31/18 (b) | 17,229 | 17,164 | |

| North American Lifting Holdings, Inc.: | |||

| Tranche 1LN, term loan 5.5% 11/27/20 (b) | 16,709 | 14,913 | |

| Tranche 2LN, term loan 10% 11/27/21 (b) | 24,370 | 21,849 | |

| The Gates Corp. Tranche B 1LN, term loan 4.25% 7/3/21 (b) | 9,900 | 9,276 | |

| Tower Automotive Holdings U.S.A. LLC term loan 4% 4/23/20 (b) | 19,867 | 19,619 | |

| TOTAL AUTOMOTIVE & AUTO PARTS | 82,821 | ||

| Broadcasting - 1.4% | |||

| Clear Channel Communications, Inc. Tranche D, term loan 6.9383% 1/30/19 (b) | 53,720 | 44,907 | |

| ION Media Networks, Inc. Tranche B, term loan 4.75% 12/18/20 (b) | 14,888 | 14,832 | |

| Nielsen Finance LLC Tranche B 2LN, term loan 3.1961% 4/15/21 (b) | 31,595 | 31,635 | |

| Univision Communications, Inc. Tranche C 4LN, term loan 4% 3/1/20 (b) | 58,165 | 57,758 | |

| TOTAL BROADCASTING | 149,132 | ||

| Building Materials - 0.5% | |||

| American Builders & Contractors Supply Co., Inc. Tranche B, term loan 3.5% 4/16/20 (b) | 19,433 | 19,299 | |

| Jeld-Wen, Inc. Tranche B, term loan 5% 7/1/22 (b) | 15,500 | 15,510 | |

| LBM Borrower LLC Tranche B 1LN, term loan 6.25% 8/20/22 (b) | 18,000 | 17,336 | |

| TOTAL BUILDING MATERIALS | 52,145 | ||

| Cable/Satellite TV - 5.7% | |||

| Cequel Communications LLC Tranche B, term loan 3.5% 2/14/19 (b) | 93,694 | 92,425 | |

| Charter Communications Operating LLC: | |||

| Tranche E, term loan 3% 7/1/20 (b) | 48,223 | 47,725 | |

| Tranche F, term loan 3% 1/3/21 (b) | 76,372 | 75,561 | |

| Tranche H, term loan 3.25% 8/24/21 (b) | 11,000 | 10,973 | |

| Tranche I, term loan 3.5% 1/24/23 (b) | 71,970 | 71,869 | |

| CSC Holdings LLC: | |||

| Tranche B, term loan 2.6883% 4/17/20 (b) | 38,093 | 38,062 | |

| Tranche B, term loan 5% 10/9/22 (b) | 24,500 | 24,570 | |

| Liberty Cablevision of Puerto Rico Tranche 1LN, term loan 4.5% 1/7/22 (b) | 14,000 | 13,601 | |

| Numericable LLC: | |||

| Tranche B 1LN, term loan 4% 7/20/22 (b) | 10,000 | 9,851 | |

| Tranche B 1LN, term loan 4.5% 5/8/20 (b) | 46,128 | 45,488 | |

| Tranche B 2LN, term loan 4.5% 5/8/20 (b) | 39,907 | 39,353 | |

| Tranche B 6LN, term loan 1/22/23 (c) | 15,000 | 14,823 | |

| UPC Broadband Holding BV Tranche AH, term loan 3.25% 6/30/21 (b) | 27,000 | 26,528 | |

| Virgin Media Investment Holdings Ltd. Tranche B, term loan 3.5% 6/30/23 (b) | 23,863 | 23,718 | |

| WideOpenWest Finance LLC Tranche B, term loan 4.5% 4/1/19 (b) | 9,950 | 9,772 | |

| Ziggo B.V.: | |||

| Tranche B 1LN, term loan 3.5% 1/15/22 (b) | 25,146 | 24,744 | |

| Tranche B 2LN, term loan 3.5% 1/15/22 (b) | 16,204 | 15,945 | |

| Tranche B 3LN, term loan 3.5% 1/15/22 (b) | 26,650 | 26,225 | |

| TOTAL CABLE/SATELLITE TV | 611,233 | ||

| Capital Goods - 0.8% | |||

| Doncasters PLC Tranche B 2LN, term loan 9.5% 10/9/20 (b) | 4,516 | 4,471 | |

| Doosan Infracore, Inc. Tranche B, term loan 4.5% 5/28/21 (b) | 20,292 | 20,279 | |

| Onex Wizard U.S. Acquisition, Inc. Tranche B, term loan 4.25% 3/13/22 (b) | 36,696 | 36,682 | |

| SRAM LLC. Tranche B, term loan 4.0169% 4/10/20 (b) | 26,196 | 24,625 | |

| TOTAL CAPITAL GOODS | 86,057 | ||

| Chemicals - 1.7% | |||

| Arizona Chem U.S., Inc.: | |||

| Tranche 2LN, term loan 7.5% 6/12/22 (b) | 6,605 | 6,627 | |

| Tranche B 1LN, term loan 4.5% 6/12/21 (b) | 13,864 | 13,837 | |

| MacDermid, Inc. Tranche B 1LN, term loan 4.5% 6/7/20 (b) | 34,013 | 32,929 | |

| Royal Holdings, Inc.: | |||

| Tranche B 1LN, term loan 4.5% 6/19/22 (b) | 13,965 | 13,821 | |

| Tranche B 2LN, term loan 8.5% 6/19/23 (b) | 6,000 | 5,975 | |

| Styrolution U.S. Holding LLC Tranche B, term loan 6.5% 11/7/19 (b) | 19,850 | 19,850 | |

| The Chemours Co. LLC Tranche B, term loan 3.75% 5/12/22 (b) | 27,531 | 25,163 | |

| Trinseo Materials Operating SCA/Trinseo Materials Finance, Inc. Tranche B 1LN, term loan 4.25% 11/5/21 (b) | 18,509 | 18,361 | |

| U.S. Coatings Acquisition, Inc. Tranche B, term loan 3.75% 2/1/20 (b) | 27,493 | 27,447 | |

| Univar, Inc. Tranche B, term loan 4.25% 7/1/22 (b) | 14,145 | 13,938 | |

| TOTAL CHEMICALS | 177,948 | ||

| Consumer Products - 0.6% | |||

| Prestige Brands, Inc. Tranche B 3LN, term loan 3.5% 9/3/21 (b) | 3,232 | 3,230 | |

| Revlon Consumer Products Corp.: | |||

| term loan 4% 8/19/19 (b) | 16,353 | 16,333 | |

| Tranche B, term loan 3.25% 11/19/17 (b) | 8,347 | 8,333 | |

| Sun Products Corp. Tranche B, term loan 5.5% 3/23/20 (b) | 9,949 | 9,591 | |

| Tempur Sealy International, Inc. Tranche B, term loan 3.5% 3/18/20 (b) | 497 | 497 | |

| Wilsonart LLC Tranche B, term loan 4% 10/31/19 (b) | 27,375 | 27,153 | |

| TOTAL CONSUMER PRODUCTS | 65,137 | ||

| Containers - 2.3% | |||

| Ardagh Holdings U.S.A., Inc. Tranche B, term loan 4% 12/17/19 (b) | 54,796 | 54,693 | |

| Berry Plastics Corp.: | |||

| Tranche E, term loan 3.75% 1/6/21 (b) | 8,592 | 8,581 | |

| Tranche F, term loan 4% 10/1/22 (b) | 20,500 | 20,528 | |

| Berry Plastics Group, Inc. term loan 3.5% 2/8/20 (b) | 88,666 | 87,825 | |

| BWAY Holding Co. Tranche B, term loan 5.5% 8/14/20 (b) | 13,561 | 13,590 | |

| Consolidated Container Co. Tranche B, term loan 5% 7/3/19 (b) | 13,199 | 12,539 | |

| Hostess Brands LLC: | |||

| Tranche B 1LN, term loan 4.5% 8/3/22 (b) | 12,120 | 12,131 | |

| Tranche B 2LN, term loan 8.5% 8/3/23 (b) | 1,445 | 1,440 | |

| Klockner Pentaplast of America Tranche B 1LN, term loan 5% 4/28/20 (b) | 4,576 | 4,582 | |

| Reynolds Consumer Products Holdings, Inc. Tranche B, term loan 4.5% 12/1/18 (b) | 24,560 | 24,601 | |

| Tricorbraun, Inc. Tranche B, term loan 4% 5/3/18 (b) | 3,673 | 3,641 | |

| TOTAL CONTAINERS | 244,151 | ||

| Diversified Financial Services - 2.8% | |||

| AlixPartners LLP Tranche B, term loan 4.5% 7/28/22 (b) | 24,165 | 24,140 | |

| Assuredpartners, Inc. Tranche B 1LN, term loan 5.75% 10/16/22 (b) | 27,620 | 27,603 | |

| Delos Finance SARL Tranche B LN, term loan 3.5% 3/6/21 (b) | 51,095 | 51,063 | |

| Energy & Minerals Group Tranche B, term loan 4.75% 3/27/20 (b) | 9,410 | 8,928 | |

| Fly Funding II Sarl Tranche B, term loan 3.5% 8/9/19 (b) | 13,774 | 13,684 | |

| Flying Fortress Holdings, Inc. Tranche B, term loan 3.5% 4/30/20 (b) | 73,390 | 73,390 | |

| HarbourVest Partners LLC Tranche B, term loan 3.25% 2/4/21 (b) | 12,689 | 12,562 | |

| IBC Capital U.S. LLC Tranche B 1LN, term loan 4.75% 9/11/21 (b) | 24,875 | 22,398 | |

| LPL Holdings, Inc. Tranche B, term loan 3.25% 3/29/19 (b) | 25,297 | 24,981 | |

| TransUnion LLC Tranche B 2LN, term loan 3.5% 4/9/21 (b) | 47,650 | 46,956 | |

| TOTAL DIVERSIFIED FINANCIAL SERVICES | 305,705 | ||

| Diversified Media - 0.4% | |||

| McGraw-Hill School Education Tranche B, term loan 6.25% 12/18/19 (b) | 18,176 | 18,085 | |

| WMG Acquisition Corp. term loan 3.75% 7/1/20 (b) | 22,628 | 21,993 | |

| TOTAL DIVERSIFIED MEDIA | 40,078 | ||

| Energy - 4.5% | |||

| Alon U.S.A. Partners LP term loan 9.25% 11/26/18 (b) | 8,644 | 8,601 | |

| Atlantic Power Ltd. Partnership Tranche B LN, term loan 4.75% 2/24/21 (b) | 21,110 | 21,071 | |

| Chelsea Petroleum Products I LLC Tranche B, term loan 7/22/22 (c) | 8,000 | 7,930 | |

| Citgo Holding, Inc. Tranche B, term loan 9.5% 5/12/18 (b) | 20,320 | 19,914 | |

| CPI Acquisition, Inc. Tranche B, term loan 6.75% 8/17/22(b) | 3,707 | 3,691 | |

| Crestwood Holdings Partners LLC Tranche B, term loan 7% 6/19/19 (b) | 19,701 | 15,629 | |

| Drillships Ocean Ventures, Inc. Tranche B, term loan 5.5% 7/25/21 (b) | 30,613 | 19,783 | |

| Empire Generating Co. LLC: | |||

| Tranche B, term loan 5.25% 3/14/21 (b) | 34,750 | 30,927 | |

| Tranche C, term loan 5.25% 3/14/21 (b) | 2,549 | 2,268 | |

| Energy Transfer Equity LP Tranche C, term loan 4% 12/2/19 (b) | 18,588 | 17,977 | |

| EP Energy LLC Tranche B 3LN, term loan 3.5% 5/24/18 (b) | 34,928 | 31,057 | |

| ExGen Renewables I, LLC Tranche B term loan 5.25% 2/6/21 (b) | 14,012 | 14,047 | |

| Expro Finservices S.a.r.l. Tranche B, term loan 5.75% 9/2/21 (b) | 43,770 | 35,962 | |

| Fieldwood Energy, LLC: | |||

| Tranche 2LN, term loan 8.375% 9/30/20 (b) | 69,385 | 25,127 | |

| Tranche B 1LN, term loan 3.875% 9/30/18 (b) | 32,844 | 28,796 | |

| Floatel International Ltd. Tranche B, term loan 6% 6/27/20 (b) | 30,855 | 17,317 | |

| MRC Global, Inc. Tranche B, term loan 4.75% 11/9/19 (b) | 22,238 | 21,626 | |

| Overseas Shipholding Group, Inc. Tranche B, term loan 5.25% 8/5/19 (b) | 15,686 | 15,500 | |

| Pacific Drilling SA Tranche B, term loan 4.5% 6/3/18 (b) | 21,527 | 11,589 | |

| Panda Sherman Power, LLC term loan 9% 9/14/18 (b) | 19,806 | 17,826 | |

| Panda Temple Power, LLC term loan 7.25% 4/3/19 (b) | 11,000 | 9,460 | |

| Penn Products Terminals LLC Tranche B, term loan 4.75% 4/13/22 (b) | 10,985 | 11,012 | |

| Seadrill Operating LP Tranche B, term loan 4% 2/21/21 (b) | 47,293 | 27,474 | |

| Sheridan Investment Partners I term loan 4.25% 12/16/20 (b) | 37,994 | 22,797 | |

| Sheridan Investment Partners I, LLC Tranche B 2LN, term loan 4.25% 10/1/19 (b) | 13,545 | 9,301 | |

| Sheridan Production Partners I: | |||

| Tranche A, term loan 4.25% 12/16/20 (b) | 5,285 | 3,171 | |

| Tranche M, term loan 4.25% 12/16/20 (b) | 1,971 | 1,183 | |

| Targa Resources Corp. term loan 5.75% 2/27/22 (b) | 5,581 | 5,560 | |

| TPF II Power, LLC Tranche B, term loan 5.5% 10/2/21 (b) | 11,720 | 11,676 | |

| Western Refining, Inc. Tranche B, term loan 4.25% 11/12/20 (b) | 21,924 | 21,321 | |

| TOTAL ENERGY | 489,593 | ||

| Entertainment/Film - 0.8% | |||

| AMC Entertainment, Inc. Tranche B, term loan 3.5% 4/30/20 (b) | 19,400 | 19,347 | |

| CDS U.S. Intermediate Holdings, Inc.: | |||

| Tranche B 1LN, term loan 5% 7/8/22 (b) | 14,370 | 14,418 | |

| Tranche B 2LN, term loan 9.25% 7/8/23 (b) | 5,305 | 5,206 | |

| Digital Cinema Implementation Partners,LLC Tranche B, term loan 3.25% 5/17/21 (b) | 26,061 | 25,953 | |

| Live Nation Entertainment, Inc. Tranche B, term loan 3.5% 8/16/20 (b) | 9,167 | 9,159 | |

| William Morris Endeavor Entertainment, LLC. Tranche B 1LN, term loan 5.25% 5/6/21 (b) | 16,743 | 16,696 | |

| TOTAL ENTERTAINMENT/FILM | 90,779 | ||

| Environmental - 0.7% | |||

| ADS Waste Holdings, Inc. Tranche B 2LN, term loan 3.75% 10/9/19 (b) | 24,179 | 23,862 | |

| The Brickman Group, Ltd.: | |||

| Tranche 2LN, term loan 7.5% 12/18/21 (b) | 5,690 | 5,349 | |

| Tranche B 1LN, term loan 4% 12/18/20 (b) | 34,093 | 33,249 | |

| WTG Holdings III Corp. Tranche B 1LN, term loan 4.75% 1/15/21 (b) | 10,808 | 10,753 | |

| TOTAL ENVIRONMENTAL | 73,213 | ||

| Food & Drug Retail - 3.0% | |||

| Albertson's LLC: | |||

| Tranche B 3LN, term loan 5% 8/25/19 (b) | 61,425 | 61,348 | |

| Tranche B 4LN, term loan 5.5% 8/25/21 (b) | 208,383 | 208,264 | |

| Ferrara Candy Co., Inc. Tranche B, term loan 7.5% 6/18/18 (b) | 15,284 | 15,093 | |

| Performance Food Group, Inc. Tranche 2LN, term loan 6.25% 11/14/19 (b) | 5,032 | 5,024 | |

| PRA Holdings, Inc. Tranche B, term loan 4.5% 9/23/20 (b) | 9,178 | 9,165 | |

| Rite Aid Corp. Tranche 2 LN2, term loan 4.875% 6/21/21 (b) | 20,210 | 20,242 | |

| SUPERVALU, Inc. Tranche B, term loan 4.5% 3/21/19 (b) | 8,608 | 8,588 | |

| TOTAL FOOD & DRUG RETAIL | 327,724 | ||

| Food/Beverage/Tobacco - 0.3% | |||

| AdvancePierre Foods, Inc. Tranche 2LN, term loan 9.5% 10/10/17 (b) | 3,000 | 2,970 | |

| JBS U.S.A. LLC Tranche B, term loan 3.75% 5/25/18 (b) | 19,242 | 19,218 | |

| Post Holdings, Inc. Tranche B, term loan 3.75% 6/2/21 (b) | 8,266 | 8,275 | |

| TOTAL FOOD/BEVERAGE/TOBACCO | 30,463 | ||

| Gaming - 6.7% | |||

| Aristocrat International (Pty) Ltd. Tranche B, term loan 4.75% 10/20/21 (b) | 36,146 | 36,207 | |

| Boyd Gaming Corp. Tranche B, term loan 4% 8/14/20 (b) | 21,923 | 21,930 | |

| Caesars Entertainment Resort Properties LLC Tranche B 1LN, term loan 7% 10/11/20 (b) | 128,175 | 121,105 | |

| Caesars Growth Properties Holdings, LLC Tranche 1LN, term loan 6.25% 5/8/21 (b) | 177,583 | 155,682 | |

| CityCenter Holdings LLC Tranche B, term loan 4.25% 10/16/20 (b) | 19,092 | 19,102 | |

| Golden Nugget, Inc. Tranche B, term loan: | |||

| 5.5% 11/21/19 (b) | 47,496 | 47,526 | |

| 5.5% 11/21/19 (b) | 20,356 | 20,368 | |

| Las Vegas Sands LLC Tranche B, term loan 3.25% 12/19/20 (b) | 34,227 | 33,747 | |

| MGM Mirage, Inc. Tranche B, term loan 3.5% 12/20/19 (b) | 67,225 | 67,085 | |

| Mohegan Tribal Gaming Authority Tranche B, term loan 5.5% 6/15/18 (b) | 24,373 | 24,081 | |

| Pinnacle Entertainment, Inc. Tranche B 2LN, term loan 3.75% 8/13/20 (b) | 4,446 | 4,438 | |

| Scientific Games Corp.: | |||

| Tranche B 2LN, term loan 6% 10/1/21 (b) | 50,578 | 49,345 | |

| Tranche B, term loan 6% 10/18/20 (b) | 94,448 | 92,161 | |

| Station Casinos LLC Tranche B, term loan 4.25% 3/1/20 (b) | 15,406 | 15,406 | |

| Yonkers Racing Corp. Tranche B 1LN, term loan 4.25% 8/20/19 (b) | 13,418 | 13,016 | |

| TOTAL GAMING | 721,199 | ||

| Healthcare - 9.7% | |||

| Alere, Inc. Tranche B, term loan 4.25% 6/18/22 (b) | 17,062 | 17,062 | |

| Alvogen Pharma U.S., Inc. Tranche B 1LN, term loan 6% 4/2/22 (b) | 16,658 | 16,325 | |

| AmSurg Corp. Tranche B, term loan 3.5% 7/16/21 (b) | 22,071 | 21,900 | |

| Community Health Systems, Inc.: | |||

| Tranche F, term loan 3.5752% 12/31/18 (b) | 45,770 | 45,522 | |

| Tranche G, term loan 3.75% 12/31/19 (b) | 56,892 | 56,617 | |

| Tranche H, term loan 4% 1/27/21 (b) | 229,889 | 229,115 | |

| Concordia Healthcare Corp. Tranche B 1LN, term loan 5.25% 10/21/21 (b) | 14,490 | 13,898 | |

| ConvaTec, Inc. Tranche B, term loan 4.25% 6/15/20 (b) | 13,396 | 13,341 | |

| DaVita HealthCare Partners, Inc. Tranche B, term loan 3.5% 6/24/21 (b) | 62,636 | 62,774 | |

| Dialysis Newco, Inc. Tranche B 1LN, term loan 4.5% 4/23/21 (b) | 7,204 | 7,175 | |

| DJO Finance LLC Tranche B 1LN, term loan 4.25% 6/7/20 (b) | 13,162 | 13,044 | |

| Drumm Investors LLC Tranche B, term loan 6.75% 5/4/18 (b) | 33,863 | 33,958 | |

| Emergency Medical Services Corp. Tranche B, term loan 4% 5/25/18 (b) | 21,272 | 21,183 | |

| Endo Pharmaceuticals, Inc. Tranche B, term loan 3.75% 9/25/22 (b) | 63,000 | 61,848 | |

| Genesis HealthCare Corp. Tranche B, term loan 10% 12/4/17 (b) | 4,405 | 4,466 | |

| Grifols, S.A. Tranche B, term loan 3.1883% 2/27/21 (b) | 44,305 | 44,201 | |

| HCA Holdings, Inc.: | |||

| Tranche B 4LN, term loan 3.0766% 5/1/18 (b) | 33,274 | 33,274 | |

| Tranche B 5LN, term loan 2.9383% 3/31/17 (b) | 110,231 | 110,206 | |

| HCR Healthcare LLC Tranche B, term loan 5% 4/6/18 (b) | 22,194 | 21,223 | |

| Hill-Rom Holdings, Inc. Tranche B, term loan 3.5% 9/8/22 (b) | 10,168 | 10,175 | |

| Jaguar Holding Co. II / Pharmaceutical Product Development LLC Tranche B, term loan 4.25% 8/18/22 (b) | 48,878 | 48,118 | |

| MPH Acquisition Holdings LLC Tranche B, term loan 3.75% 3/31/21 (b) | 4,809 | 4,740 | |

| Patheon, Inc. Tranche B, term loan 4.25% 3/11/21 (b) | 13,904 | 13,609 | |

| Pharmedium Healthcare Corp. Tranche B 1LN, term loan 4.25% 1/28/21 (b) | 8,952 | 8,923 | |

| Surgery Center Holdings, Inc. Tranche B 1LN, term loan 5.25% 11/3/20 (b) | 2,665 | 2,649 | |

| U.S. Renal Care, Inc.: | |||

| Tranche 2LN, term loan 8.5% 1/3/20 (b) | 5,545 | 5,594 | |

| Tranche B 2LN, term loan 4.25% 7/3/19 (b) | 28,616 | 28,568 | |

| Valeant Pharmaceuticals International, Inc.: | |||

| Tranche B, term loan 4% 4/1/22 (b) | 30,522 | 28,332 | |

| Tranche BC 2LN, term loan 3.75% 12/11/19 (b) | 26,437 | 24,656 | |

| Tranche BD 2LN, term loan 3.5% 2/13/19 (b) | 37,598 | 34,975 | |

| Tranche E, term loan 3.75% 8/5/20 (b) | 14,000 | 12,987 | |

| TOTAL HEALTHCARE | 1,050,458 | ||

| Homebuilders/Real Estate - 0.9% | |||

| DTZ U.S. Borrower LLC Tranche B 1LN, term loan 4.25% 11/4/21 (b) | 19,950 | 19,738 | |

| Realogy Corp. Credit-Linked Deposit 4.4463% 10/10/16 (b) | 1,536 | 1,521 | |

| Realogy Group LLC Tranche B, term loan 3.75% 3/5/20 (b) | 80,373 | 80,313 | |

| TOTAL HOMEBUILDERS/REAL ESTATE | 101,572 | ||

| Hotels - 3.0% | |||

| Four Seasons Holdings, Inc.: | |||

| Tranche 2LN, term loan 6.25% 12/27/20 (b) | 16,755 | 16,685 | |

| Tranche B 1LN, term loan 3.5% 6/27/20 (b) | 50,536 | 50,047 | |

| Hilton Worldwide Finance, LLC Tranche B, term loan 3.5% 10/25/20 (b) | 165,262 | 165,520 | |

| La Quinta Intermediate Holdings LLC Tranche B LN, Tranche B, term loan 3.75% 4/14/21 (b) | 75,167 | 74,416 | |

| Playa Resorts Holding BV Tranche B, term loan 4% 8/9/19 (b) | 20,280 | 19,976 | |

| TOTAL HOTELS | 326,644 | ||

| Insurance - 0.4% | |||

| Alliant Holdings Intermediate LLC Tranche B, term loan 4.5% 8/14/22 (b) | 28,329 | 27,963 | |

| HUB International Ltd. Tranche B 1LN, term loan 4% 10/2/20 (b) | 17,815 | 17,328 | |

| TOTAL INSURANCE | 45,291 | ||

| Leisure - 0.8% | |||

| 24 Hour Fitness Worldwide, Inc. Tranche B, term loan 4.75% 5/30/21 (b) | 28,363 | 25,314 | |

| ClubCorp Club Operations, Inc. Tranche B, term loan 4.25% 7/24/20 (b) | 13,912 | 13,898 | |

| LTF Merger Sub, Inc. Tranche B, term loan 4.25% 6/10/22 (b) | 39,750 | 39,444 | |

| Planet Fitness Holdings, LLC. Tranche B, term loan 4.75% 3/31/21 (b) | 6,565 | 6,556 | |

| TOTAL LEISURE | 85,212 | ||

| Metals/Mining - 3.2% | |||

| American Rock Salt Co. LLC Tranche B 1LN, term loan 4.75% 5/20/21 (b) | 13,803 | 13,499 | |

| Ameriforge Group, Inc.: | |||

| Tranche B 1LN, term loan 5% 12/19/19 (b) | 7,443 | 4,875 | |

| Tranche B 2LN, term loan 8.75% 12/19/20 (b) | 3,000 | 1,670 | |

| Doncasters Group, LLC Tranche B 1LN, term loan 4.5% 4/9/20 (b) | 21,355 | 21,216 | |

| Fairmount Minerals Ltd. Tranche B 2LN, term loan 4.5% 9/5/19 (b) | 14,324 | 8,212 | |

| Fortescue Metals Group Ltd. Tranche B, term loan 4.25% 6/30/19(b) | 163,355 | 137,860 | |

| Murray Energy Corp.: | |||

| Tranche B 1LN, term loan 7% 4/16/17 (b) | 9,037 | 6,620 | |

| Tranche B 2LN, term loan 7.5% 4/16/20 (b) | 95,944 | 62,004 | |

| Oxbow Carbon LLC: | |||

| Tranche 2LN, term loan 8% 1/19/20 (b) | 20,000 | 18,150 | |

| Tranche B 1LN, term loan 4.25% 7/19/19 (b) | 11,396 | 10,897 | |

| Peabody Energy Corp. Tranche B, term loan 4.25% 9/24/20 (b) | 34,348 | 22,040 | |

| U.S. Silica Co. Tranche B, term loan 4% 7/23/20 (b) | 17,958 | 16,671 | |

| Walter Energy, Inc. Tranche B, term loan 5.8% 4/1/18 (b) | 73,216 | 22,148 | |

| TOTAL METALS/MINING | 345,862 | ||

| Publishing/Printing - 1.4% | |||

| Cengage Learning Acquisitions, Inc. Tranche 1LN, term loan 7% 3/31/20 (b) | 43,906 | 43,588 | |

| Getty Images, Inc. Tranche B, term loan 4.75% 10/18/19 (b) | 75,652 | 50,516 | |

| Houghton Mifflin Harcourt Publishing, Inc. Tranche B, term loan 4% 5/29/21 (b) | 17,112 | 16,856 | |

| McGraw-Hill Global Education Holdings, LLC Tranche B, term loan 4.75% 3/22/19 (b) | 15,855 | 15,841 | |

| Merrill Communications LLC Tranche B, term loan 6.25% 6/1/22 (b) | 24,572 | 24,081 | |

| TOTAL PUBLISHING/PRINTING | 150,882 | ||

| Restaurants - 0.5% | |||

| Burger King Worldwide, Inc. Tranche B, term loan 3.75% 12/12/21 (b) | 18,927 | 18,958 | |

| Landry's Restaurants, Inc. Tranche B, term loan 4% 4/24/18 (b) | 8,213 | 8,211 | |

| Red Lobster Hospitality LLC Tranche B, term loan 6.25% 7/28/21 (b) | 28,527 | 28,432 | |

| TOTAL RESTAURANTS | 55,601 | ||

| Services - 5.0% | |||

| Acosta, Inc. Tranche B, term loan 4.25% 9/26/21 (b) | 2,000 | 1,949 | |

| ARAMARK Corp.: | |||

| Credit-Linked Deposit 3.693% 7/26/16 (b) | 1,573 | 1,557 | |

| Tranche F, term loan 3.25% 2/24/21 (b) | 55,946 | 55,795 | |

| 3.693% 7/26/16 (b) | 2,051 | 2,030 | |

| Avis Budget Group, Inc. Tranche B, term loan 3% 3/15/19 (b) | 9,676 | 9,644 | |

| Brand Energy & Infrastructure Services, Inc. Tranche B, term loan 4.75% 11/26/20 (b) | 19,502 | 18,009 | |

| Bright Horizons Family Solutions, Inc. Tranche B, term loan 3.7501% 1/30/20 (b) | 22,970 | 22,999 | |

| Cactus Wellhead LLC Tranche B, term loan 7% 7/31/20 (b) | 23,265 | 17,449 | |

| Coinmach Service Corp. Tranche B, term loan 4.25% 11/14/19 (b) | 35,364 | 34,907 | |

| Hertz Corp.: | |||

| Tranche B 2LN, term loan 3% 3/11/18 (b) | 51,798 | 51,258 | |

| Tranche B, term loan 3.75% 3/11/18 (b) | 21,295 | 21,275 | |

| Karman Buyer Corp.: | |||

| Tranche 1LN, term loan 4.25% 7/25/21 (b) | 23,607 | 23,063 | |

| Tranche 2LN, term loan 7.5% 7/25/22 (b) | 5,490 | 5,047 | |

| KC Mergersub, Inc.: | |||

| Tranche 1LN, term loan 6% 8/13/22 (b) | 15,000 | 14,719 | |

| Tranche L 2LN, term loan 10.25% 8/13/23 (b) | 3,000 | 2,940 | |

| Laureate Education, Inc. Tranche B, term loan 5% 6/16/18 (b) | 157,507 | 134,012 | |

| Lineage Logistics Holdings, LLC. Tranche B, term loan 4.5% 4/7/21 (b) | 36,358 | 34,768 | |

| Nord Anglia Education Tranche B, term loan 5% 3/31/21 (b) | 19,281 | 18,992 | |

| On Assignment, Inc. Tranche B, term loan 3.75% 6/5/22 (b) | 8,458 | 8,460 | |

| Redtop Acquisitions Ltd.: | |||

| Tranche 2LN, term loan 8.25% 6/3/21 (b) | 4,913 | 4,874 | |

| Tranche B 1LN, term loan 4.5% 12/3/20 (b) | 5,905 | 5,912 | |

| Science Applications International Corp. Tranche B, term loan 3.75% 5/4/22 (b) | 10,945 | 10,948 | |

| The ServiceMaster Co. Tranche B, term loan 4.25% 7/1/21 (b) | 35,167 | 35,140 | |

| TOTAL SERVICES | 535,747 | ||

| Steel - 0.1% | |||

| JMC Steel Group, Inc. term loan 4.75% 4/1/17 (b) | 7,196 | 6,980 | |

| Super Retail - 5.1% | |||

| Academy Ltd. Tranche B, term loan 5% 7/2/22 (b) | 32,995 | 32,851 | |

| Bass Pro Group LLC Tranche B, term loan 4% 6/5/20 (b) | 4,000 | 3,948 | |

| BJ's Wholesale Club, Inc.: | |||

| Tranche 2LN, term loan 8.5% 3/31/20 (b) | 20,110 | 19,535 | |

| Tranche B 1LN, term loan 4.5% 9/26/19 (b) | 39,004 | 38,614 | |

| Davids Bridal, Inc. Tranche B, term loan 5.25% 10/11/19(b) | 9,640 | 8,178 | |

| Dollar Tree, Inc. Tranche B 1LN, term loan 3.5% 3/9/22 (b) | 39,900 | 39,950 | |

| General Nutrition Centers, Inc. Tranche B, term loan 3.25% 3/4/19 (b) | 36,163 | 34,740 | |

| J. Crew Group, Inc. Tranche B LN, term loan 4% 3/5/21 (b) | 41,408 | 30,352 | |

| JC Penney Corp., Inc. Tranche B, term loan: | |||

| 5% 6/20/19 (b) | 17,489 | 17,396 | |

| 6% 5/22/18 (b) | 91,772 | 91,427 | |

| Party City Holdings, Inc. Tranche B, term loan 4.25% 8/19/22 (b) | 36,215 | 36,197 | |

| PETCO Animal Supplies, Inc. term loan 4% 11/24/17 (b) | 34,791 | 34,689 | |

| PetSmart, Inc. Tranche B, term loan 4.25% 3/11/22 (b) | 59,700 | 59,668 | |

| Sears Holdings Corp. Tranche ABL, term loan 5.5% 6/30/18 (b) | 66,312 | 64,219 | |

| Sports Authority, Inc. Tranche B, term loan 7.5% 11/16/17 (b) | 6,566 | 4,555 | |

| Staples, Inc. Tranche B, term loan 4/24/21 (c) | 35,000 | 34,809 | |

| TOTAL SUPER RETAIL | 551,128 | ||

| Technology - 11.0% | |||

| Activision Blizzard, Inc. Tranche B, term loan 3.25% 10/11/20 (b) | 21,911 | 21,953 | |

| Applied Systems, Inc.: | |||

| Tranche B 1LN, term loan 4.25% 1/23/21 (b) | 14,039 | 13,920 | |

| Tranche B 2LN, term loan 7.5% 1/23/22 (b) | 3,630 | 3,489 | |

| Avago Technologies, Inc. Tranche B, term loan 3.75% 5/6/21 (b) | 29,928 | 29,920 | |

| Blue Coat Systems, Inc. Tranche B, term loan 4.5% 5/22/22 (b) | 21,565 | 21,394 | |

| BMC Software Finance, Inc. Tranche B, term loan: | |||

| 5% 9/10/20 (b) | 19,161 | 17,183 | |

| 5% 9/10/20 (b) | 128,238 | 115,293 | |

| Carros U.S., LLC Tranche B, term loan 4.5% 9/30/21 (b) | 10,442 | 10,407 | |

| Computer Discount Warehouse (CDW) LLC, Tranche B, term loan 3.25% 4/29/20 (b) | 51,391 | 51,211 | |

| Dell International LLC Tranche B 2LN, term loan 4% 4/29/20 (b) | 199,000 | 198,889 | |

| Epicor Software Corp. Tranche B, term loan 4.75% 6/1/22 (b) | 34,414 | 34,181 | |

| First Data Corp.: | |||

| term loan 3.697% 3/24/17 (b) | 59,529 | 59,371 | |

| Tranche B, term loan: | |||

| 3.697% 3/24/18 (b) | 43,000 | 42,647 | |

| 3.697% 9/24/18 (b) | 40,000 | 39,700 | |

| Freescale Semiconductor, Inc. Tranche B 4LN, term loan 4.25% 3/1/20 (b) | 52,440 | 52,379 | |

| Generac Power Systems, Inc. Tranche B, term loan 3.5% 5/31/20 (b) | 27,401 | 26,990 | |

| Infor U.S., Inc.: | |||

| Tranche B 3LN, term loan 3.75% 6/3/20 (b) | 14,029 | 13,623 | |

| Tranche B 5LN, term loan 3.75% 6/3/20 (b) | 33,977 | 33,032 | |

| Informatica Corp. Tranche B, term loan 4.5% 8/6/22 (b) | 24,779 | 24,428 | |

| Kronos, Inc.: | |||

| Tranche 2LN, term loan 9.75% 4/30/20 (b) | 24,845 | 25,104 | |

| Tranche B 1LN, term loan 4.5% 10/30/19 (b) | 32,103 | 32,015 | |

| Lux FinCo U.S. SPV: | |||

| Tranche 2LN, term loan 8.713% 10/16/23 (b) | 6,000 | 5,910 | |

| Tranche B 1LN, term loan 5% 10/16/22 (b) | 10,000 | 9,867 | |

| Nuance Communications, Inc. Tranche C, term loan 2.94% 8/7/19 (b) | 16,210 | 16,000 | |

| Renaissance Learning, Inc.: | |||

| Tranche 1LN, term loan 4.5% 4/9/21 (b) | 14,233 | 13,747 | |

| Tranche 2LN, term loan 8% 4/9/22 (b) | 11,500 | 11,040 | |

| Sophia L.P. Tranche B, term loan 4.75% 9/30/22 (b) | 35,000 | 34,923 | |

| SS&C Technologies, Inc.: | |||

| Tranche B 1LN, term loan 4% 7/8/22 (b) | 38,734 | 38,831 | |

| Tranche B 2LN, term loan 4% 7/8/22 (b) | 5,993 | 6,008 | |

| SunGard Data Systems, Inc.: | |||

| Tranche C, term loan 3.9447% 2/28/17 (b) | 32,706 | 32,665 | |

| Tranche E, term loan 4% 3/8/20 (b) | 30,917 | 30,878 | |

| Syniverse Holdings, Inc. Tranche B, term loan: | |||

| 4% 4/23/19 (b) | 9,598 | 8,614 | |

| 4% 4/23/19 (b) | 19,390 | 17,524 | |

| Transfirst, Inc.: | |||

| Tranche 2LN, term loan 9% 11/12/22 (b) | 6,830 | 6,819 | |

| Tranche B 1LN, term loan 4.75% 11/12/21 (b) | 10,985 | 10,976 | |

| TTM Technologies, Inc. Tranche B 1LN, term loan 6% 5/31/21 (b) | 40,013 | 37,412 | |

| Vantiv LLC Tranche B, term loan 3.75% 6/13/21 (b) | 19,811 | 19,831 | |

| WP Mustang Holdings, LLC. Tranche B 1LN, term loan 5.5% 5/29/21 (b) | 22,085 | 22,063 | |

| TOTAL TECHNOLOGY | 1,190,237 | ||

| Telecommunications - 6.4% | |||

| Altice Financing SA Tranche B, term loan 5.5% 6/24/19 (b) | 143,362 | 143,327 | |

| Crown Castle Operating Co. Tranche B 2LN, term loan 3% 1/31/21 (b) | 61,570 | 61,544 | |

| Digicel International Finance Ltd.: | |||

| Tranche D 1LN, term loan 3.875% 3/31/17 (b) | 4,499 | 4,207 | |

| Tranche D 2LN, term loan 3.8266% 3/31/19 (b) | 28,061 | 26,237 | |

| DigitalGlobe, Inc. Tranche B, term loan 3.75% 1/31/20 (b) | 7,258 | 7,230 | |

| FairPoint Communications, Inc. Tranche B, term loan 7.5% 2/14/19 (b) | 13,045 | 13,050 | |

| FPL FiberNet, LLC. Tranche A, term loan 3.5872% 7/22/19 (b) | 19,500 | 19,500 | |

| Integra Telecom Holdings, Inc. Tranche B 1LN, term loan 5.25% 8/14/20 (b) | 24,875 | 24,603 | |

| Intelsat Jackson Holdings SA Tranche B 2LN, term loan 3.75% 6/30/19 (b) | 117,070 | 113,307 | |

| Level 3 Financing, Inc.: | |||

| Tranche B 2LN, term loan 3.5% 5/31/22 (b) | 18,400 | 18,354 | |

| Tranche B 3LN, term loan 4% 8/1/19 (b) | 13,330 | 13,361 | |

| Tranche B 4LN, term loan 4% 1/15/20 (b) | 68,000 | 68,119 | |

| LTS Buyer LLC: | |||

| Tranche 2LN, term loan 8% 4/12/21 (b) | 3,868 | 3,758 | |

| Tranche B 1LN, term loan 4% 4/11/20 (b) | 51,364 | 50,529 | |

| Mitel U.S. Holdings, Inc. Tranche B, term loan 5.5% 4/29/22 (b) | 18,554 | 17,951 | |

| SBA Senior Finance II, LLC term loan 3.25% 3/24/21 (b) | 34,563 | 34,287 | |

| Securus Technologies Holdings, Inc.: | |||

| Tranche 2LN, term loan 9% 4/30/21 (b) | 6,635 | 3,937 | |

| Tranche B 1LN, term loan 4.75% 4/30/20 (b) | 34,101 | 25,291 | |

| TCH-2 Holdings, LLC. Tranche B 1LN, term loan 5.5% 5/12/21 (b) | 7,876 | 7,807 | |

| Telesat Holding, Inc. Tranche B, term loan 3.5% 3/28/19 (b) | 36,476 | 36,146 | |

| TOTAL TELECOMMUNICATIONS | 692,545 | ||

| Transportation Ex Air/Rail - 0.2% | |||

| YRC Worldwide, Inc. Tranche B, term loan 8.25% 2/13/19 (b) | 22,057 | 20,866 | |

| Utilities - 4.9% | |||

| Alinta Energy Finance Pty. Ltd. Tranche B, term loan: | |||

| 6.375% 8/13/18 (b) | 2,274 | 2,249 | |

| 6.375% 8/13/19 (b) | 34,216 | 33,840 | |

| Calpine Construction Finance Co. LP: | |||

| Tranche B 1LN, term loan 3% 5/3/20 (b) | 83,840 | 81,493 | |

| Tranche B 2LN, term loan 3.25% 1/31/22 (b) | 29,167 | 28,401 | |

| Calpine Corp.: | |||

| Tranche B 3LN, term loan 4% 10/9/19 (b) | 24,742 | 24,761 | |

| Tranche B 5LN, term loan 3.5% 5/28/22 (b) | 69,825 | 69,014 | |

| Dynegy, Inc. Tranche B 2LN, term loan 4% 4/23/20 (b) | 13,623 | 13,513 | |

| Energy Future Holdings Corp. Tranche 1LN, term loan 4.25% 6/19/16 (b) | 57,884 | 57,848 | |

| Essential Power LLC Tranche B, term loan 4.75% 8/8/19 (b) | 13,932 | 13,816 | |

| Exgen Texas Power LLC Tranche B, term loan 5.75% 9/18/21 (b) | 26,721 | 21,377 | |

| Houston Fuel Oil Terminal Co. Tranche B, term loan 4.25% 8/19/21 (b) | 18,352 | 17,251 | |

| InterGen NV Tranche B, term loan 5.5% 6/13/20 (b) | 33,154 | 30,398 | |

| Moxie Patriot LLC Tranche B, term loan 6.75% 12/19/20 (b) | 13,000 | 12,285 | |

| NRG Energy, Inc. Tranche B, term loan 2.75% 7/1/18 (b) | 25,422 | 24,694 | |

| Southcross Energy Partners LP Tranche B, term loan 5.25% 8/4/21 (b) | 7,283 | 6,457 | |

| Southcross Holdings Borrower LP Tranche B, term loan 6% 8/4/21 (b) | 21,048 | 15,610 | |

| Southeast Powergen LLC Tranche B, term loan 4.5% 12/2/21 (b) | 5,092 | 5,072 | |

| Star West Generation LLC Tranche B, term loan 4.25% 3/13/20 (b) | 21,256 | 20,778 | |

| Tempus Public Foundation Generation Holdings LLC Tranche B, term loan 4.75% 12/31/17 (b) | 23,683 | 22,202 | |

| Veresen Midstream LP Tranche B, term loan 5.25% 3/31/22 (b) | 24,099 | 23,998 | |

| TOTAL UTILITIES | 525,057 | ||

| TOTAL BANK LOAN OBLIGATIONS | |||

| (Cost $9,842,093) | 9,384,120 | ||

| Nonconvertible Bonds - 7.2% | |||

| Banks & Thrifts - 0.7% | |||

| Ally Financial, Inc.: | |||

| 2.9952% 7/18/16 (b) | 75,000 | 74,878 | |

| 3.125% 1/15/16 | 4,000 | 4,005 | |

| TOTAL BANKS & THRIFTS | 78,883 | ||

| Broadcasting - 0.3% | |||

| AMC Networks, Inc. 4.75% 12/15/22 | 6,600 | 6,625 | |

| Clear Channel Communications, Inc. 9% 12/15/19 | 8,677 | 7,343 | |

| Starz LLC/Starz Finance Corp. 5% 9/15/19 | 9,000 | 9,204 | |

| Univision Communications, Inc. 6.75% 9/15/22 (d) | 5,368 | 5,670 | |

| TOTAL BROADCASTING | 28,842 | ||

| Building Materials - 0.1% | |||

| CEMEX S.A.B. de CV 5.0705% 10/15/18 (b)(d) | 10,000 | 10,225 | |

| Cable/Satellite TV - 0.4% | |||

| CCO Holdings LLC/CCO Holdings Capital Corp.: | |||

| 5.125% 2/15/23 | 17,065 | 17,108 | |

| 5.25% 3/15/21 | 13,070 | 13,495 | |

| Cequel Communications Escrow I LLC/Cequel Communications Escrow Capital Corp. 6.375% 9/15/20 (d) | 10,815 | 10,829 | |

| Lynx I Corp. 5.375% 4/15/21 (d) | 4,500 | 4,725 | |

| Virgin Media Finance PLC 4.875% 2/15/22 | 2,000 | 1,825 | |

| TOTAL CABLE/SATELLITE TV | 47,982 | ||

| Capital Goods - 0.0% | |||

| Shale-Inland Holdings LLC/Shale-Inland Finance Corp. 8.75% 11/15/19 (d) | 3,000 | 2,235 | |

| Chemicals - 0.0% | |||

| Nufarm Australia Ltd. 6.375% 10/15/19 (d) | 5,000 | 4,975 | |

| Containers - 1.0% | |||

| Ardagh Packaging Finance PLC/Ardagh MP Holdings U.S.A., Inc. 3.3372% 12/15/19 (b)(d) | 42,330 | 41,695 | |

| Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer (Luxembourg) SA 5.75% 10/15/20 | 58,325 | 60,658 | |

| TOTAL CONTAINERS | 102,353 | ||

| Diversified Financial Services - 0.8% | |||

| CIT Group, Inc. 5% 5/15/17 | 7,000 | 7,214 | |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | |||

| 3.5% 3/15/17 | 18,720 | 18,939 | |

| 4.875% 3/15/19 | 15,000 | 15,342 | |

| International Lease Finance Corp.: | |||

| 2.2872% 6/15/16 (b) | 29,485 | 29,429 | |

| 3.875% 4/15/18 | 7,000 | 7,105 | |

| 6.25% 5/15/19 | 10,000 | 10,875 | |

| TOTAL DIVERSIFIED FINANCIAL SERVICES | 88,904 | ||

| Diversified Media - 0.2% | |||

| Clear Channel Worldwide Holdings, Inc.: | |||

| Series A, 6.5% 11/15/22 | 5,130 | 5,284 | |

| Series B, 6.5% 11/15/22 | 13,870 | 14,459 | |

| TOTAL DIVERSIFIED MEDIA | 19,743 | ||

| Energy - 0.6% | |||

| American Energy-Permian Basin LLC/ AEPB Finance Corp. 6.8037% 8/1/19 (b)(d) | 35,115 | 19,050 | |

| Chesapeake Energy Corp. 3.5705% 4/15/19 (b) | 29,720 | 19,169 | |

| Citgo Petroleum Corp. 6.25% 8/15/22 (d) | 10,000 | 9,800 | |

| Northern Tier Energy LLC/Northern Tier Finance Corp. 7.125% 11/15/20 | 4,000 | 4,070 | |

| Targa Resources Partners LP/Targa Resources Partners Finance Corp. 6.375% 8/1/22 | 4,492 | 4,357 | |

| Western Refining, Inc. 6.25% 4/1/21 | 5,305 | 5,278 | |

| TOTAL ENERGY | 61,724 | ||

| Entertainment/Film - 0.0% | |||

| Cinemark U.S.A., Inc. 5.125% 12/15/22 | 3,185 | 3,201 | |

| Food/Beverage/Tobacco - 0.0% | |||

| ESAL GmbH 6.25% 2/5/23 (d) | 4,000 | 3,900 | |

| Gaming - 0.1% | |||

| MCE Finance Ltd. 5% 2/15/21 (d) | 10,000 | 9,363 | |

| Healthcare - 0.7% | |||

| Community Health Systems, Inc. 5.125% 8/15/18 | 10,755 | 10,957 | |

| DaVita HealthCare Partners, Inc. 5.75% 8/15/22 | 8,235 | 8,647 | |

| HCA Holdings, Inc. 3.75% 3/15/19 | 25,000 | 25,438 | |

| Tenet Healthcare Corp.: | |||

| 3.8372% 6/15/20 (b)(d) | 17,895 | 17,761 | |

| 4.75% 6/1/20 | 8,680 | 8,810 | |

| TOTAL HEALTHCARE | 71,613 | ||

| Homebuilders/Real Estate - 0.2% | |||

| CBRE Group, Inc. 5% 3/15/23 | 17,990 | 18,273 | |

| Metals/Mining - 0.0% | |||

| Murray Energy Corp. 11.25% 4/15/21 (d) | 9,000 | 2,408 | |

| Peabody Energy Corp. 6% 11/15/18 | 5,000 | 875 | |

| TOTAL METALS/MINING | 3,283 | ||

| Publishing/Printing - 0.1% | |||

| Cenveo Corp. 6% 8/1/19 (d) | 9,850 | 8,643 | |

| Services - 0.1% | |||

| Avis Budget Car Rental LLC/Avis Budget Finance, Inc. 3.0744% 12/1/17 (b) | 14,410 | 14,489 | |

| Technology - 0.5% | |||

| Brocade Communications Systems, Inc. 4.625% 1/15/23 | 7,235 | 7,054 | |

| First Data Corp. 6.75% 11/1/20 (d) | 25,460 | 26,828 | |

| NXP BV/NXP Funding LLC: | |||

| 5.75% 2/15/21 (d) | 14,760 | 15,424 | |

| 5.75% 3/15/23 (d) | 5,000 | 5,263 | |

| TOTAL TECHNOLOGY | 54,569 | ||

| Telecommunications - 1.2% | |||

| Altice Financing SA: | |||

| 6.5% 1/15/22 (d) | 7,240 | 7,331 | |

| 7.875% 12/15/19 (d) | 4,000 | 4,178 | |

| Columbus International, Inc. 7.375% 3/30/21 (d) | 14,535 | 15,116 | |

| DigitalGlobe, Inc. 5.25% 2/1/21 (d) | 3,905 | 3,513 | |

| Intelsat Jackson Holdings SA 6.625% 12/15/22 (Reg. S) | 20,000 | 15,800 | |

| Level 3 Financing, Inc. 3.9142% 1/15/18 (b) | 15,000 | 15,113 | |

| Numericable Group SA 4.875% 5/15/19 (d) | 27,120 | 27,256 | |

| Sprint Capital Corp.: | |||

| 6.875% 11/15/28 | 4,000 | 3,320 | |

| 6.9% 5/1/19 | 5,000 | 4,800 | |

| Sprint Communications, Inc.: | |||

| 6% 11/15/22 | 30,000 | 25,635 | |

| 9% 11/15/18 (d) | 3,000 | 3,298 | |

| Telesat Canada/Telesat LLC 6% 5/15/17 (d) | 3,000 | 3,045 | |

| TOTAL TELECOMMUNICATIONS | 128,405 | ||

| Utilities - 0.2% | |||

| Energy Future Intermediate Holding Co. LLC/Energy Future Intermediate Holding Finance, Inc. 12.25% 3/1/22 (d)(e) | 8,728 | 9,350 | |

| NRG Energy, Inc. 6.625% 3/15/23 | 4,000 | 3,720 | |

| The AES Corp. 3.3244% 6/1/19 (b) | 4,435 | 4,226 | |

| TOTAL UTILITIES | 17,296 | ||

| TOTAL NONCONVERTIBLE BONDS | |||

| (Cost $817,133) | 778,901 | ||

| Shares | Value (000s) | ||

| Common Stocks - 0.3% | |||

| Broadcasting - 0.1% | |||

| Cumulus Media, Inc. Class A (f) | 231,058 | 106 | |

| ION Media Networks, Inc. | 2,842 | 1,943 | |

| TOTAL BROADCASTING | 2,049 | ||

| Chemicals - 0.2% | |||

| LyondellBasell Industries NV Class A | 245,943 | 22,851 | |

| Homebuilders/Real Estate - 0.0% | |||

| Newhall Holding Co. LLC Class A (f) | 289,870 | 487 | |

| Hotels - 0.0% | |||

| Tropicana Las Vegas Hotel & Casino, Inc. Class A (f) | 48,650 | 1,581 | |

| Paper - 0.0% | |||

| White Birch Cayman Holdings Ltd. (f) | 12,570 | 0 | |

| Publishing/Printing - 0.0% | |||

| Houghton Mifflin Harcourt Co. warrants 6/22/19(f)(g) | 13,699 | 110 | |

| Telecommunications - 0.0% | |||

| FairPoint Communications, Inc. (f) | 34,287 | 550 | |

| Utilities - 0.0% | |||

| Calpine Corp. (f) | 20,715 | 321 | |

| TOTAL COMMON STOCKS | |||

| (Cost $14,688) | 27,949 | ||

| Money Market Funds - 5.2% | |||

| Fidelity Cash Central Fund, 0.18% (h) | |||

| (Cost $561,718) | 561,718,142 | 561,718 | |

| TOTAL INVESTMENT PORTFOLIO - 99.7% | |||

| (Cost $11,235,632) | 10,752,688 | ||

| NET OTHER ASSETS (LIABILITIES) - 0.3% | 31,812 | ||

| NET ASSETS - 100% | $10,784,500 |

Legend

(a) Remaining maturities of bank loan obligations may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) The coupon rate will be determined upon settlement of the loan after period end.

(d) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $271,881,000 or 2.5% of net assets.

(e) Non-income producing - Security is in default.

(f) Non-income producing

(g) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $110,000 or 0.0% of net assets.

(h) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost (000s) |

| Houghton Mifflin Harcourt Co. warrants 6/22/19 | 6/22/12 | $26 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| (Amounts in thousands) | |

| Fidelity Cash Central Fund | $1,005 |

| Total | $1,005 |

Investment Valuation

The following is a summary of the inputs used, as of October 31, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | ||||

| Investments in Securities: | ||||

| Equities: | ||||

| Consumer Discretionary | $3,740 | $106 | $110 | $3,524 |

| Financials | 487 | -- | -- | 487 |

| Materials | 22,851 | 22,851 | -- | -- |

| Telecommunication Services | 550 | 550 | -- | -- |

| Utilities | 321 | 321 | -- | -- |

| Bank Loan Obligations | 9,384,120 | -- | 9,332,655 | 51,465 |

| Corporate Bonds | 778,901 | -- | 778,901 | -- |

| Money Market Funds | 561,718 | 561,718 | -- | -- |

| Total Investments in Securities: | $10,752,688 | $585,546 | $10,111,666 | $55,476 |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 89.1% |

| Luxembourg | 3.9% |

| Australia | 1.9% |

| Netherlands | 1.8% |

| Canada | 1.0% |

| Others (Individually Less Than 1%) | 2.3% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | October 31, 2015 | |

| Assets | ||

| Investment in securities, at value — See accompanying schedule: Unaffiliated issuers (cost $10,673,914) | $10,190,970 | |

| Fidelity Central Funds (cost $561,718) | 561,718 | |

| Total Investments (cost $11,235,632) | $10,752,688 | |

| Cash | 7,360 | |

| Receivable for investments sold | 77,820 | |

| Receivable for fund shares sold | 9,171 | |

| Interest receivable | 58,927 | |

| Distributions receivable from Fidelity Central Funds | 89 | |

| Prepaid expenses | 32 | |

| Total assets | 10,906,087 | |

| Liabilities | ||

| Payable for investments purchased | $91,901 | |

| Payable for fund shares redeemed | 13,831 | |

| Distributions payable | 8,421 | |

| Accrued management fee | 5,080 | |

| Distribution and service plan fees payable | 789 | |

| Other affiliated payables | 1,433 | |

| Other payables and accrued expenses | 132 | |

| Total liabilities | 121,587 | |

| Net Assets | $10,784,500 | |

| Net Assets consist of: | ||

| Paid in capital | $11,363,197 | |

| Undistributed net investment income | 38,133 | |

| Accumulated undistributed net realized gain (loss) on investments | (133,886) | |

| Net unrealized appreciation (depreciation) on investments | (482,944) | |

| Net Assets | $10,784,500 | |

| Calculation of Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($863,204 ÷ 91,675 shares) | $9.42 | |

| Maximum offering price per share (100/97.25 of $9.42) | $9.69 | |

| Class T: | ||

| Net Asset Value and redemption price per share ($194,674 ÷ 20,706 shares) | $9.40 | |

| Maximum offering price per share (100/97.25 of $9.40) | $9.67 | |

| Class B: | ||

| Net Asset Value and offering price per share ($11,184 ÷ 1,190 shares)(a) | $9.40 | |

| Class C: | ||

| Net Asset Value and offering price per share ($670,759 ÷ 71,254 shares)(a) | $9.41 | |

| Fidelity Floating Rate High Income Fund: | ||

| Net Asset Value, offering price and redemption price per share ($6,615,341 ÷ 703,533 shares) | $9.40 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($2,429,338 ÷ 258,566 shares) | $9.40 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | Year ended October 31, 2015 | |

| Investment Income | ||

| Dividends | $1,131 | |

| Interest | 584,890 | |

| Income from Fidelity Central Funds | 1,005 | |

| Total income | 587,026 | |

| Expenses | ||

| Management fee | $68,014 | |

| Transfer agent fees | 16,425 | |

| Distribution and service plan fees | 10,403 | |

| Accounting fees and expenses | 1,659 | |

| Custodian fees and expenses | 145 | |

| Independent trustees' compensation | 53 | |

| Registration fees | 265 | |

| Audit | 173 | |

| Legal | 34 | |

| Miscellaneous | 103 | |

| Total expenses before reductions | 97,274 | |

| Expense reductions | (70) | 97,204 |

| Net investment income (loss) | 489,822 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (176,848) | |

| Total net realized gain (loss) | (176,848) | |

| Change in net unrealized appreciation (depreciation) on investment securities | (378,925) | |

| Net gain (loss) | (555,773) | |

| Net increase (decrease) in net assets resulting from operations | $(65,951) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Year ended October 31, 2015 | Year ended October 31, 2014 |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $489,822 | $533,044 |

| Net realized gain (loss) | (176,848) | 33,692 |

| Change in net unrealized appreciation (depreciation) | (378,925) | (219,514) |

| Net increase (decrease) in net assets resulting from operations | (65,951) | 347,222 |

| Distributions to shareholders from net investment income | (448,829) | (519,702) |

| Distributions to shareholders from net realized gain | (58,045) | (57,139) |

| Total distributions | (506,874) | (576,841) |

| Share transactions - net increase (decrease) | (3,268,839) | (610,631) |

| Redemption fees | 858 | 671 |

| Total increase (decrease) in net assets | (3,840,806) | (839,579) |

| Net Assets | ||

| Beginning of period | 14,625,306 | 15,464,885 |

| End of period (including undistributed net investment income of $38,133 and undistributed net investment income of $67,963, respectively) | $10,784,500 | $14,625,306 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Floating Rate High Income Fund Class A

| Years ended October 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $9.85 | $9.99 | $9.94 | $9.73 | $9.79 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .375 | .317 | .310 | .340 | .317 |

| Net realized and unrealized gain (loss) | (.425) | (.114) | .070 | .195 | (.080) |

| Total from investment operations | (.050) | .203 | .380 | .535 | .237 |

| Distributions from net investment income | (.341) | (.307) | (.282) | (.325) | (.298) |

| Distributions from net realized gain | (.040) | (.036) | (.049) | – | – |

| Total distributions | (.381) | (.343) | (.331) | (.325) | (.298) |

| Redemption fees added to paid in capitalA | .001 | –B | .001 | –B | .001 |

| Net asset value, end of period | $9.42 | $9.85 | $9.99 | $9.94 | $9.73 |

| Total ReturnC,D | (.53)% | 2.05% | 3.89% | 5.60% | 2.46% |

| Ratios to Average Net AssetsE,F | |||||

| Expenses before reductions | .98% | .98% | .99% | .99% | 1.00% |

| Expenses net of fee waivers, if any | .98% | .98% | .99% | .99% | 1.00% |

| Expenses net of all reductions | .98% | .98% | .99% | .99% | 1.00% |

| Net investment income (loss) | 3.86% | 3.17% | 3.11% | 3.47% | 3.25% |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $863 | $1,185 | $1,681 | $1,305 | $1,587 |

| Portfolio turnover rateG | 26% | 54% | 62% | 49% | 54% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Floating Rate High Income Fund Class T

| Years ended October 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $9.84 | $9.98 | $9.93 | $9.72 | $9.77 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .365 | .306 | .299 | .330 | .312 |

| Net realized and unrealized gain (loss) | (.434) | (.112) | .071 | .195 | (.070) |

| Total from investment operations | (.069) | .194 | .370 | .525 | .242 |

| Distributions from net investment income | (.332) | (.298) | (.272) | (.315) | (.293) |

| Distributions from net realized gain | (.040) | (.036) | (.049) | – | – |

| Total distributions | (.372) | (.334) | (.321) | (.315) | (.293) |

| Redemption fees added to paid in capitalA | .001 | –B | .001 | –B | .001 |

| Net asset value, end of period | $9.40 | $9.84 | $9.98 | $9.93 | $9.72 |

| Total ReturnC,D | (.72)% | 1.96% | 3.79% | 5.50% | 2.51% |

| Ratios to Average Net AssetsE,F | |||||

| Expenses before reductions | 1.07% | 1.07% | 1.09% | 1.09% | 1.05% |

| Expenses net of fee waivers, if any | 1.07% | 1.07% | 1.09% | 1.09% | 1.05% |

| Expenses net of all reductions | 1.07% | 1.07% | 1.09% | 1.09% | 1.05% |

| Net investment income (loss) | 3.77% | 3.08% | 3.01% | 3.37% | 3.19% |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $195 | $240 | $272 | $241 | $271 |

| Portfolio turnover rateG | 26% | 54% | 62% | 49% | 54% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Floating Rate High Income Fund Class B

| Years ended October 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $9.83 | $9.98 | $9.93 | $9.72 | $9.77 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .328 | .264 | .256 | .288 | .266 |

| Net realized and unrealized gain (loss) | (.425) | (.123) | .071 | .195 | (.070) |

| Total from investment operations | (.097) | .141 | .327 | .483 | .196 |

| Distributions from net investment income | (.294) | (.255) | (.229) | (.273) | (.247) |

| Distributions from net realized gain | (.040) | (.036) | (.049) | – | – |

| Total distributions | (.334) | (.291) | (.278) | (.273) | (.247) |

| Redemption fees added to paid in capitalA | .001 | –B | .001 | –B | .001 |

| Net asset value, end of period | $9.40 | $9.83 | $9.98 | $9.93 | $9.72 |

| Total ReturnC,D | (1.01)% | 1.42% | 3.35% | 5.05% | 2.03% |

| Ratios to Average Net AssetsE,F | |||||

| Expenses before reductions | 1.46% | 1.50% | 1.52% | 1.52% | 1.52% |

| Expenses net of fee waivers, if any | 1.46% | 1.50% | 1.52% | 1.52% | 1.52% |

| Expenses net of all reductions | 1.46% | 1.50% | 1.52% | 1.52% | 1.52% |

| Net investment income (loss) | 3.38% | 2.64% | 2.58% | 2.94% | 2.72% |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $11 | $17 | $23 | $24 | $32 |

| Portfolio turnover rateG | 26% | 54% | 62% | 49% | 54% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Floating Rate High Income Fund Class C

| Years ended October 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $9.85 | $9.99 | $9.94 | $9.73 | $9.78 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .301 | .241 | .235 | .267 | .244 |

| Net realized and unrealized gain (loss) | (.434) | (.113) | .070 | .195 | (.070) |

| Total from investment operations | (.133) | .128 | .305 | .462 | .174 |

| Distributions from net investment income | (.268) | (.232) | (.207) | (.252) | (.225) |

| Distributions from net realized gain | (.040) | (.036) | (.049) | – | – |

| Total distributions | (.308) | (.268) | (.256) | (.252) | (.225) |

| Redemption fees added to paid in capitalA | .001 | –B | .001 | –B | .001 |

| Net asset value, end of period | $9.41 | $9.85 | $9.99 | $9.94 | $9.73 |

| Total ReturnC,D | (1.38)% | 1.29% | 3.11% | 4.81% | 1.80% |

| Ratios to Average Net AssetsE,F | |||||

| Expenses before reductions | 1.73% | 1.73% | 1.74% | 1.74% | 1.74% |

| Expenses net of fee waivers, if any | 1.73% | 1.73% | 1.74% | 1.74% | 1.74% |

| Expenses net of all reductions | 1.73% | 1.73% | 1.74% | 1.74% | 1.74% |

| Net investment income (loss) | 3.10% | 2.41% | 2.35% | 2.72% | 2.50% |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $671 | $835 | $960 | $806 | $852 |

| Portfolio turnover rateG | 26% | 54% | 62% | 49% | 54% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Floating Rate High Income Fund

| Years ended October 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $9.84 | $9.98 | $9.93 | $9.72 | $9.77 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .401 | .344 | .337 | .368 | .345 |

| Net realized and unrealized gain (loss) | (.435) | (.113) | .071 | .195 | (.070) |

| Total from investment operations | (.034) | .231 | .408 | .563 | .275 |

| Distributions from net investment income | (.367) | (.335) | (.310) | (.353) | (.326) |

| Distributions from net realized gain | (.040) | (.036) | (.049) | – | – |

| Total distributions | (.407) | (.371) | (.359) | (.353) | (.326) |

| Redemption fees added to paid in capitalA | .001 | –B | .001 | –B | .001 |

| Net asset value, end of period | $9.40 | $9.84 | $9.98 | $9.93 | $9.72 |

| Total ReturnC | (.36)% | 2.34% | 4.19% | 5.91% | 2.86% |

| Ratios to Average Net AssetsD,E | |||||

| Expenses before reductions | .70% | .69% | .70% | .71% | .71% |

| Expenses net of fee waivers, if any | .70% | .69% | .70% | .71% | .71% |

| Expenses net of all reductions | .70% | .69% | .70% | .71% | .71% |

| Net investment income (loss) | 4.14% | 3.45% | 3.39% | 3.75% | 3.53% |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $6,615 | $9,032 | $8,882 | $5,720 | $5,399 |

| Portfolio turnover rateF | 26% | 54% | 62% | 49% | 54% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Floating Rate High Income Fund Class I

| Years ended October 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $9.83 | $9.97 | $9.92 | $9.71 | $9.77 |

| Income from Investment Operations | |||||

| Net investment income (loss)A | .396 | .339 | .332 | .363 | .341 |

| Net realized and unrealized gain (loss) | (.424) | (.113) | .071 | .196 | (.079) |

| Total from investment operations | (.028) | .226 | .403 | .559 | .262 |

| Distributions from net investment income | (.363) | (.330) | (.305) | (.349) | (.323) |

| Distributions from net realized gain | (.040) | (.036) | (.049) | – | – |

| Total distributions | (.403) | (.366) | (.354) | (.349) | (.323) |

| Redemption fees added to paid in capitalA | .001 | –B | .001 | –B | .001 |

| Net asset value, end of period | $9.40 | $9.83 | $9.97 | $9.92 | $9.71 |

| Total ReturnC | (.30)% | 2.29% | 4.15% | 5.87% | 2.72% |

| Ratios to Average Net AssetsD,E | |||||

| Expenses before reductions | .74% | .74% | .75% | .75% | .75% |

| Expenses net of fee waivers, if any | .74% | .74% | .75% | .75% | .75% |

| Expenses net of all reductions | .74% | .74% | .75% | .75% | .75% |

| Net investment income (loss) | 4.10% | 3.40% | 3.34% | 3.71% | 3.50% |

| Supplemental Data | |||||

| Net assets, end of period (in millions) | $2,429 | $3,317 | $3,646 | $2,510 | $1,992 |

| Portfolio turnover rateF | 26% | 54% | 62% | 49% | 54% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended October 31, 2015

(Amounts in thousands except percentages)

1. Organization.

Fidelity Advisor Floating Rate High Income Fund (the Fund) is a fund of Fidelity Advisor Series I (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class C, Fidelity Floating Rate High Income Fund and Class I (formerly Institutional Class) shares, each of which, along with Class B shares, has equal rights as to assets and voting privileges. Class B shares are closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund: